UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM 8-K |

|

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report: February 17, 2023

(Date of earliest event reported)

DEERE & COMPANY

(Exact name of registrant as specified in its charter)

Delaware |

|

1-4121 |

|

36-2382580 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

One John Deere Place

Moline, Illinois 61265

(Address of principal executive offices and zip code)

(309) 765-8000

(Registrant’s telephone number, including area code)

___________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

Common stock, $1 par value |

|

DE |

|

New York Stock Exchange |

6.55% Debentures Due 2028 |

|

DE28 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Items 2.02

and 7.01 Results of Operations and Financial Condition and Regulation FD Disclosure (Furnished

herewith).

Deere & Company’s press release dated February 17, 2023 concerning First Quarter of Fiscal 2023 financial results and supplemental financial information (Exhibit 99.1) is furnished under Form 8-K Items 2.02 and 7.01. The attached schedules of Other Financial Information (Exhibit 99.2) and First Quarter 2023 Earnings Conference Call Information (Exhibit 99.3) are furnished under Form 8-K Items 2.02 and 7.01. The information is not filed for purposes of the Securities Exchange Act of 1934 and is not deemed incorporated by reference by any general statements incorporating by reference this report or future filings into any filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent Deere & Company specifically incorporates the information by reference.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits

Number |

Description of Exhibit |

99.1 |

Press Release and Supplemental Financial Information (Furnished herewith) |

99.2 |

|

99.3 |

First Quarter 2023 Earnings Conference Call Information (Furnished herewith) |

104 |

Cover Page Interactive Data File (the cover page XBRL tags are imbedded in the Inline XBRL document) |

2

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

DEERE & COMPANY |

|

|

|

|

|

|

|

|

By: |

/s/ Edward R. Berk |

|

|

Edward R. Berk |

|

|

Secretary |

|

|

|

|

|

|

Dated: February 17, 2023 |

|

|

3

Exhibit 99.1

(Furnished herewith)

News Release |

|

|

|

Contact:

Jen Hartmann

Director, Public Relations

HartmannJenniferA@JohnDeere.com

Deere Reports First Quarter Net Income of $1.959 Billion

| ● | Strong execution contributes to 34% net sales gain and higher earnings. |

| ● | Market environment supported by positive fundamentals and healthy demand for farm and construction equipment. |

| ● | Full-year net income forecast increased to $8.75 billion to $9.25 billion. |

MOLINE, Illinois (February 17, 2023) — Deere & Company reported net income of $1.959 billion for the first quarter ended January 29, 2023, or $6.55 per share, compared with net income of $903 million, or $2.92 per share, for the quarter ended January 30, 2022.

Worldwide net sales and revenues increased 32 percent, to $12.652 billion, in the most recent quarter. Net sales were $11.402 billion for the quarter, compared with $8.531 billion in 2022.

“Deere’s first-quarter performance is a reflection of favorable market fundamentals and healthy demand for our equipment as well as solid execution on the part of our employees, dealers, and suppliers to get products to our customers,” said John C. May, chairman and chief executive officer. “We are, at the same time, benefiting from an improved operating environment, which is contributing to higher levels of production.”

Company Outlook & Summary

Net income attributable to Deere & Company for fiscal 2023 is forecast to be in a range of $8.75 billion to $9.25 billion.

“Deere is looking forward to another strong year on the basis of positive fundamentals, low machine inventories, and a continuation of solid execution,” May said. “We are proud of our recent performance and remain fully committed to helping our customers do their jobs in a more profitable, productive, and sustainable way. We have confidence in our ability to execute on our leap ambitions and run our businesses with real purpose, real technology, and real impact.”

4

Deere & Company |

|

First Quarter |

|

||||||

$ in millions, except per share amounts |

|

2023 |

|

2022 |

|

% Change |

|

||

Net sales and revenues |

|

$ |

12,652 |

|

$ |

9,569 |

|

32% |

|

Net income |

|

$ |

1,959 |

|

$ |

903 |

|

117% |

|

Fully diluted EPS |

|

$ |

6.55 |

|

$ |

2.92 |

|

|

|

Results for the prior period were affected by special items. See Note 1 of the financial statements for further details.

Production & Precision Agriculture |

|

First Quarter |

|

||||||

$ in millions |

|

2023 |

|

2022 |

|

% Change |

|

||

Net sales |

|

$ |

5,198 |

|

$ |

3,356 |

|

55% |

|

Operating profit |

|

$ |

1,208 |

|

$ |

296 |

|

308% |

|

Operating margin |

|

|

23.2% |

|

|

8.8% |

|

|

|

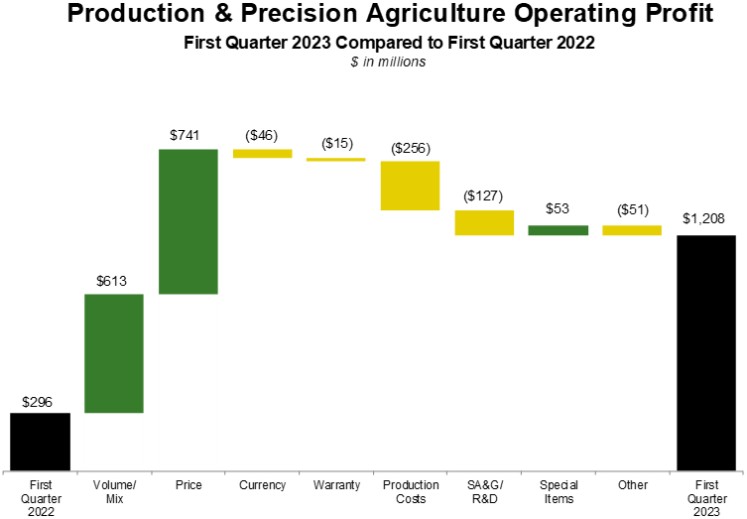

Production and precision agriculture sales increased for the quarter as a result of higher shipment volumes and price realization. Operating profit improved primarily due to price realization and improved shipment volume / mix, partially offset by higher production costs and increased SA&G and R&D expenses. UAW contract-ratification bonus costs affected the prior period.

