000153412012/312025Q3FALSEhttp://fasb.org/us-gaap/2025#DerivativeLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#DerivativeLiabilitiesNoncurrenthttp://www.avalotherapeutics.com/20250930#PropertyPlantAndEquipmentAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.avalotherapeutics.com/20250930#PropertyPlantAndEquipmentAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2025#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2025#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrentP1YP6Mxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureavtx:class_of_stockavtx:employeeavtx:segment00015341202025-01-012025-09-3000015341202025-11-0300015341202025-09-3000015341202024-12-310001534120us-gaap:SeriesDPreferredStockMember2024-12-310001534120us-gaap:SeriesDPreferredStockMember2025-09-300001534120us-gaap:SeriesEPreferredStockMember2024-12-310001534120us-gaap:SeriesEPreferredStockMember2025-09-300001534120us-gaap:SeriesCPreferredStockMember2025-09-300001534120us-gaap:SeriesCPreferredStockMember2024-12-310001534120us-gaap:ProductMember2025-07-012025-09-300001534120us-gaap:ProductMember2024-07-012024-09-300001534120us-gaap:ProductMember2025-01-012025-09-300001534120us-gaap:ProductMember2024-01-012024-09-3000015341202025-07-012025-09-3000015341202024-07-012024-09-3000015341202024-01-012024-09-3000015341202025-06-300001534120us-gaap:CommonStockMember2025-06-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2025-06-300001534120us-gaap:AdditionalPaidInCapitalMember2025-06-300001534120us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300001534120us-gaap:RetainedEarningsMember2025-06-300001534120us-gaap:CommonStockMember2025-07-012025-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2025-07-012025-09-300001534120us-gaap:AdditionalPaidInCapitalMember2025-07-012025-09-300001534120us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-07-012025-09-300001534120us-gaap:RetainedEarningsMember2025-07-012025-09-300001534120us-gaap:CommonStockMember2025-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2025-09-300001534120us-gaap:AdditionalPaidInCapitalMember2025-09-300001534120us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300001534120us-gaap:RetainedEarningsMember2025-09-300001534120us-gaap:CommonStockMember2024-12-310001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2024-12-310001534120us-gaap:AdditionalPaidInCapitalMember2024-12-310001534120us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001534120us-gaap:RetainedEarningsMember2024-12-310001534120us-gaap:CommonStockMember2025-01-012025-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2025-01-012025-09-300001534120us-gaap:AdditionalPaidInCapitalMember2025-01-012025-09-300001534120us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-09-300001534120us-gaap:RetainedEarningsMember2025-01-012025-09-3000015341202024-06-300001534120us-gaap:CommonStockMember2024-06-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2024-06-300001534120us-gaap:AdditionalPaidInCapitalMember2024-06-300001534120us-gaap:RetainedEarningsMember2024-06-300001534120avtx:ConversionOfConvertiblePreferredStockMemberus-gaap:CommonStockMember2024-07-012024-09-300001534120avtx:ConversionOfConvertiblePreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001534120avtx:ConversionOfConvertiblePreferredStockMember2024-07-012024-09-300001534120us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001534120us-gaap:RetainedEarningsMember2024-07-012024-09-3000015341202024-09-300001534120us-gaap:CommonStockMember2024-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2024-09-300001534120us-gaap:AdditionalPaidInCapitalMember2024-09-300001534120us-gaap:RetainedEarningsMember2024-09-3000015341202023-12-310001534120us-gaap:CommonStockMember2023-12-310001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2023-12-310001534120us-gaap:AdditionalPaidInCapitalMember2023-12-310001534120us-gaap:RetainedEarningsMember2023-12-310001534120us-gaap:CommonStockMember2024-01-012024-09-300001534120us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001534120avtx:AlmataBioTransactionMemberus-gaap:SeriesCPreferredStockMember2024-01-012024-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PrivatePlacementMember2024-01-012024-09-300001534120us-gaap:SeriesDPreferredStockMemberus-gaap:PrivatePlacementMember2024-01-012024-09-300001534120us-gaap:SeriesEPreferredStockMemberus-gaap:PrivatePlacementMember2024-01-012024-09-300001534120avtx:ConversionOfConvertiblePreferredStockMemberus-gaap:CommonStockMember2024-01-012024-09-300001534120avtx:ConversionOfConvertiblePreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001534120avtx:ConversionOfConvertiblePreferredStockMember2024-01-012024-09-300001534120us-gaap:RetainedEarningsMember2024-01-012024-09-300001534120srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2024-12-310001534120srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2024-09-300001534120avtx:AlmataBioTransactionMember2024-03-272024-03-270001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-03-272024-03-270001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-08-132024-08-130001534120avtx:AlmataBioTransactionMemberus-gaap:CommonStockMember2024-08-132024-08-130001534120avtx:AlmataBioTransactionMember2024-03-282024-03-280001534120avtx:AlmataBioTransactionMember2024-04-012024-04-300001534120avtx:MilestoneOneMemberavtx:AlmataBioTransactionMember2024-03-280001534120avtx:MilestoneTwoMemberavtx:AlmataBioTransactionMember2024-03-280001534120avtx:MilestoneOneMemberavtx:AlmataBioTransactionMember2024-10-012024-10-310001534120avtx:AlmataBioTransactionMember2024-01-012024-09-300001534120avtx:AlmataBioTransactionMember2024-09-300001534120avtx:AlmataBioTransactionMember2024-08-132024-08-130001534120avtx:AlmataBioTransactionMember2024-03-270001534120avtx:MillipredMember2021-07-012023-09-300001534120us-gaap:EmployeeStockOptionMember2025-07-012025-09-300001534120us-gaap:EmployeeStockOptionMember2025-01-012025-09-300001534120us-gaap:EmployeeStockOptionMember2024-07-012024-09-300001534120us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001534120avtx:WarrantCommonStockMember2025-07-012025-09-300001534120avtx:WarrantCommonStockMember2025-01-012025-09-300001534120avtx:WarrantCommonStockMember2024-07-012024-09-300001534120avtx:WarrantCommonStockMember2024-01-012024-09-300001534120us-gaap:SeriesCPreferredStockMember2025-07-012025-09-300001534120us-gaap:SeriesCPreferredStockMember2025-01-012025-09-300001534120us-gaap:SeriesCPreferredStockMember2024-01-012024-09-300001534120us-gaap:SeriesCPreferredStockMember2024-07-012024-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2025-07-012025-