UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of April 2024

Commission File Number: 333-251238

|

|

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

|

|

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

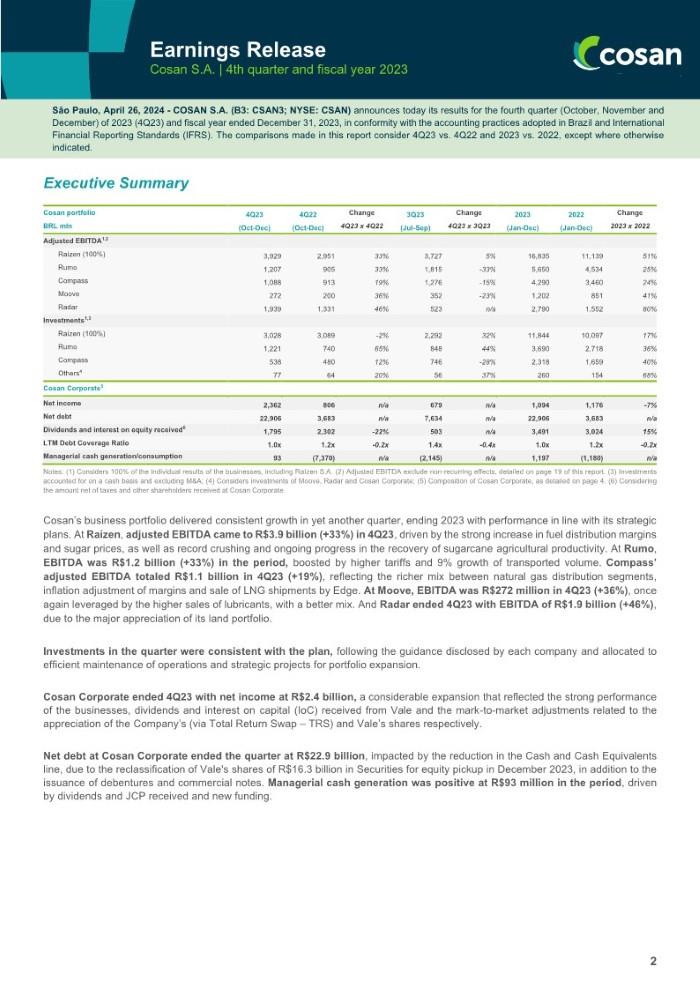

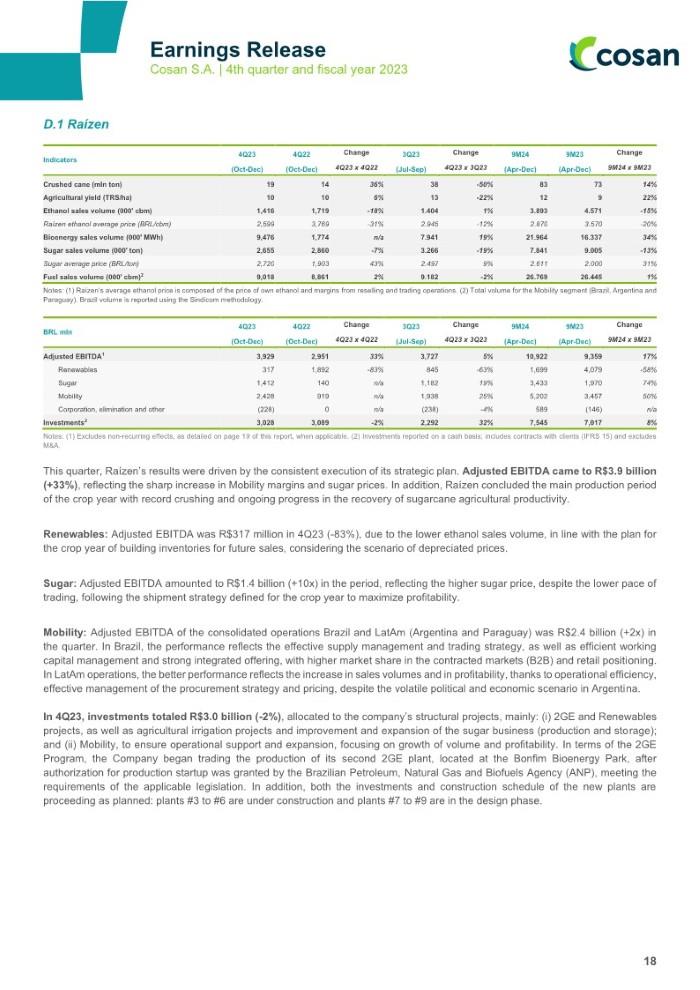

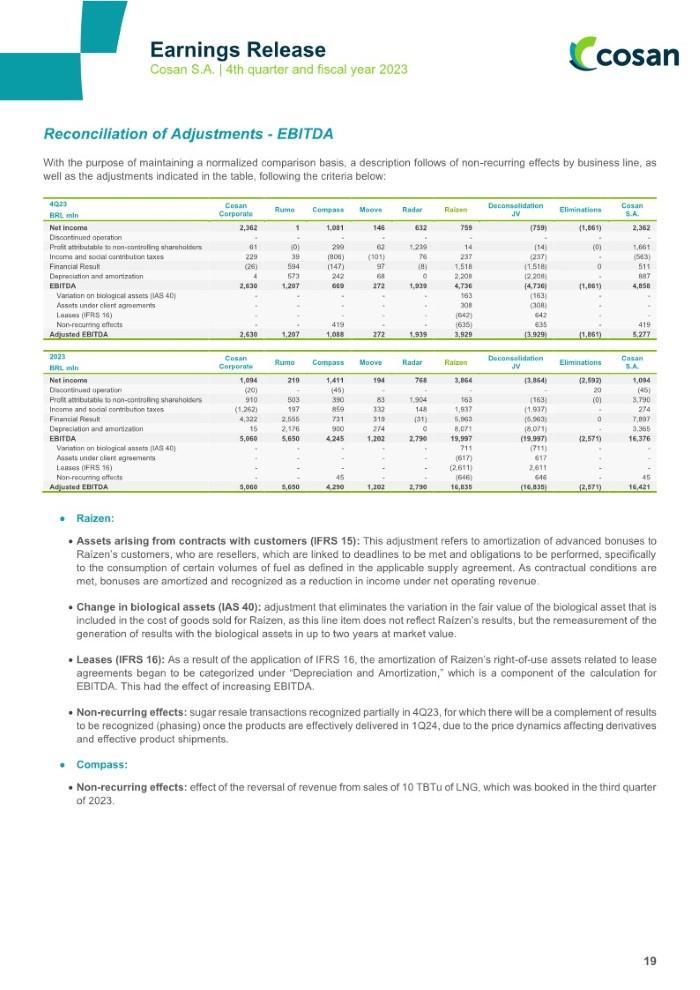

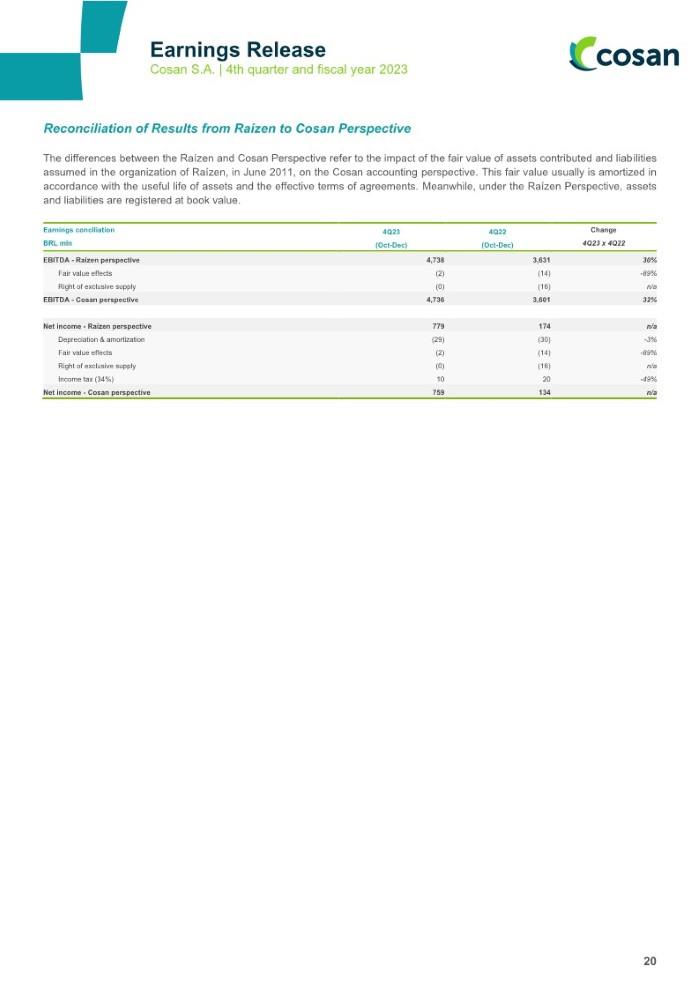

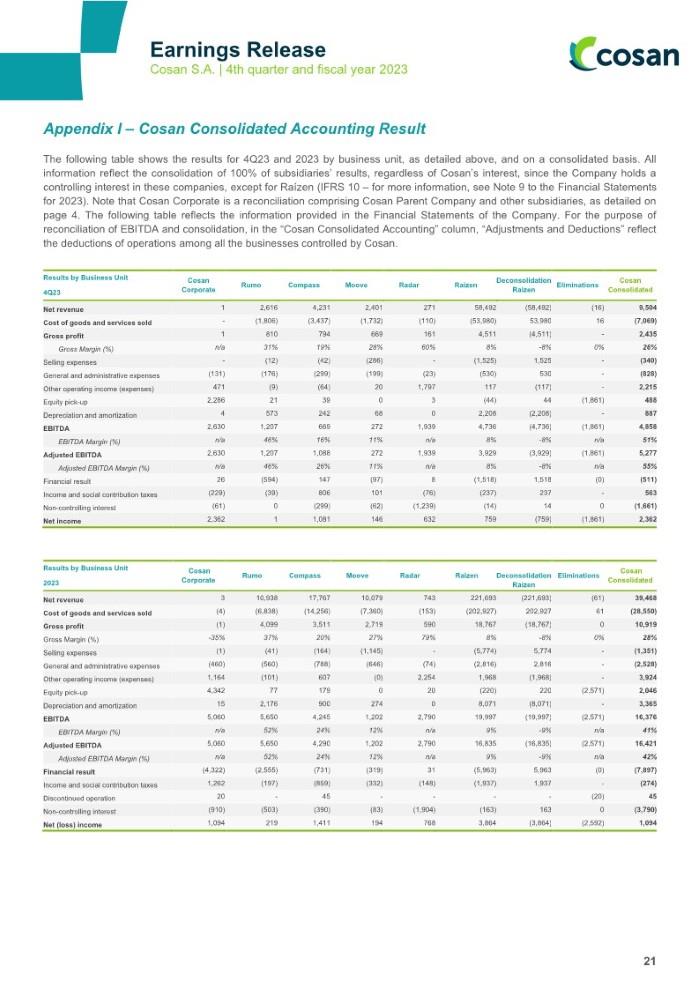

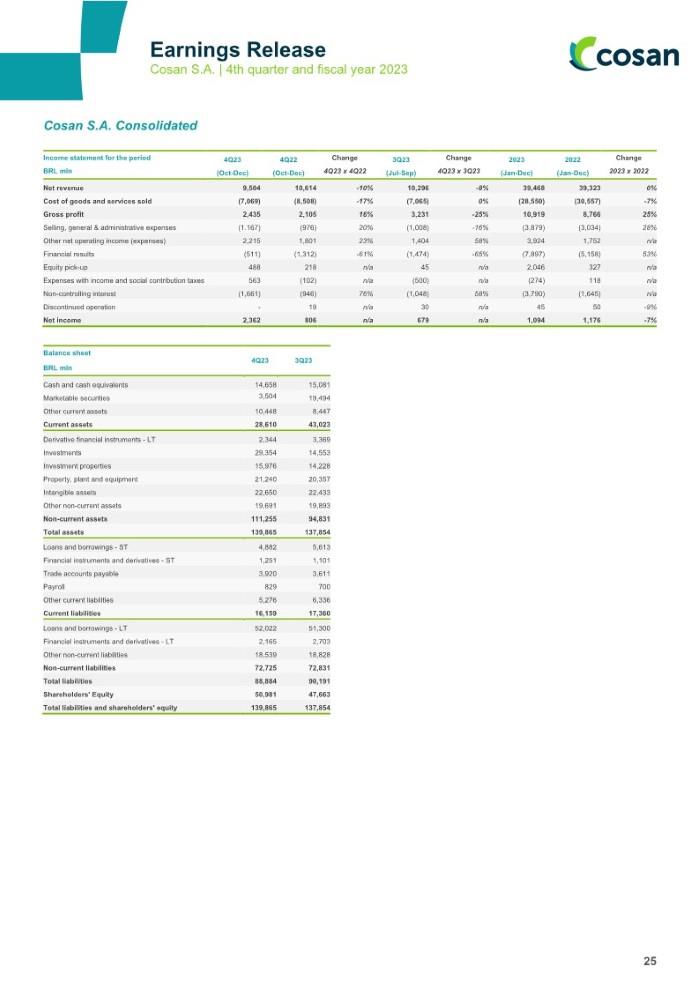

Message from the CEO We ended 2023 with a significant growth of EBITDA under management¹, totaling R$32 billion, and net income of R$1.1 billion, supported by the performance of the businesses, reinforcing the quality of our assets and resilience of our portfolio. Investments were in line with the plans for the year, allocated to the structural projects of the portfolio, as well as the efficient maintenance of our operations. Rumo’s result was boosted by the increase in transportation capacity and higher consolidated average tariff, reaching record volumes and demonstrating the growing competitiveness of the rail modal. The Lucas do Rio Verde project – extension of the railway network in Mato Grosso, one of the main regions of Brazil in grain production – will enable a major expansion in Rumo’s addressable market. At Compass, the record number of new connections, consolidation of Commit’s natural gas distribution companies, as well as the start of operations under the Edge brand, with the sale of the first LNG shipments, offset the decline in the volume of natural gas distributed, affected by the lower industrial production and higher temperatures. Furthermore, in 2023 the company created a JV among Compass and Orizon to invest in a biomethane purification plant in Paulínia (São Paulo) and executed a long-term biomethane supply agreement between Compass and São Martinho. Moove had its best year ever, driven by the higher sales and healthy margins, reflecting Moove’s leading position in the market of synthetic lubricants and ongoing improvement of its business model. Its strong international footprint is also a highlight, with significant results achieved in 2023 with the successful integration of Petrochoice. At Radar, the value of agricultural properties portfolio we invested reflects the high-quality portfolio and the strong commodity cycle. Raízen achieved an important recovery of the agricultural productivity of its sugarcane fields, setting a record for crushing in the crop year. The better sugar prices and strong fuel distribution margins drove the company’s EBITDA, offsetting the effects of the challenging scenario for ethanol. In addition, I highlight the progress in our renewable’s agenda, with the launch of the 2nd Second-Generation Ethanol (2GE) plant in Bonfim, with twice the production capacity of the 1st plant. We kicked off an intense debt management process at Cosan, with successful funding transactions in the domestic and international markets. This process has lengthened our debt amortization schedule to better support the current