UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 21, 2025

NioCorp Developments Ltd.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada (State or other jurisdiction of incorporation) |

001-41655 (Commission File Number) |

98-1262185 (IRS Employer Identification No.) |

7000 South Yosemite Street, Suite 115

Centennial, Colorado 80112

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (720) 334-7066

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, without par value | NB | The Nasdaq Stock Market LLC |

| Warrants, each exercisable for 1.11829212 Common Shares | NIOBW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On May 21, 2025, NioCorp Developments Ltd. (the “Company”) posted on its corporate website an updated investor presentation, a copy of which is attached as Exhibit 99.1 hereto. Such exhibit and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit |

Description |

| 99.1 | Investor Presentation |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| NIOCORP DEVELOPMENTS LTD. | ||

| DATE: May 21, 2025 | By: | /s/ Neal S. Shah |

|

Neal S. Shah Chief Financial Officer |

||

Exhibit 99.1

B RINGING H OME C RITICAL MINERALS S UPPLY C HAINS

Disclaimers & Technical Disclosures Forward - Looking Statements This Presentation of NioCorp Developments Ltd. (“NioCorp”) contains forward - looking statements within the meaning of the United States federal securities laws and forward - looking information within the meaning of applicable Canadian securities laws (collec tively, “forward - looking statements”). Forward - looking statements may include, but are not limited to, NioCorp’s ability to receive a final commitment of financing from the Export - Import Bank of the United States (“EXIM”), a grant from the United States Department of Defense (“DoD ”) or a debt guarantee from the UK Export Finance (“ UKEF ”); NioCorp and Stellantis N.V. (“Stellantis”) entering into binding agreements with respect to the proposed offtake transact ion and potential strategic investment, if at all; anticipated benefits of the listing of NioCorp’s common shares on Nasdaq; the fi nancial and business performance of NioCorp; NioCorp’s anticipated results and developments in the operations of NioCorp in future period s; NioCorp’s planned exploration and development activities; the adequacy of NioCorp’s financial resources; NioCorp’s ability to se cure sufficient project financing to complete construction of the Elk Creek Project and move it to commercial production, including the required financing to get to a final investment decision; NioCorp’s expectation and ability to produce niobium, scandium, and titanium and the potential t o p roduce rare earth elements at the Elk Creek Project; the technical and economic feasibility of separating rare earth oxides; NioCorp’s plans to produce and supply spe cific products and market demand for those products; the outcome of current recovery process improvement testing and the eval uat ion of the benefits and costs of electrifying the mine using Railveyor technology, and NioCorp’s expectation that such process and design improvements could lead to greater efficiencies and cost s av ings in the Elk Creek Project, including the twin ramp Railveyor design; the Elk Creek Project’s ability to produce multiple critical metals; the Elk Creek Project’s projected ore production and mining operations over its expected mine life; technica l a nd economic analyses on the potential addition of magnetic rare earth oxides to NioCorp’s planned product suite; NioCorp upda tin g its feasibility study for the Elk Creek Project, including planned advancements and projects subject to confirmation therein; statements with respect to the es tim ation of mineral resources and mineral reserves; the exercise of options to purchase additional land parcels; the execution o f c ontracts with engineering, procurement and construction companies; the advancement of offtake discussions with potential customers; NioCorp’s ongoing ev alu ation of the impact of inflation, supply chain issues and geopolitical unrest on the Elk Creek Project’s economic model; and the creation of full time and contract construction jobs over the construction period of the Elk Creek Project. In addition, any statements that refer to p roj ections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are fo rwa rd - looking statements. Forward - looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimat e,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other s im ilar words and expressions, but the absence of these words does not mean that a statement is not forward - looking. The forward - looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There ca n be no assurance that future developments will be those that have been anticipated. Forward - looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions relating to: NioCorp’s ability to receive sufficient project fina nc ing for the construction and development of the Elk Creek Project on acceptable terms or at all; the future price of metals; the stability of the financia l a nd capital markets; NioCorp’s ability to service future debt, if any, and meet the payment obligations thereunder; and curren t e stimates and assumptions regarding the benefits of NioCorp’s business combination with GX Acquisition Corp. II (the “Business Combination”) and NioCorp’s previously an nounced standby equity purchase facility (the “Yorkville Equity Facility Financing” and, together with the Business Combinati on, the “2023 Transactions”) with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as s uch , are subject to change. Forward - looking statements involve a number