UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

|

|

|

☐ |

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

|

|

☑ |

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2023 Commission File Number: 001-35297

FORTUNA SILVER MINES INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English (if applicable))

British Columbia, Canada

(Province or other jurisdiction of incorporation or organization)

|

|

|

|

|

|

1040 |

|

N/A |

|

(Primary Standard Industrial Classification Code Number (if applicable)) |

|

(I.R.S. Employer Identification Number (if applicable)) |

200 Burrard Street, Suite 650

Vancouver, British Columbia V6C 3L6, Canada

604-484-4085

(Address and telephone number of Registrant’s principal executive offices)

National Corporate Research, Ltd.

10 East 40th Street, 10th Floor

New York, New York 10016

212-947-7200

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Shares |

FSM |

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

☑ Annual information form ☑ Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

There were 306,587,630 common shares with no par value outstanding as of December 31, 2023.

Indicate by check mark whether the Registrant: (1) has filed all reports to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ◻

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☑ No ◻

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant Section 13(a) of the Exchange Act.

◻

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

DISCLOSURE REGARDING CONTROLS AND PROCEDURES

Disclosure Controls and Procedures.

Disclosure controls and procedures are defined in Rule 13a-15(e) and Rule 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as those controls and procedures designed to ensure that information required to be disclosed in the annual filings and interim filings and other reports filed or submitted by Fortuna Silver Mines Inc. (the “Company”) under the Exchange Act is duly recorded, processed, summarized and reported, within the time periods specified in rules and forms of the United States Securities and Exchange Commission (the “SEC”). Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in the Company’s reports and filings is accumulated and communicated to management, including the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) as appropriate, to allow timely decisions regarding required disclosure.

The Company evaluated, with the participation of its CEO and CFO, the effectiveness of its disclosure controls and procedures as of December 31, 2023. Based on that evaluation, the CEO and the CFO have concluded that, as of the end of the period covered by this Annual Report on Form 40-F, the disclosure controls and procedures were effective to provide reasonable assurance that information required to be disclosed in the Company’s annual filings and interim filings and other reports filed or submitted under the Exchange Act, is recorded, processed, summarized and reported within time periods specified in SEC rules and forms and is accumulated and communicated to management, including the CEO and CFO, as appropriate to allow timely decisions regarding required disclosure.

Notwithstanding the foregoing, because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that the Company’s disclosure controls and procedures will detect or uncover every situation involving the failure of persons within the Company and its subsidiaries to disclose material information otherwise required to be set forth in the Company’s periodic reports. The Company’s disclosure controls and procedures are designed to provide reasonable assurance of achieving their objective of ensuring that information required to be disclosed in the reports that the Company files or submits under the Exchange Act is communicated to management to allow timely decisions regarding required disclosure.

Management’s Annual Report on Internal Control Over Financial Reporting.

Management is responsible for establishing and maintaining adequate internal control over financial reporting (as such term is defined in Rule 13a-15(f) and Rule 15d-15(f) under the Exchange Act) and has designed such internal controls over financial reporting to provide reasonable assurance regarding the reliability of financial reporting and preparation of financial statements for external purposes in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board.

In designing and evaluating the Company’s internal control over financial reporting, the Company’s management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its reasonable judgment in evaluating the cost-benefit relationship of possible controls and procedures. Because of its inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risks that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023. In making this assessment, management used the Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management concluded that the Company’s internal control over financial reporting was effective as of December 31, 2023.

See “Management’s Report on Internal Control Over Financial Reporting” in the Management’s Discussion and Analysis for the fiscal years ended December 31, 2023 and 2022, included as Exhibit 99.3 to this Annual Report on Form 40-F. The Company’s auditors have issued an attestation report on management’s assessment of the Company’s internal control over financial reporting. See “Attestation Report of the Registered Public Accounting Firm” below.

Attestation Report of the Independent Registered Public Accounting Firm. The Company’s internal control over financial reporting as of December 31, 2023 has been audited by KPMG LLP, Independent Registered Public Accounting Firm, Vancouver, BC, Canada, Audit Firm ID 85. The required report is included in the “Report of Independent Registered Public Accounting Firm,” that accompanies the Company’s audited consolidated financial statements as at and for the fiscal years ended December 31, 2023 and 2022, filed as part of this Annual Report on Form 40-F in Exhibit 99.2.

Changes in Internal Control Over Financial Reporting. During the fiscal year ended December 31, 2023, there were no changes in the Company’s internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

None.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Company has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the audit committee are Kylie Dickson, Alfredo Sillau and David Farrell. The board of directors has determined that each of Kylie Dickson, Alfredo Sillau and David Farrell is independent, as that term is defined in Rule 10A-3 under the Exchange Act and the Listed Company Manual of the New York Stock Exchange.

AUDIT COMMITTEE FINANCIAL EXPERT

The board of directors of the Company has determined that Kylie Dickson, a member of the Company’s audit committee, qualifies as an audit committee financial expert for purposes of paragraph (8) of General Instruction B to Form 40-F. The SEC has indicated that the designation of Kylie Dickson as an audit committee financial expert does not: (i) make her an “expert” for any purpose, (ii) impose any duties, obligations or liabilities on her that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation, and (iii) or affect the duties, obligations or liabilities of any other member of the audit committee or the board of directors.

CODE OF ETHICS

The Company has adopted a “code of ethics” (as that term is defined in Form 40-F), entitled the “Code of Business Conduct and Ethics and Whistle-Blower Policy”, that applies to all of its directors, officers, employees, and consultants including its principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions.

The Code of Business Conduct and Ethics and Whistle-Blower Policy is available for viewing on the Company’s website at www.fortunasilver.com under “About Company / Corporate Governance”.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The required disclosure is included under the heading “Audit Committee” in the Company’s Annual Information Form for the fiscal year ended December 31, 2023, filed as part of this Annual Report on Form 40-F in Exhibit 99.1.

PRE-APPROVAL POLICIES AND PROCEDURES

The auditors of the Company obtain, as necessary, the pre-approval of the Audit Committee for any anticipated additional services required of the auditors for the coming fiscal year. If other service requirements arise during the year, the Audit Committee will pre-approve such services at that time, prior to the commencement of such services. During the fiscal year ended December 31, 2023, the Audit Committee did not approve any audit-related, tax or other services pursuant to paragraph (c) (7) (i) (C) of Rule 2-01 of Regulation S-X, with the exception of certain financial statement preparation services relating to the statutory audits of certain of the Company's subsidiaries, the fees for which represented less than 5% of total fees for the fiscal year ended December 31, 2023.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements required to be disclosed in this Annual Report on Form 40-F.

MINE SAFETY DISCLOSURE

The Company is currently not required to disclose the information required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

NEW YORK STOCK EXCHANGE CORPORATE GOVERNANCE

The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act and Rule 405 under the United States Securities Act of 1933, as amended, and the Company’s common shares are listed on the New York Stock Exchange (the “NYSE”). Sections 103.00, 303A.00 and 303A.11 of the NYSE Listed Company Manual permit foreign private issuers to follow home country practices in lieu of certain provisions of the NYSE Listed Company Manual. A foreign private issuer that follows home country practices in lieu of certain provisions of the NYSE Listed Company Manual must disclose any significant ways in which its corporate governance practices differ from those followed by domestic companies either on its website or in the annual report that it distributes to shareholders in the United States. A description of the significant ways in which the Company’s governance practices differ from those followed by domestic companies pursuant to NYSE standards is disclosed on the Company’s website at www.fortunasilver.com under “Company / Corporate Governance / New York Stock Exchange”.

