Document

|

|

|

|

|

|

|

|

|

|

|

|

REPORT TO SHAREHOLDERS |

|

|

| Third Quarter 2025 |

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

|

|

|

| Table of Contents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basis of Presentation

The following Management's Discussion and Analysis ("MD&A") of the financial and operating results of Pembina Pipeline Corporation ("Pembina" or the "Company") is dated November 6, 2025, and is supplementary to, and should be read in conjunction with, Pembina's unaudited condensed consolidated interim financial statements for the three and nine months ended September 30, 2025 ("Interim Financial Statements") as well as Pembina's audited consolidated annual financial statements ("Consolidated Financial Statements") and MD&A for the year ended December 31, 2024. All financial information provided in this MD&A has been prepared in accordance with International Accounting Standard ("IAS") 34 Interim Financial Reporting and is expressed in Canadian dollars, unless otherwise noted. A description of Pembina's operating segments and additional information about Pembina is filed with Canadian and U.S. securities commissions, including quarterly and annual reports, annual information forms (which are filed with the U.S. Securities and Exchange Commission under Form 40-F) and management information circulars, which can be found online at www.sedarplus.ca, www.sec.gov and through Pembina's website at www.pembina.com. Information contained in or otherwise accessible through Pembina's website does not form part of this MD&A and is not incorporated into this document by reference.

Abbreviations

For a list of abbreviations that may be used in this MD&A, refer to the "Abbreviations" section of this MD&A.

Non-GAAP and Other Financial Measures

Pembina has disclosed certain financial measures and ratios within this MD&A that management believes provide meaningful information in assessing Pembina's underlying performance, but which are not specified, defined or determined in accordance with the Canadian generally accepted accounting principles ("GAAP") and which are not disclosed in Pembina's Interim Financial Statements or Consolidated Financial Statements. Such non-GAAP financial measures and non-GAAP ratios do not have any standardized meaning prescribed by IFRS and may not be comparable to similar financial measures or ratios disclosed by other issuers. Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A for additional information regarding these non-GAAP financial measures and non-GAAP ratios.

Risk Factors and Forward-Looking Information

Management has identified the primary risk factors that could have a material impact on the financial results and operations of Pembina. Such risk factors are presented in the "Risk Factors" sections of Pembina's MD&A and Annual Information Form ("AIF"), each for the year ended December 31, 2024. The Company's financial and operational performance is potentially affected by a number of factors, including, but not limited to, the factors described within the "Forward-Looking Statements & Information" section of this MD&A. This MD&A contains forward-looking statements based on Pembina's current expectations, estimates, projections and assumptions. This information is provided to assist readers in understanding the Company's future plans and expectations and may not be appropriate for other purposes.

Pembina Pipeline Corporation Third Quarter 2025 1

1. ABOUT PEMBINA

Pembina Pipeline Corporation is a leading energy transportation and midstream service provider that has served North America's energy industry for more than 70 years. Pembina owns an extensive network of strategically located assets, including hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and an export terminals business. Through our integrated value chain, we seek to provide safe and reliable energy solutions that connect producers and consumers across the world, support a more sustainable future and benefit our customers, investors, employees and communities. For more information, please visit www.pembina.com.

Pembina's Purpose and Strategy

We deliver extraordinary energy solutions so the world can thrive.

Pembina will build on its strengths by continuing to invest in and grow the core businesses that provide critical transportation and midstream services to help ensure reliable and secure energy supply. Pembina will capitalize on exciting opportunities to leverage its assets and expertise into new service offerings that enable the transition to a lower-carbon economy. In continuing to meet global energy demand and its customers' needs, while ensuring Pembina's long-term success and resilience, the Company has established four strategic priorities:

1.To be resilient, we will sustain, decarbonize, and enhance our businesses. This priority is focused on strengthening and growing our existing franchise and demonstrating environmental leadership.

2.To thrive, we will invest in the energy transition to improve the basins in which we operate. We will prioritize lighter commodities as we continue to invest in new infrastructure and expand our portfolio to include new businesses associated with lower-carbon commodities.

3.To meet global demand, we will transform and export our products. We will continue our focus on supporting the transformation of Western Canadian Sedimentary Basin commodities into higher margin products and enabling more coastal egress.

4.To set ourselves apart, we will create a differentiated experience for our stakeholders. We remain committed to delivering excellence for our four key stakeholder groups meaning that:

a.Employees say we are the 'employer of choice' and value our safe, respectful, collaborative, and inclusive work culture.

b.Communities welcome us and recognize the net positive impact of our social and environmental commitment.

c.Customers choose us first for reliable and value-added services.

d.Investors receive sustainable industry-leading total returns.

2 Pembina Pipeline Corporation Third Quarter 2025

2. FINANCIAL & OPERATING OVERVIEW

Consolidated Financial Overview for the Three Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

| Revenue |

1,791 |

|

1,844 |

|

(53) |

|

|

Net revenue(1) |

1,211 |

|

1,259 |

|

(48) |

|

|

| Operating expenses |

259 |

|

277 |

|

(18) |

|

|

Gross profit |

658 |

|

747 |

|

(89) |

|

|

Adjusted EBITDA(1) |

1,034 |

|

1,019 |

|

15 |

|

|

|

|

|

|

|

Earnings |

286 |

|

385 |

|

(99) |

|

|

Earnings per common share – basic and diluted (dollars) |

0.43 |

|

0.60 |

|

(0.17) |

|

|

|

|

|

|

|

| Cash flow from operating activities |

810 |

|

922 |

|

(112) |

|

|

Cash flow from operating activities per common share – basic (dollars) |

1.39 |

|

1.59 |

|

(0.20) |

|

|

Adjusted cash flow from operating activities(1) |

648 |

|

724 |

|

(76) |

|

|

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

1.12 |

|

1.25 |

|

(0.13) |

|

|

| Capital expenditures |

178 |

|

262 |

|

(84) |

|

|

|

|

|

|

|

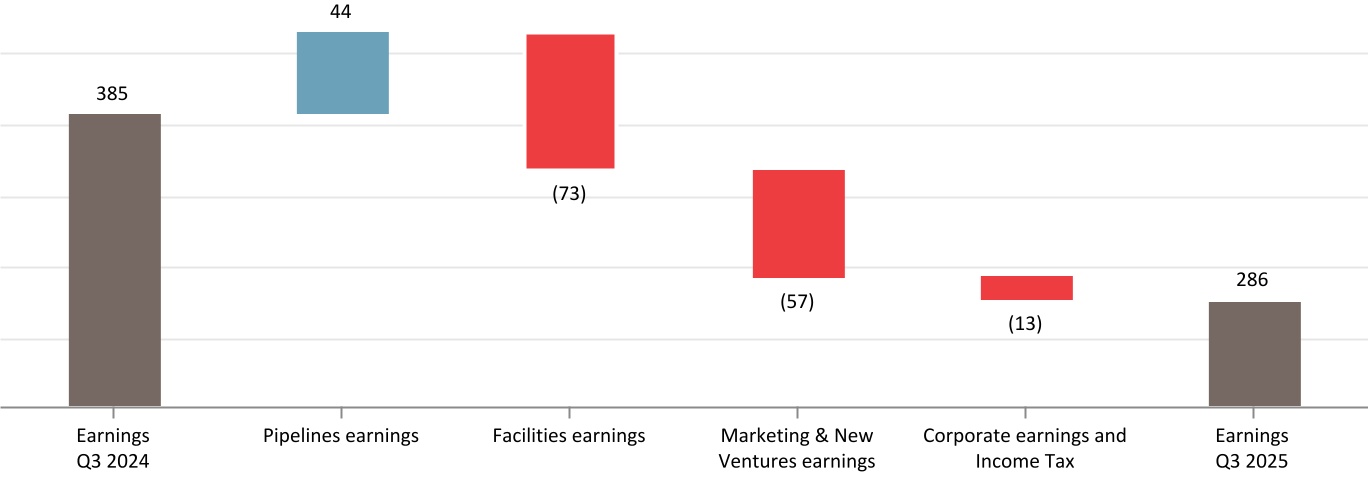

Change in Earnings ($ millions)

