UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 0-29889

Rigel Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

|

94-3248524 |

(State or other jurisdiction of incorporation or |

|

(I.R.S. Employer Identification No.) |

organization) |

|

|

|

|

|

|

|

|

611 Gateway Boulevard, Suite 900, |

|

|

South San Francisco, CA |

|

94080 |

(Address of principal executive offices) |

|

(Zip Code) |

(650) 624-1100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

|

Trading Symbol |

|

Name of each exchange on which registered: |

Common Stock, par value $0.001 per share |

|

RIGL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer ☐ |

|

|

|

Accelerated filer ☒ |

Non-accelerated filer ☐ |

|

|

|

Smaller reporting company ☐ |

Emerging Growth Company ☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 2, 2024, there were 175,406,146 shares of the registrant’s Common Stock outstanding.

RIGEL PHARMACEUTICALS, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

INDEX

|

|

|

Page |

|

3 |

||

|

3 |

||

|

Condensed Balance Sheets — March 31, 2024 (Unaudited) and December 31, 2023 |

|

3 |

|

Condensed Statements of Operations (Unaudited) — three months ended March 31, 2024 and 2023 |

|

4 |

|

Condensed Statements of Comprehensive Loss (Unaudited) — three months ended March 31, 2024 and 2023 |

|

5 |

|

|

6 |

|

|

Condensed Statements of Cash Flows (Unaudited) — three months ended March 31, 2024 and 2023 |

|

7 |

|

|

8 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

24 |

|

|

45 |

||

|

45 |

||

|

45 |

||

|

45 |

||

|

46 |

||

|

94 |

||

|

94 |

||

|

94 |

||

|

95 |

||

|

96 |

||

|

|

|

|

|

97 |

2

PART I. FINANCIAL INFORMATION

Item 1.Financial Statements

RIGEL PHARMACEUTICALS, INC.

CONDENSED BALANCE SHEETS

(In thousands)

|

|

As of |

||||

|

|

March 31, 2024 |

|

December 31, 2023 (1) |

||

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

25,574 |

|

$ |

32,786 |

Short-term investments |

|

|

23,976 |

|

|

24,147 |

Accounts receivable, net |

|

|

27,512 |

|

|

30,550 |

Inventories |

|

|

6,579 |

|

|

5,522 |

Prepaid and other current assets |

|

|

8,845 |

|

|

6,261 |

Total current assets |

|

|

92,486 |

|

|

99,266 |

Property and equipment, net |

|

|

140 |

|

|

165 |

Intangible assets, net |

|

|

28,863 |

|

|

13,878 |

Operating lease right-of-use assets |

|

|

712 |

|

|

861 |

Other assets |

|

|

4,318 |

|

|

3,055 |

Total assets |

|

$ |

126,519 |

|

$ |

117,225 |

Liabilities and stockholders’ deficit |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

9,276 |

|

$ |

7,142 |

Accrued compensation |

|

|

5,246 |

|

|

8,676 |

Accrued research and development |

|

|

4,127 |

|

|

3,513 |

Acquisition-related liabilities |

|

|

15,222 |

|

|

— |

Revenue reserves and refund liability |

|

|

16,045 |

|

|

15,684 |

Loans payable, net, current portion |

|

|

14,780 |

|

|

7,229 |

Other accrued liabilities |

|

|

5,435 |

|

|

5,334 |

Deferred revenue |

|

|

1,355 |

|

|

1,355 |

Lease liabilities, current portion |

|

|

709 |

|

|

692 |

Other long-term liabilities, current portion |

|

|

1,003 |

|

|

3,642 |

Total current liabilities |

|

|

73,198 |

|

|

53,267 |

Long-term portion of lease liabilities |

|

|

100 |

|

|

285 |

Long-term portion of loans payable, net |

|

|

44,910 |

|

|

52,373 |

Other long-term liabilities |

|

|

39,982 |

|

|

39,944 |

Total liabilities |

|

|

158,190 |

|

|

145,869 |

|

|

|

|

|

|

|

Commitments |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

— |

Common stock |

|

|

175 |

|

|

175 |

Additional paid-in capital |

|

|

1,383,956 |

|

|

1,378,723 |

Accumulated other comprehensive (loss) income |

|

|

(5) |

|

|

8 |

Accumulated deficit |

|

|

(1,415,797) |

|

|

(1,407,550) |

Total stockholders’ deficit |

|

|

(31,671) |

|

|

(28,644) |

Total liabilities and stockholders’ deficit |

|

$ |

126,519 |

|

$ |

117,225 |

| (1) | The balance sheet as of December 31, 2023 has been derived from the audited financial statements included in Rigel’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (SEC) on March 5, 2024. |

See Accompanying Notes to Condensed Financial Statements

3

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(unaudited)

|

|

Three Months Ended March 31, |

||||

|

|

2024 |

|

2023 |

||

Revenues: |

|

|

|

|

|

|

Product sales, net |

|

$ |

26,003 |

|

$ |

23,745 |

Contract revenues from collaborations |

|

|

3,531 |

|

|

2,325 |

Total revenues |

|

|

29,534 |

|

|

26,070 |

Costs and expenses: |

|

|

|

|

|

|

Cost of product sales |

|

|

2,025 |

|

|

977 |

Research and development |

|

|

6,026 |

|

|

10,089 |

Selling, general and administrative |

|

|

28,449 |

|

|

27,729 |

Total costs and expenses |

|

|

36,500 |

|

|

38,795 |

Loss from operations |

|

|

(6,966) |

|

|

(12,725) |

Interest income |

|

|

593 |

|

|

393 |

Interest expense |

|

|

(1,874) |

|

|

(1,204) |

Net loss |

|

$ |

(8,247) |

|

$ |

(13,536) |

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.05) |

|

$ |

(0.08) |

Weighted average shares used in computing net loss per share, basic and diluted |

|

|

175,203 |

|

|

173,568 |

See Accompanying Notes to Condensed Financial Statements

4

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

(unaudited)

|

|

Three Months Ended March 31, |

||||

|

|

2024 |

|

2023 |

||

Net loss |

|

$ |

(8,247) |

|

$ |

(13,536) |

Other comprehensive (loss) gain: |

|

|

|

|

|

|

Net unrealized (loss) gain on short-term investments |

|

|

(13) |

|

|

126 |

Comprehensive loss |

|

$ |

(8,260) |

|

$ |

(13,410) |

See Accompanying Notes to Condensed Financial Statements

5

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF STOCKHOLDERS’ DEFICIT

(In thousands, except share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

Accumulated Other |

|

|

|

|

Total |

|||

|

|

Common Stock |

|

Paid-in |

|

Comprehensive |

|

Accumulated |

|

Stockholders’ |

|||||||

|

|

Shares |

|

Amount |

|

Capital |

|

Income (Loss) |

|

Deficit |

|

Deficit |

|||||

Balance as of January 1, 2024 |

|

174,825,610 |

|

$ |

175 |

|

$ |

1,378,723 |

|

$ |

8 |

|

$ |

(1,407,550) |

|

$ |

(28,644) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(8,247) |

|

|

(8,247) |

Net change in unrealized loss on short-term investments |

|

— |

|

|

— |

|

|

— |

|

|

(13) |

|

|

— |

|

|

(13) |

Issuance of common stock upon exercise of options |

|

90,544 |

|

|

— |

|

|

89 |

|

|

— |

|

|

— |

|

|

89 |

Issuance of common stock upon vesting of restricted stock units (RSUs) |

|

489,992 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Stock-based compensation expense |

