UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2025

NioCorp Developments Ltd.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada (State or other jurisdiction of incorporation) |

001-41655 (Commission File Number) |

98-1262185 (IRS Employer Identification No.) |

7000 South Yosemite Street, Suite 115

Centennial, Colorado 80112

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (720) 334-7066

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares, without par value | NB | The Nasdaq Stock Market LLC |

| Warrants, each exercisable for 1.11829212 Common Shares | NIOBW | The Nasdaq Stock Market LLC |

| Common Share Purchase Rights | N/A | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

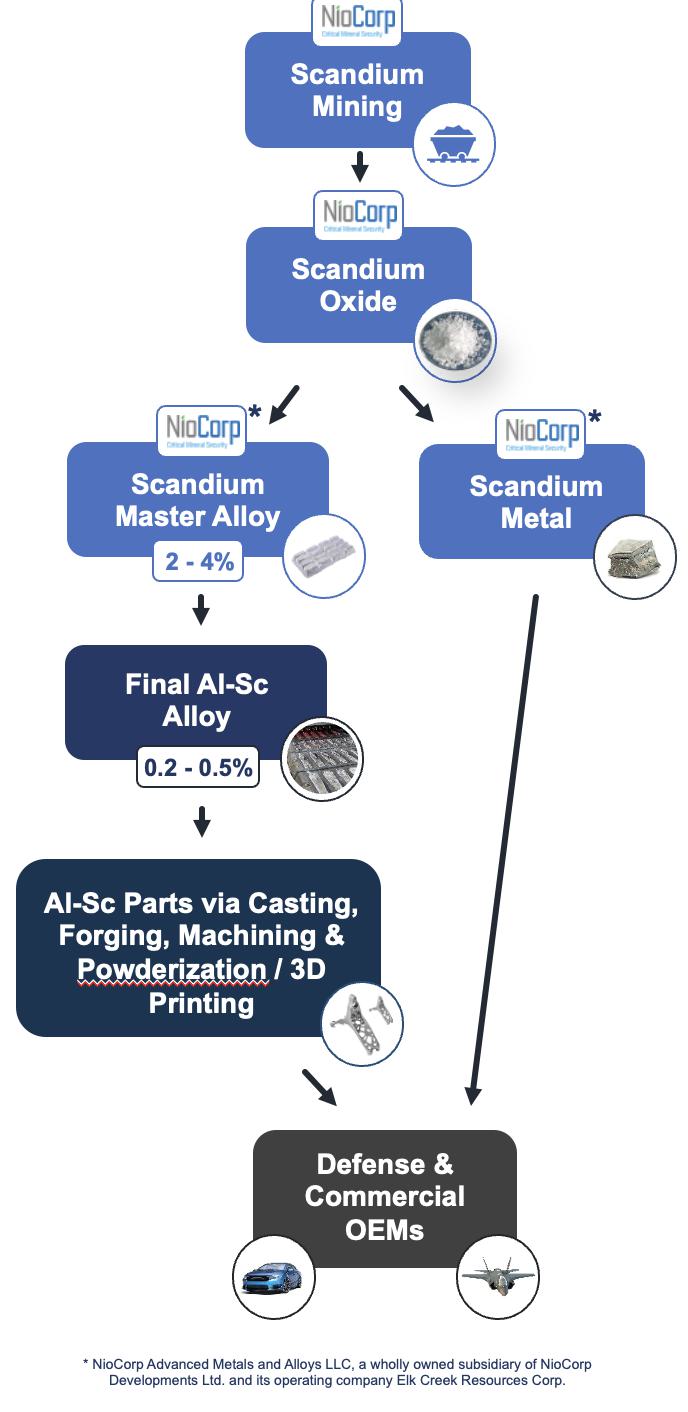

On December 4, 2025, NioCorp Advanced Metals and Alloys, LLC (the “Buyer”), an indirect subsidiary of NioCorp Developments Ltd. (the “Company”), entered into an Asset Purchase Agreement (the “Purchase Agreement”) with FEA Materials LLC (“FEA”), a producer of aluminum-scandium (“Al-Sc”) master alloy and Al-Sc alloy, and each member of FEA party thereto. Pursuant to the Purchase Agreement, on December 4, 2025, the Buyer acquired substantially all the assets, except for certain excluded assets, and assumed certain specified liabilities, of FEA, for an aggregate purchase price of $8.4 million, subject to adjustments for certain indemnification obligations that may arise, if any.

The Purchase Agreement includes customary representations, warranties and covenants, including non-competition and non-solicitation, and indemnification provisions. The assertions embodied in the representations and warranties included in the Purchase Agreement were made solely for purposes of the contract between the parties to the Purchase Agreement and may be subject to important qualifications and limitations agreed to by the parties in connection with negotiating its terms. Moreover, certain representations and warranties are subject to a contractual standard of materiality that may be different from what may be viewed as material to shareholders of the Company, and the representations and warranties may have been used to allocate risk between the parties to the Purchase Agreement rather than establishing matters as facts.

The foregoing description of the Purchase Agreement is qualified in its entirety by the full text of the Purchase Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 2.01. | Completion of Acquisition or Disposition of Assets. |

The information set forth in Item 1.01 is incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure. |

On December 4, 2025, the Company issued a press release announcing the entry into the Purchase Agreement and consummation of the transactions contemplated thereby. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. Such exhibit and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit |

Description |

|

| 2.1* | Asset Purchase Agreement, dated as of December 4, 2025, by and among NioCorp Advanced Metals and Alloys, LLC, FEA Materials LLC and each member of FEA Materials LLC party thereto | |

| 99.1 | Press Release, dated December 4, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Certain schedules and exhibits to this agreement have been omitted pursuant to Instruction 4 to Item 1.01 of Form 8-K. A copy of any omitted schedule or exhibit will be furnished to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| NIOCORP DEVELOPMENTS LTD. | ||

| DATE: December 4, 2025 | By: | /s/ Neal S. Shah |

|

Neal S. Shah Chief Financial Officer |

||

Exhibit 2.1

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this “Agreement”), dated as of December 4, 2025, is entered into between (i) FEA Materials LLC, a Mississippi limited liability company (“Seller”), (ii) the undersigned members of Seller (the “Members”), and NioCorp Advanced Metals and Alloys, LLC, a Delaware limited liability company (“Buyer”). Capitalized terms used in this Agreement have the meanings given to such terms herein, as such terms are defined or identified by the cross-references set forth in Exhibit A attached hereto.

RECITALS

WHEREAS, Seller is engaged in the business of producing AlSc master alloy and AlSc alloy (the “Business”); and

WHEREAS, Seller wishes to sell and assign to Buyer, and Buyer wishes to purchase and assume from Seller, substantially all the assets, and certain specified liabilities, of the Business, subject to the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

PURCHASE AND SALE

Section 1.01 Purchase and Sale of Assets. Subject to the terms and conditions set forth herein, at the Closing, Seller shall sell, convey, assign, transfer, and deliver to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title, and interest in, to, and under all of the tangible and intangible assets, properties, and rights of every kind and nature and wherever located (other than the Excluded Assets), which relate to, or are used or held for use in connection with, the Business (collectively, the “Purchased Assets”), including the following:

(a) Reserved;

(b) Reserved;

(c) all inventory, finished goods, raw materials, work in progress, packaging, supplies, parts, and other inventories (“Inventory”);

(d) Reserved;

(e) all furniture, fixtures, equipment, machinery, tools, vehicles, office equipment, supplies, computers, telephones, and other tangible personal property (the “Tangible Personal Property”); (f) all prepaid expenses, credits, advance payments, claims, security, refunds, rights of recovery, rights of set-off, rights of recoupment, deposits, charges, sums, and fees (including any such item relating to the payment of Taxes);

(g) all of Seller’s rights under warranties, indemnities, and all similar rights against third parties to the extent related to any Purchased Assets;

(h) all insurance benefits, including rights and proceeds, arising from or relating to the Business, the Purchased Assets, or the Assumed Liabilities;

(i) originals or, where not available, copies, of all books and records, including books of account, ledgers, and general, financial, and accounting records, machinery and equipment maintenance files, customer lists, customer purchasing histories, price lists, distribution lists, supplier lists, production data, quality control records and procedures, customer complaints and inquiry files, research and development files, records, and data (including all correspondence with any federal, state, local, or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any arbitrator, court, or tribunal of competent jurisdiction (collectively, “Governmental Authority”)), sales material and records, strategic plans and marketing, and promotional surveys, material, and research (“Books and Records”); and

(j) all goodwill and the going concern value of the Purchased Assets and the Business.