The Company’s corporate governance practices, as described on its website, are consistent with the laws, customs and practices in Canada.

INCORPORATION BY REFERENCE

Exhibits 99.1, 99.2 and 99.3 to this Annual Report on Form 40-F for the year ended December 31, 2023 are incorporated by reference into the Registration Statement on Form F-10 (Commission File No. 333-237897) of the Company.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

A Form F-X signed by the Company and its agent for service of process has been previously filed with the SEC together with the Company’s Registration Statement on Form 40-F (File No. 001-35297) in connection with its securities registered on such form.

Any changes to the name or address of the agent for service of process of the Company shall be communicated promptly to the SEC by an amendment to the Form F-X referencing the file number of the Company.

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Company certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

Date: March 28, 2024 |

FORTUNA SILVER MINES INC. |

|

||

|

By: |

“Jorge Ganoza Durant” |

|

|

|

|

Name: Jorge Ganoza Durant |

|

|

|

|

Title:President, Chief Executive Officer & Director |

||

| ||||

EXHIBIT INDEX

Exhibit |

|

Description |

|

|

|

|

||

|

|

|

|

Annual Information Form for the year ended December 31, 2023 |

|

|

|

|

|

||

|

|

|

|

Management’s Discussion and Analysis for the years ended December 31, 2023 and 2022 |

|

|

|

|

|

Consent of KPMG LLP (PCAOB ID 85) |

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

101.INS |

|

XBRL Instance |

|

|

|

101.SCH |

|

XBRL Taxonomy Extension Schema |

|

|

|

101.CAL |

|

XBRL Taxonomy Extension Calculation Linkbase |

|

|

|

101.DEF |

|

XBRL Taxonomy Extension Definition Linkbase |

|

|

|

101.LAB |

|

XBRL Taxonomy Extension Label Linkbase |

|

|

|

101.PRE |

|

XBRL Taxonomy Extension Presentation Linkbase |

|

|

|

104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

EXHIBIT 97

INCENTIVE COMPENSATION RECOVERY POLICY

FORTUNA SILVER MINES INC.

(the "Company")

INCENTIVE COMPENSATION RECOVERY POLICY

Purpose

The Board of Directors of the Company (“Board”) has adopted this Incentive Compensation Recovery Policy (“Policy”) in order to provide a measure of accountability by ensuring that Incentive-Based Compensation (as defined below) paid to its Executive Officers (as defined below) and employees is based on accurate Financial Reporting Measures (as defined below). This Policy complies with the listing requirements of the New York Stock Exchange (“NYSE Requirements”) and the Sarbanes-Oxley Act of 2002 (“SOX Requirements”) regarding the clawback of incentive-based compensation.

This Policy shall apply to Incentive-Based Compensation received on or after October 2, 2023 and which has been determined by the Board to be Erroneously Awarded Compensation (as defined below).

Definitions

“Clawback Period” means the three completed fiscal years immediately preceding the earlier of:

(1) |

the date the Board (or a committee thereof) or the officer or officers of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare a Restatement (as defined below), or |

(2) |

the date that a court, regulator, or other legally authorized body directs the Company to prepare a Restatement. |

In addition, the Clawback Period includes any transition period that results from a change in the Company’s fiscal year within or immediately following those three completed fiscal years. However, a transition period between the last day of the Company’s previous fiscal year end and the first day of its new fiscal year that comprises a period of nine to twelve months would be deemed a completed fiscal year.

“Executive Officer” means the Company’s current or former:

(1) |

President, |

(2) |

Chief Executive Officer, |

(3) |

Chief Financial Officer, |

(4) |

Vice-President of Accounting and Finance, or if there is no such officer, then any principal accounting officer, or if there is no such officer, then the Controller, |

(5) |

any Senior Vice-President, and |

any other persons who currently perform or formerly performed a significant policy-making function for the Company, including executive officers of Company subsidiaries.

“Erroneously Awarded Compensation” means the amount of Incentive-Based Compensation received by a current or former Executive Officer or employee that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the Restatement, which shall be calculated without regard to any taxes paid. For Incentive-Based Compensation based on stock price or total shareholder return, where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in an accounting restatement:

(1) |

the amount shall be based on a reasonable estimate of the effect of the accounting restatement on the stock price or total shareholder return upon which the Incentive-Based Compensation was received; and |

(2) |

the Company shall maintain and provide documentation of the determination of that reasonable estimate to the NYSE. |

“Financial Reporting Measure” means a measure that is determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measures that are derived wholly or in part from such measures. For the avoidance of doubt, a Financial Reporting Measure need not be presented within the financial statements, and stock price and total shareholder return are Financial Reporting Measures.

“Incentive-Based Compensation” means any compensation (including cash and equity compensation) that is granted, earned or vested based wholly or in part upon the attainment of any Financial Reporting Measure.

“Restatement” means any accounting restatement of the Company’s financial results due to material non-compliance of the Company with any financial reporting requirement under applicable securities laws, including any required accounting restatement to correct an error to previously issued financial statements:

(1) |

that is material to the previously issued financial statements, or |

(2) |

that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period, |

and which requires the Company to file an amended financial statement, management’s discussion and analysis or other financial report (including for the current period) to correct such Restatement.

Recovery of Erroneously Awarded Compensation upon Restatement

In the event that the Company is required to prepare a Restatement, the Board shall require each Executive Officer and, if such Restatement was caused or contributed to by the fraud, theft, embezzlement, serious misconduct or negligence of an employee who is not an Executive Officer, each applicable employee, to repay and/or forfeit the Erroneously Awarded Compensation received by such person during the Clawback Period.

Incentive-Based Compensation shall be deemed “received” in the fiscal period during which the applicable Financial Reporting Measure specified in the Incentive-Based Compensation award is attained, even if the payment or grant occurs after the end of that fiscal period.

This Policy applies to all Incentive-Based Compensation received by a person:

(1) |

after beginning service as an Executive Officer or employee (including Incentive-Based Compensation derived from an award authorized before the individual is newly hired as an Executive Officer or employee, e.g. inducement grants), |

(2) |

who served as an Executive Officer or employee at any time during the performance period for that Incentive-Based Compensation, |

(3) |

while the Company has a class of securities listed on a national securities exchange or a national securities association, and |

(4) |

during the Clawback Period. |

To the extent the Erroneously Awarded Compensation represents an award which has previously been deferred, such deferred compensation award shall be forfeited. Without otherwise limiting the Company’s authority to recover the Erroneously Awarded Compensation hereunder, the Company shall have the authority to unilaterally forfeit deferred compensation, subject to compliance with Section 409A of the U.S. Internal Revenue Code or any other applicable local employment or tax law.

Clawback of Erroneously Awarded Compensation shall be without regard to any fault, misconduct, responsibility or involvement of the Executive Officer in the material non-compliance with Financial Reporting Measures that resulted in the Restatement. The Company’s obligation to recover Erroneously Awarded Compensation is not dependent on if or when the restated financial report is filed.