cycle of major investments of our portfolio, ensuring competitive costs. In 2023 and early 2024, we consolidated our exposure to Vale, increasing our direct stake because of the unwind of the collar financing structure. This movement aims to capture Vale’s dividends in full while adequate our capital structure. We ended the year with leverage within adequate levels and, as of this quarter, we will report the interest coverage ratio, a metric that complements the perspective for liquidity of Cosan Corporate. Finally on capital allocation, we remain attentive to opportunities to repurchase shares of Cosan itself, executing Total Return Swaps worth approximately R$300 million during the year. Finally, we distributed R$800 million to our shareholders as dividends. Nelson Gomes, CEO of Cosan Notes: (1) EBITDA under management: 100% of adjusted EBITDA of the businesses of Cosan S.A. At Raízen, 2023 considers the fiscal year, while 2022 considers the crop year ended in March of subsequent year.

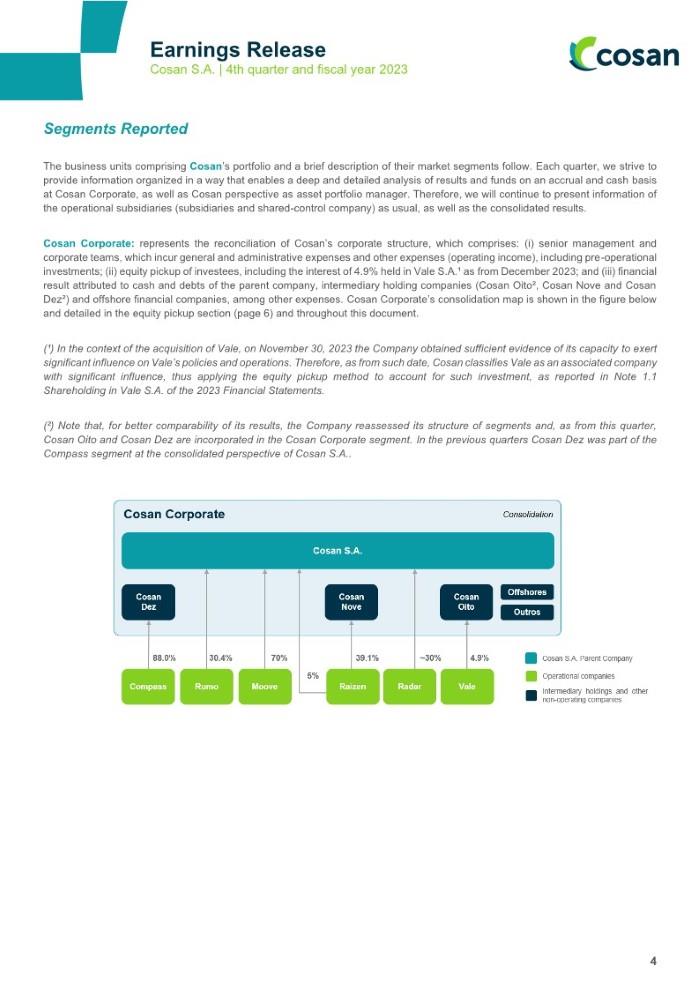

Segments Reported The business units comprising Cosan’s portfolio and a brief description of their market segments follow. Each quarter, we strive to provide information organized in a way that enables a deep and detailed analysis of results and funds on an accrual and cash basis at Cosan Corporate, as well as Cosan perspective as asset portfolio manager. Therefore, we will continue to present information of the operational subsidiaries (subsidiaries and shared-control company) as usual, as well as the consolidated results. Cosan Corporate: represents the reconciliation of Cosan’s corporate structure, which comprises: (i) senior management and corporate teams, which incur general and administrative expenses and other expenses (operating income), including pre-operational investments; (ii) equity pickup of investees, including the interest of 4.9% held in Vale S.A.¹ as from December 2023; and (iii) financial result attributed to cash and debts of the parent company, intermediary holding companies (Cosan Oito², Cosan Nove and Cosan Dez²) and offshore financial companies, among other expenses. Cosan Corporate’s consolidation map is shown in the figure below and detailed in the equity pickup section (page 6) and throughout this document. (¹) In the context of the acquisition of Vale, on November 30, 2023 the Company obtained sufficient evidence of its capacity to exert significant influence on Vale’s policies and operations. Therefore, as from such date, Cosan classifies Vale as an associated company with significant influence, thus applying the equity pickup method to account for such investment, as reported in Note 1.1 Shareholding in Vale S.A. of the 2023 Financial Statements. (²) Note that, for better comparability of its results, the Company reassessed its structure of segments and, as from this quarter, Cosan Oito and Cosan Dez are incorporated in the Cosan Corporate segment. In the previous quarters Cosan Dez was part of the Compass segment at the consolidated perspective of Cosan S.A..

