UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF FEBRUARY 2025

COMMISSION FILE NUMBER 001-38976

Genmab A/S

(Exact name of Registrant as specified in its charter)

Carl Jacobsens Vej 30

2500 Valby

Denmark

+45 70 20 27 28

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ⌧ Form 40-F ◻

This report on Form 6-K shall be deemed to be incorporated by reference in Genmab A/S’s registration statements on Form S-8 (File No. 333-232693, 333-253519, 333-262970 and 333-277273) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

GENMAB A/S |

|

|

|

|

|

BY: |

/s/ Anthony Pagano |

|

|

Name: Anthony Pagano |

|

|

Title: Executive Vice President & Chief Financial Officer |

DATE: February 12, 2025

EXHIBIT INDEX

Exhibit |

Description of Exhibit |

|

|

99.1 |

|

99.1 (a) |

|

101.INS |

Inline XBRL Instance Document |

101.SCH |

Inline XBRL Taxonomy Extension Schema Document |

101.CAL |

Inline XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF |

Inline XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB |

Inline XBRL Taxonomy Extension Labels Linkbase Document |

101.PRE |

Inline XBRL Taxonomy Extension Presentation Linkbase Document |

Exhibit 99.1

GENMAB 2024 ANNUAL REPORT |

|

Table of Contents

MANAGEMENT’S REVIEW |

|

1 |

|

3 |

|

4 |

|

5 |

|

8 |

|

10 |

|

12 |

|

14 |

|

15 |

|

15 |

|

18 |

|

19 |

|

21 |

|

22 |

|

44 |

|

58 |

|

65 |

|

66 |

|

68 |

|

73 |

|

76 |

|

80 |

|

FINANCIAL STATEMENTS FOR THE GENMAB GROUP |

158 |

FINANCIAL STATEMENTS OF THE PARENT COMPANY |

224 |

DIRECTORS’ AND MANAGEMENT’S STATEMENT ON THE ANNUAL REPORT |

241 |

INDEPENDENT AUDITOR’S REPORTS |

242 |

OTHER INFORMATION |

251 |

FORWARD LOOKING STATEMENT |

251 |

CONTACT INFORMATION |

252 |

Our Reporting Suite

| ● | 2024 Corporate Governance Report |

| ● | 2024 Compensation Report |

Our Corporate Governance and Compensation Reports for 2024 can be found on our website Genmab.com.

*The Sustainability Statements are part of Management’s Review

Our 2030 Vision

By 2030, our KYSO (knock-your-socks-off) antibody medicines® are fundamentally transforming the lives of people with cancer and other serious diseases.

GENMAB 2024 ANNUAL REPORT |

|

Our Core Purpose, Supporting Our 2030 Vision

Our unstoppable team will improve the lives of patients through innovative and differentiated antibody therapeutics.

25 Years of Innovation

1999 – 2009

| ● | Genmab founded |

| ● | Nasdaq Copenhagen A/S (Nasdaq Copenhagen) Initial Public Offering (IPO) |

| ● | First partnership (F. Hoffmann-La Roche AG (Roche)) |

| ● | Ofatumumab program announced |

| ● | Daratumumab selected |

| ● | Arzerra®1 (ofatumumab) first approval |

2010 – 2020

| ● | DuoBody® technology platform announced |

| ● | Collaboration with Seagen Inc. (Seagen) |

| ● | DuoBody research and license agreement with Johnson & Johnson (J&J, legal entity Janssen Biotech, Inc.) |

| ● | Daratumumab agreement with J&J |

| ● | HexaBody® technology platform announced |

| ● | DARZALEX®2 (daratumumab) approval and launch |

| ● | BioNTech SE (BioNTech) partnership |

| ● | U.S. IPO under Nasdaq Global Select Market; dual listed as GMAB |

| ● | Japan Operations established under Genmab K.K. |

| ● | AbbVie Inc. (AbbVie) partnership |

| ● | DARZALEX FASPRO®2 (daratumumab and hyaluronidase fihj) approval and launch |

| ● | Kesimpta®3 (ofatumumab) approval and launch |

| ● | TEPEZZA®4 (teprotumumab) approval and launch |

2021 – 2024

| ● | Tivdak®5 (tisotumab vedotin-tftv) approval and launch |

| ● | DuoBody-based bispecifics RYBREVANT®2 (amivantamab), TECVAYLI®2 (teclistamab) and TALVEY®2 (talquetamab) approval and launch |

| ● | DuoBody-based bispecific EPKINLY®6 (epcoritamab-bysp)/TEPKINLY®6 (epcoritamab) approval and launch |

| ● | argenx SE (argenx) partnership |

| ● | ProfoundBio Inc. (ProfoundBio) acquisition, including rinatabart sesutecan (Rina-S™) |

| ● | Genmab assumes full ownership of acasunlimab |

| ● | Rina-S and acasunlimab move into Phase 3 development |

1. Developed and commercialized by GlaxoSmithKline (GSK); 2. Developed and commercialized by J&J; 3. Developed and commercialized by Novartis AG (Novartis); 4. Developed and commercialized by Amgen Inc. (Amgen); 5. Co-developed and commercialized with Pfizer Inc. (Pfizer); 6. Co-developed and commercialized with AbbVie

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 2/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Chair’s Statement

Dear Shareholder,

For 25 years, Genmab has pioneered antibody-based medicines to fundamentally transform the lives of people with cancer and other serious diseases. We take pride looking back at the great leaps we have made globally and within the foundations of Genmab; however, our focus remains steadfast on the future. Our progress has led us here: over 2,700 team members across five countries, eight antibody-based medicines having an impact on patients’ lives, and two wholly owned assets now in late-stage development.

GENMAB’S EVOLUTION

Founded in 1999, Genmab celebrated its 25th anniversary in 2024, and the year gave all of us at Genmab much to celebrate. Twenty-five years of scientific progress have had an impact on the lives of patients and have inspired us to continue on our path of becoming a fully integrated biotech. This year, Genmab successfully acquired ProfoundBio. In addition to gaining worldwide rights to three clinical candidates and novel antibody-drug conjugate (ADC) platforms, the acquisition is representative of our long-term growth potential. We welcomed talented new colleagues to our Research & Development (R&D) team, and accelerated the clinical development for Rina-S, a wholly owned asset now in Phase 3 clinical development.

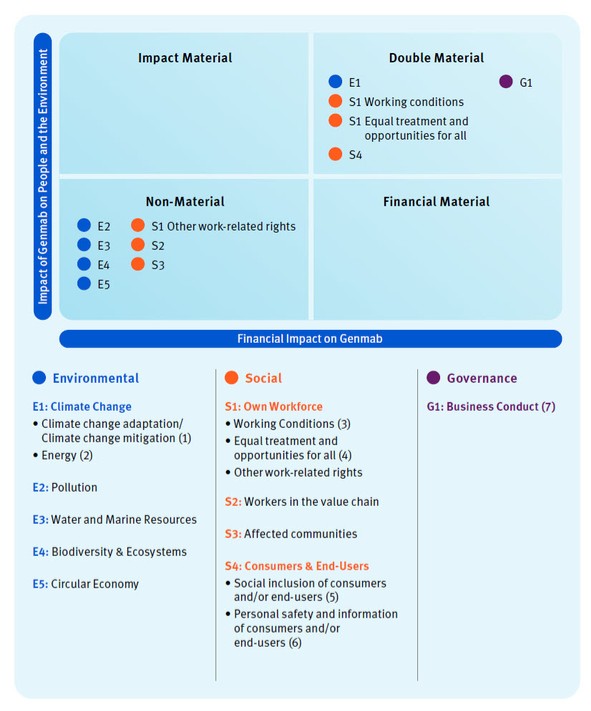

Sustainability and social responsibility are fundamental to the way we work at Genmab. This Annual Report also marks the first year for Genmab incorporating our Environmental, Social and Governance (ESG) disclosures in compliance with the European Union’s (EU) Corporate Sustainability Reporting Directive (CSRD). Our first double materiality assessment (DMA) and its outcome supported the development of our first impacts, risks and opportunities that guided our future sustainability strategy. We remain committed to ensuring our actions benefit our stakeholders and society and that our Corporate Social Responsibility (CSR) practices are integrated as a core part of our business. In 2024, 800 Genmab employees completed 4,037 service hours to make a difference in the lives of patients and their families, our communities and the environment.

EXPERIENCED LEADERSHIP

Our future looks promising under our expanded leadership. In 2024, we had two additions to our Executive Committee: Rayne Waller as Chief Technical Operations Officer, and Brad Bailey as Chief Commercial Officer. Rayne Waller joined Genmab to further solidify and strengthen our technical operations and lead all the manufacturing and supply chain capabilities of our proprietary programs through preclinical, clinical and commercial stages. Brad Bailey, previously Genmab’s Senior Vice President and U.S. General Manager, expanded his role to lead the direction, planning, and execution of Genmab’s global commercial strategies as we expand beyond our two priority markets of the U.S. and Japan. These new additions strengthen our commitment to a bold future for our diverse and innovative mid- to late-stage clinical programs.

