| Maryland | 001-36105 | 37-1645259 | ||||||||||||

| (State or other Jurisdiction of Incorporation) |

(Commission

File Number)

|

(I.R.S. Employer Identification No.) |

||||||||||||

| Delaware | 001-36106 | 45-4685158 | ||||||||||||

| (State or other Jurisdiction of Incorporation) |

(Commission

File Number)

|

(I.R.S. Employer Identification No.) |

||||||||||||

|

111 West 33rd Street,

|

12th Floor | |||||||

| New York, | New York | 10120 | ||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class |

Trading

Symbol(s)

|

Name of each exchange

on which registered

|

||||||||||||

| Empire State Realty Trust, Inc. | ||||||||||||||

| Class A Common Stock, par value $0.01 per share | ESRT | The New York Stock Exchange | ||||||||||||

| Empire State Realty OP, L.P. | ||||||||||||||

| Series ES Operating Partnership Units | ESBA | NYSE Arca, Inc. | ||||||||||||

| Series 60 Operating Partnership Units | OGCP | NYSE Arca, Inc. | ||||||||||||

| Series 250 Operating Partnership Units | FISK | NYSE Arca, Inc. | ||||||||||||

| Item 2.02. | Results of Operations and Financial Condition. | ||||

| Item 7.01. | Regulation FD Disclosure | ||||

| Exhibit No. | Description | ||||

| 104 | Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document). | ||||

|

Date: July 23, 2025

|

EMPIRE STATE REALTY TRUST, INC. (Registrant)

By: /s/ Stephen V. Horn

Name: Stephen V. Horn

Title: Executive Vice President, Chief Financial Officer & Chief Accounting Officer

|

||||

|

Date: July 23, 2025

|

EMPIRE STATE REALTY OP, L.P.

(Registrant)

By: Empire State Realty Trust, Inc., as general partner

By: /s/ Stephen V. Horn

Name: Stephen V. Horn

Title: Executive Vice President, Chief Financial Officer & Chief Accounting Officer

|

||||

June 30, 20251 |

March 31, 20251 |

June 30, 20241 |

||||||||||||

Percent occupied: |

||||||||||||||

Total commercial portfolio |

89.0% | 87.9% | 88.9% | |||||||||||

Total office |

88.9% | 87.5% | 88.6% | |||||||||||

Manhattan office |

89.5% | 88.1% | 89.3% | |||||||||||

| Total retail | 89.9% | 91.2% | 92.3% | |||||||||||

Percent leased (includes signed leases not commenced): | ||||||||||||||

Total commercial portfolio |

92.9% | 92.5% | 93.1% | |||||||||||

Total office |

93.1% | 92.3% | 93.0% | |||||||||||

Manhattan office |

93.8% | 93.0% | 93.8% | |||||||||||

| Total retail | 90.7% | 94.1% | 93.5% | |||||||||||

Total multifamily portfolio |

98.6% | 99.0% | 97.9% | |||||||||||

Total Portfolio |

Leases executed |

Square

footage executed

|

Average cash rent psf – leases executed |

% of new cash rent over / under previously escalated rents |

||||||||||

Office |

18 | 221,776 | 71.21 | 12.1 | % | |||||||||

Retail |

4 | 10,332 | 268.92 | (15.0) | % | |||||||||

Total Overall |

22 | 232,108 | 80.01 | 7.0 | % | |||||||||

Manhattan Office Portfolio |

Leases executed |

Square

footage executed

|

Average cash rent psf – leases executed |

% of new cash rent over / under previously escalated rents |

||||||||||

New Office |

16 | 202,499 | 72.28 | 14.5 | % | |||||||||

Renewal Office |

2 | 19,277 | 59.97 | (11.2) | % | |||||||||

Total Office |

18 | 221,776 | 71.21 | 12.1 | % | |||||||||

Key Assumptions |

2025 Updated Guidance (July 2025) |

2025 Initial Guidance (Feb 2025) |

Comments |

||||||||

Earnings |

|||||||||||

Core FFO Per Fully Diluted Share |

$0.83 to $0.86 |

$0.86 to $0.89 |

•2025 includes ~$0.05 from multifamily assets |

||||||||

Commercial Property Drivers |

|||||||||||

Commercial Occupancy at year-end |

89% to 91% |

89% to 91% | |||||||||

|

SS Property Cash NOI

(excluding lease termination fees)

|

–2.0% to +1.5% |

–2.0% to +1.5% |

•Assumes positive revenue y/y growth

•Assumes a ~2.0 to 4.0% y/y increase in operating expenses and real estate taxes

•2025 SS NOI y/y growth is expected to range from ~0.5 to 4.0% relative to 2024 excluding one-time items

|

||||||||

Observatory Drivers |

|||||||||||

Observatory NOI |

$90M to $94M |

$97M to $102M |

•Reflects average quarterly expenses of ~$9 to 10M |

||||||||

Low |

High |

|||||||

| Net Income (Loss) Attributable to Common Stockholders and the Operating Partnership | $0.22 | $0.25 | ||||||

Add: |

||||||||

Impairment Charge |

0.00 | 0.00 | ||||||

Real Estate Depreciation & Amortization |

0.65 | 0.65 | ||||||

Less: |

||||||||

Private Perpetual Distributions |

0.02 | 0.02 | ||||||

Gain on Disposal of Real Estate, net |

0.05 | 0.05 | ||||||

FFO Attributable to Common Stockholders and the Operating Partnership |

$0.80 | $0.83 | ||||||

Add: |

||||||||

Amortization of Below Market Ground Lease |

0.03 | 0.03 | ||||||

Core FFO Attributable to Common Stockholders and the Operating Partnership |

$0.83 | $0.86 | ||||||

Empire State Realty Trust, Inc. | |||||||||||

Condensed Consolidated Statements of Operations | |||||||||||

|

(unaudited and amounts in thousands, except per share data)

| |||||||||||

| Three Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Revenues |

|||||||||||

Rental revenue |

$ | 153,540 | $ | 152,470 | |||||||

Observatory revenue |

33,899 | 34,124 | |||||||||

Lease termination fees |

464 | — | |||||||||

Third-party management and other fees |

408 | 376 | |||||||||

Other revenue and fees |

2,939 | 2,573 | |||||||||

Total revenues |

191,250 | 189,543 | |||||||||

Operating expenses |

|||||||||||

Property operating expenses |

44,880 | 41,516 | |||||||||

Ground rent expenses |

2,332 | 2,332 | |||||||||

General and administrative expenses |

18,685 | 18,020 | |||||||||

Observatory expenses |

9,822 | 8,958 | |||||||||

Real estate taxes |

32,607 | 31,883 | |||||||||

Depreciation and amortization |

47,802 | 47,473 | |||||||||

Total operating expenses |

156,128 | 150,182 | |||||||||

Total operating income |

35,122 | 39,361 | |||||||||

Other income (expense): |

|||||||||||

Interest income |

1,867 | 5,092 | |||||||||

Interest expense |

(25,126) | (25,323) | |||||||||

Interest expense associated with property in receivership |

— | (628) | |||||||||

Gain on disposition of property |

— | 10,803 | |||||||||

Income before income taxes |

11,863 | 29,305 | |||||||||

Income tax expense |

(478) | (750) | |||||||||

Net income |

11,385 | 28,555 | |||||||||

Net income attributable to non-controlling interests: |

|||||||||||

Non-controlling interest in the Operating Partnership |

(3,815) | (10,433) | |||||||||

Preferred unit distributions |

(1,051) | (1,051) | |||||||||

Net income attributable to common stockholders |

$ | 6,519 | $ | 17,071 | |||||||

Total weighted average shares |

|||||||||||

Basic |

168,368 | 164,277 | |||||||||

Diluted |

269,951 | 268,716 | |||||||||

Earnings per share attributable to common stockholders |

|||||||||||

Basic |

$ | 0.04 | $ | 0.10 | |||||||

Diluted |

$ | 0.04 | $ | 0.10 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Condensed Consolidated Statements of Operations | |||||||||||

|

(unaudited and amounts in thousands, except per share data)

| |||||||||||

| Six Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Revenues |

|||||||||||

Rental revenue |

$ | 308,082 | $ | 306,352 | |||||||

Observatory revenue |

57,060 | 58,720 | |||||||||

Lease termination fees |

464 | — | |||||||||

Third-party management and other fees |

839 | 641 | |||||||||

Other revenue and fees |

4,871 | 5,009 | |||||||||

Total revenues |

371,316 | 370,722 | |||||||||

Operating expenses |

|||||||||||

Property operating expenses |

89,940 | 86,576 | |||||||||

Ground rent expenses |

4,663 | 4,663 | |||||||||

General and administrative expenses |

35,625 | 33,992 | |||||||||

Observatory expenses |

17,940 | 17,389 | |||||||||

Real estate taxes |

65,657 | 64,124 | |||||||||

Depreciation and amortization |

96,581 | 93,554 | |||||||||

Total operating expenses |

310,406 | 300,298 | |||||||||

Total operating income |

60,910 | 70,424 | |||||||||

Other income (expense): |

|||||||||||

Interest income |

5,653 | 9,270 | |||||||||

Interest expense |

(52,064) | (50,451) | |||||||||

Interest expense associated with property in receivership |

(647) | (628) | |||||||||

Loss on early extinguishment of debt |

— | (553) | |||||||||

Gain on disposition of property |

13,170 | 10,803 | |||||||||

Income before income taxes |

27,022 | 38,865 | |||||||||

Income tax (expense) benefit |

141 | (95) | |||||||||

Net income |

27,163 | 38,770 | |||||||||

Net income attributable to non-controlling interests: |

|||||||||||

Non-controlling interest in the Operating Partnership |

(9,323) | (13,933) | |||||||||

Non-controlling interests in other partnerships |

— | (4) | |||||||||

Preferred unit distributions |

(2,101) | (2,101) | |||||||||

Net income attributable to common stockholders |

$ | 15,739 | $ | 22,732 | |||||||

Total weighted average shares |

|||||||||||

Basic |

167,644 | 163,988 | |||||||||

Diluted |

269,739 | 268,105 | |||||||||

Earnings per share attributable to common stockholders |

|||||||||||

Basic |

$ | 0.09 | $ | 0.14 | |||||||

Diluted |

$ | 0.09 | $ | 0.14 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Reconciliation of Net Income to Funds From Operations (“FFO”), | |||||||||||

Modified Funds From Operations (“Modified FFO”) and Core Funds From Operations (“Core FFO”) | |||||||||||

(unaudited and amounts in thousands, except per share data) | |||||||||||

| Three Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Net income |

$ | 11,385 | $ | 28,555 | |||||||

Preferred unit distributions |

(1,051) | (1,051) | |||||||||

Real estate depreciation and amortization |

46,921 | 46,398 | |||||||||

Gain on disposition of property |

— | (10,803) | |||||||||

FFO attributable to common stockholders and Operating Partnership units |

57,255 | 63,099 | |||||||||

Amortization of below-market ground leases |

1,958 | 1,958 | |||||||||

Modified FFO attributable to common stockholders and Operating Partnership units |

59,213 | 65,057 | |||||||||

Interest expense associated with property in receivership |

— | 628 | |||||||||

Core FFO attributable to common stockholders and Operating Partnership units |

$ | 59,213 | $ | 65,685 | |||||||

Total weighted average shares and Operating Partnership units |

|||||||||||

Basic |

266,899 | 264,676 | |||||||||

Diluted |

269,951 | 268,716 | |||||||||

FFO per share |

|||||||||||

Basic |

$ | 0.21 | $ | 0.24 | |||||||

Diluted |

$ | 0.21 | $ | 0.23 | |||||||

Modified FFO per share |

|||||||||||

Basic |

$ | 0.22 | $ | 0.25 | |||||||

Diluted |

$ | 0.22 | $ | 0.24 | |||||||

Core FFO per share |

|||||||||||

Basic |

$ | 0.22 | $ | 0.25 | |||||||

Diluted |

$ | 0.22 | $ | 0.24 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Reconciliation of Net Income to Funds From Operations (“FFO”), | |||||||||||