Results Overview

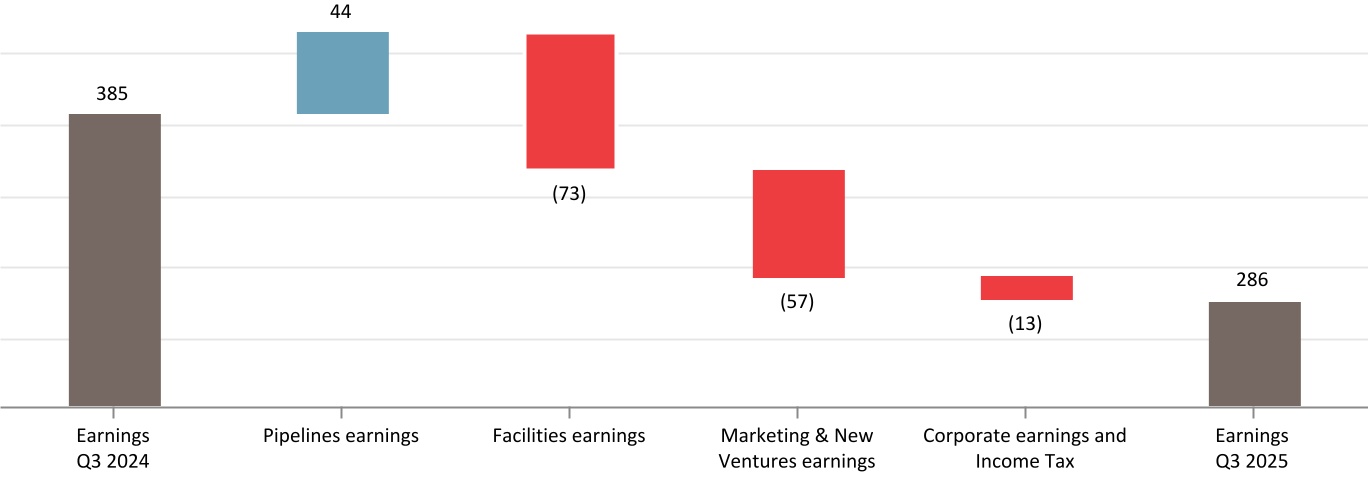

Earnings in the third quarter of 2025 decreased by $99 million compared to the prior period. Significant factors impacting the quarter by segment include:

•Pipelines: Increase largely due to the recognition of a gain on the sale of the North segment of the Western Pipeline in the third quarter of 2025, higher revenue on the Peace Pipeline system due to higher tolls mainly related to contractual inflation adjustments and increased volumes, higher demand on seasonal contracts on the Alliance Pipeline, and higher contracted volumes on the Nipisi Pipeline.

•Facilities: Decrease largely due to a share of loss from PGI in the third quarter of 2025 primarily due to an impairment of certain PGI assets compared to a share of profit in the third quarter of 2024, partially offset by the recognition of a gain following the amendment of PGI's credit facility and higher contributions from certain PGI assets.

•Marketing & New Ventures: Lower net revenue due to a decrease in revenue from risk management and physical derivatives combined with lower NGL margins, partially offset by lower share of loss from Cedar LNG primarily due to the impact of hedging activities on the credit facility.

•Corporate and Income Tax: Higher income tax expense resulting from higher taxable earnings, partially offset by lower incentive costs and integration costs.

Further details and additional factors impacting the segments are discussed in the table below and in the "Segment Results" section of this MD&A.

Pembina Pipeline Corporation Third Quarter 2025 3

|

|

|

|

|

|

|

Changes in Results for the Three Months Ended September 30 |

Net revenue(1) |

|

$48 million decrease, largely due to lower net revenue in the Marketing & New Ventures Division as a result of lower gains on crude oil-based derivatives and losses on NGL-based derivatives compared to gains in the third quarter of 2024. This is combined with lower NGL margins as a result of lower NGL prices and higher input natural gas prices, partially offset by higher NGL marketed volumes and no similar impact to the nine-day unplanned outage at Aux Sable in July 2024. Additionally, lower tolls on the Cochin Pipeline due to the replacement of long-term contracts that expired in mid-July 2024, combined with lower volumes on the Cochin Pipeline, contributed to a decrease to net revenue.

These results were partially offset by gains on renewable power purchase agreements compared to losses in the third quarter of 2024, higher tolls on the Peace Pipeline system primarily due to contractual inflation adjustments, higher interruptible volumes on the Peace Pipeline system, higher contracted volumes on the Nipisi Pipeline, as well as, higher demand on seasonal contracts on the Alliance Pipeline.

|

|

|

|

| Operating expenses |

|

$18 million decrease, primarily due to lower integrity and geotechnical spend on certain Pipelines assets, partially offset by higher operating expenses in the Facilities Division due to higher utilization at the Redwater Complex and certain other Facilities assets in the third quarter of 2025 compared to the third quarter of 2024. |

|

|

|

|

|

|

|

|

|

| Cash flow from operating activities |

|

$112 million decrease, primarily driven by a change in non-cash working capital and lower earnings adjusted for items not involving cash, partially offset by lower taxes paid. |

Adjusted cash flow from operating activities(1) |

|

$76 million decrease, primarily due to the same items impacting cash flow from operating activities, discussed above, excluding the change in non-cash working capital and taxes paid, combined with higher current income tax expense. |

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

|

$0.13 decrease, primarily due to the factors impacting adjusted cash flow from operating activities, discussed above, while outstanding common shares remained consistent with prior period. |

Adjusted EBITDA(1) |

|

$15 million increase, largely due to higher net revenue on the Peace Pipeline system and Alliance Pipeline, combined with lower realized losses on NGL-based derivatives, and higher contributions from certain PGI assets.

These results were partially offset by lower realized gains on crude-oil based derivatives and lower NGL margins, which were offset in part by higher NGL marketed volumes and no similar impact to the nine-day unplanned outage at Aux Sable in July 2024. Additionally, lower tolls and volumes on the Cochin Pipeline contributed to the decrease.

|

|

|

|

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

4 Pembina Pipeline Corporation Third Quarter 2025

Consolidated Financial Overview for the Nine Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

| Revenue |

5,865 |

|

5,239 |

|

626 |

|

|

Net revenue(1) |

3,738 |

|

3,393 |

|

345 |

|

|

| Operating expenses |

720 |

|

706 |

|

14 |

|

|

Gross profit |

2,366 |

|

2,292 |

|

74 |

|

|

Adjusted EBITDA(1) |

3,214 |

|

3,154 |

|

60 |

|

|

|

|

|

|

|

Earnings |

1,205 |

|

1,302 |

|

(97) |

|

|

Earnings per common share – basic and diluted (dollars) |

1.88 |

|

2.08 |

|

(0.20) |

|

|

|

|

|

|

|

| Cash flow from operating activities |

2,440 |

|

2,312 |

|

128 |

|

|

Cash flow from operating activities per common share – basic (dollars) |

4.20 |

|

4.06 |

|

0.14 |

|

|

Adjusted cash flow from operating activities(1) |

2,123 |

|

2,343 |

|

(220) |

|

|

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

3.65 |

|

4.11 |

|

(0.46) |

|

|

| Capital expenditures |

549 |

|

713 |

|

(164) |

|

|

|

|

|

|

|

Change in Earnings ($ millions)

Results Overview

Earnings during the first nine months of 2025 decreased by $97 million compared to the prior period. Significant factors impacting the period by segment include:

•Pipelines: Positive impacts from Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, combined with higher seasonal revenue on the Alliance Pipeline. Additionally, earnings were impacted by higher revenue on the Peace Pipeline system due to increased volumes and higher tolls mainly related to contractual inflation adjustments, higher revenue on the Nipisi Pipeline, and the recognition of a gain on the sale of the North segment of the Western Pipeline in the third quarter of 2025. These impacts were partially offset by lower net revenue on the Cochin Pipeline, Vantage Pipeline, and at the Edmonton Terminals.

•Facilities: Decrease largely due to lower share of profit from PGI primarily due to an impairment of certain PGI assets, partially offset by the positive impacts of Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, the recognition of a gain following the amendment of PGI's credit facility, and higher contributions from certain PGI assets.

•Marketing & New Ventures: Positive impacts from Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, higher revenue from risk management and physical derivative contracts, and lower share of loss from Cedar LNG primarily due to the impact of hedging activities on the credit facility. This was partially offset by lower NGL margins and lower other income.

•Corporate and Income Tax: Lower due to higher income tax expense, lower interest income, and no similar net gain on acquisition to that recognized in the second quarter of 2024, partially offset by lower acquisition and integration costs.

Further details and additional factors impacting the segments are discussed in the table below and in the "Segment Results" section of this MD&A.

