UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 29, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number 1-4121

DEERE & COMPANY

(Exact name of registrant as specified in its charter)

Delaware |

|

36-2382580 |

(State of incorporation) |

|

(IRS Employer Identification No.) |

One John Deere Place, Moline, Illinois |

|

61265 |

|

(309) 765-8000 |

(Address of principal executive offices) |

|

(Zip Code) |

|

(Telephone Number) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

Common stock, $1 par value |

|

DE |

|

New York Stock Exchange |

6.55% Debentures Due 2028 |

|

DE28 |

|

New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer ☒ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate quoted market price of voting stock of the registrant held by non-affiliates at April 28, 2023 was $110,752,079,592. At November 30, 2023, 280,255,442 shares of common stock, $1 par value, of the registrant were outstanding.

Documents Incorporated by Reference. Portions of the proxy statement for the annual meeting of stockholders to be held on February 28, 2024 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

|

|

Page |

PART I |

|

|

2 |

||

14 |

||

24 |

||

24 |

||

24 |

||

24 |

||

|

|

|

PART II |

|

|

25 |

||

26 |

||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

26 |

|

26 |

||

26 |

||

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

26 |

|

26 |

||

27 |

||

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

27 |

|

|

|

|

PART III |

|

|

27 |

||

27 |

||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

27 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

27 |

|

27 |

||

|

|

|

PART IV |

|

|

28 |

||

28 |

1

PART I

ITEM 1. BUSINESS.

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements provide our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements as they do not relate to historical or current facts and by words such as “believe,” “expect,” “estimate,” “anticipate,” “will,” “aim,” “should,” “plan,” “forecast,” “target,” “guide,” “project,” “intend,” “could,” and similar words or expressions.

All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, and other important information about forward-looking statements are disclosed under Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Forward-Looking Statements,” in this Annual Report on Form 10-K.

As used herein, the terms “John Deere,” “we,” “us,” “our,” or “the Company” refer to Deere & Company and its subsidiaries unless designated or identified otherwise. All amounts are presented in millions of dollars, unless otherwise specified.

Products

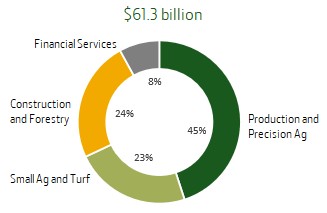

The John Deere enterprise has manufactured agricultural equipment since 1837. Deere & Company was incorporated under the laws of Delaware in 1958. Our business is managed through the following four business segments: production and precision agriculture (PPA), small agriculture and turf (SAT), construction and forestry (CF), and financial services (John Deere Financial or FS).

|

|

|

|

|

|

|

|

|

BUSINESS SEGMENT |

|

PRODUCTION AND PRECISION AGRICULTURE |

|

SMALL AGRICULTURE AND TURF |

|

CONSTRUCTION AND FORESTRY |

|

FINANCIAL SERVICES |

PRODUCTS |

|

●

Large and Certain

Mid-Size Tractors ●

Combines

●

Cotton Pickers and Cotton Strippers

●

Sugarcane Harvesters

●

Sugarcane Loaders and Pull Behind Scrapers

●

Soil Preparation, Seeding, Application, and Crop Care Equipment

●

Tillage Equipment

|

|

●

Certain Mid-Size, Utility, and Compact Utility Tractors

●

Self-Propelled Forage Harvesters

●

Hay and Forage Equipment

●

Rotary Mowers

●

Utility Vehicles

●

Riding Lawn Equipment and Commercial Mowing Equipment

●

Golf Course Equipment

|

|

●

Backhoe Loaders

●

Crawler Dozers and Loaders

●

Four-Wheel-Drive Loaders and Compact Track Loaders

●

Excavators and Compact Excavators

●

Equipment used in Timber Harvesting

●

Road Building and Road Rehabilitation Equipment

●

Articulated Dump Trucks and Motor Graders

|

|

●

Retail Notes

●

Revolving Charge Accounts

●

Wholesale Receivables

●

Leases

●

Extended Warranties

|

|

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

|||||

CROPS/FUNCTION |

|

●

Corn and Soy

●

Small Grain

●

Cotton

●

Sugarcane

|

|

●

Dairy and Livestock

●

Lawn and Property Maintenance

●

Golf Course Maintenance

●

High-Value Crop Solutions

|

|

●

Earthmoving

●

Forestry

●

Roadbuilding

|

|

●

Financial Solutions

|

|

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

2

Smart Industrial Operating Model and Leap Ambitions

In fiscal year 2020, we announced our Smart Industrial Operating Model. The model is based on the following three focus areas:

| 1. | Production Systems. A strategic alignment of products and solutions around our customers’ production systems. Production systems refer to the series of steps our customers take to execute different tasks, operations, and projects to grow an agricultural product or execute a project. |

| 2. | Technology Stack. Investments in technology, as well as research and development, that deliver intelligent solutions to our customers through hardware and devices, embedded software, connectivity, data platforms, and applications. The technology stack leverages the core technologies mentioned in the previous sentence across the enterprise, including digital capabilities, automation, autonomy, and alternative power technologies. The stack has the potential to unlock economic and sustainable value for customers by optimizing jobs, strengthening decision-making, and better connecting the steps of a production system. |

| 3. | Lifecycle Solutions. The enterprise integration of our aftermarket and support capabilities to more effectively manage customer equipment, service, and technology needs across the full lifetime of a John Deere product, and with a specific lifecycle solution focus on the ownership experience. This integrated support seeks to enhance customer value through proactive and reactive support, easy access to parts, value-add services, and precision upgrades, regardless of when a customer purchases our equipment. |

Building upon the Smart Industrial Operating Model, we announced our Leap Ambitions framework in fiscal year 2022. The Leap Ambitions are designed to boost economic value and sustainability for our customers. The ambitions align across our customers’ production systems seeking to optimize their operations to deliver better outcomes with fewer resources.

The Leap Ambitions framework has three components: (i) size the incremental market opportunity, quantifying the value that can be created; (ii) identify the key actions required to guide investment in digitalization, autonomy, automation, and alternative power technologies; and (iii) define the desired financial and sustainable outcomes we hope to achieve to help investors and stakeholders understand the opportunities that can be unlocked in the future through present investments. Applying this framework, the Leap Ambitions set goals to measure the results under our Smart Industrial Operating Model. Current financial and sustainability goals for the Leap Ambitions relate to workforce safety, agriculture customer outcomes, product circularity, environmental footprint, Solutions as a Service, and equipment operations operating return on sales (OROS).

We aim to deliver ongoing value across our product lines by digitally connecting certain equipment we produce, enabling our customers to leverage technology for better economic and more sustainable outcomes in their businesses. We are introducing viable alternative power technologies for various product families. We also plan to enhance how we deliver value by introducing and scaling a Solutions as a Service business model.

We also aim to enable our agriculture customers to be more sustainable in their production steps by providing technology solutions that help to improve their nitrogen use efficiency, increase their crop protection efficiency, and reduce their CO2e emissions.

