Document

BRISTOW GROUP REPORTS THIRD QUARTER 2025 RESULTS

Houston, Texas

November 4, 2025

Third Quarter Highlights

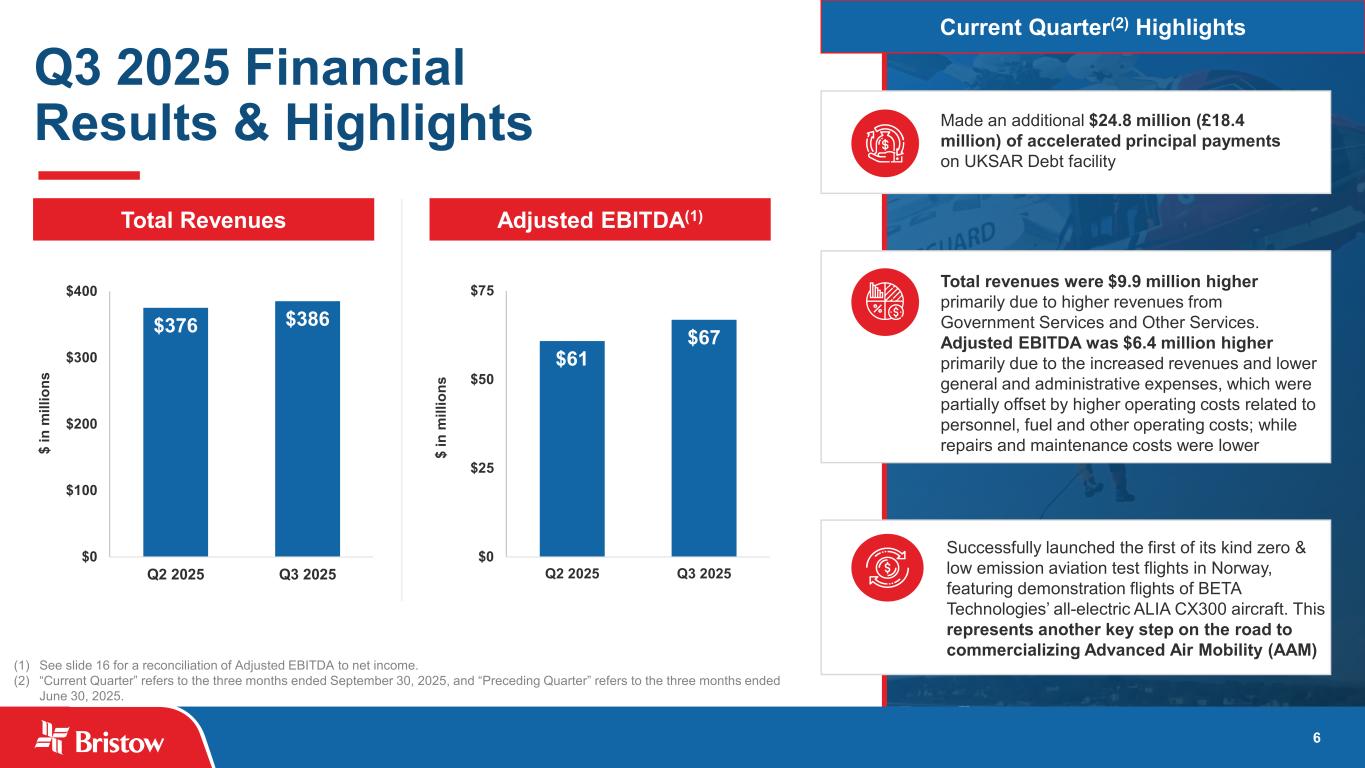

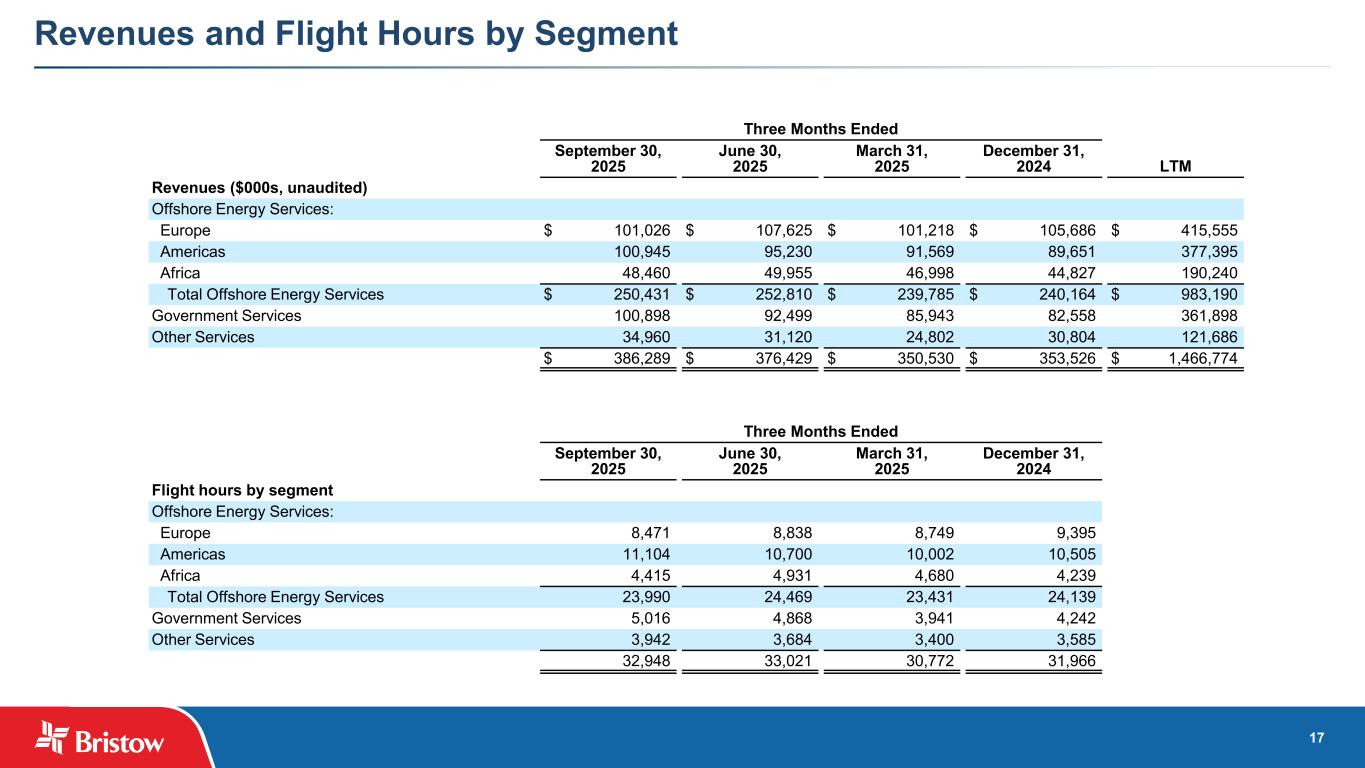

•Total revenues of $386.3 million in Q3 2025 compared to $376.4 million in Q2 2025

•Net income of $51.5 million, or $1.72 per diluted share, in Q3 2025 compared to net income of $31.7 million, or $1.07 per diluted share, in Q2 2025

•Adjusted EBITDA(1) in Q3 2025 was $67.1 million compared to $60.7 million in Q2 2025

•Updated 2025 Adjusted EBITDA outlook range to $240 - $250 million and 2026 Adjusted EBITDA outlook range to $295 - $325 million

FOR IMMEDIATE RELEASE — Bristow Group Inc. (NYSE: VTOL) (“Bristow” or the “Company”) today reported net income attributable to the Company of $51.5 million, or $1.72 per diluted share, for the quarter ended September 30, 2025 (the “Current Quarter”) on total revenues of $386.3 million compared to net income attributable to the Company of $31.7 million, or $1.07 per diluted share, for the quarter ended June 30, 2025 (the “Preceding Quarter”) on total revenues of $376.4 million.

The following table provides select financial highlights for the periods reflected (in thousands, except per share amounts). A reconciliation of net income to EBITDA and Adjusted EBITDA, operating income to Adjusted Operating Income and cash provided by (used in) operating activities to Free Cash Flow and Adjusted Free Cash Flow is included in the “Non-GAAP Financial Measures” section herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

September 30,

2025 |

|

June 30, 2025 |

| Total revenues |

$ |

386,289 |

|

|

$ |

376,429 |

|

| Operating income |

50,535 |

|

|

42,640 |

|

| Net income attributable to Bristow Group Inc. |

51,544 |

|

|

31,748 |

|

| Basic earnings per common share |

1.79 |

|

|

1.10 |

|

| Diluted earnings per common share |

1.72 |

|

|

1.07 |

|

Net cash provided by operating activities |

23,057 |

|

|

99,039 |

|

|

|

|

|

Non-GAAP(1): |

|

|

|

| Adjusted Operating Income |

$ |

62,201 |

|

|

$ |

57,330 |

|

| EBITDA |

67,449 |

|

|

79,568 |

|

| Adjusted EBITDA |

67,097 |

|

|

60,700 |

|

| Free Cash Flow |

20,257 |

|

|

94,507 |

|

| Adjusted Free Cash Flow |

21,365 |

|

|

95,293 |

|

__________________

(1)See definitions of these non-GAAP financial measures and the reconciliation of GAAP to non-GAAP financial measures in the Non-GAAP Financial Measures section further below.

”Bristow continues to have a positive outlook for offshore energy services activity, as deepwater projects are favorably positioned, offering attractive relative returns within the asset portfolios of oil and gas companies,” said Chris Bradshaw, President and CEO of Bristow Group. “While the industry is likely amidst a mid-cycle activity plateau that may persist for much of the next 12 months, the tight supply of offshore helicopters supports a more constructive outlook for our sector relative to some other offshore equipment sectors. We are pleased to report another quarter of strong financial performance in Q3 2025, and we continue to have a robust growth outlook for 2026, as evidenced by expected Adjusted EBITDA growth of approximately 27% year-over-year.“

Sequential Quarter Results

Offshore Energy Services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| ($ in thousands) |