5

Small Agriculture & Turf |

|

First Quarter |

|

||||||

$ in millions |

|

2023 |

|

2022 |

|

% Change |

|

||

Net sales |

|

$ |

3,001 |

|

$ |

2,631 |

|

14% |

|

Operating profit |

|

$ |

447 |

|

$ |

371 |

|

20% |

|

Operating margin |

|

|

14.9% |

|

|

14.1% |

|

|

|

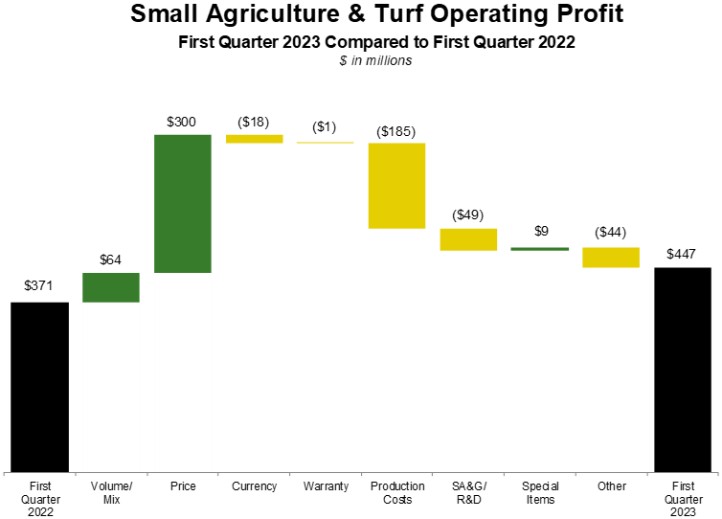

Small agriculture and turf sales increased for the quarter due to price realization and higher shipment volumes, partially offset by the negative effects of foreign currency translation. Operating profit improved primarily as a result of price realization and improved shipment volumes. These items were partially offset by higher production costs, increased SA&G and R&D expenses, and the unfavorable effects of foreign currency exchange.

6

Construction & Forestry |

|

First Quarter |

|

||||||

$ in millions |

|

2023 |

|

2022 |

|

% Change |

|

||

Net sales |

|

$ |

3,203 |

|

$ |

2,544 |

|

26% |

|

Operating profit |

|

$ |

625 |

|

$ |

272 |

|

130% |

|

Operating margin |

|

|

19.5% |

|

|

10.7% |

|

|

|

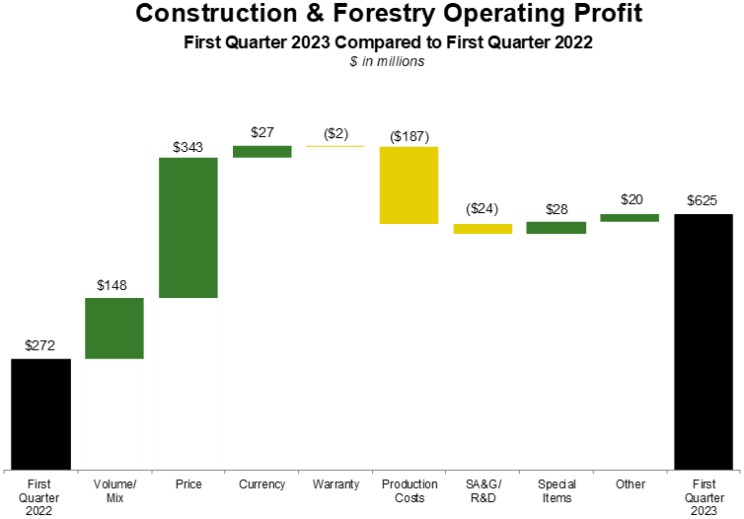

Construction and forestry sales moved higher for the quarter primarily due to higher shipment volumes and price realization, partially offset by the negative effects of foreign currency translation. Operating profit improved due to price realization and improved shipment volumes, partially offset by higher production costs. UAW contract-ratification bonus costs affected the prior period.

7

Financial Services |

|

First Quarter |

|

||||||

$ in millions |

|

2023 |

|

2022 |

|

% Change |

|

||

Net income |

|

$ |

185 |

|

$ |

231 |

|

-20% |

|

Financial services net income for the quarter decreased mainly due to less-favorable financing spreads, higher SA&G expenses, and lower gains on operating-lease dispositions, partially offset by income earned on higher average portfolio balances.

Industry Outlook for Fiscal 2023 |

|

|

|

|

|

||

Agriculture & Turf |

|

|

|

|

|

|

|

U.S. & Canada: |

|

|

|

|

|

|

|

Large Ag |

|

|

|

|

|

Up 5 to 10% |

|

Small Ag & Turf |

|

|

|

|

|

Down ~ 5% |

|

Europe |

|

|

|

|

|

Flat to Up 5% |

|

South America (Tractors & Combines) |

|

|

|

|

|

Flat to Up 5% |

|

Asia |

|

|

|

|

|

Down moderately |

|

|

|

|

|

|

|

|

|

Construction & Forestry |

|

|

|

|

|

|

|

U.S. & Canada: |

|

|

|

|

|

|

|

Construction Equipment |

|

|

|

|

|

Flat to Up 5% |

|

Compact Construction Equipment |

|

|

|

|

|

Flat to Up 5% |

|

Global Forestry |

|

|

|

|

|

Flat |

|

Global Roadbuilding |

|

|

|

|

|

Flat |

|

Deere Segment Outlook for Fiscal 2023 |

|

Currency |

|

Price |

|

||

$ in millions |

|

Net Sales |

|

Translation |

|

Realization |

|

Production & Precision Ag |

|

Up ~ 20% |

|

0% |

|

+14% |

|

Small Ag & Turf |

|

Flat to Up 5% |

|

0% |

|

+8% |

|

Construction & Forestry |

|

Up 10 to 15% |

|

0% |

|

+9% |

|

|

|

|

|

|

|

|

|

Financial Services |

|

Net Income |

|

$ 820 |

|

|

|

Financial Services. Fiscal-year 2023 net income attributable to Deere & Company for the financial services operations is forecast to be $820 million. Results are expected to be lower than fiscal year 2022 due to less-favorable financing spreads, higher SA&G expenses, and lower gains on operating-lease dispositions. These factors are expected to be partially offset by income earned on a higher average portfolio. The outlook decreased from the previous forecast provided on November 23, 2022 due to further compression in financing spreads.

John Deere Capital Corporation

The following is disclosed on behalf of the company’s financial services subsidiary, John Deere Capital Corporation (JDCC), in connection with the disclosure requirements applicable to its periodic issuance of debt securities in the public market.

|

|

First Quarter |

|

||||||

$ in millions |

|

2023 |

|

2022 |

|

% Change |

|

||

Revenue |

|

$ |

821 |

|

$ |

643 |

|

28% |

|

Net income |

|

$ |

147 |

|

$ |

190 |

|

-23% |

|

Ending portfolio balance |

|

$ |

47,227 |

|

$ |

40,353 |

|

17% |

|

Net income for the quarter was lower than the same period in 2022 primarily due to less-favorable financing spreads, higher SA&G expenses, and lower gains on operating-lease dispositions, partially offset by income earned on higher average portfolio balances.

