UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

|

|

|

Form 20-F

(Mark One)

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 1-14090

|

|

|

|

Eni SpA

(Exact name of Registrant as specified in its charter)

Republic of Italy

(Jurisdiction of incorporation or organization)

1, piazzale Enrico Mattei - 00144 Roma - Italy

(Address of principal executive offices)

Francesco Esposito

Eni SpA

1, piazza Ezio Vanoni

20097 San Donato Milanese (Milano) - Italy

Tel +39 02 52061632 - Fax +39 06 59822575

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

|

|

|

|

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Shares |

|

E |

|

New York Stock Exchange* |

|

American Depositary Shares |

|

|

|

New York Stock Exchange |

|

(Which represent the right to receive two Shares) |

|

|

|

* Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

|

Ordinary shares |

3,375,937,893 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☑ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☑

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has fi led a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board ☑ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

| ii |

Certain disclosures contained herein including, without limitation, certain information appearing in “Item 4 – Information on the Company”, and in particular “Item 4 – Exploration & Production”, “Item 5 – Operating and Financial Review and Prospects” and “Item 11 – Quantitative and Qualitative Disclosures about Market Risk” contain forward-looking statements regarding future events and the future results of Eni that are based on current expectations, estimates, forecasts, and projections about the industries in which Eni operates and the beliefs and assumptions of the management of Eni. Eni may also make forward-looking statements in other written materials, including other documents filed with or furnished to the U.S. Securities and Exchange Commission (the “SEC”). In addition, Eni’s senior management may make forward-looking statements orally to analysts, investors, representatives of the media and others. In particular, among other statements, certain statements with regard to management objectives, trends in results of operations, margins, costs, return on capital, risk management and competition are forward looking in nature. Words such as ‘expects’, ‘anticipates’, ‘targets’, ‘goals’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, ‘seeks’,‘estimates’, variations of such words, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict because they relate to events and depend on circumstances that will occur in the future. Therefore, Eni’s actual results may differ materially and adversely from those expressed or implied in any forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report on Form 20-F under the section entitled “Risk factors” and elsewhere. Any forward-looking statements made by or on behalf of Eni speak only as of the date they are made. Eni does not undertake to update forward-looking statements to reflect any changes in Eni’s expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. The reader should, however, consult any further disclosures Eni may make in documents it files with the SEC.

In this Form 20-F, the terms “Eni”, the “Group”, or the “Company” refer to the parent company Eni SpA and its consolidated subsidiaries and, unless the context otherwise requires, their respective predecessor companies. All references to “Italy” or the “State” are references to the Republic of Italy, all references to the “Government” are references to the government of the Republic of Italy. For definitions of certain oil and gas terms used herein and certain conversions, see “Glossary” and “Conversion Table”.

The Consolidated Financial Statements of Eni, included in this Annual Report, have been prepared in accordance with International Financial Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

Unless otherwise indicated, any reference herein to “Consolidated Financial Statements” is to the Consolidated Financial Statements of Eni (including the Notes thereto) included herein.

Unless otherwise specified or the context otherwise requires, references herein to “dollars”, “$”, “U.S. dollars”, “US$” and “USD” are to the currency of the United States, and references to “euro”, “EUR” and “€” are to the currency of the European Monetary Union.

Unless otherwise specified or the context otherwise requires, references herein to “Division” and “segment” are to any of the following Eni’s business activities: “Exploration & Production” (or “E&P”), “Global Gas & LNG Portfolio” (or “GGP”), “Enilive, Refining and Chemicals” (or “Enilive, Refining & C”), “Plenitude & Power” and “Corporate and Other activities”.

References to Versalis or Chemical are to Eni’s chemical activities which are managed through its fully-owned subsidiary Versalis and Versalis’ controlled entities.

References to Plenitude are to Eni’s retail gas and power activities and renewables business which are managed through its fully-owned subsidiary Plenitude and Plenitude’s controlled entities. The results of the operations of Plenitude are included in the segment information “Plenitude & Power” for financial reporting purposes.

Exhibit 99 which contains Eni’s disclosure pursuant to the EU Taxonomy regulation does not form part of this Form 20-F and is not incorporated herein.

Statements made in “Item 4 – Information on the Company” referring to Eni’s competitive position are based on the Company’s belief, and in some cases rely on a range of sources, including investment analysts’ reports, independent market studies and Eni’s internal assessment of market share based on publicly available information about the financial results and performance of market participants. Market share estimates contained in this document are based on management estimates unless otherwise indicated.

Below is a selection of the most frequently used terms throughout this Annual Report on Form 20-F. Any reference herein to a non-GAAP measure and to its most directly comparable GAAP measure shall be intended as a reference to a non-IFRS measure and the comparable IFRS measure.

Financial terms

| Identified net gains (losses) | Identified net gains (losses) include certain significant income or charges pertaining to either: (i) infrequent or unusual events and transactions, being identified as non-recurring items under such circumstances; (ii) certain events or transactions which are not considered to be representative of the ordinary course of business, as in the case of environmental provisions, restructuring charges, asset impairments or write ups and gains or losses on divestments even though they occurred in past periods or are likely to occur in future ones. Exchange rate differences and derivatives relating to industrial activities and commercial payables and receivables, particularly exchange rate derivatives to manage commodity pricing formulas which are quoted in a currency other than the functional currency are reclassified in operating profit with a corresponding adjustment to net finance charges, notwithstanding the handling of foreign currency exchange risks is made centrally by netting off naturally-occurring opposite positions and then dealing with any residual risk exposure in the derivative market. Finally, special items include the accounting effects of fair-valued commodity derivatives relating to commercial exposures: in addition to those which lack the criteria to be designed as hedges, also those which are not eligible for the own use exemption, including the ineffective portion of cash flow hedges, as well as the accounting effects of settled commodity and exchange rates derivatives whenever it is deemed that the underlying transaction is expected to occur in future reporting periods. Correspondently, special charges/gains also include the evaluation effects relating to assets/liabilities utilized in a natural hedge relation to offset a market risk, as in the case of accrued currency differences at finance debt denominated in a currency other than the reporting currency, where the cash outflows for the reimbursement are matched by highly probable cash inflows in the same currency. The deferral of both the unrealized portion of fair-valued commodity and other derivatives and evaluation effects are reversed to future reporting periods when the underlying transaction occurs. |

| Leverage | A non-GAAP measure of the Company’s financial condition, calculated as the ratio between net borrowings and shareholders’ equity, including non-controlling interest. For a discussion of management’s view of the usefulness of this measure and its reconciliation with the most directly comparable GAAP measure, “Ratio of total debt to total shareholders equity (including non-controlling interest)” see “Item 5 – Financial Condition”. |

| Net borrowings | Eni evaluates its financial condition by reference to “net borrowings”, which is a non-GAAP measure. Eni calculates net borrowings as total finance debt less: cash, cash equivalents and certain very liquid investments not related to operations, including among others non-operating financing receivables and securities not related to operations. Non-operating financing receivables consist of amounts due to Eni’s financing subsidiaries from banks and other financing institutions and amounts due to other subsidiaries from banks for investing purposes and deposits in escrow. Securities not related to operations consist primarily of government and corporate securities. For a discussion of management’s view of the usefulness of this measure and its reconciliation with the most directly comparable GAAP measure, “Total debt” see “Item 5 – Financial condition”. |

|

TSR (Total Shareholder Return) |

Management uses this measure to assess the total return on Eni’s shares. It is calculated on a yearly basis, keeping account of the change in market price of Eni’s shares (at the beginning and at end of year) and dividends distributed and reinvested at the ex-dividend date. |

