UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___ to ___

Commission File Number 001-35023

iBio, Inc.

(Exact name of registrant as specified in its charter)

Delaware |

|

26-2797813 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

8800 HSC Parkway, Bryan, TX |

|

77807-1107 |

(Address of principal executive offices) |

|

(Zip Code) |

(979) 446-0027

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

IBIO |

|

NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated Filer ☐ |

|

|

|

|

|

Accelerated Filer ☐ |

Non-accelerated Filer ☒ |

|

|

|

|

|

Smaller reporting company ☒ |

|

|

|

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Shares of Common Stock outstanding as of May 10, 2023: 16,798,014

iBio, Inc.

TABLE OF CONTENTS

3 |

||

|

|

|

Consolidated Financial Statements (Unaudited) |

3 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 |

|

45 |

||

45 |

||

|

|

|

46 |

||

|

|

|

46 |

||

46 |

||

51 |

||

51 |

||

|

|

|

52 |

||

2

PART I - FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements (Unaudited).

iBio, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

|

|

March 31, |

|

June 30, |

||

|

|

2023 |

|

2022 |

||

|

|

(Unaudited) |

|

(See Note 2) |

||

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,562 |

|

$ |

22,676 |

Investments in debt securities |

|

|

— |

|

|

10,845 |

Accounts receivable - trade |

|

|

70 |

|

|

1,000 |

Subscription receivable |

|

|

260 |

|

|

— |

Settlement receivable - current portion |

|

|

— |

|

|

5,100 |

Convertible promissory note receivable and accrued interest |

|

|

912 |

|

|

— |

Prepaid expenses and other current assets |

|

|

921 |

|

|

1,549 |

Current assets held for sale |

|

|

18,368 |

|

|

3,900 |

Total Current Assets |

|

|

27,093 |

|

|

45,070 |

|

|

|

|

|

|

|

Restricted cash |

|

|

3,253 |

|

|

5,996 |

Convertible promissory note receivable and accrued interest |

|

|

775 |

|

|

1,631 |

Finance lease right-of-use assets, net of accumulated amortization |

|

|

678 |

|

|

— |

Operating lease right-of-use asset |

|

|

2,786 |

|

|

3,068 |

Fixed assets, net of accumulated depreciation |

|

|

4,358 |

|

|

1,373 |

Intangible assets, net of accumulated amortization |

|

|

5,393 |

|

|

4,851 |

Security deposits |

|

|

50 |

|

|

29 |

Prepaid expenses - noncurrent |

|

|

— |

|

|

74 |

Noncurrent assets held for sale |

|

|

— |

|

|

37,314 |

Total Assets |

|

$ |

44,386 |

|

$ |

99,406 |

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

2,013 |

|

$ |

4,264 |

Accrued expenses |

|

|

3,821 |

|

|

3,764 |

Finance lease obligations - current portion |

|

|

265 |

|

|

— |

Operating lease obligation - current portion |

|

|

377 |

|

|

91 |

Equipment financing payable - current portion |

|

|

156 |

|

|

— |

Term note payable - net of deferred financing costs |

|

|

13,700 |

|

|

22,161 |

Contract liabilities |

|

|

— |

|

|

100 |

Current liabilities related to assets held for sale |

|

|

1,944 |

|

|

56 |

Total Current Liabilities |

|

|

22,276 |

|

|

30,436 |

|

|

|

|

|

|

|

Finance lease obligations - net of current portion |

|

|

422 |

|

|

— |

Operating lease obligation - net of current portion |

|

|

3,225 |

|

|

3,514 |

Equipment financing payable - net of current portion |

|

|

283 |

|

|

— |

Accrued expenses - noncurrent |

|

|

791 |

|

|

— |

Noncurrent liabilities related to assets held for sale |

|

|

— |

|

|

1,971 |

|

|

|

|

|

|

|

Total Liabilities |

|

|

26,997 |

|

|

35,921 |

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

Series 2022 Convertible Preferred Stock - $0.001 par value; 1,000,000 shares authorized; 0 and 1,000 shares issued and outstanding as of March 31, 2023 and June 30, 2022, respectively |

|

|

— |

|

|

— |

Common Stock - $0.001 par value; 275,000,000 shares authorized at March 31, 2023 and June 30, 2022; 15,818,149 and 8,727,158 shares issued and outstanding as of March 31, 2023 and June 30, 2022, respectively |

|

|

16 |

|

|

9 |

Additional paid-in capital |

|

|

300,280 |

|

|

287,619 |

Accumulated other comprehensive loss |

|

|

— |

|

|

(213) |

Accumulated deficit |

|

|

(282,907) |

|

|

(223,930) |

Total Stockholders’ Equity |

|

|

17,389 |

|

|

63,485 |

Total Liabilities and Stockholders' Equity |

|

$ |

44,386 |

|

$ |

99,406 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited; in thousands, except per share amounts)

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||

|

|

March 31, |

|

March 31, |

||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

— |

|

$ |

1,800 |

|

$ |

— |

|

$ |

1,884 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,644 |

|

|

3,272 |

|

|

7,971 |

|

|

6,265 |

General and administrative |

|

|

3,525 |

|

|

5,316 |

|

|

16,407 |

|

|

14,863 |

Total operating expenses |

|

|

6,169 |

|

|

8,588 |

|

|

24,378 |

|

|

21,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(6,169) |

|

|

(6,788) |

|

|

(24,378) |

|

|

(19,244) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(35) |

|

|

— |

|

|

(66) |

|

|

— |

Interest income |

|

|

23 |

|

|

40 |

|

|

163 |

|

|

111 |

Loss on sale of debt securities |

|

|

(98) |

|

|

— |

|

|

(98) |

|

|

— |

Royalty income |

|

|

— |

|

|

2 |

|

|

— |

|

|

7 |

Total other income (expense) |

|

|

(110) |

|

|

42 |

|

|

(1) |

|

|

118 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net loss from continuing operations |

|

|

(6,279) |

|

|

(6,746) |

|

|

(24,379) |

|

|

(19,126) |

Net loss attributable to noncontrolling interest |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