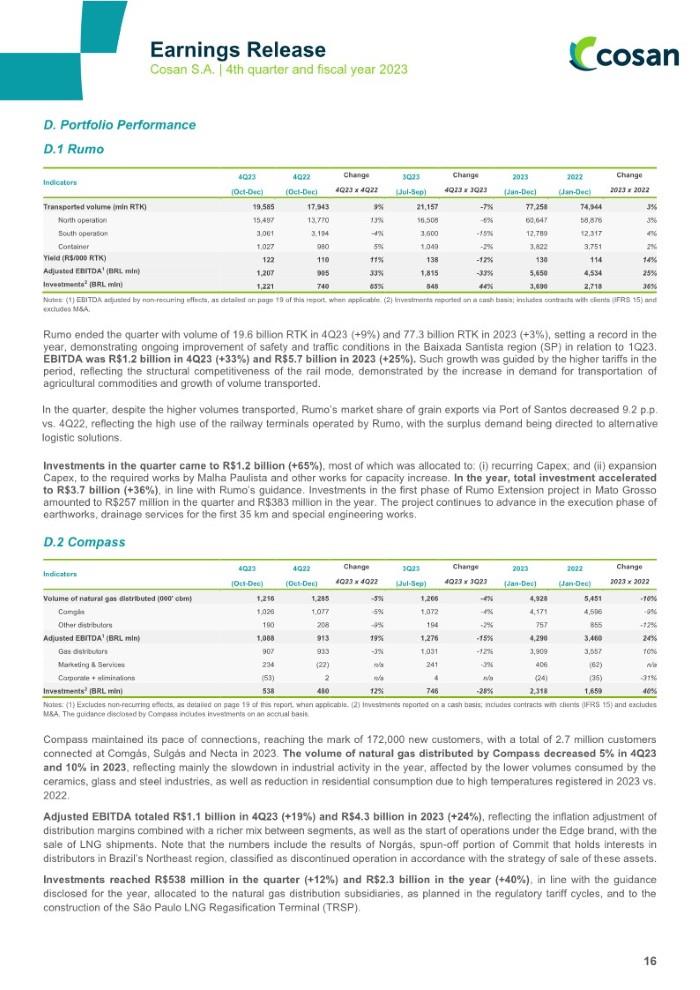

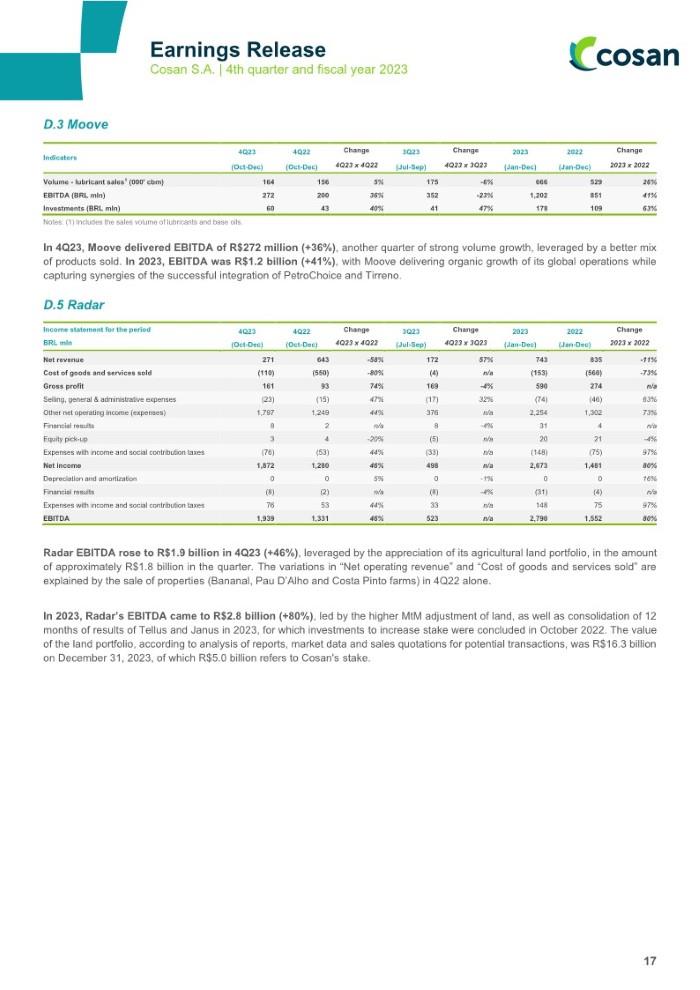

Business Portfolio: Rumo: Brazil’s largest independent rail logistics operator, connecting the country’s main agricultural commodity producing regions to the country’s main ports. It also operates in port loading and goods storage at terminals. Through Brado, Rumo also offers container operations serving both the domestic and international markets. Rumo has been listed under the ticker "RAIL3" since 2015 on the Novo Mercado, the listing segment of the São Paulo Stock Exchange (B3) with the highest corporate governance standards. The Financial Statements for the 2023 fiscal year and Earnings Release of Rumo are available at: ri.rumolog.com. Compass: Based on all the experienced amassed in the management of Comgás, Compass was created in 2020 with the purpose of creating options for an increasingly less regulated natural gas market. It offers client-centered services and solutions to expand access to natural gas safely, efficiently and competitively, which contributes to energy safety, economic development and exp ansion of Brazil’s infrastructure. In the natural gas distribution segment, Compass has Comgás, Brazil’s largest piped gas distributor, and Commit, which holds interests in 11 concessionaires in various Brazilian states, including Sulgás and Gasbrasiliano. Compass’ portfolio also includes projects in the Natural Gas and Energy sectors, such as the São Paulo LNG Regasification Terminal (TRSP). The Financial Statements for the 2023 fiscal year and Earnings Release of Compass are available at: compassbr.com. Moove: Moove produces and distributes products under the Mobil and Comma brands, with operations in Brazil and other countries in South America (Argentina, Bolivia, Uruguay and Paraguay), as well as in the United States and Europe (United Kingdom, Spai n, Portugal and France). It markets lubricants and other products for applications in the automotive and industrial segments, and also is an importer and distributor of base oils in the Brazilian market. Radar: The Land segment was renamed Radar (more information on page 17) and now includes the portfolio manager, represented by the JV with Nuveen, concluded in March 2024. A reference in agricultural land management, Radar invests in a diversified portfolio with high appreciation potential, holding interest in the companies Radar, Tellus and Janus. Its land portfolio encompasses around 320,000 hectares strategically located in eight Brazilian states. The Financial Statements for the 2023 fiscal year are available at: https://www.cosan.com.br/en/financial-information/other- documents/ . Raízen: A joint venture created by Cosan and Shell in 2011. With an integrated and unique ecosystem, Raízen operates from the production and processing of sugarcane to the production and marketing of sugar and renewable energy, including even the distribution of fuels and operations in the convenience and proximity store segment. Since August 2021, Raízen’s shares are listed on the São Paulo Stock Exchange (B3) under the ticker "RAIZ4." The Renewables business comprises the production, sourcing, marketing and trading of ethanol; production and marketing of bioenergy; resale and trading of electricity; and production and marketing of other renewable products (solar power and biogas). Meanwhile, the Sugar business involves the production, sourcing, marketing and trading of sugar. The Mobility segment encompasses the distribution of fuel and lubricants and the convenience and proximity store operations in Brazil, Argentina and Paraguay, under the Shell brand. In Brazil, we operate in the proximity segment under the brands Shell Select and OXXO, in partnership with FEMSA Comércio, through the JV Nós Group. In Argentina, the segment also includes oil refining. The Interim Financial Statements and Earnings Release of Raízen are available at: ri.raizen.com.br/en/.

