UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2023

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-33190

MCEWEN MINING INC.

(Exact name of registrant as specified in its charter)

Colorado |

|

84-0796160 |

(State or other jurisdiction of |

|

(I.R.S. Employer |

incorporation or organization) |

|

Identification No.) |

150 King Street West, Suite 2800, Toronto, Ontario Canada M5H 1J9

(Address of principal executive offices) (ZIP code)

(866) 441-0690

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock, no par value |

MUX |

New York Stock Exchange (“NYSE”) |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 47,427,584 shares outstanding as of May 8, 2023.

MCEWEN MINING INC.

FORM 10-Q

Index

|

|

|

3 |

||

|

|

|

|

3 |

|

|

|

|

|

Consolidated Balance Sheets at March 31, 2023 and December 31, 2022 (unaudited) |

4 |

|

|

|

|

5 |

|

|

|

|

|

Consolidated Statements of Cash Flows for the three months ended March 31, 2023 and 2022 (unaudited) |

6 |

|

|

|

|

7 |

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

|

|

|

|

37 |

||

|

|

|

39 |

||

|

|

|

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

40 |

||

|

|

|

41 |

||

|

|

|

42 |

||

2

PART I – FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

MCEWEN MINING INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED)

(in thousands of U.S. dollars, except per share)

|

Three months ended March 31, |

|

|

||||

|

2023 |

|

2022 |

|

|

||

Revenue from gold and silver sales |

$ |

34,752 |

|

$ |

25,542 |

|

|

Production costs applicable to sales |

|

(23,413) |

|

|

(27,824) |

|

|

Depreciation and depletion |

|

(6,896) |

|

|

(3,712) |

|

|

Gross profit (loss) |

|

4,443 |

|

|

(5,994) |

|

|

|

|

|

|

|

|

|

|

OTHER OPERATING EXPENSES: |

|

|

|

|

|

|

|

Advanced projects - Los Azules |

|

(31,880) |

|

|

(9,756) |

|

|

Advanced projects - Other |

|

(1,680) |

|

|

(1,379) |

|

|

Exploration |

|

(5,900) |

|

|

(3,210) |

|

|

General and administrative |

|

(3,441) |

|

|

(1,981) |

|

|

Loss from investment in Minera Santa Cruz S.A. (Note 9) |

|

(3,461) |

|

|

(1,120) |

|

|

Depreciation |

|

(282) |

|

|

(142) |

|

|

Reclamation and remediation (Note 11) |

|

(630) |

|

|

(527) |

|

|

|

|

(47,274) |

|

|

(18,115) |

|

|

Operating loss |

|

(42,831) |

|

|

(24,109) |

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

Interest and other finance income (expenses), net |

|

8,464 |

|

|

(1,640) |

|

|

Other (expense) income (Note 3) |

|

(2,579) |

|

|

3,871 |

|

|

Total other income |

|

5,885 |

|

|

2,231 |

|

|

Loss before income and mining taxes |

|

(36,946) |

|

|

(21,878) |

|

|

Income and mining tax recovery |

|

536 |

|

|

814 |

|

|

Net loss after income and mining taxes |

|

(36,410) |

|

|

(21,064) |

|

|

Net (income) loss attributable to non-controlling interests (Note 17) |

|

(6,666) |

|

|

334 |

|

|

Net loss and comprehensive loss attributable to McEwen shareholders |

$ |

(43,076) |

|

$ |

(20,730) |

|

|

|

|

|

|

|

|

|

|

Net loss per share (Note 13): |

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.91) |

|

$ |

(0.45) |

|

|

Weighted average common shares outstanding (thousands) (Note 13): |

|

|

|

|

|

|

|

Basic and diluted |

|

47,428 |

|

|

46,402 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

3

MCEWEN MINING INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands of U.S. dollars)

|

|

March 31, |

|

December 31, |

|

||

|

|

2023 |

|

2022 |

|

||

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents (Note 4) |

|

$ |

190,776 |

|

$ |

39,782 |

|

Investments (Note 5) |

|

|

1,591 |

|

|

1,295 |

|

Receivables, prepaids and other assets (Note 6) |

|

|

7,543 |

|

|

8,840 |

|

Inventories (Note 7) |

|

|

23,560 |

|

|

31,735 |

|

Total current assets |

|

|

223,470 |

|

|

81,652 |

|

Mineral property interests and plant and equipment, net (Note 8) |

|

|

342,516 |

|

|

346,281 |

|

Investment in Minera Santa Cruz S.A. (Note 9) |

|

|

89,990 |

|

|

93,451 |

|

Inventories (Note 7) |

|

|

16,773 |

|

|

2,432 |

|

Restricted cash (Note 16) |

|

|

4,227 |

|

|

3,797 |

|

Other assets |

|

|

703 |

|

|

1,106 |

|

TOTAL ASSETS |

|

$ |

677,679 |

|

$ |

528,719 |

|

|

|

|

|

|

|

|

|

LIABILITIES & SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

46,155 |

|

$ |

42,521 |

|

Contract liability (Note 16) |

|

|

2,335 |

|

|

6,155 |

|

Flow-through share premium (Note 12) |

|

|

2,703 |

|

|

4,056 |

|

Debt, current portion (Note 10) |

|

|

16,000 |

|

|

10,000 |

|

Lease liabilities |

|

|

1,167 |

|

|

1,215 |

|

Reclamation and remediation liabilities (Note 11) |

|

|

12,797 |

|

|

12,576 |

|

Tax liabilities |

|

|

8,231 |

|

|

7,663 |

|

Total current liabilities |

|

|

89,388 |

|

|

84,186 |

|

Lease liabilities |

|

|

968 |

|

|

1,191 |

|

Debt (Note 10) |

|

|

48,124 |

|

|

53,979 |

|

Reclamation and remediation liabilities (Note 11) |

|

|

29,410 |

|

|

29,270 |

|

Other liabilities |

|

|

4,507 |

|

|

3,819 |

|

Total liabilities |

|

$ |

172,397 |

|

$ |

172,445 |

|

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

Common shares: 47,428 as of March 31, 2023 issued and outstanding (in thousands) (Note 12) |

|

$ |

1,754,086 |

|

$ |

1,644,145 |

|

Non-controlling interests (Note 17) |

|

|

115,608 |

|

|

33,465 |

|

Accumulated deficit |

|

|

(1,364,412) |

|

|

(1,321,336) |

|

Total shareholders’ equity |

|

|

505,282 |

|

|

356,274 |

|

TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY |

|

$ |

677,679 |

|

$ |

528,719 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Commitments and contingencies: Note 16

4

MCEWEN MINING INC.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (UNAUDITED)

(in thousands of U.S. dollars and shares)

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|||

|

|

and Additional |

|

|

|

|

|

|

|

|

|

|

|||

|

|

Paid-in Capital |

|

Accumulated |

|

Non-controlling |

|

|

|

|

|||||

|

|

Shares |

|

Amount |

|

Deficit |

|

Interests |

Total |

|

|||||

Balance, December 31, 2021 |

|

459,188 |

|

$ |

1,615,596 |

|

$ |

(1,240,432) |

|

$ |

14,777 |

|

$ |

389,941 |

|

Stock-based compensation |

|

— |

|

|

183 |

|

|

— |

|

|

— |

|

|

183 |

|

Sale of flow-through common stock |

|

14,500 |

|

|

10,320 |

|

|

— |

|

|

— |

|

|

10,320 |

|

Net loss |

|

— |

|

|

— |

|

|

(20,730) |

|

|

(334) |

|

|

(21,064) |

|

Balance, March 31, 2022 |

|

473,688 |

|

$ |

1,626,099 |

|

$ |

(1,261,162) |

|

$ |

14,443 |

|

$ |

379,380 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2022 |

|

47,428 |

|

$ |

1,644,145 |

|

$ |

(1,321,336) |

|

$ |

33,465 |

|

$ |

356,274 |

|

Stock-based compensation |

|

— |

|

|

28 |

|

|

— |

|

|

— |

|

|

28 |

|

Proceeds from McEwen Copper financing (Note 17) |

|

— |

|

|

109,913 |

|

|

— |

|

|

75,477 |

|

|

185,390 |

|

Net income (loss) |

|

— |

|

|

— |

|

|

(43,076) |

|

|

6,666 |

|

|

(36,410) |

|

Balance, March 31, 2023 |

|

47,428 |

|

$ |

1,754,086 |

|

$ |

(1,364,412) |

|

$ |

115,608 |

|

$ |

505,282 |

|

The accompanying notes are an integral part of these consolidated financial statements.

