USDFALSE000154641712/282025Q3P3YP1Yhttp://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.bloominbrands.com/20250928#AccruedAndOtherLiabilitiesCurrenthttp://www.bloominbrands.com/20250928#AccruedAndOtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://www.bloominbrands.com/20250928#AccruedAndOtherLiabilitiesCurrenthttp://www.bloominbrands.com/20250928#AccruedAndOtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrentiso4217:USDxbrli:sharesxbrli:sharesiso4217:USDxbrli:pureiso4217:BRLblmn:restaurantblmn:counterpartyblmn:market00015464172024-12-302025-09-2800015464172025-11-0300015464172025-09-2800015464172024-12-290001546417us-gaap:FoodAndBeverageMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMember2024-01-012024-09-290001546417blmn:FranchiseandOtherRevenueMember2025-06-302025-09-280001546417blmn:FranchiseandOtherRevenueMember2024-07-012024-09-290001546417blmn:FranchiseandOtherRevenueMember2024-12-302025-09-280001546417blmn:FranchiseandOtherRevenueMember2024-01-012024-09-2900015464172025-06-302025-09-2800015464172024-07-012024-09-2900015464172024-01-012024-09-290001546417us-gaap:CommonStockMember2025-06-290001546417us-gaap:AdditionalPaidInCapitalMember2025-06-290001546417us-gaap:RetainedEarningsMember2025-06-290001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-290001546417us-gaap:NoncontrollingInterestMember2025-06-2900015464172025-06-290001546417us-gaap:RetainedEarningsMember2025-06-302025-09-280001546417us-gaap:NoncontrollingInterestMember2025-06-302025-09-280001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-302025-09-280001546417us-gaap:AdditionalPaidInCapitalMember2025-06-302025-09-280001546417us-gaap:CommonStockMember2025-06-302025-09-280001546417us-gaap:CommonStockMember2025-09-280001546417us-gaap:AdditionalPaidInCapitalMember2025-09-280001546417us-gaap:RetainedEarningsMember2025-09-280001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-280001546417us-gaap:NoncontrollingInterestMember2025-09-280001546417us-gaap:CommonStockMember2024-12-290001546417us-gaap:AdditionalPaidInCapitalMember2024-12-290001546417us-gaap:RetainedEarningsMember2024-12-290001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-290001546417us-gaap:NoncontrollingInterestMember2024-12-290001546417us-gaap:RetainedEarningsMember2024-12-302025-09-280001546417us-gaap:NoncontrollingInterestMember2024-12-302025-09-280001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-302025-09-280001546417us-gaap:AdditionalPaidInCapitalMember2024-12-302025-09-280001546417us-gaap:CommonStockMember2024-12-302025-09-280001546417us-gaap:CommonStockMember2024-06-300001546417us-gaap:AdditionalPaidInCapitalMember2024-06-300001546417us-gaap:RetainedEarningsMember2024-06-300001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001546417us-gaap:NoncontrollingInterestMember2024-06-3000015464172024-06-300001546417us-gaap:RetainedEarningsMember2024-07-012024-09-290001546417us-gaap:NoncontrollingInterestMember2024-07-012024-09-290001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-290001546417us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-290001546417us-gaap:CommonStockMember2024-07-012024-09-290001546417us-gaap:CommonStockMember2024-09-290001546417us-gaap:AdditionalPaidInCapitalMember2024-09-290001546417us-gaap:RetainedEarningsMember2024-09-290001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-290001546417us-gaap:NoncontrollingInterestMember2024-09-2900015464172024-09-290001546417us-gaap:CommonStockMember2023-12-310001546417us-gaap:AdditionalPaidInCapitalMember2023-12-310001546417us-gaap:RetainedEarningsMember2023-12-310001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001546417us-gaap:NoncontrollingInterestMember2023-12-3100015464172023-12-310001546417us-gaap:RetainedEarningsMember2024-01-012024-09-290001546417us-gaap:NoncontrollingInterestMember2024-01-012024-09-290001546417us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-09-290001546417us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-290001546417us-gaap:CommonStockMember2024-01-012024-09-290001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMember2024-12-300001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMember2024-12-302024-12-300001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMembersrt:ScenarioForecastMember2025-12-302025-12-300001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMember2025-06-302025-09-280001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMember2024-07-012024-09-290001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMember2024-12-302025-09-280001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMember2024-01-012024-09-290001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:OtherAssetsNetMemberblmn:BrazilDisposalGroupMember2024-12-300001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:OtherLongTermLiabilitiesMemberblmn:BrazilDisposalGroupMember2024-12-300001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMember2025-09-280001546417blmn:BoldHospitalityCompanyS.A.Member2024-12-302024-12-300001546417us-gaap:FoodAndBeverageMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:InternationalFranchiseSegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:InternationalFranchiseSegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:InternationalFranchiseSegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:InternationalFranchiseSegmentMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2025-06-302025-09-280001546417us-gaap:FranchiseMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2025-06-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2024-07-012024-09-290001546417us-gaap:FranchiseMember2025-06-302025-09-280001546417us-gaap:FranchiseMember2024-07-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:OutbackSteakhouseMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:CarrabbasItalianGrillMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:BonefishGrillMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:FlemingsPrimeSteakhouseWineBarMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:OtherU.S.Memberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:InternationalFranchiseSegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:InternationalFranchiseSegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:InternationalFranchiseSegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:InternationalFranchiseSegmentMember2024-01-012024-09-290001546417us-gaap:FoodAndBeverageMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2024-12-302025-09-280001546417us-gaap:FranchiseMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2024-12-302025-09-280001546417us-gaap:FoodAndBeverageMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMemberblmn:OtherInternationalMemberblmn:InternationalFranchiseSegmentMember2024-01-012024-09-290001546417us-gaap:FranchiseMember2024-12-302025-09-280001546417us-gaap:FranchiseMember2024-01-012024-09-290001546417us-gaap:OtherCurrentAssetsMember2025-09-280001546417us-gaap:OtherCurrentAssetsMember2024-12-290001546417blmn:GiftCardRevenueMemberblmn:UnearnedRevenueMember2025-09-280001546417blmn:GiftCardRevenueMemberblmn:UnearnedRevenueMember2024-12-290001546417blmn:LoyaltyRevenueMemberblmn:UnearnedRevenueMember2025-09-280001546417blmn:LoyaltyRevenueMemberblmn:UnearnedRevenueMember2024-12-290001546417blmn:FranchiseFeesMemberblmn:UnearnedRevenueMember2025-09-280001546417blmn:FranchiseFeesMemberblmn:UnearnedRevenueMember2024-12-290001546417blmn:OtherRevenueMemberblmn:UnearnedRevenueMember2025-09-280001546417blmn:OtherRevenueMemberblmn:UnearnedRevenueMember2024-12-290001546417blmn:UnearnedRevenueMember2025-09-280001546417blmn:UnearnedRevenueMember2024-12-290001546417blmn:FranchiseFeesMemberus-gaap:OtherNoncurrentLiabilitiesMember2025-09-280001546417blmn:FranchiseFeesMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-12-290001546417blmn:GiftCardRevenueMember2025-06-290001546417blmn:GiftCardRevenueMember2024-06-300001546417blmn:GiftCardRevenueMember2024-12-290001546417blmn:GiftCardRevenueMember2023-12-310001546417blmn:GiftCardRevenueMember2025-06-302025-09-280001546417blmn:GiftCardRevenueMember2024-07-012024-09-290001546417blmn:GiftCardRevenueMember2024-12-302025-09-280001546417blmn:GiftCardRevenueMember2024-01-012024-09-290001546417blmn:GiftCardRevenueMember2025-09-280001546417blmn:GiftCardRevenueMember2024-09-290001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:MaterialReconcilingItemsMemberblmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2025-06-302025-09-280001546417us-gaap:MaterialReconcilingItemsMemberblmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2024-07-012024-09-290001546417us-gaap:MaterialReconcilingItemsMemberblmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2024-12-302025-09-280001546417us-gaap:MaterialReconcilingItemsMemberblmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2024-01-012024-09-290001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2025-06-302025-09-280001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2024-07-012024-09-290001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2024-12-302025-09-280001546417blmn:ProvisionForImpairedAssetsAndRestaurantClosingsMember2024-01-012024-09-290001546417blmn:U.S.SegmentMemberblmn:A2025RestaurantClosuresMember2025-06-302025-09-280001546417blmn:U.S.SegmentMemberblmn:A2025RestaurantClosuresMember2024-12-302025-09-280001546417blmn:U.S.SegmentMemberblmn:A2025RestaurantClosuresMember2025-09-280001546417country:HKblmn:InternationalFranchiseSegmentMemberblmn:A2023ClosureInitiativeMember2024-06-300001546417blmn:U.S.SegmentMemberblmn:A2023ClosureInitiativeMember2024-06-300001546417srt:MinimumMembersrt:ScenarioForecastMemberblmn:U.S.SegmentMemberblmn:A2025RestaurantClosuresMember2025-09-292025-12-280001546417srt:MaximumMembersrt:ScenarioForecastMemberblmn:U.S.SegmentMemberblmn:A2025RestaurantClosuresMember2025-09-292025-12-280001546417us-gaap:FacilityClosingMemberblmn:A2025RestaurantClosuresMemberus-gaap:PropertyPlantAndEquipmentMember2024-12-302025-09-280001546417us-gaap:FacilityClosingMemberblmn:A2025RestaurantClosuresMemberblmn:OperatingLeaseRightOfUseAssetAndClosureChargesMember2024-12-302025-09-280001546417blmn:A2025RestaurantClosuresMember2024-12-302025-09-280001546417us-gaap:StockCompensationPlanMember2025-06-302025-09-280001546417us-gaap:StockCompensationPlanMember2024-07-012024-09-290001546417us-gaap:StockCompensationPlanMember2024-12-302025-09-280001546417us-gaap:StockCompensationPlanMember2024-01-012024-09-290001546417blmn:ConvertibleDebtSecuritiesAndWarrantsMember2025-06-302025-09-280001546417blmn:ConvertibleDebtSecuritiesAndWarrantsMember2024-07-012024-09-290001546417blmn:ConvertibleDebtSecuritiesAndWarrantsMember2024-12-302025-09-280001546417blmn:ConvertibleDebtSecuritiesAndWarrantsMember2024-01-012024-09-290001546417us-gaap:PerformanceSharesMember2024-12-290001546417us-gaap:RestrictedStockUnitsRSUMember2024-12-290001546417us-gaap:PerformanceSharesMember2024-12-302025-09-280001546417us-gaap:RestrictedStockUnitsRSUMember2024-12-302025-09-280001546417us-gaap:PerformanceSharesMember2025-09-280001546417us-gaap:RestrictedStockUnitsRSUMember2025-09-280001546417us-gaap:CommonStockMember2024-12-270001546417us-gaap:CommonStockMember2025-09-260001546417us-gaap:PerformanceSharesMemberblmn:A2022PSUGrantMember2024-12-302025-09-280001546417blmn:AccountsReceivableGiftCardsMember2025-09-280001546417blmn:AccountsReceivableGiftCardsMember2024-12-290001546417blmn:AccountsReceivableVendorsMember2025-09-280001546417blmn:AccountsReceivableVendorsMember2024-12-290001546417us-gaap:AccruedIncomeReceivableMember2025-09-280001546417us-gaap:AccruedIncomeReceivableMember2024-12-290001546417blmn:AccountsReceivableOtherMember2025-09-280001546417blmn:AccountsReceivableOtherMember2024-12-2900015464172024-01-012024-12-2900015464172024-12-302025-06-290001546417blmn:U.S.SegmentMemberblmn:BonefishGrillMember2025-09-280