8

FORWARD-LOOKING STATEMENTS

Certain statements contained herein, including in the section entitled “Company Outlook & Summary,” “Industry Outlook,” and “Deere Segment Outlook,” relating to future events, expectations, and trends, constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and involve factors that are subject to change, assumptions, risks, and uncertainties that could cause actual results to differ materially.

Forward-looking statements are based on currently available information and current assumptions, expectations, and projections about future events and should not be relied upon. Except as required by law, the company expressly disclaims any obligation to update or revise its forward-looking statements. Many factors could cause actual results to differ materially from these forward-looking statements. Among these factors are risks related to:

| ● | changes in U.S. and international laws, regulations, and policies relating to trade, spending, taxing, banking, monetary, environmental (including climate change and engine emission), and farming policies; |

| ● | political, economic, and social instability of the geographies in which the company operates; |

| ● | wars and other conflicts, including the current conflict between Russia and Ukraine, and natural disasters; |

| ● | adverse macroeconomic conditions, including unemployment, inflation, rising interest rates, changes in consumer practices due to slower economic growth or possible recession, and liquidity constraints; |

| ● | growth and sustainability of non-food uses for crops (including ethanol and biodiesel production); |

| ● | the ability to execute business strategies, including the company’s Smart Industrial operating model, Leap Ambitions, and mergers and acquisitions; |

| ● | the ability to understand and meet its customers’ changing expectations and demand for John Deere products; |

| ● | accurately forecasting customer demand for products and services and adequately managing inventory; |

| ● | changes to governmental communications channels (radio frequency technology); |

| ● | gaps or limitations in rural broadband coverage, capacity, and speed needed to support technology solutions; |

| ● | the company’s ability to adapt in highly competitive markets; |

| ● | dealer practices and their ability to manage distribution of John Deere products and support and service precision technology solutions; |

| ● | changes in climate patterns and unfavorable weather events; |

| ● | higher interest rates and currency fluctuations which could adversely affect the U.S. dollar, customer confidence, access to capital, and demand for our products; |

| ● | changes in the company’s credit ratings, and failure to comply with financial covenants in credit agreements could impact access to funding; |

| ● | availability and price of raw materials, components, and whole goods; |

| ● | delays or disruptions in the company’s supply chain; |

| ● | labor relations and contracts, including work stoppages and other disruptions; |

| ● | the ability to attract, develop, engage, and retain qualified personnel; |

| ● | security breaches, cybersecurity attacks, technology failures, and other disruptions to the information technology infrastructure of the company and its products; |

| ● | loss of or challenges to intellectual property rights; |

| ● | compliance with evolving U.S. and foreign laws, including economic sanctions, data privacy, and environmental laws and regulations; |

| ● | legislation introduced or enacted that could affect the company’s business model and intellectual property, such as so-called right to repair or right to modify legislation; |

| ● | investigations, claims, lawsuits, or other legal proceedings; |

| ● | events that damage the company’s reputation or brand; |

| ● | world grain stocks, available farm acres, soil conditions, harvest yields, prices for commodities and livestock, input costs (e.g., fertilizer), and availability of transport for crops; and |

| ● | housing starts and supply, real estate and housing prices, levels of public and non-residential construction, and infrastructure investment. |

Further information concerning the company and its businesses, including factors that could materially affect the company’s financial results, is included in the company’s other filings with the SEC (including, but not limited to, the factors discussed in Item 1A. “Risk Factors” of our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q).

9

DEERE & COMPANY

FIRST QUARTER 2023 PRESS RELEASE

(In millions of dollars) Unaudited

|

|

Three Months Ended |

|

||||||

|

|

January 29 |

|

January 30 |

|

% |

|

||

|

|

2023 |

|

2022 |

|

Change |

|

||

Net sales and revenues: |

|

|

|

|

|

|

|

|

|

Production & precision ag net sales |

|

$ |

5,198 |

|

$ |

3,356 |

|

+55 |

|

Small ag & turf net sales |

|

|

3,001 |

|

|

2,631 |

|

+14 |

|

Construction & forestry net sales |

|

|

3,203 |

|

|

2,544 |

|

+26 |

|

Financial services revenues |

|

|

1,040 |

|

|

870 |

|

+20 |

|

Other revenues |

|

|

210 |

|

|

168 |

|

+25 |

|

Total net sales and revenues |

|

$ |

12,652 |

|

$ |

9,569 |

|

+32 |

|

|

|

|

|

|

|

|

|

|

|

Operating profit: * |

|

|

|

|

|

|

|

|

|

Production & precision ag |

|

$ |

1,208 |

|

$ |

296 |

|

+308 |

|

Small ag & turf |

|

|

447 |

|

|

371 |

|

+20 |

|

Construction & forestry |

|

|

625 |

|

|

272 |

|

+130 |

|

Financial services |

|

|

238 |

|

|

296 |

|

-20 |

|

Total operating profit |

|

|

2,518 |

|

|

1,235 |

|

+104 |

|

Reconciling items ** |

|

|

(22) |

|

|

(82) |

|

-73 |

|

Income taxes |

|

|

(537) |

|

|

(250) |

|

+115 |

|

Net income attributable to Deere & Company |

|

$ |

1,959 |

|

$ |

903 |

|

+117 |

|

* Operating profit is income from continuing operations before corporate expenses, certain external interest expense, certain foreign exchange gains and losses, and income taxes. Operating profit of the financial services segment includes the effect of interest expense and foreign exchange gains or losses.

** Reconciling items are primarily corporate expenses, certain external interest expense, certain foreign exchange gains and losses, pension and postretirement benefit costs excluding the service cost component, and net income attributable to noncontrolling interests.

