UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 5, 2025

First Community Corporation

(Exact name of registrant as specified in its charter)

South Carolina

(State or other jurisdiction of incorporation)

| 000-28344 | 57-1010751 | |||

| (Commission File Number) | (IRS Employer Identification No.) | |||

| 5455 Sunset Blvd, Lexington, South Carolina | 29072 | |||

| (Address of principal executive offices) | (Zip Code) |

(803) 951-2265

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common stock, par value $1.00 per share | FCCO | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

First Community Corporation (“First Community”) is furnishing investor presentation materials as Exhibit 99.1 to this Form 8-K, which are to be used by First Community management in meetings with investors on November 5–7, 2025 at the 2025 Hovde Group Financial Services Conference in Naples, Florida.

The information in Items 7.01 and 9.01, including Exhibit 99.1, is furnished to, and not filed with, the U.S. Securities and Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Item | Exhibit List | |

| 99.1 | First Community Corporation Investor Presentation. This Exhibit is furnished to, and not filed with, the U.S. Securities and Exchange Commission. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FIRST COMMUNITY CORPORATION | |||

| By: |

/s/ D. Shawn Jordan |

||

| Name: |

D. Shawn Jordan |

||

| Title: | Chief Financial Officer | ||

Dated: November 5, 2025

Exhibit 99.1

November 2025

OUTLINE 2 I. Overview 3 II. 3Q25 Highlights / Topics of Interest 8 » Highlights 9 » Earning Assets 11 » Funding 16 » Net Interest Margin (NIM) 19 » Risk Management 24 » Capital 28 » Non - Interest Income Highlights 32 » Revenue 37 » Non - Interest Expense 40 » Net Income 43 III. Signature Bank of Georgia Acquisition 49 » Accomplishes two Strategic Initiatives ▪ Additional growth market ▪ Addition of SBA/GGL lines of business OVERVIEW Impacting Lives for Success and Significance

6 4

OUR IDENTITY 5

OVERVIEW Highlights 6 » Began in 1995 » Focused on Organic Growth, Augmented with Opportunistic Acquisitions ▪ 2004 – Newberry Federal ▪ 2006 – Bank of Camden ▪ 2008 – EAH Financial Planning Practice ▪ 2011 – Palmetto South Mortgage Corp. ▪ 2014 – Savannah River Financial Corp. ▪ 2017 – Cornerstone National Bank ▪ 2025 – Signature Bank of GA (pending) » Executive Leadership Team stability with leadership transition plan designed to be seamless » September 30, 2025 ▪ $2.1 billion total assets ▪ Twenty - one (21) banking offices ▪ Largest community bank in SC Midlands ▪ Fifth largest bank in SC » Dividends ▪ 95 Consecutive Quarters ▪ Current Yield – 2.36% 1 1 Based on 10/30/25 closing price of $27.13.

Three Lines of Business OVERVIEW 7

3Q25 HIGHLIGHTS / TOPICS OF INTEREST Impacting Lives for Success and Significance 3Q25 HIGHLIGHTS Impacting Lives for Success and Significance

3Q25 HIGHLIGHTS » Record earnings » NIM and NII expansion » Record investment advisory AUM exceeding $1.1 billion » Non - recurring income (expense) items ($ in thousands) » 2Q25 3Q25 Gain on sale of OREO $127 SC State Tax Credits $120 OREO write - down ($100) Gain on bank fintech fund investment $176 Merger expenses ($234) Gain on insurance proceeds $12 Merger expenses ($574) EPS (after tax) ($0.02) EPS (after tax) ($0.02) 10 Diluted EPS EARNING ASSETS Impacting Lives for Success and Significance

