UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 27, 2024

Battalion Oil Corporation

(Exact name of registrant as specified in its charter)

Delaware |

|

001-35467 |

|

20-0700684 |

(State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

820 Gessner Road |

|

77024 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (832) 538-0300

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

◻ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⌧ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

◻ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

◻ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock par value $0.0001 |

|

BATL |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ◻

Item 1.01 |

Entry into a Material Definitive Agreement |

Third Amendment to Credit Agreement

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻ On March 28, 2024 (the “Amendment Effective Date”), Battalion Oil Corporation, a Delaware corporation (the “Company” or “we”), and its wholly owned subsidiary, Halcón Holdings, LLC (the “Borrower”) entered into a Third Amendment (the “Third Amendment”) to its Amended and Restated Senior Secured Credit Agreement dated as of November 24, 2021(as the same has been amended, restated, amended and restated, supplemented and modified from time to time prior to the date hereof, the “Credit Agreement”), by and among, inter alios, the Company, the Borrower, Macquarie Bank Limited, as administrative agent and certain other financial institutions party thereto, as lenders.

The Third Amendment amended the Credit Agreement to, among other things, (a) amend the approved plan of development (the “APOD”) for certain properties, (b) remove the PDP Production Test and APOD Economic Test (each as defined in the Credit Agreement), (c) require the Borrower to receive cash proceeds from equity issuances and/or cash contributions in an aggregate amount of not less than $38 million during the period from the Amendment Effective Date through March 31, 2024 (the “Specified Additional Equity Capital”), which such Specified Additional Equity Capital shall be excluded from the calculation of the Consolidated Cash Balance (as defined in the Credit Agreement), and (d) make amendments to certain other affirmative covenants in connection with the foregoing.

The Company did not incur additional debt or receive any proceeds in connection with the Third Amendment.

The foregoing description of the Third Amendment does not purport to be complete and is qualified in its entirety by the terms and conditions of the Amendment. A copy of the Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Series A-3 Preferred Stock Transaction

On March 27, 2024, the Company entered into a Purchase Agreement (the “Series A-3 Purchase Agreement”) with each of the purchasers set forth on Schedule A thereto (the “Series A-3 Purchasers”), pursuant to which the Company agreed to sell to the Buyers, in a private placement, an aggregate of 20,000 shares of Series A-3 Redeemable Convertible Preferred Stock, par value $0.0001 per share (the “Series A-3 Preferred Stock” and the purchase and sale of such shares of Series A-3 Preferred Stock , the “Series A-3 Preferred Stock Transaction”). A description of the material terms of the Series A-3 Preferred Stock Transaction is set forth below and is qualified in its entirety by reference to the documents attached hereto as Exhibit 3.1, Exhibit 10.2 and Exhibit 10.3, which are incorporated herein by reference.

The Series A-3 Purchasers included certain funds managed by Luminus Management, LLC, Oaktree Capital Management, LP, and LSP Investment Advisors, LLC, our largest three (3) existing shareholders whose appointed representatives make up fifty percent (50%) of our board of directors. The Series A-3 Preferred Stock Transaction was approved by our board of directors upon recommendation by a special committee of disinterested directors that was established to evaluate the proposed terms of the Series A-3 Preferred Stock Transaction. The aggregate purchase price paid by the Series A-3 Purchasers for the shares of Series A-3 Preferred Stock was approximately $19,500,000, with related expenses and fees to be paid out of the proceeds. The Company intends to use the proceeds for general corporate and working capital purposes including scheduled debt principal and interest payments.

Series A-3 Preferred Stock Purchase Agreement

The Series A-3 Purchase Agreement entered into by the Company and the Series A-3 Purchasers contains representations, warranties, and covenants of the Company and each of the Series A-3 Purchasers, as well as indemnification rights and other obligations of the parties. The closing of the transaction, including the issuance of the shares of Series A-3 Preferred Stock, occurred on March 27, 2024 (the “Issuance Date”), and was conditioned on customary closing conditions, including the accuracy of the representations and warranties in the Series A-3 Purchase Agreement, the compliance by the parties with the covenants in the Series A-3 Purchase Agreement, and no material adverse effect occurred with respect to the Company.

2

Description of Series A-3 Preferred Stock

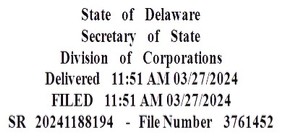

The powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series A-3 Preferred Stock issued in the transaction are set forth in the Series A-3 Certificate of Designations of the Company (the “Series A-3 CoD”), which form is attached as Exhibit 3.1 to this Current Report on Form 8-K. The Series A-3 CoD is filed with the Delaware Secretary of State.

The holders of shares of the Series A-3 Preferred Stock generally have no voting rights, except as required by the General Corporation Law of the State of Delaware (the “DGCL”), other applicable law, the Certificate of Incorporation (as amended from time to time in accordance with its terms and the DGCL, the “Certificate of Incorporation”), or as otherwise described in the Series A-3 CoD, and except that the consent of the holders of at least two-thirds of the outstanding Series A-3 Preferred Stock is required to: (a) authorize, create, or increase the authorized amount of, or issue any class or series of class or series that ranks senior to the Series A-3 Preferred Stock with respect to dividend rights or rights upon a liquidation, winding-up or dissolution of the Company (collectively, together with any warrants, rights, calls or options exercisable for or convertible into such capital stock, the “Senior Stock”), or reclassify or amend the provisions of any existing class of securities of the Company into shares of Senior Stock; (b) authorize, create or issue any stock or debt instrument or other obligation that is convertible or exchangeable into shares of its Senior Stock (or that is accompanied by options or warrants to purchase such Senior Stock); (c) amend, alter or repeal any provision of the Certificate of Incorporation or the Series A-3 CoD, in either case, in a manner that materially adversely affects the special rights, preferences, privileges or voting powers of the Series A-3 Preferred Stock; (d) declare or pay any dividends or other distributions in cash or property with respect to the Company’s common stock, par value $0.0001 per share, of the Company (the “Common Stock”) or other class or series of capital stock of the Company, the terms of which do not expressly provide that such class or series ranks senior to or on a parity with the Series A-3 Preferred Stock with respect to dividend rights or rights upon a liquidation, winding-up or dissolution of the Company (collectively, together with any warrants, rights, calls or options exercisable for or convertible into such capital stock, the “Junior Stock”); (e) redeem, repurchase or acquire shares of its Common Stock or other Junior Stock (other than with respect to customary repurchase rights or tax withholding arrangements with respect to equity awards or benefit plans); or (f) redeem, repurchase, recapitalize or acquire shares of its stock on a parity with any class or series of capital stock of the Company, the terms of which provide that such class or series ranks on a parity with the Series A-3 Preferred Stock with respect to dividend rights or rights upon a liquidation, winding-up or dissolution of the Company (such capital stock, including the Series A Redeemable Convertible Preferred Stock of the Company, par value $0.0001 per share; the Series A-1 Redeemable Convertible Preferred Stock of the Company, par value $0.0001 per share, and the Series A-2 Redeemable Convertible Preferred Stock of the Company, par value $0.0001 per share, together with any warrants, rights, calls or options exercisable for or convertible into such capital stock, the “Parity Stock”) other than (i) pro rata offers to purchase all, or a pro rata portion, of the Series A-3 Preferred Stock and such Parity Stock, (ii) as a result of a reclassification of Parity Stock for or into other Parity Stock or Junior Stock, (iii) the exchange or conversion of Parity Stock for or into other Parity Stock or Junior Stock, or (iv) the purchase of fractional interests in shares of Parity Stock pursuant to the conversion or exchange provisions of such Parity Stock or the security being converted or exchanged.

