UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period fromto

Commission File No. 001-41207

FGI Industries Ltd.

(Exact Name of Registrant as Specified in Its Charter)

Cayman Islands |

98-1603252 |

(State or Other Jurisdiction of |

(I.R.S. Employer |

Incorporation or Organization) |

Identification No.) |

|

|

906 Murray Road — East Hanover, NJ |

07936 |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (973) 428-0400

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Ordinary Shares, $0.0001 par value |

|

FGI |

|

Nasdaq Capital Market |

Warrants to purchase Ordinary Shares, $0.0001 par value |

|

FGIWW |

|

Nasdaq Capital Market |

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Smaller Reporting Company |

☒ |

|

|

|

|

|

|

Emerging Growth Company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included

in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b).☐

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2023, the aggregate value of the registrant’s common stock held by non-affiliates was approximately $4,407,360, based on the number of shares held by non-affiliates as of June 30, 2023 and the closing price of the registrant’s ordinary shares on the Nasdaq Capital Market on that date. Ordinary shares held by each director or executive officer have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 20, 2024, the registrant had 9,547,607 outstanding ordinary shares.

Documents incorporated by reference:

The information called for by Part III will be incorporated by reference from the Registrant's definitive Proxy Statement for its Annual Meeting of Shareholders to be filed pursuant to Regulation 14A or will be included in an amendment to this Form 10-K.

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

|

|

|

|

5 |

||

|

|

|

|

|

13 |

||

|

|

|

|

|

32 |

||

|

|

|

|

|

33 |

||

|

|

|

|

|

33 |

||

|

|

|

|

|

33 |

||

|

|

|

|

|

34 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

||

|

|

|

|

|

35 |

||

|

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

36 |

|

|

|

|

|

|

48 |

||

|

|

|

|

|

49 |

||

|

|

|

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

79 |

|

|

|

|

|

|

79 |

||

|

|

|

|

|

81 |

||

|

|

|

|

|

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

82 |

||

|

|

|

|

|

82 |

||

|

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

82 |

|

|

|

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

82 |

|

|

|

|

|

|

82 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

83 |

||

|

|

|

|

|

85 |

||

|

|

|

|

85 |

|||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. All statements contained in this Annual Report on Form 10-K other than statements of historical facts, including statements regarding our future results of operations and financial position, our business strategy and plans and our objectives for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “positioned,” “potential,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. In addition, statements that “we believe” or similar statements reflect our beliefs and opinions on the relevant subject. We have based these forward- looking statements on our current expectations about future events. While we believe these expectations are reasonable, such forward-looking statements are inherently subject to risks and uncertainties, many of which are beyond our control. Risks and uncertainties that could cause our actual results to differ from those expressed in, or implied by, our forward- looking statements include, but are not limited to:

| ● | the levels of residential R&R activity, and to a lesser extent, new home construction; |

| ● | our ability to maintain our strong brands and reputation and to develop innovative products; |

| ● | our ability to maintain our competitive position in our industries; |

| ● | our reliance on key suppliers and customers; |

| ● | macroeconomic uncertainty, including from wars and hostilities, pandemics or other health emergencies, changes in interest rates and inflation, the impact on domestic and international economic activity, consumer confidence, our production capabilities, our employees and our supply chain; |

| ● | the cost and availability of materials and the imposition of tariffs; |

| ● | risks associated with our international operations and global strategies; |

| ● | our ability to achieve the anticipated benefits of our strategic initiatives; |

| ● | our ability to successfully execute our acquisition strategy and integrate businesses that we may acquire; |

| ● | risks associated with our reliance on information systems and technology, and our ability to achieve the anticipated benefits from our investments in new technology; |

| ● | our ability to attract, develop and retain talented and diverse personnel; |

| ● | our ability to obtain additional capital to finance our planned operations; |

| ● | regulatory developments in the United States and internationally; |

| ● | our ability to establish and maintain intellectual property protection for our products, as well as our ability to operate our business without infringing the intellectual property rights of others; and |

| ● | other risks and uncertainties, including those listed under the caption “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K, as well as subsequent reports we file from time to time with the U.S. Securities and Exchange Commission (available at www.sec.gov). |

These forward-looking statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. Although we believe the expectations reflected in the forward-looking statements are reasonable, the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements may not be achieved or occur at all.

2

You should read this Annual Report on Form 10-K and the documents that we reference and have filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

GENERAL

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to the “Company,” “FGI,” “we,” “us” or “our” refer to FGI Industries Ltd.

SUMMARY OF RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to numerous risks, as more fully described in the section titled “Risk Factors” in this Annual Report on Form 10-K. You should read these risks before you invest in our securities. In particular, risks associated with our business include, but are not limited to, the following:

Strategic Risks

| ● | Our BPC organic growth strategy (defined under Item 1 below) is focused on capturing higher incremental gross margins by increasing our share of branded products, expanding into new product categories and creating new sales channels, all of which are impacted by a number of economic factors and other factors. |

| ● | Prolonged economic downturns may adversely impact our sales, earnings and liquidity. |

| ● | Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us. |

| ● | We may not achieve all of the anticipated benefits of our strategic initiatives. |

| ● | We may not be able to successfully execute our acquisition strategy or integrate businesses that we acquire. |

| ● | We could continue to pursue growth opportunities through either acquisitions, mergers or internally developed projects, which may be unsuccessful or may adversely affect our future financial condition and operating results. |

Business and Operational Risks

| ● | We recently began as a stand-alone business and have a limited operating history as a stand-alone business. |

| ● | Variability in the cost and availability of our raw materials, component parts and finished goods, including the imposition of tariffs, could affect our results of operations and financial position. |

| ● | Our top ten customers represent a large portion of our sales. A significant adverse change in such relationships could adversely impact our results of operations and financial condition. |

| ● | We are dependent on third-party suppliers and manufacturers, the loss of which could materially impact our business. |

| ● | There are risks associated with our international operations and global strategies. |

Competitive Risks

| ● | We could lose market share if we do not maintain our strong brands, develop innovative products or respond to changing purchasing practices and consumer preferences or if our reputation is damaged. |

3

| ● | Our failure to develop new products or respond to changing consumer preferences and purchasing practices could have a material adverse effect on our business, financial condition or results of operations. |

| ● | Changes in Cayman Islands or U.S. tax law could adversely affect our financial condition and results of operations. |

Technology and Intellectual Property Risks

| ● | We rely on information systems and technologies, and a breakdown of these systems could adversely affect our results of operations and financial position. |

| ● | We may not be able to adequately protect or prevent the unauthorized use of our intellectual property. |

| ● | We have been and may continue to be subject to cybersecurity attacks, which could adversely affect our results of operations and financial position. |