September 30, 2025 |

|

June 30, 2025 |

|

Favorable

(Unfavorable) |

| Revenues |

$ |

250,431 |

|

|

$ |

252,810 |

|

|

$ |

(2,379) |

|

(0.9) |

% |

| Operating income |

42,429 |

|

|

43,595 |

|

|

(1,166) |

|

(2.7) |

% |

| Adjusted Operating Income |

51,236 |

|

|

53,588 |

|

|

(2,352) |

|

(4.4) |

% |

| Operating income margin |

17 |

% |

|

17 |

% |

|

|

|

| Adjusted Operating Income margin |

20 |

% |

|

21 |

% |

|

|

|

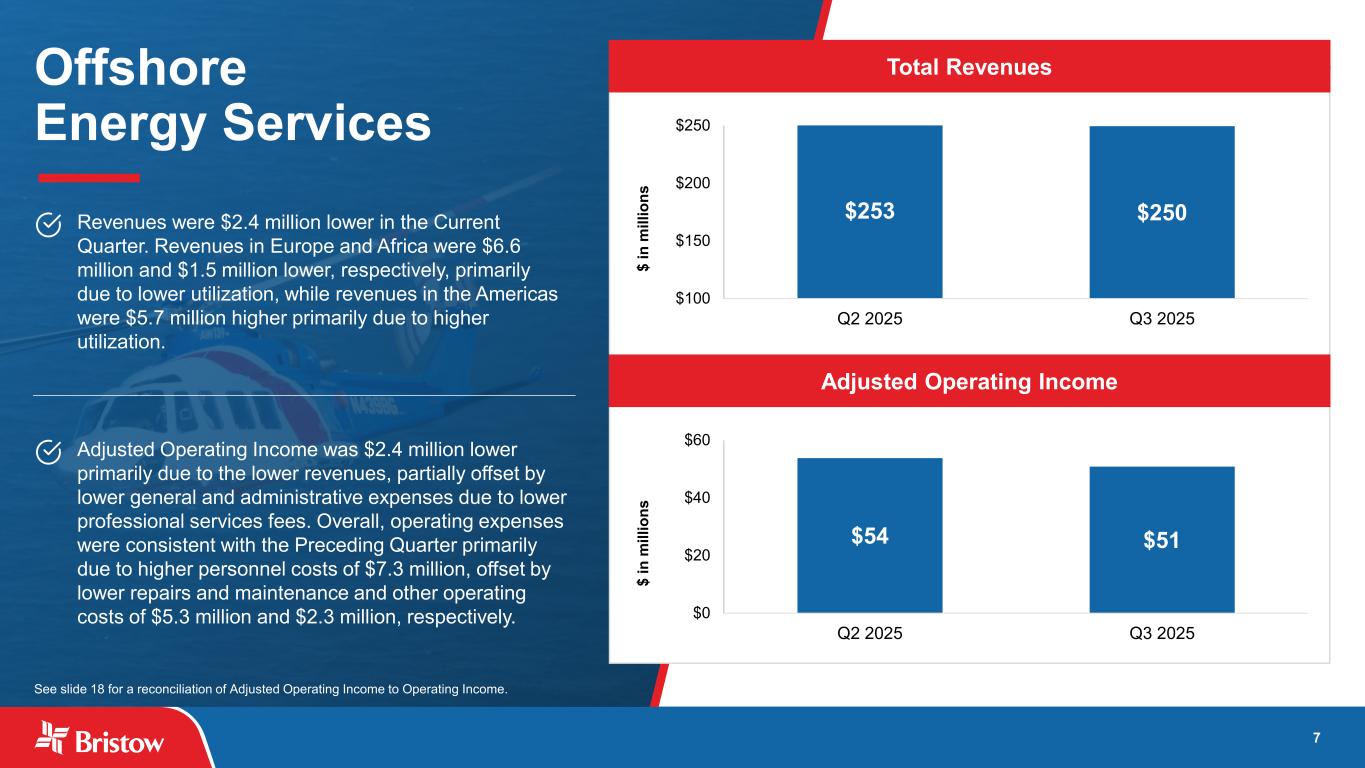

Revenues from Offshore Energy Services were $2.4 million lower in the Current Quarter. Revenues in Europe and Africa were $6.6 million and $1.5 million lower, respectively, primarily due to lower utilization, while revenues in the Americas were $5.7 million higher primarily due to higher utilization. Operating income was $1.2 million lower in the Current Quarter primarily due to the lower revenues, partially offset by lower general and administrative expenses of $1.4 million primarily due to lower professional services fees. Overall operating expenses were consistent with the Preceding Quarter primarily due to higher personnel costs, offset by lower repairs and maintenance and other operating costs. Personnel costs were $7.3 million higher primarily due to the absence of a seasonal personnel cost benefit in Norway of $4.2 million in the Preceding Quarter, higher benefits costs of $1.8 million in Europe and the U.S. in the Current Quarter, and higher overtime costs of $0.8 million in the U.S and Trinidad. Repairs and maintenance costs were $5.3 million lower primarily due to higher vendor credits. Other operating expenses were $2.3 million lower primarily due to lower subcontractor costs of $1.8 million related to activity in Africa and Norway, and lower reimbursable expenses of $1.6 million in Europe, partially offset by higher freight costs of $0.9 million.

Government Services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| ($ in thousands) |

September 30, 2025 |

|

June 30, 2025 |

|

Favorable

(Unfavorable) |

| Revenues |

$ |

100,898 |

|

|

$ |

92,499 |

|

|

$ |

8,399 |

|

9.1 |

% |

| Operating income (loss) |

2,586 |

|

|

(1,912) |

|

|

4,498 |

|

nm |

| Adjusted Operating Income |

10,810 |

|

|

6,036 |

|

|

4,774 |

|

79.1 |

% |

| Operating income (loss) margin |

3 |

% |

|

(2) |

% |

|

|

|

| Adjusted Operating Income margin |

11 |

% |

|

7 |

% |

|

|

|

__________________

nm = Not Meaningful

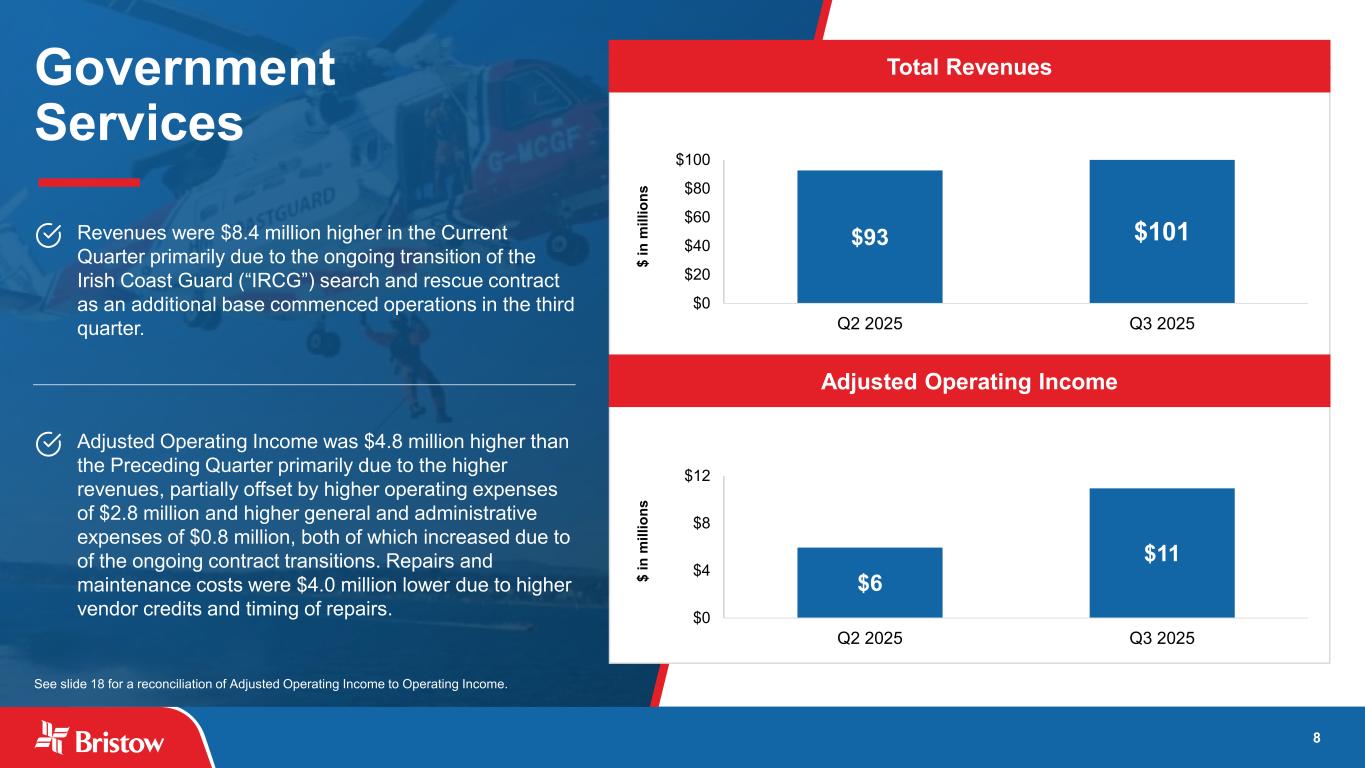

Revenues from Government Services were $8.4 million higher in the Current Quarter primarily due to the ongoing transition of the Irish Coast Guard ("IRCG") contract, as an additional base commenced operations in the third quarter. Operating income was $2.6 million in the Current Quarter compared to an operating loss of $1.9 million in the Preceding Quarter primarily due to the higher revenues, partially offset by higher operating expenses of $2.8 million and higher general and administrative expenses of $0.8 million. The increase in operating expenses was primarily due to higher other operating costs of $4.6 million due to higher subcontractor costs, increased amortization of deferred costs, and higher personnel costs of $2.2 million related to new Government Services contracts, partially offset by lower repairs and maintenance costs of $4.0 million due to higher vendor credits and the timing of repairs.

The increase in general and administrative expenses was primarily due to higher professional services fees and personnel costs related to contract transitions.

Other Services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| ($ in thousands) |

September 30, 2025 |

|

June 30, 2025 |

|

Favorable

(Unfavorable) |

| Revenues |

$ |

34,960 |

|

|

$ |

31,120 |

|

|

$ |

3,840 |

|

12.3 |

% |

| Operating income |

5,463 |

|

|

3,443 |

|

|

2,020 |

|

58.7 |

% |

| Adjusted Operating Income |

8,121 |

|

|

6,188 |

|

|

1,933 |

|

31.2 |

% |

| Operating income margin |

16 |

% |

|

11 |

% |

|

|

|

| Adjusted Operating Income margin |

23 |

% |

|

20 |

% |

|

|

|

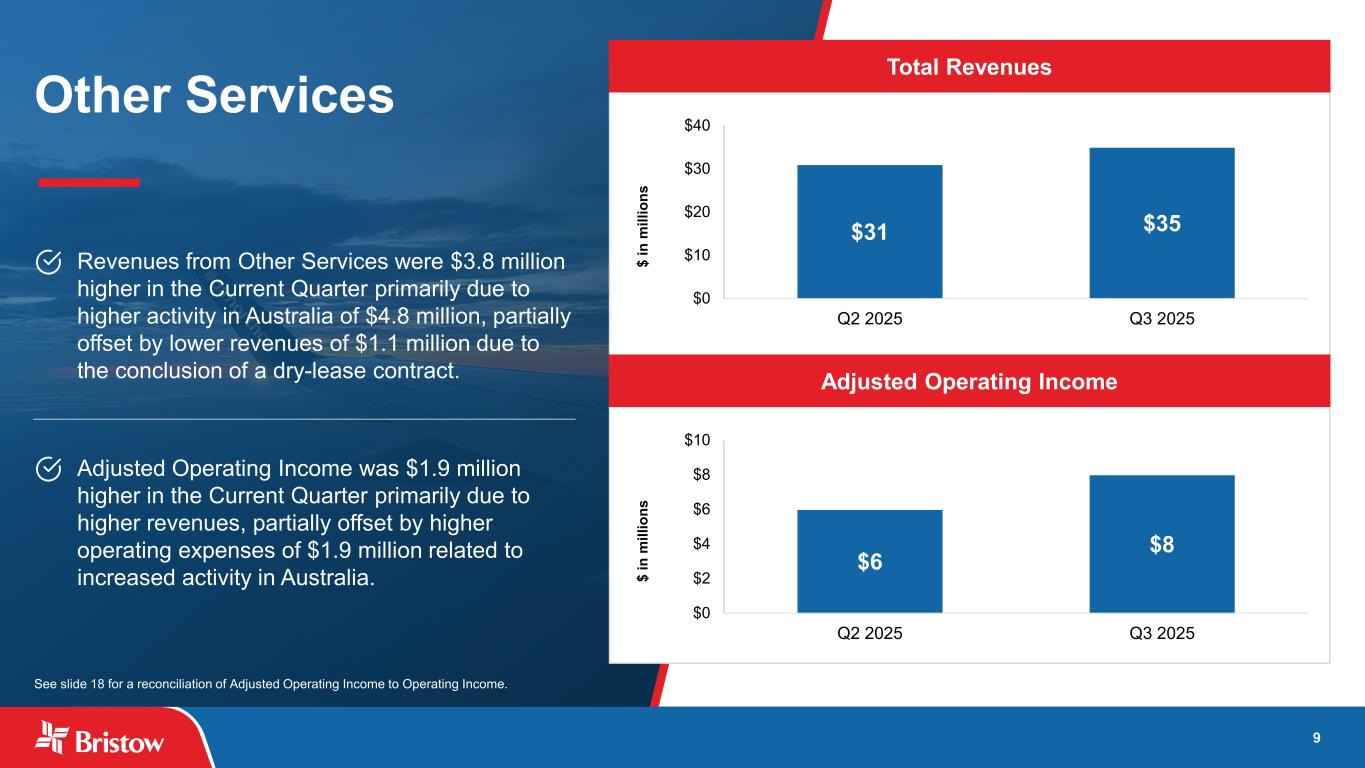

Revenues from Other Services were $3.8 million higher in the Current Quarter primarily due to higher activity in Australia of $4.8 million, partially offset by lower revenues of $1.1 million due to the conclusion of a dry-lease contract. Operating income was $2.0 million higher in the Current Quarter primarily due to the higher revenues, partially offset by higher operating expenses of $1.9 million related to the increased activity in Australia.