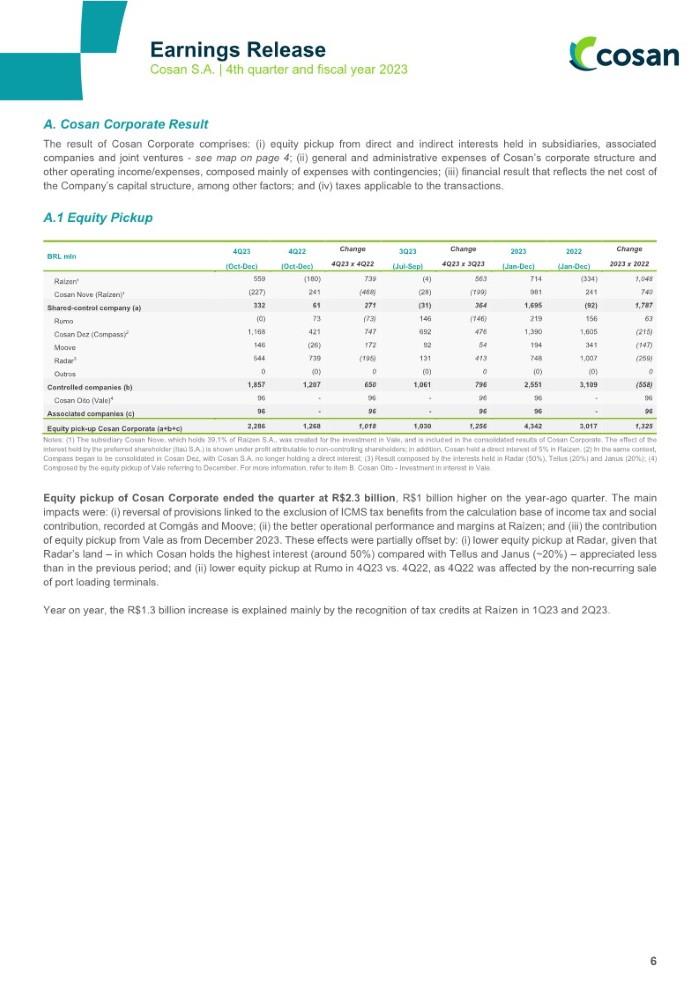

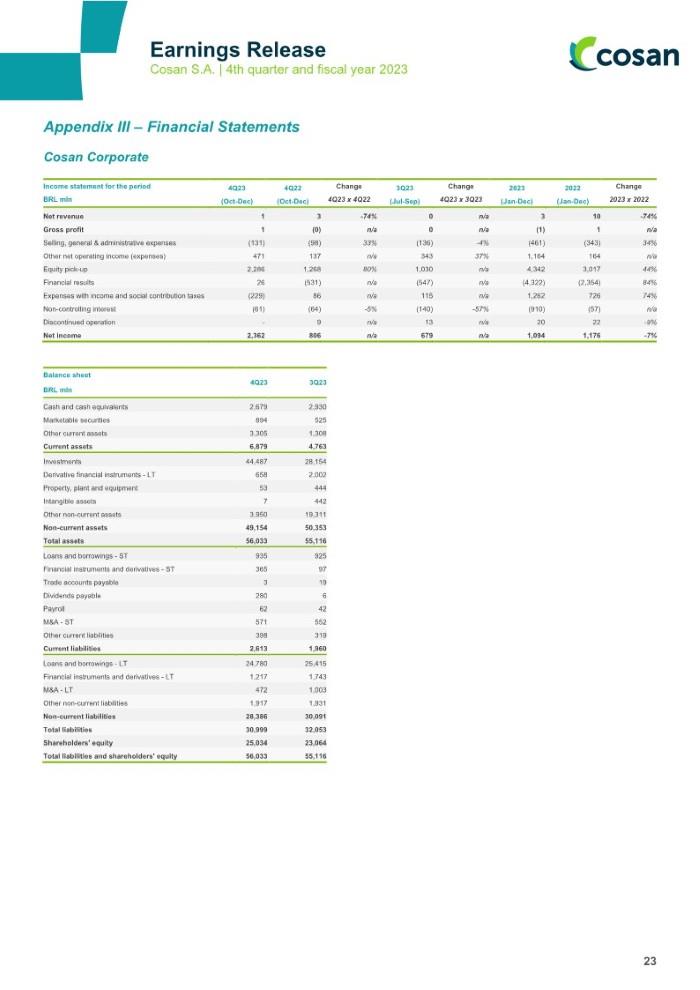

A. Cosan Corporate Result The result of Cosan Corporate comprises: (i) equity pickup from direct and indirect interests held in subsidiaries, associated companies and joint ventures - see map on page 4; (ii) general and administrative expenses of Cosan’s corporate structure and other operating income/expenses, composed mainly of expenses with contingencies; (iii) financial result that reflects the net cost of the Company’s capital structure, among other factors; and (iv) taxes applicable to the transactions. A.1 Equity Pickup BRL mln 4Q23 4Q22 Change 3Q23 Change 2023 2022 Change 2023 x 2022 (Oct-Dec) (Oct-Dec) 4Q23 x 4Q22 (Jul-Sep) 4Q23 x 3Q23 (Jan-Dec) (Jan-Dec) Raízen¹ 559 (180) 739 (4) 563 714 (334) 1,048 Cosan Nove (Raízen)¹ (227) 241 (468) (28) (199) 981 241 740 Shared-control company (a) 332 61 271 (31) 364 1,695 (92) 1,787 Rumo (0) 73 (73) 146 (146) 219 156 63 Cosan Dez (Compass)2 1,168 421 747 692 476 1,390 1,605 (215) Moove 146 (26) 172 92 54 194 341 (147) Radar3 544 739 (195) 131 413 748 1,007 (259) 0 Outros 0 (0) 0 (0) 0 (0) (0) Controlled companies (b) 1,857 1,207 650 1,061 796 2,551 3,109 (558) Cosan Oito (Vale)4 96 96 96 96 - - 96 - - Associated companies (c) 96 - - 96 96 96 96 Equity pick-up Cosan Corporate (a+b+c) 2,286 1,268 1,018 1,030 1,256 4,342 3,017 1,325 Notes: (1) The subsidiary Cosan Nove, which holds 39.1% of Raízen S.A., was created for the investment in Vale, and is includ ed in the consolidated results of Cosan Corporate. The effect of the interest held by the preferred shareholder (Itaú S.A.) is shown under profit attributable to non-controlling shareholders; in addition, Cosan held a direct interest of 5% in Raízen. (2) In the same context, Compass began to be consolidated in Cosan Dez, with Cosan S.A. no longer holding a direct interest; (3) Result composed by the interests held in Radar (50%), Tellus (20%) and Janus (20%); (4) Composed by the equity pickup of Vale referring to December. For more information, refer to item B. Cosan Oito - Investment in interest in Vale. Equity pickup of Cosan Corporate ended the quarter at R$2.3 billion, R$1 billion higher on the year-ago quarter. The main impacts were: (i) reversal of provisions linked to the exclusion of ICMS tax benefits from the calculation base of income tax and social contribution, recorded at Comgás and Moove; (ii) the better operational performance and margins at Raízen; and (iii) the contribution of equity pickup from Vale as from December 2023. These effects were partially offset by: (i) lower equity pickup at Radar, given that Radar’s land – in which Cosan holds the highest interest (around 50%) compared with Tellus and Janus (~20%) – appreciated less than in the previous period; and (ii) lower equity pickup at Rumo in 4Q23 vs. 4Q22, as 4Q22 was affected by the non-recurring sale of port loading terminals. Year on year, the R$1.3 billion increase is explained mainly by the recognition of tax credits at Raízen in 1Q23 and 2Q23.