of risks, uncertainties or other factors that may cause act ual results or performance to be materially different from those expressed or implied by these forward - looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the Securities and Exchange Com mi ssion (the “SEC”) and with the applicable Canadian securities regulatory authorities and the following: NioCorp’s ability to operate as a going concern; Nio Cor p’s requirement of significant additional capital; NioCorp’s ability to receive sufficient project financing for the construc tio n of the Elk Creek Project on acceptable terms or at all; NioCorp’s ability to receive a final commitment of financing from EXIM, a grant from the DoD or a debt guara nte e from UKEF on an acceptable timelines, on acceptable terms, or at all; NioCorp’s ability to recognize the anticipated benefits of the 20 23 Transactions, including NioCorp’s ability to access the full amount of the expected net proceeds under the Yorkville Equity Facility Financing Agreem ent ; NioCorp’s ability to continue to meet Nasdaq listing standards; risks relating to the Common Shares, including price volati lit y, lack of dividend payments and dilution or the perception of the likelihood of any of the foregoing; the extent to which NioCorp’s level of indebtedness and /or the terms contained in agreements governing NioCorp’s indebtedness, if any, or the Yorkville Equity Facility Financing Agreem en t may impair NioCorp’s ability to obtain additional financing, on acceptable terms or at all; covenants contained in agreements with NioCorp’s secured creditor s t hat may affect its assets; NioCorp’s limited operating history; NioCorp’s history of losses; the material weaknesses in NioCo rp’ s internal control over financial reporting, NioCorp’s efforts to remediate such material weaknesses and the timing of remediation; the possibility that NioCor p m ay qualify as a PFIC under the Code; the potential that the 2023 Transactions could result in NioCorp becoming subject to mat eri ally adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp’ s e xploration and, if warranted, development projects; a disruption in, or failure of, NioCorp’s information technology systems, in cluding those related to cybersecurity; equipment and supply shortages; variations in the market demand for, and prices of, niobium, scandium, titanium and rare eart h p roducts; current and future offtake agreements, joint ventures, and partnerships; NioCorp’s ability to attract qualified mana gem ent; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; th e results of technological research; changes in demand for and price of commodities (such as fuel and electricity) and curren cie s; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in feder al and/or state laws that may significantly affect the mining industry; trade policies and tensions, including tariffs; inflatio nar y pressures; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from cl imate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing a nd reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived p ote ntial of NioCorp’s projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploratio n, mining, or development activities; management of the water balance at the Elk Creek Project site; land reclamation requiremen ts related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of res erv es and resources; claims on the title to NioCorp’s properties; potential future litigation; and NioCorp’s lack of insurance c ove ring all of NioCorp’s operations. Should one or more of these risks or uncertainties materialize, or should any of the assumptions made by the management of Ni oCo rp prove incorrect, actual results may vary in material respects from those projected in these forward - looking statements. All subsequent written and oral forward - looking statements concerning the matters addressed in this communication and attributab le to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements conta ine d or referred to in this communication. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update thes e f orward - looking statements to reflect events or circumstances after the date of this communication to reflect the occurrence of u nanticipated events. Qualified Persons All technical and scientific information included in this Presentation derived from NioCorp’s 2022 NI 43 - 101 Elk Creek Technical Report with respect to mineral resources has been reviewed and approved by Matthew Batty, P.Geo ., Owner, Understood Mineral Resources Ltd., and all such information respecting NioCorp’s mineral reserves has been reviewed and approved by Gavin Clow, P. Eng., Mining Manager, Opti miz e Group. Each of Messrs. Batty and Clow is a "Qualified Person" as such term is defined in NI 43 - 101. Each of Mr. Batty and Mr. Clow and their respective firms are independent consultants who provide consulting services to NioCorp. All technical and scientific informa tio n included in this Presentation derived from NioCorp’s S - K 1300 Elk Creek Technical Report Summary with respect to mineral resou rces has been reviewed and approved by Understood Mineral Resources Ltd., and all such information respecting NioCorp’s mineral reserves has been review ed and approved by Optimize Group. Understood Mineral Resources Ltd. and Optimize Group are "Qualified Persons" as such term is def ined in S - K 1300. All other technical and scientific information included in this Presentation has been reviewed, approved and verified by Scott Ho nan , M.Sc., SME - RM, NioCorp’s Chief Operating Officer. Mr. Honan is a "Qualified Person" as such term is defined in both NI 43 - 101 and S - K 1300.

