UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of May 2025

Commission File Number: 333-251238

|

|

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

|

|

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

CONTENTS

Report on review of parent company

and consolidated

interim

financial statements

To the Board of Directors and Stockholders

Cosan S.A.

Introduction

We have reviewed the accompanying interim statement of financial position of Cosan S.A. ("Company") as at March 31, 2025 and the related statements of profit or loss, other comprehensive income, changes in equity and cash flows for the quarter then ended, as well as the accompanying consolidated interim statement of financial position of the Company and its subsidiaries ("Consolidated") as at March 31, 2025 and the related consolidated statements of profit or loss, other comprehensive income, changes in equity and cash flows for the quarter then ended, and explanatory notes.

Management is responsible for the preparation and presentation of these parent company and consolidated interim financial statements in accordance with the accounting standard CPC 21, Interim Financial Reporting, of the Brazilian Accounting Pronouncements Committee (CPC), and International Accounting Standard (IAS) 34 - Interim Financial Reporting, of the International Accounting Standards Board (IASB). Our responsibility is to express a conclusion on these interim financial statements based on our review.

Scope of review

We conducted our review in accordance with Brazilian and International Standards on Reviews of Interim Financial Information (NBC TR 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, and ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively). A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with Brazilian and International Standards on Auditing and consequently did not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the accompanying parent company and consolidated interim financial statements referred to above are not prepared, in all material respects, in accordance with CPC 21 and IAS 34.

| PricewaterhouseCoopers Auditores Independentes Ltda. | |

| Avenida Brigadeiro Faria Lima, 3732, Edifício B32, 16o, | |

| São Paulo, SP, Brasil, 04538-132 | |

| www.pwc.com.br |

T: +55 (11) 4004-8000 |

Statements of value added

The interim financial statements referred to above include the parent company and consolidated statements of value added for the quarter ended March 31, 2025. These statements are the responsibility of the Company's management and are presented as supplementary information under IAS 34. These statements have been subjected to review procedures performed together with the review of the interim financial statements for the purpose of concluding whether they are reconciled with the interim financial statements and accounting records, as applicable, and if their form and content are in accordance with the criteria defined in the accounting standard CPC 09 - "Statement of Value Added". Based on our review, nothing has come to our attention that causes us to believe that these statements of value added have not been properly prepared, in all material respects, in accordance with the criteria established in this accounting standard, and consistent with the parent company and consolidated interim financial statements taken as a whole.

Audit and review of previous year's figures

The interim financial statements referred to in the first paragraph includes accounting information corresponding to the statements of profit or loss, other comprehensive income, changes in equity, cash flows and value added for the quarter ended March 31, 2024, obtained from the interim financial statements for that quarter, and the statement of financial position ended December 31, 2024, obtained from the financial statements ended December 31, 2024, presented for comparison purposes. The review of the interim financial statements for the quarter ended March 31, 2024 and the audit of the financial statements for the year ended December 31, 2024 were conducted under the responsibility of other independent auditors, who issued review and audit reports dated May 28, 2024 and March 10, 2025, respectively, without qualifications.

São Paulo, May 15, 2025

PricewaterhouseCoopers

Auditores Independentes Ltda.

CRC 2SP000160/O-5

Alessandro Marchesino de Oliveira

Contador CRC 1SP265450/O-8

(In thousands of Reais)

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

Note |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2025 |

|

December 31, 2024 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

5.1 |

|

2,732,522 |

|

2,201,267 |

|

14,809,083 |

|

16,903,542 |

|

Restricted cash |

|

|

— |

|

— |

|

99,653 |

|

28,006 |

|

Marketable securities |

|

|

630,083 |

|

805,335 |

|

2,837,103 |

|

3,272,941 |

|

Trade receivables |

|

|

— |

|

— |

|

4,173,514 |

|

3,730,364 |

|

Derivative financial instruments |

5.3 |

|

13,804 |

|

18,402 |

|

78,582 |

|

905,341 |

|

Inventories |

|

|

— |

|

— |

|

2,041,453 |

|

2,072,905 |

|

Receivables from related parties |

5.4 |

|

147,082 |

|

114,099 |

|

232,553 |

|

197,063 |

|

Income tax receivable |

|

|

656,335 |

|

453,308 |

|

1,069,130 |

|

793,721 |

|

Other current tax receivable |

|

|

5,364 |

|

5,364 |

|

879,293 |

|

886,136 |

|

Dividend receivable |

|

|

14,194 |

|

19,377 |

|

33,621 |

|

153,548 |

|

Reduction of capital receivable |

|

|

— |

|

1,013,714 |

|

— |

|

— |

|

Sectorial financial assets |

|

|

— |

|

— |

|

227,427 |

|

221,947 |

|

Other financial assets |

|

|

— |

|

— |

|

381 |

|

675 |

|

Other current assets |

|

|

62,671 |

|

50,896 |

|

600,566 |

|

629,426 |

|

Current assets |

|

|

4,262,055 |

|

4,681,762 |

|

27,082,359 |

|

29,795,615 |

|

Current assets held for sale |

8 |

|

797,095 |

|

796,211 |

|

970,742 |

|

978,788 |

|

|

|

|

5,059,150 |

|

5,477,973 |

|

28,053,101 |

|

30,774,403 |

|

|

|

|

|

|

|

|

|

|

|

|

Trade receivables |

|

|

— |

|

— |

|

188,568 |

|

265,370 |

|

Marketable securities |

|

|

242,036 |

|

— |

|

343,262 |

|

113,360 |

|

Restricted cash |

|

|

184 |

|

— |

|

186,668 |

|

146,297 |

|

Deferred tax assets |

9 |

|

1,318,408 |

|

1,758,410 |

|

3,759,598 |

|

4,495,296 |

|

Receivables from related parties |

5.4 |

|

199,122 |

|

292,882 |

|

132,110 |

|

202,826 |

|

Income tax receivable |

|

|

— |

|

— |

|

255,817 |

|

264,308 |

|

Other non-current tax receivable |

|

|

35,613 |

|

35,177 |

|

1,371,763 |

|

1,334,553 |

|

Judicial deposits |

10 |

|

419,029 |

|

416,969 |

|

1,085,085 |

|

1,056,690 |

|

Derivative financial instruments |

5.3 |

|

326,451 |

|

1,547,093 |

|

2,012,456 |

|

2,893,987 |

|

Sectorial financial assets |

|

|

— |

|

— |

|

522,427 |

|

509,695 |

|

Other non-current assets |

|

|

55,329 |

|

140,594 |

|

730,757 |

|

739,386 |

|

Other financial assets |

|

|

— |

|

— |

|

4,267 |

|

3,820 |

|

Investments in subsidiaries and associates |

6 |

|

22,796,530 |

|

31,308,696 |

|

1,549,774 |

|

10,678,566 |

|

Investment in joint ventures |

7 |

|

1,078,449 |

|

1,193,072 |

|

9,540,470 |

|

10,545,044 |

|

Property, plant and equipment |

8.1 |

|

38,815 |

|

39,038 |

|

23,760,689 |

|

23,019,016 |

|

Intangible assets and goodwill |

8.2 |

|

10,769 |

|

9,873 |

|

26,590,388 |

|

26,330,785 |

|

Contract assets |

|

|

— |

|

— |

|

978,132 |

|

1,114,830 |

|

Right-of-use assets |

8.3 |

|

18,015 |

|

17,557 |

|

9,596,807 |

|

9,958,751 |

|

Investment property |

|

|

— |

|

— |

|

16,824,078 |

|

16,818,919 |

|

Non-current assets |

|

|

26,538,750 |

|

36,759,361 |

|

99,433,116 |

|

110,491,499 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

31,597,900 |

|

42,237,334 |

|

127,486,217 |

|

141,265,902 |

Statements of financial position

(In thousands of Reais)