001546417blmn:U.S.SegmentMemberblmn:OutbackSteakhouseMember2025-09-280001546417us-gaap:RevolvingCreditFacilityMemberblmn:SeniorSecuredCreditFacilityMemberus-gaap:SecuredDebtMember2025-09-280001546417us-gaap:RevolvingCreditFacilityMemberblmn:SeniorSecuredCreditFacilityMemberus-gaap:SecuredDebtMember2024-12-290001546417blmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2025-09-280001546417blmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2024-12-290001546417blmn:A2029NotesMemberus-gaap:UnsecuredDebtMember2025-09-280001546417blmn:A2029NotesMemberus-gaap:UnsecuredDebtMember2024-12-290001546417blmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2020-05-0800015464172025-05-162025-05-1600015464172024-12-302025-03-3000015464172025-03-312025-06-290001546417us-gaap:AccumulatedTranslationAdjustmentMember2025-06-290001546417us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300001546417us-gaap:AccumulatedTranslationAdjustmentMember2024-12-290001546417us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001546417us-gaap:AccumulatedTranslationAdjustmentMember2025-06-302025-09-280001546417us-gaap:AccumulatedTranslationAdjustmentMember2024-07-012024-09-290001546417us-gaap:AccumulatedTranslationAdjustmentMember2024-12-302025-09-280001546417us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-09-290001546417us-gaap:AccumulatedTranslationAdjustmentMember2025-09-280001546417us-gaap:AccumulatedTranslationAdjustmentMember2024-09-290001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-06-290001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-06-300001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-290001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-06-302025-09-280001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-07-012024-09-290001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-302025-09-280001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-09-290001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-09-280001546417us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-09-290001546417us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-050001546417blmn:InterestRateSwapTwelveMonthTenorMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-052024-03-050001546417blmn:InterestRateSwapTwentyOneMonthTenorMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-052024-03-050001546417blmn:InterestRateSwapDecember2023ToDecember2025Memberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-050001546417blmn:InterestRateSwapMarch2024ToMarch2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-050001546417blmn:CreditAgreementMemberblmn:AdjustedTermSOFROptionMemberus-gaap:SecuredDebtMember2024-03-052024-03-050001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMemberus-gaap:SecuredDebtMember2024-03-052024-03-050001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMemberus-gaap:SecuredDebtMember2024-03-052024-03-050001546417us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestIncomeMember2024-12-302025-09-280001546417us-gaap:InterestRateSwapMemberblmn:AccruedandOtherCurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-09-280001546417us-gaap:InterestRateSwapMemberblmn:AccruedandOtherCurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-290001546417us-gaap:InterestRateSwapMemberblmn:OtherLongTermLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-09-280001546417us-gaap:InterestRateSwapMemberblmn:OtherLongTermLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-290001546417us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-09-280001546417us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-290001546417us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SubsequentEventMember2025-10-310001546417blmn:InterestRateSwapTwelveMonthTenorMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SubsequentEventMember2025-10-012025-10-310001546417blmn:InterestRateSwapTwentyOneMonthTenorMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SubsequentEventMember2025-10-012025-10-310001546417blmn:InterestRateSwapDecember2025ToDecember2026Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SubsequentEventMember2025-10-310001546417blmn:InterestRateSwapMarch2026ToDecember2027Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SubsequentEventMember2025-10-310001546417blmn:CreditAgreementMemberblmn:AdjustedTermSOFROptionMemberus-gaap:SecuredDebtMemberus-gaap:SubsequentEventMember2025-10-012025-10-310001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberus-gaap:SubsequentEventMembersrt:MinimumMemberus-gaap:SecuredDebtMember2025-10-012025-10-310001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberus-gaap:SubsequentEventMembersrt:MaximumMemberus-gaap:SecuredDebtMember2025-10-012025-10-310001546417us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2025-09-280001546417us-gaap:GeneralAndAdministrativeExpenseMember2025-06-302025-09-280001546417us-gaap:GeneralAndAdministrativeExpenseMember2024-12-302025-09-280001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMemberus-gaap:GeneralAndAdministrativeExpenseMember2025-06-302025-09-280001546417us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberblmn:BrazilDisposalGroupMemberus-gaap:GeneralAndAdministrativeExpenseMember2024-12-302025-09-280001546417us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-290001546417us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-290001546417us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-09-280001546417us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-12-290001546417us-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-09-280001546417us-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-12-290001546417us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-09-280001546417us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-12-290001546417blmn:OperatingLeaseRightOfUseAssetAndClosureChargesMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:AssetsMeasuredWithImpairmentQuarterToDateMemberus-gaap:FairValueInputsLevel3Member2025-09-280001546417blmn:OperatingLeaseRightOfUseAssetAndClosureChargesMemberus-gaap:FairValueMeasurementsNonrecurringMember2025-06-302025-09-280001546417blmn:OperatingLeaseRightOfUseAssetAndClosureChargesMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:AssetsMeasuredWithImpairmentYearToDateMemberus-gaap:FairValueInputsLevel3Member2025-09-280001546417blmn:OperatingLeaseRightOfUseAssetAndClosureChargesMemberus-gaap:FairValueMeasurementsNonrecurringMember2024-12-302025-09-280001546417us-gaap:PropertyPlantAndEquipmentMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:AssetsMeasuredWithImpairmentQuarterToDateMemberus-gaap:FairValueInputsLevel3Member2025-09-280001546417us-gaap:PropertyPlantAndEquipmentMemberus-gaap:FairValueMeasurementsNonrecurringMember2025-06-302025-09-280001546417us-gaap:PropertyPlantAndEquipmentMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:AssetsMeasuredWithImpairmentYearToDateMemberus-gaap:FairValueInputsLevel3Member2025-09-280001546417us-gaap:PropertyPlantAndEquipmentMemberus-gaap:FairValueMeasurementsNonrecurringMember2024-12-302025-09-280001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsNonrecurringMemberblmn:AssetsMeasuredWithImpairmentQuarterToDateMemberus-gaap:FairValueInputsLevel3Member2025-09-280001546417us-gaap:FairValueMeasurementsNonrecurringMember2025-06-302025-09-280001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsNonrecurringMemberblmn:AssetsMeasuredWithImpairmentYearToDateMemberus-gaap:FairValueInputsLevel3Member2025-09-280001546417us-gaap:FairValueMeasurementsNonrecurringMember2024-12-302025-09-280001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsNonrecurringMemberblmn:AssetsMeasuredWithImpairmentQuarterToDateMemberus-gaap:FairValueInputsLevel2Member2025-09-280001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsNonrecurringMemberblmn:AssetsMeasuredWithImpairmentYearToDateMemberus-gaap:FairValueInputsLevel2Member2025-09-280001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:SeniorSecuredCreditFacilityMemberus-gaap:SecuredDebtMember2025-09-280001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:FairValueInputsLevel2Memberblmn:SeniorSecuredCreditFacilityMemberus-gaap:SecuredDebtMember2025-09-280001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:SeniorSecuredCreditFacilityMemberus-gaap:SecuredDebtMember2024-12-290001546417us-gaap:RevolvingCreditFacilityMemberus-gaap:FairValueInputsLevel2Memberblmn:SeniorSecuredCreditFacilityMemberus-gaap:SecuredDebtMember2024-12-290001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2025-09-280001546417us-gaap:FairValueInputsLevel2Memberblmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2025-09-280001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2024-12-290001546417us-gaap:FairValueInputsLevel2Memberblmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2024-12-290001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:A2029NotesMemberus-gaap:UnsecuredDebtMember2025-09-280001546417us-gaap:FairValueInputsLevel2Memberblmn:A2029NotesMemberus-gaap:UnsecuredDebtMember2025-09-280001546417us-gaap:CarryingReportedAmountFairValueDisclosureMemberblmn:A2029NotesMemberus-gaap:UnsecuredDebtMember2024-12-290001546417us-gaap:FairValueInputsLevel2Memberblmn:A2029NotesMemberus-gaap:UnsecuredDebtMember2024-12-290001546417blmn:A2025NotesMemberus-gaap:ConvertibleDebtMember2024-01-012024-09-290001546417us-gaap:PropertyLeaseGuaranteeMember2025-09-280001546417us-gaap:PropertyLeaseGuaranteeMember2024-12-290001546417us-gaap:OperatingSegmentsMemberblmn:U.S.SegmentMember2025-06-302025-09-280001546417us-gaap:OperatingSegmentsMemberblmn:U.S.SegmentMember2024-07-012024-09-290001546417us-gaap:OperatingSegmentsMemberblmn:U.S.SegmentMember2024-12-302025-09-280001546417us-gaap:OperatingSegmentsMemberblmn:U.S.SegmentMember2024-01-012024-09-290001546417us-gaap:OperatingSegmentsMemberblmn:InternationalFranchiseSegmentMember2025-06-302025-09-280001546417us-gaap:OperatingSegmentsMemberblmn:InternationalFranchiseSegmentMember2024-07-012024-09-290001546417us-gaap:OperatingSegmentsMemberblmn:InternationalFranchiseSegmentMember2024-12-302025-09-280001546417us-gaap:OperatingSegmentsMemberblmn:InternationalFranchiseSegmentMember2024-01-012024-09-290001546417us-gaap:OperatingSegmentsMember2025-06-302025-09-280001546417us-gaap:OperatingSegmentsMember2024-07-012024-09-290001546417us-gaap:OperatingSegmentsMember2024-12-302025-09-280001546417us-gaap:OperatingSegmentsMember2024-01-012024-09-290001546417us-gaap:MaterialReconcilingItemsMember2025-06-302025-09-280001546417us-gaap:MaterialReconcilingItemsMember2024-07-012024-09-290001546417us-gaap:MaterialReconcilingItemsMember2024-12-302025-09-280001546417us-gaap:MaterialReconcilingItemsMember2024-01-012024-09-290001546417us-gaap:CorporateNonSegmentMember2025-06-302025-09-280001546417us-gaap:CorporateNonSegmentMember2024-07-012024-09-290001546417us-gaap:CorporateNonSegmentMember2024-12-302025-09-280001546417us-gaap:CorporateNonSegmentMember2024-01-012024-09-290001546417us-gaap:OperatingSegmentsMemberblmn:U.S.SegmentMember2025-09-280001546417us-gaap:OperatingSegmentsMemberblmn:U.S.SegmentMember2024-12-290001546417us-gaap:OperatingSegmentsMemberblmn:InternationalFranchiseSegmentMember2025-09-280001546417us-gaap:OperatingSegmentsMemberblmn:InternationalFranchiseSegmentMember2024-12-290001546417us-gaap:OperatingSegmentsMember2025-09-280001546417us-gaap:OperatingSegmentsMember2024-12-290001546417us-gaap:CorporateNonSegmentMember2025-09-280001546417us-gaap:CorporateNonSegmentMember2024-12-290001546417us-gaap:MaterialReconcilingItemsMember2025-09-280001546417us-gaap:MaterialReconcilingItemsMember2024-12-290001546417us-gaap:MaterialReconcilingItemsMemberus-gaap:SegmentDiscontinuedOperationsMember2025-09-280001546417us-gaap:MaterialReconcilingItemsMemberus-gaap:SegmentDiscontinuedOperationsMember2024-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

