0001530804false2023FYhttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsP30DP5Yhttp://fasb.org/us-gaap/2023#RevenueFromContractWithCustomerExcludingAssessedTaxhttp://fasb.org/us-gaap/2023#OtherCostOfOperatingRevenuehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#RevenueFromContractWithCustomerExcludingAssessedTaxhttp://fasb.org/us-gaap/2023#OtherCostOfOperatingRevenuehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#RevenueFromContractWithCustomerExcludingAssessedTaxhttp://fasb.org/us-gaap/2023#OtherCostOfOperatingRevenuehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpenseP4Y00015308042023-01-012023-12-3100015308042023-06-30iso4217:USD00015308042024-01-31xbrli:shares00015308042022-01-012022-12-3100015308042021-01-012021-12-31iso4217:USDxbrli:shares00015308042023-12-3100015308042022-12-3100015308042021-12-3100015308042020-12-310001530804us-gaap:CommonStockMember2020-12-310001530804us-gaap:AdditionalPaidInCapitalMember2020-12-310001530804us-gaap:RetainedEarningsMember2020-12-310001530804us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001530804us-gaap:ParentMember2020-12-310001530804us-gaap:NoncontrollingInterestMember2020-12-310001530804us-gaap:RetainedEarningsMember2021-01-012021-12-310001530804us-gaap:ParentMember2021-01-012021-12-310001530804us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001530804us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001530804us-gaap:CommonStockMember2021-01-012021-12-310001530804us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001530804us-gaap:CommonStockMember2021-12-310001530804us-gaap:AdditionalPaidInCapitalMember2021-12-310001530804us-gaap:RetainedEarningsMember2021-12-310001530804us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001530804us-gaap:ParentMember2021-12-310001530804us-gaap:NoncontrollingInterestMember2021-12-310001530804us-gaap:RetainedEarningsMember2022-01-012022-12-310001530804us-gaap:ParentMember2022-01-012022-12-310001530804us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001530804us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001530804us-gaap:CommonStockMember2022-01-012022-12-310001530804us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001530804us-gaap:CommonStockMember2022-12-310001530804us-gaap:AdditionalPaidInCapitalMember2022-12-310001530804us-gaap:RetainedEarningsMember2022-12-310001530804us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001530804us-gaap:ParentMember2022-12-310001530804us-gaap:NoncontrollingInterestMember2022-12-310001530804us-gaap:RetainedEarningsMember2023-01-012023-12-310001530804us-gaap:ParentMember2023-01-012023-12-310001530804us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001530804us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001530804us-gaap:CommonStockMember2023-01-012023-12-310001530804us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001530804us-gaap:CommonStockMember2023-12-310001530804us-gaap:AdditionalPaidInCapitalMember2023-12-310001530804us-gaap:RetainedEarningsMember2023-12-310001530804us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001530804us-gaap:ParentMember2023-12-310001530804us-gaap:NoncontrollingInterestMember2023-12-31trox:facility0001530804country:AUus-gaap:BondsMember2022-12-310001530804country:AUus-gaap:BondsMember2023-12-310001530804srt:MinimumMemberus-gaap:LandImprovementsMember2023-12-310001530804us-gaap:LandImprovementsMembersrt:MaximumMember2023-12-310001530804srt:MinimumMemberus-gaap:BuildingMember2023-12-310001530804srt:MaximumMemberus-gaap:BuildingMember2023-12-310001530804us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-12-310001530804us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-12-310001530804us-gaap:FurnitureAndFixturesMember2023-12-310001530804srt:MinimumMember2023-12-310001530804srt:MaximumMember2023-12-310001530804srt:MinimumMember2023-01-012023-12-310001530804srt:MaximumMember2023-01-012023-12-31trox:segment0001530804srt:NorthAmericaMember2023-01-012023-12-310001530804srt:NorthAmericaMember2022-01-012022-12-310001530804srt:NorthAmericaMember2021-01-012021-12-310001530804trox:SouthAndCentralAmericaMember2023-01-012023-12-310001530804trox:SouthAndCentralAmericaMember2022-01-012022-12-310001530804trox:SouthAndCentralAmericaMember2021-01-012021-12-310001530804trox:EuropeMiddleEastAndAfricaMember2023-01-012023-12-310001530804trox:EuropeMiddleEastAndAfricaMember2022-01-012022-12-310001530804trox:EuropeMiddleEastAndAfricaMember2021-01-012021-12-310001530804srt:AsiaPacificMember2023-01-012023-12-310001530804srt:AsiaPacificMember2022-01-012022-12-310001530804srt:AsiaPacificMember2021-01-012021-12-310001530804trox:TiO2Member2023-01-012023-12-310001530804trox:TiO2Member2022-01-012022-12-310001530804trox:TiO2Member2021-01-012021-12-310001530804trox:ZirconMember2023-01-012023-12-310001530804trox:ZirconMember2022-01-012022-12-310001530804trox:ZirconMember2021-01-012021-12-310001530804us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001530804us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001530804us-gaap:ProductAndServiceOtherMember2021-01-012021-12-31xbrli:pure0001530804us-gaap:HerMajestysRevenueAndCustomsHMRCMember2023-01-012023-12-310001530804us-gaap:HerMajestysRevenueAndCustomsHMRCMember2022-01-012022-12-310001530804us-gaap:HerMajestysRevenueAndCustomsHMRCMember2021-01-012021-12-310001530804us-gaap:HerMajestysRevenueAndCustomsHMRCMembercountry:GBsrt:WeightedAverageMember2023-01-012023-12-310001530804us-gaap:PositiveOutcomeOfLitigationMemberus-gaap:SettledLitigationMembertrox:AnadarkoLitigationMember2014-01-012014-12-310001530804us-gaap:InternalRevenueServiceIRSMember2023-01-012023-12-310001530804us-gaap:InternalRevenueServiceIRSMember2022-01-012022-12-310001530804us-gaap:AustralianTaxationOfficeMember2023-01-012023-12-310001530804us-gaap:AustralianTaxationOfficeMember2022-01-012022-12-310001530804us-gaap:SwissFederalTaxAdministrationFTAMember2023-01-012023-12-310001530804us-gaap:SwissFederalTaxAdministrationFTAMember2022-01-012022-12-310001530804us-gaap:StateAdministrationOfTaxationChinaMember2023-01-012023-12-310001530804us-gaap:StateAdministrationOfTaxationChinaMember2022-01-012022-12-310001530804country:AU2023-01-012023-12-310001530804country:AU2022-01-012022-12-310001530804us-gaap:HerMajestysRevenueAndCustomsHMRCMemberus-gaap:DomesticCountryMember2023-12-310001530804us-gaap:AustralianTaxationOfficeMemberus-gaap:ForeignCountryMember2023-12-310001530804us-gaap:TaxAndCustomsAdministrationNetherlandsMemberus-gaap:ForeignCountryMember2023-12-310001530804us-gaap:MinistryOfTheEconomyFinanceAndIndustryFranceMemberus-gaap:ForeignCountryMember2023-12-310001530804trox:TaxAndCustomsAdministrationSaudiArabiaMemberus-gaap:ForeignCountryMember2023-12-310001530804us-gaap:StateAdministrationOfTaxationChinaMemberus-gaap:ForeignCountryMember2023-12-310001530804us-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMemberus-gaap:ForeignCountryMember2023-12-310001530804trox:OtherMemberus-gaap:ForeignCountryMember2023-12-310001530804us-gaap:InternalRevenueServiceIRSMemberus-gaap:ForeignCountryMember2023-12-310001530804us-gaap:StateAndLocalJurisdictionMemberus-gaap:InternalRevenueServiceIRSMember2023-12-310001530804us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001530804us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001530804us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001530804us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001530804us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001530804us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-3100015308042022-03-1500015308042022-11-3000015308042022-11-012022-11-300001530804us-gaap:AccountsPayableMember2023-12-310001530804us-gaap:AccountsPayableMember2022-12-310001530804us-gaap:LandAndLandImprovementsMember2023-12-310001530804us-gaap:LandAndLandImprovementsMember2022-12-310001530804us-gaap:BuildingMember2023-12-310001530804us-gaap:BuildingMember2022-12-310001530804us-gaap:MachineryAndEquipmentMember2023-12-310001530804us-gaap:MachineryAndEquipmentMember2022-12-310001530804us-gaap:ConstructionInProgressMember2023-12-310001530804us-gaap:ConstructionInProgressMember2022-12-310001530804us-gaap:OtherMachineryAndEquipmentMember2023-12-310001530804us-gaap:OtherMachineryAndEquipmentMember2022-12-310001530804us-gaap:CostOfSalesMember2023-01-012023-12-310001530804us-gaap:CostOfSalesMember2022-01-012022-12-310001530804us-gaap:CostOfSalesMember2021-01-012021-12-310001530804us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001530804us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001530804us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001530804us-gaap:CustomerRelationshipsMember2023-12-310001530804us-gaap:CustomerRelationshipsMember2022-12-310001530804us-gaap:PatentedTechnologyMember2023-12-310001530804us-gaap:PatentedTechnologyMember2022-12-310001530804us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001530804us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001530804us-gaap:ComputerSoftwareIntangibleAssetMember2023-01-012023-12-310001530804us-gaap:ComputerSoftwareIntangibleAssetMember2022-01-012022-12-310001530804us-gaap:RelatedPartyMember2023-12-310001530804us-gaap:RelatedPartyMember2022-12-310001530804us-gaap:NonrelatedPartyMember2023-12-310001530804us-gaap:NonrelatedPartyMember2022-12-310001530804trox:HawkinsPointLandMember2023-01-012023-12-310001530804trox:HawkinsPointLandMember2022-01-012022-12-310001530804trox:HawkinsPointLandMember2021-01-012021-12-310001530804trox:MGTLoanMember2023-01-012023-12-310001530804trox:MGTLoanMember2022-01-012022-12-310001530804trox:MGTLoanMember2021-01-012021-12-310001530804trox:TermLoanFacilityMember2023-12-310001530804trox:TermLoanFacilityMember2022-12-310001530804trox:TermLoanFacility2022Member2023-12-310001530804trox:TermLoanFacility2022Member2022-12-310001530804trox:TermLoanFacility2023Member2023-12-310001530804trox:TermLoanFacility2023Member2022-12-310001530804trox:SeniorNotesDue2029Member2023-12-310001530804trox:SeniorNotesDue2029Member2022-12-310001530804trox:StandardBankTermLoanFacilityMember2023-12-310001530804trox:StandardBankTermLoanFacilityMember2022-12-310001530804trox:AustralianGovernmentLoanMember2023-12-310001530804trox:AustralianGovernmentLoanMember2022-12-310001530804trox:MGTLoanMember2023-12-310001530804trox:MGTLoanMember2022-12-310001530804trox:TermLoanFacilityMember2023-01-012023-12-310001530804trox:TermLoanFacilityMember2022-01-012022-12-310001530804trox:TermLoanFacility2022Member2023-01-012023-12-310001530804trox:TermLoanFacility2022Member2022-01-012022-12-310001530804trox:TermLoanFacility2023Member2023-01-012023-12-310001530804trox:StandardBankTermLoanFacilityMember2023-01-012023-12-310001530804trox:StandardBankTermLoanFacilityMember2022-01-012022-12-310001530804trox:TermLoanFacilityMember2021-03-112021-03-110001530804trox:TermLoanFacilityMember2021-03-110001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2021-03-112021-03-110001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2021-03-110001530804us-gaap:RevolvingCreditFacilityMemberus-gaap:LetterOfCreditMembertrox:CashFlowRevolverMember2021-03-110001530804trox:PriorTermLoanFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-03-110001530804trox:PriorTermLoanFacilityMember2021-03-112021-03-110001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2021-01-012021-12-310001530804us-gaap:RevolvingCreditFacilityMembertrox:TermLoanFacilityMember2021-01-012021-12-310001530804trox:SecuredOvernightFinancingRateSOFRMembertrox:TermLoanFacilityMember2021-09-302021-09-300001530804trox:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2022-04-042022-04-040001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2022-06-300001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2021-06-302021-06-300001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2022-01-012022-12-310001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2022-12-310001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2023-12-310001530804us-gaap:RevolvingCreditFacilityMembertrox:CashFlowRevolverMember2022-12-012022-12-310001530804trox:TermLoanFacility2022Member2022-04-042022-04-040001530804trox:TermLoanFacility2022Member2022-04-040001530804trox:TermLoanFacility2022Memberus-gaap:BaseRateMember2022-04-042022-04-040001530804trox:SecuredOvernightFinancingRateSOFRMembertrox:TermLoanFacility2022Member2022-04-042022-04-040001530804trox:TermLoanFacility2022Memberus-gaap:BaseRateMember2023-01-012023-12-310001530804trox:TermLoanFacility2023Member2023-08-012023-08-310001530804trox:TermLoanFacility2023Member2023-08-310001530804trox:TermLoanFacility2023Memberus-gaap:BaseRateMember2023-08-012023-08-310001530804trox:SecuredOvernightFinancingRateSOFRMembertrox:TermLoanFacility2023Member2023-08-012023-08-310001530804trox:SeniorNotesDue2029Member2021-03-150001530804trox:SeniorNotesDue2029Member2021-12-310001530804trox:SeniorNotesDue2026AndSeniorNotesDue2025Member2021-01-012021-12-310001530804trox:SeniorNotesDue2026Member2021-01-012021-12-310001530804trox:StandardBankTermLoanFacilityAmortizationLoanMemberus-gaap:NotesPayableToBanksMember2021-01-012021-12-31iso4217:ZAR0001530804trox:StandardBankTermLoanFacilityAmortizationLoanMemberus-gaap:NotesPayableToBanksMember2021-12-310001530804trox:StandardBankTermLoanFacilityMember2021-10-012021-10-010001530804trox:StandardBankTermLoanFacilityMember2021-10-010001530804us-gaap:RevolvingCreditFacilityMembertrox:StandardBankRevolvingCreditFacilityMember2021-10-012021-10-010001530804us-gaap:RevolvingCreditFacilityMembertrox:StandardBankRevolvingCreditFacilityMember2021-10-010001530804trox:JohannesburgInterbankAverageRateJIBARMembertrox:StandardBankTermLoanFacilityMember2021-10-012021-10-010001530804trox:UtilizationLessThanThirtyThreePercentMembertrox:JohannesburgInterbankAverageRateJIBARMemberus-gaap:RevolvingCreditFacilityMembertrox:StandardBankRevolvingCreditFacilityMember2021-10-012021-10-010001530804trox:JohannesburgInterbankAverageRateJIBARMemberus-gaap:RevolvingCreditFacilityMembertrox:StandardBankRevolvingCreditFacilityMembertrox:UtilizationBetweenThirtyThreePercentAndSixtySixPercentMember2021-10-012021-10-010001530804trox:JohannesburgInterbankAverageRateJIBARMembertrox:UtilizationGreaterThanSixtySixPercentMemberus-gaap:RevolvingCreditFacilityMembertrox:StandardBankRevolvingCreditFacilityMember2021-10-012021-10-010001530804us-gaap:LoansPayableMembertrox:AustralianGovernmentLoanMember2019-04-102019-04-100001530804us-gaap:LoansPayableMembertrox:AustralianGovernmentLoanMember2019-04-10iso4217:AUD0001530804us-gaap:LoansPayableMembertrox:AustralianGovernmentLoanMember2023-12-310001530804trox:MGTLoanMember2020-12-170001530804trox:MGTLoanMembersrt:MinimumMember2023-