Modified Funds From Operations (“Modified FFO”) and Core Funds From Operations (“Core FFO”) | |||||||||||

(unaudited and amounts in thousands, except per share data) | |||||||||||

| Six Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Net income |

$ | 27,163 | $ | 38,770 | |||||||

Non-controlling interests in other partnerships |

— | (4) | |||||||||

Preferred unit distributions |

(2,101) | (2,101) | |||||||||

Real estate depreciation and amortization |

94,792 | 91,255 | |||||||||

Gain on disposition of property |

(13,170) | (10,803) | |||||||||

FFO attributable to common stockholders and Operating Partnership units |

106,684 | 117,117 | |||||||||

Amortization of below-market ground leases |

3,916 | 3,916 | |||||||||

Modified FFO attributable to common stockholders and Operating Partnership units |

110,600 | 121,033 | |||||||||

Interest expense associated with property in receivership |

647 | 628 | |||||||||

| Loss on early extinguishment of debt | — | 553 | |||||||||

Core FFO attributable to common stockholders and Operating Partnership units |

$ | 111,247 | $ | 122,214 | |||||||

Total weighted average shares and Operating Partnership units |

|||||||||||

Basic |

266,985 | 264,619 | |||||||||

Diluted |

269,739 | 268,105 | |||||||||

FFO per share |

|||||||||||

Basic |

$ | 0.40 | $ | 0.44 | |||||||

Diluted |

$ | 0.40 | $ | 0.44 | |||||||

Modified FFO per share |

|||||||||||

Basic |

$ | 0.41 | $ | 0.46 | |||||||

Diluted |

$ | 0.41 | $ | 0.45 | |||||||

Core FFO per share |

|||||||||||

Basic |

$ | 0.42 | $ | 0.46 | |||||||

Diluted |

$ | 0.41 | $ | 0.46 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Condensed Consolidated Balance Sheets | |||||||||||

(unaudited and amounts in thousands) | |||||||||||

| June 30, 2025 | December 31, 2024 | ||||||||||

Assets |

|||||||||||

Commercial real estate properties, at cost |

$ | 3,903,950 | $ | 3,786,653 | |||||||

Less: accumulated depreciation |

(1,341,144) | (1,274,193) | |||||||||

Commercial real estate properties, net |

2,562,806 | 2,512,460 | |||||||||

Contract asset2 |

— | 170,419 | |||||||||

Cash and cash equivalents |

94,643 | 385,465 | |||||||||

Restricted cash |

42,084 | 43,837 | |||||||||

Tenant and other receivables |

28,124 | 31,427 | |||||||||

Deferred rent receivables |

255,272 | 247,754 | |||||||||

Prepaid expenses and other assets |

85,083 | 101,852 | |||||||||

Deferred costs, net |

181,694 | 183,987 | |||||||||

Acquired below market ground leases, net |

309,495 | 313,410 | |||||||||

Right of use assets |

28,070 | 28,197 | |||||||||

Goodwill |

491,479 | 491,479 | |||||||||

Total assets |

$ | 4,078,750 | $ | 4,510,287 | |||||||

Liabilities and equity |

|||||||||||

Mortgage notes payable, net |

$ | 691,440 | $ | 692,176 | |||||||

Senior unsecured notes, net |

1,097,355 | 1,197,061 | |||||||||

Unsecured term loan facility, net |

268,883 | 268,731 | |||||||||

Unsecured revolving credit facility |

— | 120,000 | |||||||||

Debt associated with property in receivership |

— | 177,667 | |||||||||

Accrued interest associated with property in receivership |

— | 5,433 | |||||||||

Accounts payable and accrued expenses |

104,315 | 132,016 | |||||||||

Acquired below market leases, net |

17,081 | 19,497 | |||||||||

Ground lease liabilities |

28,070 | 28,197 | |||||||||

Deferred revenue and other liabilities |

55,343 | 62,639 | |||||||||

Tenants’ security deposits |

27,015 | 24,908 | |||||||||

Total liabilities |

2,289,502 | 2,728,325 | |||||||||

Total equity |

1,789,248 | 1,781,962 | |||||||||

Total liabilities and equity |

$ | 4,078,750 | $ | 4,510,287 | |||||||

|

|||||

Second Quarter 2025 | |||||

| Table of Content | Page | ||||

| Summary | |||||

| Supplemental Definitions | |||||

| Company Profile | |||||

| Condensed Consolidated Balance Sheets | |||||

| Condensed Consolidated Statements of Operations | |||||

| FFO, Modified FFO, Core FFO, FAD and EBITDA | |||||

| Highlights | |||||

| Selected Property Data | |||||

| Property Summary Net Operating Income | |||||

| Same Store Net Operating Income | |||||

| Leasing Activity | |||||

| Commercial Property Detail | |||||

| Portfolio Expirations and Vacates Summary | |||||

| Tenant Lease Expirations | |||||

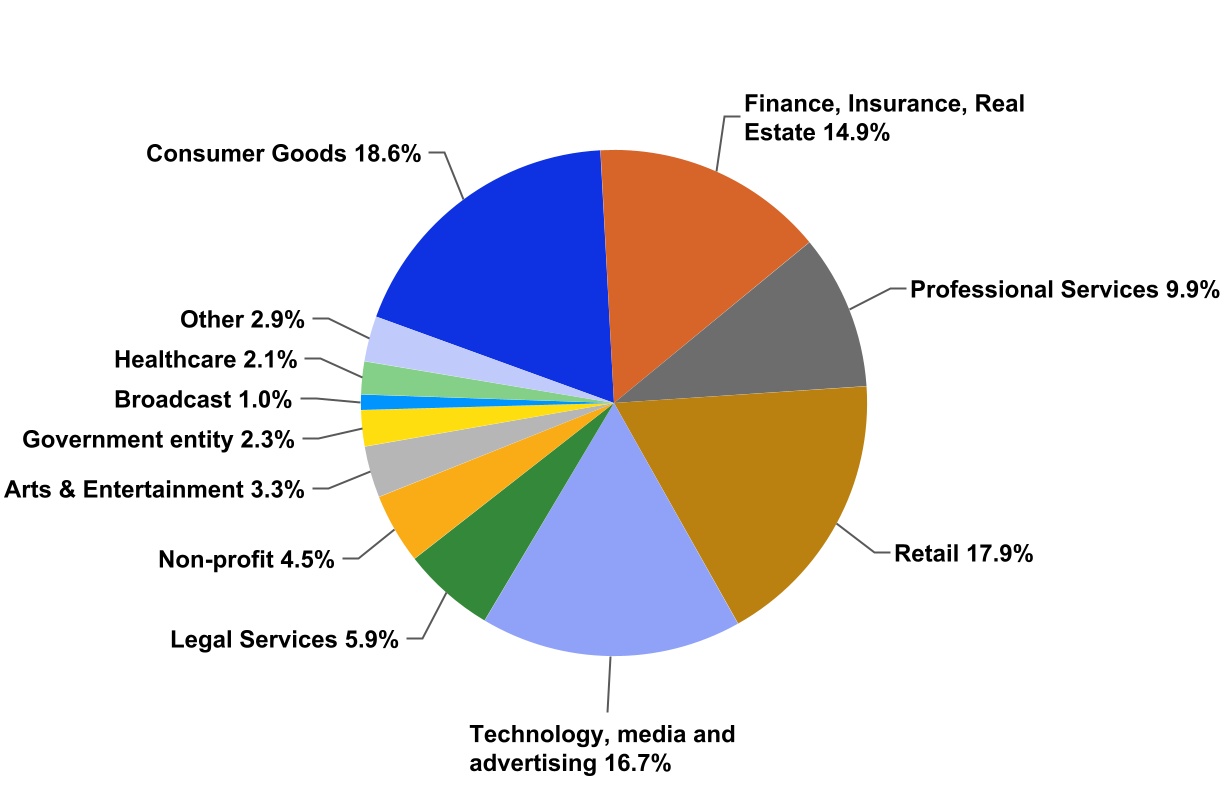

| Largest Tenants and Portfolio Tenant Diversification by Industry | |||||

| Initial Cash Rent Contributing to Cash NOI, Capital Expenditures and Redevelopment Program | |||||