Corporate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| ($ in thousands) |

September 30, 2025 |

|

June 30, 2025 |

|

Favorable

(Unfavorable) |

| Corporate: |

|

|

|

|

|

|

| Total expenses |

$ |

8,188 |

|

|

$ |

8,695 |

|

|

$ |

507 |

|

5.8 |

% |

| Gains on disposal of assets |

8,245 |

|

|

6,209 |

|

|

2,036 |

|

32.8 |

% |

| Operating income (loss) |

57 |

|

|

(2,486) |

|

|

2,543 |

|

nm |

|

|

|

|

|

|

|

| Consolidated: |

|

|

|

|

|

|

| Interest income |

$ |

2,262 |

|

|

$ |

2,039 |

|

|

$ |

223 |

|

10.9 |

% |

| Interest expense, net |

(9,962) |

|

|

(10,034) |

|

|

72 |

|

0.7 |

% |

| Other, net |

(3,087) |

|

|

17,577 |

|

|

(20,664) |

|

nm |

| Income tax benefit (expense) |

11,843 |

|

|

(20,443) |

|

|

32,286 |

|

nm |

Operating income was $0.1 million in the Current Quarter compared to an operating loss of $2.5 million in the Preceding Quarter primarily due to increased gains on asset dispositions of $2.0 million and lower general and administrative expenses of $0.5 million. During the Current Quarter, the Company sold or otherwise disposed of two AW139 medium helicopters resulting in net gains of $8.2 million. During the Preceding Quarter, the Company sold or otherwise disposed of two AW139 medium helicopters resulting in net gains of $6.2 million. General and administrative expenses were lower due to decreased personnel costs.

Other expense, net of $3.1 million in the Current Quarter resulted from foreign exchange losses. Other income, net of $17.6 million in the Preceding Quarter primarily resulted from foreign exchange gains.

Income tax benefit was $11.8 million in the Current Quarter compared to income tax expense of $20.4 million in the Preceding Quarter. The income tax benefit and resulting effective tax rate in the Current Quarter were impacted by a valuation allowance released in Australia, the earnings mix of the Company's global operations and higher deductible business interest expenses, partially offset by the recognition of certain deferred tax assets.

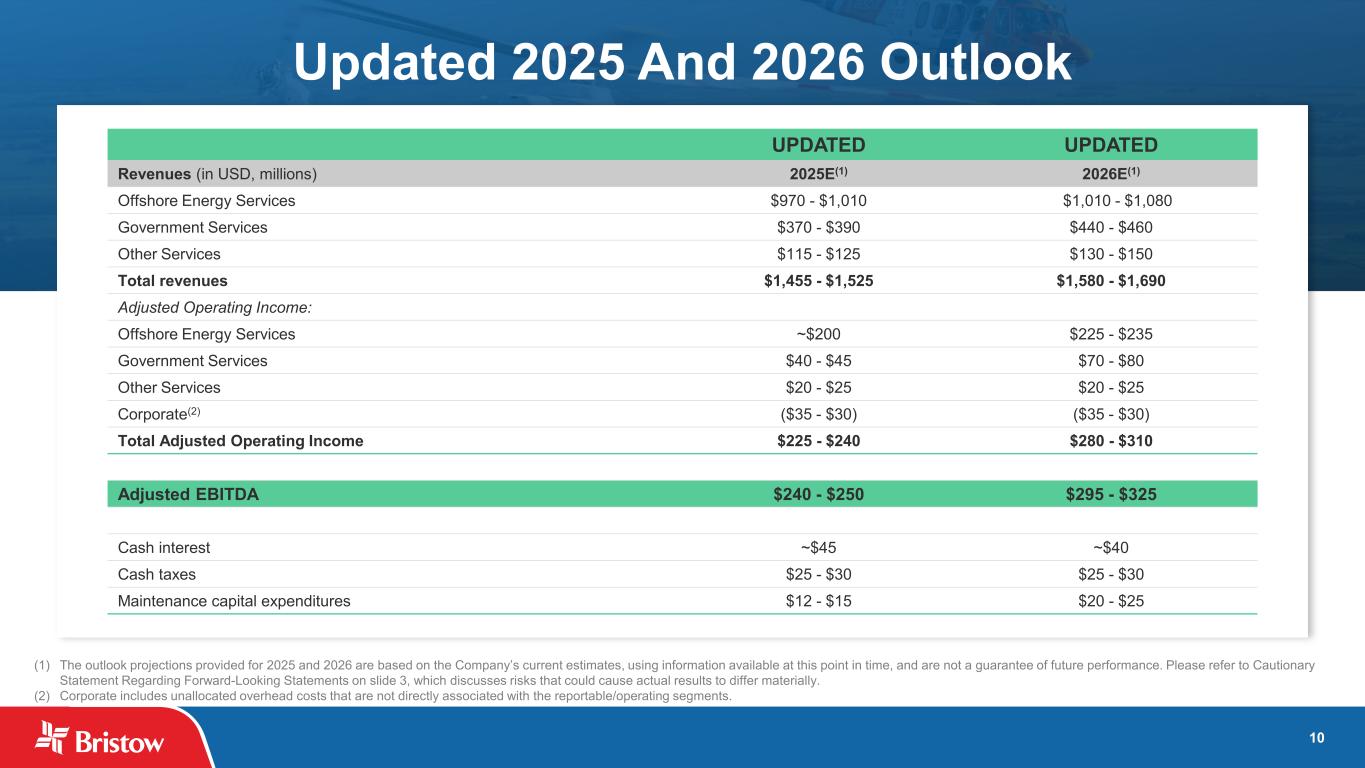

Updated 2025 and 2026 Outlook

Please refer to the section entitled "Forward-Looking Statements Disclosure" below for further discussion regarding the risks and uncertainties as well as other important information regarding Bristow’s guidance. The following guidance contains non-GAAP financial measures. Please read the section entitled “Non-GAAP Financial Measures” for further information.

Select financial outlook for 2025 and 2026 are as follows (in USD, millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