01-012023-12-310001530804trox:MGTLoanMembersrt:MaximumMember2023-01-012023-12-310001530804us-gaap:LoansPayableMembertrox:WorkingCapitalDebtAgreementInChinaTikonLoanMember2019-04-102019-04-100001530804us-gaap:LoansPayableMembertrox:WorkingCapitalDebtAgreementInChinaTikonLoanMember2021-01-012021-12-31iso4217:CNY0001530804trox:EmiratesRevolverMemberus-gaap:LineOfCreditMember2023-06-30iso4217:GBP0001530804trox:EmiratesRevolverMemberus-gaap:LineOfCreditMember2023-12-310001530804trox:SecuredOvernightFinancingRateSOFRMembertrox:EmiratesRevolverMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001530804us-gaap:EurodollarMembertrox:EmiratesRevolverMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001530804trox:EmiratesRevolverMembertrox:SterlingOvernightIndexAverageRateMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001530804trox:EmiratesRevolverMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001530804trox:SaudiBritishBankSABBCreditFacilityMemberus-gaap:NotesPayableToBanksMember2019-10-16iso4217:SAR0001530804trox:SaudiInterBankOfferedRateMembertrox:SaudiBritishBankSABBCreditFacilityMemberus-gaap:NotesPayableToBanksMember2019-10-162019-10-160001530804trox:SaudiBritishBankSABBCreditFacilityMemberus-gaap:NotesPayableToBanksMember2023-11-300001530804trox:SaudiBritishBankSABBCreditFacilityMemberus-gaap:NotesPayableToBanksMember2023-12-310001530804trox:SaudiBritishBankSABBCreditFacilityMemberus-gaap:NotesPayableToBanksMember2023-01-012023-12-310001530804trox:ItauUnibancoSACreditFacilityMemberus-gaap:NotesPayableToBanksMember2022-11-30iso4217:BRL0001530804trox:ItauUnibancoSACreditFacilityMemberus-gaap:NotesPayableToBanksMember2023-12-310001530804trox:ShortTermInsurancePremiumFinancingAgreementMember2022-08-012022-08-310001530804trox:ShortTermInsurancePremiumFinancingAgreementMember2022-08-310001530804trox:ShortTermInsurancePremiumFinancingAgreementMember2023-08-012023-08-310001530804trox:ShortTermInsurancePremiumFinancingAgreementMember2023-08-310001530804trox:ShortTermInsurancePremiumFinancingAgreementMember2023-12-310001530804trox:ShortTermInsurancePremiumFinancingAgreementMember2022-12-310001530804trox:WellsFargoRevolverMember2023-12-310001530804trox:WellsFargoRevolverMember2022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:EnergyRelatedDerivativeMember2023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:EnergyRelatedDerivativeMember2022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001530804us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-12-310001530804us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-12-310001530804us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001530804us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-12-310001530804us-gaap:SalesMember2023-01-012023-12-310001530804us-gaap:OtherOperatingIncomeExpenseMember2023-01-012023-12-310001530804us-gaap:SalesMember2022-01-012022-12-310001530804us-gaap:OtherOperatingIncomeExpenseMember2022-01-012022-12-310001530804us-gaap:SalesMember2021-01-012021-12-310001530804us-gaap:OtherOperatingIncomeExpenseMember2021-01-012021-12-310001530804us-gaap:SalesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310001530804us-gaap:NondesignatedMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310001530804us-gaap:NondesignatedMemberus-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310001530804us-gaap:SalesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310001530804us-gaap:NondesignatedMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310001530804us-gaap:NondesignatedMemberus-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310001530804us-gaap:SalesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310001530804us-gaap:NondesignatedMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310001530804us-gaap:NondesignatedMemberus-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMembersrt:NaturalGasReservesMember2023-01-012023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMembersrt:NaturalGasReservesMember2023-01-012023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherOperatingIncomeExpenseMembersrt:NaturalGasReservesMember2023-01-012023-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMembersrt:NaturalGasReservesMember2022-01-012022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMembersrt:NaturalGasReservesMember2022-01-012022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherOperatingIncomeExpenseMembersrt:NaturalGasReservesMember2022-01-012022-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMembersrt:NaturalGasReservesMember2021-01-012021-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMembersrt:NaturalGasReservesMember2021-01-012021-12-310001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherOperatingIncomeExpenseMembersrt:NaturalGasReservesMember2021-01-012021-12-310001530804us-gaap:InterestRateSwapMember2019-06-3000015308042023-03-27trox:derivative0001530804us-gaap:InterestRateSwapMember2023-03-270001530804us-gaap:InterestRateSwapMember2023-03-272023-03-270001530804trox:InterestRateSwap2Member2023-03-270001530804us-gaap:InterestRateSwapMember2023-05-1700015308042023-05-170001530804trox:InterestRateSwap2Member2023-05-170001530804us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-12-310001530804us-gaap:InterestRateSwapMemberus-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-12-310001530804us-gaap:InterestRateSwapMemberus-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-12-310001530804us-gaap:InterestRateSwapMemberus-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001530804us-gaap:InterestRateSwapMemberus-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310001530804us-gaap:InterestRateSwapMemberus-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001530804us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001530804us-gaap:NondesignatedMembertrox:ForeignExchangeContractSouthAfricanRandMember2023-12-310001530804trox:ForeignExchangeContractAustralianDollarsMemberus-gaap:NondesignatedMember2023-12-310001530804us-gaap:NondesignatedMembertrox:ForeignExchangeContractPoundSterlingMember2023-12-310001530804us-gaap:NondesignatedMembertrox:ForeignExchangeContractEuroMember2023-12-31iso4217:EUR0001530804us-gaap:NondesignatedMembertrox:ForeignExchangeContractSaudiRiyalMember2023-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:TermLoanFacilityMember2023-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:TermLoanFacilityMember2022-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:TermLoanFacility2022Member2023-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:TermLoanFacility2022Member2022-12-310001530804trox:TermLoanFacility2023Memberus-gaap:FairValueInputsLevel1Member2023-12-310001530804trox:TermLoanFacility2023Memberus-gaap:FairValueInputsLevel1Member2022-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:StandardBankTermLoanFacilityMember2023-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:StandardBankTermLoanFacilityMember2022-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:SeniorNotesDue2029Member2023-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:SeniorNotesDue2029Member2022-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:AustralianGovernmentLoanMember2023-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:AustralianGovernmentLoanMember2022-12-310001530804trox:MGTLoanMemberus-gaap:FairValueInputsLevel2Member2023-12-310001530804trox:MGTLoanMemberus-gaap:FairValueInputsLevel2Member2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:EnergyRelatedDerivativeMember2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:EnergyRelatedDerivativeMember2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2022-12-310001530804srt:MinimumMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001530804us-gaap:MeasurementInputDiscountRateMembersrt:MaximumMember2023-12-310001530804us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MinimumMember2023-12-310001530804us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2023-12-310001530804srt:MinimumMemberus-gaap:MiningPropertiesAndMineralRightsMember2023-12-310001530804us-gaap:MiningPropertiesAndMineralRightsMembersrt:MaximumMember2023-12-310001530804srt:MinimumMemberus-gaap:OtherMachineryAndEquipmentMember2023-12-310001530804us-gaap:OtherMachineryAndEquipmentMembersrt:MaximumMember2023-12-310001530804us-gaap:StandbyLettersOfCreditMembertrox:WellsFargoRevolverMember2023-12-310001530804us-gaap:GuaranteeOfIndebtednessOfOthersMembertrox:HawkinsPointMember2023-12-310001530804us-gaap:GuaranteeOfIndebtednessOfOthersMembertrox:AbsaRevolverMember2023-12-310001530804trox:UKHealthAndSafetyMatterMember2023-06-012023-06-300001530804trox:VenatorMaterialsPLCVSTronoxLimitedMembertrox:VenatorMaterialsPLCMember2019-05-012019-05-310001530804trox:VenatorMaterialsPLCVSTronoxLimitedMember2019-06-012019-06-300001530804trox:CristalNorthAmericaTiO2BusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2019-05-012019-05-010001530804trox:VenatorMaterialsPLCVSTronoxLimitedMembertrox:VenatorMaterialsPLCMember2022-04-182022-04-180001530804us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001530804us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001530804us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001530804us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001530804us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001530804us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001530804us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001530804us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001530804us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001530804us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001530804us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001530804us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001530804us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001530804us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001530804us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001530804us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001530804us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001530804us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001530804us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001530804us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001530804us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-3100015308042021-11-090001530804us-gaap:SubsequentEventMember2024-02-210001530804us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001530804us-gaap:CommonClassAMember2019-03-270001530804trox:TronoxHoldingsPlcAmendedAndRestatedManagementEquityIncentivePlanMember2020-06-242020-06-240001530804srt:ManagementMembertrox:RestrictedStockUnitsRSUsTimeBasedAwardsMember2023-01-012023-12-310001530804trox:RestrictedStockUnitsRSUsTimeBasedAwardsMember2023-01-012023-12-310001530804trox:RestrictedStockUnitsRSUsTimeBasedAwardsMembersrt:DirectorMember2023-01-012023-12-310001530804trox:RestrictedStockUnitsRSUsPerformanceBasedAwardsMember2023-01-012023-12-310001530804us-gaap:ShareBasedCompensationAwardTrancheOneMembertrox:RestrictedStockUnitsRSUsPerformanceBasedAwardsMember2023-01-012023-12-310001530804trox:RestrictedStockUnitsRSUsPerformanceBasedAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-12-310001530804trox:RestrictedStockUnitsRSUsPerformanceBasedAwardsMember2022-01-012022-12-310001530804trox:RestrictedStockUnitsRSUsPerformanceBasedAwardsMember2021-01-012021-12-310001530804us-gaap:ShareBasedCompensationAwardTrancheOneMembertrox:RestrictedStockUnitsRSUsPerformanceBasedAwardsMember2022-01-012022-12-310001530804us-gaap:ShareBasedCompensationAwardTrancheOneMembertrox:RestrictedStockUnitsRSUsPerformanceBasedAwardsMember2021-01-012021-12-310001530804us-gaap:RestrictedStockUnitsRSUMember2022-12-310001530804us-gaap:RestrictedStockUnitsRSUMember2023-12-310001530804us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001530804us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-31trox:plan0001530804us-gaap:PensionPlansDefinedBenefitMember2022-10-012022-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:RetirementPlanNameOtherMember2023-01-012023-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:RetirementPlanNameOtherMember2022-01-012022-12-310001530804country:ZAus-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-01-012023-12-310001530804country:ZAsrt:MaximumMemberus-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-01-012023-12-310001530804us-gaap:PensionPlansDefinedBenefitMembercountry:US2022-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-12-310001530804us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-12-310001530804country:USus-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-12-310001530804us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-12-310001530804country:USus-gaap:DefinedBenefitPostretirementHealthCoverageMember2021-12-310001530804us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPostretirementHealthCoverageMember2021-12-310001530804us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-01-012023-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-01-012023-12-310001530804us-gaap:PensionPlansDefinedBenefitMembercountry:US2022-01-012022-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-01-012022-12-310001530804country:USus-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-01-012023-12-310001530804us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-01-012023-12-310001530804country:USus-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-01-012022-12-310001530804us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-01-012022-12-310001530804us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-12-310001530804country:USus-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-12-310001530804us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-12-310001530804us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001530804us-gaap:PensionPlansDefinedBenefitMember2023-12-310001530804us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001530804us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001530804us-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-01-012023-12-310001530804us-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-01-012022-12-310001530804us-gaap:DefinedBenefitPostretirementHealthCoverageMember2021-01-012021-12-310001530804us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-01-012021-12-310001530804us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-01-012021-12-310001530804country:USus-gaap:DefinedBenefitPostretirementHealthCoverageMember2021-01-012021-12-310001530804us-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPostretirementHealthCoverageMember2021-01-012021-12-310001530804us-gaap:EquitySecuritiesMembercountry:US2023-12-310001530804us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMember2023-12-310001530804us-gaap:EquitySecuritiesMembercountry:US2022-12-310001530804us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001530804us-gaap:DebtSecuritiesMembercountry:US2023-12-310001530804us-gaap:DebtSecuritiesMemberus-gaap:ForeignPlanMember2023-12-310001530804us-gaap:DebtSecuritiesMembercountry:US2022-12-310001530804us-gaap:DebtSecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001530804us-gaap:DefinedBenefitPlanRealEstateMembercountry:US2023-12-310001530804us-gaap:DefinedBenefitPlanRealEstateMemberus-gaap:ForeignPlanMember2023-12-310001530804us-gaap:DefinedBenefitPlanRealEstateMembercountry:US2022-12-310001530804us-gaap:DefinedBenefitPlanRealEstateMemberus-gaap:ForeignPlanMember2022-12-310001530804trox:DefinedBenefitPlanOtherMembercountry:US2023-12-310001530804us-gaap:ForeignPlanMembertrox:DefinedBenefitPlanOtherMember2023-12-310001530804trox:DefinedBenefitPlanOtherMembercountry:US2022-12-310001530804us-gaap:ForeignPlanMembertrox:DefinedBenefitPlanOtherMember2022-12-310001530804country:US2023-12-310001530804us-gaap:ForeignPlanMember2023-12-310001530804country:US2022-12-310001530804us-gaap:ForeignPlanMember2022-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:GlobalEquitySecuritiesMember2023-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:GlobalEquitySecuritiesMember2023-12-310001530804us-gaap:FairValueInputsLevel3Membertrox:GlobalEquitySecuritiesMember2023-12-310001530804trox:GlobalEquitySecuritiesMember2023-12-310001530804trox:GlobalCommingledEquityFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:GlobalCommingledEquityFundsMember2023-12-310001530804trox:GlobalCommingledEquityFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001530804trox:GlobalCommingledEquityFundsMember2023-12-310001530804us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2023-12-310001530804us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2023-12-310001530804us-gaap:USTreasuryAndGovernmentMember2023-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtMember2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtMember2023-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtMember2023-12-310001530804us-gaap:ForeignGovernmentDebtMember2023-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001530804us-gaap:CorporateDebtSecuritiesMember2023-12-310001530804us-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignCorporateDebtSecuritiesMember2023-12-310001530804us-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001530804us-gaap:ForeignCorporateDebtSecuritiesMember2023-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:RealEstateFundsMember2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:RealEstateFundsMember2023-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:RealEstateFundsMember2023-12-310001530804us-gaap:RealEstateFundsMember2023-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:InsuranceContractsMember2023-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:InsuranceContractsMember2023-12-310001530804us-gaap:FairValueInputsLevel3Membertrox:InsuranceContractsMember2023-12-310001530804trox:InsuranceContractsMember2023-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001530804us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001530804us-gaap:FairValueInputsLevel1Member2023-12-310001530804us-gaap:FairValueInputsLevel2Member2023-12-310001530804us-gaap:FairValueInputsLevel3Member2023-12-310001530804us-gaap:FairValueInputsLevel3Membertrox:InsuranceContractsMember2022-12-310001530804us-gaap:FairValueInputsLevel3Membertrox:InsuranceContractsMember2023-01-012023-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:GlobalEquitySecuritiesMember2022-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:GlobalEquitySecuritiesMember2022-12-310001530804us-gaap:FairValueInputsLevel3Membertrox:GlobalEquitySecuritiesMember2022-12-310001530804trox:GlobalEquitySecuritiesMember2022-12-310001530804trox:GlobalCommingledEquityFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:GlobalCommingledEquityFundsMember2022-12-310001530804trox:GlobalCommingledEquityFundsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001530804trox:GlobalCommingledEquityFundsMember2022-12-310001530804us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2022-12-310001530804us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2022-12-310001530804us-gaap:USTreasuryAndGovernmentMember2022-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtMember2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtMember2022-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtMember2022-12-310001530804us-gaap:ForeignGovernmentDebtMember2022-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001530804us-gaap:CorporateDebtSecuritiesMember2022-12-310001530804us-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignCorporateDebtSecuritiesMember2022-12-310001530804us-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001530804us-gaap:ForeignCorporateDebtSecuritiesMember2022-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:RealEstateFundsMember2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:RealEstateFundsMember2022-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:RealEstateFundsMember2022-12-310001530804us-gaap:RealEstateFundsMember2022-12-310001530804us-gaap:FairValueInputsLevel1Membertrox:InsuranceContractsMember2022-12-310001530804us-gaap:FairValueInputsLevel2Membertrox:InsuranceContractsMember2022-12-310001530804trox:InsuranceContractsMember2022-12-310001530804us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310001530804us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310001530804us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310001530804us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310001530804us-gaap:FairValueInputsLevel1Member2022-12-310001530804us-gaap:FairValueInputsLevel2Member2022-12-310001530804us-gaap:FairValueInputsLevel3Member2022-12-310001530804us-gaap:FairValueInputsLevel3Membertrox:InsuranceContractsMember2021-12-310001530804us-gaap:FairValueInputsLevel3Membertrox:InsuranceContractsMember2022-01-012022-12-310001530804trox:SavingsAndInvestmentPlansMemberus-gaap:QualifiedPlanMember2023-01-012023-12-310001530804trox:SavingsAndInvestmentPlansMemberus-gaap:QualifiedPlanMember2013-01-012013-01-010001530804trox:SavingsAndInvestmentPlansMemberus-gaap:QualifiedPlanMember2022-01-012022-12-310001530804trox:SavingsAndInvestmentPlansMemberus-gaap:QualifiedPlanMember2021-01-012021-12-310001530804trox:RestorationPlanMemberus-gaap:NonqualifiedPlanMember2006-01-012006-12-310001530804trox:RestorationPlanMemberus-gaap:NonqualifiedPlanMember2023-01-012023-12-310001530804trox:RestorationPlanMemberus-gaap:NonqualifiedPlanMember2022-01-012022-12-310001530804trox:RestorationPlanMemberus-gaap:NonqualifiedPlanMember2021-01-012021-12-310001530804srt:MinimumMembertrox:SouthAfricaDefinedContributionPlansMember2023-01-012023-12-310001530804trox:SouthAfricaDefinedContributionPlansMembersrt:MaximumMember2023-01-012023-12-310001530804trox:SouthAfricaDefinedContributionPlansMember2023-01-012023-12-310001530804trox:SouthAfricaDefinedContributionPlansMember2022-01-012022-12-310001530804trox:SouthAfricaDefinedContributionPlansMember2021-01-012021-12-310001530804trox:CristalInternationalHoldingsBVMember2023-12-310001530804trox:CristalInternationalHoldingsBVMember2023-12-310001530804trox:OptionAgreementOptionToAcquireSpecialPurchaseVehicleMemberus-gaap:RelatedPartyMembertrox:AdvancedMetalIndustriesClusterCompanyLimitedMember2018-05-090001530804trox:SlaggerMembertrox:AdvancedMetalIndustriesClusterAndTohoTitaniumMetalCoLtdATTMMember2018-05-090001530804trox:OptionAgreementAmountsToBeReimbursedForCapitalExpendituresAndOperationalExpensesMemberus-gaap:RelatedPartyMembertrox:AMICMember2018-05-090001530804trox:OptionAgreementAmountsToBeReimbursedForCapitalExpendituresAndOperationalExpensesMembertrox:AMICMember2020-05-132022-12-310001530804us-gaap:RelatedPartyMembertrox:SlaggerMember2023-05-100001530804us-gaap:RelatedPartyMember2023-05-100001530804trox:OptionAgreementAmountLoanedForCapitalExpendituresAndOperationalExpensesInterestEarnedMemberus-gaap:RelatedPartyMembertrox:AdvancedMetalIndustriesClusterCompanyLimitedMember2023-12-310001530804trox:OptionAgreementAmountLoanedForCapitalExpendituresAndOperationalExpensesInterestEarnedMemberus-gaap:RelatedPartyMembertrox:AdvancedMetalIndustriesClusterCompanyLimitedMember2022-12-310001530804us-gaap:RelatedPartyMember2023-01-012023-12-310001530804us-gaap:RelatedPartyMember2022-01-012022-12-310001530804us-gaap:RelatedPartyMember2021-01-012021-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialSettledAsInKindRepaymentOfTronoxLoansMembertrox:SlaggerMember2023-01-012023-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialSettledAsInKindRepaymentOfTronoxLoansMembertrox:SlaggerMember2022-01-012022-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialSettledAsInKindRepaymentOfTronoxLoansMembertrox:SlaggerMember2021-01-012021-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialSettledInCashMembertrox:SlaggerMember2023-01-012023-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialSettledInCashMembertrox:SlaggerMember2022-01-012022-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialSettledInCashMembertrox:SlaggerMember2021-01-012021-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:SlaggerMember2023-01-012023-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:SlaggerMember2022-01-012022-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:SlaggerMember2021-01-012021-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialMemberus-gaap:RelatedPartyMembertrox:SlaggerMember2023-12-310001530804trox:AdvancedMetalIndustriesClusterCompanyLimitedMembertrox:PurchasesOfFeedstockMaterialMemberus-gaap:RelatedPartyMembertrox:SlaggerMember2022-12-310001530804us-gaap:RelatedPartyMembertrox:AMICMembertrox:AmendedTechnicalServicesAgreementMonthlyManagementFeeMember2023-01-012023-12-310001530804us-gaap:RelatedPartyMembertrox:AMICMembertrox:AmendedTechnicalServicesAgreementMonthlyManagementFeeMember2022-01-012022-12-310001530804us-gaap:RelatedPartyMembertrox:AMICMembertrox:AmendedTechnicalServicesAgreementMonthlyManagementFeeMember2021-01-012021-12-310001530804us-gaap:RelatedPartyMembertrox:AmendedTechnicalServicesAgreementOtherTechnicalSupportFeesMembertrox:AMICMember2023-01-012023-12-310001530804us-gaap:RelatedPartyMembertrox:AmendedTechnicalServicesAgreementOtherTechnicalSupportFeesMembertrox:AMICMember2022-01-012022-12-310001530804us-gaap:RelatedPartyMembertrox:AmendedTechnicalServicesAgreementOtherTechnicalSupportFeesMembertrox:AMICMember2021-01-012021-12-310001530804us-gaap:RelatedPartyMembertrox:AMICMember2023-01-012023-12-310001530804us-gaap:RelatedPartyMembertrox:AMICMember2022-01-012022-12-310001530804us-gaap:RelatedPartyMembertrox:AMICMember2021-01-012021-12-310001530804trox:AmendedTechnicalServicesAgreementMonthlyManagementFeeAndOtherTechnicalSupportFeesMemberus-gaap:RelatedPartyMembertrox:AMICMember2023-12-310001530804trox:AmendedTechnicalServicesAgreementMonthlyManagementFeeAndOtherTechnicalSupportFeesMemberus-gaap:RelatedPartyMembertrox:AMICMember2022-12-310001530804us-gaap:RelatedPartyMembertrox:AcquisitionOfAssetsProducingMetalGradeTiCl4Membertrox:AdvancedMetalIndustriesClusterCompanyLimitedMember2019-12-290001530804us-gaap:RelatedPartyMembertrox:AdvancedMetalIndustriesClusterAndTohoTitaniumMetalCoLtdATTMMembertrox:AcquisitionOfAssetsProducingMetalGradeTiCl4Member2019-12-290001530804trox:MGTLoanMembertrox:CristalMemberus-gaap:RelatedPartyMember2020-12-170001530804trox:MGTLoanMembersrt:MinimumMembertrox:CristalMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001530804trox:MGTLoanMembertrox:CristalMemberus-gaap:RelatedPartyMembersrt:MaximumMember2023-01-012023-12-310001530804trox:MGTLoanMembertrox:CristalMemberus-gaap:RelatedPartyMember2023-12-310001530804trox:MGTLoanMembertrox:CristalMemberus-gaap:RelatedPartyMember2022-12-310001530804trox:MGTLoanMembertrox:CristalMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001530804trox:MGTLoanMembertrox:CristalMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001530804trox:MGTLoanMembertrox:CristalMemberus-gaap:RelatedPartyMember2021-01-012021-12-310001530804trox:PurchaseOfChlorineGasMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001530804trox:PurchaseOfChlorineGasMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001530804trox:PurchaseOfChlorineGasMemberus-gaap:RelatedPartyMember2021-01-012021-12-310001530804trox:PurchaseOfChlorineGasMemberus-gaap:RelatedPartyMember2023-12-310001530804trox:PurchaseOfChlorineGasMemberus-gaap:RelatedPartyMember2022-12-310001530804trox:MGTMember2023-01-012023-12-310001530804trox:MGTMember2022-01-012022-12-310001530804trox:MGTMember2021-01-012021-12-310001530804trox:ReceivableFromMGTProductSalesMemberus-gaap:RelatedPartyMembertrox:AdvancedMetalIndustriesClusterAndTohoTitaniumMetalCoLtdATTMMember2023-12-310001530804trox:ReceivableFromMGTProductSalesMemberus-gaap:RelatedPartyMembertrox:AdvancedMetalIndustriesClusterAndTohoTitaniumMetalCoLtdATTMMember2022-12-310001530804trox:TenLargestThirdPartyTiO2CustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-31trox:customer0001530804trox:TenLargestThirdPartyTiO2CustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001530804trox:TenLargestThirdPartyTiO2CustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001530804country:US2023-01-012023-12-310001530804country:US2022-01-012022-12-310001530804country:US2021-01-012021-12-310001530804country:GB2023-01-012023-12-310001530804country:GB2022-01-012022-12-310001530804country:GB2021-01-012021-12-310001530804country:AU2021-01-012021-12-310001530804country:ZA2023-01-012023-12-310001530804country:ZA2022-01-012022-12-310001530804country:ZA2021-01-012021-12-310001530804country:SA2023-01-012023-12-310001530804country:SA2022-01-012022-12-310001530804country:SA2021-01-012021-12-310001530804trox:OtherForeignMember2023-01-012023-12-310001530804trox:OtherForeignMember2022-01-012022-12-310001530804trox:OtherForeignMember2021-01-012021-12-310001530804country:US2023-12-310001530804country:US2022-12-310001530804country:GB2023-12-310001530804country:GB2022-12-310001530804country:SA2023-12-310001530804country:SA2022-12-310001530804country:ZA2023-12-310001530804country:ZA2022-12-310001530804country:AU2023-12-310001530804country:AU2022-12-310001530804trox:OtherForeignMember2023-12-310001530804trox:OtherForeignMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