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001534120us-gaap:PerformanceSharesMember2025-01-012025-09-300001534120us-gaap:PerformanceSharesMember2025-07-012025-09-300001534120us-gaap:PerformanceSharesMember2024-07-012024-09-300001534120us-gaap:PerformanceSharesMember2024-01-012024-09-300001534120us-gaap:SeriesCPreferredStockMember2024-09-300001534120us-gaap:SeriesCPreferredStockMember2025-09-300001534120us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-09-300001534120us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-09-300001534120us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2025-09-300001534120us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2025-09-300001534120us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-09-300001534120us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-09-300001534120us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2025-09-300001534120us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2025-09-300001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-09-300001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-09-300001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2025-09-300001534120us-gaap:FairValueMeasurementsRecurringMember2025-09-300001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-12-310001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-12-310001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-12-310001534120us-gaap:FairValueMeasurementsRecurringMember2024-12-310001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2025-06-300001534120us-gaap:FairValueInputsLevel3Member2025-06-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2025-07-012025-09-300001534120us-gaap:FairValueInputsLevel3Member2025-07-012025-09-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300001534120us-gaap:FairValueInputsLevel3Member2025-09-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310001534120us-gaap:FairValueInputsLevel3Member2024-12-310001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2025-01-012025-09-300001534120us-gaap:FairValueInputsLevel3Member2025-01-012025-09-300001534120us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-06-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2024-06-300001534120us-gaap:FairValueInputsLevel3Member2024-06-300001534120us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-07-012024-09-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2024-07-012024-09-300001534120us-gaap:FairValueInputsLevel3Member2024-07-012024-09-300001534120us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-09-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2024-09-300001534120us-gaap:FairValueInputsLevel3Member2024-09-300001534120us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2023-12-310001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001534120us-gaap:FairValueInputsLevel3Member2023-12-310001534120us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-09-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-09-300001534120us-gaap:FairValueInputsLevel3Member2024-01-012024-09-300001534120avtx:ESTherapeuticsMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX501Member2022-12-310001534120avtx:AVTX007Memberavtx:MilestoneOneMember2022-12-310001534120avtx:AVTX007Memberavtx:MilestoneTwoMember2022-12-310001534120avtx:AVTX611Member2022-12-310001534120avtx:AVTX501AndAVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX501Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2025-09-300001534120avtx:AVTX501AndAVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2025-07-012025-09-300001534120avtx:AVTX501AndAVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2025-01-012025-09-300001534120avtx:AVTX501Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberavtx:MeasurementInputProbabilityOfSuccessMember2022-12-310001534120avtx:AVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberavtx:MeasurementInputSalesForecastPeakMember2022-10-012022-12-310001534120avtx:AVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberavtx:MeasurementInputProbabilityOfSuccessMember2022-12-310001534120avtx:AVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:MeasurementInputExpectedTermMember2022-10-012022-12-310001534120us-gaap:PrivatePlacementMemberus-gaap:WarrantMember2025-09-300001534120us-gaap:PrivatePlacementMemberus-gaap:WarrantMember2024-12-310001534120us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-03-282024-03-280001534120us-gaap:PrivatePlacementMemberus-gaap:PreferredStockMember2022-10-012022-12-3100015341202022-10-012022-12-310001534120us-gaap:MoneyMarketFundsMember2025-09-300001534120us-gaap:USTreasuryAndGovernmentMember2025-09-300001534120us-gaap:CashAndCashEquivalentsMember2025-09-300001534120us-gaap:CashAndCashEquivalentsMember2024-12-310001534120us-gaap:ShortTermInvestmentsMember2025-09-300001534120us-gaap:ShortTermInvestmentsMember2024-12-310001534120stpr:PAus-gaap:BuildingMember2025-09-300001534120stpr:PAus-gaap:BuildingMember2025-01-012025-09-300001534120stpr:MDus-gaap:BuildingMember2024-10-012024-12-310001534120stpr:MDus-gaap:BuildingMember2025-01-012025-09-300001534120stpr:MDus-gaap:BuildingMember2025-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PrivatePlacementMember2024-03-282024-03-280001534120us-gaap:PrivatePlacementMemberus-gaap:WarrantMember2024-03-282024-03-280001534120us-gaap:PrivatePlacementMemberus-gaap:PreferredStockMember2024-03-282024-03-280001534120us-gaap:PrivatePlacementMember2024-03-282024-03-280001534120us-gaap:PrivatePlacementMember2024-10-012024-12-310001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PrivatePlacementMember2024-08-132024-08-130001534120us-gaap:CommonStockMember2024-08-132024-08-130001534120us-gaap:CommonStockMember2024-10-012024-12-310001534120us-gaap:SeriesCPreferredStockMember2024-10-012024-12-310001534120us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMember2025-09-300001534120us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-10-012024-12-310001534120us-gaap:PrivatePlacementMemberus-gaap:AdditionalPaidInCapitalMember2024-10-012024-12-310001534120avtx:AlmataTransactionAndMarch2024FinancingMember2025-09-300001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2025-09-300001534120avtx:AlmataTransactionAndMarch2024FinancingMember2024-10-012024-12-310001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-12-310001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataBioTransactionAndMarch2024FinancingMemberus-gaap:AdditionalPaidInCapitalMember2024-12-310001534120us-gaap:SeriesCPreferredStockMember2025-07-012025-09-300001534120us-gaap:SeriesCPreferredStockMember2025-01-012025-09-300001534120avtx:ATMAgreementMember2025-06