Net loss attributable to iBio, Inc. from continuing operations |

|

|

(6,279) |

|

|

(6,746) |

|

|

(24,379) |

|

|

(19,125) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock dividends - iBio CDMO Tracking Stock |

|

|

— |

|

|

— |

|

|

— |

|

|

(88) |

Net loss available to iBio, Inc. stockholders from continuing operations |

|

|

(6,279) |

|

|

(6,746) |

|

|

(24,379) |

|

|

(19,213) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations |

|

|

(1,015) |

|

|

(5,644) |

|

|

(34,598) |

|

|

(14,124) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss available to iBio, Inc. stockholders |

|

$ |

(7,294) |

|

$ |

(12,390) |

|

$ |

(58,977) |

|

$ |

(33,337) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net loss |

|

$ |

(7,294) |

|

$ |

(12,390) |

|

$ |

(58,977) |

|

$ |

(33,250) |

Other comprehensive income (loss) - unrealized gain (loss) on debt securities |

|

|

134 |

|

|

(103) |

|

|

180 |

|

|

(131) |

Other comprehensive income - foreign currency adjustment |

|

|

33 |

|

|

— |

|

|

33 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss |

|

$ |

(7,127) |

|

$ |

(12,493) |

|

$ |

(58,764) |

|

$ |

(33,381) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share attributable to iBio, Inc. stockholders - basic and diluted - continuing operations |

|

$ |

(0.47) |

|

$ |

(0.77) |

|

$ |

(2.30) |

|

$ |

(2.20) |

Loss per common share attributable to iBio, Inc. stockholders - basic and diluted - discontinued operations |

|

$ |

(0.08) |

|

$ |

(0.65) |

|

$ |

(3.27) |

|

$ |

(1.62) |

Loss per common share attributable to iBio, Inc. stockholders - basic and diluted - total |

|

$ |

(0.55) |

|

$ |

(1.42) |

|

$ |

(5.57) |

|

$ |

(3.82) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding - basic and diluted |

|

|

13,184 |

|

|

8,719 |

|

|

10,592 |

|

|

8,719 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Equity

(Unaudited; in thousands)

Nine Months Ended March 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

Other |

|

|

|

|

|

|

||

|

|

Preferred Stock |

|

Common Stock |

|

Paid-In |

|

Comprehensive |

|

Accumulated |

|

|

|

||||||||||

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Capital |

|

Loss |

|

Deficit |

|

Total |

|||||||

Balance as of July 1, 2022 |

|

|

1 |

|

$ |

— |

|

8,727 |

|

$ |

9 |

|

$ |

287,619 |

|

$ |

(213) |

|

$ |

(223,930) |

|

$ |

63,485 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital raise |

|

|

— |

|

|

— |

|

176 |

|

|

— |

|

|

1,151 |

|

|

— |

|

|

— |

|

|

1,151 |

Conversion of preferred stock to common stock |

|

|

(1) |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Common stock issued - RubrYc transaction |

|

|

— |

|

|

— |

|

102 |

|

|

— |

|

|

650 |

|

|

— |

|

|

— |

|

|

650 |

Vesting of RSUs |

|

|

— |

|

|

— |

|

1 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Share-based compensation |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

1,222 |

|

|

— |

|

|

— |

|

|

1,222 |

Unrealized loss on available-for-sale debt securities |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(10) |

|

|

— |

|

|

(10) |

Net loss |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(18,130) |

|

|

(18,130) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2022 |

|

|

— |

|

$ |

— |

|

9,006 |

|

$ |

9 |

|

$ |

290,642 |

|

$ |

(223) |

|

$ |

(242,060) |

|

$ |

48,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital raise |

|

|

— |

|

|

— |

|

3,366 |

|

|

3 |

|

|

3,497 |

|

|

— |

|

|

— |

|

|

3,500 |

Cost to raise capital |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

(636) |

|

|

— |

|

|

— |

|

|

(636) |

Payment for fractional shares after reverse stock split |

|

|

— |

|

|

— |

|

(8) |

|

|

— |

|

|

(39) |

|

|

— |

|

|

— |

|

|

(39) |

Vesting of RSUs |

|

|

— |

|

|

— |

|

4 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Share-based compensation |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

1,127 |

|

|

— |

|

|

— |

|

|

1,127 |

Unrealized gain on available-for-sale debt securities |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

56 |

|

|

— |

|

|

56 |

Net loss |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(33,553) |

|

|

(33,553) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2022 |

|

|

— |

|

$ |

— |

|

12,368 |

|

$ |

12 |

|

$ |

294,591 |

|

$ |

(167) |

|

$ |

(275,613) |

|

$ |

18,823 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vesting of RSUs |

|

|

— |

|

|

— |

|

28 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Capital raise |

|

|

— |

|

|

— |

|

3,422 |

|

|

4 |

|

|

4,093 |

|

|

— |

|

|

— |

|

|

4,097 |

Share-based compensation |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

1,596 |

|

|

— |

|

|

— |

|

|

1,596 |

Unrealized gain on debt securities |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

113 |

|

|

— |

|

|

113 |

Reclassification adjustment for loss on available-for-sale debt securities realized in net income |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

21 |

|

|

— |

|

|

21 |

Foreign currency translation adjustment |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

33 |

|

|

— |

|

|

33 |

Net loss |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(7,294) |

|

|

(7,294) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2023 |

|

|

— |

|

$ |

— |

|

15,818 |

|

$ |

16 |

|

$ |

300,280 |

|

$ |

— |

|

$ |

(282,907) |

|

$ |

17,389 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Equity

(Unaudited; in thousands)

Nine Months Ended March 31, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

Other |

|

|

|

|

|

|

|

|

|

||

|

|

Preferred Stock |

|

Common Stock |

|

Paid-In |

|

Comprehensive |

|

Accumulated |

|

Noncontrolling |

|

|

|

|||||||||||

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Capital |

|

Loss |

|

Deficit |

|

Interest |

|

Total |

||||||||

Balance as of July 1, 2021 |

|

|

— |

|

$ |

— |

|

8,715 |

|

$ |

9 |

|

$ |

282,266 |

|

$ |

(63) |

|

$ |

(173,627) |

|

$ |

(17) |

|

$ |

108,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercise of stock options |

|

|

— |

|

|

— |

|

3 |

|

|

— |

|

|

77 |

|

|

— |

|

|

— |

|

|

— |

|

|

77 |

Share-based compensation |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

821 |

|

|

— |

|

|

— |

|

|

— |

|

|

821 |

Unrealized loss on debt securities |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(1) |

|

|

— |

|

|

— |

|

|

(1) |

Net loss |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(8,939) |

|

|

(1) |

|

|

(8,940) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2021 |

|

|

— |

|

$ |

— |

|

8,718 |

|

$ |

9 |

|

$ |

283,164 |

|

$ |

(64) |

|

$ |

(182,566) |

|

$ |

(18) |

|

$ |

100,525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vesting of RSUs |

|

|

— |

|

|

— |

|

4 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Warrant issued for Transaction |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