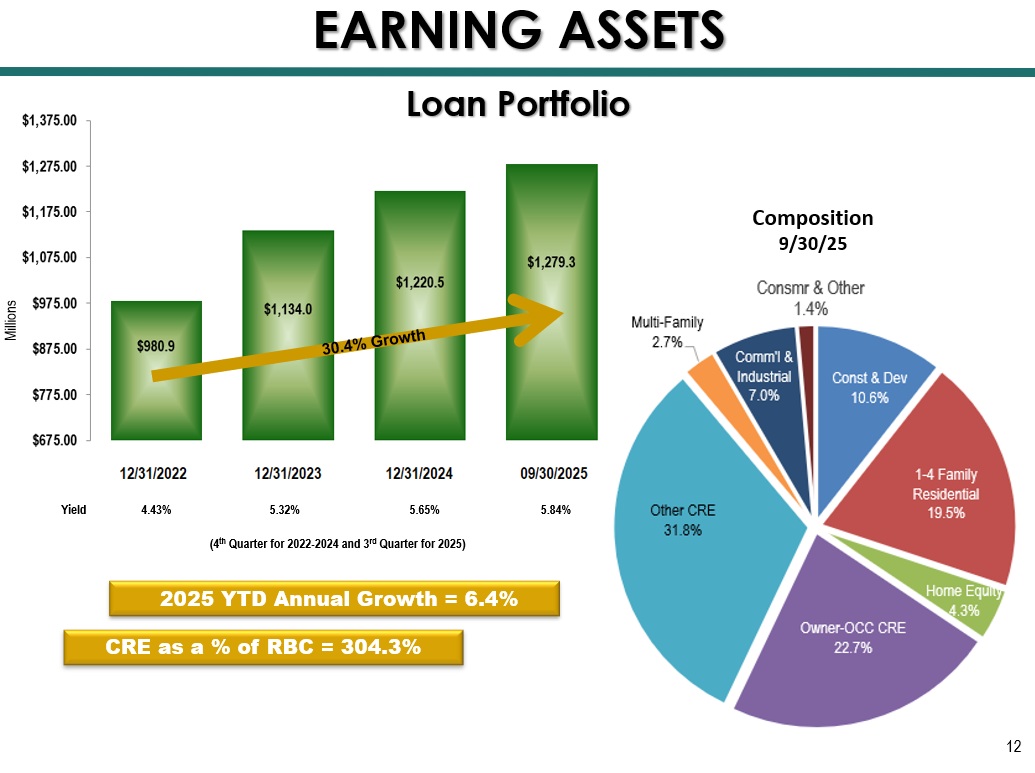

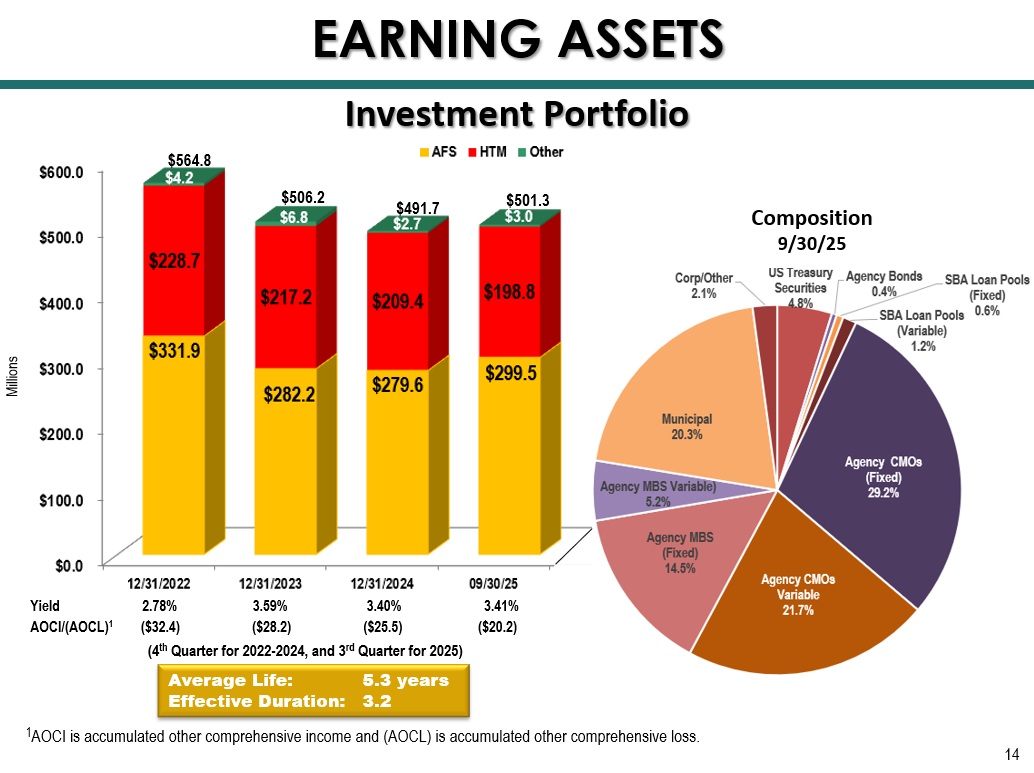

Yield 4.43% 5.32% 5.65% 5.84% Loan Portfolio 2025 YTD Annual Growth = 6.4% CRE as a % of RBC = 304.3% (4 th Quarter for 2022 - 2024 and 3 rd Quarter for 2025) 12 EARNING ASSETS Composition 9/30/25 Millions » 3Q25 $19.3 million 6.1% annualized growth rate » YTD 2025 $58.8 million 6.4% annualized growth rate Notes: » Percent of Growth : YTD25 ▪ CRE 56.9% ▪ C&I 6.4% ▪ Residential Mortgage 22.1% ▪ Other 14.6% » Interest Rate Sensitivity (9/30/25) : ▪ Principal cash flows, excluding prepayment estimates • 10/01/25 – 12/31/25 = $66.0 million at a weighted average rate of 5.70% • 2026 = $180.2 million at a weighted average rate of 5.55% 13 Loan Portfolio Growth EARNING ASSETS Yield 2.78% 3.59% 3.40% 3.41% AOCI/(AOCL) 1 ($32.4) ($28.2) ($25.5) ($20.2) Investment Portfolio (4 th Quarter for 2022 - 2024, and 3 rd Quarter for 2025) Average Life: 5.3 years Effective Duration: 3.2 $564.8 $506.2 EARNING ASSETS Millions $491.7 14 1 AOCI is accumulated other comprehensive income and (AOCL) is accumulated other comprehensive loss.

$501.3 Composition 9/30/25

Notes: Mix (3Q25) : » Floating 30.0% » Fixed 70.0% Principal Cash Flows : » 09/01/25 – 12/31/25 $14.2 million » FY2026 $62.8 million » 3Q25 - The company purchased four fixed rate agency mortgage - backed security (MBS) bonds totaling $20.0 million, with a purchase yield of 4.78% and entered into a $19.8 million ($18.7 million as of 9/30/25) amortizing notional amount pay - fixed/receive - floating interest rate swap, which was designated as a fair value hedge. This transaction was part of a hedging strategy, which converts these fixed rate agency MBS bonds to synthetic floaters. The company pays a fixed rate of 3.67% and receives overnight SOFR. 15 Investment Portfolio EARNING ASSETS FUNDING Impacting Lives for Success and Significance

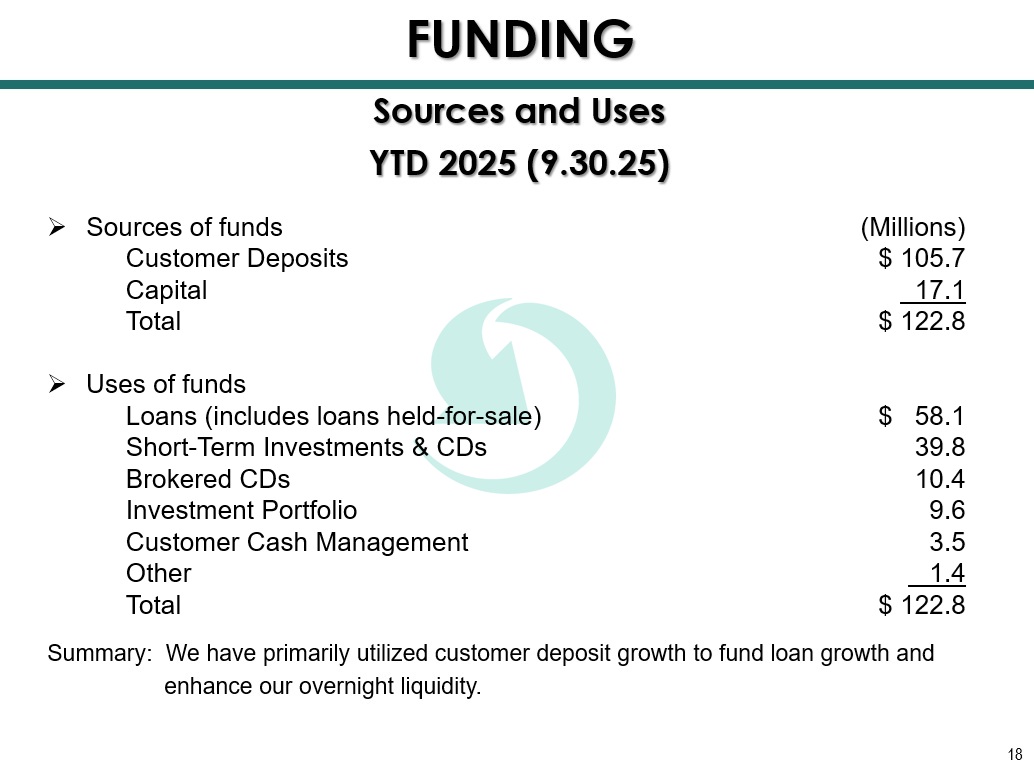

Total Deposit Cost 0.25% 1.69% 1.91% 1.81% Non - Interest Bearing 33% 29% 28% 27% Millions $1,454.1 $1,573.9 $1,779.0 (4 th Quarter for 2022 - 2024 & 3 rd Quarter for 2025) 17 High Quality Deposit Franchise $1,870.8 FUNDING 12/31/2022 12/31/2023 12/31/2024 09/30/2025 18 YTD 2025 (9.30.25) » Sources of funds (Millions) Customer Deposits $ 105.7 Capital 17.1 Total $ 122.8 » Uses of funds Loans (includes loans held - for - sale) $ 58.1 Short - Term Investments & CDs 39.8 Brokered CDs 10.4 Investment Portfolio 9.6 Customer Cash Management 3.5 Other 1.4 Total $ 122.8 Summary: We have primarily utilized customer deposit growth to fund loan growth and enhance our overnight liquidity . Sources and Uses FUNDING

