In

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission File Number: 001-38493

eXp World Holdings, Inc.

(Exact name of registrant as specified in its charter)

Delaware |

|

98-0681092 |

(State or other jurisdiction |

|

(I.R.S. Employer |

of incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

|

|

|

|

2219 Rimland Drive, Suite 301 Bellingham, WA |

|

98226 (Zip Code) |

(Address of principal executive offices) |

|

Registrant’s telephone number, including area code: (360) 685-4206 |

Securities registered pursuant to section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.00001 per share |

EXPI |

The Nasdaq Stock Market |

|

Securities registered pursuant to section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

Based on the registrant’s closing price of $20.28 as quoted on the Nasdaq Stock Market on June 30, 2023, the aggregate market value of the voting and nonvoting common equity held by non-affiliates of eXp World Holdings, Inc. was approximately $1.3 billion. The number of shares of the registrant’s $0.00001 par value common stock outstanding as of December 31, 2023 was 154,669,037.

DOCUMENTS INCORPORATED BY REFERENCE The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended December 31, 2023. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K. Portions of the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are incorporated into Part I, Item 1 and Part II, Item 7, of this Form 10-K.

TABLE OF CONTENTS

|

|

Page |

1 |

||

|

|

|

|

2 |

|

2 |

||

9 |

||

22 |

||

22 |

||

24 |

||

24 |

||

24 |

||

|

|

|

|

25 |

|

25 |

||

26 |

||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 |

|

39 |

||

40 |

||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

66 |

|

66 |

||

68 |

||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

68 |

|

|

|

|

|

68 |

|

68 |

||

68 |

||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

68 |

|

Certain Relationships and Related Transactions and Director Independence |

69 |

|

69 |

||

|

|

|

|

70 |

|

70 |

||

71 |

||

|

|

|

72 |

||

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”), the documents incorporated into this Annual Report by reference, and our other public filings contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not based on historical facts but rather represent current expectations and assumptions of future events. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Many of these risks and other factors are beyond our ability to control or predict. Forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “could,” “can,” “would,” “potential,” “seek,” “goal” and similar expressions. These risks and uncertainties, as well as other risks and uncertainties that could cause our actual results to differ significantly from management’s expectations, are described in greater detail in Item 1A, “Risk Factors”, Item 3, “Legal Proceedings,” Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 9A. “Controls and Procedures – Inherent Limitations on Effectiveness of Controls of this Annual Report.

Forward-looking statements are based on currently available operating, financial and market information and are inherently uncertain. Investors should not place undue reliance on forward-looking statements, which speak only as of the date they are made and are not guarantees of future performance. Actual future results and trends may differ materially from such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future developments or otherwise, except as may be required by law.

1

PART I

Item 1. |

BUSINESS |

General

eXp World Holdings, Inc. (“eXp,” or, collectively with its subsidiaries, the “Company,” “we,” “us,” or “our”) owns and oversees a diversified portfolio of service-oriented businesses. These businesses significantly benefit from the integration of our advanced enabling technology platform. Our strategic focus is on expanding our real estate brokerage operations. To achieve this, we emphasize enhancing the value proposition for our agents, investing in the development of immersive, cloud-based technological solutions, and offering affiliate and media services that bolster these efforts.

The following are developments in our business since the beginning of the fiscal year ended December 31, 2023:

| ● | During 2023, the Company announced various new agent incentive programs to enhance the agent experience and to attract culturally aligned agents, teams of agents and independent brokerages to the Company. New incentive programs include Boost, Accelerate, and Thrive, which offer unique financial incentives. |

| ● | In 2023, the Company launched various new ancillary programs and services to support the development and success of its agents, brokers and customers, including the continued global expansion of eXp Luxury™, Military Rewards Program, Listing Kits, Bundle Select™, eXp Exclusives™, My Link My Lead™, and affiliate relationships like HomeHunter™. |

| ● | Additional talent joined the Company in 2023, including the appointment of Peggie Pelosi to our Board of Directors in January 2023 and the appointment of Fred Reichheld to our Board of Directors in September 2023. |

Business Segments

The Company is operated and managed as four reportable segments which are North American Realty, International Realty, Virbela and Other Affiliated Services. Our business segments bring together related eXp technologies and services to support the success and development of agents, entrepreneurs and businesses and provide them remote business solutions.

North American Realty and International Realty

Both the North American Realty segment and the International Realty segment generate revenue primarily by serving as a licensed broker for the purpose of processing residential and commercial real estate transactions, from which we earn commissions. The Company in turn pays a portion of the commissions earned to the real estate agents and brokers. eXp offers an innovative cloud-based brokerage model, which reduces costs to our agents and brokers. The model features low entry fees, stock ownership opportunities for agents and brokers and a revenue-sharing plan through which agents and brokers can earn commission from transactions conducted by agents and brokers they have attracted to eXp. Our North American Realty segment also includes lead-generation and other real estate support services in North America and Canada. Our International Realty segment includes our foreign operations in the United Kingdom (the “U.K.”), Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany, the Dominican Republic, Greece, New Zealand, Chile, Poland, and Dubai.

Virbela

We operate over the internet and rely on cloud-based technologies to provide our residential real estate brokerage services. Our brokers and agents leverage our technology, services, data, lead generation and marketing tools to represent residential real estate buyers and sellers.

Among other technologies we use to operate our business, our proprietary Virbela® and Frame™ platforms offer metaverse solutions, including 3D, fully immersive, cloud offices. These cloud offices include virtual conference rooms, training centers and individual offices in which our management, employees, agents and brokers all work on a daily basis and, in separate custom settings, in which our customers operate as well, collaborating, socializing and transacting business across geographic regions.

While most Company and customer operations have taken place on the Virbela platform since 2016, many operations have begun to shift to the Frame platform as its development has matured, including its unique capability to operate fully on the web without the requirement for a separate client application. As our customers evolve post-COVID, including a return-to-work-offices, and in light of ongoing internal and external demand for web-accessible platforms and artificial intelligence solutions, we have experienced a decline in demand for our application-based platform, Virbela, and a rising interest our web-accessible platform, Frame.

2

Other Affiliated Services

Includes key assets such as SUCCESS® magazine and SUCCESS® Coaching, which provide training, classes, resources, and tools to empower our agents, brokers, staff, and general customers to excel and empower their professional development. This segment also includes SUCCESS® Space, a new kind of coworking solution offering highly flexible, on-demand rental work spaces for individual and group use, access to professional development coaching, media production services, virtual-world communications technology and full-service cafes.

Markets and Customers

Real Estate Brokerage: Our clients are primarily residential homeowners and homebuyers in the markets in which we operate as serviced by our international network of independent agents and brokers. These customers are sellers or purchasers of new or existing homes and engage us to aid in the facilitation of the closing of the real estate transaction, including, but not limited to, searching, listing, application processing and other pre- and post-close support. Our experienced agents and brokers are well suited to support our customers’ needs with a high level of professionalism, knowledge and support as they endeavor on one of the largest transactions they will most likely experience.