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

Note |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2025 |

|

December 31, 2024 |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

Loans, borrowings and debentures |

5.2 |

|

360,607 |

|

347,032 |

|

2,628,017 |

|

4,403,148 |

|

Leases |

|

|

10,088 |

|

9,227 |

|

1,024,093 |

|

1,007,533 |

|

Derivative financial instruments |

5.3 |

|

152,414 |

|

1,074,991 |

|

1,820,126 |

|

2,504,117 |

|

Trade payables |

5.5 |

|

1,304 |

|

2,900 |

|

3,886,590 |

|

5,168,593 |

|

Employee benefits payables |

|

|

13,222 |

|

43,356 |

|

498,255 |

|

794,906 |

|

Income tax payables |

|

|

24,188 |

|

18,514 |

|

140,123 |

|

414,823 |

|

Other taxes payable |

|

|

82,333 |

|

78,197 |

|

592,940 |

|

637,842 |

|

Dividends payable |

11 |

|

39 |

|

3,495 |

|

55,086 |

|

96,722 |

|

Reduction of capital payable |

|

|

— |

|

— |

|

— |

|

486,285 |

|

Concessions payable |

|

|

— |

|

— |

|

170,863 |

|

166,273 |

|

Related party payables |

5.4 |

|

126,157 |

|

210,620 |

|

434,093 |

|

416,410 |

|

Sectorial financial liabilities |

|

|

— |

|

— |

|

67,001 |

|

64,718 |

|

Other financial liabilities |

5 |

|

— |

|

— |

|

825,269 |

|

770,103 |

|

Other current liabilities |

|

|

333,881 |

|

298,534 |

|

911,523 |

|

895,223 |

|

Current liabilities |

|

|

1,104,233 |

|

2,086,866 |

|

13,053,979 |

|

17,826,696 |

|

Liabilities related to assets held for sale |

|

|

— |

|

— |

|

86,145 |

|

86,138 |

|

|

|

|

1,104,233 |

|

2,086,866 |

|

13,140,124 |

|

17,912,834 |

|

Loans, borrowings and debentures |

5.2 |

|

15,731,504 |

|

21,003,523 |

|

58,052,637 |

|

62,052,278 |

|

Leases |

|

|

14,590 |

|

15,232 |

|

5,367,814 |

|

5,502,220 |

|

Derivative financial instruments |

5.3 |

|

39,965 |

|

29,883 |

|

559,737 |

|

966,087 |

|

Trade payables |

5.5 |

|

— |

|

— |

|

19,512 |

|

19,256 |

|

Employee benefits payables |

|

|

— |

|

— |

|

25,463 |

|

19,101 |

|

Other taxes payable |

|

|

132,547 |

|

216,203 |

|

160,722 |

|

255,245 |

|

Provision for legal proceedings |

10 |

|

361,210 |

|

308,607 |

|

2,196,218 |

|

2,044,633 |

|

Concessions payable |

|

|

— |

|

— |

|

3,669,664 |

|

3,554,917 |

|

Investments with unsecured liabilities |

6.1 |

|

347,304 |

|

263,722 |

|

— |

|

— |

|

Related party payables |

5.4 |

|

5,611,623 |

|

7,052,404 |

|

1,078 |

|

1,078 |

|

Post-employment benefits |

|

|

289 |

|

279 |

|

558,608 |

|

526,620 |

|

Deferred tax liabilities |

|

|

— |

|

— |

|

6,030,613 |

|

5,973,506 |

|

Sectorial financial liabilities |

|

|

— |

|

— |

|

2,021,410 |

|

1,975,521 |

|

Deferred income |

|

|

— |

|

— |

|

15,962 |

|

16,589 |

|

Other financial liabilities |

|

|

— |

|

— |

|

153,371 |

|

297,736 |

|

Other non-current liabilities |

|

|

362,972 |

|

356,851 |

|

742,306 |

|

749,919 |

|

Non-current liabilities |

|

|

22,602,004 |

|

29,246,704 |

|

79,575,115 |

|

83,954,706 |

|

Total liabilities |

|

|

23,706,237 |

|

31,333,570 |

|

92,715,239 |

|

101,867,540 |

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

11 |

|

|

|

|

|

|

|

|

|

Share capital |

|

|

8,832,544 |

|

8,832,544 |

|

8,832,544 |

|

8,832,544 |

|

Treasury shares |

|

|

(84,496) |

|

(50,708) |

|

(84,496) |

|

(50,708) |

|

Additional paid-in capital |

|

|

1,157,267 |

|

2,205,878 |

|

1,157,267 |

|

2,205,878 |

|

Accumulated other comprehensive income |

|

|

424,048 |

|

565,855 |

|

424,048 |

|

565,855 |

|

Profit reserve |

|

|

8,773,990 |

|

8,773,990 |

|

8,773,990 |

|

8,773,990 |

|

Accumulated losses |

|

|

(11,211,690) |

|

(9,423,795) |

|

(11,211,690) |

|

(9,423,795) |

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to owners of the Company |

|

|

7,891,663 |

|

10,903,764 |

|

7,891,663 |

|

10,903,764 |

|

Non-controlling interest |

6.2 |

|

— |

|

— |

|

26,879,315 |

|

28,494,598 |

|

Total shareholders' equity |

|

|

7,891,663 |

|

10,903,764 |

|

34,770,978 |

|

39,398,362 |

|

Total liabilities and shareholders' equity |

|

|

31,597,900 |

|

42,237,334 |

|

127,486,217 |

|

141,265,902 |

(In thousands of Reais, except earnings per share)

