UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission File Number: 001-34857

Gold Resource Corporation

(Exact Name of Registrant as Specified in its charter)

Colorado |

84-1473173 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

7900 E. Union Ave, Suite 320, Denver, Colorado 80237

(Address of Principal Executive Offices) (Zip Code)

(303) 320-7708

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

a |

||

Title of each class |

Trading Symbol |

Name of each exchange where registered |

Common Stock |

GORO |

NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes⌧No◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes⌧No◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

◻ |

Accelerated filer |

☒ |

|

|

|

|

Non-accelerated filer |

◻ |

Smaller reporting company |

☒ |

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act◻

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐No⌧

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 88,468,542 shares of common stock outstanding as of July 24, 2023.

GOLD RESOURCE CORPORATION

FORM 10-Q

Table of Contents

|

|

|

Page |

|

|

2 |

|

|

|

|

|

|

|

3 |

|

Condensed Consolidated Interim Financial Statements and Notes |

3 |

||

|

|

3 |

|

|

|

4 |

|

|

|

5 |

|

|

|

7 |

|

|

|

8 |

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 |

|

|

47 |

||

|

48 |

||

|

|

|

|

|

|

48 |

|

|

48 |

||

|

49 |

||

|

49 |

||

|

49 |

||

|

49 |

||

|

49 |

||

|

49 |

||

50 |

|||

|

San Jose de Gracia, Oaxaca |

Gold Resource Corporation

1

SECOND QUARTER 2023 HIGHLIGHTS

Highlights for the three months ended June 30, 2023 are summarized below and discussed further under Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations:

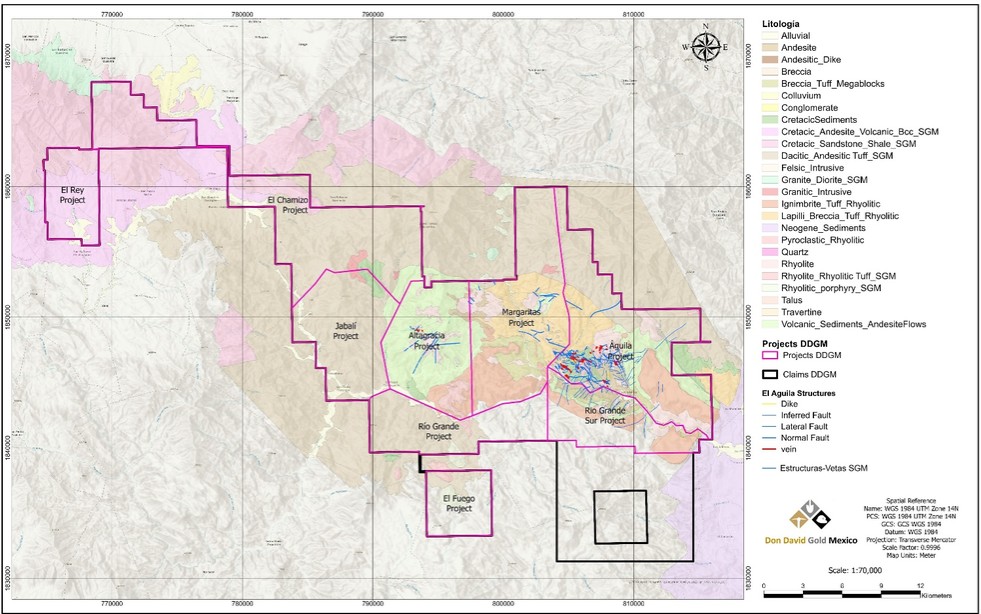

Don David Gold Mine

| ● | No lost time incidents during the quarter. Our year-to-date LTIFR safety record is 0.22 as compared to the Mexican average of 0.88 (in US equivalent). Safety at Gold Resource Corporation is paramount. Even with a good track record at the Don David Gold Mine (“DDGM”), the Company continues to strive each quarter for improved measures, awareness, and training. |

| ● | In the second quarter of 2023, the Don David Gold Mine produced and sold a total of 7,689 gold equivalent (“AuEq”) ounces, comprised of 4,287 gold ounces and 274,257 silver ounces at an average sales price per ounce of $2,010 and $25, respectively. |

| ● | The DDGM diamond drilling program has progressed as planned during the second quarter with encouraging results. Drilling continues to advance at DDGM on two fronts: (1) Infill drilling with the objective of upgrading defined Inferred resources to the Indicated category; and (2) Exploration drilling with the objective of identifying additional Inferred resources via step-out drilling along the South Soledad, Sagrario, Marena and Three Sisters vein systems, as well as on the recently identified Gloria vein system. |

Back Forty Project

| ● | Optimization work related to the metallurgy and the economic model for the Back Forty Project in Michigan, USA is near completion. The Company plans to release these updated results in a report during the third quarter. |

| ● | Updated site layout designs have focused on little to no impact on wetlands and being fully protective of the environment. The U.S. Supreme Court ruling in Sackett v. Environmental Protection Agency limits the federal government’s authority with regards to wetlands and will likely result in not needing a “dredge and fill” wetland permit. The “drawdown” of wetlands will be regulated by Michigan State authorities. |