In 2024, our Board of Directors (Board) continued to provide governance, guidance, and dedicated leadership. Comprised of experts in their fields, the Board has supported organizational growth initiatives, driven global change, and contributed value across Genmab.

On behalf of the Board, I would like to thank Genmab’s dedicated team members, Chief Executive Officer Jan van de Winkel and the entire global leadership team for their inspiration and extraordinary leadership as well as our shareholders for your continued support.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 3/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Sincerely,

Deirdre P. Connelly

Board Chair

Letter from the CEO

Dear Shareholder,

As I reflect on 2024, I am proud to share a year of remarkable progress and strategic achievement at Genmab. This year has reinforced our commitment to transforming the lives of people with cancer and other serious diseases through groundbreaking antibody-based medicines. Our advances across research, development, and commercialization activities reflect the strength of our vision, our team, and our unwavering focus on delivering value for patients and stakeholders alike.

STRATEGIC GROWTH AND INNOVATION

This year, we achieved several key milestones that drive us closer to our 2030 Vision of being a fully integrated biotech innovation powerhouse. Central to this was our acquisition of ProfoundBio, completed in May, which significantly enhanced our long-term growth potential and brought assets such as Rina-S into our pipeline. Rina-S, a next-generation ADC with best-in-class potential, entered Phase 3 development this year.

We also assumed sole responsibility for the continued development and potential commercialization of acasunlimab, underscoring our commitment to building a robust pipeline of wholly owned, late-stage programs. These advancements are supported by a growing portfolio of proprietary technologies, including the novel ADC technology platforms we acquired with ProfoundBio, and our validated DuoBody platform, which underpins our success with innovative bispecific antibodies.

TRANSFORMING SCIENCE INTO MEDICINE

This year, we carefully evaluated our investments with a focus on portfolio prioritization, and we evaluated our clinical pipeline to ensure we are investing our resources in the best and most effective way possible. This strategic prioritization means we are very focused on maximizing the potential of turning science into medicine through our Phase 3 programs, EPKINLY, Rina-S and acasunlimab. After a thorough assessment, we also decided to terminate some early-stage clinical programs that did not meet our criteria for potential KYSO® antibody-based medicines. And we decided not to pursue a Phase 3 program for Tivdak in second line plus head and neck cancer.

This year we are pleased that our commercialized medicines reached significant achievements:

| ● | EPKINLY became the first and only subcutaneous (SC) bispecific antibody approved to treat both relapsed or refractory follicular lymphoma (FL) and diffuse large B-cell lymphoma (DLBCL) in the U.S. and Europe. Strong launches in Japan and other key markets have exceeded expectations. |

| ● | Tivdak, our tissue factor (TF)-directed ADC, received full U.S. Food and Drug Administration (U.S. FDA) approval based on data demonstrating significant overall survival benefits for patients with recurrent or metastatic cervical cancer. |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 4/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

A STRONG FINANCIAL FOUNDATION TO ENABLE OUR EVOLUTION

Our financial performance this year has been a testament to the strength of our strategy. Recurring revenues grew significantly, driven by royalties from our collaborations and sales of EPKINLY and Tivdak, both of which delivered robust sales in 2024. This growth reinforces our financial position and enables continued investment based on our strategic prioritization efforts, which include our late-stage clinical programs and commercialization capabilities. This focused approach enables us to realize our vision and capitalize on significant growth opportunities ahead.

Genmab’s 25th anniversary also marked the beginning of a new era of opportunity as our company leverages the full potential of our late-stage clinical programs, the potential of the acquisition of ProfoundBio and continues to build on our existing cutting-edge antibody research and development to fulfill our mid- to long-term growth as a fully integrated biotech innovation powerhouse.

ACKNOWLEDGMENTS AND OUTLOOK

These accomplishments and our progress would not have been possible without the dedication of our exceptional team, the collaboration of our partners, and the trust of our shareholders. I want to express my deepest gratitude to all who have contributed to our success this year.

We are excited about the opportunities that lie ahead as we continue to evolve into a fully integrated biotech. With a strong foundation, an exceptional team, and a strong pipeline of innovative antibody medicines and investigational medicines, Genmab is well-positioned to deliver on our vision to have an impact on the lives of patients around the world.

Thank you for your continued confidence and support. Together, we will continue to drive forward and reach our inspirational 2030 vision.

Sincerely yours,

Jan van de Winkel, Ph.D.

President & CEO

2024 at a Glance

Operational

| ● | EPKINLY/TEPKINLY became the first and only SC bispecific antibody approved in both the U.S. and Europe to treat both relapsed or refractory FL and relapsed or refractory DLBCL after two or more lines of systemic therapy |

| ● | Acquisition of ProfoundBio, granting Genmab worldwide rights to multiple candidates in development (including Rina-S) plus ProfoundBio’s novel ADC technology platforms |

| ● | Genmab submitted a supplemental Japan New Drug Application (J-NDA) to the Ministry of Health, Labour and Welfare (MHLW) for SC EPKINLY for the treatment of relapsed or refractory FL after two or more lines of systemic therapy |

| ● | Tivdak received full U.S. FDA approval to treat recurrent or metastatic cervical cancer |

| ● | Genmab submitted a J-NDA to the MHLW for Tivdak for the treatment of advanced or recurrent cervical cancer |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 5/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

| ● | Genmab assumed sole responsibility for the continued development and potential commercialization of acasunlimab |

| ● | Two Genmab wholly owned programs, Rina-S and acasunlimab, moved into Phase 3 development |

| ● | Multiple programs entered clinical-stage development including GEN1059 (BNT314, DuoBody-EpCAMx4-1BB), GEN1055 (BNT315, HexaBody-OX40), GEN1057 (DuoBody-FAPαxDR4) and GEN1286 (EGFRxcMET ADC) |

| ● | Additional regulatory approvals for J&J therapies DARZALEX FASPRO and RYBREVANT |

| ● | Approval of Amgen’s TEPEZZA in Japan for the treatment of active thyroid eye disease (TED) |

| ● | Continued development of Genmab’s broader organizational infrastructure with the addition of over 600 new colleagues |

