| Exhibit | |||||

| 99.1 | |||||

| 99.2 | |||||

| 99.3 | |||||

| 99.4 | |||||

| 99.5 | |||||

|

BROOKFIELD RENEWABLE PARTNERS L.P. by

its general partner, Brookfield Renewable Partners Limited

|

||||||||

Date: May 3, 2024 |

By: | /s/ James Bodi |

||||||

| Name: James Bodi Title: President |

||||||||

|

River

Systems

|

Facilities | Capacity (MW) |

LTA(1)

(GWh)

|

Storage

Capacity

(GWh)

|

|||||||||||||||||||||||||

| Hydroelectric | |||||||||||||||||||||||||||||

| North America | |||||||||||||||||||||||||||||

United States(2) |

30 | 140 | 2,935 | 11,963 | 2,559 | ||||||||||||||||||||||||

| Canada | 19 | 33 | 1,361 | 5,178 | 1,261 | ||||||||||||||||||||||||

| 49 | 173 | 4,296 | 17,141 | 3,820 | |||||||||||||||||||||||||

Colombia(3) |

11 | 22 | 3,053 | 16,143 | 3,703 | ||||||||||||||||||||||||

| Brazil | 27 | 43 | 940 | 4,811 | — | ||||||||||||||||||||||||

| 87 | 238 | 8,289 | 38,095 | 7,523 | |||||||||||||||||||||||||

Wind(4) |

|||||||||||||||||||||||||||||

| North America | — | 55 | 6,830 | 21,872 | — | ||||||||||||||||||||||||

Europe(5) |

— | 56 | 1,432 | 3,309 | — | ||||||||||||||||||||||||

| Brazil | — | 37 | 890 | 3,949 | — | ||||||||||||||||||||||||

| Asia | — | 33 | 1,874 | 5,534 | — | ||||||||||||||||||||||||

| — | 181 | 11,026 | 34,664 | — | |||||||||||||||||||||||||

Utility-scale solar(6) |

— | 220 | 7,119 | 15,578 | — | ||||||||||||||||||||||||

Distributed generation & storage(7)(8) |

2 | 6,925 | 5,677 | 3,630 | 5,220 | ||||||||||||||||||||||||

| Total renewable power | 89 | 7,564 | 32,111 | 91,967 | 12,743 | ||||||||||||||||||||||||

GENERATION (GWh)(1) |

Q1 | Q2 | Q3 | Q4 | Total | ||||||||||||||||||||||||

| Hydroelectric | |||||||||||||||||||||||||||||

| North America | |||||||||||||||||||||||||||||

| United States | 3,402 | 3,469 | 2,171 | 2,921 | 11,963 | ||||||||||||||||||||||||

| Canada | 1,235 | 1,489 | 1,236 | 1,218 | 5,178 | ||||||||||||||||||||||||

| 4,637 | 4,958 | 3,407 | 4,139 | 17,141 | |||||||||||||||||||||||||

Colombia(2) |

3,697 | 4,048 | 3,944 | 4,454 | 16,143 | ||||||||||||||||||||||||

| Brazil | 1,183 | 1,198 | 1,214 | 1,216 | 4,811 | ||||||||||||||||||||||||

| 9,517 | 10,204 | 8,565 | 9,809 | 38,095 | |||||||||||||||||||||||||

Wind(3) |

8,920 | 8,840 | 7,809 | 9,095 | 34,664 | ||||||||||||||||||||||||

| Utility-scale solar | 3,346 | 4,425 | 4,558 | 3,249 | 15,578 | ||||||||||||||||||||||||

| Distributed generation & storage | 820 | 1,058 | 1,005 | 747 | 3,630 | ||||||||||||||||||||||||

| Total | 22,603 | 24,527 | 21,937 | 22,900 | 91,967 | ||||||||||||||||||||||||

GENERATION (GWh)(1) |

Q1 | Q2 | Q3 | Q4 | Total | ||||||||||||||||||||||||

| Hydroelectric | |||||||||||||||||||||||||||||

| North America | |||||||||||||||||||||||||||||

| United States | 2,224 | 2,359 | 1,466 | 1,950 | 7,999 | ||||||||||||||||||||||||

| Canada | 1,010 | 1,210 | 980 | 959 | 4,159 | ||||||||||||||||||||||||

| 3,234 | 3,569 | 2,446 | 2,909 | 12,158 | |||||||||||||||||||||||||

Colombia(2)(3) |

843 | 922 | 900 | 1,016 | 3,681 | ||||||||||||||||||||||||

| Brazil | 1,008 | 1,020 | 1,034 | 1,035 | 4,097 | ||||||||||||||||||||||||

| 5,085 | 5,511 | 4,380 | 4,960 | 19,936 | |||||||||||||||||||||||||

Wind(4) |

2,500 | 2,415 | 2,120 | 2,554 | 9,589 | ||||||||||||||||||||||||

| Utility-scale solar | 862 | 1,240 | 1,302 | 839 | 4,243 | ||||||||||||||||||||||||

| Distributed generation | 225 | 323 | 309 | 204 | 1,061 | ||||||||||||||||||||||||

| Total | 8,672 | 9,489 | 8,111 | 8,557 | 34,829 | ||||||||||||||||||||||||

|

.Letter to Unitholders

.

| ||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 5 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 6 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 7 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 8 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 9 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 10 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 11 |

||||||||

| Management’s Discussion and Analysis | ||

| For the three months ended March 31, 2024 | ||

| Part 1 – Q1 2024 Highlights | Part 5 – Liquidity and Capital Resources (continued) | |||||||||||||

| Capital expenditures | ||||||||||||||

| Part 2 – Financial Performance Review on Consolidated Information | Consolidated statements of cash flows | |||||||||||||

| Shares and units outstanding | ||||||||||||||

| Dividends and distributions | ||||||||||||||

| Part 3 – Additional Consolidated Financial Information | Contractual obligations | |||||||||||||

| Summary consolidated statements of financial position | Supplemental guarantor financial information | |||||||||||||

| Related party transactions | Off-statement of financial position arrangements | |||||||||||||

| Equity | ||||||||||||||

| Part 6 – Selected Quarterly Information | ||||||||||||||

| Part 4 – Financial Performance Review on Proportionate Information | Summary of historical quarterly results | |||||||||||||

| Proportionate results for the three months ended March 31 | Part 7 – Critical Estimates, Accounting Policies and Internal Controls | |||||||||||||

| Reconciliation of non-IFRS measures | ||||||||||||||

| Contract profile | Part 8 – Presentation to Stakeholders and Performance Measurement | |||||||||||||

| Part 5 – Liquidity and Capital Resources | Part 9 – Cautionary Statements | |||||||||||||

| Capitalization and available liquidity | ||||||||||||||

| Borrowings | ||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 12 |

||||||||

| Three months ended March 31 | |||||||||||

|

(MILLIONS, EXCEPT AS NOTED) |

2024 | 2023 | |||||||||

| Select financial information | |||||||||||

| Revenues | $ | 1,492 | $ | 1,331 | |||||||

Net loss attributable to Unitholders(1) |

(120) | (32) | |||||||||

Basic and diluted loss per LP unit(2) |

(0.23) | (0.09) | |||||||||

Proportionate Adjusted EBITDA(3) |

575 | 559 | |||||||||

Funds From Operations(3) |

296 | 275 | |||||||||

Funds From Operations per Unit(3)(4) |

0.45 | 0.43 | |||||||||

| Distribution per LP unit | 0.36 | 0.34 | |||||||||

| Operational information | |||||||||||

| Capacity (MW) | 33,640 | 25,718 | |||||||||

| Total generation (GWh) | |||||||||||

| Long-term average generation | 22,513 | 17,550 | |||||||||

| Actual generation | 20,300 | 19,030 | |||||||||

| Proportionate generation (GWh) | |||||||||||

| Actual generation | 8,461 | 8,240 | |||||||||

| (MILLIONS, EXCEPT AS NOTED) | March 31, 2024 | December 31, 2023 | |||||||||||||||

| Liquidity and Capital Resources | |||||||||||||||||

| Available liquidity | $ | 4,437 | $ | 4,121 | |||||||||||||

| Debt to capitalization – Corporate | 14 | % | 12 | % | |||||||||||||

| Debt to capitalization – Consolidated | 40 | % | 40 | % | |||||||||||||

| Non-recourse borrowings – Consolidated | 90 | % | 91 | % | |||||||||||||

Fixed rate debt exposure on a proportionate basis(1) |

95 | % | 96 | % | |||||||||||||

| Corporate borrowings | |||||||||||||||||

| Average debt term to maturity | 12 years | 10 years | |||||||||||||||

| Average interest rate | 4.4 | % | 4.3 | % | |||||||||||||

| Non-recourse borrowings on a proportionate basis | |||||||||||||||||

| Average debt term to maturity | 12 years | 12 years | |||||||||||||||

| Average interest rate | 5.4 | % | 5.4 | % | |||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 13 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 14 |

||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | |||||||||

| Revenues | $ | 1,492 | $ | 1,331 | |||||||

| Direct operating costs | (634) | (401) | |||||||||

| Management service costs | (45) | (57) | |||||||||

| Interest expense | (476) | (394) | |||||||||

| Depreciation | (502) | (429) | |||||||||

| Income tax expense | (14) | (24) | |||||||||

| Net income (loss) | $ | (70) | $ | 177 | |||||||

| Average FX rates to USD | |||||||||||

| C$ | 1.35 | 1.35 | |||||||||

| € | 0.92 | 0.93 | |||||||||

| R$ | 4.95 | 5.19 | |||||||||

| COP | 3,915 | 4,762 | |||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 15 |