Business terms

| ARERA (Italian Regulatory Authority for Energy, Networks and Environment) formerly AEEGSI (Authority for Electricity Gas and Water) | The Italian Regulatory Authority for Energy, Networks and Environment is the Italian independent body which regulates, controls and monitors the electricity, gas and water sectors and markets in Italy. The Authority’s role and purpose is to protect the interests of users and consumers, promote competition and ensure efficient, cost-effective and profitable nationwide services with satisfactory quality levels. Furthermore, since December 2017 the Authority also has regulatory and control functions over the waste cycle, including sorted, urban and related waste. |

| Associated gas | Associated gas is a natural gas found in contact with or dissolved in crude oil in the reservoir. It can be further categorized as Gas-Cap Gas or Solution Gas. |

| Average reserve life index | Ratio between the amount of reserves at the end of the year and total production for the year. |

| Barrel/BBL | Volume unit corresponding to 159 liters. A barrel of oil corresponds to about 0.137 metric tons. |

| BOE | Barrel of Oil Equivalent. It is used as a standard unit measure for oil and natural gas. The latter is converted from standard cubic meters into barrels of oil equivalent using a certain coefficient (see “Conversion Table” on page ix). |

| Compounding | Activity specialized in production of semifinished products in granular form, resulting from the combination of two or more chemical products. |

| Concession contracts | Contracts currently applied mainly in Western countries regulating relationships between states and oil companies with regards to hydrocarbon exploration and production. The company holding the mining concession has an exclusive right on exploration, development and production activities and for this reason it acquires a right to hydrocarbons extracted against the payment of royalties on production and taxes on oil revenues to the state. |

| Condensates | Condensates are a mixture of hydrocarbons that exists in the gaseous phase at original reservoir temperature and pressure, but that, when produced, is in the liquid phase at surface pressure and temperature. |

| Consob | The Italian National Commission for listed companies and the stock exchange (Commissione Nazionale per le Società e la Borsa). |

| Contingent resources | Contingent resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations, but the applied project(s) are not yet considered mature enough for commercial development due to one or more contingencies. |

| Conversion capacity | Maximum amount of feedstock that can be processed in certain dedicated facilities of a refinery to obtain finished products. Conversion facilities include catalytic crackers, hydrocrackers, visbreaking units, and coking units. |

| Conversion index | Ratio of capacity of conversion facilities to primary distillation capacity. The higher the ratio, the higher is the capacity of a refinery to obtain high value products from the heavy residue of primary distillation. |

| Deep waters | Waters deeper than 200 meters. |

| Development | Drilling and other post-exploration activities aimed at the production of oil and gas. |

| Enhanced recovery | Techniques used to increase or stretch over time the production of wells. |

| Eni carbon efficiency index | Ratio between GHG emissions (Scope 1 and Scope 2 in tonnes CO2eq.) of the main industrial activities operated by Eni divided by the productions (converted by homogeneity into barrels of oil equivalent using Eni’s average conversion factors) of the single businesses of reference. |

| EPC | Engineering, Procurement and Construction. |

| EPCI | Engineering, Procurement, Construction and Installation. |

| Exploration | Oil and natural gas exploration that includes land surveys, geological and geophysical studies, seismic data gathering and analysis and well drilling. |

| FPSO | Floating Production Storage and Offloading System. |

| FSO | Floating Storage and Offloading System. |

| Greenhouse Gases (GHG) | Gases in the atmosphere, transparent to solar radiation, that trap infrared radiation emitted by the earth’s surface. The greenhouse gases relevant within Eni’s activities are carbon dioxide (CO2), methane (CH4) and nitrous oxide (N2O). GHG emissions are commonly reported in CO2 equivalent (CO2eq) according to Global Warming Potential values in line with IPCC AR4, 4th Assessment Report. |

| Infilling wells | Infilling wells are wells drilled in a producing area in order to improve the recovery of hydrocarbons from the field and to maintain and/or increase production levels. |

| LNG | Liquefied Natural Gas obtained through the cooling of natural gas to minus 160 °C at normal pressure. The gas is liquefied to allow transportation from the place of extraction to the sites at which it is transformed back into its natural gaseous state and consumed. One tonne of LNG corresponds to 1,400 cubic meters of gas. |

| LPG | Liquefied Petroleum Gas, a mix of light petroleum fractions, gaseous at normal pressure and easily liquefied at room temperature through limited compression. |

| Margin | The difference between the average selling price and direct acquisition cost of a finished product or raw material excluding other production costs (e.g. refining margin, margin on distribution of natural gas and petroleum products or margin of petrochemical products). Margin trends reflect the trading environment and are, to a certain extent, a gauge of industry profitability. |

| Mineral Potential | (Potentially recoverable hydrocarbon volumes) Estimated recoverable volumes which cannot be defined as reserves due to a number of reasons, such as the temporary lack of viable markets, a possible commercial recovery dependent on the development of new technologies, or for their location in accumulations yet to be developed or where evaluation of known accumulations is still at an early stage. |

| Natural gas liquids (NGL) | Liquid or liquefied hydrocarbons recovered from natural gas through separation equipment or natural gas treatment plants. Propane, normal-butane and isobutane, isopentane and pentane plus, that were previously defined as natural gasoline, are natural gas liquids. |

| Net GHG Lifecycle Emissions | GHG Scope 1+2+3 emissions associated with the value chain of the energy products sold by Eni, including both those deriving from own productions and those purchased from third parties, accounted on equity basis, net of offset, mainly from Natural Climate Solutions. |

| Net Carbon Footprint | Overall Scope 1 and Scope 2 GHG emissions associated with Eni’s operations, accounted for on an equity basis, net of carbon sinks mainly from Natural Climate Solutions. |

| Net Carbon Intensity | Ratio between the Net GHG lifecycle emissions and the energy content of products sold accounted for on an equity basis. |

| Network Code | A code containing norms and regulations for access to, management and operation of natural gas pipelines. |

| Oilfield chemicals | Innovative solutions for supply of chemicals and related ancillary services for Oil & Gas business. |

| Over/Under lifting | Agreements stipulated between partners which regulate the right of each to its share in the production for a set period of time. Amounts lifted by a partner different from the agreed amounts determine temporary Over/Under lifting situations. |

| Plasmix | Plasmix is the collective name for the different plastics that currently have no use in the market of recycling and can be used as a feedstock in the new circular economy businesses of Eni. |