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

|

|

Period of three months ended March 31, |

||||||

|

|

Note |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

Net sales |

13 |

|

— |

|

— |

|

9,662,601 |

|

9,842,056 |

|

Cost of sales |

14 |

|

— |

|

— |

|

(6,791,905) |

|

(6,928,437) |

|

Gross profit |

|

|

— |

|

— |

|

2,870,696 |

|

2,913,619 |

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

14 |

|

— |

|

— |

|

(440,056) |

|

(361,404) |

|

General and administrative expenses |

14 |

|

(57,937) |

|

(103,683) |

|

(535,032) |

|

(583,255) |

|

Other operating income (expenses), net |

15 |

|

173,925 |

|

(14,238) |

|

524,130 |

|

761 |

|

Impairment |

15 |

|

— |

|

— |

|

(285,608) |

|

— |

|

Operating expenses |

|

|

115,988 |

|

(117,921) |

|

(736,566) |

|

(943,898) |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) before equity in earnings of investees, finance results and income taxes |

|

|

115,988 |

|

(117,921) |

|

2,134,130 |

|

1,969,721 |

|

|

|

|

|

|

|

|

|

|

|

|

Interest in earnings (losses) of subsidiaries and associates |

6 |

|

(493,236) |

|

824,169 |

|

19,049 |

|

461,423 |

|

Interest in losses of joint ventures |

7 |

|

(128,194) |

|

(45,874) |

|

(1,139,047) |

|

(403,908) |

|

Equity in earnings (losses) of investees |

|

|

(621,430) |

|

778,295 |

|

(1,119,998) |

|

57,515 |

|

|

|

|

|

|

|

|

|

|

|

|

Finance expense |

|

|

(763,961) |

|

(529,536) |

|

(2,713,642) |

|

(1,864,555) |

|

Finance income |

|

|

224,542 |

|

58,182 |

|

1,037,901 |

|

615,101 |

|

Foreign exchange, net |

|

|

1,079,284 |

|

(337,996) |

|

1,793,964 |

|

(531,218) |

|

Net effect of derivatives |

|

|

(1,163,099) |

|

(513,361) |

|

(2,021,218) |

|

1,343 |

|

Finance results, net |

16 |

|

(623,234) |

|

(1,322,711) |

|

(1,902,995) |

|

(1,779,329) |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) before income taxes |

|

|

(1,128,676) |

|

(662,337) |

|

(888,863) |

|

247,907 |

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

9 |

|

|

|

|

|

|

|

|

|

Current |

|

|

— |

|

(3,849) |

|

(303,162) |

|

(284,396) |

|

Deferred |

|

|

(659,219) |

|

474,011 |

|

(743,373) |

|

300,033 |

|

|

|

|

(659,219) |

|

470,162 |

|

(1,046,535) |

|

15,637 |

|

Profit (loss) for the period |

|

|

(1,787,895) |

|

(192,175) |

|

(1,935,398) |

|

263,544 |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

Owners of the Company |

|

|

(1,787,895) |

|

(192,175) |

|

(1,787,895) |

|

(192,175) |

|

Non-controlling interest |

|

|

— |

|

— |

|

(147,503) |

|

455,719 |

|

|

|

|

(1,787,895) |

|

(192,175) |

|

(1,935,398) |

|

263,544 |

|

|

|

|

|

|

|

|

|

|

|

|

Losses per share |

12 |

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

(R$0.96) |

|

(R$0.10) |

|

Diluted |

|

|

|

|

|

|

(R$0.96) |

|

(R$0.10) |

The accompanying notes are an integral part of these individual and consolidated interim financial statements.

(In thousands of Reais)

|

|

Parent Company |

|

Consolidated |

||||

|

|

Period of three months ended March 31, |

||||||

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

Profit (loss) for the period |

(1,787,895) |

|

(192,175) |

|

(1,935,398) |

|

263,544 |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

Items that are or may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

Foreign currency translation differences |

(290,696) |

|

62,887 |

|

(290,198) |

|

63,056 |

|

Gain (loss) on cash flow hedge |

162,887 |

|

(32,384) |

|

222,492 |

|

(42,564) |

| Deferred taxes | — | — | (28,025) | — | |||

|

|

(127,809) |

|

30,503 |

|

(95,731) |

|

20,492 |

|

|

|

|

|

|

|

|

|

|

Items that will not be reclassified to profit or loss: |

|

|

|

|

|

|

|

|

Actuarial losses (gains) with defined benefit plan |

(22,497) |

|

14,408 |

|

(59,336) |

|

24,286 |

|

Deferred taxes |

8,499 |

|

— |

|

17,002 |

|

(8,257) |

|

|

(13,998) |

|

14,408 |

|

(42,334) |

|

16,029 |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income for the period |

(1,929,702) |

|

(147,264) |

|

(2,073,463) |

|

300,065 |

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) attributable to: |

|

|

|

|

|

|

|

|

Owners of the Company |

(1,929,702) |

|

(147,264) |

|

(1,929,702) |

|

(147,264) |

|

Non-controlling interest |

— |

|

— |

|

(143,761) |

|

447,329 |

|

|

(1,929,702) |

|

(147,264) |

|

(2,073,463) |

|

300,065 |

The accompanying notes are an integral part of these individual and consolidated interim financial statements.

(In thousands of Reais)

|

|

|

|

|

|

|

Capital reserve |

|

|

|

Profit reserve |

|

|

|

|

|

|

|

|||||

|

|

|

Share capital |

|

Treasury shares |

|

Corporate transactions - Law 6404 |

|

Additional paid-in capital |

|

Accumulated other comprehensive income |

|

Legal |

|

Statutory reserve |

|

Accumulated loss |

|

Equity attributable to controlling shareholders |

|

Interest of non-controlling shareholders |

|

Total equity |

|

Balance as of January 1, 2025 |

|

8,832,544 |

|

(50,708) |

|

737 |

|

2,205,141 |

|

565,855 |

|

58,802 |

|

8,715,188 |

|

(9,423,795) |

|

10,903,764 |

|

28,494,598 |

|

39,398,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(1,787,895) |

|

(1,787,895) |

|

(147,503) |

|

(1,935,398) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain from cash flow hedge |

|

— |

|

— |

|

— |

|

— |

|

162,887 |

|

— |

|

— |

|

— |

|

162,887 |

|

31,580 |

|

194,467 |

|

Foreign currency translation differences |

|

— |

|

— |

|

— |

|

— |

|

(290,696) |

|

— |

|

— |

|

— |

|

(290,696) |

|

498 |

|

(290,198) |

|

Actuarial loss on defined benefit plan, net of tax |

|

— |

|

— |

|

— |

|

— |

|

(13,998) |

|

— |

|

— |

|

— |

|

(13,998) |

|

(28,336) |

|

(42,334) |

|

Total comprehensive loss for the period |

|

— |

|

— |

|

— |

|

— |

|

(141,807) |

|

— |

|

— |

|

(1,787,895) |

|

(1,929,702) |

|

(143,761) |

|

(2,073,463) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners of the Company contributions and distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase in subsidiary |