Financial

| ● | The Company has $18.0 million in cash as of June 30, 2023, and no debt. |

| ● | Net loss was $4.6 million or $0.05 per share for the quarter. |

| ● | Working capital was $20.8 million as of June 30, 2023. |

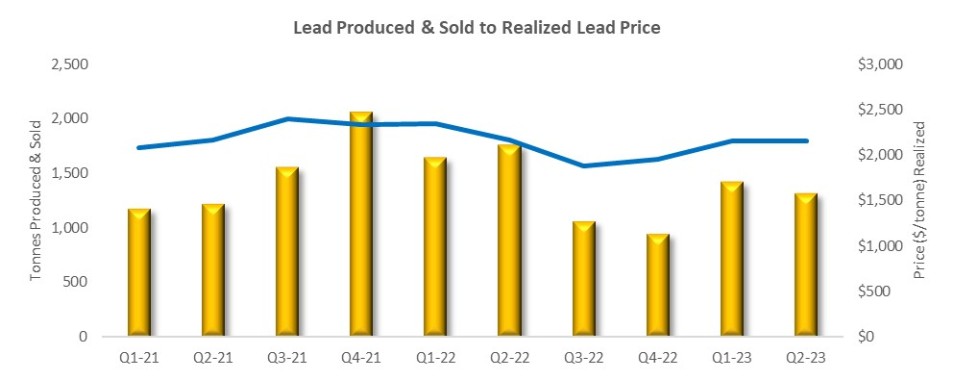

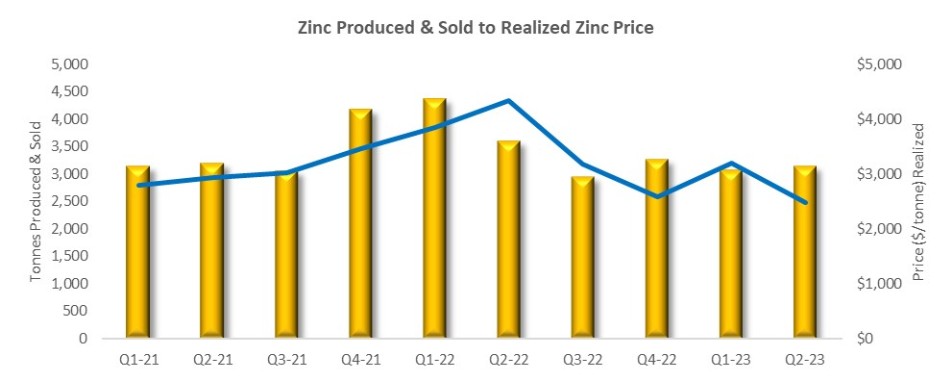

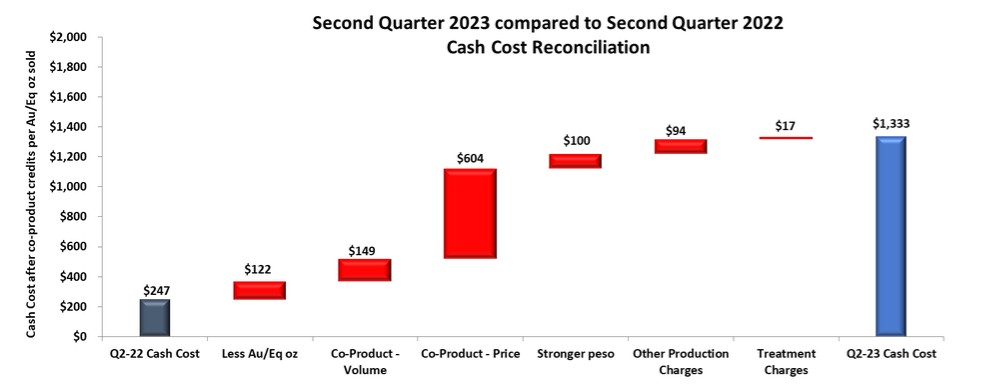

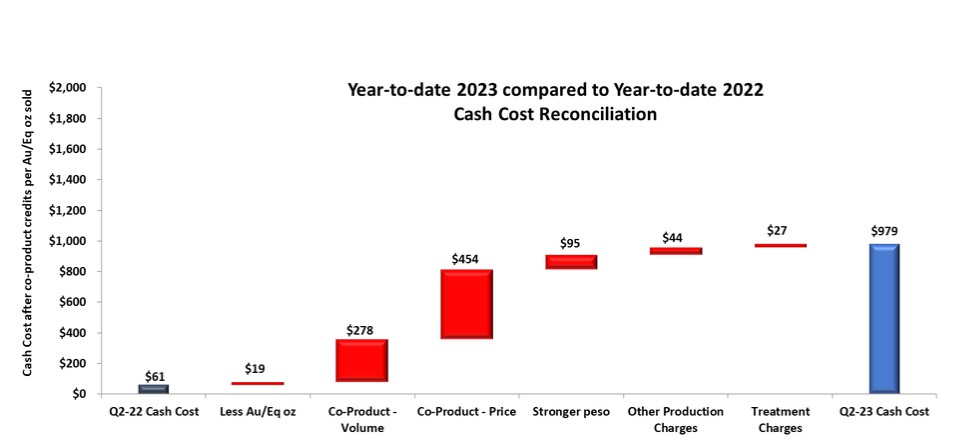

| ● | Total cash cost after co-product credits for the quarter was $1,333 per gold equivalent (“AuEq”) ounce and total all-in sustaining cost (“AISC”) after co-product credits for the quarter was $1,990 per AuEq ounce. Although the year-to-date total cash cost after co-product credits of $979 and total AISC after co-product credits of $1,551 are within guidance, the strengthening of the peso and lower zinc prices may result in needing to revise the full year guidance later in the year. (See Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures below for a reconciliation of non-GAAP measures to applicable GAAP measures). |

| ● | The Company’s At The Market Offering Agreement with H.C. Wainwright & Co., LLC (the “Agent”), which was entered into in November 2019 (the “ATM Agreement”), pursuant to which the Agent agreed to act as the Company’s sales agent with respect to the offer and sale from time to time of the Company’s common stock having an aggregate gross sales price of up to $75.0 million, was renewed in June 2023. |

Gold Resource Corporation

2

PART I - FINANCIAL INFORMATION

ITEM 1. Financial Statements

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM BALANCE SHEETS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

Note |

2023 |

|

2022 |

||

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

17,957 |

|

$ |

23,675 |

Accounts receivable, net |

|

|

4,355 |

|

|

5,085 |

Inventories, net |

4 |

|

10,874 |

|

|

13,500 |

Prepaid expenses and other current assets |

6 |

|

6,776 |

|

|

3,839 |

Total current assets |

|

|

39,962 |

|

|

46,099 |

Property, plant and mine development, net |

7 |

|

145,645 |

|

|

152,563 |

Other non-current assets |

8 |

|

5,465 |

|

|

5,509 |

Total assets |

|

$ |

191,072 |

|

$ |

204,171 |

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

13,114 |

|

$ |

13,329 |

Mining royalty taxes payable, net |

|

|

1,130 |

|

|

3,945 |

Contingent consideration |

12 |

|

2,263 |

|

|

2,211 |

Accrued expenses and other current liabilities |

9 |

|

2,608 |

|

|

5,197 |

Total current liabilities |

|

|

19,115 |

|

|

24,682 |

Reclamation and remediation liabilities |

11 |

|

12,541 |

|

|

10,366 |

Gold and silver stream agreements liability |

10 |

|

44,015 |

|

|

43,466 |

Deferred tax liabilities, net |

5 |

|

4,674 |

|

|

9,224 |

Contingent consideration |

12 |

|

2,191 |

|

|

2,179 |

Other non-current liabilities |

9 |

|

1,835 |

|

|

2,490 |

Total liabilities |

|

|

84,371 |

|

|

92,407 |

Shareholders' equity: |

|

|

|

|

|

|

Common stock - $0.001 par value, 200,000,000 shares authorized: |

|

|

|

|

|

|

88,468,542 and 88,398,109 shares outstanding at June 30, 2023 and December 31, 2022, respectively |

|

|

89 |

|

|

89 |

Additional paid-in capital |

|

|

111,580 |

|

|

111,024 |

Retained earnings |

|

|

2,087 |

|

|

7,706 |

Treasury stock at cost, 336,398 shares |

|

|

(5,884) |

|

|

(5,884) |

Accumulated other comprehensive loss |

|

|

(1,171) |

|

|

(1,171) |

Total shareholders' equity |

|

|

106,701 |

|

|

111,764 |

Total liabilities and shareholders' equity |

|

$ |

191,072 |

|

$ |

204,171 |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

3

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

|

|

For the three months ended |

|

For the six months ended |

||||||||

|

|

June 30, |

|

June 30, |

||||||||

|

Note |

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales, net |

3 |

$ |

24,807 |

|

$ |

37,064 |

|

$ |

56,035 |

|

$ |

82,481 |

Cost of sales: |

|

|

|

|

|

|

|

|

|

|

|

|

Production costs |

|

|

20,302 |

|

|

21,722 |

|

|

40,152 |

|

|

41,796 |

Depreciation and amortization |

|

|

6,474 |

|

|

7,262 |

|

|

13,728 |

|

|

13,220 |

Reclamation and remediation |

|

|

200 |

|

|

61 |

|

|

395 |

|

|

123 |

Total cost of sales |

|

|

26,976 |

|

|

29,045 |

|

|

54,275 |

|

|

55,139 |

Mine gross (loss) profit |

|

|

(2,169) |

|

|

8,019 |

|

|

1,760 |

|

|

27,342 |

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

2,130 |

|

|

1,920 |

|

|

3,323 |

|

|

3,819 |

Mexico exploration expenses |

|

|

1,045 |

|

|

810 |

|

|

2,434 |

|

|

2,047 |

Michigan Back Forty Project expenses |

|

|

395 |

|

|

2,027 |

|

|

845 |

|

|

3,095 |

Stock-based compensation |

16 |

|

7 |

|

|

393 |

|

|

604 |

|

|

1,167 |

Realized and unrealized (gain) loss on zinc zero cost collar |

17 |

|

- |

|

|

(3,799) |

|

|

- |

|

|

338 |

Other expense, net |

18 |

|

711 |

|

|

214 |

|

|

2,180 |

|

|

1,052 |

Total costs and expenses |

|

|

4,288 |

|

|

1,565 |

|

|

9,386 |

|

|

11,518 |

(Loss) income before income taxes |

|

|

(6,457) |

|

|

6,454 |

|

|

(7,626) |

|

|

15,824 |

(Benefit) provision for income taxes |

5 |

|

(1,873) |

|

|

3,781 |

|

|

(2,007) |

|

|

9,132 |

Net (loss) income |

|

$ |

(4,584) |

|

$ |

2,673 |

|

$ |

(5,619) |

|

$ |

6,692 |

Net (loss) income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net (loss) income per common share |