10

DEERE & COMPANY

STATEMENTS OF CONSOLIDATED INCOME

For the Three Months Ended January 29, 2023 and January 30, 2022

(In millions of dollars and shares except per share amounts) Unaudited

|

|

2023 |

|

2022 |

||

Net Sales and Revenues |

|

|

|

|

|

|

Net sales |

|

$ |

11,402 |

|

$ |

8,531 |

Finance and interest income |

|

|

994 |

|

|

800 |

Other income |

|

|

256 |

|

|

238 |

Total |

|

|

12,652 |

|

|

9,569 |

|

|

|

|

|

|

|

Costs and Expenses |

|

|

|

|

|

|

Cost of sales |

|

|

7,934 |

|

|

6,695 |

Research and development expenses |

|

|

495 |

|

|

402 |

Selling, administrative and general expenses |

|

|

952 |

|

|

781 |

Interest expense |

|

|

479 |

|

|

229 |

Other operating expenses |

|

|

299 |

|

|

311 |

Total |

|

|

10,159 |

|

|

8,418 |

|

|

|

|

|

|

|

Income of Consolidated Group before Income Taxes |

|

|

2,493 |

|

|

1,151 |

Provision for income taxes |

|

|

537 |

|

|

250 |

|

|

|

|

|

|

|

Income of Consolidated Group |

|

|

1,956 |

|

|

901 |

Equity in income of unconsolidated affiliates |

|

|

1 |

|

|

3 |

|

|

|

|

|

|

|

Net Income |

|

|

1,957 |

|

|

904 |

Less: Net income (loss) attributable to noncontrolling interests |

|

|

(2) |

|

|

1 |

Net Income Attributable to Deere & Company |

|

$ |

1,959 |

|

$ |

903 |

|

|

|

|

|

|

|

Per Share Data |

|

|

|

|

|

|

Basic |

|

$ |

6.58 |

|

$ |

2.94 |

Diluted |

|

$ |

6.55 |

|

$ |

2.92 |

Dividends declared |

|

$ |

1.20 |

|

$ |

1.05 |

Dividends paid |

|

$ |

1.13 |

|

$ |

1.05 |

|

|

|

|

|

|

|

Average Shares Outstanding |

|

|

|

|

|

|

Basic |

|

|

297.6 |

|

|

307.4 |

Diluted |

|

|

299.1 |

|

|

309.4 |

See Condensed Notes to Interim Consolidated Financial Statements.

11

DEERE & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions of dollars) Unaudited

|

|

January 29 |

|

October 30 |

|

January 30 |

|||

|

|

2023 |

|

2022 |

|

2022 |

|||

Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,976 |

|

$ |

4,774 |

|

$ |

4,472 |

Marketable securities |

|

|

852 |

|

|

734 |

|

|

735 |

Trade accounts and notes receivable - net |

|

|

7,609 |

|

|

6,410 |

|

|

4,855 |

Financing receivables - net |

|

|

36,882 |

|

|

36,634 |

|

|

33,191 |

Financing receivables securitized - net |

|

|

5,089 |

|

|

5,936 |

|

|

3,516 |

Other receivables |

|

|

1,992 |

|

|

2,492 |

|

|

1,936 |

Equipment on operating leases - net |

|

|

6,502 |

|

|

6,623 |

|

|

6,624 |

Inventories |

|

|

10,056 |

|

|

8,495 |

|

|

7,935 |

Property and equipment - net |

|

|

6,212 |

|

|

6,056 |

|

|

5,665 |

Goodwill |

|

|

3,891 |

|

|

3,687 |

|

|

3,192 |

Other intangible assets - net |

|

|

1,255 |

|

|

1,218 |

|

|

1,209 |

Retirement benefits |

|

|

3,793 |

|

|

3,730 |

|

|

3,158 |

Deferred income taxes |

|

|

914 |

|

|

824 |

|

|

923 |

Other assets |

|

|

2,597 |

|

|

2,417 |

|

|

2,203 |

Total Assets |

|

$ |

91,620 |

|

$ |

90,030 |

|

$ |

79,614 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

Short-term borrowings |

|

$ |

14,129 |

|

$ |

12,592 |

|

$ |

10,990 |

Short-term securitization borrowings |

|

|

4,864 |

|

|

5,711 |

|

|

3,482 |

Accounts payable and accrued expenses |

|

|

13,108 |

|

|

14,822 |

|

|

10,651 |

Deferred income taxes |

|

|

519 |

|

|

495 |

|

|

556 |

Long-term borrowings |

|

|

35,071 |

|

|

33,596 |

|

|

32,838 |

Retirement benefits and other liabilities |

|

|

2,493 |

|

|

2,457 |

|

|

3,289 |

Total liabilities |

|

|

70,184 |

|

|

69,673 |

|

|

61,806 |

|

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

100 |

|

|

92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Total Deere & Company stockholders’ equity |

|

|

21,332 |

|

|

20,262 |

|

|

17,804 |

Noncontrolling interests |

|

|

4 |

|

|

3 |

|

|

4 |

Total stockholders’ equity |

|

|

21,336 |

|

|

20,265 |

|

|

17,808 |

Total Liabilities and Stockholders’ Equity |

|

$ |

91,620 |

|

$ |

90,030 |

|

$ |

79,614 |

See Condensed Notes to Interim Consolidated Financial Statements.