Our North American Realty segment is comprised of operations in the U.S. and Canadian residential real estate markets. Through our network of independent agents and brokers, we have brokerages in all 50 states in the U.S. residential real estate market and residential real estate markets in most of the Canadian provinces. Our North American Realty segment represented 98.6% of total consolidated revenues in 2023.

Our International Realty segment operates in the U.K., Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany, the Dominican Republic, Greece, New Zealand, Chile, Poland and Dubai. Our International Realty segment represented 1.3% of total consolidated revenues in 2023.

Virbela: Our innovative technologies are used primarily by our brokerage real estate agents and their clients within our U.S., Canadian and international markets. We continue to innovate the Virbela portfolio, expanding the product offering to include and enhance our Frame platform. We have experienced a decline, among internal staff and agent users as well as among external unaffiliated customers, in demand for our application-based platform, Virbela, and an increased demand for our web-accessible platform, Frame.

Other Affiliated Services: We provide affiliated services to our agents, brokers and customers that support their professional efforts and personal betterment. Under its ownership, the Company has built upon SUCCESS® magazine and its related media properties to develop a robust SUCCESS® brand of innovative personal and professional development tools, including SUCCESS® Coaching and SUCCESS® Space.

Competition

Our real estate brokerage competes with local, regional, national and international residential real estate brokerages with respect to the sale of homes and to attract and retain agents, teams of agents, brokers and consumers — both home sellers and buyers. We compete primarily on the basis of our service, culture, collaboration, and utilization of cloud-based systems and technologies that reduce costs, while providing relevant and substantial professional development and opportunities for our agents and brokers to generate more business and participate in the growth of our Company.

Residential real estate brokerage companies typically realize revenues in the form of a commission based on a percentage of the price of each home purchased or sold, which varies based on geographical location and specific customer-agent negotiations, among other factors. Therefore, variability in the commissions earned in the real estate industry exists based on general economic and market factors, as well as the price and volume of homes sold. We are positioned to earn commissions on either — or both — of the buy side or sell side of residential real estate transactions, as well as the ability to receive other fees for complementary services provided during the closing process.

We believe that we are the only international real estate brokerage presently using a 3D immersive office environment in place of physical brick-and-mortar offices. Additionally, this innovative operational structure coupled with our distribution model allows us to effectively enter new markets with speed and flexibility and without much of the investment and cost associated with establishing a traditional brokerage. We also believe our compensation and incentive programs to attract and retain highly productive agents are one of the most compelling in the industry. As such, we believe that we are well positioned in our competitive landscape.

Resources

Software Development

Our Company continues to increase our investment in the development of our own cloud-based transaction processing platforms and further expand our technological products and service offerings. We continue to create process efficiencies and provide our agents and brokers with technologies designed to facilitate transactions in an efficient and consumer-friendly way. Our operational model and growth strategies necessitate the proprietary technologies used to support our operations now and in the future, as well as requiring us to, at times, consider existing and emerging technology companies for acquisition, partnerships and other collaborative relationships.

3

Intellectual Property

Our cloud-based real estate brokerage is highly dependent on the proprietary technology that we employ and the intellectual property that we create. “eXp Realty” is one of our registered trademarks in the United States, among other registered and nonregistered trademarks. We also own the rights to key domain names used by our domestic and international brokerages: including, for example, https://exprealty.com and https://exprealty.ca. Additionally, we own registered trademarks and the rights to domain names which are leveraged in our other business segments and in connection with services that complement our real estate brokerage, such as the “SUCCESS” registered trademark and https://success.com. We have also engaged various third parties to extend enterprise licenses for critical transaction management, client relationship management and other proprietary software.

While there can be no assurance that registered trademarks and other intellectual property rights will protect our proprietary information, we intend to assert our intellectual property rights against any infringement. Although any assertion of our rights could result in a substantial cost and diversion of management effort, we believe the protection and defense against infringement of our intellectual property rights are essential to our business.

Seasonality of Business

Seasons and weather traditionally impact the real estate industry in the markets in which we operate. Spring and summer seasons historically reflect greater sales periods and, in turn, higher revenues and operating results in comparison to fall and winter seasons. The Company has historically experienced higher revenue during the second and third quarters of its fiscal year due in part to seasonal industry patterns. By contrast, our Virbela and Other Affiliated Services segments experience generally consistent revenue during the year, with some increased adoption around the Company’s spring and fall events.

Government Regulation

See Note 13 – Commitments and Contingencies to the consolidated financial statements included elsewhere within this Annual Report for additional information on the Company’s legal proceedings. For additional information with respect to related risks facing our business, see Item “1A. – Risk Factors” included elsewhere within this Annual Report.

Legal and Regulatory Environment

All of our businesses, as well as our joint ventures (such as mortgage origination, title underwriting, and ancillary agent support services), operate in highly regulated industries and are subject to changes in government policy, variations in the interpretation and enforcement of laws by regulatory bodies and other government entities, and modifications to existing laws, regulatory frameworks, and guidelines.

Residential Real Estate

We primarily serve the residential real estate industry, which is regulated by federal, international, state, provincial and local laws and authorities as well as private associations or state-sponsored associations or organizations. Further, lawsuits, investigations, disputes and regulatory proceedings against us or other professionals or businesses in the residential real estate industry and tangential industries may impact the Company and its affiliated real estate professionals when the outcomes of those cases address practices common to the broader industry, business community, or the Company and may result in litigation or investigations for the Company.

We are a participant in multiple listing services (“MLSs”) through our subsidiary entities, employees, and affiliated real estate professionals. Many of our affiliated real estate professionals are members of the National Association of Realtors (“NAR”) and state Realtor associations. The regulations, rules and policies of these organizations are subject to change, which changes can be influenced by regulatory developments, litigation, and other actions.

From time to time, certain industry practices come under federal or state scrutiny or are the subject of litigation. The industry is currently experiencing increased scrutiny by private parties, regulators and other government offices, both on a federal and state level, particularly in the areas of antitrust and competition, Real Estate Settlement Procedures Act (“RESPA”) compliance (and similar state statutes), Telephone Consumer Protection Act compliance (“TCPA”) (and similar state statutes) and worker classification.

RESPA

RESPA, along with various state and international real estate laws, governs the payments and referrals associated with residential sales and settlement services, such as mortgages, title insurance, and home insurance. These laws may impose limitations on arrangements involving our real estate brokerage, affiliated real estate professionals, lead generation efforts, and the businesses of our joint ventures, in addition to mandating timely disclosure about such relationships. While RESPA and similar statutes allow for certain payments, fee splits, and affiliated business arrangements, compliance can be challenging due to varying interpretations by courts and regulators.

4

Violations can result in significant penalties, including fines and legal fees, particularly where RESPA and similar statutes have been invoked by plaintiffs in private litigation for various purposes. Additionally, we're bound by state laws that restrict inducements and gifts to consumers, affecting our lead-generation efforts.