2 NASDAQ :NB Disclaimers & Technical Disclosures Financial Information Certain financial information and data included in this Presentation is unaudited and may not conform to Regulation S - X. T his Presentation may contain financial forecasts and projections (collectively, “prospective financial information”) of NioCo rp. The independent registered public accounting firm of NioCorp did not audit, review, compile or perform any procedures with respect to the prospective financial information for th e p urpose of their inclusion in this Presentation, and accordingly, they did not express an opinion for the purpose of this Pres ent ation. This prospective financial information constitutes forward - looking statements and should not be relied upon as being guarantees or necessarily indicative of future results. The as sumptions and estimates underlying such prospective financial information are inherently uncertain and are subject to a wide var iety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective fi nan cial information. See “Forward - Looking Statements.” Accordingly, there can be no assurance that the prospective financial inform ation is indicative of future performance of NioCorp or that actual results will not differ materially from the results presented in the prospective financial information included in thi s P resentation. Actual results may differ materially from the results contemplated by the prospective financial information incl ude d in this Presentation. The inclusion of such prospective financial information herein should not be regarded as a representation by any person that the results reflected in such projections wi ll be achieved. The purpose of the prospective financial information is to assist investors, shareholders and others in evaluati ng the performance of NioCorp’s business. The prospective financial information may not be appropriate for other purposes. Information about NioCorp’s guidance, including the various ass umptions underlying it, is forward - looking and should be read in conjunction with “Forward - Looking Statements” in this Presentat ion, and the related disclosure and information about various economic, competitive, and regulatory assumptions, factors, and risks that may cause NioCorp’s actual future financia l a nd operating results to differ from what NioCorp currently expects. All amounts in this Presentation are expressed in U.S. do lla rs unless otherwise indicated. Mineral Reserves and Resources Unless otherwise indicated, information concerning NioCorp’s mining property included in this Presentation, including mineral re source and reserve estimates, has been prepared in accordance with the requirements of National Instrument 43 - 101 – Standards of Disclosure for Mineral Projects (“NI 43 - 101”) and the Canadian Institute of Mining and Metallurgy (“CIM”) “Definition Standards – For Mineral Resources and Mineral Rese rves, May 10, 2014” (the “CIM Definition Standards”). Beginning with NioCorp’s Annual Report on Form 10 - K for the fiscal year en ded June 30, 2022 (the “NioCorp 2022 Form 10 - K”), NioCorp’s mining property disclosures included or incorporated by reference in its SEC filings, including mineral r esource and reserve estimates, are required to be prepared in accordance with the requirements of subpart 1300 of Regulation S - K (“S - K 1300”). Previously, NioCorp prepared its estimates of mineral resources and mineral reserves following only NI 43 - 101 and the CIM Definition Standards. On J une 28, 2022, NioCorp issued a CIM - compliant NI 43 - 101 technical report (the “2022 NI 43 - 101 Elk Creek Technical Report”) for th e Elk Creek Project, which is available through the website maintained by the Canadian Securities Administrators at www.sedarplus.ca. On September 6, 2022, the Compa ny filed a technical report summary for the Elk Creek Project that conforms to S - K 1300 reporting standards (the “S - K 1300 Elk Cree k Technical Report Summary”) as Exhibit 96.1 to the NioCorp 2022 Form 10 - K, which is available through the website maintained by the SEC at www.sec.gov. The 202 2 NI 43 - 101 Elk Creek Technical Report and S - K 1300 Elk Creek Technical Report Summary are based on a feasibility study (the “Ju ne 2022 Feasibility Study”) prepared by qualified persons (within the meaning of both NI 43 - 101 and S - K 1300, as applicable) and are substantively identical to one another except for internal references to the regulations under which the report is made, and certain organizational d if ferences. The requirements and standards under Canadian securities laws, however, differ from those under S - K 1300. The terms “mineral resource,” “inferred mineral resou rce,” “indicated mineral resource,” “mineral reserve,” “probable mineral reserve,” and “proven mineral reserve” included here in are used as defined in accordance with NI 43 - 101 under the CIM Definition Standards. While the terms are substantially similar to the same terms defined under S - K 1300, t here are differences in the definitions. Accordingly, there is no assurance any mineral resource or mineral reserve estimates th at the Company may report under NI 43 - 101 will be the same as the mineral resource or mineral reserve estimates that the Company may report under S - K 1300. NioCorp discloses estimates of both mineral resources and mineral reserves. This Presentation also includes disclosure on inf err ed mineral resources that are considered too speculative geologically to have the economic considerations applied to them tha t w ould enable them to be categorized as mineral reserves. You are cautioned that mineral resources are subject to further exploration and development and are subject to additional risks and no assurance can be given that they will eventually convert to future mineral reserves. Under both regim es , inferred resources, in particular, have a great amount of uncertainty as to their existence and their economic and legal feasibility. Investors are cautioned not to as sum e that any part or all of the inferred resource exists or is economically or legally mineable. See Item 1A, Risk Factors in N ioC orp’s Annual Report on Form 10 - K for the fiscal year ended June 30, 2024. Reference should be made to the full text of the 2022 NI 43 - 101 Elk Creek Technical Report and the S - K 1300 Elk Creek Technical Report Summary for further information regarding the assumptions, qualifications and procedures rela ti ng to the estimates of mineral reserves and mineral resources as defined under NI 43 - 101 and S - K 1300, respectively. All technical and scientific information i ncluded in this Presentation has been reviewed, approved and verified by Scott Honan, M.Sc., SME - RM, NioCorp’s Chief Operating O fficer. Mr. Honan is a “Qualified Person” as such term is defined in both NI 43 - 101 and S - K 1300. No Offer or Solicitation This Presentation shall not constitute or form part of an offer to sell or the solicitation of an offer to buy any securities of NioCorp, nor shall there be any sale of such securities in any state or jurisdiction in which such offer, solicitation or sal e would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