2025E |

|

2026E |

| Revenues: |

|

|

|

| Offshore Energy Services |

$970 - $1,010 |

|

$1,010 - $1,080 |

| Government Services |

$370 - $390 |

|

$440 - $460 |

| Other Services |

$115 - $125 |

|

$130 - $150 |

| Total Revenues |

$1,455 - $1,525 |

|

$1,580 - $1,690 |

|

|

|

|

| Adjusted Operating Income: |

|

|

|

| Offshore Energy Services |

~$200 |

|

$225 - $235 |

| Government Services |

$40 - $45 |

|

$70 - $80 |

| Other Services |

$20 - $25 |

|

$20 - $25 |

| Corporate |

($35 - $30) |

|

($35 - $30) |

|

$225 - $240 |

|

$280 - $310 |

|

|

|

|

| Adjusted EBITDA |

$240 - $250 |

|

$295 - $325 |

|

|

|

|

| Cash interest |

~$45 |

|

~$40 |

| Cash taxes |

$25 - $30 |

|

$25 - $30 |

| Maintenance capital expenditures |

$12 - $15 |

|

$20 - $25 |

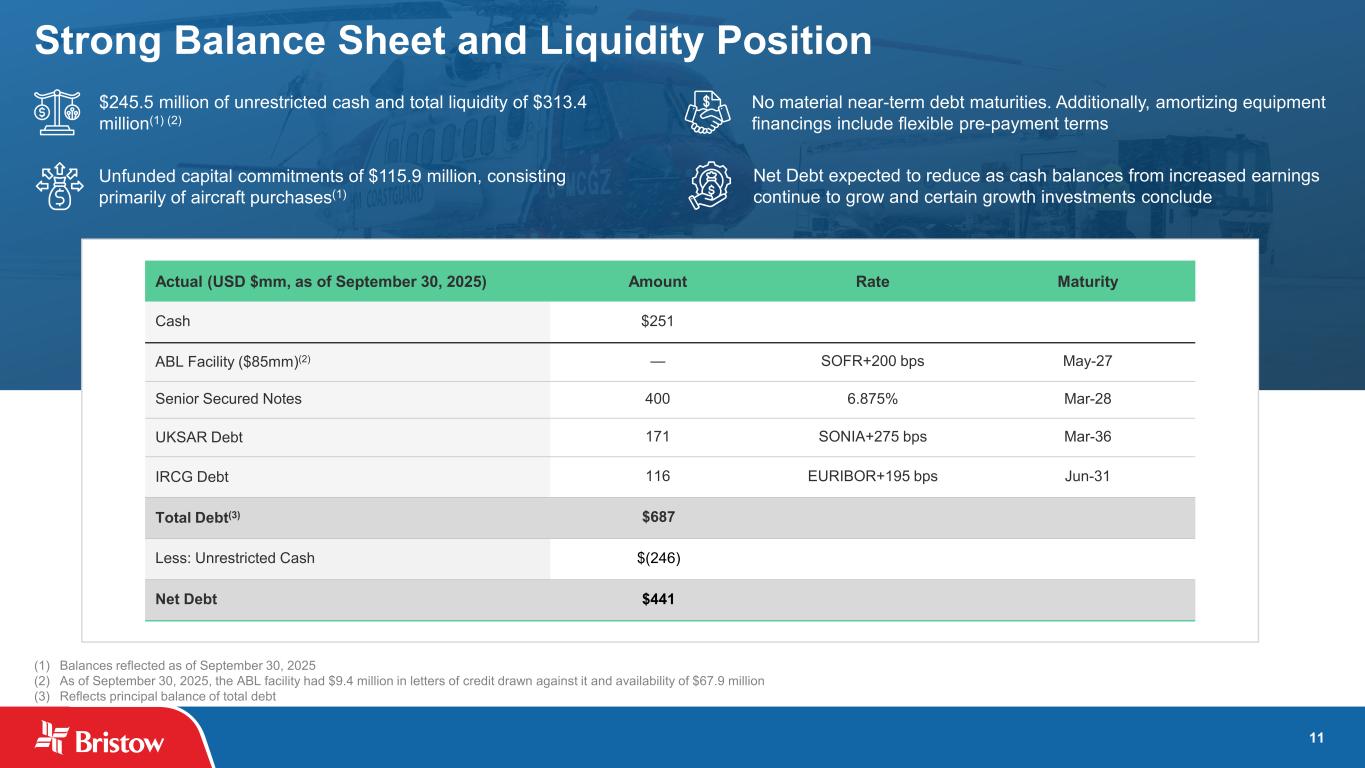

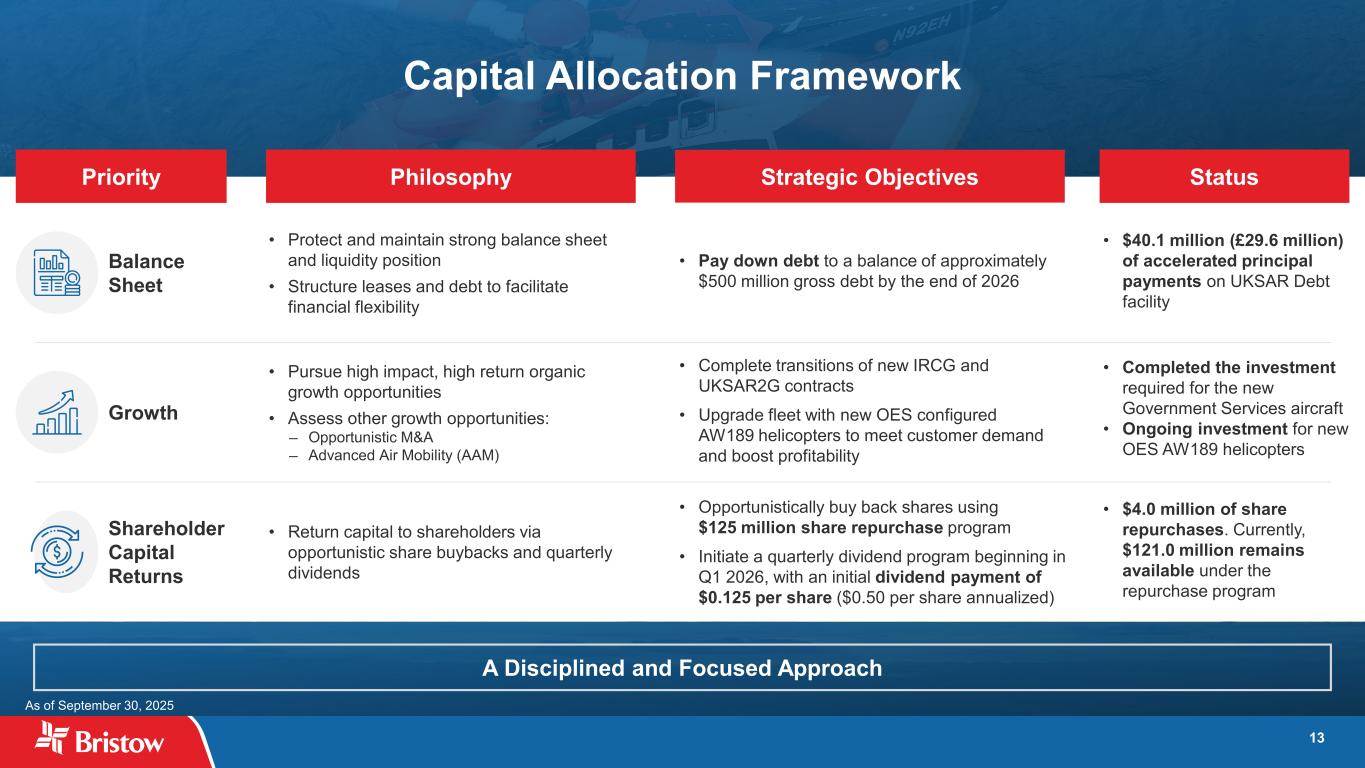

Capital Allocation and Liquidity

Consistent with its capital allocation framework, the Company made an additional $24.8 million (£18.4 million) of accelerated principal payments on its UKSAR Debt facility in the Current Quarter.

In the Current Quarter, purchases of property and equipment were $29.2 million, of which $2.8 million were maintenance capital expenditures, and cash proceeds from the sale of assets were $28.6 million. In the Preceding Quarter, purchases of property and equipment were $31.6 million, of which $4.5 million were maintenance capital expenditures, and cash proceeds from the sale of assets were $24.1 million.

As of September 30, 2025, the Company had $245.5 million of unrestricted cash and $67.9 million of remaining availability under its asset-based revolving credit facility (the “ABL Facility”) for total liquidity of $313.4 million. Borrowings under the ABL Facility are subject to certain conditions and requirements.

Conference Call

The Company’s management will conduct a conference call starting at 10:00 a.m. ET (9:00 a.m. CT) on Wednesday, November 5, 2025, to review results for the third quarter ended September 30, 2025. The conference call can be accessed using the following link:

Link to Access Earnings Call: https://www.veracast.com/webcasts/bristow/webcasts/VTOL3Q25.cfm

A replay will be available through November 26, 2025 by using the link above. A replay will also be available on the Company’s website at www.bristowgroup.com shortly after the call and will be accessible through November 26, 2025. The accompanying investor presentation will be available on November 5, 2025, on Bristow’s website at www.bristowgroup.com.

For additional information concerning Bristow, contact Jennifer Whalen at InvestorRelations@bristowgroup.com, (713) 369-4636 or visit Bristow Group’s website at https://ir.bristowgroup.com/.

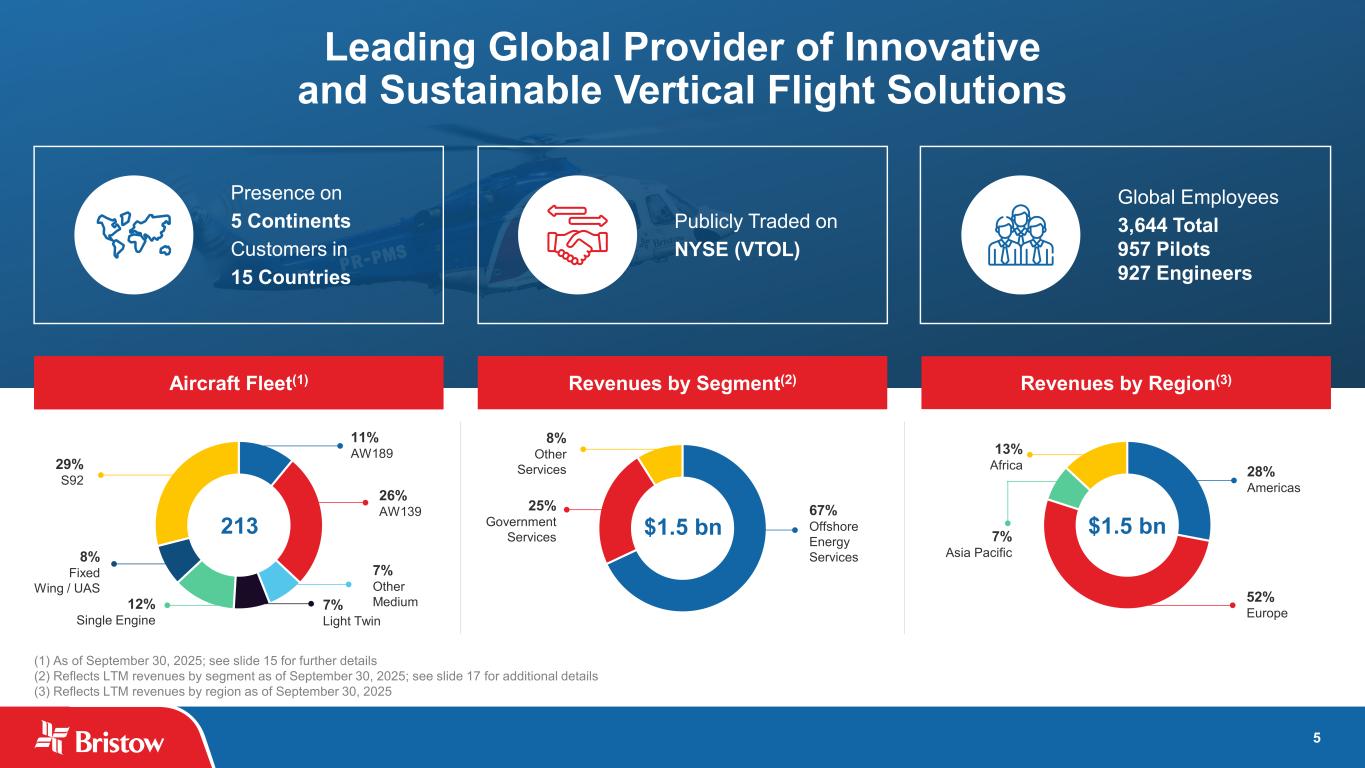

About Bristow Group

Bristow Group Inc. is the leading global provider of innovative and sustainable vertical flight solutions. Bristow primarily provides aviation services to a broad base of offshore energy companies and government entities. Our aviation services include personnel transportation, search and rescue (“SAR”), medevac, fixed wing transportation, unmanned systems and ad-hoc helicopter services. Our business is comprised of three operating segments: Offshore Energy Services, Government Services and Other Services. Our energy customers charter our helicopters primarily to transport personnel to, from and between onshore bases and offshore production platforms, drilling rigs and other installations. Our government customers primarily outsource SAR activities whereby we operate specialized helicopters and provide highly trained personnel. Our other services include fixed wing transportation services through a regional airline in Australia and dry-leasing aircraft to third-party operators in support of other industries and geographic markets.

Bristow currently has customers in Australia, Brazil, Canada, Chile, the Dutch Caribbean, the Falkland Islands, Ireland, the Netherlands, Nigeria, Norway, Spain, Suriname, Trinidad, the United Kingdom (“UK”) and the United States (“U.S.”)

Forward-Looking Statements Disclosure

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements about our future business, strategy, operations, capabilities and results; financial projections; plans and objectives of our management; expected actions by us and by third parties, including our customers, competitors, vendors and regulators; and other matters. Some of the forward-looking statements can be identified by the use of words such as “believes," “belief," “forecasts," “expects," “plans," “anticipates," “intends," “projects," “estimates," “may," “might," “will," “would," “could," “should” or other similar words; however, all statements in this press release, other than statements of historical fact or historical financial results, are forward-looking statements. Our forward-looking statements reflect our views and assumptions on the date hereof regarding future events and operating performance. We believe that they are reasonable, but they involve significant known and unknown risks, uncertainties, assumptions and other factors, many of which may be beyond our control, that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks, uncertainties and factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K, and in particular, the risks discussed in Part I, Item 1A, “Risk Factors” of such report and those discussed in other documents we file with the Securities and Exchange Commission (the “SEC”). Accordingly, you should not put undue reliance on any forward-looking statements.