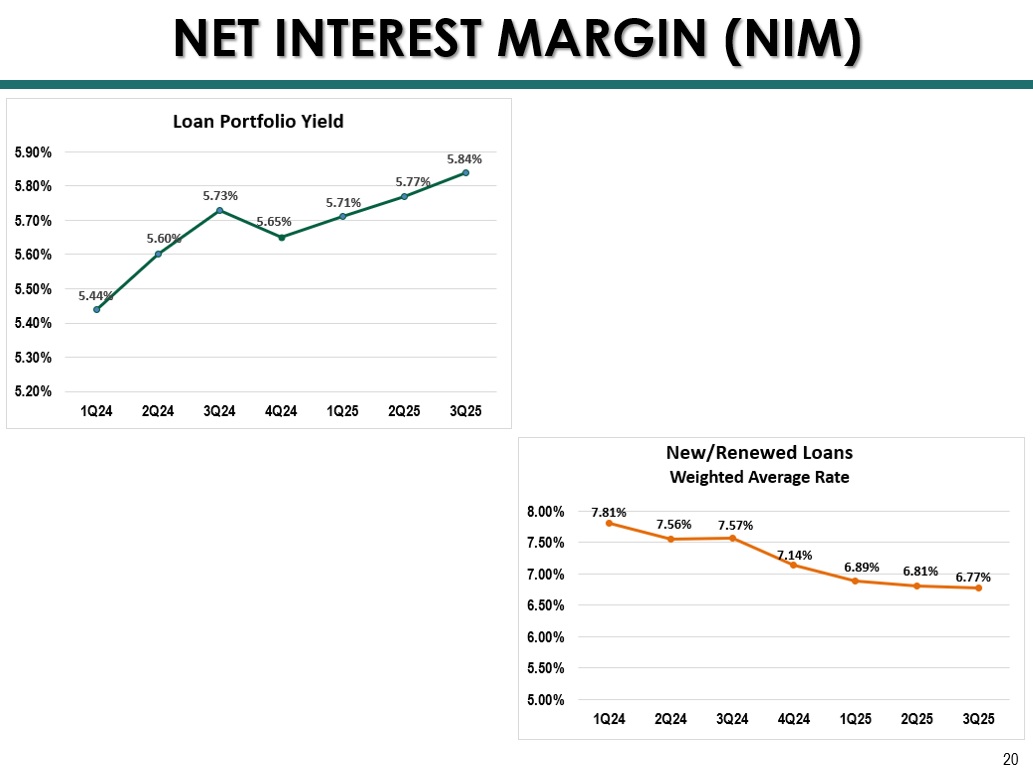

NET INTEREST MARGIN Impacting Lives for Success and Significance 20 NET INTEREST MARGIN (NIM)

21 NET INTEREST MARGIN (NIM)

22 NET INTEREST MARGIN (NIM)

23 Notes: » NIM Inflection began 2Q24 » Six consecutive quarters of NIM expansion » Effective May 5, 2023, entered into a pay - fixed /receive floating interest rate swap designated as a fair value hedge for fixed rate loans • Initial notional amount: $150.0 million • Current notional amount: $136.6 million • Synthetically converts approximately 11% of the Loan Portfolio from fixed to floating • Pay a fixed rate of 3.58% • Receive a floating rate of overnight SOFR • Matures on May 5, 2026 • 3Q25 Impact ▪ Interest Income $280 thousand ▪ Loan Portfolio Yield 9 bps ▪ Net Interest Margin 6 bps NET INTEREST MARGIN (NIM)

RISK MANAGEMENT Impacting Lives for Success and Significance 25 Credit Quality RISK MANAGEMENT Net Charge - Offs (Recoveries) NPA / Assets

26 Provision for (Release of) Credit Losses ($ in thousands) Credit Quality RISK MANAGEMENT Allowance for Credit Losses as a Percentage of Total Loans CAPITAL Impacting Lives for Success and Significance

27 RISK MANAGEMENT

29 Leverage Ratio (Bank) Total Capital Ratio (Bank) CAPITAL *On 5/9/25, announced a plan to utilize up to $7.5 million of capital to repurchase shares of FCCO’s common stock (5.0% of total shareholders’ equity at the time of the announcement).

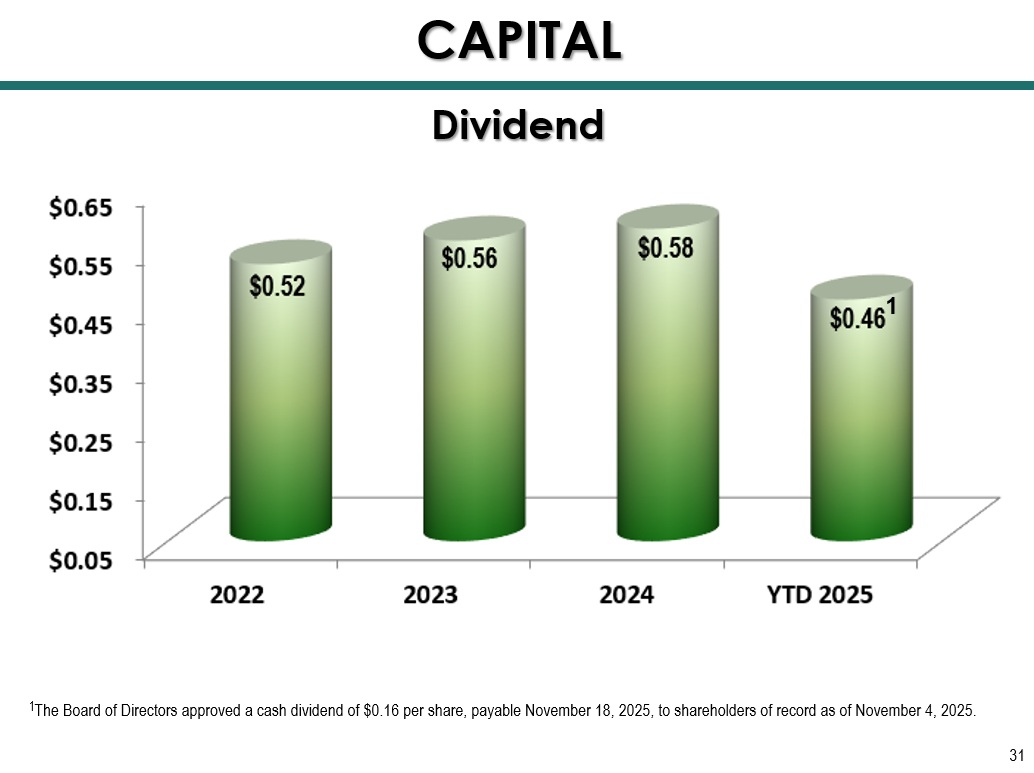

30 Tangible Book Value CAPITAL Tangible Common Equity Dividend 31 CAPITAL 1 The Board of Directors approved a cash dividend of $0.16 per share, payable November 18, 2025, to shareholders of record as o f N ovember 4, 2025.