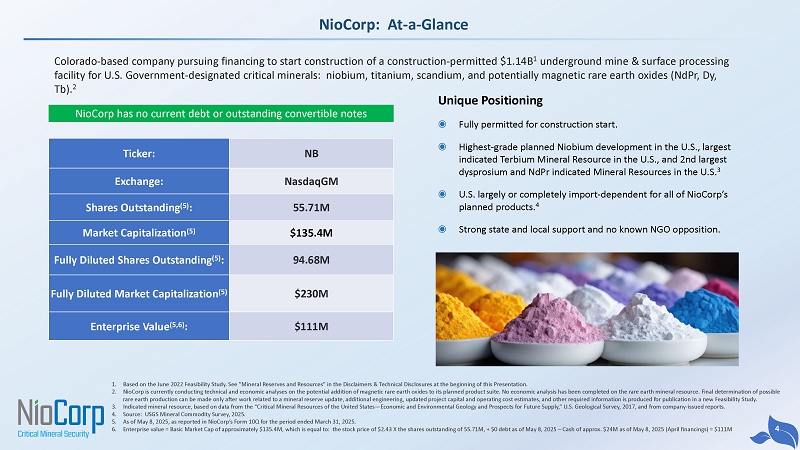

3 NASDAQ :NB NioCorp: At - a - Glance Colorado - based company pursuing financing to start construction of a construction - permitted $ 1.14B 1 underground mine & surface processing facility for U.S. Government - designated critical minerals: niobium, titanium, scandium, and potentially magnetic rare earth oxides (NdPr, Dy, Tb). 2 NB Ticker: NasdaqGM Exchange: 55.71M Shares Outstanding (5) : $135.4M Market Capitalization (5) 94.68M Fully Diluted Shares Outstanding (5) : $230M Fully Diluted Market Capitalization (5) $111M Enterprise Value (5,6) : Unique Positioning ◉ Fully permitted for construction start. ◉ Highest - grade planned Niobium development in the U.S., largest indicated Terbium Mineral Resource in the U.S., and 2nd largest dysprosium and NdPr indicated Mineral Resources in the U.S. 3 ◉ U.S. largely or completely import - dependent for all of NioCorp’s planned products. 4 ◉ Strong state and local support and no known NGO opposition. 4 1. Based on the June 2022 Feasibility Study. See "Mineral Reserves and Resources" in the Disclaimers & Technical Disclosures at the beginning of this Presentation. 2. NioCorp is currently conducting technical and economic analyses on the potential addition of magnetic rare earth oxides to it s p lanned product suite. No economic analysis has been completed on the rare earth mineral resource. Final determination of poss ibl e rare earth production can be made only after work related to a mineral reserve update, additional engineering, updated projec t c apital and operating cost estimates, and other required information is produced for publication in a new Feasibility Study. 3. I ndicated mineral resource, based on data from the “Critical Mineral Resources of the United States — Economic and Environmental Geology and Prospects for Future Supply,” U.S. G eological Survey, 2017, and from company - issued reports. 4. Source: USGS Mineral Commodity Survey, 2025. 5. As of May 8, 2025, as reported in NioCorp’s Form 10Q for the period ended March 31, 2025. 6. Enterprise value = Basic Market Cap of approximately $135.4M, which is equal to: the stock price of $2.43 X the shares outst and ing of 55.71M, + $0 debt as of May 8, 2025 – Cash of approx.

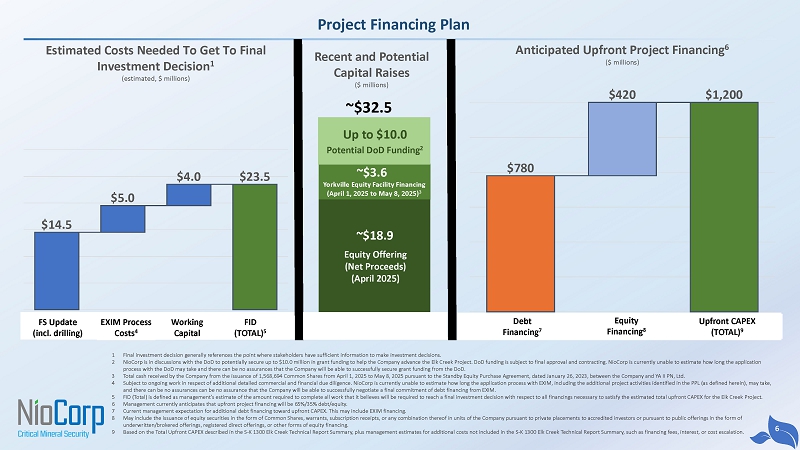

$24M as of May 8, 2025 (April financings) = $111M NioCorp has no current debt or outstanding convertible notes NASDAQ :NB Why We Are Unique Among Critical Minerals Projects 2 Highly Sought Heavy Rare Earth Products Now Constricted by China 2 3 Planned Products with High Foreign Dependence 8 Potential Robust Financial Returns 4 6 Bipartisan Political Support With Potential DoD Funding 3 1 Improved Cash Position 1 5 Key Offtake Agreements Strong Positioning as Fully Permitted for Construction 4 5 1 As of May 8, 2025, as reported in NioCorp’s Form 10Q for the period ended March 31, 2025. 2 NioCorp is currently conducting technical and economic analyses on the potential addition of magnetic rare earth oxides to it s p lanned product suite. No economic analysis has been completed on the rare earth mineral resource. Final determination of possible rare earth production can be made only after work related to a mineral rese rve update, additional engineering, updated project capital and operating cost estimates, and other required information is produced for the publication in a new FS. 3 DoD funding is subject to final approval and contracting. NioCorp is currently unable to estimate how long the application process with the DoD may take and there can be no assurances th at the Company will be able to successfully secure grant funding from the DoD. 4 Based on the June 2022 Feasibility Study. See "Mineral Reserves and Resources" in the Disclaimers & Technical Disclosures at the beginning of this Presentation. 7 One of the Few Teams in U.S. with Commercial Experience in Producing and Selling REEs Project Financing Plan 6 1 Final investment decision generally references the point where stakeholders have sufficient information to make investment de cis ions.