5

MCEWEN MINING INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands of U.S. dollars)

|

|

Three months ended March 31, |

||||

|

|

2023 |

|

2022 |

||

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(36,410) |

|

$ |

(21,064) |

Adjustments to reconcile net loss from operating activities: |

|

|

|

|

|

|

Loss from investment in Minera Santa Cruz S.A. (Note 9) |

|

|

3,461 |

|

|

1,120 |

Depreciation and amortization |

|

|

7,263 |

|

|

3,606 |

Unrealized gain on investments (Note 5) |

|

|

(296) |

|

|

(618) |

Reclamation accretion and adjustments to estimate (Note 11) |

|

|

631 |

|

|

722 |

Income and mining tax recovery |

|

|

(536) |

|

|

(814) |

Stock-based compensation |

|

|

28 |

|

|

183 |

Change in other assets related to operations |

|

|

(2,732) |

|

|

(763) |

Change in liabilities related to operations |

|

|

(17) |

|

|

2,008 |

Cash used in operating activities |

|

$ |

(28,608) |

|

$ |

(15,620) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Net additions to mineral property interests and plant and equipment |

|

$ |

(4,950) |

|

$ |

(4,045) |

Cash used in investing activities |

|

$ |

(4,950) |

|

$ |

(4,045) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from McEwen Copper financing (Note 17) |

|

$ |

185,390 |

|

$ |

— |

Issuance of flow-through common shares, net of issuance costs (Note 12) |

|

|

— |

|

|

14,376 |

Proceeds from promissory note (Note 10 and Note 14) |

|

|

— |

|

|

15,000 |

Subscription proceeds received in advance |

|

|

— |

|

|

300 |

Payment of finance lease obligations |

|

|

(408) |

|

|

(215) |

Cash provided by financing activities |

|

$ |

184,982 |

|

$ |

29,461 |

Increase in cash, cash equivalents and restricted cash |

|

|

151,424 |

|

|

9,796 |

Cash, cash equivalents and restricted cash, beginning of period |

|

|

43,579 |

|

|

60,634 |

Cash, cash equivalents and restricted cash, end of period |

|

$ |

195,003 |

|

$ |

70,430 |

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash received (paid) during period for: |

|

|

|

|

|

|

Interest paid |

|

$ |

(1,253) |

|

$ |

(1,202) |

Interest received |

|

|

9,044 |

|

|

6 |

The accompanying notes are an integral part of these consolidated financial statements.

6

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

NOTE 1 NATURE OF OPERATIONS AND BASIS OF PRESENTATION

McEwen Mining Inc. (the “Company”) was organized under the laws of the State of Colorado on July 24, 1979. The Company produces and sells gold and silver from its operations in Canada, the United States and Argentina, and has a pipeline of exploration assets in Canada, the United States, Mexico and Argentina.

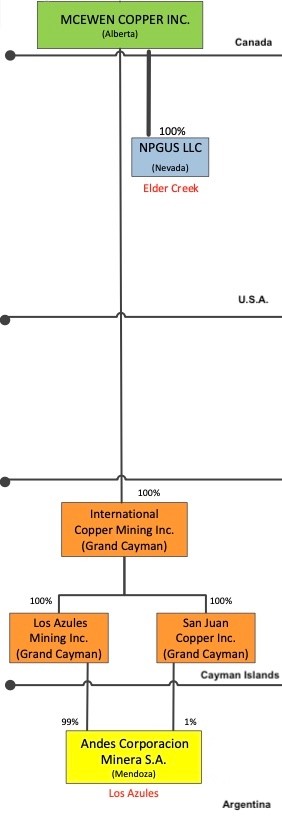

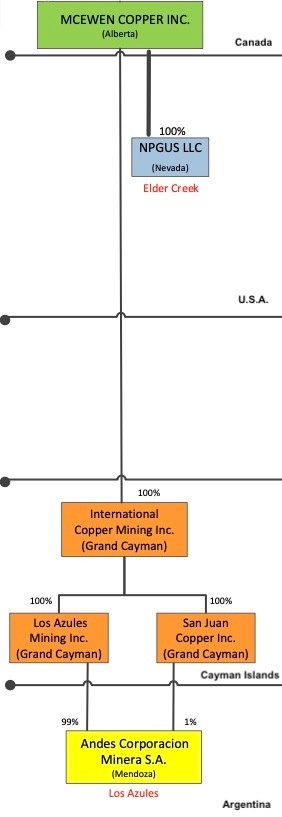

The Company owns a 100% interest in the Gold Bar mine in Nevada, United States, the Fox Complex in Ontario, Canada, the Fenix Project in Sinaloa, Mexico and a portfolio of exploration properties in Nevada, Canada, Mexico and Argentina. As of March 31, 2023, the Company also owns a 51.9% interest in McEwen Copper Inc. (“McEwen Copper”), which holds the Los Azules copper project in San Juan, Argentina and the Elder Creek exploration project in Nevada, United States. It also owns a 49% interest in Minera Santa Cruz S.A. (“MSC”), owner of the producing San José silver-gold mine in Santa Cruz, Argentina, which is operated by the joint venture majority owner Hochschild Mining plc. The Company reports its investment in McEwen Copper as a controlling interest and its investment in MSC as an equity investment.

The interim consolidated financial statements included herein have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) and are unaudited. While information and note disclosures normally included in annual financial statements and prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) have been condensed or omitted pursuant to such rules and regulations, the Company believes that the information and disclosures included in the interim consolidated financial statements are adequate and not misleading. Therefore, these interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto and the summary of significant accounting policies included in the Company’s annual report on Form 10-K for the year ended December 31, 2022. Except as noted below, there have been no material changes in the footnotes from those accompanying the audited consolidated financial statements contained in the Company’s Form 10-K for the year ended December 31, 2022.

In management’s opinion, the unaudited Consolidated Statements of Operations and Comprehensive Loss (“Statement of Operations”) for the three months ended March 31, 2023 and 2022, the unaudited Consolidated Balance Sheet as at March 31, 2023 and the audited Consolidated Balance Sheet as at December 31, 2022, the unaudited Consolidated Statement of Changes in Shareholders’ Equity for the three months ended March 31, 2023 and 2022, and the unaudited Consolidated Statements of Cash Flows for the three months ended March 31, 2023 and 2022, contained herein, reflect all adjustments, consisting solely of normal recurring items, which are necessary for the fair presentation of the Company’s financial position, results of operations and cash flows on a basis consistent with that of the Company’s prior audited consolidated financial statements. However, the results of operations for the interim periods may not be indicative of results to be expected for the full fiscal year. The consolidated financial statements include the accounts of the Company and its wholly-owned and majority-owned subsidiaries. Intercompany accounts and transactions have been eliminated. Investments over which the Company exerts significant influence but does not control through majority ownership are accounted for using the equity method.

