UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-39519

Vitru Limited

(Exact name of registrant as specified in its charter)

Rodovia José Carlos Daux, 5500, Torre Jurerê A,

2nd floor, Saco Grande, Florianópolis, State of

Santa Catarina, 88032-005, Brazil

+55 (47) 3281-9500

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F |

X |

Form 40-F |

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes |

|

No |

X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes |

|

No |

X |

TABLE OF CONTENTS

Exhibit No. |

Description |

99.1 |

Earnings Release dated November 14, 2023 – Vitru Limited Third Quarter 2023 Financial Results |

99.2 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Vitru Limited |

|

|

|

|

|

|

|

|

By: |

/s/ Carlos Henrique Boquimpani de Freitas |

|

Name: |

Carlos Henrique Boquimpani de Freitas |

|

Title: |

Chief Financial and Investor Relations Officer |

|

|

|

Date: November 14, 2023 |

|

|

Exhibit 99.1

Vitru Limited

announces

Third Quarter 2023

Financial Results

Florianópolis, Brazil, November 14, 2023 – Vitru Limited, or Vitru (Nasdaq: VTRU), the leading pure-player in the post-secondary digital education market in Brazil, today reported financial and operating results for the three-month period ended September 30, 2023 (“third quarter 2023” or “3Q23”) and nine-month periods ended September 30, 2023 (“9M23”). Financial results are expressed in Brazilian reais (R$) and are presented in accordance with International Financial Reporting Standards (IFRS). Vitru operates its hubs under the Uniasselvi and UniCesumar brands with 860.7 thousand students enrolled in digital education undergraduate and graduate courses, and 2,385 hubs distributed throughout Brazil, in each case as of September 30, 2023.

Co-CEOs LETTER

Vitru, delivering consistent growth and scale

Dear valued shareholders,

This quarter, we celebrate our third anniversary as a listed company, and we are proud to share our consistent, sustainable, and responsible trajectory reflected both in the quality of our services and the value added to all our stakeholders.

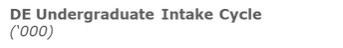

It is important to highlight that the third quarter of 2023 (3Q23) reflected for the first time a complete or fully comparable performance between quarters of consecutive years, since we started consolidating Unicesumar on May 20, 2022. In this regard, in 3Q23 our digital student base expanded 15.6% when compared to the same period of last year, reaching a total of 837.6 thousand enrolled students in Digital Education courses as of September 30, 2023. In addition, while the intake of the second semester for both companies is still ongoing, the combined intake increase amounted to 35% during the 3Q23 versus the same period of 2022. This growth can be attributed to our robust marketing efforts, the ongoing enhancement of our course offerings, and the trust and engagement of our students.

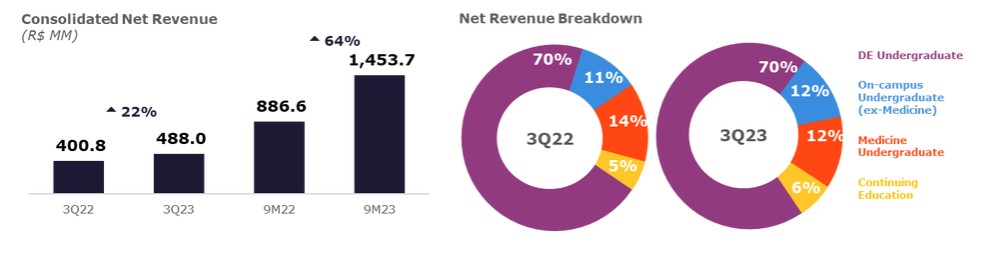

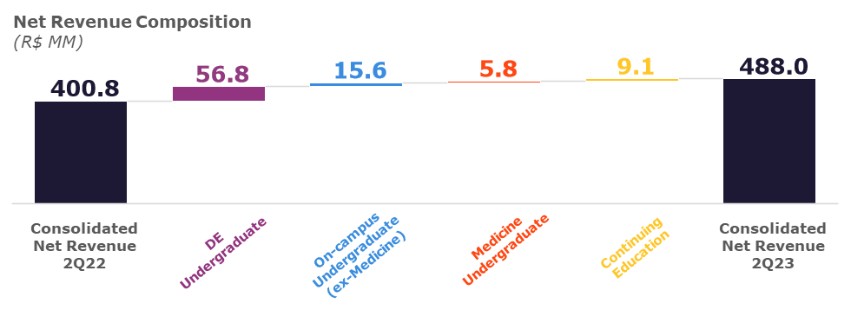

Our Net Revenue for the quarter amounted to R$ 488.0 million, an increase of 21.8% compared to the same period in 2022. Reflecting our ability to manage the integration with Unicesumar and deliver the expected synergies, Vitru’s Adj. EBITDA in 3Q23 increased 29.4% vs 3Q22, amounting to R$ 185.7 million in 3Q23 with a 2.2 p.p. increase in Adj. EBITDA margin (reaching 38.1%) when compared to the same period of last year. We believe this growth demonstrates our ability to capitalize on the increasing demand for digital education solutions, positioning us as a market leader in Brazil.

Furthermore, we recently announced our third issuance of unsecured debentures in an aggregate principal amount of up to R$600 million (R$ 500 million plus an additional amount of R$100 million that may be issued). The proceeds of this new debentures issuance will be used to pay in advance the sellers’ financing contracted by Vitru in connection with the business combination with Unicesumar.

As we think about the future, we are confident about Vitru’s prospects. We believe the digital education market in Brazil will keep experiencing sustained growth, driven by advancements in new technologies, including A.I. Additionally, the rise of active methodologies is emerging as a potent pedagogical strategy, where the student takes center stage in the learning process, becoming the lead protagonist of their own educational journey. We believe that being the leading digital education company in Brazil puts us in a great position to benefit from these opportunities.

As we move towards the last quarter of 2023, we believe our commitment to excellence will continue to drive our growth and deliver long-term value for all our stakeholders. Our mission to democratize access to quality education in Brazil is still underway, empowering individuals and shaping future generations.

|

3Q23 Results |

2 |

Thank you for your continued support.

Sincerely,

William Matos & Pedro Graça

Vitru's Co-CEOs

|

3Q23 Results |

3 |

WEBCAST INFORMATION

Vitru will discuss its third quarter 2023 results via live webcast

When: Thursday, November 14, 2023, at 8:30 a.m. EST (10:30 a.m. BRT)

Webcast: https://investors.vitru.com.br/

Replay: available on our website

Carlos Freitas |

|

Chief Financial and Investor Relations Officer |

|

|

|

|

|

Maria Carolina de Freitas Gonçalves |

Investor Relations Contact |

Investor Relations Manager |

ir@vitru.com.br |

|

3Q23 Results |

4 |

HIGHLIGHTS OF 3Q23 AND THEREAFTER

| ◾ | Most recent INEP Census report confirms Vitru as the top player in Digital Education in Brazil; |

| ◾ | 860.7k students as of the end of 3Q23, with a 15.6% increase in Digital Education Undergraduate enrolled students; |

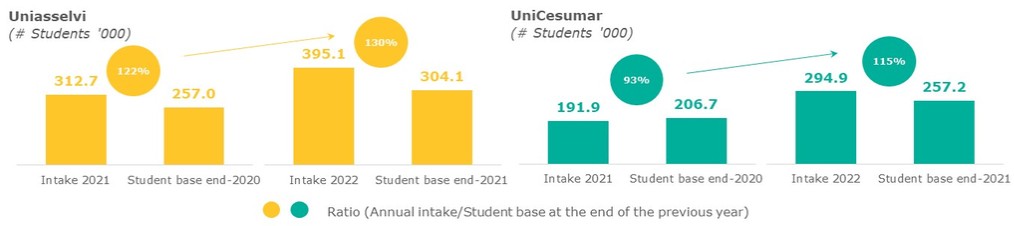

| ◾ | Average ticket in the DE Undergraduate segment increased 13.1% in 3Q23 when compared to 3Q22, confirming Vitru’s pricing discipline and product differentiation; |

| ◾ | Net revenue in the core Digital Education Undergraduate segment increased by 20.1% in 3Q23 compared to 3Q22, with Consolidated Net Revenue up 21.8%; |

| ◾ | Adjusted EBITDA increased 29.4% in 3Q23 compared to 3Q22, with Adjusted EBITDA Margin increasing 2.3 percentage points (p.p.) to 38.1% in 3Q23 compared to 3Q22; |