2 NioCorp is in discussions with the DoD to potentially secure up to $10.0 million in grant funding to help the Company advance th e Elk Creek Project. DoD funding is subject to final approval and contracting. NioCorp is currently unable to estimate how lo ng the application process with the DoD may take and there can be no assurances that the Company will be able to successfully secure grant fundi ng from the DoD. 3 Total c ash received by the Company from the issuance of 1,568,694 Common Shares from April 1, 2025 to May 8, 2025 pursuant to the Standby Equity Purchase Agreement, dated January 26, 2023, between the Company and YA II PN , Ltd. 4 Subject to ongoing work in respect of additional detailed commercial and financial due diligence. NioCorp is currently unable to estimate how long the application process with EXIM, including the additional project activities identified in the PPL (as de fi ned herein), may take, and there can be no assurances can be no assurance that the Company will be able to successfully negotiate a final commitment of debt financing from EXIM. 5 FID (Total) is defined as management’s estimate of the amount required to complete all work that it believes will be required to reach a final investment decision with respect to all financings necessary to satisfy the estimated total upfront CAPEX for t he Elk Creek Project. 6 Management currently anticipates that upfront project financing will be 65%/35% debt/equity. 7 Current management expectation for additional debt financing toward upfront CAPEX. This may include EXIM financing. 8 May include the issuance of equity securities in the form of Common Shares, warrants, subscription receipts, or any combinati on thereof in units of the Company pursuant to private placements to accredited investors or pursuant to public offerings in the fo rm of underwritten/brokered offerings, registered direct offerings, or other forms of equity financing. 9 Based on the Total Upfront CAPEX described in the S - K 1300 Elk Creek Technical Report Summary, plus management estimates for add itional costs not included in the S - K 1300 Elk Creek Technical Report Summary, such as financing fees, interest, or cost escalat ion. $780 $420 $1,200 Anticipated Upfront Project Financing 6 ($ millions) $14.5 $5.0 $4.0 $23.5 Estimated Costs Needed To Get To Final Investment Decision 1 (estimated, $ millions) FS Update (incl.

drilling) EXIM Process Costs 4 Working Capital FID (TOTAL) 5 Debt Financing 7 Equity Financing 8 Upfront CAPEX (TOTAL) 9 ~$18.9 Equity Offering (Net Proceeds) (April 2025) Up to $10.0 Potential DoD Funding 2 Recent and Potential Capital Raises ($ millions) ~$3.6 Yorkville Equity Facility Financing (April 1, 2025 to May 8, 2025) 3 US Export - Import Bank Now Processing Debt Financing Application of ~$ 800M 1 for NioCorp x NioCorp’s application has cleared EXIM’s first formal review (TRC - 1) x EXIM has provided a Preliminary Project Letter (the “PPL”) and preliminary indicative term sheet to NioCorp x Ongoing work in respect of additional detailed commercial and financial due diligence 2 x Independent consultants chosen by EXIM now conducting due diligence reviews x NioCorp has engaged JPMorgan to help lead the EXIM debt package structuring NASDAQ :NB 1 Amount based on initial indication of interest in Letter of Interest from EXIM, dated March 6, 2023. 2 The PPL summarized EXIM's initial due diligence findings and identified additional project activities to be undertaken by the Co mpany in conjunction with the EXIM evaluation process, including an updated mine plan and updated Elk Creek Project capital costs on a final or close - to - final basis reflecting updated process flows. Management is working with EXIM to continue to advance the project through the next stages of EXIM's due diligence and loan application process. NioCorp is currently unable to estimate how long the application proces s, including the additional project activities identified in the PPL, may take, and there can be no assurances that NioCorp will be able to successfully negotiate a final commitment of debt financing from EXIM, on a cce ptable terms or at all. 7 British Export Credit Agency Issues Expression of Interest to NioCorp for Potential Debt Guarantee of up to $200 Million 1 • Any loan guarantee by UKEF is contingent upon NioCorp meeting certain conditions, including execution of an offtake agreement for one or more of NioCorp’s planned products to UK - based companies that in turn can be shown to support UK exports.