|

— |

|

— |

|

— |

|

(89,084) |

|

— |

|

— |

|

— |

|

— |

|

(89,084) |

|

89,084 |

|

— |

|

Own shares acquired (note 11 (a)) |

|

— |

|

(34,022) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(34,022) |

|

— |

|

(34,022) |

|

Share based payments |

|

— |

|

234 |

|

— |

|

114 |

|

— |

|

— |

|

— |

|

— |

|

348 |

|

6,771 |

|

7,119 |

|

Dividends |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(375,782) |

|

(375,782) |

|

Employee share schemes - value of employee services |

|

— |

|

— |

|

— |

|

15,559 |

|

— |

|

— |

|

— |

|

— |

|

15,559 |

|

2,135 |

|

17,694 |

|

Total contributions and distributions |

|

— |

|

(33,788) |

|

— |

|

(73,411) |

|

— |

|

— |

|

— |

|

— |

|

(107,199) |

|

(277,792) |

|

(384,991) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners of the Company: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change of shareholding interest in subsidiary (note 6.1) |

|

— |

|

— |

|

— |

|

(975,200) |

|

— |

|

— |

|

— |

|

— |

|

(975,200) |

|

(1,193,730) |

|

(2,168,930) |

|

Total transactions with owners of the Company |

|

— |

|

— |

|

— |

|

(975,200) |

|

— |

|

— |

|

— |

|

— |

|

(975,200) |

|

(1,193,730) |

|

(2,168,930) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total transactions with owners of the Company contributions and distributions: |

|

— |

|

(33,788) |

|

— |

|

(1,048,611) |

|

— |

|

— |

|

— |

|

— |

|

(1,082,399) |

|

(1,471,522) |

|

(2,553,921) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2025 |

|

8,832,544 |

|

(84,496) |

|

737 |

|

1,156,530 |

|

424,048 |

|

58,802 |

|

8,715,188 |

|

(11,211,690) |

|

7,891,663 |

|

26,879,315 |

|

34,770,978 |

The accompanying notes are an integral part of these individual and consolidated interim financial statements.

(In thousands of Reais)

| Capital reserve | Profit reserve | ||||||||||||||||||||||||||||||||||||||

|

|

|

Share capital |

|

Treasury shares |

|

Corporate transactions - Law 6404 |

|

Capital transactions |

|

Accumulated other comprehensive income (loss) |

|

Legal |

|

Statutory reserve |

|

Retained earnings |

|

Accumulated loss |

|

Equity attributable to controlling shareholders |

|

Interest of non-controlling shareholders |

|

Total equity |

|||||||||||||||

|

Balance as of January 1, 2024 |

|

8,682,544 |

|

(93,917) |

|

737 |

|

2,561,227 |

|

314,325 |

|

58,802 |

|

8,610,796 |

|

820,793 |

|

— |

|

20,955,307 |

|

30,025,873 |

|

50,981,180 |

|||||||||||||||

|

Profit (loss) for the period |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(192,175) |

|

(192,175) |

|

455,719 |

|

263,544 |

|||||||||||||||

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Loss from cash flow hedge |

|

— |

|

— |

|

— |

|

— |

|

(32,384) |

|

— |

|

— |

|

— |

|

— |

|

(32,384) |

|

(10,180) |

|

(42,564) |

|||||||||||||||

|

Foreign currency translation differences |

|

— |

|

— |

|

— |

|

— |

|

62,887 |

|

— |

|

— |

|

— |

|

— |

|

62,887 |

|

169 |

|

63,056 |

|||||||||||||||

|

Actuarial gain on defined benefit plan, net of tax |

|

— |

|

— |

|

— |

|

— |

|

14,408 |

|

— |

|

— |

|

— |

|

— |

|

14,408 |

|

1,621 |

|

16,029 |

|||||||||||||||

|

Total comprehensive income (loss) for the period |

|

— |

|

— |

|

— |

|

— |

|

44,911 |

|

— |

|

— |

|

— |

|

(192,175) |

|

(147,264) |

|

447,329 |

|

300,065 |

|||||||||||||||

|

Transactions with owners of the Company contributions and distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Reduction of capital in subsidiary |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(20,629) |

|

(20,629) |

|||||||||||||||

|

Share based payments |

|

— |

|

23,097 |

|

— |

|

(66,792) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(43,695) |

|

— |

|

(43,695) |

|||||||||||||||

|

Dividends |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(221,019) |

|

(221,019) |

|||||||||||||||

|

Own shares acquired |

|

— |

|

(88,821) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(88,821) |

|

— |

|

(88,821) |

|||||||||||||||

|

Loss on distribution of dividends to non-controlling shareholders |

|

— |

|

— |

|

— |

|

(420) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(420) |

|

(75) |

|

(495) |

|||||||||||||||

|

Employee share schemes - value of employee services |

|

— |

|

— |

|

— |

|

2,390 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

2,390 |

|

12,072 |

|

14,462 |

|||||||||||||||

|

Total contributions and distributions |

|

— |

|

(65,724) |

|

— |

|

(64,822) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(130,546) |

|

(229,651) |

|

(360,197) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Transactions with owners of the Company: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Change of shareholding interest in subsidiary |

|

— |

|

— |

|

— |

|

(727) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(727) |

|

— |

|

(727) |

|||||||||||||||

|

Total transactions with owners of the Company |

|

— |

|

— |

|

— |

|

(727) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(727) |

|

— |

|

(727) |

|||||||||||||||

|

Total transactions with owners of the Company contributions and distributions: |

|

— |

|

(65,724) |

|

— |

|

(65,549) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(131,273) |

|

(229,651) |

|

(360,924) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Balance as of March 31, 2024 |

|

8,682,544 |

|

(159,641) |

|

737 |

|

2,495,678 |

|

359,236 |

|

58,802 |

|

8,610,796 |

|

820,793 |

|

(192,175) |

|

20,676,770 |

|

30,243,551 |

|

50,920,321 |

|||||||||||||||

The accompanying notes are an integral part of these individual and consolidated interim financial statements.