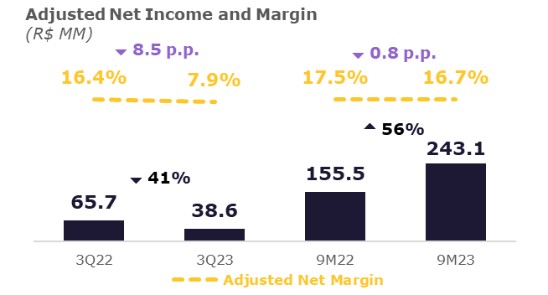

| ◾ | Adjusted Net Income down 41.2% in 3Q23 compared to 3Q22, reaching R$38.6 million; |

| ◾ | Adjusted Cash Flow from Operations increased 76.3% to R$259.9 million in 3Q23 compared to 3Q22, with an Adjusted Cash Flow Conversion from Operations of 169.2% compared to 109.8% in 3Q22. |

Table 1: Key financial highlights

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Net Revenue |

|

488.0 |

400.8 |

21.8% |

1,453.7 |

886.6 |

64.0% |

DE Undergraduate Net Revenue |

|

339.3 |

282.5 |

20.1% |

1,044.9 |

682.4 |

53.1% |

Adjusted EBITDA1 |

|

185.7 |

143.5 |

29.4% |

556.6 |

307.8 |

80.8% |

Adjusted EBITDA Margin |

|

38.1% |

35.8% |

2.3 p.p. |

38.3% |

34.7% |

3.6 p.p. |

Adjusted Net Income2 |

|

38.6 |

65.7 |

(41.2)% |

243.1 |

155.5 |

56.3% |

Adjusted Cash Flow from Operations3 |

|

259.9 |

147.4 |

76.3% |

548.5 |

267.5 |

105.0% |

Adjusted Cash Flow Conversion from Operations3 |

|

169.2% |

109.8% |

59.4 p.p. |

109.9% |

101.9% |

8.0 p.p. |

| (1) | For a reconciliation of Adjusted EBITDA, see “—Reconciliations of Non-GAAP Financial Measures—Reconciliation of Adjusted EBITDA” at the end of this document. |

| (2) | For a reconciliation of Adjusted Net Income, see “—Reconciliations of Non-GAAP Financial Measures—Reconciliation of Adjusted Net Income” at the end of this document. |

| (3) | For a reconciliation of Adjusted Cash Flow from Operations and Adjusted Cash Flow Conversion from Operations, see “—Reconciliations of Non-GAAP Financial Measures—Reconciliation of Adjusted Cash Flow Conversion from Operations” at the end of this document. |

|

3Q23 Results |

5 |

OPERATING RESULTS

Student base and hubs

We consider the number of enrolled students an important operational metric for Vitru. As of September 30, 2023, Vitru had 860.7 thousand students enrolled in the courses it provides, an increase of 15.6% compared to the number of enrolled students as of September 30, 2022.

The percentage of digital education students to total enrolled students is also a relevant metric that we believe best demonstrates our focus on digital education (comprising both undergraduate courses and continuing education courses) and its relevance to the services offered. As of September 30, 2023, students enrolled in digital education courses represented 97.3% of the total number of enrolled students, slightly up from the percentage achieved on September 30, 2022.

The number of hubs is one of the main drivers that enables the Company to increase its student base. A material portion of Vitru’s growth is driven by the expansion and subsequent maturation of these hubs.

Vitru has expanded its operations and geographic presence throughout Brazil with the opening of hubs in the last years. In fact, 92.9% of the current 2,385 hubs are still ramping up, representing a substantial growth avenue: the current average maturation ratio of hubs in expansion is only 43.4%. The Company estimates that a typical hub reaches its full capacity in terms of the number of students (and hence is deemed to be mature) after seven or eight years of operations.

Table 2: Student base and Hubs

'000 |

|

3Q23 |

3Q22 |

2Q23 |

Δ 3Q23 x 3Q22 |

Δ 3Q23 x 2Q23 |

Total enrolled students |

|

860.7 |

744.8 |

919.6 |

15.6% |

(6.4)% |

% Digital education to total enrolled students |

|

97.3% |

97.1% |

97.5% |

0.2 p.p. |

(0.2) p.p. |

Number of digital education students |

|

837.6 |

722.8 |

896.4 |

15.9% |

(6.6)% |

Undergraduate students |

|

780.8 |

672.5 |

837.4 |

16.1% |

(6.8)% |

Graduate students |

|

56.8 |

50.4 |

59.0 |

12.7% |

(3.8)% |

Number of on-campus students |

|

23.1 |

21.9 |

23.2 |

5.4% |

(0.5)% |

Undergraduate students |

|

22.7 |

21.3 |

22.9 |

6.5% |

(0.9)% |

Graduate students |

|

0.399 |

0.593 |

0.320 |

(32.7)% |

24.7% |

Number of hubs1 |

|

2,385 |

2,108 |

2,301 |

13.1% |

3.7% |

% of Expansion hubs (i.e., excluding Base hubs) |

|

92.9% |

91.0% |

92.7% |

1.9 p.p. |

0.2 p.p. |

Theoretical maturation index2 |

|

43.4% |

41.2% |

47.8% |

2.2 p.p. |

(4.4) p.p. |

| (1) | Consolidates the number of hubs of UniCesumar, excluding its four international hubs. |

| (2) | The Company calculates the theoretical maturation index as the actual number of students per hub of the Expansion hubs divided by the theoretical number of students it expects to achieve as of the maturity of the same hubs. The index comprises all Expansion hubs as of the end of each period, and hence it can actually decrease in a given quarter as new Expansion hubs are opened. |

|

3Q23 Results |

6 |

The intake process of Uniasselvi and UniCesumar in the second semester of 2023 (2023.2) is still ongoing (considering new students for our DE undergraduate courses). However, as of September, 30, 2023, it had increased by 34.7% when compared to September, 30, 2022, primarily due to the performance of UniCesumar.

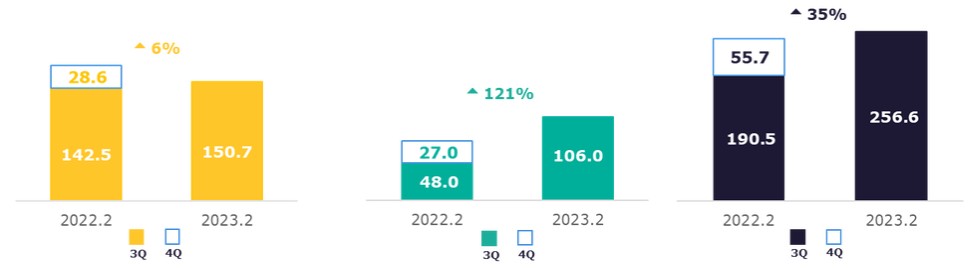

Furthermore, it is important to mention that the Company has achieved positive results in the 2022 intake cycles (40.3% growth in 2022.1 versus 2021.1 intake cycle and 30.8% growth in 2022.2 versus 2021.2 intake cycle, considering the combined intakes of Uniasselvi and UniCesumar). This performance has led to a shift in the student base composition, characterized by a higher proportion of freshman students. Consequently, the contracts of these students are now undergoing their first annual ticket readjustment. In particular, UniCesumar follows a contract anniversary-based readjustment criteria, resulting in a positive impact on tuition fees and tickets.

It is essential to highlight that the number of hubs is one of the drivers that enable the Company to increase its enrolled student base. A material portion of Vitru’s growth is driven by the expansion and subsequent maturation of the hubs.

Table 3: Key operational highlights

'000 |

|

3Q23 |

3Q22 |

% Chg |

Total DE undergraduate intake |

|

256.6 |

190.5 |

34.7% |

Uniasselvi DE undergraduate intake |

|

150.7 |

142.5 |

5.7% |

UniCesumar DE undergraduate intake |

|

106.0 |

48.0 |

120.6% |

DE undergraduate retention rate |

|

73.4% |

74.9% |

(1.5) p.p. |

Uniasselvi DE undergraduate retention rate |

|

69.6% |

71.4% |

(1.8) p.p. |

UniCesumar DE undergraduate retention rate |

|

77.4% |

79.0% |

(1.6) p.p. |

|

3Q23 Results |

7 |

Tuitions and Ticket

Table 4: Tuitions1

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Uniasselvi DE undergraduate tuitions |

|

310.8 |

254.0 |

22.4% |

962.5 |

791.4 |

21.6% |

Average ticket Uniasselvi DE undergraduate (R$/month)2 |

|

323.9 |

287.6 |

12.6% |

- |

- |

n.a. |

UniCesumar DE undergraduate tuitions |

|

262.6 |

204.9 |

28.2% |

727.5 |

618.7 |

17.6% |

Average ticket UniCesumar DE undergraduate (R$/month)2 |

|

246.7 |

216.0 |

14.2% |

- |

- |

n.a. |

Total DE undergraduate tuitions |

|

573.4 |

458.9 |

25.0% |

1,690.0 |

1,410.1 |

19.8% |

Average ticket Vitru DE undergraduate (R$/month)2 |

|

283.3 |

250.5 |

13.1% |

- |

- |

n.a. |

| (1) | Tuitions are net of cancellations. The consolidation of UniCesumar within Vitru’s financial statements started on May 20, 2022. |

| (2) | In the second quarter of each year, the Company calculates the “Average Ticket DE undergraduate (R$/month)” as the sum of the Digital Education Undergraduate Tuitions net of cancellations of the semester divided by the average number of students between the beginning and the end of the semester. |

The strength of Vitru’s model and the sustainability of its growth can be demonstrated by the total amount charged for course tuitions from digital education undergraduate students (which is the sum of gross revenue and the hub partners’ portion of the tuitions less other academic revenue and cancellations).