Litigation and Regulatory Risks

| ● | We are currently involved in legal proceedings and may in the future be a party to additional claims and litigation, which could be costly and divert significant resources. |

| ● | Compliance with laws, government regulation and industry standards are costly, and our failure to comply could adversely affect our results of operations and financial position. |

| ● | We are subject to anti-corruption, anti-bribery, anti-money laundering, financial and economic sanctions and similar laws, and non-compliance with such laws can subject us to administrative, civil and criminal fines and penalties, collateral consequences, remedial measures and legal expenses, all of which could adversely affect our business, results of operations, financial condition and reputation. |

Risks Related to Doing Business in China

| ● | We have operations in, and the majority of our suppliers are located in, China. Our or our suppliers’ ability to operate in China may be impaired by changes in Chinese laws and regulations, including those relating to taxation, environmental regulation, restrictions on foreign investment, and other matters. |

| ● | We could be subject to regulation by various political and regulatory entities, including local and municipal agencies and other governmental subdivisions. |

| ● | We could become subject to a variety of laws and other obligations regarding cybersecurity and data protection, and any failure to comply with applicable laws and obligations could have an adverse effect on our business operations in China. |

| ● | Changes in China’s economic, political or social conditions or legal system or government policies could have a material adverse effect on our business and operations. |

Risks Related to Our Securities

| ● | Foremost Groups Ltd. holds a significant majority of the voting power of our ordinary shares, approximately 72%, and will be able to exert significant control over us. |

4

PART I

ITEM 1. BUSINESS

Our Company

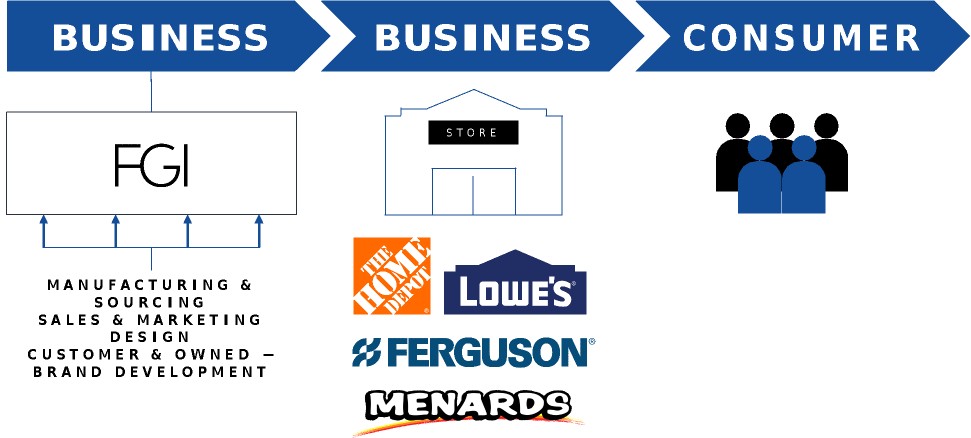

FGI is a global, diversified and reputable supplier of quality bath and kitchen products. With over thirty years of experience, FGI has become a leading business to business supplier of bath and kitchen products to large retail, wholesale, commercial and specialty channel customers around the globe specializing in the home improvement and R&R (Repair & Remodel) markets. Some of our largest customers include The Home Depot, Menards, Ferguson and Lowe’s. Throughout our history, we have achieved consistent and above-industry sales growth each year by executing on our strategic objectives which include offering well-designed, high-quality products, providing service that surpasses our competition and exceeds our customers’ expectations, and managing an efficient and resilient global supply chain.

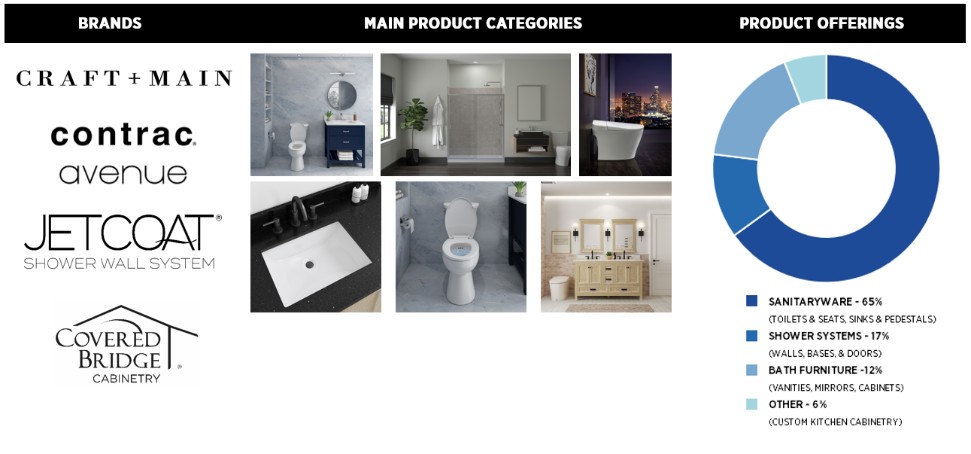

Our products are typically designed in-house or are created in conjunction with our customer and supplier partners. The majority of our products are sold under our customers’ private label brands, although we expect to continue increasing the share of our own brands over time. Below is an outline of our general business model:

Both private label and FGI’s brands require significant marketing expenditures which we typically incur or share with our customers. We offer industry-leading brands including Foremost®, avenue, contrac®, Jetcoat®™, rosenberg and Covered Bridge Cabinetry®. These brands have continued to grow and represent an increasing share of our total sales in recent years, while the majority of our products are sold under key customers’ private label brands, such as The Home Depot’s “Glacier Bay” brand and Ferguson’s “ProFlo” brand.

Major Developments in our Business

Initial Public Offering

On January 27, 2022, FGI closed an underwritten public offering of 2.5 million units (the “Units”) (consisting of (i) one ordinary share, par value $0.0001 (the “Ordinary Shares”) and, (ii) one warrant to purchase one Ordinary Share (the “Warrants”)) at a public offering price of $6.00 per unit and received net proceeds, after commissions and expenses, of approximately $12.4 million.

5

Reorganization

Prior to our initial public offering, we completed the reorganization (the “Reorganization”) of our parent company, Foremost, and its affiliates, pursuant to which, among other actions, Foremost contributed all of its equity interests in FGI Industries, Inc., FGI Europe and FGI International, each a wholly-owned subsidiary of Foremost, to the newly formed FGI Industries Ltd. Foremost was established in 1987 and has become a global leader in kitchen and bath design, indoor and outdoor furniture, food service equipment, and manufacturing. Our business now operates separately from the rest of Foremost’s business units, and we and Foremost believe that operating as a standalone company will allow FGI to more effectively execute its long-term “BPC” growth strategy while focusing more efficiently on its own capital allocation priorities.