You should consider the following key factors when evaluating these forward-looking statements: the impact of supply chain disruptions and inflation and our ability to recoup rising costs in the rates we charge to our customers; our reliance on a limited number of helicopter manufacturers and suppliers and the impact of a shortfall in availability of aircraft components and parts required for maintenance and repairs of our helicopters, including significant delays in the delivery of parts for our S92 and AW189 fleet and aircraft in general; our reliance on a limited number of customers and the reduction of our customer base as a result of consolidation and/or the energy transition; public health crises, such as pandemics and epidemics, and any related government policies and actions; our inability to execute our business strategy for diversification efforts related to government services and advanced air mobility; the potential effects of the ongoing U.S. government shutdown on our Government Services business; the potential for cyberattacks or security breaches that could disrupt operations, compromise confidential or sensitive information, damage reputation, expose to legal liability, or cause financial losses; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries OPEC and other producing countries; fluctuations in the demand for our services; the possibility of significant changes in foreign exchange rates and controls; potential effects of increased competition and the introduction of alternative modes of transportation and solutions; the possibility that portions of our fleet may be grounded for extended periods of time or indefinitely (including due to severe weather events); the possibility of political instability, civil unrest, war or acts of terrorism in any of the countries where we operate or elsewhere; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the existence of operating risks inherent in our business, including the possibility of declining safety performance; labor issues, including our inability to negotiate acceptable collective bargaining or union agreements with employees covered by such agreements; the possibility of changes in tax, environmental, trade, immigration and other laws and regulations and policies, including, without limitation, tariffs and actions of the governments that impact oil and gas operations, favor renewable energy projects or address climate change; any failure to effectively manage, and receive anticipated returns from, acquisitions, divestitures, investments, joint ventures and other portfolio actions; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; general economic conditions, including interest rates or uncertainty in the capital and credit markets; disruptions in global trade, including as a result of tariffs, trade restrictions, retaliatory trade measures or the effect of such actions on trading relationships between the United States and other countries; the possibility that reductions in spending on aviation services by governmental agencies where we are seeking contracts could adversely affect or lead to modifications of the procurement process or that such reductions in spending could adversely affect search and rescue (“SAR”) contract terms or otherwise delay service or the receipt of payments under such contracts; and the effectiveness of our environmental, social and governance initiatives.

The above description of risks and uncertainties is by no means all-inclusive, but is designed to highlight what we believe are important factors to consider. All forward-looking statements in this press release are qualified by these cautionary statements and are only made as of the date thereof. The forward-looking statements in this press release should be evaluated together with the many uncertainties that affect our businesses, particularly those discussed in greater detail in Part I, Item 1A, “Risk Factors” and Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Annual Report on Form 10-K and Part I, Item 2, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Part II, Item 1A, "Risk Factors" of the Company’s subsequent Quarterly Reports on Form 10-Q. We disclaim any obligation or undertaking, other than as required by law, to provide any updates or revisions to any forward-looking statement to reflect any change in our expectations or any change in events, conditions or circumstances on which the forward-looking statement is based, whether as a result of new information, future events or otherwise.

BRISTOW GROUP INC.

Condensed Consolidated Statements of Operations

(unaudited, in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Favorable/ (Unfavorable) |

| |

September 30,

2025 |

|

June 30,

2025 |

|

| Total revenues |

$ |

386,289 |

|

|

$ |

376,429 |

|

|

$ |

9,860 |

|

| Costs and expenses: |

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

| Personnel |

98,581 |

|

|

88,729 |

|

|

(9,852) |

|

| Repairs and maintenance |

55,537 |

|

|

64,788 |

|

|

9,251 |

|

| Insurance |

5,778 |

|

|

6,149 |

|

|

371 |

|

| Fuel |

21,396 |

|

|

20,399 |

|

|

(997) |

|

| Leased-in equipment |

26,714 |

|

|

26,515 |

|

|

(199) |

|

| Other |

75,047 |

|

|

71,911 |

|

|

(3,136) |

|

| Total operating expenses |

283,053 |

|

|

278,491 |

|

|

(4,562) |

|

| General and administrative expenses |

43,205 |

|

|

44,375 |

|

|

1,170 |

|

|

|

|

|

|

|

| Depreciation and amortization expense |

17,739 |

|

|

17,312 |

|

|

(427) |

|

| Total costs and expenses |

343,997 |

|

|

340,178 |

|

|

(3,819) |

|

| Gains on disposal of assets |

8,245 |

|

|

6,209 |

|

|

2,036 |

|

| Earnings (losses) from unconsolidated affiliates |

(2) |

|

|

180 |

|

|

(182) |

|

| Operating income |

50,535 |

|

|

42,640 |

|

|

7,895 |

|

| Interest income |

2,262 |

|

|

2,039 |

|

|

223 |

|

| Interest expense, net |

(9,962) |

|

|

(10,034) |

|

|

72 |

|

|

|

|

|

|

|

| Other, net |

(3,087) |

|

|

17,577 |

|

|

(20,664) |

|

| Total other income (expense), net |

(10,787) |

|

|

9,582 |

|

|

(20,369) |

|

| Income before income taxes |

39,748 |

|

|

52,222 |

|

|

(12,474) |

|

| Income tax benefit (expense) |

11,843 |

|

|

(20,443) |

|

|

32,286 |

|

| Net income |

51,591 |

|

|

31,779 |

|

|

19,812 |

|

| Net income attributable to noncontrolling interests |

(47) |

|

|

(31) |

|

|

(16) |

|

| Net income attributable to Bristow Group Inc. |

$ |

51,544 |

|

|

$ |

31,748 |

|

|

$ |

19,796 |

|

|

|

|

|

|

|

| Basic earnings per common share |

$ |

1.79 |

|

|

$ |

1.10 |

|

|

|

| Diluted earnings per common share |

$ |

1.72 |

|

|

$ |

1.07 |

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding, basic |

28,867 |

|

|

28,824 |

|

|

|

| Weighted average common shares outstanding, diluted |

29,932 |

|

|

29,788 |

|

|

|

|

|

|

|

|

|

| Adjusted Operating Income |

$ |

62,201 |

|

|

$ |

57,330 |

|

|

$ |

4,871 |

|

| EBITDA |

$ |

67,449 |

|

|

$ |

79,568 |

|

|

$ |

(12,119) |

|

| Adjusted EBITDA |

$ |

67,097 |

|

|

$ |

60,700 |

|

|

$ |

6,397 |

|

BRISTOW GROUP INC.

REVENUES BY SEGMENT

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

September 30,

2025 |

|

June 30, 2025 |

|

Favorable (Unfavorable) |

| Offshore Energy Services: |

|

|

|

|

|

|

| Europe |

$ |

101,026 |

|

|

$ |

107,625 |

|

|

$ |

(6,599) |

|

(6.1) |

% |

| Americas |

100,945 |

|

|

95,230 |

|

|

5,715 |

|

6.0 |

% |

| Africa |

48,460 |

|

|

49,955 |

|

|

(1,495) |

|

(3.0) |

% |

| Total Offshore Energy Services |

$ |

250,431 |

|

|

$ |

252,810 |

|

|

$ |

(2,379) |

|

(0.9) |

% |

| Government Services |

100,898 |

|

|

92,499 |

|

|

8,399 |

|

9.1 |

% |

| Other Services |

34,960 |

|

|

31,120 |

|

|

3,840 |

|

12.3 |

% |

|

$ |

386,289 |

|

|

$ |

376,429 |

|

|

$ |

9,860 |

|

2.6 |

% |

FLIGHT HOURS BY SEGMENT

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

September 30,

2025 |

|

June 30, 2025 |

|

Favorable (Unfavorable) |

| Offshore Energy Services: |

|

|

|

|

|

|

| Europe |

8,471 |

|

|

8,838 |

|

|

(367) |

|

(4.2) |

% |

| Americas |

11,104 |

|

|

10,700 |

|

|

404 |

|

3.8 |

% |

| Africa |

4,415 |

|

|

4,931 |

|

|

(516) |

|

(10.5) |

% |

| Total Offshore Energy Services |

23,990 |

|

|

24,469 |

|

|

(479) |

|

(2.0) |

% |

| Government Services |

5,016 |

|

|

4,868 |

|

|

148 |

|

3.0 |

% |

| Other Services |

3,942 |

|

|

3,684 |

|

|

258 |

|

7.0 |

% |

|

32,948 |

|

|

33,021 |

|

|

(73) |

|

(0.2) |

% |

BRISTOW GROUP INC.

Third Quarter Segment Statements of Operations

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offshore Energy Services |

|

Government Services |

|

Other Services |

|

Corporate |

|

Consolidated |

| Three Months Ended September 30, 2025 |

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

250,431 |

|

|

$ |

100,898 |

|

|

$ |

34,960 |

|

|

$ |

— |

|

|

$ |

386,289 |

|

| Less: |

|

|

|

|

|

|

|

|

|

| Personnel |

62,304 |

|

|

29,507 |

|

|

6,770 |

|

|

— |

|

|

98,581 |

|

| Repairs and maintenance |

42,777 |

|

|

9,365 |

|

|

3,395 |

|

|

— |

|

|

55,537 |

|

| Insurance |

3,486 |

|

|

1,950 |

|

|

342 |

|

|

— |

|

|

5,778 |

|

| Fuel |

13,162 |

|

|

2,794 |

|

|

5,440 |

|

|

— |

|

|

21,396 |

|

| Leased-in equipment |

15,446 |

|

|

9,572 |

|

|

1,696 |

|

|

— |

|

|

26,714 |

|

| Other segment costs |

41,325 |

|

|

26,271 |

|

|

7,451 |

|

|

— |

|

|

75,047 |

|

| Total operating expenses |

178,500 |

|

|

79,459 |

|

|

25,094 |

|

|

— |

|

|

283,053 |

|

| General and administrative expenses |

22,451 |

|

|

11,007 |

|

|

1,781 |

|

|

7,966 |

|

|

43,205 |

|

| Depreciation and amortization expense |

7,049 |

|

|

7,846 |

|

|

2,622 |

|

|

222 |

|

|

17,739 |

|

| Total costs and expenses |

208,000 |

|

|

98,312 |

|

|

29,497 |

|

|

8,188 |

|

|

343,997 |

|

| Gains on disposal of assets |

— |

|

|

— |

|

|

— |

|

|

8,245 |

|

|

8,245 |

|

| Losses from unconsolidated affiliates |

(2) |

|

|

— |

|

|

— |

|

|

— |

|

|

(2) |

|

| Operating income (loss) |

$ |

42,429 |

|

|

$ |

2,586 |

|

|

$ |

5,463 |

|

|

$ |

57 |

|

|

$ |

50,535 |

|

Non-GAAP(1): |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

7,049 |

|

|

7,846 |

|

|

2,622 |

|

|

222 |

|

|

17,739 |

|

| PBH amortization |

1,758 |

|

|

378 |

|

|

36 |

|

|

— |

|

|

2,172 |

|

| Gains on disposal of assets |

— |

|

|

— |

|

|

— |

|

|

(8,245) |

|

|

(8,245) |

|

| Adjusted Operating Income (Loss) |

$ |

51,236 |

|

|

$ |

10,810 |

|

|

$ |

8,121 |

|

|

$ |

(7,966) |

|

|

$ |

62,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offshore Energy Services |