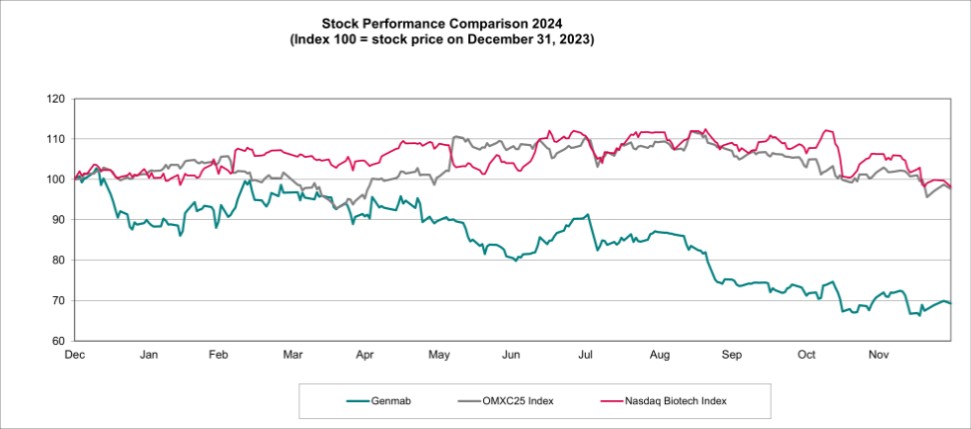

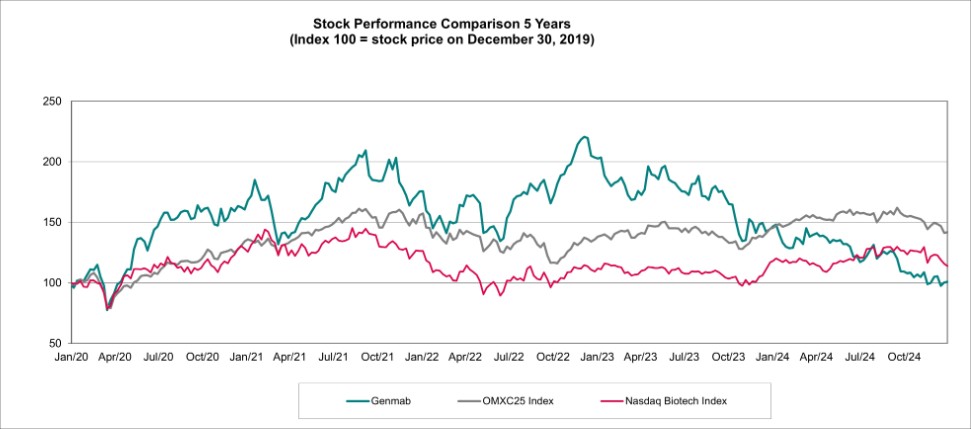

Financial

| ● | DKK 99B |

o |

2024 year-end market cap |

| ● | DKK 21,526M |

o |

2024 revenue |

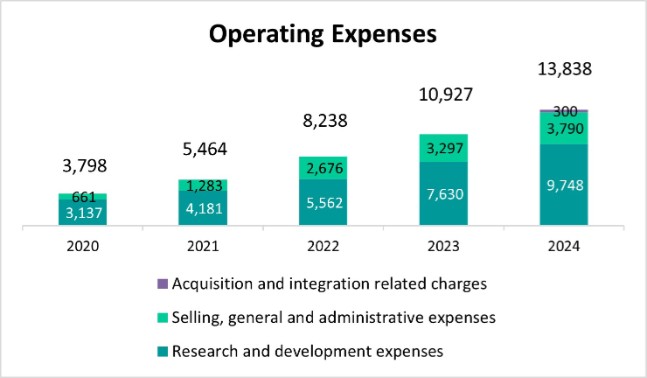

| ● | DKK 13,838M |

o |

2024 operating expenses, 72% invested in R&D |

| ● | Liquidity and Capital Resources |

| o | Marketable securities – DKK 11,243M |

| o | Cash and cash equivalents – DKK 9,858M |

| o | Shareholders’ equity – DKK 36,697M |

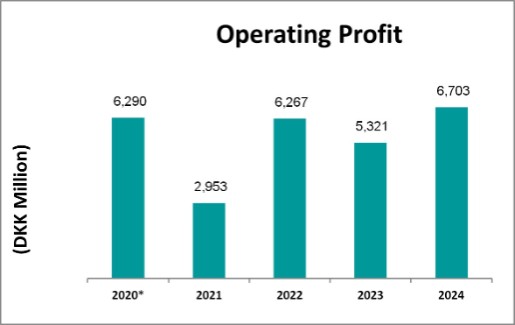

* 2020 Operating Profit impacted by one-time AbbVie upfront payment.

Sustainability

| ● | Completed first DMA in accordance with CSRD |

| ● | First year integrating our sustainability statements into Genmab’s Annual Report |

| ● | Environmental |

| o | Set first long-term emission reduction target for Scope 1 & 2 emissions |

| o | Achieved 77% renewable electricity across all sites |

| o | Established formalized processes governing supplier engagement on climate change |

| ● | Social |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 6/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

| o | Exceeded life sciences industry benchmark for favorability and participation rate for Global Employee Engagement Survey |

| o | Zero workplace injuries |

| o | 100% of eligible team members with access to year-end performance process |

| o | Training available to all team members at varying degrees |

| ● | Governance |

| o | Code of Conduct applies to all Genmab team members |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 7/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Consolidated Key Figures

(DKK million) |

|

|

|

|

|

|

|

|

|

Income Statement |

2020 |

|

2021 |

|

2022 |

|

2023 |

|

2024 |

Revenue |

10,088 |

|

8,417 |

|

14,505 |

|

16,474 |

|

21,526 |

Cost of product sales |

- |

|

- |

|

- |

|

(226) |

|

(985) |

Research and development expenses |

(3,137) |

|

(4,181) |

|

(5,562) |

|

(7,630) |

|

(9,748) |

Selling, general and administrative expenses |

(661) |

|

(1,283) |

|

(2,676) |

|

(3,297) |

|

(3,790) |

Acquisition and integration related charges |

- |

|

- |

|

- |

|

- |

|

(300) |

Total costs and operating expenses |

(3,798) |

|

(5,464) |

|

(8,238) |

|

(11,153) |

|

(14,823) |

Operating profit |

6,290 |

|

2,953 |

|

6,267 |

|

5,321 |

|

6,703 |

Net financial items |

(409) |

|

965 |

|

678 |

|

316 |

|

2,461 |

Net profit |

4,740 |

|

2,957 |

|

5,452 |

|

4,352 |

|

7,844 |

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

|

|

|

|

|

|

|

|

Total non-current assets |

2,352 |

|

1,891 |

|

1,901 |

|

2,150 |

|

17,957 |

Marketable securities |

8,819 |

|

10,381 |

|

12,431 |

|

13,268 |

|

11,243 |

Cash and cash equivalents |

7,260 |

|

8,957 |

|

9,893 |

|

14,867 |

|

9,858 |

Total assets |

21,105 |

|

24,538 |

|

30,119 |

|

35,289 |

|

45,811 |

Share capital |

66 |

|

66 |

|

66 |

|

66 |

|

66 |

Shareholders' equity |

19,083 |

|

22,107 |

|

27,282 |

|

31,610 |

|

36,697 |

|

|

|

|

|

|

|

|

|

|

Cash Flow Statement |

|

|

|

|

|

|

|

|

|

Cash flow from operating activities |

6,433 |

|

2,228 |

|

3,912 |

|

7,380 |

|

7,771 |

Cash flow from investing activities |

(2,351) |

|

(961) |

|

(2,761) |

|

(1,282) |

|

(9,907) |

Cash flow from financing activities |

71 |

|

(420) |

|

(789) |

|

(606) |

|

(3,919) |

Investments in intangible assets |

- |

|

- |

|

- |

|

(10) |

|

(117) |

Investments in tangible assets |

(307) |

|

(252) |

|

(317) |

|

(366) |

|

(187) |

|

|

|

|

|

|

|

|

|

|

Financial Ratios and Other Information |

|

|

|

|

|

|

|

|

|

Basic net profit per share |

72.72 |

|

45.22 |

|

83.38 |

|

66.64 |

|

122.21 |

Diluted net profit per share |

71.94 |

|

44.77 |

|

82.59 |

|

66.02 |

|

121.36 |

Year-end share market price |

2,463.00 |

|

2,630.00 |

|

2,941.00 |

|

2,155.00 |

|

1,492.50 |

Price / book value |

8.52 |

|

7.85 |

|

7.11 |

|

4.50 |

|

2.68 |

Shareholders' equity per share |

289.14 |

|

334.95 |

|

413.36 |

|

478.94 |

|

556.02 |

Equity ratio |

90% |

|

90% |

|

91% |

|

90% |

|

80% |

Shares outstanding |

65,545,748 |

|

65,718,456 |

|

65,961,573 |

|

66,074,535 |

|

66,187,186 |

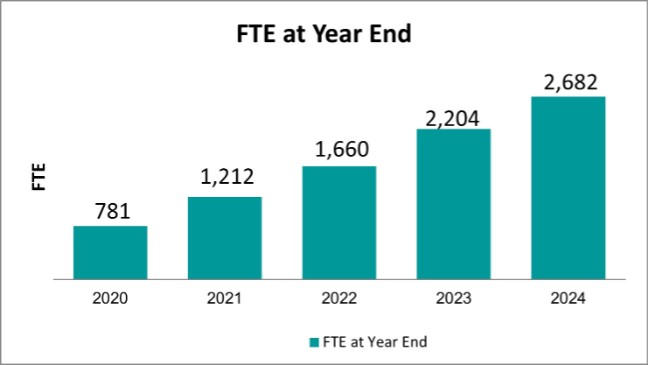

Average number of employees (FTE)* |

656 |

|

1,022 |

|

1,460 |

|

2,011 |

|

2,535 |

Number of employees (FTE) at year-end |

781 |

|

1,212 |

|

1,660 |

|

2,204 |

|

2,682 |

* Full-time equivalent (FTE) or team member

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 8/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 9/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

2025 Outlook

2025 Outlook is presented in USD as management has determined it is appropriate to change the functional currency of Genmab A/S and the presentation currency to USD effective January 1, 2025. Refer to note 5.8 for additional details regarding the change in functional and presentation currency.

(USD millions) |

2024 Actual Result |

2025 Guidance |

2025 Guidance Mid-Point |

2024 Growth % |

2025 Growth %* |

Revenue |

3,124 |

3,340 - 3,660 |

3,500 |

31% |

12% |

Royalties |

2,518 |

2,785 - 3,015 |

2,900 |

27% |

15% |

Net product sales/Collaboration revenue** |

316 |

415 - 460 |

438 |

199% |

39% |

Milestones/Reimbursement revenue |

290 |

140 - 185 |

162 |

-2% |

-44% |

Gross profit |

2,981 |

3,120 - 3,420 |

3,270 |

26% |

10% |

Operating expenses |

(2,008) |

(2,055) - (2,225) |

(2,140) |

27% |

7% |

Operating profit |

973 |

895 - 1,365 |

1,130 |

26% |

16% |

*Mid-point of guidance range

**Net product sales and collaboration revenue consists of EPKINLY net product sales in the U.S. and Japan, and Tivdak (Genmab's share of gross profits).

Revenue

Genmab expects its 2025 revenue to be in the range of USD 3.3 – 3.7 billion, compared to USD 3.1 billion in 2024.