We believe we will deliver ongoing value to our SAT customers by increasing the connectivity of their equipment, offering electric options where feasible in our product families, and working toward production of a fully autonomous, battery powered electric agricultural tractor. For our CF customers, we aim to deliver ongoing value by offering electric and hybrid-electric options where feasible in our product families and increasing the use of grade management control for earthmoving customers, intelligent boom control for forestry customers, and precision roadbuilding solutions for our roadbuilding customers.

We anticipate enabling sustainable outcomes for our customers. Specifically, we aim to enable our agriculture customers to be more sustainable in their production steps by providing technology solutions that help to improve their nitrogen use efficiency, increase their crop protection efficiency, and reduce their CO2e emissions.

Available Information

Our internet address is http://www.deere.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports are available on our website free of charge as soon as reasonably practicable after they are filed or furnished with the United States Securities and Exchange Commission (SEC or Commission). The information contained on our website is not included in, nor incorporated by reference into, this Annual Report on Form 10-K.

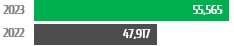

Equipment Operations

Our equipment operations consist of three of our business segments: PPA, SAT, and CF. In fiscal year 2023, PPA generated $26,790 net sales and revenue, or 48 percent of equipment operations net sales and revenues; SAT generated $13,980 net sales and revenues, or 25 percent of equipment operations net sales and revenues; and CF generated $14,795 net sales and revenues, or 27 percent of equipment operations net sales.

3

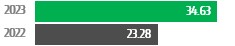

Production and Precision Agriculture

As compared with fiscal year 2022, PPA net sales for fiscal year 2023 were:

(In millions of dollars) |

2023 |

2022 |

% Change |

Net Sales |

$26,790 |

$22,002 |

22% |

The PPA segment is committed to meeting the fundamental needs of our customers through a combination of equipment and technology designed to enable our customers to overcome some of their biggest challenges: doing more with less, labor shortages, volatile input costs, and executing jobs in tighter timeframes. This segment defines, develops, and delivers global equipment and technology solutions for production-scale growers of crops like large grains (such as corn and soy), small grains (such as wheat, oats, and barley), cotton, and sugarcane. Equipment manufactured and distributed by the segment includes large and certain mid-size tractors, combines, cotton pickers, cotton strippers, sugarcane harvesters, related harvesting front-end equipment, and pull-behind scrapers. In addition, the segment includes tillage, seeding, and application equipment, including sprayers and nutrient management and soil preparation machinery.

We have been bringing innovations to agriculture for nearly 200 years and continue to invest in the development and production of advanced technology through integrated agricultural solutions and precision technologies across our portfolio of equipment. We have developed a differentiated, production system-level approach that helps us understand how customers operate, focusing on their costs, identifying the opportunities for them to reduce inputs, and increasing productivity, yield improvement, and sustainability. This approach directs our work. Advancements such as precise global navigation satellite systems technology, advanced connectivity and telematics, on-board sensors and computing power, automation software, digital tools, applications, and analytics provide seamless integration of information designed to improve customer decision-making and job execution. Our advanced telematics systems remotely connect equipment owners, business managers, and dealers to equipment in the field. This provides real-time alerts and information about equipment location, utilization, performance, and maintenance to improve productivity and efficiency, as well as to monitor agronomic job execution.

We aim to support our customers and their equipment throughout the entire equipment lifecycle. To prevent downtime, we offer a wide variety of aftermarket and customer solutions to keep equipment running, including machine monitoring, remote diagnostics, predictive maintenance alerts, and e-commerce solutions.

Examples of recent developments to unlock customer value and address challenges in the field include ExactShot™ and FurrowVision, which help customers reduce inputs during planting applications, generating cost savings, and lowering their environmental footprint; our fully autonomous 8R tillage tractor with a GPS guidance system and stereo cameras to execute tillage work without an in-cab operator, which helps to address farmers’ labor challenges and time constraints; and See & Spray™ Ultimate, which targets the application of non-residual herbicides on weeds in corn, soybean, and cotton fields.

In addition to John Deere brand names, the table below provides a list of PPA products and their associated brand names:

PRODUCT |

BRAND NAME |

Sprayers |

Hagie, Mazzotti |

Planters and Cultivators |

Monosem |

Sprayers and Planters |

PLA |

Carbon Fiber Sprayer Booms |

King Agro |

Sugarcane Harvester Aftermarket Parts |

Unimil |

Aftermarket Parts for PPA Products |

Vapormatic, A&I, Unimil, Alternatives by John Deere |

4

Small Agriculture and Turf

As compared with fiscal year 2022, SAT net sales for fiscal year 2023 were:

(In millions of dollars) |

2023 |

2022 |

% Change |

Net Sales |

$13,980 |

$13,381 |

4% |

SAT is committed to meeting the needs of our customers through defining, developing, and delivering global equipment and technology solutions designed to unlock customer value and sustainability for dairy and livestock producers, high-value crop producers, and turf and utility customers. The segment works to provide product leadership while extending integrated agricultural solutions and precision technologies across its portfolio of equipment to unlock incremental value for customers. Similar to PPA, the SAT segment aims to support customers and their equipment through the entire equipment lifecycle.

Equipment manufactured and distributed by the segment includes certain mid-size, small and utility tractors, and related loaders and attachments; turf and utility equipment, including riding lawn equipment, commercial mowing equipment, golf course equipment, utility vehicles, implements for mowing, tilling, snow and debris handling, aerating, and other residential, commercial, golf, and sports turf care applications; and hay and forage equipment, including self-propelled forage harvesters and attachments, balers, and mowers. SAT equipment is sold primarily through independent retail dealer networks, although the segment also builds turf products for sale by mass retailers, including The Home Depot and Lowe’s. Our turf equipment is sold primarily in North American, Western European, and Australian markets.

In the small agriculture market, we have introduced autonomous solutions, connectivity capabilities, and a path to electrifying our future by delivering a portfolio that helps current customers meet sustainability goals while finding innovative ways to serve new customers and unlock new markets for mechanization, at scale. For example, our joint venture with GUSS Automation, LLC in fiscal year 2022 added to our portfolio an autonomous sprayer to target our high value crop customers’ needs. In fiscal year 2023, we announced the acquisition of Smart Apply, Inc., a precision spraying equipment company. The Smart Apply Intelligent Spray Control System™ stacked with GUSS Automation’s remote sprayer is aimed at the needs of our high-value crop customers to improve their productivity and optimize inputs. On the turf side of the business, in fiscal year 2023 we launched two battery-powered walk behind mowers and announced certain hybrid innovations.

In addition to John Deere brand names, the table below provides a list of SAT products and their associated brand names:

PRODUCT |

BRAND NAME |

Equipment Attachments |

Frontier, Kemper, GreenSystem, Smart Apply |

Aftermarket Parts for SAT |

Vapormatic, A&I, Sunbelt, Alternatives by John Deere |

Agriculture and Turf Operations

Smart Industrial Operating Model. Our PPA and SAT segments offer a full line of agriculture and turf equipment and related service parts. As part of our Smart Industrial Operating Model, the segments are aligned around production systems, enabling focus on delivering equipment, technology, and solutions across all the jobs customers execute during a season. Sales and marketing support for both the PPA and SAT segments continues to be organized around four geographic regions: U.S., Canada, and Australia; Latin America and South America; Europe, Middle East, and the Commonwealth of Independent States (CIS); and Africa and Asia.