|

Government Services |

|

Other Services |

|

Corporate |

|

Consolidated |

| Three Months Ended June 30, 2025 |

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

252,810 |

|

|

$ |

92,499 |

|

|

$ |

31,120 |

|

|

$ |

— |

|

|

$ |

376,429 |

|

| Less: |

|

|

|

|

|

|

|

|

|

| Personnel |

55,047 |

|

|

27,271 |

|

|

6,411 |

|

|

— |

|

|

88,729 |

|

| Repairs and maintenance |

48,078 |

|

|

13,369 |

|

|

3,341 |

|

|

— |

|

|

64,788 |

|

| Insurance |

3,824 |

|

|

1,948 |

|

|

377 |

|

|

— |

|

|

6,149 |

|

| Fuel |

12,865 |

|

|

2,681 |

|

|

4,853 |

|

|

— |

|

|

20,399 |

|

| Leased-in equipment |

15,204 |

|

|

9,699 |

|

|

1,612 |

|

|

— |

|

|

26,515 |

|

| Other segment costs |

43,640 |

|

|

21,717 |

|

|

6,554 |

|

|

— |

|

|

71,911 |

|

| Total operating expenses |

178,658 |

|

|

76,685 |

|

|

23,148 |

|

|

— |

|

|

278,491 |

|

| General and administrative expenses |

23,813 |

|

|

10,230 |

|

|

1,850 |

|

|

8,482 |

|

|

44,375 |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

6,924 |

|

|

7,496 |

|

|

2,679 |

|

|

213 |

|

|

17,312 |

|

| Total costs and expenses |

209,395 |

|

|

94,411 |

|

|

27,677 |

|

|

8,695 |

|

|

340,178 |

|

| Gains on disposal of assets |

— |

|

|

— |

|

|

— |

|

|

6,209 |

|

|

6,209 |

|

| Earnings from unconsolidated affiliates |

180 |

|

|

— |

|

|

— |

|

|

— |

|

|

180 |

|

| Operating income (loss) |

$ |

43,595 |

|

|

$ |

(1,912) |

|

|

$ |

3,443 |

|

|

$ |

(2,486) |

|

$ |

— |

|

$ |

42,640 |

|

Non-GAAP(1): |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

6,924 |

|

|

7,496 |

|

|

2,679 |

|

|

213 |

|

|

17,312 |

|

| PBH amortization |

3,069 |

|

|

452 |

|

|

66 |

|

|

— |

|

|

3,587 |

|

| Gains on disposal of assets |

— |

|

|

— |

|

|

— |

|

|

(6,209) |

|

|

(6,209) |

|

| Adjusted Operating Income (Loss) |

$ |

53,588 |

|

|

$ |

6,036 |

|

|

$ |

6,188 |

|

|

$ |

(8,482) |

|

|

$ |

57,330 |

|

__________________

(1)See definitions of these non-GAAP financial measures and the reconciliation of GAAP to non-GAAP financial measures in the Non-GAAP Financial Measures section further below.

BRISTOW GROUP INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

December 31,

2024 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

250,705 |

|

|

$ |

251,281 |

|

| Accounts receivable, net |

233,639 |

|

|

211,590 |

|

| Inventories |

135,379 |

|

|

114,509 |

|

|

|

|

|

| Prepaid expenses and other current assets |

58,619 |

|

|

42,078 |

|

| Total current assets |

678,342 |

|

|

619,458 |

|

| Property and equipment, net |

1,145,399 |

|

|

1,076,221 |

|

| Investment in unconsolidated affiliates |

23,304 |

|

|

22,424 |

|

| Right-of-use assets |

251,371 |

|

|

264,270 |

|

| Other assets |

171,336 |

|

|

142,873 |

|

| Total assets |

$ |

2,269,752 |

|

|

$ |

2,125,246 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

90,838 |

|

|

$ |

83,462 |

|

| Deferred revenue |

26,001 |

|

|

15,186 |

|

| Current portion of operating lease liabilities |

80,118 |

|

|

78,359 |

|

| Accrued liabilities |

136,199 |

|

|

130,279 |

|

| Current maturities of long-term debt |

22,147 |

|

|

18,614 |

|

| Total current liabilities |

355,303 |

|

|

325,900 |

|

| Long-term debt, less current maturities |

652,807 |

|

|

671,169 |

|

| Other liabilities and deferred credits |

28,150 |

|

|

8,937 |

|

| Deferred taxes |

27,806 |

|

|

39,019 |

|

| Long-term operating lease liabilities |

169,537 |

|

|

188,949 |

|

| Total liabilities |

1,233,603 |

|

|

1,233,974 |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

| Common stock |

321 |

|

|

315 |

|

| Additional paid-in capital |

756,161 |

|

|

742,072 |

|

| Retained earnings |

423,316 |

|

|

312,765 |

|

| Treasury stock, at cost |

(78,915) |

|

|

(69,776) |

|

| Accumulated other comprehensive loss |

(64,399) |

|

|

(93,669) |

|

| Total Bristow Group Inc. stockholders’ equity |

1,036,484 |

|

|

891,707 |

|

| Noncontrolling interests |

(335) |

|

|

(435) |

|

| Total stockholders’ equity |

1,036,149 |

|

|

891,272 |

|

| Total liabilities and stockholders’ equity |

$ |

2,269,752 |

|

|

$ |

2,125,246 |

|

Non-GAAP Financial Measures

The Company’s management uses EBITDA, Adjusted EBITDA and Adjusted Operating Income to assess the performance and operating results of its business. Each of these measures, as well as Free Cash Flow and Adjusted Free Cash Flow, each as detailed below, are non-GAAP measures, have limitations, and are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in the Company's financial statements prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) (including the notes), included in the Company's filings with the SEC and posted on the Company's website.

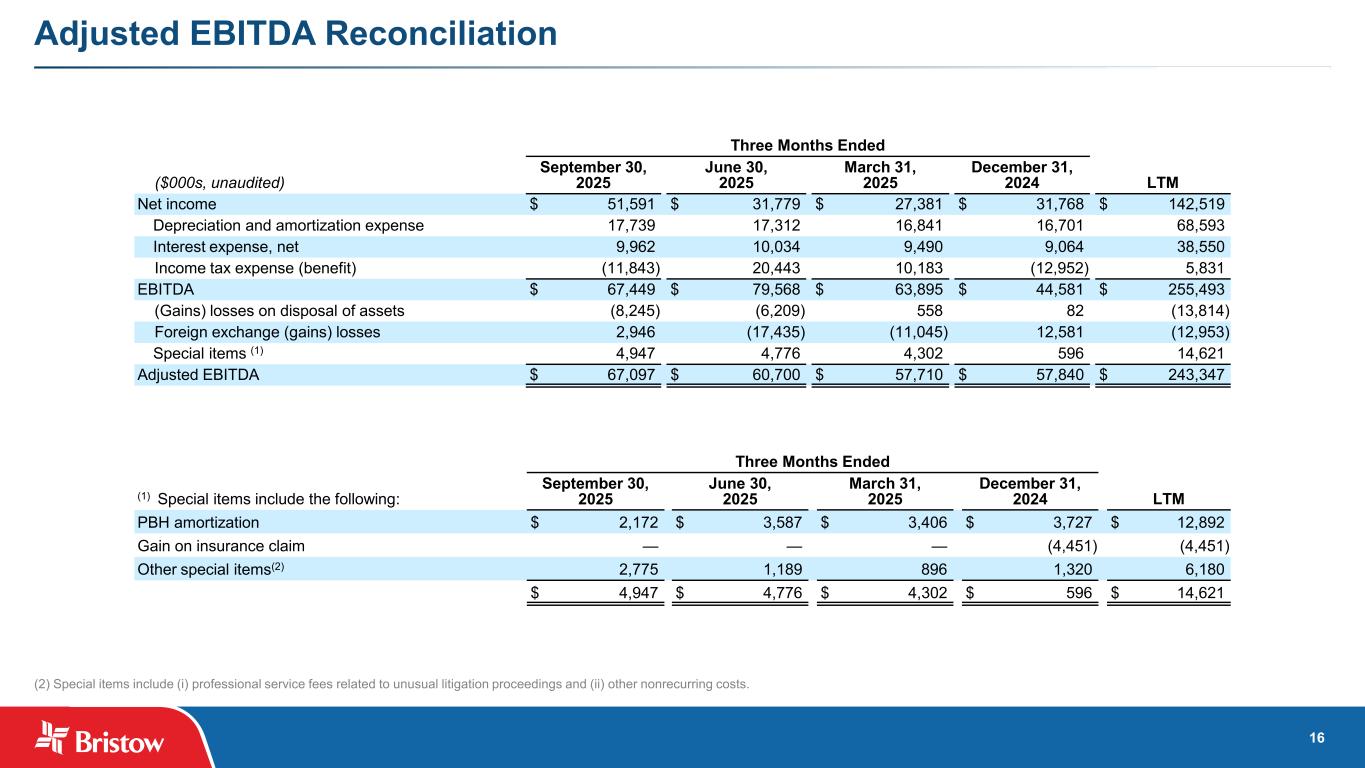

EBITDA and Adjusted EBITDA

EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for non-cash gains and losses on the sale of assets, non-cash foreign exchange gains (losses) related to the revaluation of certain balance sheet items, and certain special items that occurred during the reported period, such as the amortization of PBH maintenance agreements that are non-cash within the period, gains on insurance claims, non-cash nonrecurring insurance adjustments and other special items which include professional service fees related to unusual litigation proceedings and other nonrecurring costs related to strategic activities. The professional services fees are primarily attorneys’ fees related to litigation and arbitration matters that the Company is pursuing (where no gain contingency has been recorded or identified) that are unusual in nature and outside of the normal course of the Company’s continuing business operations. The other nonrecurring costs related to strategic activities are costs associated with financing transactions and proposed mergers and acquisitions (“M&A”) transactions. These special items are related to various pursuits that are not individually material to the Company and, as such, are aggregated for presentation. The Company views these matters and their related financial impacts on the Company’s operating performance as extraordinary and not reflective of the operational performance of the Company’s core business activities. In addition, the same costs are not reasonably likely to recur within two years nor have the same charges or gains occurred within the prior two years. The Company includes EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of its operating performance. Management believes that the use of EBITDA and Adjusted EBITDA is meaningful to investors because it provides information with respect to the Company's ability to meet its future debt service, capital expenditures and working capital requirements and the financial performance of the Company's assets without regard to financing methods, capital structure or historical cost basis. Neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP. Accordingly, they should not be used as an indicator of, or an alternative to, net income the most directly comparable GAAP measure, as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management’s discretionary use, as they do not consider certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies.

The following tables provide a reconciliation of net income, the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA (unaudited, in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

|

LTM |

| Net income |

$ |

51,591 |

|

|

$ |

31,779 |

|

|

$ |

27,381 |

|

|

$ |

31,768 |

|

|

$ |

142,519 |

|

| Depreciation and amortization expense |

17,739 |

|

|

17,312 |

|

|

16,841 |

|

|

16,701 |

|

|

68,593 |

|

| Interest expense, net |

9,962 |

|

|

10,034 |

|

|

9,490 |

|

|

9,064 |

|

|

38,550 |

|

| Income tax expense (benefit) |

(11,843) |

|

|

20,443 |

|

|

10,183 |

|

|

(12,952) |

|

|

5,831 |

|

| EBITDA |

$ |

67,449 |

|

|

$ |

79,568 |

|

|

$ |

63,895 |

|

|

$ |

44,581 |

|

|

$ |

255,493 |

|

| (Gains) losses on disposal of assets |

(8,245) |

|

|

(6,209) |

|

|

558 |

|

|

82 |

|

|

(13,814) |

|

| Foreign exchange (gains) losses |

2,946 |

|

|

(17,435) |

|

|

(11,045) |

|

|

12,581 |

|

|

(12,953) |

|

Special items(1) |

4,947 |

|

|

4,776 |

|

|

4,302 |

|

|

596 |

|

|

14,621 |

|

| Adjusted EBITDA |

$ |

67,097 |

|

|

$ |

60,700 |

|

|

$ |

57,710 |

|

|

$ |

57,840 |

|

|

$ |

243,347 |

|

(1) Special items include the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

|

LTM |

| PBH amortization |

$ |

2,172 |

|

|

$ |

3,587 |

|

|

$ |

3,406 |

|

|

$ |

3,727 |

|

|

$ |

12,892 |

|

|

|

|

|

|

|

|

|

|

|

| Gain on insurance claim |

— |

|

|

— |

|

|

— |

|

|

(4,451) |

|

|

(4,451) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other special items |

2,775 |

|

|

1,189 |

|

|

896 |

|

|

1,320 |

|

|

6,180 |

|

|

$ |

4,947 |

|

|

$ |

4,776 |

|

|

$ |

4,302 |

|

|

$ |

596 |

|

|

$ |

14,621 |

|

The Company is unable to provide a reconciliation of projected Adjusted EBITDA (non-GAAP) for the outlook periods included in this release to projected net income (GAAP) for the same periods because components of the calculation are inherently unpredictable. The inability to forecast certain components of the calculation would significantly affect the accuracy of the reconciliation. Additionally, the Company does not provide guidance on the items used to reconcile projected Adjusted EBITDA due to the uncertainty regarding timing and estimates of such items. Therefore, the Company does not present a reconciliation of projected Adjusted EBITDA (non-GAAP) to net income (GAAP) for the outlook periods.