1

NON - INTEREST INCOME HIGHLIGHTS Impacting Lives for Success and Significance Financial Planning / Investment Advisory Services AUM (millions) 33 NON - INTEREST INCOME HIGHLIGHTS

Financial Planning / Investment Advisory Services Revenue and Pre - Tax Income (thousands) 34 Pre - tax Profit Margin 33.9% 31.0% 34.8% 37.3% NON - INTEREST INCOME HIGHLIGHTS Thousands 35 Residential Mortgage Banking Production (millions) NON - INTEREST INCOME HIGHLIGHTS $107.2 $135.7 $165.6 $158.3

Pre - tax Profit Margin 3.6% 34.3% 61.3% 63.1% Residential Mortgage Banking Revenue and Pre - Tax Income ($ in thousands) 36 $9,243.3 1 $3,763.8 1 $5,201.3 1 Note: Pre - tax net income does not include fund transfer pricing or ACL allocations. 1 Includes mortgage late charges and other mortgage revenue. NON - INTEREST INCOME HIGHLIGHTS $9,479.3 1 REVENUE Impacting Lives for Success and Significance

38 (Millions) $59.5 $60.6 $66.3 Total Revenue 1 Strength in Diversity of Revenue REVENUE 1 Adjusted for Securities Gains/Losses and early extinguishment of debt. 1 $58.2 39 (Thousands) $18,372 $17,694 $20,287 Total Revenue 1 Strength in Diversity of Revenue $19,530 REVENUE $16,982 1 1 Adjusted for Securities Gains/Losses and early extinguishment of debt.

NON - INTEREST EXPENSE Impacting Lives for Success and Significance NON - INTEREST EXPENSE 41 Non - interest Expense (Millions) $38.7 1 $41.3 $43.1 1 Excludes $0.8 in merger expenses.

$47.5

NON - INTEREST EXPENSE 42 Non - interest Expense (Millions) $12.0 $13.1 2 $11.8 $12.8 1 Excludes $0.2 in merger expenses. 2 Excludes $0.6 in merger expenses $12.9 1 NET INCOME Impacting Lives for Success and Significance

1 Core net income and EPS exclude gains (losses) on sale of securities and bank premises, loss on disposition of assets related to the downtown Augusta branch closure, loss on early extinguishment of debt, gains on insurance proceeds, non - recurring BOLI income, and merger expenses. S ee non - GAAP reconciliation on pages 47 and 48. 2 This compares to 2024 YTD results of $9,648 thousand in Core Net Income and $1.26 in Core EPS. 3 This compares to 2024 YTD results of $12,940 thousand in pre - tax pre - provision earnings.

Core Net Income 1 / Core EPS 1 / Pre - Tax Pre - Provision Earnings NET INCOME Thousands 44 2 3 FORWARD - LOOKING STATEMENTS 45 SAFE HARBOR STATEMENT – In this presentation, unless the context suggests otherwise, references to “First Community,” the “Company” or “FCCO” refer to First Community Corporation and references to “we,” “us,” and “our” mean the combined business of the Company, First Community Bank (or “FCB”) and its wholly - owned subsidiaries . Any reference to “Signature Bank,” “Signature” or “ SGBG ” shall mean Signature Bank of Georgia . Additionally, unless otherwise noted, all Year - to - Date (YTD) figures refer to either September 30 , 2024 , or September 30 , 2025 , as indicated . This presentation and other written reports and statements made by us and our management from time to time may contain forward - looking statements . These statements include, without limitation, statements regarding our operating philosophy, growth plans and opportunities, strategies and financial performance, industry and economic trends and estimates and assumptions underlying accounting policies . Words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “focus,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may,” or by variations of such words or by similar expressions are intended to identify such forward - looking statements . These forward - looking statements are subject to numerous assumptions, risks and uncertainties, which change over time, are difficult to predict and are generally beyond our control . Although we believe that the assumptions underlying the forward - looking statements are reasonable, any of the assumptions could prove to be inaccurate . Therefore, we can give no assurance that the results contemplated in the forward - looking statements will be realized . The inclusion of this forward - looking information should not be construed as a representation by the Company or any other person that such future events, plans, or expectations will occur or be achieved . In addition to factors previously disclosed in the reports filed by us with the US Securities and Exchange Commission (the “SEC”), additional risks and uncertainties may include, but are not limited to : ( 1 ) the possibility that the planned acquisition of Signature Bank may not be completed in a timely manner or at all ; ( 2 ) failure to obtain required shareholder or regulatory approvals in connection with the planned acquisition ; ( 3 ) the risk that anticipated cost savings or other expected benefits of the planned acquisition may not be realized ; ( 4 ) potential disruption to client or employee relationships as a result of the planned acquisition ; ( 5 ) competitive pressures among depository and other financial institutions may increase significantly and have an effect on pricing, spending, third - party relationships and revenues ; ( 6 ) the strength of the United States economy in general and the strength of the local economies in which we conduct operations may be different than expected ; ( 7 ) the rate of delinquencies and amounts of charge - offs, the level of allowance for credit loss, the rates of loan growth, or adverse changes in asset quality in our loan portfolio, which may result in increased credit risk - related losses and expenses ; ( 8 ) changes in legislation, regulation, policies or administrative practices, whether by judicial, governmental, or legislative action ; ( 9 ) adverse conditions in the stock market, the public debt markets and other capital markets (including changes in interest rate conditions) could continue to have a negative impact on the company ; ( 10 ) changes in interest rates, which have and may continue to affect our deposit and funding costs, net income, prepayment penalty income, mortgage banking income, and other future cash flows, or the market value of our assets, including our investment securities ; ( 11 ) technology and cybersecurity risks, including potential business disruptions, reputational risks, and financial losses, associated with potential attacks on or failures by our computer systems and computer systems of our vendors and other third parties ; ( 12 ) elevated inflation which causes adverse risk to the overall economy, and could indirectly pose challenges to our customers and to our business ; ( 13 ) any increases in FDIC assessment which has increased, and may continue to increase, our cost of doing business ; and ( 14 ) the adverse effects of events beyond our control that may have a destabilizing effect on financial markets and the economy, such as epidemics and pandemics, war or terrorist activities, essential utility outages, deterioration in the global economy, instability in the credit markets, disruptions in our customers’ supply chains or disruption in transportation Additional factors that could cause results to differ materially from those described in the forward - looking statements can be found in our reports (such as the annual report on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K) filed with the SEC and available at the SEC’s internet site (http : //www . sec . gov) . All subsequent written and oral forward - looking statements by us or any person acting on our behalf is expressly qualified in its entirety by the cautionary statements above . The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements that are included herein . We undertake no obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise, except as required by law .