|

Possible reserves |

Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. |

| Probable reserves | Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. |

|

Primary balanced refining capacity |

Maximum amount of feedstock that can be processed in a refinery to obtain finished products measured in BBL/d. |

|

Production Sharing Agreement (PSA) |

Contract regulates relationships between states and oil companies with regard to the exploration and production of hydrocarbons. The mineral right is awarded to the national oil company jointly with the foreign oil company that has an exclusive right to perform exploration, development and production activities and can enter into agreements with other local or international entities. In this type of contract the national oil company assigns to the international contractor the task of performing exploration and production with the contractor’s equipment and financial resources. Exploration risks are borne by the contractor and production is divided into two portions: “Cost Oil” is used to recover costs borne by the contractor and “Profit Oil” is divided between the contractor and the national company according to variable schemes and represents the profit deriving from exploration and production. Further terms and conditions of these contracts may vary from country to country. |

| Proved reserves | Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible, from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations, prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions. Reserves are classified as either developed and undeveloped. Proved developed oil and gas reserves are reserves that can be expected to be recovered through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well, and through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. Proved undeveloped oil and gas reserves are reserves of any category that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. |

| REDD+ | The REDD+ (Reducing Emissions from Deforestation and Forest Degradation) scheme was designed by the United Nations (United Nations Framework Convention on Climate Change - UNFCC). It involves conserving forests to reduce emissions and improve the natural storage capacity of CO2, as well as helping local communities develop through socio-economic projects in line with principles on sustainable management, forest protection and nature conservation. |

| Renewable Installed Capacity | Renewable Installed Capacity is measured as the maximun generating capacity of Eni’s share of power plants that use renewable energy sources (wind, solar and wave, and any other non-fossil fuel source of generation deriving from natural resources, excluding, from the avoidance of doubt, nuclear energy) to produce electricity. The capacity is considered “installed” once the power plants are in operation or the mechanical completion phase has been reached. The mechanical completion represents the final construction stage excluding the grid connection. |

| Reserves | Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project. |

| Reserve life index | Ratio between the amount of proved reserves at the end of the year and total production for the year. |

| Reserve replacement ratio | Measure of the reserves produced replaced by proved reserves. Indicates the company’s ability to add new reserves through exploration and purchase of property. A rate higher than 100% indicates that more reserves were added than produced in the period. The ratio should be averaged on a three-year period in order to reduce the distortion deriving from the purchase of proved property, the revision of previous estimates, enhanced recovery, improvement in recovery rates and changes in the amount of reserves – in PSAs – due to changes in international oil prices. |

| Scope 1 GHG Emissions | Direct greenhouse gas emissions from company’s operations, produced from sources that are owned or controlled by the company. |

| Scope 2 GHG Emissions | Indirect greenhouse gas emissions resulting from the generation of electricity, steam and heat purchased from third parties. |

| Scope 3 GHG Emissions | Indirect GHG emissions associated with the value chain of Eni’s products. |

| SERM (Standard Eni Refining Margin) | It approximates the margin of Eni's refining system in consideration of the refinery |

| Ship-or-pay | Clause included in natural gas transportation contracts according to which the customer is requested to pay for the transportation of gas whether or not the gas is actually transported. |

| Take-or-pay | Clause included in natural gas supply contracts according to which the purchaser is bound to pay the contractual price or a fraction of such price for a minimum quantity of gas set in the contract whether or not the gas is collected by the purchaser. The purchaser has the option of collecting the gas paid for and not delivered at a price equal to the residual fraction of the price set in the contract in subsequent contract years. |

| Title Transfer Facility | The Title Transfer Facility, more commonly known as TTF, is a virtual trading point for natural gas in the Netherlands. TTF Price is quoted in euro per megawatt hour and, for business day, is quoted day-ahead, i.e. delivered next working day after assessment. |

| UN SDGs | The Sustainable Development Goals (SDGs) are the blueprint to achieve a better and more sustainable future for all by 2030. Adopted by all United Nations Member States in 2015, they address the global challenges the world is facing, including those related to poverty, inequality, climate change, environmental degradation, peace and justice. For further detail see the website https://unsdg.un.org |

| Upstream/Downstream | The Sustainable Development Goals (SDGs) are the blueprint to achieve a better and more sustainable future for all by 2030. Adopted by all United Nations Member States in 2015, they address the global challenges the world is facing, including those related to poverty, inequality, climate change, environmental degradation, peace and justice. For further detail see the website https://unsdg.un.org |

| Upstream GHG Emission intensity | Ratio between 100% Scope 1 GHG emissions from Upstream operated assets and 100% gross operated production (expressed in barrel of oil equivalent). |

| mmCF | = million cubic feet | ||

| BCF | = billion cubic feet | mmtonnes | = million tonnes MW |

| mmCM | = million cubic meters BCM | MW | = megawatt GWh |

| BCM | = billion cubic meters BOE | GWh | = gigawatthour TWh |

| BOE | = barrel of oil equivalent | TWh | = terawatthour |

| /d | = per day | ||

| KBOE | = thousand barrel of oil equivalent | /y | = per year |

| mmBOE | = million barrel of oil equivalent | E&P | = the Exploration & Production segment |

| BBOE | = billion barrel of oil equivalent | GGP | = the Global Gas & LNG Portfolio segment |

| BBL | = barrels | ||

| KBBL | = thousand barrels | ||

| mmBBL | = million barrels | ||

| BBBL | = billion barrels | ||

| mmBTU | = million British thermal unit | ||

| ktonnes | = thousand tonnes | ||

| KW | = kilowatt | ||

| GW | = gigawatt | ||

| Gcal | = giga calorie |

| 1 acre | = 0.405 hectares | |

| 1 barrel | = 42 U.S. gallons | |

| 1 BOE | = 1 barrel of crude oil | = 5,232 cubic feet of natural gas |

| 1 barrel of crude oil per day | = approximately 50 tonnes of crude oil per year | |

| 1 cubic meter of natural gas | = 35.3147 cubic feet of natural gas | |

| 1 cubic meter of natural gas | = approximately 0.00675 barrels of oil equivalent |

|

| 1 kilometer | = approximately 0.62 miles | |

| 1 short ton | = 0.907 tonnes | = 2,000 pounds |

| 1 long ton | = 1.016 tonnes | = 2,240 pounds |

| 1 tonne | = 1 metric ton | = 1,000 kilograms |

| = approximately 2,205 pounds | ||

| 1 tonne of crude oil | = 1 metric ton of crude oil | = approximately 7.3 barrels of crude oil (assuming an API gravity of 34 degrees) |

NOT APPLICABLE

NOT APPLICABLE

The Group’s performance is exposed to the volatility of the prices of crude oil and natural gas and to changing margins of refined products and oil-based chemical products

The price of crude oil and natural gas is the main driver of the Company’s operating performance, cash flow, business prospects and its ability to remunerate its shareholders, given the current size of Eni’s Exploration & Production segment relative to other Company’s business segments in terms of key financial metrics like operating profit, returns and invested capital.