Antitrust

Our business is subject to various antitrust and competition laws, including the Sherman Antitrust Act, the Federal Trade Commission Act, the Clayton Act, and other related federal, state, and provincial laws in the jurisdictions in which we operate. These laws prevent anti-competitive behaviors such as price-fixing and other conduct that unreasonably restrains trade and competition.

In 2021, the Department of Justice (“DOJ”) withdrew its consent to a November 2020 proposed settlement with NAR concerning alleged anti-competitive practices in real estate. While the DOJ dismissed its lawsuit against NAR in July 2021, it indicated a broader investigation into NAR's activities. In November 2021, NAR modified its rules to implement most of the changes the DOJ settlement sought. In January 2023, a court set aside the DOJ's new investigative demand related to NAR. The indirect and direct effects, if any, of this action upon the real estate industry are not yet clear.

While anti-competition enforcement has intensified across industries, there is a unique focus on the real estate industry in the United States and Canada. For example, the White House issued an Executive Order in July 2021 identifying real estate brokerages and listings as an area of focus. In 2018, a joint workshop by the DOJ and FTC addressed potential competition issues in the residential real estate sector which could be the subject of future enforcement actions.

As disclosed in Note 13 – Commitments and Contingencies to the consolidated financial statements included elsewhere within this Annual Report, we are a defendant in certain antitrust class action complaints which allege violations of federal antitrust law in the United States and Canada. These lawsuits, together with similar lawsuits against other businesses in our industry, have prompted discussion of regulatory changes to rules established by local or state real estate boards or MLSs. The resolution of the antitrust litigation and/or other regulatory changes may require changes to our or our brokers’ business models, including changes in agent and broker compensation. This could reduce the fees we receive from our affiliated real estate professionals, which, in turn, could adversely affect our financial condition and results of operations.

Internationally, our operations are also subject to laws against improper payments, including the U.S. Foreign Corrupt Practices Act and similar global regulations.

Worker Classification

Except for certain employees who have an active real estate license or in jurisdictions with unique local laws, our real estate professionals in our brokerage operations have been retained as independent contractors, either directly or indirectly through third-party entities formed by these independent contractors for their business purposes. With respect to these independent contractors, we are subject to the Internal Revenue Service regulations, foreign regulations and applicable state and provincial law guidelines regarding independent contractor classification. These regulations and guidelines are subject to judicial and agency interpretation. We continue to monitor these matters as well as related federal and state developments.

Cybersecurity and Data Privacy Regulations

Our business necessitates collecting and handling sensitive personal data, and we are governed by various domestic and international privacy and cybersecurity laws. For example, in the U.S., we are required to comply with the Gramm-Leach-Bliley Act, which governs the disclosure and safeguarding of consumer financial information, as well as state statutes governing privacy and cybersecurity matters like the California Consumer Privacy Act (“CCPA”). California further strengthened privacy regulations with the California Privacy Rights Act (“CPRA”) in 2020, effective January 1, 2023, introducing more stringent requirements and creating a dedicated enforcement agency. Other states have enacted or are considering their own privacy laws. Internationally, the European Union's General Data Protection Regulation (“GDPR”) grants extensive privacy rights and enforces strict penalties for non-compliance. With the E.U.-U.S. Privacy Shield being invalidated in 2020, businesses have turned to alternative mechanisms like standard contractual clauses for data transfer. Additionally, global data privacy regulations continue to evolve.

For additional information with respect to related risks facing our business, see Item 1A - Risk Factors in this Annual Report, in particular under the caption “Cybersecurity incidents could disrupt our business operations, result in the loss of critical and confidential information, adversely impact our reputation and harm our business.”

TCPA

The TCPA limits specific telemarketing actions, such as autodialing and using artificial voice messages, and has established a national Do-Not-Call registry. The TCPA has a broad definition of autodialing and mandates written consent for some communications to mobile phones. Some states have, or might introduce, their own versions of the TCPA. We are susceptible to class action claims suggesting we're responsible for contacts made by our real estate professionals.

5

Environmental Regulation

The Company operates in a cloud-based model which gives us an insignificant physical geographical footprint. Due to this, we are not materially impacted by any environmental regulation. However, sustainable investing and environmental, social, and governance practices continue to be the focus of increased regulatory scrutiny across jurisdictions. In the U.S., the SEC has proposed climate disclosure rules to require public issuers to include enhanced disclosure regarding corporate climate-related information in their periodic reports and registration statements. Such information would include climate-related risks that are reasonably likely to have a material impact on an issuer’s business or results of operations, as well as certain climate-related financial statement metrics. In addition, we expect state laws and regulations regarding these topics to continue to evolve and impose new and additional requirements. For example, in October 2023, California enacted a new climate accountability package pursuant to its new Climate Corporate Data Accountability Act that will require annual disclosure of certain greenhouse gas emissions and new Climate-Related Financial Risk Act that will require biennial disclosure of certain climate-related financial risks and mitigation measures, each beginning in 2026, subject to applicable implementing regulations and rulemaking that may impact final scope and compliance timing. Globally, the International Sustainability Standards Board and applicable sustainability disclosure standards impact how national regulators and governance bodies approach these and related topics.

Other Regulation

We operate in multiple geographies and industries which subject us to various governmental and non-governmental rules and regulations, including without limitation, franchising, fair trade, health and data privacy rules. As we expand into new businesses and markets, we assign and/or engage appropriate personnel to manage and comply with such requirements.

Environmental, Social and Governance Initiatives

As a company dedicated to disrupting the traditional industry model, eXp understands the importance of ingraining environmental, social and governance (ESG) best practices across the organization. We are committed to running a sustainable business for our agents, their clients, and the greater good of our planet by bringing people together beyond boundaries with advanced collaboration technologies. Our approach leverages the power of community and cloud-based solutions to drive positive impact for people and the environment.