19 |

$ |

(0.05) |

|

$ |

0.03 |

|

$ |

(0.06) |

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

19 |

|

88,468,542 |

|

|

88,343,992 |

|

|

88,437,413 |

|

|

88,341,398 |

Diluted |

19 |

|

88,468,542 |

|

|

88,791,552 |

|

|

88,437,413 |

|

|

88,646,849 |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

4

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share amounts)

(Unaudited)

|

|

For the three months ended June 30, 2023 and 2022 |

||||||||||||||||||

|

|

Number of |

|

Par Value of |

|

Additional Paid- |

|

Retained |

|

Treasury |

|

Accumulated |

|

Total |

||||||

Balance, March 31, 2022 |

|

88,675,172 |

|

$ |

89 |

|

$ |

109,982 |

|

$ |

20,699 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

123,715 |

Stock-based compensation |

|

- |

|

|

- |

|

|

507 |

|

|

- |

|

|

- |

|

|

- |

|

|

507 |

Common stock issued for vested restricted stock units |

|

38,503 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

Dividends declared (1) |

|

- |

|

|

- |

|

|

- |

|

|

(884) |

|

|

- |

|

|

- |

|

|

(884) |

Surrender of stock for taxes due on vesting |

|

(4,585) |

|

|

- |

|

|

(9) |

|

|

- |

|

|

- |

|

|

- |

|

|

(9) |

Net income |

|

- |

|

|

- |

|

|

- |

|

|

2,673 |

|

|

- |

|

|

- |

|

|

2,673 |

Balance, June 30, 2022 |

|

88,709,090 |

|

$ |

89 |

|

$ |

110,480 |

|

$ |

22,488 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

126,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, March 31, 2023 |

|

88,804,940 |

|

$ |

89 |

|

$ |

111,286 |

|

$ |

6,671 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

110,991 |

Stock-based compensation |

|

- |

|

|

- |

|

|

294 |

|

|

- |

|

|

- |

|

|

- |

|

|

294 |

Net loss |

|

- |

|

|

- |

|

|

- |

|

|

(4,584) |

|

|

- |

|

|

- |

|

|

(4,584) |

Balance, June 30, 2023 |

|

88,804,940 |

|

$ |

89 |

|

$ |

111,580 |

|

$ |

2,087 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

106,701 |

| (1) | Cash dividends declared and paid per share was $0.01 for the three months ended June 30, 2022. On February 13, 2023, the Company announced the suspension of future quarterly dividends to protect our balance sheet and to focus capital resources on exploration and growth opportunities. |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

5

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share amounts)

(Unaudited)

|

|

For the six months ended June 30, 2023 and 2022 |

||||||||||||||||||

|

|

Number of |

|

Par Value of |

|

Additional Paid- |

|

Retained |

|

Treasury |

|

Accumulated |

|

Total |

||||||

Balance, December 31, 2021 |

|

88,675,172 |

|

$ |

89 |

|

$ |

110,153 |

|

$ |

17,563 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

120,750 |

Stock-based compensation |

|

- |

|

|

- |

|

|

667 |

|

|

- |

|

|

- |

|

|

- |

|

|

667 |

Net stock options exercised |

|

- |

|

|

- |

|

|

(331) |

|

|

- |

|

|

- |

|

|

- |

|

|

(331) |

Common stock issued for vested restricted stock units |

|

38,503 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

Dividends declared (1) |

|

- |

|

|

- |

|

|

- |

|

|

(1,767) |

|

|

- |

|

|

- |

|

|

(1,767) |

Surrender of stock for taxes due on vesting |

|

(4,585) |

|

|

- |

|

|

(9) |

|

|

- |

|

|

- |

|

|

- |

|

|

(9) |

Net income |

|

- |

|

|

- |

|

|

- |

|

|

6,692 |

|

|

- |

|

|

- |

|

|

6,692 |

Balance, June 30, 2022 |

|

88,709,090 |

|

$ |

89 |

|

$ |

110,480 |

|

$ |

22,488 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

126,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2022 |

|

88,734,507 |

|

$ |

89 |

|

$ |

111,024 |

|

$ |

7,706 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

111,764 |

Stock-based compensation |

|

- |

|

|

- |

|

|

567 |

|

|

- |

|

|

- |

|

|

- |

|

|

567 |

Common stock issued for vested restricted stock units |

|

88,570 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

Surrender of stock for taxes due on vesting |

|

(18,137) |

|

|

- |

|

|

(11) |

|

|

- |

|

|

- |

|

|

- |

|

|

(11) |

Net loss |

|

|

|

|

- |

|

|

- |

|

|

(5,619) |

|

|

- |

|

|

- |

|

|

(5,619) |

Balance, June 30, 2023 |

|

88,804,940 |

|

$ |

89 |

|

$ |

111,580 |

|

$ |

2,087 |

|

$ |

(5,884) |

|

$ |

(1,171) |

|

$ |

106,701 |

| (1) | Cash dividends declared and paid per share were $0.02 for the six months ended June 30, 2022. On February 13, 2023, the Company announced the suspension of future quarterly dividends to protect our balance sheet and to focus capital resources on exploration and growth opportunities. |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 6 CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

GOLD RESOURCE CORPORATION

(U.S. dollars in thousands)

(Unaudited)

|

|

For the six months ended June 30, |

||||

|

Note |

2023 |

|

2022 |

||

Cash flows from operating activities: |

|

|

|

|

|

|

Net (loss) income |

|

$ |

(5,619) |

|

$ |

6,692 |

Adjustments to reconcile net (loss) income to net cash provided by operating activities: |

|

|

|

|

|

|

Deferred income tax benefit |

|

|

(2,965) |

|

|

(1,198) |

Depreciation and amortization, including accretion in reclamation |

|

|

13,772 |

|

|

13,294 |

Stock-based compensation |

|

|

604 |

|

|

1,167 |

Other operating adjustments |

21 |

|

616 |

|

|

(1,827) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

730 |

|

|

2,395 |

Inventories |

|

|

1,762 |

|

|

(1,688) |

Prepaid expenses and other current assets |

|

|

(594) |

|

|

(1,829) |

Other noncurrent assets |

|

|

(72) |

|

|

- |

Accounts payable and other accrued liabilities |

|

|

(2,394) |

|

|

(943) |

Mining royalty and income taxes payable, net |

|

|

(5,367) |

|

|

(3,857) |

Net cash provided by operating activities |

|

|

473 |

|

|

12,206 |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(6,001) |

|

|

(10,518) |

Proceeds from the sale of gold and silver rounds |

|

|

- |

|

|

533 |

Net cash used in investing activities |

|

|

(6,001) |

|

|

(9,985) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Cash settlement of options exercise |

|

|

- |

|

|

(376) |

Dividends paid |

|

|

- |

|

|

(1,767) |

Other financing activities |

|

|

(16) |

|

|

- |

Net cash used in financing activities |

|

|

(16) |

|

|

(2,143) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(174) |

|

|

(455) |

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

(5,718) |

|

|

(377) |

Cash and cash equivalents at beginning of period |

|

|

23,675 |

|

|

33,712 |

Cash and cash equivalents at end of period |

|

$ |

17,957 |

|

$ |

33,335 |

|

|

|

|

|

|

|

Supplemental Cash Flow Information |

|

|

|

|

|

|

Income and mining taxes paid |

|

$ |

6,068 |

|

$ |

15,972 |

Non-cash investing or financing activities |

|

|

|

|

|

|

Change in capital expenditures in accounts payable |

|

$ |

(795) |

|

$ |

(1,094) |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

GOLD RESOURCE CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

June 30, 2023

(Unaudited)

