Document

Exhibit 99.1

Alkami Announces Third Quarter 2025 Financial Results

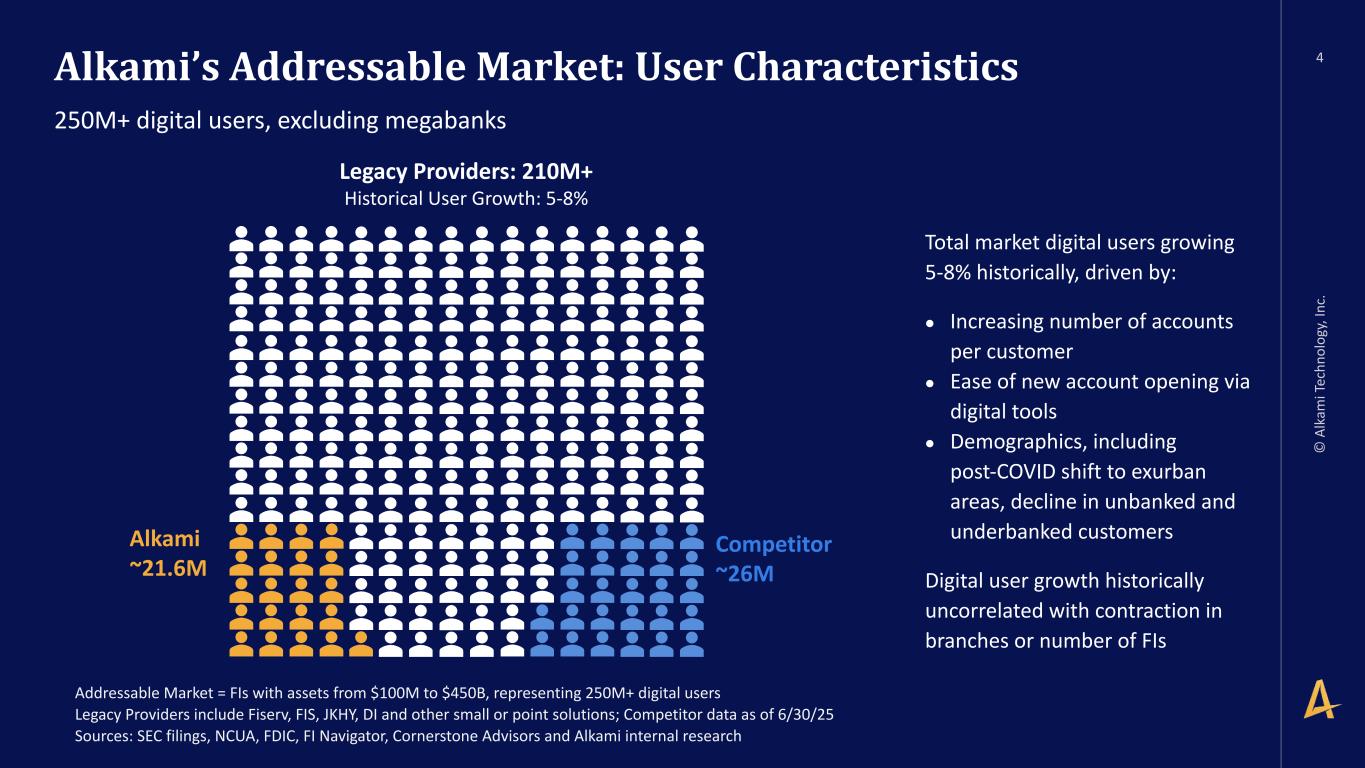

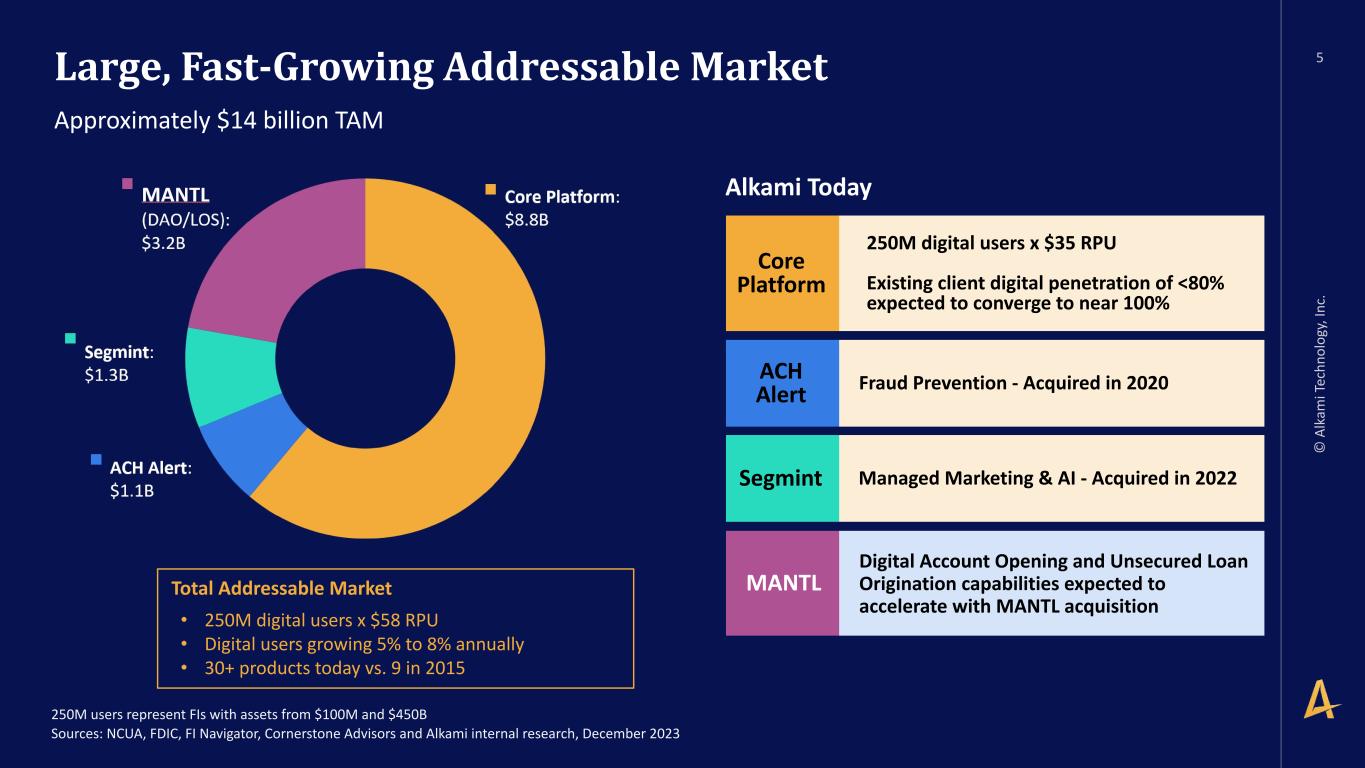

PLANO, Texas, October 30, 2025 (PRNewswire) -- Alkami Technology, Inc. (Nasdaq: ALKT) (“Alkami” or “the Company”), a leading cloud-based digital banking solutions provider for financial institutions (FIs) in the U.S., today announced results for its third quarter ending September 30, 2025.