ADDITIONAL INFORMATION 46 ADDITIONAL INFORMATION ABOUT THE ACQUISITION AND WHERE TO FIND IT FCCO filed with the SEC a registration statement on Form S - 4 containing a joint proxy statement of FCCO and SGBG and a prospectus of FCCO, and FCCO will file other documents with respect to the proposed merger . A definitive joint proxy statement/prospectus was mailed to shareholders of both FCCO and SGBG . Investors and shareholders of FCCO and SGBG are urged to read the entire joint proxy statement/prospectus and other documents filed with the SEC carefully and in their entirety because they contain important information . Investors and shareholders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (when available) and other documents filed with the SEC by FCCO through the website maintained by the SEC at https : //www . sec . gov . Copies of the documents filed with the SEC by FCCO will be available free of charge on FCCO’s internet website or by contacting FCCO . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities law of such jurisdiction . FCCO, SGBG , and each company’s respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed merger . Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available .

NON - GAAP FINANCIAL MEASURES The Bank Behind Your Business 47 NON - GAAP FINANCIAL MEASURES – This presentation contains certain non - GAAP financial measures that are not in accordance with US generally accepted accounting principles (GAAP) . We use certain non - GAAP financial measures to provide meaningful, supplemental information regarding our operational results and to enhance investors’ overall understanding of our financial performance . The limitations associated with non - GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently . These disclosures should not be considered an alternative to our GAAP results . See the end of this presentation for a non - GAAP financial measures reconciliation to the most directly comparable GAAP financial measure . The table below provides a reconciliation of non - GAAP measures to GAAP for each of the periods indicated:

NON - GAAP RECONCILIATION 48 The tables below provide a reconciliation of non - GAAP measures to GAAP for each of the periods indicated: 1 Excludes gains (losses) on sale of securities and bank premises, loss on disposition of assets related to the downtown Augusta branch closure, loss on early extinguishment of debt, gains on insurance proceeds, non - recurring BOLI income, and merger expenses. The Bank Behind Your Business SIGNATURE BANK OF GEORGIA ACQUISITION » Accomplishes two Strategic Initiatives ▪ Additional growth market ▪ Addition of GGL/SBA lines of business