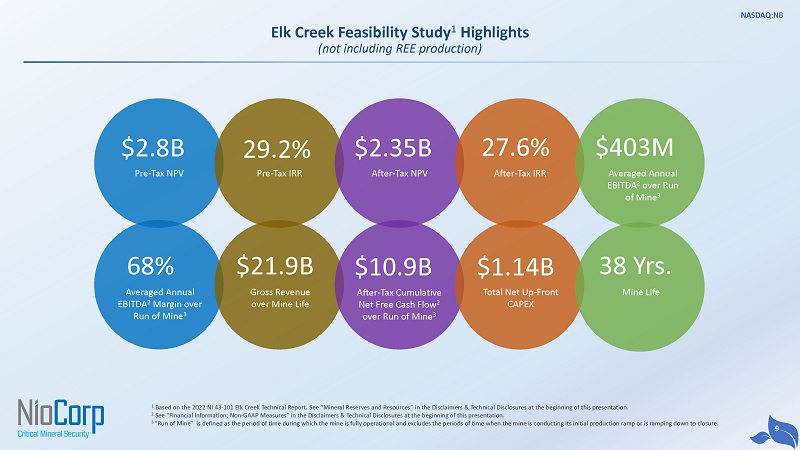

• Any UKEF debt guarantee would be coordinated with prospective debt financing now under consideration by the EXIM and any prospective loan guarantee from the German Government, for which NioCorp has previously been deemed eligible to receive. 2 • NioCorp is engaged in discussions with UK - based exporters on the potential sale of scandium - based products from the Elk Creek Project. 1 The EOI is a preliminary, non - binding letter of interest and is subject to a series of standard project finance terms and due di ligence as per UKEF policies. NioCorp can provide no assurances on the timing of the review and due diligence relating to any potential debt guarantee from UKEF nor NioCorp's engagement with UK companies relating to potential offtake agreements. 2 NioCorp can provide no assurances on the timing and process of review for any potential loan guarantee from the German Govern men t’s Untied Loan Guarantee Loan Program. 8 $2.8B Pre - Tax NPV 29.2% Pre - Tax IRR $2.35B After - Tax NPV 27.6% After - Tax IRR $403M Averaged Annual EBITDA 2 over Run of Mine 3 68% Averaged Annual EBITDA 2 Margin over Run of Mine 3 $21.9B Gross Revenue over Mine Life $10.9B After - Tax Cumulative Net Free Cash Flow 2 over Run of Mine 3 $1.14B Total Net Up - Front CAPEX 38 Yrs.

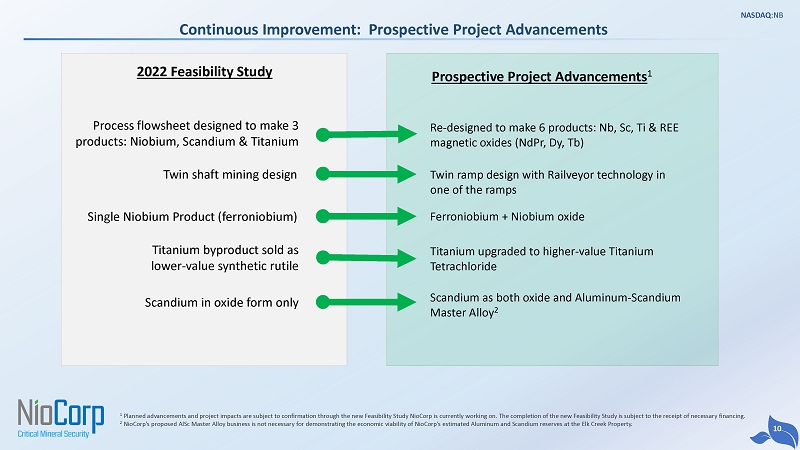

Mine Life 1 Based on the 2022 NI 43 - 101 Elk Creek Technical Report. See “Mineral Reserves and Resources” in the Disclaimers & Technical Dis closures at the beginning of this presentation. 2 See “Financial Information; Non - GAAP Measures” in the Disclaimers & Technical Disclosures at the beginning of this presentation . 3 “Run of Mine” is defined as the period of time during which the mine is fully operational and excludes the periods of time w hen the mine is conducting its initial production ramp or is ramping down to closure. Elk Creek Feasibility Study 1 Highlights (not including REE production) 9 NASDAQ :NB Continuous Improvement: Prospective Project Advancements 1 Planned advancements and project impacts are subject to confirmation through the new Feasibility Study NioCorp is currently w or king on.

The completion of the new Feasibility Study is subject to the receipt of necessary financing. 2 NioCorp’s proposed AlSc Master Alloy business is not necessary for demonstrating the economic viability of NioCorp’s estimated Aluminum and Scandium reserves at the Elk Creek Property. 2022 Feasibility Study Prospective Project Advancements 1 Single Niobium Product (ferroniobium) Ferroniobium + Niobium oxide Scandium in oxide form only Scandium as both oxide and Aluminum - Scandium Master Alloy 2 Twin shaft mining design Twin ramp design with Railveyor technology in one of the ramps Titanium byproduct sold as lower - value synthetic rutile Titanium upgraded to higher - value Titanium Tetrachloride Process flowsheet designed to make 3 products: Niobium, Scandium & Titanium Re - designed to make 6 products: Nb, Sc, Ti & REE magnetic oxides ( NdPr , Dy, Tb) 10 NASDAQ :NB Critical Minerals in the Elk Creek Resource 1 1 Based on the June 2022 Feasibility Study.