|

— |

|

|

— |

|

|

5,144 |

|

|

— |

|

|

— |

|

|

5,144 |

Balance as of March 31, 2024 |

|

175,406,146 |

|

$ |

175 |

|

$ |

1,383,956 |

|

$ |

(5) |

|

$ |

(1,415,797) |

|

$ |

(31,671) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

Accumulated Other |

|

|

|

|

Total |

|||

|

|

Common Stock |

|

Paid-in |

|

Comprehensive |

|

Accumulated |

|

Stockholders’ |

|||||||

|

|

Shares |

|

Amount |

|

Capital |

|

(Loss) |

|

Deficit |

|

Deficit |

|||||

Balance as of January 1, 2023 |

|

173,398,645 |

|

$ |

174 |

|

$ |

1,368,822 |

|

$ |

(153) |

|

$ |

(1,382,459) |

|

$ |

(13,616) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(13,536) |

|

|

(13,536) |

Net change in unrealized gain on short-term investments |

|

— |

|

|

— |

|

|

— |

|

|

126 |

|

|

— |

|

|

126 |

Issuance of common stock upon exercise of options |

|

952 |

|

|

— |

|

|

1 |

|

|

— |

|

|

— |

|

|

1 |

Issuance of common stock upon vesting of RSUs |

|

266,256 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Stock-based compensation expense |

|

— |

|

|

— |

|

|

2,768 |

|

|

— |

|

|

— |

|

|

2,768 |

Balance as of March 31, 2023 |

|

173,665,853 |

|

$ |

174 |

|

$ |

1,371,591 |

|

$ |

(27) |

|

$ |

(1,395,995) |

|

$ |

(24,257) |

See Accompanying Notes to Condensed Financial Statements

6

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

(unaudited)

|

|

Three Months Ended March 31, |

||||

|

|

2024 |

|

2023 |

||

Operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(8,247) |

|

$ |

(13,536) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Stock-based compensation expense |

|

|

5,134 |

|

|

2,758 |

Loss on sale and disposal of fixed assets |

|

|

— |

|

|

347 |

Depreciation and amortization |

|

|

400 |

|

|

357 |

Net amortization of discount on short-term investments and term loan |

|

|

(205) |

|

|

(68) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

3,038 |

|

|

10,954 |

Inventories |

|

|

(2,310) |

|

|

(1,949) |

Prepaid and other current assets |

|

|

(2,584) |

|

|

392 |

Other assets |

|

|

— |

|

|

98 |

Right-of-use assets |

|

|

149 |

|

|

807 |

Accounts payable |

|

|

2,134 |

|

|

(1,213) |

Accrued compensation |

|

|

(3,430) |

|

|

(3,205) |

Accrued research and development |

|

|

614 |

|

|

(768) |

Revenue reserves and refund liability |

|

|

361 |

|

|

1,943 |

Other accrued liabilities |

|

|

101 |

|

|

(1,389) |

Lease liability |

|

|

(168) |

|

|

(854) |

Other current and long-term liabilities |

|

|

— |

|

|

1,252 |

Net cash used in operating activities |

|

|

(5,013) |

|

|

(4,074) |

Investing activities |

|

|

|

|

|

|

Maturities of short-term investments |

|

|

8,250 |

|

|

15,650 |

Purchases of short-term investments |

|

|

(7,799) |

|

|

— |

Payments for acquisition of intangible assets |

|

|

(138) |

|

|

(15,000) |

Proceeds from sale of property and equipment |

|

|

— |

|

|

127 |

Net cash provided by investing activities |

|

|

313 |

|

|

777 |

Financing activities |

|

|

|

|

|

|

Net proceeds from term loan financing |

|

|

— |

|

|

19,950 |

Net proceeds from issuances of common stock upon exercise of options |

|

|

89 |

|

|

1 |

Cost share payments to a collaboration partner |

|

|

(2,601) |

|

|

(828) |

Net cash (used in) provided by financing activities |

|

|

(2,512) |

|

|

19,123 |

Net (decrease) increase in cash and cash equivalents |

|

|

(7,212) |

|

|

15,826 |

Cash and cash equivalents at beginning of period |

|

|

32,786 |

|

|

24,459 |

Cash and cash equivalents at end of period |

|

$ |

25,574 |

|

$ |

40,285 |

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

Interest paid |

|

$ |

1,684 |

|

$ |

1,011 |

Intangible assets included within acquisition-related liabilities |

|

$ |

15,222 |

|

$ |

— |

See Accompanying Notes to Condensed Financial Statements

7

Rigel Pharmaceuticals, Inc.

Notes to Condensed Financial Statements

(unaudited)

In this report, “Rigel,” “we,” “us” and “our” refer to Rigel Pharmaceuticals, Inc.

1. |

Organization and Summary of Significant Accounting Policies |

Description of Business

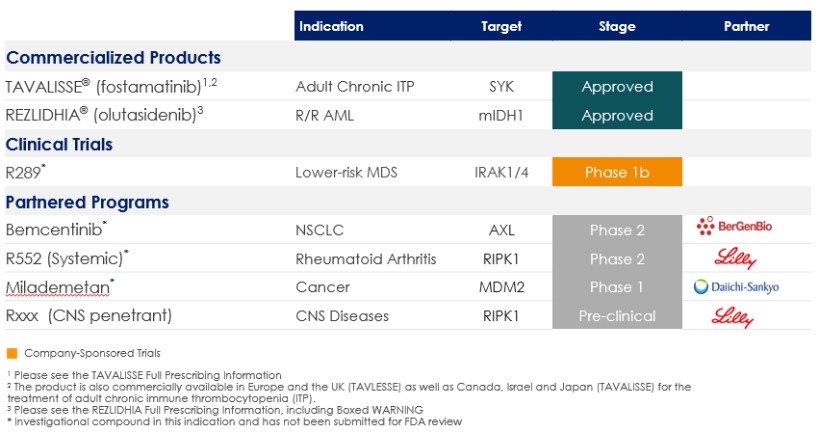

We are a biotechnology company dedicated to developing and providing novel therapies that significantly improve the lives of patients with hematologic disorders and cancer. We focus on products that address signaling pathways that are critical to disease mechanisms.

Our first product approved by the US Food and Drug Administration (FDA) is TAVALISSE® (fostamatinib disodium hexahydrate) tablets, the only approved oral spleen tyrosine kinase (SYK) inhibitor for the treatment of adult patients with chronic immune thrombocytopenia (ITP) who have had an insufficient response to a previous treatment. The product is also commercially available in Europe and the United Kingdom (UK) (as TAVLESSE), and in Canada, Israel and Japan (as TAVALISSE) for the treatment of chronic ITP in adult patients.

Our second FDA-approved product is REZLIDHIA® (olutasidenib) capsules for the treatment of adult patients with relapsed or refractory (R/R) acute myeloid leukemia (AML) with a susceptible isocitrate dehydrogenase-1 (IDH1) mutation as detected by an FDA-approved test. We began our commercialization of REZLIDHIA in December 2022. We in-licensed olutasidenib from Forma Therapeutics, Inc., now Novo Nordisk (Forma), with exclusive, worldwide rights for its development, manufacturing and commercialization.