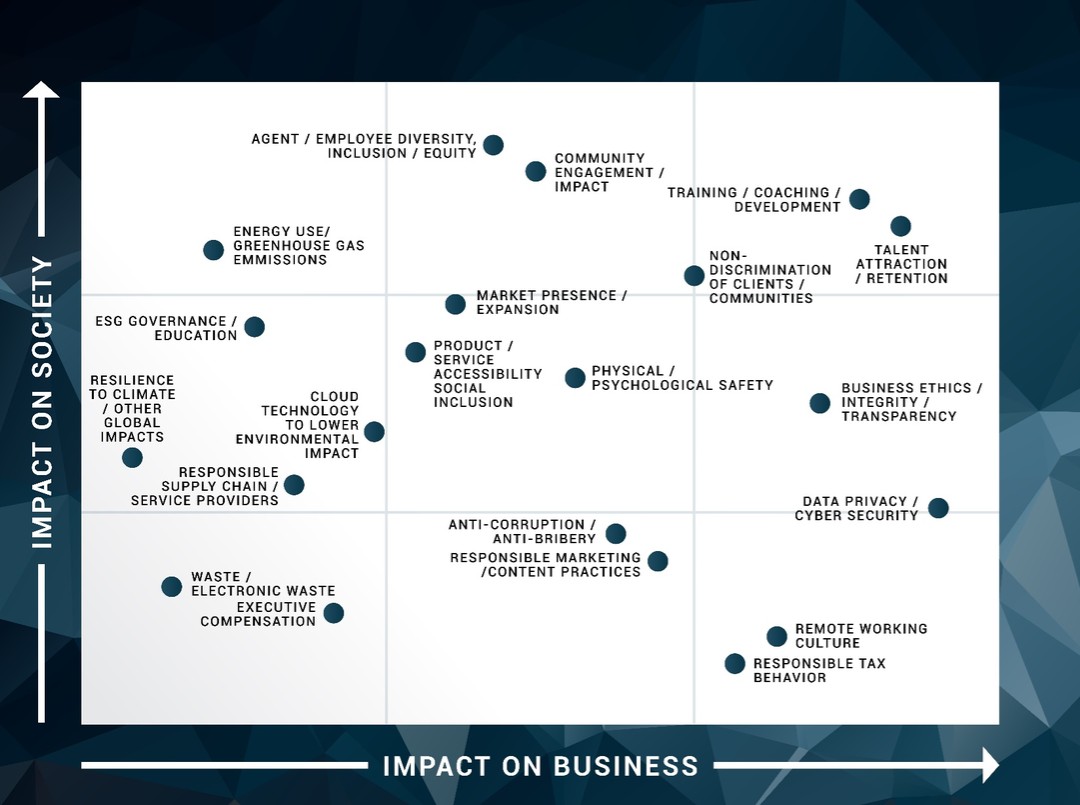

In 2022, we conducted a robust ESG materiality assessment with the assistance of an external consultant, GlobeScan, to identify the material ESG topics that have the greatest impact on the Company’s success, which was delivered in January 2023 to our leadership team, employees and agents. In 2023, the Company’s Board of Directors created a Sustainability Committee of the Board tasked with overseeing and developing, alongside management, strategies related to the material ESG topics identified in the assessment. We have chosen to focus our efforts on three key pillars that we have termed our “Core Values”: empowering people development, building inclusive and equitable communities and advancing climate-positive solutions.

The results of the materiality assessment were provided to the Company’s Board and management to identify our key focus areas and to develop a strategy to address the material ESG topics identified in the assessment.

6

During 2023, the Company had various social initiatives in support of these Core Values, including the following:

| ● | Empowering People Development: We are helping people achieve their fullest potential by fostering personal and professional growth through our tools, technology and collaboration. We have continued throughout 2023 to provide tools for productivity and health and wellbeing, for our employees, access to wellness platforms such as Calm, Vitality and Noom, and, for our real estate agents and brokers, providing toolkits for scaling business and entrepreneurship. |

| ● | Building Inclusive and Equitable Communities: We drive fairness, inclusivity and belonging by supporting diverse groups of clients, agents, brokers and employees, and encouraging them to create a positive impact in their communities through philanthropic initiatives. We are committed to creating an equitable, diverse and inclusive culture for our clients, agents, brokers and employees. Our Employee Experience team operates under the human resources department and supports this mission with diversity, equity and inclusion practices to support employee engagement and global collaboration, including the promotion of ONE eXp, an important vehicle by which we connect diverse agents and brokers with clients identifying as and/or seeking out diverse representation in their home purchase or selling journey. In 2023 we established the Realtor Safety Taskforce whose mission is ensuring the utmost safety of our agents while they are representing eXp, including at eXp-sponsored events and meetings, and we provide safe and inclusive workspaces within our virtual world. We also created the Women’s Impact Network to further the success, health and wellbeing of our female agents and employees while providing an outlet for diverse and inclusive voices. Our employees, agents and brokers are our best embodiment of the Company’s commitment to community as a core value. Many of our employees, agents and brokers are involved in their own communities to support the betterment of lives. We contribute to building equitable communities through the sponsorship of many community initiatives which are well attended by our employees, agents and brokers. The first week of October of each year is designated “I Heart eXp” week and employees, agents and brokers across the U.S. mobilize to take part in community charity initiatives. We |

7

| have continued expanding initiatives driven by our 501(c)(3) affiliated nonprofit, eXtend-a-Hand, whose mission is to provide financial assistance to independent agents of the Company who suffer catastrophic events, including, without limitation, natural disasters, illness and accidents and in the case of dependents or designated beneficiaries, the death of their independent agent family member. |

| ● | Advancing Climate-Positive Solutions: We are paving a responsible path to a better planet through our cloud-based model and will continue to promote, scale, and innovate solutions for a low-carbon economy and more resilient communities. We have reduced our GHGs and environmental impact including server energy, waste and agent travel, while also providing ESG training to all agents and employees and offering products for sustainability. We established an incentive plan for electric vehicles for agents and provided education on sustainable homes and energy efficiency. |

We are committed to furthering these goals through targets that will be regularly evaluated to ensure our continued success in meeting the pillars of our core values strategy.

Human Capital

Our employees, including our brokers and our independent contractor real estate agents, represent the human capital investments imperative to our operations. As of December 31, 2023, the Company had approximately 2,114 full-time equivalent employees and 87,515 real estate agents. Our employees are not members of any labor union and we have never experienced business interruptions due to labor disputes. We also utilize part-time and temporary employees and consultants when necessary; in many of our foreign markets we rely on the use of indirect employment structures where personnel providing certain services to the foreign entities are employed by a contractor of the Company and are not employed by the Company.

Management: Our operations are overseen directly by management. Our management oversees all responsibilities in the areas of corporate administration, business development and technological research and development. We have successfully expanded our current management to retain skilled employees with experience relevant to our business and intend to continue with this initiative. Our management’s relationships with agents, brokers, technology providers and customers will provide the foundation with which we expect to grow our business in the future. We believe the skill set of our management team will be a primary asset in the development of our brands and trademarks.

Talent and Culture: Our business is driven by nine core values of community, sustainability, integrity, service, collaboration, innovation, transparency, agile and fun. At eXp, these core values are manifested throughout everything we do and support the Company’s overall vision and shape our culture. We believe that our ongoing success is attributable in large part to our eXp employees who work across the U.S. and internationally in the cloud environment to support our agent-centric business model and core values. Attracting and retaining employee talent is a high priority for us and we look to hire passionate and driven individuals who want to be a part of our mission to continue to grow the brokerage and our related suite of services. We also value transparency and are committed to an open and accountable workplace where employees are empowered to raise issues. The Company provides multiple channels to speak up, ask for guidance and report concerns. eXp has been named one of the Best Places to Work on Glassdoor for each of the years 2019 through 2023. In 2021, 2022, and 2023, we were named as one of the Top 100 Companies to Watch for Remote Jobs by FlexJobs.