The price of crude oil has a history of volatility because, like other commodities, it is influenced by the ups and downs in the economic cycle and by several macro-variables that are beyond management’s control. In the short term, crude oil prices are mainly determined by the balance between global oil supplies and demand, the global levels of commercial inventories and producing countries’ spare capacity, as well as by expectations of financial operators who trade crude oil derivatives contracts (futures and options) influencing short-term price movements via their positioning. A downturn in economic activity normally triggers lower global demand for crude oil and possibly oversupplies and inventories build-up, because in the short-term producers are unable to quickly adapt to swings in demand. Whenever global supplies of crude oil outstrip demand, crude oil prices weaken. Factors that can influence the global economic activity in the short-term and demand for crude oil include several, unpredictable events, like trends in the economic growth which shape crude oil demand in big consumer countries like China, India and the United States, financial crisis, monetary variables (the level of inflation and of interest rates), geo-political crisis, local conflicts and wars, social instability, pandemic diseases, the flows of international commerce, trade disputes and governments’ fiscal policies, among others.

Long-term demands for crude oil is driven, on the positive side, by demographic growth, improving living standards and GDP (Gross Domestic product) expansion; on the negative side, factors that in the long-term may significantly reduce demands for crude oil include availability of alternative sources of energy (e.g., nuclear and renewables), technological breakthroughs, shifts in consumer preferences, and finally measures and other initiatives adopted or planned by governments to tackle climate change and to curb carbon-dioxide emissions (CO2 emissions), including stricter regulations and control on production and consumption of crude oil. Eni’s management believes the push to reduce worldwide greenhouse gas emissions and the ongoing energy transition towards a low carbon economy are likely to materially affect the worldwide energy mix in the long-term and may lead to structural lower crude oil demands and prices. See the section dedicated to the discussion of climate-related risks below.

Notwithstanding the USA being the first oil producer in the world since the shale oil revolution of 2011, global oil supplies are controlled to a large degree by the Organization of the Petroleum Exporting Countries (“OPEC”) cartel and its allied countries, like Russia and Kazakhstan, known as the OPEC+ alliance. Saudi Arabia plays a crucial role within the cartel, because it is estimated to hold huge amounts of reserves and a vast majority of worldwide spare production capacity. This explains why geopolitical developments in the Middle East and particularly in the Gulf area, like regional conflicts, acts of war, strikes, attacks, sabotages, and social and political tensions can have a big influence on crude oil prices. Furthermore, due to expectations of a slowdown in the growth rate of the US shale oil production or of a possible decline in the long-term due to capital discipline and industrial factors like a shrinking number of premium locations and high-yield wells, the OPEC+ alliance could exert in perspective an increasingly larger influence over the crude oil market. Finally, sanctions imposed by the United States and the EU against certain producing countries may influence trends in crude oil prices.

To a lesser extent, extreme weather events, such as hurricanes in areas of highly concentrated production like the Gulf of Mexico, and operational issues at key petroleum infrastructures may have an impact on crude oil prices.

In 2023, the price of the Brent benchmark crude declined by 18% compared to 2022 due to rising production levels in non-OPEC countries and expectations among financial market participants of a slowdown in economic activity and hence in demand for crude oil, whereas the China recovery was elusive, and the Europe economies have been stagnating. Prices were supported by curbs to production levels and quotas made by the countries of the OPEC+ alliance. In 2024, the Company expects that crude oil prices will remain at the same level as in 2023 due to continuing production gains and an uncertain macroeconomic backdrop, under the assumption that the OPEC+ alliance still retain its policy of supporting the price of crude oil.

The short-term drivers of prices and demands for natural gas are like those of crude oil. The development of massive liquefaction capacity that has occurred in recent years in countries like the USA, Qatar and Australia has helped to develop a global liquid market of natural gas, with traders being able to redirect LNG from one geography to another based on price arbitrages. Differently from crude oil, the absolute levels of natural gas prices change from region to region due to specific supply dynamics (e.g. in 2023 the price of natural gas in USA was one fifth that of Europe, because Europe is a net importer, whilst the USA is currently an oversupplied market due to growing domestic production), while consumption of natural gas is significantly exposed to seasonal patterns and competition from renewables. All those trends may result in a higher degree of volatility in natural gas prices compared to crude oil. In the long-term, demands for natural gas are exposed to the risks of the transition to a low-carbon economy.

In 2023, natural gas prices declined significantly compared to 2022, with European benchmarks down more than 60%, due to an oversupplied global market and lower consumption driven by lower industrial activity in Europe, energy savings measures, competition from renewables and mild winter weather. We expect weak natural gas prices in 2024 due to continuation of the trends observed in 2024.

The volatility of hydrocarbons prices significantly affects the Group’s financial performance. Lower hydrocarbon prices from one year to another negatively affect the Group’s consolidated results of operations and cash flow; the opposite occurs in case of a rise in prices. This is because lower prices translate into lower revenues recognised in the Company’s Exploration & Production segment at the time of the price change, whereas expenses in this segment are either fixed or less sensitive to changes in crude oil prices than revenues. In 2023, lower hydrocarbons prices, down by 18% and 66% respectively for the Brent crude oil and the European spot price of natural gas, reduced our operating profit and cash flow from operating activities by an estimated amount of approximately €5 billion and €3 billion respectively.

Finally, movements in hydrocarbons prices significantly affect the reportable amount of production and proved reserves under our production sharing agreements (“PSAs”), which represented about 55% of our proved reserves as of end of 2023. The entitlement mechanism of PSAs foresees the Company is entitled to a portion of a field’s reserves, the sale of which is intended to cover expenditures incurred by the Company to develop and operate the field. The higher the reference prices for Brent crude oil used to estimate Eni’s proved reserves, the lower the number of barrels necessary to recover the same amount of expenditure, and vice versa. In 2023 our reported production and reserves were increased by an estimated amount of respectively 3 KBOE/d and by 30 mmBOE due to a decreased Brent reference price. Considering the current portfolio of oil&gas assets, the Company estimates its production to vary by up to 1 KBOE/d for each one-dollar change in the price of the Brent crude oil.

Eni’s Enilive, Refining and Chemical businesses are in cyclical economic sectors. Their results are impacted by trends in the supply and demand of oil products and plastic commodities, which are influenced by the macro-economic scenario and by product margins. Margins for refined and chemical products depend upon the speed at which products’ prices adjust to reflect movements in oil prices.

All these risks may adversely and materially impact the Group’s results of operations, cash flow, liquidity, business prospects, financial condition, and shareholder returns, including dividends, the amount of funds available for stock repurchases and the price of Eni’s share.

Risks in connection with Russia’s military aggression of Ukraine and the Middle East conflict in the Gaza strip

Russia’s military aggression of Ukraine began in late February 2022 and has continued to drag throughout 2023 without any prospects of quick solution. This conflict has already negatively impacted the global economy by triggering an energy crisis in Europe, by souring the political relationships between Western countries and Russia, by disrupting supply chains and by increasing cybersecurity threats. In response to Russia’s aggression, the EU nations, the UK, and the USA have adopted massive economic and financial sanctions to curb Russia’s ability to fund the war, which is negatively affecting the economic activity.