Section 1.02 Excluded Assets. Notwithstanding the foregoing, the Purchased Assets shall not include the Company’s bank accounts and cash on hand at or concurrent with Closing (collectively, the “Excluded Assets”).

Section 1.03 Assumed Liabilities.

(a) Subject to the terms and conditions set forth herein, Buyer shall assume and agree to pay, perform, and discharge only the following Liabilities of Seller (collectively, the “Assumed Liabilities”), and no other Liabilities: all trade accounts payable of Seller to third parties in connection with the Business that remain unpaid and are not delinquent as of the Closing Date.

For purposes of this Agreement, “Liabilities” means liabilities, obligations, or commitments of any nature whatsoever, whether asserted or unasserted, known or unknown, absolute or contingent, accrued or unaccrued, matured or unmatured, or otherwise.

(b) Notwithstanding any provision in this Agreement to the contrary, Buyer shall not assume and shall not be responsible to pay, perform, or discharge any Liabilities of Seller or any of its Affiliates of any kind or nature whatsoever other than the Assumed Liabilities (the “Excluded Liabilities”). For purposes of this Agreement: (i) “Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person; and (ii) the term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract, or otherwise.

Section 1.04 Purchase Price. The aggregate purchase price for the Purchased Assets shall be (i) $8,400,000 (the “Purchase Price”), plus (ii) the assumption of the Assumed Liabilities. The Purchase Price shall be paid as provided in Section 2.02.

Section 1.05 Allocation of Purchase Price. The Purchase Price and the Assumed Liabilities shall be allocated among the Purchased Assets for all purposes (including Tax and financial accounting) as shown on the allocation schedule set forth on Section 1.05 of the Disclosure Schedules (the “Allocation Schedule”). The Allocation Schedule shall be prepared in accordance with Section 1060 of the Internal Revenue Code of 1986, as amended. Buyer and Seller shall file all returns, declarations, reports, information returns and statements, and other documents relating to Taxes (including amended returns and claims for refund) (“Tax Returns”) in a manner consistent with the Allocation Schedule.

Section 1.06 Reserved.

Section 1.07 Third-Party Consents. To the extent that Seller’s rights under any Purchased Asset may not be assigned to Buyer without the consent of another Person which has not been obtained, this Agreement shall not constitute an agreement to assign the same if an attempted assignment would constitute a breach thereof or be unlawful, and Seller, at its expense, shall use its reasonable best efforts to obtain any such required consent(s) as promptly as possible. If any such consent shall not be obtained or if any attempted assignment would be ineffective or would impair Buyer’s rights under the Purchased Asset in question so that Buyer would not in effect acquire the benefit of all such rights, Seller, to the maximum extent permitted by Law and the Purchased Asset, shall act after the Closing as Buyer’s agent in order to obtain for it the benefits thereunder and shall cooperate, to the maximum extent permitted by Law and the Purchased Asset, with Buyer in any other reasonable arrangement designed to provide such benefits to Buyer.

ARTICLE II

CLOSING

Section 2.01 Closing. Subject to the terms and conditions of this Agreement, the consummation of the transactions contemplated by this Agreement (the “Closing”) shall take place remotely by exchange of documents and signatures (or their electronic counterparts), at 10:00 am Denver, Colorado time, simultaneously with the execution of this Agreement, or at such other time or place or in such other manner as Seller and Buyer may mutually agree upon in writing. The date on which the Closing is to occur is herein referred to as the “Closing Date.”

Section 2.02 Closing Deliverables. The respective party’s receipt of the following closing deliverables shall be a condition precedent to Closing:

(a) At the Closing, Seller shall deliver to Buyer the following:

(i) a bill of sale in the form of Exhibit B attached hereto (the “Bill of Sale”) and duly executed by Seller, transferring the Tangible Personal Property included in the Purchased Assets to Buyer;

(ii) Reserved;

(iii) an escrow agreement in the form of Exhibit D attached hereto (the “Escrow Agreement”) and duly executed by Seller and Escrow Agent;

(iv) with respect to the Lease, an Assignment and Assumption of Lease in the form of Exhibit E attached hereto (the “Assignment and Assumption of Lease”) and duly executed by Seller and landlord under such Lease;

(v) a power of attorney in the form of Exhibit F attached hereto and duly executed by Seller;

(vi) assignments in the form of Exhibit G hereto (the “Intellectual Property Assignments”) duly executed by Seller, transferring all of Seller’s right, title and interest in and to the Intellectual Property Assets to Buyer;

(vii) a valid Form W-9, Request for Taxpayer Identification Number and Certificate, duly executed by Seller;

(viii) a certificate of the secretary (or equivalent officer) of Seller certifying as to (A) the resolutions of the managing member, which authorize the execution, delivery, and performance of this Agreement and the other agreements, instruments, and documents required to be delivered in connection with this Agreement or at the Closing (collectively, the “Transaction Documents”) and the consummation of the transactions contemplated hereby and thereby, (B) the names and signatures of the officers of Seller authorized to sign this Agreement and the other Transaction Documents, and (C) a Certificate of Good Standing (or equivalent) issued by the Secretary of State of the jurisdiction of Seller’s organization dated no earlier than 30 days prior to Closing; and

(ix) such other customary instruments of transfer or assumption, filings, or documents, in form and substance reasonably satisfactory to Buyer, as may be required to give effect to the transactions contemplated by this Agreement.

(b) At the Closing, Buyer shall deliver to Seller the following:

(i) the Purchase Price less the Indemnification Escrow Amount and any amounts which may be withheld for outstanding Tax Liabilities) pursuant to wire instructions provided by the Seller at least two business days prior to the Closing;

(ii) the Assignment and Assumption Agreement duly executed by Buyer;

(iii) the Escrow Agreement duly executed by Buyer;

(iv) the Assignment and Assumption of Lease duly executed by Buyer; and

(v) a certificate of the Secretary (or equivalent officer) of Buyer certifying as to (A) the resolutions of the board of directors of Buyer, which authorize the execution, delivery, and performance of this Agreement and the Transaction Documents and the consummation of the transactions contemplated hereby and thereby, and (B) the names and signatures of the officers of Buyer authorized to sign this Agreement and the other Transaction Documents.