One-For-Ten Share Consolidation and Articles of Amendment

Effective after the close of trading on July 27, 2022, the Company filed Articles of Amendment to its Second Amended and Restated Articles of Incorporation with the Colorado Secretary of State to, among other items, effect a one-for-ten reverse split of its outstanding common stock. This reverse split, or consolidation, resulted in every 10 shares of common stock outstanding immediately prior to the effective date being converted into one share of common stock after the effective date. The consolidation was effected following approval by the shareholders in order for the Company to regain compliance with the NYSE listing requirements, specifically those requiring a minimum share trading price of $1 per share. The consolidation was effective for trading purposes on July 28, 2022. Following the consolidation, the Company purchased fractional shares resulting from the split. All share and per share amounts in the consolidated financial statements have been retroactively restated to reflect the consolidation.

The Articles of Amendment also served to reduce the Company’s authorized capital from 675,000,002 shares to 200,000,002 shares, with 200,000,000 shares being common stock and 2 shares being a special preferred stock.

7

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

NOTE 2 OPERATING SEGMENT REPORTING

The Company is a mining and minerals production and exploration company focused on precious and base metals in the United States, Canada, Mexico, and Argentina. The Company’s chief operating decision maker (“CODM”) reviews the operating results, assesses performance and makes decisions about the allocation of resources to these segments at the geographic region level or major mine/project level where the economic characteristics of the individual mines or projects within a geographic region are not alike. As a result, these operating segments also represent the Company’s reportable segments for accounting purposes. The Company’s business activities that are not considered operating segments are included in General and Administrative and Other Income or Expense line item in the below table, and are provided for reconciliation purposes.

The CODM reviews segment income or loss, defined as gold and silver sales less production costs applicable to sales, depreciation and depletion, advanced projects and exploration costs, for all segments except for the MSC segment, which is evaluated based on the attributable equity income or loss. Gold and silver sales and production costs applicable to sales for the reportable segments are reported net of intercompany transactions.

Capital expenditures include costs capitalized in mineral property interests and plant and equipment in the respective periods.

Significant information relating to the Company’s reportable operating segments for the periods presented is summarized in the tables below:

Three months ended March 31, 2023 |

|

USA |

|

Canada |

|

Mexico |

|

MSC |

|

McEwen Copper |

|

Total |

||||||

Revenue from gold and silver sales |

|

$ |

11,587 |

|

$ |

23,165 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

34,752 |

Production costs applicable to sales |

|

|

(9,341) |

|

|

(14,072) |

|

|

— |

|

|

— |

|

|

— |

|

|

(23,413) |

Depreciation and depletion |

|

|

(1,260) |

|

|

(5,636) |

|

|

— |

|

|

— |

|

|

— |

|

|

(6,896) |

Gross profit |

|

|

986 |

|

|

3,457 |

|

|

— |

|

|

— |

|

|

— |

|

|

4,443 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advanced projects |

|

|

(289) |

|

|

— |

|

|

(1,391) |

|

|

— |

|

|

(31,880) |

|

|

(33,560) |

Exploration |

|

|

(773) |

|

|

(4,740) |

|

|

— |

|

|

— |

|

|

(387) |

|

|

(5,900) |

Loss from investment in Minera Santa Cruz S.A. |

|

|

— |

|

|

— |

|

|

— |

|

|

(3,461) |

|

|

— |

|

|

(3,461) |

Segment loss |

|

$ |

(76) |

|

$ |

(1,283) |

|

$ |

(1,391) |

|

$ |

(3,461) |

|

$ |

(32,267) |

|

$ |

(38,478) |

General and administrative and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,532 |

Loss before income and mining taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(36,946) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

2,991 |

|

$ |

2,773 |

|

$ |

— |

|

$ |

— |

|

$ |

954 |

|

$ |

6,718 |

8

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

Three months ended March 31, 2022 |

|

USA |

|

Canada |

|

Mexico |

|

MSC |

|

McEwen Copper |

|

Total |

||||||

Revenue from gold and silver sales |

|

$ |

11,742 |

|

$ |

12,896 |

|

$ |

904 |

|

$ |

— |

|

$ |

— |

|

$ |

25,542 |

Production costs applicable to sales |

|

|

(14,172) |

|

|

(8,647) |

|

|

(5,005) |

|

|

— |

|

|

— |

|

|

(27,824) |

Depreciation and depletion |

|

|

(818) |

|

|

(2,894) |

|

|

— |

|

|

— |

|

|

— |

|

|

(3,712) |

Gross profit (loss) |

|

|

(3,248) |

|

|

1,355 |

|

|

(4,101) |

|

|

— |

|

|

— |

|

|

(5,994) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advanced projects |

|

|

(45) |

|

|

(91) |

|

|

(1,243) |

|

|

— |

|

$ |

(9,756) |

|

|

(11,135) |

Exploration |

|

|

(1,449) |

|

|

(1,700) |

|

|

(1) |

|

|

— |

|

$ |

(60) |

|

|

(3,210) |

Loss from investment in Minera Santa Cruz S.A. |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,120) |

|

$ |

— |

|

|

(1,120) |

Segment loss |

|

$ |

(4,742) |

|

$ |

(436) |

|

$ |

(5,345) |

|

$ |

(1,120) |

|

$ |

(9,816) |

|

$ |

(21,459) |

General and administrative and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(419) |

Loss before income and mining taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(21,878) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

277 |

|

$ |

3,546 |

|

$ |

— |

|

$ |

— |

|

$ |

234 |

|

$ |

4,057 |

Geographic Information

Geographic information includes the long-lived asset balances and revenues presented for the Company’s operating segments, as follows:

|

|

Long-lived Assets |

|

Revenue (1) |

||||||||

|

|

March 31, |

|

December 31, |

|

Three months ended March 31, |

||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

USA (2) |

|

$ |

75,957 |

|

$ |

70,577 |

|

$ |

11,587 |

|

$ |

11,742 |

Canada |

|

|

95,326 |

|

|

91,552 |

|

|

23,165 |

|

|

12,896 |

Mexico |

|

|

29,218 |

|

|

29,219 |

|

|

— |

|

|

904 |

Argentina (3) |

|

|

253,707 |

|

|

255,718 |

|

|

— |

|

|

— |

Total consolidated |

|

$ |

454,208 |

|

$ |

447,066 |

|

$ |

34,752 |

|

$ |

25,542 |

| (1) | Presented based on the location from which the precious metals originated. |

| (2) | Includes Elder Creek exploration property of $0.8 million as of March 31, 2023 (December 31, 2022 - $0.8 million). |

| (3) | Includes Investment in MSC of $90.0 million as of March 31, 2023 (December 31, 2022 – $93.5 million) |

NOTE 3 OTHER INCOME

The following is a summary of other income for the three months ended March 31, 2023 and 2022:

|

Three months ended March 31, |

||||

|

2023 |

|

2022 |

||

Unrealized and realized gain on investments (Note 5) |

$ |

296 |

|

$ |

445 |

Foreign currency gain on Blue Chip Swap |

|

7,993 |

|

|

2,189 |

Foreign currency (loss) gain, other |

|

(10,641) |

|

|

798 |

Other (expense) income, net |

|

(227) |

|

|

439 |

Total other (expense) income |

$ |

(2,579) |

|

$ |

3,871 |

During the three months ended March 31, 2023, the Company completed two Blue Chip Swap transactions to transfer funds from its Canadian USD bank account to Argentina. These funds were used for the continued development of the Los Azules Copper project. The Company realized a net gain of $7.5 million comprised of a foreign currency gain of $7.9 million and a realized loss on investments of $0.4 million, including the impact of fees and commissions. For the three months ended March 31, 2022, the Company completed three Blue Chip Swap transactions and realized a net gain of $2.1 million comprised of a foreign currency gain of $2.2 million and a realized loss on investments of $0.1 million.