Business Environment. Sales of agricultural equipment are affected by total farm cash receipts, which reflect levels of farm commodity prices, acreage planted, crop yields, and government policies, including global trade policies, the amount and timing of government payments, and policies related to climate change. Sales also are influenced by general economic conditions, farmland prices, farmers’ debt levels and access to financing, interest and exchange rates, agricultural trends, including the production of and demand for renewable fuels, labor availability and costs, energy costs, tax policies, and other input costs associated with farming. Other key factors affecting new agricultural equipment sales are the value, age, and level of used equipment, including tractors, harvesting equipment, self-propelled sprayers, hay and forage equipment, and seeding equipment. Weather and climatic conditions also can affect buying decisions of agricultural equipment purchasers.

Innovations in machinery and technology also influence agricultural equipment purchasing. For example, larger, more productive equipment is well accepted where farmers are striving for more efficiency in their operations. Large, cost-efficient, highly mechanized agricultural operations account for an important share of worldwide farm output. These customers are increasingly adopting and integrating precision agricultural technologies like guidance, telematics, automation, and data management in their operations. The large-size agricultural equipment used on such farms has been particularly important to us.

5

A large proportion of the equipment operations’ total agricultural equipment sales in the U.S. and Canada, as well as in many countries outside the U.S. and Canada, are comprised of tractors over 100 horsepower, self-propelled combines, self-propelled cotton pickers, self-propelled forage harvesters, self-propelled sprayers, and seeding equipment. However, small tractors are also an important part of our global business. Further, we offer a number of harvesting solutions to support development of the mechanized harvesting of grain, oilseeds, cotton, sugarcane, forage, and biomass.

Retail sales of lawn and garden tractors, compact utility tractors, residential and commercial mowers, utility vehicles, and golf and turf equipment are influenced by the housing market, weather conditions, consumer spending patterns, and general economic conditions like unemployment, interest, and inflation rates.

Seasonality. Seasonal patterns in retail demand for agricultural equipment can result in substantial variations in the volume and mix of products sold to retail customers during the year. Seasonal demand must be estimated in advance, and equipment must be manufactured in anticipation of such demand to achieve efficient utilization of personnel and facilities throughout the year. The PPA and SAT segments can incur substantial seasonal variations in cash flows to finance production and inventory of agricultural and turf equipment. The segments also incur costs to finance sales to dealers in advance of seasonal demand.

For certain equipment, we offer early order programs, which can include discounts to retail customers that place orders well in advance of the use season. Production schedules are based, in part, on these early order programs; however, during periods of high demand, some factories may still produce after the use season. New combine and cotton harvesting equipment has been sold under early order programs with waivers of retail finance charges available to customers who take delivery of machines during non-use seasons.

In Australia, Canada, and the U.S., there are typically several used equipment trade-in transactions that take place in connection with most new agricultural equipment sales. To provide support to our dealers in these countries for carrying and ultimately selling this used inventory to retail customers, we provide these dealers with pools of funds awarded as a percentage of the dealer cost for eligible new equipment sales at the time of the new equipment settlement.

Retail demand for turf and utility equipment is normally higher in the second and third fiscal quarters. We have pursued a strategy of building and shipping such equipment as close to retail demand as possible. Consequently, to increase asset turnover and reduce the average level of field inventories throughout the year, production and shipment schedules of these product lines are normally proportionately higher in the second and third fiscal quarters of each year, corresponding closely to the seasonal pattern of retail sales. However, the patterns of seasonality have been affected by the supply chain disruptions experienced during fiscal year 2022.

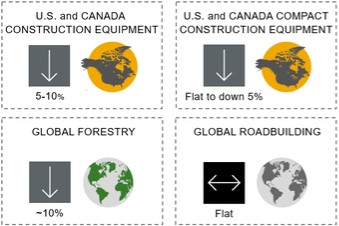

Construction and Forestry

As compared with fiscal year 2022, CF net sales for fiscal year 2023 were:

(In millions of dollars) |

2023 |

2022 |

% Change |

Net Sales |

$14,795 |

$12,534 |

18% |

Our CF segment is committed to meeting the need for smart and more sustainable solutions to help our customers meet industry challenges, including jobsite safety, a shortage of skilled labor, volatile input costs, reducing rework, maximizing uptime, and minimizing their environmental footprint. CF also aims to support customers and their equipment through the entire equipment lifecycle (see PPA section above).

To address these challenges and unlock value for customers, we deliver a robust portfolio of construction, roadbuilding, and forestry products with precision technology solutions. Our smart solutions such as SmartWeigh™, grade control offerings, machine and system automation, and operations center, are designed to allow customers to complete more functions with fewer inputs, reduce rework and guesswork, and transform data into insights to allow for better decisions. Obstacle detection solutions such as SmartDetect™ supplements operator visibility on the jobsite through a combination of cameras, radar, and machine learning. Additionally, we plan to deliver hybrid-electric and battery electric equipment solutions to help customers reduce tailpipe emissions without sacrificing power and performance. We currently have the 644X four-wheel-drive loader and 944X four-wheel-drive loader in production with an electric drive coupled with a diesel engine.

Our primary construction products include excavators, wheel loaders, motor graders, dozers, backhoes, articulated dump trucks, compact construction equipment including skid steers, compact excavators, and compact track loaders, along with a variety of attachments. Our Wirtgen roadbuilding products include milling machines, pavers, compactors, rollers, crushers, screens, and asphalt plants. Similar to the construction product lineup, the Wirtgen brand also provides a technology stack aimed at allowing customers to make smarter and more sustainable decisions. Technology offerings include Wirtgen Performance Tracker, Mill Assist, Level Pro, Vögele Roadscan, Smart Compact, WITOS Paving, Spective Connect, AutoTrac™, and John Deere Connected Support™.

6

In forestry, our primary products include skidders, wheeled and tracked feller bunchers, forwarders, knuckleboom loaders, wheeled and tracked harvesters, swing machines, and precision forestry technology solutions such as Intelligent Boom Control, TimberMatic™ maps, and TimberManager™. These solutions allow customers to closely track jobsite progress and provide visibility into fleet location, utilization, performance, and maintenance information.

We have a number of initiatives in the rent-to-rent, or short-term rental, market for construction, earthmoving, roadbuilding, and material handling equipment. These include specially designed rental programs for our dealers and expanded cooperation with major national equipment rental companies.

We own retail forestry sales operations in Australia, Brazil, Finland, Ireland, New Zealand, Norway, Sweden, and the United Kingdom. In addition, the Wirtgen Group sells its products primarily through company-owned sales and service subsidiaries in many markets worldwide (most significantly in Europe, India, and Australia). In most other geographies, we sell through an independent dealer channel.