Genmab’s projected revenue growth for 2025 is driven by higher royalties, net product sales and collaboration revenue. Royalty growth relates mainly to DARZALEX and Kesimpta net sales growth. Net product sales and collaboration revenue growth is driven by strong performance for both EPKINLY and Tivdak. Net product sales and collaboration revenue consists of EPKINLY net product sales in the U.S. and Japan, and Tivdak (50% gross profit share).

Genmab’s projected revenue for 2025 primarily consists of DARZALEX royalties of approximately USD 2.2 billion at the midpoint. Such royalties are based on estimated DARZALEX 2025 net sales of USD 12.6 – 13.4 billion compared to actual net sales in 2024 of USD 11.7 billion. DARZALEX royalties are partly offset by Genmab’s share of J&J’s royalty payments to Halozyme Therapeutics, Inc. (Halozyme) in connection with SC net sales as well as royalty reduction in countries and territories where there is no Genmab patent coverage.

The remainder of Genmab’s revenue consists of royalties from Kesimpta, TEPEZZA, RYBREVANT, TECVAYLI, TALVEY and TEPKINLY, net product sales and collaboration revenue from EPKINLY and Tivdak, reimbursement revenue and milestones.

Operating Expenses

Genmab anticipates its 2025 operating expenses to be in the range of USD 2.1 – 2.2 billion, compared to USD 2.0 billion in 2024. The increase in operating expenses is primarily related to investments in late-stage programs and launch readiness in key markets.

Operating Profit

Genmab expects its 2025 operating profit to be in the range of USD 0.9 – 1.4 billion, compared to USD ~1.0 billion.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 10/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Outlook: Risks and Assumptions

In addition to factors already mentioned, the estimates above are subject to change due to numerous reasons, including but not limited to: the achievement of certain milestones associated with Genmab’s collaboration agreements; the timing and variation of development activities (including activities carried out by Genmab’s collaboration partners) and related income and costs; DARZALEX, DARZALEX FASPRO, Kesimpta, TEPEZZA, RYBREVANT, TECVAYLI, TALVEY and TEPKINLY net sales and royalties paid to Genmab; changing rates of inflation; and currency exchange rates (the 2025 guidance assumes a USD / DKK exchange rate of 7.2). The financial guidance assumes that no significant new agreements are entered into during 2025 that could materially affect the results.

The factors discussed above, as well as other factors that are currently unforeseeable, may result in further material adverse impacts on Genmab’s business and financial performance, including unfavorable impacts on the sales of Tivdak and EPKINLY/TEPKINLY, and on the net sales of DARZALEX, Kesimpta, TEPEZZA, RYBREVANT, TECVAYLI, and TALVEY by Genmab’s collaboration partners and on Genmab’s royalties, collaboration revenue and milestone revenue therefrom.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 11/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Our Strategy | |||

Business Strategy |

Priorities in 2024 |

Priorities for 2025 |

Related Risk |

|

Build a profitable and successful biotech ●

Maintain a flexible and capital-efficient model

●

Maximize relationships with partners

●

Retain ownership of select products

|

Invest in our people and culture ●

Further scale organization aligned with

differentiated antibody product portfolio growth and future launches Become a leading integrated biotech innovation powerhouse ●

Use solid financial base to grow and broaden antibody product and technology portfolio

|

Focus investments to optimize and enable growth strategy |

Please refer to the risks included in this Annual Report. |

|

Focus on core competence ●

Identify the best disease targets

●

Develop unique first-in-class or best-in-class antibodies

●

Develop next-generation technologies

|

Build world-class differentiated pipeline ●

Acasunlimab (GEN1046/BNT311, DuoBody-PD-L1x4-1BB)

o

Initiate Phase 3 study (2L NSCLC)

●

GEN1042 (DuoBody-CD40x4-1BB)1

o

Phase 2 data and determine next steps

●

Expand and advance proprietary

product portfolio |

Expand our pipeline through organic and inorganic opportunities |

Please refer to the risks included in this Annual Report. |

|

Turn science into medicine ●

Create differentiated antibody therapeutics with significant commercial potential

|

Bring our own medicines to patients & expand our markets ●

EPKINLY2

o

Initiate three Phase 3 trials

o

Expand label to include relapsed/refractory FL

●

Tivdak3

o

Initiate Phase 3 study in head and neck

●

Execute successful launches and growth in key markets

|

Advance mid-to-late-stage pipeline assets: epcoritamab, Rina-S, acasunlimab |

Please refer to the risks included in this Annual Report. |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 12/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Sustainability Strategy |

Priorities in 2024 |

Priorities for 2025 |

Related Risk |

We are committed to embedding sustainability in our business operations with a focus on reducing our carbon footprint, upholding responsibility towards our people, patients and society while maintaining high standards of corporate governance |

●

Continue to grow our commitment to being a sustainable and responsible company

●

Ensure that policies and procedures are implemented in alignment with ESG-related reporting requirements, while continuing to monitor the regulatory landscape

●

Collaborate internally to integrate ESG into our strategic planning, business operations and risk management processes

●

Continue to develop and deliver treatments to improve lives of patients

●

Minimize our carbon footprint and map our Greenhouse Gas (GHG) emissions

●

Promote the Company’s efforts to attract, retain, motivate and recognize diverse, world-class talent

●

Invest in Diversity, Equity and Inclusion processes and efforts, which is critical to our future growth

|

General ●

Advance sustainability commitments by integrating action plans around material impacts, risks and opportunities into our business operations

●

Launch sustainability awareness training for all team members

Environmental ●

Focus on the continuous update and execution of action plans to achieve near and long-term emission reduction targets

Social ●

Continue to pursue science and innovation with the potential to improve patients’ lives through our medicines and facilitate access to these medicines

●

Continue efforts to promote employee well-being & vitality

●

Maintain training and skills development opportunities for all team members

●

Support our future business needs by attracting, retaining, developing, recognizing and motivating a diverse and talented team

Governance ●

Reasonably ensure compliance with regulatory reporting requirements in a transparent manner

●

Ensure strong governance by engaging key stakeholders, including the Board and its Committees, CSR & Sustainability Committee, senior leaders, employees and suppliers

|

Please refer to the risks included in this Annual Report. |

1. Co-development with BioNTech; 2. Co-development with AbbVie; 3. Co-development with Pfizer

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 13/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Who We Are

Our Core Values

In our quest to turn science into medicine, we use these guideposts to transform the future of cancer treatment:

| ● | Passion for innovation |

| ● | Determination — being the best at what we do |

| ● | Integrity — we do the right thing |

| ● | We work as one team and respect each other |

Genmab’s Growing Organization and Presence

| ● | Copenhagen, Denmark |

| o | Headquarters |

| o | Chemistry, Manufacturing and Controls (CMC) Operations |

| o | Development Operations |

| o | Quality Control (QC) Laboratory |

| o | Corporate Functions |

| ● | Utrecht, The Netherlands |

| o | Discovery and Antibody Research |

| o | Translational and Quantitative Sciences |

| o | Development Operations |

| o | Corporate Functions |

| ● | Princeton, U.S. |

| o | Translational and Quantitative Sciences |

| o | Development Operations |

| o | U.S. Market Operations |

| o | Corporate Functions |

| ● | Tokyo, Japan |

| o | Development Operations |

| o | Japan Market Operations |

| ● | Suzhou and Shanghai, China |

| o | Early-stage R&D |

| o | CMC Operations |

Our Key Accomplishments

Each of our achievements stands as evidence of our unyielding determination, including:

| ● | Two Genmab co-owned medicines on the market: Tivdak with Pfizer and EPKINLY/TEPKINLY with AbbVie |

| ● | Six additional medicines that were created by Genmab, or that leverage Genmab’s DuoBody technology, are being developed and marketed by global pharmaceutical and biotechnology companies |

| ● | Late-stage pipeline with high potential: EPKINLY, Rina-S and acasunlimab |

| ● | Suite of proprietary antibody technologies including bispecifics and ADC platform technologies fueling future innovations |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 14/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

| ● | Robust clinical and preclinical pipeline fueling future growth |

| ● | Over 45 Investigational New Drugs (IND) filed by Genmab and/or partners, based on Genmab’s innovations and technology, since 1999 |

| ● | Industry-leading team with antibody know-how, and expertise in R&D and commercial fields |

| ● | Partnerships with industry leaders and innovators across the innovation ecosystem of pharma, biotech and academia |

| ● | Partnership with ChatGPT to launch “AI Everywhere,” providing ChatGPT access to more than 2,000 colleagues |

| ● | Solid financial foundation enabling our evolution to a fully integrated biotech |

| ● | Building and expanding our capabilities with more than 2,700 team members across our international locations and through the acquisition of ProfoundBio in 2024 |

Business Model

At Genmab, we have built a profitable and successful biotech that creates value for our stakeholders.