Where Incentive-Based Compensation is based only in part on the achievement of a Financial Reporting Measure performance goal, the Company will determine the portion of the original Incentive-Based Compensation based on or derived from the Financial Reporting Measure which was restated and will recalculate the affected portion based on the Financial Reporting Measure as restated to determine the difference between the greater amount based on the original financial report and the lesser amount that would have been received based on the Restatement. The Erroneously Awarded Compensation will be calculated on a pre-tax basis.

Recovery Mechanisms

In the event a Restatement is required, each person subject to clawback will be given the opportunity to elect how to repay his or her Erroneously Awarded Compensation to the Company, subject to approval of the Board and compliance with this Policy.

Failing such an election, the Board shall have the discretion to cancel scheduled but not granted awards, withhold payments of vested but unpaid awards, or take such other action as it deems appropriate to recoup all Erroneously Awarded Compensation from the Executive Officers. Where the Erroneously Awarded Compensation consists of equity compensation, the Board will recover the excess portion of the equity award that would not have been vested and/or paid based on the Restatement, as follows:

(1) |

if the vested portion of the equity award has been determined but has not been paid, the excess portion of the vested portion of the award will be forfeited; |

(2) |

if the equity award has been exercised or settled into shares (the “Underlying Shares”), and the person still holds the Underlying Shares, the Company will recover and return to treasury the number of Underlying Shares relating to the excess portion of the award (less any exercise price paid for the Underlying Shares); and |

(3) |

if the Underlying Shares have been sold by person, the Company will recover the proceeds received by the person from the sale of the Underlying Shares relating to the excess portion of the award (less any exercise price paid for the Underlying Shares). |

The Board will take such action as it deems appropriate, in its sole and absolute discretion, to reasonably promptly clawback the Erroneously Awarded Compensation, unless the Company’s committee of independent directors responsible for executive compensation decisions, or in the absence of such a committee, a majority of the independent directors serving on the Board, determines that it would be impracticable to recover such amount because:

(1) |

subsequent to making a reasonable and documented attempt at recovery, the direct costs of enforcing recovery would exceed the Erroneously Awarded Compensation amount to be recovered, documentation of which shall be provided to the NYSE; or |

(2) |

recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder, based on an opinion of legal counsel; or (3) if the recovery of the incentive-based compensation would violate the employment or other home-country laws applicable to the Company based on an opinion of home country counsel, which opinion shall be provided to the NYSE. |

Additional Recovery as a Result of Misconduct pursuant to SOX Requirements

In addition to the provisions in this Policy which comply with the NYSE Requirements, if the Company is required to prepare a Restatement as a result of misconduct, then in accordance with the SOX Requirements, the Chief Executive Officer and Chief Financial Officer who were in office at the time the financial document embodying such financial reporting requirement was originally issued shall reimburse the Company for:

(1) |

any bonus or other incentive-based or equity-based compensation received from the Company during the 12-month period following the first public issuance or filing with the U.S. Securities and Exchange Commission (whichever first occurs) of such financial document; and |

(2) |

any profits realized from the sale of securities of the Company during that 12-month period. |

Such repayment shall be without regard to the knowledge, engagement or involvement of the Chief Executive Officer or Chief Financial Officer in the misconduct.

Limit of Amount Recoverable from any one Person

To the extent that the provisions of this Policy require recovery of Erroneously Awarded Compensation by the Company in compliance with both the NYSE Requirements and SOX Requirements, the amount recoverable from any one person shall be the greater of: (i) the amount required under the NYSE Requirements, and (ii) the amount required under the SOX Requirements as determined by the Board.

Changes to this Policy

The Board reserves the right, at its absolute discretion, to change this Policy from time to time as it considers necessary. Changes to this Policy will be communicated to all persons to whom this Policy applies.

General

The Board shall have full authority to interpret, amend and enforce this Policy on behalf of the Company. All determinations and decisions made by the Board (or any committee thereof) pursuant to the provisions of this Policy shall be final, conclusive and binding on the Company, its subsidiaries and the persons to whom this Policy applies.

The provisions of this Policy apply to the fullest extent of the law; provided however, to the extent that any provisions of this Policy are found to be unenforceable or invalid under any applicable law, such provision will be applied to the maximum extent permitted, and shall automatically be deemed amended in a manner consistent with its objectives to the extent necessary to conform to any limitations required under applicable law.

The Company will not indemnify or provide insurance to cover any repayment of Incentive-Based Compensation in accordance with this Policy.

This Policy is in addition to (and not in lieu of) any right of repayment, forfeiture or right of offset against any Executive Officer that is required pursuant to any other statutory repayment requirement, regardless of whether implemented at any time prior to or following the adoption of this Policy.

This Incentive Compensation Recovery Policy was adopted by the Board on November 22, 2023.

Exhibit 99.1

ANNUAL INFORMATION FORM

For the Fiscal Year Ended December 31, 2023

DATED: March 22, 2024

CORPORATE OFFICE: |

MANAGEMENT HEAD OFFICE: |

|

|

Suite 650, 200 Burrard Street |

Piso 5, Av. Jorge Chávez #154 |

Vancouver, BC V6C 3L6, Canada |

Miraflores, Lima, Peru |

Tel: 604.484.4085 |

Tel: 511.616.6060, ext. 2 |

Fax: 604.484.4029 |

|

TABLE OF CONTENTS

PRELIMINARY NOTES |

1 |

Cautionary Statement – Forward Looking Statements |

1 |

Notice Regarding Non-IFRS Measures |

5 |

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources |

6 |

Documents Incorporated by Reference |

7 |

Scientific and Technical Information |

7 |

Currency |

7 |

|

|

CORPORATE STRUCTURE |

7 |

Name, Address and Incorporation |

7 |

Intercorporate Relationships |

8 |

|

|

GENERAL DEVELOPMENT OF THE BUSINESS |

8 |

Business of the Company |

8 |

Three-Year History and Recent Developments |

9 |

|

|

DESCRIPTION OF THE BUSINESS |

27 |

General |

27 |

Sustainability Governance |

29 |

Risk Factors |

36 |

Material Mineral Properties (see Schedules “A”, “B”, “C”, “D” and “E”) |

67 |

Non-Material Mineral Properties |

67 |

|

|

DIVIDENDS |

67 |

|

|

DESCRIPTION OF CAPITAL STRUCTURE |

68 |

|

|

MARKET FOR SECURITIES |

70 |

Common Shares |

70 |

Debentures |

71 |

Prior Sales |

71 |

|

|

DIRECTORS AND EXECUTIVE OFFICERS |

71 |

Name, Occupation and Shareholding |

71 |

Cease Trade Orders or Bankruptcies |

73 |

Penalties or Sanctions |

74 |

Conflicts of Interest |

75 |

|

|

AUDIT COMMITTEE |

75 |

|

|

LEGAL PROCEEDINGS |

76 |

|

|

TRANSFER AGENT AND REGISTRAR |

76 |

|

|

MATERIAL CONTRACTS |

76 |

|

|

INTERESTS OF EXPERTS |

77 |

|

|

ADDITIONAL INFORMATION |

78 |

|

|

Material Mineral Properties: |

|

Séguéla Mine, Côte d’Ivoire |

Schedule “A” |

Yaramoko Mine, Burkina Faso |

Schedule “B” |

Lindero Mine, Argentina |

Schedule “C” |

San Jose Mine, Mexico |

Schedule “D” |

Caylloma Mine, Peru |

Schedule “E” |

Audit Committee Charter |

Schedule “F” |

FORTUNA SILVER MINES INC.