In February 2024, we entered into an Asset Purchase Agreement with Blueprint Medicines Corporation (Blueprint) to purchase certain assets comprising the right to research, develop, manufacture and commercialize GAVRETO® (pralsetinib) in the US. GAVRETO (pralsetinib) is a once daily, small molecule, oral, kinase inhibitor of wild-type rearranged during transfection (RET) and oncogenic RET fusions. GAVRETO is approved by the FDA for the treatment of adult patients with metastatic RET fusion-positive non-small cell lung cancer (NSCLC) as detected by an FDA-approved test. GAVRETO is also approved under accelerated approval based on overall response rate and duration response rate, for the treatment of adult and pediatric patients 12 years of age and older with advanced or metastatic RET fusion-positive thyroid cancer who require systemic therapy and who are radioactive iodine-refractory (if radioactive iodine is appropriate). We intend to distribute and market GAVRETO for approved indications in RET fusion-positive NSCLC and advanced thyroid cancers, and we expect to complete the transition of the asset and start recognizing product sales in July of 2024.

We continue to advance the development of our interleukin receptor-associated kinases 1 and 4 (IRAK1/4) inhibitor program, in an open-label, Phase 1b trial to determine the tolerability and preliminary efficacy of the drug in patients with lower-risk myelodysplastic syndrome (MDS) who are refractory or resistant to prior therapies.

We have strategic development collaborations with the University of Texas MD Anderson Cancer Center (MDACC) to expand our evaluation of REZLIDHIA (olutasidenib) in AML and other hematologic cancers, and with Collaborative Network for Neuro-Oncology Clinical Trials (CONNECT) to conduct a Phase 2 clinical trial to evaluate REZLIDHIA (olutasidenib) in combination with temozolomide in patients with high-grade glioma (HGG) harboring an IDH1 mutation.

We have a receptor-interacting serine/threonine-protein kinase 1 (RIPK1) inhibitor program in clinical development with our partner Eli Lilly and Company (Lilly). We also have product candidates in clinical development with partners BerGenBio ASA (BerGenBio) and Daiichi Sankyo (Daiichi).

Basis of Presentation

Our accompanying unaudited condensed financial statements have been prepared in accordance with United States generally accepted accounting principles (US GAAP), for interim financial information and pursuant to the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities Act of 1933, as amended (Securities Act).

8

Accordingly, they do not include all the information and notes required by US GAAP for complete financial statements. These unaudited condensed financial statements include only normal and recurring adjustments that we believe are necessary to fairly state our financial position and the results of our operations and cash flows. Interim-period results are not necessarily indicative of results of operations or cash flows for a full-year or any subsequent interim period. The balance sheet as of December 31, 2023 has been derived from audited financial statements at that date but does not include all disclosures required by US GAAP for complete financial statements. Because certain disclosures required by US GAAP for complete financial statements are not included herein, these interim unaudited condensed financial statements and the notes accompanying them should be read in conjunction with our audited financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2023.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results could differ from these estimates.

Significant Accounting Policies

Our significant accounting policies are described in “Note 1 – Description of Business and Summary of Significant Accounting Policies” to our “Notes to Financial Statements” contained in Part II, Item 8, “Financial Statements and Supplementary Data” of our Annual Report on Form 10-K for the year ended December 31, 2023. There have been no material changes to these accounting policies except for the accounting consideration related to the Asset Purchase Agreement with Blueprint as discussed in “Note 5 – In-licensing and Acquisition.”

Liquidity

As of March 31, 2024, we had approximately $49.6 million in cash, cash equivalents and short-term investments. Since inception, we have financed our operations primarily through sales of equity securities, debt financing, contract payments under our collaboration agreements and from product sales.

Based on our current operating plan, we believe that our existing cash, cash equivalents, and short-term investments will be sufficient to fund our expenses and capital expenditure requirements for at least the next 12 months from the date of issuance of this Form 10-Q.

Recently Issued Accounting Standards

In November 2023, FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. This update expands public entities’ segment disclosures, among others, requiring disclosure of significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit or loss; an amount and description of its composition for other segment items; and interim disclosures of a reportable segment’s profit or loss and assets. All disclosure requirements under this update are also required for public entities with a single reportable segment. This update is effective for our Annual Report on Form 10-K for the fiscal year ending December 31, 2024, and interim periods thereafter. Early adoption is permitted. The update should be applied retrospectively to all periods presented in the financial statements. We are currently evaluating the impact of adopting this update on our financial statements and disclosures.

In December 2023, FASB issued ASU 2023-09, Improvements to Income Tax Disclosures, which enhance the annual disclosure requirements regarding the tax rate reconciliation and incomes taxes paid information. This update is effective for our fiscal year ending December 31, 2025, and maybe adopted on a prospective or retrospective basis. Early adoption is permitted. We are currently assessing the impact of adopting this guidance but does not expect to have a significant impact to our financial statements and disclosures.

Other recently issued accounting guidance not discussed in this Quarterly Report on Form 10-Q are either not applicable or did not have, or are not expected to have, a material impact on us.

9

2. |

Net Loss Per Share |

Basic net loss per share is computed by dividing net loss by the weighted-average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted-average number of shares of common stock outstanding during the period and the number of additional shares of common stock that would have been outstanding if potentially dilutive securities had been issued. Potentially dilutive securities include stock options, RSUs and shares issuable under our Employee Stock Purchase Plan (Purchase Plan). The dilutive effect of these potentially dilutive securities is reflected in diluted earnings per share using the treasury stock method. Under the treasury stock method, an increase in the fair market value of our common stock can result in a greater dilutive effect from potentially dilutive securities.

The potential shares of common stock that were excluded from the computation of diluted net loss per share for the periods presented because including them would have been antidilutive are as follows (in thousands):

|

|

Three Months Ended March 31, |

||||

|

|

2024 |

|

2023 |

||

Outstanding stock options |

|

|

37,135 |

|

|

35,909 |

RSUs |

|

|

4,072 |

|

|

1,988 |

Purchase Plan |

|

|

246 |

|

|

345 |

Total |

|

|

41,453 |

|

|

38,242 |

3. |

Revenues |

Revenues disaggregated by category were as follows (in thousands):

|

|

Three Months Ended March 31, |

||||

|

|

2024 |

|

2023 |

||

Product sales: |

|

|

|

|

|

|

Gross product sales |

|

$ |

38,426 |

|

$ |

33,198 |

Discounts and allowances |

|

|

(12,423) |

|

|

(9,453) |

Total product sales, net |

|

|

26,003 |

|

|

23,745 |

Revenues from collaborations: |

|

|

|

|

|

|

Delivery of drug supplies, royalty and others |

|

|

3,531 |

|

|

2,325 |

Total revenues from collaborations |

|

|

3,531 |

|

|

2,325 |

Total revenues |

|

$ |

29,534 |

|

$ |

26,070 |

Revenue from product sales are related to sales of our commercial products, TAVALISSE and REZLIDHIA, to our specialty distributors. For detailed discussions of our revenues from collaborations, see “Note 4 – Sponsored Research, License Agreements and Government Contracts.”