967 |

|

|

— |

|

|

— |

|

|

— |

|

|

967 |

Acquisition of remaining portion of iBio CDMO |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

(68) |

|

|

— |

|

|

— |

|

|

18 |

|

|

(50) |

Share-based compensation |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

1,103 |

|

|

— |

|

|

— |

|

|

— |

|

|

1,103 |

Unrealized loss on debt securities |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(27) |

|

|

— |

|

|

— |

|

|

(27) |

Net loss |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(11,920) |

|

|

— |

|

|

(11,920) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2021 |

|

|

— |

|

$ |

— |

|

8,722 |

|

$ |

9 |

|

$ |

285,166 |

|

$ |

(91) |

|

$ |

(194,486) |

|

$ |

— |

|

$ |

90,598 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vesting of RSUs |

|

|

— |

|

|

— |

|

4 |

|

|

— |

|

|

1 |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

Cost to raise capital |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Exercise of stock options |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Share-based compensation |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

1,274 |

|

|

— |

|

|

— |

|

|

— |

|

|

1,274 |

Foreign currency translation adjustment |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Unrealized loss on debt securities |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(103) |

|

|

— |

|

|

— |

|

|

(103) |

Net loss |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(12,390) |

|

|

— |

|

|

(12,390) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2022 |

|

|

— |

|

$ |

— |

|

8,726 |

|

$ |

9 |

|

$ |

286,441 |

|

$ |

(194) |

|

$ |

(206,876) |

|

$ |

— |

|

$ |

79,380 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited; in Thousands)

|

|

Nine Months Ended |

|

||||

|

|

March 31, |

|

||||

|

|

2023 |

|

2022 |

|

||

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Consolidated net loss |

|

$ |

(58,977) |

|

$ |

(33,250) |

|

Adjustments to reconcile consolidated net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

Share-based compensation |

|

|

3,945 |

|

|

3,198 |

|

Amortization of intangible assets |

|

|

121 |

|

|

333 |

|

Amortization of finance lease right-of-use assets |

|

|

156 |

|

|

587 |

|

Amortization of operating lease right-of-use assets |

|

|

290 |

|

|

386 |

|

Depreciation of fixed assets |

|

|

508 |

|

|

1,532 |

|

Gain on sale of fixed assets |

|

|

(732) |

|

|

— |

|

Accrued interest receivable on convertible promissory note receivable |

|

|

(56) |

|

|

(56) |

|

Amortization of premiums on debt securities |

|

|

67 |

|

|

269 |

|

Loss on sale of debt securities |

|

|

98 |

|

|

— |

|

Amortization of deferred financing costs |

|

|

160 |

|

|

67 |

|

Inventory reserve |

|

|

4,915 |

|

|

— |

|

Impairment of fixed assets |

|

|

17,600 |

|

|

— |

|

Impairment of intangible assets |

|

|

565 |

|

|

— |

|

Gain on disposition of finance lease ROU assets |

|

|

(5) |

|

|

— |

|

Forgiveness of note payable and accrued interest - SBA loan |

|

|

— |

|

|

(607) |

|

Settlement of revenue contract |

|

|

— |

|

|

(84) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable - trade |

|

|

931 |

|

|

(890) |

|

Settlement receivable |

|

|

5,100 |

|

|

5,100 |

|

Inventory |

|

|

(1,015) |

|

|

(3,257) |

|

Prepaid expenses and other current assets |

|

|

627 |

|

|

(494) |

|

Prepaid expenses - noncurrent |

|

|

74 |

|

|

(975) |

|

Security deposit |

|

|

(21) |

|

|

(5) |

|

Accounts payable |

|

|

(481) |

|

|

1,649 |

|

Accrued expenses |

|

|

(18) |

|

|

618 |

|

Accrued expenses - noncurrent |

|

|

791 |

|

|

— |

|

Operating lease obligations |

|

|

(9) |

|

|

(12) |

|

Contract liabilities |

|

|

(100) |

|

|

(86) |

|

Net cash used in operating activities |

|

|

(25,466) |

|

|

(25,977) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Purchases of debt securities |

|

|

— |

|

|

(5,355) |

|

Redemption of debt securities |

|

|

4,100 |

|

|

9,711 |

|

Sale of debt securities |

|

|

6,739 |

|

|

— |

|

Purchase of equity security |

|

|

— |

|

|

(1,760) |

|

Additions to intangible assets |

|

|

— |

|

|

(4,300) |

|

Purchases of fixed assets |

|

|

(5,232) |

|

|

(3,900) |

|

Sales proceeds for fixed assets |

|

|

2,100 |

|

|

— |

|

Payment for RubrYc asset acquisition |

|

|

(692) |

|

|

— |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities |

|

|

7,015 |

|

|

(5,604) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from sales of common stock |

|

|

7,851 |

|

|

— |

|

Payments for fractional shares after reverse stock split |

|

|

(39) |

|

|

— |

|

Acquisition of noncontrolling interest |

|

|

— |

|

|

(50) |

|

Proceeds from equipment financing loan |

|

|

500 |

|

|

— |

|

Payment of equipment financing loan |

|

|

(62) |

|

|

— |

|

Payment of term note payable |

|

|

(8,523) |

|

|

— |

|

Proceeds from exercise of stock options |

|

|

— |

|

|

77 |

|

Costs to attain term note |

|

|

(22) |

|

|

(322) |

|

Payment of finance lease obligation |

|

|

(144) |

|

|

(5,820) |

|

Net cash used in financing activities |

|

|

(439) |

|

|

(6,115) |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes |

|

|

33 |

|

|

— |

|

|

|

|

|

|

|

|

|

Net decrease in cash, cash equivalents and restricted cash |

|

|

(18,857) |

|

|

(37,696) |

|

Cash, cash equivalents and restricted cash - beginning |

|

|

28,672 |

|

|

77,404 |

|

Cash, cash equivalents and restricted cash - end |

|

$ |

9,815 |

|

$ |

39,708 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited; in Thousands)