DE Undergraduate tuitions for 3Q23 amounted to R$573.4 million, an increase of 25.0% compared to the R$458.9 million recorded in 3Q22. This growth rate primarily reflects the maturation of expansion hubs (i.e. hubs that are not yet deemed to be mature) through the organic increase in the number of students enrolled in digital education undergraduate courses.

The average monthly ticket for Uniasselvi DE Undergraduate courses increased by 12.6%, from R$287.6 in 3Q22 to R$323.9 in 3Q23. We believe that this increase, despite the challenging macroeconomic conditions in Brazil, is indicative of the resilience of Vitru’s organic academic model, as well as the pricing discipline being applied over the recent years. Going forward, we believe that new courses with higher monthly tickets, such as nursing that were only launched in the second semester of 2021, have the potential for additional contribution.

The average monthly ticket for UniCesumar DE Undergraduate courses increased by 14.2% to R$246.7 in 3Q23 compared to R$216.0 in 3Q22. As part of the best practices currently being exchanged between the entities, we have been working to improve UniCesumar’s average tickets in line with the pricing strategies being applied by Uniasselvi in the recent years, which has differentiated it from the other players in the market. With that in mind, it is important to highlight that the first annual renovation of 2022.2 freshman students of UniCesumar is taking place under these new pricing strategies, which explains part of the average ticket increase for the brand, during this quarter.

|

3Q23 Results |

8 |

FINANCIAL RESULTS

Net Revenue

Consolidated Net Revenue in 3Q23 was R$488.0 million, up 21.8% from 3Q22. This growth was mainly driven by the increase in the number of enrolled students in the DE Undergraduate segment as well as higher average tickets in this segment plus the business combination with UniCesumar.

Net Revenue from digital education undergraduate courses in 3Q23 was R$339.3 million, up 20.1% from R$282.5 million in 3Q22. This achievement was primarily driven by the results of the aforementioned expansion and maturation of operational hubs, and a higher consolidated average ticket in this segment as previously presented.

Net Revenue from on-campus undergraduate courses (excluding medical courses) in 3Q23 amounted to R$58.1 million, an increase of 36.6% from R$42.5 million in 3Q22. Despite the fact that the on-campus has been decreasing over time as a segment within the education market, this quarter our revenues reflect the student base growth due to the slight recovery of the segment due to the end of the Covid-19 pandemic. Net Revenue from the whole on-campus undergraduate segment (including UniCesumar’s medical courses) reached R$118.9 million in 3Q23, an increase of 21.9% from R$97.5 million in 3Q22, given the significance of UniCesumar’s medical education activities to its overall business, which are growing less given the maturation of the Maringá campus.

Net Revenue from continuing education courses in 3Q23 was R$29.9 million, up 43.8% from R$20.8 million in 3Q22. In addition to graduate courses, our continuing education business includes technical courses and professional qualification courses. We believe this is a potential growth area and is part of our strategy to expand complementary offerings throughout our students’ lifelong journey.

|

3Q23 Results |

9 |

Table 5: Net Revenue Breakdown1

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Digital education undergraduate |

|

339.3 |

282.5 |

20.1% |

1,044.9 |

682.4 |

53.1% |

On-campus undergraduate |

|

118.9 |

97.5 |

21.9% |

329.3 |

155.2 |

112.2% |

Continuing education |

|

29.9 |

20.8 |

43.8% |

79.5 |

49.0 |

62.2% |

Net Revenue |

|

488.0 |

400.8 |

21.8% |

1,453.7 |

886.6 |

64.0% |

| (1) | Our results reflect the consolidation of UniCesumar from May 20, 2022 onwards. |

Cost of Services

Cost of services in 3Q23 amounted to R$167.5 million, a reduction of 0.8% compared to R$168.9 million in 3Q22, particularly due to the synergies impact of the integration of UniCesumar into Vitru. As a percentage of Net Revenue, a reduction of 7.8 p.p. is notable when comparing 3Q23 with 3Q22, mainly due to a decrease in the cost of payroll and academic materials over Net Revenue, as a result of the continuous effort from the company to improve the combined operations of DE segments and implementation of best practices of one brand to another. We note that the cost of services includes certain restructuring costs, which combined with depreciation and amortization expenses amounted to R$19.9 million in 3Q23 and R$21.0 million in 3Q22.

Cost of services as reported in the Adjusted EBITDA calculation (without the aforementioned restructuring

expenses and depreciation and amortization expenses) was stable at R$146.6 million in 3Q23 and in 3Q22 with a decrease of 6.5 p.p. as a percentage of Net Revenue, mainly due to the aforementioned reduction in the ratio between both payroll and academic materials costs over Net Revenue, which was accomplished due the gains of scale after the business combination with UniCesumar. It is also important to mention the reduction in the amount of new own hubs opened in 3Q23 vs 3Q22, which also contributed to lower personnel costs.

Table 6: Cost of Services1

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Cost of Services |

|

167.5 |

168.9 |

(0.8)% |

494.4 |

351.9 |

40.5% |

(-) Depreciation and amortization |

|

(19.9) |

(21.0) |

(5.2)% |

(59.3) |

(51.2) |

15.8% |

(-) Restructuring expenses |

|

(1.0) |

(1.3) |

(23.1)% |

(4.0) |

(4.2) |

(4.8)% |

Cost of Services for Adj. EBITDA calculation |

|

146.6 |

146.6 |

0.0% |

431.1 |

296.5 |

45.4% |

as % of Net Revenue |

|

30.1% |

36.6% |

(6.5) p.p. |

29.7% |

33.4% |

(3.7) p.p. |

| (1) | Our results reflect the consolidation of UniCesumar from May 20, 2022 onwards. |

|

3Q23 Results |

10 |

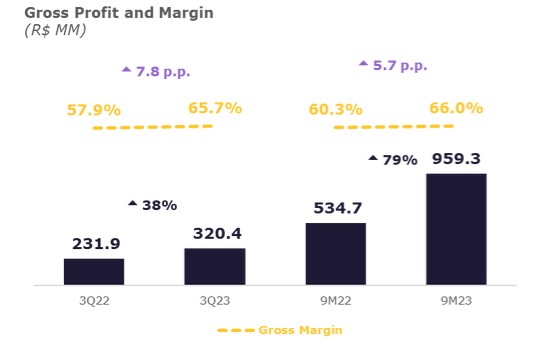

Gross Profit and Gross Margin

Gross Profit in 3Q23 was R$320.4 million, an increase of 38.2% compared to R$231.9 million in 3Q22, which was primarily due to the consistent growth of our business, and the combination with UniCesumar. Gross Margin increased 7.8 p.p. from 57.9% in 3Q22 to 65.7% in 3Q23, which was primarily attributable to the decrease in overall Cost of Services as a percentage of Net Revenue, for the aforementioned reasons including a decrease in the payroll cost ratio.

Operating Expenses

Selling Expenses

Selling expenses in 3Q23 amounted to R$93.2 million, an increase of 33.9% compared to R$69.6 million in 3Q22. This increase is primarily attributable to the increased intake this quarter, given that most of our selling expenses are aimed at attracting new students.

Selling expenses as reported in the Adjusted EBITDA calculation (i.e., excluding depreciation and amortization expenses) amounted to R$79.4 million in 3Q23 and R$55.7 million in 3Q22, representing an increase of 42.5%. As a percentage of Net Revenue, consolidated Selling Expenses for Adjusted EBITDA calculation increased from 13.9% in 3Q22 to 16.3% in 3Q23, mainly due to the aforementioned increase in intake this quarter.