Our Strengths and Differentiators

| ● | World-class antibody biology knowledge and insight into disease targets |

| ● | Discovery and development engine with proprietary technologies that allow us to build a differentiated pipeline |

| ● | In-house expertise with a solid track record of building successful strategic partnerships |

| ● | Pipeline of potential best-in-class and/or first-in-class therapies |

| ● | Experienced, diverse leadership team |

Building a Fully Integrated Biotech Innovation Powerhouse

| ● | Team: deeply driven One Genmab team rooted in science and inspired by patients |

| ● | Translational and precision medicine, data science and artificial intelligence (AI): key to accelerating development and ensuring the right therapies get to the right patients |

| ● | Collaboration: reaches across the innovation ecosystem of pharma, biotech and academia, and drives our business forward |

| ● | Strong financials: growing recurring revenues and prioritization and focused investments |

Research: track record of success and investing for tomorrow

Development: scaling up capabilities to expand from early- to late-stage development

Technical Operations and Commercialization: the next step in our evolution

Enabling functions: supporting growth and managing risk

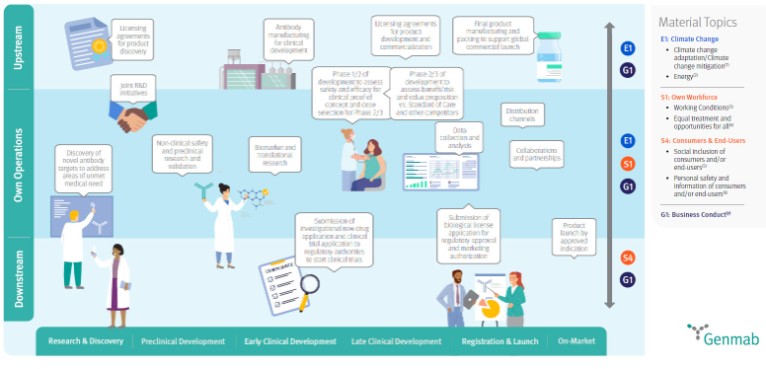

Value Chain

Genmab’s value chain is a comprehensive and integrated process that spans from early-stage R&D to the global commercialization of antibody-based therapies. Each step is designed to maximize innovation, ensure product quality, and optimize market reach, all while leveraging strategic partnerships to enhance efficiency and profitability.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 15/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Below is a breakdown of the key components as well as the key stakeholders relevant to each value chain component:

1. Research and Discovery

Target Identification: The first step in Genmab’s value chain involves identifying disease-related targets, particularly in oncology. This includes research into the biological mechanisms underlying diseases and identifying targets that can be addressed with antibody therapies.

Antibody Engineering: Genmab employs its proprietary technologies, such as DuoBody, HexaBody and its ADC platforms, to engineer and develop novel antibodies. These technologies allow for the creation of bispecific antibodies (capable of targeting two different antigens), enhanced antibody functionality and ADCs (antibodies with potent cytotoxic agents coupled to them).

2. Preclinical Development

Preclinical Development: Genmab conducts extensive preclinical testing to evaluate the efficacy, safety, and potential of these antibodies before advancing them to clinical trials.

3. Clinical Development

Clinical Trials: Genmab advances its antibody candidates through various phases of clinical trials (Phase 1, 2, and 3). This involves testing the candidates in human patients to assess safety, dosage, and efficacy.

Strategic Partnerships: During clinical development, Genmab may decide to partner with pharmaceutical or biotechnology companies to co-develop and co-fund the trials. These partnerships help mitigate risk and share the costs of development.

4. Manufacturing

Process Development: Genmab focuses on developing scalable and efficient manufacturing processes for its antibody products. Genmab does not currently own or operate large-scale manufacturing facilities but works closely with contract manufacturing organizations (CMOs) and partners to ensure high-quality production.

QC: Ensuring the consistency, safety, and quality of our products is a key part of the manufacturing process. Genmab implements strict quality control measures throughout production.

5. Registration and Launch

Regulatory Approval: Following successful clinical trials, Genmab seeks regulatory approval from authorities like the European Medicines Agency (EMA) (Europe), the U.S. FDA (U.S.) and MHLW (Japan), and other regulatory bodies. This step is crucial for bringing the investigational medicine to market.

6. Commercialization

Marketing and Sales: Once a product receives regulatory approval, Genmab, often through a variety of arrangements, markets and sells the approved medicine. This step includes establishing market strategies

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 16/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

including market access, engaging with payors, educating healthcare providers, and launching the product in various regions.

Distribution: Genmab collaborates with distribution networks, either through partners or on its own, to ensure the approved medicine reaches healthcare providers and patients in the approved jurisdictions.

Pharmacovigilance: After launch, Genmab monitors the product's performance in the market, collecting data on its safety and effectiveness in broader patient populations.

7. Partnerships and Alliances

Licensing: Genmab licenses its proprietary technologies (like the DuoBody and HexaBody platforms) to other biotech and pharmaceutical companies. This generates revenue through upfront payments, milestones, and royalties.

Business Development: Genmab’s Business Development team plays a crucial role in the value chain, particularly in bridging the gap between R&D and commercial success by identifying opportunities, helping form strategic alliances, and assisting in in-licensing and out-licensing business.

Co-Development: Genmab often enters into co-development agreements where the costs, risks, and profits are shared with partners. This collaboration is particularly important during clinical development and commercialization phases.

Strategic Alliances: Beyond traditional partnerships, Genmab engages in strategic alliances with research institutions and other biotech companies to access complementary technologies, expand its pipeline, and explore new therapeutic areas.

Refer to section SBM-2 in the sustainability statements for details of key stakeholders including a mapping to Genmab’s value chain.

Refer to the sustainability statements within this Annual Report for material topics identified as part of Genmab’s DMA. The visual maps the material topics to Genmab’s value chain. Refer to the Who We Are section for Genmab’s presence.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 17/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Research and Development Capabilities

Inspired by Nature

At Genmab, we are inspired by nature and understand how antibodies work. We are deeply knowledgeable about antibody biology and our scientists harness this expertise to create and develop differentiated investigational antibody medicines. We utilize a sophisticated and highly automated process to efficiently generate, select, produce, and evaluate antibody-based products. Our teams have established a fully integrated R&D enterprise and streamlined process to coordinate the activities of antibody product discovery, preclinical testing, manufacturing, clinical trial design and execution, and regulatory submissions across Genmab’s international operations. We have expanded our scientific focus to use data science and artificial intelligence to aid in the discovery of new targets and biomarkers and bolster our in-depth precision medicine and translational laboratory capabilities. Through our expertise in antibody drug development, we pioneer technologies that allow us to create differentiated and potentially first-in-class or best-in-class investigational medicines with the potential to improve patients’ lives. Our antibody expertise has enabled us to create our cutting-edge technology platforms: DuoBody, HexaBody, DuoHexaBody® and HexElect®. With our acquisition of ProfoundBio we gained novel ADC technology platforms. Additional information about our technologies is available on Genmab’s website, www.genmab.com/antibody-science/antibody-technology-platforms.

Sustainable and State-of-the-Art Facilities

The Netherlands

Genmab’s presence in the Netherlands is composed of three buildings in the Utrecht area: The Genmab Research and Development Center (GRDC) and the Accelerator at the Utrecht Science Park and a Genmab office in nearby Zeist. Discovery and preclinical research is conducted at our GRDC and Accelerator facilities, which house state-of-the-art laboratories, including a new chemistry lab that opened at the GRDC in 2024. The GRDC was one of the first Building Research Establishment Environmental Assessment Method (BREEAM) Excellent laboratory buildings in the Netherlands. The Accelerator, a multi-tenant ultra-modern R&D facility, was opened in 2023, enabling our continued R&D growth trajectory. These three spaces are located in close proximity to other life science companies and a premier research university. They accommodate modern auditoriums, and innovative brainstorming and meeting rooms. They provide a bright, open, and collaborative atmosphere and enable the Genmab team to continue to innovate and find new ways to help patients.

Denmark

Denmark, with its rich history of scientific achievement and innovation, has been our home for Genmab's headquarters for 25 years. We are surrounded by a vibrant ecosystem of talent, with multiple biotech and pharma peers, academia and research centers, knowledge, and resources. Genmab opened our new headquarters in Valby, Denmark in 2023, a space designed specifically for Genmab. In addition, Genmab introduced our own Good Manufacturing Practice (GMP) QC laboratory in 2023. The new space insources certain business-critical processes and capabilities for our early clinical development. With our growing pipeline and commercial ambitions, we are taking control of processes, prioritization, people, and timing and taking another tremendous step toward becoming an end-to-end biotech innovation powerhouse.

United States

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 18/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Genmab opened our new U.S. facility in 2020. This space, modeled on the open and collaborative spirit of the R&D labs and offices in Utrecht and Zeist, includes both offices and laboratories. The U.S. precision medicine laboratories allow Genmab to expand our clinical and preclinical drug development expertise and are part of the strategic growth of the Company. As with our Utrecht facilities, our U.S. office and laboratories were designed and built with sustainability in mind and meet the requirements for Leadership in Energy and Environmental Design (LEED) Gold certification for sustainable design features.