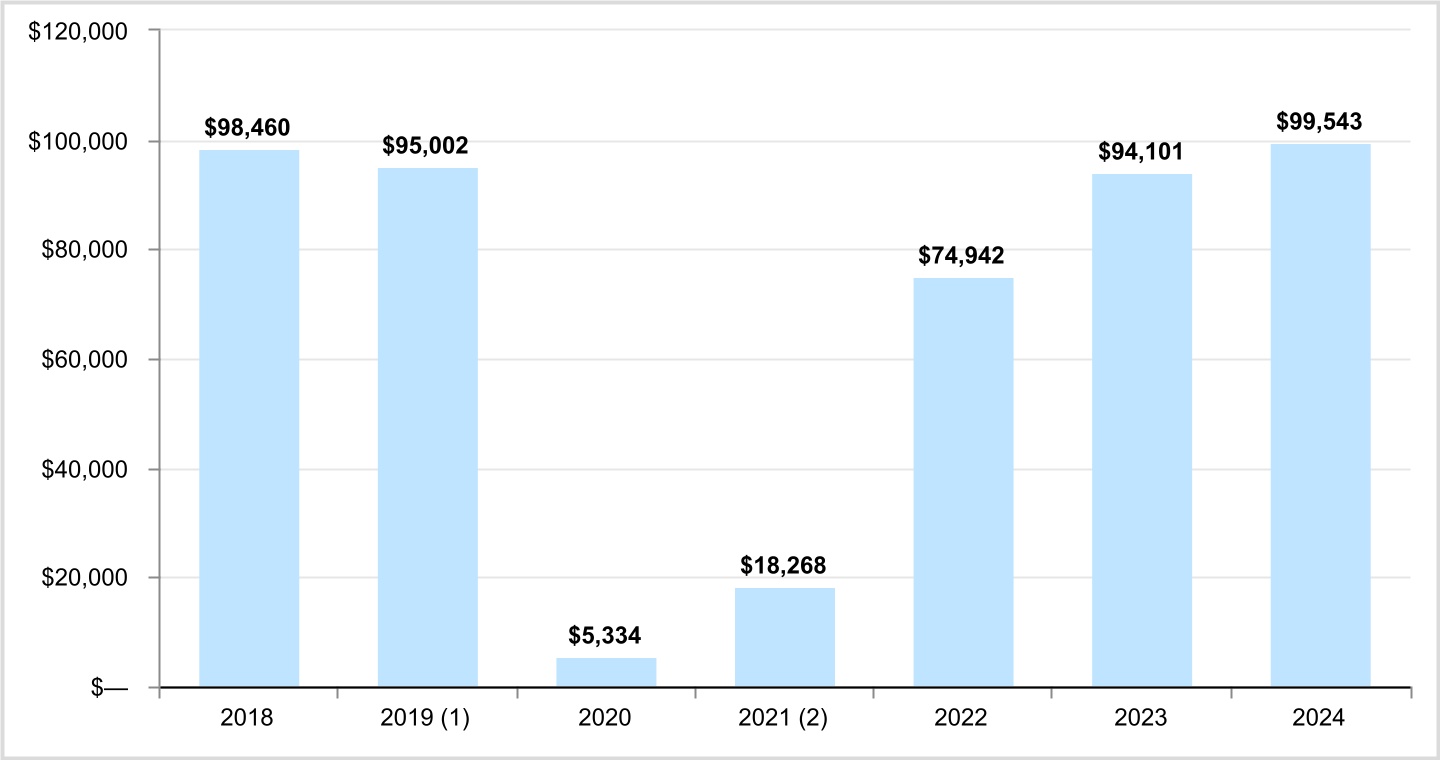

| Observatory Summary | |||||

| Financial information | |||||

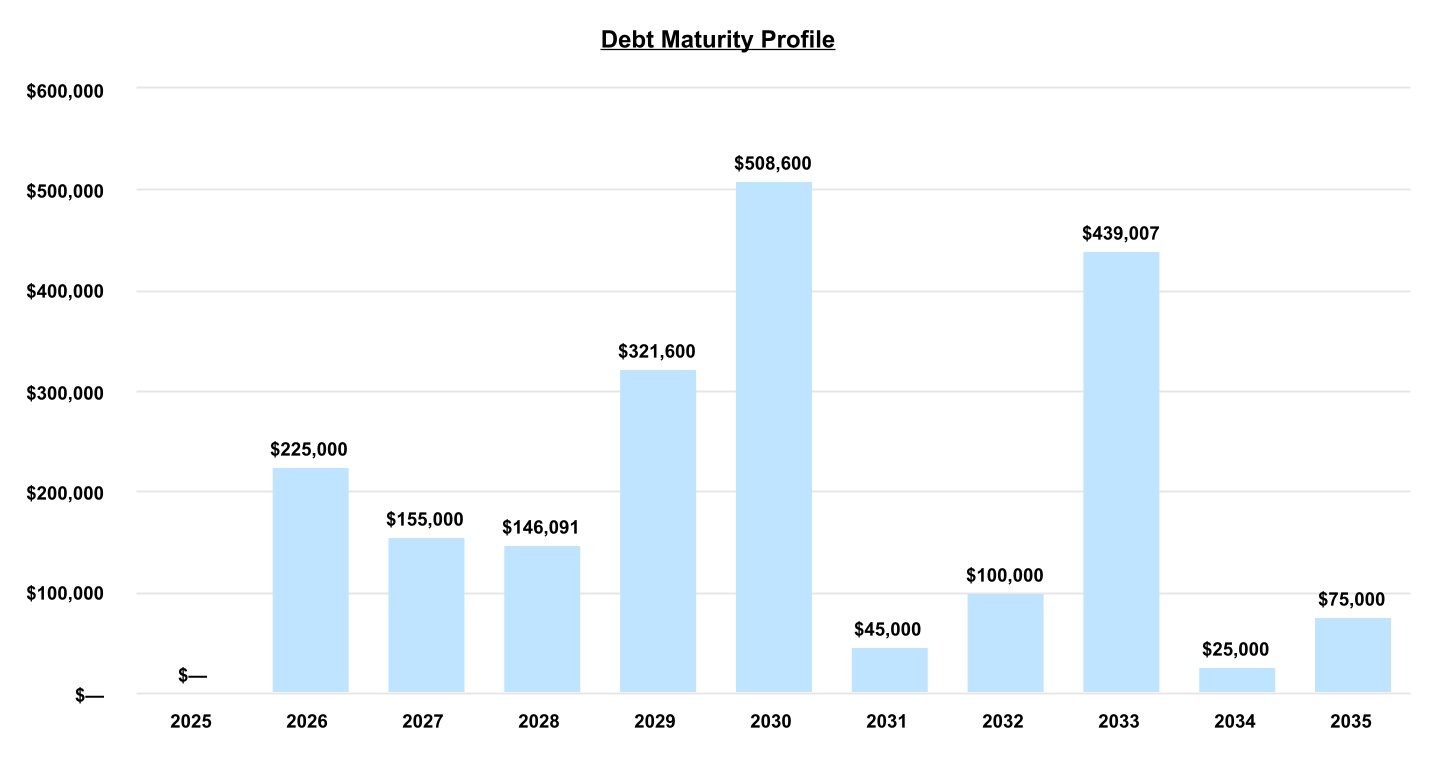

| Consolidated Debt Analysis | |||||

| Debt Summary | |||||

| Debt Detail | |||||

| Debt Maturities | |||||

| Ground Leases | |||||

|

|||||

Second Quarter 2025 | |||||

| Supplemental Definitions | |||||

|

|||||

Second Quarter 2025 | |||||

| Supplemental Definitions | |||||

|

|||||

Second Quarter 2025 | |||||

| COMPANY PROFILE | ||||||||

| BROAD OF DIRECTORS | |||||

| Anthony E. Malkin | Chairman and Chief Executive Officer | ||||

| Steven J. Gilbert | Director, Lead Independent Director, Chair of the Compensation Committee | ||||

| S. Michael Giliberto | Director, Chair of the Audit Committee | ||||

| Patricia S. Han | Director | ||||

| Grant H. Hill | Director | ||||

| R. Paige Hood | Director, Chair of the Finance Committee | ||||

| George L. W. Malkin | Director | ||||

| James D. Robinson IV | Director, Chair of the Nominating and Corporate Governance Committee | ||||

| Christina Van Tassell | Director | ||||

| Hannah Yang | Director | ||||

| EXECUTIVE MANAGEMENT | |||||

| Anthony E. Malkin | Chairman and Chief Executive Officer | ||||

| Christina Chiu | President | ||||

| Thomas P. Durels | Executive Vice President, Real Estate | ||||

| Steve Horn | Executive Vice President, Chief Financial Officer & Chief Accounting Officer | ||||

| COMPANY INFORMATION | ||||||||

| Corporate Headquarters | Investor Relations | New York Stock Exchange | ||||||

| 111 West 33rd Street, 12th Floor | IR@esrtreit.com | Trading Symbol: ESRT |

||||||

| New York, NY 10120 | ||||||||

| www.esrtreit.com | ||||||||

| (212) 687-8700 | ||||||||

| RESEARCH COVERAGE | |||||||||||

| Bank of America Merrill Lynch | Jeff Spector | (646) 855-1363 | jeff.spector@bofa.com | ||||||||

| BMO Capital Markets Corp. | John Kim | (212) 885-4115 | jp.kim@bmo.com | ||||||||

| BTIG | Thomas Catherwood | (212) 738-6140 | tcatherwood@btig.com | ||||||||

| Citi | Seth Bergey | (212) 816-2066 | seth.bergey@citi.com | ||||||||

| Evercore ISI | Steve Sakwa | (212) 446-9462 | steve.sakwa@evercoreisi.com | ||||||||

| Green Street Advisors | Dylan Burzinski | (949) 640-8780 | dburzinski@greenstreetadvisors.com | ||||||||

| KeyBanc Capital Markets | Todd Thomas | (917) 368-2286 | tthomas@key.com | ||||||||

| Wells Fargo Securities, LLC | Blaine Heck | (443) 263-6529 | blaine.heck@wellsfargo.com | ||||||||

| Wolfe Research | Ally Yaseen | (646) 582-9253 | ayaseen@wolferesearch.com | ||||||||

|

Second Quarter 2025 |

||||

| Condensed Consolidated Balance Sheet | |||||

| (unaudited and dollars in thousands) | |||||

| Assets | June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

||||||||||||||||||||||||

| Commercial real estate properties, at cost | $ | 3,903,950 | $ | 3,825,422 | $ | 3,786,653 | $ | 3,667,687 | $ | 3,503,302 | |||||||||||||||||||

| Less: accumulated depreciation | (1,341,144) | (1,306,924) | (1,274,193) | (1,241,454) | (1,206,039) | ||||||||||||||||||||||||

| Commercial real estate properties, net | 2,562,806 | 2,518,498 | 2,512,460 | 2,426,233 | 2,297,263 | ||||||||||||||||||||||||

Contract asset(1) |

— | — | 170,419 | 168,687 | 166,955 | ||||||||||||||||||||||||

| Cash and cash equivalents | 94,643 | 187,823 | 385,465 | 421,896 | 535,533 | ||||||||||||||||||||||||

| Restricted cash | 42,084 | 49,589 | 43,837 | 48,023 | 41,015 | ||||||||||||||||||||||||

| Tenant and other receivables | 28,124 | 29,071 | 31,427 | 34,068 | 34,665 | ||||||||||||||||||||||||

| Deferred rent receivables | 255,272 | 252,299 | 247,754 | 244,448 | 242,940 | ||||||||||||||||||||||||

| Prepaid expenses and other assets | 85,083 | 64,233 | 101,852 | 81,758 | 105,438 | ||||||||||||||||||||||||

| Deferred costs, net | 181,694 | 181,802 | 183,987 | 176,720 | 172,318 | ||||||||||||||||||||||||

| Acquired below-market ground leases, net | 309,495 | 311,452 | 313,410 | 315,368 | 317,326 | ||||||||||||||||||||||||

| Right of use assets | 28,070 | 28,134 | 28,197 | 28,257 | 28,318 | ||||||||||||||||||||||||

| Goodwill | 491,479 | 491,479 | 491,479 | 491,479 | 491,479 | ||||||||||||||||||||||||

| Total assets | $ | 4,078,750 | $ | 4,114,380 | $ | 4,510,287 | $ | 4,436,937 | $ | 4,433,250 | |||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||

| Mortgage notes payable, net | $ | 691,440 | $ | 691,816 | $ | 692,176 | $ | 692,989 | $ | 700,348 | |||||||||||||||||||

| Senior unsecured notes, net | 1,097,355 | 1,097,212 | 1,197,061 | 1,196,911 | 1,196,831 | ||||||||||||||||||||||||

| Unsecured term loan facility, net | 268,883 | 268,807 | 268,731 | 268,655 | 268,580 | ||||||||||||||||||||||||

| Unsecured revolving credit facility | — | — | 120,000 | 120,000 | 120,000 | ||||||||||||||||||||||||

| Debt associated with property in receivership | — | — | 177,667 | 177,667 | 177,667 | ||||||||||||||||||||||||

| Accrued interest associated with property in receivership | — | — | 5,433 | 3,511 | 1,589 | ||||||||||||||||||||||||

| Accounts payable and accrued expenses | 104,315 | 135,298 | 132,016 | 81,443 | 90,908 | ||||||||||||||||||||||||

| Acquired below-market leases, net | 17,081 | 18,306 | 19,497 | 14,702 | 11,872 | ||||||||||||||||||||||||

| Ground lease liabilities | 28,070 | 28,134 | 28,197 | 28,257 | 28,318 | ||||||||||||||||||||||||

| Deferred revenue and other liabilities | 55,343 | 61,888 | 62,639 | 70,766 | 61,890 | ||||||||||||||||||||||||

| Tenants' security deposits | 27,015 | 27,044 | 24,908 | 24,715 | 24,031 | ||||||||||||||||||||||||

| Total liabilities | 2,289,502 | 2,328,505 | 2,728,325 | 2,679,616 | 2,682,034 | ||||||||||||||||||||||||

| Total equity | 1,789,248 | 1,785,875 | 1,781,962 | 1,757,321 | 1,751,216 | ||||||||||||||||||||||||

| Total liabilities and equity | $ | 4,078,750 | $ | 4,114,380 | $ | 4,510,287 | $ | 4,436,937 | $ | 4,433,250 | |||||||||||||||||||

|

Second Quarter 2025 |

||||

| Condensed Consolidated Statements of Operations | |||||

| (unaudited and in thousands, except per share amounts) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