Prior to the Reorganization, FGI Industries, Inc., FGI Europe and FGI International operated as business units within Foremost for over thirty years. Foremost continues to be a significant holder of our ordinary shares and supports FGI via global sourcing and manufacturing arrangements. By leveraging Foremost’s long-standing experience in manufacturing and sourcing for certain of our product categories, we believe that FGI maintains a competitive advantage in supplying products that are of good design and high quality. As a standalone business, FGI is a top-tier company in many key product categories within the North American kitchen and bath products markets, with many additional expansion opportunities via existing and adjacent product, sales and geographic channels.

Our Products

As a result of the increased significance of shower systems in our product portfolio in 2023, the Company has

created a standalone “Shower Systems” product category, as detailed below. The “Other” category continues to comprise our kitchen cabinetry and other smaller offerings. The updates were applied retroactively to impacted product categories. Such changes had no impact on the Company's historical consolidated financial position, results of operations or cash flows.

We offer a wide variety of products that fall into four categories: Sanitaryware, Bath Furniture, Shower Systems and Other. Our brand and category makeup of our net sales is as follows:

Sanitaryware. Our Sanitaryware category includes a range of bath products, such as toilets, sinks, pedestals and toilet seats. The majority of these products are sourced from third-party suppliers in China and are sold throughout the United States, Canada and Europe.

6

Our main owned brands in this category include Foremost®, which is retail-focused, and contrac®, which is wholesale-focused.

Bath Furniture. Our Bath Furniture category primarily includes wood and wood-substitute furniture for bathrooms, including vanities, mirrors, laundry and medicine cabinets and other storage systems. The majority of these products are sourced from Southeast Asia and China and are sold principally in the United States and Canada. We typically sell our bath furniture products under the Foremost brand.

Shower Systems. Our Shower Systems category includes a range of shower-related products such as shower walls, shower doors and shower basins. The majority of these products are sourced from third-party suppliers in China and are sold throughout the United States and Canada. These products are typically sold as private label or under our Craft + Main and Jetcoat brands.

Other. Our Other category includes several smaller categories, most prominently custom kitchen cabinetry brand under our “Covered Bridge Cabinetry” and “Craft + Main Cabinetry” (formerly “Kitchens by Foremost”) lines of products. Our custom kitchen lines represent some of the highest margin, highest quality products that we sell, and are sold primarily through local kitchen and bath dealerships while involving a heavy marketing element with contractors and designers. While custom kitchen cabinetry currently represents less than 3% of our total sales, it is an area where we see significant long term organic growth, gross margin expansion and consolidation possibilities. The majority of our custom kitchen cabinetry and shower products are sourced from Southeast Asia.

In each category, we sell branded and private label products at various price points to attract a wide base of customers and ultimate consumers. We position our products in a “good, better, best” market position, with a variety of price points to address the varying needs of our customer base. However, we typically eschew selling low, or “opening” price point items, and focus primarily on the mid-to-upper price point product categories. We continue to see opportunities to introduce new product categories. Some of our recent product introductions that we expect to drive material sales growth include our Jetcoat-branded shower systems and intelligent (electronic) toilets.

Our Industry

The core bath and kitchen product markets in which we operate principally cater to the R&R markets, consisting of fragmented suppliers and a diffuse network of retailers, wholesalers and independent dealer networks on both national and regional levels. While our sales are principally impacted by the growth of the R&R markets, we are selectively focusing on newbuild markets as well.

According to the National Kitchen and Bath Association, the projected consumer spend for the U.S. bath and kitchen markets is estimated to be approximately $173 billion in 2024, of which approximately half is in product categories that we currently operate within. Outside of extreme recession years in the United States, such as 2007-2009, the R&R markets have experienced consistent 3% to 5% annual growth rates for more than 25 years, providing a predictable and recurring revenue model for the majority of our product lines. The primary drivers of such consistent and above-GDP growth rates are the pace of household formation, home price appreciation, strong housing turnover and the continued aging of the U.S. housing stock in our primary geographic markets.

Our Growth Strategy

Combining our well-developed global business platform with our relatively small revenue base, our aim is to achieve mid-to-high single-digit organic revenue growth rates over the long term. In order to achieve these growth objectives, we pursue a “BPC” growth strategy, focused on Brands, Products and Channels:

| ● | Brands: Branded products typically come with higher gross margins and significantly reinforce our long-term competitive positioning within our product markets. We plan to continue to focus on building our branded-product footprint over the long term while increasing the share of brands as a percentage of our total sales. |

7

| ● | Products: We have significant “whitespace” opportunities in several product categories within our core kitchen and bath markets. As an example, we believe we are currently significantly under- penetrated in categories such as bath and kitchen fixtures, “behind the wall” plumbing, and acrylic products such as bathtubs. With significant investment opportunities in new materials, sourcing, leading product design and superior customer service, we have vast product expansion opportunities in relation to our relatively small share of the overall market. |

| ● | Channels: We feel that we have strong growth potential in key sales channels, including our existing customers, new e-commerce retailers (such as Wayfair) and commercial sales channels (local kitchen and bath product distributors). We believe we have untapped potential in markets outside of the United States, and while we have made significant headway in Canada and Germany in recent years, we believe we have many more growth and expansion opportunities in those two countries as well as other international markets. |

In addition, we continue to evaluate opportunities to pursue selective “bolt-on” acquisitions of smaller companies that complement our core competencies in an effort to increase our scale and profitability, as well as to broaden our product offerings, capabilities and resources. We are also seeking strategic partnerships within the United States and internationally with the goal of strengthening the sources of our product supply. Our key criteria for potential acquisitions include looking for well-run organizations (not turnarounds), opportunities that offer tangible synergies within our core kitchen and bath markets, and investments that meet our stringent return on capital criteria.

Our Customers

We serve a large and global customer base that covers five main categories of businesses: mass retailers, wholesalers, commercial, e-commerce channels and independent distributors. As we grow our own brands, we will increasingly focus our investments on creating end-consumer mindshare and awareness, helping to grow sales through our main customer categories.

Mass Retailers

Our products are primarily used by do-it-yourself homeowners, contractors, builders and remodelers for R&R projects. In North America, products for such projects are predominantly purchased through mass retail home centers such as The Home Depot, Lowe’s and Menard’s. Due to the market presence, store network and customer reach of these large home centers, we have developed decades-long relationships with our key retailer partners to distribute our products. Approximately 34% of our net sales in 2023 were to large retailers.

Wholesalers

Our products are sold through some of the largest bath and kitchen product wholesalers in North America including Ferguson, HD Supply (owned by The Home Depot) and Orgill. The large wholesalers are similar in scale to many of our large retail partners, catering to national and local networks of professional contractors, plumbers, property developers and other significant “influencers” within the residential and non- residential construction markets.

In 2023, approximately 34% of our net sales were to our wholesale partners.

Commercial

Our products are sold through numerous smaller-scale local distribution companies which in turn cater to professional plumbers, contractors and property developers. In Canada, we are a leading supplier to market leaders such as Yorkwest Plumbing, and have developed a strong presence in other commercial sales channels as well. Our numerous relationships tend to be quite stable and strong, built on years of mutual trust and understanding among tightly-knit groups of local professionals. We see an enormous market potential in the Commercial channel and are continuously evaluating additional opportunities for market penetration.