(c) At the Closing, Buyer shall deliver to the Escrow Agent:

(i) the Indemnification Escrow Amount pursuant to wire instructions provided by the Escrow Agent at least two business days prior to the Closing, to be held for the purpose of securing the indemnification obligations of Seller Parties set forth in Article VI; and

(ii) the Escrow Agreement.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF SELLER AND MEMBERS

Except as set forth in the correspondingly numbered Section of the Disclosure Schedules, Seller and each of the Members, severally and not jointly, represent and warrant to Buyer that the statements contained in this ARTICLE III are true and correct as of the date hereof. The representations and warranties made by Seller and Members in Sections 3.08 to 3.22 are made to the best of Seller and Members’ Knowledge.

Section 3.01 Organization and Authority. Seller is a limited liability company duly organized, validly existing, and in good standing under the Laws of the State of Mississippi. Seller has full power and authority to enter into this Agreement and the other Transaction Documents to which Seller is a party, to carry out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Seller of this Agreement and any other Transaction Document to which Seller is a party, the performance by Seller of its obligations hereunder and thereunder, and the consummation by Seller of the transactions contemplated hereby and thereby have been duly authorized by all requisite action on the part of Seller. This Agreement and the Transaction Documents constitute legal, valid, and binding obligations of Seller enforceable against Seller in accordance with their respective terms. Each Member, whether an individual or an entity, hereby represents and warrants that (a) if such member is an entity, it is duly organized, validly existing, and in good standing under the Laws of its jurisdiction of organization, and has full power and authority to execute and deliver this Agreement and the other Transaction Documents to which it is a party, to perform its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby; (b) if such member is an individual, he or she has full legal capacity, power, and authority to execute and deliver this Agreement and the other Transaction Documents to which he or she is a party, to perform his or her obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby; and (c) this Agreement and the other Transaction Documents to which such member is a party constitute legal, valid, and binding obligations of such member, enforceable against such member in accordance with their respective terms.

Section 3.02 No Conflicts or Consents. The execution, delivery, and performance by Seller of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate or conflict with any provision of the formation or governing documents of Seller; (b) violate or conflict with any provision of any statute, law, ordinance, regulation, rule, code, constitution, treaty, common law, other requirement, or rule of law of any Governmental Authority (collectively, “Law”) or any order, writ, judgment, injunction, decree, stipulation, determination, penalty, or award entered by or with any Governmental Authority (“Governmental Order”) applicable to Seller, the Business, or the Purchased Assets; (c) except as set forth on Section 3.02 of the Disclosure Schedules, require the consent, notice, declaration, or filing with or other action by any individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association, or other entity (“Person”) or require any permit, license, or Governmental Order; (d) violate or conflict with, result in the acceleration of, or create in any party the right to accelerate, terminate, modify, or cancel any Contract to which Seller is a party or by which Seller or the Business is bound or to which any of the Purchased Assets are subject; or (e) result in the creation or imposition of any charge, claim, pledge, equitable interest, lien, security interest, restriction of any kind, or other encumbrance (“Encumbrance”) on the Purchased Assets.

Section 3.03 Financial Statements. Complete copies of the Company’s financial statements consisting of the balance sheet of the Company as at September 30, 2025 and statements of income for the years 2020, 2021, 2022, 2023 and 2024 and nine-month period ending September 30, 2025 (the “Financial Statements”) have been delivered to Buyer. The Financial Statements are based on the books and records of the Company, and fairly present in all material respects the financial condition of the Company as of the respective dates they were prepared and the results of the operations of the Company for the periods indicated. The balance sheet of the Company as of September 30, 2025 is referred to herein as the “Balance Sheet” and the date thereof as the “Balance Sheet Date.”

Section 3.04 Undisclosed Liabilities. Seller has no Liabilities with respect to the Business, except (a) those which are adequately reflected or reserved against in the Balance Sheet as of the Balance Sheet Date, (b) those which have been incurred in the ordinary course of business consistent with past practice since the Balance Sheet Date and which are not, individually or in the aggregate, material in amount, or (c) those which have been disclosed on the Disclosure Schedule, if any.

Section 3.05 Absence of Certain Changes, Events, and Conditions. Since the Balance Sheet Date, the Business has been conducted in the ordinary course of business consistent with past practice and there has not been any change, event, condition, or development that is, or could reasonably be expected to be, individually or in the aggregate, materially adverse to: (a) the business, results of operations, condition (financial or otherwise), or assets of the Business; or (b) the value of the Purchased Assets.

Section 3.06 Reserved.

Section 3.07 Title to Purchased Assets. Seller has good and valid title to all the Purchased Assets, free and clear of Encumbrances.

Section 3.08 Condition of Assets. Each item of Tangible Personal Property is structurally sound, is in good operating condition and repair, and is adequate for the uses to which it is being put, and no item of Tangible Personal Property is in need of maintenance or repairs except for ordinary, routine maintenance and repairs that are not material in nature or cost.

Section 3.09 Inventory. All Inventory, whether or not reflected in the Balance Sheet, consists of a quality and quantity usable and salable in the ordinary course of business consistent with past practice, except for obsolete, damaged, defective, or slow-moving items that have been written off or written down to fair market value or for which adequate reserves have been established.

Section 3.10 Reserved.

Section 3.11 Material Customers and Suppliers.

(a) Section 3.11(a) of the Disclosure Schedules sets forth with respect to the Business (i) each customer who has paid aggregate consideration to Seller for goods or services rendered in an amount greater than or equal to $1,000 for the most recent fiscal year (collectively, the “Material Customers”); and (ii) the amount of consideration paid by each Material Customer during such periods. Seller has not received any notice, and has no reason to believe, that any of the Material Customers has ceased, or intends to cease after the Closing, to use the goods or services of the Business or to otherwise terminate or materially reduce its relationship with the Business.

(b) Section 3.11(b) of the Disclosure Schedules sets forth with respect to the Business (i) each supplier to whom Seller has paid aggregate consideration for goods or services rendered in an amount greater than or equal to $1,000 for the most recent fiscal year (collectively, the “Material Suppliers”); and (ii) the amount of purchases from each Material Supplier during such periods. Seller has not received any notice, and has no reason to believe, that any of the Material Suppliers has ceased, or intends to cease, to supply goods or services to the Business or to otherwise terminate or materially reduce its relationship with the Business.

Section 3.12 Legal Proceedings; Governmental Orders.

(a) There are no claims, actions, causes of action, demands, lawsuits, arbitrations, inquiries, audits, notices of violation, proceedings, litigation, citations, summons, subpoenas, or investigations of any nature, whether at law or in equity (collectively, “Actions”) pending or, to Seller’s or such Member’s Knowledge, threatened against or by Seller: (i) relating to or affecting the Business, the Purchased Assets, or the Assumed Liabilities; or (ii) that challenge or seek to prevent, enjoin, or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

(b) There are no outstanding Governmental Orders against, relating to, or affecting the Business or the Purchased Assets.

Section 3.13 Compliance with Laws. Seller is in compliance with all Laws applicable to the conduct of the Business as currently conducted or the ownership and use of the Purchased Assets.

Section 3.14 Taxes. All Taxes due and owing by Seller have been, or will be, timely paid. No extensions or waivers of statutes of limitations have been given or requested with respect to any Taxes of Seller. All Tax Returns with respect to the Business required to be filed by Seller for any tax periods prior to Closing have been, or will be, timely filed. Such Tax Returns are, or will be, true, complete, and correct in all respects. The term “Taxes” means all federal, state, local, foreign, and other income, gross receipts, sales, use, production, ad valorem, transfer, documentary, franchise, registration, profits, license, withholding, payroll, employment, unemployment, excise, severance, stamp, occupation, premium, property (real or personal), customs, duties, or other taxes, fees, assessments, or charges of any kind whatsoever, together with any interest, additions, or penalties with respect thereto.