Rental revenue (1) |

$ | 153,540 | $ | 154,542 | $ | 155,127 | $ | 153,117 | $ | 152,470 | |||||||||||||||||||

| Observatory revenue | 33,899 | 23,161 | 38,275 | 39,382 | 34,124 | ||||||||||||||||||||||||

| Lease termination fees | 464 | — | — | 4,771 | — | ||||||||||||||||||||||||

| Third-party management and other fees | 408 | 431 | 258 | 271 | 376 | ||||||||||||||||||||||||

| Other revenue and fees | 2,939 | 1,932 | 3,942 | 2,058 | 2,573 | ||||||||||||||||||||||||

| Total revenues | 191,250 | 180,066 | 197,602 | 199,599 | 189,543 | ||||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||

| Property operating expenses | 44,880 | 45,060 | 46,645 | 45,954 | 41,516 | ||||||||||||||||||||||||

| Ground rent expenses | 2,332 | 2,331 | 2,332 | 2,331 | 2,332 | ||||||||||||||||||||||||

| General and administrative expenses | 18,685 | 16,940 | 17,870 | 18,372 | 18,020 | ||||||||||||||||||||||||

| Observatory expenses | 9,822 | 8,118 | 9,730 | 9,715 | 8,958 | ||||||||||||||||||||||||

| Real estate taxes | 32,607 | 33,050 | 32,720 | 31,982 | 31,883 | ||||||||||||||||||||||||

| Depreciation and amortization | 47,802 | 48,779 | 45,365 | 45,899 | 47,473 | ||||||||||||||||||||||||

| Total operating expenses | 156,128 | 154,278 | 154,662 | 154,253 | 150,182 | ||||||||||||||||||||||||

| Total operating income | 35,122 | 25,788 | 42,940 | 45,346 | 39,361 | ||||||||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||||||||

| Interest income | 1,867 | 3,786 | 5,068 | 6,960 | 5,092 | ||||||||||||||||||||||||

| Interest expense | (25,126) | (26,938) | (27,380) | (27,408) | (25,323) | ||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | (647) | (1,921) | (1,922) | (628) | ||||||||||||||||||||||||

| Gain on disposition of property | — | 13,170 | 1,237 | 1,262 | 10,803 | ||||||||||||||||||||||||

| Income before income taxes | 11,863 | 15,159 | 19,944 | 24,238 | 29,305 | ||||||||||||||||||||||||

| Income tax (expense) benefit | (478) | 619 | (1,151) | (1,442) | (750) | ||||||||||||||||||||||||

| Net income | 11,385 | 15,778 | 18,793 | 22,796 | 28,555 | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests: | |||||||||||||||||||||||||||||

| Non-controlling interests in the Operating Partnership | (3,815) | (5,508) | (6,575) | (8,205) | (10,433) | ||||||||||||||||||||||||

| Private perpetual preferred unit distributions | (1,051) | (1,050) | (1,050) | (1,050) | (1,051) | ||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 6,519 | $ | 9,220 | $ | 11,168 | $ | 13,541 | $ | 17,071 | |||||||||||||||||||

| Weighted average common shares outstanding | |||||||||||||||||||||||||||||

| Basic | 168,368 | 167,181 | 166,671 | 164,880 | 164,277 | ||||||||||||||||||||||||

| Diluted | 269,951 | 269,529 | 270,251 | 269,613 | 268,716 | ||||||||||||||||||||||||

| Earnings per share attributable to common stockholders | |||||||||||||||||||||||||||||

| Basic | $ | 0.04 | $ | 0.06 | $ | 0.07 | $ | 0.08 | $ | 0.10 | |||||||||||||||||||

| Diluted | $ | 0.04 | $ | 0.05 | $ | 0.07 | $ | 0.08 | $ | 0.10 | |||||||||||||||||||

| Dividends per share | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Rental Revenue | June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

||||||||||||||||||||||||

| Base rent | $ | 133,987 | $ | 136,096 | $ | 135,629 | $ | 132,492 | $ | 136,328 | |||||||||||||||||||

| Billed tenant expense reimbursement | 19,553 | 18,446 | 19,498 | 20,625 | 16,142 | ||||||||||||||||||||||||

| Total rental revenue | $ | 153,540 | $ | 154,542 | $ | 155,127 | $ | 153,117 | $ | 152,470 | |||||||||||||||||||

|

Second Quarter 2025 |

||||

| FFO, Modified FFO, Core FFO, Core FAD and EBITDA | |||||

| (unaudited and in thousands, except per share amounts) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Reconciliation of Net Income to FFO, Modified FFO, and Core FFO | June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

||||||||||||||||||||||||

| Net Income | $ | 11,385 | $ | 15,778 | $ | 18,793 | $ | 22,796 | $ | 28,555 | |||||||||||||||||||

| Preferred unit distributions | (1,051) | (1,050) | (1,050) | (1,050) | (1,051) | ||||||||||||||||||||||||

| Real estate depreciation and amortization | 46,921 | 47,871 | 44,386 | 44,871 | 46,398 | ||||||||||||||||||||||||

| Gain on disposition of property | — | (13,170) | (1,237) | (1,262) | (10,803) | ||||||||||||||||||||||||

| FFO attributable to common stockholders and the Operating Partnership | 57,255 | 49,429 | 60,892 | 65,355 | 63,099 | ||||||||||||||||||||||||

| Amortization of below-market ground lease | 1,958 | 1,958 | 1,958 | 1,958 | 1,958 | ||||||||||||||||||||||||

| Modified FFO attributable to common stockholders and the Operating Partnership | 59,213 | 51,387 | 62,850 | 67,313 | 65,057 | ||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | 647 | 1,921 | 1,922 | 628 | ||||||||||||||||||||||||

| Core FFO attributable to common stockholders and the Operating Partnership | $ | 59,213 | $ | 52,034 | $ | 64,771 | $ | 69,235 | $ | 65,685 | |||||||||||||||||||

| Total weighted average shares and Operating Partnership units | |||||||||||||||||||||||||||||

| Basic | 266,899 | 267,073 | 264,798 | 264,787 | 264,676 | ||||||||||||||||||||||||

| Diluted | 269,951 | 269,529 | 270,251 | 269,613 | 268,716 | ||||||||||||||||||||||||

| FFO attributable to common stockholders and the Operating Partnership per share and unit | |||||||||||||||||||||||||||||

| Basic | $ | 0.21 | $ | 0.19 | $ | 0.23 | $ | 0.25 | $ | 0.24 | |||||||||||||||||||

| Diluted | $ | 0.21 | $ | 0.18 | $ | 0.23 | $ | 0.24 | $ | 0.23 | |||||||||||||||||||

| Modified FFO attributable to common stockholders and the Operating Partnership per share and unit | |||||||||||||||||||||||||||||

| Basic | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.25 | $ | 0.25 | |||||||||||||||||||

| Diluted | $ | 0.22 | $ | 0.19 | $ | 0.23 | $ | 0.25 | $ | 0.24 | |||||||||||||||||||

| Core FFO attributable to common stockholders and the Operating Partnership per share and unit | |||||||||||||||||||||||||||||

| Basic | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.26 | $ | 0.25 | |||||||||||||||||||

| Diluted | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.26 | $ | 0.24 | |||||||||||||||||||

| Reconciliation of Core FFO to Core FAD | |||||||||||||||||||||||||||||

| Core FFO | $ | 59,213 | $ | 52,034 | $ | 64,771 | $ | 69,235 | $ | 65,685 | |||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 1,080 | 1,094 | 1,099 | 1,110 | 1,050 | ||||||||||||||||||||||||

| Non-real estate depreciation and amortization | 880 | 908 | 979 | 1,029 | 1,074 | ||||||||||||||||||||||||

| Amortization of non-cash compensation expense | 6,900 | 4,980 | 6,107 | 5,752 | 6,388 | ||||||||||||||||||||||||

| Amortization of loss on interest rate derivative | 1,386 | 1,386 | 1,386 | 1,386 | 1,480 | ||||||||||||||||||||||||

| Deduct: | |||||||||||||||||||||||||||||

| Straight-line rental revenues, above/below market rent, and other non-cash adjustments | (4,913) | (6,407) | (5,044) | (3,082) | (2,744) | ||||||||||||||||||||||||

| Corporate capital expenditures | (234) | (83) | (226) | (121) | (157) | ||||||||||||||||||||||||

| Tenant improvements - second generation | (36,890) | (39,304) | (45,969) | (17,149) | (25,087) | ||||||||||||||||||||||||

| Building improvements - second generation | (7,868) | (5,770) | (9,377) | (7,838) | (11,362) | ||||||||||||||||||||||||

| Leasing commissions - second generation | (7,605) | (7,629) | (10,769) | (3,753) | (3,807) | ||||||||||||||||||||||||

| Core FAD | $ | 11,949 | $ | 1,209 | $ | 2,957 | $ | 46,569 | $ | 32,521 | |||||||||||||||||||

| Reconciliation of Net Income to EBITDA and Adjusted EBITDA | |||||||||||||||||||||||||||||

| Net income | $ | 11,385 | $ | 15,778 | $ | 18,793 | $ | 22,796 | $ | 28,555 | |||||||||||||||||||

| Interest expense | 25,126 | 26,938 | 27,380 | 27,408 | 25,323 | ||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | 647 | 1,921 | 1,922 | 628 | ||||||||||||||||||||||||

| Income tax expense (benefit) | 478 | (619) | 1,151 | 1,442 | 750 | ||||||||||||||||||||||||

| Depreciation and amortization | 47,802 | 48,779 | 45,365 | 45,899 | 47,473 | ||||||||||||||||||||||||

| EBITDA | 84,791 | 91,523 | 94,610 | 99,467 | 102,729 | ||||||||||||||||||||||||

| Gain on disposition of property | — | (13,170) | (1,237) | (1,262) | (10,803) | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 84,791 | $ | 78,353 | $ | 93,373 | $ | 98,205 | $ | 91,926 | |||||||||||||||||||

|

Second Quarter 2025 |

||||

| Highlights | |||||

| (unaudited and dollars and shares in thousands, except per share amounts) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Office and Retail Metrics: | June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

||||||||||||||||||||||||

| Total rentable square footage | 8,626,395 | 8,617,292 | 8,616,284 | 8,592,481 | 8,549,496 | ||||||||||||||||||||||||

Percent occupied (1) |

89.0 | % | 87.9 | % | 88.6 | % | 89.1 | % | 88.9 | % | |||||||||||||||||||

Percent leased (2) |

92.9 | % | 92.5 | % | 93.5 | % | 93.4 | % | 93.1 | % | |||||||||||||||||||

| Same Store Property Cash Net Operating Income (NOI) - excluding lease termination fees: | |||||||||||||||||||||||||||||

| Manhattan office portfolio | $ | 63,589 | $ | 61,548 | $ | 64,110 | $ | 65,069 | $ | 67,165 | |||||||||||||||||||

| Greater New York office portfolio | 1,393 | 1,584 | 1,769 | 1,651 | 1,825 | ||||||||||||||||||||||||

| Retail portfolio | 2,298 | 2,433 | 2,472 | 2,431 | 2,517 | ||||||||||||||||||||||||

| Total Same Store Property Cash NOI | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | $ | 71,507 | |||||||||||||||||||

| Multifamily Metrics: | |||||||||||||||||||||||||||||

| Multifamily Cash NOI | $ | 5,173 | $ | 4,643 | $ | 4,168 | $ | 4,506 | $ | 4,533 | |||||||||||||||||||

| Total number of units | 743 | 732 | 732 | 732 | 727 | ||||||||||||||||||||||||

| Percent occupied | 98.6 | % | 99.0 | % | 98.5 | % | 96.8 | % | 97.9 | % | |||||||||||||||||||

| Observatory Metrics: | |||||||||||||||||||||||||||||

| Observatory NOI | $ | 24,077 | $ | 15,043 | $ | 28,545 | $ | 29,667 | $ | 25,166 | |||||||||||||||||||