Third Quarter 2025 Financial Highlights

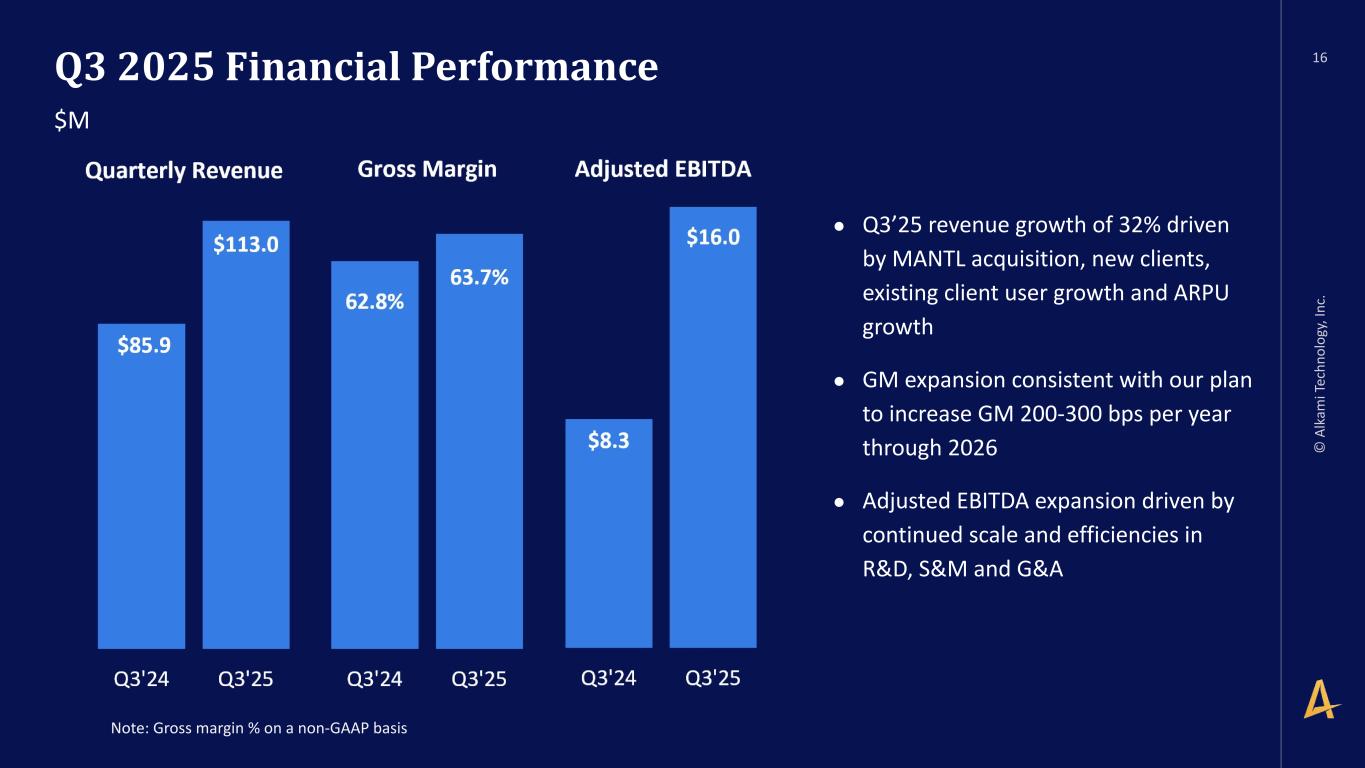

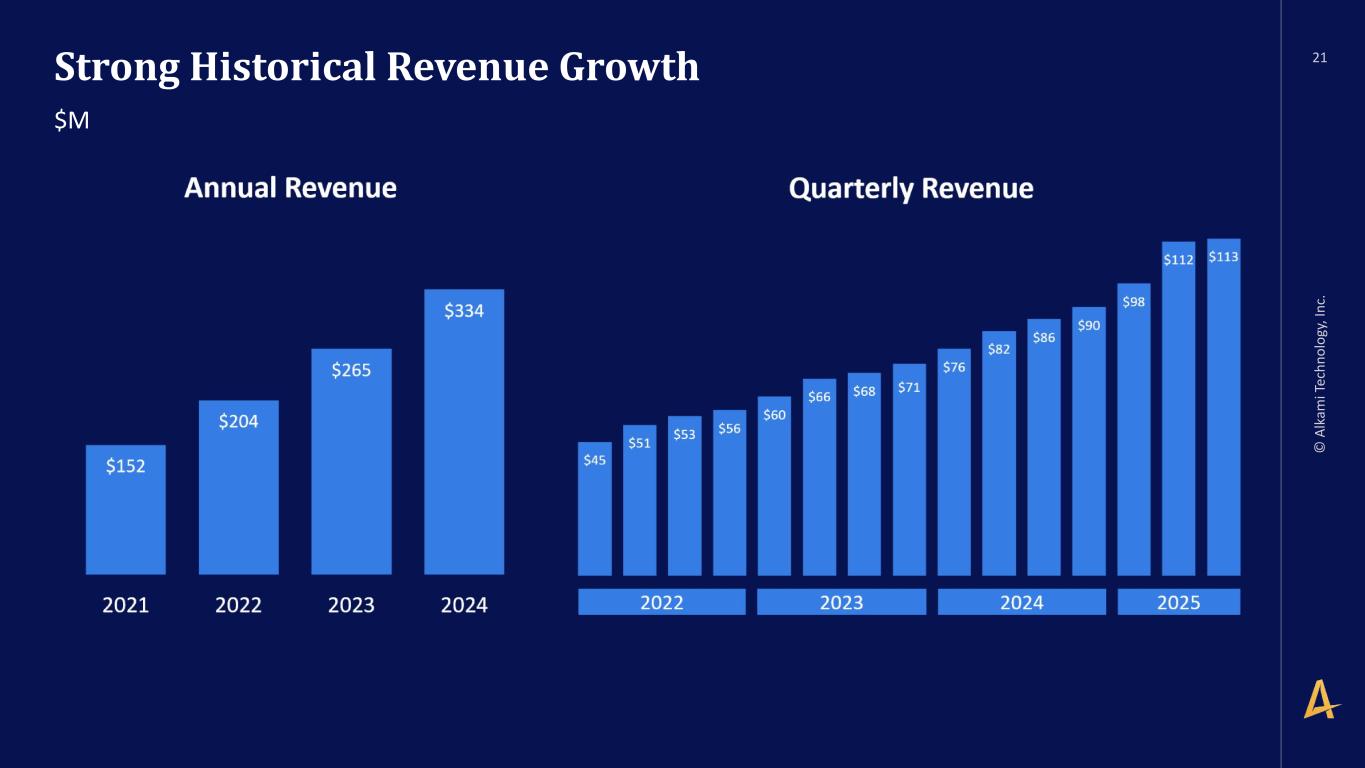

•GAAP total revenue of $113.0 million, an increase of 31.5% compared to the year-ago quarter;

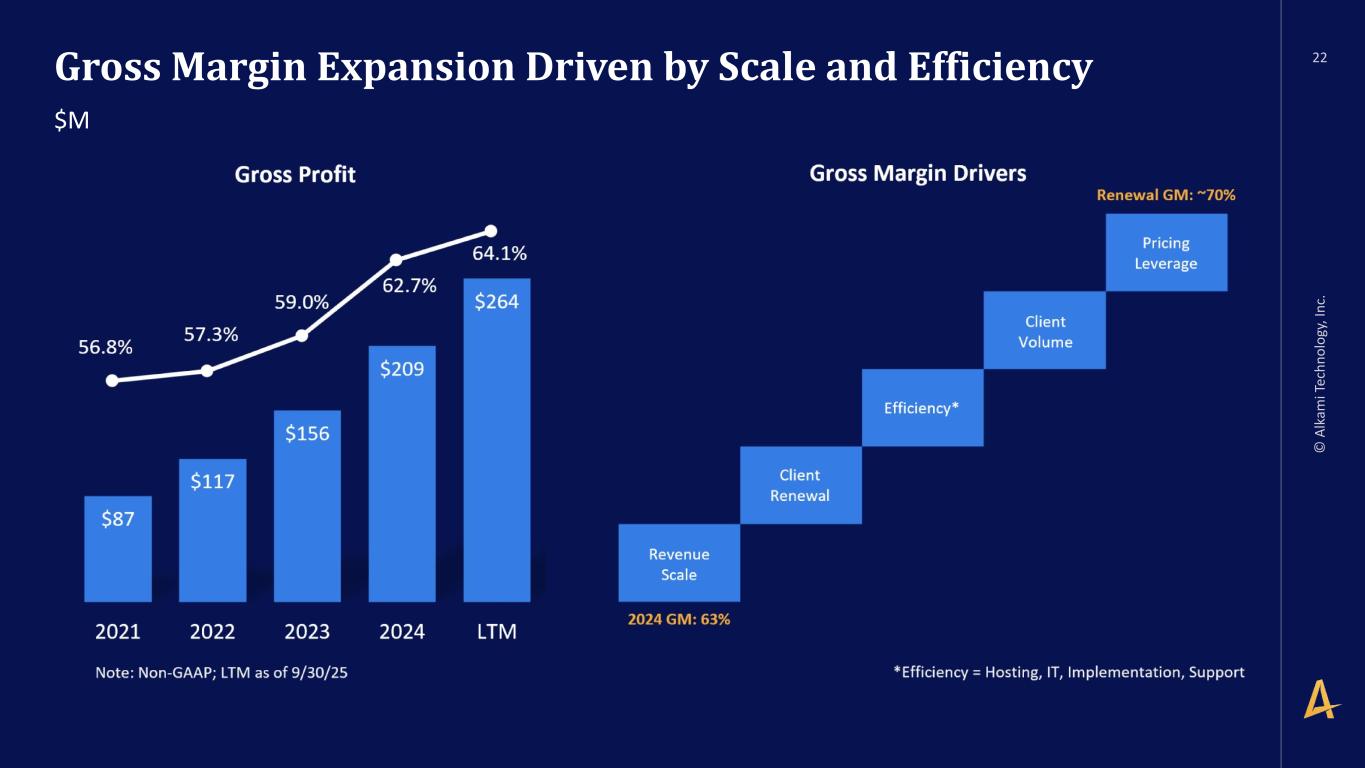

•GAAP gross margin of 56.8%, compared to 58.9% in the year-ago quarter;

•Non-GAAP gross margin of 63.7%, compared to 62.8% in the year-ago quarter;

•GAAP net loss of $(14.8) million, compared to $(9.4) million in the year-ago quarter; and

•Adjusted EBITDA of $16.0 million, compared to $8.3 million in the year-ago quarter.