Pembina Pipeline Corporation Third Quarter 2025 5

|

|

|

|

|

|

|

Changes in Results for the Nine Months Ended September 30 |

Net revenue(1) |

|

$345 million increase, largely due to Pembina acquiring a controlling ownership interest in Alliance and Aux Sable on April 1, 2024. The Marketing & New Ventures Division had higher net revenue largely due to lower losses on renewable power purchase agreements and gains on NGL-based derivatives in the 2025 period compared to losses in the 2024 period. Higher net revenue was also the result of an increase in demand on seasonal contracts on the Alliance Pipeline, higher net revenue on the Peace Pipeline system due to higher utilization in the 2025 period compared to the same period in 2024 which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, and increased contracted volumes on the Peace Pipeline system and Nipisi Pipeline, along with higher tolls on the Peace Pipeline system primarily due to contractual inflation adjustments.

These results were partially offset by lower gains on crude oil-based derivatives and lower net revenue on the Cochin Pipeline primarily due to lower tolls resulting from the replacement of long-term contracts that expired in mid-July 2024. Also contributing to a decrease to net revenue were lower NGL margins due to lower NGL prices and higher input gas prices, lower volumes and tolls on the Vantage Pipeline, lower revenue at the Edmonton Terminals largely related to the decommissioning of the Edmonton South Rail Terminal in the second quarter of 2024, and lower recoverable power and geotechnical costs.

|

|

|

|

| Operating expenses |

|

$14 million increase, primarily due to operating expenses from Alliance and Aux Sable now being fully consolidated as of April 1, 2024, as well as higher environmental costs in the current period, as the 2024 period included a recovery related to the Northern Pipeline system outage. Additionally, higher transportation costs in the Marketing & New Ventures Division and higher integrity spend in the Facilities Division, also contributed to an increase to operating expenses. These increases were partially offset by lower geotechnical spend on certain Pipelines assets and lower recoverable power costs resulting from the lower power pool price during the 2025 period. |

|

|

|

| Cash flow from operating activities |

|

$128 million increase, primarily driven by lower taxes paid, an increase in earnings adjusted for items not involving cash, and the change in non-cash working capital. This was partially offset by lower distributions from equity accounted investees and higher net interest paid, both largely the result of Pembina acquiring a controlling ownership interest in Alliance and Aux Sable on April 1, 2024, as well as the net change in contract liabilities. |

Adjusted cash flow from operating activities(1) |

|

$220 million decrease, primarily driven by the same factors impacting cash flow from operating activities, discussed above. However, when excluding the change in non-cash working capital and taxes paid, the adjusted result reflects a decrease. This is further impacted by higher current income tax expense, partially offset by lower accrued share-based payment expense. |

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

|

$0.46 decrease, primarily due to the factors impacting adjusted cash flow from operating activities, discussed above, as well as an increase in outstanding common shares following the conversion of subscription receipts into common shares, concurrent with the closing of Pembina's acquisition of a controlling ownership interest in Alliance and Aux Sable on April 1, 2024. |

Adjusted EBITDA(1) |

|

$60 million increase, largely due to Pembina acquiring a controlling ownership interest in Alliance and Aux Sable on April 1, 2024, and higher revenue on the Alliance Pipeline due to higher demand on seasonal contracts. Higher revenue on the Peace Pipeline system and Nipisi Pipeline, as well as lower realized losses on NGL-based derivatives, also contributed to an increase to adjusted EBITDA. Additionally, contributions from certain PGI assets were higher as a result of the Whitecap Transactions, higher capital recoveries, and higher volumes at the Duvernay Complex, partially offset by outages at certain PGI assets in the second quarter of 2025 that continued into the third quarter, and third-party restrictions impacting the Dawson Assets.

These results were partially offset by lower realized gains on crude oil-based derivatives, lower revenue on the Cochin Pipeline, lower NGL margins, lower volumes and tolls on the Vantage Pipeline, and lower revenue at the Edmonton Terminals.

|

|

|

|

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

6 Pembina Pipeline Corporation Third Quarter 2025

3. SEGMENT RESULTS

Business Overview

The Pipelines Division provides customers with pipeline transportation, terminalling, and storage in key market hubs in Canada and the United States for crude oil, condensate, natural gas liquids and natural gas. The Pipelines Division manages pipeline transportation capacity of 3.0 mmboe/d(1) and above ground storage capacity of approximately 10 mmbbls(1) within its conventional, oil sands and heavy oil, and transmission assets. The conventional assets include strategically located pipelines and terminalling hubs that gather and transport light and medium crude oil, condensate and natural gas liquids from western Alberta and northeast British Columbia to downstream pipelines and processing facilities in the Edmonton, Alberta area. The oil sands and heavy oil assets transport heavy and synthetic crude oil produced within Alberta to the Edmonton, Alberta area and offer associated storage and terminalling. The transmission assets transport natural gas, ethane and condensate throughout Canada and the United States on long haul pipelines linking various key market hubs. In addition, the Pipelines Division assets provide linkages to Pembina's Facilities Division assets across North America, enhancing flexibility and optionality in our customer service offerings. Together, these assets supply products from hydrocarbon producing regions to refineries, fractionators and market hubs in Alberta, British Columbia, and Illinois, as well as other regions throughout North America.

The Facilities Division includes infrastructure that provides Pembina's customers with natural gas, condensate and NGL services. Through its wholly-owned assets and its interest in PGI, Pembina's natural gas gathering and processing facilities are strategically positioned in active, liquids-rich areas of the WCSB and Williston Basin and may be serviced by the Company's other businesses. Pembina provides sweet and sour gas gathering, compression, condensate stabilization, and both shallow cut and deep cut gas processing services with a total capacity of approximately 6.7 bcf/d(1) for its customers. Condensate and NGL extracted at virtually all Canadian-based facilities have access to transportation on Pembina's pipelines. In addition, all NGL transported along the Alliance Pipeline are extracted through the Channahon Facility at the terminus. The Facilities Division includes approximately 430 mbpd(1) of NGL fractionation capacity, 21 mmbbls(1) of cavern storage capacity, various oil batteries, associated pipeline and rail terminalling facilities and a liquefied propane export facility on Canada's West Coast. These facilities are accessible to Pembina's other strategically-located assets and pipeline systems, providing customers with flexibility and optionality to access a comprehensive suite of services to enhance the value of their hydrocarbons. In addition, Pembina owns a bulk marine import/export terminal in Vancouver, British Columbia.

The Marketing & New Ventures Division leverages Pembina's integrated value chain and existing network of pipelines, facilities, and energy infrastructure assets to maximize the value of hydrocarbon liquids and natural gas originating in the basins where the Company operates. Pembina pursues the creation of new markets, and further enhances existing markets, to support both the Company's and its customers' business interests. In particular, Pembina seeks to identify opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure.

Within the Marketing & New Ventures Division, Pembina undertakes value-added commodity marketing activities, including buying and selling products (natural gas, ethane, propane, butane, condensate, crude oil, electricity, and carbon credits), commodity arbitrage, and optimizing storage opportunities. The marketing business enters into contracts for capacity on both Pembina's and third-party infrastructure, handles proprietary and customer volumes and aggregates production for onward sale. Through this infrastructure capacity, including Pembina's Prince Rupert Terminal, as well as utilizing the Company's expansive rail fleet and logistics capabilities, Pembina's marketing business adds incremental value to the commodities by accessing high value markets across North America and globally.

The Marketing & New Ventures Division is also responsible for the development of new large-scale, or value chain extending projects, including those that seek to provide enhanced access to global markets and to support a transition to a lower-carbon economy. The Marketing & New Ventures Division includes Pembina's interest in the Cedar LNG project, a floating liquified natural gas ("LNG") export facility currently under construction (the "Cedar LNG Project"). Additionally, Pembina is pursuing opportunities associated with low-carbon commodities and large-scale greenhouse gas ("GHG") emissions reductions.

(1)Net capacity.