||||||||

| (MILLIONS) | March 31, 2024 | December 31, 2023 | |||||||||

| Assets held for sale | $ | 256 | $ | — | |||||||

| Current assets | 4,050 | 4,610 | |||||||||

| Equity-accounted investments | 2,484 | 2,546 | |||||||||

| Property, plant and equipment, at fair value | 63,527 | 64,005 | |||||||||

| Total assets | 75,110 | 76,128 | |||||||||

| Liabilities directly associated with assets held for sale | 98 | — | |||||||||

| Corporate borrowings | 3,545 | 2,833 | |||||||||

| Non-recourse borrowings | 25,579 | 26,869 | |||||||||

| Deferred income tax liabilities | 7,091 | 7,174 | |||||||||

| Total liabilities and equity | 75,110 | 76,128 | |||||||||

| Spot FX rates to USD | |||||||||||

| C$ | 1.35 | 1.33 | |||||||||

| € | 0.93 | 0.91 | |||||||||

| R$ | 5.00 | 4.84 | |||||||||

| COP | 3,842 | 3,822 | |||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 16 |

||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

| Revenues | |||||||||||

| Power purchase and revenue agreements | $ | 16 | $ | 44 | |||||||

| Direct operating costs | |||||||||||

| Energy marketing fee and other services | (7) | (1) | |||||||||

| Interest expense | |||||||||||

| Borrowings | $ | (9) | $ | (7) | |||||||

| Contract balance accretion | (8) | (8) | |||||||||

| $ | (17) | $ | (15) | ||||||||

| Other | |||||||||||

| Distribution income | $ | 2 | $ | 1 | |||||||

| Other related party services | $ | 1 | $ | — | |||||||

| Financial instrument gain/loss | $ | 2 | $ | 5 | |||||||

| Management service costs | $ | (45) | $ | (57) | |||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 17 |

||||||||

| (MILLIONS) | Related party | March 31, 2024 | December 31, 2023 | ||||||||||||||

| Current assets | |||||||||||||||||

| Trade receivables and other current assets | |||||||||||||||||

| Contract asset | Brookfield | $ | 63 | $ | 61 | ||||||||||||

| Due from related parties | |||||||||||||||||

| Amounts due from | Brookfield(1) |

209 | 1,386 | ||||||||||||||

| Equity-accounted investments and other | 39 | 57 | |||||||||||||||

| 248 | 1,443 | ||||||||||||||||

| Non-current assets | |||||||||||||||||

| Financial instrument assets | Brookfield | 172 | 170 | ||||||||||||||

| Other long-term assets | |||||||||||||||||

| Contract asset | Brookfield | 297 | 314 | ||||||||||||||

| Amounts due from | Equity-accounted investments and other | 134 | 135 | ||||||||||||||

| Current liabilities | |||||||||||||||||

| Contract liability | Brookfield | 38 | 35 | ||||||||||||||

| Financial instrument liabilities | Brookfield Reinsurance | 2 | 2 | ||||||||||||||

| Due to related parties | |||||||||||||||||

| Amounts due to | Brookfield(2) |

548 | 541 | ||||||||||||||

| Equity-accounted investments and other | 22 | 13 | |||||||||||||||

| Brookfield Reinsurance | 233 | 242 | |||||||||||||||

| Accrued distributions payable on LP units, BEPC exchangeable shares, Redeemable/Exchangeable partnership units and GP interest | Brookfield | 49 | 39 | ||||||||||||||

| 852 | 835 | ||||||||||||||||

| Non-current liabilities | |||||||||||||||||

| Financial instrument liabilities | Brookfield Reinsurance | 2 | 2 | ||||||||||||||

| Due to related parties | |||||||||||||||||

| Amounts due to | Brookfield(2) |

477 | 496 | ||||||||||||||

| Equity-accounted investments and other | 204 | 209 | |||||||||||||||

| 681 | 705 | ||||||||||||||||

| Corporate borrowings | Brookfield Reinsurance | 7 | 8 | ||||||||||||||

| Non-recourse borrowings | Brookfield Reinsurance and associates | 100 | 101 | ||||||||||||||

| Other long-term liabilities | |||||||||||||||||

| Contract liability | Brookfield | 682 | 680 | ||||||||||||||

| Equity | |||||||||||||||||

| Preferred limited partners equity | Brookfield Reinsurance and associates | $ | 11 | $ | 11 | ||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 18 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 19 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 20 |

||||||||

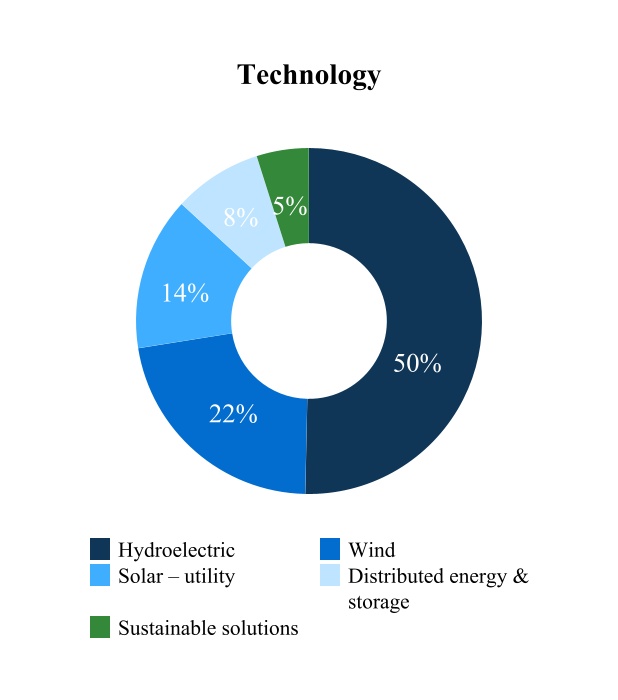

| (GWh) | (MILLIONS) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Generation | LTA Generation | Revenues | Adjusted EBITDA(1) |

Funds From Operations | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hydroelectric | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | 3,621 | 3,576 | 3,234 | 3,237 | $ | 303 | $ | 335 | $ | 206 | $ | 230 | $ | 137 | $ | 158 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brazil | 1,014 | 1,207 | 1,008 | 1,008 | 59 | 61 | 42 | 45 | 36 | 38 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Colombia | 694 | 1,010 | 843 | 853 | 79 | 66 | 45 | 48 | 20 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5,329 | 5,793 | 5,085 | 5,098 | 441 | 462 | 293 | 323 | 193 | 219 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wind | 2,128 | 1,677 | 2,500 | 1,998 | 170 | 142 | 121 | 107 | 87 | 78 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Utility-scale solar | 720 | 484 | 844 | 568 | 93 | 88 | 90 | 69 | 61 | 40 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributed energy & storage | 284 | 233 | 225 | 181 | 52 | 61 | 43 | 45 | 34 | 33 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sustainable solutions | — | — | — | — | 119 | 19 | 35 | 12 | 33 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate | — | — | — | — | — | — | (7) | 3 | (112) | (106) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 8,461 | 8,187 | 8,654 | 7,845 | $ | 875 | $ | 772 | $ | 575 | $ | 559 | $ | 296 | $ | 275 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 21 |

||||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | |||||||||

| Revenue | $ | 441 | $ | 462 | |||||||

| Other income | 8 | 6 | |||||||||

| Direct operating costs | (156) | (145) | |||||||||

| Adjusted EBITDA | 293 | 323 | |||||||||

| Interest expense | (94) | (94) | |||||||||

| Current income taxes | (6) | (10) | |||||||||

| Funds From Operations | $ | 193 | $ | 219 | |||||||

Generation (GWh) – LTA |

5,085 | 5,098 | |||||||||

| Generation (GWh) – actual | 5,329 | 5,793 | |||||||||

| Average revenue per MWh | 74 | 69 | |||||||||

|

Actual

Generation (GWh)

|

Average

revenue

per MWh(1)

|

Adjusted

EBITDA(2)

|

Funds From Operations |

||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||||||

| North America | |||||||||||||||||||||||||||||||||||||||||||||||

| United States | 2,454 | 2,390 | $ | 78 | $ | 82 | $ | 130 | $ | 149 | $ | 89 | $ | 108 | |||||||||||||||||||||||||||||||||

| Canada | 1,167 | 1,186 | 71 | 63 | 76 | 81 | 48 | 50 | |||||||||||||||||||||||||||||||||||||||

| 3,621 | 3,576 | 76 | 76 | 206 | 230 | 137 | 158 | ||||||||||||||||||||||||||||||||||||||||

| Brazil | 1,014 | 1,207 | 58 | 51 | 42 | 45 | 36 | 38 | |||||||||||||||||||||||||||||||||||||||

| Colombia | 694 | 1,010 | 88 | 65 | 45 | 48 | 20 | 23 | |||||||||||||||||||||||||||||||||||||||

| Total | 5,329 | 5,793 | $ | 74 | $ | 69 | $ | 293 | $ | 323 | $ | 193 | $ | 219 | |||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 22 |

||||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | |||||||||

| Revenue | $ | 170 | $ | 142 | |||||||

| Other income | 10 | 1 | |||||||||

| Direct operating costs | (59) | (36) | |||||||||

| Adjusted EBITDA | 121 | 107 | |||||||||

| Interest expense | (31) | (26) | |||||||||

| Current income taxes | (3) | (3) | |||||||||

| Funds From Operations | $ | 87 | $ | 78 | |||||||

| Generation (GWh) – LTA | 2,500 | 1,998 | |||||||||

Generation (GWh) – actual |

2,128 | 1,677 | |||||||||

| Average revenue per MWh | 74 | 87 | |||||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | |||||||||