PRELIMINARY NOTES

This Annual Information Form (“AIF”) is dated March 22, 2024 and presents information about Fortuna Silver Mines Inc. (referred to herein as the “Company” or “Fortuna”). Except as otherwise indicated, the information contained herein is presented as at December 31, 2023, being the date of the Company’s most recently completed financial year end.

Fortuna has a number of direct and indirect subsidiaries which own and operate assets and conduct activities in different jurisdictions. The terms "Fortuna" or the "Company" are use in this AIF for simplicity of the discussion provided herein and may include references to subsidiaries that have an affiliation with Fortuna, without necessarily identifying the specific nature of such affiliation.

Cautionary Statement – Forward-Looking Statements

Certain statements contained in this AIF and the documents incorporated by reference into this AIF constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and forward-looking information within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). All statements included herein, other than statements of historical fact, are forward-looking statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements. The forward-looking statements in this AIF include, without limitation, statements relating to:

| ● | Mineral Reserves (as defined herein) and Mineral Resources (as defined herein) at the Caylloma, Lindero, San Jose, Séguéla and Yaramoko mines and at the Arizaro Project, as they involve implied assessment, based on estimates and assumptions that the Mineral Reserves and Mineral Resources described exist in the quantities predicted or estimated and can be profitably produced in the future; |

| ● | estimated rates of production for gold silver and the other metals that we produce, timing of production and the cash costs and all-in sustaining cash costs (“AISC”) estimates; |

| ● | expectations with respect to metal grade estimates and the impact of any variations relative to metal grades experienced; |

| ● | the Company's plans and expectations for its material properties and future Brownfields and Greenfields exploration, development and operating activities including, without limitation, capital expenditures, exploration activities and budgets, forecasts and schedule estimates, as well as their impact on the results of operations or financial condition of the Company; |

| ● | results from the feasibility and optimization work at the Séguéla Mine to realize the opportunity to incorporate underground mineable resources at the Sunbird, Ancien and Koula deposits; |

| ● | life of mine estimates for the Caylloma, Lindero, San Jose, Séguéla and Yaramoko Mines, including the exhaustion of Mineral Reserves at the San Jose Mine, the timing of the closure of the San Jose Mine, and the estimated costs of associated with such closure; |

| ● | the proposed expansion of ore processing at the Séguéla Mine above the target prepared and estimated in 2021 and the initiatives to de-bottleneck the processing plant to be put in place in 2024; |

| ● | timing for delivery of materials and equipment for the Company’s properties; |

| ● | timing and cost of sustaining capital projects at the Company’s mines, including the one-time phase II expansion of the leach pad at the Lindero Mine; the replacement and overhaul of heavy equipment and purchase of critical spare parts at the Lindero Mine; the expansion of the tailings storage facility at the Séguéla Mine; and the enhancement of the power grid substation and the completion of phase II of the plant power substation at the Caylloma Mine; |

| ● | the sufficiency of the Company’s cash on hand and available credit lines and estimated cash flows to fund planned capital and exploration programs at its properties; |

| ● | the Company’s financial performance being closely linked to the prices of silver and gold and other metals; |

| ● | rising costs caused by the effect of the Ukraine - Russian conflict and the Israel - Hamas war, causing increased rates of inflation and pressures on the global supply chain; |

|

ANNUAL INFORMATION FORM |

Page | 1 |

FORTUNA SILVER MINES INC.

| ● | the anticipated rates of returns from mining projects, as reflected in preliminary economic assessments, pre-feasibility and feasibility studies or other reports prepared in relation to development of projects; |

| ● | future sales of the metals and concentrates or other products that the Company produces, the availability and location of refineries and sales counterparts, and any plans and expectations with respect to hedging; |

| ● | the Company’s intentions with respect to the exploration of the Diamba Sud gold project (“Diamba Sud Project”); the results and anticipated timing of the 42,700 meter drill program at the Diamba Sud Project which is intended to confirm and to expand the historical mineral resource prepared under the JORC Code, and support the development of the project towards the preparation of a resource model in late 2024; |

| ● | undisclosed risks and liabilities relating to the acquisition of Chesser Resources Limited; |

| ● | restrictions on the ability of employees to travel and restrictions on supply chains as a result of epidemics, pandemics, and health crises may adversely affect the Company’s business and operations, and financial condition; |

| ● | the appeal by the Secretaria de Medio Ambiente y Recursos Naturales (“SEMARNAT”) to the reinstatement of the 12-year environmental impact authorization (“EIA”) for the San Jose Mine; |

| ● | the payments due under, and the maturity dates of the Company’s financial liabilities, lease obligations and other contractual commitments, including the Company’s outstanding convertible debentures in the aggregate amount of $45.7 million which mature in October 2024 and its senior secured credit facility of which an aggregate of $165 million was outstanding as at December 31, 2023 and which matures in November 2025; |

| ● | the expiry dates of bank letters of guarantee; |

| ● | compliance with environmental, health, safety and other regulations; |

| ● | the Company’s commitment to sustainable development, by conducting its operations in an environmentally and socially responsible manner, including complying with its Sustainability Framework, its environmental, social and governance (“ESG”) policies and targets and other operational and governance policies, such as the Company’s commitment to implementing standards and ensuring compliance with applicable requirements of Global Industry Standard on Tailings Management for its tailings storage facilities by 2027; |

| ● | the ability of the Company to reduce its greenhouse gas (“GHG”) emissions to transition to a lower carbon economy and lessen the impact of its operations on climate change, through projects such as solar power plants at the Lindero and Séguéla Mines; and changing to an energy supplier at its Caylloma Mine which provides energy from 100% renewable energy sources; |

| ● | the Company’s commitment to mitigating the physical risks of climate change at its mine sites and to minimize its operational water consumption as well as to reduce its exposure to climate-related transition risks; |

| ● | complying with anti-corruption laws; |

| ● | litigation matters; |

| ● | estimated mine closure costs, including remediation and reclamation and timing thereof; and |

| ● | future income tax rate. |

Often, but not always, these forward-looking statements can be identified by the use of words such as “anticipates”, “believes”, “plans”, “estimates”, “expects”, “forecasts”, “scheduled”, “targets”, “possible”, “strategy”, “potential”, “intends”, “advance”, “goal”, “objective”, “projects”, “budget”, “calculates” or statements that events, “will”, “may”, “could” or “should” occur or be achieved and similar expressions, including negative variations.

The forward-looking statements in this AIF also include financial outlooks and other forward-looking metrics relating to Fortuna and its business, including references to financial and business prospects and future results of operations, including production, and cost guidance and anticipated future financial performance. Such information, which may be considered future oriented financial information or financial outlooks within the meaning of applicable Canadian securities legislation (collectively, “FOFI”), has been approved by management of the Company and is based on assumptions which management believes were reasonable on the date such FOFI was prepared, having regard to the industry, business, financial conditions, plans and prospects of Fortuna and its business and properties. These projections are provided to describe the prospective performance of the Company’s business. Nevertheless, readers are cautioned that such information is highly subjective and should not be relied on as necessarily indicative of future

|

ANNUAL INFORMATION FORM |

Page | 2 |

FORTUNA SILVER MINES INC.

results and that actual results may differ significantly from such projections. FOFI constitutes forward-looking statements and is subject to the same assumptions, uncertainties, risk factors and qualifications as set forth below.