The prevailing levels of residential, commercial, and public construction, investment in infrastructure, and the condition of the forestry products industry influence retail sales of our construction, roadbuilding, and forestry equipment. General economic conditions, interest rate levels, the availability of credit, and certain commodity prices, such as those applicable to oil and gas, pulp, paper, and saw logs, also influence sales.

In addition to John Deere brand names, the table below provides a list of CF products and their associated brand names:

PRODUCT |

BRAND NAME |

Roadbuilding Equipment |

Wirtgen, Vögele, Hamm, Kleemann, Benninghoven, and Ciber |

Forestry Attachments |

Waratah |

Competition

The equipment operations sell products and services in a variety of competitive global and regional markets. The principal competitive factors in all markets include product performance, innovation, quality, distribution, sustainability, customer service, and value. John Deere’s brand recognition is a competitive factor in North America and many other parts of the world.

The agricultural equipment industry continues to change and is becoming even more competitive through the emergence and expanding global capability of many competitors. The competitive environment for the agriculture and turf operations includes some global competitors, including AGCO Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Kubota Tractor Corporation, Mahindra & Mahindra Limited, and The Toro Company, as well as many regional and local competitors. These competitors have varying numbers of product lines competing with our products and each has varying degrees of regional focus. Additional competition within the agricultural equipment industry has come from a variety of short-line and specialty manufacturers, as well as local or regional competitors, with differing manufacturing and marketing methods. As technology increasingly enables enhanced productivity in agriculture, the industry is also attracting non-traditional competitors, including technology-focused companies and start-up ventures.

Our forestry and roadbuilding businesses operate globally. The construction business operates in competitive markets in North and South America, as well as other global markets. Global competitors of the CF segment include Caterpillar Inc., CNH Industrial N.V., Doosan Infracore Co., Ltd. and its subsidiary Doosan Bobcat Inc., Fayat Group, GOMACO Corporation, Hitachi Construction Machinery, Komatsu Ltd., Kubota Tractor Corporation, Ponsse Plc, SANY Group Co., Ltd., Terex, Tigercat Industries Inc., Volvo Construction Equipment (part of Volvo Group AB), and XCMG.

Manufacturing and Assembly

Common manufacturing processes and techniques are used in producing components for PPA, SAT, and CF equipment sold by us and our dealers. The equipment operations also pursue external sales of selected parts that can be manufactured and supplied to third parties on a competitive basis, including engines, power train components, and electronic components. The equipment operations’ manufacturing strategy involves four elements: Build a Stronger Business, Deliver Innovation, Excite the Customer, and Live the Team.

Build a Stronger Business refers to our ability to execute lean initiatives supported by safety, quality, delivery, and productivity goals.

Deliver Innovation refers to implementing our digitally connected factory projects to improve efficiency and differentiated value. We implement technology solutions to support our factories across the globe to increase our speed of manufacturing innovation and allow the workforce to focus on high-value tasks.

7

Excite the Customer refers to designing operations to be flexible and accommodate product design changes to meet market conditions and changing customer requirements.

Live the Team refers to building a safety culture by ensuring that employees are safe at work.

To utilize manufacturing facilities and technology more effectively, the equipment operations pursue continuous improvements in manufacturing processes, including steps to streamline manufacturing processes and enhance responsiveness to customers. Our flexible assembly lines can accommodate a wider product mix and deliver products in line with dealer and customer demand. Additionally, considerable effort is being directed to manufacturing cost reduction through process improvement and improvements in product design, advanced manufacturing technology, and supply management and logistics, as well as compensation incentives related to productivity and organizational structure.

See Item 2 “Properties” in this Annual Report on Form 10-K for more information about our manufacturing facilities.

Patents, Trademarks, Copyrights, and Trade Secrets

We own a significant number of patents, trademarks, copyrights, trade secrets, and intellectual property licenses related to our products and services and expect the number to grow as we continue to pursue technological innovations. We further our competitive position by filing patent and trademark applications in the U.S. and internationally to protect technology, improvements considered important to the business, and our brand. We believe that, taken together, our rights under these patents and licenses are important to our operations and competitive position, but do not regard any of our businesses as being dependent upon any single patent or family of patents. See “Risk Factors- Our business could be adversely affected by the infringement or loss of intellectual property rights” for more information.

Sales and Distribution

Through the U.S. and Canada, we market products to approximately 2,050 independent dealer locations. Of these, approximately 1,600 sell agricultural equipment, while approximately 450 sell construction, earthmoving, material handling, roadbuilding, and/or forestry equipment. In addition, roadbuilding equipment is sold at approximately 90 roadbuilding-only locations that may carry products that compete with our construction, earthmoving, material handling, and/or forestry equipment. Turf equipment is sold at most John Deere agricultural equipment locations, a few construction, earthmoving, material handling, roadbuilding, and/or forestry equipment locations, and about 280 turf-only locations, many of which also sell dissimilar lines of non-John Deere products. In addition, certain lawn and garden product lines are sold through The Home Depot and Lowe’s.

Outside the U.S. and Canada, our agriculture and turf equipment is sold to distributors and dealers for resale in over 100 countries. Sales and administrative offices are in Argentina, Australia, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Singapore, Sweden, South Africa, Spain, Ukraine, and the United Kingdom. Turf equipment sales outside the U.S. and Canada occur primarily in Western Europe and Australia. Construction, earthmoving, material handling, and forestry equipment is sold to distributors and dealers primarily by sales offices located in Australia, Brazil, Finland, New Zealand, Singapore, and the United Kingdom. Some of these dealers are independently owned while we own others. Roadbuilding equipment is sold directly to retail customers and independent distributors and dealers for resale. As of November 1, 2022, we did not renew dealer agreements in Russia, and in October 2023, we sold our roadbuilding business in Russia. Consequently, we no longer sell equipment in Russia. The Wirtgen Group operates company-owned sales and service subsidiaries in Australia, Austria, Belgium, Bulgaria, China, Denmark, Estonia, Finland, France, Georgia, Germany, Hungary, India, Ireland, Italy, Japan, Latvia, Lithuania, Malaysia, the Netherlands, Norway, Poland, Romania, South Africa, Sweden, Taiwan, Thailand, Turkey, Ukraine, and the United Kingdom. The equipment operations operate centralized parts distribution warehouses in the U.S., Brazil, and Germany in coordination with regional parts depots and distribution centers in Argentina, Australia, China, India, Mexico, South Africa, Sweden, and the United Kingdom.

We market engines, power trains, and electronic components worldwide through select sales branches or directly to regional and global original equipment manufacturers and independently owned engine distributors.

Raw Materials

We purchase raw materials, manufactured components, and replacement parts for our equipment, engines, and other products from leading suppliers both domestically and internationally. These materials and components include a variety of steel products, metal castings, forgings, plastics, hydraulics, electronics, and ready-to-assemble components made to certain specifications. We also purchase various goods and services used for production, logistics, offices, and research and development. We develop and maintain sourcing strategies for our purchased materials and emphasize long-term supplier relationships at the core of these strategies. We use a variety of agreements with suppliers intended to drive innovation, ensure availability and delivery of industry-leading quality raw materials and components, manage costs on a globally competitive basis, protect our intellectual property, and minimize other supply-related risks. We actively monitor supply chain risks to minimize the likelihood of business disruptions caused by the supply base, including supplier financial viability, capacity, business continuity, labor availability, quality, delivery, cybersecurity, weather-related events, and natural disasters.