| Revenue | $ | 93 | $ | 88 | |||||||

| Other income | 28 | 8 | |||||||||

| Direct operating costs | (31) | (27) | |||||||||

| Adjusted EBITDA | 90 | 69 | |||||||||

| Interest expense | (30) | (27) | |||||||||

| Current income taxes | 1 | (2) | |||||||||

| Funds From Operations | $ | 61 | $ | 40 | |||||||

| Generation (GWh) – LTA | 844 | 568 | |||||||||

| Generation (GWh) – actual | 720 | 484 | |||||||||

| Average revenue per MWh | 87 | 138 | |||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 23 |

||||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | |||||||||

| Revenue | $ | 52 | $ | 61 | |||||||

| Other income | 14 | 3 | |||||||||

| Direct operating costs | (23) | (19) | |||||||||

| Adjusted EBITDA | 43 | 45 | |||||||||

| Interest expense | (8) | (11) | |||||||||

| Current income taxes | (1) | (1) | |||||||||

| Funds From Operations | $ | 34 | $ | 33 | |||||||

| Generation (GWh) – LTA | 225 | 181 | |||||||||

| Generation (GWh) – actual | 284 | 233 | |||||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | |||||||||

| Revenue | $ | 119 | $ | 19 | |||||||

| Other income | 13 | 2 | |||||||||

| Direct operating costs | (97) | (9) | |||||||||

| Adjusted EBITDA | 35 | 12 | |||||||||

| Interest expense | (1) | (1) | |||||||||

| Current income taxes | (1) | — | |||||||||

| Funds From Operations | $ | 33 | $ | 11 | |||||||

| (MILLIONS, EXCEPT AS NOTED) | 2024 | 2023 | |||||||||

| Other income | $ | 4 | $ | 12 | |||||||

| Direct operating costs | (11) | (9) | |||||||||

| Adjusted EBITDA | (7) | 3 | |||||||||

| Management service costs | (45) | (57) | |||||||||

| Interest expense | (35) | (28) | |||||||||

Distributions(1) |

(25) | (24) | |||||||||

| Funds From Operations | $ | (112) | $ | (106) | |||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 24 |

||||||||

| Hydroelectric | Wind | Utility-scale solar | Distributed energy & storage | Sustainable solutions | Corporate | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS) | North America | Brazil | Colombia | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 93 | $ | 1 | $ | 28 | $ | 9 | $ | (61) | $ | (28) | $ | (6) | $ | (106) | $ | (70) | |||||||||||||||||||||||||||||||||||

| Add back or deduct the following: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation | 104 | 20 | 37 | 210 | 96 | 31 | 4 | — | 502 | ||||||||||||||||||||||||||||||||||||||||||||

| Deferred income tax (recovery) expense | (2) | — | 4 | (6) | (1) | (3) | — | (6) | (14) | ||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange and financial instrument loss (gain) | (48) | 3 | 11 | (75) | 7 | 8 | (23) | (3) | (120) | ||||||||||||||||||||||||||||||||||||||||||||

Other(1) |

(45) | 4 | (6) | (29) | (21) | (24) | 10 | 16 | (95) | ||||||||||||||||||||||||||||||||||||||||||||

| Management service costs | — | — | — | — | — | — | — | 45 | 45 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 84 | 17 | 97 | 111 | 85 | 32 | 3 | 47 | 476 | ||||||||||||||||||||||||||||||||||||||||||||

| Current income tax expense | 1 | 2 | 15 | 9 | — | 1 | — | — | 28 | ||||||||||||||||||||||||||||||||||||||||||||

Amount attributable to equity accounted investments and non-controlling interests(2) |

19 | (5) | (141) | (108) | (15) | 26 | 47 | — | (177) | ||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA attributable to Unitholders | $ | 206 | $ | 42 | $ | 45 | $ | 121 | $ | 90 | $ | 43 | $ | 35 | $ | (7) | $ | 575 | |||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 25 |

||||||||

| Hydroelectric | Wind | Utility-scale solar | Distributed energy & storage | Sustainable solutions | Corporate | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS) | North America | Brazil | Colombia | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 161 | $ | 10 | $ | 67 | $ | 29 | $ | (48) | $ | 26 | $ | 27 | $ | (95) | $ | 177 | |||||||||||||||||||||||||||||||||||

| Add back or deduct the following: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation | 103 | 23 | 28 | 150 | 82 | 29 | 14 | — | 429 | ||||||||||||||||||||||||||||||||||||||||||||

| Deferred income tax expense (recovery) | 23 | — | 2 | — | (1) | (14) | 1 | (30) | (19) | ||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange and financial instrument loss (gain) | (93) | (1) | — | (40) | 2 | (10) | 1 | (5) | (146) | ||||||||||||||||||||||||||||||||||||||||||||

Other(1) |

19 | 4 | 2 | 5 | 12 | 16 | (13) | 29 | 74 | ||||||||||||||||||||||||||||||||||||||||||||

| Management service costs | — | — | — | — | — | — | — | 57 | 57 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 92 | 12 | 79 | 62 | 65 | 23 | 11 | 50 | 394 | ||||||||||||||||||||||||||||||||||||||||||||

| Current income tax expense | 1 | 2 | 31 | 4 | 5 | — | — | — | 43 | ||||||||||||||||||||||||||||||||||||||||||||

Amount attributable to equity accounted investments and non-controlling interests(2) |

(76) | (5) | (161) | (103) | (48) | (25) | (29) | (3) | (450) | ||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA attributable to Unitholders | $ | 230 | $ | 45 | $ | 48 | $ | 107 | $ | 69 | $ | 45 | $ | 12 | $ | 3 | $ | 559 | |||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 26 |

||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

| Net income (loss) | $ | (70) | $ | 177 | |||||||

| Add back or deduct the following: | |||||||||||

| Depreciation | 502 | 429 | |||||||||

| Deferred income tax expense (recovery) | (14) | (19) | |||||||||

| Foreign exchange and financial instruments gain | (120) | (146) | |||||||||

Other(1) |

(95) | 74 | |||||||||

Amount attributable to equity accounted investments and non-controlling interest(2) |

93 | (240) | |||||||||

| Funds From Operations | $ | 296 | $ | 275 | |||||||

| 2024 | 2023 | ||||||||||

Basic loss per LP unit(1) |

$ | (0.23) | $ | (0.09) | |||||||

| Depreciation | 0.38 | 0.37 | |||||||||

| Foreign exchange and financial instruments (gain) loss | (0.06) | (0.07) | |||||||||

| Deferred income tax recovery | (0.03) | — | |||||||||

Other(2) |

0.39 | 0.22 | |||||||||

Funds From Operations per Unit(3) |

$ | 0.45 | $ | 0.43 | |||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 27 |

||||||||

| (GWh, except as noted) | Balance of 2024 | 2025 | 2026 | 2027 | 2028 | ||||||||||||||||||||||||

| Hydroelectric | |||||||||||||||||||||||||||||

| North America | |||||||||||||||||||||||||||||

United States(1) |

5,275 | 6,610 | 5,630 | 5,347 | 4,721 | ||||||||||||||||||||||||

| Canada | 2,746 | 3,620 | 3,620 | 3,620 | 3,620 | ||||||||||||||||||||||||

| 8,021 | 10,230 | 9,250 | 8,967 | 8,341 | |||||||||||||||||||||||||

| Wind | 6,011 | 8,193 | 8,097 | 7,795 | 7,657 | ||||||||||||||||||||||||

| Utility-scale solar | 3,198 | 4,084 | 4,080 | 4,066 | 4,026 | ||||||||||||||||||||||||

| Distributed energy & storage | 822 | 1,027 | 1,017 | 999 | 986 | ||||||||||||||||||||||||

| Sustainable solutions | 35 | 47 | 44 | 44 | 43 | ||||||||||||||||||||||||

| Contracted on a proportionate basis | 18,087 | 23,581 | 22,488 | 21,871 | 21,053 | ||||||||||||||||||||||||

| Uncontracted on a proportionate basis | 2,173 | 3,519 | 4,612 | 5,229 | 6,047 | ||||||||||||||||||||||||

| Long-term average on a proportionate basis | 20,260 | 27,100 | 27,100 | 27,100 | 27,100 | ||||||||||||||||||||||||

| Non-controlling interests | 33,684 | 45,013 | 45,013 | 45,013 | 45,013 | ||||||||||||||||||||||||

| Total long-term average | 53,944 | 72,113 | 72,113 | 72,113 | 72,113 | ||||||||||||||||||||||||

| Contracted generation as a % of total generation on a proportionate basis | 89 | % | 87 | % | 83 | % | 81 | % | 78 | % | |||||||||||||||||||

| Price per MWh – total generation on a proportionate basis | $ | 78 | $ | 78 | $ | 80 | $ | 81 | $ | 83 | |||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 28 |

||||||||

| Corporate | Consolidated | ||||||||||||||||||||||

| (MILLIONS, EXCEPT AS NOTED) | March 31, 2024 | December 31, 2023 | March 31, 2024 | December 31, 2023 | |||||||||||||||||||