12

DEERE & COMPANY

STATEMENTS OF CONSOLIDATED CASH FLOWS

For the Three Months Ended January 29, 2023 and January 30, 2022

(In millions of dollars) Unaudited

|

|

2023 |

|

2022 |

||

Cash Flows from Operating Activities |

|

|

|

|

|

|

Net income |

|

$ |

1,957 |

|

$ |

904 |

Adjustments to reconcile net income to net cash used for operating activities: |

|

|

|

|

|

|

Provision (credit) for credit losses |

|

|

(130) |

|

|

|

Provision for depreciation and amortization |

|

|

494 |

|

|

486 |

Share-based compensation expense |

|

|

23 |

|

|

18 |

Provision (credit) for deferred income taxes |

|

|

(56) |

|

|

210 |

Changes in assets and liabilities: |

|

|

|

|

|

|

Trade, notes, and financing receivables related to sales |

|

|

(1,015) |

|

|

(106) |

Inventories |

|

|

(1,279) |

|

|

(1,297) |

Accounts payable and accrued expenses |

|

|

(1,577) |

|

|

(1,554) |

Accrued income taxes payable/receivable |

|

|

199 |

|

|

(184) |

Retirement benefits |

|

|

(48) |

|

|

(1,010) |

Other |

|

|

186 |

|

|

(20) |

Net cash used for operating activities |

|

|

(1,246) |

|

|

(2,553) |

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

Collections of receivables (excluding receivables related to sales) |

|

|

7,198 |

|

|

6,435 |

Proceeds from sales of equipment on operating leases |

|

|

497 |

|

|

479 |

Cost of receivables acquired (excluding receivables related to sales) |

|

|

(6,322) |

|

|

(5,603) |

Acquisitions of businesses, net of cash acquired |

|

|

|

|

|

(24) |

Purchases of property and equipment |

|

|

(315) |

|

|

(193) |

Cost of equipment on operating leases acquired |

|

|

(497) |

|

|

(391) |

Collateral on derivatives - net |

|

|

345 |

|

|

(13) |

Other |

|

|

(146) |

|

|

(42) |

Net cash provided by investing activities |

|

|

760 |

|

|

648 |

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

Increase (decrease) in total short-term borrowings |

|

|

697 |

|

|

(1,018) |

Proceeds from long-term borrowings |

|

|

2,505 |

|

|

2,353 |

Payments of long-term borrowings |

|

|

(1,925) |

|

|

(1,940) |

Proceeds from issuance of common stock |

|

|

21 |

|

|

11 |

Repurchases of common stock |

|

|

(1,257) |

|

|

(623) |

Dividends paid |

|

|

(341) |

|

|

(327) |

Other |

|

|

(39) |

|

|

(33) |

Net cash used for financing activities |

|

|

(339) |

|

|

(1,577) |

|

|

|

|

|

|

|

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash |

|

|

62 |

|

|

(74) |

|

|

|

|

|

|

|

Net Decrease in Cash, Cash Equivalents, and Restricted Cash |

|

|

(763) |

|

|

(3,556) |

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period |

|

|

4,941 |

|

|

8,125 |

Cash, Cash Equivalents, and Restricted Cash at End of Period |

|

$ |

4,178 |

|

$ |

4,569 |

See Condensed Notes to Interim Consolidated Financial Statements.

13

DEERE & COMPANY |

|

Condensed Notes to Interim Consolidated Financial Statements |

|

(In millions of dollars) Unaudited |

|

| (1) | In the first quarter of 2022, the company had a one-time payment related to the ratification of the UAW collective bargaining agreement, totaling $90 million. |

|

|

Production & Precision Ag |

|

Small Ag & Turf |

|

Construction & Forestry |

|

Total |

|

||||

UAW ratification bonus – Cost of sales |

|

$ |

53 |

|

$ |

9 |

|

$ |

28 |

|

$ |

90 |

|

| (2) | The calculation of basic net income per share is based on the average number of shares outstanding. The calculation of diluted net income per share recognizes any dilutive effect of share-based compensation. |

| (3) | The consolidated financial statements represent the consolidation of all Deere & Company’s subsidiaries. The supplemental consolidating data is presented for informational purposes. Transactions between the Equipment Operations and Financial Services have been eliminated to arrive at the consolidated financial statements. In the supplemental consolidating data in Note 4 to the financial statements, the “Equipment Operations” represents the enterprise without “Financial Services”, which include the company’s production and precision agriculture operations, small agriculture and turf operations, and construction and forestry operations, and other corporate assets, liabilities, revenues, and expenses not reflected within “Financial Services.” |

14

DEERE & COMPANY

(4) SUPPLEMENTAL CONSOLIDATING DATA

STATEMENTS OF INCOME

For the Three Months Ended January 29, 2023 and January 30, 2022

(In millions of dollars) Unaudited

|

|

EQUIPMENT |

|

FINANCIAL |

|

|

|

|

|

|

||||||||||||||||

|

|

OPERATIONS |

|

SERVICES |

|

ELIMINATIONS |

|

CONSOLIDATED |

|

|

||||||||||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

||||||||

Net Sales and Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

11,402 |

|

$ |

8,531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

11,402 |

|

$ |

8,531 |

|

|

Finance and interest income |

|

|

114 |

|

|

34 |

|

$ |

1,067 |

|

$ |

829 |

|

$ |

(187) |

|

$ |

(63) |

|

|

994 |

|

|

800 |

1 |

|

Other income |

|

|

234 |

|

|

217 |

|

|

177 |

|

|

87 |

|

|

(155) |

|

|

(66) |

|

|

256 |

|

|

238 |

2, 3 |

|

Total |

|

|

11,750 |

|

|

8,782 |

|

|

1,244 |

|

|

916 |

|

|

(342) |

|

|

(129) |

|

|

12,652 |

|

|

9,569 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

7,940 |

|

|

6,696 |

|

|

|

|

|

|

|

|

(6) |

|

|

(1) |

|

|

7,934 |

|

|

6,695 |

4 |

|

Research and development expenses |

|

|

495 |

|

|

402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

495 |

|

|

402 |

|

|

Selling, administrative and general expenses |

|

|

783 |

|

|

657 |

|

|

172 |

|

|

126 |

|

|

(3) |

|

|

(2) |

|

|

952 |

|

|

781 |

4 |

|

Interest expense |

|

|

101 |

|

|

90 |

|

|

442 |

|

|

158 |

|

|

(64) |

|

|

(19) |

|

|

479 |

|

|

229 |

5 |

|

Interest compensation to Financial Services |

|

|

123 |

|

|

44 |

|

|

|

|

|

|

|

|

(123) |

|

|

(44) |

|

|

|

|

|

|

5 |

|

Other operating expenses |

|

|

53 |

|

|

39 |

|

|

392 |

|

|

335 |

|

|

(146) |

|

|

(63) |

|

|

299 |

|

|

311 |

6, 7 |

|

Total |

|

|

9,495 |

|

|

7,928 |

|

|

1,006 |

|

|

619 |

|

|

(342) |

|

|

(129) |

|

|

10,159 |

|

|

8,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before Income Taxes |

|

|

2,255 |

|

|

854 |

|

|

238 |

|

|

297 |

|

|

|

|

|

|

|

|

2,493 |

|

|

1,151 |

|

|

Provision for income taxes |

|

|

483 |

|

|

182 |

|

|

54 |

|

|

68 |

|

|

|

|

|

|

|

|

537 |

|

|

250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income after Income Taxes |

|

|

1,772 |

|

|

672 |

|

|

184 |

|

|

229 |

|

|

|

|

|

|

|

|

1,956 |

|

|

901 |

|

|

Equity in income of unconsolidated affiliates |

|

|

|

|

|

1 |

|

|

1 |

|

|

2 |

|

|

|

|

|

|

|

|

1 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

|

1,772 |

|

|

673 |

|

|

185 |

|

|

231 |

|

|

|

|

|

|

|

|

1,957 |

|

|

904 |

|

|

Less: Net income (loss) attributable to noncontrolling interests |

|

|

(2) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

1 |

|

|

Net Income Attributable to Deere & Company |

|

$ |

1,774 |

|

$ |

672 |

|

$ |

185 |

|

$ |

231 |

|

|

|

|

|

|

|

$ |

1,959 |

|

$ |

903 |

|

|

1 Elimination of Financial Services’ interest income earned from Equipment Operations.

2 Elimination of Equipment Operations’ margin from inventory transferred to equipment on operating leases.

3 Elimination of Financial Services’ income related to intercompany guarantees of investments in certain international markets and intercompany service revenue.