|

|

|

|

|

|

|

|

|

|

| (Mark One) |

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the quarterly period ended September 28, 2025 |

| or |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from ______ to ______ |

Commission File Number: 001-35625

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

20-8023465 |

| (State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

2202 North West Shore Boulevard, Suite 500, Tampa, FL 33607

(Address of principal executive offices) (Zip Code)

(813) 282-1225

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

$0.01 par value |

|

BLMN |

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐

Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 3, 2025, 85,217,091 shares of common stock of the registrant were outstanding.

INDEX TO QUARTERLY REPORT ON FORM 10-Q

For the Quarterly Period Ended September 28, 2025

(Unaudited)

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

| |

|

Page No. |

|

|

|

| Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

| Item 2. |

|

|

|

|

|

| Item 3. |

|

|

|

|

|

| Item 4. |

|

|

|

|

|

| |

|

|

| Item 1. |

|

|

|

|

|

| Item 1A. |

|

|

|

|

|

| Item 2. |

|

|

|

|

|

| Item 5. |

|

|

|

|

|

| Item 6. |

|

|

| |

|

|

| |

|

|

PART I: FINANCIAL INFORMATION

Item 1. Financial Statements

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

|

|

|

|

|

|

|

|

|

|

|

|

|

SEPTEMBER 28, 2025 |

|

DECEMBER 29, 2024 |

|

(UNAUDITED) |

|

|

| ASSETS |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

66,479 |

|

|

$ |

70,056 |

|

|

|

|

|

| Inventories |

59,178 |

|

|

68,699 |

|

| Other current assets, net |

225,592 |

|

|

158,775 |

|

| Current assets of discontinued operations held for sale |

— |

|

|

22,989 |

|

| Total current assets |

351,249 |

|

|

320,519 |

|

|

|

|

|

|

|

|

|

| Property, fixtures and equipment, net |

920,864 |

|

|

948,521 |

|

| Operating lease right-of-use assets |

987,871 |

|

|

1,012,857 |

|

| Goodwill |

213,323 |

|

|

213,323 |

|

| Intangible assets, net |

426,223 |

|

|

429,091 |

|

| Deferred income tax assets, net |

203,623 |

|

|

185,522 |

|

| Equity method investment |

64,709 |

|

|

— |

|

| Other assets, net |

112,201 |

|

|

74,471 |

|

| Non-current assets of discontinued operations held for sale |

— |

|

|

200,501 |

|

| Total assets |

$ |

3,280,063 |

|

|

$ |

3,384,805 |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

$ |

141,693 |

|

|

$ |

153,161 |

|

| Current operating lease liabilities |

176,252 |

|

|

158,806 |

|

| Accrued and other current liabilities |

161,062 |

|

|

178,314 |

|

| Unearned revenue |

295,413 |

|

|

374,099 |

|

| Current liabilities of discontinued operations held for sale |

— |

|

|

87,956 |

|

|

|

|

|

| Total current liabilities |

774,420 |

|

|

952,336 |

|

|

|

|

|

| Non-current operating lease liabilities |

1,057,603 |

|

|

1,088,518 |

|

| Deferred income tax liabilities, net |

24,398 |

|

|

33,822 |

|

| Long-term debt, net |

962,248 |

|

|

1,027,398 |

|

| Other long-term liabilities, net |

113,387 |

|

|

93,420 |

|

| Non-current liabilities of discontinued operations held for sale |

— |

|

|

49,865 |

|

| Total liabilities |

2,932,056 |

|

|

3,245,359 |

|

| Commitments and contingencies (Note 15) |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

| Bloomin’ Brands stockholders’ equity |

|

|

|

Preferred stock, $0.01 par value, 25,000,000 shares authorized; no shares issued and outstanding as of September 28, 2025 and December 29, 2024 |

— |

|

|

— |

|

Common stock, $0.01 par value, 475,000,000 shares authorized; 85,166,769 and 84,854,768 shares issued and outstanding as of September 28, 2025 and December 29, 2024, respectively |

852 |

|

|

849 |

|

| Additional paid-in capital |

1,239,678 |

|

|

1,273,288 |

|

| Accumulated deficit |

(904,122) |

|

|

(925,834) |

|

| Accumulated other comprehensive income (loss) |

7,680 |

|

|

(212,793) |

|

| Total Bloomin’ Brands stockholders’ equity |

344,088 |

|

|

135,510 |

|

| Noncontrolling interests |

3,919 |

|

|

3,936 |

|

| Total stockholders’ equity |

348,007 |

|

|

139,446 |

|

| Total liabilities and stockholders’ equity |

$ |

3,280,063 |

|

|

$ |

3,384,805 |

|

|

| The accompanying notes are an integral part of these unaudited consolidated financial statements. |

BLOOMIN’ BRANDS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(IN THOUSANDS, EXCEPT PER SHARE DATA, UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIRTEEN WEEKS ENDED |