1. Basis of Preparation of Financial Statements

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 7 The Condensed Consolidated Interim Financial Statements (“interim financial statements”) of Gold Resource Corporation and its subsidiaries (collectively, the “Company”) are unaudited and have been prepared in accordance with the rules of the Securities and Exchange Commission (“SEC”) for interim statements. Certain information and footnote disclosures required by United States Generally Accepted Accounting Principles (“U.S. GAAP”) have been condensed or omitted as permitted by such rules, although the Company believes that the disclosures included are adequate to make the information presented not misleading. In the opinion of management, all adjustments (including normal recurring adjustments) and disclosures necessary for a fair presentation of these interim financial statements have been included. The results reported in these interim financial statements are not necessarily indicative of the results that may be reported for the entire year. These interim financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2022 included in the Company’s annual report on Form 10-K (the “2022 Annual Report”). The year-end balance sheet data was derived from the audited financial statements. Unless otherwise noted, there have been no material changes to the footnotes from those accompanying the audited consolidated financial statements contained in the 2022 Annual Report.

Certain items in the prior period’s consolidated financial statements and notes have been reclassified to conform to the current presentation. In the three and six months ended June 30, 2022, exploration expenses included both the Don David Gold Mine (“DDGM”) exploration expenses and the Back Forty Project expenses. In 2023, these are presented on separate lines in the Consolidated Statements of Operations to align with the current presentation. These reclassifications had no effect on the reported results of operations.

2. Recently Adopted Accounting Standards

Recent accounting pronouncements issued have been evaluated and do not presently impact our financial statements and supplemental data.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 8 The Company derives its revenue from the sale of doré and concentrates.

3. Revenue

The following table presents the Company’s net sales for each period presented, disaggregated by source:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

For the six months ended June 30, |

||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

|

|

(in thousands) |

|

(in thousands) |

||||||||

Doré sales, net |

|

|

|

|

|

|

|

|

|

|

|

|

Gold |

|

$ |

543 |

|

$ |

2,484 |

|

$ |

2,268 |

|

$ |

3,728 |

Silver |

|

|

32 |

|

|

57 |

|

|

101 |

|

|

77 |

Less: Refining charges |

|

|

(17) |

|

|

(10) |

|

|

(42) |

|

|

(17) |

Total doré sales, net |

|

|

558 |

|

|

2,531 |

|

|

2,327 |

|

|

3,788 |

Concentrate sales |

|

|

|

|

|

|

|

|

|

|

|

|

Gold |

|

|

7,949 |

|

|

13,850 |

|

|

18,571 |

|

|

28,391 |

Silver |

|

|

6,609 |

|

|

5,146 |

|

|

13,182 |

|

|

11,231 |

Copper |

|

|

2,749 |

|

|

2,708 |

|

|

5,743 |

|

|

6,805 |

Lead |

|

|

2,782 |

|

|

3,768 |

|

|

5,747 |

|

|

7,595 |

Zinc |

|

|

7,928 |

|

|

14,352 |

|

|

17,479 |

|

|

30,669 |

Less: Treatment and refining charges |

|

|

(3,311) |

|

|

(3,127) |

|

|

(6,470) |

|

|

(5,868) |

Total concentrate sales, net |

|

|

24,706 |

|

|

36,697 |

|

|

54,252 |

|

|

78,823 |

Realized gain - embedded derivative, net (1) |

|

|

248 |

|

|

1,160 |

|

|

882 |

|

|

2,026 |

Unrealized (loss) - embedded derivative, net |

|

|

(705) |

|

|

(3,324) |

|

|

(1,426) |

|

|

(2,156) |

Total sales, net |

|

$ |

24,807 |

|

$ |

37,064 |

|

$ |

56,035 |

|

$ |

82,481 |

| (1) | Copper, lead, and zinc are co-products. In the Realized gain - embedded derivative, net, there is $0.1 million loss and $0.3 million gain, respectively, related to these co-products for the three and six months ended June 30, 2023. There is $1.2 million and $1.7 million gain, respectively, in the Realized gain - embedded derivative, net, related to the co-products for the three and six months ended June 30, 2022. |

4. Inventories, net

At June 30, 2023 and December 31, 2022, inventories, net, consisted of the following:

|

|

|

|

|

|

|

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

|

2023 |

|

2022 |

||

|

|

(in thousands) |

||||

Stockpiles - underground mine |

|

$ |

244 |

|

$ |

597 |

Concentrates |

|

|

1,384 |

|

|

3,271 |

Doré, net |

|

|

359 |

|

|

653 |

Subtotal - product inventories |

|

|

1,987 |

|

|

4,521 |

Materials and supplies (1) |

|

|

8,887 |

|

|

8,979 |

Total |

|

$ |

10,874 |

|

$ |

13,500 |

| (1) | Net of reserve for obsolescence of $0.1 million as of June 30, 2023 and December 31, 2022. |

5. Income Taxes

The Company recorded an income tax benefit of $1.9 million and $2.0 million, respectively, for the three and six months ended June 30, 2023. For the three and six months ended June 30, 2022, the Company recorded an income tax expense of $3.8 million and $9.1 million, respectively. In accordance with applicable accounting rules, the interim provision for taxes is calculated using the estimated consolidated annual effective tax rate. The consolidated effective tax rate is a function of the combined effective tax rates for the jurisdictions in which the Company operates. Variations in the relative

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 9 proportions of jurisdictional income could result in fluctuations to the Company’s consolidated effective tax rate.

At the federal level, the Company’s income in the U.S. is taxed at 21%, and a 5% withholding tax applies to dividends received from Mexico. The Mexico income is taxed at 37.5% (30% income tax and 7.5% mining tax), and Canada income is taxed at 26.5%, which results in a consolidated effective tax rate above statutory U.S. Federal rates. The U.S. and Canadian jurisdictions do not currently generate taxable income.

Mexico Mining Taxation

Mining entities in Mexico are subject to two mining duties, in addition to the 30% Mexico corporate income tax: (i) a “special” mining duty of 7.5% of taxable income as defined under Mexican tax law (also referred to as “mining royalty tax”) on extraction activities performed by concession holders, and (ii) the “extraordinary” mining duty of 0.5% on gross revenue from the sale of gold, silver, and platinum. The mining royalty tax is generally applicable to earnings before income tax, depreciation, depletion, amortization, and interest. In calculating the mining royalty tax, there are no Gold Resource Corporation deductions related to depreciable costs from operational fixed assets, but prospecting and exploration expenses are amortized using a 10% rate in a 10-year straight line. Both duties are tax deductible for income tax purposes. As a result, our effective tax rate applicable to the Company’s Mexican operations is higher than Mexico’s statutory rate.