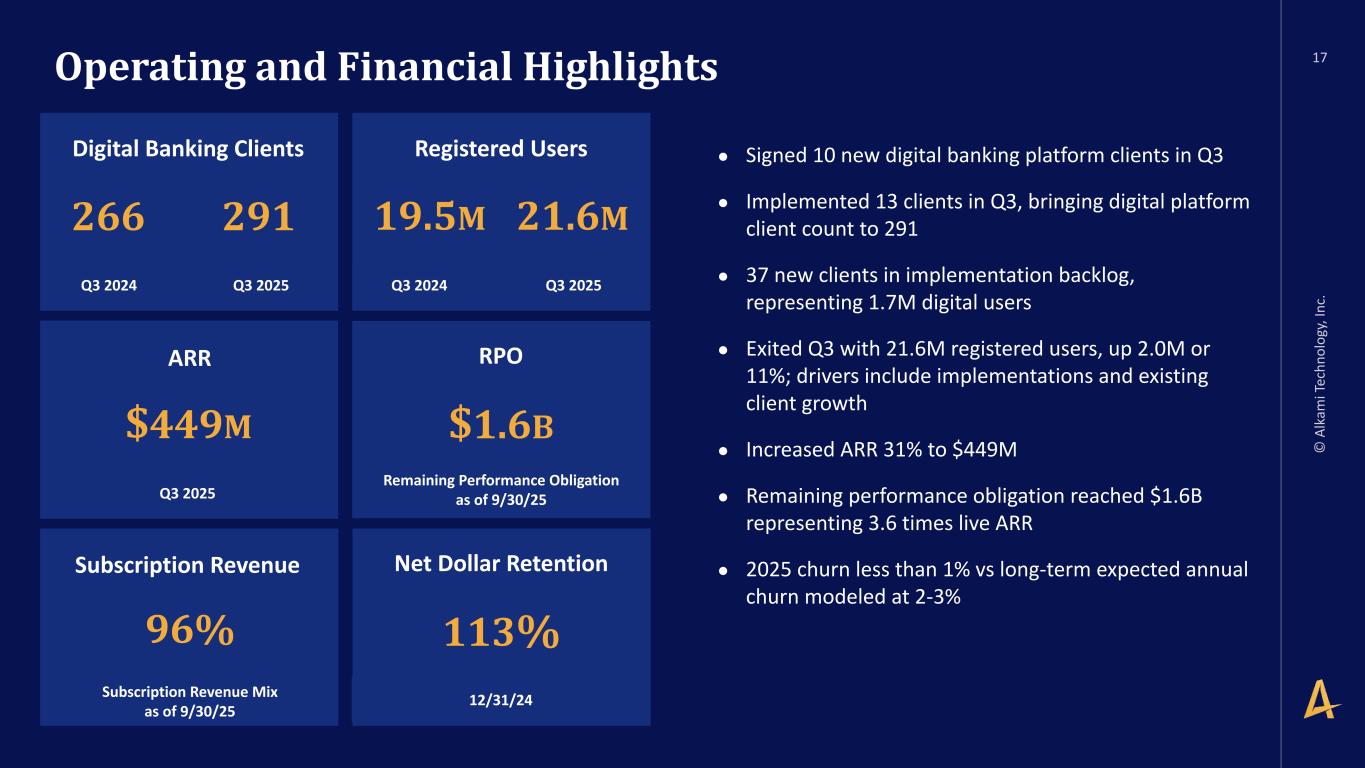

Comments on the News

Alex Shootman, Chief Executive Officer, said, "We are very pleased to report strong financial performance for the third quarter, with solid revenue growth and continued expansion of Adjusted EBITDA. We are particularly excited about the successful launch of 13 new financial institutions - including six banks - in the third quarter, a record for Alkami.”

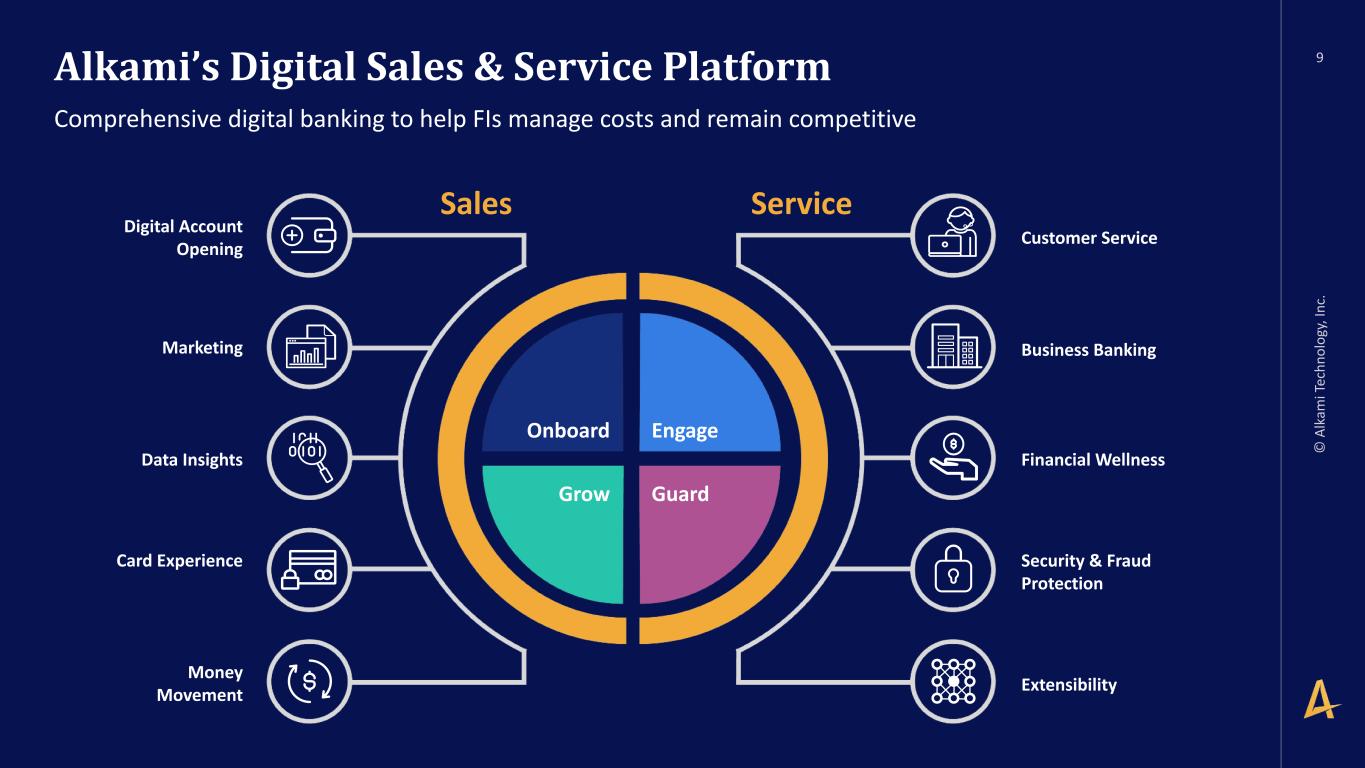

Shootman added, "Demand among regional and community financial institutions continues to drive favorable pipeline and revenue opportunities. We are also seeing early momentum in demand for holistic solutions such as Alkami’s Digital Sales & Service Platform, which combines our Onboarding & Account Opening Solution, our Digital Banking Solution, and our Data & Marketing Solution.”