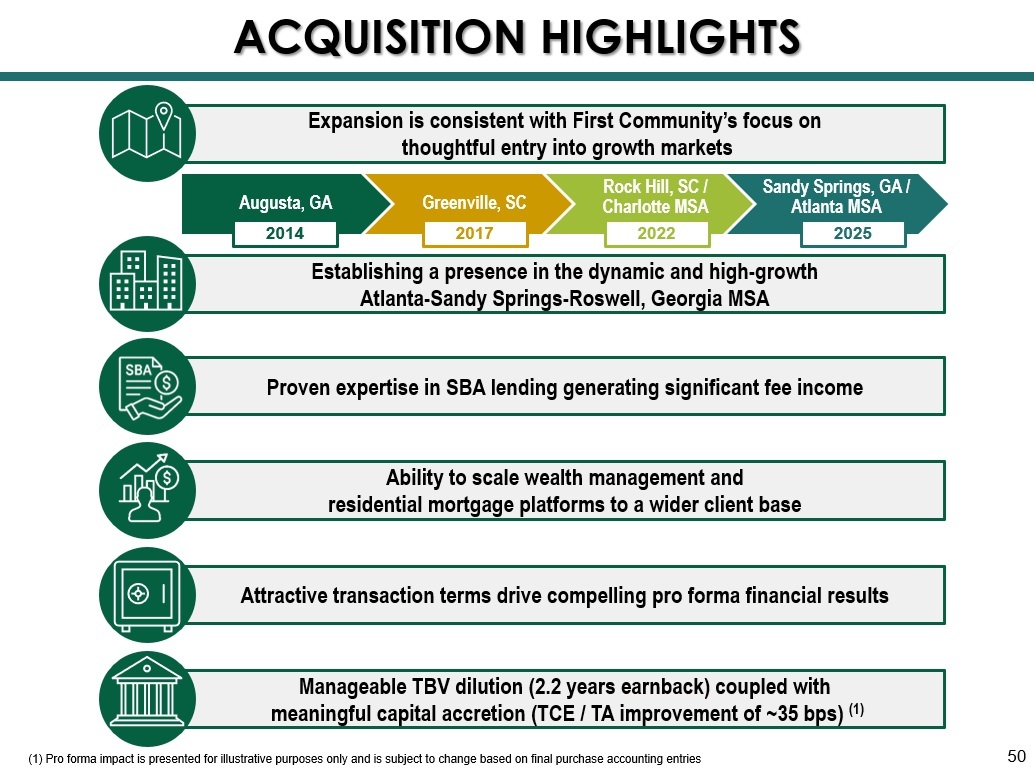

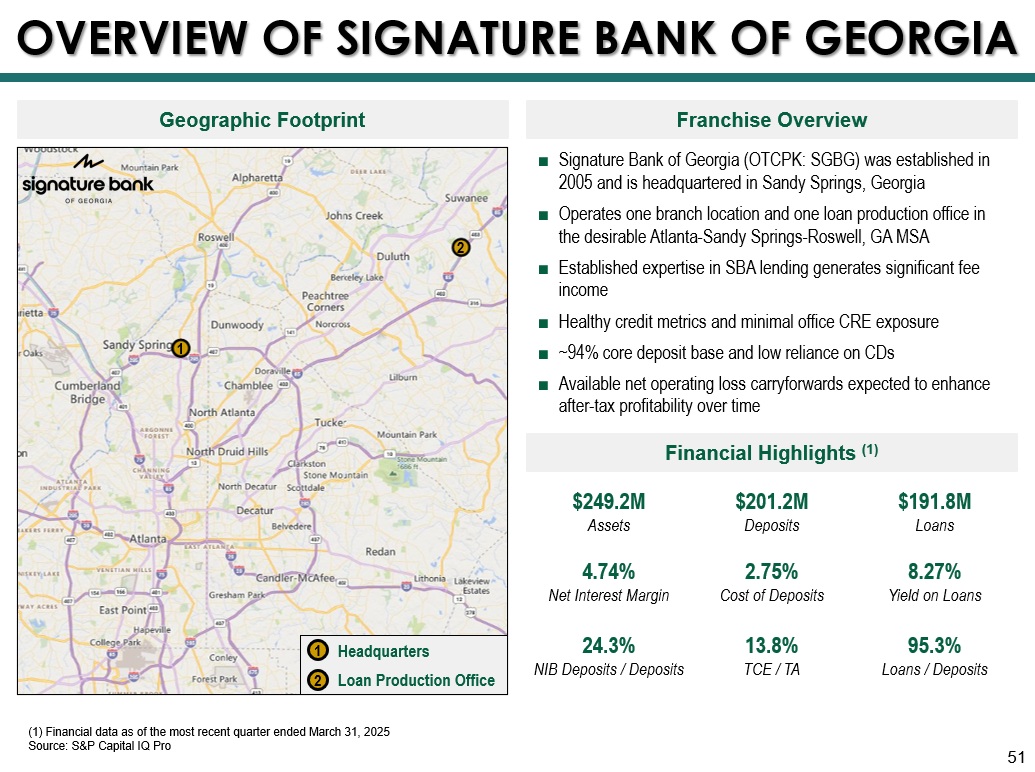

Establishing a presence in the dynamic and high - growth Atlanta - Sandy Springs - Roswell, Georgia MSA Attractive transaction terms drive compelling pro forma financial results Proven expertise in SBA lending generating significant fee income Manageable TBV dilution (2.2 years earnback ) coupled with meaningful capital accretion (TCE / TA improvement of ~35 bps) (1) Ability to scale wealth management and residential mortgage platforms to a wider client base ACQUISITION HIGHLIGHTS 50 Expansion is consistent with First Community’s focus on thoughtful entry into growth markets Augusta, GA Greenville, SC Rock Hill, SC / Charlotte MSA Sandy Springs, GA / Atlanta MSA 2014 2017 2022 2025 (1) Pro forma impact is presented for illustrative purposes only and is subject to change based on final purchase accounting ent ries OVERVIEW OF SIGNATURE BANK OF GEORGIA 51 (1) Financial data as of the most recent quarter ended March 31, 2025 Source: S&P Capital IQ Pro Geographic Footprint Franchise Overview Financial Highlights (1) ■ Signature Bank of Georgia (OTCPK: SGBG) was established in 2005 and is headquartered in Sandy Springs, Georgia ■ Operates one branch location and one loan production office in the desirable Atlanta - Sandy Springs - Roswell, GA MSA ■ Established expertise in SBA lending generates significant fee income ■ Healthy credit metrics and minimal office CRE exposure ■ ~94% core deposit base and low reliance on CDs ■ Available net operating loss carryforwards expected to enhance after - tax profitability over time 1 2 Headquarters Loan Production Office 1 2 $191.8M Loans $201.2M Deposits $249.2M Assets 8.27% Yield on Loans 2.75% Cost of Deposits 4.74% Net Interest Margin 95.3% Loans / Deposits 13.8% TCE / TA 24.3% NIB Deposits / Deposits

4.39% 4.07% 4.79% Atlanta MSA Georgia Legacy FCCO 2025 - 2030 Projected Population Growth ATLANTA MARKET OVERVIEW 52 Source: S&P Capital IQ Pro; U.S. Census Bureau; U.S. Bureau of Economic Analysis; Georgia Department of Transportation Market Highlights Expanding into the Atlanta MSA ■ High - Growth, Demographically Attractive Market: The Atlanta MSA has added over 750,000 residents since 2010 and is projected to grow another 1.8 million by 2050, with household income rising at a 3.6% CAGR since 2015 ■ Business - Friendly Environment: Georgia ranks among the top 10 states for business (CNBC, 2024), with Atlanta attracting numerous corporate HQs and expansions, bolstering demand for commercial banking relationships ■ Diverse and Expanding Economy: Atlanta is the economic engine of the Southeast, anchored by key industries including fintech, healthcare, logistics, and education, contributing to a regional GDP exceeding $450 billion ■ Strategic Transportation and Logistics Hub: Home to the world’s busiest airport and intersected by three major interstates, the Atlanta region offers a competitive advantage for deposit - rich businesses and commercial lending growth Companies Headquartered in Atlanta ■ Establishing a strategic foothold in the Atlanta MSA positions FCCO to capitalize on long - term growth opportunities ■ A large and growing base of small and mid - sized businesses provides opportunities for relationship - based commercial lending and deposit growth ■ High in - migration of affluent households and young professionals creates demand for retail banking, mortgage, and wealth management services ■ With few remaining community banks of scale, organic market entry or platform expansion via acquisition represents a rare opportunity for footprint growth $87,947 $75,118 $67,212 Atlanta MSA Georgia Legacy FCCO 2025 Median HHI ($)