Material Risks and Assumptions

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual events, results, performance or achievements of the Company to be materially different from any events, results, performance or achievements expressed or implied by the forward-looking statements. Such risks, uncertainties and factors include, among others:

| ● | operational risks associated with mining and mineral processing; |

| ● | uncertainty relating to Mineral Resource and Mineral Reserve estimates; |

| ● | uncertainty relating to capital and operating costs, production schedules and economic returns; |

| ● | uncertainties related to new operations such as the Séguéla Mine, including the possibility that actual capital and operating costs and economic returns will differ significantly from those estimated for such projects prior to production; |

| ● | uncertainty relating to the financing and timing of the Company’s sustaining capital projects at its mines due to the increased costs and rising rates of inflation; |

| ● | risks relating to the Company’s ability to replace its Mineral Reserves; |

| ● | risks associated with mineral exploration and project development; |

| ● | risk related to the exploration of projects such as the Diamba Sud Project, including whether a mineral resource estimate prepared under NI 43-101 (as defined herein) will be confirmed, and if confirmed will be in an amount satisfactory to the Company; |

| ● | risks associated with political instability and changes to the regulations governing the Company’s business operations; |

| ● | uncertainty relating to the repatriation of funds as a result of currency controls; |

| ● | environmental matters including obtaining or renewing environmental permits and potential liability claims; |

| ● | uncertainties related to the timing of the closure of the San Jose Mine; |

| ● | changes in national and local government legislation, taxation, controls, regulations and political or economic developments in countries in which the Company does or may carry on business, including potential changes by the new Argentine Government to national macroeconomic policies, the taxation system and import and export duties; |

| ● | risks associated with war, hostilities or other conflicts, such as the Ukrainian – Russian conflict and the Israel – Hamas war, and the possible impact of such conflicts on global economic activity; |

| ● | risks relating to the termination of the Company’s mining concessions in certain circumstances; |

| ● | risks related to International Labour Organization (“ILO”) Convention 169 compliance; |

| ● | developing and maintaining relationships with local communities and stakeholders; |

| ● | risks associated with losing control of public perception as a result of social media and other web-based applications; |

| ● | potential opposition to the Company’s exploration, development and operational activities; |

| ● | risks related to the Company’s ability to obtain adequate financing for planned exploration and development activities; |

| ● | substantial reliance on the Séguéla Mine, the Lindero Mine, the Yaramoko Mine and the Caylloma Mine for revenues; |

| ● | property title matters; |

| ● | risks relating to the integration of businesses and assets acquired by the Company; |

| ● | failure to meet covenants under the 2021 Credit Facility (as defined herein), or an event of default which may reduce the Company’s liquidity and adversely affect its business; |

| ● | impairments; |

| ● | restrictions on the 2021 Credit Facility being temporary in nature; |

| ● | reliance on key personnel; |

| ● | uncertainty relating to potential conflicts of interest involving the Company’s directors and officers; |

|

ANNUAL INFORMATION FORM |

Page | 3 |

FORTUNA SILVER MINES INC.

| ● | risks associated with the Company’s reliance on local counsel and advisors and its management and Board (as defined herein) in foreign jurisdictions; |

| ● | adequacy of insurance coverage; |

| ● | operational safety and security risks; |

| ● | risks related to the Company’s compliance with the Sarbanes-Oxley Act; |

| ● | risks related to the foreign corrupt practices regulations and anti-bribery laws; |

| ● | uncertainties regarding the outcome of the appeal of the reinstatement of the Company’s 12 year EIA at the San Jose Mine; |

| ● | legal proceedings and potential legal proceedings; |

| ● | uncertainties relating to general economic conditions; |

| ● | competition; |

| ● | fluctuations in metal prices; |

| ● | risks associated with entering into commodity forward and option contracts for base metals production; |

| ● | fluctuations in currency exchange rates; |

| ● | tax audits and reassessments; |

| ● | risks related to hedging; |

| ● | uncertainty relating to concentrate treatment charges and transportation costs; |

| ● | sufficiency of monies allotted by the Company for land reclamation; |

| ● | risks associated with dependence upon information technology systems, which are subject to disruption, damage, failure and risks with implementation and integration; |

| ● | the possibility of an outbreak of a communicable disease, epidemic or pandemic in areas in which Fortuna operates, which could affect global economic growth and impact the Company’s business, operations, financial condition and share price; |

| ● | uncertainty relating to nature and climate conditions; |

| ● | risks associated with climate change legislation; |

| ● | our ability to manage physical and transition risks related to climate change and successfully adapt our business strategy to a low carbon global economy; |

| ● | the anticipated nature and effect of climate related risks; |

| ● | risks related to the volatility of the trading price of the Company’s common shares (“Common Shares”) and the Company’s senior subordinated unsecured convertible debentures in the aggregate principal amount of US$45.7 million (the “Debentures”); |

| ● | dilution from future equity or convertible debt financings; |

| ● | risks related to future insufficient liquidity resulting from a decline in the price of the Common Shares or Debentures; |

| ● | uncertainty relating to the Company’s ability to pay dividends in the future; |

| ● | risks relating to the market for the Company’s securities; |

| ● | risks relating to the Debentures of the Company; |

| ● | uncertainty relating to the enforcement of U.S. judgments against the Company; and |

| ● | risk factors referred to in the “Risk Factors” section in this AIF, and the documents incorporated by reference herein (if any). |

Forward-looking statements contained in this AIF are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to:

| ● | that all required third party contractual, regulatory and governmental approvals will be obtained and maintained for the exploration, development, construction and production of its properties; |

| ● | there being no significant disruptions affecting operations, whether relating to labor, supply, power, damage to equipment or any other matter; |

| ● | there being no material and negative impact to the various contractors, suppliers and subcontractors at the Company’s mine sites as a result of the Ukrainian – Russian conflict and the Isarael – Hamas war or otherwise that would impair their ability to provide goods and services; |

| ● | permitting, construction, development and expansion proceeding on a basis consistent with the Company’s current expectations; |

|

ANNUAL INFORMATION FORM |

Page | 4 |

FORTUNA SILVER MINES INC.

| ● | expected trends and specific assumptions regarding metal prices and currency exchange rates; |

| ● | prices for and availability of fuel, electricity, parts and equipment and other key supplies remaining consistent with current levels; |

| ● | production forecasts meeting expectations; |

| ● | any investigations, claims, and legal, labor and tax proceedings arising in the ordinary course of business will not have a material effect on the results of operations or financial condition of the Company; and |

| ● | the accuracy of the Company’s current Mineral Resource and Mineral Reserve estimates. |

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. These forward-looking statements are made as of the date of this AIF. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements. Except as required by law, the Company does not assume the obligation to revise or update these forward looking-statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

Notice Regarding Non-IFRS Measures

Fortuna’s audited consolidated financial statements for the years ended December 31, 2023 and 2022 (the “2023 Financial Statements”) which are referred to in this AIF have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board. However, this AIF includes certain financial measures and ratios that are not defined under IFRS and are not disclosed in the 2023 Financial Statements, including but not limited to: cash cost per ounce of gold sold; cash cost per tonne of processed ore; cash cost per ounce of silver equivalent; consolidated cash cost per ounce of gold equivalent sold; AISC per ounce of gold sold; AISC per ounce of silver equivalent; and consolidated AISC per ounce of gold equivalent.