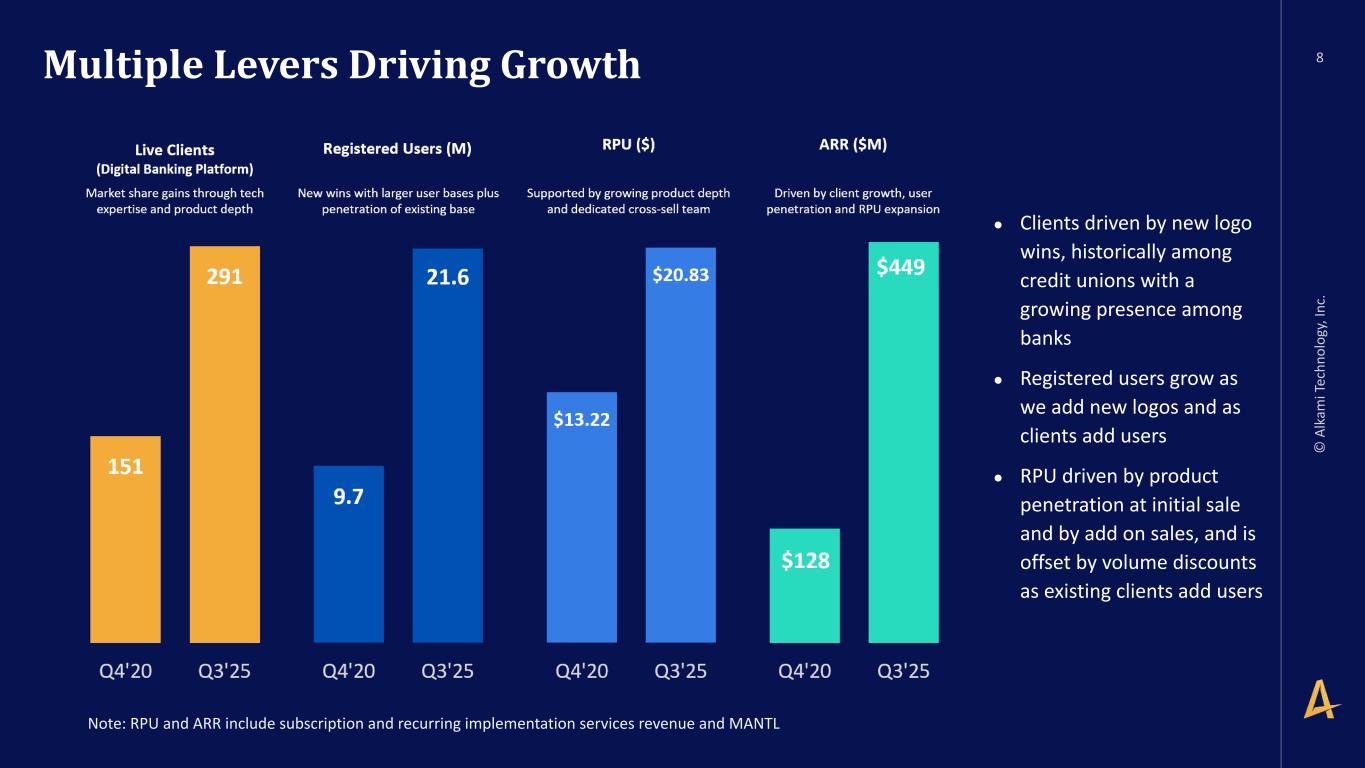

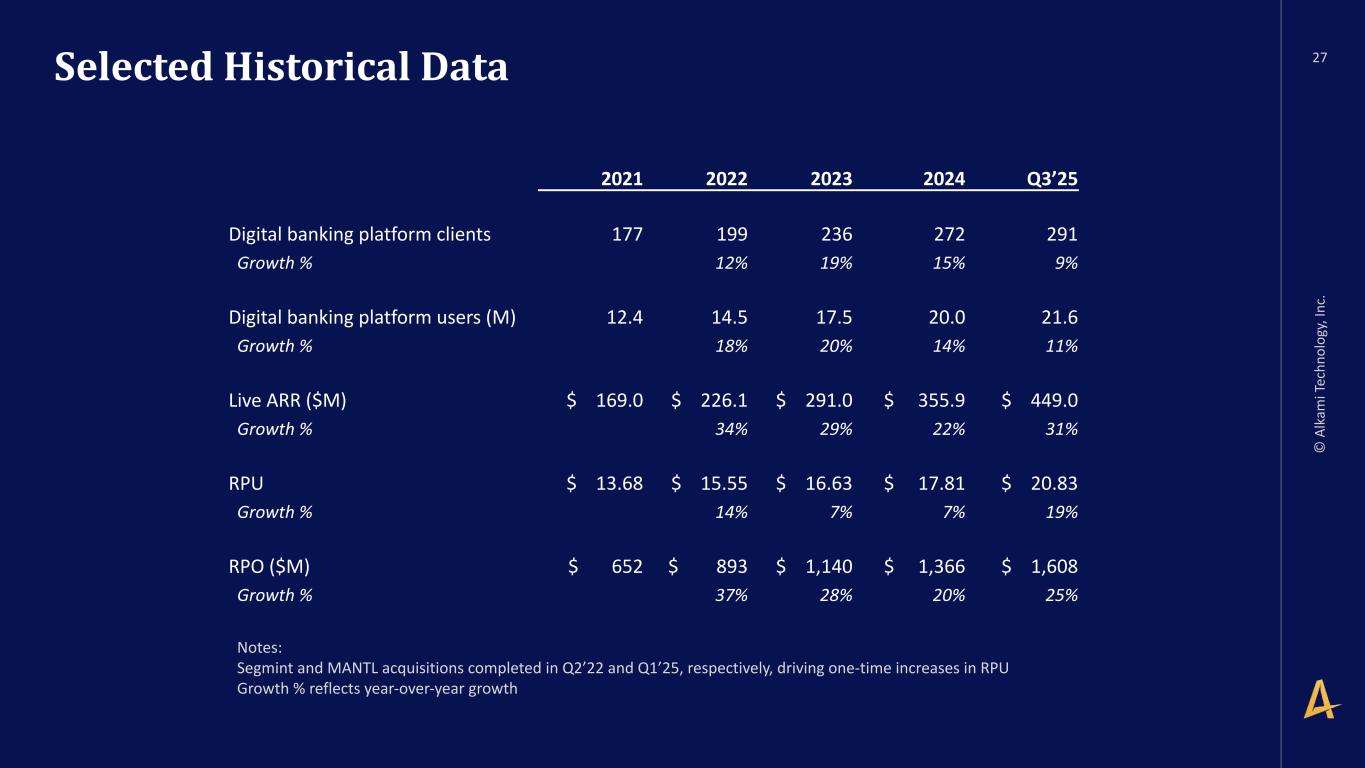

Bryan Hill, Chief Financial Officer, said, "We exited the third quarter with annual recurring revenue of $449 million, up 31%, and revenue per registered user of $20.83, up 19% compared to the year-ago quarter. We outperformed our Adjusted EBITDA target by 18%, demonstrating the significant progress we have made in scaling the business."

2025 Financial Outlook

The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Statement Regarding Forward-Looking Statements.”

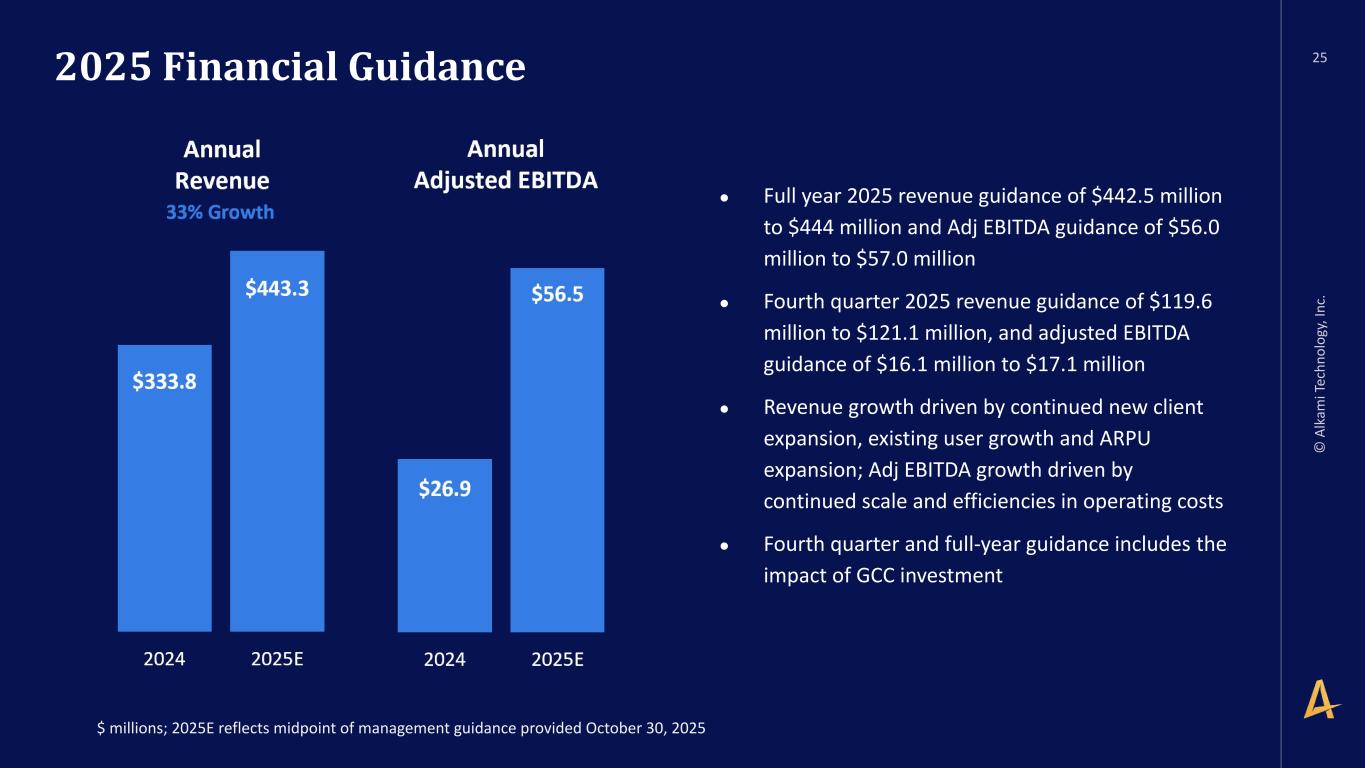

Alkami is providing guidance for its fourth quarter ending December 31, 2025 of:

•GAAP total revenue in the range of $119.6 million to $121.1 million;

•Adjusted EBITDA in the range of 16.1 million to 17.1 million.

Alkami is providing guidance for its fiscal year ending December 31, 2025 of:

•GAAP total revenue in the range of $442.5 million to $444.0 million;

•Adjusted EBITDA in the range of 56.0 million to 57.0 million.

Conference Call Information

The Company will host a conference call at 5:00 p.m. ET today to discuss its financial results with investors. A live webcast of the event will be available on the Alkami investor relations website at investors.alkami.com. In addition, a live dial-in will be available domestically at 1-800-836-8184 and internationally at 1-646-357-8785, using passcode 05691. The webcast replay will be available on the Alkami investor relations website.

About Alkami

Alkami Technology, Inc. is a leading cloud-based digital banking solutions provider for financial institutions in the United States that enables clients to grow confidently, adapt quickly, and build thriving digital communities. Alkami helps clients transform through retail and business banking, onboarding and account opening opening, payment security, and data and marketing solutions. To learn more, visit www.alkami.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains “forward-looking” statements relating to Alkami Technology, Inc.’s strategy, goals, future focus areas, and expected, possible or assumed future results, including its future cash flows and its financial outlook. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Forward-looking statements include all statements that are not historical facts and may be identified by terms such as “expects,” “believes,” “plans,” or similar expressions and the negatives of those terms. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements, expressed or implied by the forward-looking statements. Factors that may materially affect such forward-looking statements include: Our limited operating history and history of operating losses; our ability to manage future growth; our ability to attract new clients and retain and expand existing clients’ use of our solutions; the unpredictable and time-consuming nature of our sales cycles; our ability to maintain, protect and enhance our brand; our ability to accurately predict the long-term rate of client subscription renewals or adoption of our solutions; our reliance on third-party software, content and services; our ability to effectively integrate our solutions with other systems used by our clients; intense competition in our industry; any downturn, consolidation or decrease in technology spend in the financial services industry, including as a result of recent closures of certain financial institutions and liquidity concerns at other financial institutions; our ability and the ability of third parties on which we rely to prevent and identify breaches of security measures (including cybersecurity) and resulting disruptions of our systems or operations and unauthorized access to client customer and other data; our ability to successfully integrate acquired companies or businesses; our ability to comply with regulatory and legal requirements and developments; our ability to attract and retain key employees; the political, economic and competitive conditions in the markets and jurisdictions where we operate; our ability to maintain, develop and protect our intellectual property; our ability to respond to evolving technological requirements to develop or acquire new and enhanced products that achieve market acceptance in a timely manner; our ability to estimate our expenses, future revenues, capital requirements, our needs for additional financing and our ability to obtain additional capital and other factors described in the Company’s filings with the Securities and Exchange Commission. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