Section 3.15 Related Party Transactions. Except as set forth on Section 3.15 of the Disclosure Schedules, there are no Contracts or other arrangements involving the Business in which Seller, its Affiliates, or any of its or their respective directors, officers, or employees or any immediate family members thereof is a party, has a financial interest, or otherwise owns or leases any Purchased Asset.

Section 3.16 Brokers. No broker, finder, or investment banker is entitled to any brokerage, finder’s, or other fee or commission in connection with the transactions contemplated by this Agreement or any other Transaction Document based upon arrangements made by or on behalf of Seller.

Section 3.17 Leased Property. Section 3.17 of the Disclosure Schedules sets forth each parcel of real property leased by Seller and used in or necessary for the conduct of the Business as currently conducted (together with all rights, title and interest of Seller in and to leasehold improvements relating thereto, including, but not limited to, security deposits, reserves or prepaid rents paid in connection therewith, collectively, the “Leased Real Property”), and a true and complete list of all leases, subleases, licenses, concessions and other agreements (whether written or oral), including all amendments, extensions renewals, guaranties and other agreements with respect thereto, pursuant to which Seller holds any Leased Real Property (collectively, the “Leases”). Seller has delivered to Buyer a true and complete copy of each Lease. With respect to each Lease:

(i) such Lease is valid, binding, enforceable and in full force and effect, and Seller enjoys peaceful and undisturbed possession of the Leased Real Property;

(ii) Seller is not in breach or default under such Lease, and no event has occurred or circumstance exists which, with the delivery of notice, passage of time or both, would constitute such a breach or default, and Seller has paid all rent due and payable under such Lease;

(iii) Seller has not received nor given any notice of any default or event that with notice or lapse of time, or both, would constitute a default by Seller under any of the Leases and, to the Knowledge of Seller and such Member, no other party is in default thereof, and no party to any Lease has exercised any termination rights with respect thereto;

(iv) Seller has not subleased, assigned or otherwise granted to any Person the right to use or occupy such Leased Real Property or any portion thereof; and

(v) Seller has not pledged, mortgaged or otherwise granted an Encumbrance on its leasehold interest in any Leased Real Property.

Section 3.18 Intellectual Property.

(a) Section 3.18(a) of the Disclosure Schedules contains a correct, current and complete list of: (i) all Intellectual Property Registrations, specifying as to each, as applicable: the title, mark, or design; the jurisdiction by or in which it has been issued, registered or filed; the patent, registration or application serial number; the issue, registration or filing date; and the current status; (ii) all unregistered Trademarks included in the Intellectual Property Assets; and (iv) all other Intellectual Property Assets that are used or held for use in the conduct of the Business as currently conducted or proposed to be conducted.

(b) Section 3.18(b) of the Disclosure Schedules contains a correct, current and complete list of all Intellectual Property Agreements: (i) under which Seller is a licensor or otherwise grants to any Person any right or interest relating to any Intellectual Property Asset; (ii) under which Seller is a licensee or otherwise granted any right or interest relating to the Intellectual Property of any Person; and (iii) which otherwise relate to the Seller’s ownership or use of any Intellectual Property in the conduct of the Business as currently conducted or proposed to be conducted, in each case identifying the Intellectual Property covered by such Intellectual Property Agreement. Seller has provided Buyer with true and complete copies (or in the case of any oral agreements, a complete and correct written description) of all such Intellectual Property Agreements, including all modifications, amendments and supplements thereto and waivers thereunder. Each Intellectual Property Agreement is valid and binding on Seller in accordance with its terms and is in full force and effect. Neither Seller nor any other party thereto is, or is alleged to be, in breach of or default under, or has provided or received any notice of breach of, default under, or intention to terminate (including by non-renewal), any Intellectual Property Agreement. All Intellectual Property Agreements are in compliance with all applicable Laws in all jurisdictions in which Seller conducts any business operations, including those pertaining to remittance of foreign exchange and taxation.

(c) Seller is the sole and exclusive legal and beneficial, and with respect to the Intellectual Property Registrations, record, owner of all right, title and interest in and to the Intellectual Property Assets, and has the valid and enforceable right to use all other Intellectual Property used or held for use in or necessary for the conduct of the Business as currently conducted or as proposed to be conducted, in each case, free and clear of Encumbrances. The Intellectual Property Assets are all of the Intellectual Property necessary to operate the Business as presently conducted or proposed to be conducted. Seller has entered into binding, valid and enforceable written Contracts with each current and former employee and independent contractor who is or was involved in or has contributed to the invention, creation, or development of any Intellectual Property during the course of employment or engagement with Seller whereby such employee or independent contractor (i) acknowledges Seller’s exclusive ownership of all Intellectual Property Assets invented, created or developed by such employee or independent contractor within the scope of his or her employment or engagement with Seller; (ii) grants to Seller a present, irrevocable assignment of any ownership interest such employee or independent contractor may have in or to such Intellectual Property; and (iii) irrevocably waives any right or interest, including any moral rights, regarding such Intellectual Property, to the extent permitted by applicable Law. All assignments and other instruments necessary to establish, record, and perfect Seller’s ownership interest in the Intellectual Property Registrations have been validly executed, delivered, and filed with the relevant Governmental Authorities and authorized registrars.

(d) Neither the execution, delivery, or performance of this Agreement, nor the consummation of the transactions contemplated hereunder, will result in the loss or impairment of or payment of any additional amounts with respect to, or require the consent of any other Person in respect of, the Buyer’s right to own or use any Intellectual Property Assets in the conduct of the Business as currently conducted and as proposed to be conducted. Immediately following the Closing, all Intellectual Property Assets will be owned or available for use by Buyer on identical terms as they were owned or available for use by Seller immediately prior to the Closing. The consummation of the transactions contemplated hereby will not affect the validity, or result in any loss or modification to, or any revocation, termination, cancellation or withdrawal of, any of the Intellectual Property Assets and will not require the consent or approval of any Person under, or in connection with, any of the Intellectual Property Assets.

(e) All of the Intellectual Property Assets are valid and enforceable, and all Intellectual Property Registrations are subsisting and in full force and effect (other than those noted in Section 3.18(a) of the Disclosure Schedules to be expired). Seller has taken all reasonable and necessary steps to maintain and enforce the Intellectual Property Assets and to preserve the confidentiality of all Trade Secrets included in the Intellectual Property Assets, including by requiring all Persons having access thereto to execute binding, written non-disclosure agreements. There is no unauthorized use or disclosure of any of the Intellectual Property Assets by any third party, including any employee or former employee of Seller. Seller has, as of the date hereof, and will have as of the Closing, satisfied all current requirements necessary to maintain all Intellectual Property Assets. All required filings and fees related to the Intellectual Property Registrations, including all maintenance fees, annuities, and renewal fees, have been and will be timely submitted with and paid to the relevant Governmental Authorities and authorized registrars. All pending Intellectual Property Registrations are pending without challenge (other than office actions issued in the ordinary course before the United States Patent and Trademark Office or its foreign equivalents).

(f) The conduct of the Business as currently and formerly conducted and as proposed to be conducted, including the use of the Intellectual Property Assets in connection therewith, and the products, processes, and services of the Business have not nor have been alleged by a third party to have infringed, misappropriated, or otherwise violated and will not infringe, misappropriate, or otherwise violate the Intellectual Property or other rights of any Person. There are not any efforts or actions by others to interfere with, infringe upon, misappropriate or otherwise come into conflict with any Intellectual Property. No Person other than Seller is using any of the Intellectual Property Assets, and no Person, including any employee or former employee of Seller, has infringed, misappropriated, or otherwise violated any Intellectual Property Assets.