|

|

Nine Months Ended |

|

||||

|

|

March 31, |

|

||||

|

|

2023 |

|

2022 |

|

||

Schedule of non-cash activities: |

|

|

|

|

|

|

|

Fixed assets included in accounts payable in prior period, paid in current period |

|

$ |

1,769 |

|

$ |

791 |

|

Increase in finance lease ROU assets for new leases |

|

$ |

814 |

|

$ |

— |

|

Increase in finance lease obligation for new leases |

|

$ |

814 |

|

$ |

— |

|

RubrYc asset acquisition by issuance of common stock |

|

$ |

650 |

|

$ |

— |

|

Costs to raise capital paid directly from gross proceeds |

|

$ |

636 |

|

$ |

— |

|

Sales of fixed assets receivable |

|

$ |

460 |

|

$ |

— |

|

Subscription receivable |

|

$ |

260 |

|

$ |

— |

|

Cost accrued to amend term note payable |

|

$ |

75 |

|

$ |

— |

|

Unpaid fixed assets included in accounts payable |

|

$ |

21 |

|

$ |

2,193 |

|

Termination of finance ROU assets including issuance of warrant |

|

$ |

— |

|

$ |

25,386 |

|

Note payable to acquire Facility |

|

$ |

— |

|

$ |

22,375 |

|

Increase in operating lease ROU assets for new lease - net of lease incentive |

|

$ |

— |

|

$ |

5,570 |

|

Settlement of revenue contract |

|

$ |

— |

|

$ |

580 |

|

Issuance of warrant for final finance lease obligation payment |

|

$ |

— |

|

$ |

217 |

|

Lease incentive for construction in progress |

|

$ |

— |

|

$ |

82 |

|

Acquisition of noncontrolling interest |

|

$ |

— |

|

$ |

18 |

|

Unrealized (gain) loss on available-for-sale debt securities |

|

$ |

(159) |

|

$ |

131 |

|

Supplemental cash flow information: |

|

|

|

|

|

|

|

Cash paid during the period for interest |

|

$ |

523 |

|

$ |

860 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

8

iBio, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Nature of Business

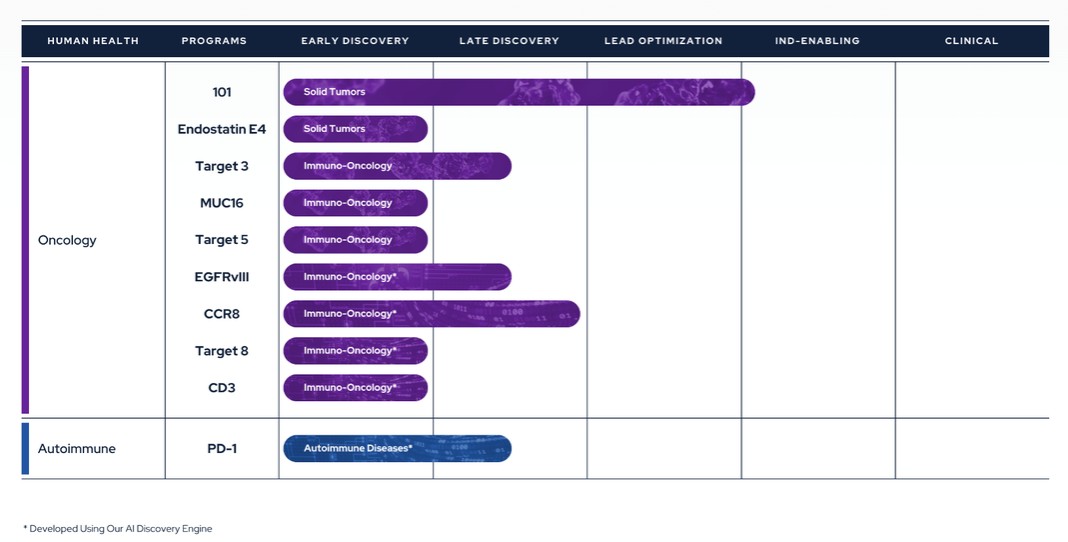

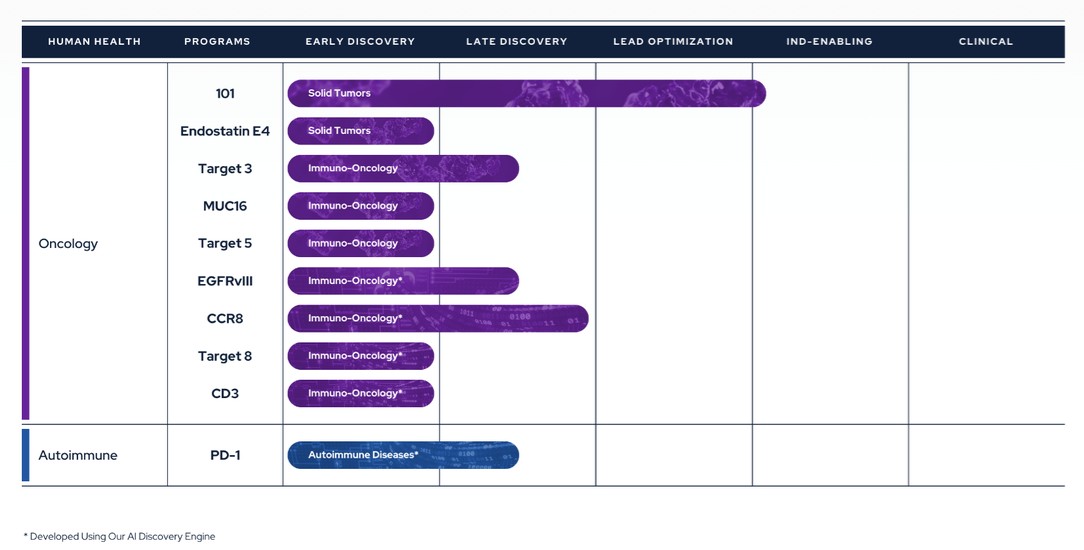

iBio, Inc. (“we”, “us”, “our”, “iBio”, “iBio, Inc” or the “Company”) is an Artificial Intelligence (“AI”)-driven innovator of precision antibody immunotherapies. The Company has a pipeline of innovative primarily immuno-oncology antibodies against hard-to-drug targets where it may face reduced competition and with antibodies that may be more selective. The Company plans to use its AI-driven discovery platform to continue adding antibodies against hard-to-drug targets or to work with partners on AI-driven drug development.