(In thousands of Reais)

| Parent Company |

Consolidated |

||||||||

| Period of three months ended March 31, |

|||||||||

| Note | 2025 | 2024 | 2025 | 2024 | |||||

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

Loss (profit) before income taxes |

|

|

(1,128,676) |

|

(662,337) |

|

(888,863) |

|

247,907 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments for: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

14 |

|

4,713 |

|

3,851 |

|

967,894 |

|

907,264 |

|

Loss on disposed assets |

15 |

|

— |

|

— |

|

285,608 |

|

— |

|

Interest in earnings (losses) of subsidiaries and associates |

6 |

|

493,236 |

|

(824,169) |

|

(19,049) |

|

(461,423) |

|

Interest in losses of joint ventures |

7 |

|

128,194 |

|

45,874 |

|

1,139,047 |

|

403,908 |

|

Loss (gain) on disposed assets |

15 |

|

— |

|

7 |

|

(4,194) |

|

8,659 |

|

Share based payment |

17 |

|

6,220 |

|

21,194 |

|

23,892 |

|

47,557 |

|

Provision for legal proceedings |

15 |

|

35,589 |

|

10,842 |

|

84,992 |

|

81,260 |

|

Interest, derivatives, monetary and foreign exchange, net |

|

|

762,997 |

|

1,343,237 |

|

2,397,005 |

|

2,109,721 |

|

Sectorial financial assets and liabilities, net |

|

|

— |

|

— |

|

8,586 |

|

(53,026) |

|

Provisions for employee benefits |

|

|

(579) |

|

6,323 |

|

93,871 |

|

87,258 |

|

Allowance for expected credit losses |

|

|

— |

|

— |

|

11,110 |

|

13,033 |

|

Deferred income |

|

|

— |

|

— |

|

(635) |

|

(650) |

|

Revenue from finance investment |

|

|

(9,143) |

|

— |

|

(9,143) |

|

— |

|

Previously recognized gain in other comprehensive income reclassified to profit or loss upon disposal of investment |

|

|

(206,388) |

|

— |

|

(206,388) |

|

— |

|

Other |

|

|

10 |

|

620 |

|

(88,830) |

|

50,812 |

|

|

|

|

86,173 |

|

(54,558) |

|

3,794,903 |

|

3,442,280 |

|

Variation in: |

|

|

|

|

|

|

|

|

|

|

Trade receivable |

|

|

— |

|

— |

|

(263,936) |

|

(521,801) |

|

Inventories |

|

|

— |

|

— |

|

(99,705) |

|

(125,602) |

|

Other taxes, net |

|

|

2,764 |

|

(7,312) |

|

(138,771) |

|

46,145 |

|

Income tax |

|

|

(26,586) |

|

29,044 |

|

(614,678) |

|

(328,439) |

|

Related parties, net |

|

|

21,633 |

|

(7,751) |

|

(21,353) |

|

126,498 |

|

Trade payables |

|

|

(1,596) |

|

1,427 |

|

(280,419) |

|

(156,761) |

|

Employee benefits |

|

|

(29,555) |

|

(54,135) |

|

(374,402) |

|

(323,520) |

|

Provision for legal proceedings |

|

|

67 |

|

2,008 |

|

(38,754) |

|

(95,857) |

|

Derivatives financial instruments |

|

|

— |

|

— |

|

(5,107) |

|

(4,922) |

|

Other financial liabilities |

|

|

— |

|

— |

|

(53,150) |

|

(51,119) |

|

Judicial deposits |

|

|

(1,561) |

|

(883) |

|

(12,589) |

|

(98,858) |

|

Post-employment benefits obligation |

|

|

— |

|

— |

|

(9,848) |

|

(6,576) |

|

Other assets and liabilities, net |

|

|

(5,646) |

|

40,015 |

|

(152,287) |

|

44,617 |

|

|

|

|

(40,480) |

|

2,413 |

|

(2,064,999) |

|

(1,496,195) |

|

|

|

|

|

|

|

|

|

|

— |

|

Net cash (generated) used in operating activities |

|

|

45,693 |

|

(52,145) |

|

1,729,904 |

|

1,946,085 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

Shareholder payments for future capital increases |

|

|

— |

|

(4,070,000) |

|

— |

|

— |

|

Capital contribution to associates |

6 |

|

(331,000) |

|

— |

|

— |

|

— |

|

Capital contribution in joint ventures |

|

|

— |

|

(4,337) |

|

— |

|

(4,337) |

|

Capital reduction in subsidiaries |

|

|

1,013,760 |

|

5,227 |

|

11,000 |

|

— |

|

Purchase of marketable securities |

|

|

193,880 |

|

347,038 |

|

472,358 |

|

(444,102) |

Statement of cash flows

(In thousands of Reais)

| Parent Company |

Consolidated |

||||||||

| Period of three months ended March 31, |

|||||||||

| Note | 2025 | 2024 | 2025 | 2024 | |||||

|

Restricted cash |

|

|

(184) |

|

7,197 |

|

(114,600) |

|

5,508 |

|

Dividends received from associates |

|

|

14,110 |

|

244,324 |

|

4,277 |

|

587,744 |

|

Dividends received from joint venture |

|

|

5,184 |

|

228,342 |

|

45,640 |

|

293,912 |

|

Dividends received from finance investment |

|

|

87,608 |

|

— |

|

87,608 |

|

— |

|

Cash in the incorporation operation |

|

|

10,089 |

|

— |

|

— |

|

— |

|

Acquisition of property, plant and equipment, intangible and contract assets |

|

|

(3,797) |

|

(1,160) |

|

(2,284,909) |

|

(1,535,849) |

|

Proceeds from the sale of investments |

2.1 |

|

8,892,802 |

|

— |

|

8,892,802 |

|

— |

|

Cost of acquiring new business |

6.3 |

|

— |

|

— |

|

(213,086) |

|

— |

|

Receipt of derivative financial instruments, except debt |

|

|

— |

|

— |

|

— |

|

65 |

|

Payment of derivative financial instruments, except debt |

|

|

(981,504) |

|

— |

|

(981,504) |

|

(180) |

|

Related parties |

|

|

25,592 |

|

— |

|

25,592 |

|

— |

|

Cash received on the sale of property, plant and equipment and intangible assets |