-012025-06-300001534120avtx:ATMAgreementMember2025-01-012025-09-300001534120avtx:ATMAgreementMember2025-07-012025-09-300001534120avtx:CommonStockWarrantsExpirationJune2031Memberus-gaap:CommonClassAMember2025-09-300001534120avtx:A2016ThirdAmendedPlanMember2025-01-012025-09-300001534120avtx:A2016FourthAmendedPlanMember2025-01-012025-01-010001534120avtx:A2016ThirdAmendedPlanMember2025-09-300001534120avtx:InducementAwardPlanMember2025-09-300001534120avtx:InducementAwardPlanMember2025-01-012025-09-300001534120avtx:A2016ThirdAmendedPlanMemberus-gaap:EmployeeStockOptionMember2025-01-012025-09-300001534120us-gaap:EmployeeStockOptionMembersrt:MaximumMemberavtx:A2016ThirdAmendedPlanMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2025-01-012025-09-300001534120us-gaap:EmployeeStockOptionMembersrt:MinimumMemberavtx:A2016ThirdAmendedPlanMembersrt:DirectorMember2025-01-012025-09-300001534120us-gaap:EmployeeStockOptionMembersrt:MaximumMemberavtx:A2016ThirdAmendedPlanMembersrt:DirectorMember2025-01-012025-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2025-07-012025-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2025-01-012025-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2025-07-012025-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2025-01-012025-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001534120avtx:ServiceBasedOptionsMember2024-12-310001534120avtx:ServiceBasedOptionsMember2024-01-012024-12-310001534120avtx:ServiceBasedOptionsMember2025-01-012025-09-300001534120avtx:ServiceBasedOptionsMember2025-09-300001534120avtx:ServiceBasedOptionsMember2024-01-012024-09-300001534120avtx:ServiceBasedOptionsMember2025-07-012025-09-300001534120avtx:ServiceBasedOptionsMember2024-07-012024-09-300001534120srt:MinimumMemberavtx:ServiceBasedOptionsMember2025-09-300001534120srt:MaximumMemberavtx:ServiceBasedOptionsMember2025-09-300001534120srt:MinimumMemberavtx:ServiceBasedOptionsMember2025-01-012025-09-300001534120srt:MaximumMemberavtx:ServiceBasedOptionsMember2025-01-012025-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-12-310001534120us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2025-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-08-132024-08-130001534120us-gaap:RestrictedStockUnitsRSUMember2025-07-012025-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001534120avtx:A2016FourthAmendedPlanMemberus-gaap:PerformanceSharesMember2025-08-012025-08-310001534120avtx:A2016FourthAmendedPlanMemberus-gaap:PerformanceSharesMember2025-01-012025-09-300001534120us-gaap:PerformanceSharesMember2025-09-300001534120us-gaap:PerformanceSharesMembersrt:MaximumMemberavtx:A2016FourthAmendedPlanMember2025-01-012025-09-300001534120srt:MinimumMemberus-gaap:PerformanceSharesMember2025-09-300001534120srt:MaximumMemberus-gaap:PerformanceSharesMember2025-09-300001534120us-gaap:EmployeeStockMember2016-04-052016-04-050001534120us-gaap:EmployeeStockMember2016-04-050001534120us-gaap:EmployeeStockMember2025-01-012025-01-010001534120us-gaap:EmployeeStockMember2025-01-012025-09-300001534120us-gaap:EmployeeStockMember2025-07-012025-09-300001534120avtx:LillyLicenseAgreementMemberavtx:AVTX009LillyLicenseAgreementMember2024-03-270001534120avtx:AVTX009LillyLicenseAgreementMemberavtx:LillyLicenseAgreementMembersrt:MinimumMember2024-03-270001534120avtx:AVTX009LillyLicenseAgreementMemberavtx:LillyLicenseAgreementMembersrt:MaximumMember2024-03-270001534120avtx:LillyLicenseAgreementMemberavtx:AVTX009LillyLicenseAgreementMember2024-03-272024-03-270001534120avtx:LillyLicenseAgreementMemberavtx:AVTX009LillyLicenseAgreementMember2025-01-012025-09-300001534120avtx:LillyLicenseAgreementMemberavtx:AVTX009LillyLicenseAgreementMember2025-07-012025-09-300001534120avtx:LillyLicenseAgreementMemberavtx:AVTX009LillyLicenseAgreementMember2025-09-300001534120avtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2021-03-250001534120avtx:MilestoneOneMemberavtx:AVTX002KKCLicenseAgreementMemberavtx:KyowaKirinCoLtdKKCMember2021-03-250001534120avtx:MilestoneTwoMemberavtx:AVTX002KKCLicenseAgreementMemberavtx:KyowaKirinCoLtdKKCMember2021-03-250001534120avtx:KyowaKirinCoLtdKKCMemberus-gaap:ContractTerminationMembersrt:MinimumMember2021-03-252021-03-250001534120avtx:KyowaKirinCoLtdKKCMemberus-gaap:ContractTerminationMembersrt:MaximumMember2021-03-252021-03-250001534120avtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2025-07-012025-09-300001534120avtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2025-01-012025-09-300001534120avtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2025-09-300001534120avtx:CHOPLicenseAgreementMemberavtx:AVTX002KKCLicenseAgreementMember2020-02-030001534120avtx:CHOPLicenseAgreementMemberavtx:AVTX002KKCLicenseAgreementMember2020-02-032020-02-030001534120avtx:CHOPLicenseAgreementMemberavtx:AVTX002KKCLicenseAgreementMember2025-09-300001534120avtx:CHOPLicenseAgreementMember2020-02-032020-02-030001534120avtx:CHOPLicenseAgreementMemberus-gaap:ContractTerminationMember2020-02-032020-02-030001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006AstellasLicenseAgreementMember2019-07-150001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006Member2019-07-152019-07-150001534120avtx:AstellasPharmaIncAstellasMember2019-07-152019-07-150001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006AstellasLicenseAgreementMember2025-01-012025-09-300001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006AstellasLicenseAgreementMember2025-07-012025-09-300001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006AstellasLicenseAgreementMember2025-09-300001534120avtx:AltoMemberavtx:AVTX301OutLicenseMember2021-05-280001534120avtx:AVTX301OutLicenseMember2021-05-282021-05-280001534120avtx:AltoMemberavtx:AVTX301OutLicenseMember2025-09-300001534120avtx:AVTX406LicenseAssignmentMemberavtx:MilestoneOneMemberavtx:ESMember2021-06-090001534120avtx:AVTX406LicenseAssignmentMemberavtx:MilestoneTwoMemberavtx:ESMember2021-06-090001534120avtx:ESMemberavtx:AVTX406LicenseAssignmentMember2025-09-300001534120avtx:AVTX800SeriesAssetSaleMemberavtx:PurchaseAgreementMemberavtx:AUGTherapeuticsLLCMember2023-10-272023-10-270001534120avtx:AVTX800SeriesAssetSaleMemberavtx:PurchaseAgreementMemberavtx:AUGTherapeuticsLLCMember2023-10-270001534120avtx:AVTX009Memberavtx:MilestoneTwoMember2024-04-300001534120avtx:AVTX009Memberavtx:MilestoneThreeMember2024-10-012024-10-3100015341202019-07-012019-07-310001534120avtx:ReportableSegmentMember2025-07-012025-09-300001534120avtx:ReportableSegmentMember2024-07-012024-09-300001534120avtx:ReportableSegmentMember2025-01-012025-09-300001534120avtx:ReportableSegmentMember2024-01-012024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