Number of visitors (3) |

629,000 | 428,000 | 718,000 | 727,000 | 648,000 | ||||||||||||||||||||||||

| Change in visitors year-over-year | (2.9) | % | (11.8) | % | 1.0 | % | (2.2) | % | (2.7) | % | |||||||||||||||||||

| Ratios: | |||||||||||||||||||||||||||||

Debt to Total Market Capitalization (4) |

46.9 | % | 47.8 | % | 44.0 | % | 42.3 | % | 46.4 | % | |||||||||||||||||||

Net Debt to Total Market Capitalization (4) |

45.8 | % | 45.4 | % | 39.5 | % | 37.5 | % | 39.9 | % | |||||||||||||||||||

|

Debt and Perpetual Preferred Units to

Total Market Capitalization (4)

|

49.0 | % | 49.8 | % | 45.7 | % | 44.0 | % | 48.2 | % | |||||||||||||||||||

|

Net Debt and Perpetual Preferred Units to

Total Market Capitalization (4)

|

47.8 | % | 47.5 | % | 41.4 | % | 39.3 | % | 41.9 | % | |||||||||||||||||||

Debt to Adjusted EBITDA (5) |

5.8x | 5.8x | 6.4x | 6.4x | 6.6x | ||||||||||||||||||||||||

Net Debt to Adjusted EBITDA (5) |

5.6x | 5.2x | 5.3x | 5.2x | 5.1x | ||||||||||||||||||||||||

Core FFO Payout Ratio (6) |

16 | % | 19 | % | 15 | % | 14 | % | 15 | % | |||||||||||||||||||

| Core FAD Payout Ratio | 82 | % | 805 | % | 324 | % | 21 | % | 30 | % | |||||||||||||||||||

| Core FFO per share - diluted | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.26 | $ | 0.24 | |||||||||||||||||||

| Diluted weighted average shares | 269,951 | 269,529 | 270,251 | 269,613 | 268,716 | ||||||||||||||||||||||||

| Class A common stock price at quarter end | $ | 8.09 | $ | 7.82 | $ | 10.32 | $ | 11.08 | $ | 9.38 | |||||||||||||||||||

| Dividends declared and paid per share | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | |||||||||||||||||||

| Dividends per share - annualized | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | |||||||||||||||||||

Dividend yield (7) |

1.7 | % | 1.8 | % | 1.4 | % | 1.3 | % | 1.5 | % | |||||||||||||||||||

| Series 2014 Private Perpetual Preferred Units outstanding ($16.62 liquidation value) |

1,560 | 1,560 | 1,560 | 1,560 | 1,560 | ||||||||||||||||||||||||

| Series 2019 Private Perpetual Preferred Units outstanding ($13.52 liquidation value) |

4,664 | 4,664 | 4,664 | 4,664 | 4,664 | ||||||||||||||||||||||||

| Class A common stock | 168,301 | 167,094 | 166,405 | 165,507 | 164,483 | ||||||||||||||||||||||||

Class B common stock (8) |

975 | 976 | 978 | 981 | 982 | ||||||||||||||||||||||||

| Operating partnership units | 109,308 | 110,662 | 106,768 | 107,664 | 108,713 | ||||||||||||||||||||||||

|

Total common stock and operating partnership units

outstanding (9)

|

278,584 | 278,732 | 274,151 | 274,152 | 274,178 | ||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| Property Summary - Same Store NOI | |||||

| (unaudited and dollars in thousands) | |||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

June 30, 2025 |

June 30, 2024 |

|||||||||||||||||||||||||||||||||||

Same Store Portfolio(1) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 143,776 | $ | 143,916 | $ | 146,969 | $ | 145,501 | $ | 140,763 | $ | 287,692 | $ | 280,910 | |||||||||||||||||||||||||||

| Operating expenses | (74,612) | (74,891) | (76,317) | (75,596) | (68,762) | (149,503) | (140,248) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 69,164 | 69,025 | 70,652 | 69,905 | 72,001 | 138,189 | 140,662 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (3,213) | (4,831) | (3,782) | (2,184) | (1,887) | (8,044) | (5,105) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | (629) | (587) | (477) | (528) | (565) | (1,216) | (1,130) | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | 1,958 | 1,958 | 1,958 | 1,958 | 1,958 | 3,916 | 3,916 | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | $ | 71,507 | $ | 132,845 | $ | 138,343 | |||||||||||||||||||||||||||

| Percent change over prior year | (5.9) | % | (1.9) | % | (2.9) | % | 5.2 | % | 7.4 | % | (4.0) | % | 9.7 | % | |||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | $ | 71,507 | $ | 132,845 | $ | 138,343 | |||||||||||||||||||||||||||

| Lease termination fees | 464 | — | — | 4,771 | — | 464 | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 67,744 | $ | 65,565 | $ | 68,351 | $ | 73,922 | $ | 71,507 | $ | 133,309 | $ | 138,343 | |||||||||||||||||||||||||||

Same Store Manhattan Office(1),(2) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 136,543 | $ | 136,408 | $ | 139,380 | $ | 138,060 | $ | 133,180 | $ | 272,951 | $ | 267,099 | |||||||||||||||||||||||||||

| Operating expenses | (71,336) | (71,598) | (73,062) | (72,287) | (65,473) | (142,934) | (133,646) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 65,207 | 64,810 | 66,318 | 65,773 | 67,707 | 130,017 | 133,453 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (2,947) | (4,633) | (3,689) | (2,134) | (1,935) | (7,580) | (5,163) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | (629) | (587) | (477) | (528) | (565) | (1,216) | (1,130) | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | 1,958 | 1,958 | 1,958 | 1,958 | 1,958 | 3,916 | 3,916 | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | 63,589 | 61,548 | 64,110 | 65,069 | 67,165 | 125,137 | 131,076 | ||||||||||||||||||||||||||||||||||

| Lease termination fees | 464 | — | — | 4,771 | — | 464 | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 64,053 | $ | 61,548 | $ | 64,110 | $ | 69,840 | $ | 67,165 | $ | 125,601 | $ | 131,076 | |||||||||||||||||||||||||||

Same Store Greater New York Metropolitan Area Office(1) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 2,985 | $ | 3,154 | $ | 3,213 | $ | 3,060 | $ | 3,319 | $ | 6,139 | $ | 6,163 | |||||||||||||||||||||||||||

| Operating expenses | (1,551) | (1,606) | (1,572) | (1,612) | (1,656) | (3,157) | (3,250) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 1,434 | 1,548 | 1,641 | 1,448 | 1,663 | 2,982 | 2,913 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (41) | 36 | 128 | 203 | 162 | (5) | 295 | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | 1,393 | 1,584 | 1,769 | 1,651 | 1,825 | 2,977 | 3,208 | ||||||||||||||||||||||||||||||||||

| Lease termination fees | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 1,393 | $ | 1,584 | $ | 1,769 | $ | 1,651 | $ | 1,825 | $ | 2,977 | $ | 3,208 | |||||||||||||||||||||||||||

Same Store Retail(1) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 4,248 | $ | 4,354 | $ | 4,376 | $ | 4,381 | $ | 4,264 | $ | 8,602 | $ | 7,648 | |||||||||||||||||||||||||||

| Operating expenses | (1,725) | (1,687) | (1,683) | (1,697) | (1,633) | (3,412) | (3,352) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 2,523 | 2,667 | 2,693 | 2,684 | 2,631 | 5,190 | 4,296 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (225) | (234) | (221) | (253) | (114) | (459) | (237) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | 2,298 | 2,433 | 2,472 | 2,431 | 2,517 | 4,731 | 4,059 | ||||||||||||||||||||||||||||||||||

| Lease termination fees | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 2,298 | $ | 2,433 | $ | 2,472 | $ | 2,431 | $ | 2,517 | $ | 4,731 | $ | 4,059 | |||||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| Same Store NOI | |||||

| (unaudited and dollars in thousands) | |||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| Reconciliation of Net Income to Cash NOI and Same Store Cash NOI | June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

June 30, 2025 |

June 30, 2024 |

||||||||||||||||||||||||||||||||||

| Net income | $ | 11,385 | $ | 15,778 | $ | 18,793 | $ | 22,796 | $ | 28,555 | $ | 27,163 | $ | 38,770 | |||||||||||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||||||||||||||

| General and administrative expenses | 18,685 | 16,940 | 17,870 | 18,372 | 18,020 | 35,625 | 33,992 | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 47,802 | 48,779 | 45,365 | 45,899 | 47,473 | 96,581 | 93,554 | ||||||||||||||||||||||||||||||||||

| Interest expense | 25,126 | 26,938 | 27,380 | 27,408 | 25,323 | 52,064 | 50,451 | ||||||||||||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | 647 | 1,921 | 1,922 | 628 | 647 | 628 | ||||||||||||||||||||||||||||||||||

| Loss on early extinguishment of debt | — | — | — | — | — | — | 553 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 478 | (619) | 1,151 | 1,442 | 750 | (141) | 95 | ||||||||||||||||||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||||||||||||||

| Gain on disposition of property | — | (13,170) | (1,237) | (1,262) | (10,803) | (13,170) | (10,803) | ||||||||||||||||||||||||||||||||||

| Third-party management and other fees | (408) | (431) | (258) | (271) | (376) | (839) | (641) | ||||||||||||||||||||||||||||||||||

| Interest income | (1,867) | (3,786) | (5,068) | (6,960) | (5,092) | (5,653) | (9,270) | ||||||||||||||||||||||||||||||||||

| Net operating income | 101,201 | 91,076 | 105,917 | 109,346 | 104,478 | 192,277 | 197,329 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (3,748) | (5,283) | (4,045) | (2,277) | (1,900) | (9,031) | (4,961) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | (840) | (798) | (674) | (476) | (513) | (1,638) | (1,027) | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | 1,958 | 1,958 | 1,958 | 1,958 | 1,958 | 3,916 | 3,916 | ||||||||||||||||||||||||||||||||||

| Total cash NOI - including Observatory and lease termination fees | 98,571 | 86,953 | 103,156 | 108,551 | 104,023 | 185,524 | 195,257 | ||||||||||||||||||||||||||||||||||

| Less: Observatory NOI | (24,077) | (15,043) | (28,545) | (29,667) | (25,166) | (39,120) | (41,331) | ||||||||||||||||||||||||||||||||||

| Less: cash NOI from non-Same Store properties | (6,750) | (6,345) | (6,260) | (4,962) | (7,350) | (13,095) | (15,583) | ||||||||||||||||||||||||||||||||||

| Total Same Store property cash NOI - including lease termination fees | 67,744 | 65,565 | 68,351 | 73,922 | 71,507 | 133,309 | 138,343 | ||||||||||||||||||||||||||||||||||

| Less: Lease termination fees | (464) | — | — | (4,771) | — | (464) | — | ||||||||||||||||||||||||||||||||||

| Total Same Store property cash NOI - excluding Observatory and lease termination fees | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | $ | 71,507 | $ | 132,845 | $ | 138,343 | |||||||||||||||||||||||||||

| Multifamily NOI | |||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 9,846 | $ | 9,646 | $ | 9,322 | $ | 9,140 | $ | 9,161 | $ | 19,492 | $ | 17,633 | |||||||||||||||||||||||||||

| Operating expenses | (4,665) | (4,993) | (5,145) | (4,623) | (4,578) | (9,658) | (8,787) | ||||||||||||||||||||||||||||||||||

| NOI | 5,181 | 4,653 | 4,177 | 4,517 | 4,583 | 9,834 | 8,846 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (67) | (67) | (67) | (69) | (109) | (134) | (211) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | 59 | 57 | 58 | 58 | 59 | 116 | 115 | ||||||||||||||||||||||||||||||||||

| Cash NOI | $ | 5,173 | $ | 4,643 | $ | 4,168 | $ | 4,506 | $ | 4,533 | $ | 9,816 | $ | 8,750 | |||||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| Property Summary - Leasing Activity by Quarter | |||||