Holders of Series A-3 Preferred Stock are entitled to receive dividends at the rate per share of Series A-3 Preferred Stock equal to the Series A-3 Dividend Rate (the “Series A-3 Dividend”). The “Series A-3 Dividend Rate” means fourteen and one-half percent (14.50%) per annum on the then-applicable liquidation preference. If a Series A-3 Dividend is not declared and paid in cash on a Dividend Payment Date, then in full discharge of such Series A-3 Dividend for such Dividend Period, the Liquidation Preference of each outstanding share of Series A-3 Preferred Stock, regardless of its date of issue, automatically increases on such Dividend Payment Date by an amount equal to sixteen percent (16.00%) per annum multiplied by the Liquidation Preference in effect immediately after the immediately prior Dividend Payment Date (or the Issuance Date in respect of the first Dividend Period) (such automatic increase, the “Unpaid Dividend Accrual”), which, for the avoidance of doubt, will be pro-rated for the period of time elapsed during such Dividend Period. The period from the Issuance Date to and including March 31, 2024, and each period from but excluding a Dividend Payment Date to and including the following Dividend Payment Date is herein referred to as a “Dividend Period.” “Dividend Payment Date” means March 31, June 30, September 30 and December 31 of each year, commencing on March 31, 2024, and the “Liquidation Preference” equals one thousand dollars ($1,000) per share of Series A-3 Preferred Stock, which amount shall be adjusted as the result of any Unpaid Dividend Accrual (or payment thereof), and as otherwise set forth in the Series A-3 CoD.

3

Commencing on the date that is one hundred twenty (120) days after the Issuance Date, each Series A-3 Purchaser has the option from time to time to convert all or a portion of such Series A-2 Purchaser’s shares of Series A-3 Preferred Stock into Common Stock at the Conversion Ratio. The “Conversion Ratio” means, for each share of Series A-3 Preferred Stock, the quotient of (i) the Liquidation Preference as of the date of the conversion and (ii) the then applicable Conversion Price. The “Conversion Price” is initially $6.83, which may be adjusted from time to time as set forth in the Series A-3 CoD.

Fourth Amendment to Registration Rights Agreement

In connection with the Series A-3 Purchase Agreement, the Company also entered into the Fourth Amendment, dated March 27, 2024, by and between the Company and the parties identified thereto (the “Amendment No. 4”) to the Registration Rights Agreement, dated as of October 8, 2019, as amended (the “Registration Rights Agreement”). Under Amendment No. 4, the Company granted the parties certain registration rights with respect to Common Stock issuable upon conversion of the Series A-3 Preferred Stock.

The foregoing summaries of the material terms of the Series A-3 Purchase Agreement, the Series A-3 CoD, and the Registration Rights Agreement (as amended by Amendment No. 4) are not complete and are qualified in their entirety by reference to the full text thereof, copies of which are filed herewith as Exhibit 3.1, Exhibit 10.2 and Exhibit 10.3, respectively, and incorporated by reference herein.

Item 3.02 |

Unregistered Sale of Equity Securities. |

The information regarding the Series A-3 Preferred Stock Transaction set forth in Item 1.01 and Item 5.03 of this Current Report on Form 8-K, is incorporated by reference into this Item 3.02.

The private placement of the Series A-3 Preferred Stock pursuant to the Series A-3 Purchase Agreement was undertaken in reliance upon an exemption from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof.

Item 3.03 |

Material Modification to Rights of Security Holders. |

The information set forth under Item 5.03 is incorporated by reference into this Item 3.03.

Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

A summary of the rights, preferences and privileges of the Series A-3 Preferred Stock and other material terms and conditions of the Certificate of Designations is set forth in Item 1.01 of this Current Report on Form 8-K and is incorporated by reference into this Item 5.03.

The foregoing description of the Certificate of Designations does not purport to be complete and is qualified in its entirety by reference to the complete text of the Certificate of Designations, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Important Information for Investors and Stockholders

This communication is being made in respect of the proposed transaction involving the Company and Parent. In connection with the proposed transaction, the Company intends to file the relevant materials with the SEC, including a proxy statement on Schedule 14A and a transaction statement on Schedule 13e-3 (the “Schedule 13e-3”). Promptly after filing its definitive proxy statement with the SEC, the Company will mail the definitive proxy statement and a proxy card to each stockholder of the Company entitled to vote at the special meeting relating to the proposed transaction. This communication is not a substitute for the proxy statement, the Schedule 13e-3 or any other document that the Company may file with the SEC or send to its stockholders in connection with the proposed transaction. The materials to be filed by the Company will be made available to the Company’s investors and stockholders at no expense to them and copies may be obtained free of charge on the Company’s website at www.battalionoil.com. In addition, all of those materials will be available at no charge on the SEC’s website at www.sec.gov. Investors and stockholders of the Company are urged to read the proxy statement, the Schedule 13e-3 and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction because they contain important information about the Company and the proposed transaction.

4

The Company and its directors, executive officers, other members of its management and employees may be deemed to be participants in the solicitation of proxies of the Company stockholders in connection with the proposed transaction under SEC rules. Investors and stockholders may obtain more detailed information regarding the names, affiliations and interests of the Company’s executive officers and directors in the solicitation by reading the Company’s Annual Report on Form 10-K, as amended on Form 10-K/A, for the fiscal year ended December 31, 2022, and the proxy statement, the Schedule 13e-3 and other relevant materials that will be filed with the SEC in connection with the proposed transaction when they become available. Information concerning the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of the Company’s stockholders generally, will be set forth in the proxy statement relating to the proposed transaction and the Schedule 13e-3 when they become available.

Forward-Looking Statements

All statements and assumptions in this communication that do not directly and exclusively relate to historical facts could be deemed “forward-looking statements.” Forward-looking statements are often identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “may,” “could,” “should,” “forecast,” “goal,” “intends,” “objective,” “plans,” “projects,” “strategy,” “target” and “will” and similar words and terms or variations of such. These statements represent current intentions, expectations, beliefs or projections, and no assurance can be given that the results described in such statements will be achieved. Forward-looking statements include, among other things, statements about the potential benefits of the proposed transaction; the prospective performance and outlook of the Company’s business, performance and opportunities; the ability of the parties to complete the proposed transaction and the expected timing of completion of the proposed transaction; as well as any assumptions underlying any of the foregoing. Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of the Company’s control. Important factors that could cause actual results to differ materially from those described in forward-looking statements include, but are not limited to, (i) the risk that the proposed transaction may not be completed in a timely manner or at all; (ii) the failure to receive, on a timely basis or otherwise, the required approvals of the proposed transaction by the Company’s stockholders; (iii) the possibility that any or all of the various conditions to the consummation of the proposed transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals); (iv) the possibility that competing offers or acquisition proposals for the Company will be made; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction, including in circumstances, which would require the Company to pay a termination fee; (vi) the effect of the announcement or pendency of the proposed transaction on the Company’s ability to attract, motivate or retain key executives and employees, its ability to maintain relationships with its customers, suppliers and other business counterparties, or its operating results and business generally; (vii) risks related to the proposed transaction diverting management’s attention from the Company’s ongoing business operations; (viii) the amount of costs, fees and expenses related to the proposed transaction; (ix) the risk that the Company’s stock price may decline significantly if the Merger is not consummated; (x) the risk of shareholder litigation in connection with the proposed transaction, including resulting expense or delay; and (xi) other factors as set forth from time to time in the Company’s filings with the SEC, including its Annual Report on Form 10-K, as amended, for the fiscal year ended December 31, 2022, as may be updated or supplemented by any subsequent Quarterly Reports on Form 10-Q or other filings with the SEC. Readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. The Company does not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events except as required by law.