Commercial paper(1) |

658 | 183 | 658 | 183 | |||||||||||||||||||

| Debt | |||||||||||||||||||||||

Medium term notes(2) |

2,899 | 2,660 | 2,899 | 2,660 | |||||||||||||||||||

Non-recourse borrowings(3) |

— | — | 25,736 | 27,020 | |||||||||||||||||||

| 2,899 | 2,660 | 28,635 | 29,680 | ||||||||||||||||||||

Deferred income tax liabilities, net(4) |

— | — | 6,860 | 6,930 | |||||||||||||||||||

| Equity | |||||||||||||||||||||||

| Non-controlling interest | — | — | 18,669 | 18,863 | |||||||||||||||||||

| Preferred equity | 570 | 583 | 570 | 583 | |||||||||||||||||||

| Perpetual subordinated notes | 738 | 592 | 738 | 592 | |||||||||||||||||||

Preferred limited partners' equity(6) |

634 | 760 | 634 | 760 | |||||||||||||||||||

| Unitholders' equity | 8,636 | 9,181 | 8,636 | 9,181 | |||||||||||||||||||

| Total capitalization | $ | 13,477 | $ | 13,776 | $ | 64,742 | $ | 66,589 | |||||||||||||||

| Debt-to-total capitalization | 22 | % | 19 | % | 44 | % | 45 | % | |||||||||||||||

Debt-to-total capitalization (market value)(5) |

14 | % | 12 | % | 40 | % | 40 | % | |||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 29 |

||||||||

| (MILLIONS) | March 31, 2024 | December 31, 2023 | |||||||||

| Brookfield Renewable's share of cash and cash equivalents | $ | 694 | $ | 567 | |||||||

| Investments in marketable securities | 296 | 309 | |||||||||

| Corporate credit facilities | |||||||||||

| Authorized credit facilities | 2,375 | 2,375 | |||||||||

Draws on credit facilities(1) |

(150) | (165) | |||||||||

| Authorized letter of credit facility | 500 | 500 | |||||||||

| Issued letters of credit | (317) | (307) | |||||||||

| Available portion of corporate credit facilities | 2,408 | 2,403 | |||||||||

| Available portion of subsidiary credit facilities on a proportionate basis | 1,039 | 842 | |||||||||

| Available liquidity | $ | 4,437 | $ | 4,121 | |||||||

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||||||||

| Weighted-average | Weighted-average | ||||||||||||||||||||||||||||||||||

| (MILLIONS EXCEPT AS NOTED) |

Interest

rate (%)(1)

|

Term

(years)

|

Total(1) |

Interest

rate (%)(1)

|

Term

(years)

|

Total(1) |

|||||||||||||||||||||||||||||

| Corporate borrowings | |||||||||||||||||||||||||||||||||||

| Credit facilities | N/A | 4 | — | N/A | 5 | — | |||||||||||||||||||||||||||||

| Commercial paper | 5.9 | <1 | $ | 658 | 6.0 | <1 | $ | 183 | |||||||||||||||||||||||||||

| Medium term notes | 4.4 | 12 | 2,899 | 4.3 | 10 | 2,660 | |||||||||||||||||||||||||||||

Proportionate non-recourse borrowings(2) |

|||||||||||||||||||||||||||||||||||

| Hydroelectric | 5.9 | 12 | 5,116 | 6.0 | 12 | 5,215 | |||||||||||||||||||||||||||||

| Wind | 5.0 | 9 | 2,384 | 5.0 | 9 | 2,408 | |||||||||||||||||||||||||||||

| Utility-scale solar | 5.0 | 13 | 2,581 | 5.1 | 13 | 2,596 | |||||||||||||||||||||||||||||

| Distributed energy & storage | 4.4 | 8 | 943 | 4.5 | 8 | 917 | |||||||||||||||||||||||||||||

| Sustainable solutions | 7.2 | 7 | 395 | 6.6 | 7 | 391 | |||||||||||||||||||||||||||||

| 5.4 | 12 | 11,419 | 5.4 | 12 | 11,527 | ||||||||||||||||||||||||||||||

| 14,976 | 14,370 | ||||||||||||||||||||||||||||||||||

| Proportionate unamortized financing fees, net of unamortized premiums | (93) | (88) | |||||||||||||||||||||||||||||||||

| 14,883 | 14,282 | ||||||||||||||||||||||||||||||||||

| Equity-accounted borrowings | (1,001) | (991) | |||||||||||||||||||||||||||||||||

Non-controlling interests and other(3) |

15,242 | 16,411 | |||||||||||||||||||||||||||||||||

| As per IFRS Statements | $ | 29,124 | $ | 29,702 | |||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 30 |

||||||||

| (MILLIONS) | Balance of 2024 | 2025 | 2026 | 2027 | 2028 | Thereafter | Total | |||||||||||||||||||||||||||||||||||||

Debt Principal repayments(1) |

||||||||||||||||||||||||||||||||||||||||||||

Medium term notes(2) |

$ | — | $ | 295 | $ | — | $ | 369 | $ | — | $ | 2,235 | $ | 2,899 | ||||||||||||||||||||||||||||||

Non-recourse borrowings(3) |

||||||||||||||||||||||||||||||||||||||||||||

| Hydroelectric | 24 | 383 | 307 | 170 | 184 | 1,303 | 2,371 | |||||||||||||||||||||||||||||||||||||

| Wind | 76 | 84 | 73 | 1 | 186 | 298 | 718 | |||||||||||||||||||||||||||||||||||||

| Utility-scale solar | 2 | 38 | 42 | 1 | 172 | 288 | 543 | |||||||||||||||||||||||||||||||||||||

|

Distributed energy &

storage

|

3 | 168 | — | 40 | 179 | 109 | 499 | |||||||||||||||||||||||||||||||||||||

| Sustainable solutions | 1 | 3 | 3 | 2 | 12 | 334 | 355 | |||||||||||||||||||||||||||||||||||||

| 106 | 676 | 425 | 214 | 733 | 2,332 | 4,486 | ||||||||||||||||||||||||||||||||||||||

| Amortizing debt principal repayments | ||||||||||||||||||||||||||||||||||||||||||||

| Non-recourse borrowings | ||||||||||||||||||||||||||||||||||||||||||||

| Hydroelectric | 126 | 162 | 178 | 152 | 173 | 1,954 | 2,745 | |||||||||||||||||||||||||||||||||||||

| Wind | 154 | 179 | 168 | 165 | 145 | 855 | 1,666 | |||||||||||||||||||||||||||||||||||||

| Utility-scale solar | 145 | 162 | 138 | 153 | 149 | 1,291 | 2,038 | |||||||||||||||||||||||||||||||||||||

|

Distributed energy &

storage

|

33 | 37 | 36 | 26 | 26 | 286 | 444 | |||||||||||||||||||||||||||||||||||||

| Sustainable solutions | 3 | 5 | 5 | 5 | 5 | 17 | 40 | |||||||||||||||||||||||||||||||||||||

| 461 | 545 | 525 | 501 | 498 | 4,403 | 6,933 | ||||||||||||||||||||||||||||||||||||||

| Total | $ | 567 | $ | 1,516 | $ | 950 | $ | 1,084 | $ | 1,231 | $ | 8,970 | $ | 14,318 | ||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 31 |

||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

| Cash flow provided by (used in): | |||||||||||

| Operating activities before changes in due to or from related parties and net working capital change | $ | 391 | $ | 480 | |||||||

| Changes in due to or from related parties | 58 | 32 | |||||||||

| Net change in working capital balances | (125) | 151 | |||||||||

| Operating activities | 324 | 663 | |||||||||

| Financing activities | 821 | 640 | |||||||||

| Investing activities | (835) | (1,176) | |||||||||

| Foreign exchange gain (loss) on cash | (17) | 14 | |||||||||

| Increase in cash and cash equivalents | $ | 293 | $ | 141 | |||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 32 |

||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

Class A Preference Shares(1) |

31,035,967 | 31,035,967 | |||||||||

| Perpetual Subordinated Notes | |||||||||||

| Balance, beginning of year | 24,400,000 | 24,400,000 | |||||||||

| Issuance | 6,000,000 | — | |||||||||

| Balance, end of period | 30,400,000 | 24,400,000 | |||||||||

Preferred Units(2) |

38,000,000 | 38,000,000 | |||||||||

| GP interest | 3,977,260 | 3,977,260 | |||||||||

| Redeemable/Exchangeable partnership units | 194,487,939 | 194,487,939 | |||||||||

BEPC exchangeable shares(3) |

|||||||||||

| Balance, beginning of year | 179,651,526 | 172,218,098 | |||||||||

| Issuance | — | 7,441,893 | |||||||||

| Exchanged for BEP LP units | (2,683) | (8,465) | |||||||||

| Balance, end of period | 179,648,843 | 179,651,526 | |||||||||

| LP units | |||||||||||

| Balance, beginning of year | 287,164,340 | 275,358,750 | |||||||||

| Issuance | — | 13,348,270 | |||||||||

| Repurchase of LP units for cancellation | (1,216,254) | (1,856,044) | |||||||||

| Distribution reinvestment plan | 95,018 | 304,899 | |||||||||

| Issued in exchange for BEPC exchangeable shares | 2,683 | 8,465 | |||||||||

| Balance, end of period | 286,045,787 | 287,164,340 | |||||||||

Total LP units on a fully-exchanged basis(4) |

660,182,569 | 661,303,805 | |||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 33 |

||||||||

| Three months ended March 31, 2024 | |||||||||||||||||||||||

| Declared | Paid | ||||||||||||||||||||||

| (MILLIONS) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Class A Preference Shares | $ | 7 | $ | 7 | $ | 7 | $ | 7 | |||||||||||||||

| Perpetual Subordinated Notes | 7 | 7 | 7 | 7 | |||||||||||||||||||

| Class A Preferred LP units | 11 | 10 | 11 | 10 | |||||||||||||||||||

Participating non-controlling interests – in operating subsidiaries |

107 | 158 | 107 | 118 | |||||||||||||||||||

| GP interest and incentive distributions | 34 | 28 | 33 | 28 | |||||||||||||||||||