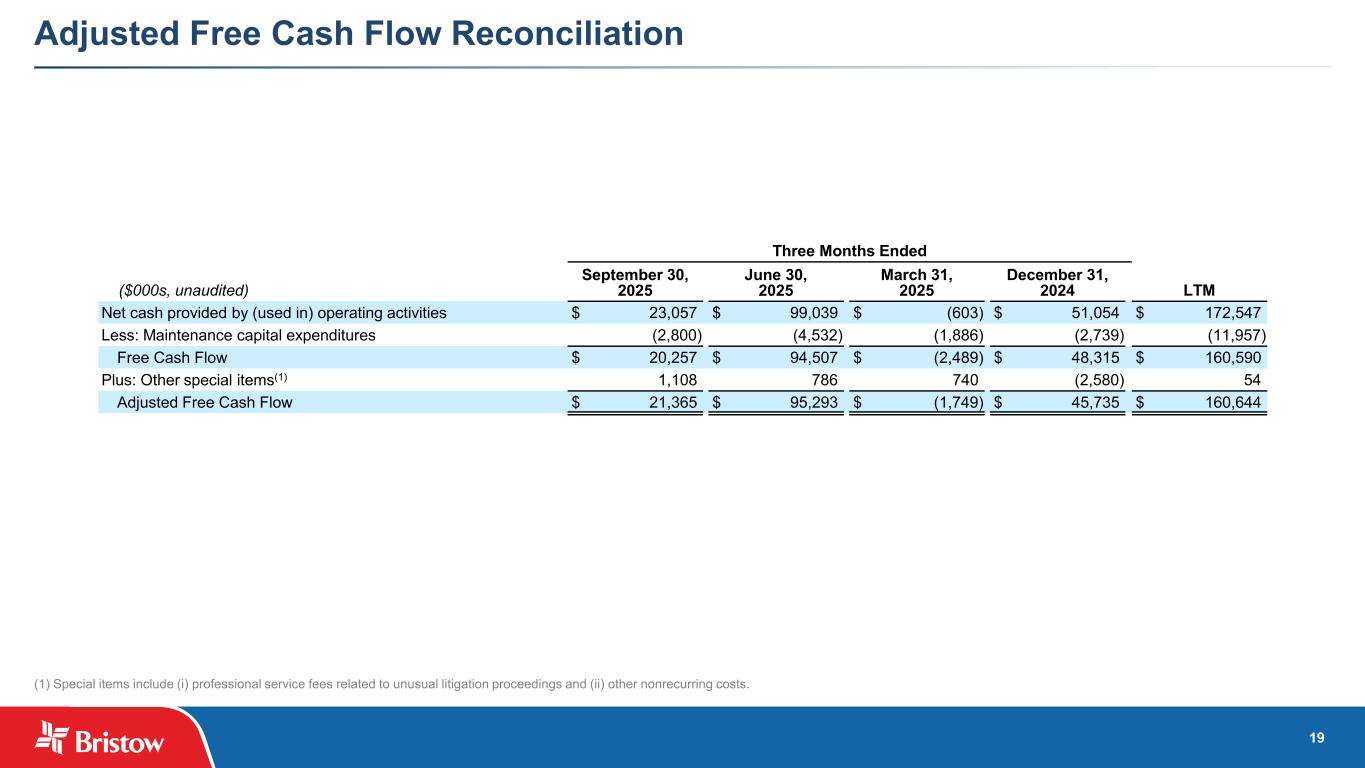

Free Cash Flow and Adjusted Free Cash Flow

Free Cash Flow represents the Company’s net cash provided by (used in) operating activities less maintenance capital expenditures. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude costs paid in relation to certain special items which primarily include (i) professional service fees related to unusual litigation proceedings and (ii) other nonrecurring costs related to strategic activities. The professional services fees are primarily attorneys’ fees related to litigation and arbitration matters that the Company is pursuing (where no gain contingency has been recorded or identified) that are unusual in nature and outside of the normal course of the Company’s continuing business operations. The other nonrecurring costs related to strategic activities are costs associated with financing transactions and proposed M&A transactions. These special items are related to various pursuits that are not individually material to the Company and, as such, are aggregated for presentation. The Company views these matters and their related financial impacts on the Company’s operating performance as extraordinary and not reflective of the operational performance of the Company’s core business activities. In addition, the same costs are not reasonably likely to recur within two years nor have the same charges or gains occurred within the prior two years. Management believes that Free Cash Flow and Adjusted Free Cash Flow are meaningful to investors because they provide information with respect to the Company’s ability to generate cash from the business. Neither Free Cash Flow nor Adjusted Free Cash Flow is a recognized term under GAAP. Accordingly, these measures should not be used as an indicator of, or an alternative to, net cash provided by operating activities, the most directly comparable GAAP measure. Investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Free Cash Flow and Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. As such, they may not be comparable to other similarly titled measures used by other companies. The following table provides a reconciliation of net cash provided by operating activities, the most directly comparable GAAP measure, to Free Cash Flow and Adjusted Free Cash Flow (unaudited, in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

|

LTM |

| Net cash provided by (used in) operating activities |

$ |

23,057 |

|

|

$ |

99,039 |

|

|

$ |

(603) |

|

|

$ |

51,054 |

|

|

$ |

172,547 |

|

| Less: Maintenance capital expenditures |

(2,800) |

|

|

(4,532) |

|

|

(1,886) |

|

|

(2,739) |

|

|

(11,957) |

|

| Free Cash Flow |

$ |

20,257 |

|

|

$ |

94,507 |

|

|

$ |

(2,489) |

|

|

$ |

48,315 |

|

|

$ |

160,590 |

|

|

|

|

|

|

|

|

|

|

|

| Plus: Special items |

1,108 |

|

|

786 |

|

|

740 |

|

|

(2,580) |

|

|

54 |

|

| Adjusted Free Cash Flow |

$ |

21,365 |

|

|

$ |

95,293 |

|

|

$ |

(1,749) |

|

|

$ |

45,735 |

|

|

$ |

160,644 |

|

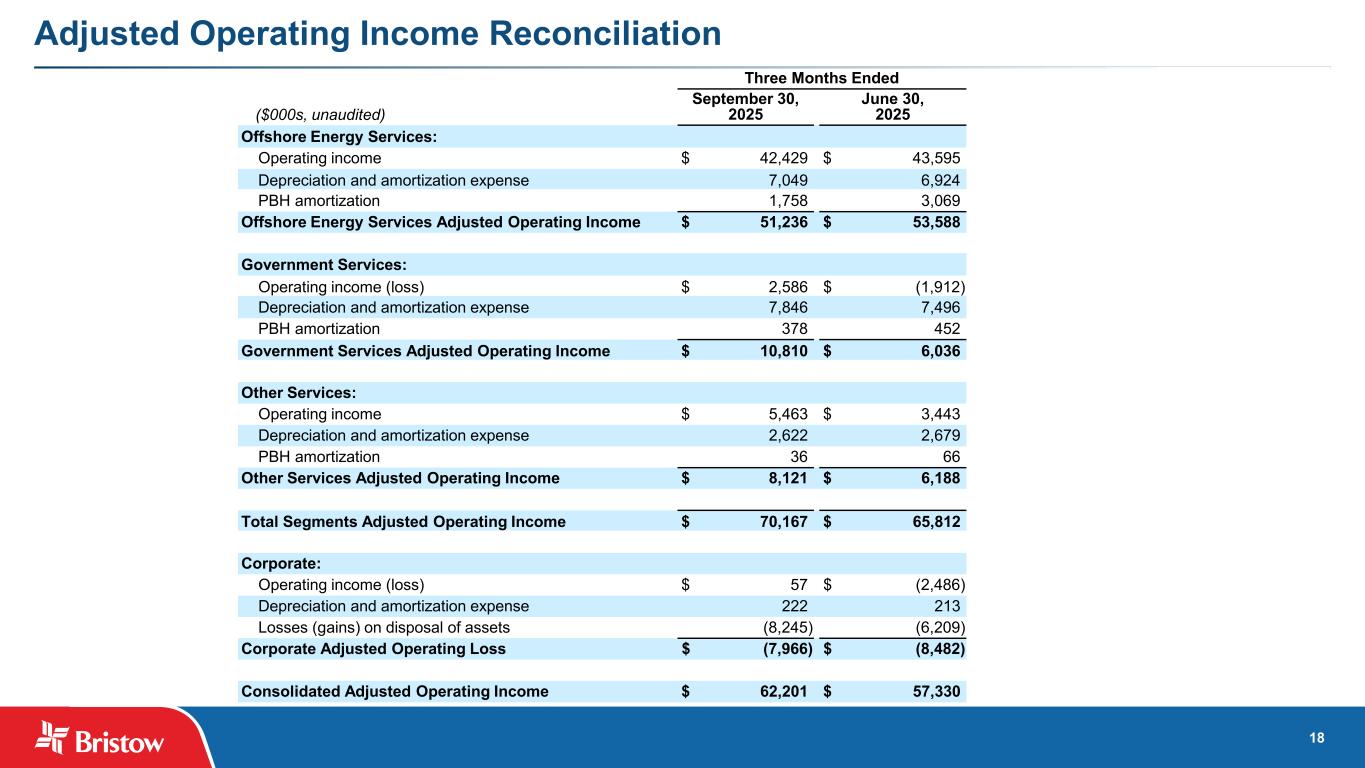

Adjusted Operating Income by Segment

Adjusted Operating Income (Loss) (“Adjusted Operating Income”) is defined as operating income (loss) before depreciation and amortization (including PBH amortization) and gains or losses on asset dispositions that occurred during the reported period. The Company includes Adjusted Operating Income to provide investors with a supplemental measure of each segment’s operating performance. Management believes that the use of Adjusted Operating Income is meaningful to investors because it provides information with respect to each segment’s ability to generate cash from its operations. Adjusted Operating Income is not a recognized term under GAAP. Accordingly, this measure should not be used as an indicator of, or an alternative to, operating income (loss), the most directly comparable GAAP measure, as a measure of operating performance. Because the definition of Adjusted Operating Income (or similar measures) may vary among companies and industries, it may not be comparable to other similarly titled measures used by other companies.