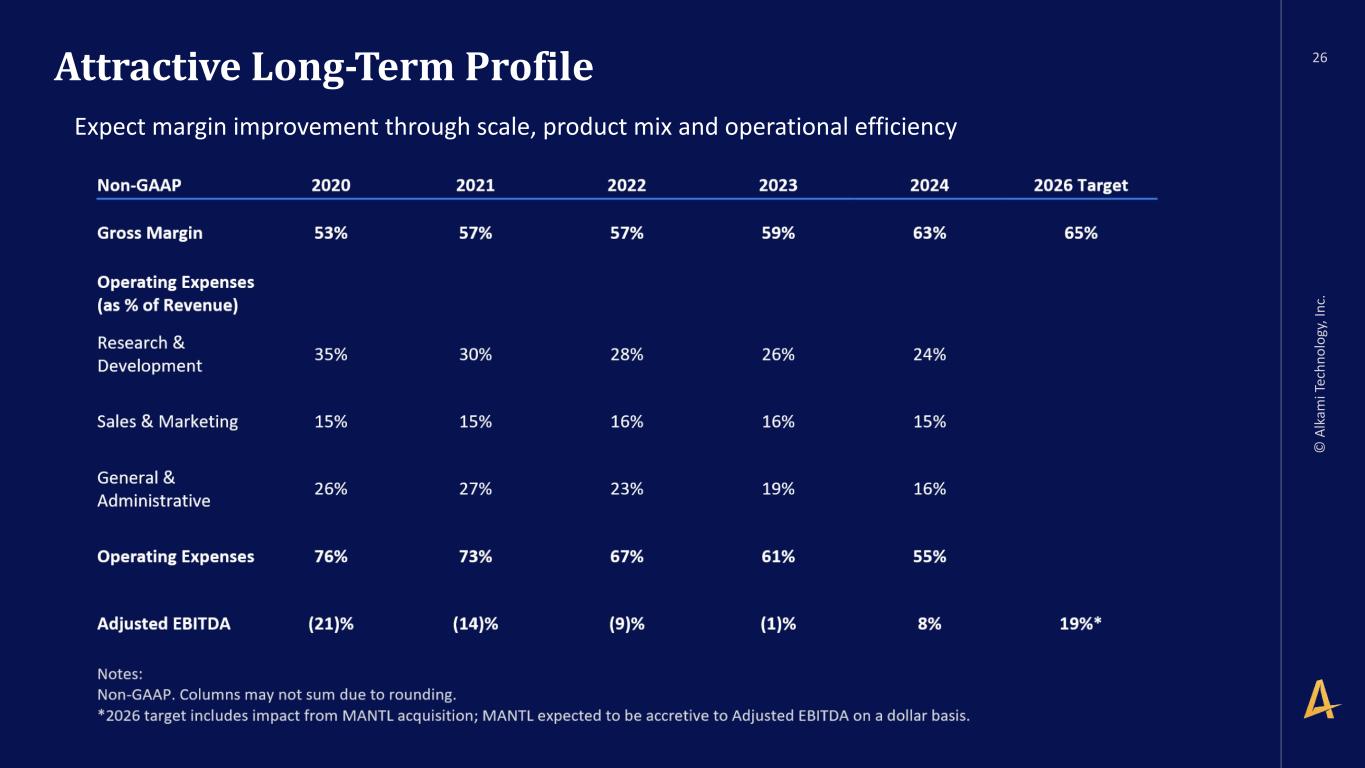

Explanation of Non-GAAP Financial Measures and Key Business Metrics

The company reports its financial results in accordance with accounting principles generally accepted in the United States of America, or GAAP. However, the company believes that, in order to properly understand its short-term and long-term financial, operational and strategic trends, it may be helpful for investors to exclude certain non-cash or non-recurring items when used as a supplement to financial performance measures in accordance with GAAP. These items result from facts and circumstances that vary in both frequency and impact on continuing operations. The company also uses results of operations excluding such items to evaluate the operating performance of Alkami and compare it against prior periods, make operating decisions, determine executive compensation, and serve as a basis for long-term strategic planning. These non-GAAP financial measures provide the company with additional means to understand and evaluate the operating results and trends in its ongoing business by eliminating certain non-cash expenses and other items that Alkami believes might otherwise make comparisons of its ongoing business with prior periods more difficult, obscure trends in ongoing operations, reduce management’s ability to make useful forecasts, or obscure the ability to evaluate the effectiveness of certain business strategies and management incentive structures. In addition, the company also believes that investors and financial analysts find this information to be helpful in analyzing the company’s financial and operational performance and comparing this performance to the company’s peers and competitors.

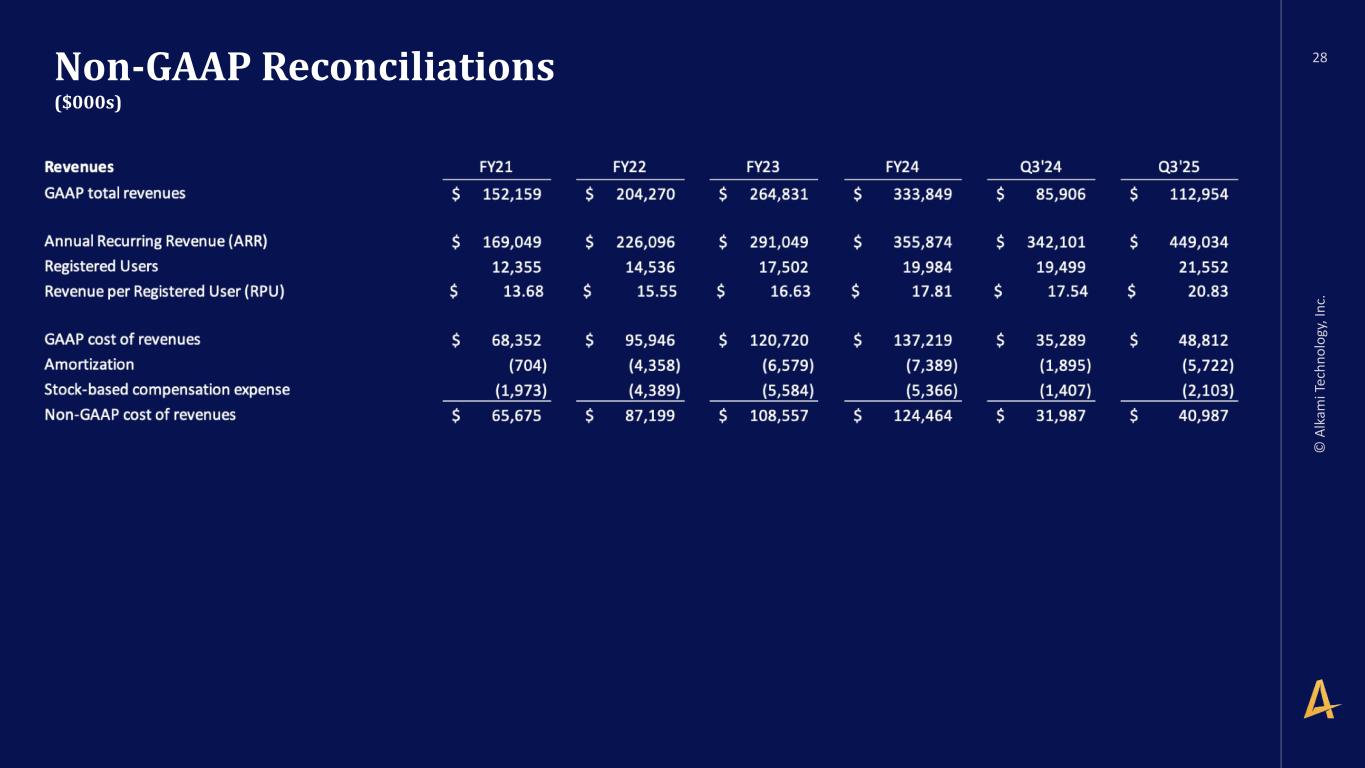

The company defines “Non-GAAP Cost of Revenues” as cost of revenues, excluding (1) amortization and (2) stock-based compensation expense. The company believes that investors and financial analysts find this non-GAAP financial measure to be useful in analyzing the company’s financial and operational performance, comparing this performance to the company’s peers and competitors, and understanding the company’s ability to generate income from ongoing business operations.