These non-IFRS financial measures and non-IFRS ratios are widely reported in the mining industry as benchmarks for performance and are used by management to monitor and evaluate the Company’s operating performance and ability to generate cash. The Company believes that, in addition to financial measures and ratios prepared in accordance with IFRS, certain investors use these non-IFRS financial measures and ratios to evaluate the Company’s performance. However, the measures do not have a standardized meaning under IFRS and may not be comparable to similar financial measures disclosed by other companies. Accordingly, non-IFRS financial measures and non-IFRS ratios should not be considered in isolation or as a substitute for measures and ratios of the Company's performance prepared in accordance with IFRS.

Except as otherwise described below, the Company has calculated these non-IFRS financial measures and non-IFRS ratios consistently for all periods presented.

To facilitate a better understanding of these measures and ratios as calculated by the Company, descriptions are provided below. In addition, see “Non-IFRS Financial Measures” in the Company’s management’s discussion and analysis for the fiscal year ended December 31, 2023 (“2023 MD&A”), which section is incorporated by reference in this AIF, for additional information regarding each non-IFRS financial measure and non-IFRS ratio disclosed in this AIF, including an explanation of their composition; an explanation of how such measures and ratios provide useful information to an investor and the additional purposes, if any, for which management of Fortuna uses such measures and ratios; and a qualitative reconciliation of each non-IFRS financial measure to the most directly comparable financial measure that is disclosed in the Company’s 2023 Financial Statements. The 2023 MD&A may be accessed on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov under the Company’s profile, Fortuna Silver Mines Inc.

Equivalent Ounces

At our San Jose and Caylloma Mines, production and sales of other metals are treated as a silver equivalent in determining a combined precious metal production or sales unit, commonly referred to as silver equivalent ounces. Silver equivalent ounces are calculated by converting other metal production to its silver equivalent using relative

|

ANNUAL INFORMATION FORM |

Page | 5 |

FORTUNA SILVER MINES INC.

metal/silver metal prices at realized prices and adding the converted metal production expressed in silver ounces to the ounces of silver production. The Lindero, Yaramoko and Séguéla Mines do not make use of an equivalent ounce measure as all material production is gold.

However, consolidated cash costs for production of all mines is provided on a gold equivalent basis. Gold equivalent ounces are calculated by converting other metal production to its gold equivalent using relative metal/gold metal prices at realized prices and adding the converted metal production expressed in gold ounces to the ounces of gold production.

Cash Cost and AISC

In this AIF, the Company has disclosed certain cash cost and AISC figures on a per unit basis, with each such per unit measure being a non-IFRS ratio.

Cash cost is a non-IFRS measure that is an industry-standard method of comparing certain costs on a per unit basis. Cash costs include all direct and indirect operating cash costs related directly to the physical activities of producing metals, including mining and processing costs, third-party refining and treatment charges, on-site general and administrative expenses, applicable production taxes and royalties which are not based on sales or taxable income calculations , net of by-product credits, but are exclusive of the impact of non-cash items that are included as part of the cost of sales that is calculated in the consolidated Income Statement including depreciation and depletion, reclamation, capital, development and exploration costs.

The most directly comparable financial measure to cash cost that is defined in IFRS and disclosed in the Company’s 2023 Financial Statements is cost of sales. Unit based cash cost ratios contained in this AIF include:

| ● | cash cost per ounce of gold sold; |

| ● | cash cost per tonne of processed ore; |

| ● | cash cost per ounce of silver equivalent; and |

| ● | consolidated cash cost per ounce of gold equivalent sold |

AISC: The Company, in conjunction with an initiative undertaken within the gold mining industry, has adopted AISC and all-in sustaining cost measures based on guidance published by World Gold Council. The Company conforms its AISC and all-in cash cost definitions to that set out in the guidance and the Company presents the cash cost figures on a sold ounce basis.

AISC is a non-IFRS measure that includes total production cash costs incurred at the applicable mining operation but excludes mining royalty recognized as income tax within the scope of IAS-12, as well as non-sustaining capital expenditures. Sustaining capital expenditures, corporate selling, general and administrative expenses, and Brownfields exploration expenditures are added to the cash cost. AISC is estimated at realized metal prices.

The most directly comparable financial measure to AISC that is defined in IFRS and disclosed in the Company's 2023 Financial Statements is cost of sales. Unit based AISC ratios contained in this AIF include:

| ● | all-in sustaining cash cost per ounce of gold sold; |

| ● | all-in sustaining cash cost per ounce of silver equivalent; and |

| ● | consolidated all-in sustaining cash cost per ounce of gold equivalent sold |

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

The Company is a Canadian “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act and is permitted to prepare the technical information contained herein in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the securities laws currently in effect in the United States.

|

ANNUAL INFORMATION FORM |

Page | 6 |

FORTUNA SILVER MINES INC.

Technical disclosure regarding our properties included herein and, in the documents, incorporated herein by reference, if applicable, was prepared in accordance with National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. Accordingly, information contained herein is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Documents Incorporated by Reference

The information provided in this AIF is supplemented by disclosure contained in the documents listed below which are incorporated by reference into this AIF. These documents must be read together with the AIF in order to provide full, true and plain disclosure of all material facts relating to Fortuna. The documents listed below are not contained within or attached to this document. The documents may be accessed on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov under the Company’s profile for Fortuna Silver Mines Inc.

Document |

Effective Date |

Date Filed on |

Document |

Technical Report, Séguéla Gold Mine, Côte d’Ivoire |

December 31, 2023 |

February 16, 2024 |

Technical Report(s) |

Technical Report, Yaramoko Gold Mine, Burkina Faso |

December 31, 2022 |

March 24, 2023 |

Technical Report(s) |

Technical Report, Lindero Mine and Arizaro Project, Argentina |

December 31, 2022 |

March 28, 2023 |

Technical Report(s) |

Technical Report, San Jose Mine, Mexico |

December 31, 2023 |

March 8, 2024 |

Technical Report(s) |

Technical Report, Caylloma Mine, Peru |

December 31, 2023 |

February 16, 2024 |

Technical Report(s) |

Scientific and Technical Information

Eric Chapman, Senior Vice President of Technical Services of the Company, is a “Qualified Person” as defined by NI 43-101. Mr. Chapman is responsible for ensuring that the technical information contained in this AIF is an accurate summary of the original reports and data provided to or developed by the Company and he has reviewed and approved the scientific and technical information contained in this AIF.

Currency

Unless otherwise noted, all dollar amounts in this AIF are expressed in United States dollars. References to “$” or “US$” in this AIF are to United States dollars and references to CAD$ are to Canadian dollars.

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated on September 4, 1990 pursuant to the Company Act (British Columbia) under the name Jopec Resources Ltd. and subsequently transitioned under the Business Corporations Act (British Columbia). On February 3, 1999, the Company changed its name to Fortuna Ventures Inc. and on June 28, 2005 to Fortuna Silver Mines Inc.

|

ANNUAL INFORMATION FORM |

Page | 7 |

FORTUNA SILVER MINES INC.