In 2023, approximately 13% of our net sales were to our commercial partners.

8

E-Commerce

We sell a growing number of our products through the e-commerce channels of our retail partners as well as “e-commerce only” retailers such as Build.com and Wayfair.com, both of which are rapidly increasing market penetration in the home R&R space. Our sales through e-commerce channels and retailers represented about 12% of our net sales in 2023 up from less than 2% in 2010.

Independent Dealers & Distributors

We have historically sold our products through independent (or “mom and pop”) bath and kitchen product specialists. Independent dealers and distributors represented 7% of our net sales in 2023.

Raw Materials, Suppliers and Manufacturing

Many of our sanitaryware products contain ceramics, the major components of which are clay and enamel. Other primary raw materials used in our bath furniture, kitchen cabinetry and shower products include hard maple, oak, cherry and beech lumber and plywood as well as paint, particleboard, medium density fiberboard, high density fiberboard, glass, aluminum, manufactured components and hardware. We have more than one source for these and other raw materials and generally believe them to be readily available. For many of our products, our third-party suppliers have standardized raw material inputs and a number of production processes, which reduces the logistical manufacturing specifications and allows for greater economies of scale in sourcing these inputs.

The majority of our products are outsourced from Foremost-owned manufacturing facilities and several third-party manufacturers, all primarily based in China and parts of Southeast Asia. We own one facility in Southeast Asia to support our custom kitchen cabinetry programs. We have entered into long-term sourcing agreements with Foremost to secure continued use of their facilities. We generally utilize six to seven factories located in China and parts of Southeast Asia. We have long-term agreements in place with the suppliers of our sanitaryware products for terms ranging from one year, renewable, to perpetuity. The geographic distances involved in these arrangements, together with the differences in business practices, shipping and delivery requirements, and laws and regulations add complexity to our supply chain logistics and increase the potential for interruptions in our production scheduling. In addition, prices and availability of these components may be affected by world market conditions and government policies and tariffs.

Tangshan Huida Ceramic Group Co., Ltd (“Huida”) supplies the majority of our sanitaryware products. Huida accounted for approximately 71.4% of the total balance of our accounts payable as of December 31, 2023. No other supplier accounts for more than 10% of our accounts payable as of December 31, 2023.

We regularly evaluate our organizational productivity and supply chains and seek opportunities to reduce costs and enhance quality. We strive to improve quality, speed and flexibility to meet changing and uncertain market conditions, as well as manage cost inflation, including wages and employee medical costs.

FGI and its subsidiaries are party to two shared services agreements with Foremost Groups Ltd., our largest shareholder, or its subsidiaries, pursuant to which the parties provide certain general and administrative services to one another in certain geographies.

Competition

We operate in a highly fragmented industry that is composed of numerous local, regional and national manufacturers. Most of our competitors compete on a local or regional basis, but others, like us, compete on a national basis as well. Our competitors include large national and international brands such as American Standard, Kohler, Masco (Delta), Mansfield, Gerber, Niagara, Ove Decors and Woodcrafters, as well as numerous OEM suppliers and other smaller brands. Due to the highly-differentiated nature of our product categories and the scarcity of industry data, there is little reliable information on precise market shares for our product categories.

9

We believe that brand reputation is an important factor in consumer selection, and that competition in this industry is also based largely on product features and innovation, product quality, customer service, breadth of product offerings and price. Our principal means for competition are our breadth and variety of product offerings, expanded service capabilities, geographic reach, competitive price points for our products and affordable quality.

In general, our Sanitaryware product categories tend to be more consolidated and we compete primarily with a small group of large suppliers with a global footprint in any specific product line, including American Standard, Kohler, Toto, Masco (Delta), Mansfield, Gerger and Niagara, and on occasion with numerous regional suppliers. For our Bath Furniture and Other product categories, we compete with dozens of regional suppliers in any given product line, although we believe that relatively few can compete with us on a truly national scale, particularly with regards to our mass retail channels.

Our Competitive Strengths

Trusted by Customers Around the World

The core markets in which we operate tend to be conservative, with an emphasis on stable and durable relationships. FGI is a top-tier supplier of many key North American bath- and kitchen-related product categories. With support from Foremost, we are one of a select number of large market participants with national and international manufacturing and distribution capabilities. Our supply chain network, operating footprint and long-standing customer relationships provide us an ability to service our retail, wholesale and commercial channel customers worldwide and offer a broad set of products to serve our customers across a variety of price points. We believe the scale and breadth of our operations differentiate us and result in a competitive advantage that allows us to provide well-designed, high-quality products with price points and service that exceed our competitors’ offerings and our customers’ expectations.

Deep Relationships with Leading Suppliers

In the markets in which we operate, production and supply chain quality and stability are crucial to success. Our industry is fundamentally stable and conservative, with high barriers for potential new entrants. We have built strong and stable relationships with a base of long-standing suppliers across the globe, all of whom maintain stringent manufacturing standards. We believe our customers value our decades-long experience in the industry and international footprint, which allows us to meet demanding logistics and performance criteria. At the same time, our third-party manufacturing suppliers are reliant on our stable and growing platform in order to effectively utilize their own fixed-asset investments. The importance of these strengths has been highlighted during the outbreak and ongoing spread of the novel coronavirus (“COVID-19”) pandemic, as we believe that we have remained among the most consistent and reliable suppliers in our industry despite the unprecedented challenges which were presented.

Stable Technological and Industry Dynamics

Our core bath and kitchen product markets are generally less prone to fast-paced technological innovation or “fast fashion” consumer trends. We believe this is largely due to the core functionalities of the products we offer, which have tended to evolve gradually over decades, rather than in a few years (or even months, as with certain industries). As a result, we have confidence in our ability to execute our long-term growth plans, while allocating our capital in a patient and thoughtful manner, with relatively high and predictable rates of return.

Commercial and Regulatory Barriers to Entry

The kitchen and bath markets operate under a myriad of international, national, federal, provincial and local codes. This is particularly the case as much of the product markets on which we focus are ultimately related to water and the prevention of water leakage and damage. On a fundamental level, our kitchen and bath products need to pass heavy quality control and regulatory standards, making it difficult for potential new entrants.

10

Experienced Management Team

We have assembled an executive team with a deep base of management experience within industrial manufacturing companies. David Bruce, our Chief Executive Officer, Bob Kermelewicz, our Executive Vice President, United States, Jennifer Earl, our Executive Vice President, Canada and Norman Kroenke, our Executive Vice President, Europe each have over twenty years of industry experience. Our Executive Chairman John Chen has more than twelve years of investment management and financial experience. Our team has identified and begun to execute on opportunities for operational improvement, growth and business expansion as a standalone company.