The Company periodically transfers funds from its Mexican wholly owned subsidiary to the U.S. in the form of dividends, which are subject to a 10% Mexico withholding tax, unless otherwise provided per a tax treaty. The current U.S.-Mexico tax treaty limits the dividend withholding tax between these countries to 5%, as long as certain requirements are met. Based on the Company’s understanding that it meets these requirements, the Company pays a 5% withholding tax on dividends paid from Mexico. The impact of the planned annual dividends for 2023 is reflected in the estimated annual effective tax rate. As of June 30, 2023, the Company recorded $0.6 million deferred tax liability related to the 5% withholding tax on funds available for transfer to the U.S. as dividends in the future are no longer deemed to be permanently reinvested in Mexico. If these funds are distributed to the U.S. from Mexico in the future, at that time, they will be subject to the 5% dividend withholding tax payment upon distribution.

As of June 30, 2023, the Company believes that it has no liability for uncertain tax positions.

6. Prepaid Expenses and Other Current Assets

At June 30, 2023 and December 31, 2022, prepaid expenses and other current assets consisted of the following:

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

|

2023 |

|

2022 |

||

|

|

(Unaudited) |

|

|

|

|

|

|

(in thousands) |

||||

Advances to suppliers |

|

$ |

706 |

|

$ |

867 |

Prepaid insurance |

|

|

2,436 |

|

|

1,298 |

Prepaid income tax |

|

|

2,813 |

|

|

432 |

Other current assets |

|

|

821 |

|

|

1,242 |

Total |

|

$ |

6,776 |

|

$ |

3,839 |

A value added (“IVA”) tax in Mexico is assessed on the sales of products and purchases of materials and services. Businesses owe IVA taxes as the business sells a product and collects IVA taxes from its customers. Likewise, businesses are generally entitled to recover the taxes they have paid related to purchases of materials and services, either as a refund or credit to IVA tax payable. Amounts recorded as IVA taxes in the consolidated financial statements represent the net estimated IVA tax payable or receivable, since there is a legal right of offset of IVA taxes. As of June 30, 2023, this resulted in an asset balance, included in Other current assets.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

10

7. Property, Plant and Mine Development, net

At June 30, 2023 and December 31, 2022, property, plant and mine development, net consisted of the following:

|

|

|

|

|

|

|

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

|

2023 |

|

2022 |

||

|

|

(in thousands) |

||||

Asset retirement costs |

|

$ |

7,449 |

|

$ |

7,449 |

Construction-in-progress |

|

|

208 |

|

|

351 |

Furniture and office equipment |

|

|

1,827 |

|

|

1,732 |

Land |

|

|

9,033 |

|

|

9,033 |

Mineral interest |

|

|

79,543 |

|

|

79,543 |

Light vehicles and other mobile equipment |

|

|

2,151 |

|

|

2,327 |

Machinery and equipment |

|

|

41,774 |

|

|

41,343 |

Mill facilities and infrastructure |

|

|

35,915 |

|

|

35,917 |

Mine Development |

|

|

110,625 |

|

|

105,263 |

Software and licenses |

|

|

1,554 |

|

|

1,552 |

Subtotal (1) |

|

|

290,079 |

|

|

284,510 |

Accumulated depreciation and amortization |

|

|

(144,434) |

|

|

(131,947) |

Total |

|

$ |

145,645 |

|

$ |

152,563 |

| (1) | Includes accrued capital expenditures of $0.4 million and $1.3 million at June 30, 2023 and December 31, 2022, respectively. |

The Company recorded depreciation and amortization expense of $6.5 million and $13.7 million, respectively, for the three and six months ended June 30, 2023 as compared to $7.3 million and $13.2 million, respectively, for the same periods ended June 30, 2022.

8. Other Non-current Assets

At June 30, 2023 and December 31, 2022, other non-current assets consisted of the following:

|

|

|

|

|

|

|

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

|

2023 |

|

2022 |

||

|

|

(in thousands) |

||||

Investment in Maritime |

|

$ |

1,418 |

|

$ |

1,559 |

Investment in Green Light Metals |

|

|

3,697 |

|

|

3,611 |

Other non-current assets |

|

|

350 |

|

|

339 |

Total |

|

$ |

5,465 |

|

$ |

5,509 |

Investment in Maritime

On September 22, 2022, the Company invested Canadian Dollar (“C$”) 2.4 million (or $1.7 million) in the common shares of Maritime Resources Corp. The 47 million shares purchased represented 9.9% of the issued and outstanding shares of Maritime. As of June 30, 2023 and December 31, 2022, the value of the investment was $1.4 and $1.6 million, respectively.

Investment in Green Light Metals

A promissory note was acquired in the Aquila Resources Inc. (“Aquila”) acquisition. In October 2021, Aquila sold its Wisconsin assets to Green Light Metals in return for a C$4.9 million ($3.9 million) promissory note. In December 2022, an amended agreement was executed (1) amending the maturity date to December 28, 2022, (2) clarifying the definition of “qualified financing” which set the value to C$0.40 per share for the common shares that were to be issued at maturity; and (3) adding a top-up provision that would result in additional common shares being issued to the Company if any Green

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 11 Light Metals financing was raised at less than C$0.40 per share before March 31, 2023, essentially preventing dilution and ensuring that the total value of the Green Light Metals shares held by the Company at March 31, 2023 remains at C$4.9 million.

Upon maturity on December 28, 2022, the Company received 12,250,000 private shares of Green Light Metals, which settled the promissory note. The shares received represented 28.5% ownership in Green Light Metals at the time. After this settlement and before March 31, 2023, additional financing was raised by Green Light Metals at C$0.40 per share. Therefore, the top-up provision was not triggered and no additional shares were received. The Company’s ownership in Green Light Metals as of June 30, 2023 is approximately 28%. As of June 30, 2023 and as of December 31, 2022, the value of this equity investment was $3.7 and $3.6 million, respectively.

9. Accrued Expenses and Other Liabilities

At June 30, 2023 and December 31, 2022, accrued expenses and other liabilities consisted of the following:

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

|

2023 |

|

2022 |

||

|

|

(in thousands) |

||||

Accrued royalty payments |

|

$ |

1,054 |

|

$ |

1,787 |

Share-based compensation liability |

|

|

147 |

|

|

- |

Liability for Aquila drillhole capping (1) |

|

|

110 |

|

|

- |

Employee profit sharing obligation |

|

|

98 |

|

|

2,206 |

Other payables |

|

|

1,199 |

|

|

1,204 |

Total accrued expenses and other current liabilities |

|

$ |

2,608 |

|

$ |

5,197 |

|

|

|

|

|

|

|

Accrued non-current labor obligation |

|

$ |

1,237 |

|

$ |

1,050 |

Share-based compensation liability |

|

|

506 |

|

|

884 |

Other long-term liabilities |

|

|

92 |

|

|

556 |

Total other non-current liabilities |

|

$ |

1,835 |

|

$ |

2,490 |

| (1) | This is the current portion of the Company’s reclamation and remediation liabilities. Please see Note 11— Reclamation and Remediation in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. |

10. Gold and Silver Stream Agreements

The following table presents the Company’s liabilities related to the Gold and Silver Stream Agreements as of June 30, 2023 and December 31, 2022:

|

|

|

|

|

|

|

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

|

2023 |

|

2022 |

||

|

|

(in thousands) |

||||

Liability related to the Gold Stream Agreement |

|

$ |

20,995 |

|

$ |

20,881 |

Liability related to the Silver Stream Agreement |

|

|

23,020 |

|

|

22,585 |

Total liability |

|

$ |

44,015 |

|

$ |

43,466 |

Periodic interest expense will be incurred based on an implied interest rate. The implied interest rate is determined based on the timing and probability of future production and an 8% discount rate. Interest expense is recorded to the Consolidated Statements of Operations, and the gold and silver stream agreement liability recorded on the Consolidated Balance Sheet. These liabilities approximate fair value.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 12 In November 2017, Aquila entered into a stream agreement with Osisko Bermuda Limited (“OBL”), a wholly owned subsidiary of Osisko Gold Royalties Ltd (TSX & NYSE: OR), pursuant to which OBL agreed to commit approximately $55 million to Aquila through a gold stream purchase agreement.