Table 7: Selling Expenses1

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Selling Expenses |

|

93.2 |

69.6 |

33.9% |

262.0 |

159.4 |

64.4% |

(-) Depreciation and amortization |

|

(13.8) |

(13.9) |

(0.7)% |

(41.3) |

(20.0) |

106.5% |

(-) M&A and pre-offering expenses |

|

- |

- |

n.a. |

- |

(0.2) |

n.a. |

Selling Expenses for Adj. EBITDA calculation |

|

79.4 |

55.7 |

42.5% |

220.7 |

139.2 |

58.5% |

as % of Net Revenue |

|

16.3% |

13.9% |

2.4 p.p. |

15.2% |

15.7% |

(0.5) p.p. |

| (1) | Our results reflect the consolidation of UniCesumar from May 20, 2022 onwards. |

|

3Q23 Results |

11 |

General and Administrative Expenses

General and Administrative (G&A) expenses in 3Q23 amounted to R$76.8 million, an increase of 100.5%, compared to 3Q22. This increase was mainly caused by certain one-off M&A expenses (earn-out payments in the context of the UniCesumar acquisition that have been accounted as expenses) incurred in 3Q23, for a total amount of R$ 31.2 million, and higher payroll expenses, reflecting an increase in personnel.

G&A expenses as reported in the Adjusted EBITDA calculation amounted to R$32.1 million in 3Q23 and R$22.8 million in 3Q22, representing an increase of 40.4%, mainly driven by the aforementioned increase in payroll expenses. G&A expenses as reported in the Adjusted EBITDA calculation reached 6.6% of Net Revenue in 3Q23, an expansion of 0.9 p.p. compared to 5.7% of Net Revenue in 3Q22.

Table 8: G&A Expenses1

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

General and Administrative (G&A) Expenses |

|

76.8 |

38.3 |

100.5% |

191.9 |

123.0 |

56.0% |

(-) Depreciation and amortization expenses |

|

(17.2) |

(17.0) |

1.2% |

(56.2) |

(26.8) |

109.7% |

(-) Share-based compensation plan |

|

3.6 |

9.5 |

(62.1)% |

5.0 |

1.7 |

194.1% |

(-) M&A, pre-offering expenses and restructuring expenses |

|

(31.1) |

(8.0) |

288.8% |

(53.4) |

(40.8) |

30.9% |

G&A Expenses for Adj. EBITDA calculation |

|

32.1 |

22.8 |

40.8% |

87.3 |

57.1 |

52.9% |

as % of Net Revenue |

|

6.6% |

5.7% |

0.9 p.p. |

6.0% |

6.4% |

(0.4) p.p. |

| (1) | Our results reflect the consolidation of UniCesumar from May 20, 2022 onwards. |

Net Impairment Losses on Financial Assets

Net impairment losses on financial assets represent the provisions for doubtful accounts (PDA). In 3Q23, PDA expenses were R$51.1 million, which represents 10.5% of the Net Revenue in the period, while in 3Q22 PDA expenses amounted to R$41.6 million, equivalent to 10.4% of the Net Revenue. This slight increase of 0.1 p.p. in our PDA expenses as a percentage of Net Revenue in 3Q23 compared to 3Q22 was primarily due to the high intake growth in previous quarters since most of our bad debt is related to newly enrolled students, and the provision is recognized in the 12 months after the revenue recognition. It is important to highlight that UniCesumar has more effective onboarding and retention processes and procedures than Uniasselvi, which we believe represent a solid opportunity in the medium term for synergies via the broader use of such best practices for both brands, improving our consolidated PDA levels. Besides, the current macroeconomic environment in Brazil has also impacted the consumption and payment capacity of our target clientele, comprised of the low-to-middle income brackets of the country.

|

3Q23 Results |

12 |

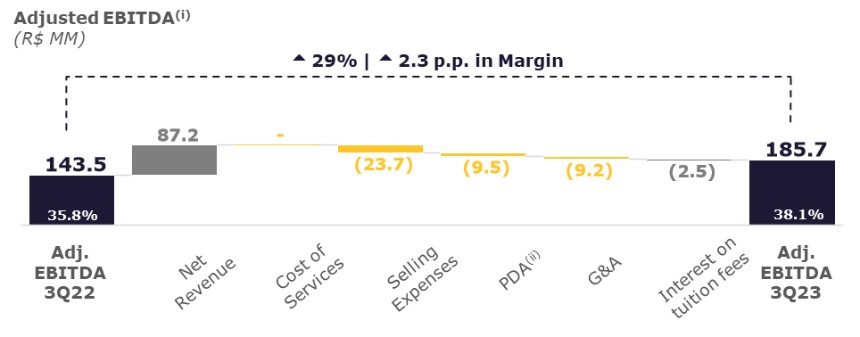

Adjusted EBITDA

Adjusted EBITDA in 3Q23 amounted to R$185.7 million, an increase of 29.4% from R$143.5 million in 3Q22. Adjusted EBITDA Margin was 38.1%, a 2.3 p.p. increase when compared to 35.8% for 3Q22. This increase in the Adjusted EBITDA reflects mainly the improvement of our operational results reflecting the success of the combined operations of Uniasselvi and UniCesumar, including our ability to manage the growth on students base, hubs maturation and average tickets.

Notes: (i) all figures in this graph include the adjustments applied in our definition of Adjusted EBITDA; (ii) PDA is defined as “Net impairment losses on financial assets” in our Financial Statements.

Adjusted Net Income

Adjusted Net Income in 3Q23 was R$38.6 million, a decrease of 41.2% compared to 3Q22. This decrease reflects the growth in Adjusted EBITDA in 3Q23 compared to 3Q22 as previously described, combined with two non-cash one-off impacts in 3Q23: (i) a R$52.1 million provision in the Deferred Tax Asset account, leading to a decrease of the Deferred Tax Income and ultimately of the Net Income for the period, which was due to revised calculations of the effective recoverability, over the next ten years, of such tax assets within our wholly-owned subsidiary Vitru Brasil Empreendimentos, Participações e Comércio S.A., an intermediate holding company which holds our equity interests in both Uniasselvi and UniCesumar, and which also bears the indebtedness of the Vitru group; and (ii) a write-off of R$38.4 million in certain assets of UniCesumar, as a result of the first inventory exercise conducted after the closing of the business combination with Vitru.

|

3Q23 Results |

13 |

Cash Flow and Cash Conversion from Operations

Adjusted Cash Flow from Operations amounted to R$271.9 million in 3Q23, an increase of 77.6% compared to 3Q22. This improvement in cash flow generation was primarily a result of the more positive working capital dynamics in both Uniasselvi and Unicesumar, in particular improvements in collection and bad debt management and extended payment periods to certain suppliers.

Adjusted Cash Flow Conversion from Operations amounted to 169.3% in 3Q23, representing an increase of 59.4 p.p. compared to the conversion ratio achieved in 3Q22. This performance was mainly caused by a general improvement in our organic operating results and the lower increase, in 3Q23 vs 3Q22, of trade receivables (net of PDA) when compared to the increase in Net Revenue over the last twelve months, which may signal a reversal of the negative trend in collection observed throughout the last quarters (due mainly to the macroeconomic environment).

Table 9: Cash Flow & Cash Conversion1

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Cash Flow from Operations |

|

271.9 |

153.1 |

77.6% |

580.5 |

283.6 |

104.7% |

(+) Income tax paid |

|

(12.1) |

(5.7) |

112.3% |

(32.1) |

(16.1) |

99.4% |

Adjusted Cash Flow from Operations |

|

259.9 |

147.4 |

76.3% |

548.5 |

267.5 |

105.0% |

Adjusted EBITDA |

|

185.7 |

143.5 |

29.4% |

556.6 |

307.8 |

80.8% |

(-) M&A, pre-offering expenses and restructuring expenses |

|

(32.1) |

(9.3) |

245.2% |

(57.4) |

(45.2) |

27.0% |

Adjusted EBITDA excluding M&A, pre-offering expenses and restructuring expenses |

|

153.6 |

134.2 |

14.5% |

499.2 |

262.6 |

90.1% |

Adjusted Cash Flow Conversion from Operations2 |

|

169.2% |

109.8% |

59.4 p.p. |

109.9% |

101.9% |

8.0 p.p. |

| (1) | Our results reflect the consolidation of UniCesumar from May 20, 2022 onwards. |

| (2) | The Company calculates Adjusted Cash Flow Conversion from Operations as adjusted cash flow from operations (which we calculate as cash from operations plus income tax paid) divided by Adjusted EBITDA (as defined above but without taking non-recurring expenses, related to M&A, pre-offering expenses and restructuring expenses, into consideration). Adjusted Cash Flow Conversion from Operations is a non-GAAP measure. The calculation of Adjusted Cash Flow Conversion from Operations may be different from the calculation used by other companies, including competitors in the industry, and therefore, the Company’s measures may not be comparable to those of other companies. For further information see “Reconciliations of Non-GAAP Financial Measures”. |