|

|

|

|

|

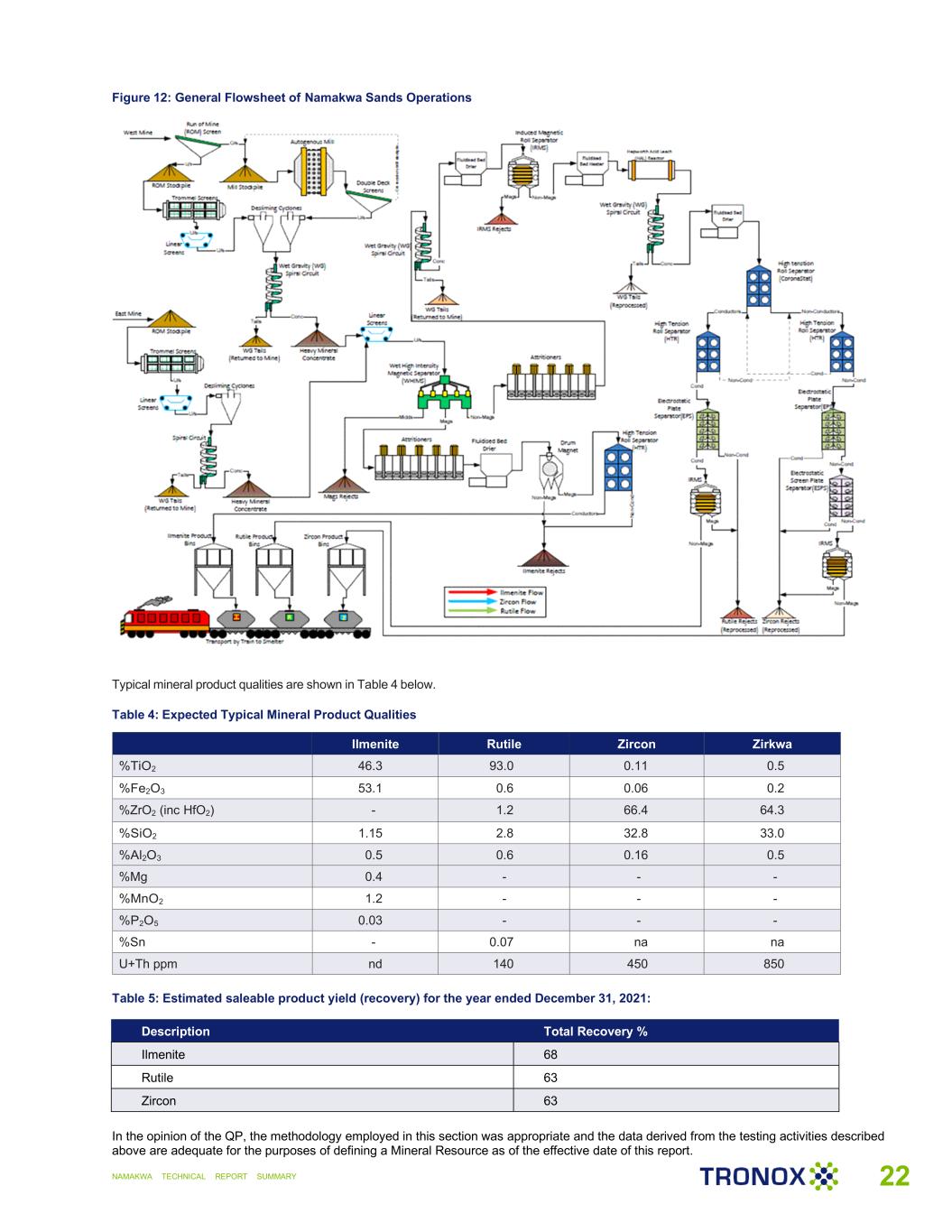

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Year ended December 31, 2023

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

1-35573

(Commission file number)

TRONOX HOLDINGS PLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

England and Wales |

|

98-1467236 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

263 Tresser Boulevard, Suite 1100 |

|

Laporte Road, Stallingborough |

Stamford, Connecticut 06901 |

|

Grimsby, North East Lincolnshire, DN40 2PR |

|

|

United Kingdom |

Registrant’s telephone number, including area code: (203) 705-3800

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class |

|

Name of each exchange on which registered |

Ordinary Shares, par value $0.01 per share |

|

New York Stock Exchange |

Trading Symbol: TROX

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements

of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant

to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the ordinary shares held by non-affiliates of the registrant as of June 30, 2023 was approximately $1,515,118,314.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No ☐

As of January 31, 2024, the registrant had 156,793,755 ordinary shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its 2024 annual general meeting of shareholders are incorporated by reference in this Form 10-K in response to Part III Items 10, 11, 12, 13 and 14.

TRONOX HOLDINGS PLC

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

INDEX

|

|

|

|

|

|

|

|

|

|

Page |

| Form 10-K Item Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made statements under the captions “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and in other sections of this Form 10-K that are forward-looking statements. Forward-looking statements also can be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks and uncertainties outlined in “Risk Factors.”

These risks and uncertainties are not exhaustive. Other sections of this Form 10-K may include additional factors, which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Unless otherwise required by applicable law, we are under no duty to update any of these forward-looking statements after the date of this Form 10-K to conform our prior statements to actual results or revised expectations and we do not intend to do so.

When considering forward-looking statements, you should keep in mind the risks, uncertainties and other cautionary statements made in this Form 10-K and the documents incorporated by reference, including, in particular, the factors discussed below. These factors may be revised or supplemented in subsequent reports on Forms 10-Q and 8-K.

Factors that may affect future results include, but are not limited to:

•the risk that our customers might reduce demand for our products;

•market conditions and price volatility for titanium dioxide (“TiO2”), zircon and other feedstock products, as well as global and regional economic downturns, that adversely affect the demand for our end-use products;

•the continued increase in exports from China of TiO2, both via chloride and sulfate technology, and expansion of Chinese TiO2 production capacity, including via chloride technology;

•changes in prices or supply availability for energy, other raw materials and/or shipping vessels;

•liability, production delays and additional expenses from environmental and industrial accidents;

•production curtailments, shutdowns or additional expenditures resulting from equipment upgrades, industrial accidents, equipment failures and deterioration of assets;

•the possibility that cybersecurity incidents or other security breaches may seriously impact our results of operations and financial condition;

•risks of operating a global business;

•war, political and social instability, and/or hostilities, in the regions in which we operate, including, but not limited to, the ongoing Russia and Ukraine and Middle East conflicts;

•fluctuations in currency exchange rates;

•the risk that the agreements governing our debt may restrict our ability to operate our business in certain ways, as well as impact our liquidity;

•our inability to obtain additional capital on favorable terms;

•the risk that we may not realize expected returns or there may be a delay in realizing expected returns on our capital projects, including Project newTRON and our Atlas Campaspe mining investment;

•an unpredictable regulatory environment in South Africa where we have significant mining and beneficiation operations, including amendments by the South African Department of Mineral Resources and Energy to the Mining Charter (as defined elsewhere herein);

•the risk that our TiO2 products are subject to increased regulatory scrutiny that may impede or inhibit widespread usage of TiO2 and/or diminish the Company's ability to sustain or grow its business or may add significant costs of doing business;

•ESG issues, including those related to climate change and sustainability, may subject us to additional costs and restrictions;

•extreme weather conditions could pose physical risks to our facilities and disrupt the operations of our supply chain and increase operational costs;

•the risk that our ability to use our tax attributes to offset future income may be limited;

•concentrated share ownership in the hands of Cristal (as defined elsewhere herein) may result in conflicts of interest and/or prevent minority shareholders from influencing the Company;

•the risk that we are dependent on, and compete with other mining and chemical businesses for, key human resources in the countries in which we operate; and

•impact of English law and our articles of association on our ability to manage our capital structure flexibly and the anti-takeover protections incorporated into our articles of association.

We are committed to providing timely and accurate information to the investing public, consistent with our legal and regulatory obligations. To that end, we use our website to convey information about our businesses, including the anticipated release of quarterly financial results, quarterly financial and statistical and business-related information. Investors can access announcements about the Company through our website available at http://www.tronox.com. Our website is included as an inactive textual reference only and the information contained therein or connected thereto shall not be deemed to be incorporated into this Form 10-K.

PART I

For the purposes of this discussion, references to “we,” “us,” and, “our” refer to Tronox Holdings plc, together with its consolidated subsidiaries (collectively referred to as “Tronox” or the "Company”). We are a public limited company formed under the laws of England and Wales. We are considered a domestic company in the United Kingdom and, as such, are required to comply with filing requirements in the United Kingdom. Additionally, we are not considered a “foreign private issuer” in the U.S.; therefore, we are required to comply with the reporting and other requirements imposed by the U.S. securities law on U.S. domestic issuers, which, among other things, requires reporting under accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Item 1. Business