|

THIRTY-NINE WEEKS ENDED |

|

SEPTEMBER 28, 2025 |

|

SEPTEMBER 29, 2024 |

|

SEPTEMBER 28, 2025 |

|

SEPTEMBER 29, 2024 |

| Revenues |

|

|

|

|

|

|

|

| Restaurant sales |

$ |

911,920 |

|

|

$ |

889,784 |

|

|

$ |

2,926,208 |

|

|

$ |

2,914,253 |

|

| Franchise and other revenues |

16,893 |

|

|

20,229 |

|

|

54,565 |

|

|

64,202 |

|

| Total revenues |

928,813 |

|

|

910,013 |

|

|

2,980,773 |

|

|

2,978,455 |

|

| Costs and expenses |

|

|

|

|

|

|

|

| Food and beverage |

275,081 |

|

|

261,338 |

|

|

886,717 |

|

|

871,620 |

|

| Labor and other related |

297,390 |

|

|

286,300 |

|

|

928,134 |

|

|

901,350 |

|

| Other restaurant operating |

255,476 |

|

|

243,803 |

|

|

766,836 |

|

|

744,626 |

|

| Depreciation and amortization |

44,947 |

|

|

44,344 |

|

|

133,492 |

|

|

130,434 |

|

| General and administrative |

59,103 |

|

|

59,989 |

|

|

180,007 |

|

|

175,660 |

|

| Provision for impaired assets and restaurant closings |

33,236 |

|

|

5,597 |

|

|

35,126 |

|

|

31,154 |

|

| Total costs and expenses |

965,233 |

|

|

901,371 |

|

|

2,930,312 |

|

|

2,854,844 |

|

| (Loss) income from operations |

(36,420) |

|

|

8,642 |

|

|

50,461 |

|

|

123,611 |

|

| Loss on extinguishment of debt |

— |

|

|

(225) |

|

|

— |

|

|

(136,022) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

(11,112) |

|

|

(16,483) |

|

|

(32,998) |

|

|

(45,455) |

|

| (Loss) income before (benefit) provision for income taxes |

(47,532) |

|

|

(8,066) |

|

|

17,463 |

|

|

(57,866) |

|

| (Benefit) provision for income taxes |

(2,404) |

|

|

(8,030) |

|

|

(10,249) |

|

|

1,392 |

|

| Loss from equity method investment, net of tax |

(337) |

|

|

— |

|

|

(3,434) |

|

|

— |

|

| Net (loss) income from continuing operations |

(45,465) |

|

|

(36) |

|

|

24,278 |

|

|

(59,258) |

|

| Net income from discontinued operations, net of tax |

189 |

|

|

7,577 |

|

|

714 |

|

|

14,140 |

|

| Net (loss) income |

(45,276) |

|

|

7,541 |

|

|

24,992 |

|

|

(45,118) |

|

| Less: net income attributable to noncontrolling interests |

583 |

|

|

629 |

|

|

3,280 |

|

|

3,439 |

|

Net (loss) income attributable to Bloomin’ Brands |

$ |

(45,859) |

|

|

$ |

6,912 |

|

|

$ |

21,712 |

|

|

$ |

(48,557) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

$ |

(45,276) |

|

|

$ |

7,541 |

|

|

$ |

24,992 |

|

|

$ |

(45,118) |

|

| Other comprehensive (loss) income: |

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

3,367 |

|

|

(11,849) |

|

|

2,745 |

|

|

(23,638) |

|

| Reclassification of foreign currency translation adjustments into earnings due to sale of business |

— |

|

|

— |

|

|

217,548 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain (loss) on derivatives, net of tax |

67 |

|

|

(3,474) |

|

|

180 |

|

|

(1,987) |

|

|

|

|

|

|

|

|

|

| Comprehensive (loss) income |

(41,842) |

|

|

(7,782) |

|

|

245,465 |

|

|

(70,743) |

|

| Less: comprehensive income attributable to noncontrolling interests |

583 |

|

|

629 |

|

|

3,280 |

|

|

3,439 |

|

| Comprehensive (loss) income attributable to Bloomin’ Brands |

$ |

(42,425) |

|

|

$ |

(8,411) |

|

|

$ |

242,185 |

|

|

$ |

(74,182) |

|

|

|

|

|

|

|

|

|

| Basic (loss) earnings per share: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

(0.54) |

|

|

$ |

(0.01) |

|

|

$ |

0.25 |

|

|

$ |

(0.73) |

|

| Discontinued operations |

— |

|

|

0.09 |

|

|

0.01 |

|

|

0.16 |

|

| Net basic (loss) earnings per share |

$ |

(0.54) |

|

|

$ |

0.08 |

|

|

$ |

0.26 |

|

|

$ |

(0.56) |

|

|

|

|

|

|

|

|

|

| Diluted (loss) earnings per share: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

(0.54) |

|

|

$ |

(0.01) |

|

|

$ |

0.25 |

|

|

$ |

(0.73) |

|

| Discontinued operations |

— |

|

|

0.09 |

|

|

0.01 |

|

|

0.16 |

|

| Net diluted (loss) earnings per share |

$ |

(0.54) |

|

|

$ |

0.08 |

|

|

$ |

0.25 |

|

|

$ |

(0.56) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

85,093 |

|

|

85,063 |

|

|

85,012 |

|

|

86,258 |

|

| Diluted |

85,093 |

|

|

85,063 |

|

|

85,222 |

|

|

86,258 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Amounts may not add due to rounding.

BLOOMIN’ BRANDS, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(IN THOUSANDS, EXCEPT PER SHARE DATA, UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BLOOMIN’ BRANDS, INC. |

|

|

|

|

|

COMMON STOCK |

|

ADDITIONAL PAID-IN CAPITAL |

|

ACCUM-

ULATED DEFICIT |

|

ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS) |

|

NON-CONTROLLING INTERESTS |

|

TOTAL |

|

SHARES |

|

AMOUNT |

|

|

|

|

|

Balance,

June 29, 2025 |

85,062 |

|

|

$ |

851 |

|

|

$ |

1,250,403 |

|

|

$ |

(858,263) |

|

|

$ |

4,246 |

|

|

$ |

4,057 |

|

|

$ |

401,294 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

— |

|

|

— |

|

|

— |

|

|

(45,859) |

|

|

— |

|

|

583 |

|

|

(45,276) |

|

| Other comprehensive income, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3,434 |

|

|

— |

|

|

3,434 |

|

Cash dividends declared, $0.15 per common share |

— |

|

|

— |

|

|

(12,760) |

|

|

— |

|

|

— |

|

|

— |

|

|

(12,760) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

— |

|

|

— |

|

|

2,353 |

|

|

— |

|

|

— |

|

|

— |

|

|

2,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock issued under stock plans (1) |

105 |

|

|

1 |

|

|

(318) |

|

|

— |

|

|

— |

|

|

— |

|

|

(317) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions to noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(986) |

|

|

(986) |

|

| Contributions from noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

265 |

|

|

265 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

September 28, 2025 |

85,167 |

|

|

$ |

852 |

|

|

$ |

1,239,678 |

|

|

$ |

(904,122) |

|

|

$ |

7,680 |

|

|

$ |

3,919 |

|

|

$ |

348,007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

December 29, 2024 |

84,855 |

|

|

$ |

849 |

|

|

$ |

1,273,288 |

|

|

$ |

(925,834) |

|

|

$ |

(212,793) |

|

|

$ |

3,936 |

|

|

$ |

139,446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

21,712 |

|

|

— |

|

|

3,280 |

|

|

24,992 |

|

| Other comprehensive income, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

220,473 |

|

|

— |

|

|

220,473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared, $0.45 per common share |

— |

|

|

— |

|

|

(38,266) |

|

|

— |

|

|

— |

|

|

— |

|

|

(38,266) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

— |

|

|

— |

|

|

5,985 |

|

|

— |

|

|

— |

|

|

— |

|

|

5,985 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock issued under stock plans (1) |

312 |

|

|

3 |

|

|

(930) |

|

|

— |

|

|

— |

|

|

— |

|

|

(927) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions to noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,437) |

|

|

(4,437) |

|

| Contributions from noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,140 |

|

|

1,140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retirement of warrants |