Indebtedness

In May 2022, Vitru Brasil Empreendimentos, Participações e Comércio S.A. (Vitru Brasil), a wholly owned subsidiary of Vitru Ltd., completed the issuance of two series of simple, secured, non-convertible debentures (Brazilian bonds denominated in R$) in an offering with restricted distribution efforts directed solely at professional investors in Brazil. The two series of debentures amounted to R$1.95 billion at interest rates indexed to the CDI (Certificado de Depósito Interbancário) for a five-year term in total, in connection with the business combination with UniCesumar, as follows:

| ◾ | Series 1 1st Debentures: R$0.5 billion (final maturity on May 15, 2024); and |

| ◾ | Series 2 1st Debentures: R$1.45 billion (final maturity on May 15, 2027). |

On May 5, 2023, we announced the issuance by Vitru Brasil of its second secured, non-convertible debentures in an offering with restricted distribution efforts directed solely at professional investors in Brazil. The series of debentures amounted to R$190 million at interest rates indexed to the CDI (Certificado de Depósito Interbancário) for a five-year term in total (final maturity on May 5, 2028). The amount raised with this new debentures issuance will be used for extending the Company’s average maturity term in its indebtedness, as well as for general working capital purposes.

|

3Q23 Results |

14 |

Among our obligations under the indenture governing since the 1st issuance, one of the main covenants to which we are subject is to maintain our Net Debt to Adjusted EBITDA ratio ( ) at a figure no greater than the following:

) at a figure no greater than the following:

| ◾ | 4.5x in June 2023; |

| ◾ | 4.0x in December 2023; |

| ◾ | 3.5x in June 2024; and |

| ◾ | 3.0x in December 2024. |

Once the covenant began to apply (from June 2023 onwards), the figures for this calculation are on an ex-IFRS 16 basis. The following table summarizes our net debt position as of September 30, 2023 and 2022:

Table 10: Net Debt

R$ million |

|

September 30, |

December 31, |

September 30, |

Net Debt (ex-IFRS 16)1 |

|

1,874.0 |

2,054.0 |

2,484.8 |

Lease Liabilities |

|

329.5 |

323.3 |

333.8 |

Total Net Debt (IFRS 16) |

|

2,203.5 |

2,377.4 |

2,818.6 |

| (1) | Including Loans & financing and Payables from acquisition of subsidiaries. For a reconciliation of Net Debt (ex-IFRS 16), see "—Reconciliations of Non-GAAP Financial Measures—Reconciliation of Net Debt" at the end of this document. |

Furthermore, on October 27, 2023, we announced the issuance by Vitru Brasil of its third unsecured, non-convertible debentures in a private offering directed solely at professional investors in Brazil. The series of debentures are expected to initially amount an aggregate principal of R$500 million and an additional amount of R$100 million may be issued at interest rates indexed to the CDI (Certificado de Depósito Interbancário). It is expected that the Debentures will be issued on or around November 16. The first series will have a maturity period of 5 (five) years and the second series will have a maturity period of 7 (seven) years, counting of the date of issuance. The amount raised with this new debentures issuance will be used to pre-payment of the financing contracted by the Company with sellers within the scope of the acquisition of UniCesumar (Sellers’ Financing).

CAPEX

Capital Expenditures (CAPEX) in 3Q23 totaled R$31.8 million, an increase of 22.8% compared to the amount spent in 3Q22. This increase was mainly due to stronger investments in intangible assets like content production and learning systems, aligned with the expansion of our business throughout Unicesumar and Uniasselvi brands, alongside a reduction in Property Plant and Equipment (PP&E) expenditures mainly due to a smaller number of own hubs opened in 2023 vs 2022.

Table 11: CAPEX1

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Property and equipment |

|

11.8 |

13.9 |

(15.1)% |

26.9 |

23.1 |

16.5% |

Intangible assets |

|

20.1 |

12.1 |

66.1% |

59.4 |

27.9 |

112.9% |

Investing activities |

|

31.8 |

25.9 |

22.8% |

86.3 |

51.0 |

69.2% |

as % of Net Revenue |

|

6.5% |

6.5% |

0.0 p.p. |

5.9% |

5.8% |

0.1 p.p. |

| (1) | Our results reflect the consolidation of UniCesumar from May 20, 2022 onwards. |

|

3Q23 Results |

15 |

ABOUT VITRU (NASDAQ: VTRU)

VITRU is the leading pure-player in the private post-secondary digital education market in Brazil based on the number of enrolled undergraduate students, according to the most recent INEP census released by the Brazilian Ministry of Education (Ministério da Educação), in February 2022.

Vitru has been listed on the Nasdaq stock exchange in the United States (ticker symbol: VTRU) since September 18, 2020, and its mission is to democratize access to education in Brazil through a digital ecosystem and empower every student to create their own successful story.

Through its subsidiaries, Vitru provides a complete pedagogical ecosystem focused on a hybrid distance learning experience for undergraduate and continuing education students. All the academic content is delivered in multiple formats (videos, eBooks, podcasts and html text, among others) through its proprietary Virtual Learning Environment, or VLE. The pedagogical model also incorporates in-person weekly meetings hosted by dedicated tutors who are mostly local working professionals in the subject area they teach. The Company believes that this unique tutor-centric learning experience sets it apart, creating a stronger sense of community and belonging and contributing to higher engagement and retention rates of its student base.

The Company’s results are based on three operating segments:

| ◾ | Digital education undergraduate courses. What differentiates Vitru’s digital education model are the higher quality and its hybrid methodology with synchronous learning, which consists of weekly in-person or online meetings with tutors for Uniasselvi, and weekly online classes for UniCesumar students, alongside the benefit of the virtual learning environment, where students are able to study where and when they prefer. The Company’s portfolio of courses is composed mainly of pedagogy, business administration, accounting, physical education, vocational, engineering, and health-related courses. |

| ◾ | On-campus undergraduate courses. Vitru (through Uniasselvi and UniCesumar) has several campuses that offer traditional on-campus undergraduate courses, including medical, engineering, law, and health-related courses. On-campus students experience a complete learning ecosystem, mixing theory with practical applications as well as access to sports activities and cultural events. |

| ◾ | Continuing education courses. Vitru (through Uniasselvi and UniCesumar) offers continuing education and graduate courses predominantly in pedagogy, finance, and business, but also in other subjects such as law, engineering, IT and health-related courses. Courses are offered in three different versions, consisting of (i) hybrid model, (ii) 100% online, and (iii) on-campus. This also includes technical courses and professional qualification courses. |

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. All statements, other than statements of historical fact, could be deemed forward-looking, including risks and uncertainties related to statements about the proposed business combination, including the benefits of the business combination, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the business combination; the effect of the COVID-19 outbreak on general economic and business conditions in Brazil and globally, and any restrictive measures imposed by governmental authorities in response to the outbreak; our ability to implement, in a timely and efficient manner, any measure necessary to respond to, or reduce the effects of, the COVID-19 outbreak on our business, operations, cash flow, prospects, liquidity and financial condition; our ability to efficiently predict, and react to, temporary or long-lasting changes in consumer behavior resulting from the COVID-19 outbreak, including after the outbreak has been sufficiently controlled; our competition; our ability to implement our business strategy; our ability to adapt to

|

3Q23 Results |

16 |

technological changes in the educational sector; the availability of government authorizations on terms and conditions and within periods acceptable to us; our ability to continue attracting and retaining new students; our ability to maintain the academic quality of our programs; our ability to maintain the relationships with our hub partners; our ability to collect tuition fees; the availability of qualified personnel and the ability to retain such personnel; changes in government regulations applicable to the education industry in Brazil; government interventions in education industry programs, which affect the economic or tax regime, the collection of tuition fees or the regulatory framework applicable to educational institutions; a decline in the number of students enrolled in our programs or the amount of tuition we can charge; our ability to compete and conduct our business in the future; the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors; changes in consumer demands and preferences and technological advances, and our ability to innovate to respond to such changes; changes in labor, distribution and other operating costs; our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us; general market, political, economic and business conditions; and our financial targets. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the potential effects of the COVID-19 pandemic on our business operations, financial results and financial position and on the Brazilian economy.