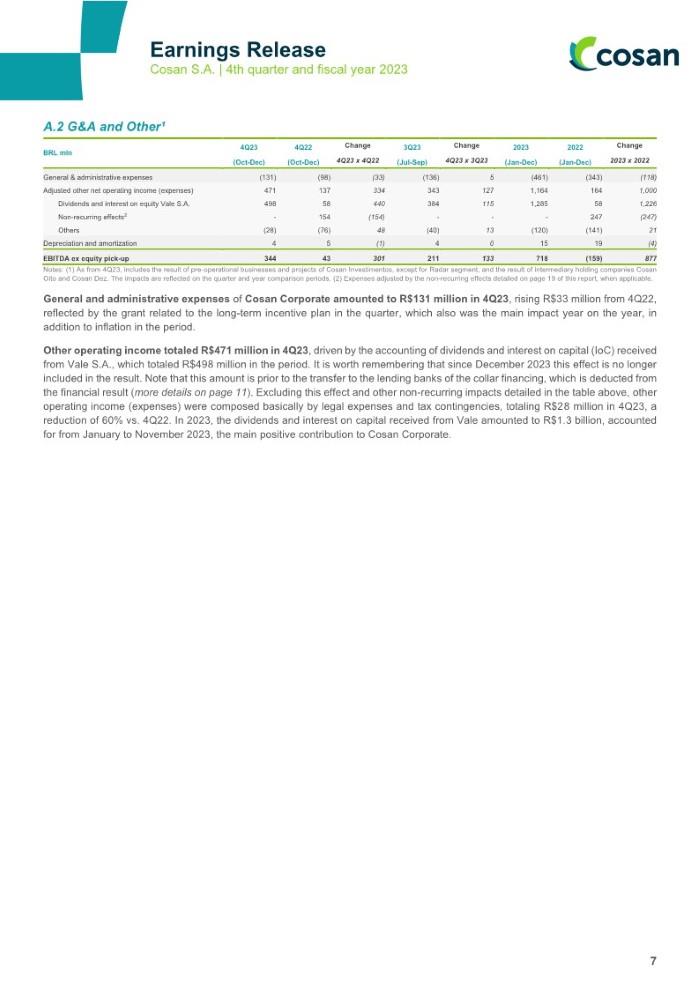

A.2 G&A and Other¹ BRL mln 4Q23 (Oct-Dec) 4Q22 (Oct-Dec) Change 4Q23 x 4Q22 3Q23 (Jul-Sep) Change 4Q23 x 3Q23 2023 (Jan-Dec) 2022 (Jan-Dec) Change 2023 x 2022 General & administrative expenses (131) (98) (33) (136) 5 (461) (343) (118) Adjusted other net operating income (expenses) 471 137 334 343 127 1,164 164 1,000 Dividends and interest on equity Vale S.A. 498 58 440 384 115 1,285 58 1,226 Non-recurring effects2 - 154 (154) - - - 247 (247) Others (28) (76) 48 (40) 13 (120) (141) 21 Depreciation and amortization 4 5 (1) 4 0 15 19 (4) EBITDA ex equity pick-up 344 43 301 211 133 718 (159) 877 Notes: (1) As from 4Q23, includes the result of pre-operational businesses and projects of Cosan Investimentos, except for Radar segment, and the result of intermediary holding companies Cosan Oito and Cosan Dez. The impacts are reflected on the quarter and year comparison periods. (2) Expenses adjusted by the non-recurring effects detailed on page 19 of this report, when applicable. General and administrative expenses of Cosan Corporate amounted to R$131 million in 4Q23, rising R$33 million from 4Q22, reflected by the grant related to the long-term incentive plan in the quarter, which also was the main impact year on the year, in addition to inflation in the period. Other operating income totaled R$471 million in 4Q23, driven by the accounting of dividends and interest on capital (IoC) received from Vale S.A., which totaled R$498 million in the period. It is worth remembering that since December 2023 this effect is no longer included in the result. Note that this amount is prior to the transfer to the lending banks of the collar financing, which is deducted from the financial result (more details on page 11). Excluding this effect and other non-recurring impacts detailed in the table above, other operating income (expenses) were composed basically by legal expenses and tax contingencies, totaling R$2 8 million in 4Q23, a reduction of 60% vs. 4Q22. In 2023, the dividends and interest on capital received from Vale amounted to R$1.3 billion, accounted for from January to November 2023, the main positive contribution to Cosan Corporate.

.

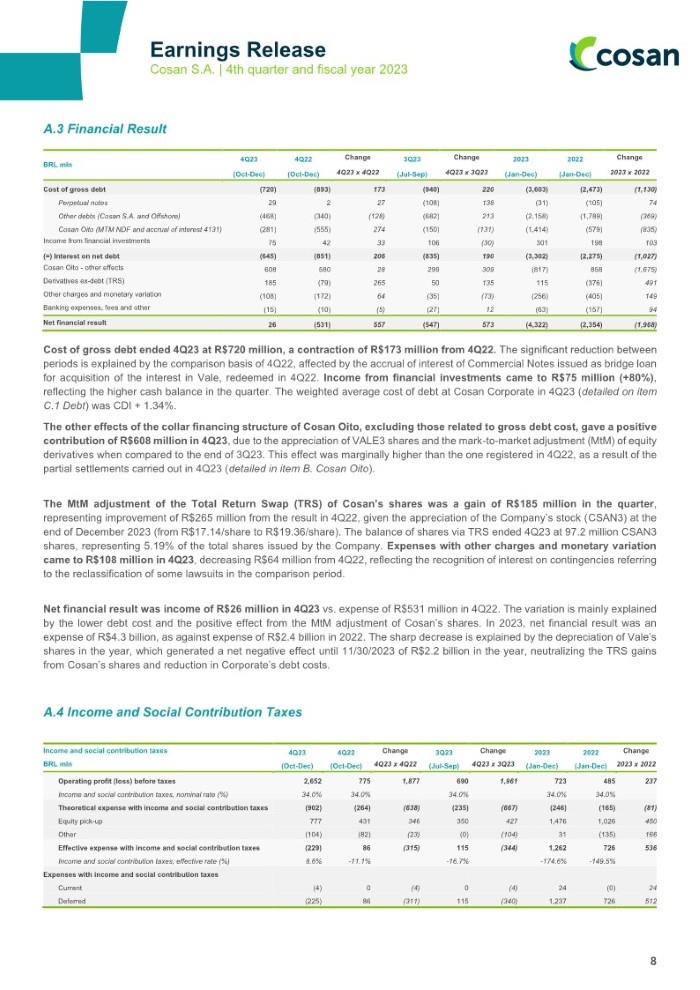

.A.3 Financial Result BRL mln 4Q23 (Oct-Dec) 4Q22 (Oct-Dec) Change 4Q23 x 4Q22 3Q23 (Jul-Sep) Change 4Q23 x 3Q23 2023 (Jan-Dec) 2022 (Jan-Dec) Change 2023 x 2022 Cost of gross debt (720) (893) 173 (940) 220 (3,603) (2,473) (1,130) Perpetual notes 29 2 27 (108) 138 (31) (105) 74 Other debts (Cosan S.A. and Offshore) (468) (340) (128) (682) 213 (2,158) (1,789) (369) Cosan Oito (MTM NDF and accrual of interest 4131) (281) (555) 274 (150) (131) (1,414) (579) (835) Income from financial investments 75 42 33 106 (30) 301 198 103 (=) Interest on net debt (645) (851) 206 (835) 190 (3,302) (2,275) (1,027) Cosan Oito - other effects 608 580 28 299 309 (817) 858 (1,675) Derivatives ex-debt (TRS) 185 (79) 265 50 135 115 (376) 491 Other charges and monetary variation (108) (172) 64 (35) (73) (256) (405) 149 Banking expenses, fees and other (15) (10) (5) (27) 12 (63) (157) 94 Net financial result 26 (531) 557 (547) 573 (4,322) (2,354) (1,968) Cost of gross debt ended 4Q23 at R$720 million, a contraction of R$173 million from 4Q22. The significant reduction between periods is explained by the comparison basis of 4Q22, affected by the accrual of interest of Commercial Notes issued as bridge loan for acquisition of the interest in Vale, redeemed in 4Q22. Income from financial investments came to R$75 million (+80%), reflecting the higher cash balance in the quarter. The weighted average cost of debt at Cosan Corporate in 4Q23 (detailed on item C.1 Debt) was CDI + 1.34%. The other effects of the collar financing structure of Cosan Oito, excluding those related to gross debt cost, gave a positive contribution of R$608 million in 4Q23, due to the appreciation of VALE3 shares and the mark-to-market adjustment (MtM) of equity derivatives when compared to the end of 3Q23. This effect was marginally higher than the one registered in 4Q22, as a result of the partial settlements carried out in 4Q23 (detailed in item B. Cosan Oito). The MtM adjustment of the Total Return Swap (TRS) of Cosan’s shares was a gain of R$185 million in the quarter, representing improvement of R$265 million from the result in 4Q22, given the appreciation of the Company’s stock (CSAN3) at the end of December 2023 (from R$17.14/share to R$19.36/share). The balance of shares via TRS ended 4Q23 at 97.2 million CSAN3 shares, representing 5.19% of the total shares issued by the Company. Expenses with other charges and monetary variation came to R$108 million in 4Q23, decreasing R$64 million from 4Q22, reflecting the recognition of interest on contingencies referring to the reclassification of some lawsuits in the comparison period. Net financial result was income of R$26 million in 4Q23 vs. expense of R$531 million in 4Q22. The variation is mainly explained by the lower debt cost and the positive effect from the MtM adjustment of Cosan’s shares. In 2023, net financial result was an expense of R$4.3 billion, as against expense of R$2.4 billion in 2022. The sharp decrease is explained by the depreciation of Vale’s shares in the year, which generated a net negative effect until 11/30/2023 of R$2.2 billion in the year, neutralizing the TRS gains from Cosan’s shares and reduction in Corporate’s debt costs. A.4 Income and Social Contribution Taxes Income and social contribution taxes BRL mln 4Q23 (Oct-Dec) 4Q22 (Oct-Dec) Change 4Q23 x 4Q22 3Q23 (Jul-Sep) Change 4Q23 x 3Q23 2023 (Jan-Dec) 2022 (Jan-Dec) Change 2023 x 2022 Operating profit (loss) before taxes 2,652 775 1,877 690 1,961 723 485 237 Income and social contribution taxes, nominal rate (%) 34.0% 34.0% 34.0% 34.0% 34.0% Theoretical expense with income and social contribution taxes (902) (264) (638) (235) (667) (246) (165) (81) Equity pick-up 777 431 346 350 427 1,476 1,026 450 Other (104) (82) (23) (0) (104) 31 (135) 166 Effective expense with income and social contribution taxes (229) 86 (315) 115 (344) 1,262 726 536 Income and social contribution taxes, effective rate (%) 8.6% -11.1% -16.7% -174.6% -149.5% Expenses with income and social contribution taxes Current (4) 0 (4) 0 (4) 24 (0) 24 Deferred (225) 86 (311) 115 (340) 1,237 726 512