Overview

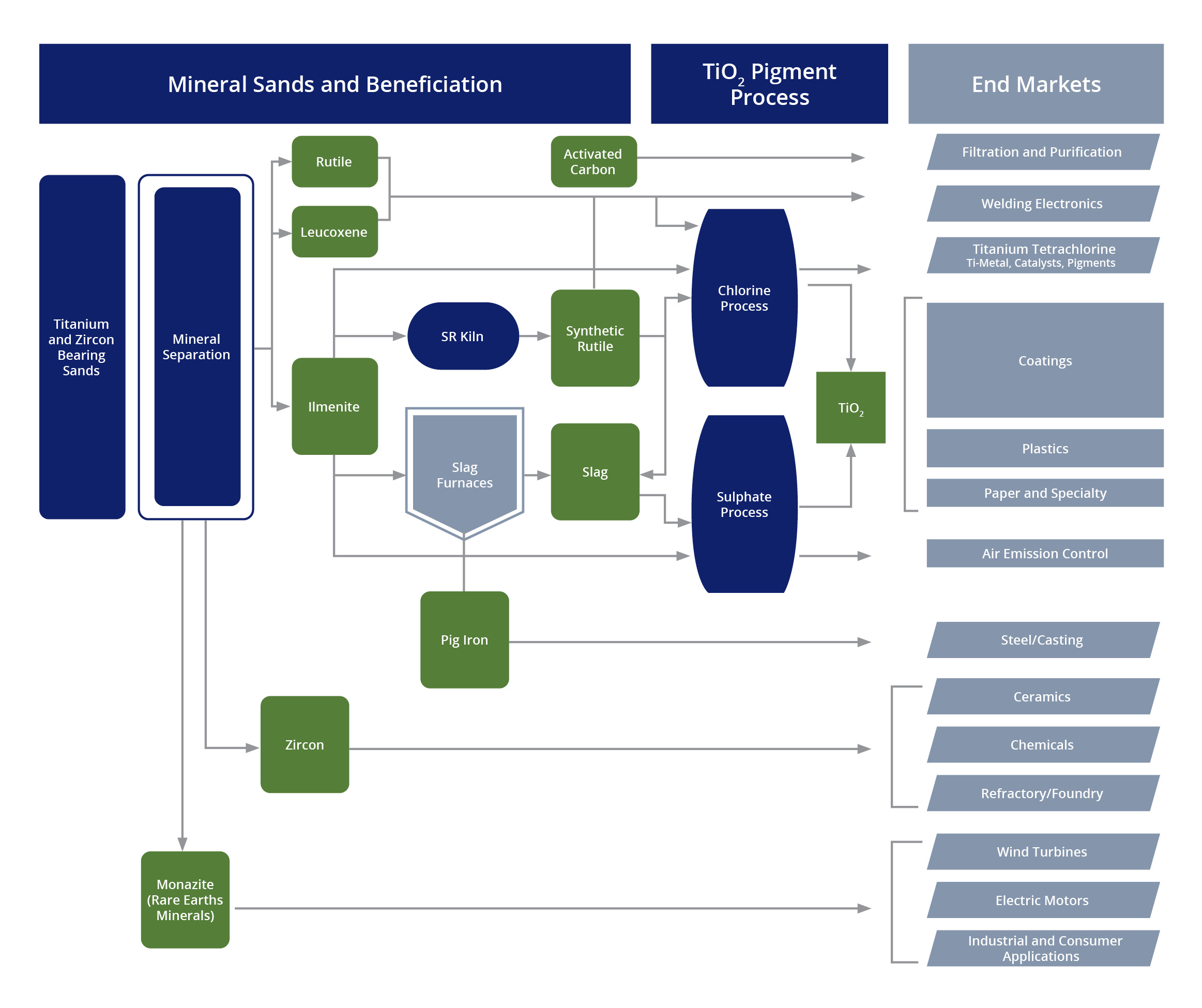

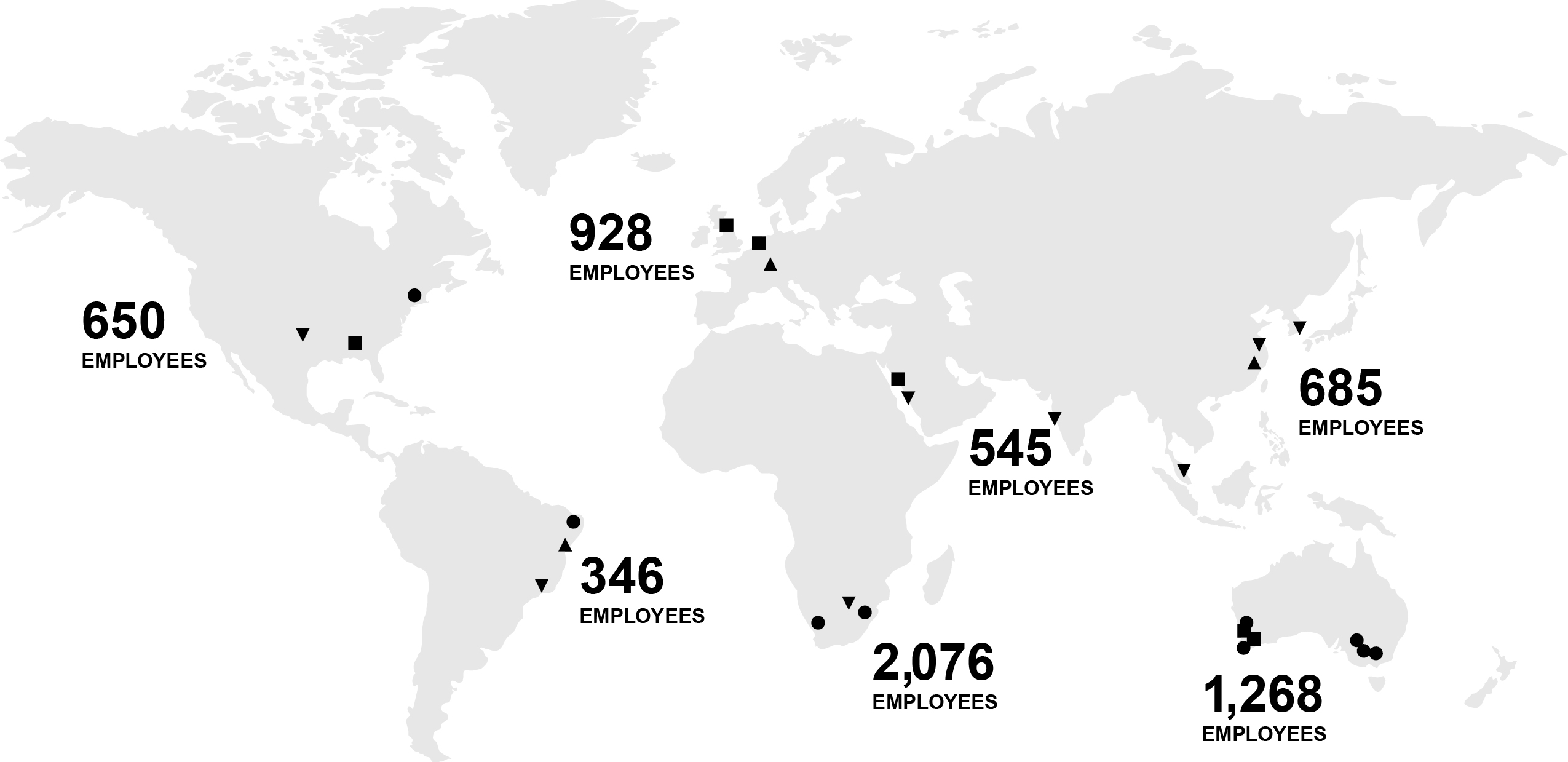

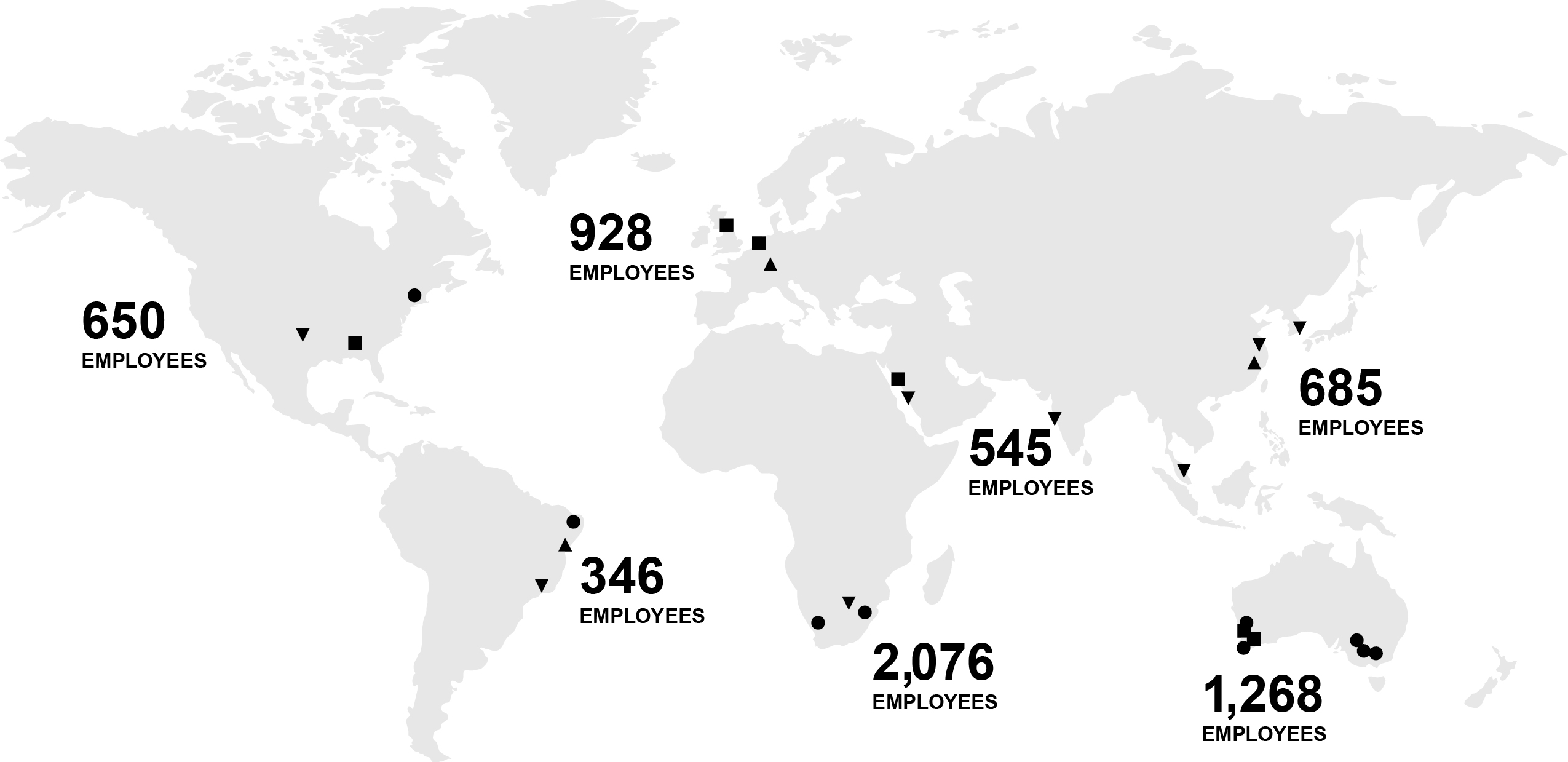

Tronox is the world’s leading vertically integrated manufacturer of TiO2 pigment. We operate titanium-bearing mineral sand mines and beneficiation and smelting operations in Australia and South Africa to produce feedstock materials that can be processed into TiO2 for pigment, high purity titanium chemicals, including titanium tetrachloride, and ultrafine TiO2 used in certain specialty applications. Our strategy is to be vertically integrated and produce enough feedstock materials to be as self-sufficient as possible in the production of TiO2 at our nine pigment facilities located in the United States, Australia, Brazil, UK, France, the Netherlands, China and the Kingdom of Saudi Arabia ("KSA"). We believe that vertical integration is the best way to achieve our ultimate goal of delivering low cost, high-quality pigment to our approximately 1,200 TiO2 customers throughout the world. The mining, beneficiation and smelting of titanium bearing mineral sands also creates meaningful quantities of co-products including zircon, pig iron and the rare-earth bearing mineral, monazite, which we also supply to customers around the world.

The following chart highlights the TiO2 value chain we participate in.

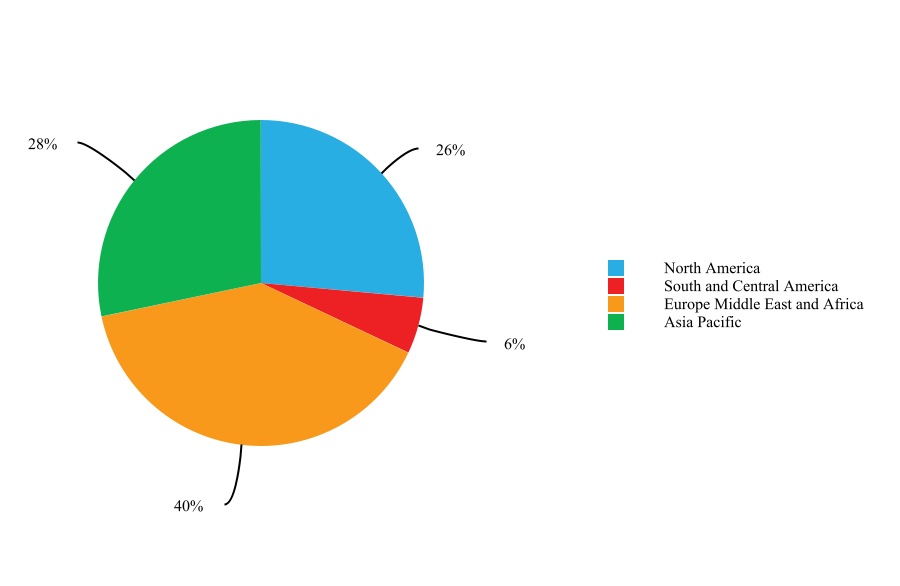

The following sets forth the percentage of our revenue derived from sales of our products by geographic region for the year ended December 31, 2023.

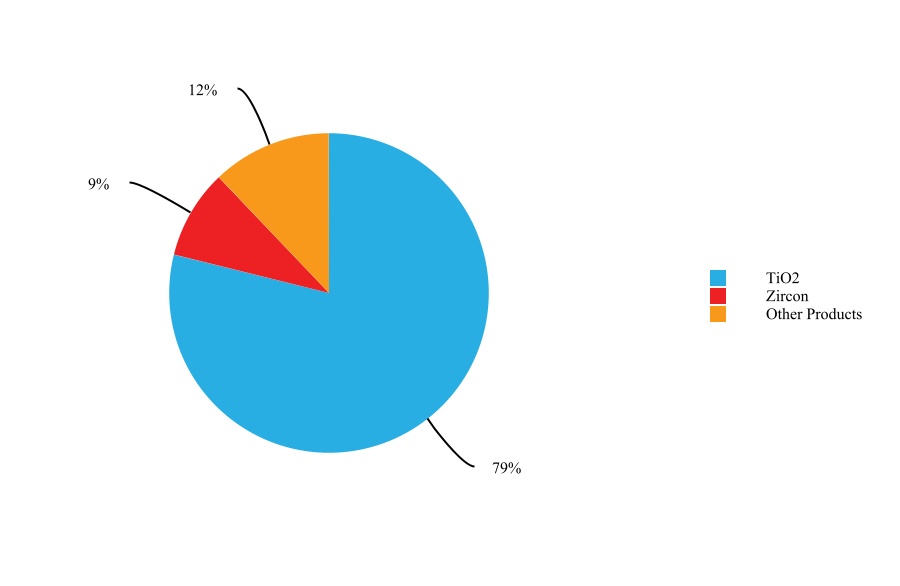

The below sets forth the percentage of our revenue derived from sales of our products for the year ended December 31, 2023.

For further financial information regarding our products and geographic regions, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, as well as Notes 3 and 23 of notes to our consolidated financial statements, each included elsewhere in this Form 10-K.

2023 Key Strategic Initiatives

The following sets forth the key strategic initiatives underway in 2023:

Become the Low Cost TiO2 Producer by Investing in our Business Processes and Strengthening Vertical Integration

Our ability to compete effectively in the TiO2 industry is determined by many factors, including innovation, reliability, product quality, customer service and price. The business processes that allow us to maximize the benefit of our vertical integration and global footprint --- the so-called “hidden factory” --- needs to be optimized if we are to successfully meet the pricing and other competitive pressures that characterize our industry. During 2023, we continued to progress with our multi-year IT-enabled transformation program that includes both operational and business transformation.

In addition, in terms of strengthening vertical integration, 2023 saw the commencement of a significant new mine in Eastern Australia called Atlas. Atlas has replaced feedstock supply from our Snapper / Ginkgo mines in Eastern Australia which is expected to cease mining operations in the first half of 2024. We believe Atlas is abundant in natural rutile and zircon, and will be a significant source of high grade ilmenite suitable for direct use, synthetic rutile production, or slag processing. The investment in Atlas is expected to generate returns above the Company's cost of capital and sustain Tronox's position as a leading low-cost producer.

Moreover, in 2023, we invested in expanding our Fairbreeze and Namakwa mines in South Africa. Like Atlas, we believe these expansions are extremely attractive mine development projects, rich in ilmenite, rutile and zircon that are expected to replace existing mines which are reaching end of life. We have numerous other mine development projects in earlier stages of development in Western Australia and on the Eastern and Western Capes of South Africa, all of which are intended to maintain our level of feedstock vertical integration. We are also continuing to evaluate opportunities to leverage our expertise in mining and the exposure we have to rare earth materials, including monazite, through our operations.

Capital Allocation

In addition to returning approximately $89 million in cash to shareholders in the form of dividends and investing $261 million of capital during 2023, we also strengthened our liquidity position by closing a $350 million incremental term loan. We believe the added liquidity from this incremental borrowing will enable us to continue our capital investment program — primarily, replacing mineral reserves for mines reaching end of life in South Africa — that we believe will increase shareholder value in the short-, medium- and long-term. At the end of 2023, we had cash on hand of $273 million and untapped short-term borrowing capacity of $488 million.

Develop Our Position as a Significant Supplier of Rare Earth Oxides

Tronox’s existing mining operations and tailing piles in South Africa and Australia contain significant quantities of monazite, a mineral containing rare earth elements (REEs) widely recognized as a critical mineral for the energy transformation underway to decarbonize the world’s economy. For these applications, REE must first be processed into an oxide form --- rare earth oxides or “REO” --- that can then be metallized for the production of permanent magnets. Every step of the REE supply chain today is dominated by China. China’s dominance of the processing of REO and production of permanent magnets is widely recognized as a serious strategic challenge by democratic governments around the world.

The separation, beneficiation and processing technologies that Tronox uses to turn titanium-bearing ores into TiO2 are applicable for turning monazite into REO. In the past, we sold our monazite in unconcentrated form as a waste product but given the increased value associated with REE, we are now seeking to maximize the value of our existing geologic resources and deploy our substantial technical know how and human capital to become a significant supplier of REO to non-Chinese producers of metals and permanent magnets.

Our Principal Products

TiO2

TiO2 Pigment

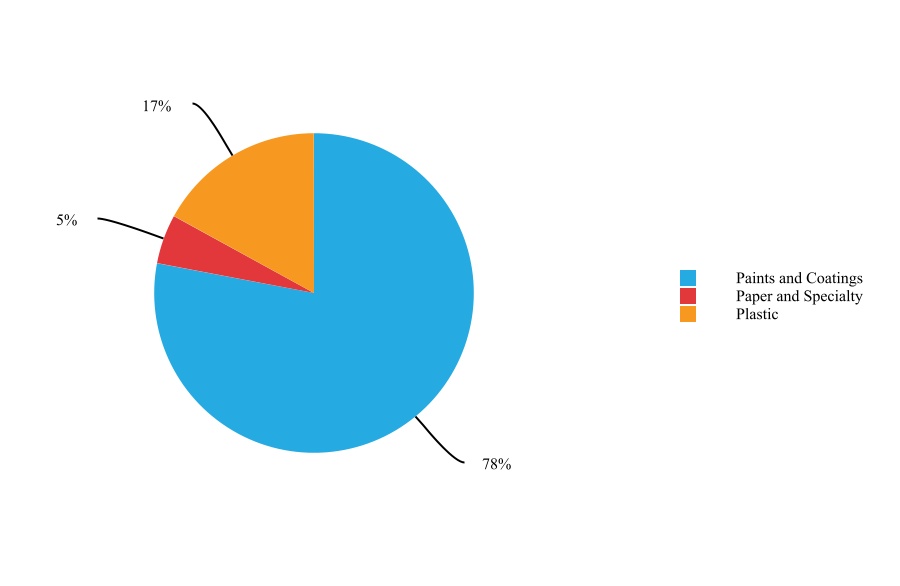

TiO2 pigment is used in a wide range of products due to its ability to impart whiteness, brightness, and opacity. TiO2 pigment is used extensively in the manufacture of paint and other coatings, plastics and paper, and in a wide range of other applications. Moreover, it is a critical component of everyday consumer applications due to its superior ability to cover or mask other materials effectively and efficiently relative to alternative white pigments and extenders. TiO2 pigment is considered to be a quality of life product. At present, it is our belief that there is no effective substitute for TiO2 pigment because no other white pigment has the physical properties for achieving comparable opacity and brightness or can be incorporated as cost effectively.