See “Mineral Reserves and Resources” in the Disclaimers & Technical Disclosures at t he beginning of this presentation. 2 NioCorp is currently assessing the feasibility of producing Titanium Tetrachloride in addition to, or in lieu of, Titanium Di ox ide. No economic analysis has been completed on the rare earth mineral resource. Final determination of possible rare earth production can be made only after work related to a mineral reserve update, additional engineering, updated project capital a nd operating cost estimates, and other required information is produced for publication in a new Feasibility Study. 3 NioCorp is currently conducting technical and economic analyses on the potential addition of magnetic rare earth oxides to its planned product suite. No economic analysis has been completed on the rare earth mineral resource. Final determination of possible rare earth production can be made only after work related to a mineral reserve update, additional e ngi neering, updated project capital and operating cost estimates, and other required information is produced for publication in a new Feasibility Study. 4 Indicated mineral resource, based on data from the “Critical Mineral Resources of the United States — Economic and Environmental Geology and Prospects for Future Supply,” U.S. G eological Survey, 2017, and from company - issued reports. Titanium Dioxide (or TiCl4) 2 Resource: 4,221,000 tonnes High import reliance for U.S. Is expected to be produced by NioCorp as a co - product. Dysprosium Oxide 3 Resource: 9,100 tonnes No production in the U.S. from domestic ore Elk Creek Project contains the 2nd largest indicated Dysprosium Mineral Resource in the U.S. 4 Terbium Oxide 3 Resource: 2,300 tonnes No production in the U.S. from domestic ore Elk Creek Project contains the largest indicated Terbium Mineral Resource in the U.S. 4 Neodymium - Praseodymium Oxide 3 Resource: 125,800 tonnes Minimal production in the U.S. Elk Creek Project contains the 2nd largest indicated NdPr Mineral Resource in the U.S. 4 Critical Minerals Magnetic Rare Earths No production in the U.S. Largest planned producer in N.A. Scandium Oxide Resource: 11,337 tonnes No production in the U.S. Highest grade Niobium project under development in N.A. 1 Ferroniobium Resource: 970,300 tonnes 11 NASDAQ :NB • Working toward a definitive agreement for a 10 - year offtake contract for high - purity, separated rare earth oxides: NdPr, Dysprosium, and Te rbium.

1,2,3 1 NioCorp is currently conducting technical and economic analyses on the potential addition of magnetic rare earth oxides to its p lanned product suite. No economic analyses has been completed on the rare earth mineral resource. F inal determination of possible rare earth production can be made only after work related to a mineral reserve update, additional e ngi neering, updated project capital and operating cost estimates, and other required information is produced for publication in a new Feasibility Study. 2 Subject to receipt of necessary project financing and commencement of operations at the Elk Creek Project. 3 Subject to ongoing negotiations and completion of due diligence. NioCorp is currently unable to estimate how long the negotia ti on process with Stellantis may take, and there can be no assurances that NioCorp will be able to successfully negotiate an offtake agreement or strategic investment with Stellantis, on acceptable terms, or at all. • Final volumes to be determined. • NioCorp and Stellantis collaborating on the larger permanent RE magnet supply chain. 12 Term Sheet Also Envisions a Possible Strategic Investment by Stellantis in NioCorp's Elk Creek Critical Minerals Project 12 Stellantis and NioCorp Sign Non - Binding Rare Earth 1 Offtake Term Sheet in June 2023 Offtake Agreements for Potential Products ThyssenKrupp Metallurgical Products 2 CMC Cometals 3 50% of NioCorp’s planned ferroniobium production for first 10 yrs.

1 Pricing set at 3.75% discount to Argus Metals index pricing for ferroniobium 25% of NioCorp’s planned ferroniobium production for first 10 yrs. 1 Pricing set at 3.75% discount to Argus Metals index pricing for ferroniobium Traxys North America LLC 4 Up to 12 tonnes per year of NioCorp’s planned scandium production over 10 yrs. 1 Largest commercial sales agreement for Scandium known to have been executed. Scandium Niobium 1 Subject to receipt of necessary project financing and commencement of operations at the Elk Creek Project. 2 Contract with Thyssen Metallurgical Products GmbH, dated November 10, 2014. 3 Contract with CMC Cometals, dated June 13, 2016, which was subsequently assigned to Traxys Cometals USA, LLC. 4 Contract with Traxys North America LLC, dated October 3, 2018. 5 NioCorp is currently conducting technical and economic analyses on the potential addition of magnetic rare earth oxides to its p lanned product suite. No economic analysis has been completed on the rare earth mineral resource. F inal determination of possible rare earth production can be made only after work related to a mineral reserve update, additional engineering, updated projec t c apital and operating cost estimates, and other required information is produced for publication in a new Feasibility Study. 6 Subject to ongoing negotiations and completion of due diligence. NioCorp is currently unable to estimate how long the negotia tio n process with Stellantis may take, and there can be no assurances that NioCorp will be able to successfully negotiate an off tak e agreement or strategic investment with Stellantis, on acceptable terms, or at all. 13 75% of NioCorp’s planned Ferroniobium production already contracted for the first 10 years of operation Titanium NioCorp is in discussions with multiple potential customers for the titanium it intends to make, in the form of titanium tetrachloride and/or titanium dioxide. NASDAQ :NB Rare Earths 5 Stellantis, 3rd largest global automaker, and NioCorp executed a non - binding term sheet in July 2023 on the prospective sale of NioCorp’s magnetic rare earth oxides.