Gold Streaming Agreement

In June 2020, Aquila amended its agreement with Osisko, reducing the total committed amount to $50 million, as well as adjusting certain milestone dates under the gold stream to align with the current project development timeline. Aquila had received a total of $20 million of the committed funds at the time of the Gold Resource Corporation acquisition. Remaining deposits from OBL are $5 million upon receipt of permits required for the development and operation of the Back Forty Project and $25 million upon the first drawdown of an appropriate project debt finance facility. OBL has been provided a general security agreement over the Back Forty Project, which consists of the subsidiaries of Gold Resource Acquisition Sub. Inc., a 100% owned subsidiary of Gold Resource Corporation. The initial term of the agreement is for 40 years, automatically renewable for successive ten-year periods. The agreement is subject to certain operating and financial covenants, which are in good standing as of June 30, 2023.

The $20 million received from OBL through June 30, 2023 is shown as a long-term liability on the Consolidated Balance Sheet, along with an implied interest. The implied interest rate is applied on OBL advance payments and calculated on the total expected life-of-mine production to be deliverable (as supported in the Back Forty Project Preliminary Economic Assessment) at December 31, 2022 closing gold and silver metal price and is discounted at 8.0%. As the remaining $30 million deposit is subject to the completion of certain milestones and the satisfaction of certain other conditions, this amount is not reflected on the Consolidated Balance Sheet.

Per the terms of the gold stream agreement, OBL will purchase 18.5% of the refined gold from Back Forty (the “Threshold Stream Percentage”) until the Company has delivered 105,000 ounces of gold (the “Production Threshold”). Upon satisfaction of the Production Threshold, the Threshold Stream Percentage will be reduced to 9.25% of the refined gold (the “Tail Stream”). In exchange for the refined gold delivered under the Stream Agreement, OBL will pay the Company ongoing payments equal to 30% of the spot price of gold on the day of delivery, subject to a maximum payment of $600 per ounce. Where the market price of gold is greater than the price paid, the difference realized from the sale of the gold will be applied against the deposit received from Osisko. (See Note 12—Commitments and Contingencies in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information.)

Silver Stream Agreement

Through a series of contracts, Aquila executed a silver stream agreement with OBL to purchase 85% of the silver produced and sold at the Back Forty Project. A total of $17.2 million has been advanced under the agreement of June 30, 2023. There are no future deposits remaining under the agreement. The initial term of the agreement is for 40 years, automatically renewable for successive ten-year periods. The agreement is subject to certain operating and financial covenants, which are in good standing as of June 30, 2023.

Per the terms of the silver stream agreement, OBL will purchase 85% of the silver produced from the Back Forty Project at a fixed price of $4 per ounce of silver. Where the market price of silver is greater than $4 per ounce, the difference realized from the sale of the silver will be applied against the deposit received from Osisko.

The $17.2 million received from OBL through June 30, 2023 is shown as a long-term liability on the Consolidated Balance Sheet along with an implied interest. (See Note 12—Commitments and Contingencies in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information.)

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 13 The following table presents the reclamation and remediation obligations as of June 30, 2023 and December 31, 2022:

11. Reclamation and Remediation

|

|

|

|

|

|

|

|

|

As of |

|

As of |

||

|

|

June 30, |

|

December 31, |

||

|

|

2023 |

|

2022 |

||

|

|

(in thousands) |

||||

Current reclamation and remediation liabilities (1) |

|

$ |

110 |

|

$ |

- |

Non-current reclamation and remediation liabilities |

|

|

12,541 |

|

|

10,366 |

Total |

|

$ |

12,651 |

|

$ |

10,366 |

| (1) | The current portion of reclamation and remediation liabilities are included in Accrued expenses and other current liabilities. Please see Note 9— Accrued Expenses and Other Liabilities in Item 1— Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. |

The following table presents the changes in reclamation and remediation obligations for the six months ended June 30, 2023 and the year ended December 31, 2022:

|

|

2023 |

|

2022 |

||

|

|

(in thousands) |

||||

Reclamation liabilities – balance at beginning of period |

|

$ |

1,949 |

|

$ |

1,833 |

Foreign currency exchange loss |

|

|

260 |

|

|

116 |

Reclamation liabilities – balance at end of period |

|

|

2,209 |

|

|

1,949 |

|

|

|

|

|

|

|

Asset retirement obligation – balance at beginning of period (1) |

|

|

8,417 |

|

|

1,279 |

Changes in estimate (1) |

|

|

- |

|

|

6,384 |

Liability for Aquila drillhole capping (2) |

|

|

514 |

|

|

- |

Accretion |

|

|

354 |

|

|

668 |

Foreign currency exchange loss |

|

|

1,157 |

|

|

86 |

Asset retirement obligation – balance at end of period |

|

|

10,442 |

|

|

8,417 |

Total period end balance |

|

$ |

12,651 |

|

$ |

10,366 |

| (1) | In 2022, the Company updated its closure plan study, which resulted in a $6.4 million increase in the estimated liability and asset retirement costs. This increase is a result of formalizing a tailings storage facility closure plan, the addition of the dry stack facility and the filtration plant, and the increase of inflation in Mexico. |

| (2) | As of December 31, 2022, the Company reported the liability to remediate exploration drill holes at the Back Forty Project in Michigan, USA in other non-current liabilities. As of March 31, 2023, this liability was reclassified to non-current reclamation and remediation liabilities. Upon completion of the optimization work and the related mine closure plan, an asset for asset retirement obligation and corresponding liability for reclamation and remediation will be recorded. |

The Company’s undiscounted reclamation liabilities of $2.2 million and $1.9 million as of June 30, 2023 and December 31, 2022, respectively, are related to the Don David Gold Mine in Mexico. These represent reclamation liabilities that were expensed through 2013 before proven and probable reserves were established and the Company was considered to be a development stage entity; therefore, most of the costs, including asset retirement costs, were not allowed to be capitalized as part of our Property, Plant & Mine Development.

The Company’s asset retirement obligations reflect the additions to the asset for reclamation and remediation costs in Property, Plant & Mine Development, post 2013 development stage status, which are discounted using a credit adjusted risk-free rate of 8%. As of June 30, 2023 and December 31, 2022, the Company’s asset retirement obligation related to was $10.4 million and $8.4 million, respectively, and was mostly related to the Don David Gold Mine in Mexico.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 14 As of June 30, 2023 and December 31, 2022, the Company has equipment purchase commitments of approximately $0.7 million and $1.2 million, respectively.

12. Commitments and Contingencies

Commitments

Contingent Consideration

With the Aquila acquisition, the Company assumed a contingent consideration related to the December 30, 2013, Aquila acquisition of 100% of the shares of HudBay Michigan Inc. (“HMI”), a subsidiary of HudBay Minerals Inc. (“HudBay”), effectively giving Aquila 100% ownership in the Back Forty Project (the “HMI Acquisition”). Pursuant to the HMI Acquisition, HudBay’s 51% interest in the Back Forty Project was acquired in consideration for the issuance of common shares of Aquila, future milestone payments tied to the development of the Back Forty Project, and a 1% net smelter return royalty on production from certain land parcels in the project. The issuance of shares and 1% net smelter obligations were settled before the Company acquired Aquila.