4 Elimination of intercompany service fees.

5 Elimination of Equipment Operations’ interest expense to Financial Services.

6 Elimination of Financial Services’ lease depreciation expense related to inventory transferred to equipment on operating leases.

7 Elimination of Equipment Operations’ expense related to intercompany guarantees of investments in certain international markets and intercompany service expenses.

15

DEERE & COMPANY

SUPPLEMENTAL CONSOLIDATING DATA (Continued)

CONDENSED BALANCE SHEETS

(In millions of dollars) Unaudited

|

|

EQUIPMENT |

|

FINANCIAL |

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

OPERATIONS |

|

SERVICES |

|

ELIMINATIONS |

|

CONSOLIDATED |

|

|

||||||||||||||||||||||||||||

|

|

Jan 29 |

|

Oct 30 |

|

Jan 30 |

|

Jan 29 |

|

Oct 30 |

|

Jan 30 |

|

Jan 29 |

|

Oct 30 |

|

Jan 30 |

|

Jan 29 |

|

Oct 30 |

|

Jan 30 |

|

|

||||||||||||

|

|

2023 |

|

2022 |

|

2022 |

|

2023 |

|

2022 |

|

2022 |

|

2023 |

|

2022 |

|

2022 |

|

2023 |

|

2022 |

|

2022 |

|

|

||||||||||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,665 |

|

$ |

3,767 |

|

$ |

3,596 |

|

$ |

1,311 |

|

$ |

1,007 |

|

$ |

876 |

|

|

|

|

|

|

|

|

|

|

$ |

3,976 |

|

$ |

4,774 |

|

$ |

4,472 |

|

|

Marketable securities |

|

|

18 |

|

|

61 |

|

|

2 |

|

|

834 |

|

|

673 |

|

|

733 |

|

|

|

|

|

|

|

|

|

|

|

852 |

|

|

734 |

|

|

735 |

|

|

Receivables from Financial Services |

|

|

5,348 |

|

|

6,569 |

|

|

5,307 |

|

|

|

|

|

|

|

|

|

|

$ |

(5,348) |

|

$ |

(6,569) |

|

$ |

(5,307) |

|

|

|

|

|

|

|

|

|

8 |

|

Trade accounts and notes receivable - net |

|

|

1,342 |

|

|

1,273 |

|

|

996 |

|

|

7,827 |

|

|

6,434 |

|

|

4,843 |

|

|

(1,560) |

|

|

(1,297) |

|

|

(984) |

|

|

7,609 |

|

|

6,410 |

|

|

4,855 |

9 |

|

Financing receivables - net |

|

|

51 |

|

|

47 |

|

|

56 |

|

|

36,831 |

|

|

36,587 |

|

|

33,135 |

|

|

|

|

|

|

|

|

|

|

|

36,882 |

|

|

36,634 |

|

|

33,191 |

|

|

Financing receivables securitized - net |

|

|

|

|

|

|

|

|

9 |

|

|

5,089 |

|

|

5,936 |

|

|

3,507 |

|

|

|

|

|

|

|

|

|

|

|

5,089 |

|

|

5,936 |

|

|

3,516 |

|

|

Other receivables |

|

|

1,583 |

|

|

1,670 |

|

|

1,818 |

|

|

489 |

|

|

832 |

|

|

153 |

|

|

(80) |

|

|

(10) |

|

|

(35) |

|

|

1,992 |

|

|

2,492 |

|

|

1,936 |

9 |

|

Equipment on operating leases - net |

|

|

|

|

|

|

|

|

|

|

|

6,502 |

|

|

6,623 |

|

|

6,624 |

|

|

|

|

|

|

|

|

|

|

|

6,502 |

|

|

6,623 |

|

|

6,624 |

|

|

Inventories |

|

|

10,056 |

|

|

8,495 |

|

|

7,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,056 |

|

|

8,495 |

|

|

7,935 |

|

|

Property and equipment - net |

|

|

6,178 |

|

|

6,021 |

|

|

5,629 |

|

|

34 |

|

|

35 |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

6,212 |

|

|

6,056 |

|

|

5,665 |

|

|

Goodwill |

|

|

3,891 |

|

|

3,687 |

|

|

3,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,891 |

|

|

3,687 |

|

|

3,192 |

|

|

Other intangible assets - net |

|

|

1,255 |

|

|

1,218 |

|

|

1,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,255 |

|

|

1,218 |

|

|

1,209 |

|

|

Retirement benefits |

|

|

3,728 |

|

|

3,666 |

|

|

3,095 |

|

|

67 |

|

|

66 |

|

|

65 |

|

|

(2) |

|

|

(2) |

|

|

(2) |

|

|

3,793 |

|

|

3,730 |

|

|

3,158 |

10 |

|

Deferred income taxes |

|

|

1,015 |

|

|

940 |

|

|

1,095 |

|

|

53 |

|

|

45 |

|

|

50 |

|

|

(154) |

|

|

(161) |

|

|

(222) |

|

|

914 |

|

|

824 |

|

|

923 |

11 |

|

Other assets |

|

|

1,936 |

|

|

1,794 |

|

|

1,730 |

|

|

684 |

|

|

626 |

|

|

477 |

|

|

(23) |

|

|

(3) |

|

|

(4) |

|

|

2,597 |

|

|

2,417 |

|

|

2,203 |

9 |

|

Total Assets |

|

$ |

39,066 |

|

$ |

39,208 |

|

$ |

35,669 |

|

$ |

59,721 |

|

$ |

58,864 |

|

$ |

50,499 |

|

$ |

(7,167) |

|

$ |

(8,042) |

|

$ |

(6,554) |

|

$ |

91,620 |

|

$ |

90,030 |

|

$ |

79,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term borrowings |

|

$ |

969 |

|

$ |

1,040 |

|

$ |

1,516 |

|

$ |

13,160 |

|

$ |

11,552 |

|

$ |

9,474 |

|

|

|

|

|

|

|

|

|

|

$ |

14,129 |

|

$ |

12,592 |

|

$ |

10,990 |

|

|

Short-term securitization borrowings |

|

|

|

|

|

|

|

|

8 |

|

|

4,864 |

|

|

5,711 |

|

|

3,474 |

|

|

|

|

|

|

|

|

|

|

|

4,864 |

|

|

5,711 |

|

|

3,482 |

|

|

Payables to Equipment Operations |

|

|

|

|

|

|

|

|

|

|

|

5,348 |

|

|

6,569 |

|

|

5,307 |

|

$ |

(5,348) |

|

$ |

(6,569) |

|

$ |

(5,307) |

|

|

|

|

|

|

|

|

|

8 |

|

Accounts payable and accrued expenses |

|

|

11,819 |

|

|

12,962 |

|

|

9,704 |

|

|

2,952 |

|

|

3,170 |

|

|

1,970 |

|

|

(1,663) |

|

|

(1,310) |

|

|

(1,023) |

|

|

13,108 |

|

|

14,822 |