Therapeutics Pipeline

IBIO-101: an anti-CD25 molecule that works by depletion of immunosuppressive T-regulatory cells (“Tregs”) via antibody-dependent cellular cytotoxicity (“ADCC”), without disrupting activation of effector T-cells (“Teffs”) in the tumor microenvironment. IBIO-101 could potentially be used to treat solid tumors, hairy cell leukemia, relapsed multiple myeloma, lymphoma, or head and neck cancer. IBIO-101 is currently in the Investigational New Drug (“IND”) enabling stage. We have contracted with a contract research organization (“CRO”) to assist with the development of the manufacturing process, which includes but is not limited to process and cell line development for the production of the drug substance and drug product. IBIO-101 is strategically positioned as a fast follower to Hoffman-La Roche’s RG6292 molecule that recently released Phase 1 clinical data. While RG6292 showed signs of efficacy, especially in combination with PD-L1 monoclonal antibody, and was well tolerated, we anticipate additional clinical research will be needed to determine whether different cancer types are more efficacious than others. As a result, we have decided to pause the IND enabling studies until additional data is released on RG6292. This approach will allow us to gather more information, thoroughly evaluate the market potential and optimize our financial resources and the development plan for IBIO-101 to maximize its potential for success.

CCR8: targets depletion of highly immunosuppressive CCR8+ Tregs in the tumor microenvironment via an ADCC mechanism with selective binding to CCR8 over its closely related cousin, CCR4, to avoid off-target effects. A CCR8 program could potentially be broadly applicable in solid tumors and/or as a prospective combination therapy.

EGFRvIII: binds a tumor-specific mutation of EGFR variant III with an afucosylated antibody for high ADCC. Because of its specificity binding to the tumor-specific mutation, it could potentially reduce toxicity and/or expand the therapeutic window compared to simple broad EGFR-targeted alternatives. EGFRvIII is constantly “switched on” which can lead to the development of a range of different cancers. An EGFRvIII antibody could potentially be used to treat glioblastoma, head and neck cancer or non-small cell lung cancer.

9

CD3 antibody panel: provides a range of CD3 affinities with cross-reactivity to non-human primates and increased the humanness of the antibody sequences. The antibody panel is intended to serve as one arm of T-cell-redirecting bispecific antibodies, a new class of therapeutic antibodies designed to simultaneously bind to T-cells via CD3 and to tumor cells via tumor-specific antigens or tumor-associated antigens, inducing T-cell-mediated killing of tumor cells.

MUC16: a highly expressed target on ovarian cancer cells and an attractive tumor associated target for therapeutic antibodies. However, antibodies targeting MUC16 are prone to tumor resistance via epitope shedding and dysregulated glycosylation. Epitope-steered antibodies that bind to an epitope that avoids both of these tumor resistance mechanisms could potentially be used to treat MUC16 positive tumors, particularly those tumors that are resistant to other MUC16 antibodies.

PD-1 Agonist: selectively binds PD-1 to suppress auto-reactive T-cells without PD-L1/PD-L2 blocking. A PD-1 agonist could potentially be used to treat inflammatory bowel disease, systemic lupus erythematosus, multiple sclerosis or other inflammatory diseases.

In addition to the programs described above, the Company also has three additional early discovery programs that have the potential to advance into later stages of preclinical development and are designed to tackle hard-to-drug targets.

IBIO-100 and Endostatin E4

Our preclinical anti-fibrotic program, IBIO-100, has been undergoing a review process as part of our ongoing effort to prioritize our resources and focus on the most promising opportunities. The IBIO-100 program design is based upon work by Dr. Carol Feghali-Bostwick, Professor of Medicine at the Medical University of South Carolina and Vice-Chair of the Scleroderma Foundation. Her initial work was conducted at the University of Pittsburgh, and we have licensed the patents relevant for the continued development of the molecule from the university. After careful consideration, in February 2023, the Company terminated all efforts on IBIO-100 anti-fibrotic program and provided a six (6) month notice of termination of the license agreement to the University of Pittsburgh, as required by the license agreement. Pursuant to the license agreement with the University of Pittsburgh, the Company’s financial obligations for the management of the patents under the license will cease on August 14, 2023, and at such time, will transition back to the University of Pittsburgh.

As part of this decision, we are intending to complete the pre-clinical cancer studies we are conducting in collaboration with University of Texas Southwestern using E4 endostatin peptide, which is derived from IBIO-100. After the pre-clinical studies are completed, we will re-assess whether to further pursue the oncology program and have further discussions with the University of Pittsburgh. This approach allows us to gather valuable data and insights that will inform our future decisions regarding the potential of E4 endostatin peptide as an oncology program.

AI Drug Discovery Platform

In September 2022, the Company purchased substantially all of the assets of RubrYc Therapeutics (for a complete description of the transaction please see Note 6 – Significant Transactions). The AI Drug Discovery platform technology is designed to be used to discover antibodies that bind to hard-to-target subdominant and conformational epitopes for further development within our existing portfolio or in partnership with outside entities. The RubrYc AI platform is built upon three key technologies.

| 1. | Epitope Targeting Engine: A patented machine-learning platform that combines computational biology and 3D-modeling to identify molecules that mimic hard-to-target binding sites on target proteins, specifically, subdominant and conformational epitopes. The creation of these small mimics enables the engineering of therapeutic antibody candidates that can selectively bind immune and cancer cells better than ”trial and error” antibody engineering and screening methods that are traditionally focused on dominant epitopes. |

| 2. | RubrYcHuTM Library: An AI-generated human antibody library free of significant sequence liabilities that provides a unique pool of antibodies to screen. The combination of the Epitope Targeting Engine and screening with the RubrYcHu Library has been shown to reduce the discovery time from ideation to in vivo proof-of-concept (“PoC’) by up to four months. This has the potential to enable more, and better, therapeutic candidates to reach the clinic faster. |

| 3. | StableHuTM Library: An AI-powered sequence optimization library used to improve antibody performance. Once an antibody has been advanced to the lead optimization stage, StableHu allows precise and rapid optimization of the antibody binding regions to rapidly move a candidate molecule into the IND-enabling stage. |

On January 3, 2023, the United States Patent and Trademark Office issued U.S. Patent No. 11,545,238, entitled “Machine Learning Method for Protein Modelling to Design Engineered Peptides,” which, among other claims, covers a machine learning model for engineering peptides, including antibody epitope therapeutics.