Pembina Pipeline Corporation Third Quarter 2025 7

Financial and Operational Overview by Division

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended September 30 |

|

2025 |

2024 |

($ millions, except where noted) |

Volumes(1) |

Earnings (loss) |

|

|

Adjusted EBITDA(2) |

Volumes(1) |

Earnings (loss) |

|

|

Adjusted EBITDA(2) |

| Pipelines |

2,750 |

|

477 |

|

|

|

630 |

|

2,738 |

|

433 |

|

|

|

593 |

|

| Facilities |

861 |

|

58 |

|

|

|

354 |

|

810 |

|

131 |

|

|

|

324 |

|

Marketing & New Ventures |

348 |

|

68 |

|

|

|

99 |

|

344 |

|

125 |

|

|

|

159 |

|

| Corporate |

— |

|

(205) |

|

|

|

(49) |

|

— |

|

(215) |

|

|

|

(57) |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

— |

|

(112) |

|

|

|

— |

|

— |

|

(89) |

|

|

|

— |

|

| Total |

|

286 |

|

|

|

1,034 |

|

|

385 |

|

|

|

1,019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 Months Ended September 30 |

|

2025 |

2024 |

($ millions, except where noted) |

Volumes(1) |

Earnings (loss) |

|

|

Adjusted EBITDA(2) |

Volumes(1) |

Earnings (loss) |

|

|

Adjusted EBITDA(2) |

| Pipelines |

2,775 |

|

1,468 |

|

|

|

1,953 |

|

2,684 |

|

1,373 |

|

|

|

1,847 |

|

| Facilities |

861 |

|

384 |

|

|

|

1,030 |

|

823 |

|

489 |

|

|

|

974 |

|

Marketing & New Ventures |

340 |

|

342 |

|

|

|

383 |

|

319 |

|

324 |

|

|

|

490 |

|

| Corporate |

— |

|

(624) |

|

|

|

(152) |

|

— |

|

(1,210) |

|

|

|

(157) |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax (expense) recovery |

— |

|

(365) |

|

|

|

— |

|

— |

|

326 |

|

|

|

— |

|

| Total |

|

1,205 |

|

|

|

3,214 |

|

|

1,302 |

|

|

|

3,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes for Pipelines and Facilities divisions are revenue volumes, which are physical volumes plus volumes recognized from take-or-pay commitments. Volumes for Marketing & New Ventures are marketed crude oil and NGL volumes.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

8 Pembina Pipeline Corporation Third Quarter 2025

Equity Accounted Investees Overview by Division

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended September 30 |

|

|

|

|

|

|

2025 |

2024 |

| ($ millions, except where noted) |

Share of loss |

Adjusted EBITDA(5) |

Contributions |

Distributions |

Volumes(6) |

Share of (loss) profit |

Adjusted EBITDA(5) |

Contributions |

Distributions |

Volumes(6) |

Pipelines(1) |

(1) |

|

— |

|

— |

|

— |

|

— |

|

(1) |

|

1 |

|

— |

|

— |

|

— |

|

Facilities(2) |

(51) |

|

194 |

|

74 |

|

128 |

|

357 |

|

34 |

|

173 |

|

124 |

|

133 |

|

360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing &

New Ventures(3)

|

(14) |

|

(1) |

|

34 |

|

— |

|

— |

|

(50) |

|

(1) |

|

— |

|

— |

|

— |

|

| Total |

(66) |

|

193 |

|

108 |

|

128 |

|

357 |

|

(17) |

|

173 |

|

124 |

|

133 |

|

360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 Months Ended September 30 |

|

|

|

|

|

|

2025 |

2024 |

| ($ millions, except where noted) |

Share of profit (loss) |

Adjusted EBITDA(5) |

Contributions |

Distributions |

Volumes(6) |

Share of profit (loss) |

Adjusted EBITDA(5) |

Contributions |

Distributions |

Volumes(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pipelines(1)(4) |

— |

|

3 |

|

— |

|

— |

|

— |

|

42 |

|

88 |

|

5 |

|

80 |

|

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Facilities(2) |

60 |

|

544 |

|

198 |

|

396 |

|

356 |

|

172 |

|

522 |

|

124 |

|

384 |

|

358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing &

New Ventures(3)(4)

|

(22) |

|

(3) |

|

86 |

|

— |

|

— |

|

(19) |

|

39 |

|

242 |

|

31 |

|

12 |

|

| Total |

38 |

|

544 |

|

284 |

|

396 |

|

356 |

|

195 |

|

649 |

|

371 |

|

495 |

|

419 |

|

(1) Pipelines includes Grand Valley.

(2) Facilities includes PGI and Fort Corp.

(3) Marketing and New Ventures includes Greenlight in 2025, Cedar LNG and ACG.

(4) For the comparative 2024 period, the results of Alliance and Aux Sable are equity-accounted for the first three months of the nine months ended September 30, 2024. Pembina owned a 50 percent interest in Alliance, approximately a 42.7 percent interest in Aux Sable's U.S operations, and a 50 percent interest in Aux Sable's Canadian operations up to the closing of the acquisition on April 1, 2024. Following the closing of the acquisition, the results of Alliance and Aux Sable are fully consolidated and incorporated into Pembina's financial results. See Note 3 to the Interim Financial Statements.

(5) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(6) Volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Refer to the "Segment Results – Changes in Results" sections of this MD&A under each of the divisions for additional information.

For the three and nine months ended September 30, 2025, contributions in the Facilities Division were made to PGI to partially fund growth capital projects. Contributions in Marketing & New Ventures in both 2025 and 2024 were made to Cedar LNG to fund the Cedar LNG Project. Refer to the "Segment Results – Marketing & New Ventures Division – Projects & New Developments" sections of this MD&A for additional information.

Pembina Pipeline Corporation Third Quarter 2025 9

Pipelines

Financial Overview for the Three Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pipelines revenue(1) |

882 |

|

860 |

|

22 |

|

|

Cost of goods sold(1) |

10 |

|

9 |

|

1 |

|

|

Net revenue(1)(2) |

872 |

|

851 |

|

21 |

|

|

Operating expenses(1) |

221 |

|

244 |

|

(23) |

|

|

| Depreciation and amortization included in gross profit |

161 |

|

151 |

|

10 |

|

|

| Share of loss from equity accounted investees |

(1) |

|

(1) |

|

— |

|

|

| Gross profit |

489 |

|

455 |

|

34 |

|

|

| Earnings |

477 |

|

433 |

|

44 |

|

|

Adjusted EBITDA(2) |

630 |

|

593 |

|

37 |

|

|

Volumes(3) |

2,750 |

|

2,738 |

|

12 |

|

|

|

|

|

|

|

|

|

| Change in Results |

|

|

|

|

|

|

|

|

|

|

|

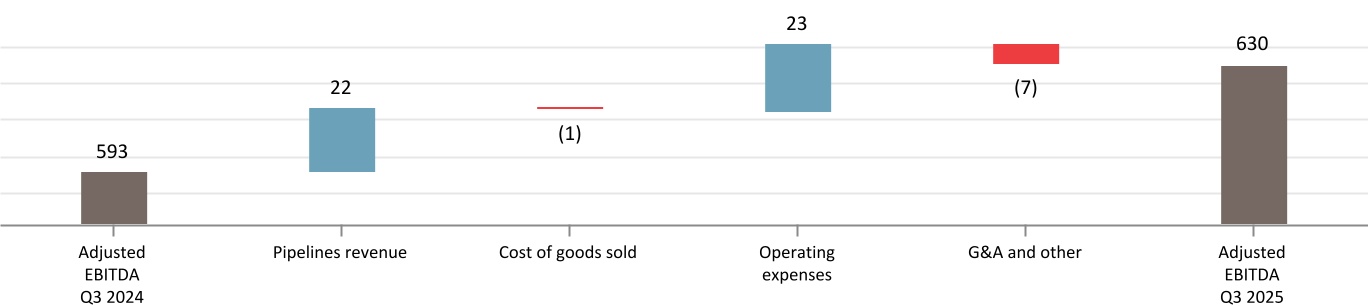

Net revenue(1)(2) |

|

Increase largely the result of higher demand on seasonal contracts on the Alliance Pipeline, higher tolls on the Peace Pipeline system mainly related to contractual inflation adjustments, higher interruptible volumes on the Peace Pipeline, and higher contracted volumes on the Nipisi Pipeline. Higher net revenue on the NEBC Pipeline in the third quarter of 2025 was driven by the NEBC MPS Expansion being placed into service in November 2024. These increases were partially offset by lower tolls on the Cochin Pipeline due to the replacement of long-term contracts that expired in mid-July 2024, lower volumes on the Cochin Pipeline, discussed below, and lower recoverable costs. |

|

|

|

Operating expenses(1) |

|

Decrease largely due to lower integrity and geotechnical spend on certain Pipelines assets, combined with minor decreases across multiple operating costs. |

| Depreciation and amortization included in gross profit |

|

Higher primarily due to a decrease in the estimated useful life of an intangible asset. |

|

|

|

| Earnings |

|

Increase largely due to the recognition of a gain on the sale of the North segment of the Western Pipeline in the third quarter of 2025, along with higher net revenue on certain Pipelines assets, discussed above. These increases were partially offset by higher depreciation and amortization expense as a result of a decrease in the estimated useful life of an intangible asset, along with lower revenue on the Cochin Pipeline. |