|

|

— |

|

— |

|

1,024 |

|

— |

|

Other financial assets |

|

|

— |

|

— |

|

(80) |

|

— |

|

Net cash (generated) used in investing activities |

|

|

8,926,540 |

|

(3,243,369) |

|

5,946,122 |

|

(1,097,239) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

Proceeds from loans, borrowings and debentures |

5.2 |

|

2,442,980 |

|

2,980,221 |

|

6,486,495 |

|

7,577,959 |

|

Principal repayment of loans, borrowings and debentures |

5.2 |

|

(7,148,782) |

|

— |

|

(11,504,819) |

|

(4,418,898) |

|

Payment of interest on loans, borrowings and debentures |

5.2 |

|

(459,313) |

|

(262,844) |

|

(1,271,271) |

|

(1,007,511) |

|

Payment of derivative financial instruments |

|

|

(213,110) |

|

(238,456) |

|

(938,580) |

|

(1,378,647) |

|

Proceeds from derivative financial instruments |

|

|

347,361 |

|

13,530 |

|

979,572 |

|

516,758 |

|

Costs of banking operations with derivatives |

|

|

— |

|

— |

|

— |

|

(29,828) |

|

Principal repayment of leases |

|

|

(1,822) |

|

(1,558) |

|

(143,920) |

|

(120,611) |

|

Payment of interest on leases |

|

|

(666) |

|

(828) |

|

(98,596) |

|

(87,946) |

|

Capital reduction |

|

|

— |

|

— |

|

(486,240) |

|

(20,520) |

|

Related parties |

|

|

(1,223,068) |

|

(184,739) |

|

— |

|

— |

|

Payments to redeem the entity’s shares and acquisition of treasury shares |

11 |

|

(34,022) |

|

(91,332) |

|

(34,022) |

|

(91,332) |

|

Acquisition of non-controlling shareholders’ shares |

2.1 |

|

(2,169,000) |

|

— |

|

(2,169,000) |

|

— |

|

Dividends paid |

11 |

|

— |

|

— |

|

(44,032) |

|

(93,851) |

|

Dividends paid for preferred shares |

11 |

|

— |

|

— |

|

(371,000) |

|

— |

|

Gain on derivative banking operations |

|

|

22,100 |

|

— |

|

22,100 |

|

— |

|

Net cash (used in) generated from financing activities |

|

|

(8,437,342) |

|

2,213,994 |

|

(9,573,313) |

|

845,573 |

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

|

534,891 |

|

(1,081,520) |

|

(1,897,287) |

|

1,694,419 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period |

|

|

2,201,267 |

|

1,769,976 |

|

16,903,542 |

|

14,658,481 |

|

Effect of foreign exchange rate changes |

|

|

(3,636) |

|

3,272 |

|

(197,172) |

|

45,521 |

|

Cash and cash equivalents at the end of the period |

|

|

2,732,522 |

|

691,728 |

|

14,809,083 |

|

16,398,421 |

|

|

|

|

|

|

|

|

|

|

|

|

Additional information |

|

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

|

— |

|

— |

|

371,123 |

|

251,518 |

The accompanying notes are an integral part of these individual and consolidated interim financial statements.

Statement of cash flows

(In thousands of Reais)

Non-cash transactions:

The Company presents its statements of cash flow using the indirect method. During the period ended March 31, 2025, the Company carried out the following transactions that did not involve cash and, therefore, are not reflected in the parent company and consolidated statement of cash flows:

| (i) | Recognition of right-of-use as a counterpart to the lease liability in the amount of R$135,098 (R$15,775 on March 31, 2024), resulting from the application of inflation indexes and new contracts classified under the leasing rule (Note 8.3). |

| (ii) | Acquisition of property, plant and equipment and intangible assets with payment in installments of R$567,019 (R$696,688 on March 31, 2024). |

| (iii) | The remaining balance of the acquisition of Compagas in the amount of R$613,385, which will be settled by September 2026. |

Disclosure of interest and dividends:

Dividends and interest in shareholders' equity are classified by the Company as cash flow from investing activities. Dividends and interest received or paid are classified as cash flow from financing activities.

(In thousands of Reais)

|

|

Parent Company |

|

Consolidated |

||||

|

|

Period of three months ended March 31, |

||||||

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

Revenue |

|

|

|

|

|

|

|

|

Net sales |

— |

|

— |

|

10,946,098 |

|

11,515,795 |

|

Other income (expenses), net |

218,008 |

|

(1,192) |

|

639,449 |

|

66,357 |

|

Impairment gain (loss) on trade receivables |

— |

|

— |

|

(11,110) |

|

4,832 |

|

|

218,008 |

|

(1,192) |

|

11,574,437 |

|

11,586,984 |

|

Inputs purchased from third parties |

|

|

|

|

|

|

|

|

Cost of goods sold and services rendered |

— |

|

— |

|

6,015,910 |

|

6,410,877 |

|

Materials, energy, third-party services and other |

39,748 |

|

40,493 |

|

484,732 |

|

561,922 |

|

Impairment |

— |

|

— |

|

285,608 |

|

— |

|

|

39,748 |

|

40,493 |

|

6,786,250 |

|

6,972,799 |

|

|

|

|

|

|

|

|

|

|

Gross value added |

178,260 |

|

(41,685) |

|

4,788,187 |

|

4,614,185 |

|

|

|

|

|

|

|

|

|

|

Retention |

|

|

|

|

|

|

|

|

Depreciation and amortization |

4,713 |

|

3,851 |

|

967,894 |

|

907,264 |

|

Net value added |

173,547 |

|

(45,536) |

|

3,820,293 |

|

3,706,921 |

|

|

|

|

|

|

|

|

|

|

Value added transferred in |

|

|

|

|

|

|

|

|

Interest in earnings (losses) of subsidiaries and associates |

(493,236) |

|

824,169 |

|

19,049 |

|

461,423 |

|

Interest in losses of joint ventures |

(128,194) |

|

(45,874) |

|

(1,139,047) |

|

(403,908) |

|

Finance income |

1,303,826 |

|

58,182 |

|

2,831,865 |

|

615,101 |

|

|

682,396 |

|

836,477 |

|

1,711,867 |

|

672,616 |

|

|

|

|

|

|

|

|

|

|

Value added to be distributed |

855,943 |

|

790,941 |

|

5,532,160 |

|

4,379,537 |

|

|

|

|

|

|

|

|

|

|

Distribution of value added |

|

|

|

|

|

|

|

|

Personnel and payroll charges |

45,508 |

|

54,597 |

|

679,116 |

|

629,026 |

|

Direct remuneration |

38,243 |

|

41,097 |

|

577,358 |

|

504,154 |

|

Benefits |

4,530 |

|

3,409 |

|

72,222 |

|

89,653 |

|

FGTS and other |

2,735 |

|

10,091 |

|

29,536 |

|

35,219 |

|

|

|

|

|

|

|

|

|

|

Taxes, fees and contributions |

671,267 |

|

(452,371) |

|

2,130,166 |

|

1,070,957 |

|

Federal |

667,807 |

|

(457,914) |

|

1,411,485 |

|

361,718 |

|

State |

1 |

|

— |

|

683,991 |

|

661,006 |

|

Municipal |

3,459 |

|

5,543 |

|

34,690 |

|

48,233 |

|

|

|

|

|

|

|

|

|

|

Financial expenses and rents |

1,927,063 |

|

1,380,890 |

|

4,658,276 |

|

2,416,010 |

|

Interest and foreign exchange variation |

1,827,712 |

|

1,371,928 |

|

4,275,125 |

|

2,306,059 |

|

Rents |

— |

|

— |

|

19,533 |

|

29,077 |

|

Other |

99,351 |

|

8,962 |

|

363,618 |

|

80,874 |

|

|

|

|

|

|

|

|

|

|

Equity remuneration |

(1,787,895) |

|

(192,175) |

|

(1,935,398) |

|

263,544 |

|

Non-controlling interests |

— |

|

— |

|

(147,503) |

|

455,719 |

|

Retained losses |

(1,787,895) |

|

(192,175) |

|

(1,787,895) |

|

(192,175) |

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

Cosan S.A. (“Cosan” or “the Company”) is a publicly traded company at B3 S.A. - Brasil, Bolsa, Balcão (“B3”) in the special New Market (Novo Mercado) segment under the ticker “CSAN3”. The Company's American Depositary Shares (“ADSs”) are listed on the New York Stock Exchange, or “NYSE”, and are traded under the ticker “CSAN”. Cosan is a corporation (sociedade anônima) of indefinite term incorporated under the laws of Brazil, with its registered office in the city of São Paulo, state of São Paulo (SP). Mr. Rubens Ometto Silveira Mello is the ultimate controlling shareholder of Cosan.