Significant ownership and support from Foremost

Foremost is a family-controlled and privately held holding company. As an approximate 72% owner of FGI’s ordinary shares, Foremost remains committed to supporting FGI’s strategic development and growth plans. For over 30 years, Foremost has built an industry-leading reputation as a reliable manufacturer and supply source for numerous wood and ceramic-based products which form the foundation of many FGI product categories. As a standalone company, FGI continues to benefit from Foremost’s long-standing experience in global manufacturing and sourcing, providing a solid foundation from which to pursue alternate sources of supply for our key product categories as we see fit.

Intellectual Property

We sell many of our products under a number of registered and unregistered trademarks, which we believe are widely recognized in our industry. FGI maintains a significant portfolio of trademarks and copyrights, most notably under our avenue, contrac®, rosenberg and Covered Bridge Cabinetry® brands. We have also acquired rights to the Foremost® brand from Foremost with regards to any Foremost branded products that we continue to sell. We rely on trade secrets and confidentiality agreements to develop and maintain our competitive position.

Environmental Matters and Regulatory Matters

Our operations are subject to national, state and local environmental laws and regulations relating to, among other things, the generation, storage, handling, emission, transportation and discharge of regulated materials into the environment. Permits are required for certain of our operations, and these permits are subject to revocation, modification and renewal by issuing authorities. Governmental authorities have the power to enforce compliance with their regulations, and violations may result in the payment of fines or the entry of injunctions, or both. We may also incur liability for investigation and clean-up of soil or groundwater contamination on or emanating from current or formerly owned and operated properties, or at offsite locations at which regulated materials are located where we are identified as a responsible party. Discovery of currently unknown conditions could require responses that could result in significant costs. We monitor applicable laws and regulations and incur ongoing expense relating to compliance, however we do not expect that compliance with federal, state, local and foreign regulations, will result in material capital expenditures or have a material adverse effect on our results of operations and financial position.

We believe that responsibility does not stop at national borders, which is why FGI is working to protect and sustain our global environment. By designing products that meet Environmental Protection Agency (“EPA”) standards, like our Water Sense qualifying toilets that provide high efficiency waste removal while using 20% less water with every flush, FGI is using innovative engineering to make the most of our resources.

Our bath furniture use California Air Resource Board (“CARB”) Phase II compliant wood products which limit urea-formaldehyde emissions into the environment. We only use wood products from managed forest resources to discourage clear-cut logging and the depletion of global rainforests. We encourage customers to order products using material that is Forest Stewardship Council (“FSC”) certified, ensuring the responsible use of our forest resources and equitable treatment of indigenous people of producing regions.

Environmental responsibility is everyone’s task at FGI, to ensure that we as a company protect our employees, our customers and our planet for this generation and the ones that follow.

11

Seasonality

Our business has been subject to seasonal influences, with higher sales typically realized during the second and third calendar quarters, corresponding with the peak season for R&R activity. The costs of our products are subject to inflationary pressures and commodity price fluctuations. We have generally been able over time to recover the effects of inflation, commodity price and currency fluctuations through sales price increases.

Human Capital

As of December 31, 2023, we employed approximately 287 employees, all of which are full-time, with no employees covered by collective bargaining agreements. We believe that our employee relations are good.

We believe that the performance of our company is impacted by our human capital management, and as a result we consistently work to attract, select, develop, engage and retain strong, diverse talent. We are focused on three key strategic talent priorities: leadership, diversity, equity and inclusion, and our future workforce. Our Human Resources Department is responsible for developing and executing our human capital strategy and provides regular updates to our Board of Directors’ Organization and Compensation Committee on our progress toward the achievement of our strategic initiatives. We believe that all of our human capital initiatives work together to assure we have an environment where our employees are engaged, feel a sense of belonging, and can reach their full potential.

The safety of our employees is integral to our company. In support of our safety efforts, we identify, assess and investigate incidents and injury data, and each year set goals to improve key safety performance indicators. We train, promote, consult and communicate with our workforce in this process. In 2020, the COVID-19 pandemic highlighted the importance of employee welfare. We reacted quickly to keep our employees safe through the implementation of policies and safety measures that adhered to best practices from the World Health Organization and the Centers for Disease Control. Despite the ongoing COVID-19 pandemic, we did not experience a material change to our daily operations as we quickly adjusted employee work schedules in alignment with the exigencies of both the pandemic and our business requirements.

Corporate History and Information

We were incorporated in the Cayman Islands on May 26, 2021 in connection with a reorganization (the “Reorganization”) of our parent company, Foremost, and its affiliates, pursuant to which, among other actions, Foremost contributed all of its equity interests in FGI Industries, Inc. (“FGI USA”), FGI Europe Investment Limited, a British Virgin Islands entity (“FGI Europe”), and FGI International Limited, a Hong Kong entity (“FGI International”), each a wholly-owned subsidiary of Foremost, to the newly formed FGI Industries Ltd. Foremost was established in 1987 and has become a global leader in kitchen and bath design, indoor and outdoor furniture, food service equipment, and manufacturing. As Foremost has grown, our business has come to operate separately from the rest of Foremost’s business units.

Prior to the Reorganization, FGI Industries, Inc., FGI Europe and FGI International operated as business units within Foremost for over thirty years. Foremost continues to be a significant holder of our ordinary shares and supports FGI via global sourcing and manufacturing arrangements. By leveraging Foremost’s long-standing experience in manufacturing and sourcing for certain of our product categories, we believe that FGI maintains a competitive advantage in supplying products that are of good design and high quality. As a standalone business, FGI is a top-tier company in many key product categories within the North American kitchen and bath products markets, with many additional expansion opportunities via existing and adjacent product, sales and geographic channels.

Our principal executive offices are located at 906 Murray Road, East Hanover, NJ 07936, and our telephone number is (973) 428-0400. Our website address is www.fgi-industries.com. The information contained on, or accessible through, our website is not incorporated by reference into this Annual Report on Form 10-K, and you should not consider any information contained in, or that can be accessed through, our website as part of this Annual Report on Form 10-K.

12

We are a Cayman Islands exempted company. Exempted companies are Cayman Islands companies conducting business mainly outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Act (2022 Revision) of the Cayman Islands (the “Companies Act”) as the same may be amended from time to time. As an exempted company, we may apply for a tax exemption undertaking from the Cayman Islands government that, in accordance with Section 6 of the Tax Concessions Act (2018 Revision) of the Cayman Islands, for a period of 30 years from the date of the undertaking, no law which is enacted in the Cayman Islands imposing any tax to be levied on profits, income, gains or appreciations will apply to us or our operations and, in addition, that no tax to be levied on profits, income, gains or appreciations or which is in the nature of estate duty or inheritance tax will be payable (i) on or in respect of our shares, debentures or other obligations or (ii) by way of the withholding in whole or in part of a payment of dividend or other distribution of income or capital by us to our shareholders or a payment of principal or interest or other sums due under a debenture or other obligation of us.