5

Item 9.01 |

Financial Statements and Exhibits. |

(d)Exhibits.

Exhibit No. |

|

Description |

|---|---|---|

|

|

|

3.1 |

|

|

10.1 |

|

|

10.2 |

|

|

10.3 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

6

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

BATTALION OIL CORPORATION |

|

|

|

|

|

|

|

March 28, 2024 |

By: |

/s/ Matthew B. Steele |

|

Name: |

Matthew B. Steele |

|

Title: |

Chief Executive Officer |

7

Exhibit 3.1

BATTALION OIL CORPORATION

____________________

CERTIFICATE OF DESIGNATIONS

Pursuant to Section 151 of the General

Corporation Law of the State of Delaware

____________________

SERIES A-3 REDEEMABLE CONVERTIBLE PREFERRED STOCK

(Par Value $0.0001 Per Share)

Battalion Oil Corporation (the “Corporation”), a corporation organized and existing under and by virtue of the provisions of the General Corporation Law of the State of Delaware (the “General Corporation Law”), hereby certifies that, pursuant to the authority expressly granted to and vested in the Board of Directors of the Corporation (the “Board of Directors”) by the Amended and Restated Certificate of Incorporation of the Corporation (as amended from time to time in accordance with its terms and the General Corporation Law, the “Certificate of Incorporation”), which authorizes the Board of Directors to issue shares of the preferred stock of the Corporation (the “Preferred Stock”), in one or more series of Preferred Stock and to fix for each such series such voting powers, full or limited, and such designations, preferences and relative, participating, optional, or other special rights and such qualifications, limitations or restrictions thereof, and in accordance with the provisions of Section 151 of the General Corporation Law, the Board of Directors duly adopted on March 26, 2024 the following resolution:

RESOLVED, that the rights, powers and preferences, and the qualifications, limitations and restrictions, of the Series A-3 Preferred Stock as set forth in this Certificate of Designations are hereby approved and adopted by the Board of Directors and Series A-3 Preferred Stock is hereby authorized out of the Corporation’s authorized preferred stock, par value $0.0001 per share; and the form, terms and provisions of this Certificate of Designations are hereby approved, adopted, ratified and confirmed in all respects as follows:

| 1. | General. |

Term |

Section |

|---|---|

30 Day Date |

Section 8(c) |

Board of Directors |

Preamble |

Business Day |

Section 4(b) |

Capital Stock |

Section 1(d) |

Certificate of Incorporation |

Preamble |

Change of Control |

Section 8(b)(iv) |

CoC Conversion Consideration |

Section 8(b)(ii) |

Common Stock |

Section 1(d)(i) |

Conversion Notice |

Section 7(a) |

Conversion Price |

Section 7(a) |

Conversion Ratio |

Section 7(a) |

Corporation |

Preamble |

Corporation Event |

Section 7(f) |

2

Term |

Section |

|---|---|

Debt |

Section 7(b)(ii) |

Dividend Payment Date |

Section 2(a) |

Dividend Period |

Section 2(a) |

General Corporation Law |

Preamble |

Holder |

Section 3(a) |

Issuance Date |

Section 2(a) |

Issuer Conversion Notice |

Section 7(b) |

Junior Stock |

Section 1(d)(i) |

Liquidation |

Section 3(a) |

Liquidation Distribution |

Section 3(a) |

Liquidation Preference |

Section 3(a) |

Mandatory CoC Redemption Offer |

Section 8(b)(ii) |

Mandatory Conversion Conditions |

Section 7(b) |

Material Adverse Effect |

Section 7(b) |

Maturity Date |

Section 8(b)(vii) |

NYMEX Prices |

Section 7(b)(v) |

NYSE American Issuance Limitation |

Section 9(a) |

Optional CoC Conversion |

Section 8(b)(iii) |

Optional CoC Redemption Offer |

Section 8(b)(iii) |

Optional Holder Conversion |

Section 7(a) |

Parity Stock |

Section 1(d)(ii) |

PDP PV-20 |

Section 7(b)(i) |

Permitted Holder |

Section 8(b)(iv) |

Person |

Section 8(b)(ix) |

Preferred Stock |

Preamble |

Proved Developed Producing Reserves |

Section 7(b)(iv) |

Purchase Agreement |

Section 5(b) |

Redemption Notice |

Section 8(a) |

Redemption Price |

Section 8(a) |

Schedule 14C Action |

Section 9(c) |

SEC |

Section 9(c) |

Senior Stock |

Section 1(d)(iii) |

Series A-3 Dividend |

Section 2(a) |

Series A-3 Dividend Rate |

Section 2(a) |

Series A-3 Preferred Stock |

Section 1(a) |

Stockholder Approval |

Section 9(b) |

Subject Transaction |

Section 9(d) |

Term Loan Credit Agreement |

Section 8(b)(vi) |

Term Loan Restricted Period |

Section 8(b)(v) |

Unpaid Dividend Accrual |

Section 2(d) |

Working Capital Adjustments |

Section 7(b)(iii) |

| 2. | Dividends. |

3

4

| 3. | Liquidation. |

5

| 4. | Voting. |

6

If the Corporation shall propose to take any action enumerated above in clauses (i) through (vi) of this Section 4(b) then, and in each such case, the Corporation shall give notice of such proposed action to each Holder of record appearing on the stock books of the Corporation as of the date of such notice at the address of said Holder shown therein. Such notice shall specify, inter alia (x) the proposed effective date of such action; (y) the date on which a record is to be taken for the purposes of such action, if applicable; and (z) the other material terms of such action. Such notice shall be given at least two Business Days prior to the applicable date or effective date specified above. For the purposes of this Certificate of Designations, “Business Day” shall mean each day that is not a Saturday, Sunday or other day on which banking institutions in Houston, Texas or New York, New York are authorized or required by law to close. If at any time the Corporation shall cancel any of the proposed actions for which notice has been given under this Section 4(b) prior to the consummation thereof, the Corporation shall give prompt notice of such cancellation to each holder of record of the shares of Series A-3 Preferred Stock appearing on the stock books of the Corporation as of the date of such notice at the address of said Holder shown therein. For the avoidance of doubt, if a holder of record of shares of Series A-3 Preferred Stock does not respond to the aforementioned notice, such non-response shall in no way be deemed to constitute the written consent or affirmative vote of such Holder regarding any of the aforementioned actions in this Section 4(b) or described within such notice.

| 5. | Reservation of Common Stock. |

| 6. | Uncertificated Shares |

The shares of Series A-3 Preferred Stock shall be in uncertificated, book-entry form as permitted by the Seventh Amended and Restated Bylaws of the Corporation (the “Bylaws”) and the General Corporation Law. Within a reasonable time after the issuance or transfer of uncertificated shares, the Corporation shall send to the registered owner thereof any written notice as required by the General Corporation Law.