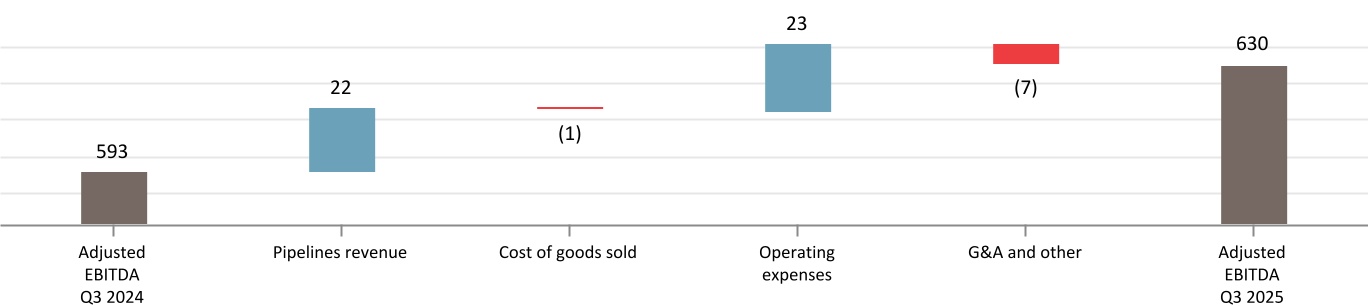

Adjusted EBITDA(2) |

|

Increase largely due to higher net revenue on certain Pipelines assets, partially offset by lower tolls and volumes on the Cochin Pipeline. |

Volumes(3) |

|

Higher largely due to increased contracted volumes on the Nipisi Pipeline and higher interruptible volumes on the Peace Pipeline system, partially offset by lower volumes on AEGS due to a temporary curtailment following a third-party outage that began in the second quarter of 2025 and continued into the third quarter. Additionally, narrower condensate price differentials resulted in lower interruptible volumes on the Cochin Pipeline, which was partially offset by higher contracted volumes as the third quarter in 2024 was impacted by a contracting gap from mid-July to August 1 2024, associated with the return of line fill to certain customers. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

10 Pembina Pipeline Corporation Third Quarter 2025

Financial Overview for the Nine Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pipelines revenue(1) |

2,650 |

|

2,438 |

|

212 |

|

|

Cost of goods sold(1) |

37 |

|

35 |

|

2 |

|

|

Net revenue(1)(2) |

2,613 |

|

2,403 |

|

210 |

|

|

Operating expenses(1) |

604 |

|

601 |

|

3 |

|

|

| Depreciation and amortization included in gross profit |

477 |

|

410 |

|

67 |

|

|

| Share of profit from equity accounted investees |

— |

|

42 |

|

(42) |

|

|

| Gross profit |

1,532 |

|

1,434 |

|

98 |

|

|

| Earnings |

1,468 |

|

1,373 |

|

95 |

|

|

Adjusted EBITDA(2) |

1,953 |

|

1,847 |

|

106 |

|

|

Volumes(3) |

2,775 |

|

2,684 |

|

91 |

|

|

|

|

|

|

|

|

|

| Change in Results |

|

|

|

|

|

|

|

|

|

|

|

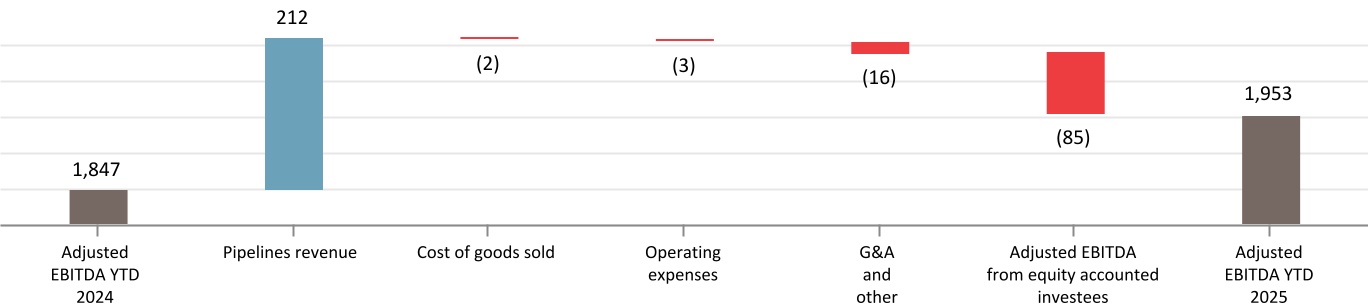

Net revenue(1)(2) |

|

Increase largely due to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, and higher demand on seasonal contracts on the Alliance Pipeline. Also contributing to the increase were higher volumes on the Peace Pipeline system due to higher utilization in the 2025 period compared to the 2024 period which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, higher contracted volumes on the Peace Pipeline system and Nipisi Pipeline, and higher tolls on the Peace Pipeline system mainly related to contractual inflation adjustments. Higher net revenue on the NEBC Pipeline in the 2025 period due to the NEBC MPS Expansion being placed into service in November 2024, along with favourable U.S. dollar foreign exchange rate impacts on certain assets, also contributed to an increase to net revenue. These increases were offset in part by lower net revenue on the Cochin Pipeline largely due to lower tolls as a result of the replacement of long-term contracts that expired in mid-July 2024. In addition, lower volumes and tolls on the Vantage Pipeline, lower revenue at the Edmonton Terminals largely related to the decommissioning of the Edmonton South Rail Terminal in the second quarter of 2024, and lower recoverable power and geotechnical costs, contributed to a decrease to net revenue. |

|

|

|

Operating expenses(1) |

|

Consistent with prior period. Higher costs related to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024 and higher environmental costs as the 2024 period included a recovery related to the Northern Pipeline system outage, were largely offset by lower geotechnical spend on certain Pipelines assets, combined with lower recoverable power costs resulting from a lower power pool price during the 2025 period. |

Depreciation and amortization included in gross profit |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, a decrease in the estimated useful life of an intangible asset in the 2025 period, and new assets placed into service in the second and fourth quarters of 2024. |

Share of profit from equity accounted investees |

|

Following Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, the results from Alliance are no longer accounted for in share of profit and are fully consolidated. |

| Earnings |

|

Higher largely due to the net impacts of Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024 and higher seasonal revenue on the Alliance Pipeline, combined with higher revenue on the Peace Pipeline system, Nipisi Pipeline, and NEBC Pipeline. Earnings were also higher due to the recognition of a gain on the sale of the North segment of the Western Pipeline in the third quarter of 2025 and favourable foreign exchange rate impacts on certain assets. These factors were partially offset by lower net revenue on certain Pipelines assets, discussed above, along with higher depreciation and amortization expense as a result of a decrease in the estimated useful life of an intangible asset. |

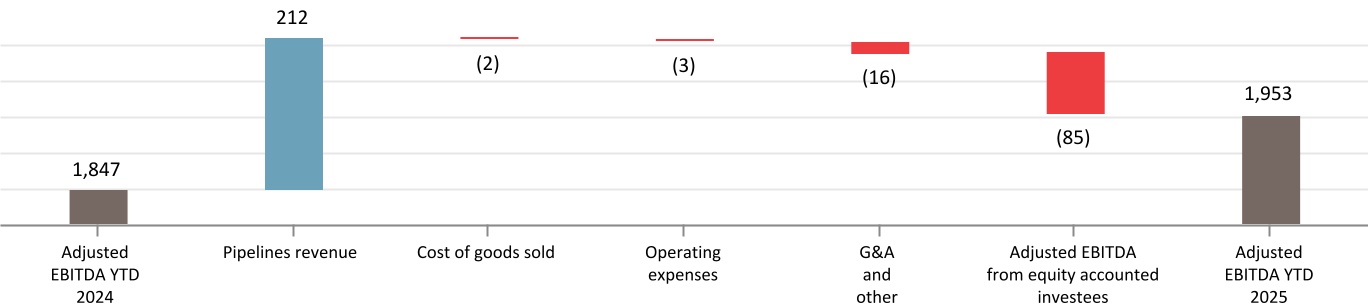

Adjusted EBITDA(2) |

|

Increase largely due to the same factors impacting earnings, discussed above, excluding the gain on the sale of the North segment of the Western Pipeline and the change in depreciation and amortization expense. |