Japan

Genmab’s Japan office is located in Roppongi, an international business district in the center of Tokyo. It offers an open and collaborative environment that fosters Genmab’s culture of innovation and teamwork.

China

As part of our acquisition of ProfoundBio, Genmab expanded our presence to our newest locations with state-of-the-art research and CMC capabilities in Suzhou, China.

As Genmab continues to grow our geographical footprint, we will endeavor to do so with minimal impact to the environment and with a focus on sustainable practices.

Bringing Our Own Innovative Medicines to Patients

We are creating lasting impact as we bring our medicines to more patients around the world.

We are making continuous progress in our ambition to become a fully-integrated, end-to-end biotech, which includes advancing the development of our fully owned medicines and delivering them to patients around the world.

Building on our legacy of innovation and our patient-first approach, we have successfully launched two therapies through partnerships. This year, we expanded the reach of these medicines to additional geographies and patient populations while also progressing the development of wholly-owned, late-stage investigational products.

Expanding the Potential of Bispecifics in Lymphoma

In June 2024, the U.S. FDA approved a second indication for EPKINLY (epcoritamab-bysp), specifically for the treatment of adults with relapsed or refractory FL after two or more lines of systemic therapy. With this approval, EPKINLY became the first and only T-cell engaging bispecific antibody administered subcutaneously approved in the U.S. to treat this patient population.

Subsequently in August 2024, epcoritamab, under the brand name TEPKINLY, became the first subcutaneous bispecific antibody approved as a monotherapy in the EU to treat relapsed or refractory FL after two or more lines of systemic therapy.

Additionally in September 2024, the U.S. FDA granted a second breakthrough therapy designation for EPKINLY in relapsed or refractory FL when administered in combination with rituximab and lenalidomide.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 19/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

In Japan, a supplemental J-NDA was submitted to the MHLW for EPKINLY for the treatment of patients with third line plus relapsed or refractory FL grade 1-3A.

Follicular lymphoma is the second most common form of non-Hodgkin’s lymphoma (NHL). It is considered incurable, and historically, patients may relapse or face a shortened duration of response with prior standards of care.

Since 2023, EPKINLY has received regulatory approvals in more than 50 countries. It was the first bispecific approved in the world with a dual indication in third line plus relapsed or refractory DLBCL and third line plus relapsed or refractory FL. In the U.S., it continues to be the only bispecific with this dual indication. In Japan, it remains the first and only T-cell engaging bispecific antibody administered subcutaneously approved for the treatment of adults with relapsed or refractory large B-cell lymphoma (LBCL) or grade 3B FL. EPKINLY/TEPKINLY is developed and commercialized in partnership with AbbVie.

Driving Progress in Cervical Cancer Care

Advanced cervical cancer remains a disease with high medical need. In the U.S., up to 16% of cervical cancer cases are diagnosed at the metastatic stage, and up to 61% of earlier-stage diagnoses progress to metastatic disease. Globally, cervical cancer is the fourth most common cause of cancer death in women.

In April 2024, the U.S. FDA approved the supplemental Biologics License Application (sBLA) granting approval for Tivdak (tisotumab vedotin-tftv), which we market in the U.S. in partnership with Pfizer. This U.S. FDA action converted the September 2021 accelerated approval of Tivdak to a full approval. Tivdak remains the first and only approved ADC for the treatment of patients with recurrent or metastatic cervical cancer in the U.S.

In Japan, the incidence and mortality rates for cervical cancer have been increasing, attributable in part to low vaccination rates for the human papillomavirus (HPV) (<5%) and regular checkups (40%). In April 2024, a J-NDA was submitted to the MHLW for Tivdak for the treatment of advanced or recurrent cervical cancer with disease progression after chemotherapy. Currently, patients whose disease progresses or recurs following initial treatment face limited options. If approved, Tivdak could provide renewed hope to the cervical cancer community.

Creating Community with CeMe™

The CeMe™ campaign in the U.S., created in partnership with Pfizer, builds community and a sense of belonging among those impacted by cervical cancer.

“After the treatment, I didn’t know what to do next,” said Anna Ogo. “That’s about when I found a community of women who had experienced cervical cancer like me, and they helped me tremendously. With their support, I began to find confidence in sharing my story.”

www.youtube.com/cemestories

Ensuring Rapid and Sustainable Access to Medicines

We are focused in our pursuit to turn innovative science into medicines that create value and deliver meaningful impact to patients and health systems.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 20/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Ultimately, we positively impact the lives of people with cancer when our science becomes medicine, our medicine creates value, and the value of our medicine is realized by patients who can benefit. Patient access and affordability are key components of this.

Our Approach to Value, Access, and Pricing

| ● | Value: The value of our medicines is driven by our innovative science. |

| ● | Access: Patient impact happens when our medicines reach the people who need them and help them live better. |

| ● | Pricing: The price of our medicines reflects the innovation behind our science, its impact on patients, and our commitment to bringing that science to patients. |

We aim to ensure that the price of our medicines allows patients, regardless of their socioeconomic or insurance status, to have timely access while considering the transformational potential of our science, its benefit to healthcare systems and society, and our ability to invest in the breakthrough science of the future.

At the same time, together with our partners, we work with local country regulatory and payer authorities in the U.S., Japan, and throughout Europe to facilitate registration and reimbursement to help enable patient access to our medicines around the world.

We recognize that true patient impact happens when our medicines reach the patients who need them. In the U.S., MyNavCare™ Patient Support by Genmab was created to offer support services to patients prescribed Genmab medicines to help them navigate each step of their unique treatment journey

MyNavCare

MyNavCare offers a range of resources and services, from financial assistance to ongoing support, to help patients access the Genmab medication they need.

Part of this can include ongoing support from Patient Engagement Liaisons – such as Ann Fodrey. During a hurricane in 2024, one of the patients Ann supports was impacted by the storm and the roof of his home was heavily damaged. Fodrey provided consistent support, checking in to make sure the patient, a retired military veteran, was able to safely get to his treatment and also connected him with a veteran’s organization that was able to install a temporary roof on his house.

“Every day we do small things like this. It doesn’t have to be pointing them to an organization that can provide the support they need. It could be connecting them with a peer-to-peer resource, so they have somebody that’s going through a similar experience – listening to them,” Fodrey said. “And that’s just as important.”

www.mynavcare.com

Antibody Discovery and Development

We are experts in antibody discovery and development. Our appreciation for, and understanding of, the power of the human immune system gives us a unique perspective on how to respond to the constant challenges of oncology drug development. We entered a new chapter in Genmab’s evolution with the commercialization and launch of our first medicine, Tivdak, co-owned with Pfizer, in 2021, and we successfully launched our second medicine, EPKINLY/TEPKINLY, in 2023 under our collaboration with

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 21/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

AbbVie. As part of our transformation to a fully integrated biotech, at the end of 2024, we also had two wholly owned programs in Phase 3 development, Rina-S and acasunlimab.

Products and Technologies

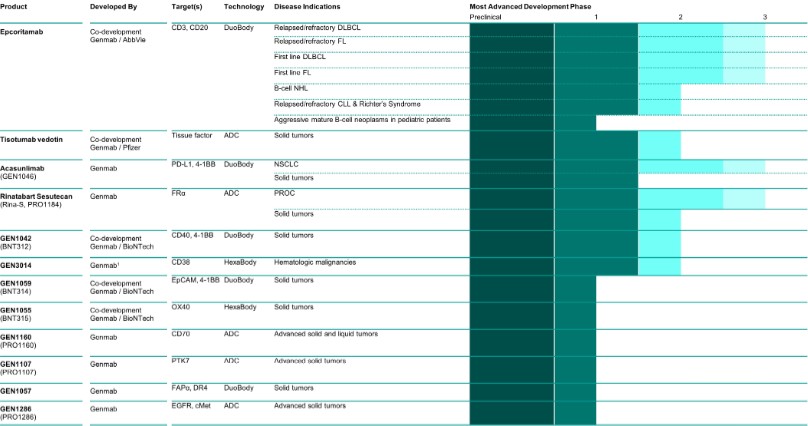

Pipeline

At the end of 2024, Genmab’s proprietary pipeline of investigational medicines, where we are responsible for at least 50% of development, consisted of twelve antibody products in clinical development. These include Genmab’s approved medicines, Tivdak, developed and commercialized together with Pfizer, and EPKINLY/TEPKINLY, developed and commercialized together with AbbVie. In addition to our own pipeline, there are multiple investigational medicines in development by global pharmaceutical and biotechnology companies, including six approved medicines powered by Genmab’s technology and innovations. Beyond the investigational medicines in clinical development, our pipeline includes multiple preclinical programs. An overview of the development status of our approved medicines and of each of our investigational medicines is provided in the following sections. Detailed descriptions of dosing and efficacy and safety data from certain clinical trials have been disclosed in company announcements and media releases published via the Nasdaq Copenhagen stock exchange and may also be found in Genmab’s filings with the U.S. Securities and Exchange Commission (SEC). Additional information is available on Genmab’s website, www.genmab.com. The information accessible through our website is not part of and is not incorporated by reference herein.