Health & Safety: Our employees operate in a fully remote environment and are located across the U.S. and internationally. During 2023, the Company offered self-defense training to real estate agents and brokers attending our annual fall convention and our human resources department expanded existing offerings to support the health and safety of our employees in their remote work environments. The Realtor Safety Taskforce has been established to continue fostering an environment of safety and ensure that all company related activities, events and meetings are planned and executed with safety at the forefront.

Independent Agent and Broker Support: We provide entrepreneurial business opportunities and a competitive compensation structure to our agents and brokers. Additionally, our agents and brokers have a unique choice to attain a greater vested interest in eXp through the acceptance of equity awards in eXp stock as part of their compensation offerings. These programs and our agent support platforms — including training, back-office support and communications — allow agents and brokers to successfully operate their own businesses that are aligned with our strategies and goals, creating synergies across our distribution network. We believe it is critical to our success that agent voices are heard at every level of the Company, including management, whose mission is supported by our Agent Advisory Council and our Board of Directors, which includes a rotating agent director seat. Refer to our Agent Advisory Council section of our website at https://expworldholdings.com/agent-advisory-council/ for information on agent participation in the management of eXp. Information contained on our website is not incorporated by reference into this Annual Report.

Available Information

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as amended (the “Exchange Act”), are filed with the U.S. Securities and Exchange Commission (the “SEC”). Such reports and information for the previous 12 months are available free of charge through our website at www.expworldholdings.com/investors/sec-filings/.

8

Additionally, the SEC maintains an internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The public can obtain any documents that we file with the SEC at www.sec.gov.

Our Company also uses the following channels as a means of disclosing information about the Company on a broad, non-exclusionary basis, including information about our brokerage, upcoming investor and industry conferences, our planned financial and other announcements and other matters and for complying with our disclosure obligations under Regulation FD:

eXp investors website (www.expworldholdings.com/investors/)

eXp Realty X Account (https://x.com/eXpRealty)

eXp World Holdings X Account (https://x.com/eXpWorldIR)

eXp Realty LinkedIn page (https://www.linkedin.com/company/exp-realty/)

eXp World Holdings LinkedIn page (https://www.linkedin.com/company/expworldholdings/)

eXp Realty Facebook Page (https://www.facebook.com/eXpRealty)

eXp World Holdings Facebook Page (https://www.facebook.com/eXpWorldHoldings)

eXp Realty Instagram Page (https://www.instagram.com/eXpRealty_)

eXp World Holdings Instagram Page (https://www.instagram.com/eXpWorldHoldings)

Please note that this list may be updated from time to time. The contents of any website referred to in this Annual Report on Form 10-K are not intended to be incorporated into this Annual Report on Form 10-K or in any other report or document we file with the SEC and any references to our websites are intended to be inactive textual references only.

Item 1A. |

RISK FACTORS |

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or results of operations in future periods. The risks described below are not the only risks facing our Company. Additional risks not currently known to us or that we currently deem to be immaterial may materially adversely affect our business, financial condition or results of operations in future periods. You should carefully consider the risk factors described below, together with all of the other information in this Annual Report, including our consolidated financial statements and notes thereto and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Annual Report. Certain statements in this Annual Report are forward-looking statements. See the section of this Annual Report titled “Forward-Looking Statements.”

Risks Related to Our Industries

Our profitability is tied to the strength of the residential real estate market, which is subject to a number of general business and macroeconomic conditions beyond our control.

Our profitability is closely related to the strength of the residential real estate market, which is cyclical in nature and typically is affected by changes in national, state and local economic conditions, which are beyond our control. Macroeconomic conditions that could adversely impact the growth of the real estate market and have a material adverse effect on our business include, but are not limited to, economic slowdown or recession, increased unemployment, increased energy costs, reductions in the availability of credit or higher interest rates, increased costs of obtaining mortgages, an increase in foreclosure activity, inflation, disruptions in capital markets, declines in the stock market, adverse tax policies or changes in other regulations, lower consumer confidence, lower wage and salary levels, war, terrorist attacks or other geopolitical and security issues, including Russia’s ongoing war with Ukraine, the conflict between Israel and Hamas and rising tensions between China and Taiwan, natural disasters or adverse weather events, or the public perception that any of these events may occur. Unfavorable general economic conditions, such as a recession or economic slowdown, in the U.S., Canada, or other markets we enter and operate within, could negatively affect the affordability of and consumer demand for, our services, which could have a material adverse effect on our business and profitability. In addition, international, federal and state governments, agencies and government-sponsored entities such as Fannie Mae, Freddie Mac and Ginnie Mae could take actions that result in unforeseen consequences to the real estate market or that otherwise could negatively impact our business.

Monetary policies of the U.S. federal government and its agencies may have a material adverse impact on our operations.

The U.S. real estate market is substantially reliant on the monetary policies of the U.S. federal government and its agencies and is particularly affected by the policies of the Federal Reserve Board, which regulates the supply of money and credit in the U.S., which, in turn impacts interest rates. Our business could be negatively impacted by any rising interest rate environment. As mortgage rates rise, the number of home sale transactions may decrease as potential home sellers choose to stay with their lower mortgage rate rather than sell their home and pay a higher mortgage rate with the purchase of another home. Similarly, in higher interest rate environments, potential homebuyers may choose to rent rather than pay higher mortgage rates. Changes in the interest rate environment and mortgage market are beyond our control and are difficult to predict and, as such, could have a material adverse effect on our business and profitability.

9

Home inventory levels may result in excessive or insufficient supply, which could negatively impact home sale transaction growth.

Home inventory levels have been meaningfully declining or increasing in certain markets and price points in recent years. In both instances, homeowners are more likely to retain their homes for longer periods of time, resulting in a negative impact on home sale volume growth. Insufficient home inventory levels can cause a reduction in housing affordability, which can result in potential homebuyers deferring entry or reentry into the residential real estate market. Alternatively, excessive home inventory levels can contribute to a reduction in home values, which can result in some potential home sellers deferring entry into the residential real estate market. These inventory trends are caused by many pressures outside of our control, including slow or accelerated new housing construction, macroeconomic conditions, including rising interest rates and inflation, real estate industry models that purchase homes for long-term rental or corporate use and other market conditions and behavioral trends discussed herein. The U.S. home inventory levels have been low throughout 2023 and 2022. Continuing constraints on home inventory levels may adversely impact the volume of home sale transactions closed by our brokers and agents and, as such, could have a material adverse effect on our business and profitability.

Material decreases in the average brokerage commission rate, due to conditions beyond our control, could materially adversely affect our financial results.