9

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

NOTE 4 CASH AND CASH EQUIVALENTS

The following table provides a reconciliation of cash and cash equivalents reported in the Consolidated Balance Sheets:

|

|

|

|

|

|

|

|

|

March 31, 2023 |

|

December 31, 2022 |

||

Cash and cash equivalents held in USD |

|

$ |

45,697 |

|

$ |

36,305 |

Cash and cash equivalents held in ARS¹ |

|

|

143,796 |

|

|

2,144 |

Cash and cash equivalents held in other currencies |

|

|

1,283 |

|

|

1,333 |

Total cash and cash equivalents |

|

$ |

190,776 |

|

$ |

39,782 |

| (1) | Argentine Peso (“ARS”) |

As of March 31, 2023, the cash balance of ARS $29.5 billion was converted to the USD using the official exchange rate of 209.0:1. As of December 31, 2022, the cash balance of ARS $0.4 billion was converted to the USD using the official exchange rate of 177.2:1.

As of March 31, 2023, of $190.8 million of cash and cash equivalents, $149.1 million in cash and $9.7 million in bankers’ acceptance notes with maturity dates between 34 to 81 days were held by McEwen Copper.

NOTE 5 INVESTMENTS

The following is a summary of the activity in investments for the three months ended March 31, 2023:

|

|

As at |

|

Additions/ |

|

Net gain |

|

Disposals/ |

|

Unrealized |

|

As at |

||||||

|

|

December 31, |

|

transfers during |

|

(loss) on |

|

transfers during |

|

gain on |

|

March 31, |

||||||

|

|

2022 |

|

period |

|

securities sold |

|

period |

|

securities held |

|

2023 |

||||||

Marketable equity securities – fair value |

|

|

1,133 |

|

|

— |

|

|

— |

|

|

— |

|

|

296 |

|

|

1,429 |

Warrants |

|

|

162 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

162 |

Total Investments |

|

$ |

1,295 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

296 |

|

$ |

1,591 |

On June 23, 2021, the Company closed the sale of two projects in Nevada, Limousine Butte and Cedar Wash, with Nevgold Corp. (“Nevgold”). In addition to $0.5 million cash received as part of the consideration, the Company received 4,963,455 common shares and 2,481,727 warrants of Nevgold. Upon issuance, the common shares received by the Company represented 10% of the issued and outstanding shares of Nevgold. The warrants have an exercise price of C$0.60 per share and are exercisable until June 23, 2023. The common shares trade on the TSX Venture Exchange.

NOTE 6 RECEIVABLES, PREPAIDS AND OTHER CURRENT ASSETS

The following is a breakdown of balances in receivables, prepaids and other assets as at March 31, 2023 and December 31, 2022:

|

|

March 31, 2023 |

|

December 31, 2022 |

||

Government sales tax receivable |

|

$ |

2,467 |

|

$ |

2,868 |

Prepaids and other assets |

|

|

5,076 |

|

|

5,972 |

Receivables, prepaid and other current assets |

|

$ |

7,543 |

|

$ |

8,840 |

10

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

NOTE 7 INVENTORIES

Inventories at March 31, 2023 and December 31, 2022 consisted of the following:

|

|

March 31, 2023 |

|

December 31, 2022 |

||

Material on leach pads |

|

$ |

16,564 |

|

$ |

7,571 |

In-process inventory |

|

|

3,797 |

|

|

3,674 |

Stockpiles |

|

|

11,275 |

|

|

15,392 |

Precious metals |

|

|

1,896 |

|

|

2,119 |

Materials and supplies |

|

|

6,801 |

|

|

5,411 |

|

|

$ |

40,333 |

|

$ |

34,167 |

Less long-term portion |

|

|

(16,773) |

|

|

(2,432) |

|

|

$ |

23,560 |

|

$ |

31,735 |

During the three months ended March 31, 2022, inventory at the Fox Complex, El Gallo and Gold Bar operations were written down to their estimated net realizable value by $0.8 million, $3.4 million and $nil respectively. Of these write-downs, a total of $4.2 million was included in production costs applicable to sales and $nil was included in depreciation and depletion in the Statement of Operations.

NOTE 8 MINERAL PROPERTY INTERESTS AND PLANT AND EQUIPMENT

The applicable definition of proven and probable reserves is set forth in the new Regulation S-K 1300 requirements of the SEC. If proven and probable reserves exist at the Company’s properties, the relevant capitalized mineral property interests and asset retirement costs are charged to expense based on the units of production method upon commencement of production. The Company’s Gold Bar Mine and San José properties have proven and probable reserves estimated in accordance with S-K 1300. The Fox Complex is depleted and depreciated using the units-of-production method over the stated mine life, as the project does not have proven and probable reserves compliant with S-K 1300.

The Company reviews and evaluates its long-lived assets for impairment on a quarterly basis or when events or changes in circumstances indicate that the related carrying amounts may not be recoverable. Once it is determined that impairment exists, an impairment loss is measured as the amount by which the asset carrying value exceeds its estimated fair value.

During the three months ended March 31, 2023, no indicators of impairment have been noted for any of the Company’s mineral property interests.

NOTE 9 INVESTMENT IN MINERA SANTA CRUZ S.A. (“MSC”) – SAN JOSÉ MINE

The Company accounts for investments over which it exerts significant influence but does not control through majority ownership using the equity method of accounting. MSC is operated by the Company’s joint venture partner, Hochschild Mining PLC.

In applying the equity method of accounting, MSC’s financial statements, which are originally prepared by MSC in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, have been adjusted to conform with U.S. GAAP. As such, the summarized financial data presented under this heading is presented in accordance with U.S. GAAP.

11

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

A summary of the operating results for MSC for the three months ended March 31, 2023 and 2022 is as follows:

|

|

Three months ended March 31, |

||||

|

|

2023 |

|

2022 |

||

Minera Santa Cruz S.A. (100%) |

|

|

|

|

|

|

Revenue from gold and silver sales |

|

$ |

45,740 |

|

$ |

39,207 |

Production costs applicable to sales |

|

|

(41,124) |

|

|

(31,789) |

Depreciation and depletion |

|

|

(8,230) |

|

|

(6,896) |

Gross (loss) profit |

|

|

(3,614) |

|

|

522 |

Exploration |

|

|

(1,952) |

|

|

(1,735) |

Other expenses(1) |

|

|

(3,234) |

|

|

(3,880) |

Net loss before tax |

|

$ |

(8,800) |

|

$ |

(5,093) |

Current and deferred tax expense |

|

|

3,315 |

|

|

3,807 |

Net loss |

|

$ |

(5,485) |

|

$ |

(1,286) |

|

|

|

|

|

|

|

Portion attributable to McEwen Mining Inc. (49%) |

|

|

|

|

|

|

Net loss |

|

$ |

(2,687) |

|

$ |

(630) |

Amortization of fair value increments |

|

|

(884) |

|

|

(613) |

Income tax recovery |

|

|

110 |

|

|

123 |

Loss from investment in MSC, net of amortization |

|

$ |

(3,461) |

|

$ |

(1,120) |

(1) Other expenses include foreign exchange, accretion of asset retirement obligations and other finance-related expenses.

The income or loss from the investment in MSC attributable to the Company includes amortization of the fair value increments arising from the initial purchase price allocation and related income tax recovery. The income tax recovery reflects the impact of the devaluation of the Argentine peso against the U.S. dollar on the peso-denominated deferred tax liability recognized at the time of acquisition, as well as income tax rate changes over the periods.