The contingent consideration is composed of the following in Canadian dollars:

The value of future installments is based on C$9 million tied to development of the Back Forty project as follows:

| a. | C$3 million payable on completion of any form of financing for purposes including the commencement of construction of Back Forty. Up to 50% of the C$3 million can be paid, at the Company’s option, in Gold Resource Corporation shares with the balance payable in cash. (If, as of the tenth anniversary of the HMI acquisition by Aquila, this milestone has not been achieved or payment made, HudBay has the right to repurchase a 51% ownership in the Back Forty Project); |

| b. | C$2 million payable in cash 90 days after the commencement of commercial production; |

| c. | C$2 million payable in cash 270 days after the commencement of commercial production; and |

| d. | C$2 million payable in cash 450 days after the commencement of commercial production. |

The value of the contingent consideration as of June 30, 2023 was $4.5 million, including $2.3 million in current liabilities and $2.2 million in non-current liabilities. As the Company has the option to pay the first milestone payment of C$3 million ($2.3 million) in 2023 in order to prevent the repurchase of 51% ownership by HMI, this portion is presented as a current liability, with $2.2 million remaining in long-term liability. The contingent consideration is adjusted for the time value of money and the likelihood of the milestone payments. Any future changes in the value of the contingent consideration will be recognized in the Consolidated Statements of Operations.

Other Contingencies

The Company has certain other contingencies resulting from litigation, claims, and other commitments and is subject to a variety of environmental and safety laws and regulations incident to the ordinary course of business. The Company currently has no basis to conclude that any or all of such contingencies will materially affect its financial position, results of operations, or cash flows. However, in the future, there may be changes to these contingencies, or additional contingencies may occur, any of which might result in an accrual or a change in current accruals recorded by the Company, and there can be no assurance that their ultimate disposition will not have a material adverse effect on the Company’s financial position, results of operations or cash flows.

With the acquisition of Aquila Resources Inc. on December 10, 2021, the Company assumed substantial liabilities that relate to the gold and silver stream agreements with Osisko Bermuda Limited. Under the agreements, Osisko deposited a total of $37.2 million upfront in exchange for a portion of the future gold and silver production from the Back Forty Project. The stream agreements contain customary provisions regarding default and security. In the event that our subsidiary defaults under the stream agreements, including failing to achieve commercial production at a future date, it may be required

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 15 to repay the deposit plus accumulated interest at a rate agreed with Osisko.

If it fails to do so, Osisko may be entitled to enforce its remedies as a secured party and take possession of the assets that comprise the Back Forty Project.

13. Shareholders’ Equity

No dividends were declared and paid in 2023. During the three and six months ended June 30, 2022, the Company declared and paid dividends of $0.01 per common share and $0.02 per common share for an aggregate total of $0.9 million and $1.8 million, respectively.

14. Derivatives

Embedded Derivatives

Concentrate Sales

Concentrate sales contracts contain embedded derivatives due to the provisional pricing terms for unsettled shipments. At the end of each reporting period, the Company records an adjustment to accounts receivable and revenue to reflect the mark-to-market adjustments for outstanding provisional invoices based on forward metal prices. Please see Note—20 Fair Value Measurement in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information on the realized and unrealized gain (loss) recorded to adjust accounts receivable and revenue.

The following table summarizes the Company’s unsettled sales contracts at June 30, 2023 with the quantities of metals under contract subject to final pricing expected to occur through August 2023:

|

|

Gold |

|

Silver |

|

Copper |

|

Lead |

|

Zinc |

|

|

Total |

|||||

|

|

(ounces) |

|

(ounces) |

|

(tonnes) |

|

(tonnes) |

|

(tonnes) |

|

|

|

|||||

Under contract |

|

|

4,681 |

|

|

334,989 |

|

|

326 |

|

|

2,371 |

|

|

4,681 |

|

|

|

Average forward price (per ounce or tonne) |

|

$ |

1,954 |

|

$ |

23.65 |

|

$ |

8,434 |

|

$ |

2,110 |

|

|

2,719 |

|

|

|

Unsettled sales contracts value (in thousands) |

|

$ |

9,147 |

|

$ |

7,922 |

|

$ |

2,749 |

|

$ |

5,003 |

|

$ |

12,728 |

|

$ |

37,549 |

Other Derivatives

Zinc zero cost collar

Derivative instruments that are not designated as hedging instruments are required to be recorded on the balance sheet at fair value. Changes in fair value will impact the Company’s earnings through mark-to-market adjustments until the physical commodity is delivered or the financial instrument is settled. The fair value does not reflect the realized or cash value of the instrument. As of December 31, 2022, the Company’s hedge program concluded, but the Company may utilize similar programs in the future to manage near-term exposure to cash flow variability from metal prices.

The Company manages credit risk by selecting counterparties believed to be financially strong, by entering into netting arrangements with counterparties and by requiring other credit risk mitigants, as appropriate. The Company actively evaluates the creditworthiness of its counterparties, assigns appropriate credit limits, and monitors credit exposures against those assigned limits.

15. Employee Benefits

Effective October 2012, the Company adopted a profit sharing plan (the “Plan”) which covers all U.S. employees. The Plan meets the requirements of a qualified retirement plan pursuant to the provisions of Section 401(k) of the Internal Revenue Code. The Plan also provides eligible employees the opportunity to make tax deferred contributions to a retirement trust account up to 90% of their qualified wages, subject to the IRS annual maximums.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 16 Under Mexican law, employees are entitled to receive statutory profit sharing (Participación a los Trabajadores de las Utilidades or “PTU”) payments.

The required cash payment to employees in the aggregate is equal to 10% of their employer’s profit subject to PTU, which differs from profit determined under U.S. GAAP. Please see Note 9—Accrued Expenses and Other Liabilities in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information.

16. Stock-Based Compensation

The Company’s compensation program comprises three main elements: base salary, an annual short-term incentive plan (“STIP”) cash award, and long-term equity-based incentive compensation (“LTIP”) in the form of deferred stock units (“DSUs”), restricted stock units (“RSUs”), stock options, and performance share units (“PSUs”).

The Gold Resource Corporation 2016 Equity Incentive Plan (the “Incentive Plan”) allows for the issuance of up to 5 million shares of common stock in the form of incentive and non-qualified stock options, stock appreciation rights, RSUs, stock grants, stock units, performance shares, PSUs, and performance cash. Additionally, pursuant to the terms of the Incentive Plan, any award outstanding under the prior plan that is terminated, expired, forfeited, or canceled for any reason, will be available for grant under the Incentive Plan.

DSUs of nil and 278,663, respectively, were granted to the Board of Directors during the three and six months ended June 30, 2023. DSUs of nil and 214,357 were granted to the Board of Directors during the three and six months ended June 30, 2022, respectively. DSUs are vested immediately and redeemable in cash or shares at the earlier of 10 years or upon the eligible directors’ termination. Termination is deemed to occur on the earliest of: (1) the date of voluntary resignation or retirement of the director from the Board; (2) the date of death of the director; or (3) the date of removal of the director from the Board whether by shareholder resolution, failure to achieve re-election, or otherwise; and on which date the director is not a director or employee of the Company or any of its affiliates. These awards contain a cash settlement feature and are therefore classified as a liability and are marked to market each reporting period.