The management head office of the Company is located at Piso 5, Av. Jorge Chávez #154, Miraflores, Lima, Peru. The corporate head and registered office of the Company is located at 200 Burrard Street, Suite 650, Vancouver, BC V6C 3L6.

Intercorporate Relationships

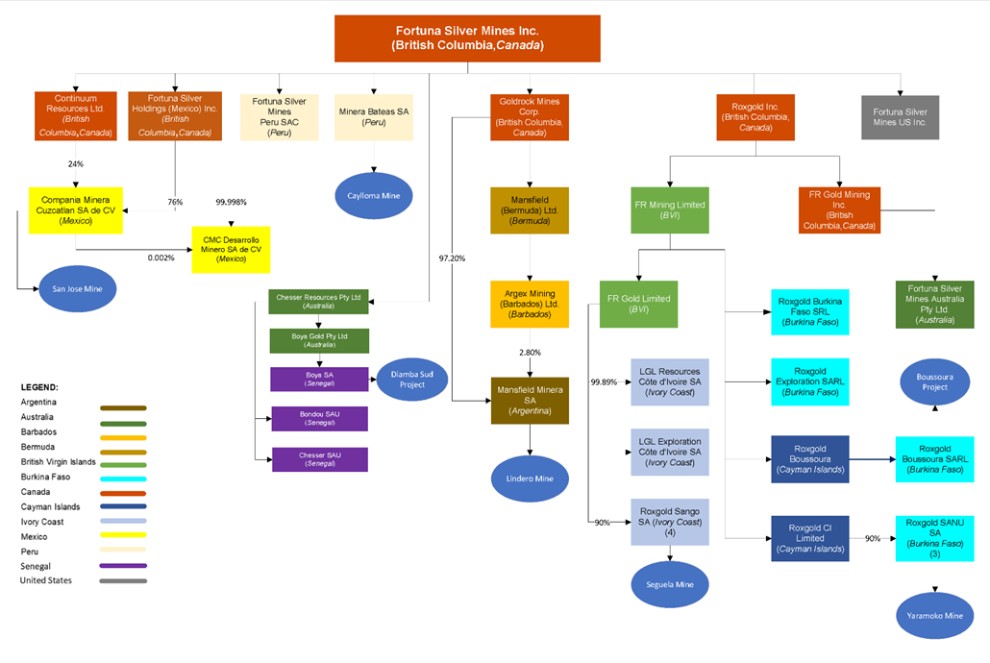

The chart below illustrates the Company’s intercorporate relationships with its subsidiaries including the name, jurisdiction of incorporation and the Company’s respective percentage ownership of each subsidiary:

Notes:

1. |

In some jurisdictions where the Company operates, laws require that a company operating mineral properties must have more than one shareholder. For those jurisdictions, a nominal interest may be held by an individual or other affiliated entity and this may not be represented on the above chart. |

2. |

All ownership of subsidiaries is 100% unless otherwise indicated. |

3. |

10% of the issued and outstanding shares of Roxgold Sanu S.A. are held by the State of Burkina Faso |

4. |

10% of the issued and outstanding shares of Roxgold Sango S.A. are held by the State of Côte d’Ivoire. |

GENERAL DEVELOPMENT OF THE BUSINESS

Business of the Company

Fortuna is engaged in precious and base metals mining and related activities in Latin America and West Africa, including exploration, extraction, and processing. The Company’s principal products are gold and silver, although it also produces and sells lead and zinc.

|

ANNUAL INFORMATION FORM |

Page | 8 |

FORTUNA SILVER MINES INC.

As at December 31, 2023, Fortuna:

| ● | operates the underground San Jose silver and gold mine (the “San Jose Mine”) (100% ownership) in southern Mexico; |

| ● | operates the Lindero open pit gold mine (the “Lindero Mine”) (100% ownership) in northern Argentina; |

| ● | operates the Yaramoko open pit gold mine (the “Yaramoko Mine”) (90% ownership) in southwestern Burkina Faso; |

| ● | operates the underground Caylloma silver, lead and zinc mine (the “Caylloma Mine”) (100% ownership) in southern Peru, and |

| ● | operates the Séguéla open pit gold mine (the “Séguéla Mine”) (90% ownership) in northwestern Côte d’Ivoire. |

The Company also has various Greenfields exploration properties at different stages of development in Côte d’Ivoire, Mexico, and Senegal.

Three-Year History and Recent Developments

Over the three most recently completed financial years, the significant events described below contributed to the development of the Company’s business.

2021 Developments

The Company reported full year production results for 2021 from its four operating mines: the San Jose Mine in Mexico, the Lindero Mine in Argentina, the Yaramoko Mine in Burkina Faso, and the Caylloma Mine in Peru. In 2021, the Company produced 207,192 ounces of gold (274% increase over 2020), 7,498,701 ounces of silver (5% increase over 2020), 32,989,973 pounds of lead (11% increase over 2020) and 47,549,301 pounds of zinc (4% increase 2020). Production results for each mine in 2021 compared to 2020 are as follows:

Yaramoko Mine: as a result of the Roxgold Acquisition completed in July 2021, the Company acquired the Yaramoko Mine. From July 2, 2021, the Company produced 57,538 ounces of gold with an average gold head grade of 7.13 g/t. Cash cost per ounce of gold sold1 for the second semester of 2021 was $739.

Lindero Mine: in 2021, the Company produced 104,161 ounces of gold, comprised of 99,313 ounces in doré, 730 ounces of gold contained in precipitate/sludge and 4,118 ounces of gold-in-carbon (GIC) inventory, an increase of 675% over the 13,435 ounces produced in 2020. Cash cost per ounce of gold sold2 for the first full year of production in 2021 was $617.

San Jose Mine: in 2021, the Company produced 6,425,029 ounces of silver, an increase over 2020 of 4%, and 39,406 ounces of gold, an increase over 2020 of 4%. Average head grades for silver and gold for the year were 209 g/t and 1.29 g/t, respectively, both a decrease of 7% over the respective head grades in 2020. Cash cost per tonne of processed ore3 for 2021 increased to $75.80 compared to $68.79 for 2020 due to higher mine preparation and support and higher indirect costs.

Caylloma Mine: in 2021, the Company produced 1,073,62 ounces of silver, an increase over 2020 of 11%. Annual average head grade for silver was 76 g/t. Base metal production at the Caylloma Mine in 2021 totaled 33.0 million pounds of lead, an increase of 11% over 2020, and 47.5 million pounds of zinc, an increase of 4% over 2020. Average head grades for lead and zinc were 3.16% and 4.56%, respectively, for the year. Gold production for 2021 totaled 6,086 ounces, an increase of 48% over 2020, with an average head grade of 0.49 g/t. Cash cost

1 |

Cash cost per ounce of gold sold is a non-IFRS measure. Refer to “Notice Regarding Non-IFRS Measures” section above. |

2 |

Refer to footnote 1, above. |

3 |

Cash cost per tonne of processed ore is a non-IFRS measure. Refer to “Notice Regarding Non-IFRS Measures” section above. |

|

ANNUAL INFORMATION FORM |

Page | 9 |

FORTUNA SILVER MINES INC.

per tonne of processed ore4 for the full year 2021 increased to $88.41 compared to $77.19 for 2020 due to higher mine preparation and support and higher indirect costs related to administration and energy.