Our net product sales include gross product sales, net of chargebacks, discounts and fees, government and other rebates and returns. Of the total discounts and allowances from gross product sales for the three months ended March 31, 2024 and 2023, $12.3 million and $9.2 million, respectively, was accounted for as additions to revenue reserves and refund liability, and $0.1 million and $0.3 million, respectively, as reductions in accounts receivable (as it relates to allowance for prompt pay discount) and prepaid and other current assets (as it relates to certain chargebacks and other fees that were prepaid) in the condensed balance sheet. The following tables summarize the activities in chargebacks, discounts and fees, government and other rebates and returns that were accounted for within revenue reserves and refund liability, for each of the periods presented (in thousands):

|

|

Chargebacks, |

|

Government |

|

|

|

|

||||

|

|

Discounts and |

|

and Other |

|

|

|

|

||||

|

|

Fees |

|

Rebates |

|

Returns |

|

Total |

||||

Balance as of January 1, 2024 |

|

$ |

8,236 |

|

$ |

3,517 |

|

$ |

3,931 |

|

$ |

15,684 |

Provision related to current period sales |

|

|

9,763 |

|

|

2,280 |

|

|

224 |

|

|

12,267 |

Credit or payments made during the period |

|

|

(10,255) |

|

|

(1,609) |

|

|

(42) |

|

|

(11,906) |

Balance as of March 31, 2024 |

|

$ |

7,744 |

|

$ |

4,188 |

|

$ |

4,113 |

|

$ |

16,045 |

10

|

|

Chargebacks, |

|

Government |

|

|

|

|

|

|

||

|

|

Discounts and |

|

and Other |

|

|

|

|

|

|

||

|

|

Fees |

|

Rebates |

|

Returns |

|

Total |

||||

Balance as of January 1, 2023 |

|

$ |

6,213 |

|

$ |

2,636 |

|

$ |

3,296 |

|

$ |

12,145 |

Provision related to current period sales |

|

|

7,231 |

|

|

1,795 |

|

|

197 |

|

|

9,223 |

Credit or payments made during the period |

|

|

(5,777) |

|

|

(1,422) |

|

|

(81) |

|

|

(7,280) |

Balance as of March 31, 2023 |

|

$ |

7,667 |

|

$ |

3,009 |

|

$ |

3,412 |

|

$ |

14,088 |

The following table summarizes the percentages of revenues from each of our customers who individually accounted for 10% or more of the total net product sales and revenues from collaborations:

|

|

Three Months Ended March 31, |

||||

|

|

2024 |

|

2023 |

||

McKesson Specialty Care Distribution Corporation |

|

|

42% |

|

|

45% |

Cardinal Healthcare |

|

|

23% |

|

|

24% |

Cencora Inc. (formerly ASD Healthcare) |

|

|

23% |

|

|

22% |

4. |

Sponsored Research, License Agreements and Government Contracts |

Sponsored Research and License Agreements

We conduct research and development programs independently and in connection with our corporate collaborators. As of March 31, 2024, we are a party to collaboration agreements with Lilly to develop and commercialize R552, a RIPK1 inhibitor, for the treatment of non-central nervous system (non-CNS) diseases and collaboration aimed at developing additional RIPK1 inhibitors for the treatment of central nervous system (CNS) diseases; with Grifols S.A. (Grifols) to commercialize fostamatinib for human diseases in all indications in Grifols territory which includes Europe, the UK, Turkey, the Middle East, North Africa and Russia (including Commonwealth of Independent States); with Kissei Pharmaceutical Co., Ltd. (Kissei) to develop and commercialize fostamatinib in Kissei territory which includes Japan, China, Taiwan and the Republic of Korea; with Medison Pharma Trading AG (Medison Canada) and Medison Pharma Ltd. (Medison Israel and, together with Medison Canada, Medison) to commercialize fostamatinib in all indications, in Medison territory which includes Canada and Israel; and with Knight Therapeutics International SA (Knight) to commercialize fostamatinib in all indications, in Knight territory which includes Latin America, consisting of Mexico, Central and South America, and the Caribbean (Knight territory).

Further, we are also a party to collaboration agreements, but do not have ongoing performance obligations with BerGenBio for the development and commercialization of AXL receptor tyrosine kinase (AXL) inhibitors in oncology, and with Daiichi to pursue research related to murine double minute 2 (MDM2) inhibitors, a novel class of drug targets called ligases.

Under the above existing agreements that we entered into in the ordinary course of business, we received or may be entitled to receive upfront cash payments, payments contingent upon specified events achieved by such partners and royalties on any net sales of products sold by such partners under the agreements. As of March 31, 2024, total future contingent payments to us under all of the above existing agreements, excluding terminated agreements, could exceed $1.3 billion if all potential product candidates achieved all of the payment triggering events under all of our current agreements. Of this amount, $279.5 million relates to the achievement of development events, $263.1 million relates to the achievement of regulatory events and $796.0 million relates to the achievement of certain commercial events. This estimated future contingent amount does not include any estimated royalties that could be due to us if the partners successfully commercialize any of the licensed products. Future events that may trigger payments to us under the agreements are based solely on our partners’ future efforts and achievements of specified development, regulatory and/or commercial events.

We account for the milestone payments when such milestones are considered probable of being achieved, and estimate the amount to be included in the transaction price using the most likely amount method. If it is probable that a significant revenue reversal would not occur, the associated milestone value is included in the transaction price. Milestone payments that are not within our or the licensee’s control, such as regulatory approvals, are not considered probable of being achieved until uncertainty associated with the approvals has been resolved.

11

The transaction price is then allocated to each performance obligation, on a relative standalone selling price basis, for which we recognize revenue as or when the performance obligations under the contract are satisfied. At the end of each subsequent reporting period, we re-evaluate the probability of achieving such milestones and any related constraint, and if necessary, adjust our estimate of the overall transaction price. Any such adjustments are recorded on a cumulative catch-up basis, and recorded as part of contract revenues from collaborations during the period of adjustment.

Global Exclusive License Agreement with Lilly

We have a global exclusive license agreement and strategic collaboration with Lilly (Lilly Agreement) entered in February 2021, which became effective on March 27, 2021, upon clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, to develop and commercialize R552 for the treatment of non-CNS diseases. In addition, the collaboration is aimed at developing additional RIPK1 inhibitors for the treatment of CNS diseases. Pursuant to the terms of the Lilly Agreement, we granted Lilly the exclusive rights to develop and commercialize R552 and related RIPK1 inhibitors in all indications worldwide. The parties’ collaboration is governed through a joint governance committee and appropriate subcommittees.

Under the terms of the Lilly Agreement, we were entitled to receive a non-refundable and non-creditable upfront cash payment amounting to $125.0 million, which we received in April 2021. We are also entitled to additional milestone payments for non-CNS disease products consisting of up to $330.0 million in milestone payments upon the achievement of specified development, regulatory and commercial milestones, and up to $100.0 million in sales milestone payments on a product-by-product basis. In addition, depending on the extent of our co-funding of R552 development activities, we would be entitled to receive tiered royalty payments on net sales of non-CNS disease products at percentages ranging from the mid-single digits to high-teens, subject to certain standard reductions and offsets. We are also eligible to receive milestone payments for CNS disease products consisting of up to $255.0 million in milestone payments upon the achievement of specified development, regulatory and commercial milestones, and up to $150.0 million in sales milestone payments on a product-by-product basis. We would be entitled to receive tiered royalty payments on net sales of CNS disease products up to low-double digits, subject to certain standard reductions and offsets.