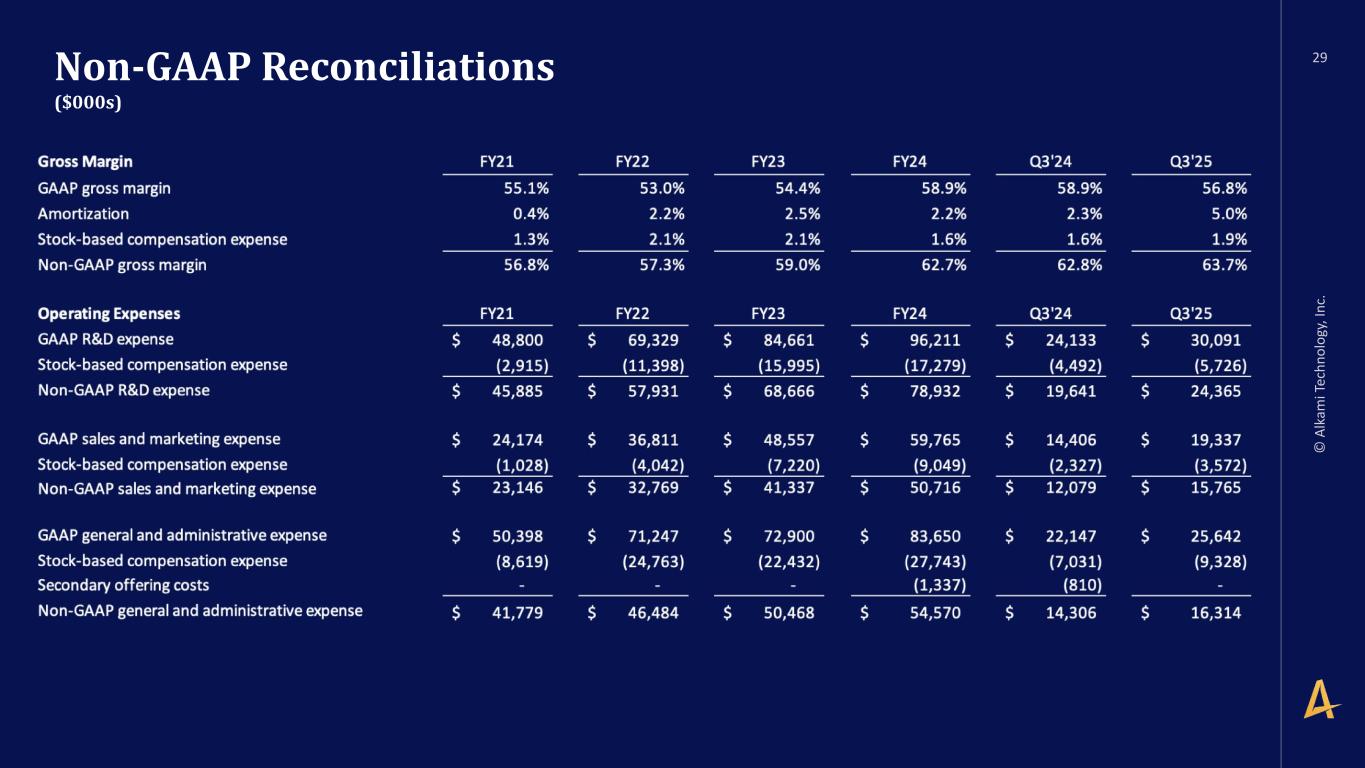

The company defines “Non-GAAP Gross Margin” as gross profit, plus (1) amortization and (2) stock-based compensation expense, all divided by revenue. The company believes that investors and financial analysts find this non-GAAP financial measure to be useful in analyzing the company’s financial and operational performance, comparing this performance to the company’s peers and competitors, and understanding the company’s ability to generate income from ongoing business operations.

The company defines “Non-GAAP Research and Development Expense” as research and development expense, excluding stock-based compensation expense. The company believes that investors and financial analysts find this non-GAAP financial measure to be useful in analyzing the company’s financial and operational performance, comparing this performance to the company’s peers and competitors, and understanding the company’s ongoing expenditures related to product innovation.

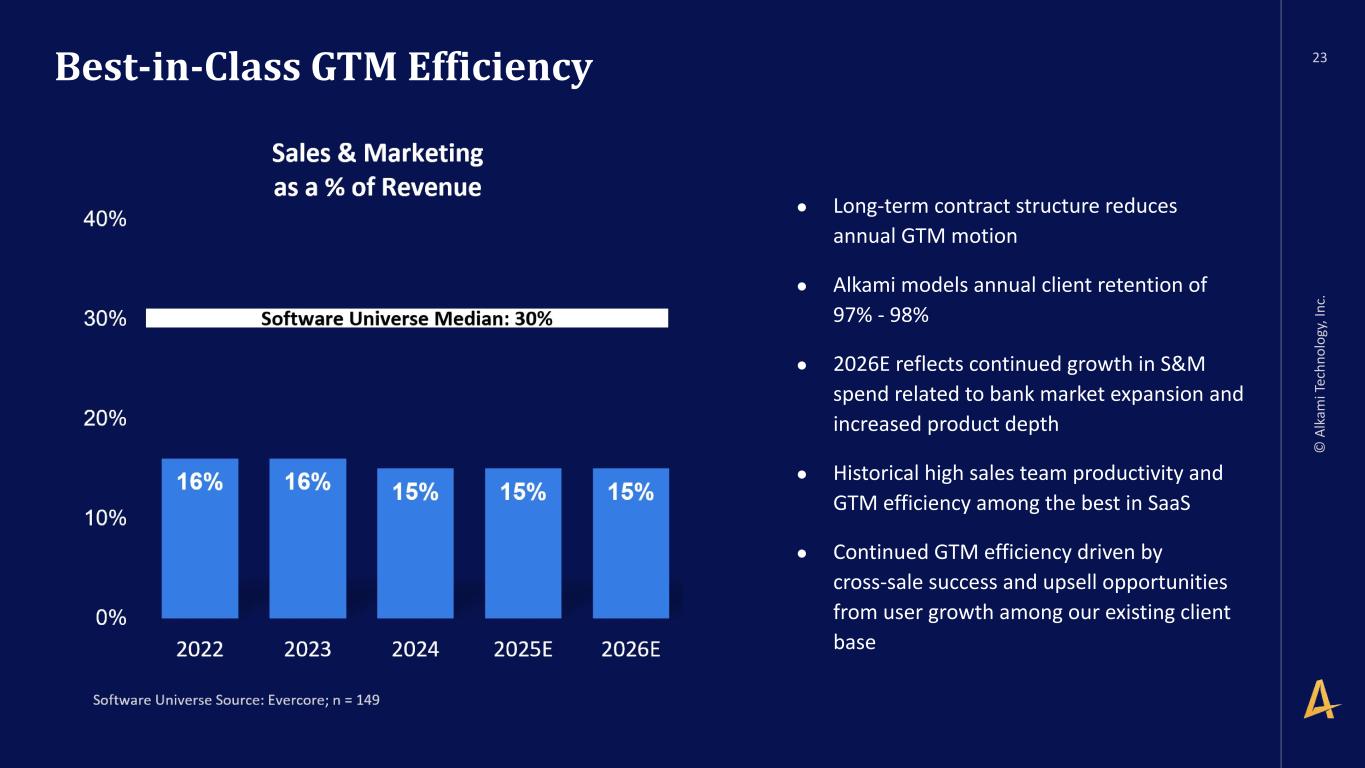

The company defines “Non-GAAP Sales and Marketing Expense” as sales and marketing expense, excluding stock-based compensation expense. The company believes that investors and financial analysts find this non-GAAP financial measure to be useful in analyzing the company’s financial and operational performance, comparing this performance to the company’s peers and competitors, and understanding the company’s ongoing expenditures related to its sales and marketing strategies.

The company defines “Non-GAAP General and Administrative Expense” as general and administrative expense, excluding stock-based compensation expense. The company believes that investors and financial analysts find this non-GAAP financial measure to be useful in analyzing the company’s financial and operational performance, comparing this performance to the company’s peers and competitors, and understanding the company’s underlying expense structure to support corporate activities and processes.

The company defines “Non-GAAP Income Before Income Taxes” as loss before income taxes, plus (1) amortization, (2) stock-based compensation expense, (3) secondary offering costs, (4) acquisition-related expenses, and (5) loss on impairment of intangible assets. The company believes that investors and financial analysts find this non-GAAP financial measure to be useful in analyzing the company’s financial and operational performance, comparing this performance to the company’s peers and competitors, and understanding the company’s ability to generate income from ongoing business operations.