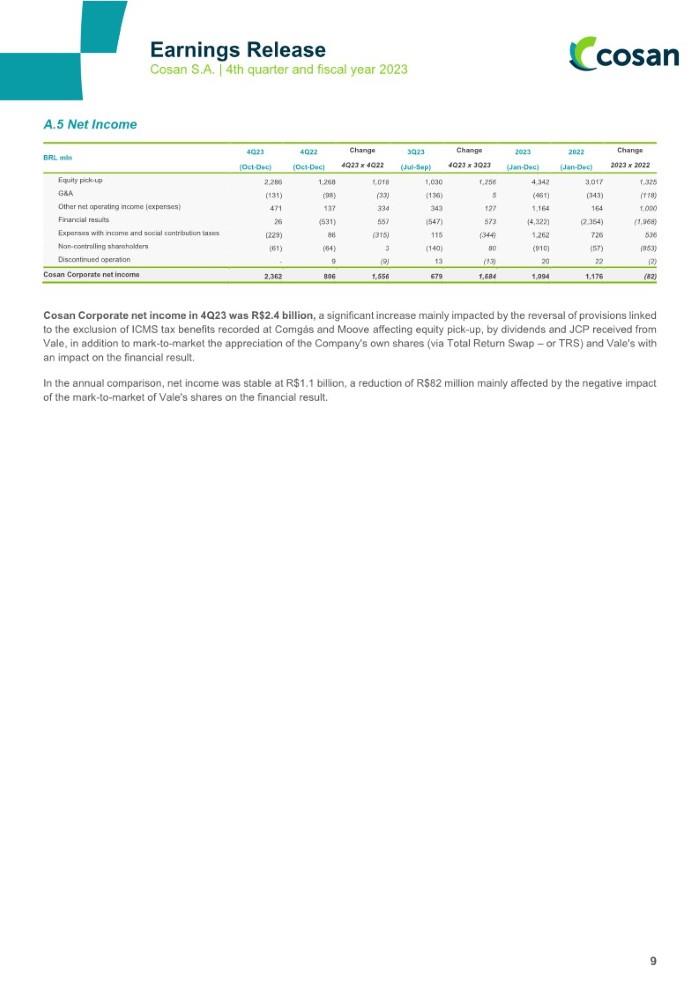

A.5 Net Income BRL mln 4Q23 (Oct-Dec) 4Q22 (Oct-Dec) Change 4Q23 x 4Q22 3Q23 (Jul-Sep) Change 4Q23 x 3Q23 2023 (Jan-Dec) 2022 (Jan-Dec) Change 2023 x 2022 Equity pick-up 2,286 1,268 1,018 1,030 1,256 4,342 3,017 1,325 G&A (131) (98) (33) (136) 5 (461) (343) (118) Other net operating income (expenses) 471 137 334 343 127 1,164 164 1,000 Financial results 26 (531) 557 (547) 573 (4,322) (2,354) (1,968) Expenses with income and social contribution taxes (229) 86 (315) 115 (344) 1,262 726 536 Non-controlling shareholders (61) (64) 3 (140) 80 (910) (57) (853) Discontinued operation - 9 (9) 13 (13) 20 22 (2) Cosan Corporate net income 2,362 806 1,556 679 1,684 1,094 1,176 (82) Cosan Corporate net income in 4Q23 was R$2.4 billion, a significant increase mainly impacted by the reversal of provisions linked to the exclusion of ICMS tax benefits recorded at Comgás and Moove affecting equity pick-up, by dividends and JCP received from Vale, in addition to mark-to-market the appreciation of the Company's own shares (via Total Return Swap – or TRS) and Vale's with an impact on the financial result. In the annual comparison, net income was stable at R$1.1 billion, a reduction of R$82 million mainly affected by the negative impact of the mark-to-market of Vale's shares on the financial result.

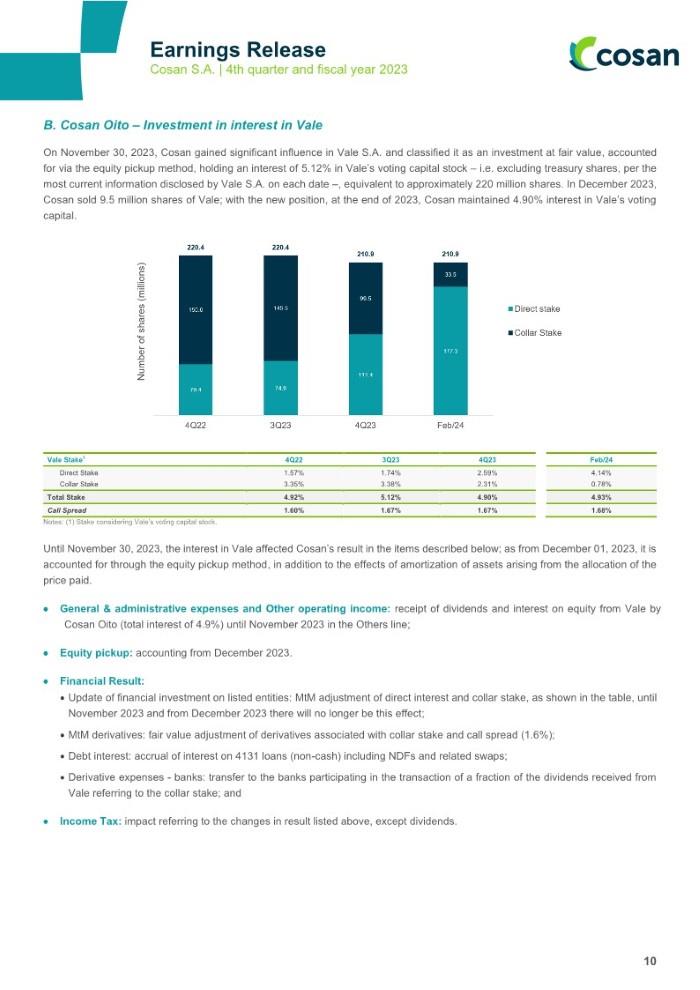

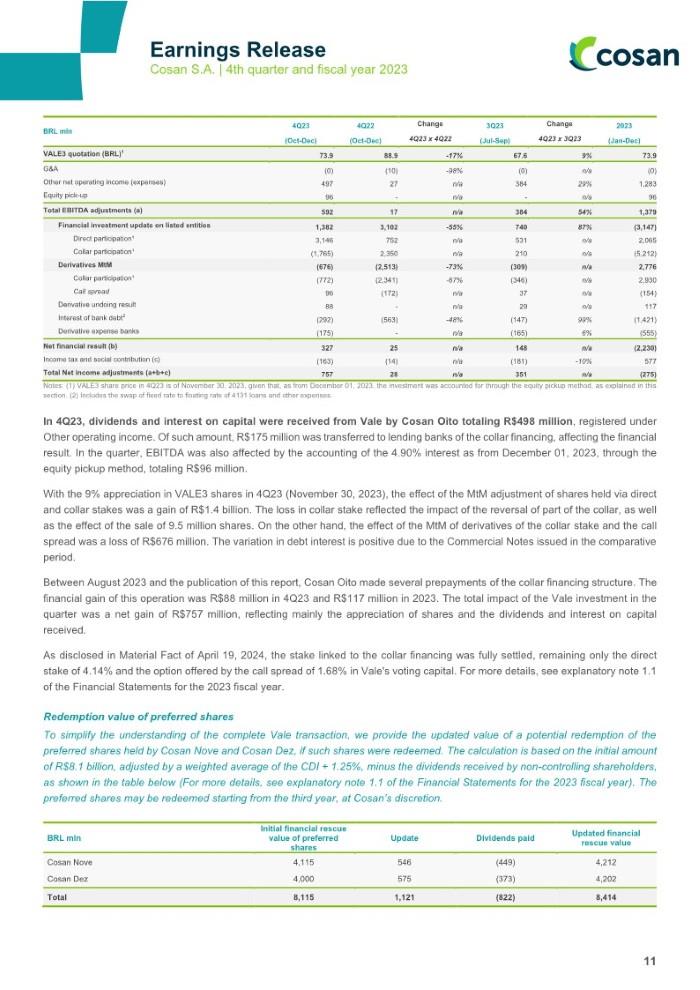

B. Cosan Oito – Investment in interest in Vale On November 30, 2023, Cosan gained significant influence in Vale S.A. and classified it as an investment at fair value, accounted for via the equity pickup method, holding an interest of 5.12% in Vale’s voting capital stock – i.e. excluding treasury shares, per the most current information disclosed by Vale S.A. on each date –, equivalent to approximately 220 million shares. In December 2023, Cosan sold 9.5 million shares of Vale; with the new position, at the end of 2023, Cosan maintained 4.90% interest in Vale’s voting capital. Vale Stake1 4Q22 3Q23 4Q23 Feb/24 Direct Stake 1.57% 1.74% 2.59% 4.14% Collar Stake 3.35% 3.38% 2.31% 0.78% Total Stake 4.92% 5.12% 4.90% 4.93% Call Spread 1.60% 1.67% 1.67% 1.68% Notes: (1) Stake considering Vale’s voting capital stock. Until November 30, 2023, the interest in Vale affected Cosan’s result in the items described below; as from December 01, 2023, it is accounted for through the equity pickup method, in addition to the effects of amortization of assets arising from the allocation of the price paid. • General & administrative expenses and Other operating income: receipt of dividends and interest on equity from Vale by Cosan Oito (total interest of 4.9%) until November 2023 in the Others line; • Equity pickup: accounting from December 2023. • Financial Result: • Update of financial investment on listed entities: MtM adjustment of direct interest and collar stake, as shown in the table, until November 2023 and from December 2023 there will no longer be this effect; • MtM derivatives: fair value adjustment of derivatives associated with collar stake and call spread (1.6%); • Debt interest: accrual of interest on 4131 loans (non-cash) including NDFs and related swaps; • Derivative expenses - banks: transfer to the banks participating in the transaction of a fraction of the dividends received from Vale referring to the collar stake; and • Income Tax: impact referring to the changes in result listed above, except dividends.