Under the Lilly Agreement, we are responsible for performing and funding initial discovery and identification of CNS disease development candidates. Following candidate selection, Lilly will be responsible for performing and funding all future development and commercialization of the CNS disease development candidates. We are responsible for 20% of development costs for R552 in the US, Europe, and Japan, up to a specified cap, and Lilly is responsible for funding the remainder of all development activities for R552 and other non-CNS disease development candidates. Pursuant to the terms of the Lilly Agreement, we have the right to opt-out of co-funding the R552 development activities in the US, Europe and Japan at two different specified times and as a result receive lesser royalties from sales. Prior to us providing our first opt-out notice as discussed below, under the Lilly Agreement, we were required to fund our share of the R552 development activities up to a maximum funding commitment of $65.0 million through April 1, 2024.

On September 28, 2023, we entered into an amendment to the Lilly Agreement which provides, among others that if we exercise our first opt-out right, we have the right to opt-in to the co-funding of R552 development, upon us providing notice to Lilly within 30 days of certain events as specified in the Lilly Agreement, and as a result receive greater royalties from sales. Following the amendment to the Lilly Agreement, on September 29, 2023, we provided the first opt-out notice to Lilly. We continued to fund our share of the R552 development activities up to $22.6 million through April 1, 2024 as provided for in the amended Lilly Agreement. If we decide to exercise our opt-in right, we will be required to continue to share in global development costs, and if we later exercise our second opt-out right (no later than April 1, 2025), our share in global development costs will be up to a specified cap through December 31, 2025, as provided for in the Lilly Agreement.

We accounted for this agreement under ASC 606 and identified the following distinct performance obligations at inception of the agreement: (a) granting of the license rights over the non-CNS penetrant intellectual property (IP), and (b) granting of the license rights over the CNS penetrant IP which will be delivered to Lilly upon completion of the additional research and development efforts specified in the agreement. We concluded that each of these performance obligations is distinct. We based our assessment on the assumption that Lilly can benefit from each of the licenses on its own by developing and commercializing the underlying product using its own resources.

12

At the inception of the Lilly Agreement, given our rights to opt-out from the development of R552, we believed at the minimum, we had a commitment to fund the development costs up to $65.0 million as discussed above. We considered this commitment to fund the development costs as a significant financing component of the contract, which we accounted for as a reduction of the upfront fee to derive the transaction price. This financing component was recorded as a liability at its net present value of approximately $57.9 million using a 6.4% discount rate. Interest expense is accreted on such liability over the expected commitment period, adjusted for timing of expected cost share payments. No interest was accreted during the three months ended March 31, 2024 and 2023. Through March 31, 2024, Lilly billed us $20.3 million for our share of development costs incurred as of the fourth quarter of 2023, and the amount was fully paid as of March 31, 2024. As of March 31, 2024 and December 31, 2023, the outstanding liability to Lilly was $41.0 million and $43.6 million, respectively, and included within other long-term liabilities, current portion, and other long-term liabilities in the condensed balance sheet. As discussed above, following the amendment to the Lilly Agreement, and us providing the first opt-out notice to Lilly, our cumulative share of the R552 development cost is now capped at $22.6 million through April 1, 2024. Although our cumulative share of the development cost is now at the specified cap that is less than our outstanding recorded liability at the balance sheet date, such excess amount has not been recognized as revenue because we cannot conclude that it is probable that a significant reversal of the amount of revenue, if recognized, will not occur until the likelihood of us exercising our opt-in right becomes remote, or when the opt-in right period lapses.

At the inception, we allocated the net transaction price of $67.1 million to each performance obligation based on our best estimate of its relative standalone selling price using the adjusted market assessment approach. The transaction price allocated to the non-CNS penetrant IP of $60.4 million was recognized as revenue upon delivery of the non-CNS penetrant IP to Lilly during the first quarter of 2021. The transaction price allocated to the CNS penetrant IP of $6.7 million was recognized as revenue from the effective date of the Lilly Agreement through the eventual acceptance by Lilly using the input method, since we were required to perform additional research and development efforts before the final acceptance of the license by Lilly. In June 2022, Lilly provided notice of continuance pursuant to the terms of the Lilly Agreement, whereby Lilly elected its option to lead the identification and selection of CNS penetrant lead candidate. As such, we recognized the remaining outstanding deferred revenue in the second quarter of 2022. There was no outstanding deferred revenue related to Lilly Agreement as of March 31, 2024 and December 31, 2023.

Grifols License Agreement

We have an exclusive commercialization license agreement with Grifols entered in January 2019 with exclusive rights to commercialize fostamatinib for human diseases, and non-exclusive rights to develop fostamatinib in Grifols territory. Under the agreement, we received an upfront payment of $30.0 million, with the potential for $297.5 million in total regulatory and commercial milestones. We are also entitled to receive stepped double-digit royalty payments based on tiered net sales which may reach 30% of net sales. The agreement also required us to continue to conduct our long-term open-label extension study on patients with ITP through European Medicines Agency (EMA) approval of ITP in Europe or until the study ends as well as conduct the Phase 3 trial of fostamatinib in autoimmune hemolytic anemia (AIHA).

In January 2020, the European Commission (EC) granted a centralized Marketing Authorization (MA) for fostamatinib valid throughout the European Union (EU) and in the UK after the departure of the UK from the EU for the treatment of chronic ITP in adult patients who are refractory to other treatments. With this approval, in February 2020, we received $20.0 million non-refundable payment, composed of a $17.5 million payment due upon Marketing Authorization Application (MAA) approval by the EMA of fostamatinib for the first indication and a $2.5 million creditable advance royalty payment, based on the terms of our collaboration agreement with Grifols. The above milestone payment was allocated to the distinct performance obligations in the collaboration agreement with Grifols.

We accounted for this agreement under ASC 606 and identified the following distinct performance obligations at inception of the agreement: (a) granting of the license, (b) performance of research and regulatory services related to our long-term open-label extension study on patients with ITP, and (c) performance of research services related to our Phase 3 study in AIHA. We allocated the transaction price to the distinct performance obligations in our collaboration agreement based on our best estimate of the relative standalone selling price, and recognized the corresponding revenue in the periods we satisfied the performance obligations. No outstanding deferred revenue related to Grifols license agreement as of March 31, 2024 and December 31, 2023.

13

We entered into a Commercial Supply Agreement with Grifols in October 2020 to supply and sell our drug product priced at a certain markup specified in the agreement, in quantities Grifols order from us pursuant to and in accordance with the agreement. Prior to the Commercial Supply Agreement, we had a Drug Product Purchase Agreement with Grifols entered in December 2019. For the three months ended March 31, 2024 and 2023, no revenue and $1.6 million of revenue, respectively, was recognized related to delivery of drug supply to Grifols.

We recognize royalty revenue from Grifols included within contract revenues from collaboration. For the three months ended March 31, 2024 and 2023, we recognized royalty revenue of $1.1 million and $0.7 million, respectively.