Changes in the Company’s investment in MSC for the three months ended March 31, 2023 and year ended December 31, 2022 are as follows:

|

Three months ended March 31, 2023 |

|

Year ended |

||

Investment in MSC, beginning of period |

$ |

93,451 |

|

$ |

90,961 |

Attributable net (loss) income from MSC |

|

(2,687) |

|

|

6,303 |

Amortization of fair value increments |

|

(884) |

|

|

(4,155) |

Income tax recovery |

|

110 |

|

|

628 |

Dividend distribution received |

|

— |

|

|

(286) |

Investment in MSC, end of period |

$ |

89,990 |

|

$ |

93,451 |

A summary of the key assets and liabilities of MSC as at March 31, 2023, before and after adjustments for fair value increments arising from the purchase price allocation, are as follows:

As at March 31, 2023 |

|

Balance excluding FV increments |

|

Adjustments |

|

Balance including FV increments |

|||

Current assets |

|

$ |

81,676 |

|

$ |

705 |

|

$ |

82,381 |

Total assets |

|

$ |

188,078 |

|

$ |

79,484 |

|

$ |

267,562 |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

(52,936) |

|

$ |

— |

|

$ |

(52,936) |

Total liabilities |

|

$ |

(82,855) |

|

$ |

(1,071) |

|

$ |

(83,926) |

12

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

NOTE 10 DEBT

A reconciliation of the Company’s debt for the three months ended March 31, 2023 and for the year ended December 31, 2022 is as follows:

|

|

Three months ended March 31, 2023 |

|

Year ended |

||

Balance, beginning of year |

|

$ |

63,979 |

|

$ |

48,866 |

Promissory notes - initial recognition |

|

|

— |

|

|

15,000 |

Interest expense |

|

|

1,347 |

|

|

5,488 |

Interest payments |

|

|

(1,202) |

|

|

(4,875) |

Financing fee |

|

|

- |

|

|

(500) |

Balance, end of period |

|

$ |

64,124 |

|

$ |

63,979 |

Less: current portion |

|

|

16,000 |

|

|

10,000 |

Long-term portion |

|

$ |

48,124 |

|

|

53,979 |

NOTE 11 ASSET RETIREMENT OBLIGATIONS

The Company is responsible for the reclamation of certain past and future disturbances at its properties. The most significant properties subject to these obligations are the Gold Bar and Tonkin properties in Nevada, the Fox Complex properties in Canada and the El Gallo Project in Mexico.

A reconciliation of the Company’s asset retirement obligations for the three months ended March 31, 2023 and for the year ended December 31, 2022 are as follows:

|

Three months ended March 31, 2023 |

|

Year ended |

||

Asset retirement obligation liability, beginning balance |

$ |

41,846 |

|

$ |

35,452 |

Settlements |

|

(270) |

|

|

(774) |

Accretion of liability |

|

610 |

|

|

2,354 |

Revisions to estimates and discount rate |

|

20 |

|

|

5,664 |

Foreign exchange revaluation |

|

1 |

|

|

(850) |

Asset retirement obligation liability, ending balance |

$ |

42,207 |

|

$ |

41,846 |

Less current portion |

|

12,797 |

|

|

12,576 |

Long-term portion |

$ |

29,410 |

|

$ |

29,270 |

Reclamation expense in the Statement of Operations includes adjustments for updates in the reclamation liability for properties that do not have reserves in compliance with S-K 1300. Reclamation accretion for all properties is as follows:

|

Three months ended March 31, |

||||

|

2023 |

|

2022 |

||

Reclamation adjustment reflecting updated estimates |

$ |

20 |

|

$ |

— |

Reclamation accretion |

|

610 |

|

|

527 |

Total |

$ |

630 |

|

|

527 |

13

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

NOTE 12 SHAREHOLDERS’ EQUITY

Equity Issuances

Flow-Through Shares Issuance – Canadian Exploration Expenditures (“CEE”)

The Company is required to spend the flow-through share proceeds from the 2022 issuance on flow-through eligible CEE as defined by subsection 66.1(6) of the Income Tax Act (Canada). As of March 31, 2023, the Company had incurred a total of $5.6 million in eligible CEE (as of December 31, 2022 – $1.0 million). The Company expects to fulfill its remaining CEE commitments of $9.5 million by the end of 2023.

Shareholders’ Distributions

Pursuant to the Amended and Restated Credit Agreement, the Company is prevented from paying any dividends on its common stock, so long as the loan is outstanding.

NOTE 13 NET LOSS PER SHARE

Basic net loss per share is computed by dividing the net loss attributable to the Company’s common shareholders by the weighted average number of common shares outstanding during the period. Potentially dilutive instruments are not included in the calculation of diluted net loss per share for the three months ended March 31, 2023 and 2022, as they would be anti-dilutive.

For the three months ended March 31, 2023, all the outstanding stock options (409,470) and all of the outstanding warrants (2,976,816) were excluded from the computation of diluted loss per share. Similarly, for the three months ended March 31, 2022, the outstanding stock options (599,110) and the outstanding warrants (2,977,077) were excluded.

NOTE 14 RELATED PARTY TRANSACTIONS

The Company recorded the following expense in respect to the related parties outlined below during the periods presented:

|

Three months ended March 31, |

||||

|

2023 |

|

2022 |

||

REVlaw |

$ |

48 |

|

|

214 |

The Company has the following outstanding accounts payable balances in respect to the related parties outlined below:

|

March 31, 2023 |

|

December 31, 2022 |

||

REVlaw |

$ |

160 |

|

|

112 |

REVlaw is a company owned by Carmen Diges, General Counsel & Secretary of the Company. The legal services of Ms. Diges as General Counsel & Secretary and other support staff, as needed, are provided by REVlaw in the normal course of business and have been recorded at their exchange amount.

An affiliate of Robert R. McEwen, Chairman and Chief Executive Officer participated as a lender in the $50.0 million term loan to which the Company is borrower by providing $25.0 million of the total $50.0 million funding and continued as such under the ARCA. During the three months ended March 31, 2023, the Company paid $0.6 million, (three months ended March 31, 2022 – $0.6 million) in interest to this affiliate. The payments to the affiliate of Mr. McEwen are on the same terms as the non-affiliated lender. Interest is payable monthly at a rate of 9.75% per annum.

14

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

On March 31, 2022, the Company issued a $15.0 million unsecured subordinated promissory note to a company controlled by Mr. McEwen. The Promissory Note is payable in full on or before September 25, 2025, interest is payable monthly at a rate of 8% per annum and is subordinated to the ARCA loan facility. The amount of interest paid for the period ended March 31, 2023 was $0.3 million (March 31, 2022 – $nil).

NOTE 15 FAIR VALUE ACCOUNTING

As required by accounting guidance, certain assets and liabilities on the Consolidated Balance Sheets are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

Warrants

Upon initial recognition, the warrants received as part of the asset sale to Nevgold (Note 5) were valued using the Black-Scholes valuation model as they are not quoted in an active market. The warrants have been accounted for as equity investment at cost. Average volatility of 94.6% was determined based on a selection of similar junior mining companies. The warrants are exercisable upon receipt and have an exercise price of $0.60 per share and expire June 23, 2023. As of March 31, 2023, no warrants related to the Nevgold transaction have been exercised.

Assets and liabilities measured at fair value on a recurring basis.

The following table identifies certain of the Company’s assets and liabilities measured at fair value on a recurring basis by level within the fair value hierarchy as at March 31, 2023 and December 31, 2022, as reported in the Consolidated Balance Sheets:

|

|

Fair value as at March 31, 2023 |

|

Fair value as at December 31, 2022 |

||||||||||||||

|

|

Level 1 |

|

Level 2 |

|

Total |

|

Level 1 |

|

Level 2 |

|

Total |

||||||

Marketable equity securities |

|

$ |

1,429 |

|

$ |

— |

|

$ |

1,429 |

|

$ |

1,133 |

|

$ |

— |

|

$ |

1,133 |

Total investments |

|

$ |

1,429 |

|

$ |

— |

|

$ |

1,429 |

|

$ |

1,133 |

|

$ |

— |

|

$ |

1,133 |

Marketable equity securities that the Company holds are exchange-traded and are valued using quoted market prices in active markets and as such are classified within Level 1 of the fair value hierarchy. The fair value of the investment is calculated as the quoted market price of the marketable equity security multiplied by the number of shares held by the Company.