An uncertain global macroeconomic backdrop has been further compounded since last October by a resurgence of tensions in Middle East, culminating in Israelis military invasion of the Gaza strip and risks of enlargement of the conflict.

A prolonged armed conflict in those two areas, a possible escalation of the military action in Middle East, and a further tightening up of the economic sanctions against Russia represent elements of uncertainty that could eventually sap consumers’ confidence and deter investment decisions, increasing the risks of a worldwide macroeconomic recession and with it, expectations of a reduction in hydrocarbons demands. This scenario would lead to lower commodity prices and would adversely and significantly affect our results of operations and cash flow, as well as business prospects, with a possible lower remuneration of our shareholders.

Risks in connection with our presence in Russia and our commercial relationships with Russia’s State-owned companies

The most important exposure of Eni to Russia is relating to the purchase of natural gas from Russian state-owned company Gazprom and its affiliates, based on long-term supply contracts with take-or-pay clauses. In the past, the volumes supplied from Russia have represented a material amount of our global portfolio of natural gas supplies (see table “Natural gas supply” in Item 4 – Global Gas & LNG Portfolio, providing information about the last three-year period). In 2023, natural gas supplies from Russia decreased materially to 12% of our total purchases of natural gas (down from 28% in 2022) due to unilateral decisions from our Russian supplier to suspend deliveries, against the backdrop of a commercial dispute between the two parties. We intend to continue our effort to substitute Russian-origin natural gas in our portfolio, with the aim to continue to reduce such dependence in the shortest possible timeframe, including the termination of the current contracts.

The Group's business plans have been factoring the assumption of reducing to zero the supplies from Russia and sales plans have been adapted accordingly by limiting sales commitments. To cope with the expected reduced availability of Russian natural gas, the Group has increased purchases from other geographies through various commercial initiatives, such as using contractual flexibilities to increase deliveries from existing long-term contracts or by developing integrated upstream-midstream projects leveraging equity natural gas reserves and new liquefactions capacity. The process of replacing Russian-origin natural gas, including terminating existing contracts, may entail operational and financial risks which may be significant.

Other Eni assets in Russia are immaterial to the Group results of operations (see Item 4).

There is strong competition worldwide, both within the oil industry and with other industries, to supply energy and petroleum products to the industrial, commercial, and residential energy markets

The current competitive environment in which Eni operates is characterized by volatile prices and margins of energy commodities, limited product differentiation and complex relationships with state-owned companies and national agencies of the countries where hydrocarbons reserves are located to obtain mineral rights. As commodity prices are beyond the Company’s control, Eni’s ability to remain competitive and profitable in this environment requires continuous focus on technological innovation, the achievement of efficiencies in operating costs, effective management of capital resources and the ability to provide valuable services to energy buyers. It also depends on Eni’s ability to gain access to new investment opportunities. Competitive trends represent a risk to the profitability of all Eni’s business segment:

More information about the competitive trends of Eni’s segments are disclosed in Item 4.

Rising concerns about climate change and effects of the energy transition could continue to lead to a fall in demand and potentially lower prices for hydrocarbons. Climate change could also have a physical impact on our assets and supply chains. This risk may also lead to additional legal and/or regulatory measures, resulting in project delays or cancellations, potential additional litigation, operational restrictions, and additional compliance obligations

Societal demand for urgent action on climate change has increased, especially since the Intergovernmental Panel on Climate Change (IPCC) Special Report of 2018 on 1.5°C effectively made the more ambitious goal of the Paris Agreement to limit the rise in global average temperature this century to 1.5 degrees Celsius the default target. This increasing focus on climate change and drive for an energy transition have created a risk environment that is changing rapidly, resulting in a wide range of governmental actions at global, local and company levels, increasing pressure from civil society and the investing and lending community to speed up our decarbonization plans. The potential impact and likelihood of the associated exposure for Eni could vary across different time horizons, depending on the specific components of the risk.

We expect that a growing share of our greenhouse gas (GHG) emissions will be subject to regulation, resulting in increased compliance costs and operational restrictions. Regulators may seek to limit certain oil and gas projects or make it more difficult to obtain required permits. Additionally, climate activists are challenging the grant of new and existing regulatory permits. We expect that these challenges and protests are likely to continue and could delay or prohibit operations in certain cases. Our strategy to achieve our target of becoming net zero on all emissions from our operations has resulted in and could continue to require additional costs. We also expect that actions by customers to reduce their emissions will continue to lower demand and potentially affect prices for fossil fuels, as will GHG emissions regulation through taxes, fees and/or other incentives. This could be a factor contributing to additional provisions for our assets and result in lower earnings, cancelled projects and potential impairment of certain assets.

The pace and extent of the energy transition could pose a risk to Eni if we decarbonize our operations and the energy we sell is not aligned to the demand of to society. If we are slower than society, customers may prefer a different supplier, which would reduce demand for our products and adversely affect our reputation besides materially affecting our earnings and financial results. If we move much faster than society, we risk investing in technologies, markets or low-carbon products that are unsuccessful because there is limited demand for them.

The physical effects of climate change such as, but not limited to, increases in temperature and sea levels and fluctuations in water levels could also adversely affect our operations and supply chains.

Certain investors have decided to divest their investments in fossil fuel companies. If this were to continue, it could have a material adverse effect on the price of our securities and our ability to access capital markets. Stakeholder groups are also putting pressure on commercial and investment banks to stop financing fossil fuel companies. Some financial institutions have started to limit their exposure to fossil fuel projects. Accordingly, our ability to use financing for these types of future projects may be adversely affected. This could also adversely affect our potential partners’ ability to finance their portion of costs, either through equity or debt.

In some countries, governments, regulators, organizations, and individuals have filed lawsuits seeking to hold oil companies liable for costs associated with climate change or seeking to have oil companies condemned to speed up decarbonization plans based on alleged crimes against the environment or human rights violations. While we believe these lawsuits to be without merit, losing could have a material adverse effect on our business. We expect to see additional regulatory requirements to provide disclosures related to climate risks.

In summary, rising climate change concerns, the pace at which we decarbonize our operations relative to society and effects of the energy transition have led and could lead to a decrease in demand and potentially affect prices for fossil fuels. The Company’s traditional oil and gas business may increase or decrease depending upon regulatory or market forces, among other factorsIf we are unable to find economically viable, publicly acceptable solutions that reduce our GHG emissions and/or GHG intensity for new and existing projects and for the products we sell, we could experience financial penalties or extra costs, delayed or cancelled projects, potential impairments of our assets, additional provisions and/or reduced production and product sales. future results of operations, cash flow, liquidity, business prospects, financial condition, shareholder returns, including dividends, the amount of funds available for stock repurchases and the price of Eni’s shares may be adversely and significantly affected.