|

|

10,651 |

9 |

|

Deferred income taxes |

|

|

404 |

|

|

380 |

|

|

425 |

|

|

269 |

|

|

276 |

|

|

353 |

|

|

(154) |

|

|

(161) |

|

|

(222) |

|

|

519 |

|

|

495 |

|

|

556 |

11 |

|

Long-term borrowings |

|

|

8,155 |

|

|

7,917 |

|

|

8,760 |

|

|

26,916 |

|

|

25,679 |

|

|

24,078 |

|

|

|

|

|

|

|

|

|

|

|

35,071 |

|

|

33,596 |

|

|

32,838 |

|

|

Retirement benefits and other liabilities |

|

|

2,384 |

|

|

2,351 |

|

|

3,182 |

|

|

111 |

|

|

108 |

|

|

109 |

|

|

(2) |

|

|

(2) |

|

|

(2) |

|

|

2,493 |

|

|

2,457 |

|

|

3,289 |

10 |

|

Total liabilities |

|

|

23,731 |

|

|

24,650 |

|

|

23,595 |

|

|

53,620 |

|

|

53,065 |

|

|

44,765 |

|

|

(7,167) |

|

|

(8,042) |

|

|

(6,554) |

|

|

70,184 |

|

|

69,673 |

|

|

61,806 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

100 |

|

|

92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Deere & Company stockholders’ equity |

|

|

21,332 |

|

|

20,262 |

|

|

17,804 |

|

|

6,101 |

|

|

5,799 |

|

|

5,734 |

|

|

(6,101) |

|

|

(5,799) |

|

|

(5,734) |

|

|

21,332 |

|

|

20,262 |

|

|

17,804 |

12 |

|

Noncontrolling interests |

|

|

4 |

|

|

3 |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

3 |

|

|

4 |

|

|

Financial Services equity |

|

|

(6,101) |

|

|

(5,799) |

|

|

(5,734) |

|

|

|

|

|

|

|

|

|

|

|

6,101 |

|

|

5,799 |

|

|

5,734 |

|

|

|

|

|

|

|

|

|

12 |

|

Adjusted total stockholders' equity |

|

|

15,235 |

|

|

14,466 |

|

|

12,074 |

|

|

6,101 |

|

|

5,799 |

|

|

5,734 |

|

|

|

|

|

|

|

|

|

|

|

21,336 |

|

|

20,265 |

|

|

17,808 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

39,066 |

|

$ |

39,208 |

|

$ |

35,669 |

|

$ |

59,721 |

|

$ |

58,864 |

|

$ |

50,499 |

|

$ |

(7,167) |

|

$ |

(8,042) |

|

$ |

(6,554) |

|

$ |

91,620 |

|

$ |

90,030 |

|

$ |

79,614 |

|

|

8 Elimination of receivables / payables between Equipment Operations and Financial Services.

9 Primarily reclassification of sales incentive accruals on receivables sold to Financial Services.

10 Reclassification of net pension assets / liabilities.

11 Reclassification of deferred tax assets / liabilities in the same taxing jurisdictions.

12 Elimination of Financial Services’ equity.

16

DEERE & COMPANY

SUPPLEMENTAL CONSOLIDATING DATA (Continued)

STATEMENTS OF CASH FLOWS

For the Three Months Ended January 29, 2023 and January 30, 2022

(In millions of dollars) Unaudited

|

|

EQUIPMENT |

|

FINANCIAL |

|

|

|

|

|

|

||||||||||||||||

|

|

OPERATIONS |

|

SERVICES |

|

ELIMINATIONS |

|

CONSOLIDATED |

|

|

||||||||||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

||||||||

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

1,772 |

|

$ |

673 |

|

$ |

185 |

|

$ |

231 |

|

|

|

|

|

|

|

$ |

1,957 |

|

$ |

904 |

|

|

Adjustments to reconcile net income to net cash provided by (used for) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (credit) for credit losses |

|

|

1 |

|

|

(2) |

|

|

(131) |

|

|

2 |

|

|

|

|

|

|

|

|

(130) |

|

|

|

|

|

Provision for depreciation and amortization |

|

|

279 |

|

|

257 |

|

|

252 |

|

|

266 |

|

$ |

(37) |

|

$ |

(37) |

|

|

494 |

|

|

486 |

13 |

|

Share-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

18 |

|

|

23 |

|

|

18 |

14 |

|

Distributed earnings of Financial Services |

|

|

3 |

|

|

42 |

|

|

|

|

|

|

|

|

(3) |

|

|

(42) |

|

|

|

|

|

|

15 |

|

Provision (credit) for deferred income taxes |

|

|

(39) |

|

|

223 |

|

|

(17) |

|

|

(13) |

|

|

|

|

|

|

|

|

(56) |

|

|

210 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade, notes, and financing receivables related to sales |

|

|

(23) |

|

|

158 |

|

|

|

|

|

|

|

|

(992) |

|

|

(264) |

|

|

(1,015) |

|

|

(106) |

16, 18, 19 |

|

Inventories |

|

|

(1,254) |

|

|

(1,277) |

|

|

|

|

|

|

|

|

(25) |

|

|

(20) |

|

|

(1,279) |

|

|

(1,297) |

17 |

|

Accounts payable and accrued expenses |

|

|

(1,458) |

|

|

(1,346) |

|

|

145 |

|

|

(66) |

|

|

(264) |

|

|

(142) |

|

|

(1,577) |

|

|

(1,554) |

18 |

|

Accrued income taxes payable/receivable |

|

|

192 |

|

|

(192) |

|

|

7 |

|

|

8 |

|

|

|

|

|

|

|

|

199 |

|

|

(184) |

|

|

Retirement benefits |

|

|

(49) |

|

|

(1,012) |

|

|

1 |

|

|

2 |

|

|

|

|

|

|

|

|

(48) |

|

|

(1,010) |

|

|

Other |

|

|

17 |

|

|

(12) |

|

|

163 |

|

|

(19) |

|

|

6 |

|

|

11 |

|

|

186 |

|

|

(20) |

13, 14, 17 |

|

Net cash provided by (used for) operating activities |

|

|

(559) |

|

|

(2,488) |

|

|

605 |

|

|

411 |

|

|

(1,292) |

|

|

(476) |

|

|

(1,246) |

|

|

(2,553) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collections of receivables (excluding receivables related to sales) |