Kissei License Agreement

We have an exclusive license and supply agreement with Kissei entered in October 2018, to develop and commercialize fostamatinib in all current and potential indications in Kissei’s territory. Kissei is responsible for performing and funding all development activities for fostamatinib in the above-mentioned territories. We received an upfront cash payment of $33.0 million, with the potential for up to an additional $147.0 million in development, regulatory and commercial milestone payments, and will receive mid- to upper twenty percent, tiered, escalated net sales-based payments for the supply of fostamatinib. Under the agreement, we granted Kissei the license rights to fostamatinib in Kissei’s territory and are obligated to supply Kissei with drug product for use in clinical trials and pre-commercialization activities. We are also responsible for the manufacture and supply of fostamatinib for all future development and commercialization activities under the agreement.

We accounted for this agreement under ASC 606 and identified the following distinct performance obligations at inception of the agreement: (a) granting of the license, (b) supply of fostamatinib for clinical use and (c) material right associated with discounted fostamatinib that is supplied for use other than clinical or commercial. In addition, we will provide commercial product supply if the product is approved in the licensed territory. We concluded that each of these performance obligations is distinct. We determined that the upfront fee of $33.0 million represented the transaction price and was allocated to the performance obligations based on our best estimate of the relative standalone selling price and recognized the corresponding revenue in the period we satisfied the performance obligations. As of March 31, 2024 and December 31, 2023, the remaining deferred revenue was related to the material right associated with discounted fostamatinib supply which amounted to $1.4 million. No revenue was recognized during the three months ended March 31, 2024 and 2023 associated with the remaining performance obligation.

For the three months ended March 31, 2024 and 2023, $2.3 million of revenue, and no revenue, respectively, was recognized related to the delivery of fostamatinib supply to Kissei mainly for commercial use.

In April 2022, Kissei announced that an NDA was submitted to Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) for fostamatinib in chronic ITP. With this milestone event, we received $5.0 million non-refundable and non-creditable payment from Kissei pursuant to the terms of our collaboration agreement, and such amount was recognized as revenue in the second quarter of 2022. In December 2022, Kissei announced that Japan’s PMDA approved the NDA for fostamatinib in chronic ITP. With this milestone event, we were entitled to receive $20.0 million non-refundable and non-creditable payment from Kissei pursuant to the terms of our collaboration agreement, which we recognized as revenue in the fourth quarter of 2022. The amount was subsequently collected in January 2023.

Medison Commercial and License Agreements

We have two exclusive commercial and license agreements with Medison entered in October 2019 for the commercialization of fostamatinib for chronic ITP in Medison territory, pursuant to which, we received a $5.0 million upfront payment with respect to the agreement in Canada. We accounted for this agreement under ASC 606 and identified the following combined performance obligations at inception of the agreement: (a) granting of the license and (b) obtaining regulatory approval in Canada of fostamatinib in ITP. However, under the agreement, we have the option to buy back all rights to the product in Canada within six months from obtaining regulatory approval for the treatment of AIHA in Canada. We determined that the non-refundable upfront fee represented the transaction price, however, due to the buyback provision, we accounted this upfront payment as financing arrangement under ASC 606. In 2022, management concluded that the likelihood of exercising the buyback option right was remote considering the top-line results from our Phase 3 trial of fostamatinib in warm auto immune hemolytic anemian (wAIHA) which showed that the trial did not demonstrate statistical significance in the primary efficacy endpoint, and the guidance received from the FDA. As such, in accordance with ASC 606, we relieved the outstanding financing liability which includes the upfront payment and accreted interest, and recognized such amount as revenue in 2022. There was no outstanding deferred revenue related to Medison license agreement as of March 31, 2024 and December 31, 2023.

14

For the three months ended March 31, 2024, we recognized $0.1 million of revenue from Medison related to the delivery of drug supplies and royalty revenue. For the three months ended March 31, 2023, we recognized $0.1 million of revenue related to the delivery of drug supplies.

Knight Commercial License and Supply Agreement

We have commercial license and supply agreements with Knight entered in May 2022 for the commercialization of fostamatinib for approved indications in Knight territory. Pursuant to such commercial license agreement, we received a $2.0 million one-time, non-refundable, and non-creditable upfront payment, with potential for up to an additional $20.0 million in regulatory and sales-based commercial milestone payments, and will receive twenty- to mid-thirty percent, tiered, escalated net-sales based royalty payments for products sold in the Knight territory. We accounted for this agreement under ASC 606 and identified that the upfront payment was a consideration for granting Knight the license to commercialize fostamatinib for approved indication in the Knight territory, and no further material deliverables associated to such upfront payment. As such, we recognized the upfront payment as revenue during the second quarter of 2022. We are also responsible for the exclusive manufacture and supply of fostamatinib for all future development and commercialization activities under the agreement.

Government Contracts

US Department of Defense (DOD)

In January 2021, we were awarded up to $16.5 million by the DOD to support our ongoing Phase 3 clinical trial to evaluate the safety and efficacy of fostamatinib for the treatment of hospitalized high-risk patients with COVID-19. No revenue was recognized during the three months ended March 31, 2024 and 2023. Through March 31, 2024, we received $16.0 million of the award.

Biomedical Advanced Research and Development (BARDA)

In August 2023, we were awarded up to $0.8 million by BARDA, part of the Office of the Assistant Secretary for the Preparedness and Response at the US Department of Health and Human Services (DHHS), for our evaluation of fostamatinib in mitigating the impact of long-term respiratory distress. No revenue was recognized during the three months ended March 31, 2024 and 2023. Through March 31, 2024, we received $0.1 million of the award.

Strategic Development Collaborations with MDACC and CONNECT

In December 2023, we entered into a Strategic Collaboration Agreement with MDACC, a comprehensive cancer research, treatment, and prevention center. The collaboration will expand our evaluation of REZLIDHIA (olutasidenib) in AML and other hematologic cancers. Under the collaboration, we will provide MDACC the study materials and $15.0 million in time-based milestone payments as compensation for services to be provided for the studies, over the five-year collaboration term, unless terminated earlier as provided for in the agreement. Through March 31, 2024, we provided $2.0 million funding to MDACC.

In January 2024, we announced our collaboration with CONNECT, an international collaborative network of pediatric cancer centers, to conduct a Phase 2 clinical trial to evaluate REZLIDHIA (olutasidenib) in glioma. Under the collaboration, we will provide funding up to $3.0 million and study material over the four-year collaboration.

We account for the funding we provide under the above research collaboration agreements as prepaid research and development in the balance sheet to the extent the payment is made in advance of services being rendered, and recognize such amount as research and development expense within the statements of operations as the collaborative partners render the services under the respective agreement.

15

5. |

In-licensing and Acquisition |

Asset Purchase Agreement with Blueprint

On February 22, 2024, we acquired the US rights to research, develop, manufacture and commercialize GAVRETO (pralsetinib) from Blueprint pursuant to an Asset Purchase Agreement. The acquired assets include, among other things, applicable intellectual property related to pralsetinib in the US, including patents, copyrights and trademarks, as well as clinical regulatory and commercial data and records. Pursuant to the Asset Purchase Agreement, we agreed to pay a purchase price of $15.0 million, $10.0 million of which is payable upon our first commercial sale of GAVRETO (pralsetinib) and an additional $5.0 million of which is payable on the first anniversary of the closing date of the agreement, subject to certain conditions. Blueprint is also eligible to receive up to $97.5 million in future commercial milestone payments and up to $5.0 million in future regulatory milestone payments. The potential regulatory milestones include full regulatory approval of pralsetinib (or related compounds) for the treatment of adult RET-fusion positive thyroid cancer, and maintenance of the current regulatory approval of pralsetinib for the treatment of adult RET-fusion positive thyroid cancer during the period beginning on February 22, 2024 and ending on the third anniversary of the first commercial sale of pralsetinib subject to certain conditions. Subject to the terms and conditions of the Asset Purchase Agreement, Blueprint would be entitled to tiered royalty payments on net sales of products containing pralsetinib (or related compounds) ranging from 10% to 30%, subject to certain reductions and offsets.