The above mentioned risks may emerge in the short, medium, and long term.

a) Regulatory risk: increasing worldwide efforts to tackle climate change may lead to the adoption of stricter regulations to curb carbon emissions and this could lead to increasing expenditures in the short term and may end up suppressing demands for our products in medium-to-long term.

Regulatory actions intended to reduce greenhouse gas emissions include adoption of cap-and-trade regimes, carbon taxes, carbon-based import duties or other trade tariffs, minimum renewable usage requirements, restrictive permitting, increased mileage and other efficiency standards, mandates for sales of electric vehicles, mandates for use of specific fuels or technologies, and other incentives or mandates designed to support transitioning to lower-emission energy sources. Depending on how policies and regulations are formulated and applied, such policies and regulations could negatively affect our investment returns, make our hydrocarbon-based products more expensive or less competitive, lengthen project implementation times, and reduce demand for hydrocarbons, as well as shift hydrocarbon demand toward relatively lower-carbon alternatives. Current and pending greenhouse gas regulations or policies may also increase our compliance costs, such as for monitoring or sequestering emissions.

b) Market/Technological risk: in the long-term demands for hydrocarbons may be materially reduced by the projected mass adoption of electric vehicles, the development of green hydrogen, the deployment of massive investments to grow renewable energies also supported by governments fiscal policies and the development of other technologies to produce clean feedstock, fuels, and energy.

In the long term, the weight of hydrocarbons in the global energy mix may decline due to an expected increase in the amount of energy generated by renewables, the possible emergence of new products and technologies, as well as changing consumers’ preferences.

A large portion of Eni’s business depends on the global demand for oil and natural gas. If existing or future laws, regulations, treaties, or international agreements related to GHG and climate change, including state incentives to conserve energy or use alternative energy sources, technological breakthroughs in the field of renewable energies, hydrogen, production of nuclear energy or mass adoption of electric vehicles trigger a structural decline in worldwide demand for oil and natural gas, Eni’s results of operations and business prospects may be materially and adversely affected in case the Company fail to adapt its business model at the same pace of the energy transition as the economy.

c) Legal risk: several lawsuits are pending in various jurisdictions against oil&gas companies based on alleged violations of human rights, damage to environment and other claims and such legal actions may be brought against us.

In recent years, there has been a marked increase in climate-based litigation. Courts could be more likely to hold companies who have allegedly made the most significant contributions to climate change to account. Courts may condemn oil and gas companies to compensate individuals, communities, and states for the economic losses due to global warming as a consequence of their alleged responsibility in supporting hydrocarbons and their alleged awareness of knowingly hurting the environment. In some cases, companies’ boards have been summoned for having allegedly failed to take effective actions to contrast climate change.

For example, we are defending in California against claims brought to us by local administrations and certain associations of individuals who are seeking compensation for alleged economic losses and environmental damage due to climate change.

Private individuals, associations and NGOs may also bring legal actions against states or companies to get them condemned to adopt stricter targets in reducing GHG emissions and that could entail more restrictive measures on businesses. For example, in 2023, certain NGOs and several private citizens filed a complaint before an Italian court alleging that Eni and agencies of the Italian State are liable for climate change. The plaintiffs claimed economic losses and other damages and requested that Eni revises its decarbonisation strategy and immediately stops any harmful conducts, alleging several environmental crimes and violations of human rights.

As such, climate litigation represents a significant risk. In case the Company is condemned to reduce its GHG emissions at a much faster rate than planned by management or to compensate for damage related to climate change due to ongoing or potential lawsuits, we could incur a material adverse effect on our results of operations and business’s prospects.

d) Reputational risk: the consideration of oil&gas companies as poorly performing investments from an environmental standpoint by financial market participants, could reduce the attractiveness of their securities or limit their ability to access the capital markets. Activist investors have been seeking to interfere in companies’ plans and strategies through matter of shareholders’ resolutions.

The reputational risk of oil&gas companies owes to the growing perception by governments, financial institutions, and the general public that those companies may be liable for global warming due to GHG emissions across the hydrocarbon value chain, particularly related to the use of energy products, and may be poorly performing players in the ESG dimensions. This could possibly impair their reputation and make their securities and debt instruments less attractive than other industrial sectors to investors.

Banks, financing institutions, lenders and insurance companies are cutting exposure to the fossil fuel industry due to the need to comply with ESG mandate or to reach emission reduction targets in their portfolios and this could limit our ability to access new financing, could drive a rise in borrowing costs to us or increase the costs of insuring our assets.

As a result of those developments, we could expect the cost of capital to the Company to rise in the future and reduced ability on part of Eni to obtain financing for future projects in the oil&gas business or to obtain it at competitive rates, which may curb our investment opportunities or drive an increase in financing expenses, negatively affecting our results of operations and business prospects.

e) climate change adaptation: extreme weather phenomena, which are allegedly caused by climate change, may disrupt our operations

The scientific community has concluded that increasing global average temperature produces significant physical effects, such as the increased frequency and severity of hurricanes, storms, droughts, floods, or other extreme climatic events that could interfere with Eni’s operations and damage Eni’s facilities. Extreme and unpredictable weather phenomena can result in material disruption to Eni’s operations, and consequent loss of or damage to properties and facilities, as well as a loss of output, loss of revenues, increasing maintenance and repair expenses and cash flow shortfall.

As a result of these trends, climate-related risks could have a material and adverse effect on the Group’s results of operations, cash flow, liquidity, business prospects, financial condition, and shareholder returns, including dividends and the price of Eni’s shares.

Investments in our low-carbon products and services may not achieve expected returns

We are building our portfolio of low-carbon products and services such as electricity generated from solar and wind power, biofuels, projects for permanent geological sequestration of CO2, and charging for electric vehicles through organic and inorganic growth.

In expanding our offerings of these low-carbon products and services, we expect to undertake acquisitions and form partnerships. The success of these transactions will depend on our ability to realise the synergies from combining our respective resources and capabilities, including the development of new processes, systems and distribution channels. For example, it may take time to develop these areas through retraining our workforce and recruitment for the necessary new skills. It may take longer to realise the expected returns from these transactions.

The operating margins for our low-carbon products and services may not be as high as the margins we have experienced historically in our oil and gas operations.

Therefore, developing our low-carbon products and services is subject to challenges which could have a material adverse effect on future results of operations, cash flow, liquidity, business prospects, financial condition, shareholder returns, including dividends, the amount of funds available for stock repurchases and the price of Eni’s shares may be adversely and significantly affected.

Risks deriving from Eni’s exposure to weather conditions

Significant changes in weather conditions in Italy and in the rest of Europe from year to year may affect demand for natural gas and some refined products. In colder years, demand for such products is higher. Accordingly, the results of operations of Eni’s businesses engaged in the marketing of natural gas and, to a lesser extent, the Enilive and Refining business, as well as the comparability of results over different periods may be affected by such changes in weather conditions. Over recent years, this pattern could have been possibly affected by the rising frequency of weather trends like milder winter or extreme weather events like heatwaves or unusually cold snaps, which are possible consequences of climate change.