Redeemable/Exchangeable partnership units |

70 | 67 | 69 | 66 | |||||||||||||||||||

| BEPC Exchangeable shares | 65 | 58 | 64 | 58 | |||||||||||||||||||

| LP units | 103 | 97 | 94 | 91 | |||||||||||||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

Revenues(1) |

$ | — | $ | — | |||||||

| Gross profit | — | — | |||||||||

| Dividend income from non-guarantor subsidiaries | 18 | 18 | |||||||||

| Net income | (32) | (12) | |||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 34 |

||||||||

| (MILLIONS) | March 31, 2024 | December 31, 2023 | |||||||||

Current assets(1) |

$ | 811 | $ | 776 | |||||||

Total assets(2)(3) |

2,304 | 2,521 | |||||||||

Current liabilities(4) |

8,771 | 8,399 | |||||||||

Total liabilities(4) |

8,825 | 8,455 | |||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 35 |

||||||||

| 2024 | 2023 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS, EXCEPT AS NOTED) | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | |||||||||||||||||||||||||||||||||||||||

Total Generation (GWh) – LTA |

22,514 | 22,641 | 16,800 | 18,622 | 17,636 | 17,692 | 15,097 | 16,280 | |||||||||||||||||||||||||||||||||||||||

Total Generation (GWh) – actual |

20,300 | 17,006 | 15,870 | 17,798 | 18,875 | 16,450 | 14,906 | 16,488 | |||||||||||||||||||||||||||||||||||||||

Proportionate Generation (GWh) – LTA |

8,653 | 8,512 | 7,112 | 8,403 | 7,899 | 7,655 | 6,905 | 8,152 | |||||||||||||||||||||||||||||||||||||||

Proportionate Generation (GWh) – actual |

8,461 | 7,151 | 6,533 | 7,543 | 8,243 | 6,826 | 6,440 | 7,978 | |||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 1,492 | $ | 1,323 | $ | 1,179 | $ | 1,205 | $ | 1,331 | $ | 1,196 | $ | 1,105 | $ | 1,274 | |||||||||||||||||||||||||||||||

| Net income (loss) attributable to Unitholders | (120) | 35 | (64) | (39) | (32) | (82) | (136) | 1 | |||||||||||||||||||||||||||||||||||||||

| Basic loss per LP unit | (0.23) | 0.01 | (0.14) | (0.10) | (0.09) | (0.16) | (0.25) | (0.03) | |||||||||||||||||||||||||||||||||||||||

| Funds From Operations | 296 | 255 | 253 | 312 | 275 | 225 | 243 | 294 | |||||||||||||||||||||||||||||||||||||||

| Funds From Operations per Unit | 0.45 | 0.38 | 0.38 | 0.48 | 0.43 | 0.35 | 0.38 | 0.46 | |||||||||||||||||||||||||||||||||||||||

| Distribution per LP Unit | 0.36 | 0.34 | 0.34 | 0.34 | 0.34 | 0.32 | 0.32 | 0.32 | |||||||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 36 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 37 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 38 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 39 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 40 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 41 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 42 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 43 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 44 |

||||||||

|

UNAUDITED

(MILLIONS)

|

Notes | March 31, 2024 | December 31, 2023 | ||||||||||||||

| Assets | |||||||||||||||||

| Current assets | |||||||||||||||||

| Cash and cash equivalents | 12 | $ | 1,423 | $ | 1,141 | ||||||||||||

| Restricted cash | 13 | 264 | 310 | ||||||||||||||

| Trade receivables and other current assets | 14 | 1,629 | 1,517 | ||||||||||||||

| Financial instrument assets | 3 | 230 | 199 | ||||||||||||||

| Due from related parties | 17 | 248 | 1,443 | ||||||||||||||

| Assets held for sale | 2 | 256 | — | ||||||||||||||

| 4,050 | 4,610 | ||||||||||||||||

| Financial instrument assets | 3 | 1,813 | 1,768 | ||||||||||||||

| Equity-accounted investments | 11 | 2,484 | 2,546 | ||||||||||||||

| Property, plant and equipment, at fair value | 6 | 63,527 | 64,005 | ||||||||||||||

| Goodwill | 1,944 | 1,944 | |||||||||||||||

| Deferred income tax assets | 5 | 231 | 244 | ||||||||||||||

| Other long-term assets | 1,061 | 1,011 | |||||||||||||||

| Total Assets | $ | 75,110 | $ | 76,128 | |||||||||||||

| Liabilities | |||||||||||||||||

| Current liabilities | |||||||||||||||||

| Accounts payable and accrued liabilities | 15 | $ | 1,585 | $ | 1,539 | ||||||||||||

| Financial instrument liabilities | 3 | 750 | 687 | ||||||||||||||

| Due to related parties | 17 | 852 | 835 | ||||||||||||||

| Corporate borrowings | 7 | 658 | 183 | ||||||||||||||

| Non-recourse borrowings | 7 | 3,197 | 4,752 | ||||||||||||||

| Provisions | 37 | 42 | |||||||||||||||

| Liabilities directly associated with assets held for sale | 2 | 98 | — | ||||||||||||||

| 7,177 | 8,038 | ||||||||||||||||

| Financial instrument liabilities | 3 | 2,613 | 2,433 | ||||||||||||||

| Corporate borrowings | 7 | 2,887 | 2,650 | ||||||||||||||

| Non-recourse borrowings | 7 | 22,382 | 22,117 | ||||||||||||||

| Deferred income tax liabilities | 5 | 7,091 | 7,174 | ||||||||||||||

| Provisions | 1,222 | 1,268 | |||||||||||||||

| Due to related parties | 17 | 681 | 705 | ||||||||||||||

| Other long-term liabilities | 1,684 | 1,764 | |||||||||||||||

| Equity | |||||||||||||||||

| Non-controlling interests | |||||||||||||||||

| Participating non-controlling interests – in operating subsidiaries | 8 | 18,669 | 18,863 | ||||||||||||||

| General partnership interest in a holding subsidiary held by Brookfield | 8 | 52 | 55 | ||||||||||||||

| Participating non-controlling interests – in a holding subsidiary – Redeemable/Exchangeable units held by Brookfield | 8 | 2,529 | 2,684 | ||||||||||||||

| BEPC exchangeable shares | 8 | 2,336 | 2,479 | ||||||||||||||

| Preferred equity | 8 | 570 | 583 | ||||||||||||||

| Perpetual subordinated notes | 8 | 738 | 592 | ||||||||||||||

| Preferred limited partners' equity | 9 | 760 | 760 | ||||||||||||||

| Limited partners' equity | 10 | 3,719 | 3,963 | ||||||||||||||

| Total Equity | 29,373 | 29,979 | |||||||||||||||

| Total Liabilities and Equity | $ | 75,110 | $ | 76,128 | |||||||||||||

| Approved on behalf of Brookfield Renewable Partners L.P.: | |||||

|

|

||||

|

Patricia Zuccotti

Director

|

David Mann

Director

|

||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 45 |

||||||||

|

UNAUDITED

(MILLIONS, EXCEPT PER UNIT INFORMATION)

|

Three months ended March 31 | ||||||||||||||||

| Notes | 2024 | 2023 | |||||||||||||||

| Revenues | 17 | $ | 1,492 | $ | 1,331 | ||||||||||||

| Other income | 34 | 26 | |||||||||||||||

Direct operating costs(1) |

(634) | (401) | |||||||||||||||

| Management service costs | 17 | (45) | (57) | ||||||||||||||

| Interest expense | 7 | (476) | (394) | ||||||||||||||

| Share of earnings from equity-accounted investments | 11 | (33) | 33 | ||||||||||||||

| Foreign exchange and financial instruments gain | 3 | 120 | 146 | ||||||||||||||

| Depreciation | 6 | (502) | (429) | ||||||||||||||

| Other | (12) | (54) | |||||||||||||||

| Income tax (expense) recovery | |||||||||||||||||

| Current | 5 | (28) | (43) | ||||||||||||||

| Deferred | 5 | 14 | 19 | ||||||||||||||

| (14) | (24) | ||||||||||||||||

| Net income (loss) | $ | (70) | $ | 177 | |||||||||||||

| Net income (loss) attributable to: | |||||||||||||||||

| Non-controlling interests | |||||||||||||||||

| Participating non-controlling interests – in operating subsidiaries | 8 | $ | 25 | $ | 185 | ||||||||||||

| General partnership interest in a holding subsidiary held by Brookfield | 8 | 33 | 28 | ||||||||||||||

| Participating non-controlling interests – in a holding subsidiary – Redeemable/Exchangeable units held by Brookfield | 8 | (45) | (18) | ||||||||||||||

| BEPC exchangeable shares | 8 | (41) | (16) | ||||||||||||||

| Preferred equity | 8 | 7 | 7 | ||||||||||||||

| Perpetual subordinated notes | 8 | 7 | 7 | ||||||||||||||

| Preferred limited partners' equity | 9 | 11 | 10 | ||||||||||||||

| Limited partners' equity | 10 | (67) | (26) | ||||||||||||||

| $ | (70) | $ | 177 | ||||||||||||||

| Basic and diluted loss per LP unit | $ | (0.23) | $ | (0.09) | |||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 46 |

||||||||

|

UNAUDITED

(MILLIONS)

|

Three months ended March 31 | ||||||||||||||||

| Notes | 2024 | 2023 | |||||||||||||||

| Net income (loss) | $ | (70) | $ | 177 | |||||||||||||

| Other comprehensive income (loss) that will not be reclassified to net income (loss) | |||||||||||||||||