(g) There are no Actions (including any opposition, cancellation, revocation, review, or other proceeding), whether settled, pending or threatened (including in the form of offers to obtain a license): (i) alleging any infringement, misappropriation, or other violation of the Intellectual Property of any Person by Seller in the conduct of the Business; (ii) challenging the validity, enforceability, registrability, patentability, or ownership of any Intellectual Property Assets; or (iii) by Seller or any other Person alleging any infringement, misappropriation, or other violation by any Person of any Intellectual Property Assets. Seller is not aware of any facts or circumstances that could reasonably be expected to give rise to any such Action. Seller is not subject to any outstanding or prospective Governmental Order (including any motion or petition therefor) that does or could reasonably be expected to restrict or impair the use of any Intellectual Property Assets.

(h) Section 3.18(h) of the Seller Disclosure Schedules contains a correct, current, and complete list of all social media accounts used by Seller in the conduct of the Business. Seller has complied with all terms of use, terms of service, and other Contracts and all associated policies and guidelines relating to its use of any social media platforms, sites, or services in the conduct of the Business (collectively, “Platform Agreements”). There are no Actions settled, pending, or threatened alleging (i) any breach or other violation of any Platform Agreement by Seller; or (ii) defamation, any violation of publicity rights of any Person, or any other violation by Seller in connection with its use of social media in the conduct of the Business.

(i) All Business IT Systems are in good working condition and are sufficient for the operation of the Business as currently conducted and as proposed to be conducted. In the past three years, there has been no malfunction, failure, continued substandard performance, denial-of-service, or other cyber incident, including any cyberattack, or other impairment of the Business IT Systems that has resulted or is reasonably likely to result in disruption or damage to the Business. Seller has taken all commercially reasonable steps to safeguard the confidentiality, availability, security, and integrity of the Business IT Systems, including implementing and maintaining appropriate backup, disaster recovery, and Software and hardware support arrangements.

(j) Seller has complied with all applicable Laws and all internal or publicly posted policies, notices, and statements concerning the collection, use, processing, storage, transfer, and security of personal information in the conduct of the Business. In the past three years, Seller has not (i) experienced any actual, alleged, or suspected data breach or other security incident involving personal information in its possession or control or (ii) been subject to or received any written notice of any audit, investigation, complaint, or other Action by any Governmental Authority or other Person concerning the Seller’s collection, use, processing, storage, transfer, or protection of personal information or actual, alleged, or suspected violation of any applicable Law concerning privacy, data security, or data breach notification, in each case in connection with the conduct of the Business, and to Seller’s Knowledge, there are no facts or circumstances that could reasonably be expected to give rise to any such Action.

Section 3.19 Insurance. Section 3.19 of the Disclosure Schedules sets forth (a) a true and complete list of all current policies or binders of fire, liability, product liability, umbrella liability, real and personal property, workers’ compensation, vehicular, fiduciary liability and other casualty and property insurance maintained by Seller or its Affiliates and relating to the Business, the Purchased Assets or the Assumed Liabilities (collectively, the “Insurance Policies”); and (b) with respect to the Business, the Purchased Assets or the Assumed Liabilities, a list of all pending claims and the claims history for Seller since January 1, 2020. There are no claims related to the Business, the Purchased Assets or the Assumed Liabilities pending under any Insurance Policies as to which coverage has been questioned, denied or disputed or in respect of which there is an outstanding reservation of rights. Neither Seller nor any of its Affiliates has received any written notice of cancellation of, premium increase with respect to, or alteration of coverage under, any of the Insurance Policies. All premiums due on the Insurance Policies have either been paid or, if not yet due, accrued. All the Insurance Policies (a) are in full force and effect and enforceable in accordance with their terms; (b) are provided by carriers who are financially solvent; and (c) have not been subject to any lapse in coverage. None of Seller or any of its Affiliates is in default under, or has otherwise failed to comply with, in any material respect, any provision contained in any Insurance Policy. The Insurance Policies are of the type and in the amounts customarily carried by Persons conducting a business similar to the Business and are sufficient for compliance with all applicable Laws and Contracts to which Seller is a party or by which it is bound. True and complete copies of the Insurance Policies have been made available to Buyer.

Section 3.20 Environmental Matters.

(a) The operations of Seller with respect to the Business and the Purchased Assets are currently and have been in compliance with all Environmental Laws. Seller has not received from any Person, with respect to the Business or the Purchased Assets, any: (i) Environmental Notice or Environmental Claim; or (ii) written request for information pursuant to Environmental Law, which, in each case, either remains pending or unresolved, or is the source of ongoing obligations or requirements as of the Closing Date.

(b) Seller has obtained and is in material compliance with all Environmental Permits (each of which is disclosed in Section 3.20(b) of the Disclosure Schedules) necessary for the conduct of the Business as currently conducted or the ownership, lease, operation or use of the Purchased Assets and all such Environmental Permits are in full force and effect and shall be maintained in full force and effect by Seller through the Closing Date in accordance with Environmental Law, and Seller is not aware of any condition, event or circumstance that might prevent or impede, after the Closing Date, the conduct of the Business as currently conducted or the ownership, lease, operation or use of the Purchased Assets. With respect to any such Environmental Permits, Seller has undertaken, or will undertake prior to the Closing Date, all measures necessary to facilitate transferability of the same, and Seller is not aware of any condition, event or circumstance that might prevent or impede the transferability of the same, and has not received any Environmental Notice or written communication regarding any material adverse change in the status or terms and conditions of the same.

(c) None of the Business or the Purchased Assets is listed on, or has been proposed for listing on, the National Priorities List (or CERCLIS) under CERCLA, or any similar state list.

(d) There has been no Release of Hazardous Materials in contravention of Environmental Law with respect to the Business or the Purchased Assets, and Seller has not received an Environmental Notice that any of the Business or the Purchased Assets (including soils, groundwater, surface water, buildings and other structure located thereon) has been contaminated with any Hazardous Material which could reasonably be expected to result in an Environmental Claim against, or a violation of Environmental Law or term of any Environmental Permit by, Seller.

(e) There are no active or abandoned aboveground or underground storage tanks owned or operated by Seller in connection with the Business or the Purchased Assets.

(f) Seller has not retained or assumed, by contract or operation of Law, any liabilities or obligations of third parties under Environmental Law.

(g) Seller is not aware of or reasonably anticipates, as of the Closing Date, any condition, event or circumstance concerning the Release or regulation of Hazardous Materials that might, after the Closing Date, prevent, impede or materially increase the costs associated with the ownership, lease, operation, performance or use of the Business or the Purchased Assets as currently carried out.

Section 3.21 Employment Matters.

(a) Section 3.21(a) of the Disclosure Schedules contains a list of all persons who are employees, independent contractors or consultants of the Business as of the date hereof, including any employee who is on a leave of absence of any nature, paid or unpaid, authorized or unauthorized, and sets forth for each such individual the following: (i) name; (ii) title or position (including whether full-time or part-time); (iii) hire or retention date; (iv) current annual base compensation rate or contract fee; (v) commission, bonus or other incentive-based compensation; and (vi) a description of the fringe benefits provided to each such individual as of the date hereof. As of the date hereof, all compensation, including wages, commissions, bonuses, fees and other compensation, payable to all employees, independent contractors or consultants of the Business for services performed on or prior to the date hereof have been paid in full and there are no outstanding agreements, understandings or commitments of Seller with respect to any compensation, commissions, bonuses or fees.