Ultrafine Specialty TiO2

We produce ultrafine TiO2 at our manufacturing facility in Thann, France. We market ultrafine TiO2 products under the CristalActiv® trademark. Ultrafine TiO2 has highly catalytic properties due to the relatively high surface area of each TiO2 molecule. The principal use of ultrafine TiO2 products is in NOx emission control products utilized in stationary, mobile and marine applications.

In 2023, we generated $2.2 billion in revenue from sales of TiO2.

Zircon

Zircon (ZrSiO4) is a co-product of mining mineral sands deposits for titanium feedstock. Zircon is used as an additive in ceramic glazes, which makes the ceramic glaze more water, chemical and abrasion resistant. It is also used for the production of zirconium metal and zirconium chemicals, in refractories, as molding sand in foundries, and for TV screen glass, where it adds its structural stability at high temperatures and resistance to abrasive and corrosive conditions. Zircon typically represents a relatively low proportion of the in-situ heavy mineral sands deposits we mine, but has a relatively high value compared to other heavy mineral products. Refractories containing zircon are expensive and are only used in demanding, high-wear and corrosive applications in the glass, steel and cement industries. Foundry applications use zircon when casting articles of high quality and value where accurate sizing is crucial, such as aerospace, automotive, medical, and other high-end applications.

In 2023, we generated $257 million in revenue from sales of zircon.

Other Products

High Purity Pig Iron

During the process of smelting ilmenite at our smelters to increase the concentration of titanium and produce titanium slag, high purity pig iron is produced as a co-product. High purity pig iron is used as a raw material in foundries for the production of high-quality ductile iron castings. Ductile iron is used extensively throughout the world for the production of safety critical automotive parts, such as engine blocks, brake calipers and steering knuckles in cars and trucks.

Monazite

Like zircon, monazite is a co-product of mining mineral sands deposits for titanium feedstock. Monazite is concentrated and processed to remove contaminants, such as uranium and thorium, before being separated into specific rare earth oxides (REOs) such as neodymium (Nd), praseodymium (Pr), terbium (Tb), and dysprosium (Dy). These REOs can then be metallized and formed into permanent magnets, particularly NdFeB magnets, that are needed to manufacture electric vehicle motors, wind turbines and other green economy applications.

Feedstock

Most TiO2 products are derived from three naturally occurring minerals which are commonly referred to as heavy minerals or mineral sands: ilmenite, leucoxene and rutile. Ilmenite, rutile, leucoxene, as well as titanium slag and synthetic rutile which are processed from ilmenite, are the primary feedstock materials that we use for the production of TiO2 pigment. Titanium slag is produced by smelting ilmenite in an electric arc furnace to separate titanium-oxide from the iron and other impurities. Synthetic rutile is produced by reducing ilmenite in a rotary kiln, followed by leaching under various conditions to remove the metallic iron from the reduced ilmenite grains. The purpose of both processes is to increase the titanium concentration of the ilmenite. There is substantial overlap amongst each of the aforementioned with the primary differentiating factor being the level of titanium content. For instance, rutile has the highest titanium dioxide content of approximately 94% to 96%, while ilmenite has the lowest of approximately 45% to 65%. As a result of our continued pursuit of our vertical integration strategy, we currently do not expect to actively sell feedstock going forward.

Titanium Tetrachloride

We sell titanium tetrachloride (“TiCl4”) from our facilities in Thann, France and Yanbu, KSA. At our Thann facility in France, we produce TiCl4 dedicated for merchant market sales to customers for use mainly in the production of various types of pigments and catalyst products. At our Yanbu facility, we produce excess TiCl4 which we both sell directly to a joint venture between Advanced Metal Industries Cluster and Toho Titanium Metal Co. Ltd. ("ATTM") for use at ATTM's titanium sponge plant facility that is adjacent to our Yanbu facility and in the merchant market.

In 2023, we generated $345 million in revenue from the sale of high purity pig iron, monazite, titanium tetrachloride and other products.

The demand for certain of our products during a given year is subject to seasonal fluctuations. See “Risk Factors –

Risks Relating to our Business - The markets for many of our products have seasonally affected sales patterns”.

Mining and Beneficiation of Mineral Sands Deposits

Our current operational mining and beneficiation of mineral sands deposits are comprised of the following:

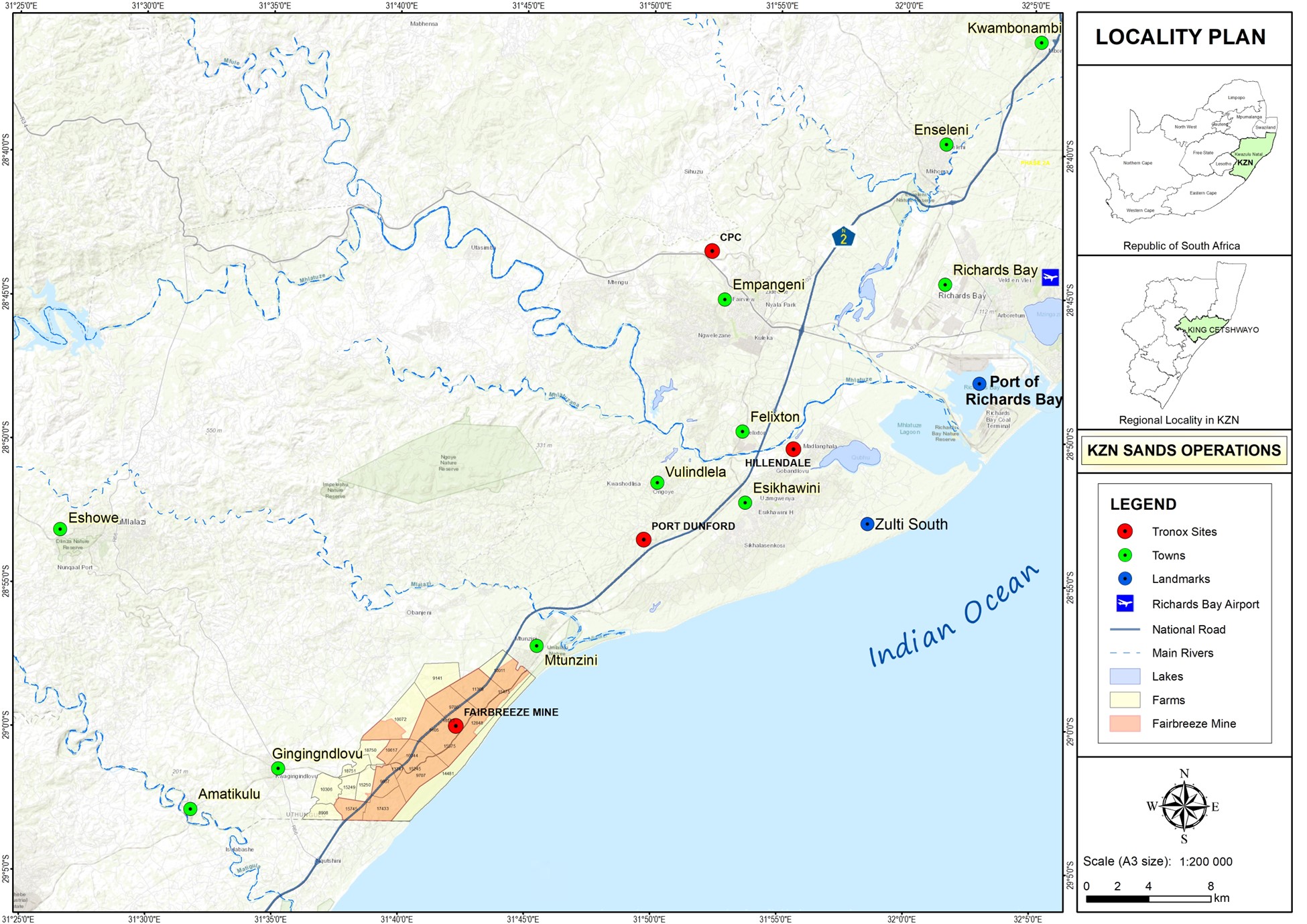

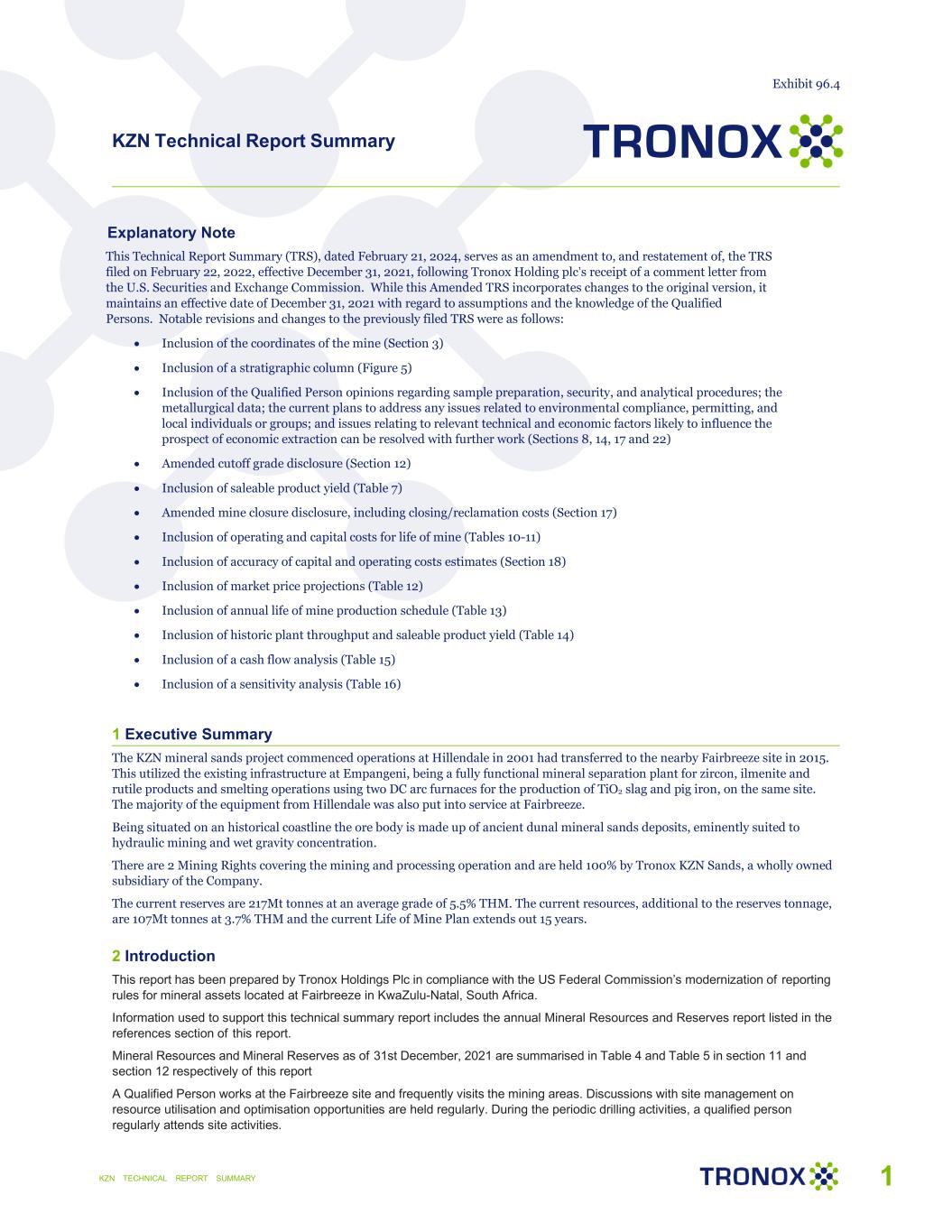

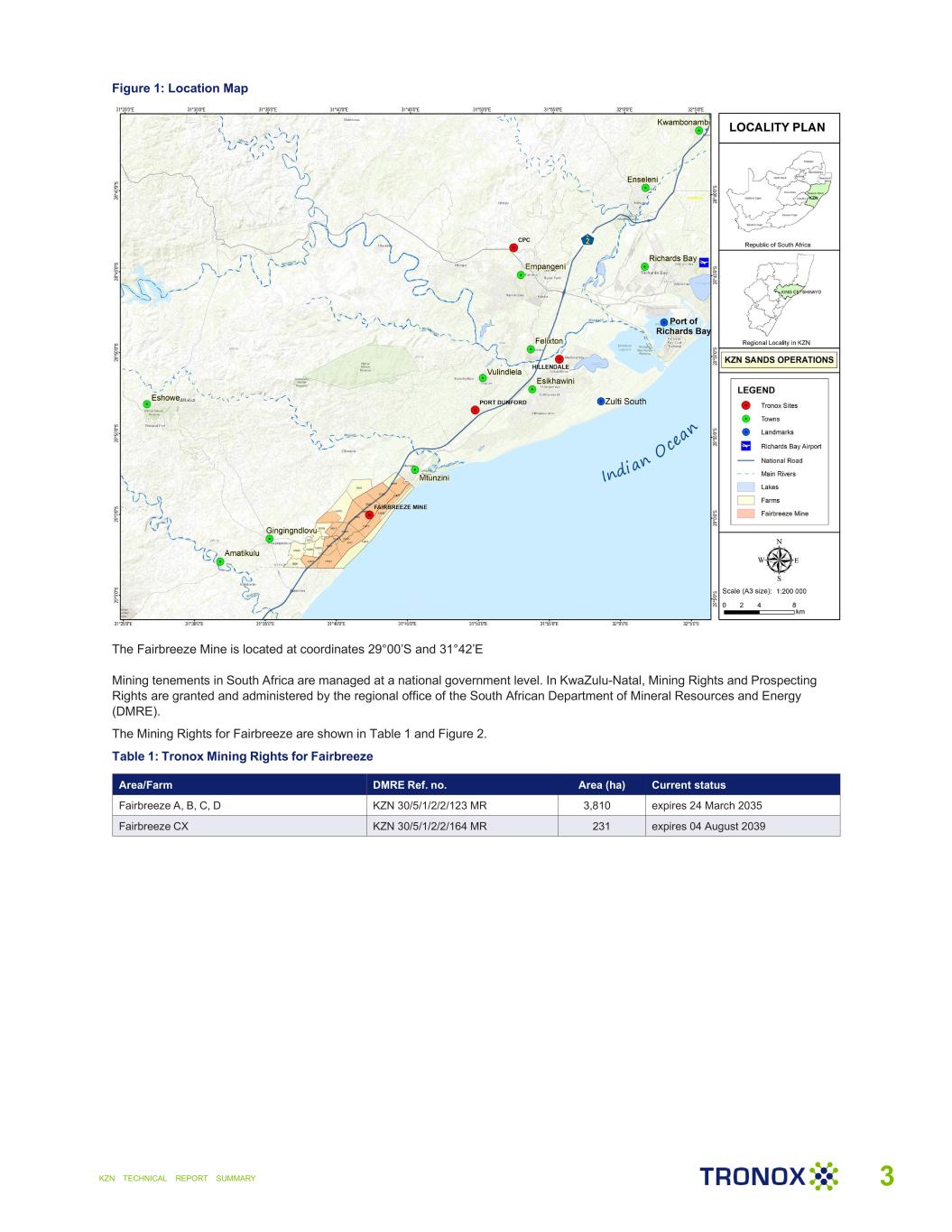

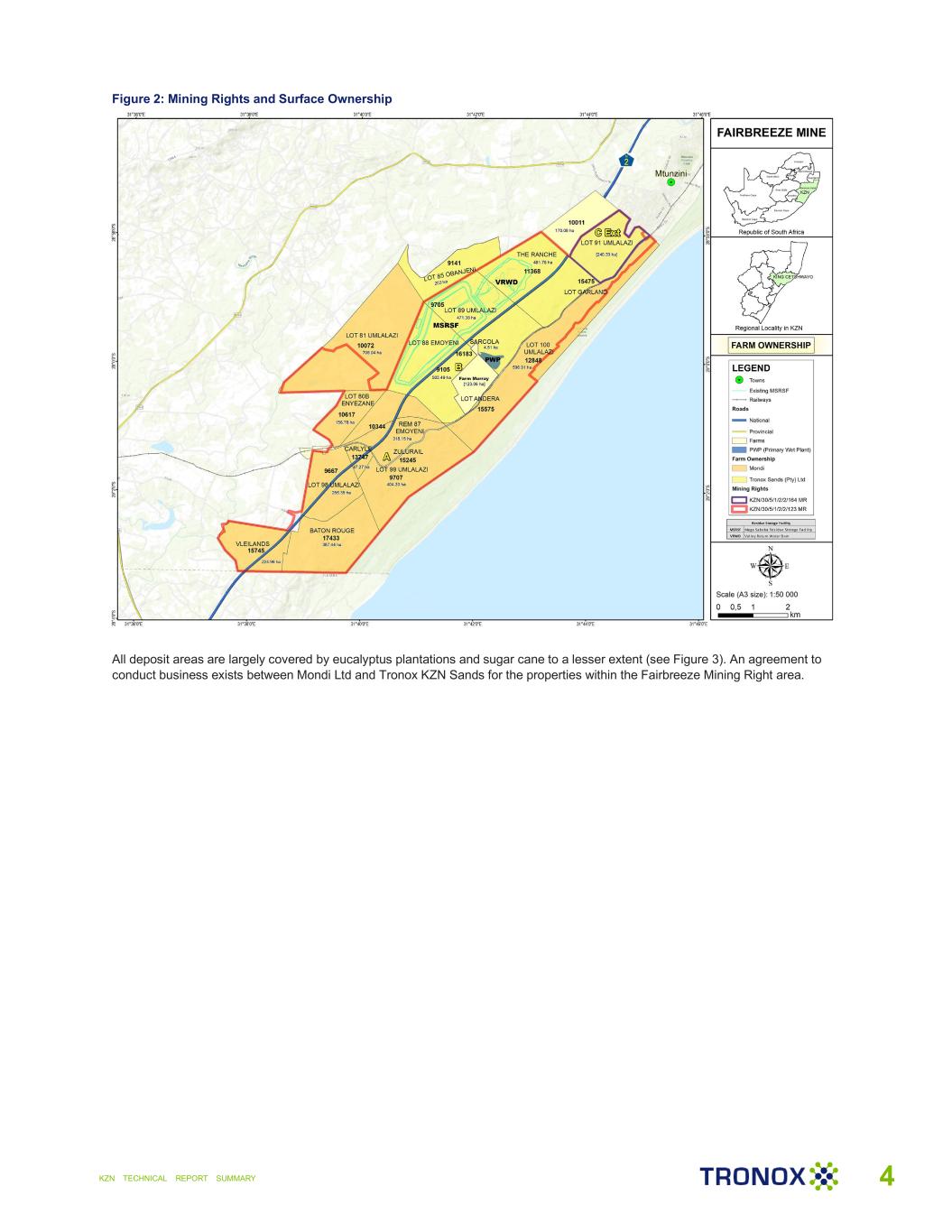

•KwaZulu-Natal (“KZN”) Sands operations located on the eastern coast of South Africa consisting of the Fairbreeze mine, a concentration plant, a mineral separation plant and two smelting furnaces that produce titanium slag;

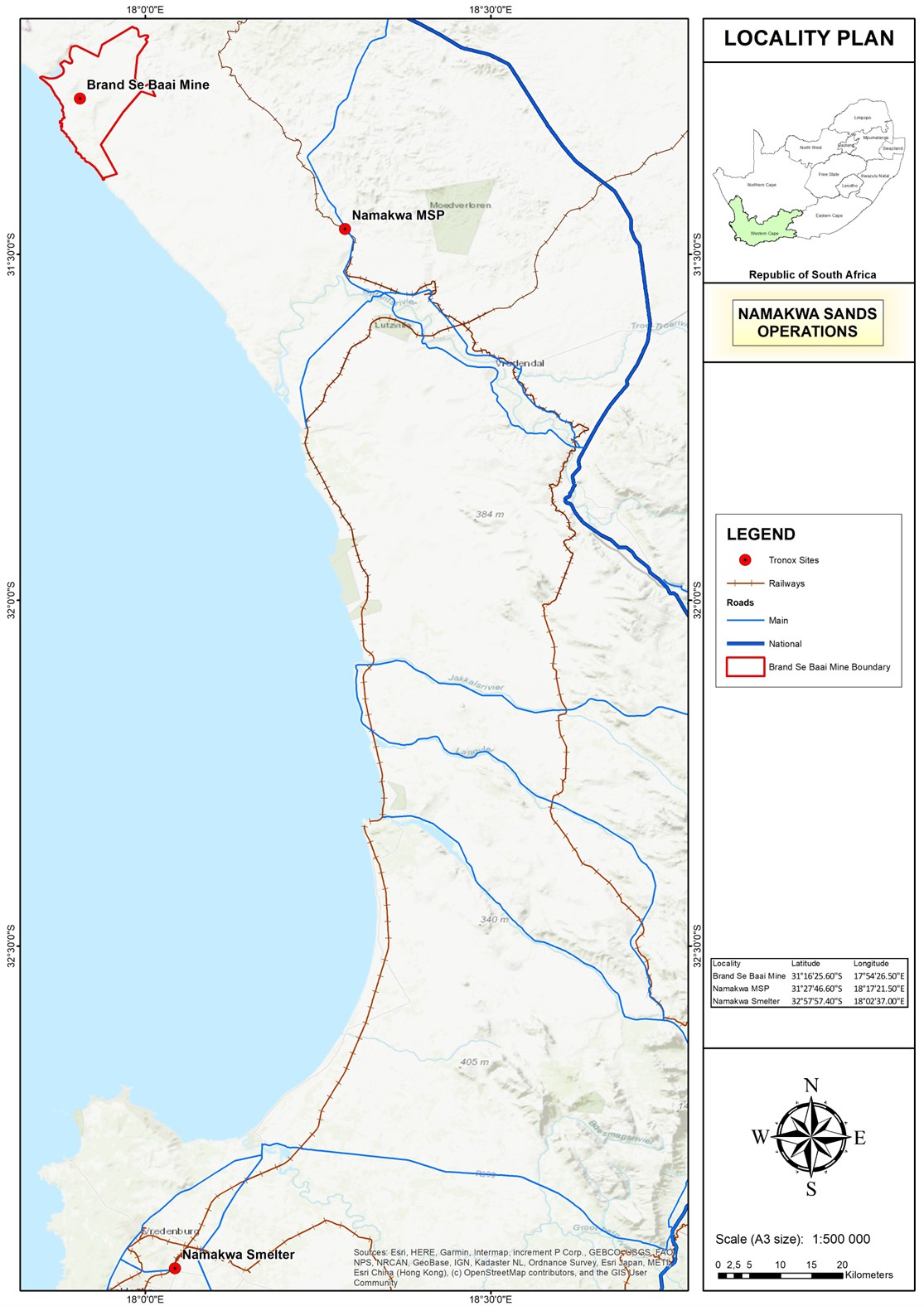

•Our Namakwa Sands operations located on the western coast of South Africa consisting of the Namakwa mine, two concentration plants, a mineral separation plant, as well as two smelting furnaces that produce titanium slag;