The following table provides a reconciliation of operating income (loss), the most directly comparable GAAP measure, to Adjusted Operating Income for each segment and Corporate (unaudited, in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

September 30, 2025 |

|

June 30, 2025 |

|

Increase

(Decrease) |

| Offshore Energy Services: |

|

|

|

|

|

|

| Operating income |

$ |

42,429 |

|

|

$ |

43,595 |

|

|

$ |

(1,166) |

|

(2.7) |

% |

| Depreciation and amortization expense |

7,049 |

|

|

6,924 |

|

|

125 |

|

1.8 |

% |

| PBH amortization |

1,758 |

|

|

3,069 |

|

|

(1,311) |

|

(42.7) |

% |

|

|

|

|

|

|

|

| Offshore Energy Services Adjusted Operating Income |

$ |

51,236 |

|

|

$ |

53,588 |

|

|

$ |

(2,352) |

|

(4.4) |

% |

|

|

|

|

|

|

|

| Government Services: |

|

|

|

|

|

|

| Operating income (loss) |

$ |

2,586 |

|

|

$ |

(1,912) |

|

|

$ |

4,498 |

|

nm |

| Depreciation and amortization expense |

7,846 |

|

|

7,496 |

|

|

350 |

|

4.7 |

% |

| PBH amortization |

378 |

|

|

452 |

|

|

(74) |

|

(16.4) |

% |

|

|

|

|

|

|

|

| Government Services Adjusted Operating Income |

$ |

10,810 |

|

|

$ |

6,036 |

|

|

$ |

4,774 |

|

79.1 |

% |

|

|

|

|

|

|

|

| Other Services: |

|

|

|

|

|

|

| Operating income |

$ |

5,463 |

|

|

$ |

3,443 |

|

|

$ |

2,020 |

|

58.7 |

% |

| Depreciation and amortization expense |

2,622 |

|

|

2,679 |

|

|

(57) |

|

(2.1) |

% |

| PBH amortization |

36 |

|

|

66 |

|

|

(30) |

|

(45.5) |

% |

|

|

|

|

|

|

|

| Other Services Adjusted Operating Income |

$ |

8,121 |

|

|

$ |

6,188 |

|

|

$ |

1,933 |

|

31.2 |

% |

|

|

|

|

|

|

|

| Total Segment Adjusted Operating Income |

$ |

70,167 |

|

|

$ |

65,812 |

|

|

$ |

4,355 |

|

6.6 |

% |

|

|

|

|

|

|

|

| Corporate: |

|

|

|

|

|

|

| Operating income (loss) |

$ |

57 |

|

|

$ |

(2,486) |

|

|

$ |

2,543 |

|

nm |

| Depreciation and amortization expense |

222 |

|

|

213 |

|

|

9 |

|

4.2 |

% |

| Gains on disposal of assets |

(8,245) |

|

|

(6,209) |

|

|

(2,036) |

|

(32.8) |

% |

| Corporate Adjusted Operating Loss |

$ |

(7,966) |

|

|

$ |

(8,482) |

|

|

$ |

516 |

|

6.1 |

% |

|

|

|

|

|

|

|

| Consolidated Adjusted Operating Income |

$ |

62,201 |

|

|

$ |

57,330 |

|

|

$ |

4,871 |

|

8.5 |

% |

The Company is unable to provide a reconciliation of projected Adjusted Operating Income by segment (non-GAAP) for the outlook periods included in this release to projected operating income (GAAP) for the same periods because components of the calculation are inherently unpredictable. The inability to forecast certain components of the calculation would significantly affect the accuracy of the reconciliation. Additionally, the Company does not provide guidance on the items used to reconcile projected Adjusted Operating Income by segment due to the uncertainty regarding timing and estimates of such items. Therefore, the Company does not present a reconciliation of projected Adjusted Operating Income by segment (non-GAAP) to operating income (GAAP) for the outlook periods.

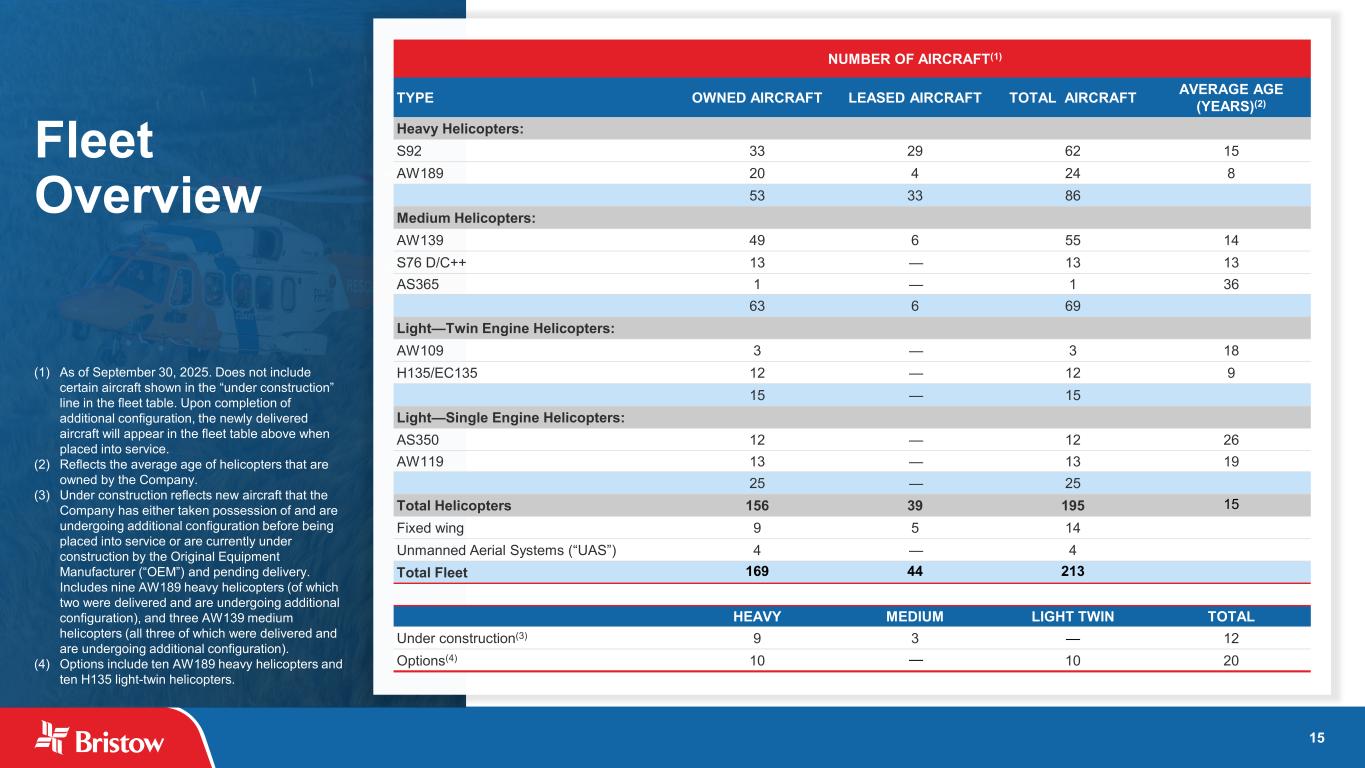

BRISTOW GROUP INC.

FLEET COUNT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Number of Aircraft |

|

|

|

|

|

| Type |

Owned

Aircraft |

|

Leased

Aircraft |

|

|

|

Total Aircraft |

|

Maximum

Passenger

Capacity |

|

Average Age (years)(1) |

|

| Heavy Helicopters: |

|

|

|

|

|

|

|

|

|

|

|

|

| S92 |

33 |

|

|

29 |

|

|

|

|

62 |

|

|

19 |

|

|

15 |

|

|

| AW189 |

20 |

|

|

4 |

|

|

|

|

24 |

|

|

16 |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

53 |

|

|

33 |

|

|

|

|

86 |

|

|

|

|

|

|

| Medium Helicopters: |

|

|

|

|

|

|

|

|

|

|

|

|

| AW139 |

49 |

|

|

6 |

|

|

|

|

55 |

|

|

12 |

|

|

14 |

|

|

| S76 D/C++ |

13 |

|

|

— |

|

|

|

|

13 |

|

|

12 |

|

|

13 |

|

|

| AS365 |

1 |

|

|

— |

|

|

|

|

1 |

|

|

12 |

|

|

36 |

|

|

|

63 |

|

|

6 |

|

|

|

|

69 |

|

|

|

|

|

|

| Light—Twin Engine Helicopters: |

|

|

|

|

|

|

|

|

|

|

|

|

| AW109 |

3 |

|

|

— |

|

|

|

|

3 |

|

|

7 |

|

|

18 |

|

|

| H135/EC135 |

12 |

|

|

— |

|

|

|

|

12 |

|

|

6 |

|

|

9 |

|

|

|

15 |

|

|

— |

|

|

|

|

15 |

|

|

|

|

|

|

| Light—Single Engine Helicopters: |

|

|

|

|

|

|

|

|

|

|

|

|

| AS350 |

12 |

|

|

— |

|

|

|

|

12 |

|

|

4 |

|

|

26 |

|

|

| AW119 |

13 |

|

|

— |

|

|

|

|

13 |

|

|

7 |

|

|

19 |

|

|

|

25 |

|

|

— |

|

|

|

|

25 |

|

|

|

|

|

|

| Total Helicopters |

156 |

|

|

39 |

|

|

|

|

195 |

|

|

|

|

15 |

|

|

| Fixed Wing |

9 |

|

|

5 |

|

|

|

|

14 |

|

|

|

|

|

|

| Unmanned Aerial Systems (“UAS”) |

4 |

|

|

— |

|

|

|

|

4 |

|

|

|

|

|

|

| Total Fleet |

169 |

|

|

44 |

|

|

|

|

213 |

|

|

|

|

|

|

______________________

(1)Reflects the average age of helicopters that are owned by the Company.

The table below presents the number of aircraft in our fleet and their distribution among the segments in which we operate as of September 30, 2025 and the percentage of revenues that each of our segments provided during the Current Quarter.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Percentage of

Total

Revenues |

|

Helicopters |

|

Fixed

Wing |

|

UAS |

|

|

| |

Heavy |

|

Medium |

|

Light Twin |

|

Light Single |

|

Total |

| Offshore Energy Services |

67 |

% |

|

56 |

|

|

61 |

|

|

12 |

|

|

— |

|

|

1 |

|

|

— |

|

|

130 |

|

| Government Services |

25 |

% |

|

30 |

|

|

8 |

|

|

3 |

|

|

20 |

|

|

— |

|

|

4 |

|

|

65 |

|

| Other Services |

8 |

% |

|

— |

|

|

— |

|

|

— |

|

|

5 |

|

|

13 |

|

|

— |

|

|

18 |

|

| Total |

100 |

% |

|

86 |

|

|

69 |

|

|

15 |

|

|

25 |

|

|

14 |

|

|

4 |

|

|

213 |

|

| Aircraft not currently in fleet: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under construction(1) |

|

|

9 |

|

|

3 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options(2) |

|

|

10 |

|

|

— |

|

|

10 |

|

|

— |

|

|

— |

|

|

— |

|

|

20 |

|

(1) Under construction reflects new aircraft that the Company has either taken possession of and are undergoing additional configuration before being placed into service or are currently under construction by the Original Equipment Manufacturer (“OEM”) and pending delivery. Includes nine AW189 heavy helicopters (of which two were delivered and are undergoing additional configuration) and three AW139 medium helicopters (all three of which were delivered and are undergoing additional configuration).

(2)Options include 10 AW189 heavy helicopters and 10 H135 light-twin helicopters.