B. Cosan Oito – Investment in interest in Vale On November 30, 2023, Cosan gained significant influence in Vale S.A. and classified it as an investment at fair value, accounted for via the equity pickup method, holding an interest of 5.12% in Vale’s voting capital stock – i.e. excluding treasury shares, per the most current information disclosed by Vale S.A. on each date –, equivalent to approximately 220 million shares. In December 2023, Cosan sold 9.5 million shares of Vale; with the new position, at the end of 2023, Cosan maintained 4.90% interest in Vale’s voting capital. Vale Stake1 4Q22 3Q23 4Q23 Feb/24 Direct Stake 1.57% 1.74% 2.59% 4.14% Collar Stake 3.35% 3.38% 2.31% 0.78% Total Stake 4.92% 5.12% 4.90% 4.93% Call Spread 1.60% 1.67% 1.67% 1.68% Notes: (1) Stake considering Vale’s voting capital stock. Until November 30, 2023, the interest in Vale affected Cosan’s result in the items described below; as from December 01, 2023, it is accounted for through the equity pickup method, in addition to the effects of amortization of assets arising from the allocation of the price paid. • General & administrative expenses and Other operating income: receipt of dividends and interest on equity from Vale by Cosan Oito (total interest of 4.9%) until November 2023 in the Others line; • Equity pickup: accounting from December 2023. • Financial Result: • Update of financial investment on listed entities: MtM adjustment of direct interest and collar stake, as shown in the table, until November 2023 and from December 2023 there will no longer be this effect; • MtM derivatives: fair value adjustment of derivatives associated with collar stake and call spread (1.6%); • Debt interest: accrual of interest on 4131 loans (non-cash) including NDFs and related swaps; • Derivative expenses - banks: transfer to the banks participating in the transaction of a fraction of the dividends received from Vale referring to the collar stake; and • Income Tax: impact referring to the changes in result listed above, except dividends.