— |

|

|

— |

|

|

(399) |

|

|

— |

|

|

— |

|

|

— |

|

|

(399) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

September 28, 2025 |

85,167 |

|

|

$ |

852 |

|

|

$ |

1,239,678 |

|

|

$ |

(904,122) |

|

|

$ |

7,680 |

|

|

$ |

3,919 |

|

|

$ |

348,007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(CONTINUED...) |

BLOOMIN’ BRANDS, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(IN THOUSANDS, EXCEPT PER SHARE DATA, UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BLOOMIN’ BRANDS, INC. |

|

|

|

|

|

COMMON STOCK |

|

ADDITIONAL PAID-IN CAPITAL |

|

ACCUM-

ULATED DEFICIT |

|

ACCUMULATED OTHER

COMPREHENSIVE LOSS |

|

NON-CONTROLLING INTERESTS |

|

TOTAL |

|

SHARES |

|

AMOUNT |

|

|

|

|

|

Balance,

June 30, 2024 |

85,776 |

|

|

$ |

858 |

|

|

$ |

1,309,482 |

|

|

$ |

(834,926) |

|

|

$ |

(188,606) |

|

|

$ |

2,885 |

|

|

$ |

289,693 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

6,912 |

|

|

— |

|

|

629 |

|

|

7,541 |

|

| Other comprehensive loss, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(15,323) |

|

|

— |

|

|

(15,323) |

|

Cash dividends declared, $0.24 per common share |

— |

|

|

— |

|

|

(20,375) |

|

|

— |

|

|

— |

|

|

— |

|

|

(20,375) |

|

Repurchase and retirement of common stock, including excise tax of $177 |

(969) |

|

|

(10) |

|

|

— |

|

|

(18,362) |

|

|

— |

|

|

— |

|

|

(18,372) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

2,360 |

|

|

— |

|

|

— |

|

|

— |

|

|

2,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock issued under stock plans (1) |

23 |

|

|

— |

|

|

109 |

|

|

— |

|

|

— |

|

|

— |

|

|

109 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions to noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,082) |

|

|

(1,082) |

|

| Contributions from noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

420 |

|

|

420 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

September 29, 2024 |

84,830 |

|

|

$ |

848 |

|

|

$ |

1,291,576 |

|

|

$ |

(846,376) |

|

|

$ |

(203,929) |

|

|

$ |

2,852 |

|

|

$ |

244,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

December 31, 2023 |

86,969 |

|

|

$ |

870 |

|

|

$ |

1,115,387 |

|

|

$ |

(528,831) |

|

|

$ |

(178,304) |

|

|

$ |

2,881 |

|

|

$ |

412,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

— |

|

|

— |

|

|

— |

|

|

(48,557) |

|

|

— |

|

|

3,439 |

|

|

(45,118) |

|

| Other comprehensive loss, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(25,625) |

|

|

— |

|

|

(25,625) |

|

Cash dividends declared, $0.72 per common share |

— |

|

|

— |

|

|

(62,212) |

|

|

— |

|

|

— |

|

|

— |

|

|

(62,212) |

|

Repurchase and retirement of common stock, including excise tax of $328 |

(10,073) |

|

|

(100) |

|

|

(5,681) |

|

|

(260,645) |

|

|

— |

|

|

— |

|

|

(266,426) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

5,291 |

|

|

— |

|

|

— |

|

|

— |

|

|

5,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock issued under stock plans (1) |

734 |

|

|

7 |

|

|

(1,617) |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,610) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions to noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,556) |

|

|

(4,556) |

|

| Contributions from noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,088 |

|

|

1,088 |

|

| Issuance of common stock from repurchase of convertible senior notes |

7,489 |

|

|

74 |

|

|

216,078 |

|

|

— |

|

|

— |

|

|

— |

|

|

216,152 |

|

| Retirement of convertible senior note hedges |

(289) |

|

|

(3) |

|

|

126,543 |

|

|

(8,343) |

|

|

— |

|

|

— |

|

|

118,197 |

|

| Retirement of warrants |

— |

|

|

— |

|

|

(102,213) |

|

|

— |

|

|

— |

|

|

— |

|

|

(102,213) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

September 29, 2024 |

84,830 |

|

|

$ |

848 |

|

|

$ |

1,291,576 |

|

|

$ |

(846,376) |

|

|

$ |

(203,929) |

|

|

$ |

2,852 |

|

|

$ |

244,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________________

(1)Net of shares withheld for employee taxes.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BLOOMIN’ BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS, UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

THIRTY-NINE WEEKS ENDED |

|

SEPTEMBER 28, 2025 |

|

SEPTEMBER 29, 2024 |

|

|

|

|

| Cash flows provided by operating activities: |

|

|

|

| Net income (loss) |

$ |

24,992 |

|

|

$ |

(45,118) |

|

| Net income from discontinued operations, net of tax |

714 |

|

|

14,140 |

|

| Net income (loss) from continuing operations |

24,278 |

|

|

(59,258) |

|

| Adjustments to reconcile Net income (loss) from continuing operations to cash provided by operating activities of continuing operations: |

|

|

|

| Depreciation and amortization |

133,492 |

|

|

130,434 |

|

|

|

|

|

| Amortization of deferred gift card sales commissions |

16,027 |

|

|

17,155 |

|

| Provision for impaired assets and restaurant closings |

35,126 |

|

|

31,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense |

5,985 |

|

|

5,291 |

|

| Deferred income tax expense (benefit) |

2,286 |

|

|

(17,623) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on extinguishment of debt |

— |

|

|

136,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on foreign currency forward contracts |

25,564 |

|

|

— |

|

| Loss from equity method investment, net of tax |

3,434 |

|

|

— |

|

| Foreign currency translation gain on installment receivable from sale of business |