6 ~12% of NioCorp’s planned production already contracted for the first 10 years of operation Management Team Scott Honan, MSc, SME - RM Mr. Honan joined NioCorp in 2014. He has 30+ years of experience in the niobium, base metals, gold and rare earth industries. He served as General Manager and Environmental Manager and Vice President Health, Environment, Safety and Sustainability at Molycorp. Scott is a graduate of Queen’s University in Mining Engineering in both Mineral Processing (B.Sc. Honors) and Environmental Management (M.Sc.) disciplines. He is a registered member (No. 04231597) of the Society for Mining, Metallurgy & Exploration (SME). Chief Operating Officer, NioCorp President, Elk Creek Resources Corp. Jim Sims Mr. Sims joined NioCorp in 2015 and has 30+ years of experience representing companies in mining, chemical, manufacturing, utility, and renewable energy sectors, including Dow Chemical, Calpine, FMC, MidAmerican Energy, Danaher, and others. He was VP of Corporate Communications for Molycorp and is the former head of the U.S. Geothermal Energy Association, the Western Business Roundtable, and the Rare Earth Technology Alliance. A former White House staffer, Jim served for 11 years in the U.S. Senate, including as a Chief of Staff, and held a top - secret security clearance. He is an honors graduate of Georgetown University. Chief Communications Officer Neal Shah, BSME, MBA Mr. Shah has been with NioCorp since 2014. With 25 years of experience in various industries as diverse as high - tech to rare earths, Neal’s past experience includes finance, business development, and engineering positions with Molycorp , Intel, IBM, Boeing, and Covidien. During his time at Molycorp , he was instrumental in realizing the company’s Mines - to - Magnets vertical integration strategy, and served as a Director on Intermetallics , Inc., which was the Molycorp /Mitsubishi/Daido Steel joint venture formed to build magnets outside of China. He is a graduate of the University of Colorado’s Mechanical Engineering program (BSME) and Purdue University’s Krannert School of Management (MBA). Chief Financial Officer & Corporate Secretary Mark A. Smith, P.E. Mr. Smith joined NioCorp as CEO and Chairman in 2013. He has 40+ years of experience in the mining and mineral processing industries. Formerly, he was President, CEO & Director of Molycorp; CEO and Director of Largo Resources; CEO and President of Chevron Mining; and Director of Companhia Brasileira de Metalurgia e Mineracao Ltd. (“CBMM”), the largest niobium producer in the world. Mr. Smith also serves as CEO and Chairman of IBC Advanced Alloys and US Vanadium LLC. He holds a B.Sc. degree in engineering from Colorado State University and a J.D. (cum laude) from Western State University, College of Law. Executive Chairman, President and Chief Executive Officer A management team with decades of combined experience in mineral production.

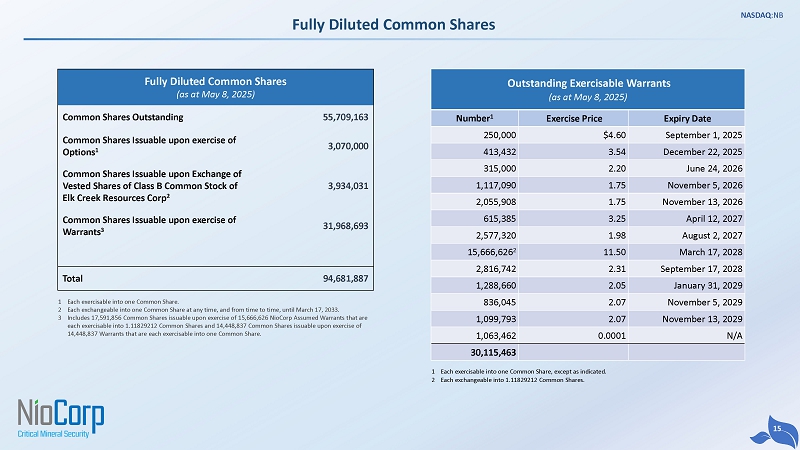

14 NASDAQ :NB Fully Diluted Common Shares 15 NASDAQ :NB Outstanding Exercisable Warrants (as at May 8, 2025) Expiry Date Exercise Price Number 1 September 1, 2025 $4.60 250,000 December 22, 2025 3.54 413,432 June 24, 2026 2.20 315,000 November 5, 2026 1.75 1,117,090 November 13, 2026 1.75 2,055,908 April 12, 2027 3.25 615,385 August 2, 2027 1.98 2,577,320 March 17, 2028 11.50 15,666,626 2 September 17, 2028 2.31 2,816,742 January 31, 2029 2.05 1,288,660 November 5, 2029 2.07 836,045 November 13, 2029 2.07 1,099,793 N/A 0.0001 1,063,462 30,115,463 Fully Diluted Common Shares (as at May 8, 2025) 55,709,163 Common Shares Outstanding 3,070,000 Common Shares Issuable upon exercise of Options 1 3,934,031 Common Shares Issuable upon Exchange of Vested Shares of Class B Common Stock of Elk Creek Resources Corp 2 31,968,693 Common Shares Issuable upon exercise of Warrants 3 94,681,887 Total 1 Each exercisable into one Common Share. 2 Each exchangeable into one Common Share at any time, and from time to time, until March 17, 2033. 3 Includes 17,591,856 Common Shares issuable upon exercise of 15,666,626 NioCorp Assumed Warrants that are each exercisable into 1.11829212 Common Shares and 14,448,837 Common Shares issuable upon exercise of 14,448,837 Warrants that are each exercisable into one Common Share. 1 Each exercisable into one Common Share , except as indicated. 2 Each exchangeable into 1.11829212 Common Shares. MA0 MA1 CONTACT For More Information NioCorp Jim Sims Chief Communications Officer jim.sims@niocorp.com +1 (720) 334 - 7066 16