The Group is exposed to significant operational and economic risks associated with the exploration and production of crude oil and natural gas

The exploration and production of oil and natural gas require high levels of capital expenditures and are subject to specific operational and economic risks as well as to natural hazards and other uncertainties. The natural hazards and the economic risks described below could have an adverse, significant impact on Eni’s future growth prospects, results of operations, cash flows, liquidity, and shareholders’ returns.

a) Operational risks in connection to drilling and extraction operations

The physical and geological characteristics of oil and gas fields entail natural hazards and other operational risks including risks of eruptions of hydrocarbons, discovery of hydrocarbon pockets with abnormal pressure, crumbling of well openings, oil spills, gas leaks, risks of blowout, fire or explosion and risks of earthquake in connection with drilling and extraction activities. Eni has material offshore operations which are inherently riskier than onshore activities. In 2023, approximately 70% of Eni’s total oil and gas production for the year derived from offshore fields, mainly in Egypt, Norway Libya, Angola, Kazakhstan, Indonesia, Venezuela, the United Arab Emirates, Congo and the United States. Offshore accidents and oil spills could cause damage of catastrophic proportions to the ecosystem and to communities’ health and security due to the apparent difficulties in handling hydrocarbons containment in the sea, pollution, poisoning of water and organisms, length and complexity of cleaning operations and other factors. Furthermore, offshore operations are subject to marine risks, including storms and other adverse weather conditions and perils of vessel collisions, which may cause material adverse effects on the Group’s operations and the ecosystem.

b) Exploratory drilling efforts may be unsuccessful

Exploration activities are mainly subject to the mining risk, i.e. the risk of dry holes or failure to find commercial quantities of hydrocarbons. The costs of drilling and completing wells have margins of uncertainty, and drilling operations may be unsuccessful because of a large variety of factors, including geological failure, unexpected drilling conditions, pressure or heterogeneities in formations, equipment failures, well control (blowouts) and other forms of accidents. A large part of the Company exploratory drilling operations is located offshore, including in deep and ultra-deep waters, in remote areas and in environmentally sensitive locations (such as the Barents Sea, the Gulf of Mexico, deep water leases off West Africa, Indonesia, the Mediterranean Sea and the Caspian Sea). In these locations, the Company generally experiences higher operational risks and more challenging conditions and incurs higher exploration costs than onshore. Furthermore, deep and ultra-deep water operations require significant time before commercial production of discovered reserves can commence, increasing both the operational and the financial risks associated with these activities.

Because Eni plans to make significant investments in executing exploration projects, it is possible that the Company will incur significant amounts of dry hole expenses in future years. Unsuccessful exploration activities and failure to discover additional commercial reserves could reduce future production of oil and natural gas, which is highly dependent on the rate of success of exploration projects and could have an adverse impact on Eni’s future performance, growth prospects and returns.

c) Development projects bear significant operational risks which may adversely affect actual returns

Projects to develop and market reserves of crude oil and natural gas normally entail long lead times because of the complexity of the activities required to achieve the production start-up. Those activities include appraising a discovery, defining contractual and fiscal terms and conditions with state-owned entities and other partners to reach a final investment decision, and building and commissioning large-scale plants and equipment. Delays in the construction of key plants and facilities or in obtaining all necessary authorizations from competent authorities, costs overruns due to unplanned drilling and other operational conditions, as well as unexpected events resulting in temporarily stoppage of activities (e.g. third-party claims, environmentalists protests, changes to the work scope requested by governmental authorities, contractors’ underperformance) could significantly and adversely affect projects’ expected returns. Moreover, projects executed with partners and joint venture partners reduce the ability of the Company to manage risks and costs, and Eni could have limited influence over and control of the operations and performance of its partners. The occurrence of any of such risks may negatively affect the time-to-market of the reserves and may cause cost overruns and start-up delays, lengthening the project pay-back period. Those risks would adversely affect the economic returns of Eni’s development projects and the achievement of production growth targets, also considering that those projects are exposed to the volatility of oil and gas prices which may be substantially different from those estimated when the investment decision was made, thereby leading to lower return rates.

Finally, if the Company is unable to develop and operate major projects as planned, or in case actual reservoir performance and natural field decline do not meet management’s expectations, it could incur significant impairment losses of capitalized costs associated with reduced future cash flows of those projects.

The Group is currently engaged in the execution of several development projects to put into production its proved oil and natural gas reserves. The Company has changed its approach on how to manage development projects in the hydrocarbon segment, which normally feature long-lead times. In recent years we have implemented a phased approach to developing activities so to accelerate the production start-up, as well we have favoured near field development to exploit synergies with existing infrastructures and reutilization/reconversion of existing plants and vessels. This strategy in developing activities is intended to shorten the time-to-market of reserves and to accelerate the pay-back period. However, the achievement of the expected time-to-market and execution of development projects on time and on budget depends on several elusive factors which are inherently difficult to schedule:

• appraising a discovery to evaluate the technical and economic feasibility of a development project,

• finalizing negotiations with joint venture partners, governments and state-owned companies, suppliers and potential customers to define project terms and conditions, including, for example, the fiscal take, the production sharing terms with the first party, or negotiating favorable long-term contracts to market gas reserves;

• obtaining timely issuance of permits and licenses by government agencies, including obtaining all necessary administrative authorizations to drill locations, install producing infrastructures, build pipelines and related equipment to transport and market hydrocarbons;

• effectively carrying out the front-end engineering design in order to prevent the occurrence of technical inconvenience during the execution phase;

• timely manufacturing and delivery of critical plants and equipment by contractors, like floating production storage and offloading (FPSO) vessels, floating units for the production of liquefied natural gas (FLNG) and platforms, as well as building transport infrastructures to export production to final markets;

• preventing risks associated with the use of new technologies and the inability to develop advanced technologies to maximise the recoverability rate of hydrocarbons or gain access to previously inaccessible reservoirs;

• carefully planning the commissioning and hook-up phase where mismanagement might lead to delays to achieve first oil;

• changes in operating conditions and cost overruns. We expect the prices of key input factors such as labour, basic materials (steel, cement, and other metals) and utilities to remain elevated in the next year or two until inflationary pressures throughout the entire supply chain moderate on the back of a slowing economy. We also expect daily rates of leased rigs and other drilling vessels and facilities to not come down as much as oil companies competes for a stable amount of supply of this kind of equipment considering the restructuring the oilfield service sector has undergone due to reduced capital spending by their clients.

All the above-mentioned factors can cause delays and cost overruns therefore negatively impacting expected rate of returns of projects, also considering the volatility of hydrocarbons prices.

d) Inability to replace oil and natural gas reserves could adversely impact results of operations and financial condition, including cash flows

Future oil and gas production is a function of the Company’s ability to access new reserves through new discoveries, application of improved techniques, success in development activity, negotiations with national oil companies and other owners of known reserves and acquisitions.