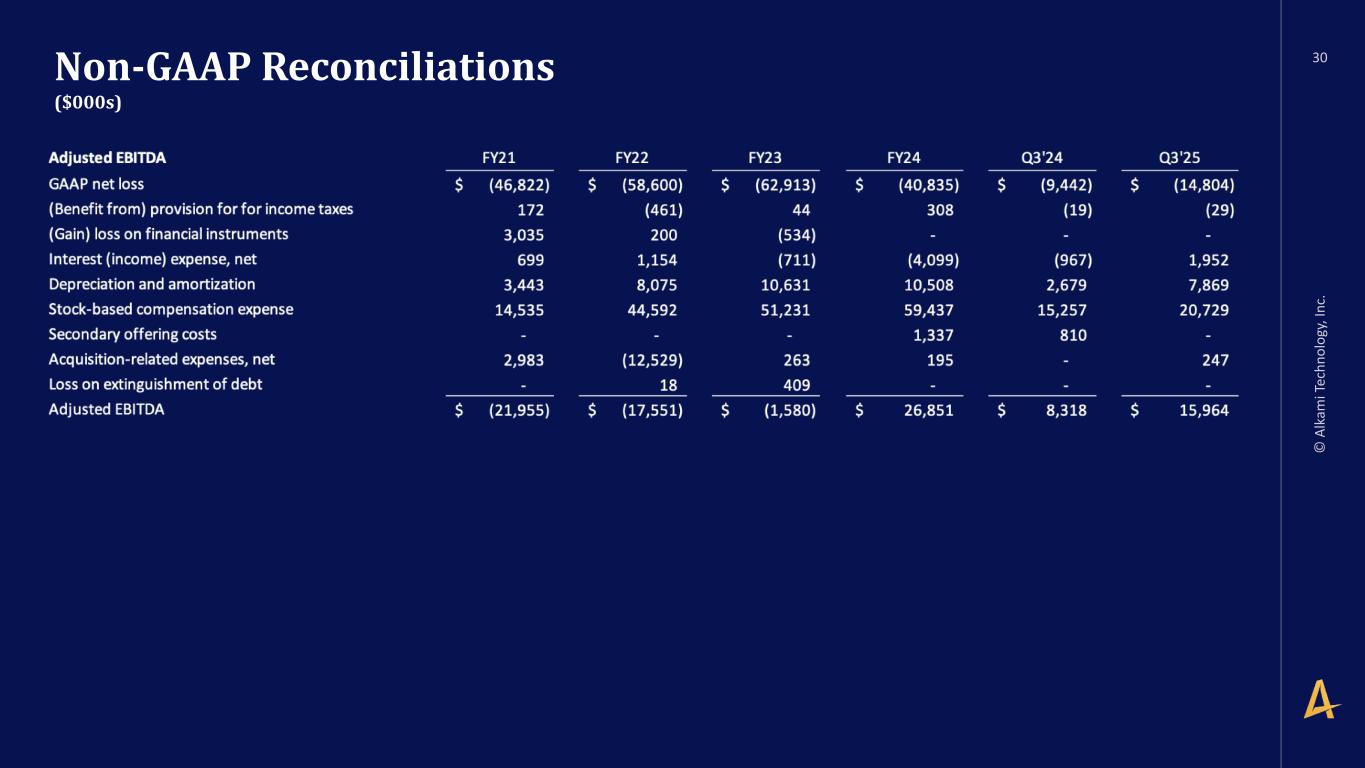

The company defines “Adjusted EBITDA” as net loss plus (1) (benefit from) provision for income taxes, (2) interest expense (income), net, (3) depreciation and amortization (4) stock-based compensation expense, (5) secondary offering costs, (6) acquisition-related expenses, and (7) loss on impairment of intangible assets. The company believes adjusted EBITDA provides investors and other users of our financial information consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations.

In addition, the Company also uses the following important operating metrics to evaluate its business:

The company defines “Annual Recurring Revenue (ARR)” by aggregating annualized recurring revenue related to SaaS subscription services recognized in the last month of the reporting period as well as the next 12 months of expected implementation services revenues in the last month of the reporting period. We believe ARR provides important information about our future revenue potential, our ability to acquire new clients, and our ability to maintain and expand our relationship with existing clients.

The company defines “Registered Users” as an individual or business related to an account holder of an FI client on our digital banking platform and has access as of the last day of the reporting period presented. We exclude individuals or businesses that solely use the products and services of our acquisitions. We price our digital banking platform based on the number of registered users, so as the number of registered users of our digital banking platform increases, our ARR grows. We believe growth in the number of registered users provides important information about our ability to expand market adoption of our digital banking platform and its associated software products, and therefore to grow revenues over time.

The company defines “Revenue per Registered User (RPU)” by dividing ARR for the reporting period by the number of registered users as of the last day of the reporting period. We believe RPU provides important information about our ability to grow the number of software products adopted by new clients over time, as well as our ability to expand the number of software products that our existing clients add to their contracts with us over time.

The company does not provide a reconciliation of our adjusted EBITDA outlook to GAAP net loss because certain significant information required for such reconciliation is not available without unreasonable efforts, including benefit from/provision for income taxes, gain/loss on financial instruments, stock-based compensation expense, and acquisition-related expenses, net, all of which may be significant.

|

|

|

|

|

|

|

|

|

|

|

|

| ALKAMI TECHNOLOGY, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (In thousands, except share and per share data) |

| (UNAUDITED) |

|

September 30, |

|

December 31, |

|

2025 |

|

2024 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

57,316 |

|

|

$ |

94,359 |

|

| Marketable securities |

33,596 |

|

|

21,375 |

|

| Accounts receivable, net |

50,675 |

|

|

38,739 |

|

| Deferred costs, current |

14,868 |

|

|

13,207 |

|

| Prepaid expenses and other current assets |

18,413 |

|

|

13,697 |

|

| Total current assets |

174,868 |

|

|

181,377 |

|

| Property and equipment, net |

25,437 |

|

|

22,075 |

|

| Right-of-use assets |

13,856 |

|

|

14,565 |

|

| Deferred costs, net of current portion |

42,581 |

|

|

37,178 |

|

| Intangibles, net |

165,562 |

|

|

29,021 |

|

| Goodwill |

403,404 |

|

|

148,050 |

|

| Other assets |

9,467 |

|

|

5,011 |

|

| Total assets |

$ |

835,175 |

|

|

$ |

437,277 |

|

| Liabilities and Stockholders' Equity |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

$ |

7,261 |

|

|

$ |

6,129 |

|

| Accrued liabilities |

40,644 |

|

|

24,520 |

|

| Deferred revenues, current portion |

31,148 |

|

|

13,578 |

|

| Lease liabilities, current portion |

1,578 |

|

|

1,343 |

|

| Total current liabilities |

80,631 |

|

|

45,570 |

|

| Deferred revenues, net of current portion |

24,882 |

|

|

15,526 |

|

| Deferred income taxes |

2,448 |

|

|

1,822 |

|

| Convertible senior notes, net |

335,717 |

|

|

— |

|

| Revolving loan |

25,000 |

|

|

— |

|

| Lease liabilities, net of current portion |

16,148 |

|

|

17,109 |

|

| Other non-current liabilities |

233 |

|

|

220 |

|

| Total liabilities |

485,059 |

|

|

80,247 |

|

| Stockholders’ Equity |

|

|

|

Preferred stock, $0.001 par value, 10,000,000 shares authorized and 0 shares issued and outstanding as of September 30, 2025 and December 31, 2024 |

— |

|

|

— |

|

Common stock, $0.001 par value, 500,000,000 shares authorized; and 105,004,011 and 102,088,783 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively |

105 |

|

|

102 |

|

| Additional paid-in capital |

862,423 |

|

|

833,129 |

|

| Accumulated deficit |

(512,412) |

|

|

(476,201) |

|

| Total stockholders’ equity |

350,116 |

|

|

357,030 |

|

| Total liabilities and stockholders' equity |

$ |

835,175 |

|

|

$ |

437,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALKAMI TECHNOLOGY, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (In thousands, except share and per share data) |

| (UNAUDITED) |

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues |

$ |

112,954 |

|

|

$ |

85,906 |

|

|

$ |

322,848 |

|

|

$ |

244,193 |

|

Cost of revenues(1) |

48,812 |

|

|

35,289 |

|

|

135,328 |

|

|

100,773 |

|

| Gross profit |

64,142 |

|

|

50,617 |

|

|

187,520 |

|

|

143,420 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Research and development |

30,091 |

|

|

24,133 |

|

|

87,207 |

|

|

70,862 |

|

| Sales and marketing |

19,337 |

|

|

14,406 |

|

|

60,227 |

|

|

45,213 |

|

| General and administrative |

25,642 |

|

|

22,147 |

|

|

75,452 |

|

|

62,074 |

|

| Acquisition-related expenses |

247 |

|

|

— |

|

|

3,138 |

|

|

195 |

|

| Amortization of acquired intangibles |

1,706 |

|

|

359 |

|

|

3,981 |

|

|

1,076 |

|

| Loss on impairment of intangible assets |

— |

|

|

— |

|

|

1,655 |

|

|

— |

|

| Total operating expenses |

77,023 |

|

|

61,045 |

|

|

231,660 |

|

|

179,420 |

|

| Loss from operations |

(12,881) |

|

|

(10,428) |

|

|

(44,140) |

|

|

(36,000) |

|

| Non-operating income (expense): |

|

|

|

|

|

|

|

| Interest income |

1,026 |

|

|

1,147 |

|

|

3,286 |

|

|

3,490 |

|

| Interest expense |

(2,978) |

|

|

(180) |

|

|

(6,967) |

|

|

(327) |

|

| Loss before income taxes |

(14,833) |

|

|

(9,461) |

|

|

(47,821) |

|

|

(32,837) |

|

| (Benefit from) provision for income taxes |

(29) |

|

|

(19) |

|

|

(11,610) |

|

|

355 |

|

| Net loss |

$ |

(14,804) |

|

|

$ |

(9,442) |

|

|

$ |

(36,211) |

|

|

$ |

(33,192) |

|

| Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

| Basic and diluted |

$ |

(0.14) |

|

|

$ |

(0.09) |

|

|

$ |

(0.35) |

|

|

$ |

(0.34) |

|

| Weighted-average number of shares of common stock outstanding: |

|

|

|

|

|

|

|

| Basic and diluted |

104,345,319 |

|

|

99,435,002 |

|

|

103,395,497 |

|

|

98,165,903 |

|

(1) Includes amortization of acquired technology of $4.9 million and $1.3 million for the three months ended September 30, 2025 and 2024, respectively and $11.7 million and $4.0 million for the nine months ended September 30, 2025 and 2024, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

| ALKAMI TECHNOLOGY, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (In thousands) |