| (unaudited) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

Total Office and Retail Portfolio(1) |

|||||||||||||||||||||||||||||

| Total leases executed | 22 | 20 | 20 | 31 | 35 | ||||||||||||||||||||||||

| Weighted average lease term | 9.9 years | 8.4 years | 8.0 years | 7.0 years | 7.0 years | ||||||||||||||||||||||||

| Average free rent period | 7.6 months | 7.8 months | 5.7 months | 5.2 months | 7.4 months | ||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||

| Total square footage executed | 221,776 | 229,367 | 378,913 | 291,418 | 262,991 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 71.21 | $ | 66.43 | $ | 78.40 | $ | 70.11 | $ | 66.60 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 63.50 | $ | 60.63 | $ | 71.03 | $ | 68.34 | $ | 65.31 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 12.1 | % | 9.6 | % | 10.4 | % | 2.6 | % | 2.0 | % | |||||||||||||||||||

| Retail | |||||||||||||||||||||||||||||

| Total square footage executed | 10,332 | 1,181 | — | 12,792 | 8,990 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 268.92 | $ | 193.00 | $ | — | $ | 203.88 | $ | 91.14 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 316.28 | $ | 183.74 | $ | — | $ | 332.35 | $ | 75.03 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | (15.0) | % | 5.0 | % | — | (38.7) | % | 21.5 | % | ||||||||||||||||||||

| Total Office and Retail Portfolio | |||||||||||||||||||||||||||||

| Total square footage executed | 232,108 | 230,548 | 378,913 | 304,210 | 271,981 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 80.01 | $ | 67.08 | $ | 78.40 | $ | 75.74 | $ | 67.41 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 74.75 | $ | 61.27 | $ | 71.03 | $ | 79.44 | $ | 65.63 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 7.0 | % | 9.5 | % | 10.4 | % | (4.7) | % | 2.7 | % | |||||||||||||||||||

| Leasing commission costs per square foot | $ | 31.62 | $ | 22.39 | $ | 21.73 | $ | 19.67 | $ | 18.87 | |||||||||||||||||||

| Tenant improvement costs per square foot | 86.85 | 47.92 | 49.46 | 42.90 | 65.69 | ||||||||||||||||||||||||

Total LC and TI per square foot(2) |

$ | 118.47 | $ | 70.31 | $ | 71.19 | $ | 62.57 | $ | 84.56 | |||||||||||||||||||

| Total LC and TI per square foot per year of weighted average lease term | $ | 11.93 | $ | 8.34 | $ | 8.89 | $ | 8.94 | $ | 12.14 | |||||||||||||||||||

Occupancy(3) |

89.0 | % | 87.9 | % | 88.6 | % | 89.1 | % | 88.9 | % | |||||||||||||||||||

| Manhattan Office Portfolio | |||||||||||||||||||||||||||||

| Total leases executed | 18 | 18 | 18 | 25 | 31 | ||||||||||||||||||||||||

| Office - New Leases | |||||||||||||||||||||||||||||

| Total square footage executed | 202,499 | 43,184 | 184,258 | 130,688 | 162,655 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 72.28 | $ | 69.13 | $ | 71.07 | $ | 66.07 | $ | 67.44 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 63.11 | $ | 66.77 | $ | 59.54 | $ | 63.21 | $ | 64.36 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 14.5 | % | 3.5 | % | 19.4 | % | 4.5 | % | 4.8 | % | |||||||||||||||||||

Office - Renewal Leases(1) |

|||||||||||||||||||||||||||||

| Current Renewals | 19,277 | 177,328 | 10,178 | 53,622 | 43,895 | ||||||||||||||||||||||||

| Early Renewals | — | — | 172,286 | 105,019 | 54,761 | ||||||||||||||||||||||||

| Total square footage executed | 19,277 | 177,328 | 182,464 | 158,641 | 98,656 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 59.97 | $ | 66.62 | $ | 86.98 | $ | 73.11 | $ | 65.50 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 67.51 | $ | 59.35 | $ | 83.14 | $ | 72.24 | $ | 67.09 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | (11.2) | % | 12.3 | % | 4.6 | % | 1.2 | % | (2.4) | % | |||||||||||||||||||

| Total Manhattan Office Portfolio | |||||||||||||||||||||||||||||

| Total square footage executed | 221,776 | 220,512 | 366,722 | 289,329 | 261,311 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 71.21 | $ | 67.11 | $ | 78.99 | $ | 69.93 | $ | 66.71 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 63.50 | $ | 60.80 | $ | 71.28 | $ | 68.16 | $ | 65.40 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 12.1 | % | 10.4 | % | 10.8 | % | 2.6 | % | 2.0 | % | |||||||||||||||||||

| Leasing commission costs per square foot | $ | 28.97 | $ | 22.47 | $ | 21.85 | $ | 17.40 | $ | 18.13 | |||||||||||||||||||

| Tenant improvement costs per square foot | 89.60 | 49.50 | 47.96 | 42.82 | 68.02 | ||||||||||||||||||||||||

Total LC and TI per square foot(2) |

$ | 118.57 | $ | 71.97 | $ | 69.81 | $ | 60.22 | $ | 86.15 | |||||||||||||||||||

| Total LC and TI per square foot per year of weighted average lease term | $ | 11.79 | $ | 8.41 | $ | 8.66 | $ | 8.67 | $ | 12.49 | |||||||||||||||||||

Occupancy(3) |

89.5 | % | 88.1 | % | 89.0 | % | 89.6 | % | 89.3 | % | |||||||||||||||||||

|

Second Quarter 2025 |

||||

| Property Summary - Leasing Activity by Quarter - (Continued) | |||||

| (unaudited) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Retail Portfolio | |||||||||||||||||||||||||||||

| Total leases executed | 4 | 1 | — | 5 | 3 | ||||||||||||||||||||||||

| Total square footage executed | 10,332 | 1,181 | — | 12,792 | 8,990 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 268.92 | $ | 193.00 | $ | — | $ | 203.88 | $ | 91.14 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 316.28 | $ | 183.74 | $ | — | $ | 332.35 | $ | 75.03 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | (15.0) | % | 5.0 | % | — | (38.7) | % | 21.5 | % | ||||||||||||||||||||

| Leasing commission costs per square foot | $ | 88.59 | $ | 63.04 | $ | — | $ | 74.25 | $ | 41.87 | |||||||||||||||||||

| Tenant improvement costs per square foot | 27.88 | — | — | 51.72 | 9.45 | ||||||||||||||||||||||||

Total LC and TI per square foot(2) |

$ | 116.47 | $ | 63.04 | $ | — | $ | 125.97 | $ | 51.32 | |||||||||||||||||||

| Total LC and TI per square foot per year of weighted average lease term | $ | 16.15 | $ | 6.25 | $ | — | $ | 14.73 | $ | 5.33 | |||||||||||||||||||

Occupancy(3) |

89.9 | % | 91.2 | % | 90.4 | % | 91.1 | % | 92.3 | % | |||||||||||||||||||

| Multifamily Portfolio | |||||||||||||||||||||||||||||

| Percent occupied | 98.6 | % | 99.0 | % | 98.5 | % | 96.8 | % | 97.9 | % | |||||||||||||||||||

| Total number of units | 743 | 732 | 732 | 732 | 727 | ||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| Commercial Property Detail | |||||

| (unaudited) | |||||

| Property Name | Location or Sub-Market | Rentable Square Feet (1) |

Percent Occupied (2),(3) |

Percent Leased (3),(4) |

Annualized Rent (5) |

Annualized Rent per Occupied Square Foot (6) |

Number of Leases (7) |

||||||||||||||||||||||||||||||||||

| Office - Manhattan | |||||||||||||||||||||||||||||||||||||||||

| The Empire State Building | Penn Station -Times Sq. South | 2,711,344 | 92.2 | % | 96.6 | % | $ | 170,956,876 | $ | 69.05 | 148 | ||||||||||||||||||||||||||||||

| One Grand Central Place | Grand Central | 1,224,683 | 87.2 | % | 93.3 | % | 68,905,466 | 64.59 | 128 | ||||||||||||||||||||||||||||||||

1400 Broadway (8) |

Penn Station -Times Sq. South | 917,281 | 87.0 | % | 94.5 | % | 50,618,224 | 63.42 | 18 | ||||||||||||||||||||||||||||||||

111 West 33rd Street (9) |

Penn Station -Times Sq. South | 639,595 | 92.6 | % | 94.3 | % | 41,656,476 | 70.32 | 21 | ||||||||||||||||||||||||||||||||

| 250 West 57th Street | Columbus Circle - West Side | 476,831 | 81.6 | % | 82.9 | % | 27,777,535 | 71.46 | 29 | ||||||||||||||||||||||||||||||||

| 1359 Broadway | Penn Station -Times Sq. South | 456,634 | 89.3 | % | 92.4 | % | 24,325,517 | 59.71 | 28 | ||||||||||||||||||||||||||||||||

| 501 Seventh Avenue | Penn Station -Times Sq. South | 455,432 | 90.2 | % | 90.2 | % | 22,742,723 | 55.41 | 16 | ||||||||||||||||||||||||||||||||

1350 Broadway (10) |

Penn Station -Times Sq. South | 383,588 | 88.0 | % | 97.0 | % | 21,435,654 | 63.63 | 47 | ||||||||||||||||||||||||||||||||

| 1333 Broadway | Penn Station -Times Sq. South | 297,126 | 89.8 | % | 89.8 | % | 15,494,116 | 58.09 | 11 | ||||||||||||||||||||||||||||||||

| Office - Manhattan | 7,562,514 | 89.5 | % | 93.8 | % | 443,912,587 | 65.83 | 446 | |||||||||||||||||||||||||||||||||

| Office - Greater New York Metropolitan Area | |||||||||||||||||||||||||||||||||||||||||

| Metro Center | Stamford, CT | 282,176 | 74.1 | % | 74.1 | % | 12,148,780 | 58.12 | 21 | ||||||||||||||||||||||||||||||||

| Office - Greater New York Metropolitan Area | 282,176 | 74.1 | % | 74.1 | % | 12,148,780 | 58.12 | 21 | |||||||||||||||||||||||||||||||||

| Total/Weighted Average Office Properties | 7,844,690 | 88.9 | % | 93.1 | % | 456,061,367 | 65.60 | 467 | |||||||||||||||||||||||||||||||||

| Retail Properties | |||||||||||||||||||||||||||||||||||||||||

| North Sixth Street Collection | Williamsburg - Brooklyn | 102,191 | 78.0 | % | 78.0 | % | 11,195,391 | 140.50 | 16 | ||||||||||||||||||||||||||||||||

112 West 34th Street (9) |

Penn Station -Times Sq. South | 93,057 | 100.0 | % | 100.0 | % | 25,108,425 | 269.82 | 4 | ||||||||||||||||||||||||||||||||

| The Empire State Building | Penn Station -Times Sq. South | 88,445 | 78.7 | % | 78.7 | % | 8,039,762 | 115.45 | 12 | ||||||||||||||||||||||||||||||||

| One Grand Central Place | Grand Central | 70,810 | 79.6 | % | 79.6 | % | 6,947,677 | 123.23 | 11 | ||||||||||||||||||||||||||||||||

| 1333 Broadway | Penn Station -Times Sq. South | 67,001 | 100.0 | % | 100.0 | % | 10,297,889 | 153.70 | 4 | ||||||||||||||||||||||||||||||||

| 250 West 57th Street | Columbus Circle - West Side | 63,443 | 93.2 | % | 93.2 | % | 8,580,632 | 145.19 | 6 | ||||||||||||||||||||||||||||||||

| 10 Union Square | Union Square | 58,049 | 88.2 | % | 88.2 | % | 7,983,831 | 155.91 | 8 | ||||||||||||||||||||||||||||||||

| 1542 Third Avenue | Upper East Side | 56,211 | 95.0 | % | 100.0 | % | 2,517,661 | 47.16 | 3 | ||||||||||||||||||||||||||||||||

| 1010 Third Avenue | Upper East Side | 38,235 | 100.0 | % | 100.0 | % | 3,498,187 | 91.49 | 2 | ||||||||||||||||||||||||||||||||

| 1359 Broadway | Penn Station -Times Sq. South | 29,247 | 99.4 | % | 99.4 | % | 2,220,926 | 76.37 | 5 | ||||||||||||||||||||||||||||||||

| 501 Seventh Avenue | Penn Station -Times Sq. South | 27,213 | 78.9 | % | 89.4 | % | 1,442,201 | 67.20 | 7 | ||||||||||||||||||||||||||||||||

| 77 West 55th Street | Midtown | 25,388 | 100.0 | % | 100.0 | % | 2,124,815 | 83.69 | 3 | ||||||||||||||||||||||||||||||||