The fair value of financial assets and liabilities held at March 31, 2023 were assumed to approximate their carrying values due to their historically negligible credit losses.

Debt is recorded at a carrying value of $64.1 million (December 31, 2022 – $64.0 million). The debt is not traded on quoted markets and approximates its fair value based on recent refinancing.

NOTE 16 COMMITMENTS AND CONTINGENCIES

In addition to the commitments for payments on operating and finance leases and the repayment of long-term debt (Note 10), as at March 31, 2023, the Company has the following commitments and contingencies:

Reclamation Obligations

As part of its ongoing business and operations, the Company is required to provide bonding for its environmental reclamation obligations. As at March 31, 2023, the Company had a surety facility in place to cover all its bonding obligations, which include $27.8 million of bonding in Nevada and $11.5 million (C$15.6 million) of bonding in Canada.

15

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

The terms of the facility carry an average annual financing fee of 2.3% and require a deposit of 10%. The surety bonds are available for draw-down by the beneficiary in the event the Company does not perform its reclamation obligations. If the specific reclamation requirements are met, the beneficiary of the surety bonds will release the instrument to the issuing entity. The Company believes it is in compliance with all applicable bonding obligations and will be able to satisfy future bonding requirements, through existing or alternative means, as they arise. As at March 31, 2023, the Company recorded $4.2 million in restricted cash in non-current assets as a deposit against the surety facility.

Streaming Agreement

As part of the acquisition of the Black Fox Complex in 2017, the Company assumed a gold purchase agreement (streaming contract) related to production from certain land claims. The Company is obligated to sell 8% of gold production from the Black Fox mine and 6.3% from the adjoining Pike River property (Black Fox extension) to Sandstorm Gold Ltd. at the lesser of market price or $561 per ounce (with inflation adjustments of up to 2% per year) until 2090.

The Company records the revenue from these shipments based on the contract price at the time of delivery to the customer. During the three months ended March 31, 2023, the Company recorded revenue of $0.4 million (2022 - $0.4 million) related to the gold stream sales.

Flow-through Eligible Expenses

On March 2, 2022, the Company completed a flow-through share issuance for gross proceeds of $15.1 million. The proceeds of this offering are required to be used for the continued exploration of the Company’s properties in the Timmins region of Canada. As at March 31, 2023, the Company has incurred $5.6 million of the required CEE spend and expects to fulfill the remaining $9.5 million of the CEE commitments by the end of 2023.

Prepayment Agreement

On July 27, 2022, the Company entered into a precious metals purchase agreement with Auramet International LLC (“Auramet”). Under this agreement, the Company may sell the gold on a Spot Basis, on a Forward Basis and on a Supplier Advance basis, i.e. the gold is priced and paid for while the gold is:

| (i) | at a mine for a maximum of 15 business days before shipment; or |

| (ii) | in-transit to a refinery; or |

| (iii) | while being refined at a refinery. |

During the three months ended March 31, 2023, the Company received the combined net proceeds of $22.8 million from the sales on a Supplier Advance Basis. The Company recorded revenue of $26.7 million related to the gold sales, with the remaining $2.3 million representing 1,200 ounces pledged but not yet delivered to Auramet, recorded as a contract liability on the Consolidated Balance Sheets.

Other potential contingencies

The Company’s mining and exploration activities are subject to various laws and regulations governing the protection of the environment. These laws and regulations are continually changing and generally becoming more restrictive. The Company conducts its operations so as to protect public health and the environment, and believes its operations are materially in compliance with all applicable laws and regulations. The Company has made, and expects to make in the future, expenditures to comply with such laws and regulations.

16

MCEWEN MINING INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2023

(tabular amounts are in thousands of U.S. dollars, unless otherwise noted)

The Company and its predecessors have transferred their interest in several mining properties to third parties throughout its history. The Company could remain potentially liable for environmental enforcement actions related to its prior ownership of such properties. However, the Company has no reasonable belief that any violation of relevant environmental laws or regulations has occurred regarding these transferred properties.

NOTE 17 NON-CONTROLLING INTERESTS

On February 23, 2023, the Company and its subsidiary, McEwen Copper, closed the equity financing with a single investor, FCA Argentina S.A., an Argentinian subsidiary of Stellantis N.V (“Stellantis”), which consisted of a private placement of 2,850,000 additional common shares issued by McEwen Copper for gross proceeds of ARS $20.9 billion ($108.8 million) and a secondary sale of an additional 1,250,000 shares of McEwen Copper common stock indirectly owned by the Company for aggregate proceeds of ARS $9.1 billion ($46.6 million).

On March 15, 2023, Nuton LLC, a current shareholder of McEwen Copper and subsidiary of Rio Tinto (“Nuton”), exercised its preemptive rights under an existing shareholder agreement to purchase 350,000 shares of McEwen Copper common stock directly from McEwen Copper for aggregate proceeds of $6.6 million. On the same date, the Company and Nuton closed a secondary sale of an additional 1,250,000 shares of McEwen Copper common stock indirectly owned by the Company for aggregate proceeds of $23.4 million.

As a result of the transactions, the Company’s 68.1% ownership in McEwen Copper was reduced by 16.2% to 51.9%. The Company determined that it still controlled McEwen Copper and, consequently, the Company recorded $72.1 million as non-controlling interests and $113.3 million as additional paid-in-capital in 2023.

As of March 31, 2023, the Company recorded $6.7 million net income attributed to non-controlling interests of 48.1% (March 31, 2022 - $0.3 million net loss attributed to non-controlling interests of 18.6%).

17

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In the following discussion, “McEwen Mining,” the “Company,” “we,” “our,” and “us” refers to McEwen Mining Inc. and as the context requires, its consolidated subsidiaries.

The following discussion analyzes our financial condition at March 31, 2023 and compares it to our financial condition at December 31, 2022. The discussion also analyzes our results of operations for the three months ended March 31, 2023 and compares those to the results for the three months ended March 31, 2022. Regarding properties or projects that are not in production, we provide some details of our plan of operation. We suggest that you read this discussion in conjunction with MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS and our audited consolidated financial statements contained in our annual report on Form 10-K for the year ended December 31, 2022.

The discussion contains financial performance measures that are not prepared in accordance with United States Generally Accepted Accounting Principles (“US GAAP” or “GAAP”). Each of the following is a non-GAAP measure: adjusted net income or loss, adjusted net income or loss per share, cash gross profit, cash costs, cash cost per ounce, all-in sustaining costs (“AISC”), all-in sustaining cost per ounce, average realized price per ounce, and liquid assets. These non-GAAP measures are used by management in running the business and we believe they provide useful information that can be used by investors to evaluate our performance and our ability to generate cash flows. These measures do not have standardized definitions and should not be relied upon in isolation or as a substitute for measures prepared in accordance with GAAP. Cash Costs equals Production Costs Applicable to Sales and is used interchangeably throughout the document.

For a reconciliation of these non-GAAP measures to the amounts included in our Consolidated Statements of Operations and Comprehensive Loss for the three months ended March 31, 2023 and 2022 and to our Consolidated Balance Sheets as of March 31, 2023 and December 31, 2022, and certain limitations inherent in such measures, please see the discussion under “Non-GAAP Financial Performance Measures,” beginning on page 30.