(17,752) |

|

|

— |

|

|

|

|

|

| Other, net |

457 |

|

|

(1,674) |

|

| Change in assets and liabilities |

(73,729) |

|

|

(126,958) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

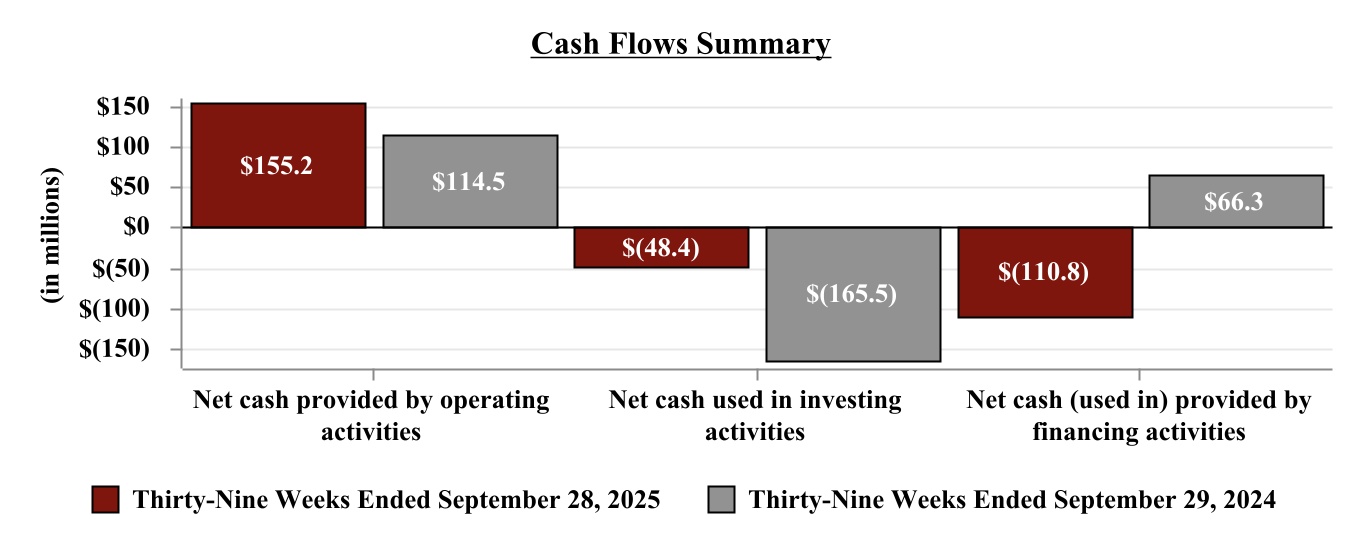

| Net cash provided by operating activities of continuing operations |

155,168 |

|

|

114,543 |

|

| Net cash provided by (used in) operating activities of discontinued operations |

2,385 |

|

|

(6,161) |

|

| Net cash provided by operating activities |

$ |

157,553 |

|

|

$ |

108,382 |

|

|

|

|

|

| Cash flows used in investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital expenditures |

$ |

(124,451) |

|

|

$ |

(167,715) |

|

| Payments on foreign currency forward contracts |

(21,116) |

|

|

— |

|

| Cash received from sale, net of tax withheld and cash left in business |

95,863 |

|

|

— |

|

| Other investments, net |

1,340 |

|

|

2,192 |

|

| Net cash used in investing activities of continuing operations |

(48,364) |

|

|

(165,523) |

|

| Net cash used in investing activities of discontinued operations |

(1,623) |

|

|

(30,953) |

|

| Net cash used in investing activities |

$ |

(49,987) |

|

|

$ |

(196,476) |

|

|

|

|

|

|

(CONTINUED...) |

BLOOMIN’ BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS, UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

THIRTY-NINE WEEKS ENDED |

|

SEPTEMBER 28, 2025 |

|

SEPTEMBER 29, 2024 |

|

|

|

|

| Cash flows (used in) provided by financing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from borrowings on revolving credit facilities |

$ |

1,100,000 |

|

|

$ |

2,040,000 |

|

| Repayments of borrowings on revolving credit facilities |

(1,145,000) |

|

|

(1,646,000) |

|

|

|

|

|

| Financing fees |

— |

|

|

(6,945) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repayments of finance lease obligations |

(2,040) |

|

|

(1,309) |

|

| Principal settlements and repurchase of convertible senior notes |

(20,724) |

|

|

(2,335) |

|

| Proceeds from retirement of convertible senior note hedges |

— |

|

|

118,197 |

|

| Payments for retirement of warrants |

(399) |

|

|

(102,213) |

|

| Payment of taxes from share-based compensation, net |

(927) |

|

|

(1,610) |

|

| Distributions to noncontrolling interests |

(4,437) |

|

|

(4,556) |

|

| Contributions from noncontrolling interests |

1,140 |

|

|

1,088 |

|

| Purchase of noncontrolling interests |

(100) |

|

|

(100) |

|

|

|

|

|

| Repurchase of common stock |

— |

|

|

(265,695) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends paid on common stock |

(38,266) |

|

|

(62,212) |

|

|

|

|

|

| Net cash (used in) provided by financing activities of continuing operations |

(110,753) |

|

|

66,310 |

|

| Net cash used in financing activities of discontinued operations |

(65) |

|

|

(751) |

|

| Net cash (used in) provided by financing activities |

(110,818) |

|

|

65,559 |

|

| Effect of exchange rate changes on cash and cash equivalents |

(325) |

|

|

(8,206) |

|

|

|

|

|

| Net decrease in cash and cash equivalents |

(3,577) |

|

|

(30,741) |

|

| Cash and cash equivalents as of the beginning of the period |

70,056 |

|

|

114,373 |

|

| Cash and cash equivalents as of the end of the period |

$ |

66,479 |

|

|

$ |

83,632 |

|

| Supplemental disclosures of cash flow information: |

|

|

|

| Cash paid for interest |

$ |

40,169 |

|

|

$ |

41,914 |

|

| Cash paid for income taxes, net of refunds |

$ |

23,787 |

|

|

$ |

19,509 |

|

| Supplemental disclosures of non-cash activities: |

|

|

|

|

|

|

|

| Capital expenditures included in current liabilities |

$ |

27,840 |

|

|

$ |

40,031 |

|

| Shares issued on settlement of convertible senior notes |

$ |

— |

|

|

$ |

216,152 |

|

| Shares received and retired on exercise of call option under bond hedge upon settlement of convertible senior notes |

$ |

— |

|

|

$ |

(8,346) |

|

| Financing fees in accrued liabilities |

$ |

— |

|

|

$ |

2,040 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

BLOOMIN’ BRANDS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)