10

Subject to any potential patent term extensions, the patent will expire on May 13, 2040.

2. Basis of Presentation

Interim Consolidated Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared from the books and records of the Company and include all normal and recurring adjustments which, in the opinion of management, are necessary for a fair presentation in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim consolidated financial information and Rule 8-03 of Regulation S-X promulgated by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, these interim financial statements do not include all of the information and footnotes required for complete annual consolidated financial statements. Interim results are not necessarily indicative of the results that may be expected for the full year. Interim unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the prior year ended June 30, 2022, filed with the SEC on October 11, 2022 (the “Annual Report”), from which the accompanying condensed consolidated balance sheet dated June 30, 2022 was derived.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated as part of the consolidation. Non-controlling interest in the consolidated financial statements represented the share of the loss in iBio CDMO, LLC (“iBio CDMO”) for an affiliate of Eastern Capital Limited (“Eastern Capital”) through November 1, 2021, the date the Company acquired the remaining interest in iBio CDMO. See Note 6 – Significant Transactions.

Going Concern

The history of significant losses, the negative cash flow from operations, the limited cash resources on hand and the dependence by the Company on its ability to obtain additional financing to fund its operations after the current cash resources are exhausted raise substantial doubt about the Company's ability to continue as a going concern. In an effort to remain a going concern and increase cash reserves, the Company completed a public equity offering, reduced its work force by approximately 60% (a reduction of approximately 69 positions) in November 2022, and ceased operations of its CDMO facility thereby reducing annual spend on expenses by approximately 50%. Additionally, in July 2022, the Company initiated the selling of the CDMO assets and facility, and since then has sold a substantial portion of the CDMO assets. (See Note 3 – Discontinued Operations for more information.) Additional potential options being considered to further increase liquidity include lowering the Company’s expenses further, focusing product development on a select number of product candidates, the sale of the CDMO, the sale or out-licensing of certain product candidates, additional equipment sales, raising money from capital markets, grant revenue or collaborations, or a combination thereof.

The Company’s cash, cash equivalents, and restricted cash of $9.8 million as of March 31, 2023, is not anticipated to be sufficient to support operations through the first quarter of Fiscal 2024 unless the Company reduces its burn rate further, sells the CDMO facility for amounts above its term note payable, or increases its capital as described above. Regardless of whether the Company is able to reduce its burn rate or sell or out-license certain assets or parts of the business, the Company will need to raise additional capital in order to fully execute its near and long-term business plan. It is the Company’s goal to implement one or more potential options described above to allow the Company to have a cash runway for at least 12 months from the date of the filing of this Quarterly Report on Form 10-Q. However, there can be no assurance that the Company will be successful in implementing any of the options that it is evaluating.

The accompanying consolidated financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

Reverse Stock Split

On September 22, 2022, the Company's Board of Directors approved the implementation of a reverse stock split (the “Reverse Split”) at a ratio of one-for-twenty five (1:25) shares of the Company's common stock, par value $0.001 (the “Common Stock”). The Reverse Split was effective as of October 7, 2022. All share and per share amounts of the Common Stock presented have been retroactively adjusted to reflect the Reverse Split. See Note 16 – Stockholders’ Equity for more information.

11

3. Discontinued Operations

On November 3, 2022, the Company announced it is seeking to divest its contract development and manufacturing organization (iBio CDMO, LLC) in order to complete its transformation into an antibody discovery and development company. In conjunction with the divestment, the Company commenced a workforce reduction of approximately 60% of the current Company staffing levels (a reduction of approximately 69 positions). The Company substantially completed the employee reduction by January 2, 2023. Through the process of seeking to divest its contract development and manufacturing organization, the Company continues to market for sale the 130,000-square-foot cGMP facility location in Bryan, Texas (the “Facility”). Additionally, on February 10, 2021, the Company, entered into an Auction Sale Agreement (the “Auction Sale Agreement”) with Holland Industrial Group, together with Federal Equipment Company and Capital Recovery Group LLC (collectively, the “Auctioneers”) for the sale at public auction of equipment and other tangible personal property (the “Equipment”) located at the Facility. The Auctioneer guaranteed an amount of gross proceeds from the sale of the equipment of $2.1 million, which was paid to the Company on February 17, 2023. The auction, which commenced on March 24, 2023 and concluded on March 30, 2023, resulted in total proceeds of approximately $2.9 million. In accordance with the Auction Sale Agreement, the Company received 80% of the excess proceeds, after Holland Industrial Group’s $0.2 million fee, which approximated $0.5 million during the fourth quarter of Fiscal 2023 and is included in prepaid and other assets as of March 31, 2023.

The Company incurred pre-tax charges of approximately $1.9 million for the employee reduction which consisted of severance obligations, continuation of salaries and benefits over a 60-day transitional period during which impacted employees remain employed but were not expected to provide active service, and other customary employee benefit payments in connection with an employee reduction. At March 31, 2023, $0.1 million remains in accrued expenses as a current liability. The Company recorded a charge in discontinued operations for $34.6 million for the nine months ended March 31, 2023, of which approximately $17.6 million was the result of a fixed asset impairment charge (see Note 11 – Fixed Assets for more information), approximately $4.9 million to write down inventory to its net realizable value, approximately $7.5 million of personnel costs including severance and the balance related to operational costs related to winding down the CDMO business.