|

|

|

|

|

|

☑

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the quarterly period ended September 30, 2025 |

| OR |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-37590

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State of incorporation)

|

45-0705648

(I.R.S. Employer Identification No.)

|

|

1500 Liberty Ridge Drive, Suite 321

Wayne, Pennsylvania 19087

(Address of principal executive offices)

|

(410) 522-8707

(Registrant’s telephone number,

including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

AVTX |

Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

Non-accelerated filer ☑ |

|

Smaller reporting company ☑ |

Emerging growth company ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☑

As of November 3, 2025, the registrant had 18,133,968 shares of common stock outstanding.

AVALO THERAPEUTICS, INC.

FORM 10-Q

For the Quarter Ended September 30, 2025

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

|

|

(unaudited) |

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

26,963 |

|

|

$ |

134,546 |

|

|

|

|

|

|

Short-term investments |

|

84,654 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Prepaid expenses and other current assets |

|

2,139 |

|

|

4,325 |

|

| Restricted cash, current portion |

|

90 |

|

|

19 |

|

| Total current assets |

|

113,846 |

|

|

138,890 |

|

| Property and equipment, net |

|

542 |

|

|

1,209 |

|

| Goodwill |

|

10,502 |

|

|

10,502 |

|

| Restricted cash, net of current portion |

|

210 |

|

|

131 |

|

| Total assets |

|

$ |

125,100 |

|

|

$ |

150,732 |

|

| Liabilities, mezzanine equity and stockholders’ equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Accounts payable |

|

$ |

474 |

|

|

$ |

283 |

|

| Accrued expenses and other current liabilities |

|

7,498 |

|

|

6,317 |

|

| Derivative liability, current |

|

— |

|

|

360 |

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

7,972 |

|

|

6,960 |

|

| Royalty obligation |

|

2,000 |

|

|

2,000 |

|

| Deferred tax liability, net |

|

304 |

|

|

270 |

|

| Derivative liability, non-current |

|

23,160 |

|

|

8,120 |

|

| Other long-term liabilities |

|

117 |

|

|

350 |

|

| Total liabilities |

|

33,553 |

|

|

17,700 |

|

| Mezzanine equity: |

|

|

|

|

Series D Preferred Stock—$0.001 par value; 1 share of Series D Preferred Stock authorized at September 30, 2025 and December 31, 2024; 1 share of Series D Preferred Stock issued and outstanding at September 30, 2025 and December 31, 2024 |

|

— |

|

|

— |

|

Series E Preferred Stock—$0.001 par value; 1 share of Series E Preferred Stock authorized at September 30, 2025 and December 31, 2024; 1 share of Series E Preferred Stock issued and outstanding at September 30, 2025 and December 31, 2024 |

|

— |

|

|

— |

|

| Stockholders’ equity: |

|

|

|

|

Common stock—$0.001 par value; 200,000,000 shares authorized at September 30, 2025 and December 31, 2024; 17,827,635 and 10,471,934 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively |

|

18 |

|

|

10 |

|

Series C Preferred Stock—$0.001 par value; 34,326 shares of Series C Preferred Stock authorized at September 30, 2025 and December 31, 2024; 19,364 and 24,896 shares of Series C Preferred Stock issued and outstanding at September 30, 2025 and December 31, 2024, respectively |

|

— |

|

|

— |

|

| Additional paid-in capital |

|

526,290 |

|

|

503,285 |

|

| Accumulated other comprehensive income |

|

41 |

|

|

— |

|

| Accumulated deficit |

|

(434,802) |

|

|

(370,263) |

|

| Total stockholders’ equity |

|

91,547 |

|

|

133,032 |

|

| Total liabilities, mezzanine equity and stockholders’ equity |

|

$ |

125,100 |

|

|

$ |

150,732 |

|

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income (Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

|

| Product revenue, net |

|

$ |

— |

|

|

$ |

249 |

|

|

$ |

— |

|

|

$ |

249 |

|

|

|

|

|

|

|

|

|

|

| Total revenues, net |

|

— |

|

|

249 |

|

|

— |

|

|

249 |

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Cost of product sales |

|

$ |

— |

|

|

$ |

(714) |

|

|

$ |

— |

|

|

$ |

(453) |

|

| Research and development |

|

13,621 |

|

|

9,538 |

|

|

36,817 |

|

|

16,254 |

|

| General and administrative |

|

5,577 |

|

|

4,286 |

|

|

16,366 |

|

|

12,008 |

|

| Acquired in-process research and development |

|

— |

|

|

— |

|

|

— |

|

|

27,641 |

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

19,198 |

|

|

13,110 |

|

|

53,183 |

|

|

55,450 |

|

| Loss from operations |

|

(19,198) |

|

|

(12,861) |

|

|

(53,183) |

|

|

(55,201) |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

| Change in fair value of derivative liability |

|

(12,530) |

|

|

(1,100) |

|

|

(14,680) |

|

|

(6,260) |

|

| Interest income, net |

|

1,117 |

|

|

964 |

|

|

3,367 |

|

|

2,101 |

|

| Excess of initial warrant fair value over private placement proceeds |

|

— |

|

|

— |

|

|

— |

|

|

(79,276) |

|

| Change in fair value of warrant liability |

|

— |

|

|

36,025 |

|

|

— |

|

|

148,071 |

|

| Private placement transaction costs |

|

— |

|

|

— |

|

|

— |

|

|

(9,220) |

|

| Other expense, net |

|

(3) |

|

|

(5) |

|

|

(8) |

|

|

(5) |

|

| Total other (expense) income, net |

|

(11,416) |

|

|

35,884 |

|

|

(11,321) |

|

|

55,411 |

|

| (Loss) income before taxes |

|

(30,614) |

|

|

23,023 |

|

|

(64,504) |

|

|

210 |

|

| Income tax expense (benefit) |

|

11 |

|

|

(14) |

|

|

35 |

|

|

— |

|

Net (loss) income |

|

$ |

(30,625) |

|

|

$ |

23,037 |

|

|

$ |

(64,539) |

|

|

$ |

210 |

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share of common stock - basic |