| Revaluations of property, plant and equipment | 6 | (25) | (42) | ||||||||||||||

| Actuarial gain (loss) on defined benefit plans | 2 | (1) | |||||||||||||||

| Deferred tax recovery (expense) on above item | (3) | — | |||||||||||||||

| Equity-accounted investments | 11 | — | 10 | ||||||||||||||

Total items that will not be reclassified to net income |

(26) | (33) | |||||||||||||||

| Other comprehensive income (loss) that may be reclassified to net income | |||||||||||||||||

| Foreign currency translation | (241) | 272 | |||||||||||||||

| Gain (loss) arising during the period on financial instruments designated as cash-flow hedges | 3 | (174) | 128 | ||||||||||||||

| Gain (loss) on foreign exchange swaps – net investment hedge | 3 | 22 | (19) | ||||||||||||||

| Reclassification adjustments for amounts recognized in net income (loss) | 3 | (29) | (49) | ||||||||||||||

| Deferred income taxes on above items | 24 | (11) | |||||||||||||||

| Equity-accounted investments | 11 | (13) | (7) | ||||||||||||||

| Total items that may be reclassified subsequently to net income (loss) | (411) | 314 | |||||||||||||||

| Other comprehensive income (loss) | (437) | 281 | |||||||||||||||

| Comprehensive income (loss) | $ | (507) | $ | 458 | |||||||||||||

| Comprehensive income (loss) attributable to: | |||||||||||||||||

| Non-controlling interests | |||||||||||||||||

| Participating non-controlling interests – in operating subsidiaries | 8 | $ | (272) | $ | 354 | ||||||||||||

| General partnership interest in a holding subsidiary held by Brookfield | 8 | 32 | 29 | ||||||||||||||

| Participating non-controlling interests – in a holding subsidiary – Redeemable/Exchangeable units held by Brookfield | 8 | (82) | 15 | ||||||||||||||

| BEPC exchangeable shares | 8 | (75) | 13 | ||||||||||||||

| Preferred equity | 8 | (6) | 9 | ||||||||||||||

| Perpetual subordinated notes | 8 | 7 | 7 | ||||||||||||||

| Preferred limited partners' equity | 9 | 11 | 10 | ||||||||||||||

| Limited partners' equity | 10 | (122) | 21 | ||||||||||||||

| $ | (507) | $ | 458 | ||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 47 |

||||||||

| Accumulated other comprehensive income | Non-controlling interests | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

UNAUDITED

THREE MONTHS ENDED

MARCH 31

(MILLIONS)

|

Limited partners' equity |

Foreign currency translation |

Revaluation surplus |

Actuarial losses on defined benefit plans | Cash flow hedges |

Investments in equity securities | Total limited partners' equity |

Preferred limited partners' equity |

Preferred equity |

Perpetual subordinated notes | BEPC exchangeable shares | Participating non-controlling interests – in operating subsidiaries |

General partnership interest in a holding subsidiary held by Brookfield | Participating non-controlling interests – in a holding subsidiary – Redeemable/Exchangeable units held by Brookfield |

Total equity |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance, as at December 31, 2023 |

$ | (2,118) | $ | (701) | $ | 6,743 | $ | 2 | $ | 36 | $ | 1 | $ | 3,963 | $ | 760 | $ | 583 | $ | 592 | $ | 2,479 | $ | 18,863 | $ | 55 | $ | 2,684 | $ | 29,979 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | (67) | — | — | — | — | — | (67) | 11 | 7 | 7 | (41) | 25 | 33 | (45) | (70) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | (35) | (5) | — | (15) | — | (55) | — | (13) | — | (34) | (297) | (1) | (37) | (437) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Equity issuance (Note 8) |

— | — | — | — | — | — | — | — | — | 146 | — | — | — | — | 146 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LP Units purchased for cancellation (Note 10) |

(28) | — | — | — | — | — | (28) | — | — | — | — | — | — | (28) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | — | — | — | — | — | 167 | — | — | 167 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Disposal | — | — | — | — | — | — | — | — | — | — | — | (16) | — | — | (16) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions or dividends declared | (103) | — | — | — | — | — | (103) | (11) | (7) | (7) | (65) | (107) | (34) | (70) | (404) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution reinvestment plan | 2 | — | — | — | — | — | 2 | — | — | — | — | — | — | — | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 9 | 1 | (2) | — | (1) | — | 7 | — | — | — | (3) | 34 | (1) | (3) | 34 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in period | (187) | (34) | (7) | — | (16) | — | (244) | — | (13) | 146 | (143) | (194) | (3) | (155) | (606) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance, as at March 31, 2024 |

$ | (2,305) | $ | (735) | $ | 6,736 | $ | 2 | $ | 20 | $ | 1 | $ | 3,719 | $ | 760 | $ | 570 | $ | 738 | $ | 2,336 | $ | 18,669 | $ | 52 | $ | 2,529 | $ | 29,373 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance, as at December 31, 2022 |

$ | (1,898) | $ | (845) | $ | 6,817 | $ | 4 | $ | 17 | $ | 1 | $ | 4,096 | $ | 760 | $ | 571 | $ | 592 | $ | 2,561 | $ | 14,755 | $ | 59 | $ | 2,892 | 26,286 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | (26) | — | — | — | — | — | (26) | 10 | 7 | 7 | (16) | 185 | 28 | (18) | 177 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | 38 | (4) | 1 | 12 | — | 47 | — | 2 | — | 29 | 169 | 1 | 33 | 281 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | — | — | — | — | — | 994 | — | — | 994 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Disposal | 14 | — | (14) | — | — | — | — | — | — | — | — | (388) | — | — | (388) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions or dividends declared | (97) | — | — | — | — | — | (97) | (10) | (7) | (7) | (58) | (158) | (28) | (67) | (432) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution reinvestment plan | 2 | — | — | — | — | — | 2 | — | — | — | — | — | — | — | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | (3) | 11 | 2 | — | 1 | — | 11 | — | — | — | 6 | (31) | (2) | 8 | (8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in period | (110) | 49 | (16) | 1 | 13 | — | (63) | — | 2 | — | (39) | 771 | (1) | (44) | 626 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance, as at March 31, 2023 |

$ | (2,008) | $ | (796) | $ | 6,801 | $ | 5 | $ | 30 | $ | 1 | $ | 4,033 | $ | 760 | $ | 573 | $ | 592 | $ | 2,522 | $ | 15,526 | $ | 58 | $ | 2,848 | $ | 26,912 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 48 |

||||||||

| UNAUDITED | Three months ended March 31 | ||||||||||||||||

| (MILLIONS) | Notes | 2024 | 2023 | ||||||||||||||

| Operating activities | |||||||||||||||||

| Net income (loss) | $ | (70) | $ | 177 | |||||||||||||

| Adjustments for the following non-cash items: | |||||||||||||||||

| Depreciation | 6 | 502 | 429 | ||||||||||||||

| Unrealized foreign exchange and financial instruments gain | 3 | (117) | (130) | ||||||||||||||

| Share of (earnings) loss from equity-accounted investments | 11 | 33 | (33) | ||||||||||||||

| Deferred income tax expense | 5 | (14) | (19) | ||||||||||||||

| Other non-cash items | 56 | 37 | |||||||||||||||

| Dividends received from equity-accounted investments | 11 | 1 | 19 | ||||||||||||||

| 391 | 480 | ||||||||||||||||

| Changes in due to or from related parties | 17 | 58 | 32 | ||||||||||||||

| Net change in working capital balances | (125) | 151 | |||||||||||||||

| 324 | 663 | ||||||||||||||||

| Financing activities | |||||||||||||||||

| Proceeds from medium term notes | 7 | 297 | 293 | ||||||||||||||

| Commercial paper, net | 7 | 476 | (69) | ||||||||||||||

| Proceeds from non-recourse borrowings | 7,17 |

1,878 | 1,528 | ||||||||||||||

| Repayment of non-recourse borrowings | 7,17 |

(2,846) | (1,622) | ||||||||||||||

| Capital contributions from participating non-controlling interests – in operating subsidiaries | 8 | 167 | 994 | ||||||||||||||

| Capital repaid to participating non-controlling interests – in operating subsidiaries | 8 | (16) | — | ||||||||||||||

| Issuance of equity instruments and related costs | 8,10 |

146 | — | ||||||||||||||

| Redemption and repurchase of equity instruments | 9 | (28) | — | ||||||||||||||

| Distributions paid: | |||||||||||||||||

To participating non-controlling interests – in operating subsidiaries, preferred shareholders, preferred limited partners unitholders, and perpetual subordinate notes |

8,9 |

(132) | (142) | ||||||||||||||

| To unitholders of Brookfield Renewable or BRELP and shareholders of Brookfield Renewable Corporation | 8,10 |