7

| 7. | Conversion. |

8

9

10

| 8. | Redemption |

11

12

13

14

| 9. | NYSE American Issuance Limitation. |

| 10. | Additional Procedures. |

15

| 11. | No Other Rights. |

The shares of Series A-3 Preferred Stock shall not have any powers, designations, preferences or relative, participating, optional, or other special rights, nor shall there be any qualifications, limitations or restrictions or any powers, designations, preferences or rights of such shares, other than as set forth herein or in the Certificate of Incorporation, or as may be provided by law.

| 12. | Other Provisions. |

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND MAY NOT BE TRANSFERRED, SOLD OR OTHERWISE DISPOSED OF EXCEPT WHILE A REGISTRATION STATEMENT RELATING THERETO IS IN EFFECT UNDER THE SECURITIES ACT OR PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT.

16

THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE ALSO SUBJECT TO CERTAIN RESTRICTIONS ON TRANSFERS SET FORTH IN THE CERTIFICATE OF DESIGNATIONS FILED WITH THE SECRETARY OF STATE FOR THE STATE OF DELAWARE PURSUANT TO SECTION 202 OF THE DELAWARE GENERAL CORPORATION LAW (THE “CERTIFICATE OF DESIGNATIONS”). NO TRANSFER, SALE, ASSIGNMENT, PLEDGE, HYPOTHECATION OR OTHER DISPOSITION OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE MAY BE MADE EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF THE CERTIFICATE OF DESIGNATIONS. A COPY OF THE CERTIFICATE OF DESIGNATIONS WILL BE FURNISHED WITHOUT CHARGE BY THE CORPORATION TO THE HOLDER UPON REQUEST.

| 13. | Effective Date. |

This Certificate of Designations shall become effective on March 27, 2024.

[The Remainder of this Page Intentionally Left Blank]

17

IN WITNESS WHEREOF, Battalion Oil Corporation has caused this Certificate of Designations to be duly executed this 27th day of March, 2024.

|

BATTALION OIL CORPORATION |

|

|

|

|

|

|

|

By: |

/s/ Matthew B. Steele |

|

|

Name: |

Matthew B. Steele |

|

Title: |

Chief Executive Officer |

[Signature Page to Certificate of Designations]

Annex A-1

Conversion Notice

The undersigned holder of Series A-3 Preferred Stock hereby irrevocably elects to convert the number of shares of Series A-3 Preferred Stock indicated below pursuant to Section 7(a) of the Certificate of Designations into shares of Common Stock at the Conversion Ratio. Capitalized terms utilized but not defined herein shall have the meaning ascribed to such terms in that certain Certificate of Designations of Series A-3 Redeemable Convertible Preferred Stock, filed by Battalion Oil Corporation on March 27, 2024 (the “Certificate of Designations”).

Conversion Calculations:

Number of shares of Series A-3 Preferred Stock owned prior to conversion: [_____]

Number of shares of Series A-3 Preferred Stock to be converted: [_____]

Number of shares of Common Stock to be issued: [_____]

[HOLDER]

Annex A-2

Issuer Conversion Notice

Battalion Oil Corporation, a Delaware corporation, hereby irrevocably elects to convert the number of shares of Series A-3 Preferred Stock held by you indicated below into shares of Common Stock at the Conversion Ratio on the date set forth below pursuant to Section 7(b) of the Certificate of Designations. Capitalized terms utilized but not defined herein shall have the meaning ascribed to such terms in that certain Certificate of Designations of Series A-3 Redeemable Convertible Preferred Stock, filed by Battalion Oil Corporation on March 27, 2024 (the “Certificate of Designations”).

Holder: [_____]

Conversion Calculations:

Number of Shares of Series A-3 Preferred Stock owned by you prior to conversion: [_____]

Number of Shares of Series A-3 Preferred Stock owned by you to be converted: [_____]

Number of shares of Common Stock to be issued: [_____]

BATTALION OIL CORPORATION

Annex B

Redemption Notice

Battalion Oil Corporation, a Delaware corporation, hereby irrevocably elects to redeem the number of shares of Series A-3 Preferred Stock held by you indicated below on the date set forth below. Capitalized terms utilized but not defined herein shall have the meaning ascribed to such terms in that certain Certificate of Designations of Series A-3 Redeemable Convertible Preferred Stock, filed by Battalion Oil Corporation on March 27, 2024.

Holder: [_____]

Date of redemption: [_____]

Redemption Calculations:

Number of Shares of Series A-3 Preferred Stock owned by you prior to redemption: [____]

Number of Shares of Series A-3 Preferred Stock owned by you to be redeemed: [_____]

Redemption Price: [___]

Elect a Single Form of Payment of Redemption Price:

___ Cash (Cash payment to be made to you: [_____])

BATTALION OIL CORPORATION

Exhibit 10.1

Execution Version

THIRD AMENDMENT TO AMENDED AND RESTATED SENIOR SECURED CREDIT AGREEMENT

This THIRD AMENDMENT TO AMENDED AND RESTATED SENIOR SECURED CREDIT AGREEMENT (this “Third Amendment”) is entered into as of March 28, 2024, by and among Halcón Holdings, LLC, a Delaware limited liability company (the “Borrower”), Macquarie Bank Limited, as administrative agent (in such capacity, the “Administrative Agent”) for the lenders party from time to time to the Credit Agreement referred to below (the “Lenders”), the Lenders party hereto, the Guarantors party hereto and Battalion Oil Corporation, a Delaware corporation (“Holdings”).

RECITALS

WHEREAS, the Borrower, the Administrative Agent and the Lenders are party to that certain Amended and Restated Senior Secured Credit Agreement dated as of November 24, 2021 (as amended by that certain First Amendment to Amended and Restated Senior Secured Credit Agreement, dated as of August 2, 2022, that certain Second Amendment to Amended and Restated Senior Secured Credit Agreement, dated as of November 14, 2022, and that certain Corrective Amendment to Amended and Restated Senior Secured Credit Agreement, dated as of June 6, 2023, the “Credit Agreement”);

WHEREAS, pursuant to the Credit Agreement, the Lenders have made Loans to the Borrower and provided certain other credit accommodations to the Borrower; and

WHEREAS, the Borrower has requested that the Lenders agree to amend certain provisions of the Credit Agreement, and the Lenders party hereto, which constitute all Lenders party to the Credit Agreement, have agreed to amend the Credit Agreement upon the terms and conditions set forth herein and to be effective as of the Third Amendment Effective Date (as defined below).

NOW THEREFORE, for and in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged and confessed, the Loan Parties, the Administrative Agent and the Lenders party hereto hereby agree as follows:

The Administrative Agent shall notify the Borrower and the Lenders of the Third Amendment Effective Date, and such notice shall be conclusive and binding.

2

3

[Signature Pages to Follow]

4

IN WITNESS WHEREOF, the parties hereto have caused this Third Amendment to be duly executed by their respective authorized officers on the date and year first above written.