Because Foremost holds approximately 72% of the voting power of our ordinary shares, we are considered a “controlled company” under the corporate governance rules of Nasdaq. However, we do not currently rely upon the “controlled company” exemptions.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the United States Securities and Exchange Commission, or the SEC, and all amendments to these filings, are available, free of charge, on our website at www.fgi-industries.com as soon as reasonably practicable following our filing of any of these reports with the SEC. You can also obtain copies free of charge by contacting our Investor Relations department at our office address listed above. The SEC also maintains a website that contains all the materials we file with, or furnish to, the SEC. Its website is www.sec.gov.

The contents of our website are not incorporated by reference into this Annual Report on Form 10-K or any other document we file with the SEC, and any reference to our website is intended to be an inactive textual reference only.

ITEM 1A.RISK FACTORS

Our business is subject to numerous risks. You should carefully consider the following risks and all other information contained in this Annual Report, as well as general economic and business risks, together with any other documents we file with the SEC. If any of the following events actually occur or risks actually materialize, it could have a material adverse effect on our business, operating results and financial condition and cause the trading price of our ordinary shares to decline.

INDEX TO RISK FACTORS

3 |

|

3 |

|

4 |

|

23 |

|

24 |

|

25 |

|

28 |

|

31 |

13

Strategic Risks

Our BPC organic growth strategy is focused on capturing higher incremental gross margins by increasing our share of branded products, expanding into new product categories and creating new sales channels, all of which are impacted by a number of economic factors and other factors.

Our business relies on residential repair and remodel (“R&R”) activity and, to a lesser extent, on new home and commercial construction activity. A number of factors impact consumers’ spending on home improvement projects as well as new home construction activity, including:

| ● | consumer confidence levels; |

| ● | fluctuations in home prices; |

| ● | existing home sales; |

| ● | inflationary pressures and interest rates; |

| ● | unemployment and underemployment levels; |

| ● | consumer income and debt levels; |

| ● | household formation; |

| ● | the availability of skilled tradespeople for R&R work; |

| ● | the availability of home equity loans and mortgages and the interest rates for and tax deductibility of such loans; |

| ● | trends in lifestyle and housing design; and |

| ● | natural disasters, terrorist acts, pandemics, wars or conflicts or other catastrophic events. |

The fundamentals driving our business are impacted by economic cycles, and we have been negatively impacted by recent supply chain disruptions, rising interest rates and inflationary pressures. Adverse changes or uncertainty involving the factors listed above or an economic contraction in the United States and worldwide could result in a decline in spending on residential R&R activity and a decline in demand for new home construction and could adversely impact our businesses by: causing consumers to delay or decrease homeownership; making consumers more price conscious resulting in a shift in demand to smaller, less expensive homes; making consumers more reluctant to make investments in their existing homes, including large kitchen and bath R&R projects; or making it more difficult or expensive to secure loans for major renovations, which could have a material adverse effect on our results of operations and financial position.

Prolonged economic downturns may adversely impact our sales, earnings and liquidity.

Our industry can fluctuate with economic cycles. During economic downturns, our industry could experience longer periods of recession and greater declines than the general economy. We believe that our industry, particularly North American home improvement, R&R and new home construction activity, is significantly influenced particularly by housing activity, consumer confidence, the level of personal discretionary spending, demographics, credit availability, inflation and interest rates and other business conditions. Recently, higher interest rates, inflation and general tightening of credit availability have affected these markets. These factors may affect not only the ultimate consumer of our products, but also may impact home centers, builders and our other primary customers. As a result, a worsening of economic conditions, could have a material adverse effect on our sales and earnings as well as our cash flow and liquidity.

14

Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us.

The ability of our business to grow and compete depends on the availability of adequate capital, which in turn depends in large part on our cash flow from operations and the availability of equity and debt financing. Furthermore, our existing indebtedness, which was approximately $7.0 million as of December 31, 2023, may adversely affect our financial flexibility and our competitive position in the future. We cannot assure you that our cash flow from operations will be sufficient or that we will be able to obtain equity or debt financing on acceptable terms to implement our “BPC” growth strategy. We may need additional cash resources in the future if we experience changed business conditions or other developments and may also need additional cash resources in the future if we wish to pursue opportunities for investment, acquisition, strategic cooperation or other similar actions. As a result, we cannot assure you that adequate capital will be available to finance our current growth plans, take advantage of business opportunities or respond to competitive pressures, any of which could have a material adverse effect on our results of operations and financial position.

We may not achieve all of the anticipated benefits of our strategic initiatives.

We continue to pursue our strategic initiatives of investing in our branded products, developing new product categories, and utilizing sales channels positioned for long term growth through the “BPC” strategy, our methodology to drive growth and productivity. These initiatives are designed to grow shareholder value over the long term. Our results of operations and financial position could be materially and adversely affected if we are unable to successfully execute these initiatives or if we are unable to execute these initiatives in a timely and efficient manner. We could also be adversely affected if we have not appropriately prioritized and balanced our initiatives or if we are unable to effectively manage change throughout our organization.

We may not be able to successfully execute our acquisition strategy or integrate businesses that we acquire.

Pursuing the acquisition of businesses complementary to our portfolio is a component of our strategy for future growth. If we are not able to identify suitable acquisition candidates or consummate potential acquisitions within a desired time frame or with acceptable terms and prices, our long-term competitive positioning may be affected. Even if we are successful in acquiring and/or merging with businesses, the businesses we acquire or merge with may not be able to achieve the revenue, profitability or growth we anticipate, or we may experience challenges and risks in integrating these businesses into our existing business. Such risks include:

| ● | difficulties realizing expected synergies and economies of scale; |

| ● | diversion of management attention and our resources; |

| ● | unforeseen liabilities; |

| ● | issues or conflicts with our new or existing customers or suppliers; and |

| ● | difficulties in retaining critical employees of the acquired businesses. |

Future foreign acquisitions may also increase our exposure to foreign currency risks and risks associated with interpretation and enforcement of foreign regulations. Our failure to address these risks could cause us to incur additional costs and fail to realize the anticipated benefits of our acquisitions and could have a material adverse effect on our results of operations and financial position.

We could continue to pursue growth opportunities through either acquisitions, mergers or internally developed projects, which may be unsuccessful or may adversely affect our future financial condition and operating results.

Although we are not currently considering any specific business combinations, we could pursue opportunities for growth through either acquisitions, mergers or internally developed projects as part of our “BPC” growth strategy. We cannot assure you that we will be successful in integrating an acquired business or that an internally developed project will perform at the levels we anticipate.

15

We may pay for future acquisitions using cash, stock, the assumption of debt, or a combination of these. Future acquisitions could result in dilution to existing shareholders and to earnings per share. In addition, we may fail to identify significant liabilities or risks associated with a given acquisition that could adversely affect our future financial condition and operating results or result in us paying more for the acquired business or assets than they are worth.