1350 Broadway (10) |

Penn Station -Times Sq. South | 19,511 | 100.0 | % | 100.0 | % | 4,137,484 | 212.06 | 6 | ||||||||||||||||||||||||||||||||

1400 Broadway (8) |

Penn Station -Times Sq. South | 17,017 | 82.2 | % | 82.2 | % | 1,753,002 | 125.39 | 6 | ||||||||||||||||||||||||||||||||

| 561 10th Avenue | Hudson Yards | 11,822 | 100.0 | % | 100.0 | % | 1,618,381 | 136.90 | 2 | ||||||||||||||||||||||||||||||||

| 298 Mulberry Street | NoHo | 10,365 | 100.0 | % | 100.0 | % | 1,981,662 | 191.19 | 1 | ||||||||||||||||||||||||||||||||

| 345 East 94th Street | Upper East Side | 3,700 | 100.0 | % | 100.0 | % | 261,661 | 70.72 | 1 | ||||||||||||||||||||||||||||||||

| Total/Weighted Average Retail Properties | 781,705 | 89.9 | % | 90.7 | % | 99,709,587 | 141.83 | 97 | |||||||||||||||||||||||||||||||||

| Portfolio Total | 8,626,395 | 89.0 | % | 92.9 | % | $ | 555,770,954 | $ | 72.60 | 564 | |||||||||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| Total Portfolio Expirations and Vacates Summary | |||||

| (unaudited and in square feet) | |||||

| Actual | Forecast (1) |

Forecast (1) |

|||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

Total Office and Retail Portfolio (2) |

March 31, 2025 |

June 30, 2025 |

September 30, 2025 |

December 31, 2025 |

July to Dec. 2025 | Full Year 2026 | |||||||||||||||||||||||||||||

| Total expirations | 164,025 | 79,269 | 60,286 | 197,267 | 257,553 | 510,412 | |||||||||||||||||||||||||||||

| Less: broadcasting | — | — | (1,417) | — | (1,417) | — | |||||||||||||||||||||||||||||

| Office and retail expirations | 164,025 | 79,269 | 58,869 | 197,267 | 256,136 | 510,412 | |||||||||||||||||||||||||||||

Renewals & relocations (3) |

31,205 | 8,483 | 15,635 | 14,461 | 30,096 | 119,513 | |||||||||||||||||||||||||||||

New leases (4) |

50,486 | 21,120 | — | 126,391 | 126,391 | 19,463 | |||||||||||||||||||||||||||||

Vacates (5) |

82,334 | 49,666 | 40,918 | 50,035 | 90,953 | 229,314 | |||||||||||||||||||||||||||||

Unknown (6) |

— | — | 2,316 | 6,380 | 8,696 | 142,122 | |||||||||||||||||||||||||||||

| Total Office and Retail Portfolio expirations and vacates | 164,025 | 79,269 | 58,869 | 197,267 | 256,136 | 510,412 | |||||||||||||||||||||||||||||

| Manhattan Office Portfolio | |||||||||||||||||||||||||||||||||||

| Total expirations | 147,055 | 77,329 | 55,207 | 195,800 | 251,007 | 416,307 | |||||||||||||||||||||||||||||

| Less: broadcasting | — | — | (1,417) | — | (1,417) | — | |||||||||||||||||||||||||||||

| Office and retail expirations | 147,055 | 77,329 | 53,790 | 195,800 | 249,590 | 416,307 | |||||||||||||||||||||||||||||

Renewals & relocations (3) |

16,775 | 8,483 | 15,635 | 14,461 | 30,096 | 117,842 | |||||||||||||||||||||||||||||

New leases (4) |

50,486 | 21,120 | — | 126,391 | 126,391 | 19,463 | |||||||||||||||||||||||||||||

Vacates (5) |

79,794 | 47,726 | 35,839 | 48,921 | 84,760 | 212,716 | |||||||||||||||||||||||||||||

Unknown (6) |

— | — | 2,316 | 6,027 | 8,343 | 66,286 | |||||||||||||||||||||||||||||

| Total expirations and vacates | 147,055 | 77,329 | 53,790 | 195,800 | 249,590 | 416,307 | |||||||||||||||||||||||||||||

| Greater New York Metropolitan Area Office Portfolio | |||||||||||||||||||||||||||||||||||

| Office expirations | 2,540 | — | 5,079 | — | 5,079 | 23,268 | |||||||||||||||||||||||||||||

Renewals & relocations (3) |

— | — | — | — | — | — | |||||||||||||||||||||||||||||

New leases (4) |

— | — | — | — | — | — | |||||||||||||||||||||||||||||

Vacates (5) |

2,540 | — | 5,079 | — | 5,079 | — | |||||||||||||||||||||||||||||

Unknown (6) |

— | — | — | — | — | 23,268 | |||||||||||||||||||||||||||||

| Total expirations and vacates | 2,540 | — | 5,079 | — | 5,079 | 23,268 | |||||||||||||||||||||||||||||

| Retail Portfolio | |||||||||||||||||||||||||||||||||||

| Office expirations | 14,430 | 1,940 | — | 1,467 | 1,467 | 70,837 | |||||||||||||||||||||||||||||

Renewals & relocations (3) |

14,430 | — | — | — | — | 1,671 | |||||||||||||||||||||||||||||

New leases (4) |

— | — | — | — | — | — | |||||||||||||||||||||||||||||

Vacates (5) |

— | 1,940 | — | 1,114 | 1,114 | 16,598 | |||||||||||||||||||||||||||||

Unknown (6) |

— | — | — | 353 | 353 | 52,568 | |||||||||||||||||||||||||||||

| Total expirations and vacates | 14,430 | 1,940 | — | 1,467 | 1,467 | 70,837 | |||||||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| Tenant Lease Expirations | |||||

| (unaudited) | |||||

| Total Office and Retail Lease Expirations | Number of Leases Expiring(1) |

Rentable Square Feet Expiring(2) |

Percent of Portfolio Rentable Square Feet Expiring | Annualized Rent(3) |

Percent of Annualized Rent | Annualized Rent Per Rentable Square Foot | |||||||||||||||||||||||||||||

| Available | — | 642,124 | 7.4 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | 21 | 328,609 | 3.8 | % | — | — | % | — | |||||||||||||||||||||||||||

2Q 2025(4) |

6 | 45,336 | 0.5 | % | 2,812,089 | 0.5 | % | 62.03 | |||||||||||||||||||||||||||

| 3Q 2025 | 14 | 59,360 | 0.7 | % | 3,802,172 | 0.7 | % | 64.05 | |||||||||||||||||||||||||||

| 4Q 2025 | 19 | 197,267 | 2.3 | % | 12,995,985 | 2.3 | % | 65.88 | |||||||||||||||||||||||||||

| Total 2025 | 39 | 301,963 | 3.5 | % | 19,610,246 | 3.5 | % | 64.94 | |||||||||||||||||||||||||||

| 1Q 2026 | 15 | 148,843 | 1.7 | % | 9,365,060 | 1.7 | % | 62.92 | |||||||||||||||||||||||||||

| 2Q 2026 | 7 | 26,719 | 0.3 | % | 1,846,306 | 0.3 | % | 69.10 | |||||||||||||||||||||||||||

| 3Q 2026 | 18 | 107,713 | 1.2 | % | 6,691,424 | 1.2 | % | 62.12 | |||||||||||||||||||||||||||

| 4Q 2026 | 22 | 227,137 | 2.6 | % | 12,259,510 | 2.2 | % | 53.97 | |||||||||||||||||||||||||||

| Total 2026 | 62 | 510,412 | 5.8 | % | 30,162,300 | 5.4 | % | 59.09 | |||||||||||||||||||||||||||

| 2027 | 87 | 707,724 | 8.2 | % | 47,867,236 | 8.6 | % | 67.64 | |||||||||||||||||||||||||||

| 2028 | 63 | 873,723 | 10.1 | % | 52,913,755 | 9.5 | % | 60.56 | |||||||||||||||||||||||||||

| 2029 | 66 | 795,575 | 9.2 | % | 68,365,795 | 12.3 | % | 85.93 | |||||||||||||||||||||||||||

| 2030 | 60 | 777,381 | 9.0 | % | 58,892,496 | 10.6 | % | 75.76 | |||||||||||||||||||||||||||

| 2031 | 35 | 240,815 | 2.8 | % | 27,161,717 | 4.9 | % | 112.79 | |||||||||||||||||||||||||||

| 2032 | 31 | 388,724 | 4.5 | % | 29,292,989 | 5.3 | % | 75.36 | |||||||||||||||||||||||||||

| 2033 | 34 | 306,026 | 3.5 | % | 23,515,571 | 4.2 | % | 76.84 | |||||||||||||||||||||||||||

| 2034 | 22 | 361,995 | 4.2 | % | 27,256,503 | 4.9 | % | 75.30 | |||||||||||||||||||||||||||

| 2035 | 23 | 461,318 | 5.3 | % | 32,068,550 | 5.8 | % | 69.52 | |||||||||||||||||||||||||||

| Thereafter | 42 | 1,930,006 | 22.7 | % | 138,663,796 | 25.0 | % | 71.85 | |||||||||||||||||||||||||||

| Total | 585 | 8,626,395 | 100.0 | % | $ | 555,770,954 | 100.0 | % | $ | 72.60 | |||||||||||||||||||||||||

Manhattan Office Properties(5) |

|||||||||||||||||||||||||||||||||||

| Available | — | 495,958 | 6.6 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | 19 | 322,924 | 4.3 | % | — | — | % | — | |||||||||||||||||||||||||||