(b) Seller is not, and has not been for the past four years, a party to, bound by, or negotiating any collective bargaining agreement or other Contract with a union, works council or labor organization (collectively, “Union”), and there is not, and has not been for the past four years, any Union representing or purporting to represent any employee of Seller, and, to Seller’s Knowledge, no Union or group of employees is seeking or has sought to organize employees for the purpose of collective bargaining. There has never been, nor has there been any threat of, any strike, slowdown, work stoppage, lockout, concerted refusal to work overtime or other similar labor disruption or dispute affecting Seller or any employees of the Business. Seller has no duty to bargain with any Union.

(c) Seller is and has been in compliance in all material respects with all applicable Laws pertaining to employment and employment practices to the extent they relate to employees, consultants and independent contractors of the Business, including all Laws relating to labor relations, equal employment opportunities, fair employment practices, employment discrimination, harassment, retaliation, reasonable accommodation, disability rights or benefits, immigration, wages, hours, overtime compensation, child labor, hiring, promotion and termination of employees, working conditions, meal and break periods, privacy, health and safety, workers’ compensation, leaves of absence, paid sick leave and unemployment insurance. All individuals characterized and treated by Seller as consultants or independent contractors of the Business are properly treated as independent contractors under all applicable Laws. All employees of the Business classified as exempt under the Fair Labor Standards Act and state and local wage and hour laws are properly classified in all material respects. Seller is in compliance with and has complied with all immigration laws, including Form I-9 requirements and any applicable mandatory E-Verify obligations. There are no Actions against Seller pending, or to the Seller’s Knowledge, threatened to be brought or filed, by or with any Governmental Authority or arbitrator in connection with the employment of any current or former applicant, employee, consultant or independent contractor of the Business, including, without limitation, any charge, investigation or claim relating to unfair labor practices, equal employment opportunities, fair employment practices, employment discrimination, harassment, retaliation, reasonable accommodation, disability rights or benefits, immigration, wages, hours, overtime compensation, employee classification, child labor, hiring, promotion and termination of employees, working conditions, meal and break periods, privacy, health and safety, workers’ compensation, leaves of absence, paid sick leave, unemployment insurance or any other employment related matter arising under applicable Laws.

Section 3.22 Full Disclosure. No representation or warranty by Seller or Members in this Agreement and no statement contained in the Disclosure Schedules to this Agreement or any certificate or other document or information, in whatever form, furnished or to be furnished to Buyer pursuant to this Agreement contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein, in light of the circumstances in which they are made, not misleading.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller that the statements contained in this ARTICLE IV are true and correct as of the date hereof.

Section 4.01 Organization and Authority of Buyer. Buyer is a limited liability company duly formed, validly existing, and in good standing under the Laws of the State of Delaware. Buyer has all limited liability company power and authority to enter into this Agreement and the other Transaction Documents to which Buyer is a party, to carry out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Buyer of this Agreement and any other Transaction Document to which Buyer is a party, the performance by Buyer of its obligations hereunder and thereunder, and the consummation by Buyer of the transactions contemplated hereby and thereby have been duly authorized by all requisite limited liability company action on the part of Buyer. This Agreement and the Transaction Documents constitute legal, valid, and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms.

Section 4.02 No Conflicts; Consents. The execution, delivery, and performance by Buyer of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate or conflict with any provision of the certificate of incorporation, by-laws, or other organizational documents of Buyer; (b) violate or conflict with any provision of any Law or Governmental Order applicable to Buyer; or (c) require the consent, notice, declaration, or filing with or other action by any Person or require any permit, license, or Governmental Order.

Section 4.03 Brokers. No broker, finder, or investment banker is entitled to any brokerage, finder’s, or other fee or commission in connection with the transactions contemplated by this Agreement or any other Transaction Document based upon arrangements made by or on behalf of Buyer.

Section 4.04 Legal Proceedings. There are no Actions pending or, to Buyer’s Knowledge, threatened against or by Buyer that challenge or seek to prevent, enjoin, or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

ARTICLE V

COVENANTS

Section 5.01 Confidentiality. From and after the Closing, Seller and each Member shall, and shall cause their respective Affiliates to, hold, and shall use its reasonable best efforts to cause its or their respective directors, officers, employees, consultants, counsel, accountants, and other agents (“Representatives”) to hold, in confidence any and all information, whether written or oral, concerning the Business, except to the extent that Seller or such Member can show that such information: (a) is generally available to and known by the public through no fault of Seller or such Member, any of their respective Affiliates, or their respective Representatives; or (b) is lawfully acquired by Seller or such Member, any of their respective Affiliates, or their respective Representatives from and after the Closing from sources which are not prohibited from disclosing such information by a legal, contractual, or fiduciary obligation. If Seller or such Member or any of their respective Affiliates or their respective Representatives are compelled to disclose any information by Governmental Order or Law, Seller or such Member shall promptly notify Buyer in writing and shall disclose only that portion of such information which is legally required to be disclosed, provided that Seller or such Member shall use reasonable best efforts to obtain as promptly as possible an appropriate protective order or other reasonable assurance that confidential treatment will be accorded such information.

Section 5.02 Non-Competition; Non-Solicitation.

(a) Each Restricted Party acknowledges the competitive nature of the Business and accordingly agrees, in connection with the sale of the Purchased Assets, including the goodwill of the Business, which Buyer considers to be a valuable asset, and in exchange for good and valuable consideration, that for a period of 5 years commencing on the Closing Date (the “Restricted Period”), each Restricted Party shall not, and shall not permit any of its Affiliates (excluding the Non-Restricted Parties) to, directly or indirectly, (i) engage in or assist others in engaging in Business (the “Restricted Business”) within any geographic area in which the Restricted Business has conducted, or has actively planned or solicited to conduct, operations, customers, or sales during the twelve (12) months preceding the Closing Date, or any area in which the Buyer or Business is reasonably expected to conduct business during the Restricted Period (the “Territory”); (ii) have an interest in any Person that engages directly or indirectly in the Restricted Business in the Territory in any capacity, including as a partner, shareholder, director, member, manager, employee, principal, agent, trustee, or consultant; or (iii) cause, induce, or encourage any material actual or prospective client, customer, supplier, or licensor of the Business (including any existing or former client or customer of Seller and any Person that becomes a client or customer of the Business after the Closing), or any other Person who has a material business relationship with the Business, to terminate or modify any such actual or prospective relationship. Notwithstanding the foregoing, each Restricted Party may own, directly or indirectly, solely as an investment, securities of any Person traded on any national securities exchange if such Restricted Party is not a controlling Person of, or a member of a group which controls, such Person and does not, directly or indirectly, own five percent (5%) or more of any class of securities of such Person.

(b) During the Restricted Period, each Restricted Party shall not, and shall not permit any of its Affiliates (excluding the Non-Restricted Parties), directly or indirectly, hire or solicit any person who is or was employed in the Business during the Restricted Period, or encourage any such employee to leave such employment or hire any such employee who has left such employment, except pursuant to a general solicitation which is not directed specifically to any such employees; provided that nothing in this Section 5.02(b) shall prevent such Restricted Party or any of its Affiliates from hiring (i) any employee whose employment has been terminated by Buyer; or (ii) after one hundred eighty (180) days from the date of termination of employment, any employee whose employment has been terminated by the employee.

(c) Each Restricted Party acknowledges that a breach or threatened breach of this Section 5.02 would give rise to irreparable harm to Buyer, for which monetary damages would not be an adequate remedy, and hereby agrees that in the event of a breach or a threatened breach by any Restricted Party of any such obligations, Buyer shall, in addition to any and all other rights and remedies that may be available to it in respect of such breach, be entitled to seek equitable relief, including a temporary restraining order, an injunction, specific performance, and any other relief that may be available from a court of competent jurisdiction (without any requirement to post bond).