(260) | (243) | ||||||||||||||

| Inflows from related party | 17 | 1,265 | — | ||||||||||||||

| Outflows to related party | 17 | (126) | (99) | ||||||||||||||

| 821 | 640 | ||||||||||||||||

| Investing activities | |||||||||||||||||

| Acquisitions, net of cash and cash equivalents, in acquired entity | (11) | (81) | |||||||||||||||

| Investment in property, plant and equipment | 6 | (840) | (572) | ||||||||||||||

| Investment in equity-accounted investments | 2 | (93) | |||||||||||||||

| Proceeds from disposal of assets, net of cash and cash equivalents disposed | — | 3 | |||||||||||||||

| Purchases of financial assets | 3 | (5) | (452) | ||||||||||||||

| Proceeds from financial assets | 3 | 5 | 3 | ||||||||||||||

| Restricted cash and other | 14 | 16 | |||||||||||||||

| (835) | (1,176) | ||||||||||||||||

| Foreign exchange (gain) loss on cash | (17) | 14 | |||||||||||||||

| Cash and cash equivalents | |||||||||||||||||

| Increase | 293 | 141 | |||||||||||||||

| Net change in cash classified within assets held for sale | (11) | 1 | |||||||||||||||

| Balance, beginning of period | 1,141 | 998 | |||||||||||||||

| Balance, end of period | $ | 1,423 | $ | 1,140 | |||||||||||||

| Supplemental cash flow information: | |||||||||||||||||

| Interest paid | $ | 421 | $ | 305 | |||||||||||||

| Interest received | $ | 24 | $ | 16 | |||||||||||||

| Income taxes paid | $ | 39 | $ | 31 | |||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 49 |

||||||||

| Notes to the consolidated financial statements | Page | |||||||

| 1. | Basis of preparation and material accounting policy information | |||||||

| 2. | Assets held for sale | |||||||

| 3. | Risk management and financial instruments | |||||||

| 4. | Segmented information | |||||||

| 5. | Income taxes | |||||||

| 6. | Property, plant and equipment | |||||||

| 7. | Borrowings | |||||||

| 8. | Non-controlling interests | |||||||

| 9. | Preferred limited partners' equity | |||||||

| 10. | Limited partners' equity | |||||||

| 11. | Equity-accounted investments | |||||||

| 12. | Cash and cash equivalents | |||||||

| 13. | Restricted cash | |||||||

| 14. | Trade receivables and other current assets | |||||||

| 15. | Accounts payable and accrued liabilities | |||||||

| 16. | Commitments, contingencies and guarantees | |||||||

| 17. | Related party transactions | |||||||

| 18. | Subsidiary public issuers | |||||||

| 19. | Subsequent events | |||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 50 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 51 |

||||||||

| (MILLIONS) | March 31, 2024 | ||||

| Assets | |||||

| Cash and cash equivalents | $ | 11 | |||

| Trade receivables and other current assets | 9 | ||||

| Property, plant and equipment, at fair value | 236 | ||||

| Assets held for sale | $ | 256 | |||

| Liabilities | |||||

| Current liabilities | $ | 4 | |||

| Non-recourse borrowings | 38 | ||||

| Financial instrument liabilities | 28 | ||||

| Other long-term liabilities | 15 | ||||

| Deferred tax liability | 12 | ||||

| Provisions | 1 | ||||

| Liabilities directly associated with assets held for sale | $ | 98 | |||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 52 |

||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||

| (MILLIONS) | Level 1 | Level 2 | Level 3 | Total | Total | ||||||||||||||||||||||||

| Assets measured at fair value: | |||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 1,423 | $ | — | $ | — | $ | 1,423 | $ | 1,141 | |||||||||||||||||||

Restricted cash(1) |

383 | — | — | 383 | 391 | ||||||||||||||||||||||||

Financial instrument assets(1) |

|||||||||||||||||||||||||||||

| IFRS 9 PPAs | — | — | 37 | 37 | 50 | ||||||||||||||||||||||||

| Energy derivative contracts | — | 109 | — | 109 | 90 | ||||||||||||||||||||||||

| Interest rate swaps | — | 256 | — | 256 | 233 | ||||||||||||||||||||||||

| Foreign exchange swaps | — | 34 | — | 34 | 27 | ||||||||||||||||||||||||

| Tax equity | — | — | 43 | 43 | 27 | ||||||||||||||||||||||||

| Investments in debt and equity securities | — | 46 | 1,518 | 1,564 | 1,540 | ||||||||||||||||||||||||

| Property, plant and equipment | — | — | 63,527 | 63,527 | 64,005 | ||||||||||||||||||||||||

| Liabilities measured at fair value: | |||||||||||||||||||||||||||||

Financial instrument liabilities(1) |

|||||||||||||||||||||||||||||

| IFRS 9 PPAs | — | (52) | (857) | (909) | (798) | ||||||||||||||||||||||||

| Energy derivative contracts | — | (108) | — | (108) | (82) | ||||||||||||||||||||||||

| Interest rate swaps | — | (93) | — | (93) | (105) | ||||||||||||||||||||||||

| Foreign exchange swaps | — | (380) | — | (380) | (353) | ||||||||||||||||||||||||

| Tax equity | — | — | (1,873) | (1,873) | (1,782) | ||||||||||||||||||||||||

Contingent consideration(2) |

— | — | (90) | (90) | (92) | ||||||||||||||||||||||||

Liabilities for which fair value is disclosed: |

|||||||||||||||||||||||||||||

Corporate borrowings(1) |

(3,417) | — | — | (3,417) | (2,731) | ||||||||||||||||||||||||

Non-recourse borrowing(1) |

(2,081) | (23,299) | — | (25,380) | (26,839) | ||||||||||||||||||||||||

| Total | $ | (3,692) | $ | (23,487) | $ | 62,305 | $ | 35,126 | $ | 34,722 | |||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 53 |

||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||

| (MILLIONS) | Assets | Liabilities | Net Assets (Liabilities) |

Net Assets (Liabilities) |

|||||||||||||||||||

| IFRS 9 PPAs | $ | 37 | $ | 909 | $ | (872) | $ | (748) | |||||||||||||||

| Energy derivative contracts | 109 | 108 | 1 | 8 | |||||||||||||||||||

| Interest rate swaps | 256 | 93 | 163 | 128 | |||||||||||||||||||

| Foreign exchange swaps | 34 | 380 | (346) | (326) | |||||||||||||||||||

| Investments in debt and equity securities | 1,564 | — | 1,564 | 1,540 | |||||||||||||||||||

| Tax equity | 43 | 1,873 | (1,830) | (1,755) | |||||||||||||||||||

| Total | 2,043 | 3,363 | (1,320) | (1,153) | |||||||||||||||||||

| Less: current portion | 230 | 750 | (520) | (488) | |||||||||||||||||||

| Long-term portion | $ | 1,813 | $ | 2,613 | $ | (800) | $ | (665) | |||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 54 |

||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

| Energy derivative contracts | $ | 11 | $ | 66 | |||||||

| IFRS 9 PPAs | 16 | 57 | |||||||||

| Investment in debt and equity securities | 28 | 13 | |||||||||

| Interest rate swaps | 11 | (6) | |||||||||

| Foreign exchange swaps | (4) | (5) | |||||||||

| Tax equity | 56 | 8 | |||||||||

| Foreign exchange gain | 2 | 13 | |||||||||

| $ | 120 | $ | 146 | ||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

| Energy derivative contracts | $ | 6 | $ | 166 | |||||||

| IFRS 9 PPAs | (192) | 12 | |||||||||

| Interest rate swaps | 16 | (46) | |||||||||

| Foreign exchange swaps | (4) | (4) | |||||||||

| (174) | 128 | ||||||||||

| Foreign exchange swaps – net investment | 22 | (19) | |||||||||

| Investments in debt and equity securities | — | 10 | |||||||||

| $ | (152) | $ | 119 | ||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

| Energy derivative contracts | $ | (31) | $ | (48) | |||||||

| Interest rate swaps | 2 | (1) | |||||||||

| $ | (29) | $ | (49) | ||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 55 |

||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 56 |

||||||||

| Attributable to Unitholders | Contribution from equity-accounted investments | Attributable to non-controlling interests |

As per

IFRS

financials(1)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hydroelectric | Wind | Utility-scale solar | Distributed energy & storage | Sustainable solutions | Corporate | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS) | North America |

Brazil | Colombia | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 303 | $ | 59 | $ | 79 | $ | 170 | $ | 93 | $ | 52 | $ | 119 | $ | — | $ | 875 | $ | (157) | $ | 774 | $ | 1,492 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other income | 6 | 1 | 1 | 10 | 28 | 14 | 13 | 4 | 77 | (6) | (37) | 34 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Direct operating costs | (103) | (18) | (35) | (59) | (31) | (23) | (97) | (11) | (377) | 112 | (369) | (634) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share of revenue, other income and direct operating costs from equity-accounted investments | — | — | — | — | — | — | — | — | — | 51 | — | 51 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 206 | 42 | 45 | 121 | 90 | 43 | 35 | (7) | 575 | — | 368 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Management service costs | — | — | — | — | — | — | — | (45) | (45) | — | — | (45) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | (68) | (4) | (22) | (31) | (30) | (8) | (1) | (35) | (199) | 7 | (284) | (476) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current income taxes | (1) | (2) | (3) | (3) | 1 | (1) | (1) | — | (10) | 2 | (20) | (28) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions attributable to | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred limited partners equity |

— | — | — | — | — | — | — | (11) | (11) | — | — | (11) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred equity |

— | — | — | — | — | — | — | (7) | (7) | — | — | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Perpetual subordinated notes | — | — | — | — | — | — | — | (7) | (7) | — | — | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Share of interest and cash taxes from equity accounted investments |

— | — | — | — | — | — | — | — | — | (9) | — | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Share of Funds From Operations attributable to non-controlling interests |

— | — | — | — | — | — | — | — | — | — | (64) | (64) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Funds From Operations |

137 | 36 | 20 | 87 | 61 | 34 | 33 | (112) | 296 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Depreciation |

(502) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange and financial instrument gain | 120 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred income tax expense (recovery) | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other |

(12) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Share of earnings from equity-accounted investments |

(75) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to non-controlling interests | 39 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income (loss) attributable to Unitholders(2) |