As such, the results of iBio CDMO's operations are reported as discontinued operations for the three and nine months ended March 31, 2023. The Company has retrospectively recast its condensed consolidated statement of operations for the three and nine months ended March 31, 2022 presented. In addition, those assets and liabilities associated with the discontinued operations of the CDMO that the Company intends to sell have been classified as “held for sale” as of March 31, 2023. The Company has retrospectively recast its consolidated balance sheet as of June 30, 2022 for assets and liabilities held for sale. The Company has chosen not to segregate the cash flows of iBio CDMO in the consolidated statement of cash flows. Supplemental disclosures related to discontinued operations for the statements of cash flows have been provided below. Unless noted otherwise, discussion in the Notes to the Condensed Consolidated Financial Statements refers to the Company's continuing operations.

The following table presents a reconciliation of the major financial lines constituting the results of operations for discontinued operations to the loss from discontinued operations presented separately in the condensed consolidated statements of operations (in thousands):

|

|

Three Months Ended |

|

Three Months Ended |

||

|

|

March 31, |

|

March 31, |

||

|

|

2023 |

|

2022 |

||

Revenues |

|

$ |

205 |

|

$ |

143 |

Cost of goods sold |

|

|

25 |

|

|

48 |

Gross profit |

|

|

180 |

|

|

95 |

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

837 |

|

|

2,278 |

General and administrative |

|

|

929 |

|

|

3,211 |

Gain on sale of fixed assets |

|

|

(732) |

|

|

— |

Total operating expenses |

|

|

1,034 |

|

|

5,489 |

|

|

|

|

|

|

|

Other expenses: |

|

|

|

|

|

|

Interest expense - term note payable |

|

|

(158) |

|

|

(249) |

Other |

|

|

(3) |

|

|

(1) |

Total other expenses |

|

|

(161) |

|

|

(250) |

|

|

|

|

|

|

|

Loss from discontinued operations |

|

$ |

(1,015) |

|

$ |

(5,644) |

12

|

|

Nine Months Ended |

|

Nine Months Ended |

||

|

|

March 31, |

|

March 31, |

||

|

|

2023 |

|

2022 |

||

Revenues |

|

$ |

391 |

|

$ |

438 |

Cost of goods sold |

|

|

52 |

|

|

201 |

Gross profit |

|

|

339 |

|

|

237 |

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

6,361 |

|

|

5,128 |

General and administrative |

|

|

6,165 |

|

|

8,659 |

Fixed asset impairments |

|

|

17,600 |

|

|

— |

Gain on sale of fixed assets |

|

|

(732) |

|

|

— |

Inventory reserve |

|

|

4,933 |

|

|

— |

Total operating expenses |

|

|

34,327 |

|

|

13,787 |

|

|

|

|

|

|

|

Other income (expenses): |

|

|

|

|

|

|

Interest expense - term note payable |

|

|

(606) |

|

|

(372) |

Interest expense - related party |

|

|

— |

|

|

(810) |

Forgiveness of note payable and accrued interest - SBA loan |

|

|

— |

|

|

607 |

Other |

|

|

(4) |

|

|

1 |

Total other income (expenses) |

|

|

(610) |

|

|

(574) |

|

|

|

|

|

|

|

Loss from discontinued operations |

|

$ |

(34,598) |

|

$ |

(14,124) |

The following table presents net carrying values related to the major classes of assets that were classified as held for sale at March 31, 2023 and June 30, 2022 (in thousands):

|

|

March 31, |

|

June 30, |

||

|

|

2023 |

|

2022 |

||

Current assets: |

|

|

|

|

|

|

Inventory |

|

$ |

— |

|

$ |

3,900 |

Operating lease right-of-use assets |

|

|

1,944 |

|

|

— |

Property and equipment, net |

|

|

16,424 |

|

|

— |

Total current assets |

|

$ |

18,368 |

|

$ |

3,900 |

|

|

|

|

|

|

|

Other assets: |

|

|

|

|

|

|

Property and equipment, net |

|

$ |

— |

|

$ |

35,289 |

Finance lease right-of-use assets |

|

|

— |

|

|

74 |

Operating lease right-of-use assets |

|

|

— |

|

|

1,951 |

Total other assets |

|

$ |

— |

|

$ |

37,314 |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Finance lease obligation |

|

$ |

— |

|

$ |

46 |

Operating lease obligation |

|

|

1,944 |

|

|

10 |

Total current liabilities |

|

$ |

1,944 |

|

$ |

56 |

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

Finance lease obligation |

|

$ |

— |

|

$ |

30 |

Operating lease obligation |

|

|

— |

|

|

1,941 |

Total long-term liabilities |

|

$ |

— |

|

$ |

1,971 |

13

The following table presents the supplemental disclosures related to discontinued operations for the statements of cash flows (in thousands):

|

|

Nine Months Ended |

|

Nine Months Ended |

||

|

|

March 31, |

|

March 31, |

||

|

|

2023 |

|

2022 |

||

Depreciation expense |

|

$ |

273 |

|

$ |

1,532 |

Amortization of finance lease right-of-use assets |

|

|

20 |

|

|

587 |

Purchase of fixed assets |

|

|

1,041 |

|

|

28,384 |

Fixed asset impairments |

|

|

17,600 |

|

|

— |

Inventory reserve |

|

|

4,933 |

|

|

— |

Sales proceeds of fixed assets |

|

|

2,100 |

|

|

— |

Investing non-cash transactions: |

|

|

|

|

|

|

Fixed assets included in accounts payable in prior period, paid in current period |

|

|

1,542 |

|

|

791 |

Unpaid fixed assets included in accounts payable |

|

|

— |

|

|

2,193 |

Sales of fixed assets receivable |

|

|

460 |

|

|

— |

4. Summary of Significant Accounting Policies

The Company’s significant accounting policies are described in Note 3 of the Notes to Consolidated Financial Statements in the Annual Report.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. These estimates include liquidity assertions, the valuation of intellectual property and fixed assets held for sale, the incremental borrowing rate utilized in the finance and operating lease calculations, legal and contractual contingencies and share-based compensation. Although management bases its estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances, actual results could differ from these estimates.