(d) Each Restricted Party acknowledges that the restrictions contained in this Section 5.02 are reasonable and necessary to protect the legitimate interests of Buyer and constitute a material inducement to Buyer to enter into this Agreement and consummate the transactions contemplated by this Agreement. In the event that any covenant contained in this Section 5.02 should ever be adjudicated to exceed the time, geographic, product or service, or other limitations permitted by applicable Law in any jurisdiction or any Governmental Order, then any court is expressly empowered to reform such covenant in such jurisdiction to the maximum time, geographic, product or service, or other limitations permitted by applicable Law or such Governmental Order. The covenants contained in this Section 5.02 and each provision hereof are severable and distinct covenants and provisions. The invalidity or unenforceability of any such covenant or provision as written shall not invalidate or render unenforceable the remaining covenants or provisions hereof, and any such invalidity or unenforceability in any jurisdiction shall not invalidate or render unenforceable such covenant or provision in any other jurisdiction.

Section 5.03 Public Announcements and Required Disclosure. Unless otherwise required by applicable Law, including obligations under U.S. or Canadian securities laws, regulations, or stock exchange rules, no party to this Agreement shall make any public announcements in respect of this Agreement or the transactions contemplated hereby without the prior written consent of the other party (which consent shall not be unreasonably withheld or delayed), and the parties shall cooperate as to the timing and contents of any such announcement.

Section 5.04 Bulk Sales Laws. The parties hereby waive compliance with the provisions of any bulk sales, bulk transfer, or similar Laws of any jurisdiction that may otherwise be applicable with respect to the sale of any or all of the Purchased Assets to Buyer. Any Liabilities arising out of the failure of Seller to comply with the requirements and provisions of any bulk sales, bulk transfer, or similar Laws of any jurisdiction which would not otherwise constitute Assumed Liabilities shall be treated as Excluded Liabilities.

Section 5.05 Receivables. From and after the Closing, if Seller or any of its Affiliates receives or collects any funds relating to any Purchased Asset, Seller or its Affiliate shall remit such funds to Buyer within five (5) business days after its receipt thereof. From and after the Closing, if Buyer or its Affiliate receives or collects any funds relating to any Excluded Asset, Buyer or its Affiliate shall remit any such funds to Seller within five (5) business days after its receipt thereof.

Section 5.06 Transfer Taxes. All sales, use, registration, and other such Taxes and fees (including any penalties and interest) incurred in connection with this Agreement and the other Transaction Documents, if any, shall be borne and paid by Seller when due. Seller shall, at its own expense, timely file any Tax Return or other document with respect to such Taxes or fees (and Buyer shall cooperate with respect thereto as necessary).

Section 5.07 Further Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective Affiliates to, execute and deliver such additional documents, instruments, conveyances, and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement and the other Transaction Documents.

ARTICLE VI

INDEMNIFICATION

Section 6.01 Survival. All representations, warranties, covenants, and agreements contained herein and all related rights to indemnification shall survive the Closing and shall remain in full force and effect until the date that is 18 months from the Closing Date; provided, that the representations and warranties in Section 3.01, Section 3.02, Section 3.07, Section 3.14, Section 3.18, Section 4.01, Section 4.02 and Section 4.03 shall survive until the date that is five (5) years from the Closing Date. Notwithstanding the foregoing, any claims asserted in good faith with reasonable specificity (to the extent known at such time) and in writing by notice from the non-breaching party to the breaching party prior to the expiration date of the applicable survival period shall not thereafter be barred by the expiration of the relevant representation or warranty and such claims shall survive until finally resolved.

Section 6.02 Indemnification by Seller. Subject to the other terms and conditions of this ARTICLE VI, from and after Closing, Seller and each Member, severally and jointly (collectively, the “Seller Parties”) shall indemnify and defend each of Buyer and its Affiliates and their respective Representatives (collectively, the “Buyer Indemnitees”) against, and shall hold each of them harmless from and against, any and all losses, damages, liabilities, deficiencies, Actions, judgments, interest, awards, penalties, fines, costs, or expenses of whatever kind, including reasonable attorneys’ fees (collectively, “Losses”), incurred or sustained by, or imposed upon, the Buyer Indemnitees based upon, arising out of, or with respect to:

(a) any inaccuracy in or breach of any of the representations or warranties of Seller Parties contained in this Agreement, any other Transaction Document, or any schedule, certificate, or exhibit related thereto, as of the date such representation or warranty was made or as if such representation or warranty was made on and as of the Closing Date (except for representations and warranties that expressly relate to a specified date, the inaccuracy in or breach of which will be determined with reference to such specified date);

(b) any breach or non-fulfillment of any covenant, agreement, or obligation to be performed by Seller Parties pursuant to this Agreement, any other Transaction Document, or any schedule, certificate, or exhibit related thereto;

(c) any Excluded Asset or any Excluded Liability; or

(d) any Third-Party Claim based upon, resulting from, or arising out of the business, operations, properties, assets, or obligations of Seller or any of its Affiliates (other than the Purchased Assets or Assumed Liabilities) conducted, existing, or arising on or prior to the Closing Date. For purposes of this Agreement, “Third-Party Claim” means notice of the assertion or commencement of any Action made or brought by any Person who is not a party to this Agreement or an Affiliate of a party to this Agreement or a Representative of the foregoing.

Section 6.03 Indemnification by Buyer. Subject to the other terms and conditions of this ARTICLE VI, from and after Closing, Buyer shall indemnify and defend each of Seller and its Affiliates and their respective Representatives (collectively, the “Seller Indemnitees”) against, and shall hold each of them harmless from and against any and all Losses incurred or sustained by, or imposed upon, the Seller Indemnitees based upon, arising out of, or with respect to:

(a) any inaccuracy in or breach of any of the representations or warranties of Buyer contained in this Agreement, any other Transaction Document, or any schedule, certificate, or exhibit related thereto, as of the date such representation or warranty was made or as if such representation or warranty was made on and as of the Closing Date (except for representations and warranties that expressly relate to a specified date, the inaccuracy in or breach of which will be determined with reference to such specified date); (b) any breach or non-fulfillment of any covenant, agreement, or obligation to be performed by Buyer pursuant to this Agreement; or

(c) any Assumed Liability.

Section 6.04 Certain Limitations. The indemnification provided for in Section 6.02 and Section 6.03 shall be subject to the following limitations:

(a) Seller Parties shall not be liable to the Buyer Indemnitees for indemnification under Section 6.02(a) until the aggregate amount of all Losses in respect of indemnification under Section 6.02(a) exceeds $50,000 (the “Basket”), in which event Seller Parties shall be required to pay or be liable for all such Losses from the first dollar. The aggregate amount of all Losses for which Seller Parties shall be liable pursuant to Section 6.02(a) shall not exceed 10% of the Purchase Price (the “Cap”).

(b) Buyer shall not be liable to the Seller Indemnitees for indemnification under Section 6.03(a) until the aggregate amount of all Losses in respect of indemnification under Section 6.03(a) exceeds the Basket, in which event Buyer shall be required to pay or be liable for all such Losses from the first dollar. The aggregate amount of all Losses for which Buyer shall be liable pursuant to Section 6.03(a) shall not exceed the Cap.