In accordance with ASC 805 Business Combinations (ASC 805), the transaction was accounted for as an asset acquisition, because substantially all of the fair value of the gross assets acquired is concentrated in a single asset, which is the GAVRETO product rights. The GAVRETO product rights comprised developed technology, customers, trademarks and trade name, and are considered a single asset as they are inextricably linked. ASC 805 provides for a screen test, wherein if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or group of similar identifiable assets, the assets acquired are not considered to be a business.

The following table summarizes the total purchase consideration in connection with the asset acquisition (in thousands):

Closing purchase price |

|

$ |

15,000 |

Transaction costs |

|

|

360 |

Total purchase consideration |

|

$ |

15,360 |

The closing purchase price was recorded within acquisition-related liabilities in the condensed balance sheet. The transaction cost of $0.2 million was also recorded within acquisition-related liabilities, and the remaining $0.1 million has been paid in cash as of March 31, 2024. The contingent considerations relating to future commercial and regulatory milestones were not included in the total purchase price consideration, and will be accounted for when the contingency is resolved and the consideration becomes payable. Royalties will be recognized within cost of sales, as revenue from GAVRETO product sales is recognized.

In an asset acquisition, the acquiring entity should recognize the assets acquired at cost to the acquiring entity which includes transaction costs and consideration given, allocated based on a relative fair value of the assets acquired measured at acquisition date. The fair value of the developed technology, customers, trademarks and trade name was estimated using a multi-period excess earnings income approach that discounts expected cash flows to present value by applying discount rate that represents the estimated rate that market participants would use to value such assets. The relative fair value are based on estimates that required judgement and certain assumptions, categorized as Level 3 in the fair value hierarchy. Since we acquired a single asset, the total purchase consideration was recorded as intangible assets. The related intangible assets is being amortized on a straight-line basis over the estimated useful life of 12 years, and the related amortization is recorded within cost of sales.

Simultaneously and in connection with entering into the Asset Purchase Agreement, we also entered into certain supporting agreements, including a customary transition agreement, pursuant to which, during the transition period, Blueprint will transition regulatory and distribution responsibility for GAVRETO (pralsetinib) to us. We also agreed to purchase certain drug product inventories from Blueprint amounting to approximately $7.0 million under a Material Transfer Agreement. As of March 31, 2024, we received inventories amounting to approximately $3.1 million, and the remaining inventories are expected to be delivered to us in the second quarter of 2024.

16

License and Transition Services Agreement with Forma

We have a license and transition services agreement with Forma entered in July 2022, for an exclusive license to develop, manufacture and commercialize olutasidenib, a proprietary inhibitor of mutated IDH1 (mIDH1), for any uses worldwide, including for the treatment of AML and other malignancies. Forma became a wholly owned subsidiary of Novo Nordisk following the closing of its acquisition by Novo Nordisk in October 2022. Pursuant to the terms of the license and transition services agreement, we paid an upfront fee of $2.0 million, with the potential to pay up to $67.5 million of additional payments upon achievement of specified development and regulatory milestones and up to $165.5 million of additional payments upon achievement of certain commercial milestones. In addition, subject to the terms and conditions of the license and transition services agreement, Forma would be entitled to tiered royalty payments on net sales of licensed products at percentages ranging from low-teens to mid-thirties, as well as certain portion of our sublicensing revenue, subject to certain standard reductions and offsets.

The transaction was accounted for as an acquisition of asset under ASC 730, Research and Development. In accordance with the guidance, in a transaction accounted for as an asset acquisition, any acquired IPR&D that does not have alternative future use is charged to expense at the acquisition date. At the acquisition date, the acquired license asset was accounted for as IPR&D, and we anticipated no other economic benefit to be derived from such acquired licensed asset other than the primary indications. As such, we accounted for the upfront fee of $2.0 million as IPR&D and recorded such cost within research and development expense in the statements of operations in 2022.

Under the accounting guidance, we account for contingent payments when a contingency is resolved, and the consideration becomes payable. We account for milestone payment obligations incurred at development stage and prior to a regulatory approval of an indication associated with the acquired licensed asset as research and development expense when the event requiring payment of the milestone occurs. Milestone payment obligations incurred upon and after a regulatory approval of an indication associated with the acquired licensed asset, and at the commercial stage, are recorded as intangible assets when the event requiring payment of the milestones occurs. Prior to the FDA approval of REZLIDHIA in December 2022, a certain regulatory milestone was met which entitled Forma to receive a $2.5 million milestone payment. Because such milestone payment obligation was incurred prior to a regulatory approval of an indication associated with the acquired licensed asset, we recorded such amount as research and development expense in the fourth quarter of 2022. On December 1, 2022, the FDA approved REZLIDHIA capsules for the treatment of adult patients with R/R AML with susceptible IDH1 mutations as detected by an FDA-approved test. Following the FDA approval, we launched REZLIDHIA and made first shipments of the product to our customers in December 2022. With this FDA approval and first commercial sale of the product, Forma was entitled to receive a total of $15.0 million milestone payments. Since such milestone payment obligations were incurred upon and after regulatory approval of the product, we recorded such amount as intangible assets on our condensed balance sheet in the fourth quarter of 2022. No new milestone was met in 2023 and during the three months ended March 31, 2024.

The amount recorded as intangible asset is being amortized on a straight-line basis over the estimated useful life of 14 years, and the related amortization is recorded within cost of sales. Royalties are recognized within cost of sales, as revenue from REZLIDHIA product sales is recognized.

6. |

Stock-Based Compensation |

Stock-based compensation for the periods presented was as follows (in thousands):

|

|

Three Months Ended March 31, |

|

||||

|

|

2024 |

|

2023 |

|

||

Selling, general and administrative |

|

$ |

4,484 |

|

$ |

1,735 |

|

Research and development |

|

|

650 |

|

|

1,023 |

|

Total stock-based compensation expense |

|

$ |

5,134 |

|

$ |

2,758 |

|

17

During the three months ended March 31, 2024, we granted stock options to purchase 5,410,890 shares of common stock with weighted-average grant-date fair value of $0.97 per share, and 90,544 stock options were exercised. The stock options granted during the three months ended March 31, 2024 generally vest over 3 years. As of March 31, 2024, there were 37,135,396 stock options outstanding, of which, 1,322,500 are outstanding performance-based stock options wherein the achievement of the corresponding corporate-based milestones were assessed not probable as of March 31, 2024. Accordingly, none of the $2.5 million grant date fair value for these awards has been recognized as stock-based compensation expense as of March 31, 2024.