8

We have implemented mitigation efforts to minimize the impact of potential and actual supply chain disruptions on our customers. Examples include working with the supply base to prioritize allocations to improve material availability, multi-sourcing selected parts and materials, entering long term contracts for some critical components, and using alternative freight carriers to expedite delivery.

Backlog Orders

The dollar amount of backlog orders as of October 29, 2023 was approximately $7.9 billion for the PPA segment and $3.3 billion for the SAT segment, compared with $9.7 billion and $4.6 billion, respectively, at October 30, 2022. The agriculture and turf backlog are generally highest in the second and third quarters due to seasonal buying trends in these industries. The dollar amount of backlog orders for the CF segment was approximately $6.4 billion at October 29, 2023, compared with $8.2 billion at October 30, 2022, including, for both periods, backlog orders for roadbuilding equipment, which had not historically been included in discussions of the CF segment’s backlog orders. Backlog orders for equipment operations include all orders deemed to be firm as of the referenced date. Backlog orders decreased as demand has declined.

Financial Services

U.S. and Canada. The financial services segment primarily provides and administers financing for retail purchases from our dealers of new equipment manufactured by our agricultural and turf and construction and forestry markets, as well as used equipment taken in trade for this equipment. The Company and John Deere Construction & Forestry Company (a wholly owned subsidiary of the Company) are referred to as the “sales companies.” John Deere Capital Corporation (Capital Corporation), a U.S. financial services subsidiary, generally purchases retail installment sales and loan contracts (retail notes) from the sales companies. In Canada, John Deere Financial Inc., a Canadian financial services subsidiary, purchases and finances retail notes acquired by John Deere Canada ULC, our Canadian sales company. The terms of retail notes and the basis on which the financial services operations acquire retail notes from the sales companies are governed by agreements with the sales companies. The financial services segment also finances and services revolving charge accounts, in most cases acquired from and offered through merchants in the agricultural and turf markets. Additionally, the financial services operations provide wholesale financing to dealers of our agriculture and turf equipment and construction and forestry equipment (wholesale notes), primarily to finance inventories of equipment for those dealers. The various financing options offered by the financial services operations are designed to enhance sales of our products and generate financing income for the financial services operations. In the U.S. and Canada, certain subsidiaries included in the financial services segment offer extended equipment warranties.

Retail notes acquired by the sales companies are immediately sold to the financial services operations. The equipment operations are the financial services operations’ major source of business, although many retail purchasers of our products finance their purchases outside our organization through a variety of sources, including commercial banks and finance and leasing companies.

The financial services operations offer retail leases to equipment users in the U.S. A small number of leases are executed with units of local governments. Leases are usually written for periods ranging from less than one year to seven years, and typically contain an option permitting the customer to purchase the equipment at the end of the lease term. Retail leases also are offered in a generally similar manner to customers in Canada.

The financial services operations’ terms for financing equipment retail sales (other than smaller items financed with unsecured revolving charge accounts) generally provide for retention of a security interest in the equipment financed. Finance charges are sometimes waived for specified periods or reduced on certain John Deere products sold or leased in advance of the season of use or in other sales promotions. The financial services operations generally receive compensation from the sales companies at approximate market interest rates for periods during which finance charges are waived or reduced on the retail notes or leases. The cost is accounted for as a deduction in arriving at net sales by the equipment operations.

We have an agreement with Capital Corporation to make payments to Capital Corporation such that its consolidated ratio of earnings to fixed charges is not less than 1.05 to 1 for any four consecutive fiscal quarterly periods. We also have committed to continuing to own, directly or through one or more wholly-owned subsidiaries, at least 51 percent of the voting shares of capital stock of Capital Corporation and to maintain Capital Corporation’s consolidated tangible net worth at not less than $50 million. Our obligations to make payments to Capital Corporation under this agreement are independent of whether Capital Corporation is in default on its indebtedness, obligations, or other liabilities. Further, our obligations under the agreement are not measured by the amount of Capital Corporation’s indebtedness, obligations, or other liabilities. Our obligations to make payments under this agreement are expressly stated not to be a guaranty of any specific indebtedness, obligation, or liability of Capital Corporation and are enforceable only by or in the name of Capital Corporation. As of October 29, 2023, we were in compliance with all of our obligations, and no payments were required under this agreement in fiscal year 2023 or fiscal year 2022. At October 29, 2023, we indirectly owned 100 percent of the voting shares of Capital Corporation’s capital stock and Capital Corporation’s consolidated tangible net worth was $5,901.6 million.

9

Outside the U.S. and Canada. The financial services operations also offer financing, primarily for our products, in Argentina, Australia, Brazil, China, India, Mexico, New Zealand, and in several other countries in Africa, Asia, Europe, and Latin America. John Deere Financial sold its financial services business in Russia during the second quarter of fiscal year 2023. In certain markets, financing is offered through cooperation agreements or joint ventures with other financial institutions. The way the financial services operations offer financing in these countries is affected by a variety of country-specific laws, regulations, and customs, including those governing property rights and debtor obligations, which are subject to change, and which may introduce greater risk to the financial services operations.

The financial services operations also offer to select customers and dealers credit enhanced international export financing primarily for the purchase of our products.

Additional information on the financial services operations is provided in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (MD&A) section in this Annual Report on Form 10-K.

Environmental Matters

We are subject to a variety of local, state, and federal environmental laws and regulations in the U.S., as well as the environmental laws and regulations of other countries in which we conduct business. We strive to comply with applicable laws and regulations; however, in the event of noncompliance, we could be subject to fines and other penalties. Compliance with these laws and regulations adds to the cost of our production operations. Compliance with emissions regulations adds to the cost of our products. However, we do not expect to incur material capital expenditures for environmental control facilities during fiscal year 2024. In addition to ensuring compliance with laws and regulations, we aim to reduce our environmental footprint through our Leap Ambitions framework and seek opportunities to reduce environmental impacts on the communities where we operate.

The U.S., the European Union (EU), India, and other governments throughout the world have enacted, and continue to enact, laws and regulations to reduce off-road engine emissions. Compliance with these regulations requires significant investments in the development of new engine technologies and after-treatment systems.

Governments also are implementing laws regulating products across their life cycles, including raw material sourcing and the storage, distribution, sale, use, and disposal of products at their end-of-life. These laws and regulations include requirements to develop less hazardous chemical substances and products, right-to-know, restriction of hazardous substances, and product take-back laws.

We are evaluating, cleaning-up, or conducting corrective action at a limited number of sites. We do not expect that these matters or other expenses or liabilities we may incur in connection with any noncompliance with environmental laws, regulations, or the clean-up of any additional properties, will have a material adverse effect on our consolidated financial position, results of operations, cash flows, or competitive position.

We continue to monitor and review developing sustainability frameworks, standards, and global regulations and work to incorporate those most applicable to our business into our sustainability reporting.