There are many factors that contribute to average broker commission rates that are beyond our control. Factors that can contribute to a material decrease in brokerage commissions include regulation, litigation (including pending litigation described elsewhere in this Annual Report), the rise of certain competitive brokerage or non-traditional competitor modes, an increase in the popularity of discount brokers and agents, increased adoption of flat fees, commission models with more competitive rates, rebates or lower commission rates on transactions, adverse outcomes of pending antitrust litigation across our industry, as well as other competitive factors. The average broker commission rate for a real estate transaction is a key determinant of our profitability and a material decrease in brokerage commission rates could have a material adverse effect on our business and profitability.

The introduction and integration of emerging technologies into the real estate industry and any delay or inability to successfully integrate such technologies into our business or the businesses of our real estate professionals could result in competitive harm.

The real estate brokerage industry is susceptible to disruption by emerging technologies, particularly artificial intelligence and machine learning. Integrating advancements like natural language processing, artificial intelligence, and machine learning is vital for optimizing efficiency and reducing operational costs for real estate brokerages, professionals, and clients. These tools have the potential to streamline operations, enhance client interactions, and provide insights derived from vast data sets. These emerging technologies may also allow for new industry entrants and new industry platforms that compete with existing industry brokerages, including the Company, and agents and such new entrants and platforms could offer solutions that are more cost-effective, efficient, or user-friendly, and which may change broker, agent, and client expectations. Delays in embracing and integrating these AI-driven technologies could adversely impact existing industry participants to compete or risk displacement of traditional real estate offerings and services. If we and our affiliated real estate professionals are unable to provide enhancements and new features and efficiencies for our existing offerings or innovate quickly enough to keep pace with these rapid technological developments, our business could be harmed.

Our operating results are subject to seasonality and vary significantly among quarters during each calendar year, making meaningful comparisons of successive quarters difficult.

Seasons and weather traditionally impact the real estate industry. Continuous poor weather or natural disasters negatively impact listings and sales. Spring and summer seasons historically reflect greater sales periods in comparison to fall and winter seasons. We have historically experienced lower revenues during the fall and winter seasons, as well as during periods of unseasonable weather, which reduces our operating income, net income, operating margins and cash flow.

Real estate listings precede sales and a period of poor listings activity will negatively impact revenue. Past performance in similar seasons or during similar weather events can provide no assurance of future or current performance and macroeconomic shifts in the markets we serve can conceal the impact of poor weather or seasonality.

Home sales in successive quarters can fluctuate widely due to a wide variety of factors, including holidays, national or international emergencies, the school year calendar’s impact on timing of family relocations, interest rate changes, speculation of pending interest rate changes and the overall macroeconomic market. Our revenue and operating margins each quarter will remain subject to seasonal fluctuations, poor weather and natural disasters and macroeconomic market changes that may make it difficult to compare or analyze our financial performance effectively across successive quarters.

10

General changes in consumer attitudes and behaviors could negatively impact home sale transaction volume.

The real estate market is affected by changes in consumer attitudes and behaviors, including as a result of changing attitudes toward and behaviors related to home ownership. Certain real estate markets have or may experience a decline in homeownership based on changing social behaviors, including as a result of declining marriage and birth rates. Because of these changing attitudes and behaviors, consumers may be more or less likely to prefer renting a home versus purchasing a home. In the event consumer attitudes and behaviors in any of our markets cause a declining interest in home purchasing, it may adversely impact the volume of home sale transactions closed by our brokers and agents and, as such, could have a material adverse effect on our business and profitability.

Home sale transaction volume can be impacted by natural disasters and other climate-related interruptions.

Natural disasters are occurring more frequently and/or with more intense effects and may impact general population trends. Areas afflicted by natural disasters may experience a decline in home sale transaction volume due to home destruction and/or general population movement out of the afflicted area, and the risk of non-insurability against such disasters. Such events can make it difficult or impossible for home owners and builders to sell their homes and result in slowdowns in home sale transaction volume. Additionally, the risk of non-insurability may disqualify certain prospective homebuyers whether due to heightened mortgage underwriting requirements or the perceived risk of loss to the homebuyer. Because the real estate industry relies on home sale transactions, climate crises can exacerbate negative financial results for real estate companies operating in particularly affected areas.

Risks Related to our General Business and Operations

We may be unable to attract and retain additional qualified personnel.

To execute our business strategy, we must attract and retain highly qualified personnel. In particular, we compete with many other real estate brokerages for qualified brokers who manage our operations in each state. We must also compete with technology companies for developers with high levels of experience in designing, developing and managing cloud-based software, as well as for skilled service and operations professionals and we may not be successful in attracting and retaining the professionals we need. Additionally, in order to realize the potential benefits of acquisitions, we may need to retain employees from the acquired businesses or hire additional personnel to fully capitalize on the opportunities that such acquisitions may offer and we may not be successful in retaining or attracting such individuals following an acquisition. From time to time in the past, we have experienced and we expect to continue to experience in the future, difficulty in hiring and retaining highly skilled employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we do. In addition, in making employment decisions, particularly in the software industry, job candidates often consider the value of the stock options or other equity incentives they are to receive in connection with their employment. If the price of our stock declines or continues to experience significant volatility, our ability to attract or retain key employees may be adversely affected. If we fail to attract new personnel or fail to retain and motivate our current personnel, our growth prospects could be severely harmed.

Our business, financial condition and reputation may be substantially harmed by security breaches, interruptions, delays and failures in our systems and operations.

The performance and reliability of our systems and operations are critical to our reputation and ability to attract agents, teams of agents and brokers into our company as well as our ability to service homebuyers and sellers. Our systems and operations are vulnerable to security breaches, interruption or malfunction due to events beyond our control, including natural disasters, such as earthquakes, fire and flood, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. In addition, we rely on third-party vendors to provide the cloud office platform and to provide additional systems and related support. If we cannot continue to retain these services on acceptable terms, our access to these systems and services could be interrupted. Any security breach, interruption, delay or failure in our systems and operations could substantially reduce the transaction volume that can be processed with our systems, impair quality of service, increase costs, prompt litigation and other consumer claims and damage our reputation, any of which could substantially harm our financial condition.

Cybersecurity incidents could disrupt our business operations, result in the loss of critical and confidential information, adversely impact our reputation and harm our business.

Cybersecurity threats and incidents directed at us could range from uncoordinated individual attempts to gain unauthorized access to information technology systems to sophisticated and targeted measures aimed at disrupting business or gathering personal data of customers. Additionally, bad actors are increasingly using artificial intelligence technology to launch more automated, targeted and coordinated attacks generally. In the ordinary course of our business, we and our agents and brokers collect and store sensitive data, including proprietary business information and personal information about our clients and customers. Our business and particularly our cloud-based platform, is reliant on the uninterrupted functioning of our information technology systems. The secure processing, maintenance and transmission of information are critical to our operations, especially the processing and closing of real estate transactions.