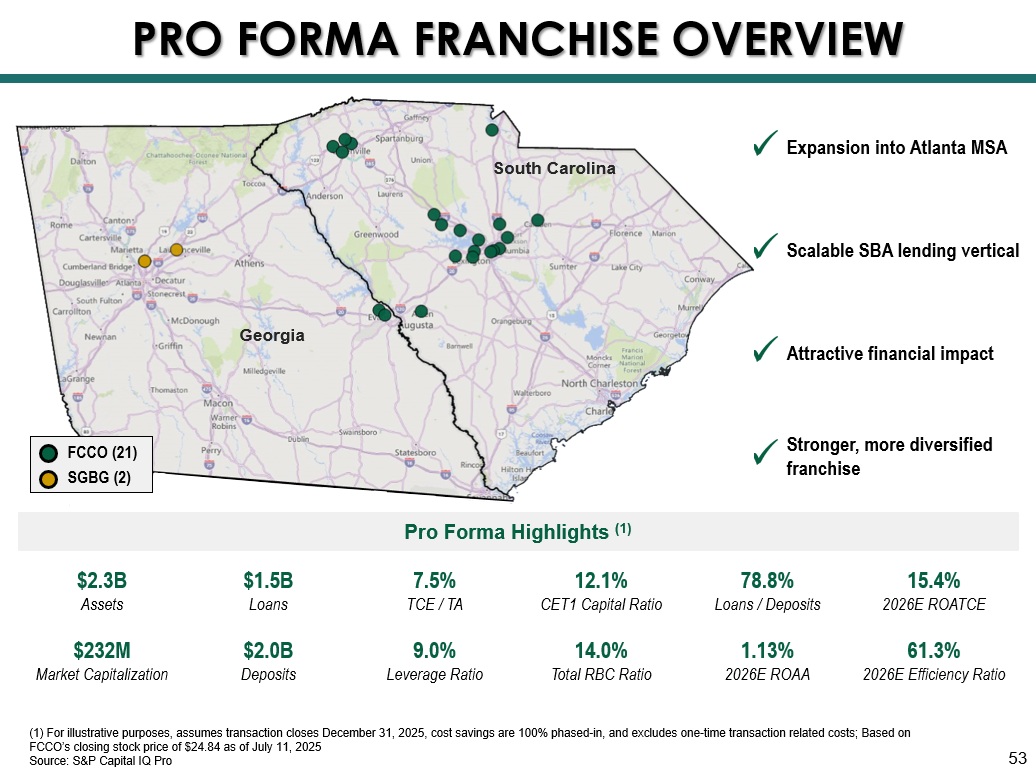

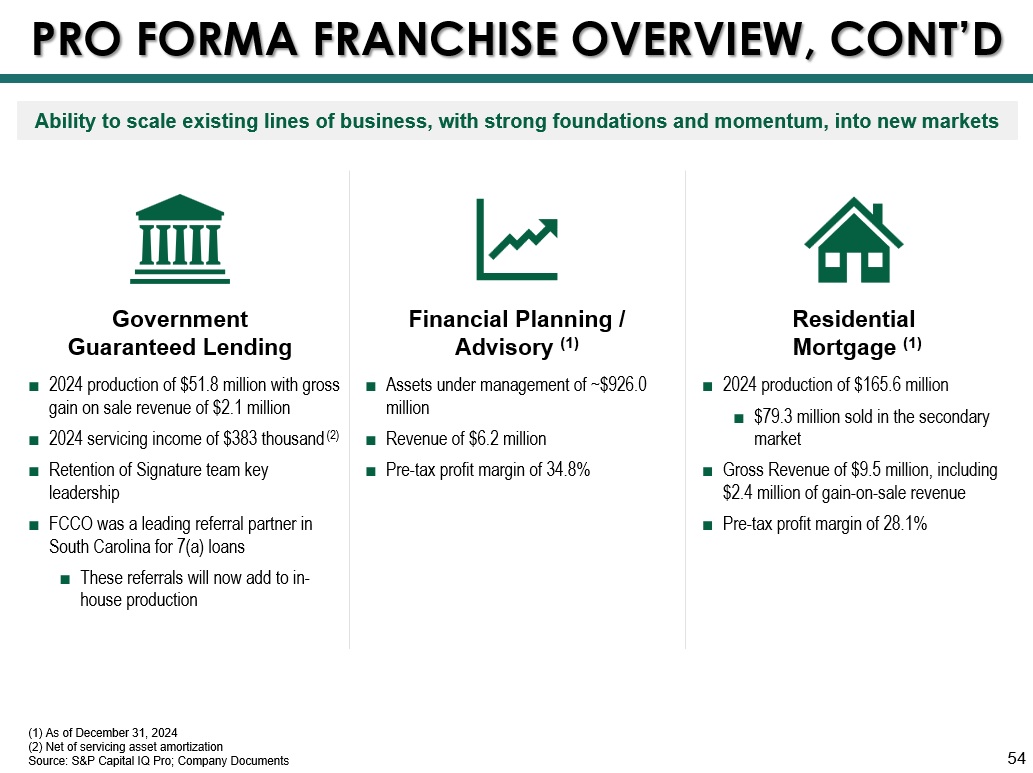

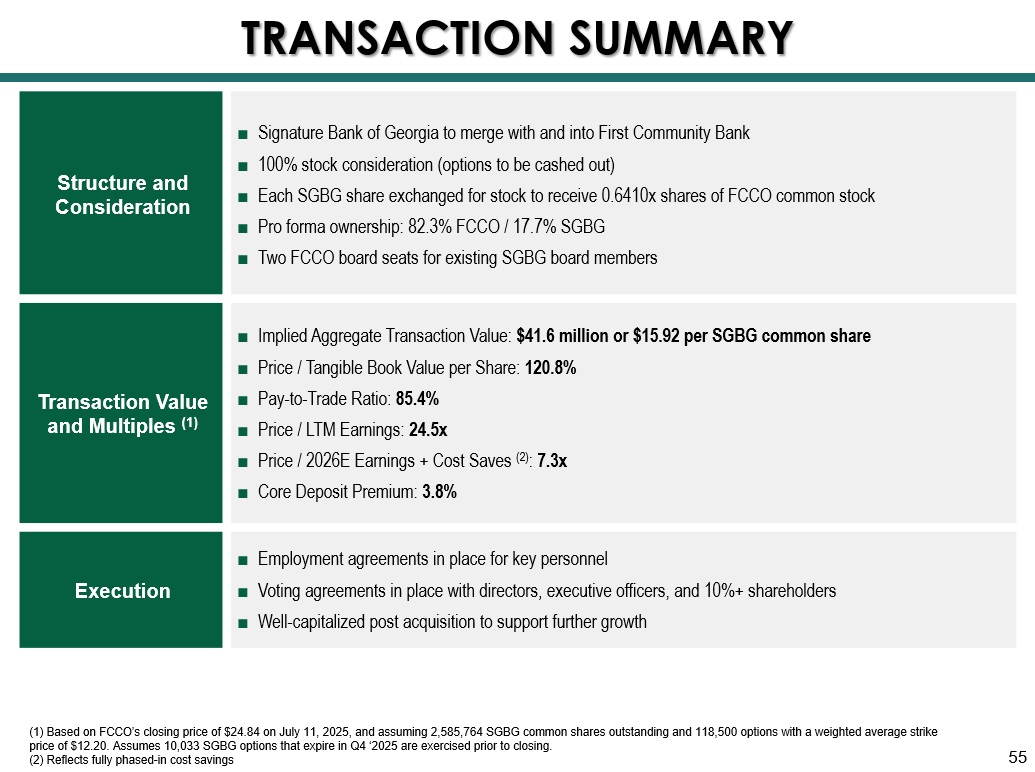

Expansion into Atlanta MSA x Scalable SBA lending vertical x Attractive financial impact x Stronger, more diversified franchise x PRO FORMA FRANCHISE OVERVIEW 53 (1) For illustrative purposes, assumes transaction closes December 31, 2025, cost savings are 100% phased - in, and excludes one - t ime transaction related costs; Based on FCCO’s closing stock price of $24.84 as of July 11, 2025 Source: S&P Capital IQ Pro FCCO (21) SGBG (2) Georgia South Carolina Pro Forma Highlights (1) 15.4% 2026E ROATCE 78.8% Loans / Deposits 12.1% CET1 Capital Ratio 7.5% TCE / TA $1.5B Loans $2.3B Assets 61.3% 2026E Efficiency Ratio 1.13% 2026E ROAA 14.0% Total RBC Ratio 9.0% Leverage Ratio $2.0B Deposits $232M Market Capitalization PRO FORMA FRANCHISE OVERVIEW, CONT’D 54 (1) As of December 31, 2024 (2) Net of servicing asset amortization Source: S&P Capital IQ Pro; Company Documents Ability to scale existing lines of business, with strong foundations and momentum, into new markets Government Guaranteed Lending Financial Planning / Advisory (1) Residential Mortgage (1) ■ 2024 production of $51.8 million with gross gain on sale revenue of $2.1 million ■ 2024 servicing income of $383 thousand (2) ■ Retention of Signature team key leadership ■ FCCO was a leading referral partner in South Carolina for 7(a) loans ■ These referrals will now add to in - house production ■ Assets under management of ~$926.0 million ■ Revenue of $6.2 million ■ Pre - tax profit margin of 34.8% ■ 2024 production of $165.6 million ■ $79.3 million sold in the secondary market ■ Gross Revenue of $9.5 million, including $2.4 million of gain - on - sale revenue ■ Pre - tax profit margin of 28.1% TRANSACTION SUMMARY 55 (1) Based on FCCO’s closing price of $24.84 on July 11, 2025, and assuming 2,585,764 SGBG common shares outstanding and 118,5 00 options with a weighted average strike price of $12.20.

Assumes 10,033 SGBG options that expire in Q4 ‘2025 are exercised prior to closing.