The forward-looking statements can be identified, in certain cases, through the use of words such as “believe,” “may,” “might,” “can,” “could,” “is designed to,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “forecast,” “plan,” “predict,” “potential,” “aspiration,” “should,” “purpose,” “belief,” and similar, or variations of, or the negative of, such words and expressions. Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events. The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. Readers should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent management’s beliefs and assumptions only as of the date such statements are made. Further information on these and other factors that could affect the Company’s financial results is included in filings made with the U.S. Securities and Exchange Commission (“SEC”) from time to time, including the section titled “Item 3. Key Information—D. Risk Factors” in the most recent Annual Report on Form 20-F of the Company. These documents are available on the SEC Filings section of the investor relations section of our website at investors.vitru.com.br.

NON-GAAP FINANCIAL MEASURES

To supplement the Company’s consolidated financial statements, which are prepared and presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board—IASB, VITRU uses Adjusted EBITDA, Adjusted Net Income, Adjusted Cash Flow Conversion from Operations, and Net Debt information which are non-GAAP financial measures, for the convenience of the investment community. A non-GAAP financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable GAAP measure.

VITRU calculates Adjusted EBITDA as the net income (loss) for the period plus:

| ◾ | deferred and current income tax, which is calculated based on income, adjusted based on certain additions and exclusions provided for in applicable legislation. The income taxes in Brazil consist of corporate income tax (Imposto de Renda Pessoa Jurídica), or IRPJ, and CSLL, which are social contribution taxes; |

| ◾ | financial results, which consist of interest expenses less interest income; |

| ◾ | depreciation and amortization; |

|

3Q23 Results |

17 |

| ◾ | interest on tuition fees paid in arrears, which refers to interest received from students on late payments of monthly tuition fees and which is added back; |

| ◾ | impairment of non-current assets, which consists of impairment charges associated with the on-campus undergraduate courses segment, given the deterioration in the prospects of this business; |

| ◾ | share-based compensation plan, which consists of non-cash expenses related to the grant of share-based compensation, as well as fair value adjustments for share-based compensation expenses classified as a liability in the consolidated financial statements; |

| ◾ | other income (expenses), net, which consists of other expenses such as contractual indemnities and deductible donations among others; and |

| ◾ | M&A, pre-offering expenses and restructuring expenses, which consists of adjustments that the Company believes are appropriate to provide additional information to investors about certain material non-recurring items. Such M&A, pre-offering expenses and restructuring expenses comprise: mergers and acquisitions, or M&A, and pre-offering expenses, which are expenses related to mergers, acquisitions and divestments (including due diligence, transaction and integration costs), as well as the expenses related to the preparation of offerings; and restructuring expenses, which refers to expenses related to employee severance costs in connection with organizational and academic restructurings. |

VITRU calculates Adjusted Net Income as net income (loss) for the period plus:

| ◾ | share-based compensation plan, as defined above; |

| ◾ | M&A, pre-offering expenses, and restructuring expenses, as defined above; |

| ◾ | impairment of non-current assets, as defined above; |

| ◾ | amortization of intangible assets recognized as a result of business combinations, which refers to the amortization of the following intangible assets from business combinations: software, trademark, distance learning operation licenses, non-compete agreements, customer relationship, teaching-learning material, licenses to operate medical courses, and leasing contracts. For more information, see notes to the unaudited interim condensed consolidated financial statements in the Company’s filings with the U.S. Securities and Exchange Commission; |

| ◾ | interest accrued at the original effective interest rate (excluding restatement as a result of inflation) on the accounts payable from the acquisition of subsidiaries. See notes to the unaudited interim condensed consolidated financial statements in the Company’s filings with the U.S. Securities and Exchange Commission; and |

| ◾ | corresponding tax effects on adjustments, which represents the tax effect of pre-tax items excluded from adjusted net income (loss). The tax effect of pre-tax items excluded from adjusted net income (loss) is computed using the statutory rate related to the jurisdiction that was affected by the adjustment after taking into account the effect of permanent differences and valuation allowances. |

VITRU calculates Adjusted Cash Flow Conversion from Operations as adjusted cash flow from operations (which is calculated as cash from operations plus income tax paid) divided by Adjusted EBITDA (as defined above but without taking M&A, pre-offering expenses, and restructuring expenses into consideration).

VITRU calculates Net Debt (ex-IFRS 16) as the sum of loans and financing, payables from acquisition of subsidiaries, and lease liabilities less cash and cash equivalents and short-term investments.

Adjusted EBITDA, Adjusted Net Income, Adjusted Cash Flow Conversion from Operations, and Net Debt are the key performance indicators used by Vitru to measure the financial performance and condition of its core operations, and Vitru believes that these measures facilitate period-to-period comparisons on a consistent basis. As a result, its management believes that these non-GAAP financial measures provide useful information to the investment community. These summarized, non-audited, or non-GAAP financial measures are in addition to, and not a substitute for, or superior to, measures of financial performance prepared in accordance with IFRS. Additionally, the calculations of Adjusted EBITDA, Adjusted Net Income, Adjusted Cash Flow Conversion from Operations, and Net Debt may be different from the calculations used by other companies, including competitors in the education services industry, and therefore, Vitru’s measures may not be comparable to those of other companies. For a reconciliation of Adjusted EBITDA, Adjusted Net Income, Adjusted Cash Flow Conversion from Operations, and Net Debt to the most directly comparable IFRS measure, see the tables at the end of this document.

|

3Q23 Results |

18 |

FINANCIAL TABLES

Unaudited interim condensed consolidated statements of profit or loss and other comprehensive income for the three- and six-month period ended June 30, 2023 and 2022

|

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||

R$ million (except earnings per share) |

|

2023 |

2022 |

2023 |

2022 |

|

|

|

|

|

|

NET REVENUE |

|

488.0 |

400.8 |

1,453.7 |

886.6 |

|

|

|

|

|

|

Cost of services rendered |

|

(167.5) |

(168.9) |

(494.4) |

(351.9) |

|

|

|

|

|

|

GROSS PROFIT |

|

320.4 |

231.9 |

959.3 |

534.7 |

|

|

|

|

|

|

General and administrative expenses |

|

(76.8) |

(38.3) |

(191.9) |

(123.0) |

Selling expenses |

|

(93.2) |

(69.6) |

(262.1) |

(159.4) |

Net impairment losses on financial assets |

|

(51.1) |

(41.6) |

(178.5) |

(105.9) |

Other income (expenses), net |

|

(2.2) |

(2.8) |

(2.9) |

(1.8) |

Operating expenses |

|

(223.4) |

(152.3) |

(635.3) |

(390.1) |

|

|

|

|

|

|

OPERATING PROFIT |

|

97.0 |

79.6 |

323.9 |

144.6 |

|

|

|

|

|

|

Financial income |

|

21.1 |

19.6 |

45.8 |

49.1 |

Financial expenses |

|

(86.8) |

(90.8) |

(250.0) |

(167.5) |

Financial results |

|

(65.7) |

(71.2) |

(204.3) |

(118.4) |

|

|

|

|

|

|

PROFIT BEFORE TAXES |

|

31.4 |

8.4 |

119.6 |

26.2 |

|

|

|

|

|

|

Current income taxes |

|

(16.6) |

(5.8) |

(33.9) |

(13.5) |

Deferred income taxes |

|

(17.5) |

33.2 |

54.8 |

68.0 |

Income taxes |

|

(34.2) |

27.4 |

20.9 |

54.5 |

|

|

|

|

|

|

NET INCOME FOR THE PERIOD |

|

(2.8) |

35.8 |

140.5 |

80.7 |

|

|

|

|

|

|

Other comprehensive income |

|

- |

- |

- |

- |

|

|

|

|

|

|

TOTAL COMPREHENSIVE INCOME |

|

(2.8) |

35.8 |

140.5 |

80.7 |

|

|

|

|

|

|

Basic earnings per share (R$) |

|

(0.1) |

1.3 |

4.2 |

3.1 |

Diluted earnings per share (R$) |

|

- |

1.1 |

4.0 |

2.9 |

|

3Q23 Results |

19 |

Unaudited interim condensed consolidated statements of financial position as of June 30, 2023 and December 31, 2022