11

Although we employ measures designed to prevent, detect, address and mitigate these threats (including access controls, data encryption, vulnerability assessments and maintenance of backup and protective systems), cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption, or unavailability of critical data and confidential or proprietary information (our own or that of third parties, including potentially sensitive personal information of our clients and customers) and the disruption of business operations. Any such compromises to our security could cause harm to our reputation, which could cause customers to lose trust and confidence in us or could cause agents and brokers to stop working for us. In addition, we may incur significant costs for remediation that may include liability for stolen assets or information, repair of system damage and compensation to clients, customers and business partners. We may also be subject to legal claims, government investigations and additional state and federal statutory requirements.

The potential consequences of a material cybersecurity incident include regulatory violations of applicable U.S. and foreign privacy and other laws, reputational damage, loss of market value, litigation with third parties (which could result in our exposure to material civil or criminal liability), diminution in the value of the services we provide to our customers and increased cybersecurity protection and remediation costs (that may include liability for stolen assets or information), which in turn could have a material adverse effect on our competitiveness and results of operations.

Loss of our current executive officers or other key management could significantly harm our business.

We depend on the industry experience and talent of our current executives. We believe that our future results will depend in part upon our ability to retain and attract highly skilled and qualified management. The loss of our executive officers could have a material adverse effect on our operations because other officers may not have the experience and expertise to readily replace these individuals. To the extent that one or more of our top executives or other key management personnel depart from the Company, our operations and business prospects may be adversely affected. In addition, changes in executives and key personnel could be disruptive to our business.

We may not be able to utilize a portion of our net operating loss or research tax credit carryforwards, which may adversely affect our profitability.

As of December 31, 2023, we had federal, state and foreign net operating losses carryforward due to prior years’ losses. Pre-fiscal 2018 certain state and foreign net operating losses will carry forward for a limited number of years. Federal, as well as some state and foreign net operating losses generated in and after fiscal 2018 do not expire and can be carried forward indefinitely. We also have recorded federal research tax credits for the years 2020-2023 which will carry forward for 20 years and are expected to be fully utilized before expiration. A nominal portion of our net operating loss may expire, increasing future income tax liabilities which may adversely affect our profitability.

In addition, under Section 382 of the Internal Revenue Code of 1986, as amended, our ability to utilize net operating loss carryforwards or other tax attributes, in any taxable year, may be limited if we experience an "ownership change.” A Section 382 “ownership change” generally occurs if one or more stockholders or groups of stockholders who own at least 5% of our stock increase their ownership by more than 50 percentage points over their lowest ownership percentage within a rolling three-year period. Similar rules may apply under state tax laws. It is possible that an ownership change, or any future ownership change, could have a material effect on the use of our net operating loss carryforwards or other tax attributes, which could adversely affect our profitability.

We could be subject to changes in tax laws and regulations that may have a material adverse effect in our business.

We operate and are subject to taxes in the United States and numerous other jurisdictions throughout the world. Changes to federal, state, local, or international tax laws on income, sales, use, indirect, or other tax laws, statutes, rules or regulations may adversely affect our effective tax rate, operating results or cash flows.

Our effective tax rate could increase due to several factors, including: changes in the relative amounts of income before taxes in the various jurisdictions in which we operate that have differing statutory tax rates; changes in tax laws, tax treaties, and regulations or the interpretation of them, including the Tax Cuts and Jobs Act of 2017 (the “Tax Act”) which requires research and experimental expenditures attributable to research conducted in the United States to be capitalized as of January 1, 2022 and amortized over a five-year period or expenditures attributable to research conducted outside the United States to be amortized over a fifteen-year period; the Inflation Reduction Act of 2022 which imposes a one-percent non-deductible excise tax on repurchases of stock that are made by U.S publicly traded corporation after December 31, 2022; changes to our assessment about our ability to realize our deferred tax assets that are based on estimates of our future results, the prudence and feasibility of possible tax planning strategies, and the economic and political environments in which we do business; the outcome of current and future tax audits, examinations or administrative appeals; and limitations or adverse findings regarding our ability to do business in some jurisdictions.

In particular, new income, sales and use or other tax laws or regulations could be enacted at any time, which could adversely affect our business operations and financial performance. Further, existing tax laws and regulations could be interpreted, modified or applied adversely to us. For example, the Tax Act enacted many significant changes to the U.S. tax laws. Future guidance from the Internal Revenue Service and other tax authorities with respect to the Tax Act may affect us, and certain aspects of the Tax Act could be repealed or modified in future legislation.

12

In addition, it is uncertain if and to what extent various states will conform to the Tax Act or any newly enacted federal tax legislation. Changes in corporate tax rates, the realization of net operating losses, and other deferred tax assets relating to our operations, the taxation of foreign earnings, and the deductibility of expenses under the Tax Act or future reform legislation could have a material impact on the value of our deferred tax assets and could increase our future U.S. tax expense.

We may be unable to effectively and efficiently manage growth in our business.

We may struggle to manage growth in our business efficiently. Failing to scale our operations to meet the increasing demands of our real estate professionals could negatively impact our performance. As we onboard more real estate professionals, the need to enhance our systems, integrate third-party systems, and maintain infrastructure becomes vital. Any delay in these upgrades can lead to system issues and reduced satisfaction among our real estate professionals. This could deter existing and potential professionals from associating with our Company. Expanding our systems efficiently may be challenging and also poses inherent risks, and we cannot guarantee timely and effective implementation. Such efforts might lead to decreased revenues and margins, impacting our financial results.

Our business could be adversely affected if we are unable to expand, maintain and improve the systems and technologies which we rely on to operate or fail to adopt and integrate new technologies.

As the number of agents and brokers in our company grows, our success will depend on our ability to expand, maintain and improve the technology that supports our business operations, including, but not limited to, our cloud office platform, as well as our ability to adopt and integrate new technologies, including, but not limited to, machine learning and artificial intelligence solutions. Loss of key personnel or the lack of adequate staffing with the requisite expertise and training could impede our efforts in this regard. If we do not adopt and offer new in-demand technologies and/or if our systems and technologies lack capacity or quality sufficient to service agents and their clients, then the number of agents who wish to use our products could decrease, the level of client service and transaction volume afforded by our systems could suffer and our costs could increase. In addition, our competitors or other third parties may incorporate artificial intelligence and emerging technologies into their products or operations more quickly or more successfully than we do, which could impair our ability to compete effectively. Additionally, artificial intelligence algorithms and other emerging technologies may be flawed and datasets underlying such technologies may be insufficient or contain biased information. If the new technologies integrated into our products or that we use in our operations produce analyses or recommendations that are or are alleged to be deficient, inaccurate, or biased, our reputation, business, financial condition, and results of operations may be adversely affected.

We intend to evaluate acquisitions, mergers, joint ventures or investments in third-party technologies and businesses, but we may not realize the anticipated benefits from and may have to pay substantial costs related to, any acquisitions, mergers, joint ventures, or investments that we undertake.