|

$ |

(2.19) |

|

|

$ |

0.98 |

|

|

$ |

(5.47) |

|

|

$ |

0.01 |

|

| Net loss per share of common stock - diluted |

|

$ |

(2.19) |

|

|

$ |

(2.83) |

|

|

$ |

(5.47) |

|

|

$ |

(22.63) |

|

Weighted average common shares outstanding - basic |

|

14,000,451 |

|

|

5,546,257 |

|

|

11,795,810 |

|

|

2,491,114 |

|

Weighted average common shares outstanding - diluted |

|

14,000,451 |

|

|

10,784,037 |

|

|

11,795,810 |

|

|

6,540,963 |

|

Comprehensive (loss) income: |

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(30,625) |

|

|

$ |

23,037 |

|

|

$ |

(64,539) |

|

|

$ |

210 |

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

| Unrealized income on investments, net |

|

75 |

|

|

— |

|

|

41 |

|

|

— |

|

Comprehensive (loss) income |

|

$ |

(30,550) |

|

|

$ |

23,037 |

|

|

$ |

(64,498) |

|

|

$ |

210 |

|

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Mezzanine and Stockholders’ Equity (Unaudited)

(In thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Mezzanine preferred stock |

|

|

Common stock |

|

Series C preferred stock |

|

|

|

Additional paid-in |

|

Accumulated other |

|

Accumulated |

Total stockholders’ |

| |

Shares |

Amount |

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

capital |

|

comprehensive income |

|

deficit |

|

equity |

Three Months Ended September 30, 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, June 30, 2025 |

2 |

|

$ |

— |

|

|

|

10,837,356 |

|

|

$ |

11 |

|

|

24,696 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

508,774 |

|

|

$ |

(34) |

|

|

$ |

(404,177) |

|

|

$ |

104,574 |

|

| Issuance of common stock in exchange for retirement of Series C Preferred Stock |

— |

|

— |

|

|

|

5,331,946 |

|

|

5 |

|

|

(5,332) |

|

|

— |

|

|

|

|

|

|

(5) |

|

|

— |

|

|

— |

|

|

— |

|

| Issuance of common stock pursuant to ATM Program, net |

— |

|

— |

|

|

|

1,658,333 |

|

|

2 |

|

|

— |

|

|

— |

|

|

|

|

|

|

14,368 |

|

|

— |

|

|

— |

|

|

14,370 |

|

| Unrealized gain on investments, net |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

75 |

|

|

— |

|

|

75 |

|

| Stock-based compensation |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

3,153 |

|

|

— |

|

|

— |

|

|

3,153 |

|

| Net loss |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

(30,625) |

|

|

(30,625) |

|

| Balance, September 30, 2025 |

2 |

|

$ |

— |

|

|

|

17,827,635 |

|

|

$ |

18 |

|

|

19,364 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

526,290 |

|

|

$ |

41 |

|

|

$ |

(434,802) |

|

|

$ |

91,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Mezzanine preferred stock |

|

|

Common stock |

|

Series C preferred stock |

|

|

|

Additional paid-in |

|

Accumulated other |

|

Accumulated |

Total stockholders’ |

| |

Shares |

Amount |

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

capital |

|

comprehensive income |

|

deficit |

|

equity |

Nine Months Ended September 30, 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2024 |

2 |

|

$ |

— |

|

|

|

10,471,934 |

|

|

$ |

10 |

|

|

24,896 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

503,285 |

|

|

$ |

— |

|

|

$ |

(370,263) |

|

|

$ |

133,032 |

|

Issuance of common stock in exchange for retirement of Series C Preferred Sock |

— |

|

— |

|

|

|

5,531,946 |

|

|

6 |

|

|

(5,532) |

|

|

— |

|

|

|

|

|

|

(6) |

|

|

— |

|

|

— |

|

|

— |

|

| Issuance of common stock pursuant to ATM Program, net |

— |

|

— |

|

|

|

1,658,333 |

|

|

2 |

|

|

— |

|

|

— |

|

|

|

|

|

|

14,368 |

|

|

— |

|

|

— |

|

|

14,370 |

|

Vesting of Restricted Stock Units net of shares withheld for taxes |

— |

|

— |

|

|

|

155,686 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

(510) |

|

|

— |

|

|

— |

|

|

(510) |

|

Shares purchased through employee stock purchase plan |

— |

|

— |

|

|

|

9,736 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

40 |

|

|

— |

|

|

— |

|

|

40 |

|

| Unrealized gain on investments, net |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

41 |

|

|

— |

|

|

41 |

|

| Stock-based compensation |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

9,113 |

|

|

— |

|

|

— |

|

|

9,113 |

|

Net loss |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

(64,539) |

|

|

(64,539) |

|

| Balance, September 30, 2025 |

2 |

|

$ |

— |

|

|

|

17,827,635 |

|

|

$ |

18 |

|

|

19,364 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

526,290 |

|

|

$ |

41 |

|

|

$ |

(434,802) |

|

|

$ |

91,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Mezzanine preferred stock |

|

|

Common stock |

|

|

|

Series C preferred stock |

|

Additional paid-in |

|

Accumulated |

Total stockholders’ |

|

|

| |

Shares |

Amount |

|

|

Shares |

|

Amount |

|

|

|

|

|

Shares |

|

Amount |

|

capital |

|

deficit |

|

equity |

|

|

| Three Months Ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, June 30, 2024 |

22,360 |

|

$ |

11,457 |

|

|

|

1,034,130 |

|

|

$ |

1 |

|

|

|

|

|

|

— |

|

|

$ |

— |

|

|

$ |

344,352 |

|

|

$ |

(357,961) |

|

|

$ |

(13,608) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retirement of Series C Preferred Stock in exchange for issuance of common stock |

(8,648) |

|

(9,799) |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

| Issuance of common stock in exchange for retirement of Series C Preferred Stock |