Genmab’s Proprietary1 Products

Approved Medicines

Approved Product |

Target |

Developed By |

Disease Indication(s)2 |

|

EPKINLY (epcoritamab-bysp, epcoritamab) TEPKINLY (epcoritamab) |

CD3xCD20 |

Co-development Genmab/AbbVie |

Approved in multiple territories including the U.S. and Europe for adult patients with relapsed or refractory DLBCL after two or more lines of systemic therapy and in Japan for adult patients with certain types of relapsed or refractory LBCL after two or more lines of systemic therapy |

|

|

|

Approved in multiple territories including the U.S. and Europe for adult patients with relapsed or refractory FL after two or more lines of systemic therapy |

|

Tivdak (tisotumab vedotin-tftv) |

TF |

Co-development Genmab/Pfizer |

Approved in the U.S. for adult patients with recurrent/metastatic cervical cancer with disease progression on or after chemotherapy |

1Approved and investigational medicines where Genmab has ≥50% ownership, in co-development with partners as indicated.

2Refer to local country prescribing information for precise indication and safety information.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 22/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Pipeline, Including Further Development for Approved Medicines

1Genmab is developing HexaBody-CD38 in an exclusive worldwide license and option agreement with J&J.

CLL = chronic lymphocytic leukemia

In 2024, Genmab discontinued the GEN1047 (DuoBody-CD3xB7H4), GEN3017 (DuoBody-CD3xCD30) and GEN1056 (with BioNTech, BNT322) programs following a strategic re-evaluation of Genmab’s portfolio. For similar reasons, Genmab and BioNTech took the decision to discontinue the clinical development of GEN1053 (HexaBody-CD27, BNT313) including the Phase 1/2 clinical trial (NCT05435339) in solid tumors.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 23/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

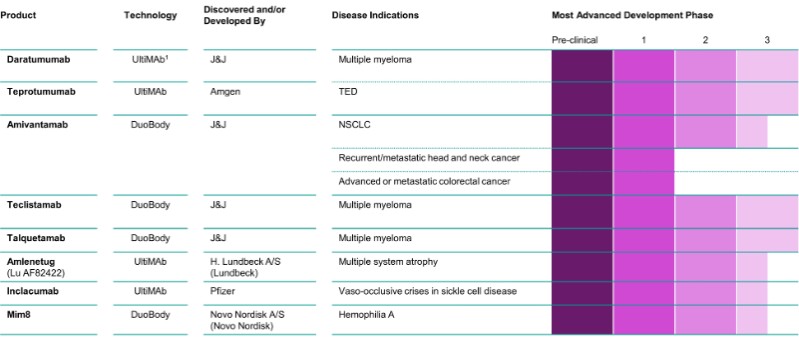

Programs Incorporating Genmab’s Innovation and Technology1

Approved Medicines

Approved Product |

Discovered and/or Developed & Marketed By |

Disease Indication(s)2 |

|

DARZALEX (daratumumab)/DARZALEX FASPRO (daratumumab and hyaluronidase-fihj) |

J&J (Royalties to Genmab on net global sales) |

Multiple myeloma |

Light-chain (AL) Amyloidosis |

||

|

Kesimpta (ofatumumab) |

Novartis (Royalties to Genmab on net global sales) |

Relapsing multiple sclerosis (RMS) |

|

TEPEZZA (teprotumumab-trbw) |

Amgen (under sublicense from Roche, royalties to Genmab on net global sales) |

TED |

|

RYBREVANT (amivantamab/amivantamab-vmjw) |

J&J (Royalties to Genmab on net global sales) |

NSCLC |

|

TECVAYLI (teclistamab/teclistamab-cqyv) |

J&J (Royalties to Genmab on net global sales) |

Relapsed and refractory multiple myeloma |

|

TALVEY (talquetamab/talquetamab-tgvs) |

J&J (Royalties to Genmab on net global sales) |

Relapsed and refractory multiple myeloma |

1Approved and investigational medicines created by Genmab or created by collaboration partners leveraging Genmab’s DuoBody technology platform, under development, and where relevant, commercialized by a third party.

2See local prescribing information for precise indication and safety information.

Pipeline, Including Further Development for Approved Medicines, ≥Phase 2 Development

1UltiMab transgenic mouse technology licensed from Medarex, Inc. (Medarex), a wholly owned subsidiary of Bristol-Myers Squibb.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 24/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

Genmab’s Proprietary Pipeline

Programs where Genmab has ≥50% ownership.

EPKINLY/TEPKINLY (epcoritamab)

First and only bispecific antibody approved in the U.S. and Europe to treat both relapsed or refractory FL and DLBCL after two or more lines of systemic therapy

| ● | SC bispecific antibody targeting CD3 and CD20 created using Genmab’s DuoBody technology platform |

| ● | Epcoritamab (approved as EPKINLY and TEPKINLY) has received regulatory approvals in multiple territories including in the U.S. and Europe for adult patients with relapsed or refractory DLBCL after two or more lines of systemic therapy, and in Japan for adult patients with certain types of relapsed or refractory LBCL after two or more lines of systemic therapy |

| ● | EPKINLY/TEPKINLY have also been approved in the U.S. and Europe for the treatment of adults with relapsed or refractory FL after two or more lines of systemic therapy. Regulatory submission for epcoritamab for this indication is currently under review in Japan |

| ● | Multiple clinical trials are ongoing across different settings and histologies, including five Phase 3 trials, with more trials in planning |

| ● | Co-developed and co-commercialized in collaboration with AbbVie |

Epcoritamab is a proprietary bispecific antibody created using Genmab’s DuoBody technology platform. Epcoritamab targets CD3, which is expressed on T-cells, and CD20, a clinically validated target on malignant B-cells. Genmab used technology licensed from Medarex to generate the CD20 antibody forming part of epcoritamab. Epcoritamab is marketed as EPKINLY in the U.S., Japan, and other regions, and as TEPKINLY in Europe and other regions. See local prescribing information for specific indications and safety information. In 2020, Genmab entered into a collaboration agreement with AbbVie to jointly develop and commercialize epcoritamab. The companies share commercialization responsibilities in the U.S. and Japan, with AbbVie responsible for further global commercialization. Genmab records sales in the U.S. and Japan and receives tiered royalties between 22% and 26% on remaining global sales outside of these territories, subject to certain royalty reductions. The companies have a broad clinical development program for epcoritamab including five ongoing Phase 3 trials and additional trials in planning. Please refer to Note 5.6 of the financial statements for further details regarding the epcoritamab collaboration with AbbVie. Please consult the U.S. Prescribing Information for EPKINLY and the European Summary of Product Characteristics for TEPKINLY for the labeled indication and safety information.

FOURTH QUARTER UPDATE

| ● | December: Multiple presentations at the 66th American Society of Hematology (ASH) Annual Meeting, including four oral presentations. Data from the EPCORE® CLL-1 trial of epcoritamab monotherapy in patients with relapsed or refractory CLL was selected for presentation during the prestigious ASH Annual Meeting Press Program. |

UPDATES FROM FIRST QUARTER TO THIRD QUARTER

| ● | September: The U.S. FDA granted a Breakthrough Therapy Designation (BTD) for epcoritamab in combination with rituximab and lenalidomide for the treatment of adult patients with relapsed or refractory FL after at least one line of systemic therapy. This is the second BTD granted for epcoritamab. |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 25/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

| ● | August: The European Commission (EC) granted conditional marketing authorization for TEPKINLY (epcoritamab) as a monotherapy for the treatment of adult patients with relapsed or refractory FL after two or more lines of systemic therapy. The conditional marketing authorization was supported by data from the FL cohort of the EPCORE NHL-1 trial (NCT03625037). |

| ● | June: The U.S. FDA approved EPKINLY (epcoritamab-bysp) for the treatment of adult patients with relapsed or refractory FL after two or more lines of systemic therapy. The approval was supported by data from the FL cohort of the EPCORE NHL-1 trial. |

| ● | June: The EMA’s Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion recommending the granting of conditional marketing authorization of epcoritamab for the treatment of adult patients with relapsed or refractory FL after two or more lines of systemic therapy. |

| ● | June: Multiple data presentations were featured at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting including two rapid oral presentations. These presentations included data from the pivotal and cycle 1 dose optimization FL cohorts of the EPCORE NHL-1 clinical trial, which was subsequently selected for presentation at the Best of ASCO conference. |

| ● | June: Multiple data presentations were featured at the 2024 European Hematology Association (EHA) Congress including three oral presentations. |

| ● | June: Data published in The Lancet Haematology, “Epcoritamab monotherapy in patients with relapsed or refractory follicular lymphoma (EPCORE NHL-1): a phase 2 cohort of a single-arm, multicentre study.” |

| ● | May: Epcoritamab monotherapy was added to the National Comprehensive Cancer Network® (NCCN®) Clinical Practice Guidelines in Oncology (NCCN Guidelines®) for “B-cell Lymphomas” (Version 2.2024) for third-line and subsequent therapy for patients with FL as a Category 2A, preferred regimen. |

| ● | March: Genmab submitted a supplemental J-NDA to the MHLW in Japan for SC epcoritamab for the treatment of relapsed or refractory FL after two or more lines of systemic therapy. The application was supported by data from the FL cohort of the EPCORE NHL-1 trial and the EPCORE NHL-3 (NCT04542824) trial. |

| ● | February: The U.S. FDA granted Priority Review for the sBLA for epcoritamab-bysp for the treatment of adult patients with relapsed or refractory FL after two or more lines of systemic therapy. The submission was supported by data from the FL cohort of the EPCORE NHL-1 trial. |

| ● | February: A new Phase 3 clinical trial was initiated, evaluating the safety and efficacy of SC epcoritamab in combination with rituximab and lenalidomide compared to chemoimmunotherapy in previously untreated FL (EPCORE FL-2, NCT06191744). |

| ● | February: Multiple data presentations, including oral presentations, at the 21st Annual Meeting of the Japanese Society of Medical Oncology (JSMO). |