|

|

September 30, |

December 31, |

R$ million |

|

2023 |

2022 |

ASSETS |

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

20.0 |

47.2 |

Short-term investments |

|

486.0 |

26.4 |

Trade receivables |

|

264.2 |

224.1 |

Income taxes recoverable |

|

5.1 |

7.0 |

Prepaid expenses |

|

29.2 |

20.0 |

Receivables from hub partners |

|

25.3 |

32.0 |

Other current assets |

|

23.6 |

14.9 |

|

|

|

|

TOTAL CURRENT ASSETS |

|

853.5 |

371.5 |

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

|

Trade receivables |

|

48.9 |

47.0 |

Indemnification assets |

|

18.3 |

9.9 |

Deferred tax assets |

|

226.0 |

203.0 |

Receivables from hub partners |

|

56.8 |

48.1 |

Other non-current assets |

|

25.1 |

6.9 |

Right-of-use assets |

|

354.3 |

350.4 |

Property and equipment |

|

195.1 |

194.6 |

Intangible assets |

|

4,372.1 |

4,427.6 |

|

|

|

|

TOTAL NON-CURRENT ASSETS |

|

5,296.6 |

5,287.5 |

|

|

|

|

TOTAL ASSETS |

|

6,150.1 |

5,659.1 |

|

3Q23 Results |

20 |

|

|

September 30, |

December 31, |

R$ million |

|

2023 |

2022 |

LIABILITIES |

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

Trade payables |

|

88.0 |

99.7 |

Loans and financing |

|

289.2 |

131.2 |

Lease liabilities |

|

51.6 |

51.3 |

Labor and social obligations |

|

131.0 |

43.1 |

Payables from acquisition of subsidiaries |

|

532.2 |

- |

Taxes payable |

|

15.3 |

16.0 |

Prepayments from customers |

|

53.7 |

43.6 |

Other current liabilities |

|

1.6 |

7.5 |

|

|

|

|

TOTAL CURRENT LIABILITIES |

|

1,162.6 |

392.4 |

|

|

|

|

NON-CURRENT |

|

|

|

|

|

|

|

Trade payables |

|

2.4 |

- |

Loans and financing |

|

1,558.7 |

1,489.1 |

Lease liabilities |

|

277.9 |

272.0 |

Payables from acquisition of subsidiaries |

|

- |

507.4 |

Taxes payable |

|

11.0 |

- |

Provisions for contingencies |

|

38.9 |

29.2 |

Deferred tax liabilities |

|

741.5 |

773.4 |

Share-based compensation |

|

7.7 |

19.8 |

Other non-current liabilities |

|

23.0 |

1.5 |

|

|

|

|

TOTAL NON-CURRENT LIABILITIES |

|

2,661.0 |

3,092.3 |

|

|

|

|

TOTAL LIABILITIES |

|

3,823.6 |

3,484.7 |

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

Share capital |

|

0.008 |

0.008 |

Capital reserves |

|

2,066.1 |

2,054.5 |

Retained earnings |

|

260.3 |

119.9 |

|

|

|

|

TOTAL EQUITY |

|

2,326.5 |

2,174.4 |

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

6,150.1 |

5,659.1 |

|

3Q23 Results |

21 |

Unaudited interim condensed consolidated statements of cash flows for the six-month period ended June 30, 2023 and 2022

|

|

Nine Months Ended September 30, |

|

R$ million |

|

2023 |

2022 |

Cash flows from operating activities |

|

|

|

Profit before taxes |

|

119.6 |

26.1 |

Adjustments to reconcile income before taxes to cash provided on operating activities |

|

|

|

Depreciation and amortization |

|

156.7 |

98.0 |

Net impairment losses on financial assets |

|

178.5 |

105.9 |

Provision for revenue cancellation |

|

0.9 |

0.6 |

Provision for contingencies |

|

5.9 |

2.9 |

Accrued interests |

|

227.6 |

148.0 |

Share-based compensation |

|

(5.0) |

(1.7) |

Loss on sale or disposal of non-current assets |

|

38.5 |

2.2 |

Modification of lease contracts |

|

- |

(0.6) |

Rent concessions |

|

- |

- |

Changes in operating assets and liabilities |

|

|

|

Trade receivables |

|

(221.3) |

(154.5) |

Prepayments |

|

(9.2) |

(1.0) |

Other assets |

|

(26.2) |

(5.4) |

Trade payables |

|

(9.3) |

21.6 |

Labor and social obligations |

|

87.9 |

34.8 |

Other taxes payable |

|

10.2 |

(0.2) |

Prepayments from customers |

|

10.1 |

9.1 |

Other payables |

|

15.7 |

(2.2) |

Cash from operations |

|

580.5 |

283.6 |

|

|

|

|

Income tax paid |

|

(32.1) |

(16.1) |

Interest paid |

|

(155.0) |

(19.4) |

Contingencies paid |

|

(7.7) |

(3.4) |

Net cash provided by operating activities |

|

385.7 |

244.7 |

|

|

|

|

Cash flows from investing activities |

|

|

|

Purchase of property and equipment |

|

(26.9) |

(23.1) |

Purchase and capitalization of intangible assets |

|

(59.4) |

(27.9) |

Payments for the acquisition of interests in subsidiaries, net of cash |

|

- |

(2,200.8) |

Acquisition of short-term investments, net |

|

(459.7) |

189.6 |

Net cash used in investing activities |

|

(546.0) |

(2,062.2) |

|

|

|

|

Cash flows from financing activities |

|

|

|

Payments of lease liabilities |

|

(51.6) |

(10.0) |

Proceeds from loans and financing, net of transaction costs |

|

367.5 |

1,905.8 |

Costs related to future issuances |

|

- |

16.8 |

Capital contributions net of treasury shares |

|

5.1 |

18.3 |

Net cash provided by financing activities |

|

133.1 |

1,931.0 |

|

|

|

|

Net increase in cash and cash equivalents |

|

(27.2) |

113.5 |

Cash and cash equivalents at the beginning of the period |

|

47.2 |

75.6 |

Cash and cash equivalents at the end of the period |

|

20.0 |

189.0 |

|

3Q23 Results |

22 |

Reconciliations of Non-GAAP Financial Measures

Reconciliation of Adjusted EBITDA

|

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||

R$ million |

|

2023 |

2022 |

2023 |

2022 |

Net income for the period |

|

(2.8) |

35.8 |

140.5 |

80.6 |

(+) Deferred and current income tax |

|

34.2 |

(27.4) |

(20.9) |

(54.5) |

(+) Financial result |

|

65.7 |

71.2 |

204.3 |

118.4 |

(+) Depreciation and amortization |

|

50.9 |

51.9 |

156.9 |

98.0 |

(+) Interest on tuition fees paid in arrears |

|

6.9 |

9.4 |

20.5 |

20.0 |

(+) Share-based compensation plan |

|

(3.6) |

(9.5) |

(5.0) |

(1.7) |

(+) Other income (expenses), net |

|

2.2 |

2.8 |

2.9 |

1.8 |

(+) M&A, pre-offering expenses and restructuring expenses |

|

32.1 |

9.3 |

57.4 |

45.2 |

Adjusted EBITDA |

|

185.7 |

143.5 |

556.6 |

307.8 |

Reconciliation of Adjusted Net Income

|

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||

R$ million |

|

2023 |

2022 |

2023 |

2022 |

Net income for the period |

|

(2.8) |

35.8 |

140.6 |

80.6 |

(+) M&A, pre-offering expenses and restructuring expenses |

|

32.1 |

9.3 |

57.4 |

45.2 |

(+) Share-based compensation plan |

|

(3.6) |

(9.5) |

(5.0) |

(1.7) |

(+) Amortization of intangible assets from business combinations |

|

31.5 |

31.3 |

94.1 |

46.5 |

(+) Interest accrued on accounts payable from the acquisition of subsidiaries |

|

1.8 |

9.4 |

5.9 |

15.5 |

(-) Corresponding tax effects on adjustments |

|

(20.4) |

(10.6) |

(49.8) |

(30.6) |

Adjusted Net Income |

|

38.6 |

65.7 |

243.1 |

155.5 |

Reconciliation of Adjusted Cash Flow Conversion from Operations

|

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||

R$ million |

|

2023 |

2022 |

2023 |

2022 |

Cash from Operations |

|

271.9 |

153.1 |

580.5 |

283.6 |

(+) Income tax paid |

|

(12.1) |

(5.7) |

(32.1) |

(16.1) |

Adjusted Cash Flow from Operations |

|

259.9 |

147.4 |

548.5 |

267.5 |

|

|

|

|

|

|

Adjusted EBITDA |

|

185.7 |

143.5 |

556.6 |

307.8 |

(-) M&A, pre-offering expenses and restructuring expenses |

|

(32.1) |

(9.3) |

(57.4) |

(45.2) |

Adjusted EBITDA excluding M&A, pre-offering expenses and restructuring expenses |