BORROWER: |

HALCÓN HOLDINGS, LLC |

||

|

|

||

By: |

/s/ Matthew B. Steele |

||

Name: |

Matthew B. Steele |

||

Title: |

Chief Executive Officer & President |

||

|

|

||

HOLDINGS |

|||

(solely with respect to Article IX-A of |

|||

|

BATTALION OIL CORPORATION |

||

|

|||

|

By: |

/s/ Matthew B. Steele |

|

|

Name: |

Matthew B. Steele |

|

|

Title: |

Chief Executive Officer |

|

|

|||

GUARANTORS: |

BATTALION OIL MANAGEMENT, INC. HALCÓN ENERGY PROPERTIES, INC. HALCÓN OPERATING CO., INC. HALCÓN FIELD SERVICES, LLC HALCÓN PERMIAN, LLC |

||

|

|||

By: |

/s/ Matthew B. Steele |

||

Name: |

Matthew B. Steele |

||

Title: |

Chief Executive Officer |

||

|

|

|

|

ADMINISTRATIVE AGENT: |

MACQUARIE BANK LIMITED, |

||

|

|||

|

By: |

/s/ Chris Horne |

|

|

|

Name: |

Chris Horne |

|

|

Title: |

Division Director |

|

|||

|

By: |

/s/ Robert Trevena |

|

|

|

Name: |

Robert Trevena |

|

|

Title: |

Division Director |

|

|

|

|

|

(Signed in Sydney under MBL POA No. 3322, expiring 31 January 2025) |

||

[Signature Page to Third Amendment]

LENDERS: |

|||

|

J. ARON & COMPANY LLC, |

||

|

|||

|

By: |

/s/ Simon Collier |

|

|

|

Name: |

Simon Collier |

|

|

Title: |

Authorized Signatory |

|

|

||

|

ARES CAPITAL CORPORATION, |

||

|

|||

|

By: |

/s/ James Miller |

|

|

|

Name: |

James Miller |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

IVY XIX FINANCING, LLC, |

||

|

|||

|

By: |

/s/ Shelly Cleary |

|

|

|

Name: |

Shelly Cleary |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

CION ARES DIVESTIFIED CREDIT FUND, |

||

|

|||

|

By: |

/s/ James Miller |

|

|

|

Name: |

James Miller |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

FORTRESS CREDIT OPPORTUNITIES IX CLO LIMITED, |

||

|

By: FCOD CLO Management LLC, its collateral manager |

||

|

|||

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

|

FORTRESS CREDIT OPPORTUNITIES VI CLO LIMITED, |

||

|

By: FCOO CLO Management LLC, its collateral manager |

||

|

|

||

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

[Signature Page to Third Amendment]

|

FORTRESS CREDIT OPPORTUNITIES XI CLO LIMITED, |

||

|

By: FCOD CLO Management LLC, its collateral manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

|

FORTRESS CREDIT OPPORTUNITIES XIX CLO LLC, |

||

|

By: FCOD CLO Management LLC, its collateral manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

|

FORTRESS CREDIT OPPORTUNITIES XV CLO LIMITED, |

||

|

By: FCOD CLO Management LLC, its collateral manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

|

FLF II HOLDINGS FINANCE L.P., |

||

|

By: Fortress Lending Advisors II LLC, its investment manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

|

FLF II MA-CRPTF HOLDINGS FINANCE L.P., |

||

|

By: FLF II MA-CRPTF Advisors LLC, its investment manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

[Signature Page to Third Amendment]

|

FLF II GMS HOLDINGS FINANCE L.P., |

||

|

By: FLF II GMS Holdings Finance CM LLC, as servicer |

||

|

By: Fortress Lending II Holdings LP, its sole member |

||

|

By: Fortress Lending Advisors II LLC, its investment manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

|

CAVALRY 1ST CO., LTD., |

||

|

|

||

|

By: |

/s/ Giuk Choi |

|

|

Name: |

Giuk Choi |

|

|

Title: |

Representative Director |

|

|

|

||

|

FORTRESS CREDIT OPPORTUNITIES XXI CLO LLC, |

||

|

By: FCOD CLO Management LLC, its collateral manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

|

|

||

|

FORTRESS CREDIT OPPORTUNITIES XXIII CLO LLC, |

||

|

By: FCOD CLO Management LLC, its collateral manager |

||

|

|

|

|

|

By: |

/s/ Brad Bailey |

|

|

|

Name: |

Brad Bailey |

|

|

Title: |

Authorized Signatory |

[Signature Page to Third Amendment]

Exhibit A

Conformed Credit Agreement

[Attached]

Execution Version

Exhibit A to Third Amendment

AMENDED AND RESTATED SENIOR SECURED CREDIT AGREEMENT

dated as of

November 24, 2021

among

BATTALION OIL CORPORATION,

as Holdings,

HALCÓN HOLDINGS, LLC,

as Borrower,

MACQUARIE BANK LIMITED,

as Administrative Agent,

and

The Lenders Party Hereto

MACQUARIE BANK LIMITED

as Sole Lead Arranger

TABLE OF CONTENTS

Page

i

Table of Contents

(continued)

Page

ii

Table of Contents

(continued)

Page

iii

Table of Contents

(continued)

Page

iv

Table of Contents

(continued)

Page

v

EXHIBITS AND SCHEDULES

Exhibit A-1 |

Form of Initial Term Loan Note |

Exhibit A-2 |

Form of Delayed Draw Term Loan Note |

Exhibit B |

Form of Borrowing Request |

Exhibit C |

[Reserved] |

Exhibit D |

Form of Compliance Certificate |

Exhibit E |

Security Instruments |

Exhibit F |

Form of Assignment and Assumption |

Exhibit G-1 |

Form of U.S. Tax Compliance Certificate |

Exhibit G-2 |

Form of U.S. Tax Compliance Certificate |

Exhibit G-3 |

Form of U.S. Tax Compliance Certificate |

Exhibit G-4 |

Form of U.S. Tax Compliance Certificate |

Exhibit H |

Form of Solvency Certificate |

Exhibit I |

[Reserved] |

Exhibit J |

Form of Reserve Report Certificate |

Exhibit K |

Form of Guarantee and Collateral Agreement |

Schedule 1.02(a) |

APOD |

Schedule 1.02(b) |

Commitments |

Schedule 1.02(c) |

Forecasted Specified PDP Production |

Schedule 1.02(d) |

JV Entities |

Schedule 7.05 |

Litigation |

Schedule 7.14 |

Subsidiaries and Partnerships |

Schedule 7.18 |

Gas Imbalances |

Schedule 7.19 |

Marketing Contracts |

Schedule 7.20 |

Swap Agreements |

Schedule 7.28 |

Suspense Accounts |

Schedule 7.29 |

Gas Gathering and Transportation Agreements |

Schedule 9.02 |

Existing Indebtedness |

Schedule 9.03 |

Existing Liens |

Schedule 9.05(a) |

Existing Investments |

Schedule 9.05(l) |

JV Holdco Investments |

vi

THIS AMENDED AND RESTATED SENIOR SECURED CREDIT AGREEMENT (this “Agreement”) dated as of November 24, 2021 is among HALCÓN HOLDINGS, LLC, a Delaware limited liability company (the “Borrower”), each of the Lenders from time to time party hereto and MACQUARIE BANK LIMITED (in its individual capacity, “MBL”), as administrative agent for the Lenders (in such capacity, together with its successors in such capacity, the “Administrative Agent”) and, solely with respect to Article IX-A hereof, BATTALION OIL CORPORATION, a Delaware corporation, (“Holdings”).