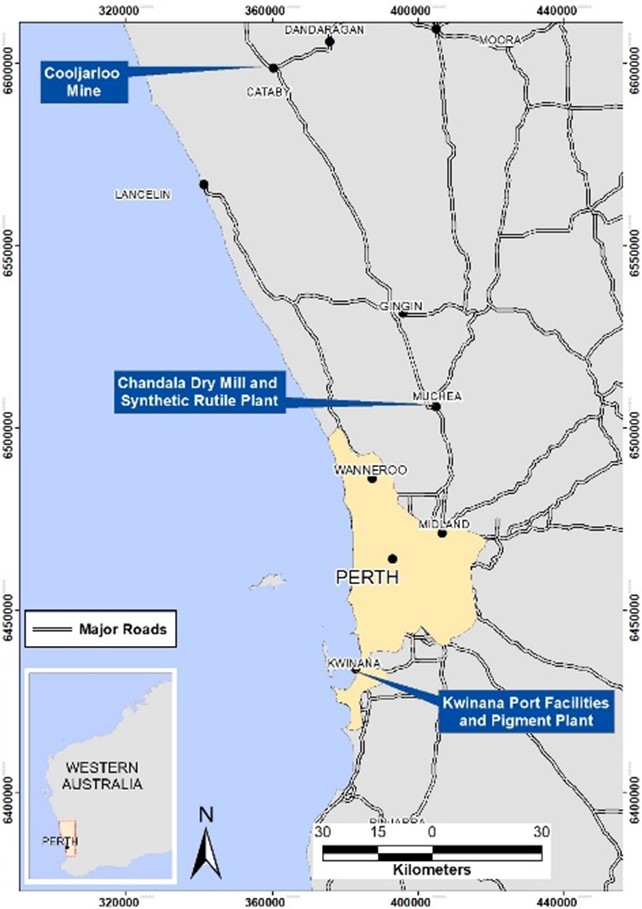

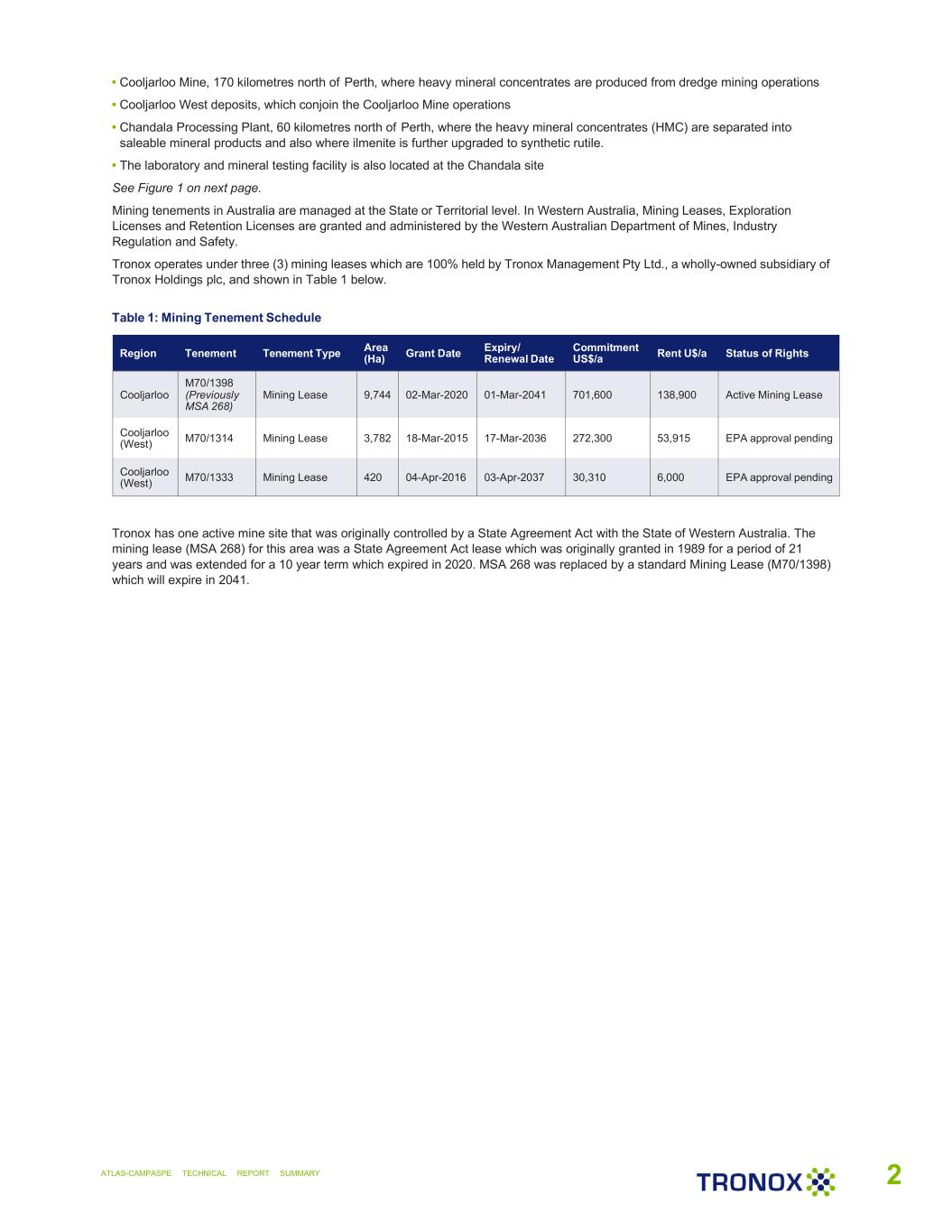

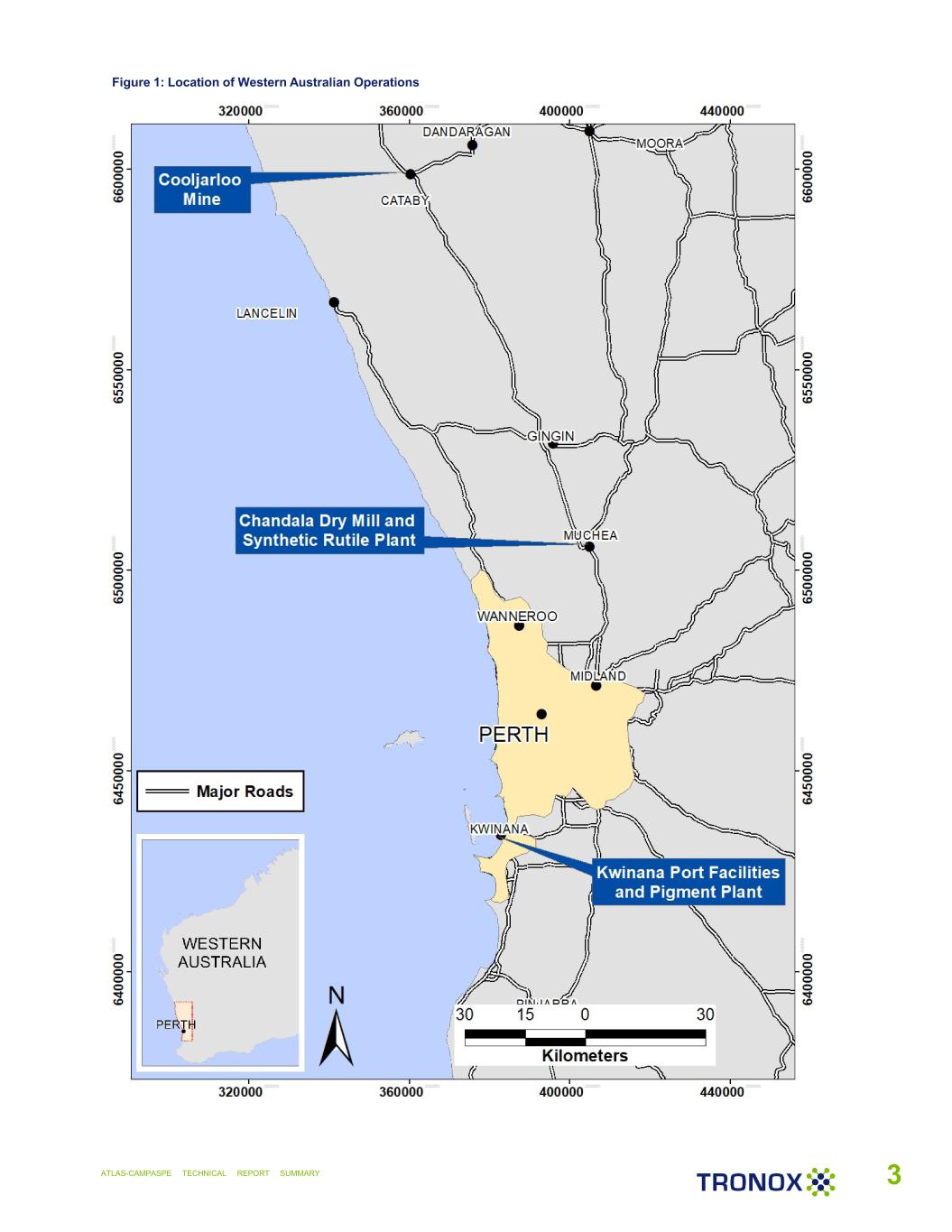

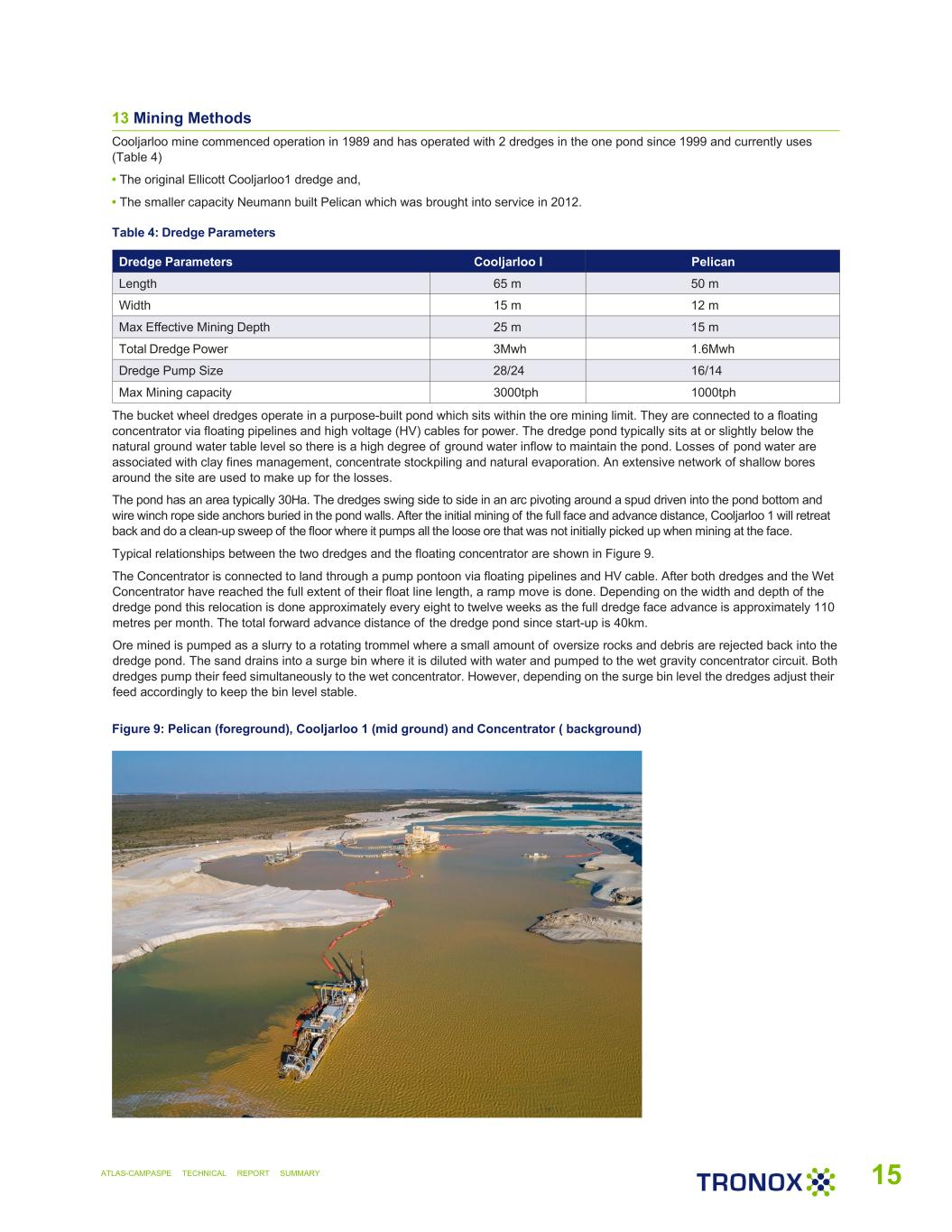

•Our Northern Operations complex in Western Australia consisting of the Cooljarloo dredge mine and floating heavy mineral concentration plant and the Chandala metallurgical site which includes a mineral separation plant and a synthetic rutile plant that produces synthetic rutile;

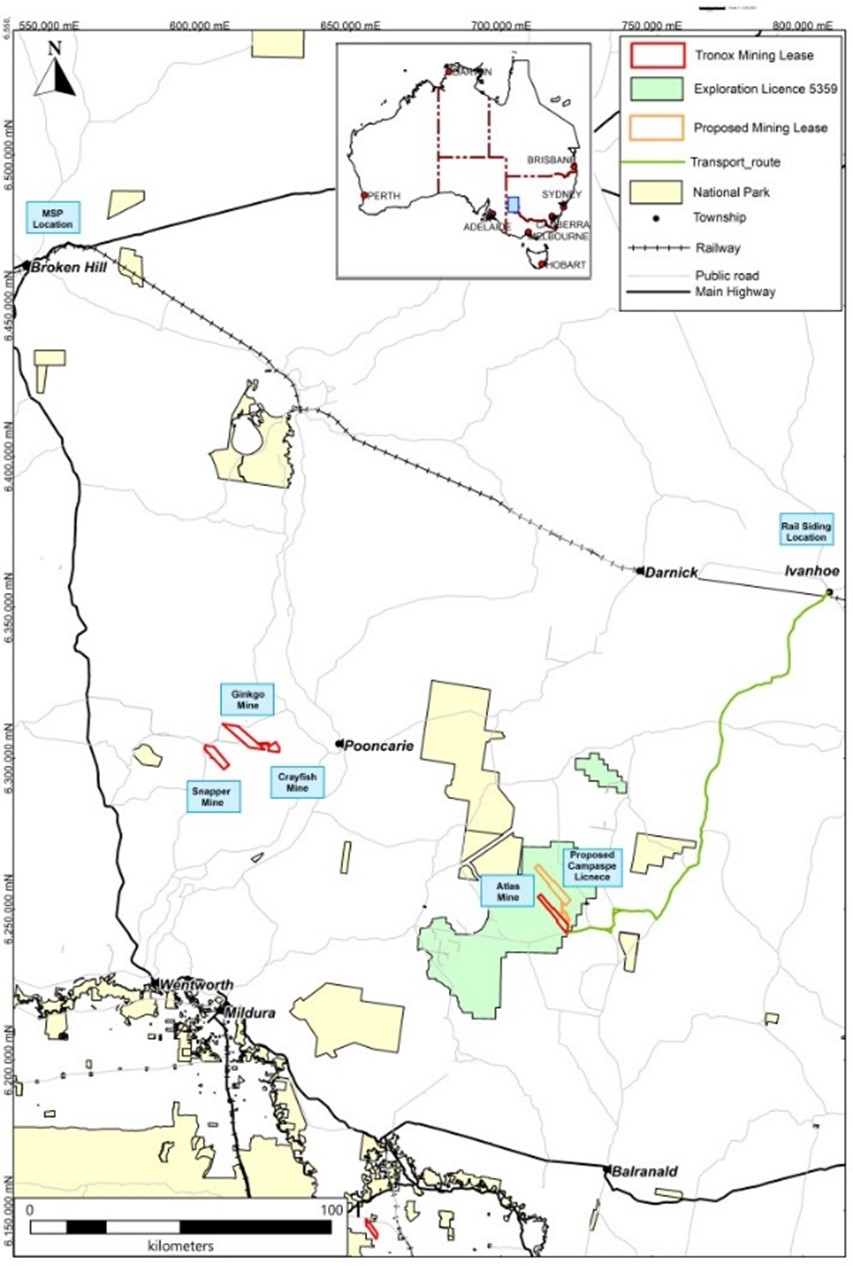

•Eastern Australia operations consisting of the Ginkgo mine, a floating heavy mineral concentration plant located there, the Atlas mine and a heavy mineral concentration plant located there and a mineral separation plant located at Broken Hill, New South Wales; and

•Perth Basin operations in Western Australia consisting of the Wonnerup mine and a mineral separation plant.

Zircon and monazite are often, but not always, found in mineral sands deposits containing ilmenite. They are extracted, alongside ilmenite and rutile, as part of the initial mineral sands separation process.

The mining of mineral sands deposits is conducted either “wet,” by dredging or hydraulic water jets, or “dry,” by using earth-moving equipment to excavate and transport the sands. The type of mining operation we deploy is dependent upon the characteristics of the ore body. Dredge mining is generally the favored method of mining mineral sands, provided that the ground conditions are suitable, water is readily available and the deposit is low in slime content. Dry mining techniques are generally preferred in situations involving hard ground, discontinuous ore bodies, small tonnage, high slimes contents and/or very high grades.

Regardless of the type of mining technique, the first step in the beneficiation process after the mineral sands have been mined is to utilize wet concentrator plants to produce a high grade of heavy mineral concentrate (typically approximately 90% to 98% heavy mineral content). Screened ore is first de-slimed, a process by which slimes are separated from larger particles of minerals, and then processed through a series of spiral separators that use gravity to separate the heavy mineral sands from lighter materials, such as quartz. Residue from the concentration process is pumped back into either the open pits or slimes dams for rehabilitation and water recovery.

After producing heavy mineral concentrate in our wet concentrator plants, we separate the non-magnetic (rutile, zircon and monazite) and magnetic (ilmenite) fractions utilizing a variety of techniques. Through the separation process, we produce zircon which is sold directly to customers, rutile and leucoxene which can immediately be used as feedstock material to make TiO2 pigment, and monazite which we currently sell in a relatively unconcentrated form but which we plan on further processing before sale to extract greater value.

Ilmenite is generally further refined for use in our TiO2 pigment manufacturing processes. Depending on the characteristics of the ilmenite we use two fundamental processes to refine ilmenite. Both processes involve the removal of iron and other non-titanium material.

•Titanium slag is made by smelting ilmenite in an electric arc furnace to separate titanium-oxide from the iron and other impurities. The result is two products: “slag” which contains 86% to 89% titanium dioxide and is considered a TiO2 feedstock material, and high purity pig iron which is ready for sale to end-use customers.