The fair value of each option award is estimated on the date of grant using the Black-Scholes option pricing model. The following table summarizes the weighted-average assumptions relating to options granted pursuant to our Equity Incentive Plans (our 2018 Equity Incentive Plan and Inducement Plan, as amended) for the periods presented:

|

|

Three Months Ended March 31, |

|

|||

|

|

2024 |

|

2023 |

|

|

Risk-free interest rate |

|

4.1 |

% |

3.7 |

% |

|

Expected term (in years) |

|

6.2 |

|

7.0 |

|

|

Dividend yield |

|

0.0 |

% |

0.0 |

% |

|

Expected volatility |

|

87.4 |

% |

82.8 |

% |

|

During the three months ended March 31, 2024, we granted 2,763,979 RSUs with a grant-date weighted-average fair value of $1.27 per share, and 489,992 RSUs were released. The RSUs granted during the three months ended March 31, 2024 generally vest over 3 years. As of March 31, 2024, there were 4,071,854 RSUs outstanding.

As of March 31, 2024, there was approximately $16.2 million of unrecognized stock-based compensation cost which is expected to be recognized over a remaining weighted-average period of 2.49 years, related to time-based stock options, performance-based stock options wherein achievement of the corresponding corporate-based milestones was considered as probable, and RSUs.

In March 2024, our Board of Directors approved additional 375,000 shares of common stock reseved for issuance under our Inducement Plan. As of March 31, 2024, there were 7,129,161 shares of common stock available for future grant under our Equity Incentive Plans.

Employee Stock Purchase Plan

Our Purchase Plan provides for a 24-month offering period comprises four six-month purchase periods with a look-back option. A look-back option is a provision in our Purchase Plan under which eligible employees can purchase shares of our common stock at a price per share equal to the lesser of 85% of the fair market value on the first day of the offering period or 85% of the fair market value on the purchase date. Our Purchase Plan also includes a feature that provides for a new offering period to begin when the fair market value of our common stock on any purchase date during an offering period falls below the fair market value of our common stock on the first day of such offering period. This feature is called a “reset.” Participants are automatically enrolled in the new offering period.

Our previous 24-month offering period under our Purchase Plan ended on June 30, 2022, and a new 24-month offering period started on July 1, 2022. The fair value of awards under our Purchase Plan is estimated on the date of our new offering period using the Black-Scholes option pricing model, which is being amortized over the requisite service periods. As of March 31, 2024, unrecognized stock-based compensation cost related to our Purchase Plan amounted to $0.1 million, which is expected to be recognized over the remaining weighted average period of 0.24 years.

During the three months ended March 31, 2024, there were no shares purchased under the Purchase Plan. As of March 31, 2024, there were 2,495,835 shares reserved for future issuance under the Purchase Plan.

18

7. |

Other Balance Sheet Components |

Inventories

Inventories for the periods presented consist of the following (in thousands):

|

|

|

|

|

|

|

|

|

As of |

||||

|

|

March 31, 2024 |

|

December 31, 2023 |

||

Raw materials |

|

$ |

3,918 |

|

$ |

4,609 |

Work in process |

|

|

5,120 |

|

|

1,876 |

Finished goods |

|

|

1,275 |

|

|

1,508 |

Total |

|

$ |

10,313 |

|

$ |

7,993 |

Reported as: |

|

|

|

|

|

|

Inventories |

|

$ |

6,579 |

|

$ |

5,522 |

Other assets |

|

|

3,734 |

|

|

2,471 |

Total |

|

$ |

10,313 |

|

$ |

7,993 |

Inventories as of March 31, 2024 and December 31, 2023 include inventories acquired from Forma pursuant to the license and transition services agreement. Inventories as of March 31, 2024 also include inventories acquired from Blueprint pursuant to a Material Transfer Agreement as discussed in Note 5 – In-licencing and Acquisition. As of March 31, 2024, advance payments to the manufacturer of our raw materials were included within prepaid and other current assets in the condensed balance sheet amounted to $0.7 million. No such advance payment was included within prepaid and other current assets as of December 31, 2023.

Non-current inventories consist of active pharmaceutical ingredient classified as raw materials which have multi-year shelf life, as well as certain work in process and finished goods inventories that are not expected to be consumed beyond our normal operating cycle.

Intangible assets

Intangible assets consist of the following (in thousands):

|

|

As of |

||||

|

|

March 31, 2024 |

|

December 31, 2023 |

||

Intangible asset cost |

|

$ |

30,360 |

|

$ |

15,000 |

Accumulated amortization |

|

|

(1,497) |

|

|

(1,122) |

Intangible asset, net |

|

$ |

28,863 |

|

$ |

13,878 |

See “Note 5 – In-licensing and Acquisition” for related discussions of capitalized intangible assets. For the three months ended March 31, 2024 and 2023, amortization expense recorded within cost of sales in the statements of operations were $0.4 million and $0.3 million, respectively.

The following table presents the estimated future amortization expense of intangible assets as of March 31, 2024 (in thousands):

Remainder of 2024 |

|

$ |

1,764 |

2025 |

|

|

2,351 |

2026 |

|

|

2,351 |

2027 |

|

|

2,351 |

2028 |

|

|

2,351 |

Thereafter |

|

|

17,695 |

|

|

$ |

28,863 |

19

8.Cash, Cash Equivalents and Short-Term Investments

Cash, cash equivalents and short-term investments for the periods presented consist of the following (in thousands):

|

|

As of |

||||

|

|

March 31, 2024 |

|

December 31, 2023 |

||

Cash |

|

$ |

5,843 |

|

$ |

8,247 |

Money market funds |

|

|

9,767 |

|

|

9,685 |

US treasury bills |

|

|

12,906 |

|

|

12,594 |

Government-sponsored enterprise securities |

|

|

5,469 |

|

|

11,233 |

Corporate bonds and commercial paper |

|

|

15,565 |

|

|

15,174 |

|

|

$ |

49,550 |

|

$ |

56,933 |

Reported as: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

25,574 |

|

$ |

32,786 |

Short-term investments |

|

|

23,976 |

|

|

24,147 |

|

|

$ |

49,550 |

|

$ |

56,933 |

Cash equivalents and short-term investments include the following securities with gross unrealized gains and losses (in thousands):

|

|

|

|

|

Gross |

|

Gross |

|

|

|

|

||

|

|

Amortized |

|

Unrealized |

|

Unrealized |

|

|

|

|

|||

As of March 31, 2024 |

|

Cost |

|

Gains |

|

Losses |

|

Fair Value |

|

||||

US treasury bills |

|

$ |

12,907 |

|

$ |

— |

|

$ |

(1) |

|

$ |

12,906 |

|

Government-sponsored enterprise securities |

|

|

5,468 |

|

|

2 |

|

|

(1) |

|

$ |

5,469 |

|

Corporate bonds and commercial paper |

|

|

15,570 |

|

|

1 |

|

|

(6) |

|

|

15,565 |

|

Total |

|

$ |

33,945 |

|

$ |

3 |

|

$ |

(8) |

|

$ |

33,940 |

|

|

|

|

|

|

Gross |

|

Gross |

|

|

|

|

||

|

|

Amortized |

|

Unrealized |

|

Unrealized |

|

|

|

|

|||

As of December 31, 2023 |

|

Cost |

|

Gains |

|

Losses |

|

Fair Value |

|

||||

US treasury bills |

|

$ |

12,591 |

|

$ |

3 |

|