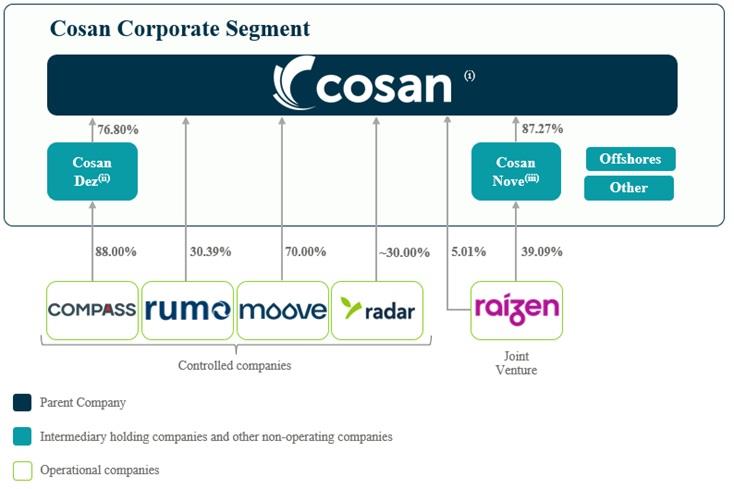

As at March 31, 2025, Cosan Corporate (Cosan’s Corporate segment) is formed of the following entities:

| (i) | Parent company with direct or indirect equity interest in subsidiaries and joint ventures. The main effects on its profit or loss are general and administrative expenses, contingencies, equity income and financial results attributed to loans. |

| (ii) | Bradesco BBI S.A. (“Bradesco”) holds preferred shares corresponding to a 23.20% stake in Cosan Dez Participações S.A. (“Cosan Dez”), which has a direct 88% stake in Compass. |

| (iii) | Itaú Unibanco S.A. (“Itaú”) holds preferred shares corresponding to a 12.73% stake in Cosan Nove Participações S.A. (“Cosan Nove”), which has a direct 39.09% stake in Raízen S.A. (“Raízen”). |

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

Acquisition of DIPI Holdings Ltda by Moove

On September 29, 2024, Cosan Lubrificantes e Especialidades S.A. (“CLE”) entered into a purchase and sale agreement to acquire 100% of the shares of DIPI Holdings Ltda, for the price of R$329,006. The transaction was concluded on January 2, 2025, after all the conditions precedent had been met. The Company made the preliminary recognition of the price allocation, as detailed in Note 6.3.

Incorporation of Cosan Oito S.A.

On January 8, 2025, the Company successfully finalized the merger with Cosan Oito S.A. ("Cosan Oito"), after securing the requisite regulatory approvals. Consequently, all assets, liabilities, and shareholders' equity of Cosan Oito were comprehensively transferred to the Company. See Note 6.1.

Partial disposal of investment in Vale S.A.

On January 16, 2025, the Company sold 173,073,795 Vale S.A. (“Vale”) common shares, representing 4.05% of Vale's share capital, for a net commission of R$8,892,802 (see Note 6.1(b)). After this transaction, the Company kept 4,268,720 Vale common shares, corresponding to 0.10% of the share capital, in the amount of R$ 242,036.

Discontinuation of the operation of the Costa Pinto second generation ethanol (“E2G”) pilot plat

On January 17, 2025, Raízen, jointly controlled by the Company, announced the discontinuation of the recurring operation of Costa Pinto's Second-Generation Ethanol (E2G) pilot plant (Plant 1), located in Piracicaba, São Paulo. The plant, inaugurated in 2015, will operate as a unit dedicated to the testing and future development of biofuel from the harvest starting on April 1, 2025.

The commercial commitments previously linked to Plant 1 will be met by the Bonfim Plant (Plant 2), which is already in operation, and by the Univalem (Plant 3) and Barra (Plant 4) plants, which are in the commissioning phase and will begin operations after obtaining the necessary regulatory authorizations.

Fire incident at Moove’s Industrial Complex

On February 8, 2025, a fire broke out at Moove's Industrial Complex (“CIG”), located in Rio de Janeiro. The incident affected part of the production area and the administrative offices, which were inoperative at the time of the incident, representing 10% of the total area of the complex.

Moove promptly activated all the emergency and risk management protocols to control the incident. The containment measures, implemented through the Moove's contingency plan, were effective in minimizing damage to the structure, the local community and the environment. There were no victims or injuries, and no significant environmental or social impacts were identified.

Bulk lubricant and base oil operations, the tank terminal, maritime operations and pier operations, which account for approximately one third of production, were not affected and continue to operate normally. Moove has begun implementing a continuity plan to re-establish blending and filling operations.

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

a) Operational interruption

The fire has been successfully controlled and is limited to the area where finished lubricant products are manufactured, which remains closed for inspections and assessments. The other operations of the industrial complex (bulk lubricant and base oil operations, tank terminal, marine operations and pier operations) continue to operate, representing between 30% and 35% of total production.

To mitigate the impact of the interruption, Moove implemented the following measures:

(i) Reallocation of blending and filling to other production plants.

(ii) Use of strategic alliance to guarantee product availability and supply chain continuity.

(iii) Production through third-party partners approved.

(iv) Use of safety stock distributed in the distribution center network.

b) Insurance coverage

Moove's global operations have comprehensive insurance coverage, which includes operational risks, business interruption damage, civil liability and environmental liability. The indemnity limit for this incident in the affected region totals approximately R$1,200,000. Moove has begun the process of evaluation and inspection with insurers.

c) Write-off of Assets

Moove will record the write-down of the affected assets in 2025, impacting the balance sheet and the income statement. The loss amount is under review, with the current estimate ranging between R$190,413 and R$285,620 for inventory and fixed asset losses. Of this amount, R$44,756, related to the assets located at the ignition point of the fire, are considered highly probable to be confirmed as lost by March 31, 2025. Estimates of losses related to business interruption are still in the early stages of analysis

Moove has hired a specialized company, knowledgeable about its operations, to conduct a physical inventory of the affected and unaffected assets at the CIG. The objective is to ascertain the actual extent of the loss with greater precision, identify and catalog the affected assets, and measure the impairment losses (cost value less accumulated depreciation), in accordance with CPC 01/IAS 36 – Impairment of Assets. The specialized company will issue a loss assessment report to support the accounting records. As of the date of issuance of these financial statements, the assessment work was not completed due to difficulties in accessing restricted areas and the extent of the work required for events of this magnitude.