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 26/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

ONGOING CLINICAL TRIALS

R-CHOP = rituximab-cyclophosphamide, hydroxydaunorubicin, vincristine, prednisone; ASCT = autologous stem cell transplant; R2 = rituximab, lenalidomide

About Diffuse Large B-cell Lymphoma

DLBCL is the most common type of B-cell NHL worldwide, accounting for approximately 25%-30% of all NHL cases.1,2 In the U.S. there are approximately 25,000 new cases of DLBCL diagnosed each year. 3 DLBCL can arise in lymph nodes as well as in organs outside of the lymphatic system, occurs more commonly in the elderly and is slightly more prevalent in men.4,5 DLBCL is a fast-growing type of NHL, a cancer that develops in the lymphatic system and affects B-cell lymphocytes, a type of white blood cell. For many people living with DLBCL, their cancer either relapses, which means it may return after treatment, or becomes refractory, meaning it does not respond to treatment. Although new therapies have become available, treatment management can remain a challenge.6,7

1. Lymphoma Research Foundation. Diffuse Large B-Cell Lymphoma. Accessed November 22, 2024. https://lymphoma.org/understanding-lymphoma/aboutlymphoma/nhl/dlbcl/

2. Padala, et al. Diffuse Large B-Cell Lymphoma. StatPearls [Internet]. Treasure Island (FL): StatPearls Publishing; 2024 Jan. 2023 Apr 24.

3. Leukemia and Lymphoma Society. Diffuse Large B-Cell Lymphoma (DLBCL). Accessed November 22, 2024. https://www.lls.org/research/diffuse-large-b-cell-lymphoma-dlbcl

4. Sehn LH, Salles G. N Engl J Med. 2021;384:842-858.

5. Kanas G, Ge W, Quek RGW, et al. Leukemia & Lymphoma. 2022;63(1):54-63.

6. Sehn LH, Salles G. N Engl J Med. 2021;384:842-858.

7. Crump M, Neelapu SS, Farooq U, et al. Blood. 2017;130(16):1800-1808.

About Follicular Lymphoma

FL is typically an indolent (or slow-growing) form of NHL that arises from B-lymphocytes and is the second most common form of NHL accounting for 20-30% of all cases.1 About 15,000 people develop FL each year in the U.S.2 and it is considered incurable with current standard of care therapies.3 Patients often relapse and, with each relapse the remission and time to next treatment is shorter.4 Over time, transformation to DLBCL,

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 27/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

an aggressive form of NHL associated with poor survival outcomes, can occur in more than 25% of FL patients.5

1. Lymphoma Research Foundation official website. https://lymphoma.org/aboutlymphoma/nhl/fl/. Accessed November 22, 2024.

2. Leukemia & Lymphoma Society. https://www.lls.org/research/follicular-lymphoma-fl. Accessed November 22, 2024.

3. Ghione P, Palomba ML, Ghesquieres H, et al. Treatment patterns and outcomes in relapsed/refractory follicular lymphoma: results from the international SCHOLAR-5 study. Haematologica. 2023;108(3):822-832. doi: 10.3324/haematol.2022.281421.

4. Rivas-Delgado A, Magnano L, Moreno-Velázquez M, et al. Response duration and survival shorten after each relapse in patients with follicular lymphoma treated in the rituximab era. Br J Haematol. 2018;184(5):753-759. doi:10.1111/bjh.15708.

5. Al-Tourah AJ, Gill KK, Chhanabhai M, et al. Population-based analysis of incidence and outcome of transformed non-Hodgkin's lymphoma. J Clin Oncol. 2008 Nov 10;26(32):5165-9. doi: 10.1200/JCO.2008.16.0283. Epub 2008 Oct 6. PMID: 18838711.

Tivdak (tisotumab vedotin-tftv)

First and Only U.S. FDA Approved ADC for Recurrent or Metastatic Cervical Cancer

| ● | An ADC directed to TF, a protein highly prevalent on solid tumors, including cervical cancer, which is associated with poor prognosis |

| ● | Full approval granted by the U.S. FDA for tisotumab vedotin-tftv, marketed as Tivdak, for the treatment of patients with recurrent or metastatic cervical cancer with disease progression on or after chemotherapy; Tivdak is the first ADC with demonstrated overall survival data to be granted full U.S. FDA approval in this patient population |

| ● | Regulatory submissions for tisotumab vedotin for the treatment of recurrent or metastatic cervical cancer are currently under review in both Japan and Europe |

| ● | Co-developed globally and co-promoted in the U.S. in collaboration with Pfizer |

Tisotumab vedotin is an ADC composed of Genmab’s human monoclonal antibody directed to TF and Pfizer’s ADC technology that utilizes a protease-cleavable linker that covalently attaches the microtubule-disrupting agent monomethyl auristatin E to the antibody. Genmab used technology licensed from Medarex to generate the TF antibody forming part of tisotumab vedotin. Tisotumab vedotin-tftv, marketed as Tivdak, is the first and only U.S. FDA approved ADC for the treatment of adult patients with recurrent or metastatic cervical cancer with disease progression on or after chemotherapy. Tisotumab vedotin is being co-developed by Genmab and Pfizer. Under a joint commercialization agreement, Genmab is co-promoting Tivdak in the U.S. and will lead commercial operational activities in Japan once approved. Pfizer is leading commercial operational activities in the U.S. and will lead commercial operational activities in China once approved. In the U.S. market there will be a 50:50 profit split. Effective January 1, 2025, Genmab and Pfizer agreed to amend the License and Collaboration Agreement and the Joint Commercialization Agreement for Tivdak, assigning Genmab sole responsibility for the development and commercialization of Tivdak for second line plus recurrent or metastatic cervical cancer in Europe and all other regions globally, excluding the United States and the China region. Genmab will record sales for Europe, Japan and rest of world markets (excluding the United States and the China region), once commercialized, and will provide royalties to Pfizer on net sales in the low teens. The companies have joint decision-making power on the worldwide development and commercialization strategy for Tivdak. Please refer to Note 5.6 of the financial statements for further details regarding the tisotumab vedotin collaboration with Pfizer. Please consult the U.S. Prescribing Information for Tivdak for the labeled indication and safety information, including the boxed warning.

|

|

|

Genmab A/S |

Tel: +45 7020 2728 |

Company Announcement no. 03 |

Carl Jacobsens Vej 30 |

|

Page 28/252 |

2500 Valby, Denmark |

www.genmab.com |

CVR no. 2102 3884 |

GENMAB 2024 ANNUAL REPORT |

|

FOURTH QUARTER UPDATE

| ● | December: The U.S. NCCN updated its Clinical Practice Guidelines in Oncology for Cervical Cancer with tisotumab vedotin-tftv changing from a category 2A to a category 1. Tisotumab vedotin-tftv plus pembrolizumab was also added as an option for PD-L1 positive tumors. |

| ● | October: Upon strategic evaluation we have decided to discontinue preparation for a Phase 3 study in second/third line squamous cell carcinoma of the head and neck. |

UPDATES FROM FIRST QUARTER TO THIRD QUARTER

| ● | July: Data from innovaTV 301 clinical trial (NCT04697628) published in New England Journal of Medicine, Tisotumab Vedotin as Second- or Third-Line Therapy for Recurrent Cervical Cancer. |

| ● | June: Two data presentations were featured at the 2024 ASCO Annual Meeting including a rapid oral presentation of data from the Phase 2 innovaTV 207 (NCT03485209) trial, evaluating tisotumab vedotin in pretreated patients with relapsed/metastatic head and neck squamous cell carcinoma. |

| ● | April: Genmab submitted a J-NDA to the MHLW in Japan for Tivdak for the treatment of adult patients with advanced or recurrent cervical cancer that has progressed on or after chemotherapy. |