As part of our business and growth strategy, we evaluate acquisitions of, or investments in, a wide array of potential strategic opportunities, including third-party technologies and businesses, as well as other real estate brokerages. If we are not able to effectively integrate acquired businesses and assets or successfully execute joint venture strategies, our operating results and prospects could be harmed. Since 2019, we have acquired new technology and operations and entered into various joint venture arrangements. We will continue to look for opportunities to acquire technologies or operations that we believe will contribute to our growth and development. The success of our future acquisition strategy will depend on our ability to identify, negotiate, complete and integrate acquisitions. The success of our future joint venture strategies will depend on our ability to identify, negotiate, complete and successfully manage and grow joint ventures with other parties. In addition, acquisitions and joint ventures could cause potentially dilutive issuances of equity securities or incurrence of debt.

Acquisitions and joint ventures are inherently risky and any we complete may not be successful. Any acquisitions and joint ventures we pursue would involve numerous risks, including the following:

| ● | difficulties in integrating and managing the operations and technologies of the companies we acquire, including higher than expected integration costs and longer integration periods; |

| ● | diversion of our management’s attention from normal daily operations of our business; |

| ● | our inability to maintain the customers, key employees, key business relationships and reputations of the businesses we acquire; |

| ● | our inability to generate sufficient revenue or business efficiencies from acquisitions or joint ventures to offset our increased expenses associated with acquisitions or joint ventures; |

| ● | our responsibility for the liabilities of the businesses we acquire or gain ownership in through joint ventures, including, without limitation, liabilities arising out of their failure to maintain effective data security, data integrity, disaster recovery and privacy controls prior to the acquisition, their infringement or alleged infringement of third-party intellectual property, |

13

| contract or data access rights prior to the acquisition, or failure to comply with regulatory standards applicable to new business lines; |

| ● | difficulties in complying with new markets or regulatory standards to which we were not previously subject; |

| ● | delays in our ability to implement internal standards, controls, procedures and policies in the businesses we acquire or gain ownership in through joint ventures and increased risk that our internal controls will be ineffective; |

| ● | operations in a nascent state depend directly on utilization by eXp Realty agents and brokers and new and existing customers; |

| ● | adverse effects of acquisition and joint venture activity on the key performance indicators we use to monitor our performance as a business; and |

| ● | inability to fully realize intangible assets recognized through acquisitions or joint ventures and related non-cash impairment charges that may result if we are required to revalue such intangible assets. |

Our failure to address these risks or any other challenges we encounter with our future acquisitions, joint ventures and investments could cause us to not realize all or any of the anticipated benefits of such acquisitions, mergers, joint ventures or investments, incur unanticipated liabilities and harm our business, which could negatively impact our operating results, financial condition and cash flows.

Our international operations are subject to risks not generally experienced by our U.S. operations.

We have operations in Canada, the U.K., Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany, the Dominican Republic, Greece, New Zealand, Chile, Poland, and Dubai. Our international operations are subject to risks not generally experienced by our U.S. operations. The risks involved in our international operations and relationships that could result in losses against which we are not insured and, therefore, affect our profitability include:

| ● | fluctuations in foreign currency exchange rates; |

| ● | exposure to local economic conditions and local laws and regulations; |

| ● | employment laws that are significantly different that U.S. laws; |

| ● | diminished ability to legally enforce our contractual rights and use of our trademarks in foreign countries; |

| ● | difficulties in registering, protecting or preserving trade names and trademarks in foreign countries; |

| ● | restrictions on the ability to obtain or retain licenses required for operations; |

| ● | withholding and other taxes on third-party cross-border transactions as well as remittances and other payments by subsidiaries; |

| ● | onerous requirements, subject to broad interpretation, for indirect taxes and income taxes that can result in audits with potentially significant financial outcomes; |

| ● | changes in foreign taxation structures; |

| ● | compliance with the Foreign Corrupt Practices Act, the U.K. Bribery Act, or similar laws of other countries; and |

| ● | regional and country specific data protection and privacy laws including the European Union’s General Data Protection Regulation (“GDPR”). |

In addition, activities of agents and brokers outside of the U.S. are more difficult and more expensive to monitor and improper activities or mismanagement may be more difficult to detect. Negligent or improper activities involving our agents and brokers may result in reputational damage to us and may lead to direct claims against us based on theories of vicarious liability, negligence, joint operations and joint employer liability which, if determined adversely, could increase costs and subject us to incremental liability for their actions.

Failure to protect intellectual property rights could adversely affect our business.

Our intellectual property rights, including existing and future trademarks, trade secrets, patents and copyrights, are important assets of the business. We have taken measures to protect our intellectual property, but these measures may not be sufficient or effective. We may bring lawsuits to protect against the potential infringement of our intellectual property rights and other companies, including our competitors, could make claims against us alleging our infringement of their intellectual property rights.

14

There can be no assurance that we would prevail in such lawsuits. Any significant impairment of our intellectual property rights could harm our business.

We are actively, and intend to continue, developing new products and services complementary to our brokerage business and our failure to accurately predict their demand or growth could have an adverse effect on our business.

We are actively and intend in the future to continue, investing resources in developing new technology, services, products and other offerings complementary to our brokerage business. New business initiatives are inherently risky and may involve unproven business strategies and markets with which we have limited or no prior development or operating experience. Risks from these new initiatives include those associated with potential defects in the design, ongoing development and maintenance of technologies, reliance on data or user inputs that may prove inadequate or unavailable, failure to design products and services in a way that is more effective or affordable than competing third-party products and services and failure to scale businesses as they grow, among others. As a result of these risks, we could experience increased legal claims, reputational damage, financial loss or other adverse effects, which could be material. We can provide no assurance that we will be able to efficiently or effectively develop, commercialize and achieve market acceptance of new products and services. Additionally, the human and financial capital committed to develop new products and services may either be insufficient or result in expenses that exceed the revenue actually originated from these new products and services. In addition, our efforts to develop new products and services could distract management from current operations and could divert capital and other resources from our existing business, including our brokerage business. Failure to achieve the expected benefits of our investments may occur and could harm our business.

Risks Related to our Real Estate Business

We may be unable to maintain our agent growth rate, which would adversely affect our revenue growth and results of operations.

During the year ended December 31, 2023, our agent and broker base grew to 87,515 agents and brokers, or by 2%, from 86,203 agents and brokers as of December 31, 2022. Because we derive revenue from real estate transactions in which our brokers and agents receive commissions, the amount and rate of growth of our revenue typically correlate to the amount and rate of growth of our agent and broker base, respectively. The rate of growth of our agent and broker base cannot be predicted and is subject to many factors outside of our control, including actions taken by our competitors and macroeconomic factors affecting the real estate industry in general. We cannot provide assurances that we will be able to maintain or increase our recent agent growth rate or that our agent and broker base will continue to expand in future periods. A slowdown in our agent growth rate would have a material adverse effect on revenue growth and could adversely affect our business, results of operations, financial condition and cash flows.

Inflation and rising interest rates have and may continue to contribute to declining real estate transaction volumes, which have and may continue to materially impact operating results, profits and cash flows.