Business and Operational Risks

We recently began as a stand-alone business and have a limited operating history as a stand-alone business.

The historical financial information we have included does not reflect, and the pro forma financial information included may not reflect, what our financial condition, results of operations or cash flows would have been had we been a stand-alone entity during the historical periods presented, or what our financial condition, results of operations or cash flows will be in the future as an independent entity.

In addition, we have not made pro forma adjustments to reflect many significant changes that will occur in our cost structure, funding and operations as a result of our transition to becoming a public company, including changes in our employee base, potential increased costs associated with reduced economies of scale and increased costs associated with being a publicly traded, stand-alone company.

Variability in the cost and availability of our raw materials, component parts and finished goods, including the imposition of tariffs, could affect our results of operations and financial position.

We purchase substantial amounts of raw materials, component parts and finished goods from outside sources, including international sources, and our products are manufactured outside of the United States. Increases in the cost of the materials we purchase have in the past and may in the future increase the prices for our products, including as a result of new tariffs. There is a risk that additional tariffs on imports from China or new tariffs could be imposed, which could further increase the cost of the materials we purchase or import or the products we manufacture internationally. Further, our production could be affected if we or our suppliers are unable to procure our requirements for various commodities, including, among others, brass, porcelain, wood and engineered wood, or if a shortage of these commodities results in significantly increased costs. Rising energy costs could also increase our production and transportation costs. These factors could have a material adverse effect on our results of operations and financial position.

It can be difficult for us to pass on to customers our cost increases. Our existing arrangements with customers, competitive considerations and customer resistance to price increases may delay or make us unable to adjust selling prices. If we are not able to sufficiently increase the prices of our products or achieve cost savings to offset increased material and production costs, including the impact of increasing tariffs, our results of operations and financial position could be adversely affected. When our material costs decline, we may in the future receive pressure from our customers to reduce our prices. Such reductions could have a material adverse effect on our results of operations and financial position.

We have entered into long-term agreements with certain significant suppliers to help ensure continued availability of our manufactured product supply and to establish firm pricing, but at times these contractual commitments may result in our paying above market prices for manufactured products during the term of the contract.

Our top ten customers represent a large portion of our sales. A significant adverse change in such relationships could adversely impact our results of operations and financial condition.

Our sales are concentrated with ten significant customers who collectively represented over 72% and 76% of our consolidated net sales for 2023 and 2022, respectively, and this concentration may continue to increase. In particular, The Home Depot represented approximately 18% and 22% of our consolidated net sales in 2023 and 2022, respectively. The Home Depot and other home center retailers can significantly affect the prices we receive for our products and the terms and conditions on which we do business with them. Additionally, these home center retailers may reduce the number of vendors from which they purchase and could make significant changes in their volume of purchases from us.

16

The loss of one or more key customers, a material reduction in products purchased by them, or our inability to maintain our competitive position in our industries could cause us to experience a decline in net sales, which could adversely affect our results of operations and financial position. In addition, there can be no assurance that such customers will not experience financial difficulties or other adverse conditions which could delay such customers in paying for products on a timely basis or at all. Although other retailers, dealers, distributors and homebuilders represent other channels of distribution for our products and services, we might not be able to quickly replace, if at all, the loss of all or a substantial portion of our sales, and any such loss would have a material adverse effect on our business, results of operations and financial position.

We are dependent on a few key third-party suppliers.

We are dependent on third-party suppliers for many of our products and components, and are largely dependent on one large supplier, Tangshan Huida Ceramic Group Co., Ltd, an entity formed and located in China (“Huida”), who accounted for and approximately 71% and 86% of the total balance of our accounts payable as of December 31, 2023 and 2022, respectively, for the majority of our sanitaryware products, and our ability to offer a wide variety of products depends on our ability to obtain an adequate and timely supply of these products and components.

Failure of our suppliers and, particularly, of Huida, to timely provide us quality products on commercially reasonable terms, or to comply with applicable legal and regulatory requirements, or our policies regarding our supplier business practices, could have a material adverse effect on our results of operations and financial position or could damage our reputation. Sourcing these products and components from alternate suppliers, including suppliers from new geographic regions, is time-consuming and costly and could result in inefficiencies or delays in our business operations. Accordingly, the loss of Huida or other critical suppliers, or a substantial decrease in the availability of products or components from our suppliers, could disrupt our business and have a material adverse effect on our results of operations and financial position.

We previously had an agreement with Huida pursuant to which we had an exclusive right to distribute and resell in the United States and Canadian markets any products designed and created by Huida and Huida was not permitted to manufacture or sell any products we designed or created, for which we retained all intellectual property rights, without our prior consent. This agreement was ended in 2022, but Huida remains a key supplier and we believe we maintain a good business relationship. However, it is possible that, in the future, Huida may seek to sell directly into markets in which we operate, which may affect our supplier relationship or negatively impact our sales in such markets.

Additionally, many of the suppliers we rely upon are located in foreign countries, primarily China. The differences in business practices, shipping and delivery requirements, changes in economic conditions and trade policies and laws and regulations, together with the limited number of suppliers, have increased the complexity of our supply chain logistics and the potential for interruptions in our production scheduling. If we are unable to effectively manage our supply chain or if we experience constraints to or disruption in transporting the products or components or we have to pay higher transportation costs for timely delivery of our products or components, our results of operations and financial position could be materially and adversely affected. See “— Risks Related to Doing Business In China” below.

We are dependent on third-party manufacturers.

We are reliant upon Foremost, our former parent company, and other third-party manufacturers to supply the majority of our products. Failure of our manufacturers to timely deliver quality products on commercially reasonable terms, or to comply with applicable legal and regulatory requirements, or our policies regarding our manufacturer business practices, could have a material adverse effect on our results of operations and financial position or could damage our reputation. In addition, we may experience delays, disruptions or quality control problems in our manufacturing operations, over which we have little to no control.

17

Natural disasters or other disruptions could have a material adverse effect on our business, financial condition or results of operations.

Our manufacturers and suppliers are located in regions that are vulnerable to natural disasters and other risks, such as earthquakes, fires, floods, tropical storms, hurricanes and snow and ice, which at times have disrupted the local economy and posed risks to our supply chain. In addition, the continued threat of terrorism and heightened security and military action in response to this threat, or any future acts of terrorism, may cause further disruptions to the economies of the United States and other countries. Our redundant, multiple site capacity may not be sufficient in the event of a natural disaster, terrorist act or other catastrophic event. Such disruptions could, among other things, disrupt our manufacturing or distribution facilities or those of our suppliers and result in delays or cancellations of customer orders for our products, which in turn could have a material adverse effect on our business, financial condition and results of operations. Further, if a natural disaster occurs in a region from which we derive a significant portion of our revenue, end-user customers in that region may delay or forego purchases of our products, which may materially and adversely impact our operating results for a particular period.

There are risks associated with our international operations and global strategies.