The Company may also issue DSUs for directors in lieu of board fees at their request. During the three and six months ended June 30, 2023, respectively, there were 17,652 and 31,301 DSUs granted in lieu of board fees that are also subject to mark-to-market adjustment. During the three and six months ended June 30, 2022, respectively, there were 3,352 and 6,708 DSUs granted in lieu of board fees that are also subject to mark-to-market adjustment. Additionally, during the first quarter of 2023, executives were granted 212,407 DSUs in lieu of half of their STIP cash bonus for 2022.

During both the three and six months ended June 30, 2023, there were 323,900 DSUs redeemed for the cash value of $0.3 million. There were no DSU redemptions during the same periods in 2022.

As of June 30, 2023 and 2022, the non-current liability balances related to DSUs were $0.4 million and $0.6 million, respectively. For the three months ended June 30, 2023 and 2022, respectively, the changes in liabilities related to DSUs resulted in $0.3M million and $0.2 million credit to stock-based compensation expense. For the six months ended June 30, 2023 and 2022, respectively, the changes in liabilities related to DSUs resulted in $0.1 million and $0.4 million stock-based compensation expense, respectively.

RSUs of 167,133 and 779,192 were granted during the three and six months ended June 30, 2023, respectively. RSUs of 377,076 and 611,681 were granted during the three and six months ended June 30, 2022, respectively. During the three and six months ended June 30, 2023, respectively, a total of nil and 195,525 RSUs vested. Both during the three and six months ended June 30, 2022, a total of 77,801 RSUs vested. For the RSUs vesting in 2023, 70,433 common shares were issued with an intrinsic value and a fair value of $61,981, RSUs of 18,137 were withheld for taxes due to net settlement, and 106,955 RSUs were deferred.

No stock options were granted nor exercised during the three and six months ended June 30, 2023. Stock options of nil and 320,816 were granted during the three and six months ended June 30, 2022, respectively. Stock options of nil and 355,000, respectively, were exercised during the three and six months ended June 30, 2022. The exercises in 2022 were settled in cash.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 17 PSUs of nil and 534,890 were granted during the three and six months ended June 30, 2023 respectively.

PSUs of 400,894 and 695,041 were granted during the three and six months ended June 30, 2022, respectively. PSUs cliff vest usually in three years based on the relative and absolute total shareholder return of a predetermined peer group and are expected to be settled in cash.

During the three and six months ended June 30, 2023, there were 60,214 and 98,483 PSUs, respectively, forfeited due to employee terminations. There were no forfeitures during the same periods in 2022.

As of June 30, 2023 and 2022, the current liability balances related to PSUs were $0.1 million and nil, respectively, and the non-current liability balances related to PSUs were $0.2 million and $0.1 million, respectively.

Stock-based compensation expense for the periods presented is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

For the six months ended June 30, |

||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

|

|

(in thousands) |

|

(in thousands) |

||||||||

Deferred stock units |

|

|

(288) |

|

|

(207) |

|

|

69 |

|

|

370 |

Restricted stock units |

|

|

174 |

|

|

256 |

|

|

327 |

|

|

304 |

Stock options |

|

$ |

120 |

|

$ |

250 |

|

$ |

240 |

|

$ |

399 |

Performance stock units |

|

|

1 |

|

|

94 |

|

|

(32) |

|

|

94 |

Total |

|

$ |

7 |

|

$ |

393 |

|

$ |

604 |

|

$ |

1,167 |

The Company’s STIP for its management team provides annual cash payable upon achievement of specified performance metrics. As of June 30, 2023, the Company accrued $0.8 million payable in cash related to the 2023 STIP program.

17. Zinc Zero Cost Collar

During the three and six months ended June 30, 2023 and 2022, the realized and unrealized (gains) losses related to the Company’s zinc zero cost collar are the following:

|

|

For the three months ended June 30, |

|

For the six months ended June 30, |

||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

|

|

(in thousands) |

|

(in thousands) |

||||||||

Realized loss on zinc zero cost collar |

|

$ |

- |

|

$ |

829 |

|

$ |

- |

|

$ |

2,457 |

Unrealized gain on zinc zero cost collar (1) |

|

|

- |

|

|

(4,628) |

|

|

- |

|

|

(2,119) |

Total |

|

$ |

- |

|

$ |

(3,799) |

|

$ |

- |

|

$ |

338 |

| (1) | Gains and losses due to changes in fair value are non-cash in nature until such time that they are realized through cash transactions. |

On May 18, 2021, the Company entered into a Trading Agreement with Auramet International LLC that governs nonexchange traded, over-the-counter, spot, forward and option transactions on both a deliverable and non-deliverable basis involving various metals and currencies. Gains and losses due to changes in fair value are non-cash in nature until such time that they are realized through cash transactions. Please see Note 14—Derivatives in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. As of December 31, 2022, the Company’s hedge program concluded, but the Company may utilize similar programs in the future to manage near-term exposure to cash flow variability from metal prices.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited) 18 Other expense, net, for the periods presented consisted of the following:

18. Other Expense, net

|

|

For the three months ended June 30, |

|

For the six months ended June 30, |

||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

|

|

(in thousands) |

|

(in thousands) |

||||||||

Unrealized currency exchange (gain) loss (1) |

|

$ |

(114) |

|

$ |

77 |

|

$ |

339 |

|

$ |

522 |

Realized currency exchange loss |

|

|

133 |

|

|

30 |

|

|

309 |

|

|

159 |

Realized and unrealized loss (gain) from gold and silver rounds, net |

|

|

6 |

|

|

8 |

|

|

(3) |

|

|

(28) |

Loss on disposal of fixed assets |

|

|

12 |

|

|

- |

|

|

12 |

|

|

- |

Interest on streaming liabilities |

|

|

275 |

|

|

134 |

|

|

549 |

|

|

310 |

Severance (2) |

|

|

267 |

|

|

- |

|

|

877 |

|

|

- |

Other expense (income) |

|

|

132 |

|

|

(35) |

|

|

97 |

|

|

89 |

Total |

|

$ |

711 |

|

$ |

214 |

|

$ |

2,180 |

|

$ |

1,052 |

| (1) | Gains and losses due to changes in fair value are non-cash in nature until such time that they are realized through cash transactions. For additional information regarding the Company’s fair value measurements and investments, please see Note 20—Fair Value Measurement in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. |

| (2) | This is due to an organized reduction of workforce and leadership change at DDGM in Mexico. |

19. Net Income per Common Share

Basic net income per common share is calculated based on the weighted average number of common shares outstanding for the period. Diluted earnings per common share are calculated based on the assumption that stock options and other dilutive securities outstanding, which have an exercise price less than the average market price of the Company’s common shares during the period, would have been exercised on the later of the beginning of the period or the date granted and that the funds obtained from the exercise were used to purchase common shares at the average market price during the period. All the Company’s RSUs are considered to be dilutive in periods with net income.

The effect of the Company’s dilutive securities is calculated using the treasury stock method and only those instruments that result in a reduction in net income per common share are included in the calculation. Options to purchase 1.5 million shares of common stock at weighted average exercise prices of $2.88 were outstanding as of June 30, 2023 but had no dilutive effect due to the net loss. Options to purchase 2.3 million shares of common stock at a weighted average exercise prices of $4.49 were outstanding as of June 30, 2022 but were not included in the computation of diluted weighted average common shares outstanding, as the exercise price of the options exceeded the average price of the Company’s common stock during the reporting period, and therefore are anti-dilutive.

Basic and diluted net income per common share is calculated as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

||||||||

|

|