An inability to replace produced reserves by discovering, acquiring, and developing additional reserves could adversely impact future production levels and growth prospects. If Eni is unsuccessful in meeting its long-term targets of reserve replacement, Eni’s future total proved reserves and production will decline.

e) Uncertainties in estimates of oil and natural gas reserves

The accuracy of proved reserve estimates and of projections of future rates of production and timing of development costs depends on several factors, assumptions and variables, including:

| ● | the quality of available geological, technical and economic data and their interpretation and judgment; | |

| ● | management’s assumptions regarding future rates of production and costs and timing of operating and development costs. The projections of higher operating and development costs may impair the ability of the Company to economically produce reserves leading to downward reserve revisions; | |

| ● | changes in the prevailing tax rules, other government regulations and contractual terms and conditions; | |

| ● | results of drilling, testing and the actual production performance of Eni’s reservoirs after the date of the estimates which may drive substantial upward or downward revisions; and | |

| ● | changes in oil and natural gas prices which could affect the quantities of Eni’s proved reserves since the estimates of reserves are based on prices and costs existing as of the date when these estimates are made. Lower oil prices may impair the ability of the Company to economically produce reserves leading to downward reserve revisions. |

Many of the factors, assumptions and variables underlying the estimation of proved reserves involve management’s judgment or are outside management’s control (prices, governmental regulations) and may change over time, therefore affecting the estimates of oil and natural gas reserves from year-to-year.

The prices used in calculating Eni’s estimated proved reserves are, in accordance with the U.S. Securities and Exchange Commission (the “U.S. SEC”) requirements, calculated by determining the unweighted arithmetic average of the first-day-of-the-month commodity prices for the preceding 12 months. For the 12-months ending at December 31, 2023, average prices were based on 83 $/barrel for the Brent crude oil, lower than the 2022 reference price 101 $/barrel, resulting in us having 37 million BOE of reserves that have become uneconomical at a lower price and were therefore removed from proved reserves.

Accordingly, the estimated reserves reported as of the end of 2023 could be significantly different from the quantities of oil and natural gas that will be ultimately recovered. Any downward revision in Eni’s estimated quantities of proved reserves would indicate lower future production volumes, which could adversely impact Eni’s business prospects, results of operations, cash flows and liquidity.

f) The development of the Group’s proved undeveloped reserves “PUD” may take longer and may require higher levels of capital expenditures than it currently anticipates, or the Group’s proved undeveloped reserves may not ultimately be developed or produced

As of December 31, 2023, approximately 38% of the Group’s total estimated proved reserves (by volume) were undeveloped and may not be ultimately developed or produced. Recovery of PUD requires significant capital expenditures and successful drilling operations. The Group’s reserve estimates assume it can and will make these expenditures and conduct these operations successfully. These assumptions may prove to be inaccurate and are subject to the risk of a structural decline in the prices of hydrocarbons, which could reduce available funds to develop PUD and/or make development uneconomical. The Group’s reserve report as of December 31, 2023 includes estimates of total future development and decommissioning costs associated with the Group’s proved total reserves of approximately €42.6 billion (undiscounted, including consolidated subsidiaries and equity-accounted entities; €44.3 billion in 2022). It cannot be certain that estimated costs of the development of these reserves will prove correct, development will occur as scheduled, or the results of such development will be as estimated. In case of change in the Company’s plans to develop those reserves, or if it is not otherwise able to successfully develop these reserves as a result of the Group’s inability to fund necessary capital expenditures due to a prolonged decline in the price of hydrocarbons or otherwise, it will be required to remove the associated volumes from the Group’s reported proved reserves.

g) The oil&gas industry is a capital-intensive business and needs large amount of funds to find and develop reserves. In case the Group does not have access to sufficient funds its oil&gas business may decline

The oil and gas industry is a capital intensive business. Eni makes and expects to continue making substantial capital expenditures in its business for the exploration, development and production of oil and natural gas reserves. Historically, Eni’s capital expenditures have been financed with cash generated from operations, proceeds from asset disposals, borrowings under its credit facilities and proceeds from the issuance of debt and bonds. The actual amount and timing of future capital expenditures may differ materially from Eni’s estimates as a result of, among other things, changes in commodity prices, changes in cost of oil services, available cash flows, lack of access to capital, actual drilling results, the availability of drilling rigs and other services and equipment, the availability of transportation capacity, and regulatory, technological and competitive developments. Eni’s cash flows from operations and access to capital markets are subject to several variables, including but not limited to:

| ● | the amount of Eni’s proved reserves; | |

| ● | the volume of crude oil and natural gas Eni is able to produce and sell from existing wells; | |

| ● | the prices at which crude oil and natural gas are marketed; | |

| ● | Eni’s ability to acquire, find and produce new reserves; and | |

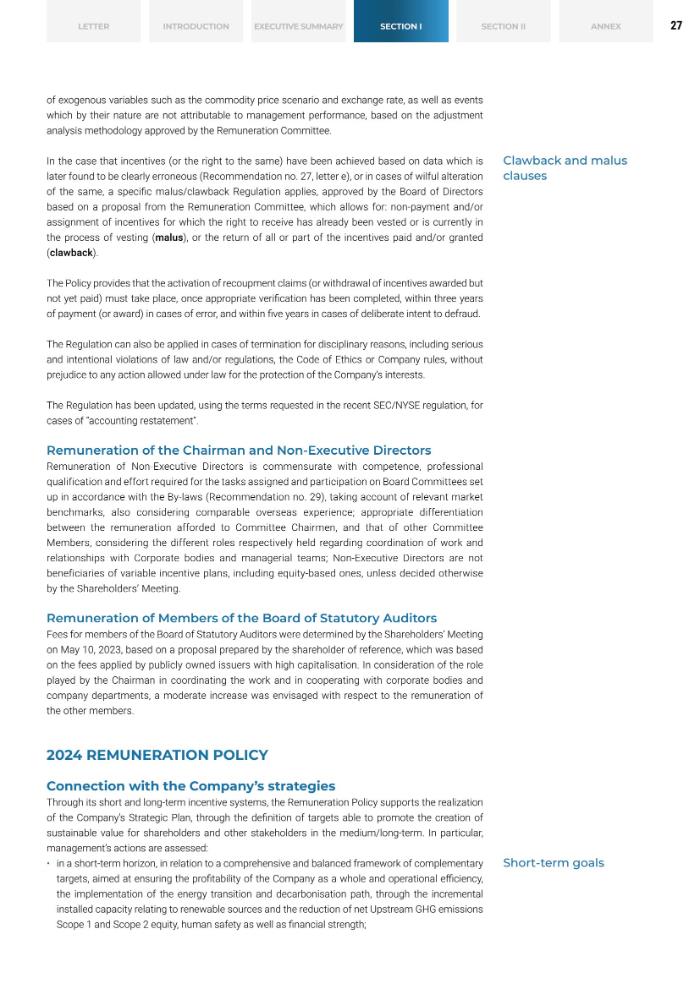

| ● | the ability and willingness of Eni’s lenders to extend credit or of participants in the capital markets to invest in Eni’s bonds considering that adoption of ESG targets by lenders may restrict our access to third-party financing. |