R E C I T A L S

A.Holdings previously entered into that certain Senior Secured Revolving Credit Agreement, dated as of October 8, 2019 (as amended prior to the date hereof, the “Existing Credit Agreement”), by and among Holdings, as borrower, Bank of Montreal, as administrative agent (in such capacity, the “Existing Administrative Agent”), and the lenders party thereto (the “Existing Lenders”), which provided for a revolving credit facility made available by the Existing Lenders to Holdings.

B.Pursuant to that certain Amendment No. 6 and Assignment of Loans and Liens dated as of November 24, 2021 (the “Master Assignment”) among the Existing Lenders, the Existing Administrative Agent, the Loan Parties, the Lenders and the Administrative Agent, (i) the Existing Lenders have assigned and conveyed the Assigned Interests (as defined therein) to the Lenders and (ii) the Existing Administrative Agent has resigned as administrative agent under the Existing Credit Agreement and assigned and conveyed the Assigned Security Interests (as defined therein) to the Administrative Agent.

C.Pursuant to the Borrower Assumption Agreement, immediately after giving effect to the Master Assignment, the Borrower assumed all of the Existing Obligations of the Existing Borrower from the Existing Borrower;

D.Holdings, the Borrower, the Lenders and the Administrative Agent desire to amend and restate the Existing Credit Agreement in its entirety by this Agreement.

E.In consideration of the foregoing and the mutual covenants and agreements herein contained and of the loans, extensions of credit and commitments hereinafter referred to, the parties hereto agree as follows:

“ABR” means, for any day, a rate per annum equal to the greater of (a) the Prime Rate in effect on such day and (b) the Federal Funds Effective Rate in effect on such day plus 0.50%. Any change in the Alternate Base Rate due to a change in the Prime Rate or the Federal Funds Effective Rate shall be effective from and including the effective date of such change in the Prime Rate or the Federal Funds Effective Rate, respectively.

1

For the avoidance of doubt, if the Alternate Base Rate as determined pursuant to the foregoing would be less than 0.00%, such rate shall be deemed to be 0.00% for purposes of this Agreement.

“ABR Loan” means a Loan that bears interest based on the ABR.

“Accounting Change” has the meaning assigned to such term in Section 1.05.

“Acquisition Conditions” means, with respect to any acquisition of assets (including any assets constituting a business unit, line of business or division) or Equity Interests, (a) if such acquisition involves the acquisition of Equity Interests of a Person that upon such acquisition would become a Subsidiary, such acquisition shall result in the issuer of such Equity Interests becoming a Subsidiary and, to the extent required by Section 8.14, a Guarantor; (b) such acquisition shall result in the Administrative Agent, for the benefit of the Secured Parties, being granted a security interest in any Equity Interests or any assets so acquired to the extent required by Section 8.14; (c) subject to Section 1.07, immediately after giving effect to such acquisition, no Default or Event of Default shall have occurred and be continuing; (d) immediately after giving effect to such acquisition, the Borrower and its Subsidiaries shall be in pro forma compliance with Section 9.01 as of the last day of the most recently ended fiscal quarter for which financial statements are required to have been delivered pursuant to Section 8.01(b) (or, if the most recently ended fiscal quarter is the fiscal quarter ending on December 31 of any year, for which annual financial statements are required to have been delivered pursuant to Section 8.01(a)); (e) (i) the Asset Coverage Ratio immediately after giving pro forma effect to such acquisition shall be no lower than the Asset Coverage Ratio immediately prior to giving pro forma effect to such acquisition and (ii) the Total Net Leverage Ratio immediately after giving pro forma effect to such acquisition shall be no greater than the Total Net Leverage Ratio immediately prior to giving pro forma effect to such acquisition; and (f) immediately after giving effect to such acquisition, the Borrower and its Subsidiaries shall be in compliance with Section 9.07.

“Actual Specified PDP Production” means, for any period, the aggregate actual production of Hydrocarbons (measured in barrels of oil equivalent) from the Specified PDP Reserves for such period.

“Adjusted Term SOFR” means, for purposes of any calculation, the rate per annum equal to (a) Term SOFR for such calculation plus (b) the Term SOFR Adjustment; provided that if Adjusted Term SOFR as so determined shall ever be less than the Floor, then Adjusted Term SOFR shall be deemed to be the Floor.

“Administrative Agent” has the meaning assigned to such term in the preamble hereto.

“Administrative Questionnaire” means an Administrative Questionnaire in a form supplied by the Administrative Agent.

“Aggregate AFE Gross Well Cost” means, with respect to any APOD Well Pad, the aggregate amount of the “AFE Gross Well Cost” set forth on Schedule 1.02(a) for such APOD Well Pad.

2

“Affected Financial Institution” means (a) any EEA Financial Institution or (b) any UK Financial Institution.

“Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

“Agreement” means this Amended and Restated Senior Secured Credit Agreement, including the Annexes, Schedules and Exhibits hereto, as the same may be amended, restated, amended and restated, supplemented or modified from time to time.

“Annual Budget” has the meaning assigned to such term in Section 8.01(e).

“Anti-Corruption Laws” means the United States Foreign Corrupt Practices Act of 1977 and all other laws, rules, and regulations of any jurisdiction applicable to the Borrower or any of its Subsidiaries from time to time concerning or relating to bribery or corruption.

“APOD” means the oil and gas wells located within the APOD Boundary and described on Schedule 1.02(a) proposed to be developed by the Borrower and the Subsidiaries, as the same may be updated from time to time in accordance with Section 8.22.

“APOD Boundary” means the geographic boundary depicted on Schedule 1.02(a) after giving effect to the Third Amendment.

“APOD Economic Test” means, as of any APOD Economic Test Date, the internal rate of return (calculated as of such date in accordance with the IRR Parameters) of all Producing APOD Wells as of such date. The Borrower shall deemed to be in compliance with the APOD Economic Test as of any APOD Economic Test Date if the internal rate of return described in the preceding sentence is equal to or greater than thirty percent (30%).

“APOD Economic Test Date” means (a) the last day of the calendar month in which the APOD Tranche consisting of the Initial APOD Wells first becomes a Producing APOD Tranche and (b) the last day of each fiscal quarter thereafter and prior to December 31, 2023.

“APOD Tranche” means (a) the Initial APOD Wells and (b) each group of six (6) wells in the APOD to be drilled after the Initial APOD Wells.

“APOD Well Pad” means each grouping of two wells located on the applicable Specified Pad set forth on Schedule 1.02(a).

“Applicable Borrowing Date” means (a) for the Initial Term Loans, the Closing Date and (b) for any Delayed Draw Term Loans, the date on which such Delayed Draw Term Loans are made to the Borrower.

“Applicable Margin” means (a) with respect to SOFR Loans (or Loans bearing interest at a rate determined by reference to any other Benchmark), 7.50% per annum and (b) with respect to ABR Loans, 6.50% per annum.