| (UNAUDITED) |

|

Nine months ended September 30, |

|

2025 |

|

2024 |

| Cash flows from operating activities: |

|

|

|

| Net loss |

$ |

(36,211) |

|

|

$ |

(33,192) |

|

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization expense |

19,055 |

|

|

7,854 |

|

| Accrued interest on marketable securities, net |

(667) |

|

|

(928) |

|

| Stock-based compensation expense |

56,336 |

|

|

43,822 |

|

| Amortization of discount and debt issuance costs |

1,367 |

|

|

161 |

|

| Loss on impairment of intangible assets |

1,655 |

|

|

— |

|

| Deferred taxes |

(11,971) |

|

|

61 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable |

(10,457) |

|

|

(6,909) |

|

| Prepaid expenses and other assets |

(5,882) |

|

|

(2,619) |

|

| Accounts payable and accrued liabilities |

14,424 |

|

|

6,316 |

|

| Deferred costs |

(6,538) |

|

|

(5,067) |

|

| Deferred revenues |

5,189 |

|

|

2,987 |

|

| Net cash provided by operating activities |

26,300 |

|

|

12,486 |

|

| Cash flows from investing activities: |

|

|

|

| Purchase of marketable securities |

(35,854) |

|

|

(30,721) |

|

| Proceeds from sales, maturities and redemptions of marketable securities |

24,300 |

|

|

62,812 |

|

| Purchases of property and equipment |

(1,156) |

|

|

(1,036) |

|

| Capitalized software development costs |

(5,255) |

|

|

(5,009) |

|

| Acquisition of business, net of cash acquired |

(375,499) |

|

|

— |

|

| Net cash (used in) provided by investing activities |

(393,464) |

|

|

26,046 |

|

| Cash flows from financing activities: |

|

|

|

| Payments on revolving loan |

(35,000) |

|

— |

|

| Debt issuance costs paid |

(1,898) |

|

(363) |

|

| Proceeds from Employee Stock Purchase Plan issuances |

2,943 |

|

2,598 |

|

| Proceeds from issuance of convertible senior notes |

335,513 |

|

— |

|

| Proceeds from borrowing under revolving loan |

60,000 |

|

|

— |

|

| Purchase of capped call transaction |

(33,879) |

|

|

— |

|

| Payments for taxes related to net settlement of equity awards |

— |

|

|

(12,820) |

|

| Proceeds from stock option exercises |

2,442 |

|

|

12,082 |

|

| Net cash provided by financing activities |

330,121 |

|

|

1,497 |

|

| Net (decrease) increase in cash and cash equivalents |

(37,043) |

|

|

40,029 |

|

| Cash and cash equivalents, beginning of period |

94,359 |

|

|

40,927 |

|

| Cash and cash equivalents, end of period |

$ |

57,316 |

|

|

$ |

80,956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALKAMI TECHNOLOGY, INC. |

| RECONCILIATION OF GAAP TO NON-GAAP MEASURES |

| (In thousands, except per share data) |

| (UNAUDITED) |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP total revenues |

$ |

112,954 |

|

|

$ |

85,906 |

|

|

$ |

322,848 |

|

|

$ |

244,193 |

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

|

|

2025 |

|

2024 |

|

|

|

|

| Annual Recurring Revenue (ARR) |

$ |

449,034 |

|

|

$ |

342,101 |

|

|

|

|

|

| Registered Users |

21,552 |

|

|

19,499 |

|

|

|

|

|

| Revenue per Registered User (RPU) |

$ |

20.83 |

|

|

$ |

17.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Cost of Revenues |

|

|

|

|

|

| Set forth below is a presentation of the company’s “Non-GAAP Cost of Revenues.” Please reference the “Explanation of Non-GAAP Measures” section. |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP cost of revenues |

$ |

48,812 |

|

|

$ |

35,289 |

|

|

$ |

135,328 |

|

|

$ |

100,773 |

|

| Amortization |

(5,722) |

|

|

(1,895) |

|

|

(13,856) |

|

|

(5,463) |

|

| Stock-based compensation expense |

(2,103) |

|

|

(1,407) |

|

|

(6,445) |

|

|

(3,932) |

|

| Non-GAAP cost of revenues |

$ |

40,987 |

|

|

$ |

31,987 |

|

|

$ |

115,027 |

|

|

$ |

91,378 |

|

|

|

|

|

|

|

|

|

| Non-GAAP Gross Margin |

|

|

|

|

|

| Set forth below is a presentation of the company’s “Non-GAAP Gross Margin.” Please reference the “Explanation of Non-GAAP Measures” section. |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP gross margin |

56.8 |

% |

|

58.9 |

% |

|

58.1 |

% |

|

58.7 |

% |

| Amortization |

5.0 |

% |

|

2.3 |

% |

|

4.4 |

% |

|

2.3 |

% |

| Stock-based compensation expense |

1.9 |

% |

|

1.6 |

% |

|

1.9 |

% |

|

1.6 |

% |

| Non-GAAP gross margin |

63.7 |

% |

|

62.8 |

% |

|

64.4 |

% |

|

62.6 |

% |

|

|

|

|

|

|

|

|

| Non-GAAP Research and Development Expense |

|

|

|

|

|

| Set forth below is a presentation of the company’s “Non-GAAP Research and Development Expense.” Please reference the “Explanation of Non-GAAP Measures” section. |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP research and development expense |

$ |

30,091 |

|

|

$ |

24,133 |

|

|

$ |

87,207 |

|

|

$ |

70,862 |

|

| Stock-based compensation expense |

(5,726) |

|

|

(4,492) |

|

|

(16,584) |

|

|

(12,746) |

|

| Non-GAAP research and development expense |

$ |

24,365 |

|

|

$ |

19,641 |

|

|

$ |

70,623 |

|

|

$ |

58,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Sales and Marketing Expense |

|

|

|

|

|

| Set forth below is a presentation of the company’s “Non-GAAP Sales and Marketing Expense.” Please reference the “Explanation of Non-GAAP Measures” section. |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP sales and marketing expense |

$ |

19,337 |

|

|

$ |

14,406 |

|

|

$ |

60,227 |

|

|

$ |

45,213 |

|

| Stock-based compensation expense |

(3,572) |

|

|

(2,327) |

|

|

(9,969) |

|

|

(6,649) |

|

| Non-GAAP sales and marketing expense |

$ |

15,765 |

|

|

$ |

12,079 |

|

|

$ |

50,258 |

|

|

$ |

38,564 |

|

|

|

|

|

|

|

|

|

| Non-GAAP General and Administrative Expense |

|

|

|

|

|

| Set forth below is a presentation of the company’s “Non-GAAP General and Administrative Expense.” Please reference the “Explanation of Non-GAAP Measures” section. |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP general and administrative expense |

$ |

25,642 |

|

|

$ |

22,147 |

|

|

$ |

75,452 |

|

|

$ |

62,074 |

|

| Stock-based compensation expense |

(9,328) |

|

|

(7,031) |

|

|

(27,248) |

|

|

(20,495) |

|

| Secondary offering costs |

— |

|

|

(810) |

|

|

— |

|

|

(810) |

|

| Non-GAAP general and administrative expense |

$ |

16,314 |

|

|

$ |

14,306 |

|

|

$ |

48,204 |

|

|

$ |

40,769 |

|

|

|

|

|

|

|

|

|

| Non-GAAP Income Before Income Taxes |

|

|

|

|

|

| Set forth below is a presentation of the company’s “Non-GAAP Income Before Income Taxes.” Please reference the “Explanation of Non-GAAP Measures” section. |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP loss before income taxes |

$ |

(14,833) |

|

|

$ |

(9,461) |

|

|

$ |

(47,821) |

|

|

$ |

(32,837) |

|

| Amortization |

7,468 |

|

|

2,254 |

|

|

17,904 |

|

|

6,539 |

|

| Stock-based compensation expense |

20,729 |

|

|

15,257 |

|

|

60,246 |

|

|

43,822 |

|

| Secondary offering costs |

— |

|

|

810 |

|

|

— |

|

|

810 |

|

| Acquisition-related expenses |

247 |

|

|

— |

|

|

3,138 |

|

|

195 |

|

| Loss on impairment of intangible assets |

— |

|

|

— |

|

|

1,655 |

|

|

— |

|

| Non-GAAP income before income taxes |

$ |

13,611 |

|

|

$ |

8,860 |

|

|

$ |

35,122 |

|

|

$ |

18,529 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

| Set forth below is a presentation of the company’s “Adjusted EBITDA.” Please reference the “Explanation of Non-GAAP Measures” section. |

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP net loss |

$ |

(14,804) |

|

|

$ |

(9,442) |

|

|

$ |

(36,211) |

|

|

$ |

(33,192) |

|

| (Benefit from) provision for income taxes |

(29) |

|

|

(19) |

|

|

(11,610) |

|

|

355 |

|

| Interest expense (income), net |

1,952 |

|

|

(967) |

|

|

3,681 |

|

|

(3,163) |

|

| Depreciation and amortization |

7,869 |

|

|

2,679 |

|

|

19,055 |

|

|

7,854 |

|

| Stock-based compensation expense |

20,729 |

|

|

15,257 |

|

|

60,246 |

|

|

43,822 |

|

| Secondary offering costs |

— |

|

|

810 |

|

|

— |

|

|

810 |

|

| Acquisition-related expenses |

247 |

|

|

— |

|

|

3,138 |

|

|

195 |

|

| Loss on impairment of intangible assets |

— |

|

|

— |

|

|

1,655 |

|

|

— |

|

| Adjusted EBITDA |

$ |

15,964 |

|

|

$ |

8,318 |

|

|

$ |

39,954 |

|

|

$ |

16,681 |

|

Investor Relations Contact

Steve Calk

ir@alkami.com

Media Relations Contacts

Marla Pieton

marla.pieton@alkami.com

Valerie Kerner

alkami@fullyvested.com