Potential corporate reorganization proposal of Rumo Malha Norte

On February 19, 2025, Rumo S.A. (“Rumo”) and Rumo Malha Norte S.A. (“Rumo Malha Norte”) informed their shareholders and the market in general of the approval, by their respective Boards of Directors, of a potential corporate reorganization proposal. The proposal will be submitted for approval by the shareholders of the companies involved at their respective general meetings.

To conduct the negotiation of the exchange ratio in the potential corporate reorganization, special independent committees were set up and their members elected.

If approved, the corporate reorganization will optimize the corporate structure by incorporating the shares of the minority shareholders (0.26% of the share capital) of Rumo Malha Norte into Rumo, converting Rumo Malha Norte into a wholly owned subsidiary of Rumo. The minority shareholders of Rumo Malha Norte who retain their shares until the date of approval of the corporate reorganization by the general meetings of the companies involved will receive common shares in Rumo, in proportion to their holdings in the share capital of Rumo Malha Norte.

Cosan Dez capital reduction

On February 27, 2025, the Company received the amount of R$1,013,760 related to the capital reduction of Cosan Dez, approved at the Extraordinary General Meeting on June 26, 2024.

Redemption of Cosan Nove preferred shares

On March 28, 2025, the Company redeemed 1,087,179,567 preferred shares of Cosan Nove, previously held by Banco Itaú, for the amount of R$ 2,169,000 thousand. After the transaction, the preferred shares were converted into common shares. As a result, the Company's stake in Cosan Nove increased to 87.27% (see Note 6.1).

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

Early redemptions of debentures

On January 22, 2025, the Company requested the optional early redemption of the 1st Series of the 3rd Issue of Simple Debentures, non-convertible into shares, unsecured, with original maturity in 2028, in the total amount of R$750,000 to be increased by the remuneration calculated pro rata temporis from the date of the last payment until the date of the actual payment and the premium.

Early call (Bond 2027)

On January 29, 2025, the Company informed the market that it had exercised the early redemption clause of the 2027 Bond, maturing in January 2027. The full redemption, in the amount of U.S.$392,000 thousand, equivalent to R$2,250,825, was carried out on March 14, 2025, at the face value of the bonds.

Tender offers - Bonds 2029, 2030 and 2031and debentures

During the first quarter of 2025, the Company made partial repurchases of the 5th and 6th issue of Debentures and securities issued by Cosan Luxembourg S.A. (“Cosan Lux”), specifically Bonds 2029, 2030 and 2031, as detailed in the table below:

|

Notes |

Added value of the principal |

Added value paid on repurchase |

Interest paid |

Prize |

Gain/Loss |

|

5.500% Senior notes – 2029 |

1,347,741 |

1,228,072 |

30,487 |

67,135 |

52,534 |

|

7.500% Senior notes – 2030 |

1,568,974 |

1,541,476 |

16,842 |

78,522 |

(51,024) |

|

7.250% Senior notes – 2031 |

1,594,064 |

1,544,299 |

16,798 |

79,604 |

(29,839) |

|

5th and 6th Debentures |

1,152,469 |

1,152,469 |

52,384 |

(17,714) |

(17,714) |

Early redemption

On February 12 and 13, 2025, respectively, the Company settled in advance Loan 4.131 in the amount of U.S.$600,000 thousand, equivalent to R$3,462,660, and Debenture in the amount of U.S.$300,000 thousand, equivalent to R$1,733,640, acquired in February 2024 and December 2023, respectively.

With the early settlement of these debts, the Total Return Swap (“TRS”) and Time Deposit operations were also settled, which had been used to internalize debts.

New debts

|

Segment / Modalities |

Date |

Incidence of interest |

Index |

Objective |

Funding costs |

Value |

Maturity |

|

Cosan Corporate |

|

|

|

|

|

|

|

|

Debenture |

03/12/2025 |

Yearly |

CDI + 0,60% p.a. |

Ordinary Capital management |

(46,633) |

1,500,000 |

01/27/2029 |

|

Debenture |

03/12/2025 |

Yearly |

CDI + 0,70% p.a. |

Ordinary Capital management |

(13,797) |

500,000 |

03/27/2030 |

|

Debenture |

03/12/2025 |

Yearly |

CDI + 1,00% p.a. |

Ordinary Capital management |

(13,721) |

500,000 |

03/27/2032 |

|

Compass |

|

|

|

|

|

|

|

|

Debenture |

01/10/2025 |

Yearly |

DI + spread 0.50% p.a. |

OrdinaryCapital management |

— |

410,000 |

01/07/2027 |

|

Debenture |

02/18/2025 |

Six-monthly |

IPCA + 7.44% p.a. |

Capital management |

(18,546) |

800,000 |

01/15/2033 |

| Loan 4.131 | 03/20/2025 | Yearly | CDI + 0.78% | Investment |

(659) |

350,000 | 03/20/2026 |

| Rumo | |||||||

|

Debenture |

03/28/2025 |

Yearly |

IPCA + 7.47% p.a. |

Ordinary Capital management |

(17,020) |

434,949 |

03/28/2037 |

|

Debenture |

03/28/2025 |

Yearly |

IPCA + 7.53% p.a. |

Ordinary Capital management |

(63,990) |

1,365,051 |

03/28/2040 |

| Moove | |||||||

|

Loan 4.131 |

01/16/2025 |

Yearly |

CDI+0.45% p.a. |

Capital management |

— |

500,000 |

01/18/2028 |

|

18 |

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

The individual and consolidated interim financial statements were prepared and are being presented in accordance with Technical Pronouncement CPC 21 (R1) - Interim Financial Statements, International Accounting Standard (IAS 34) - Interim Financial Reporting, issued by the International Accounting Standards Board (“IASB”), the Brazilian Corporation Law and the rules of the Brazilian Securities Commission (“CVM”) applicable to the preparation of Quarterly Information (“ITR”).

These interim financial statements should be read in conjunction with the Company's annual consolidated financial statements for the fiscal year ended December 31, 2024 (“annual financial statements”). They do not include all the information required for a complete set of financial statements prepared in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (“IFRS”). However, selected explanatory notes have been included to clarify events and transactions relevant to an understanding of the changes in the Company's financial position and performance since the last annual financial statements.

The presentation of the Statement of Value-Added Statements (“VAS”), both individual and consolidated, is required by Brazilian corporate law and by the accounting practices adopted in Brazil applicable to publicly traded companies. The DVA was prepared in accordance with the criteria established in Technical Pronouncement CPC 09 - Statement of Value Added. IFRS do not require the presentation of this statement; therefore, it is presented as supplementary information to the individual and consolidated interim financial statements.