(c) Notwithstanding the foregoing, the limitations set forth in Section 6.04(a) and Section 6.04(b) shall not apply to Losses based upon, arising out of, with respect to or by any reason of any inaccuracy in or breach of any representation or warranty in Section 3.01, Section 3.02, Section 3.07, Section 3.14, Section 3.18, Section 4.01, Section 4.02 and Section 4.03, for which Seller Parties’ aggregate potential liability hereunder shall not exceed the Purchase Price.

Section 6.05 Indemnification Procedures. Whenever any claim shall arise for indemnification hereunder, the party entitled to indemnification (the “Indemnified Party”) shall promptly provide written notice of such claim to the other party (the “Indemnifying Party”). In connection with any claim giving rise to indemnity hereunder resulting from or arising out of any Action by a Person who is not a party to this Agreement, the Indemnifying Party, at its sole cost and expense and upon written notice to the Indemnified Party, may assume the defense of any such Action with counsel reasonably satisfactory to the Indemnified Party. The Indemnified Party shall be entitled to participate in the defense of any such Action, with its counsel and at its own cost and expense. If the Indemnifying Party does not assume the defense of any such Action, the Indemnified Party may, but shall not be obligated to, defend against such Action in such manner as it may deem appropriate, including settling such Action, after giving notice of it to the Indemnifying Party, on such terms as the Indemnified Party may deem appropriate and no action taken by the Indemnified Party in accordance with such defense and settlement shall relieve the Indemnifying Party of its indemnification obligations herein provided with respect to any damages resulting therefrom. The Indemnifying Party shall not settle any Action without the Indemnified Party’s prior written consent (which consent shall not be unreasonably withheld or delayed).

Section 6.06 Payments; Indemnification Escrow Fund.

(a) Once a Loss is agreed to by the Indemnifying Party or finally adjudicated to be payable pursuant to this Article VI, the Indemnifying Party shall satisfy its obligations within 15 Business Days by wire transfer of immediately available funds.

(b) Any Losses payable to a Buyer Indemnitee pursuant to this Article VI shall be satisfied: (i) from the Indemnification Escrow Amount; and (ii) to the extent the amount of Losses exceeds the amounts available to the Buyer Indemnitee in the Indemnification Escrow Amount, from Seller Parties. If Buyer becomes entitled to any distribution of all or any portion of the Indemnification Escrow Amount pursuant to this Article VI, Buyer and Seller shall take all actions necessary under the Escrow Agreement (including the execution and delivery of joint written instructions to the Escrow Agent) to cause the Escrow Agent to release to Buyer the amounts to be paid from the Indemnification Escrow Amount to Buyer in accordance with this Agreement.

Section 6.07 Effect of Investigation. The representations, warranties and covenants of the Indemnifying Party, and the Indemnified Party’s right to indemnification with respect thereto, shall not be affected or deemed waived by reason of any investigation made by or on behalf of the Indemnified Party (including by any of its Representatives) or by reason of the fact that the Indemnified Party or any of its Representatives knew or should have known that any such representation or warranty is, was or might be inaccurate.

Section 6.08 Cumulative Remedies. The rights and remedies provided in this ARTICLE VI are cumulative and are in addition to and not in substitution for any other rights and remedies available at law or in equity or otherwise.

ARTICLE VII

MISCELLANEOUS

Section 7.01 Expenses. All costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the party incurring such costs and expenses.

Section 7.02 Notices. All notices, claims, demands, and other communications hereunder shall be in writing and shall be deemed to have been given: (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by email of a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours of the recipient, or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid. Such communications must be sent to the respective parties at the following addresses (or at such other address for a party as shall be specified in a notice given in accordance with this Section 7.02):

| If to Seller: |

120 East Palmetto Park Road, Suite 405 Boca Raton, FL 33432 |

|

with a copy to:

|

Email: [***] Attention: Eric Kosta |

| If to Buyer: |

7000 S. Yosemite Street, Suite 115 Centennial, CO 80112 |

Section 7.03 Interpretation; Headings. This Agreement shall be construed without regard to any presumption or rule requiring construction or interpretation against the party drafting an instrument or causing any instrument to be drafted. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section 7.04 Severability. If any term or provision of this Agreement is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Agreement.

Section 7.05 Entire Agreement. This Agreement and the other Transaction Documents constitute the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein and therein, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Agreement and those in the other Transaction Documents, the Exhibits, and the Disclosure Schedules (other than an exception expressly set forth as such in the Disclosure Schedules), the statements in the body of this Agreement will control.

Section 7.06 Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior written consent of the other party, which consent shall not be unreasonably withheld or delayed. Any purported assignment in violation of this Section shall be null and void. No assignment shall relieve the assigning party of any of its obligations hereunder.

Section 7.07 Amendment and Modification; Waiver. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each party hereto. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No failure to exercise, or delay in exercising, any right or remedy arising from this Agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right or remedy hereunder preclude any other or further exercise thereof or the exercise of any other right or remedy.

Section 7.08 Governing Law; Submission to Jurisdiction; Waiver of Jury Trial.

(a) All matters arising out of or relating to this Agreement shall be governed by and construed in accordance with the internal laws of the State of Massachusetts without giving effect to any choice or conflict of law provision or rule (whether of the State of Massachusetts or any other jurisdiction). Any legal suit, action, proceeding, or dispute arising out of or related to this Agreement, the other Transaction Documents, or the transactions contemplated hereby or thereby may be instituted in the federal courts of the United States of America or the courts of the State of Massachusetts in each case located in the city of Worcester and county of Worcester County, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action, proceeding, or dispute.

(b) EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT OR THE OTHER TRANSACTION DOCUMENTS IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL ACTION, PROCEEDING, CAUSE OF ACTION, OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT, INCLUDING ANY EXHIBITS AND SCHEDULES ATTACHED TO THIS AGREEMENT, THE OTHER TRANSACTION DOCUMENTS, OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY. EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT: (I) NO REPRESENTATIVE OF THE OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT THE OTHER PARTY WOULD NOT SEEK TO ENFORCE THE FOREGOING WAIVER IN THE EVENT OF A LEGAL ACTION; (II) EACH PARTY HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER; (III) EACH PARTY MAKES THIS WAIVER KNOWINGLY AND VOLUNTARILY; AND (IV) EACH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION.

Section 7.09 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by email or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[Remainder of Page Intentionally Left Blank; Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their duly authorized representatives.

| SELLER: | |||

| FEA Materials LLC | |||

| By | /s/ Andrew Intrater | ||

| Name: | Andrew Intrater | ||

| Title: | Managing Member | ||

Seller Signature Page to Asset Purchase Agreement

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their duly authorized representatives.

| BUYER: | |||

| NioCorp Advanced Metals and Alloys, LLC | |||

| By | /s/ Neal Shah | ||

| Name: | Neal Shah | ||

| Title: | Treasurer and Secretary | ||

Buyer Signature Page to Asset Purchase Agreement

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their duly authorized representatives.

| MEMBERS: | |||

| FEA Innovations LLC | |||

| By | /s/ Andrew Intrater | ||

| Name: | Andrew Intrater | ||

| Title: | Managing Member | ||

| Adventures D2L Holdings LLC | |||

| By | /s/ Andrew Intrater | ||

| Name: | Andrew Intrater | ||

| Title: | Manager | ||

Member Signature Page to Asset Purchase Agreement

EXHIBIT A

DEFINITIONS

The following terms have the meanings set forth herein or in the location in this Agreement referenced below:

| Term | Section |

| Actions | Section 3.12(a) |

| Affiliate | Section 1.03(b) |

| Agreement | Preamble |

| Allocation Schedule | Section 1.05 |

| Assignment and Assumption Agreement | Section 2.02(a)(ii) |