(2) Reflects fully phased - in cost savings ■ Signature Bank of Georgia to merge with and into First Community Bank ■ 100% stock consideration (options to be cashed out) ■ Each SGBG share exchanged for stock to receive 0.6410x shares of FCCO common stock ■ Pro forma ownership: 82.3% FCCO / 17.7% SGBG ■ Two FCCO board seats for existing SGBG board members Structure and Consideration ■ Implied Aggregate Transaction Value: $41.6 million or $15.92 per SGBG common share ■ Price / Tangible Book Value per Share: 120.8% ■ Pay - to - Trade Ratio: 85.4% ■ Price / LTM Earnings: 24.5x ■ Price / 2026E Earnings + Cost Saves (2) : 7.3x ■ Core Deposit Premium: 3.8% Transaction Value and Multiples (1) ■ Employment agreements in place for key personnel ■ Voting agreements in place with directors, executive officers, and 10%+ shareholders ■ Well - capitalized post acquisition to support further growth Execution KEY PRO FORMA FINANCIAL ASSUMPTIONS 56 ■ Pre - tax merger costs of $7.6 million ■ Cost savings equal to 30.9% of SGBG’s non - interest expense base anticipated ■ No branch or office closings are planned with this acquisition One - Time Merger Expenses and Cost Savings ■ Total gross credit mark of $2.1 million pre - tax, or 1.1% of SGBG’s loan portfolio ■ $1.0 (~47%) million non - PCD loans credit mark (~0.5% of total loans) accreted into earnings over time ■ $1.1 (~53%) million PCD loans credit mark recorded as allowance for credit losses ■ Additional estimated $1.0 million for Day 2 CECL Provision for non - PCD loans Credit Assumptions (1) ■ $1.4 million loan interest rate write - down, accreted into earnings over time ■ Core deposit intangible assumed to be 3.5% of SGBG’s core deposits, amortized SYD over 10 years ■ OREO markdown of $0.3 million ■ Deferred tax asset markdown of $0.2 million Other Purchase Accounting Adjustments ■ Anticipated closing in early Q1 ‘2026 ■ Subject to FCCO and SGBG shareholder approvals and customary regulatory approvals Timing and Approvals Note: As of July 11, 2025 (1) Pro forma impact is presented for illustrative purposes only and is subject to change based on final purchase accounting ent ries STRATEGICALLY COMPELLING ACQUISITION 57 (1) Estimated pro forma capital ratios at close; Based on FCCO’s closing price of $24.84 on July 11, 2025 (2) Pro forma impact is presented for illustrative purposes only and is subject to change based on final purchase accounting ent ries ■ Gaining foothold in the Atlanta MSA — a demographically attractive and economically robust region ■ Capital accretive to tangible common equity ■ Right - sized acquisition supports efficient and high - synergy integration ■ Enables broader distribution of existing wealth management capabilities ■ Established SBA platform offers entry into government - backed lending with expansion potential in legacy markets ■ Combining with an institution grounded in similar principles and relationship - driven culture ■ Significant revenue synergies and operating leverage created by the following: ■ Net interest income growth driven by enhanced liquidity and a larger legal lending limit and therefore, larger potential commercial relationships ■ Fee income growth created by scaling the SBA, Investment Advisory, and Residential Mortgage lines of business across a wider footprint ■ Proven and experienced acquirer Strategic Rationale ~14.0% Total RBC Ratio ~12.1% CET1 Capital Ratio ~9.0% Leverage Ratio ~7.5% TCE / TA Strong Pro Forma Capital Position (1) Desirable Earnings Profile Attractive Earnings and TBV Impact (2) ~3.5% 2026E NIM ~4.4% 2026E EPS Accretion 2.2 Years TBVPS Earnback ~2.6% TBVPS Dilution at Close 27.6% Internal Rate of Return 6WDQGDORQH 3UR )RUPD ( 52$$ 6WDQGDORQH 3UR )RUPD ( 52$7&(

COMPREHENSIVE DUE DILIGENCE 58 Approach Summary ■ Joint management - led diligence effort supported by legal, accounting, and consulting advisors ■ Emphasis on cultural alignment and operational compatibility between the two institutions ■ Granular credit and operational analysis to support confident integration and synergy realization Scope of Loan Review Comprehensive review of loan portfolio, including all criticized and classified loans Portfolio Coverage Underwriting, performance, borrower capacity, and loan structure Focus Areas Full review of Special Mention, Substandard, and Non - Accrual Special Assets Random sampling of select loan classes Sampling Highlights ■ No material credit, compliance, or operational red flags uncovered ■ Conducted on - site diligence visits and extensive management meetings ■ Conservative credit philosophy with a focus on risk mitigation Diligence Focus Areas Operational & Risk Functions Revenue Generating Functions Finance & Accounting Risk Management Compliance & Regulatory Data & Cybersecurity Human Resources Audit & Legal Credit & Underwriting Commercial & Retail Banking Consumer Lending Mortgage Banking SBA Lending Investment Portfolio & ALCO Impacting Lives for Success and Significance APPENDIX

2026E ROAA vs. Public Southeast Banks $2.0B to $10.0B in Total Assets Enhanced Pro Forma Earnings 2026E ROATCE vs. Public Southeast Banks $2.0B to $10.0B in Total Assets Improved Capital Generation 2026E Efficiency Ratio vs. Public Southeast Banks $2.0B to $10.0B in Total Assets Greater Operational Efficiency ATTRACTIVE PRO FORMA RESULTS 60 Note: Peer group includes major exchange traded banks headquartered in the Southeast (as defined by S&P Capital IQ Pro) with tot al assets $2.0B - $10.0B as of March 31, 2025; Excludes merger targets and companies without consensus analyst estimates as compiled and reported by S&P Capita IQ Pro (1) For illustrative purposes, assumes transaction closes December 31, 2025, cost savings are 100% phased - in, and excludes one - t ime transaction related costs Pro Forma (1) Pro Forma (1) Pro Forma (1)

1 - 4 Family 24.0% C&D 11.6% Multifamily 2.3% NOO - CRE 30.8% OO - CRE 22.4% C&I 5.1% Consumer 1.6% Other 2.1% PRO FORMA LOAN & DEPOSIT COMPOSITION 61 Note: Financial data as of March 31, 2025; Loan and deposit compositions reflect Call Report data (1) Pro Forma compositions exclude purchase accounting adjustments; Pro Forma totals may not sum due to rounding Source: S&P Capital IQ Pro First Community Bank Signature Bank of Georgia Pro Forma (1) Loan Composition Deposit Composition MRQ Yield on Loans: 5.54% 1 - 4 Family 4.1% C&D 20.0% NOO - CRE 37.7% OO - CRE 30.3% C&I 8.1% $192M 1 - 4 Family 21.4% C&D 12.7% Multifamily 2.0% NOO - CRE 31.7% OO - CRE 23.5% C&I 5.5% Consumer 1.4% Other 1.8% $1.5B $1.3B MRQ Yield on Loans: 8.27% MRQ Yield on Loans: 5.91% MRQ Cost on Deposits: 1.80% MRQ Cost on Deposits: 2.75% MRQ Cost on Deposits: 1.90% Noninterest - Bearing 27.3% Retail Time 14.2% Jumbo Time 5.4% IB, MMDA, & Savings 53.0% Noninterest - Bearing 24.3% Retail Time 3.4% Jumbo Time 3.3% IB, MMDA, & Savings 69.0% Noninterest - Bearing 27.0% Retail Time 13.1% Jumbo Time 5.2% IB, MMDA, & Savings 54.7% $1.7B $201M $1.9B OUR PURPOSE, CAUSE, AND IDENTITY 62 Providing the best products and services possible is what we do; however, that’s not why we do it.

We know that everything we do has an impact, and we believe it’s our responsibility to make sure it’s a positive one. Everything we do has an impact Shareholders Communities Impacting lives for success and significance Customers Employees