With respect to properties and businesses that have been or will be acquired, we conduct due diligence into potential exposure to environmental liabilities but cannot be certain that we have identified, or will identify, all adverse environmental conditions. Compliance with these laws and regulations adds to the cost of our production operations. Compliance with emissions regulations adds to the cost of our products. However, we do not expect to incur material capital expenditures for environmental controls facilities during fiscal year 2024. In addition to ensuring compliance with laws and regulations, we aim to reduce our environmental footprint through our Leap Ambitions framework and seek opportunities to reduce environmental impacts on the communities where we operate.

New regulations applicable to John Deere products

California promulgated regulations prohibiting the use of small off-road spark-ignition engines under 25 horsepower. These regulations go into effect in 2024 and will impact some of our products, such as our turf care and golf course maintenance products. Even though we do not expect a material impact to our business from these regulations, to comply with new laws and regulations that limit off-road gasoline and diesel-powered engines, we intend to offer an electric option in each turf and compact utility tractor product family by 2026. However, compliance with emissions regulations has added, and will continue to add, to the cost of our products.

10

Government Regulations

We are subject to a wide variety of local, state, and federal laws and regulations in the countries where we operate. These laws and regulations include a range of trade, product, foreign exchange, employment, tax, environmental, safety, data privacy, antitrust, and other laws and regulations.

Compliance with these laws and regulations often requires the dedication of time and effort of our employees, as well as financial resources. In fiscal year 2023, compliance with the regulations applicable to us did not have a material effect on our capital expenditures, earnings, or competitive position. At this time, we do not expect to incur material capital expenditures related to compliance with regulations during fiscal year 2024. Additional information about the impact of government regulations on our business is included in Item 1A, “Risk Factors – Strategic Risks” and “Legal and Compliance Risks.”

Human Capital

Higher Purpose

Our employees are guided by our higher purpose: We run so life can leap forward. Employees are further guided by our Code of Business Conduct (Code), which helps them to uphold and strengthen the standards of honor and integrity that have defined us since our founding. Our world and business may change, yet we continue to be guided by our core values— integrity, quality, commitment, and innovation.

Employees

At October 29, 2023, we had approximately 83,000 employees, including approximately 33,800 employees in the U.S. and Canada. We also retain consultants, independent contractors, temporary, and part-time workers. Unions are certified as bargaining agents for approximately 80 percent of our U.S. production and maintenance employees. Approximately 11,500 of our active U.S. production and maintenance workers are covered by a collective bargaining agreement with the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (UAW), with an expiration date of November 1, 2027. A small number of U.S. production employees are represented by the International Association of Machinists and Aerospace Workers (IAM). Collective bargaining agreements covering our employees in the U.S. expire between 2024 and 2027. Unions also represent the majority of employees at our manufacturing facilities outside the U.S.

There is no guarantee that we will be able to renew collective bargaining agreements or whether such agreements will be on terms satisfactory to us. For further discussion, see “Risk Factors—Disputes with labor unions may adversely affect our ability to operate in our facilities as well as impact our financial results.”

Code of Business Conduct

We are committed to conducting business in accordance with the highest ethical standards. We require all employees to complete training on our Code and, where permitted by law, also require that employees regularly certify compliance with the Code. The Code provides specific guidance to all our employees, outlining how they can and must uphold and strengthen the integrity that has defined John Deere since its founding. In addition, we maintain a global compliance hotline to allow for concerns of potential violations of the Code, global policies, or the law to be brought forward.

Health and Safety

We strive to achieve safety excellence through increased focus on leading indicators, risk reduction, health and safety management systems, and prevention. We have made progress on implementing best practices and leading indicators for enabling employee safety over recent years with our Health and Safety Management System.

We utilize a safety balanced scorecard, which includes leading and lagging indicators, and is designed to enable continuous measurement of safety performance and drive continuous improvement. Leading indicators include incident corrective action closure rates, ergonomic scorecard, and risk reduction from safety and ergonomic risk assessment projects. Lagging indicators include total recordable incident rate, ergonomic recordable case rate, and near-miss rate. Leading indicators are tracked by most of our manufacturing facilities and internally reported. In fiscal year 2023, we reported a total recordable incident rate of 2.08 and a lost time frequency rate of 0.65. To improve our total recordable incident rate, we will prioritize risk and injury reduction strategies, improve ergonomic programs, and focus on prevention through design.

We also updated our new employee onboarding in fiscal year 2023 to include training labs, hands-on-training, tooling and process exposures on the shop floor, operator checklists, and training videos of workstations.

Diversity, Equity, and Inclusion (DEI)

We adhere to the principle of equal employment opportunity and we believe that a diverse workforce is essential to our long-term success and solving our customers’ most pressing challenges. We strive to foster a diverse, equitable, and inclusive culture. We embrace employees’ differences in race, color, religion, age, sex, sexual orientation, gender, gender identity and expression, marital or partnership status, family status, citizenship, national origin, ancestry, geographic background, military or veteran status, disability (mental or physical), and any other characteristics that make our employees unique.

11

Our leadership team works to set a consistent and transparent tone on DEI issues and strategy. We also create spaces for open conversations and learning through our Employee Resources Groups (ERGs) speaker series and micro-learnings. We sponsor 13 ERGs that are run by employees, open to all employees, and are a key driver of inclusion. ERGs build organization-wide networks that allow employees to come together and discuss shared interests. The global chapters work with local teams to support efforts to attract, retain, and develop the best talent. In addition, our global DEI strategy focuses on embedding DEI into world-wide business operations and people processes.

In addition to recruiting from a wide array of colleges and universities, we partner with several professional organizations to support our diversity recruitment strategy, including AnitaB.org – a global organization for women in technology, Minorities in Agriculture Natural Resources and Related Sciences, the National Association of Black Accountants, Inc., the National Black MBA Association, Inc., the National Society of Black Engineers, the Society of Women Engineers, the Thurgood Marshall College Fund Leadership Institute, and the Society of Hispanic Professional Engineers. Our broad recruiting strategy helps us identify talent from all backgrounds.

Compensation & Benefits

Our total rewards are intended to be competitive, meet the varied needs of our global workforce, and reinforce our values. We are committed to providing comprehensive and competitive pay and benefits to our employees. We invested, and continue to invest, in employees through growth and development and well-being initiatives.

Our work environment is designed to promote innovation, well-being, and reward performance. Our total rewards for employees include a variety of components that aim to support sustainable employment and the ability to build a strong financial future, including competitive market-based pay and comprehensive benefits. In addition to earning base pay, eligible employees are compensated for their contributions to our goals with both short-term cash incentives and long-term equity-based incentives.

Eligible full-time employees in the U.S. have access to medical, dental, and vision plans; savings and retirement plans; parental leave and paid time off; and other resources, such as the Employee Assistance Program, which provides mental health and wellness services. We also offer a variety of working arrangements to eligible employees, including flexible schedules, remote work, and job sharing to help employees manage home and work-life situations. Programs and benefits differ internationally for a variety of reasons, such as local legal requirements, market practices, and negotiations with works councils, trade unions, and other employee representative bodies.