Volumes(3) |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024. Additionally, higher contracted volumes on the Peace Pipeline system and the Nipisi Pipeline, and higher utilization on the Peace Pipeline system in the 2025 period compared to the same period in 2024 which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, contributed to an increase to volumes. Higher contracted volumes on the Cochin Pipeline was due to the volumes in the third quarter of 2024 being impacted by a contracting gap from mid-July to August 1 2024, associated with the return of line fill to certain customers, which was largely offset by lower interruptible volumes in the third quarter of 2025 due to narrower condensate price differentials. These increases were also offset in part by lower volumes on AEGS due to a temporary curtailment following a third-party outage that began in the second quarter of 2025 and continued into the third quarter. |

Pembina Pipeline Corporation Third Quarter 2025 11

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Financial and Operational Overview

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended September 30 |

9 Months Ended September 30 |

|

|

|

|

2025 |

2024 |

2025 |

2024 |

| ($ millions, except where noted) |

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Pipelines(3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Conventional |

1,001 |

|

308 |

|

351 |

|

992 |

|

264 |

|

318 |

|

1,013 |

|

906 |

|

1,060 |

|

990 |

|

828 |

|

997 |

|

| Transmission |

699 |

|

135 |

|

214 |

|

713 |

|

136 |

|

208 |

|

720 |

|

461 |

|

698 |

|

675 |

|

432 |

|

641 |

|

Oil Sands &

Heavy Oil |

1,050 |

|

34 |

|

65 |

|

1,033 |

|

33 |

|

67 |

|

1,042 |

|

101 |

|

195 |

|

1,019 |

|

113 |

|

209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

2,750 |

|

477 |

|

630 |

|

2,738 |

|

433 |

|

593 |

|

2,775 |

|

1,468 |

|

1,953 |

|

2,684 |

|

1,373 |

|

1,847 |

|

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's conventional, transmission and oil sands and heavy oil assets within the Pipelines Division. Refer to Pembina's AIF for the year ended December 31, 2024.

Projects & New Developments(1)

The following outlines the projects and new developments that have recently come into service within Pipelines:

|

|

|

|

|

|

| Significant Projects |

In-service Date |

Phase VIII Peace Pipeline Expansion |

May 2024 |

| NEBC MPS Expansion |

November 2024 |

|

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2024 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

Pembina is advancing more than $1.0 billion of conventional NGL and condensate pipeline expansions to reliably and cost-effectively meet rising transportation demand from growing production in the WCSB. Pembina's outlook for volume growth is secured by long-term contracts underpinned by take-or-pay agreements, areas of dedication across the Montney and Duvernay formations, and other long-term agreements that ensure a strong base of committed volumes.

Engineering activities are continuing and subject to regulatory and board approval, Pembina expects to move forward with each of the following expansions:

•Fox Creek-to-Namao Expansion – an expansion of the Peace Pipeline system that, through the addition of new pump stations, would add approximately 70,000 bpd of propane-plus capacity to the market delivery pipelines from Fox Creek, Alberta to Namao, Alberta. A final investment decision is expected by the end of 2025.

•Taylor-to-Gordondale Project – a new approximately 89 kilometer, 16-inch pipeline proposed by Pouce Coupé Pipe Line Ltd. (a subsidiary of Pembina) connecting mostly condensate volumes from Taylor, British Columbia to the Gordondale, Alberta area. A final investment decision is anticipated in 2026.

•Birch-to-Taylor NEBC System Expansion – a new 95-kilometre pipeline and facility upgrades that would add propane-plus and condensate capacity to that segment of the NEBC Pipeline system. A final investment decision is expected in 2026.

12 Pembina Pipeline Corporation Third Quarter 2025

Facilities

Financial Overview for the Three Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

Facilities revenue(1) |

300 |

|

282 |

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses(1) |

134 |

|

123 |

|

11 |

|

|

Depreciation and amortization included in gross profit |

48 |

|

50 |

|

(2) |

|

|

Share of (loss) profit from equity accounted investees |

(51) |

|

34 |

|

(85) |

|

|

| Gross profit |

67 |

|

143 |

|

(76) |

|

|

| Earnings |

58 |

|

131 |

|

(73) |

|

|

Adjusted EBITDA(2) |

354 |

|

324 |

|

30 |

|

|

Volumes(3) |

861 |

|

810 |

|

51 |

|

|

|

|

|

|

|

|

|

| Changes in Results |

|

|

|

|

|

|

|

|

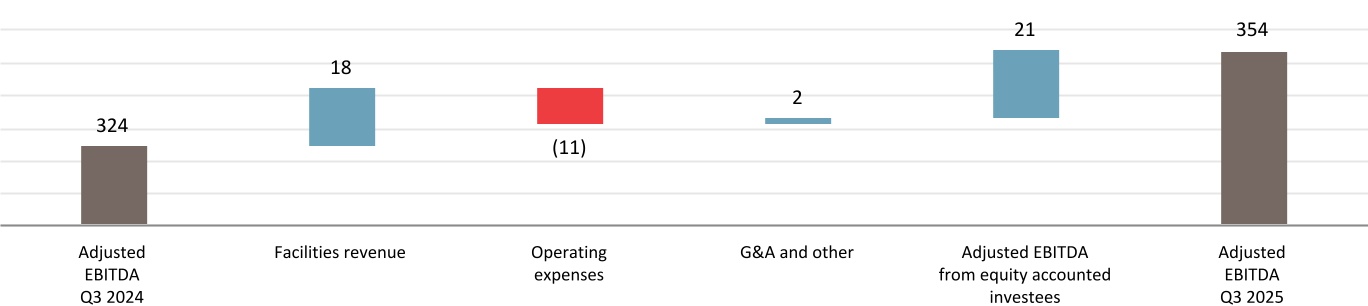

Revenue(1) |

|

Increase largely due to higher utilization at the Redwater Complex and certain other Facilities assets in the third quarter of 2025 compared to the third quarter in 2024, which resulted in higher recoveries. |

Operating expenses(1) |

|

Increase primarily due to higher utilization at the Redwater Complex and certain other Facilities assets in the third quarter of 2025 compared to the third quarter in 2024, which resulted in minor increases across multiple operating costs. |

|

|

|

| Share of (loss) profit from equity accounted investees |

|

Decrease due to lower earnings from PGI largely the result of impairment of $146 million (net to Pembina, after tax), recognized on certain PGI assets. This was partially offset by the recognition of a $23 million gain (net to Pembina, after tax) following the amendment of PGI's credit facility in the third quarter of 2025, as well as lower losses recognized by PGI on interest rate derivative financial instruments. Additionally, offsets include higher contributions from certain PGI assets related to the net impact of PGI's acquisition of a 50 percent working interest in Whitecap Resources Inc.’s (“Whitecap”) Kaybob Complex and PGI’s acquisition of Whitecap’s Gold Creek and Karr oil batteries, in the fourth quarter of 2024 (collectively, the “Whitecap Transactions”). This is combined with higher capital recoveries due to a turnaround that began in the second quarter of 2025 and continued into the third quarter, and higher volumes at the Duvernay Complex. |

| Earnings |

|

Decrease largely due to a share of loss from PGI in the third quarter of 2025, compared to a share of profit in the third quarter of 2024, discussed above. |