|

|

|

|

|

|

|

|

7,495 |

|

|

6,845 |

|

|

(297) |

|

|

(410) |

|

|

7,198 |

|

|

6,435 |

16 |

|

Proceeds from sales of equipment on operating leases |

|

|

|

|

|

|

|

|

497 |

|

|

479 |

|

|

|

|

|

|

|

|

497 |

|

|

479 |

|

|

Cost of receivables acquired (excluding receivables related to sales) |

|

|

|

|

|

|

|

|

(6,375) |

|

|

(5,719) |

|

|

53 |

|

|

116 |

|

|

(6,322) |

|

|

(5,603) |

16 |

|

Acquisitions of businesses, net of cash acquired |

|

|

|

|

|

(24) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(24) |

|

|

Purchases of property and equipment |

|

|

(315) |

|

|

(193) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(315) |

|

|

(193) |

|

|

Cost of equipment on operating leases acquired |

|

|

|

|

|

|

|

|

(531) |

|

|

(419) |

|

|

34 |

|

|

28 |

|

|

(497) |

|

|

(391) |

17 |

|

Increase in trade and wholesale receivables |

|

|

|

|

|

|

|

|

(1,499) |

|

|

(684) |

|

|

1,499 |

|

|

684 |

|

|

|

|

|

|

16 |

|

Collateral on derivatives - net |

|

|

|

|

|

4 |

|

|

345 |

|

|

(17) |

|

|

|

|

|

|

|

|

345 |

|

|

(13) |

|

|

Other |

|

|

(9) |

|

|

(22) |

|

|

(137) |

|

|

(36) |

|

|

|

|

|

16 |

|

|

(146) |

|

|

(42) |

19 |

|

Net cash provided by (used for) investing activities |

|

|

(324) |

|

|

(235) |

|

|

(205) |

|

|

449 |

|

|

1,289 |

|

|

434 |

|

|

760 |

|

|

648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in total short-term borrowings |

|

|

(136) |

|

|

123 |

|

|

833 |

|

|

(1,141) |

|

|

|

|

|

|

|

|

697 |

|

|

(1,018) |

|

|

Change in intercompany receivables/payables |

|

|

1,469 |

|

|

150 |

|

|

(1,469) |

|

|

(150) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from long-term borrowings |

|

|

1 |

|

|

18 |

|

|

2,504 |

|

|

2,335 |

|

|

|

|

|

|

|

|

2,505 |

|

|

2,353 |

|

|

Payments of long-term borrowings |

|

|

|

|

|

(124) |

|

|

(1,925) |

|

|

(1,816) |

|

|

|

|

|

|

|

|

(1,925) |

|

|

(1,940) |

|

|

Proceeds from issuance of common stock |

|

|

21 |

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

11 |

|

|

Repurchases of common stock |

|

|

(1,257) |

|

|

(623) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,257) |

|

|

(623) |

|

|

Dividends paid |

|

|

(341) |

|

|

(327) |

|

|

(3) |

|

|

(42) |

|

|

3 |

|

|

42 |

|

|

(341) |

|

|

(327) |

15 |

|

Other |

|

|

(27) |

|

|

(22) |

|

|

(12) |

|

|

(11) |

|

|

|

|

|

|

|

|

(39) |

|

|

(33) |

|

|

Net cash used for financing activities |

|

|

(270) |

|

|

(794) |

|

|

(72) |

|

|

(825) |

|

|

3 |

|

|

42 |

|

|

(339) |

|

|

(1,577) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash |

|

|

48 |

|

|

(75) |

|

|

14 |

|

|

1 |

|

|

|

|

|

|

|

|

62 |

|

|

(74) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash |

|

|

(1,105) |

|

|

(3,592) |

|

|

342 |

|

|

36 |

|

|

|

|

|

|

|

|

(763) |

|

|

(3,556) |

|

|

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period |

|

|

3,781 |

|

|

7,200 |

|

|

1,160 |

|

|

925 |

|

|

|

|

|

|

|

|

4,941 |

|

|

8,125 |

|

|

Cash, Cash Equivalents, and Restricted Cash at End of Period |

|

$ |

2,676 |

|

$ |

3,608 |

|

$ |

1,502 |

|

$ |

961 |

|

|

|

|

|

|

|

$ |

4,178 |

|

$ |

4,569 |

|

|

13 Elimination of depreciation on leases related to inventory transferred to equipment on operating leases.

14 Reclassification of share-based compensation expense.

15 Elimination of dividends from Financial Services to the Equipment Operations, which are included in the Equipment Operations operating activities.

16 Primarily reclassification of receivables related to the sale of equipment.

17 Reclassification of direct lease agreements with retail customers.

18 Reclassification of sales incentive accruals on receivables sold to Financial Services.

19 Elimination and reclassification of the effects of Financial Services partial financing of the construction and forestry retail locations sales and subsequent collection of those amounts.

17

Exhibit 99.2

(Furnished herewith)

DEERE & COMPANY

OTHER FINANCIAL INFORMATION

The company evaluates its business results on the basis of accounting principles generally accepted in the United States. In addition, it uses a metric referred to as Shareholder Value Added (SVA), which management believes is an appropriate measure for the performance of its businesses. SVA is, in effect, the pretax profit left over after subtracting the cost of enterprise capital. The company is aiming for a sustained creation of SVA and is using this metric for various performance goals. Certain compensation is also determined on the basis of performance using this measure. For purposes of determining SVA, each of the equipment segments is assessed a pretax cost of assets, which on an annual basis is approximately 12 percent of the segment’s average identifiable operating assets during the applicable period with inventory at standard cost. Management believes that valuing inventories at standard cost more closely approximates the current cost of inventory and the company’s investment in the asset. The Financial Services segment is assessed an annual pretax cost of approximately 13 percent of the segment's average equity. The cost of assets or equity, as applicable, is deducted from the operating profit or added to the operating loss of each segment to determine the amount of SVA.

|

|

Equipment |

Production & |

Small Ag |

Construction |

||||||||||||||||||||

For the Three Months Ended |

|

Operations |

Precision Ag |

& Turf |

& Forestry |

||||||||||||||||||||

|

|

Jan 29 |

|

Jan 30 |

|

Jan 29 |

|

Jan 30 |

|

Jan 29 |

|

Jan 30 |

|

Jan 29 |

|

Jan 30 |

|

||||||||

Dollars in millions |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

||||||||

Net Sales |

|

$ |

11,402 |

|

$ |

8,531 |

|

$ |

5,198 |

|

$ |

3,356 |

|

$ |

3,001 |

|