Training and Development

Employees are critical to the long-term success of our business. We encourage employees to identify the paths that can build the skills, experience, knowledge, and competencies needed for career advancement. We support employees by creating purpose-driven work opportunities, comprehensive performance reviews and development plans, mentoring opportunities, and professional and personal development opportunities.

We encourage employees to provide feedback across the enterprise through our internal voluntary employee experience survey, ad-hoc “pulse” surveys, and new-hire and exit surveys. Reports from these surveys help equip us to address needs across the employee lifecycle to improve the overall experience and engagement of our workforce.

Around the world, we offer internships, training, upskilling, apprenticeships, and leadership development at all stages of an employee’s career. Training programs are tailored to different geographic regions and job functions and include topics such as technical operation of equipment, equipment assembly, relationships with customers and dealers, our culture and values, compliance with the Code, compliance with anti-bribery/corruption laws and policies, compliance with management of private data and cybersecurity, conflicts of interest, discrimination and workplace harassment policies, sexual harassment policies, and leadership development.

Human Rights and Our Code of Conduct

We honor human rights and respect the individual dignity of all persons globally. Our commitment to human rights requires that we understand and fulfill our responsibilities consistent with our values and practices. We strive to ensure that human rights are upheld for our employees and workers in our supply chain. Our commitment to human rights is defined in the Code, our Supplier Code of Conduct, our Dealer Code of Conduct, related policies and procedures, and our statement “Support of Human Rights in our Business Practice,” each of which is available on our website under “Governance.” These documents establish guidelines for our employees, suppliers, and dealers. We do not tolerate human rights abuses, such as forced labor, unlawful child labor, and human trafficking.

12

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following are our executive officers as of December 6, 2023. All executive officers are elected or appointed by the Board of Directors and hold office until the meeting of the Board of Directors following the annual meeting of stockholders each year.

Name (Age) |

Present Deere Position (Effective Date) |

Business Experience (Effective Date) |

John C. May (54) |

Chairman, Chief Executive Officer, and President (2020) |

-

Chief Executive Officer and President (2019)

-

President and Chief Operating Officer (2019)

-

President, Worldwide Agriculture & Turf Division Global Harvesting and Turf Platforms, Ag Solutions Americas, and Australia (2018)

|

Joshua A. Jepsen (46) |

Senior Vice President and Chief Financial Officer (2022) |

-

Deputy Financial Officer (2022)

-

Director, Investor Relations (2018)

|

Ryan D. Campbell (49) |

President, Worldwide Construction & Forestry Division and Power Systems (2022) |

-

Senior Vice President and Chief Financial Officer (2019)

-

Deputy Financial Officer (2018)

|

Jahmy J. Hindman (48) |

Senior Vice President and Chief Technology Officer (2023) |

-

Chief Technology Officer (2020)

-

Global Director Tractor Platform Engineering (2018)

-

Global Manager, Architecture, Systems, Modules (2018)

|

Mary K.W. Jones (55) |

Senior Vice President, General Counsel and Worldwide Public Affairs (2019) |

-

Senior Vice President and General Counsel (2013)

|

Rajesh Kalathur (55) |

President, John Deere Financial, and Chief Information Officer (2022) |

-

President, John Deere Financial and Senior Vice President, Global Information Technology and Chief Financial Officer (2022)

-

President, John Deere Financial, and Chief Information Officer (2019)

-

Senior Vice President, Chief Financial Officer and Chief Information Officer (2018)

|

Deanna M. Kovar (45) |

President, Worldwide Agriculture & Turf Division, Small Ag & Turf, Sales and Marketing Regions of Europe, CIS, Asia, and Africa (2023) |

-

Vice President, Production Systems, Production & Precision Ag (2023)

-

Vice President, Production Systems (2020)

-

Director, Operation Station (2018)

|

Felecia J. Pryor (49) |

Senior Vice President and Chief People Officer (2022) |

-

Executive Vice President & Chief Human Resources Officer, BorgWarner Inc (2022)

-

Global Vice President Human Resources, BorgWarner, Inc. - Morse Systems (2019)

-

Vice President Human Resources ASEAN, Ford Motor Company (2016)

|

Cory J. Reed (53) |

President, Worldwide Agriculture & Turf Division, Production & Precision Ag, Sales and Marketing Regions of the Americas and Australia (2020) |

-

President, Worldwide Agriculture & Turf Division, Americas and Australia, Global Harvesting and Turf Platforms, Agricultural Solutions (2019)

-

President, John Deere Financial (2016)

|

Justin R. Rose (44) |

President, Lifecycle Solutions, Supply Management, and Customer Success (2022) |

-

Senior Partner and Managing Director at the Boston Consulting Group (BCG) (2020)

-

Various roles of increasing responsibility from Associate to Partner and Managing Director at BCG (2002)

|

13

ITEM 1A.RISK FACTORS.

The following risks are considered material to our business based upon current knowledge, information, and assumptions. This discussion of risk factors should be considered closely in conjunction with the MD&A, including the risks and uncertainties described in the Forward-Looking Statements, and the Notes to Consolidated Financial Statements. These risk factors and other forward-looking statements relate to future events, expectations, trends, and operating periods. They involve certain factors that are subject to change and important risks and uncertainties that could cause actual results to differ materially. Some of these risks and uncertainties could affect particular lines of business, while others could affect all our businesses. Although the risks are organized by headings and each risk is discussed separately, many are interrelated. The risks described in this Annual Report on Form 10-K and the Forward-Looking Statements in this report are not the only risks faced by us.

STRATEGIC RISKS

We may face risks associated with international, national, and regional trade laws, regulations, and policies, and government farm programs and policies which could significantly impair our profitability and growth prospects.

International, national, and regional laws, regulations, and policies directly or indirectly related to or restricting the import and export of our products, services, and technology, or those of our customers, or for the benefit of favored industries or sectors, could harm our global business. We are subject to various regulatory risks including, but not limited to, the following:

| ● | Restricted access to global markets could impair our ability to export goods and services from various manufacturing locations around the world. Restricted access could limit the ability to access raw materials and high-quality parts and components at competitive prices on a timely basis. For example, expanding export controls or limits on foreign investment can impact global supply of key materials and components, and actions taken within the US-China trade conflict can impact business in China, as well as sales, import/exports, and/or business engagement with Chinese entities globally. |

| ● | Trade restrictions, negotiation of new trade agreements, non-tariff trade barriers, local content requirements, and imposition of new or retaliatory tariffs against certain countries or covering certain products, including developments in U.S.-China trade relations, export control and sanctions against Russia, have limited, and could continue to limit, our ability to capitalize on current and future growth opportunities in international markets. These trade restrictions, and changes in, or uncertainty surrounding global trade policies, may affect our competitive position. |

| ● | Trade restrictions could impede those in developing countries from achieving a higher standard of living, which could negatively impact our future growth opportunities arising from increasing global demand for food, fuel, and infrastructure. |

| ● | Policies impacting exchange rates and commodity prices, or those limiting the export or import of commodities, could have a material adverse effect on the international flow of agricultural and other commodities that may result in a corresponding negative effect on the demand for agricultural and forestry equipment in many areas of the world. Our agricultural equipment sales could be harmed by such policies because farm income influences sales of agricultural equipment around the world. |

| ● | Changes in government farm programs and policies can influence demand for agricultural equipment as well as create unequal competition for multinational companies relative to domestic companies. |

We may be unable to manage increasing political, economic, and social uncertainty in certain regions of the world, which could significantly change the dynamics of our competition, customer base, and product offerings globally.