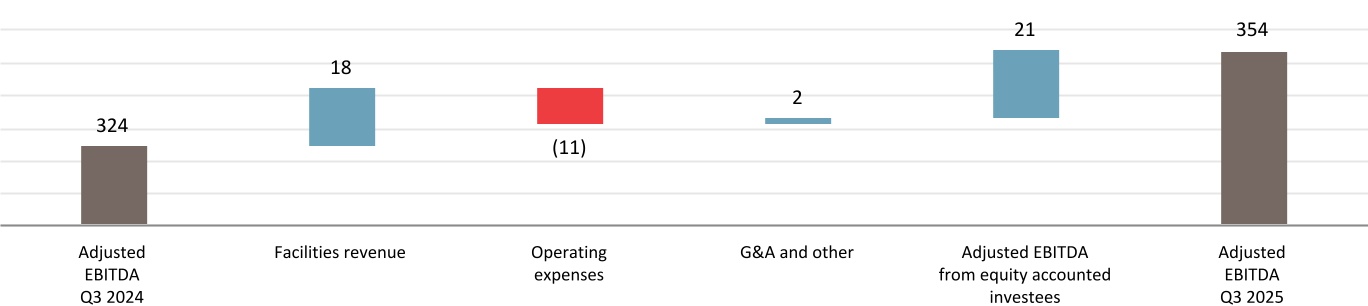

Adjusted EBITDA(2) |

|

Increase primarily due to higher contributions from PGI assets related to the Whitecap Transactions, higher capital recoveries, and higher volumes at the Duvernay Complex. Included in adjusted EBITDA is $191 million (2024: $170 million) related to PGI. |

|

|

|

Volumes(3) |

|

Increase is primarily attributed to higher volumes at the Redwater Complex and at Younger due to a planned outage and a rail strike impacting the Redwater Complex that occurred in the third quarter of 2024, which resulted in volume curtailments. Additionally, increased volumes at Aux Sable due to higher utilization in the 2025 period as the 2024 period was impacted by a nine-day unplanned outage in July 2024. These increases were partially offset by lower volumes at PGI, largely due to volume curtailments at certain PGI assets resulting from a turnaround that began in the second quarter of 2025 and continued into the third quarter, offset in part by higher volumes at the Duvernay Complex and on certain other PGI assets due to the Whitecap Transactions. Volumes include 357 mboe/d (2024: 360 mboe/d) related to PGI. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation Third Quarter 2025 13

Financial Overview for the Nine Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

Facilities revenue(1) |

902 |

|

807 |

|

95 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses(1) |

400 |

|

336 |

|

64 |

|

|

Depreciation and amortization included in gross profit |

152 |

|

128 |

|

24 |

|

|

Share of profit from equity accounted investees |

60 |

|

172 |

|

(112) |

|

|

| Gross profit |

410 |

|

515 |

|

(105) |

|

|

| Earnings |

384 |

|

489 |

|

(105) |

|

|

Adjusted EBITDA(2) |

1,030 |

|

974 |

|

56 |

|

|

Volumes(3) |

861 |

|

823 |

|

38 |

|

|

|

|

|

|

|

|

|

| Changes in Results |

|

|

|

|

|

|

|

|

Revenue(1) |

|

Increase largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with higher operating recoveries at the fractionation facilities within the Redwater Complex, partially offset by the impact of a planned outage at the Redwater Complex related to an asset upgrade in the second quarter of 2025. |

Operating expenses(1) |

|

Increase largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with higher integrity spending at the Redwater Complex, the majority of which are recovered in revenue, along with minor increases across multiple operating costs. |

| Depreciation and amortization included in gross profit |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with an asset upgrade and associated retirement at the Redwater Complex in the second quarter of 2025, resulting in a planned outage during the same period. |

|

|

|

|

|

|

| Share of profit from equity accounted investees |

|

Decrease due to lower earnings from PGI largely the result of impairment of $146 million (net to Pembina, after tax), recognized on certain PGI assets. Additionally, lower revenue driven by lower volumes as a result of outages at certain PGI assets in the second quarter of 2025 that continued into the third quarter, as well as third-party restrictions impacting the Dawson Assets, contributed to a decrease in share of profit from PGI. This was partially offset by the recognition of a $23 million gain (net to Pembina, after tax) following the amendment of PGI's credit facility and lower losses recognized by PGI on interest rate derivative financial instruments. Additionally, higher contributions due to the net impact of the Whitecap Transactions on certain PGI assets, higher capital recoveries due to a turnaround that began in the second quarter of 2025 and continued into the third quarter, and higher volumes at the Duvernay Complex, contributed to the offsetting increase to share of profit from PGI. |

| Earnings |

|

Decrease primarily due to lower share of profit from PGI and higher depreciation expense. This was partially offset by the net impacts of Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024. |

Adjusted EBITDA(2) |

|

Increase primarily due to the net impacts of Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024 and higher contributions from PGI largely the result of the Whitecap Transactions, higher capital recoveries, and higher volumes at the Duvernay Complex. This was partially offset by outages at certain PGI assets in the second quarter of 2025 that continued into the third quarter, and third-party restrictions impacting the Dawson Assets. Included in adjusted EBITDA is $537 million (2024: $516 million) related to PGI. |

Volumes(3) |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with higher utilization in the 2025 period as the 2024 period was impacted by the nine-day unplanned outage at Aux Sable in July 2024. Additionally, higher volumes at the Redwater Complex and Younger were due to a planned outage and a rail strike impacting the Redwater Complex that occurred in the third quarter of 2024, which resulted in volume curtailments. These increases were partially offset by lower volumes at PGI, largely due to volume curtailments at certain PGI assets resulting from a turnaround that began in the second quarter of 2025 and continued into the third quarter, combined with third-party restrictions impacting the Dawson Assets, offset in part by higher volumes at the Duvernay Complex and on certain other PGI assets due to the Whitecap Transactions. Volumes include 356 mboe/d (2024: 358 mboe/d) related to PGI. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

14 Pembina Pipeline Corporation Third Quarter 2025

Financial and Operational Overview

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended September 30 |

9 Months Ended September 30 |

|

2025 |

2024 |

2025 |

2024 |

| ($ millions, except where noted) |

Volumes(1) |

Earnings (loss) |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Facilities(3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Services |

598 |

|

(33) |

|

219 |

|

584 |

|

47 |

|

194 |

|

602 |

|

118 |

|

623 |

|

598 |

|

222 |

|

595 |

|

| NGL Services |

262 |

|

91 |

|

135 |

|

226 |

|

84 |

|

130 |

|

258 |

|

266 |

|

407 |

|

225 |

|

267 |

|

379 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

861 |

|

58 |

|

354 |

|

810 |

|

131 |

|

324 |

|

861 |

|

384 |

|

1,030 |

|

823 |

|

489 |

|

974 |

|

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's gas services and NGL services assets within the Facilities operating segment. For a description of Pembina's gas and NGL assets, refer to Pembina's AIF for the year ended December 31, 2024.

Projects & New Developments(1)

Facilities continues to grow its natural gas and NGL processing and fractionation assets to service customer demand. The following outlines the projects and new developments within Facilities:

|

|

|

|

|

|

|

|

|

| RFS IV |

|

|

Capital Budget: $525 million |

|

|

Revised Capital Cost: $500 million |

In-service Date(2): Q2 2026 |

Status: On time, trending under budget |

RFS IV is a 55,000 bpd propane-plus fractionator at the existing Redwater fractionation and storage complex (the "Redwater Complex"). The project includes additional rail loading capacity and will leverage the design, engineering, and operating best practices of the existing facilities at the Redwater Complex. With the addition of RFS IV, the fractionation capacity at the Redwater Complex will total 256,000 bpd. Pembina has entered into a lump-sum engineering, procurement and construction agreement in respect of the project, for more than 70 percent of the project cost. Engineering, procurement, and fabrication is substantially complete, while field construction has progressed to approximately 75 percent complete. |

|

|

|

|

|

|

|

|

|

| Wapiti Expansion |

|

|

Capital Budget: $140 million (net to Pembina) |

In-service Date(2): Q1 2026 |

Status: On time, trending on budget |

PGI is developing an expansion that will increase natural gas processing capacity at the Wapiti Plant by 115 mmcf/d (gross to PGI). The expansion opportunity is driven by strong customer demand supported by growing Montney production and is fully underpinned by long-term, take-or-pay contracts. The project includes a new sales gas pipeline and other related infrastructure. During the third quarter of 2025, construction activities progressed, with tie-in work nearing completion. |

|

|

|

|

|

|

|

|

|

| K3 Cogeneration Facility |

|

|

Capital Budget: $70 million (net to Pembina) |

In-service Date(2): Q1 2026 |

Status: On time, trending under budget |

PGI is developing a 28 MW cogeneration facility at its K3 Plant, which is expected to reduce overall operating costs by providing power and heat to the gas processing facility, while reducing customers' exposure to power prices. The K3 Cogeneration Facility is expected to fully supply the K3 Plant's power requirements, with excess power sold to the grid at market rates. Further, through the utilization of the cogeneration waste heat and the low-emission power generated, the project is expected to contribute to a reduction in annual emissions compliance costs at the K3 Plant. During the third quarter of 2025, engineering work was completed and construction activities progressed. |

|

|

|

|

|

|

|

|

|

| Prince Rupert Terminal Optimization |

|

|

Capital Budget: $145 million |

In-service Date(2): Mid-2028 |

Status: Recently sanctioned |

| Pembina is optimizing its Prince Rupert Terminal ("PRT"), primarily through increasing storage capacity, that will allow PRT to accommodate Medium Gas Carrier vessels. The PRT optimization is expected to expand access to additional markets with higher realized propane prices, while significantly reducing shipping costs per unit, thereby improving netbacks for Pembina and its customers. The project was sanctioned in the second quarter of 2025. |

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2024 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

(2) Subject to environmental and regulatory approvals. See the "Forward-Looking Statements & Information" section of this MD&A.