3

“Applicable Measurement Date” means (a) for all Loans outstanding on the Second Amendment Effective Date, the Second Amendment Effective Date and (b) for any Delayed Draw Term Loans made after the Second Amendment Effective Date, the date on which such Delayed Draw Term Loans are made to the Borrower.

“Applicable Percentage” means, with respect to any Lender, a percentage equal to a fraction (a) the numerator of which is an amount equal to such Lender’s Credit Exposure (b) the denominator of which is the sum of the Credit Exposure of all Lenders; provided that, in the case of Section 4.04 when a Defaulting Lender shall exist, “Applicable Percentage” shall be adjusted to disregard any Defaulting Lender’s Credit Exposure.

“Applicable Prepayment Premium” means, from and after the Second Amendment Effective Date:

Date of Prepayment / Repayment |

Applicable Prepayment Premium |

|

●

Prior to the first anniversary of the Applicable Borrowing Date

|

●

Make-Whole Amount

|

|

●

From and after the first anniversary of the Applicable Borrowing Date to but excluding the second anniversary of the Applicable Borrowing Date

|

●

2.00%

|

|

●

From and after the second anniversary of the Applicable Borrowing Date to but excluding the third anniversary of the Applicable Borrowing Date

|

●

1.00%

|

|

●

From and after the third anniversary of the Applicable Borrowing Date

|

●

0.00%

|

4

; or

Date of Prepayment / Repayment |

Applicable Prepayment Premium |

|

●

Prior to the first anniversary of the Applicable Measurement Date

|

●

Make-Whole Amount

|

|

●

From and after the first anniversary of the Applicable Measurement Date to but excluding the second anniversary of the Applicable Measurement Date

|

●

2.00%

|

|

●

From and after the second anniversary of the Applicable Measurement Date

|

●

0.00%

|

; and

Date of Prepayment / Repayment |

Applicable Prepayment Premium |

|

●

Prior to the second anniversary of the Applicable Measurement Date

|

●

2.00%

|

5

|

●

From and after the second anniversary of the Applicable Measurement Date

|

●

0.00%

|

“Approved Counterparty” means (a) Macquarie Bank Limited or any of its Affiliates, (b) J. Aron & Company LLC or any of its Affiliates and (c) any Person who, at the time a Swap Agreement is entered into, (i) is (A) the Administrative Agent or any Affiliate of the Administrative Agent or (B) any Lender or any Affiliate of a Lender and (ii) has (or whose parent company has) a long term senior unsecured debt rating of A- or higher by S&P or A3 or higher by Moody’s (or their equivalent).

“Approved Electronic Platform” has the meaning assigned such term in Section 11.14.

“Approved Fund” means any Person (other than a natural person) that is engaged in making, purchasing, holding or investing in bank loans and similar extensions of credit in the ordinary course of its business and that is administered or managed by (a) a Lender, (b) an Affiliate of a Lender or (c) an entity or an Affiliate of an entity that administers or manages a Lender.

“Approved Petroleum Engineers” means NSAI and any other independent petroleum engineers reasonably acceptable to the Administrative Agent.

“Arranger” means Macquarie Bank Limited in its capacity as sole lead arranger.

“Asset Coverage Ratio” means, as of any date, the ratio of (a) Total PDP PV-10 as of such date (plus, for purposes of compliance with 0 only, as of such date, the Quarterly D&C Expenses incurred during the most recently ended fiscal quarter) to (b) Consolidated Total Net Indebtedness as of such date.

“Assignment and Assumption” means an assignment and assumption entered into by a Lender and an assignee (with the consent of any party whose consent is required by Section 12.04(b)), and accepted by the Administrative Agent, in the form of Exhibit F or any other form approved by the Administrative Agent.

“Available Tenor” means, as of any date of determination and with respect to the then-current Benchmark, as applicable, (a) if such Benchmark is a term rate, any tenor for such Benchmark (or component thereof) that is or may be used for determining the length of an Interest Period pursuant to this Agreement or (b) otherwise, any payment period for interest calculated with reference to such Benchmark (or component thereof) that is or may be used for determining any frequency of making payments of interest calculated with reference to such Benchmark pursuant to this Agreement, in each case, as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then-removed from the definition of “Interest Period” pursuant to Section 3.03(d).

“Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable Resolution Authority in respect of any liability of an Affected Financial Institution.

6

“Bail-In Legislation” means (a) with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law, regulation rule or requirement for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule and (b) with respect to the United Kingdom, Part I of the United Kingdom Banking Act 2009 (as amended from time to time) and any other law, regulation or rule applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (other than through liquidation, administration or other insolvency proceedings).

“Bankruptcy Code” has the meaning assigned to such term in the recitals hereto.

“Bankruptcy Event” means, with respect to any Person, such Person becomes the subject of a voluntary or involuntary bankruptcy or insolvency proceeding, or has had a receiver, conservator, trustee, administrator, custodian, assignee for the benefit of creditors or similar Person charged with the reorganization or liquidation of its business appointed for it, or, in the good faith determination of the Administrative Agent, has taken any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any such proceeding or appointment or has had any order for relief in such proceeding entered in respect thereof, provided that a Bankruptcy Event shall not result solely by virtue of any ownership interest, or the acquisition of any ownership interest, in such Person by a Governmental Authority or instrumentality thereof, provided, further, that such ownership interest does not result in or provide such Person with immunity from the jurisdiction of courts within the United States or from the enforcement of judgments or writs of attachment on its assets or permit such Person (or such Governmental Authority or instrumentality) to reject, repudiate, disavow or disaffirm any contracts or agreements made by such Person.

“Benchmark” means, initially, the Term SOFR Reference Rate; provided that if a Benchmark Transition Event has occurred with respect to the Term SOFR Reference Rate or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to Section 3.03(a).

“Benchmark Replacement” means, with respect to any Benchmark Transition Event, the first alternative set forth in the order below that can be determined by the Administrative Agent for the applicable Benchmark Replacement Date:

(a)the sum of (i) Daily Simple SOFR plus (ii) 0.15% (15 basis points); or

(b)the sum of: (i) the alternate benchmark rate that has been selected by the Administrative Agent and the Borrower giving due consideration to (A) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (B) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement to the then-current Benchmark for Dollar-denominated syndicated credit facilities and (ii) the related Benchmark Replacement Adjustment; If the Benchmark Replacement as determined pursuant to clause (a)or (b) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and the other Loan Documents.

7

“Benchmark Replacement Adjustment” means, with respect to any replacement of the then-current Benchmark with an Unadjusted Benchmark Replacement, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Administrative Agent and the Borrower giving due consideration to (a) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body or (b) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for Dollar-denominated syndicated credit facilities at such time.