— |

|

— |

|

|

|

8,648,244 |

|

|

9 |

|

|

|

|

|

|

— |

|

|

— |

|

|

9,790 |

|

|

— |

|

|

9,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

1,848 |

|

|

— |

|

|

1,848 |

|

|

|

| Net income |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

23,037 |

|

|

23,037 |

|

|

|

| Balance, September 30, 2024 |

13,712 |

|

$ |

1,658 |

|

|

|

9,682,374 |

|

|

$ |

10 |

|

|

|

|

|

|

— |

|

|

$ |

— |

|

|

$ |

355,990 |

|

|

$ |

(334,924) |

|

|

$ |

21,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Mezzanine preferred stock |

|

|

Common stock |

|

Series C preferred stock |

|

Additional paid-in |

|

Accumulated |

Total stockholders’ |

| |

Shares |

Amount |

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

capital |

|

deficit |

|

equity |

Nine Months Ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2023 |

— |

|

$ |

— |

|

|

|

801,746 |

|

|

$ |

1 |

|

|

— |

|

|

$ |

— |

|

|

$ |

342,437 |

|

|

$ |

(335,134) |

|

|

$ |

7,304 |

|

Impact of reverse split fractional share round-up |

— |

|

— |

|

|

|

60,779 |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

Issuance of common stock pursuant to AlmataBio Transaction |

— |

|

— |

|

|

|

171,605 |

|

|

— |

|

|

— |

|

|

— |

|

|

815 |

|

|

— |

|

|

815 |

|

Issuance of Series C Preferred Stock pursuant to AlmataBio Transaction |

2,412 |

|

11,457 |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Series C Preferred Stock in private placement |

19,946 |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Series D Preferred Stock in private placement |

1 |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Series E Preferred Stock in private placement |

1 |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Retirement of Series C Preferred Stock in exchange

for issuance of common stock |

(8,648) |

|

(9,799) |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of common stock in exchange for

retirement of Series C Preferred Stock |

— |

|

— |

|

|

|

8,648,244 |

|

|

9 |

|

|

— |

|

|

— |

|

|

9,790 |

|

|

— |

|

|

9,799 |

|

| Stock-based compensation |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,948 |

|

|

— |

|

|

2,948 |

|

| Net income |

— |

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

210 |

|

|

210 |

|

Balance, September 30, 2024 |

13,712 |

|

$ |

1,658 |

|

|

|

9,682,374 |

|

|

$ |

10 |

|

|

— |

|

|

$ |

— |

|

|

$ |

355,990 |

|

|

$ |

(334,924) |

|

|

$ |

21,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, |

| |

|

2025 |

|

2024 |

| Operating activities |

|

|

|

|

| Net (loss) income |

|

$ |

(64,539) |

|

|

$ |

210 |

|

| Adjustments to reconcile net loss used in operating activities: |

|

|

|

|

| Depreciation and amortization |

|

328 |

|

|

101 |

|

| Stock-based compensation |

|

9,113 |

|

|

2,948 |

|

Accretion of available-for-sale investments, net |

|

(493) |

|

|

— |

|

| Acquired in-process research and development |

|

— |

|

|

27,641 |

|

| Excess of initial warrant fair value over private placement proceeds |

|

— |

|

|

79,276 |

|

| Change in fair value of warrant liability |

|

— |

|

|

(148,071) |

|

| Transaction costs paid pursuant to private placement |

|

— |

|

|

7,485 |

|

Contingent consideration paid pursuant to AlmataBio Transaction |

|

— |

|

|

(7,500) |

|

|

|

|

|

|

| Transaction costs payable upon exercise of warrants issued in private placement |

|

— |

|

|

1,734 |

|

|

|

|

|

|

| Change in fair value of derivative liability |

|

14,680 |

|

|

6,260 |

|

|

|

|

|

|

| Deferred taxes |

|

34 |

|

|

— |

|

| Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prepaid expenses and other current assets |

|

2,186 |

|

|

(3,270) |

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

191 |

|

|

1,365 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accrued expenses and other current liabilities |

|

1,312 |

|

|

(2,110) |

|

| Lease liability, net |

|

(24) |

|

|

(81) |

|

| Net cash used in operating activities |

|

(37,212) |

|

|

(34,012) |

|

| Investing activities |

|

|

|

|

Purchases of investments |

|

(94,621) |

|

|

— |

|

| Maturities of investments |

|

10,500 |

|

|

— |

|

Cash assumed from AlmataBio Transaction |

|

— |

|

|

356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by investing activities |

|

(84,121) |

|

|

356 |

|

| Financing activities |

|

|

|

|

| Proceeds from issuance of common stock pursuant to ATM Program, net |

|

14,370 |

|

|

— |

|

| Cash paid related to withholding shares to satisfy RSU tax withholding obligations |

|

(510) |

|

|

— |

|

| Proceeds from issuance of common stock under employee stock purchase plan |

|

40 |

|

|

— |

|

| Proceeds from private placement investment, gross |

|

— |

|

|

115,625 |

|

| Transaction costs paid pursuant to private placement |

|

— |

|

|

(7,485) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

13,900 |

|

|

108,140 |

|

(Decrease) increase in cash, cash equivalents and restricted cash |

|

(107,433) |

|

|

74,484 |

|

| Cash, cash equivalents, and restricted cash at beginning of period |

|

134,696 |

|

|

7,546 |

|

| Cash, cash equivalents, and restricted cash at end of period |

|

$ |

27,263 |

|

|

$ |

82,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosures of non-cash activities |

|

|

|

|

|

|

|

|

|

Issuance of common stock and Series C Preferred Stock pursuant to AlmataBio Transaction |