This discussion also includes references to “advanced-stage properties,” which are defined as properties for which advanced studies and reports have been completed indicating the presence of mineralized material or proven and probable reserves, or that have obtained or are in the process of obtaining the required permitting. Our designation of certain properties as “advanced-stage properties” should not suggest that we have or ever will have proven or probable reserves at those properties as defined by S-K 1300.

Throughout this Management’s Discussion and Analysis (“MDA”), the reporting periods for the three months ended on March 31, 2023 and March 31, 2022 are abbreviated as Q1/23 and Q1/22, the reporting for the year ended December 31, 2022 is abbreviated as the full year 2022. All quarterly and other interim results are unaudited.

In addition, in this report, gold equivalent ounces (“GEO”) includes gold and silver ounces calculated based on a silver to gold ratio of 84:1 for Q1/23, and 78:1 for Q1/22. Beginning with Q2/19, we adopted a variable silver to gold ratio for reporting that approximates the average price during each fiscal quarter.

OVERVIEW

The Company was organized under the laws of the State of Colorado on July 24, 1979. We produce and sell gold and silver from our operations in Canada, the United States and Argentina, and have a pipeline of exploration assets in Canada, the United States, Mexico and Argentina.

The Company owns a 100% interest in the Gold Bar mine in Nevada, United States, the Fox Complex in Ontario, Canada, the Fenix Project in Sinaloa, Mexico and a portfolio of exploration properties in Nevada, Canada, Mexico and Argentina. As of March 31, 2023, the Company also owns a 51.9% interest in McEwen Copper Inc. (“McEwen Copper”), which holds the Los Azules copper project in San Juan, Argentina and the Elder Creek exploration project in Nevada, United States. It also owns a 49% interest in Minera Santa Cruz S.A. (“MSC”), which owns the producing San José silver-gold mine in Santa Cruz, Argentina and is operated by MSC’s majority owner, Hochschild Mining plc. The Company reports its investment in McEwen Copper as a controlling interest and its investment in MSC as an equity investment.

18

In this report, “Au” represents gold; “Ag” represents silver; “oz” represents troy ounce; “t” represents metric tonne; “g/t” represents grams per metric tonne; “ft” represents feet; “m” represents meter; “sq” represents square; C$ refers to Canadian dollars; and ARS refers to Argentine pesos. All of our financial information is reported in United States (U.S.) dollars unless otherwise noted.

Index to Management’s Discussion and Analysis:

|

|

20 |

|

21 |

|

22 |

|

23 |

|

23 |

|

24 |

|

24 |

|

24 |

|

25 |

|

25 |

|

25 |

|

26 |

|

26 |

|

26 |

|

27 |

|

27 |

|

28 |

|

28 |

|

30 |

|

35 |

|

35 |

|

35 |

19

Q1/23 OPERATING AND FINANCIAL HIGHLIGHTS

Highlights for the quarter ended March 31, 2023 are summarized below and discussed further under “Consolidated Performance”:

Corporate Developments

| ● | We closed significant financings during Q1/23, primarily to advance our Los Azules copper project. On February 23, 2023, we closed an ARS $30 billion investment by FCA Argentina S.A., a subsidiary of Stellantis N.V. (“Stellantis”) to acquire shares of McEwen Copper in a two-part transaction. The transaction consisted of a private placement of 2,850,000 common shares of McEwen Copper, and the purchase of 1,250,000 common shares indirectly owned by McEwen Mining in a secondary sale. Additionally, on March 15, 2023, we closed a $30 million investment by Nuton LLC, a Rio Tinto Venture and existing McEwen Copper shareholder to acquire shares of McEwen Copper in a two-part transaction. The transaction consisted of a private placement of 350,000 common shares of McEwen Copper, and the purchase of 1,250,000 common shares indirectly owned by McEwen Mining in a secondary sale. Proceeds of these transactions will be used to advance development of the Los Azules copper project, as well as for general corporate purposes at both McEwen Mining and McEwen Copper. A portion of the proceeds is also expected to be used to repay debt at McEwen Mining. |

Operational Highlights

| ● | GEO production improved during Q1/23 compared to Q1/22. We produced 30,397 GEOs in Q1/23 which included 11,241 attributable GEOs from the San José mine(1) and reiterate our consolidated production guidance of 150,000 to 170,000 GEOs for full year 2023. Q1/23 GEOs produced increased by 21% compared to Q1/22. |

| ● | Mill throughput increased by 25% at our Fox Complex operations. Crushing at the Stock Mill was replaced with remote crushing at Froome mine, which resulted in an increase in average tonnes per day (“tpd”) from 955 tpd in Q4/22 to 1,195 tpd in Q1/23. This sustained throughput improvement directly impacted our Q1/23 production of 12,700 GEOs, which places Fox Complex on track to meet guidance of 42,000 to 48,000 GEOs for full year 2023. |

| ● | At the Gold Bar Mine, we placed 15,036 contained gold ounces on our leach pad during Q1/23 from material mined from Gold Bar South, which represents a significant increase from Q4/22 of 12,495 ounces. As a result, increases in gold ounce production compared to Q1/23 are expected to be realized during the remainder of full year 2023 to meet production guidance of 42,000 to 48,000 GEOs at the Gold Bar mine. |

| ● | At the San José Mine, Q1/23 production was impacted by seasonal labor impacts and weaker than expected gold and silver mined grade against original forecast. MSC is executing on an infill drilling campaign to derisk its 2023 revised mine plan in order to meet its production guidance of 68,600 to 71,800 GEOs for full year 2023. |