|

153.6 |

134.2 |

499.2 |

262.6 |

|

|

|

|

|

|

Adjusted Cash Flow Conversion from Operations |

|

169.2% |

109.8% |

109.9% |

101.9% |

|

3Q23 Results |

23 |

Reconciliation of M&A, Pre-offering and Restructuring Expenses

R$ million |

|

3Q23 |

3Q22 |

% Chg |

9M23 |

9M22 |

% Chg |

Integration UniCesumar (pre- and post-closing) |

|

1.1 |

5.8 |

(80.9)% |

8.7 |

35.1 |

(75.2)% |

UniCesumar earn-out payments (accounted as expenses) |

|

28.7 |

- |

- |

28.7 |

- |

- |

Other M&A expenses (including advisors' fees) |

|

0.7 |

0.6 |

23.6% |

6.3 |

1.2 |

413.0% |

Others |

|

1.6 |

3.0 |

(47.1)% |

13.7 |

8.9 |

53.9% |

Total M&A, pre-offering expenses and restructuring expenses |

|

32.1 |

9.4 |

243.1% |

57.4 |

45.2 |

26.9% |

Reconciliation of Net Debt

R$ million |

|

September 30, |

December 31, |

September 30, |

Net Debt (ex-IFRS 16) |

|

1,874.0 |

2,054.0 |

2,484.8 |

Loans and financing |

|

1,847.9 |

1,620.2 |

2,007.7 |

Payables from acquisition of subsidiaries |

|

532.2 |

507.4 |

729.5 |

(-) Cash and cash equivalents |

|

(20.0) |

(47.2) |

(189.0) |

(-) Short-term investments |

|

(486.0) |

(26.4) |

(63.4) |

Lease Liabilities |

|

329.5 |

323.3 |

333.8 |

Total Net Debt (IFRS 16) |

|

2,203.5 |

2,377.4 |

2,818.6 |

|

3Q23 Results |

24 |

Exhibit 99.2

Vitru Limited

Unaudited interim

condensed consolidated

financial statements

September 30, 2023

Vitru Limited

(In thousands of Brazilian Reais)

|

|

|

|

|

|

|

|

|

Note |

|

September 30, 2023 |

|

December 31, 2022 |

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

6 |

|

20,018 |

|

47,187 |

Short-term investments |

|

6 |

|

486,046 |

|

26,389 |

Trade receivables |

|

7 |

|

264,211 |

|

224,128 |

Income taxes recoverable |

|

|

|

5,145 |

|

6,994 |

Prepaid expenses |

|

9 |

|

29,165 |

|

20,010 |

Receivables from hub partners |

|

10 |

|

25,324 |

|

31,979 |

Other current assets |

|

|

|

23,607 |

|

14,853 |

TOTAL CURRENT ASSETS |

|

|

|

853,516 |

|

371,540 |

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

Trade receivables |

|

7 |

|

48,854 |

|

47,012 |

Indemnification assets |

|

|

|

18,291 |

|

9,853 |

Deferred tax assets |

|

8 |

|

226,003 |

|

203,043 |

Receivables from hub partners |

|

10 |

|

56,829 |

|

48,117 |

Other non-current assets |

|

|

|

25,100 |

|

6,903 |

Right-of-use assets |

|

11 |

|

354,333 |

|

350,393 |

Property and equipment |

|

12 |

|

195,057 |

|

194,575 |

Intangible assets |

|

13 |

|

4,372,124 |

|

4,427,643 |

TOTAL NON-CURRENT ASSETS |

|

|

|

5,296,591 |

|

5,287,539 |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

|

|

6,150,107 |

|

5,659,079 |

The accompanying notes are an integral part of the unaudited interim condensed consolidated financial statements.

1

1

Vitru Limited

(In thousands of Brazilian Reais)

Consolidated Balance Sheet

|

|

Note |

|

September 30, 2023 |

|

December 31, 2022 |

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Trade payables |

|

|

|

87,993 |

|

99,697 |

Loans and financing |

|

14 |

|

289,177 |

|

131,158 |

Lease liabilities |

|

11 |

|

51,595 |

|

51,310 |

Labor and social obligations |

|

15 |

|

131,012 |

|

43,105 |

Payables from acquisition of subsidiaries |

|

16 |

|

532,209 |

|

- |

Taxes payable |

|

|

|

15,258 |

|

16,006 |

Prepayments from customers |

|

|

|

53,749 |

|

43,606 |

Other current liabilities |

|

|

|

1,642 |

|

7,484 |

TOTAL CURRENT LIABILITIES |

|

|

|

1,162,635 |

|

392,366 |

|

|

|

|

|

|

|

NON-CURRENT |

|

|

|

|

|

|

Trade payables |

|

|

|

2,355 |

|

- |

Loans and financing |

|

14 |

|

1,558,725 |

|

1,489,088 |

Lease liabilities |

|

11 |

|

277,890 |

|

272,029 |

Payables from acquisition of subsidiaries |

|

16 |

|

- |

|

507,361 |

Taxes payable |

|

|

|

10,965 |

|

- |

Provisions for contingencies |

|

17 |

|

38,870 |

|

29,182 |

Deferred tax liabilities |

|

8 |

|

741,520 |

|

773,394 |

Share-based compensation |

|

5 |

|

7,650 |

|

19,805 |

Other non-current liabilities |

|

|

|

23,003 |

|

1,465 |

TOTAL NON-CURRENT LIABILITIES |

|

|

|

2,660,978 |

|

3,092,324 |

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

|

3,823,613 |

|

3,484,690 |

|

|

|

|

|

|

|

EQUITY |

|

18 |

|

|

|

|

Share capital |

|

|

|

8 |

|

8 |

Capital reserves |

|

|

|

2,066,141 |

|

2,054,527 |

Retained earnings |

|

|

|

260,345 |

|

119,854 |

TOTAL EQUITY |

|

|

|

2,326,494 |

|

2,174,389 |

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

|

|

6,150,107 |

|

5,659,079 |

The accompanying notes are an integral part of the unaudited interim condensed consolidated financial statements.

2

2

Vitru Limited

Unaudited interim condensed consolidated statements of profit or loss and other comprehensive income for the three and nine months periods ended September 30 2023 and 2022.

(In thousands of Brazilian Reais, except earnings per share)

Consolidated Statement of lncome

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

||||

|

|

|

|

September 30, |

|

September 30, |

||||

|

|

Note |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

NET REVENUE |

|

22 |

|

487,965 |

|

400,827 |

|

1,453,684 |

|

886,633 |

|

|

|

|

|

|

|

|

|

|

|

Cost of services rendered |

|

23 |

|

(167,546) |

|

(168,859) |

|

(494,401) |

|

(351,909) |

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

|

|

320,419 |

|

231,968 |

|

959,283 |

|

534,724 |

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

23 |

|

(76,800) |

|

(38,262) |

|

(191,859) |

|

(122,975) |

Selling expenses |

|

23 |

|

(93,212) |

|

(69,604) |

|

(262,083) |

|

(159,402) |

Net impairment losses on financial assets |

|

7 |

|

(51,138) |

|

(41,565) |

|

(178,489) |

|

(105,898) |

Other income (expenses), net |

|

24 |

|

(2,223) |

|

(2,805) |

|

(2,933) |

|

(1,827) |

Operating expenses |

|

|

|

(223,373) |

|

(152,236) |

|

(635,364) |

|

(390,102) |

|

|

|

|

|

|

|

|

|

|

|

OPERATING PROFIT |

|

|

|

97,046 |

|

79,732 |

|

323,919 |

|

144,622 |

|

|

|

|

|

|

|

|

|

|

|

Financial income |

|

25 |

|

21,077 |

|

19,574 |

|

45,744 |

|

49,052 |

Financial expenses |

|

25 |

|

(86,753) |

|

(90,833) |

|

(250,060) |

|

(167,573) |

Financial results |

|

|

|

(65,676) |

|

(71,259) |

|

(204,316) |

|

(118,521) |

|

|

|

|

|

|

|

|

|

|

|

PROFIT BEFORE TAXES |

|

|

|

31,370 |

|

8,473 |

|

119,603 |

|

26,101 |

|

|

|

|

|

|

|

|

|

|

|

Current income taxes |

|

8 |

|

(16,644) |

|

(5,844) |

|

(33,946) |

|

(13,488) |

Deferred income taxes |

|

8 |

|

(17,511) |

|

33,177 |

|

54,834 |

|

67,990 |

Income taxes |

|

|

|

(34,155) |

|

27,333 |

|

20,888 |

|

54,502 |

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) FOR THE PERIOD |

|

|

|

(2,785) |

|

35,806 |

|

140,491 |

|

80,603 |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMPREHENSIVE INCOME (LOSS) |

|

|

|

(2,785) |

|

35,806 |

|

140,491 |

|

80,603 |

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share (R$) |

|

19 |

|

(0.08) |

|

125 |

|

4.16 |

|

3.13 |

Diluted earnings per share (R$) |

|

19 |

|

(0.08) |

|

113 |

|

3.94 |

|

2.89 |

The accompanying notes are an integral part of the unaudited interim condensed consolidated financial statements.

3