|

$ |

— |

|

|

$ |

12,272 |

|

|

|

|

|

|

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

2025 |

|

2024 |

| Cash and cash equivalents |

|

$ |

26,963 |

|

|

$ |

81,858 |

|

| Restricted cash, current |

|

90 |

|

|

41 |

|

| Restricted cash, non-current |

|

210 |

|

|

131 |

|

| Total cash, cash equivalents and restricted cash |

|

$ |

27,263 |

|

|

$ |

82,030 |

|

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Business

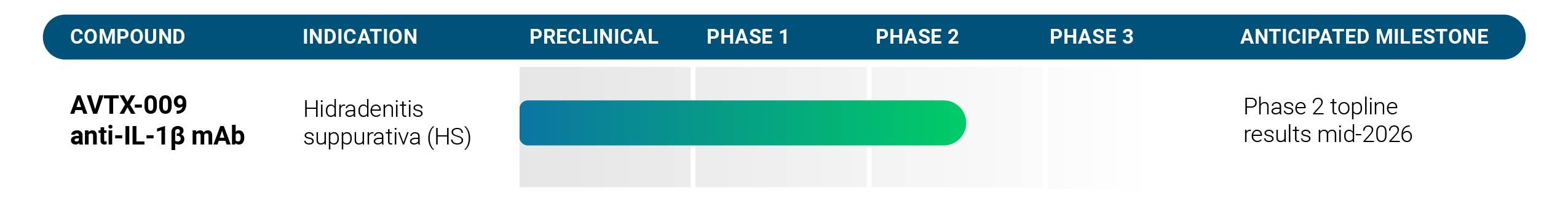

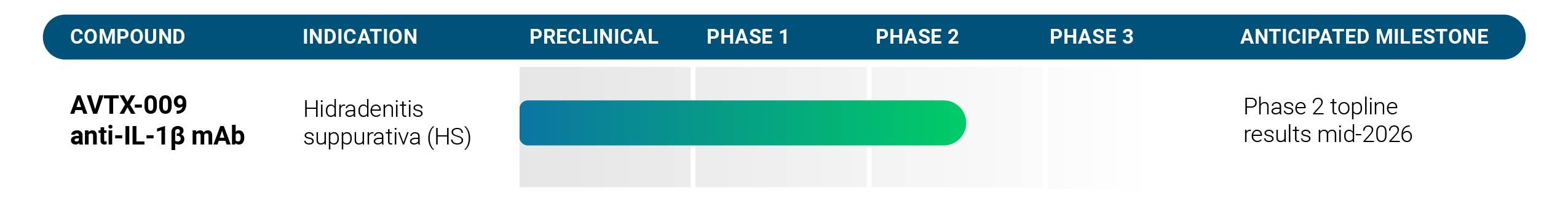

Avalo Therapeutics, Inc. (the “Company,” “Avalo” or “we”) is a clinical stage biotechnology company fully dedicated to developing IL-1β-based treatments for immune-mediated inflammatory diseases. Our lead asset, AVTX-009, is in a Phase 2 clinical trial for hidradenitis suppurativa (“HS”). The Company is also exploring additional opportunities to make an impact in prevalent indications that have significant remaining unmet needs.

Avalo was incorporated in Delaware and commenced operation in 2011, and completed its initial public offering in October 2015.

Liquidity

Since inception, we have incurred significant operating and cash losses from operations. We have primarily funded our operations to date through sales of equity securities, out-licensing transactions and sales of assets.

For the nine months ended September 30, 2025, Avalo generated a net loss of $64.5 million and negative cash flows from operations of $37.2 million. As of September 30, 2025, Avalo had $111.6 million in cash and cash equivalents and short-term investments.

In accordance with Accounting Standards Codification Topic 205-40, Presentation of Financial Statements - Going Concern, the Company evaluated its ability to continue as a going concern within one year after the date that the accompanying condensed consolidated financial statements are issued. Based on our current operating plans, we expect that our existing cash and cash equivalents and short-term investments are sufficient to fund operations for at least twelve months from the filing date of this Quarterly Report on Form 10-Q. The Company closely monitors its cash and cash equivalents and short-term investments and seeks to balance the level of cash and cash equivalents with our projected needs to allow us to withstand periods of uncertainty relative to the availability of funding on favorable terms. We may satisfy any future cash needs through sales of equity securities under the Company’s at-the-market program or other equity financings, out-licensing transactions, strategic alliances/collaborations, sale of programs, and/or mergers and acquisitions. There can be no assurance that any financing or business development initiatives can be realized by the Company, or if realized, what the terms may be. To the extent that we raise capital through the sale of equity, the ownership interest of our existing stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of our stockholders. Further, if the Company raises additional funds through collaborations, strategic alliances or licensing arrangements with third parties, the Company might have to relinquish valuable rights to its technologies, future revenue streams, research programs or product candidates.

2. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (the “FASB”). The unaudited condensed consolidated financial statements have been prepared on the basis of continuity of operations, realization of assets, and the satisfaction of liabilities in the ordinary course of business.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly the Company’s financial position, results of operations, and cash flows. The condensed consolidated balance sheet at December 31, 2024 has been derived from audited financial statements at that date. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to instructions, rules, and regulations prescribed by the United States Securities and Exchange Commission (“SEC”).

The Company believes that the disclosures provided herein are adequate to make the information presented not misleading when these unaudited condensed consolidated financial statements are read in conjunction with the December 31, 2024 audited consolidated financial statements.

In the first quarter of 2025, the Company concluded that it would include other receivables within the prepaid and other current assets line in the Company’s unaudited condensed consolidated balance sheets and statement of cash flows. The Company reclassified $0.6 million from other receivables to prepaid and current assets as of December 31, 2024 within the unaudited condensed consolidated balance sheets and $0.9 million from other receivables to prepaid and other current assets for the nine months ended September 30, 2024 within the unaudited statement of cash flows, to conform with the current period presentation.

Unless otherwise indicated, all amounts in the following tables are in thousands except share and per share amounts.

Significant Accounting Policies

During the nine months ended September 30, 2025, there were no significant changes to the Company’s summary of significant accounting policies contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on March 20, 2025, except for the policies as described below.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or fewer when purchased to be cash equivalents. These assets include investments in money market funds and U.S. Treasury securities. Cash equivalents are reflected at fair value, as further described in Note 6 - Fair Value Measurements.

Concentration of Credit Risk

The primary financial instruments that subject the Company to concentrated credit risk include cash, cash equivalents, and short-term investments. The Company maintains its cash, cash equivalents, and short-term investments with high-quality financial institutions and, consequently, the Company believes that such funds are subject to minimal credit risk. The Company’s cash equivalents consist of money market funds, which are invested in U.S. Treasury and government agency obligations, and the Company’s short-term investments consist of U.S. Treasury securities. Credit risk in these securities is reduced as a result of the Company’s investment policy to make high credit quality investments with its cash and cash equivalents. The Company’s investment policy limits investment instruments to investment-grade securities with the objective to preserve capital and to maintain liquidity until the funds can be used in business operations.