$ | (120) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 57 |

||||||||

| Attributable to Unitholders | Contribution from equity-accounted investments | Attributable to non- controlling interests |

As per

IFRS

financials(1)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hydroelectric | Wind | Utility-scale solar | Distributed energy & storage | Sustainable Solutions | Corporate | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS) | North America |

Brazil | Colombia | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 335 | $ | 61 | $ | 66 | $ | 142 | $ | 88 | $ | 61 | $ | 19 | $ | — | $ | 772 | $ | (79) | $ | 638 | $ | 1,331 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other income | 4 | 1 | 1 | 1 | 8 | 3 | 2 | 12 | 32 | (5) | (1) | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Direct operating costs | (109) | (17) | (19) | (36) | (27) | (19) | (9) | (9) | (245) | 34 | (190) | (401) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share of revenue, other income and direct operating costs from equity-accounted investments | — | — | — | — | — | — | — | — | — | 50 | — | 50 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 230 | 45 | 48 | 107 | 69 | 45 | 12 | 3 | 559 | — | 447 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Management service costs | — | — | — | — | — | — | — | (57) | (57) | — | — | (57) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | (71) | (5) | (18) | (26) | (27) | (11) | (1) | (28) | (187) | 10 | (217) | (394) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current income taxes | (1) | (2) | (7) | (3) | (2) | (1) | — | — | (16) | 3 | (30) | (43) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions attributable to | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred limited partners equity |

— | — | — | — | — | — | — | (10) | (10) | — | — | (10) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred equity |

— | — | — | — | — | — | — | (7) | (7) | — | — | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Perpetual subordinated notes | — | — | — | (7) | (7) | — | — | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Share of interest and cash taxes from equity accounted investments |

— | — | — | — | — | — | — | — | — | (13) | — | (13) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Share of Funds From Operations attributable to non-controlling interests |

— | — | — | — | — | — | — | — | — | — | (200) | (200) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Funds From Operations |

158 | 38 | 23 | 78 | 40 | 33 | 11 | (106) | 275 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Depreciation |

(429) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange and financial instrument gain (loss) | 146 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Deferred income tax expense |

19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other |

(54) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share of earnings from equity-accounted investments | (4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to non-controlling interests | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net (loss) attributable to Unitholders(2) |

$ | (32) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 58 |

||||||||

| Attributable to Unitholders | Contribution from equity-accounted investments | Attributable to non- controlling interests |

As per IFRS financials |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hydroelectric | Wind | Utility-scale solar | Distributed energy & storage | Sustainable solutions | Corporate | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (MILLIONS) | North America |

Brazil | Colombia | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As at March 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 141 | $ | 38 | $ | 15 | $ | 244 | $ | 167 | $ | 57 | $ | 30 | $ | — | $ | 692 | $ | (79) | $ | 810 | $ | 1,423 | |||||||||||||||||||||||||||||||||||||||||||||||

| Property, plant and equipment | 14,961 | 1,629 | 2,501 | 5,776 | 3,614 | 2,421 | 322 | — | 31,224 | (1,582) | 33,885 | 63,527 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | 16,045 | 1,852 | 2,749 | 6,665 | 4,496 | 2,882 | 1,510 | 269 | 36,468 | (1,515) | 40,157 | 75,110 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 9,109 | 545 | 1,739 | 4,568 | 3,442 | 1,734 | 754 | 3,880 | 25,771 | (1,515) | 21,481 | 45,737 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As at December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 77 | $ | 20 | $ | 12 | $ | 225 | $ | 123 | $ | 50 | $ | 30 | $ | 3 | $ | 540 | $ | (85) | $ | 686 | $ | 1,141 | |||||||||||||||||||||||||||||||||||||||||||||||

| Property, plant and equipment | 15,134 | 1,694 | 2,490 | 6,024 | 3,635 | 2,386 | 341 | — | 31,704 | (1,578) | 33,879 | 64,005 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | 16,143 | 1,880 | 2,738 | 6,802 | 4,518 | 2,842 | 1,540 | 257 | 36,720 | (1,529) | 40,937 | 76,128 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 9,231 | 531 | 1,645 | 4,727 | 3,484 | 1,705 | 1,126 | 3,159 | 25,608 | (1,529) | 22,070 | 46,149 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 59 |

||||||||

| Three months ended March 31 | |||||||||||

| (MILLIONS) | 2024 | 2023 | |||||||||

| Hydroelectric | |||||||||||

| North America | $ | 340 | $ | 422 | |||||||

| Brazil | 66 | 67 | |||||||||

| Colombia | 351 | 283 | |||||||||

| 757 | 772 | ||||||||||

| Wind | 422 | 319 | |||||||||

| Utility-scale solar | 229 | 164 | |||||||||

| Distributed energy & storage | 77 | 64 | |||||||||

| Sustainable solutions | 7 | 12 | |||||||||

| Total | $ | 1,492 | $ | 1,331 | |||||||

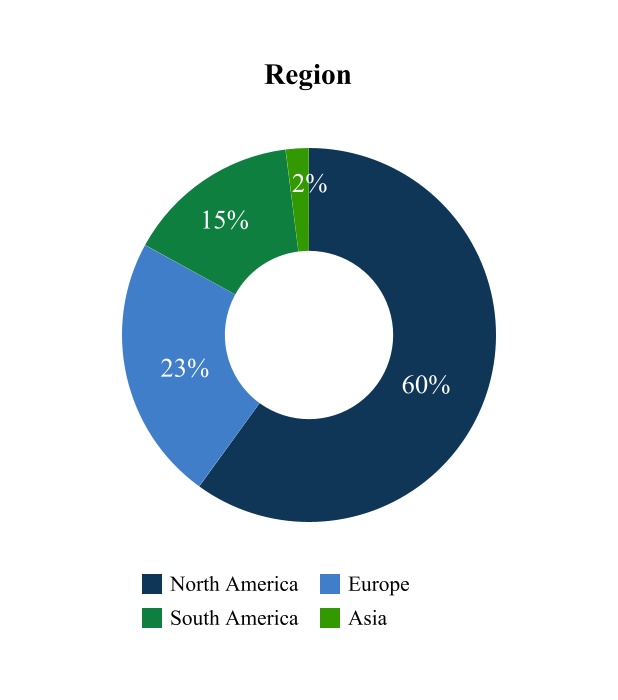

| (MILLIONS) | March 31, 2024 | December 31, 2023 | |||||||||

| United States | $ | 34,602 | $ | 34,303 | |||||||

| Colombia | 10,499 | 10,585 | |||||||||

| Canada | 7,262 | 7,483 | |||||||||

| Brazil | 5,382 | 5,622 | |||||||||

| Europe | 4,668 | 5,046 | |||||||||

| Asia | 3,402 | 3,320 | |||||||||

| Other | 196 | 192 | |||||||||

| $ | 66,011 | $ | 66,551 | ||||||||

| Brookfield Renewable Partners L.P. | Interim Report | March 31, 2024 |

||||||

Page 60 |

||||||||

| (MILLIONS) | Hydroelectric | Wind | Solar | Other(1) |

Total | ||||||||||||||||||||||||

Property, plant and equipment, at fair value |

|||||||||||||||||||||||||||||

As at December 31, 2023 |

$ | 32,646 | $ | 15,224 | $ | 11,022 | $ | 197 | $ | 59,089 | |||||||||||||||||||

| Additions, net | 1 | (30) | 20 | (12) | (21) | ||||||||||||||||||||||||

| Transfer from construction work-in-progress | 1 | 206 | 388 | — | 595 | ||||||||||||||||||||||||

| Transfer to assets held for sale | — | (15) | — | (44) | (59) | ||||||||||||||||||||||||

| Items recognized through OCI: | |||||||||||||||||||||||||||||

| Change in fair value | — | — | — | (25) | (25) | ||||||||||||||||||||||||

| Foreign exchange | (242) | (115) | (97) | (3) | (457) | ||||||||||||||||||||||||

| Items recognized through net income: | |||||||||||||||||||||||||||||

| Depreciation | (158) | (210) | (129) | (5) | (502) | ||||||||||||||||||||||||

As at March 31, 2024 |

$ | 32,248 | $ | 15,060 | $ | 11,204 | $ | 108 | $ | 58,620 | |||||||||||||||||||

| Construction work-in-progress | |||||||||||||||||||||||||||||

| As at December 31, 2023 | $ | 300 | $ | 1,617 | $ | 2,987 | $ | 12 | $ | 4,916 | |||||||||||||||||||

| Additions | 22 | 117 | 608 | 36 | 783 | ||||||||||||||||||||||||

| Transfer to property, plant and equipment | (1) | (206) | (388) | — | (595) | ||||||||||||||||||||||||

| Transfer to assets held for sale | — | (175) | — | (3) | (178) | ||||||||||||||||||||||||

| Items recognized through OCI: | |||||||||||||||||||||||||||||

| Foreign exchange | 5 | (9) | (13) | (2) | (19) | ||||||||||||||||||||||||

As at March 31, 2024 |

$ | 326 | $ | 1,344 | $ | 3,194 | $ | 43 | $ | 4,907 | |||||||||||||||||||

| Total property, plant and equipment, at fair value | |||||||||||||||||||||||||||||

As at December 31, 2023(2)(3) |

$ | 32,946 | $ | 16,841 | $ | 14,009 | $ | 209 | $ | 64,005 | |||||||||||||||||||

As at March 31, 2024(2)(3) |

$ | 32,574 | $ | 16,404 | $ | 14,398 | $ | 151 | $ | 63,527 | |||||||||||||||||||