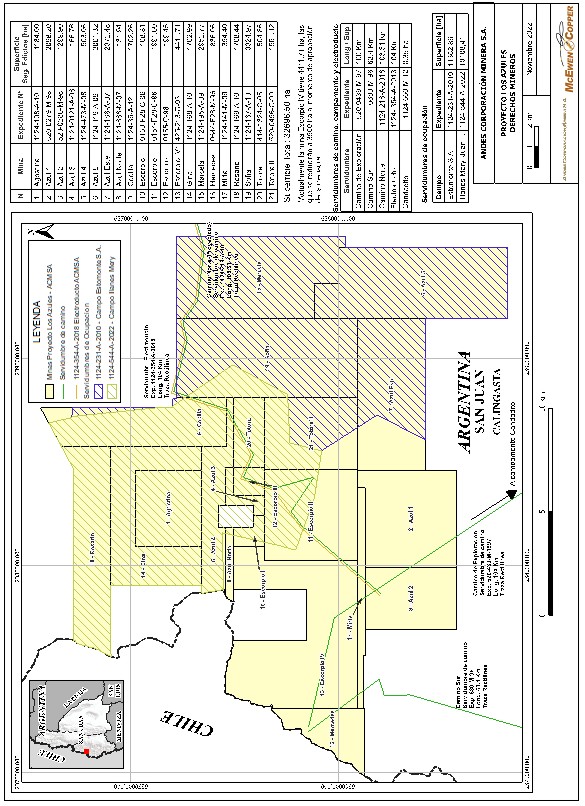

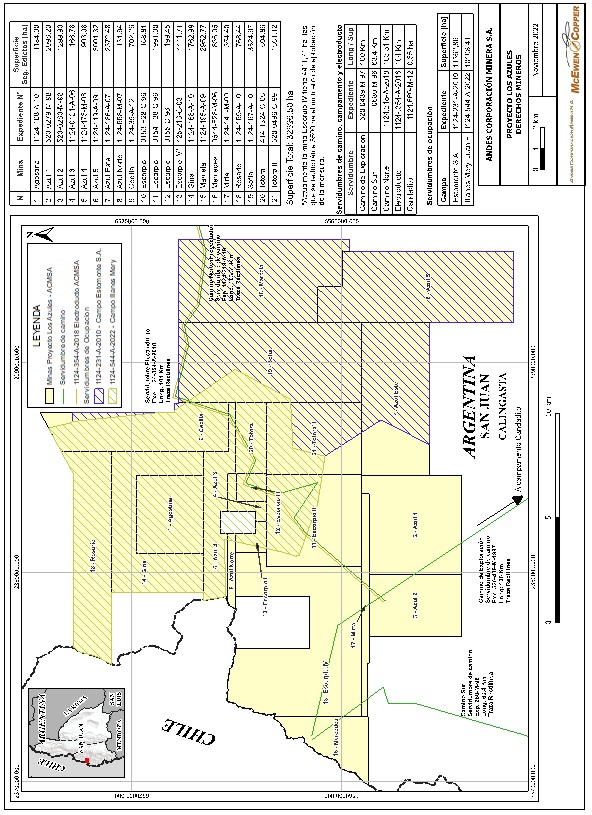

| ● | Progress at Los Azules: Including April, we have now drilled over 105,000 feet (32,000 meters) this drilling season, exceeding the original target of 80,000 feet (25,000 meters). On April 14, 2023 McEwen Copper submitted its Environmental Impact Report (“EIR”) for the future exploitation phase of the Los Azules project to authorities in San Juan, Argentina. |

| ● | We continue to meet safety expectations. Our 100% owned operations continued to experience zero lost-time incidents (“LTIs”) during Q1/23. |

Financial Highlights

| ● | We reported consolidated cash and cash equivalents of $190.8 million, of which $158.8 is to be used towards advancing the Los Azules copper project, and consolidated working capital of $134.7 million as at March 31, 2023. |

| ● | Revenues of $34.8 million were reported in Q1/23 from the sale of 19,193 GEOs from our 100% owned operations at an average realized price(2) of $1,856 per GEO. This compares to Q1/22 revenues of $25.5 million from the sale of 13,931 GEOs from our 100% owned operations at a realized price of $1,895 per GEO. |

20

| ● | We reported a gross profit of $4.4 million and cash gross profit(2) of $11.3 million in Q1/23, compared to gross loss of $6.0 million and cash gross loss(2) of $2.3 million in Q1/22. The increase in gross profit and cash gross profit directly resulted from improvements in productivity across our Fox Complex and Gold Bar mine operations. |

| ● | Net loss for Q1/23 was $43.1 million, or $0.91 per share, compared to Q1/22 of $20.7 million, or $0.45 per share. Compared to our gross profit, our net loss in Q1/23 was impacted by higher year-over-year exploration and advanced project expenditures, particularly at our Los Azules copper project. |

| ● | We reported adjusted net loss of $6.4 million in Q1/23 compared to $13.0 million in Q1/22. Adjusted net loss excludes the impact of the results of McEwen Copper and MSC, and we believe this metric best represents the results of our 100% owned precious metal operations. For Q1/23, adjusted net loss includes $7.2 million in exploration and advanced project expenditures at our Fox Complex, Gold Bar mine and Fenix Project operations. |

| ● | Cash costs per GEO sold for the Fox Complex in Q1/23 was $1,088, slightly above full year 2023 guidance of $1,000. At our Gold Bar mine, our cash costs per GEO sold in Q1/23 was $1,491, slightly above full year 2023 guidance of $1,400. At MSC, Q1/23 cash costs per GEO sold was $1,800, above full year 2023 guidance of $1,250. |

| ● | AISC per GEO sold for the Fox Complex in Q1/23 was $1,311, or slightly below full year 2023 guidance of $1,320. At our Gold Bar mine, our AISC per GEO sold in Q1/23 was $1,725 was slightly above full year 2023 guidance of $1,680. At MSC, Q1/23 AISC per GEO sold was $2,234, above full year 2023 guidance of $1,550. |

Exploration and Mineral Resources and Reserves

| ● | We spent $31.9 million on our Los Azules copper project in Argentina during Q1/23 to advance our multiple drill programs, the EIR, and our updated preliminary economic assessment, which we expect to release in Q2/23. |

| ● | We also incurred $5.9 million in exploration expenses, primarily in respect of defining our resource at our Stock West advanced project in the Fox Complex and de-risking our mine plan at the Gold Bar mine through additional drilling in our Pick pits. |

| (1) | At our 49% attributable interest. |

| (2) | As used here and elsewhere in this report, this is a Non-GAAP financial performance measure. See “Non-GAAP Financial Performance Measures” beginning on page 30. |

SELECTED CONSOLIDATED FINANCIAL AND OPERATING RESULTS

The following tables present select financial and operating results of our company for the three months ended March 31, 2023 and 2022:

|

|

Three months ended March 31, |

||||

|

|

2023 |

|

2022 |

||

|

|

(in thousands, except per share) |

||||

Revenue from gold and silver sales(1) |

|

$ |

34,752 |

|

$ |

25,542 |

Production costs applicable to sales(1) |

|

$ |

(23,413) |

|

$ |

(27,824) |

Gross profit (loss)(1) |

|

$ |

4,443 |

|

$ |

(5,994) |

Adjusted net loss |

|

$ |

(6,403) |

|

$ |

(13,015) |

Adjusted net loss per share |

|

$ |

(0.14) |

|

$ |

(0.28) |

Net loss |

|

$ |

(43,076) |

|

$ |

(19,327) |

Net loss per share |

|

$ |

(0.91) |

|

$ |

(0.45) |

Cash gross profit (loss)(1) |

|

$ |

11,339 |

|

$ |

(2,282) |

Cash used in operating activities |

|

$ |

(28,608) |

|

$ |

(15,620) |

Cash additions to mineral property interests and plant and equipment |

|

$ |

(4,950) |

|

$ |

(4,045) |

Cash and cash equivalents |

|

$ |

190,776 |

|

$ |

63,783 |

Working capital |

|

$ |

134,082 |

|

$ |

36,190 |

| (1) | Excludes results from the San José mine, which is accounted for under the equity method. |

21

|

|

|

|

|

|

|

|

|

Three months ended March 31, |

||||

|

|

2023 |

|

2022 |

||

|

|

(in thousands, except per ounce) |

||||

GEOs produced(1) |

|

|

30.4 |

|

|

25.1 |

100% owned operations |

|

|

19.2 |

|

|

14.4 |

San José mine (49% attributable) |

|

|

11.2 |

|

|

10.7 |

GEOs sold(1) |

|

|

30.4 |

|

|

23.6 |

100% owned operations |

|

|

19.2 |

|

|

13.9 |

San José mine (49% attributable) |

|

|

11.2 |

|

|

9.8 |

Average realized price ($/GEO)(2)(3) |

|

$ |

1,856 |

|

$ |

1,895 |

P.M. Fix Gold ($/oz) |

|

$ |

1,890 |

|

$ |

1,877 |

Cash costs per ounce sold ($/GEO):(2) |

|

|

|

|

|

|

100% owned operations |

|

$ |

1,220 |

|

$ |

1,696 |

San José mine (49% attributable) |

|

$ |

1,800 |

|

$ |

1,589 |

AISC per ounce sold ($/GEO):(2) |

|

|

|

|

|

|

100% owned operations |

|

$ |

1,446 |

|

$ |

2,146 |

San José mine (49% attributable) |

|

$ |

2,234 |

|

$ |

2,103 |

Cash gross profit (loss)(2) |

|

$ |

11,339 |

|

$ |

(2,282) |

Silver:gold ratio(1) |

|

|

84:1 |

|

|

78:1 |

| (1) | Silver production is presented as a gold equivalent with a silver: gold ratio of 84:1 for Q1/23 and 78:1 for Q1/22. |

| (2) | As used here and elsewhere in this report, this is a Non-GAAP financial performance measure. See “Non-GAAP Financial Performance Measures” beginning on page 30. |