Investments

The Company generally invests its excess cash in money market funds and marketable debt securities. Such investments are included in either cash and cash equivalents (if the original maturity, from the date of purchase, is 90 days or fewer) or short-term investments (if the original maturity, from the date of purchase, is in excess of 90 days and less than 1 year) on the unaudited condensed consolidated balance sheet, as they represent the investment of funds readily convertible to cash to fund current operations. The Company classifies its investments as either trading, held-to-maturity or available-for-sale based on facts and circumstances present at the time it purchases the securities. As of September 30, 2025, all of our investments were classified as available-for-sale, which are reported at fair value at each balance sheet date, and for which fair value measurement data is obtained from independent pricing services. For securities with unrealized holding gains and losses (the adjustments to fair value), when the Company expects to receive cash flows sufficient to recover the amortized cost basis of a security, such gains and losses are included in “Accumulated other comprehensive income (loss)” as a component of stockholders’ equity. The Company identifies credit losses when it does not expect to receive cash flows sufficient to recover the amortized cost basis of a security. On a quarterly basis, the Company evaluates whether decreases in the fair values of its investments are below their amortized cost, and if so, it marks the investment to market through a charge to our unaudited condensed consolidated statements of operations and comprehensive (loss) income. Realized gains and losses, if any, are included in interest income, net on the unaudited condensed consolidated statements of operations and comprehensive (loss) income. The amortized costs of investments are adjusted for amortization of premiums and accretion of discounts to maturity, which is included in interest income, net on the unaudited condensed consolidated statements of operations and comprehensive (loss) income.

Recently Issued Accounting Pronouncements Not Yet Adopted

In September 2025, the FASB issued ASU 2025-07, Derivatives and Hedging (Topic 815) and Revenue from Contracts with Customers (Topics 606): Derivatives Scope Refinements and Scope Clarification for Share-based Noncash Consideration from a Customer in a Revenue Contract (“ASU 2025-07”), which, among other items, amends the application of derivative accounting to contracts with features based on the operations or activities of one of the parties to the contract. The amendments are expected to (a) reduce the cost and complexity of evaluating whether contracts with features based on the operations or activities of one of the parties to the contract are derivatives, (b) better portray the economics of those contracts in the financial statements, and (c) reduce diversity in practice resulting from the broad application of the current guidance and changing business environment. The standard is effective for fiscal years beginning after December 15, 2026, with early adoption permitted. The Company is currently evaluating the impact of adopting ASU 2025-07.

In November 2024, the FASB issued ASU 2024-03, Disaggregation of Income Statement Expenses, which requires disaggregation and disclosure of specified information about certain costs and expenses in the notes to the financial statements. The standard is effective for fiscal years beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027, with early adoption permitted. The Company is currently evaluating the impact of adopting ASU 2024-03.

In December 2023, the FASB issued ASU 2023-09, Income taxes (Topic 740): Improvements to Income Tax Disclosures, which amends guidance to enhance the transparency and decision usefulness of income tax disclosures. It is effective for fiscal years beginning after December 15, 2024. The Company is required to adopt this standard in its Form 10-K for the year ended December 31, 2025, and does not expect it to have a material impact on its consolidated financial statements and related disclosures.

3. Asset Acquisition

AlmataBio Transaction

On March 27, 2024, the Company acquired AVTX-009, an anti-IL-1β mAb, through a merger of AlmataBio, Inc. (“AlmataBio”) with and into its wholly owned subsidiary (the “AlmataBio Transaction”). The Company’s acquisition of AlmataBio was structured as a stock-for-stock transaction whereby all outstanding equity interests in AlmataBio were exchanged in a merger for a combination of the Company’s common stock and shares of the Company’s non-voting convertible preferred stock (the “Series C Preferred Stock”), resulting in the issuance of 171,605 shares of Company common stock and 2,412 shares of Series C Preferred Stock. Upon Company stockholder approval on August 13, 2024 and subject to beneficial ownership limitations, 2,063 shares of Series C Preferred Stock issued to former AlmataBio stockholders automatically converted into 2,062,930 shares of common stock.

In addition to the shares issued, a cash payment of $7.5 million was due to the former AlmataBio stockholders upon the closing of a private placement. The private placement closed on March 28, 2024 and the Company paid the $7.5 million in April 2024. The Company is also required to pay potential development milestone payments to the former AlmataBio stockholders, including $5.0 million due upon the first patient dosed in a Phase 2 trial in patients with HS for AVTX-009, and $15.0 million due upon the first patient dosed in a Phase 3 trial for AVTX-009, both of which are payable in cash or Avalo stock at the election of the former AlmataBio stockholders, subject to the terms and conditions of the definitive merger agreement. In October 2024, the first development milestone was met and the Company paid the $5.0 million cash payment.

The Company was the acquiring company for accounting purposes. In connection with the AlmataBio Transaction, substantially all of the consideration paid is allocable to the fair value of acquired in-process research and development (“IPR&D”), specifically AVTX-009, and as such the acquisition is treated as an asset acquisition. The Company initially recognized AlmataBio’s assets and liabilities by allocating the accumulated cost of the acquisition based on their relative fair values, as estimated by management. The net assets acquired as of the transaction date have been combined with the assets, liabilities, and results of operations of the Company on consummation of the AlmataBio Transaction. In accordance with ASC 730, Research and Development, the portion of the consideration allocated to the acquired IPR&D, specifically AVTX-009, based on its relative fair value, is included as an operating expense as there is no alternative future use.

Below is a summary of the total consideration, assets acquired and the liabilities assumed in connection with the AlmataBio Transaction (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024 |

Stock consideration1 |

|

$ |

12,272 |

|

|

|

Milestone payment due upon close of private placement investment2 |

|

7,500 |

|

|

|

Milestone payment due upon first patient dosed in a Phase 2 trial2 |

|

5,000 |

|

|

|

| Transaction costs |

|

2,402 |

|

|

|

| Total GAAP Purchase Price at Close |

|

$ |

27,174 |

|

|

|

|

|

|

|

|

| Acquired IPR&D |

|

$ |

27,641 |

|

|

|

| Cash |

|

356 |

|

|

|

| Accrued expenses and other current liabilities |

|

(823) |

|

|

|

| Total net assets acquired and liabilities assumed |

|

$ |

27,174 |

|

|

|

1 Equal to the aggregate common stock issued of 171,605 and the aggregate shares of Series C Preferred Stock issued of 2,412 (as-convertible to 2,412,000 shares of common stock), multiplied by the Company’s closing stock price of $4.75 on March 27, 2024. On August 13, 2024 upon Company stockholder approval and subject to beneficial ownership limitations, 2,063 of the 2,412 shares of Series C Preferred Stock were converted into 2,062,930 shares of common stock.

2 Avalo deemed these milestones probable and estimable as of the transaction close date and therefore included them as part of the GAAP purchase price at close. The milestone payment due upon the close of the private placement was paid in April 2024. The milestone payment due upon the first patient dosed in a Phase 2 trial was paid in October 2024.

4. Revenue