Pembina Pipeline Corporation Third Quarter 2025 15

Pursuant to an agreement with Whitecap, PGI has committed to support infrastructure development in the Lator area, including a new battery and gathering laterals (the "Lator Infrastructure"), which PGI will own. PGI anticipates funding up to $400 million ($240 million net to Pembina) for the battery and gathering laterals within the first phase of the Lator Infrastructure development, with all gas volumes flowing to PGI's Musreau facility upon startup, which is expected in the fourth quarter of 2026, supporting long-term plant utilization. Detailed engineering has been completed, long-lead equipment has been ordered, and site clearing is progressing.

Pursuant to an agreement with Whitecap, PGI has committed to fund capital up to $300 million ($180 million net to Pembina) for battery and gathering infrastructure in the Gold Creek and Karr areas, which is expected to be in service in the first half of 2026. Site clearing is complete, construction of the pipeline and detailed engineering is advancing, and the majority of long-lead equipment has been ordered.

Pursuant to an agreement with a Montney producer, PGI has committed to fund and acquire an under-construction battery and additional infrastructure (the "North Gold Creek Battery") in the Wapiti/North Gold Creek Montney area for a capital commitment up to $150 million ($90 million net to Pembina). The North Gold Creek Battery will be operated by the producer and highly contracted under a long-term, take-or-pay agreement. Site clearing has been completed and initial equipment has been set in place. The expected in-service date of the North Gold Creek Battery is the second quarter of 2026.

16 Pembina Pipeline Corporation Third Quarter 2025

Marketing & New Ventures

Financial Overview for the Three Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

Marketing revenue(1) |

861 |

|

938 |

|

(77) |

|

|

Cost of goods sold(1) |

739 |

|

732 |

|

7 |

|

|

Net revenue(1)(2) |

122 |

|

206 |

|

(84) |

|

|

Operating expenses(1) |

7 |

|

5 |

|

2 |

|

|

| Depreciation and amortization included in gross profit |

16 |

|

15 |

|

1 |

|

|

| Share of loss from equity accounted investees |

(14) |

|

(50) |

|

36 |

|

|

| Gross profit |

85 |

|

136 |

|

(51) |

|

|

| Earnings |

68 |

|

125 |

|

(57) |

|

|

Adjusted EBITDA(2) |

99 |

|

159 |

|

(60) |

|

|

Crude oil sales volumes(3) |

111 |

|

117 |

|

(6) |

|

|

NGL sales volumes(3) |

237 |

|

227 |

|

10 |

|

|

|

|

|

|

|

|

|

| Change in Results |

|

|

|

|

|

|

|

|

Net revenue(1)(2) |

|

Lower net revenue from contracts with customers was largely due to a decrease in NGL margins as a result of lower NGL prices and higher input natural gas prices at Aux Sable, partially offset by higher NGL marketed volumes and no similar impact to the nine-day unplanned outage at Aux Sable in July 2024.

Lower revenue from risk management and physical derivative contracts was primarily due to lower realized gains on crude-oil based derivatives and lower unrealized gains on NGL-based derivatives in the third quarter of 2025 compared to the third quarter of 2024. These results were partially offset by unrealized gains on renewable power purchase agreements in the third quarter of 2025 compared to losses in the third quarter of 2024, along with lower realized losses on NGL-based derivatives. The third quarter of 2025 includes unrealized gains on commodity-related derivatives of $1 million (2024: $18 million gain) and realized gains on commodity-related derivatives of $39 million (2024: $70 million gain).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share of loss from equity accounted investees |

|

Increase due to lower unrealized losses on interest rate derivative financial instruments recognized by Cedar LNG, partially offset by unrealized foreign exchange losses on U.S. dollar denominated debt recognized in the third quarter of 2025 compared to gains in the third quarter of 2024. |

| Earnings |

|

Decrease primarily due to lower revenue from risk management and physical derivative contracts, discussed above, combined with lower NGL margins. These decreases were partially offset by lower share of loss from Cedar LNG, higher NGL marketed volumes, and no similar impact to the nine-day unplanned outage at Aux Sable in July 2024. |

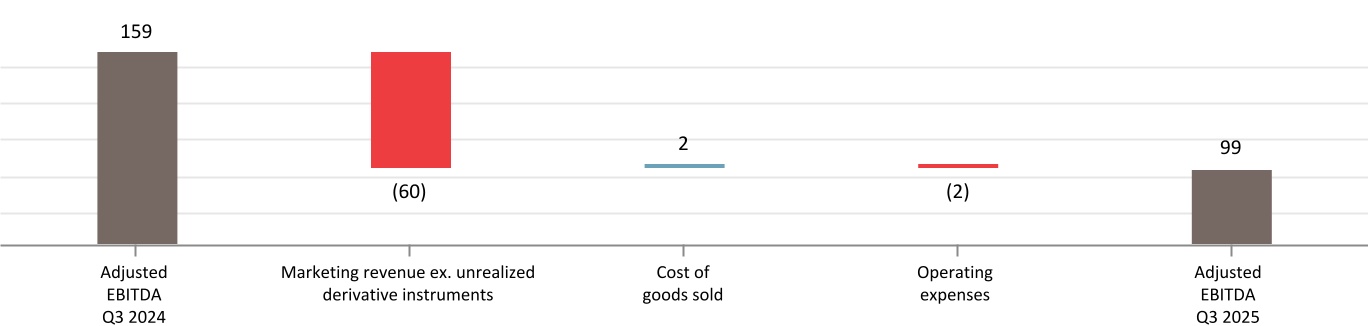

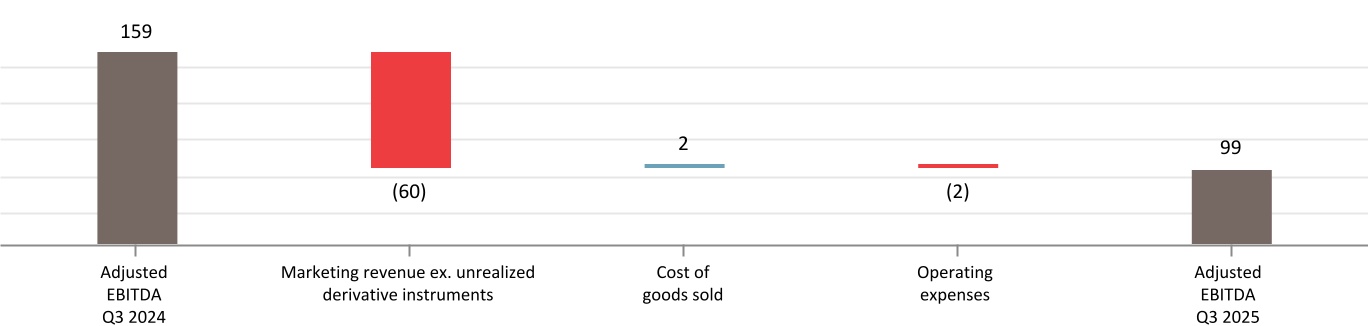

Adjusted EBITDA(2) |

|

Decrease largely due to lower realized gains on crude-oil based derivatives and lower NGL margins, partially offset by lower realized losses on NGL-based derivative, higher NGL marketed volumes, and no similar impact to the nine-day unplanned outage at Aux Sable in July 2024. |

|

|

|

NGL sales volumes(3) |

|

Increase primarily driven by higher supply volumes from the Redwater Complex as the third quarter of 2024 was impacted by a planned outage and a rail strike, which resulted in volume curtailments, combined with no similar impact to the nine-day unplanned outage at Aux Sable in July 2024. This was partially offset by lower ethane sales at Aux Sable. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Marketed crude oil and NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation Third Quarter 2025 17

Financial Overview for the Nine Months Ended September 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

Marketing revenue(1) |

3,080 |

|

2,663 |

|

417 |

|

|

Cost of goods sold(1) |