2Q 2025(4) |

5 | 43,396 | 0.6 | % | 2,564,393 | 0.6 | % | 59.09 | |||||||||||||||||||||||||||

| 3Q 2025 | 13 | 54,281 | 0.7 | % | 3,510,274 | 0.8 | % | 64.67 | |||||||||||||||||||||||||||

| 4Q 2025 | 17 | 195,800 | 2.6 | % | 12,881,357 | 2.9 | % | 65.79 | |||||||||||||||||||||||||||

| Total 2025 | 35 | 293,477 | 3.9 | % | 18,956,024 | 4.3 | % | 64.59 | |||||||||||||||||||||||||||

| 1Q 2026 | 13 | 139,705 | 1.8 | % | 8,703,399 | 2.0 | % | 62.30 | |||||||||||||||||||||||||||

| 2Q 2026 | 7 | 26,719 | 0.4 | % | 1,846,306 | 0.4 | % | 69.10 | |||||||||||||||||||||||||||

| 3Q 2026 | 14 | 72,794 | 1.0 | % | 4,468,416 | 1.0 | % | 61.38 | |||||||||||||||||||||||||||

| 4Q 2026 | 20 | 177,089 | 2.3 | % | 11,075,014 | 2.5 | % | 62.54 | |||||||||||||||||||||||||||

| Total 2026 | 54 | 416,307 | 5.5 | % | 26,093,135 | 5.9 | % | 62.68 | |||||||||||||||||||||||||||

| 2027 | 77 | 626,173 | 8.3 | % | 38,399,735 | 8.7 | % | 61.32 | |||||||||||||||||||||||||||

| 2028 | 58 | 854,533 | 11.3 | % | 50,714,632 | 11.4 | % | 59.35 | |||||||||||||||||||||||||||

| 2029 | 51 | 648,524 | 8.6 | % | 42,748,001 | 9.6 | % | 65.92 | |||||||||||||||||||||||||||

| 2030 | 43 | 657,412 | 8.7 | % | 44,481,444 | 10.0 | % | 67.66 | |||||||||||||||||||||||||||

| 2031 | 23 | 151,071 | 2.0 | % | 11,204,439 | 2.5 | % | 74.17 | |||||||||||||||||||||||||||

| 2032 | 23 | 344,120 | 4.6 | % | 25,144,502 | 5.7 | % | 73.07 | |||||||||||||||||||||||||||

| 2033 | 19 | 198,333 | 2.6 | % | 13,053,369 | 2.9 | % | 65.82 | |||||||||||||||||||||||||||

| 2034 | 16 | 337,787 | 4.5 | % | 23,828,011 | 5.4 | % | 70.54 | |||||||||||||||||||||||||||

| 2035 | 18 | 446,299 | 5.9 | % | 30,558,955 | 6.9 | % | 68.47 | |||||||||||||||||||||||||||

| Thereafter | 29 | 1,769,596 | 23.2 | % | 118,730,340 | 26.7 | % | 67.09 | |||||||||||||||||||||||||||

| Total Manhattan office properties | 465 | 7,562,514 | 100.0 | % | $ | 443,912,587 | 100.0 | % | $ | 65.83 | |||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| Tenant Lease Expirations | |||||

| (unaudited) | |||||

|

Greater New York Metropolitan

Area Office Portfolio

|

Number of Leases Expiring(1) |

Rentable Square Feet Expiring(2) |

Percent of Portfolio Rentable Square Feet Expiring | Annualized Rent(3) |

Percent of Annualized Rent | Annualized Rent Per Rentable Square Foot | |||||||||||||||||||||||||||||

| Available | — | 73,147 | 25.9 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

2Q 2025(4) |

— | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 3Q 2025 | 1 | 5,079 | 1.8 | % | 291,898 | 2.4 | % | 57.47 | |||||||||||||||||||||||||||

| 4Q 2025 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| Total 2025 | 1 | 5,079 | 1.8 | % | 291,898 | 2.4 | % | 57.47 | |||||||||||||||||||||||||||

| 1Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 2Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 3Q 2026 | 1 | 23,268 | 8.2 | % | 1,448,235 | 11.9 | % | 62.24 | |||||||||||||||||||||||||||

| 4Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| Total 2026 | 1 | 23,268 | 8.2 | % | 1,448,235 | 11.9 | % | 62.24 | |||||||||||||||||||||||||||

| 2027 | 4 | 21,546 | 7.6 | % | 1,264,659 | 10.4 | % | 58.70 | |||||||||||||||||||||||||||

| 2028 | 2 | 11,480 | 4.1 | % | 658,539 | 5.4 | % | 57.36 | |||||||||||||||||||||||||||

| 2029 | 3 | 12,208 | 4.3 | % | 720,869 | 5.9 | % | 59.05 | |||||||||||||||||||||||||||

| 2030 | 5 | 42,827 | 15.2 | % | 2,516,457 | 20.7 | % | 58.76 | |||||||||||||||||||||||||||

| 2031 | 1 | 15,030 | 5.3 | % | 879,672 | 7.2 | % | 58.53 | |||||||||||||||||||||||||||

2032(6) |

2 | 7,281 | 2.6 | % | 381,961 | 3.1 | % | 52.46 | |||||||||||||||||||||||||||

| 2033 | 1 | 63,173 | 22.4 | % | 3,618,934 | 29.8 | % | 57.29 | |||||||||||||||||||||||||||

| 2034 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 2035 | 1 | 7,137 | 2.6 | % | 367,556 | 3.2 | % | 51.50 | |||||||||||||||||||||||||||

| Thereafter | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| Total greater New York metropolitan area office portfolio | 21 | 282,176 | 100.0 | % | $ | 12,148,780 | 100.0 | % | $ | 58.12 | |||||||||||||||||||||||||

| Retail Properties | |||||||||||||||||||||||||||||||||||

| Available | — | 73,019 | 9.3 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | 2 | 5,685 | 0.7 | % | — | — | % | — | |||||||||||||||||||||||||||

2Q 2025(4) |

1 | 1,940 | 0.2 | % | 247,696 | 0.2 | % | 127.68 | |||||||||||||||||||||||||||

| 3Q 2025 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 4Q 2025 | 2 | 1,467 | 0.2 | % | 114,628 | 0.1 | % | 78.14 | |||||||||||||||||||||||||||

| Total 2025 | 3 | 3,407 | 0.4 | % | 362,324 | 0.3 | % | 106.35 | |||||||||||||||||||||||||||

| 1Q 2026 | 2 | 9,138 | 1.2 | % | 661,661 | 0.7 | % | 72.41 | |||||||||||||||||||||||||||

| 2Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 3Q 2026 | 3 | 11,651 | 1.5 | % | 774,773 | 0.8 | % | 66.50 | |||||||||||||||||||||||||||

| 4Q 2026 | 2 | 50,048 | 6.4 | % | 1,184,496 | 1.2 | % | 23.67 | |||||||||||||||||||||||||||

| Total 2026 | 7 | 70,837 | 9.1 | % | 2,620,930 | 2.7 | % | 37.00 | |||||||||||||||||||||||||||

| 2027 | 6 | 60,005 | 7.7 | % | 8,202,842 | 8.2 | % | 136.70 | |||||||||||||||||||||||||||

| 2028 | 3 | 7,710 | 1.0 | % | 1,540,584 | 1.5 | % | 199.82 | |||||||||||||||||||||||||||

| 2029 | 12 | 134,843 | 17.2 | % | 24,896,925 | 25.0 | % | 184.64 | |||||||||||||||||||||||||||

| 2030 | 12 | 77,142 | 9.9 | % | 11,894,595 | 11.9 | % | 154.19 | |||||||||||||||||||||||||||

| 2031 | 11 | 74,714 | 9.6 | % | 15,077,606 | 15.1 | % | 201.80 | |||||||||||||||||||||||||||

| 2032 | 6 | 37,323 | 4.8 | % | 3,766,526 | 3.8 | % | 100.92 | |||||||||||||||||||||||||||

| 2033 | 14 | 44,520 | 5.7 | % | 6,843,268 | 6.9 | % | 153.71 | |||||||||||||||||||||||||||

| 2034 | 6 | 24,208 | 3.1 | % | 3,428,492 | 3.4 | % | 141.63 | |||||||||||||||||||||||||||

| 2035 | 4 | 7,882 | 1.0 | % | 1,142,039 | 1.1 | % | 144.89 | |||||||||||||||||||||||||||

| Thereafter | 13 | 160,410 | 20.5 | % | 19,933,456 | 20.1 | % | 124.27 | |||||||||||||||||||||||||||

| Total retail properties | 99 | 781,705 | 100.0 | % | $ | 99,709,587 | 100.0 | % | $ | 141.83 | |||||||||||||||||||||||||

|

Second Quarter 2025 |

||||

| 20 Largest Tenants and Portfolio Tenant Diversification by Industry | |||||

| (unaudited) | |||||

| 20 Largest Tenants | Property | Lease Expiration(1) |

Weighted Average Remaining Lease Term(2) |

Total Occupied Square Feet(3) |

Percent of Portfolio Rentable Square Feet(4) |

Annualized Rent(5) |

Percent of Portfolio Annualized Rent(6) |

|||||||||||||||||||||||||||||||||||||

| 1. | Empire State Building | Feb. 2026 - Aug. 2036 | 10.3 years | 423,544 | 4.97 | % | $ | 31,010,761 | 5.58 | % | ||||||||||||||||||||||||||||||||||

| 2. | Flagstar Bank | 1400 Broadway | Aug. 2039 | 14.2 years | 313,109 | 3.68 | % | 19,600,190 | 3.53 | % | ||||||||||||||||||||||||||||||||||

| 3. | Centric Brands Inc. | Empire State Building | Oct. 2028 | 3.3 years | 252,929 | 2.97 | % | 14,255,159 | 2.56 | % | ||||||||||||||||||||||||||||||||||

| 4. | PVH Corp. | 501 Seventh Avenue | Jan. 2026 - Oct. 2028 | 2.7 years | 237,281 | 2.79 | % | 13,507,462 | 2.43 | % | ||||||||||||||||||||||||||||||||||

| 5. | Institutional Capital Network, Inc. | One Grand Central Place | Nov. 2027 - Dec. 2041 | 15.6 years | 154,050 | 1.81 | % | 11,012,076 | 1.98 | % | ||||||||||||||||||||||||||||||||||

| 6. | Sephora USA, Inc. | 112 West 34th Street | Jan. 2029 | 3.6 years | 11,334 | 0.13 | % | 10,563,141 | 1.90 | % | ||||||||||||||||||||||||||||||||||

| 7. | Target Corporation | 112 West 34th St., 10 Union Sq. | Jan. 2038 | 12.6 years | 81,340 | 0.95 | % | 9,543,763 | 1.72 | % | ||||||||||||||||||||||||||||||||||

| 8. | Macy's | 111 West 33rd Street | May 2030 | 4.9 years | 131,117 | 1.54 | % | 9,520,794 | 1.71 | % | ||||||||||||||||||||||||||||||||||

| 9. | Coty Inc. | Empire State Building | Jan. 2030 | 4.6 years | 157,892 | 1.85 | % | 9,339,709 | 1.68 | % | ||||||||||||||||||||||||||||||||||

| 10. | URBAN OUTFITTERS | 1333 Broadway | Sep. 2029 | 4.3 years | 56,730 | 0.67 | % | 8,287,997 | 1.49 | % | ||||||||||||||||||||||||||||||||||

| 11. | Li & Fung | 1359 Broadway, ESB | Oct. 2027 - Oct. 2028 | 3.0 years | 149,061 | 1.75 | % | 8,173,187 | 1.47 | % | ||||||||||||||||||||||||||||||||||

| 12. | Foot Locker, Inc. | 112 West 34th Street | Sep. 2031 | 6.3 years | 34,192 | 0.40 | % | 7,834,994 | 1.41 | % | ||||||||||||||||||||||||||||||||||

| 13. | FDIC | Empire State Building | Dec. 2025 | 0.5 years | 119,226 | 1.40 | % | 7,751,788 | 1.39 | % | ||||||||||||||||||||||||||||||||||

| 14. | Shutterstock, Inc. | Empire State Building | Apr. 2029 | 3.8 years | 108,937 | 1.28 | % | 7,558,689 | 1.36 | % | ||||||||||||||||||||||||||||||||||

| 15. | Fragomen | 1400 Broadway | Feb. 2035 | 9.7 years | 107,680 | 1.26 | % | 7,118,080 | 1.28 | % | ||||||||||||||||||||||||||||||||||

| 16. | The Michael J. Fox Foundation | 111 West 33rd Street | Nov. 2029 | 4.4 years | 86,492 | 1.02 | % | 6,549,061 | 1.18 | % | ||||||||||||||||||||||||||||||||||

| 17. | ASCAP | 250 West 57th Street | Aug. 2034 | 9.2 years | 87,943 | 1.03 | % | 6,476,281 | 1.17 | % | ||||||||||||||||||||||||||||||||||

| 18. | Burlington Merchandising Corporation | 1400 Broadway | Jan. 2038 | 12.6 years | 102,898 | 1.21 | % | 6,463,891 | 1.16 | % | ||||||||||||||||||||||||||||||||||