Efforts to grow our businesses depend in part upon access and developing market share and profitability in additional geographic markets, including, but not limited to, Argentina, Brazil, China, India, and South Africa. There are various risks associated with our global footprint, including, but not limited to, the following:

| ● | In some cases, these countries have greater political and economic volatility, greater vulnerability to infrastructure and labor disruptions, and differing customer product preferences and requirements than our other markets. In fiscal year 2023, as a result of the war in Ukraine, we suspended shipments of machines and service parts to Russia. The suspension of shipments to Russia reduced actual and forecasted revenue for the region and resulted in impairments of most long-lived assets, among other impacts. In addition, we initiated a voluntary separation program for employees in Russia in the third quarter of fiscal year 2022. |

| ● | Having business operations in various regions and countries exposes us to multiple and potentially conflicting business practices and legal and regulatory requirements that are subject to change. These practices and legal requirements are often complex and difficult to navigate, including those related to tariffs and trade regulations, investments, property ownership rights, taxation, repatriation of earnings, and advanced technologies. |

14

| ● | Expanding business operations globally also increases exposure to currency fluctuations, which can materially affect our financial results. |

| ● | While we maintain a positive corporate image and our brands are widely recognized and valued in our traditional markets, the brands are less known in some emerging markets, which could impede our efforts to successfully compete in these markets. |

| ● | Changing U.S. export controls and sanctions on various foreign countries and on various parties could affect our ability to collect receivables, provide aftermarket warranty support for our equipment, sell products, and otherwise impact our reputation and business. |

We may be impacted by general negative economic conditions and outlook, causing weakened demand for our equipment and services, limiting access to funding, and resulting in higher funding costs.

The demand for our products and services depends on the fundamentals in the markets in which we operate and can be significantly reduced in an economic environment characterized by high unemployment, high interest rates, cautious consumer spending, inflation, lower corporate earnings, and lower business investment. Negative or uncertain economic conditions that cause our customers to lack confidence in the general economic outlook can significantly reduce their likelihood of purchasing our equipment. These economic events adversely affected and may continue to adversely affect our operations.

Sustained general negative economic conditions and outlook also affect housing starts, energy prices and demand, and other construction, which dampens demand for certain construction equipment. Our turf operations and our construction and forestry segments are dependent on construction activity and have also been affected by recent adverse economic conditions. Decreases in construction activity and housing starts could have a material adverse effect on our financial results.

If negative economic conditions affect the overall farm economy, there could be a similar effect on our agricultural equipment sales. Uncertain or negative outlook with respect to pervasive U.S. fiscal issues as well as general economic conditions and outlook, such as market volatility and continuing interest rate increases by the Federal Reserve, have caused and could continue to cause significant changes in market liquidity conditions. Such changes could impact access to funding and associated funding costs, which could reduce our earnings and cash flows.

We may be affected by changing worldwide demand for food and different forms of renewable energy, which could impact the price of farm commodities and consequently the demand for our equipment. This could result in higher research and development costs related to changing machine fuel requirements.

Changing worldwide demand for farm outputs to meet the world’s growing food and renewable energy demands, driven in part by government policies, including those related to climate change, and a growing world population, are likely to result in fluctuating agricultural commodity prices, which directly affect sales of agricultural equipment. Lower agricultural commodity prices directly affect farm incomes, which could negatively affect sales of agricultural equipment and result in higher credit losses. While higher commodity prices benefit our crop-producing agricultural equipment customers, they could result in greater feed costs for livestock and poultry producers, which in turn may result in lower levels of equipment purchased by these customers. In addition, changing energy renewable demands may cause farmers to change the types or quantities of the crops they raise, with corresponding changes in equipment demands. Finally, changes in governmental policies regulating bio-fuel utilization could affect commodity demand and commodity prices, demand for our diesel-fueled equipment, and result in higher research and development costs related to equipment fuel standards.

We may not realize the anticipated benefits of our Smart Industrial Operating Model and Leap Ambitions.

Failure to realize the anticipated benefits of our Smart Industrial Operating Model and related business strategies in production systems, precision technologies, and aftermarket support could adversely affect results of our operations and financial condition. Several factors could impact our ability to successfully execute our Smart Industrial Operating Model, including, among other things:

| ● | Failure to accurately assess market opportunities and the technology required to address such opportunities; |

| ● | Failure to develop and introduce new technologies or lack of adoption of such technologies by our customers; |

| ● | Failure to holistically provide lifecycle solutions; and |

| ● | Failure to optimize our capital allocation in connection with the Smart Industrial Operating Model. |

15

Similarly, we may not realize the anticipated benefits of our Leap Ambitions and related goals within the expected timelines, or at all. As part of our Leap Ambitions we adopted various goals we expect to achieve by 2026 or 2030. We may not be able to achieve these goals for a variety reasons, some of which may be beyond our control. Examples include:

| ● | Our estimates and assumptions related to efficiency of our products and the adoption of precision technology may not be accurate; |

| ● | Certain materials, such as quality battery cells and cameras, may become unavailable or too costly; |

| ● | The infrastructure required to achieve our goals, such as sufficient charging stations or fuel availability, may become too costly or may not be developed on the expected timeline; and |

| ● | The actual or perceived failure to achieve our Leap Ambitions could negatively impact our ability to execute the Smart Industrial Operating Model. |

We may not realize all anticipated benefits of acquisitions, joint ventures, and divestitures, or these benefits may take longer to realize than expected.

From time to time, we make strategic acquisitions and divestitures and participate in joint ventures. Acquisitions and joint ventures we have entered, or may enter in the future, may involve significant challenges and risks, including that the acquisitions or joint ventures do not advance our business strategy, or fail to produce satisfactory returns on investment. Other risks include:

| ● | We may encounter difficulties in integrating acquisitions with our operations, applying internal control processes to these acquisitions, managing strategic investments, assimilating new capabilities to meet the future needs of our businesses, and/or combining business cultures; |

| ● | We may choose not to fully integrate businesses and may face regulatory or compliance exposure until appropriate processes and controls are put in place; |

| ● | Integrating acquisitions is often costly and may require significant attention from management and personnel; |

| ● | We may not realize all the anticipated benefits of acquisitions or joint ventures, or the realized benefits may be significantly delayed; and |

| ● | Due diligence evaluations of potential transactions include business, legal, and financial reviews with the goal of identifying and evaluating the material risks involved. These due diligence reviews may not identify all of the issues necessary to accurately estimate the cost and potential risks of a particular acquisition or joint venture, including potential exposure to regulatory sanctions resulting from an acquisition target’s or joint venture partner’s previous activities or costs associated with any quality issues with an acquisition target’s or joint venture’s products or services. |