Accounts Receivable

Accounts receivable are reported at their outstanding unpaid principal balances net of allowances for uncollectible accounts. The Company provides for allowances for uncollectible receivables based on its estimate of uncollectible amounts considering age, collection history, and other factors considered appropriate. Management’s policy is to write off accounts receivable against the allowance for doubtful accounts when a balance is determined to be uncollectible. At March 31, 2023 and June 30, 2022, the Company determined that an allowance for doubtful accounts was not needed. The Company had accounts receivable of $426,000 at June 30, 2021.

Revenue Recognition

The Company accounts for its revenue recognition under Accounting Standards Codification ("ASC") 606, Revenue from Contracts with Customers. Under this standard, the Company recognizes revenue when a customer obtains control of promised services or goods in an amount that reflects the consideration to which the Company expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from customer contracts.

The Company’s contract revenue consists primarily of amounts earned under contracts with third-party customers and reimbursed expenses under such contracts. The Company analyzes its agreements to determine whether the elements can be separated and accounted for individually or as a single unit of accounting. Allocation of revenue to individual elements that qualify for separate accounting is based on the separate selling prices determined for each component, and total contract consideration is then allocated pro rata across the components of the arrangement. If separate selling prices are not available, the Company will use its best estimate of such selling prices, consistent with the overall pricing strategy and after consideration of relevant market factors.

In general, the Company applies the following steps when recognizing revenue from contracts with customers: (i) identify the contract, (ii) identify the performance obligations, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations and (v) recognize revenue when a performance obligation is satisfied.

14

Recognition of revenue is driven by satisfaction of the performance obligations using one of two methods: revenue is either recognized over time or at a point in time. Contracts containing multiple performance obligations classify those performance obligations into separate units of accounting either as standalone or combined units of accounting. For those performance obligations treated as a standalone unit of accounting, revenue is generally recognized based on the method appropriate for each standalone unit. For those performance obligations treated as a combined unit of accounting, revenue is generally recognized as the performance obligations are satisfied, which generally occurs when control of the goods or services have been transferred to the customer or client or once the client or customer is able to direct the use of those goods and/or services as well as obtaining substantially all of its benefits. As such, revenue for a combined unit of accounting is generally recognized based on the method appropriate for the last delivered item but due to the specific nature of certain project and contract items, management may determine an alternative revenue recognition method as appropriate, such as a contract whereby one deliverable in the arrangement clearly comprises the overwhelming majority of the value of the overall combined unit of accounting. Under this circumstance, management may determine revenue recognition for the combined unit of accounting based on the revenue recognition guidance otherwise applicable to the predominant deliverable.

If a loss on a contract is anticipated, such loss is recognized in its entirety when the loss becomes evident. When the current estimates of the amount of consideration that is expected to be received in exchange for transferring promised goods or services to the customer indicates a loss will be incurred, a provision for the entire loss on the contract is made. At March 31, 2023 and June 30, 2022, the Company had no contract loss provisions.

Fixed-Fee

Under a fixed-fee contract, the Company charges a fixed agreed upon amount for a deliverable. Fixed-fee contracts have fixed deliverables upon completion of the project. Typically, the Company recognizes revenue for fixed-fee contracts after projects are completed, delivery is made and title transfers to the customer, and collection is reasonably assured.

Revenue can be recognized either 1) over time or 2) at a point in time. All revenue was recognized at a point in time for all periods presented.

For the three months ended March 31, 2022, revenue was recognized from a license agreement and for the nine months ended March 31, 2022, revenue was recognized from a license agreement and the settlement of a revenue contract. No revenue was recognized for all other periods presented.

Time and Materials

Under a time and materials contract, the Company charges customers an hourly rate plus reimbursement for other project specific costs. The Company recognizes revenue for time and material contracts based on the number of hours devoted to the project multiplied by the customer’s billing rate plus other project specific costs incurred.

Contract Assets

A contract asset is an entity’s right to payment for goods and services already transferred to a customer if that right to payment is conditional on something other than the passage of time. Generally, an entity will recognize a contract asset when it has fulfilled a contract obligation but must perform other obligations before being entitled to payment.

Contract assets consist primarily of the cost of project contract work performed by third parties for which the Company expects to recognize any related revenue at a later date, upon satisfaction of the contract obligations. At March 31, 2023 and June 30, 2022, contract assets were $0.

Contract Liabilities

A contract liability is an entity’s obligation to transfer goods or services to a customer at the earlier of (1) when the customer prepays consideration or (2) the time that the customer’s consideration is due for goods and services the entity will yet provide. Generally, an entity will recognize a contract liability when it receives a prepayment.

Contract liabilities consist primarily of consideration received, usually in the form of payment, on project work to be performed whereby the Company expects to recognize any related revenue at a later date, upon satisfaction of the contract obligations. At March 31, 2023, June 30, 2022, and June 30, 2021, contract liabilities were $0, $100,000 and $423,000, respectively. The Company recognized revenue of $53,000 and $100,000 during the three and nine months ended March 31, 2023, respectively, that was included in the contract liabilities balance as of June 30, 2022 and was reported in discontinued operations. The Company recognized revenue of $52,000 and $178,000 during the three and nine months ended March 31, 2022, respectively, that was included in the contract liabilities balance as of June 30, 2021 and was reported in discontinued operations. The Company recognized revenue of $0 and $84,000 during the three and nine months ended March 31, 2022 that was included in the contract liabilities balance as of June 30, 2021 and reported as part of continuing operations.

15

Leases

The Company accounts for leases under the guidance of Accounting Standards Codification ("ASC") 842, Leases ("ASC 842"). The standard established a right-of-use (“ROU”) model requiring a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months and classified as either an operating or finance lease. The adoption of ASC 842 had a significant effect on the Company’s balance sheet, resulting in an increase in non-current assets and both current and non-current liabilities.

In accordance with ASC 842, at the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on the unique facts and circumstances present and the classification of the lease including whether the contract involves the use of a distinct identified asset, whether the Company obtains the right to substantially all the economic benefit from the use of the asset, and whether the Company has the right to direct the use of the asset. Leases with a term greater than one year are recognized on the balance sheet as ROU assets, lease liabilities and, if applicable, long-term lease liabilities. The Company has elected not to recognize on the balance sheet leases with terms of one year or less under practical expedient in paragraph ASC 842-20-25-2. For contracts with lease and non-lease components, the Company has elected not to allocate the contract consideration and to account for the lease and non-lease components as a single lease component.