In each of 2023 and 2022, approximately 36% and 36%, respectively of our sales were made outside of the United States (principally in Canada and Europe) and transacted in currencies other than the U.S. dollar. In addition to our Canadian and European operations, we manufacture products and source products and components from China and parts of Southeast Asia. Risks associated with our international operations include:

| ● | differences in culture, economic and labor conditions and practices; |

| ● | the policies of the U.S. and foreign governments; |

| ● | disruptions in trade relations and economic instability; |

| ● | differences in enforcement of contract and intellectual property rights; |

| ● | social and political unrest; and |

| ● | natural disasters, terrorist attacks, pandemics or other catastrophic events. |

We are also affected by domestic and international laws and regulations applicable to companies doing business abroad or importing and exporting goods and materials. These include tax laws, laws regulating competition, anti-bribery/anti-corruption and other business practices, and trade regulations, including duties and tariffs. Compliance with these laws is costly, and future changes to these laws may require significant management attention and disrupt our operations. Additionally, while it is difficult to assess what changes may occur and the relative effect on our international tax structure, significant changes in how U.S. and foreign jurisdictions tax cross-border transactions could materially and adversely affect our results of operations and financial position. For specific risks associated with operations in China, see “— Risks Related to Doing Business in China” below.

The international scope of our business exposes us to risks associated with foreign exchange rates.

We report our financial results in U.S. dollars. However, a significant portion of our revenues, expenses, assets, indebtedness and other liabilities are denominated in foreign currencies, particularly the Euro, the Chinese Renminbi and the Canadian dollar. Fluctuations in currency exchange rates, including as a result of inflation, central bank monetary policies, currency controls or other currency exchange restrictions have had, and could continue to have, an adverse impact on our financial performance. We may seek to mitigate the risk of such impacts through hedging, but such hedging activities may be costly and may not be effective. In addition, emerging market economies in which we operate may be particularly vulnerable to the impact of rising interest rates, inflationary pressures, weaker oil and other commodity prices, and large external deficits. Risks in one country can limit our opportunities for portfolio growth and negatively affect our operations in another country or countries. Such conditions or developments could have an adverse impact on our operations. In addition, we may be exposed to credit risks in some of those markets.

18

Global or regional unrest, conflict, geopolitical disputes or catastrophic events could affect our operations and results of operations.

Our business can be affected by war, large-scale terrorist or other hostile acts, especially those directed against the United States or other major industrialized countries in which we do business or supply products, major natural disasters, long-term periods of drought, or widespread outbreaks of infectious diseases. Such events could impair our ability to manage our business, could disrupt our supply of raw materials, and could affect production, transportation and delivery of products. For example, the U.S.-China trade relations remain uncertain, and if tensions continue to worsen, we may our supply chain, production and delivery of products could be negatively impacted. Further, regional conflicts, such as the Ukraine-Russia and Israel-Hamas conflicts, could escalate and expand, which in turn could have negative impacts on our operations, the global economy and financial markets. Such disruptions of regional or global economic activity can affect consumers’ purchasing power in the affected areas and, therefore, reduce demand for our products.

The long-term performance of our businesses relies on our ability to attract, develop and retain talented and diverse personnel.

To be successful, we must invest significant resources to attract, develop and retain highly qualified, talented and diverse employees at all levels, who have the experience, knowledge and expertise to implement our strategic initiatives. We compete for employees with a broad range of employers in many different industries, including large multinational firms, and we may fail in recruiting, developing, motivating and retaining them, particularly when there are low unemployment levels. From time to time, we have been affected by a shortage of qualified personnel in certain geographic areas. Our growth, competitive position and results of operations and financial position could be materially and adversely affected by our failure to attract, develop and retain key employees and diverse talent, to build strong leadership teams, or to develop effective succession planning to assure smooth transitions of those employees and the knowledge and expertise they possess, or by a shortage of qualified employees.

Failure to effectively monitor and respond to environmental, social and governance (“ESG”) matters, including our ability to set and meet reasonable goals related to climate change and sustainability efforts, may negatively affect our business and operations.

Regulatory developments and stakeholder expectations relating to ESG matters are rapidly changing. Concern over climate change has increased focus on the sustainability of practices and products in the markets we serve, and changes to laws and regulations regarding climate change mitigation may result in increased costs and disruption to operations. Moreover, the standards by which ESG matters are measured are developing and evolving, and certain areas are subject to assumptions that could change over time. If we are unable to recognize and respond to such developments, or if our existing practices and procedures are not adequate to meet new regulatory requirements, we may miss corporate opportunities, become subject to regulatory scrutiny or third-party claims, or incur costs to revise operations to meet new standards.

The outbreak of contagious diseases, such as the COVID-19 pandemic, could disrupt our business and impact our results of operations and financial condition.

Our business could be adversely affected by the effects of a widespread outbreak of contagious diseases, similar to COVID-19, which impacted global, national and local economies, created a number of macroeconomic challenges that impacted our business, including volatility and uncertainty in business planning, disruptions in global supply chains, material, freight and labor inflation, shortages of and delays in obtaining certain materials and labor shortages.

The extent of the impact of a pandemic similar to the COVID-19 pandemic on our business and financial results will depend on numerous evolving factors that we are not able to accurately predict and that all will vary by market, including the duration and scope of the pandemic, the emergence of new variants of the virus and the efficacy of vaccines against such variants, global economic conditions during and after the pandemic, including disruptions in the global supply chain, inflation and labor shortages, government actions that may be taken in the future, in response to the pandemic, and changes in customer behavior in response to the pandemic, some of which may be more than just temporary.

19

Risks Related to Doing Business in China

We have limited operations in China, but many of our products are sourced from China. Our ability or the ability of our suppliers to operate in China may be impaired by changes in Chinese laws and regulations, including those relating to taxation, environmental regulation, restrictions on foreign investment, and other matters.

While we are a Cayman Islands exempted company headquartered in the United States and derive no revenue from China, we do have limited sourcing and product development operations in China. As of the date of this report, approximately 27 of our 287 employees are based in China. Moreover, suppliers of a majority of our product materials are based in China.

The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. The central Chinese government or local governments having jurisdiction within China may impose new, stricter regulations, or interpretations of existing regulations, that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. As such, our subsidiaries or our third-party suppliers in the People’s Republic of China (PRC) maybe subject to governmental and regulatory interference in the provinces in which they operate. Our subsidiaries or our third-party suppliers could also be subject to regulation by various political and regulatory entities, including local and municipal agencies and other governmental subdivisions. Our ability, and the ability of our suppliers, to operate in China may be impaired by any such laws or regulations, or any changes in laws and regulations in the PRC. We or our third-party suppliers may incur increased costs necessary to comply with existing and future laws and regulations or penalties for any failure to comply. If our suppliers incur increased costs, they may attempt to pass such costs on to us. Any such increased costs or disruptions to our operations or the operations of our suppliers could adversely impact our results of operations.