“Benchmark Replacement Conforming Changes” means, with respect to either the use or administration of Adjusted Term SOFR or the use, administration, adoption or implementation of any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition “Business Day,” the definition of “U.S. Government Securities Business Day,” the definition of “Interest Period” or any similar or analogous definition (or the addition of a concept of “interest period”), timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, the applicability and length of lookback periods, the applicability of breakage provisions and other technical, administrative or operational matters) that the Administrative Agent decides may be appropriate to reflect the adoption and implementation of any such rate or to permit the use and administration thereof by the Administrative Agent in a manner substantially consistent with market practice (or, if the Administrative Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Administrative Agent determines that no market practice for the administration of any such rate exists, in such other manner of administration as the Administrative Agent decides is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

(a)in the case of clause (a) or (b) of the definition of “Benchmark Transition Event,” the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); or

(b)in the case of clause (c) of the definition of “Benchmark Transition Event,” the first date on which all Available Tenors of such Benchmark (or the published component used in the calculation thereof) have been determined and announced by the regulatory supervisor for the administrator of such Benchmark (or such component thereof)

8

to be non-representative; provided that such non-representativeness will be determined by reference to the most recent statement or publication referenced in such clause (c) and even if any Available Tenor of such Benchmark (or such component thereof) continues to be provided on such date.

For the avoidance of doubt, the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (a) or (b) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof).

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

(a)a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof);

(b)a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Federal Reserve Board, the Federal Reserve Board of New York, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or

(c)a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that all Available Tenors of such Benchmark (or such component thereof) are no longer representative.

For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof).

“Benchmark Unavailability Period” means the period (if any) (x) beginning at the time that a Benchmark Replacement Date pursuant to clauses (a) or (b) of that definition has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 3.03 and (y) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 3.03.

9

“Beneficial Ownership Certification” means a certification regarding beneficial ownership or control as required by the Beneficial Ownership Regulation.

“Beneficial Ownership Regulation” means 31 C.F.R. § 1010.230.

“Benefit Plan” means any of (a) an “employee benefit plan” (as defined in ERISA) that is subject to Title I of ERISA, (b) a “plan” as defined in and subject to Section 4975 of the Code or (c) any Person whose assets include (for purposes of ERISA Section 3(42) or otherwise for purposes of Title I of ERISA or Section 4975 of the Code) the assets of any such “employee benefit plan” or “plan.”

“BHC Act Affiliate” of a party means an “affiliate” (as such term is defined under, and interpreted in accordance with, 12 U.S.C. 1841(k)) of such party.

“Blowdown Trigger Event” has the meaning assigned to such term in Section 9.21(b).

“Blowdown Wells” has the meaning assigned to such term in Section 9.22(b).

“Board” means the Board of Governors of the Federal Reserve System of the United States of America or any successor Governmental Authority.

“Borrower” has the meaning assigned to such term in the preamble hereto.

“Borrower Assumption Agreement” means that certain Assumption Agreement dated as of November 24, 2021, by and among the Existing Borrower and the Borrower.

“Borrowing” means Loans made on the same date.

“Borrowing Request” means a request by the Borrower, substantially in the form of Exhibit B or any other form approved by the Administrative Agent, for a Borrowing in accordance with Section 2.03.

“Business Day” means any day that is not a Saturday, Sunday or other day on which commercial banks in New York City or Houston, Texas are authorized or required by law to remain closed.

“Capital Expenditures” means, with respect to any Person, all expenditures by such Person for the acquisition or leasing of fixed or capital assets or additions to equipment (including replacements, capitalized repairs and improvements and capitalized workover expenses) that are required to be capitalized under GAAP on a balance sheet of such Person. For purposes of this definition, the purchase price of equipment that is purchased simultaneously with the trade-in of existing equipment owned by such Person or with insurance proceeds shall be included in Capital Expenditures only to the extent of the gross amount of such purchase price minus the credit granted by the seller of such equipment for such equipment being traded in at such time, or the amount of such proceeds, as the case may be.

10

For the avoidance of doubt, it is hereby understood and agreed that (x) expenditures pursuant to clause (c) of the definition of “Investment” and (y) G&A Expenses shall not constitute Capital Expenditures.

“Cash Equivalent” means cash held in US dollars and all Investments of the type identified in Section 9.05(c) through Section 9.05(f).

“Casualty Event” means any loss, casualty or other insured damage to, or any nationalization, taking under power of eminent domain or by condemnation or similar proceeding of, any Property of the Borrower or any of its Subsidiaries.

“Change in Control” means (a) Holdings ceases to own directly one hundred percent (100%) of the issued and outstanding Equity Interests of the Borrower, (b) the acquisition of ownership, directly or indirectly, beneficially or of record, by any Person (other than a Permitted Holder) or group (within the meaning of the Securities Exchange Act of 1934 and the rules of the SEC) (other than a group of Permitted Holders) of Equity Interests representing more than 50% of the aggregate ordinary voting power represented by the issued and outstanding Equity Interests of Holdings, (c) occupation of a majority of the seats (other than vacant seats) on the board of directors of Holdings by Persons who were not (i) directors of Holdings on the Closing Date, (ii) nominated or appointed by the board of directors of Holdings or (iii) approved by the board of directors of Holdings as director candidates prior to their election or (d) a Specified Change of Control shall have occurred.

“Change in Control Prepayment” means any prepayment or repayment of the Loans in full in connection with the occurrence of a Change in Control, whether at the Borrower’s option pursuant to Section 3.04(a) or following an acceleration of the Loans pursuant to Section 10.01, in each case so long as such prepayment or repayment is made no later than two (2) Business Days after the date of such Change in Control.

“Change in Law” means (a) the adoption of or taking effect of any law, rule or regulation or treaty after the date of this Agreement, (b) any change in any law, rule or regulation or treaty or in the administration, in the interpretation, implementation or application thereof by any Governmental Authority after the date of this Agreement or (c) compliance by any Lender or the Issuing Bank (or, for purposes of Section 5.01(c), by any lending office of such Lender or by such Lender’s or the Issuing Bank’s holding company, if any) with any request, guideline or directive (whether or not having the force of law) of any Governmental Authority made or issued after the date of this Agreement; provided that notwithstanding anything herein to the contrary, (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith or in the implementation thereof and (y) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States of America or foreign regulatory authorities, in each case pursuant to Basel III (but not Basel II), shall in each case be deemed to be a “Change in Law”, regardless of the date enacted, issued, adopted, promulgated or implemented.

11

“Closing Date” means the date on which the conditions specified in Section 6.01 are satisfied (or waived in accordance with Section 12.02).

“Code” means the Internal Revenue Code of 1986, as amended from time to time, and any successor statute.

“Collateral” means all Property of the Loan Parties, now owned or hereafter acquired, upon which a Lien is purported to be created by any Security Instrument; provided that at no time shall Excluded Assets be included in the Collateral (only for so long as such assets constitute “Excluded Assets”).

“Collateral Coverage Minimum” has the meaning assigned to such term in Section 8.14(a).

“Commitment” means an Initial Term Loan Commitment or a Delayed Draw Term Loan Commitment, as the context requires.

“Commodities Account” has the meaning assigned to such term in the UCC.

“Commodity Exchange Act” means the Commodity Exchange Act (7 U.S.C. § 1 et seq.), as amended from time to time, and any successor statute, and any regulations promulgated thereunder.

“Compliance Certificate” means the Compliance Certificate, signed by a Financial Officer, substantially in the form of Exhibit D or any other form approved by the Administrative Agent.

“Communications” means, collectively, any notice, demand, communication, information, document or other material provided by or on behalf of the Borrower or any Guarantor pursuant to any Loan Document or the transactions contemplated therein which is distributed by the Administrative Agent, any Lender or any Issuing Bank by means of electronic communications pursuant to this Agreement, including through an Approved Electronic Platform.

12