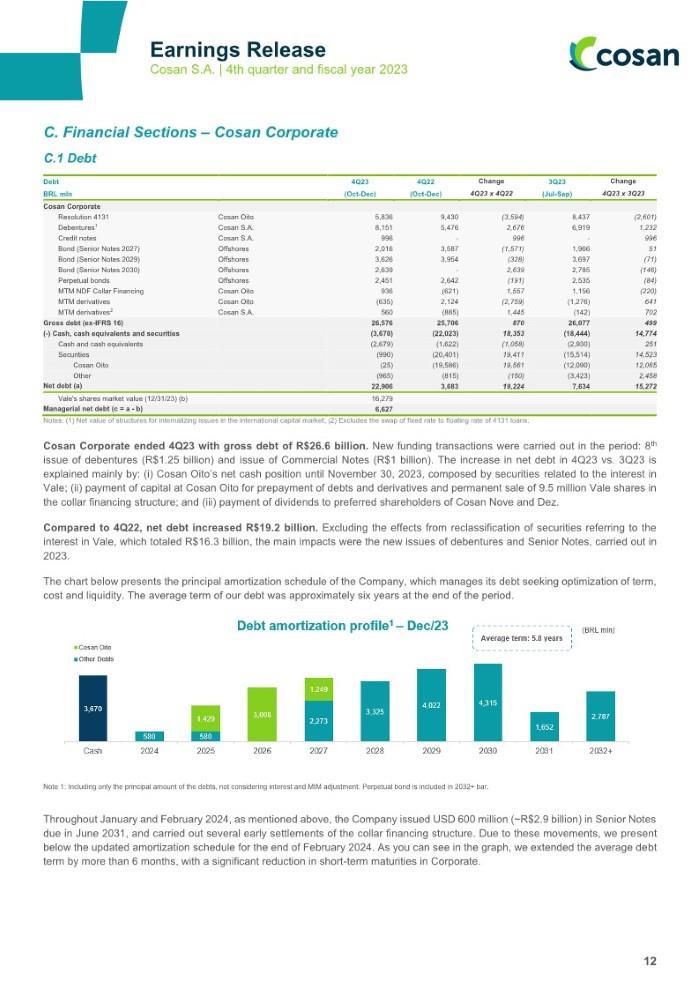

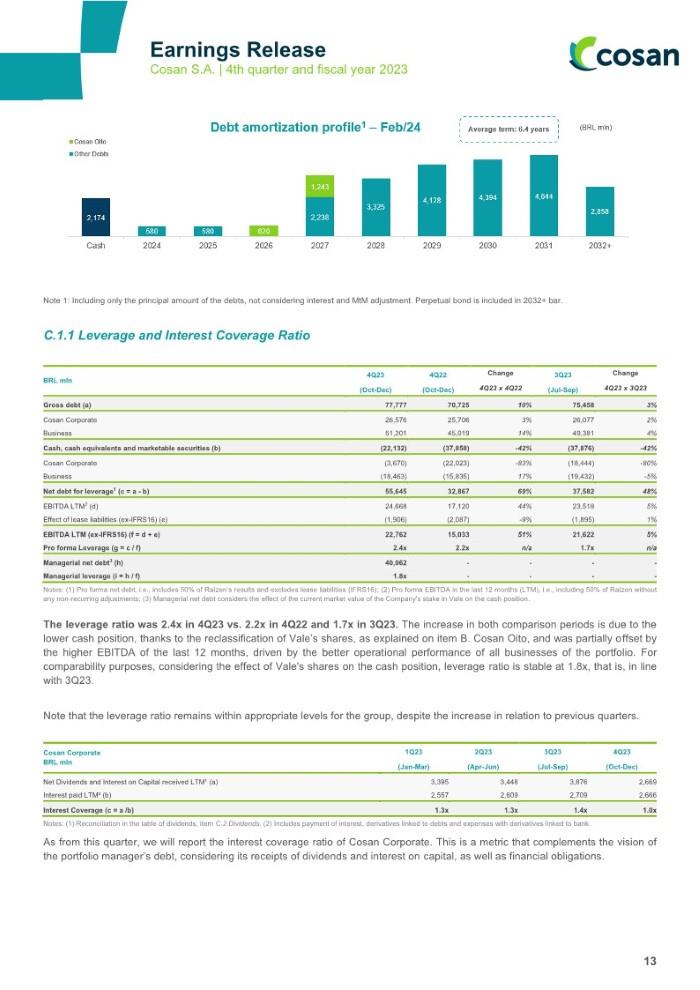

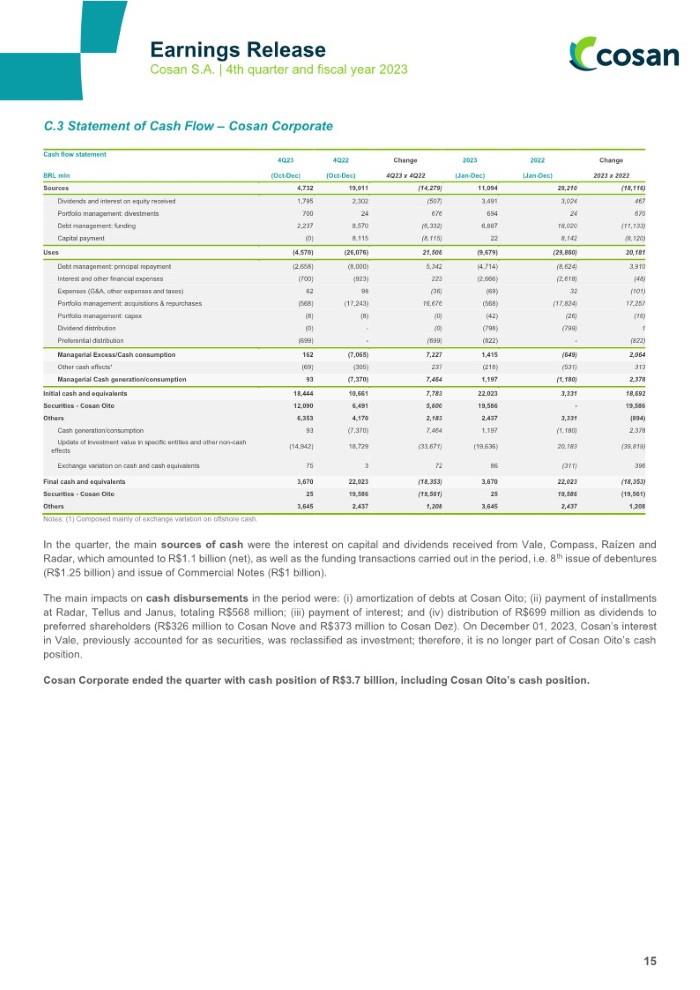

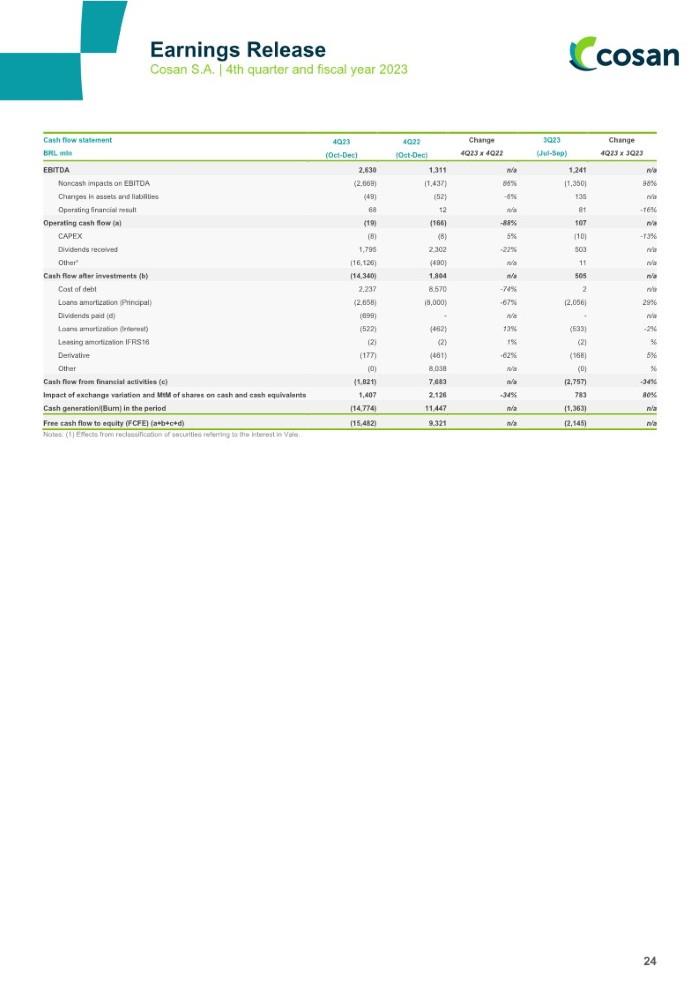

C. Financial Sections – Cosan Corporate C.1 Debt Debt BRL mln 4Q23 (Oct-Dec) 4Q22 (Oct-Dec) Change 4Q23 x 4Q22 3Q23 (Jul-Sep) Change 4Q23 x 3Q23 Cosan Corporate Resolution 4131 Cosan Oito 5,836 9,430 (3,594) 8,437 (2,601) Debentures1 Cosan S.A. 8,151 5,476 2,676 6,919 1,232 Credit notes Cosan S.A. 996 - 996 - 996 Bond (Senior Notes 2027) Offshores 2,016 3,587 (1,571) 1,966 51 Bond (Senior Notes 2029) Offshores 3,626 3,954 (328) 3,697 (71) Bond (Senior Notes 2030) Offshores 2,639 - 2,639 2,785 (146) Perpetual bonds Offshores 2,451 2,642 (191) 2,535 (84) MTM NDF Collar Financing Cosan Oito 936 (621) 1,557 1,156 (220) MTM derivatives Cosan Oito (635) 2,124 (2,759) (1,276) 641 MTM derivatives2 Cosan S.A. 560 (885) 1,445 (142) 702 Gross debt (ex-IFRS 16) 26,576 25,706 870 26,077 499 (-) Cash, cash equivalents and securities (3,670) (22,023) 18,353 (18,444) 14,774 Cash and cash equivalents (2,679) (1,622) (1,058) (2,930) 251 Securities (990) (20,401) 19,411 (15,514) 14,523 Cosan Oito (25) (19,586) 19,561 (12,090) 12,065 Other (965) (815) (150) (3,423) 2,458 Net debt (a) 22,906 3,683 19,224 7,634 15,272 Vale's shares market value (12/31/23) (b) 16,279 Managerial net debt (c = a - b) 6,627 Notes: (1) Net value of structures for internalizing issues in the international capital market; (2) Excludes the swap of fixed rate to floating rate of 4131 loans. Cosan Corporate ended 4Q23 with gross debt of R$26.6 billion. New funding transactions were carried out in the period: 8th issue of debentures (R$1.25 billion) and issue of Commercial Notes (R$1 billion). The increase in net debt in 4Q23 vs. 3Q23 is explained mainly by: (i) Cosan Oito’s net cash position until November 30, 2023, composed by securities related to the interest in Vale; (ii) payment of capital at Cosan Oito for prepayment of debts and derivatives and permanent sale of 9.5 million Vale shares in the collar financing structure; and (iii) payment of dividends to preferred shareholders of Cosan Nove and Dez. Compared to 4Q22, net debt increased R$19.2 billion. Excluding the effects from reclassification of securities referring to the interest in Vale, which totaled R$16.3 billion, the main impacts were the new issues of debentures and Senior Notes, carried out in 2023. The chart below presents the principal amortization schedule of the Company, which manages its debt seeking optimization of term, cost and liquidity. The average term of our debt was approximately six years at the end of the period. Note 1: Including only the principal amount of the debts, not considering interest and MtM adjustment. Perpetual bond is included in 2032+ bar. Throughout January and February 2024, as mentioned above, the Company issued USD 600 million (~R$2.9 billion) in Senior Notes due in June 2031, and carried out several early settlements of the collar financing structure. Due to these movements, we present below the updated amortization schedule for the end of February 2024. As you can see in the graph, we extended the average debt term by more than 6 months, with a significant reduction in short-term maturities in Corporate.

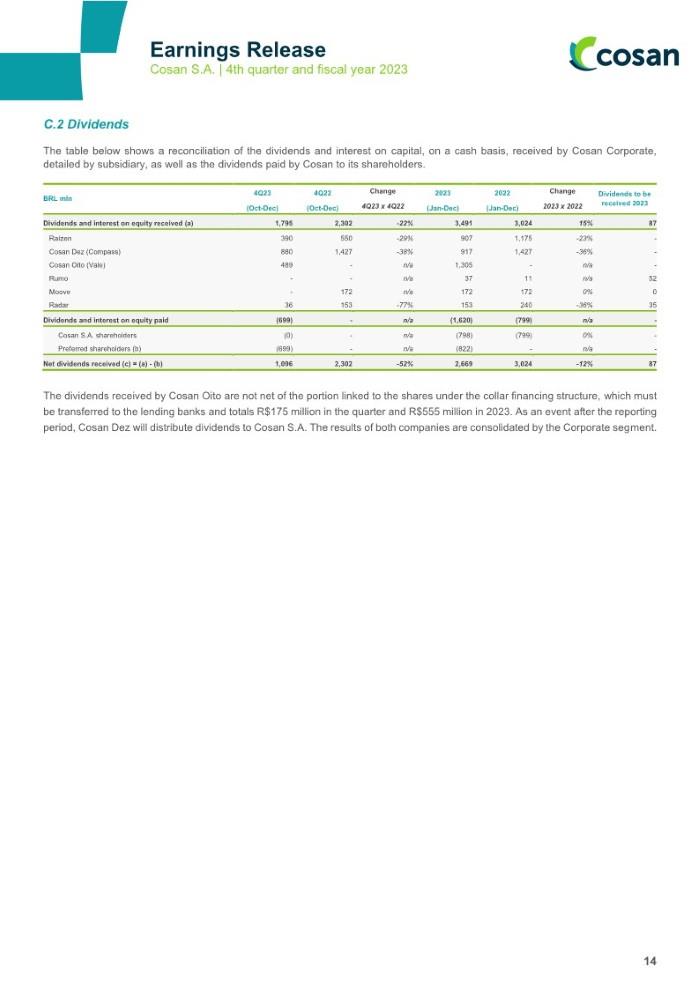

C.1.1 Leverage and Interest Coverage Ratio BRL mln 4Q23 (Oct-Dec) 4Q22 (Oct-Dec) Change 4Q23 x 4Q22 3Q23 (Jul-Sep) Change 4Q23 x 3Q23 Gross debt (a) 77,777 70,725 10% 75,458 3% Cosan Corporate 26,576 25,706 3% 26,077 2% Business 51,201 45,019 14% 49,381 4% Cash, cash equivalents and marketable securities (b) (22,132) (37,858) -42% (37,876) -42% Cosan Corporate (3,670) (22,023) -83% (18,444) -80% Business (18,463) (15,835) 17% (19,432) -5% 1 Net debt for leverage (c = a - b) 55,645 32,867 69% 37,582 48% 2 EBITDA LTM (d) 24,668 17,120 44% 23,518 5% Effect of lease liabilities (ex-IFRS16) (e) (1,906) (2,087) -9% (1,895) 1% EBITDA LTM (ex-IFRS16) (f = d + e) 22,762 15,033 51% 21,622 5% Pro forma Leverage (g = c / f) 2.4x 2.2x n/a 1.7x n/a Managerial net debt3 (h) Managerial leverage (i = h / f) 40,062 1.8x - - - - - - - - Notes: (1) Pro forma net debt, i.e., includes 50% of Raízen’s results and excludes lease liabilities (IFRS16); (2) Pro forma EBITDA in the last 12 months (LTM), i.e., including 50% of Raízen without any non-recurring adjustments; (3) Managerial net debt considers the effect of the current market value of the Company's stake in Vale on the cash position . The leverage ratio was 2.4x in 4Q23 vs. 2.2x in 4Q22 and 1.7x in 3Q23. The increase in both comparison periods is due to the lower cash position, thanks to the reclassification of Vale’s shares, as explained on item B. Cosan Oito, and was partially o ffset by the higher EBITDA of the last 12 months, driven by the better operational performance of all businesses of the portfolio. For comparability purposes, considering the effect of Vale's shares on the cash position, leverage ratio is stable at 1.8x, that is, in line with 3Q23. Note that the leverage ratio remains within appropriate levels for the group, despite the increase in relation to previous quarters. Cosan Corporate BRL mln 1Q23 (Jan-Mar) 2Q23 (Apr-Jun) 3Q23 (Jul-Sep) 4Q23 (Oct-Dec) Net Dividends and Interest on Capital received LTM¹ (a) 3,395 3,448 3,876 2,669 Interest paid LTM² (b) 2,557 2,609 2,709 2,666 Interest Coverage (c = a /b) 1.3x 1.3x 1.4x 1.0x Notes: (1) Reconciliation in the table of dividends, item C.2 Dividends. (2) Includes payment of interest, derivatives linked to debts and expenses with derivatives linked to bank. As from this quarter, we will report the interest coverage ratio of Cosan Corporate. This is a metric that complements the vision of the portfolio manager’s debt, considering its receipts of dividends and interest on capital, as well as financial obligations.

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

Earnings Release Cosan S.A. 4th Quarter of 2023 Cosan Faz acontecer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 26, 2024

|

COSAN S.A. |

||

|

By: |

/s/ Rodrigo Araujo Alves |

|

|

|

Name: Rodrigo Araujo Alves |

|

|

|

Title: Chief Financial Officer |

|

| 1 |