On February 8, 2021, the Company announced the resignation of Simon Ridgway as a director and Chairman of the Board. David Laing was appointed as an independent Chair of the board of directors of the Company (the “Board”).

On March 29, 2021, the Company announced the results from a successful 4,670 meters of step-out and infill drilling over 22 drill holes at the San Jose Mine which established continuity of high-grade mineralization in the upper levels of the Trinidad Footwall structures.

In 2009, SEMARNAT granted an EIA to Fortuna’s Mexican subsidiary, Companía Minera Cuzcatlan (“Minera Cuzcatlan”), which authorized the construction, execution and maintenance of the San Jose Mine for a period of 12 years effective until October 23, 2021. In May 2021, Minera Cuzcatlan filed an application to extend the term of the EIA for an additional period of 10 years. On November 10, 2021 Minera Cuzcatlan received written notification from SEMARNAT that the application to extend the EIA had been denied. Minera Cuzcatlan appealed the decision of SEMARNAT and obtained the protection of the Mexican courts to continue to operate the San Jose Mine beyond the expiry date of the EIA. On December 20, 2021, the Company announced that SEMARNAT had granted a 12 year extension to the EIA at the San Jose Mine. On February 4, 2022, the Company announced that it had received a notice from SEMARNAT which advised that SEMARNAT had made a typographical error in the extension to the term of the EIA for the San Jose Mine and that the correct extension term is two years. Minera Cuzcatlan initiated legal proceedings to challenge and revoke the allegation of the typographical error and to reconfirm the 12 year extension granted by SEMARNAT in December 2021. The Mexican Federal Administrative Court admitted the Company’s legal proceedings and granted an injunction in favour of the Company, which suspended the reduction of the term of the EIA from 12 years to two years during the course of the legal proceedings. See “2022 Developments” and “2023 Developments” below for further updates on this matter.

On July 2, 2021, the Company completed its acquisition of all of the issued and outstanding common shares (“Roxgold Shares”) of Roxgold Inc. (“Roxgold”) by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) pursuant to an arrangement agreement between the Company and Roxgold dated effective April 26, 2021 (the “Arrangement Agreement”). Under the terms of the Arrangement Agreement, holders of Roxgold Shares received 0.283 of a Common Share and CAD$0.01 in cash for each Roxgold Share held. Upon completion of the Roxgold Acquisition, Fortuna issued an aggregate of 106,106,225 Common Shares and CAD$374,934 in cash and Roxgold became a wholly-owned subsidiary of Fortuna. As a result of the Roxgold Acquisition, the Company acquired the producing Yaramoko mine in Burkina Faso, the Séguéla advanced gold project in Côte d’Ivoire and certain exploration projects in Burkina Faso and Côte d’Ivoire. See “Business of the Company”.

In connection with the Roxgold Acquisition, Kate Harcourt was appointed a director of the Company and a member of the Sustainability Committee of the Company (the “Sustainability Committee”) on July 2, 2021. Additionally, various changes in the Company’s executive officers were made during the second half of 2021 to reflect the expansion of the Company’s operations into West Africa.

On September 7, 2021, the Company announced continued high grade results from extension and scout drilling at the Séguéla Project in Côte d’Ivoire and the Boussoura project in Burkina Faso. Exploration activities at the Séguéla Project included a 7,115 meter step-out drilling program at the Koula deposit; a 1,774 meter 11 hole program at the Sunbird prospect and a 2,070 meter 11 hole program at the Gabbro North prospect. Exploration activities at the Boussoura project included a 5,958 meter 47 hole program at the Fofora Main prospect and a 3,419 meter 12 hole program at the Galgouli prospect.

On September 29, 2021, the Company announced the decision to proceed with the construction of an open pit mine at the Séguéla Project in Côte d’Ivoire with long lead items procured and development teams established on the ground. The updated Séguéla Project budgeted total capital investment is $173.5 million. The anticipated construction schedule is approximately 20 months, with ramp-up to design capacity expected in the third quarter of 2023.

4 |

Refer to footnote 3. |

|

ANNUAL INFORMATION FORM |

Page | 10 |

FORTUNA SILVER MINES INC.

On October 7, 2021, the Company and the Mexican Geological Service (“SGM”) entered into a settlement agreement related to a disputed royalty on one of the mining concessions at the San Jose mine in Mexico. Pursuant to the settlement agreement, the Company paid to the SGM the amount of $9.6 million plus value added tax to end any prior dispute and agreed to pay to the SGM a three percent royalty on the billing value of minerals obtained from the concession from May 1, 2021 on an ongoing basis. The terms of the royalty are set out in a royalty agreement between the parties dated March 18, 2022. The remaining terms of the settlement are confidential, and the Company has not admitted any liability.

In November 2021, the Company entered into a fourth amended and restated credit agreement (the “2021 Credit Facility”) with a syndicate of banks led by BNP Paribas, and including the Bank of Nova Scotia, Bank of Montreal and Societe Generale which converted the Company’s non-revolving and revolving facility into a revolving credit facility and increased the amount of the facility from $120 million to $200 million, subject to certain terms and conditions. The 2021 Credit Facility has a term of four years maturing in November 2025 and steps down to $150 million after three years. Interest initially accrued on LIBOR loans under the 2021 Credit Facility at LIBOR plus an applicable margin (now SOFR loans plus an applicable margin) of between two and three percent, which varied according to the consolidated leverage levels of the Company. The Company’s principal operating subsidiaries in Mexico, Peru, Côte d’Ivoire and Burkina Faso, and their respective direct and indirect holding companies, have pledged all of their respective assets to secure their respective guarantees of such payment, including the shares of the Company’s principal operating subsidiaries in Mexico and Peru. The Company’s principal operating subsidiary in Burkina Faso has pledged its bank accounts to secure the obligations under its guarantee and the holding companies of the Company’s principal operating subsidiaries in Burkina Faso and Côte d’Ivoire and Burkina Faso have pledged the shares of those principal operating subsidiaries to secure the obligations under their guarantees. The 2021 Credit Facility was amended in 2022. See “2022 Developments” below for further details.

On December 9, 2021, the Company announced results from the exploration programs at the Séguéla Project, the San Jose Mine, the Arizaro project in Argentina, and the Caylloma Mine.

In 2021, the Company made significant progress on the development of its corporate climate change strategy. It conducted gap assessments to analyze how its then climate change practices compared to climate change best practices and the practices of its peers in the areas of governance, strategy, risk management, metrics and targets, and reporting and disclosure. The Company developed a multi-year climate change strategy implementation roadmap which focuses on addressing gaps between our existing practices and climate change best practices. A key milestone on this roadmap was to disclose a credible and achievable GHG emissions reduction target, supported by clear reduction pathways.

2022 Developments

The Company reported full year production results for 2022 from its four operating mines: the San Jose Mine in Mexico, the Lindero Mine in Argentina, the Yaramoko Mine in Burkina Faso, and the Caylloma Mine in Peru. In 2022, the Company produced 259,427 ounces of gold (25% increase over 2021), 6,907,275 ounces of silver (8% decrease over 2021), 34,588,324 pounds of lead (5% increase over 2021) and 46,175,821 pounds of zinc (3% decrease over 2021). Production results for each mine in 2022 compared to 2021 are as follows: