Investor Presentation Fourth Quarter 2023

2 When used in this presentation, and in any other oral statements made with the approval of an authorized executive officer, the words or phrases “may,” “could,” “should,” “hope,” “might,” “believe,” “expect,” “plan,” “assume,” “intend,” “estimate,” “anticipate,” “project,” “likely,” or similar expressions are intended to identify “forward-looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties, including among other things: (i) Adverse changes in the economy or business conditions, either nationally or in our markets, including, without limitation, inflation, supply chain issues, labor shortages, and the adverse effects of the COVID-19 pandemic on the global, national, and local economy, which may affect the Corporation’s credit quality, revenue, and business operations; (ii) Competitive pressures among depository and other financial institutions nationally and in our markets; (iii) Increases in defaults by borrowers and other delinquencies; (iv) Our ability to manage growth effectively, including the successful expansion of our client support, administrative infrastructure, and internal management systems; (v) Fluctuations in interest rates and market prices; (vi) The consequences of continued bank acquisitions and mergers in our markets, resulting in fewer but much larger and financially stronger competitors; (vii) Changes in legislative or regulatory requirements applicable to us and our subsidiaries; (viiii) Changes in tax requirements, including tax rate changes, new tax laws, and revised tax law interpretations; (ix) Fraud, including client and system failure or breaches of our network security, including our internet banking activities; and (x) Failure to comply with the applicable SBA regulations in order to maintain the eligibility of the guaranteed portions of SBA loans. These risks could cause actual results to differ materially from what FBIZ has anticipated or projected. These risks could cause actual results to differ materially from what we have anticipated or projected. These risk factors and uncertainties should be carefully considered by our shareholders and potential investors. For further information about the factors that could affect the Corporation’s future results, please see the Corporation’s annual report on Form 10-K for the year ended December 31, 2022 and other filings with the Securities and Exchange Commission. Investors should not place undue reliance on any such forward-looking statement, which speaks only as of the date on which it was made. The factors described within the filings could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods. Where any such forward-looking statement includes a statement of the assumptions or bases underlying such forward-looking statement, FBIZ cautions that, while its management believes such assumptions or bases are reasonable and are made in good faith, assumed facts or bases can vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending on the circumstances. Where, in any forward-looking statement, an expectation or belief is expressed as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will be achieved or accomplished. FBIZ does not intend to, and specifically disclaims any obligation to, update any forward-looking statements. Forward-Looking Statements

Table of Contents Company Snapshot ...................................................... 4 Why FBIZ? ..................................................................... 5 Drivers of Growth & Profitability ................................. 12 Strategic Plan ............................................................... 23 Appendix ...................................................................... 26

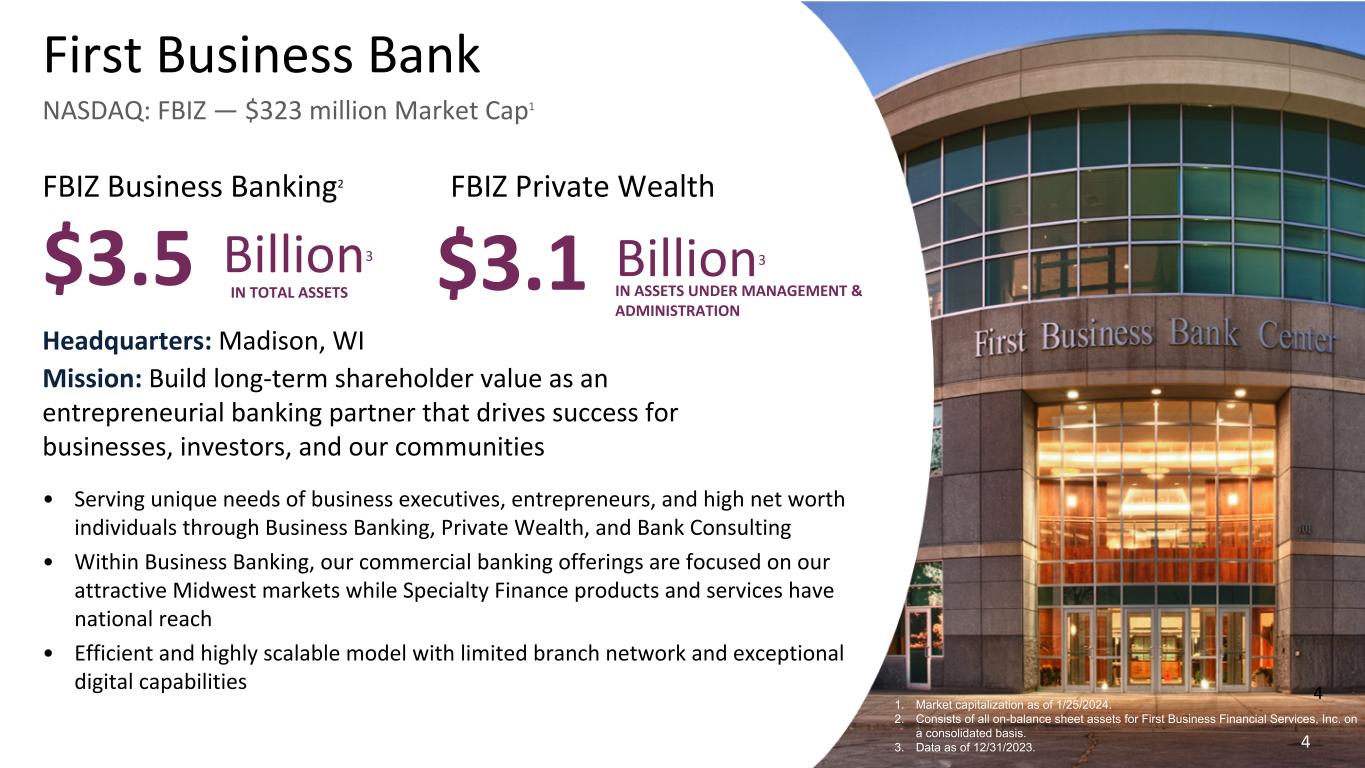

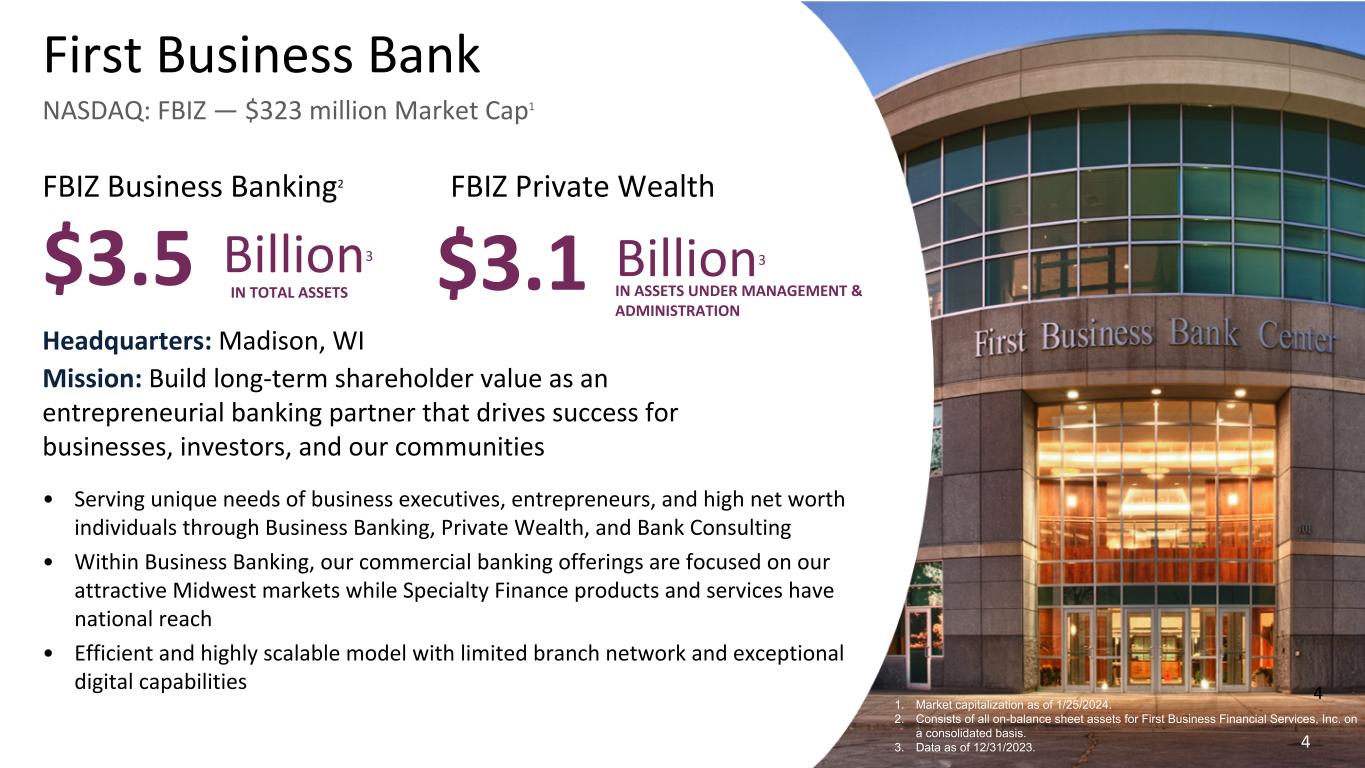

4 • Serving unique needs of business executives, entrepreneurs, and high net worth individuals through Business Banking, Private Wealth, and Bank Consulting • Within Business Banking, our commercial banking offerings are focused on our attractive Midwest markets while Specialty Finance products and services have national reach • Efficient and highly scalable model with limited branch network and exceptional digital capabilities Headquarters: Madison, WI Mission: Build long-term shareholder value as an entrepreneurial banking partner that drives success for businesses, investors, and our communities FBIZ Business Banking2 $3.5 Billion3 FBIZ Private Wealth $3.1 Billion3 IN ASSETS UNDER MANAGEMENT & ADMINISTRATION 1. Market capitalization as of 1/25/2024. 2. Consists of all on-balance sheet assets for First Business Financial Services, Inc. on a consolidated basis. 3. Data as of 12/31/2023. 4 IN TOTAL ASSETS First Business Bank NASDAQ: FBIZ — $323 million Market Cap1

WHY FBIZ?

6 M ill io ns Operating Trends - 5 Year Net Operating Revenue CAGR of 15% $32.5 $39.1 $41.2 $48.1 $57.4 FYE 2019 FYE 2020 FYE 2021 FYE 2022 FYE 2023 $0.0 $15.0 $30.0 $45.0 $60.0 $75.0 $90.0 $105.0 $120.0 $135.0 $150.0 Balanced and Steady Growth Operating Fundamentals Drive Earnings Power Note: Net interest income is the sum of "Pure Net Interest Income" and "Fees in Lieu of Interest". Non-interest income is the sum of "Trust Fee Income", "Other Fee Income", "Service Charges", "SBA Gains", and "Swap Fees". 1. "Pure Net Interest Income" and "Net Operating Income" are non-GAAP measurements. See appendix for non-GAAP reconciliation schedules. 2. "Net Tax Credits" represent management's estimate of the after-tax contribution related to the investment in tax credits as of the reporting period disclosed. 3. "Fees in Lieu of Interest" is defined as prepayment fees, asset-based loan fees, non-accrual interest, and loan fee amortization. M ill io ns $13.0 $13.5 $13.6 $14.9 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 • Steady revenue expansion supported by: ◦ Double-digit loan and deposit growth ◦ Strong and stable net interest margin ◦ Diverse sources of non- interest income • Strategic investments drive growth while maintaining positive operating leverage • Robust earnings power reflected in expansion of PTPP Adjusted ROAA to a record 1.75% for 2023. 5 Net Operating Income Year CAGR = XX% Operating Income Highlights

7 Positive Operating Leverage Ability to grow revenues faster than expenses outpaces peer group Note: Peer group defined as publicly traded bank with total assets between $1.5 billion and $5.5 billion. 1. Operating leverage is defined as the percent growth in operating revenue less the percent growth in operating expenses. 2. Represents operating leverage for the nine months ended September 30, 2023 compared to the nine months ended September 30, 2022 Operating Leverage (1) FBIZ Peer Group Median 2019 2020 2021 2022 YTD 9/30/23 (2) (8)% (5)% (3)% —% 3% 5% 8% 10% • We believe our focus on strategic initiatives directed toward revenue growth and operating efficiency through use of technology will continue to generate positive annual operating leverage. • Initiatives include: ◦ Expanding higher-yielding C&I lending business lines ◦ Strong focus on treasury management and growing in-market deposits ◦ Increasing our commercial banking market share outside of Madison ◦ Scaling our private wealth management business in our less mature commercial banking markets ◦ Robotic process automation implementation ◦ AI usage discovery and roll out

8 Profitability Exceeds Peers Top Line Revenue Growth and Efficient Capital Management Drives Strong Profitability Note: Peer Group defined as publicly-traded banks with total assets between $1.5 billion and $5.5 billion. Source S&P Global. 1. Represents growth rate for the nine months ended September 30, 2023 compared to the nine months ended September 30, 2022. 2. YTD 2023 represents data for the nine months ended September 30, 2023. Return on Average Common Equity FBIZ Peer Group Median 2021 2022 YTD 2023 (2) —% 3% 5% 8% 10% 13% 15% 18% Top Line Revenue Growth FBIZ Peer Group Median 2021 2022 YTD 2023 (1) —% 3% 5% 8% 10% 13% 15% 18%

9 Tangible Book Value Growth History of Steady, Consistent TBV and Dividend Growth Through Economic and Interest Rate Cycles TBV 3YR CAGR = 10% Div/Share 3YR CAGR = 10% 2023 TBV Growth = 13% TBV/Share Div/Share Great Recession & Pandemic Recession '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 $5 $10 $15 $20 $25 $30 $35 1. Q3 2023 dividends per share calculation is annualized. 2. TBV growth compares Q3 2023 to Q3 2022.

10 Rate Cycle Consistency TBV/share above peers in current rate cycle Note: Peer Group defined as publicly-traded banks with total assets between $1.5 billion and $5.5 billion. Cumulative TBV % Change During Current Rate Cycle FBIZ Peer Group Median 12/31/21 03/31/22 06/30/22 09/30/22 12/31/22 03/31/23 06/30/23 09/30/23 12/31/23 (20.0)% (10.0)% —% 10.0% 20.0% 30.0% Differentiated Approach Aids TBV Preservation • FBIZ holds a small securities portfolio, and does not extend maturities to reach for yield • FBIZ uses wholesale funding to match maturities with long-term fixed rate loans to lock in interest rate spread and maintain greater stability in net interest margin • In the recent rising rate environment, this approach mitigates the impact of mark-to-market adjustments on our Accumulated Other Comprehensive Income (AOCI), a component of equity • In contrast, the median peer bank experienced a 4% decrease in equity capital during the rate cycle due to the change in AOCI, compared to the 21% increase the Bank experienced • During the current rate cycle, FBIZ’s strong earnings more than offset the decline in AOCI, as tangible book value per share grew 22.3% compared to a decline of 6.2% for median peer banks.

11 Note: Peer Group defined as publicly traded banks with total assets between $1.5 billion and $5.5 billion. 1. 1-Year, 3-Year, and 5-Year TSR is through 12/31/23. 2. Data as of 9/30/2023. Total Shareholder Return Above Peer Group Median Despite recent outperformance, Price/LTM EPS remains below peers Total Shareholder Return (1) FBIZ Peer Group Median S&P 500 Bank Russell 2000 1-Year TSR 3-Year TSR 5-Year TSR (25)% 0% 25% 50% 75% 100% 125% 150% Price/LTM EPS (2) FBIZ Peer Group Median 0.0 2.0 4.0 6.0 8.0 10.0 FBIZ Investment Profile(1) Closing Price $35.09 52-Week High $35.27 52-Week Low $25.70 Common Shares Outstanding 8,467,955 Price/LTM EPS 8.65% Price/Tangible Book Value 125.68% 50 Day Average Daily Volume 20,693 Annualized Dividend $0.79 Dividend Yield 2.25%

Drivers of Growth & Profitability

13 Net Income $9.6 MM In-Market Deposits +27% Loans + 13% NIM 3.69% PTPP ROA 1.77% TBV per Share +14% Solid bottom line profitability reflects success of efforts to grow deposits and loans at a double-digit pace, bolstering revenue growth and bringing relative stability to net interest margin in a volatile environment Continued Deposit Growth • In-market deposits grew 27.4% annualized from the linked quarter and 19.0% from the fourth quarter of 2022 Robust Expansion Across Loan Products and Geographies • Loans grew 12.5% annualized from the third quarter of 2023 and 16.7% from the fourth quarter of 2022 Diversified Balance Sheet Growth Drives Net Interest Income Expansion • Net interest income grew 3.3% from the linked quarter and 7.6% from the fourth quarter of 2022 • GAAP net interest margin of 3.69% declined seven basis points from the linked quarter Strong Pre-tax, Pre-Provision (“PTPP”) Income • PTPP grew 8.4% from the linked quarter and 17.8% from the fourth quarter of 2022 • PTPP adjusted return on average assets rose to 1.77% for the fourth quarter of 2023, growing from 1.72% for the linked quarter and remaining well above peers Strong earnings generation produced a 13.9% annualized increase in tangible book value per share compared to the linked quarter and 12.9% compared to the prior year quarter Fourth Quarter 2023 Highlights Strong performance driven by robust deposit growth, sustained loan growth, and positive operating leverage Note: Percentages represent growth over the prior quarter.

14 Relationship Banking Key to Success Solid In-Market Deposit Growth Despite Banking Industry Trends • Long-term client relationships drive in-market deposit growth, aided by clients’ comfort with utilizing the Bank’s longstanding extended deposit insurance products • Successful execution of client deposit initiatives has attracted new relationships and increased gross treasury management service charges • Long-held top-quartile deposit pricing strategy promotes retention • Net Promoter Score1 of 78 is well above industry benchmark score of 23. M ill io ns In-Market Deposits In-Market Deposits 12/31/22 12/31/23 $1,800 $1,900 $2,000 $2,100 $2,200 $2,300 $2,400 1. Net promoter score benchmarks reported in “The State of B2B Account Experience: B2B NPS & CX Benchmarking Report,” CustomerGauge, 2021 NPS benchmarks reported in “The State of B2B Account Experience: B2B NPS & CX Benchmarking Report,” CustomerGauge, 2021. Net promoter score assesses likelihood to recommend on an 11-point scale, where detractors (scores 0-6) are subtracted from promoters (scores 9-10), while passives (scores 7-8) are not considered. The score ranges from -100 to +100. 1. Net promoter score assesses likelihood to recommend on an 11-point scale, where detractors (scores 0-6) are subtracted from promoters (scores 9-10), while passives (scores 7-8) are not considered. See appendix for additional information on the source of the net promoter score. Th ou sa nd s Gross Treasury Management Service Charges Analyzed Charges 4Q22 4Q23 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 Growth over prior year quarter = 19% Growth over prior year quarter = 17%

15 Core Deposit Strength FBIZ Continues to Grow Core Deposits as Industry and Peers Decline Source: S&P Capital IQ. Core Deposits defined as deposits in U.S. offices excluding time deposits over $250,000 and brokered deposits of $250,000 or less. Core Deposit2 Growth: 2Q22 through 1Q23 FBIZ 3.8% Proxy Peers Median -6.8% All Publicly Traded Banks Median Public Banks with $1.5-$5.5 Assets Median Core Deposit Growth Q3 2022 through Q3 2023 5.0% (5.7)% (4.8)% (4.9)% FBIZ Proxy Peers Median All Publicly Traded Banks Median Public Banks with $1.5-$.5B Assets Median (8)% (6)% (4)% (2)% 0% 2% 4% 6%

16 Deposit-Centric Strategy Key to Growth Double Digit In-Market Deposit Growth Supports Double Digit Loan Growth 1. In-market deposits defined as total deposits less wholesale deposits. Period end balances are presented. M ill io ns In-Market Deposit Growth History (1) DDA IB DDA MMA CD '18 '19 '20 '21 '22 '23 $0 $500 $1,000 $1,500 $2,000 $2,500 • Deposit growth one of four major strategies from 5-year strategic plan launched in 2019 • Deposit-centric sales strategy led by treasury management sales located in all bank markets with direct production and outside calling goals • Lenders trained to fund their loan production with deposit growth goals • Deposit-focused individual BDO incentive compensation and bank level bonus plans 5YR CAGR = 11.4% DDA 5-Year CAGR = 10% Total In-Market Deposits 5-Year CAGR = 15% M ill io ns Deposit Growth History (1) DDA IB DDA MMA CD 9/30/2022 12/31/2022 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500

17 Diversified Lending Growth Continuing to grow higher yielding C&I lending mix Th ou sa nd s Net Loan Growth Q4 2021 $82,268 $1,739 $20,236 $18,844 $11,304 $10,884 $6,167 $1,819 Commercial Lending Private Wealth Asset- Based Lending Accounts Receivable Financing SBA Lending Equipment Finance Floorplan Financing Other $— $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 $175,000 Net Deposit Growth $52,399 $(49,768) $53,062 $(1,682) DDA IB DDA MMA CD $— $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Specialized Lending Mix % of Total Loans Long-Term Goal 3Q20 4Q20 1Q21 2Q21 3Q21 10% 15% 20% 25% 30% 1. Specialized Lending includes Asset-Based Lending, Accounts Receivable Financing, SBA Lending, Vendor Finance, and Floorplan Financing. Th ou sa nd s Loan Growth (YOY) (1) $121,601 $3,183 $43,368 $19,651 $5,211 $60,748 $16,220 $(458) Commercial Lending Private Wealth Asset- Based Lending Accounts Receivable Financing SBA Lending Equipment Finance Floorplan Financing Other $— $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 M ill io ns Loan Growth History (1) CRE C&I All Other '18 '19 '20 '21 '22 '23 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 1. Period end balances excluding PPP loans are presented. On January 1, 2023, the Bank adopted ASU 2016-03 Financial Instruments - Credit losses (“ASC 326”). The Bank adopted ASC 326 using the modified retrospective method which does not require restatement of prior periods. The balances as of December 31, 2023 reflect a reclassification of $43 million to commercial and industrial from commercial real estate, and $7 million from consumer and other to commercial real estate. 2. Average balances excluding PPP loans are presented. 3. Excluding the impact of PPP loan fees and interest income YOY Growth = 13.1% 5 Year CAGR = 12% Exceeds strategic plan goal of 10% Continued Growth in Higher Yielding C&I Lending (2) C&I Loan Mix C&I Lending Yield(3) CRE and Other Yield Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 —% 2.00% 4.00% 6.00% 8.00% 10.00% 20.00% 22.50% 25.00% 27.50% 30.00% 32.50% 35.00% 37.50% 40.00% 42.50% Consider bullet point on loan growth appetite and related capital assumptions/plans to accommodate growth

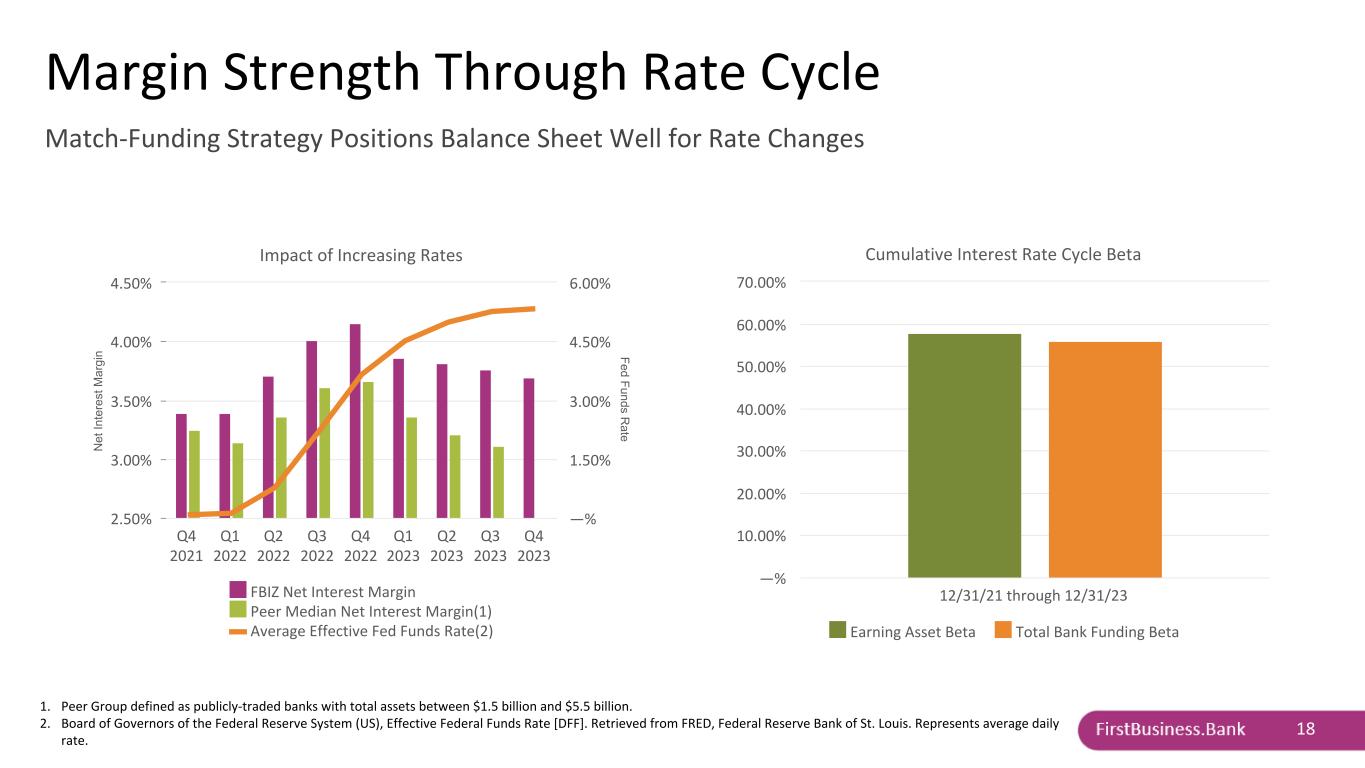

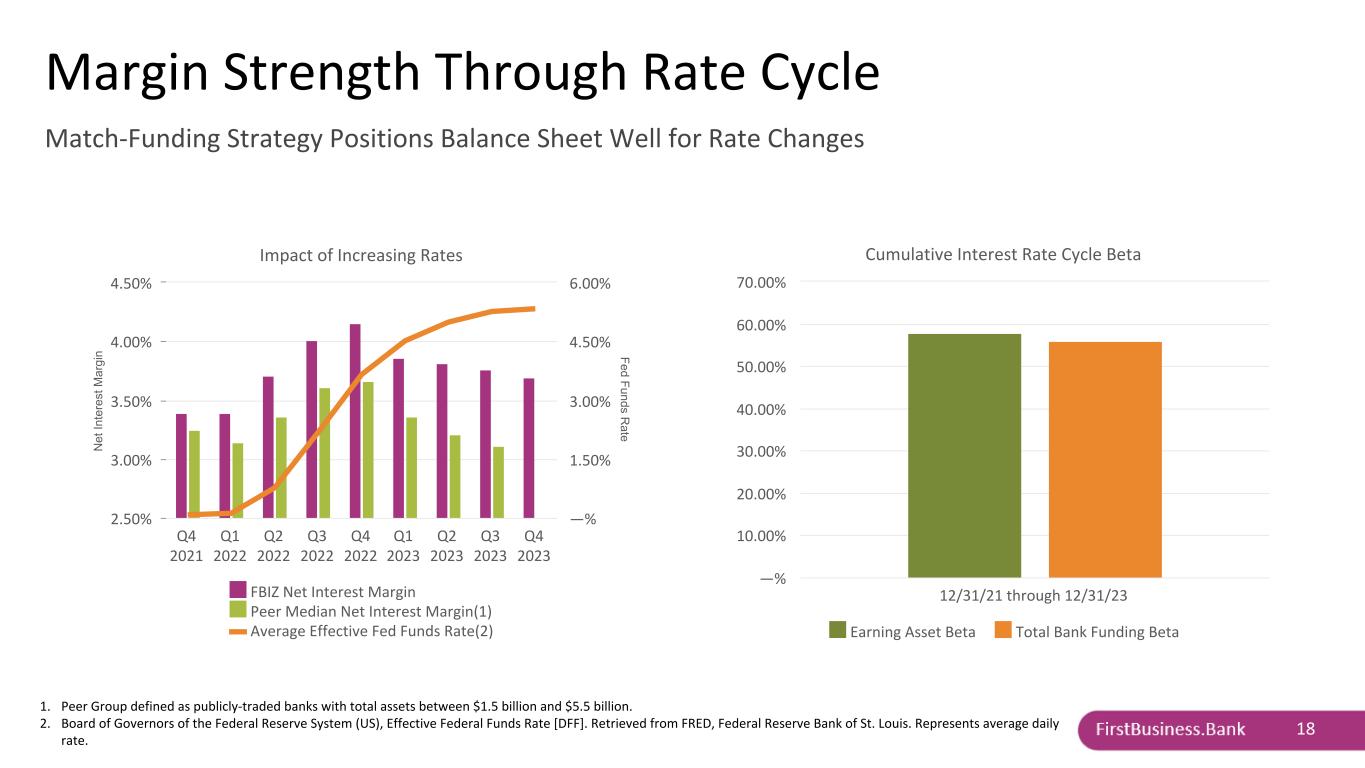

18 Margin Strength Through Rate Cycle Match-Funding Strategy Positions Balance Sheet Well for Rate Changes NIM, Yields, and Costs 5.55% 3.95% 4.51% 3.73% 3.14% 3.69% 2.40% 1.99% 1.76% 1.42% 0.54% 0.45% Average Loan Yield Net Interest Margin Securities Yield Cost of Funds (5) Q4 2019 Q3 2020 Q4 2020 N et In te re st M ar gi n Fed Funds R ate Impact of Increasing Rates FBIZ Net Interest Margin Peer Median Net Interest Margin(1) Average Effective Fed Funds Rate(2) Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 2.50% 3.00% 3.50% 4.00% 4.50% —% 1.50% 3.00% 4.50% 6.00% Cumulative Interest Rate Cycle Beta Earning Asset Beta Total Bank Funding Beta 12/31/21 through 12/31/23 —% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 1. Peer Group defined as publicly-traded banks with total assets between $1.5 billion and $5.5 billion. 2. Board of Governors of the Federal Reserve System (US), Effective Federal Funds Rate [DFF]. Retrieved from FRED, Federal Reserve Bank of St. Louis. Represents average daily rate.

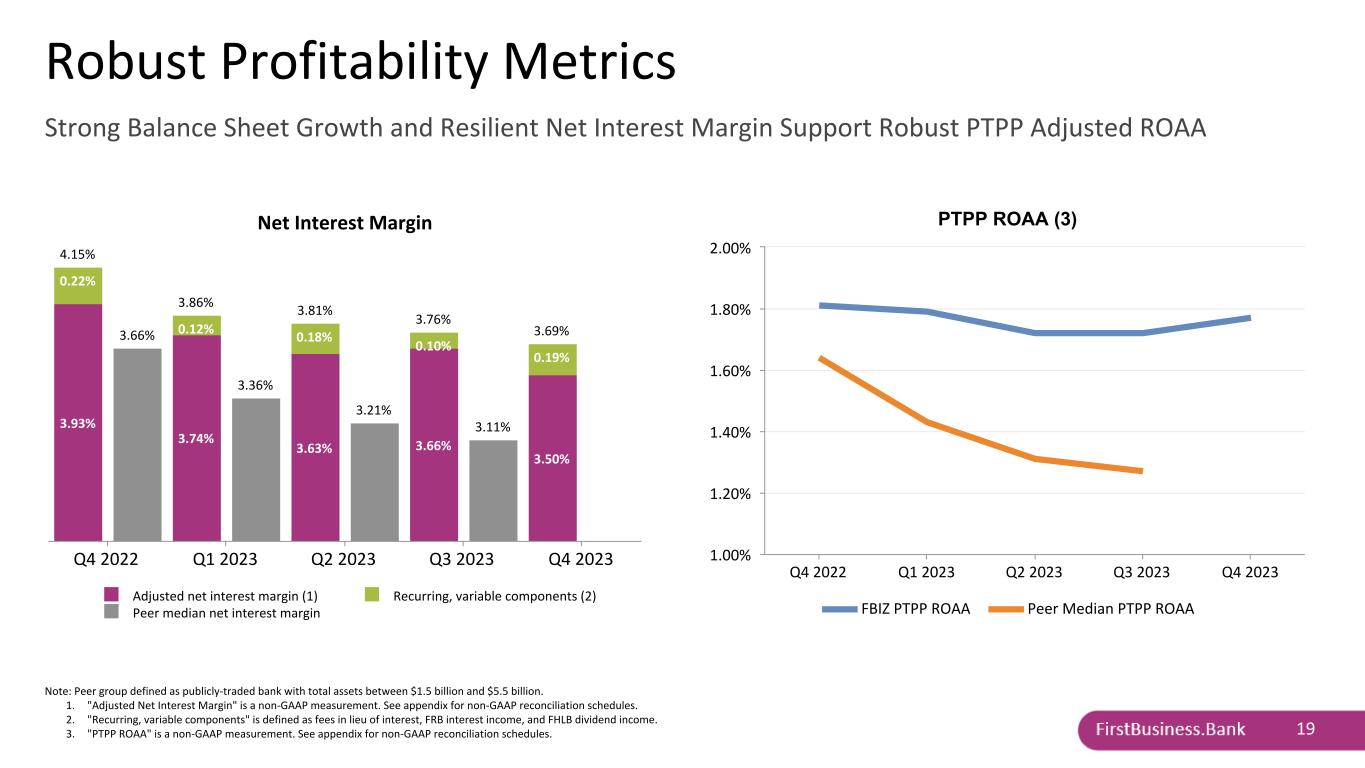

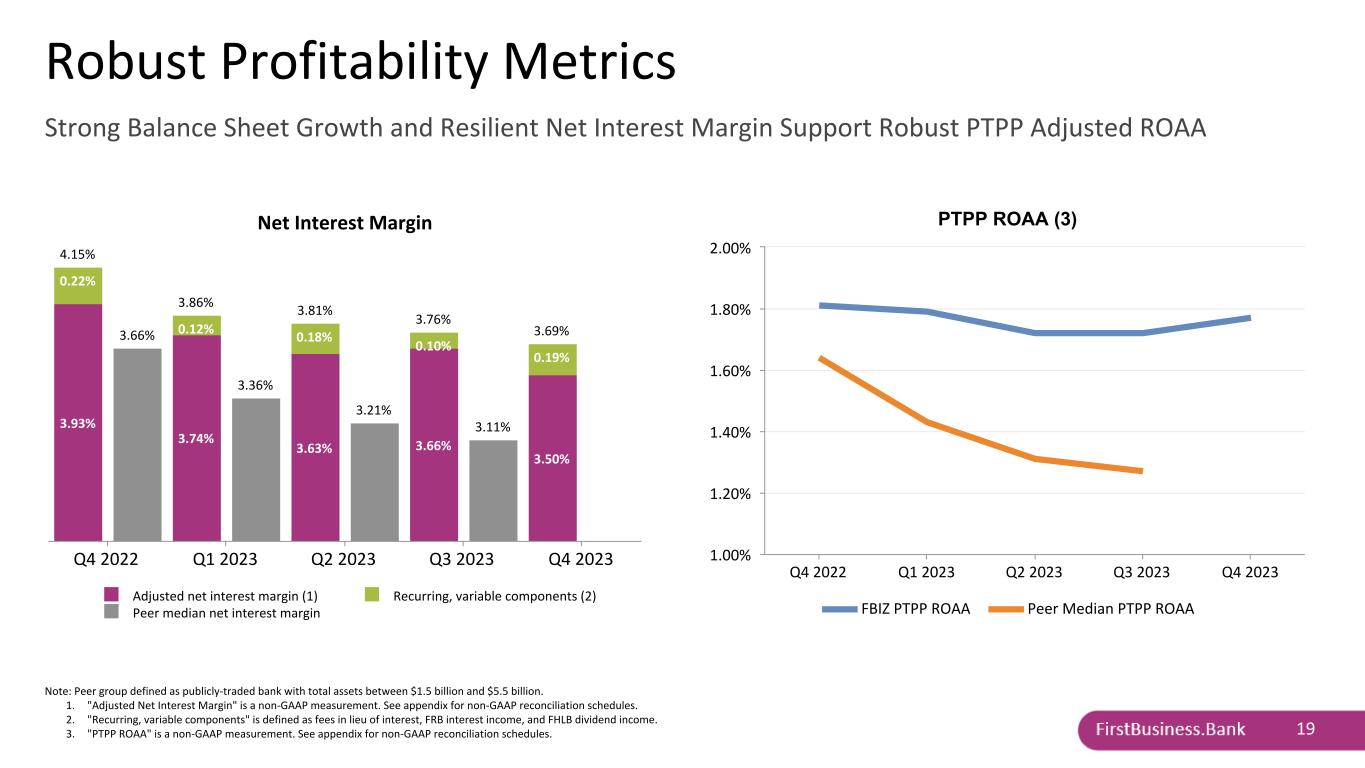

19 Robust Profitability Metrics Strong Balance Sheet Growth and Resilient Net Interest Margin Support Robust PTPP Adjusted ROAA Net Interest Margin 4.15% 3.86% 3.81% 3.76% 3.69%3.66% 3.36% 3.21% 3.11%3.93% 3.74% 3.63% 3.66% 3.50% 0.22% 0.12% 0.18% 0.10% 0.19% Adjusted net interest margin (1) Recurring, variable components (2) Peer median net interest margin Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Note: Peer group defined as publicly-traded bank with total assets between $1.5 billion and $5.5 billion. 1. "Adjusted Net Interest Margin" is a non-GAAP measurement. See appendix for non-GAAP reconciliation schedules. 2. "Recurring, variable components" is defined as fees in lieu of interest, FRB interest income, and FHLB dividend income. 3. "PTPP ROAA" is a non-GAAP measurement. See appendix for non-GAAP reconciliation schedules. PTPP ROAA (3) FBIZ PTPP ROAA Peer Median PTPP ROAA Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 1.00% 1.20% 1.40% 1.60% 1.80% 2.00%

20 Net Interest Margin Components 1. Wholesale funding defined as brokered CDs and non-reciprocal interest-bearing transaction accounts plus FHLB advances. 2. Cost of funds is defined as total interest expense on deposits and FHLB advances, divided by the sum of total average deposits and average FHLB advances. • NIM range in forecast • Rate assumptions in forecast • Beta outlook • Impact under differing scenarios 5YR CAGR = 11.4% Drivers of NIM Change 3.76% 0.07% 0.04% 0.04% (0.14)% (0.04)% —% 0.01% (0.03)% 3.69% 3Q 23 N IM ST In ve st m en ts Se cu rit ie s Lo an s Ex ist in g N on -M at ur ity D ep os its Ne w N on -M at ur ity D ep os its Ti m e De po sit s W ho le sa le fu nd in g ( 1) Bo rro w in gs 4Q 23 N IM In-Market Deposit Flows Interest Bearing Deposits Non-Interest Bearing Deposits $ Change Q3 2023 over Q2 2023 $— $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 NIM, Yield, and Costs Yield on Loans Yield on Securities NIM Cost of Funds (2) 4Q22 1Q23 2Q23 3Q23 4Q23 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% • Non-maturity deposit balance increases were split between $68.3 million in growth from new accounts at a weighted average rate of 3.54% and $76.0 million in growth from existing accounts at a weighted average rate of 2.83% • Certificate of deposit runoff of $163.4 million at a weighted average rate of 4.22% was replaced by new and renewed certificates of deposit of $170.8 million at a weighted average rate of 4.69%

21 Solid Asset Quality Non-Performing Assets/Total Assets Remain Well Managed M ill io ns Non-Performing Assets FBIZ NPA w/o ABL Loan ABL Loan (1) FBIZ NPA/TA Peer NPA/TA 2021 2022 1Q23 2Q23 3Q23 4Q23 $0.0 $4.0 $8.0 $12.0 $16.0 $20.0 $24.0 —% 0.20% 0.40% 0.60% 0.80% 1.00% Note: Peer group defined as publicly-traded bank with total assets between $1.5 billion and $5.5 billion. 1. Represents a $8.9 million fully collateralized ABL credit, for which the Company expects full repayment. Excluding this credit, non-performing assets totaled $8.1 million, or 0.24% of total assets. 2. For more detailed definitions on credit quality categories see the Bank's 10-K filed with the SEC on February 22, 2023. Credit Quality Indicators Category I Category II Category III Category IV Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $— $500 $1,000 $1,500 $2,000 $2,500 $3,000 • As of 12/31/2023, 95% of the loan portfolio was classified in category I(2) and 99.5% of loans were current. • In the ABL pool, we continue to expect full repayment related to the second quarter $10.9 million default. Excluding this credit, non-performing assets totaled $12.0 million, or 0.34% of total assets. • Isolated weakness in the $61mm Transportation segment of the Equipment Finance portfolio.

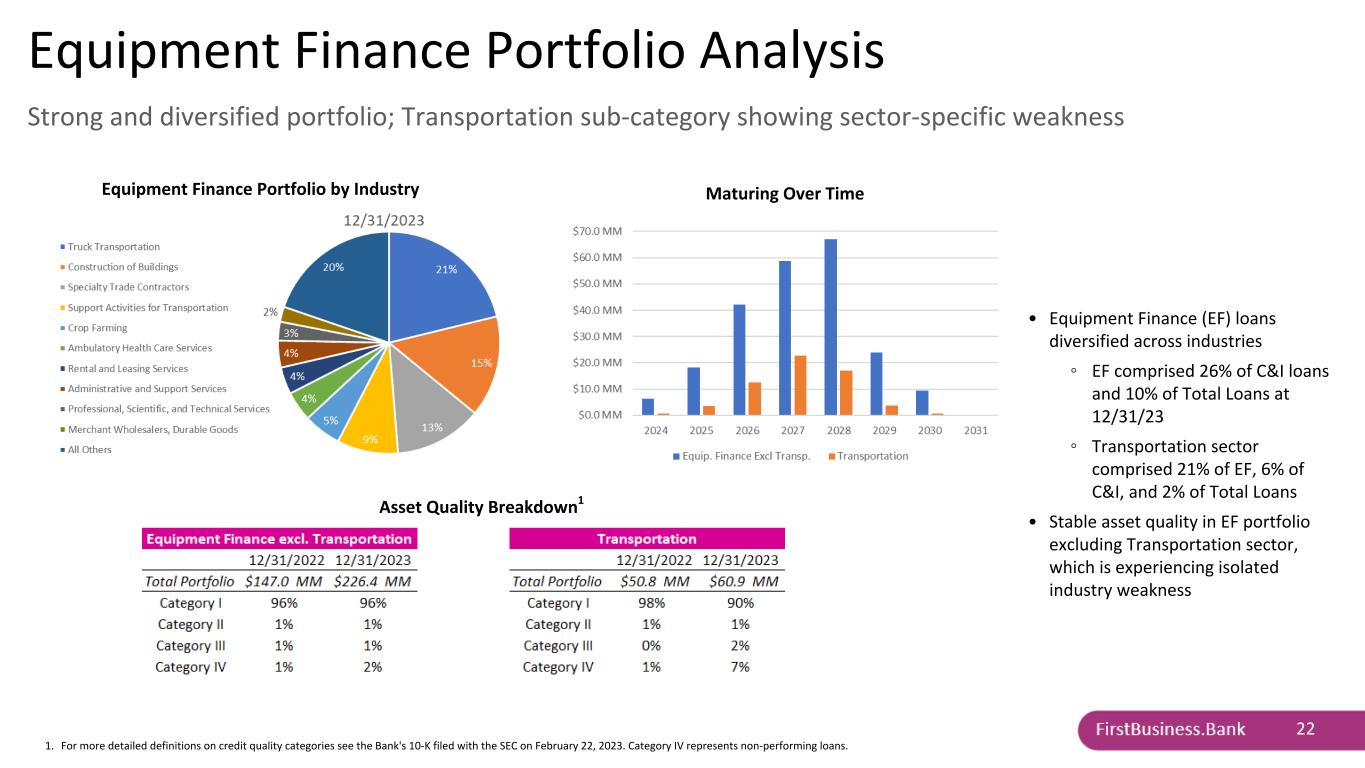

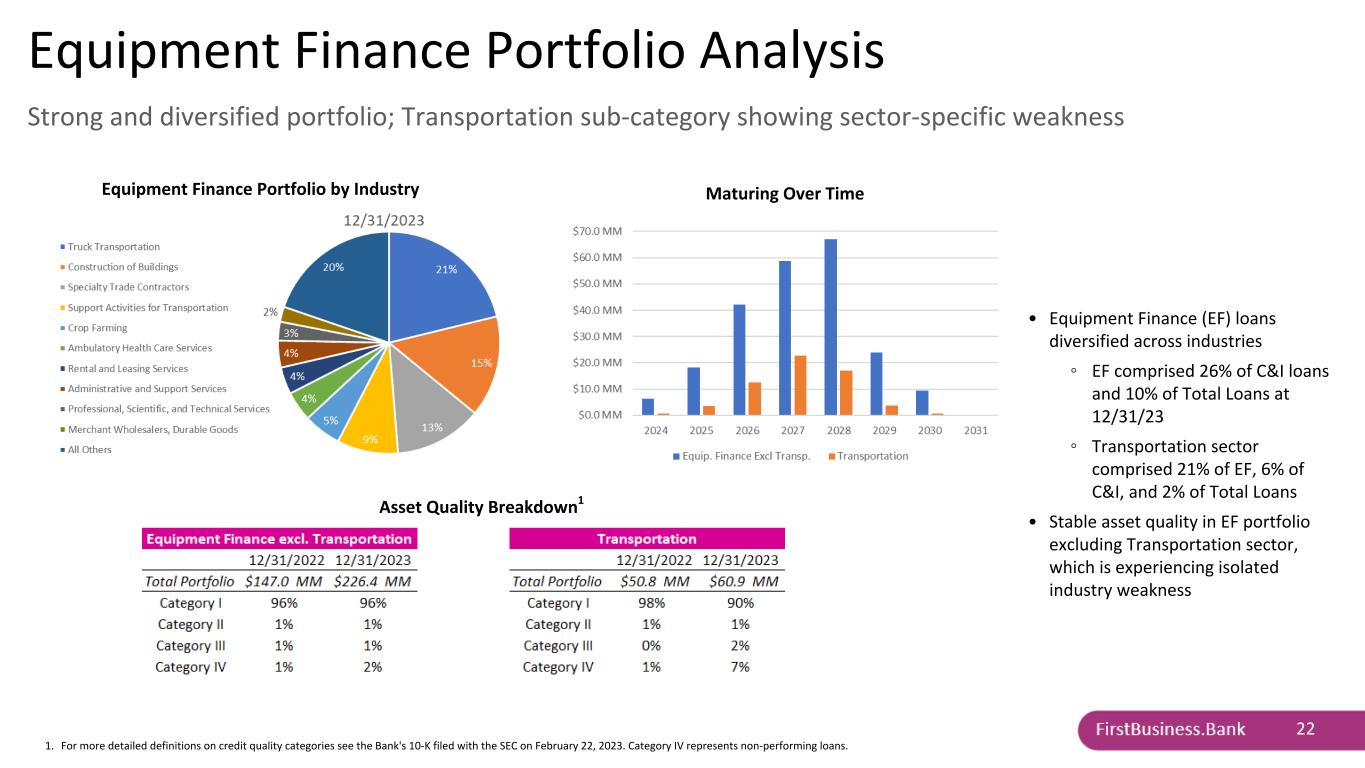

22 Equipment Finance Portfolio by Industry 1. For more detailed definitions on credit quality categories see the Bank's 10-K filed with the SEC on February 22, 2023. Category IV represents non-performing loans. Equipment Finance Portfolio Analysis Strong and diversified portfolio; Transportation sub-category showing sector-specific weakness Asset Quality Breakdown1 • Equipment Finance (EF) loans diversified across industries ◦ EF comprised 26% of C&I loans and 10% of Total Loans at 12/31/23 ◦ Transportation sector comprised 21% of EF, 6% of C&I, and 2% of Total Loans • Stable asset quality in EF portfolio excluding Transportation sector, which is experiencing isolated industry weakness Maturing Over Time

Strategic Plan

24 FBIZ Strategic Plan 2019-2023 4 Strategies Designed to Navigate the Company over a 5-Year Time Horizon Planning process is nearing completion for next 5-year plan beginning in 2024

25 FBIZ Strategic Plan 2019-2023 Proven execution of strategic objectives Goal Actual 2019 Actual 2020 Actual 2021 Actual 2022 Actual 2023 Strategic Plan Return on average common equity 12.55% 8.64% 16.21% 16.79% 13.79% 13.50% Return on average assets 1.14% 0.70% 1.37% 1.46% 1.13% 1.15% Top line revenue growth 9.10% 11.50% 8.41% 13.38% 12.55% ≥ 10% per year In-market deposits to total bank funding 75.50% 74.80% 82.88% 76.07% 75.99% ≥ 75% Fee income ratio(1) 25.10% 25.90% 24.92% 23.02% 21.76% 25.00% Client satisfaction 93% 96% 93% 95% 93% ≥ 90% Employee engagement 82% 91% 87% 87% 90% ≥ 80% 1. Decrease throughout the plan year mainly due to net interest margin and loan growth greatly exceeding plan targets leading to exceptional net interest income growth.

APPENDIX SUPPLEMENTAL DATA & NON-GAAP RECONCILIATIONS

27 Offerings Designed Exclusively for Business and Wealth Management Services that meet the evolving needs of our growing client base

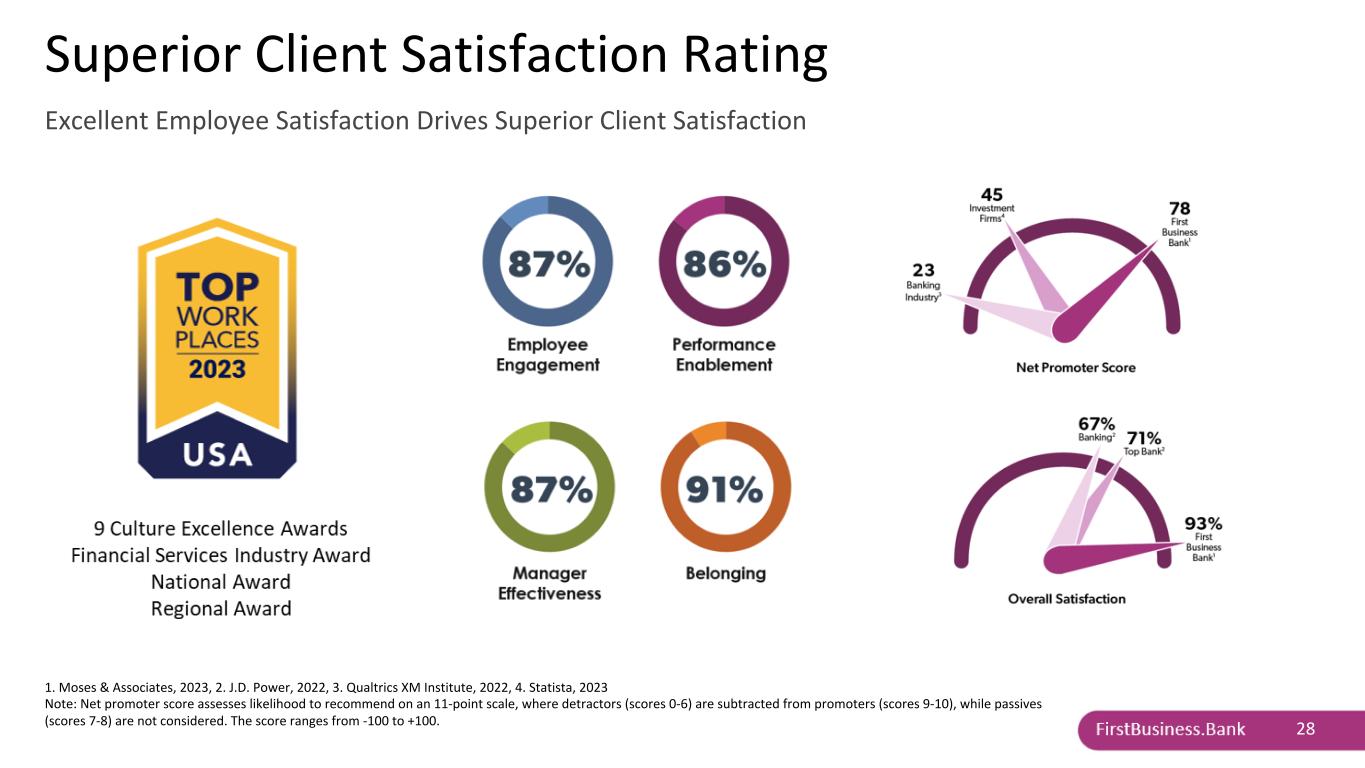

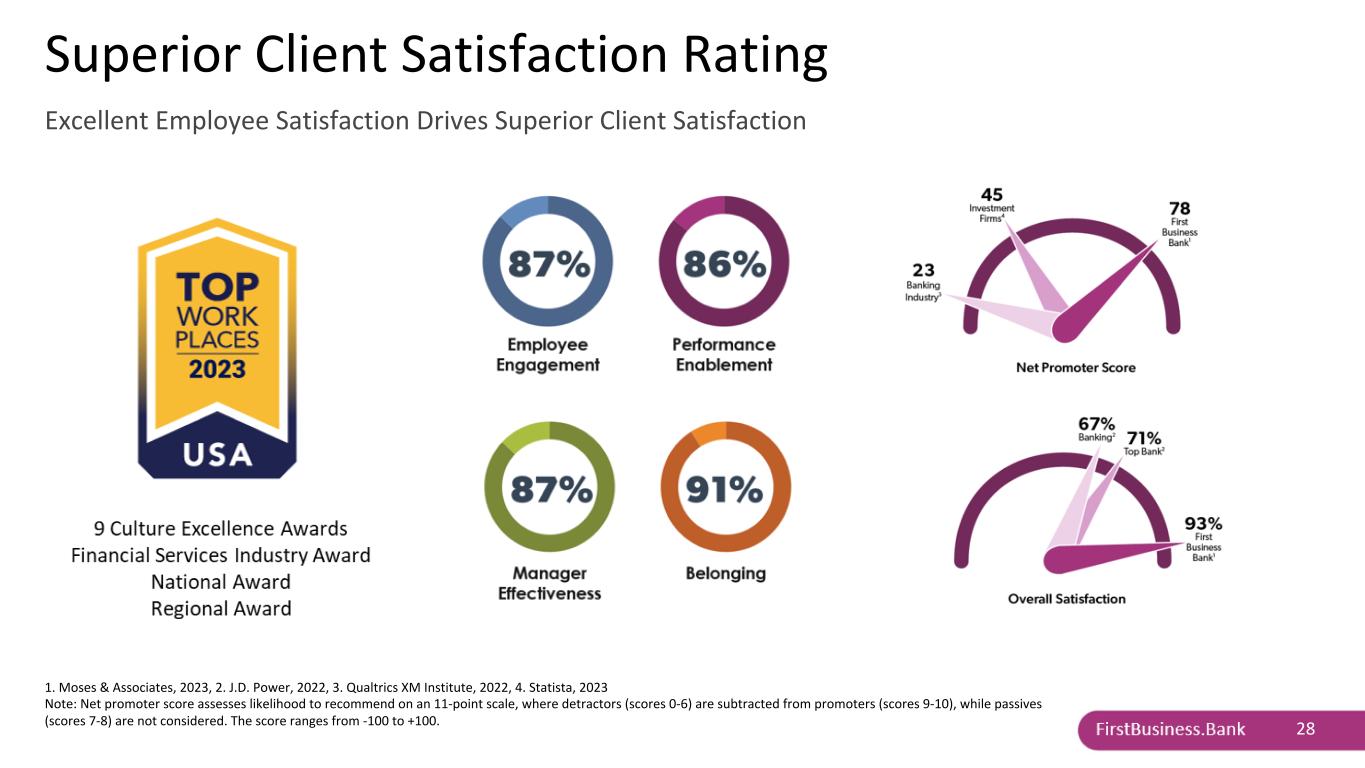

28 Superior Client Satisfaction Rating Excellent Employee Satisfaction Drives Superior Client Satisfaction 1. Moses & Associates, 2023, 2. J.D. Power, 2022, 3. Qualtrics XM Institute, 2022, 4. Statista, 2023 Note: Net promoter score assesses likelihood to recommend on an 11-point scale, where detractors (scores 0-6) are subtracted from promoters (scores 9-10), while passives (scores 7-8) are not considered. The score ranges from -100 to +100. Striving for Continuous Improvement • Net Promoter Score is the most widely used measure of likelihood to recommend a company to others • Anonymous survey conducted annually by a third party to assess client satisfaction • Allows us to compare our performance against other leading financial institutions

29 ESG Framework Environmental, social, and governance practices are integrated into our core business strategy • Branch-lite model with only one location in each of the banking markets we serve • Support hybrid and remote work options to reduce carbon emissions related to commuting (even prior to COVID) • Reduced paper usage via implementation of Docusign • Minimal technology eco-footprint by continued use of state-of-the art technology to minimize power consumption • Recycled almost 5,000 pounds of company- generated and employee-owned e-waste in 2022 • Employee e-waste recycling is now offered year-round • Named to the national list of Top Workplaces USA for the second straight year • Awarded nine culture of excellence awards by Top Workplaces which included Leadership, Innovation, Compensation & Benefits, Work-Life Flexibility, Purpose & Values, DEI Practices, Employee Appreciation, Employee Well-Being, and Professional Development • CEO performance goals include furthering DEI and ESG initiatives • Increased advisory board diversity (to over 40%) to enhance our business development efforts with a diverse client base in all markets • Provide all employees with 8 hours of paid time to support volunteer efforts and give back to their communities in a meaningful way of their choosing • Corporate Governance and Nominating Committee monitors key governance structure risks, effectiveness of the Board DEI policy practices and strategies, and oversight of the overall ESG program • To ensure alignment with the Company's ESG principles, responsibility for Board delegated ESG risks and opportunities are defined in all committee charters • Commitment to board diversity – 30% female and 10% ethnic or racial directors and 50% of standing committees chaired by female directors • 90% director independence, and 100% committee membership independence

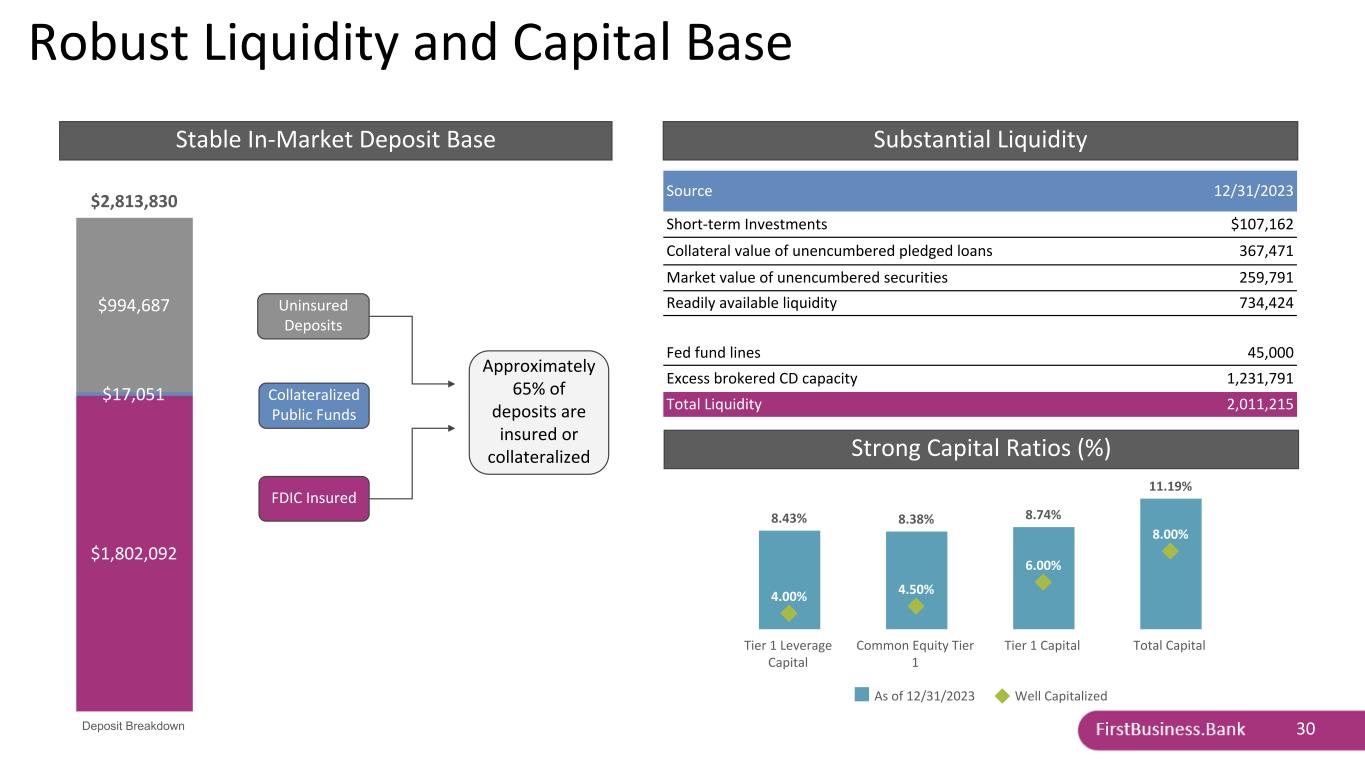

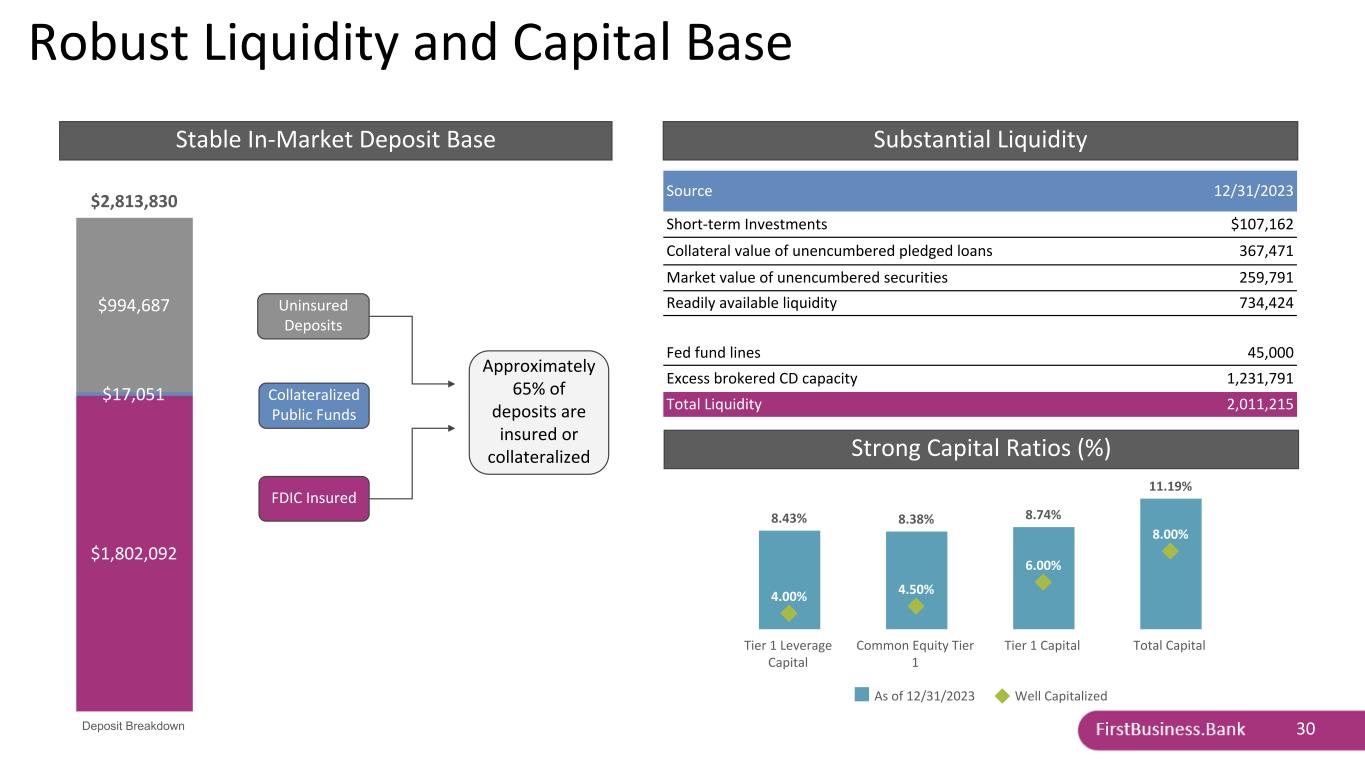

30 Robust Liquidity and Capital Base Stable In-Market Deposit Base Substantial Liquidity Conservative Securities Portfolio Strong Capital Ratios (%) Source 12/31/2023 Short-term Investments $107,162 Collateral value of unencumbered pledged loans 367,471 Market value of unencumbered securities 259,791 Readily available liquidity 734,424 Fed fund lines 45,000 Excess brokered CD capacity 1,231,791 Total Liquidity 2,011,215 3Q23 2Q23 1Q23 4Q22 3Q22 Investment Securities $280,852 $263,456 $248,450 $224,659 $210,097 Securities/Assets 8.2 % 8.1 % 7.9 % 7.5 % 7.4 % • Percent of AFS securities on balance sheet • other comment $2,813,830 $1,802,092 $17,051 $994,687 Deposit Breakdown 8.43% 8.38% 8.74% 11.19% 4.00% 4.50% 6.00% 8.00% As of 12/31/2023 Well Capitalized Tier 1 Leverage Capital Common Equity Tier 1 Tier 1 Capital Total Capital Uninsured Deposits Collateralized Public Funds FDIC Insured Approximately 65% of deposits are insured or collateralized

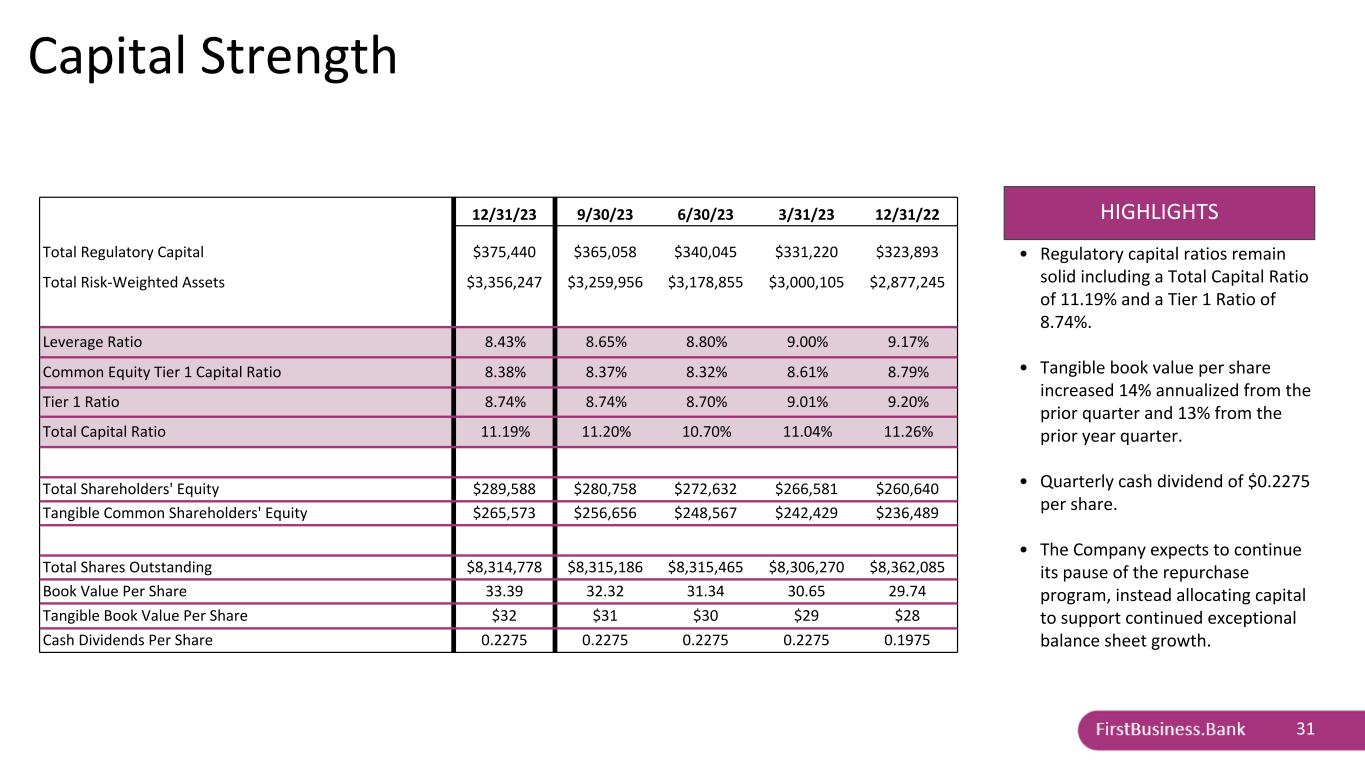

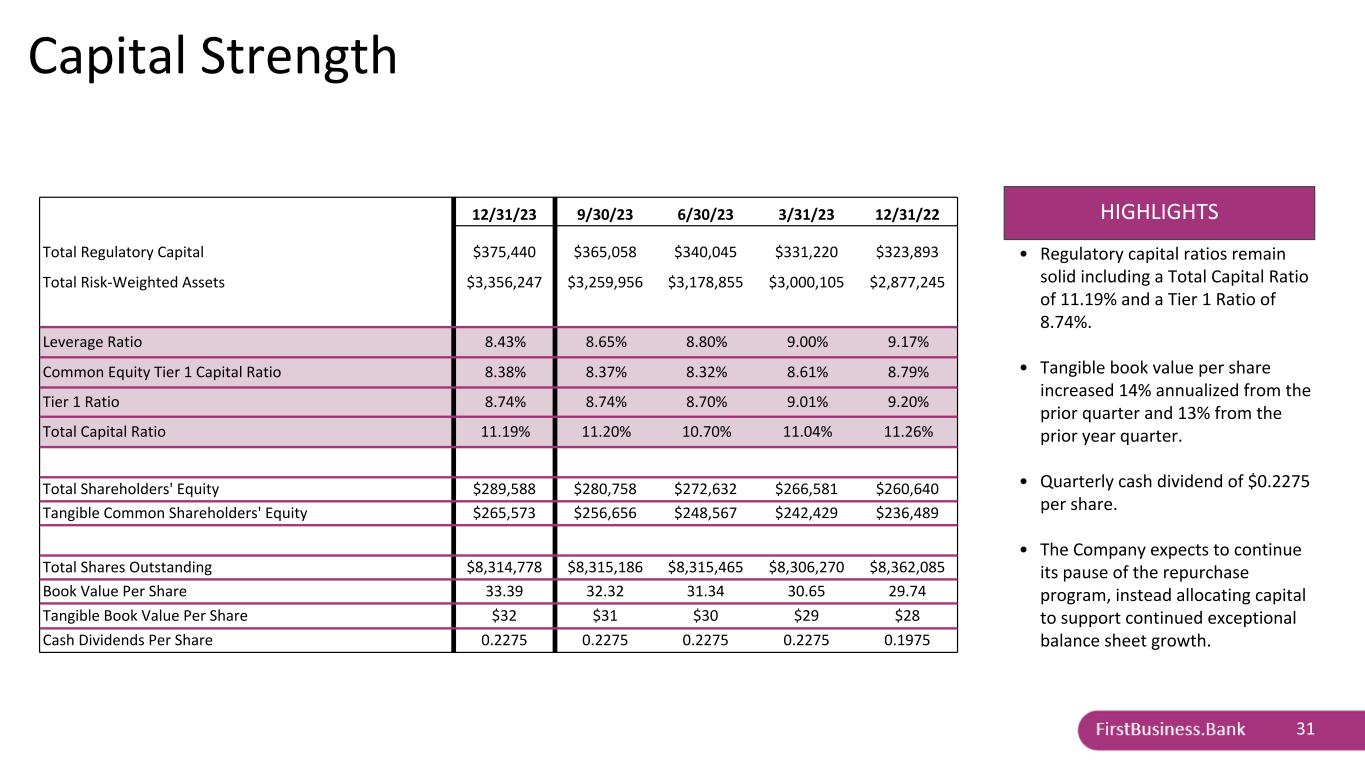

31 Capital Strength 12/31/23 9/30/23 6/30/23 3/31/23 12/31/22 Total Regulatory Capital $375,440 $365,058 $340,045 $331,220 $323,893 Total Risk-Weighted Assets $3,356,247 $3,259,956 $3,178,855 $3,000,105 $2,877,245 Leverage Ratio 8.43% 8.65% 8.80% 9.00% 9.17% Common Equity Tier 1 Capital Ratio 8.38% 8.37% 8.32% 8.61% 8.79% Tier 1 Ratio 8.74% 8.74% 8.70% 9.01% 9.20% Total Capital Ratio 11.19% 11.20% 10.70% 11.04% 11.26% Total Shareholders' Equity $289,588 $280,758 $272,632 $266,581 $260,640 Tangible Common Shareholders' Equity $265,573 $256,656 $248,567 $242,429 $236,489 Total Shares Outstanding $8,314,778 $8,315,186 $8,315,465 $8,306,270 $8,362,085 Book Value Per Share 33.39 32.32 31.34 30.65 29.74 Tangible Book Value Per Share $32 $31 $30 $29 $28 Cash Dividends Per Share 0.2275 0.2275 0.2275 0.2275 0.1975 • Regulatory capital ratios remain solid including a Total Capital Ratio of 11.19% and a Tier 1 Ratio of 8.74%. • Tangible book value per share increased 14% annualized from the prior quarter and 13% from the prior year quarter. • Quarterly cash dividend of $0.2275 per share. • The Company expects to continue its pause of the repurchase program, instead allocating capital to support continued exceptional balance sheet growth. HIGHLIGHTS

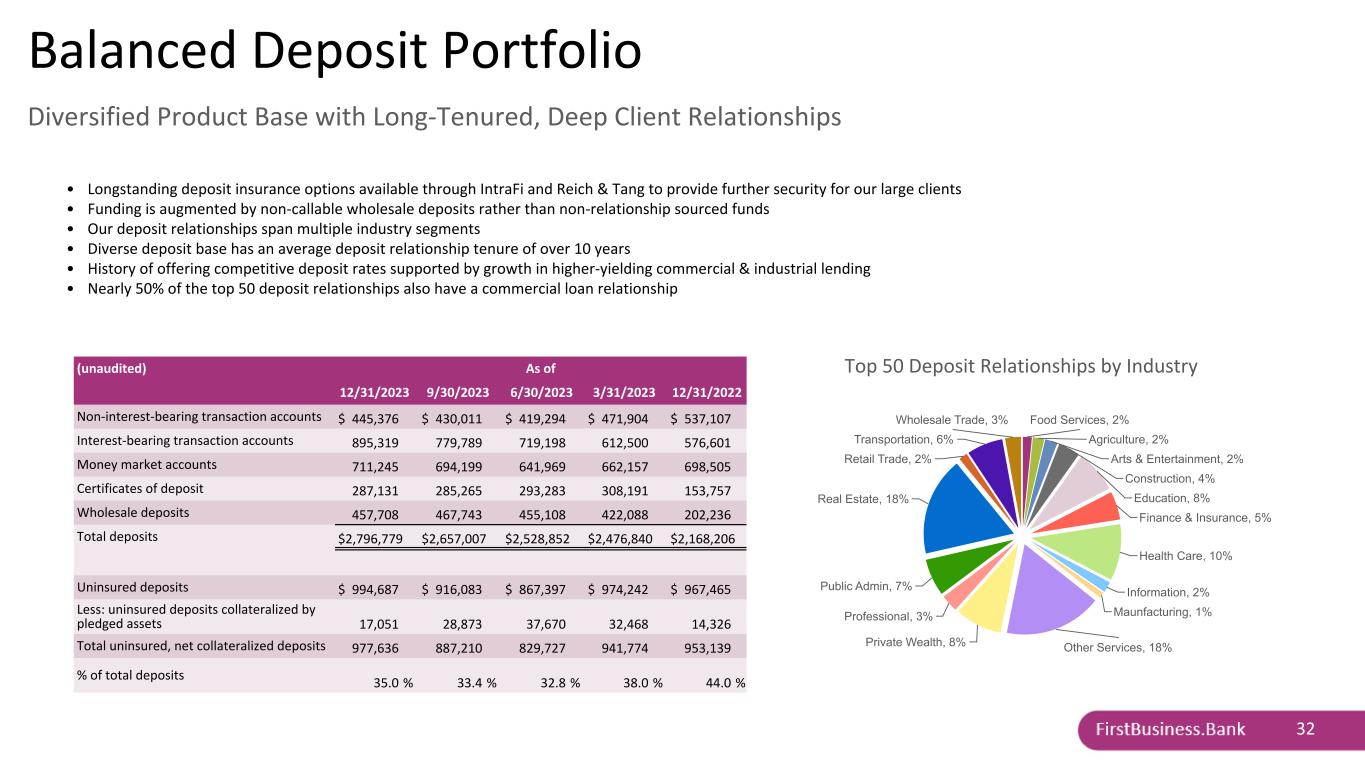

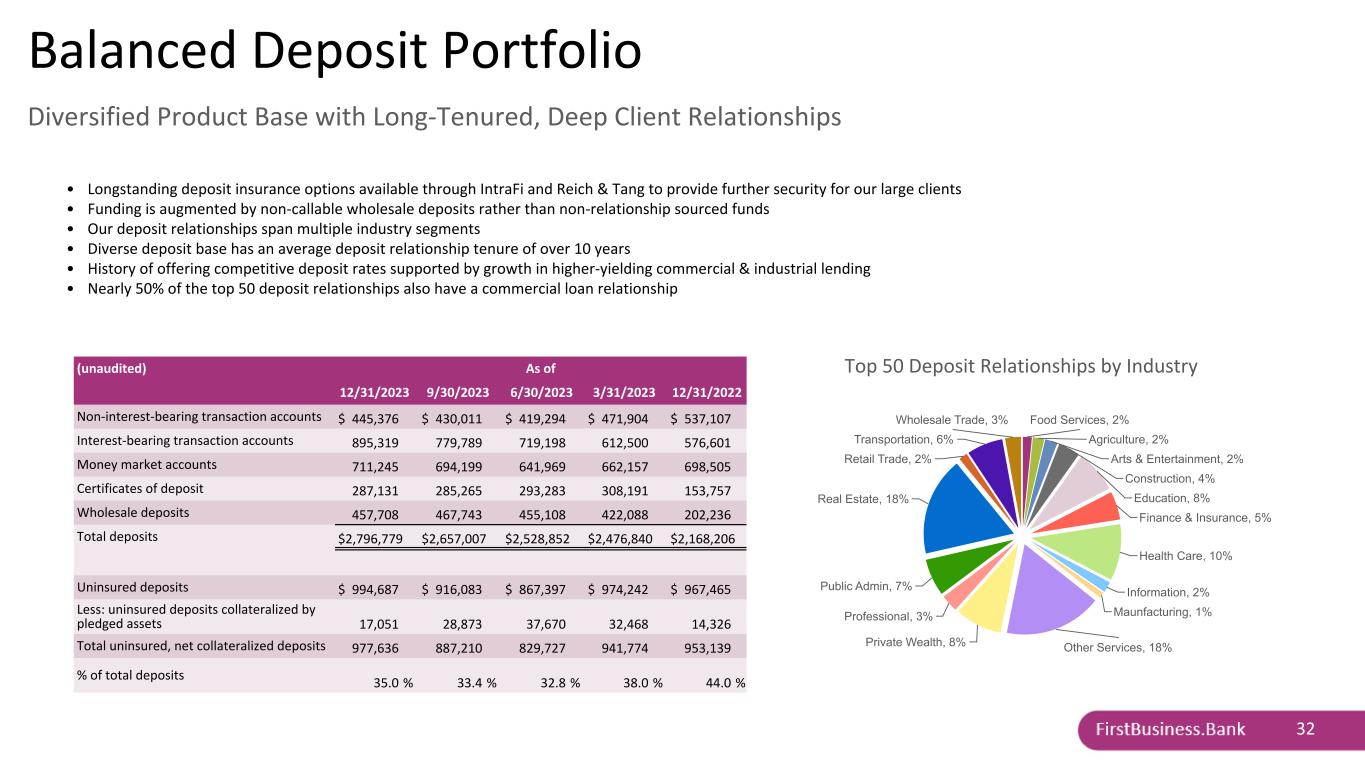

32 Balanced Deposit Portfolio Diversified Product Base with Long-Tenured, Deep Client Relationships Top 50 Deposit Relationships by Industry Food Services, 2% Agriculture, 2% Arts & Entertainment, 2% Construction, 4% Education, 8% Finance & Insurance, 5% Health Care, 10% Information, 2% Maunfacturing, 1% Other Services, 18%Private Wealth, 8% Professional, 3% Public Admin, 7% Real Estate, 18% Retail Trade, 2% Transportation, 6% Wholesale Trade, 3% (unaudited) As of 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 Non-interest-bearing transaction accounts $ 445,376 $ 430,011 $ 419,294 $ 471,904 $ 537,107 Interest-bearing transaction accounts 895,319 779,789 719,198 612,500 576,601 Money market accounts 711,245 694,199 641,969 662,157 698,505 Certificates of deposit 287,131 285,265 293,283 308,191 153,757 Wholesale deposits 457,708 467,743 455,108 422,088 202,236 Total deposits $ 2,796,779 $ 2,657,007 $ 2,528,852 $ 2,476,840 $ 2,168,206 Uninsured deposits $ 994,687 $ 916,083 $ 867,397 $ 974,242 $ 967,465 Less: uninsured deposits collateralized by pledged assets 17,051 28,873 37,670 32,468 14,326 Total uninsured, net collateralized deposits 977,636 887,210 829,727 941,774 953,139 % of total deposits 35.0 % 33.4 % 32.8 % 38.0 % 44.0 % • Longstanding deposit insurance options available through IntraFi and Reich & Tang to provide further security for our large clients • Funding is augmented by non-callable wholesale deposits rather than non-relationship sourced funds • Our deposit relationships span multiple industry segments • Diverse deposit base has an average deposit relationship tenure of over 10 years • History of offering competitive deposit rates supported by growth in higher-yielding commercial & industrial lending • Nearly 50% of the top 50 deposit relationships also have a commercial loan relationship

33 Diversified Lending Products Double digit loan growth driven by stellar performance across all areas of the bank Th ou sa nd s Net Loan Growth Q4 2021 $82,268 $1,739 $20,236 $18,844 $11,304 $10,884 $6,167 $1,819 Commercial Lending Private Wealth Asset- Based Lending Accounts Receivable Financing SBA Lending Equipment Finance Floorplan Financing Other $— $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 $175,000 Net Deposit Growth $52,399 $(49,768) $53,062 $(1,682) DDA IB DDA MMA CD $— $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Specialized Lending Mix % of Total Loans Long-Term Goal 3Q20 4Q20 1Q21 2Q21 3Q21 10% 15% 20% 25% 30% 1. Specialized Lending includes Asset-Based Lending, Accounts Receivable Financing, SBA Lending, Vendor Finance, and Floorplan Financing. Th ou sa nd s n ual Period E Lo Growth $115,056 $2,978 $29,982 $6,661 $(6,514) $83,047 $1,936 $(3,636) Commercial Lending Private Wealth Asset-Based Lending Accounts Receivable Financing SBA Lending Equipment Finance Floorplan Financing Other $— $50,000 $100,000 $150,000 $200,000 $250,000 M ill io ns Loan Growth History (1) All Other Lending Specialized Lending Conventional C&I '18 '19 '20 '21 Q3 2022 $0 $500 $1,000 $1,500 $2,000 $2,500 YOY Growth = 10.4% 3 Year CAGR = 11% Total Loan Breakdown 60% 39% 2% CRE C&I All Other Commercial Real Estate Breakdown 15% 46% 11% 27% 2% CRE-OO CRE-NOO Construction Multi-family 1-4 Family C&I Breakdown by Product 36% 20% 26% 8% 7% 4% All Other C&I Lending Asset-Based Lending Equipment Finance Floorplan Finance Accounts Receivable Financing SBA Lending Note: Period end balances as of 12/31/2023 presented.

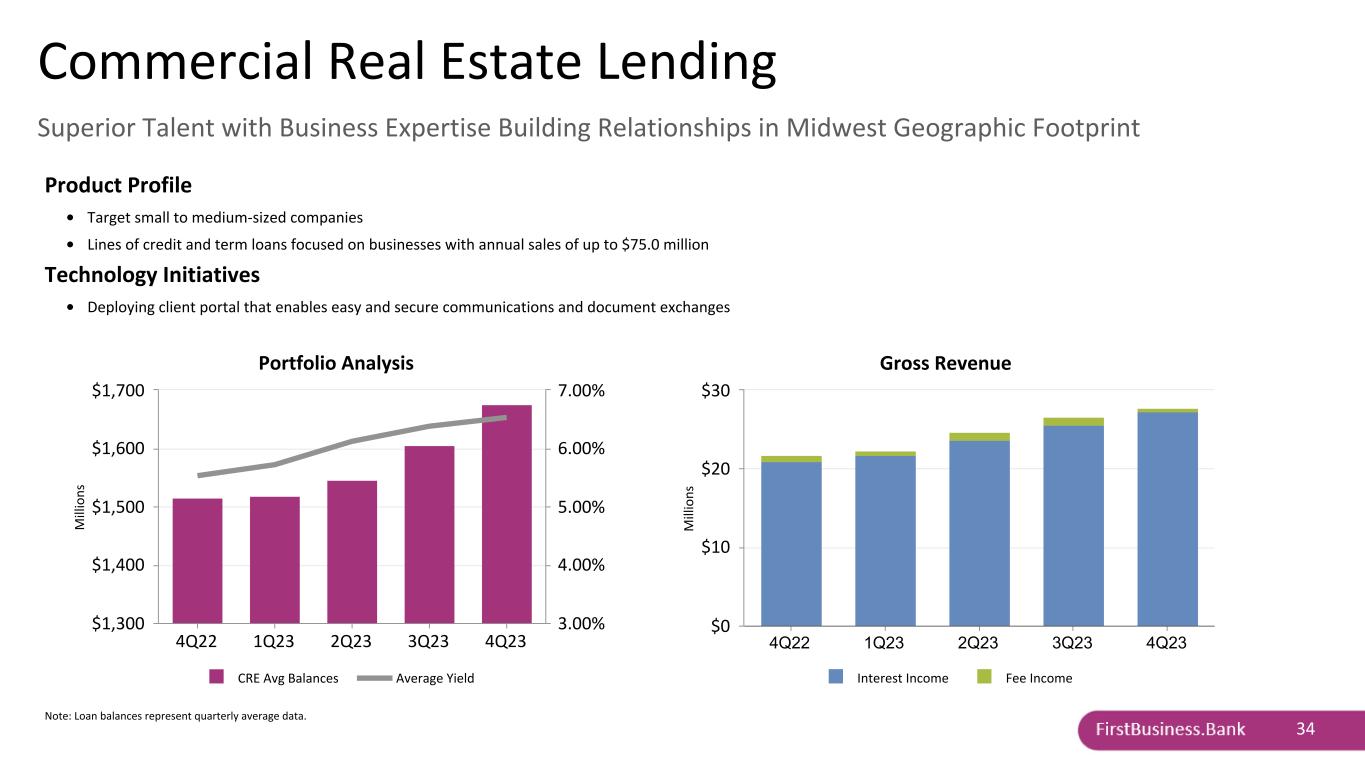

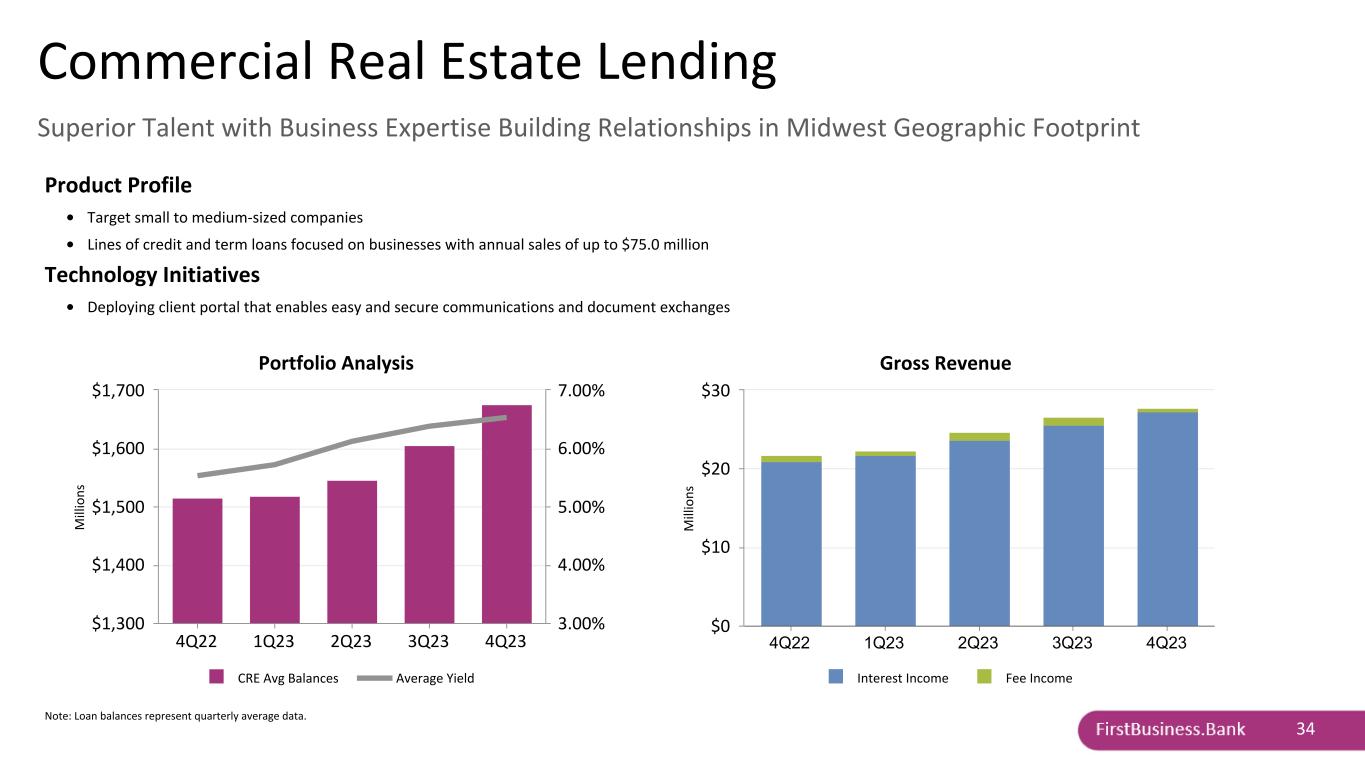

34 Product Profile • Target small to medium-sized companies • Lines of credit and term loans focused on businesses with annual sales of up to $75.0 million Technology Initiatives • Deploying client portal that enables easy and secure communications and document exchanges M ill io ns Portfolio Analysis CRE Avg Balances Average Yield 4Q22 1Q23 2Q23 3Q23 4Q23 $1,300 $1,400 $1,500 $1,600 $1,700 3.00% 4.00% 5.00% 6.00% 7.00% M ill io ns Gross Revenue Interest Income Fee Income 4Q22 1Q23 2Q23 3Q23 4Q23 $0 $10 $20 $30 Note: Loan balances represent quarterly average data. Commercial Real Estate Lending Superior Talent with Business Expertise Building Relationships in Midwest Geographic Footprint

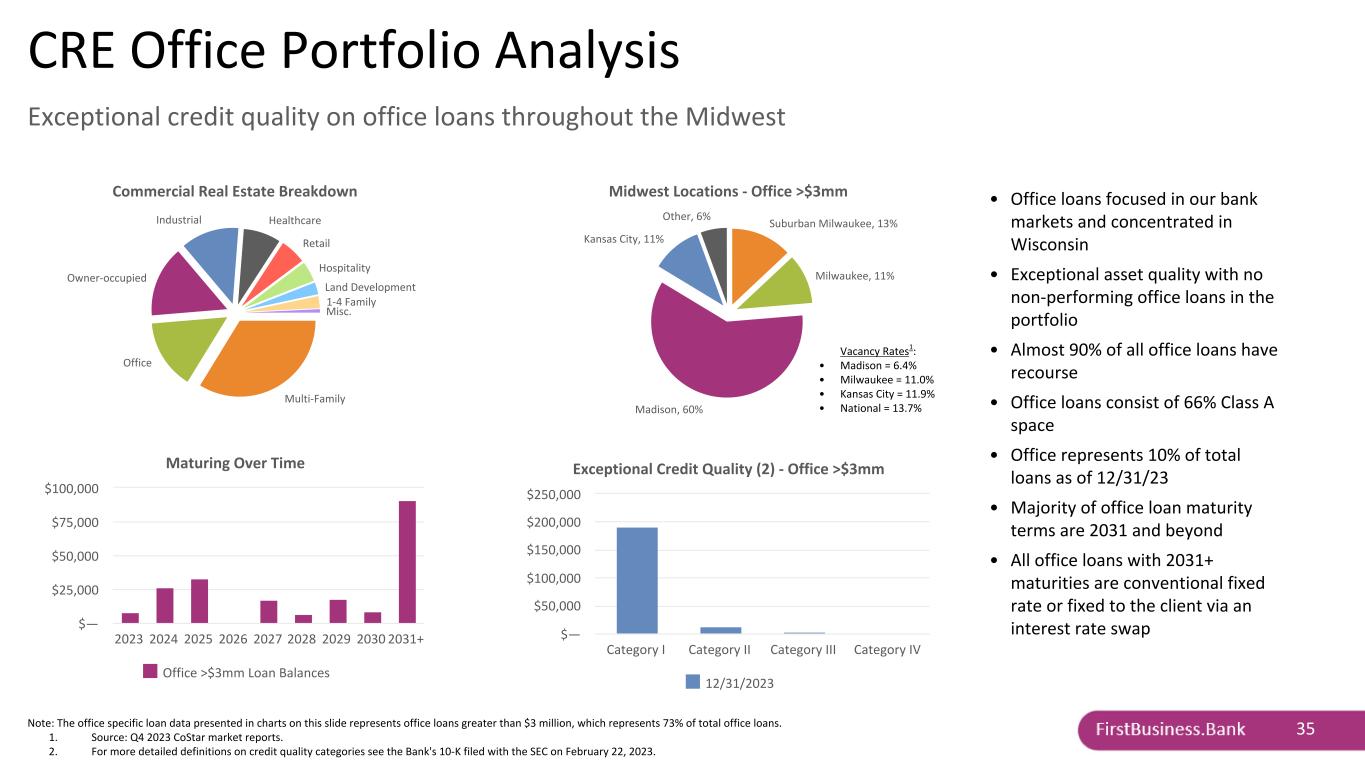

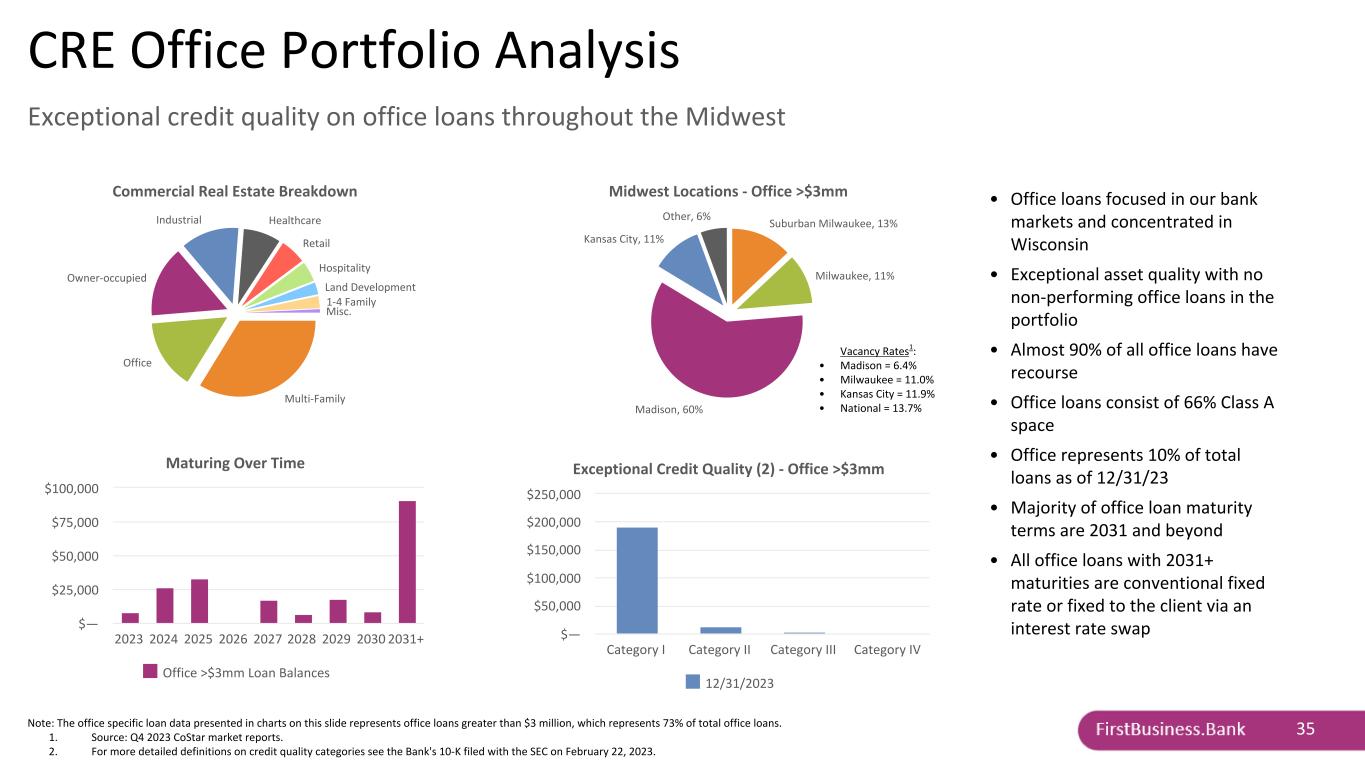

35 Midwest Locations - Office >$3mm Suburban Milwaukee, 13% Milwaukee, 11% Madison, 60% Kansas City, 11% Other, 6% Exceptional Credit Quality (2) - Office >$3mm 12/31/2023 Category I Category II Category III Category IV $— $50,000 $100,000 $150,000 $200,000 $250,000 Maturing Over Time Office >$3mm Loan Balances 2023 2024 2025 2026 2027 2028 2029 2030 2031+ $— $25,000 $50,000 $75,000 $100,000 Vacancy Rates1: • Madison = 6.4% • Milwaukee = 11.0% • Kansas City = 11.9% • National = 13.7% • Office loans focused in our bank markets and concentrated in Wisconsin • Exceptional asset quality with no non-performing office loans in the portfolio • Almost 90% of all office loans have recourse • Office loans consist of 66% Class A space • Office represents 10% of total loans as of 12/31/23 • Majority of office loan maturity terms are 2031 and beyond • All office loans with 2031+ maturities are conventional fixed rate or fixed to the client via an interest rate swap Commercial Real Estate Breakdown Multi-Family Office Owner-occupied Industrial Healthcare Retail Hospitality Land Development 1-4 Family Misc. Note: The office specific loan data presented in charts on this slide represents office loans greater than $3 million, which represents 73% of total office loans. 1. Source: Q4 2023 CoStar market reports. 2. For more detailed definitions on credit quality categories see the Bank's 10-K filed with the SEC on February 22, 2023. CRE Office Portfolio Analysis Exceptional credit quality on office loans throughout the Midwest

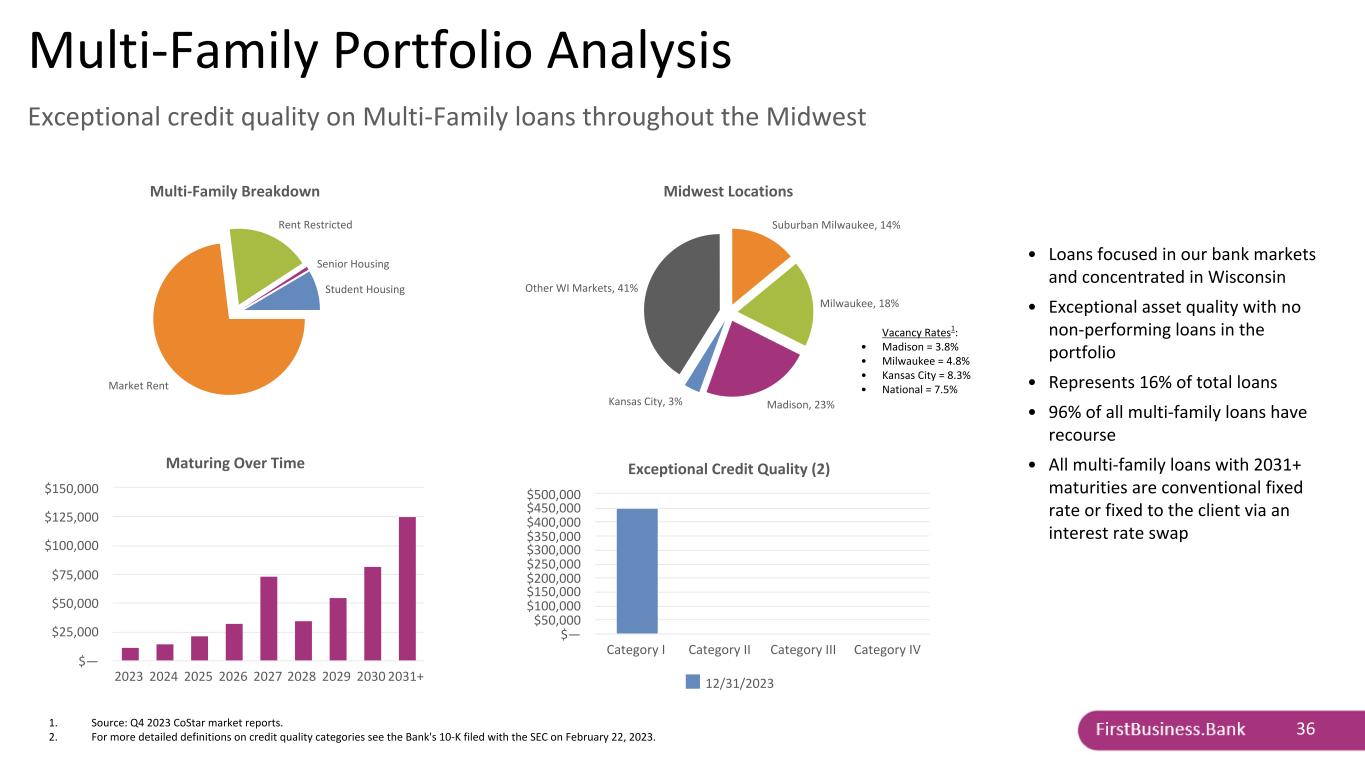

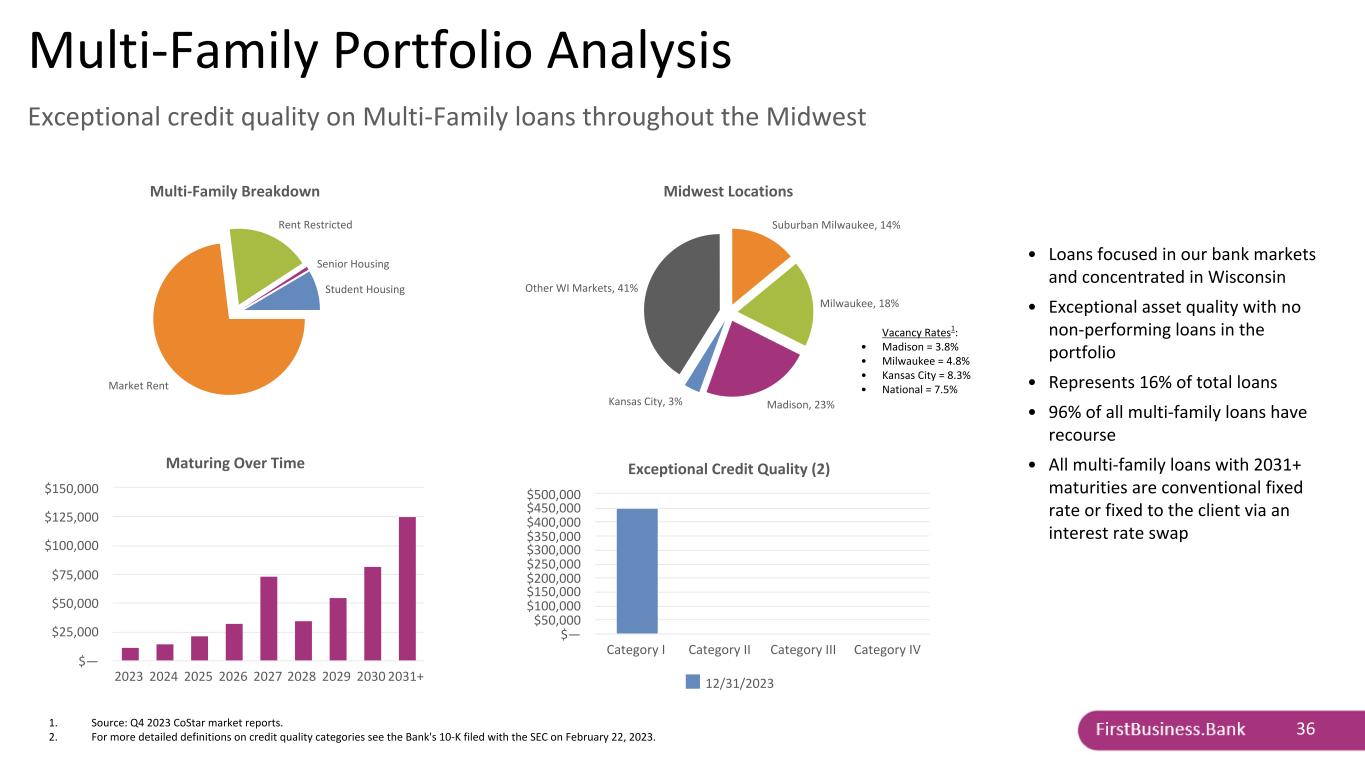

36 Midwest Locations Suburban Milwaukee, 14% Milwaukee, 18% Madison, 23%Kansas City, 3% Other WI Markets, 41% Exceptional Credit Quality (2) 12/31/2023 Category I Category II Category III Category IV $— $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 $500,000 Maturing Over Time 2023 2024 2025 2026 2027 2028 2029 2030 2031+ $— $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 Vacancy Rates1: • Madison = 3.8% • Milwaukee = 4.8% • Kansas City = 8.3% • National = 7.5% • Loans focused in our bank markets and concentrated in Wisconsin • Exceptional asset quality with no non-performing loans in the portfolio • Represents 16% of total loans • 96% of all multi-family loans have recourse • All multi-family loans with 2031+ maturities are conventional fixed rate or fixed to the client via an interest rate swap Multi-Family Breakdown Market Rent Rent Restricted Senior Housing Student Housing 1. Source: Q4 2023 CoStar market reports. 2. For more detailed definitions on credit quality categories see the Bank's 10-K filed with the SEC on February 22, 2023. Multi-Family Portfolio Analysis Exceptional credit quality on Multi-Family loans throughout the Midwest

37 Product Profile • Target small and medium companies in a variety of industries • Financings range from $250,000 to $10 million Technology Initiatives • Deploying client portal that enables easy and secure communications and document exchanges M ill io ns Portfolio Analysis All Other C&I Lending Asset-Based Lending Equipment Finance Accounts Receivable Financing Floorplan Financing SBA Lending Average Yield 4Q22 1Q23 2Q23 3Q23 4Q23 $0 $400 $800 $1,200 4.00% 6.00% 8.00% 10.00% M ill io ns Gross Revenue Interest Income Fee Income 4Q22 1Q23 2Q23 3Q23 4Q23 $0 $5 $10 $15 $20 $25 Note: Loan balances represent quarterly average data. C&I Lending Diversified commercial product offerings target companies nationwide

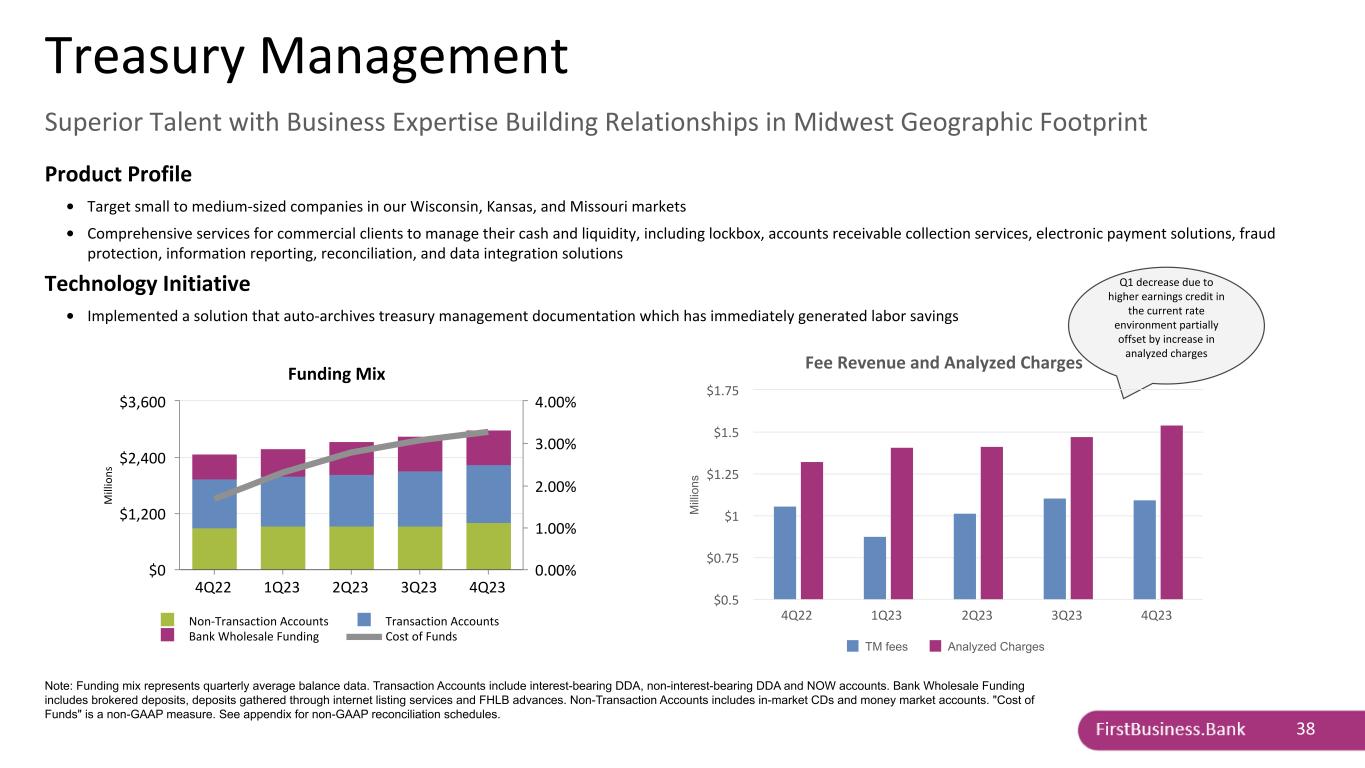

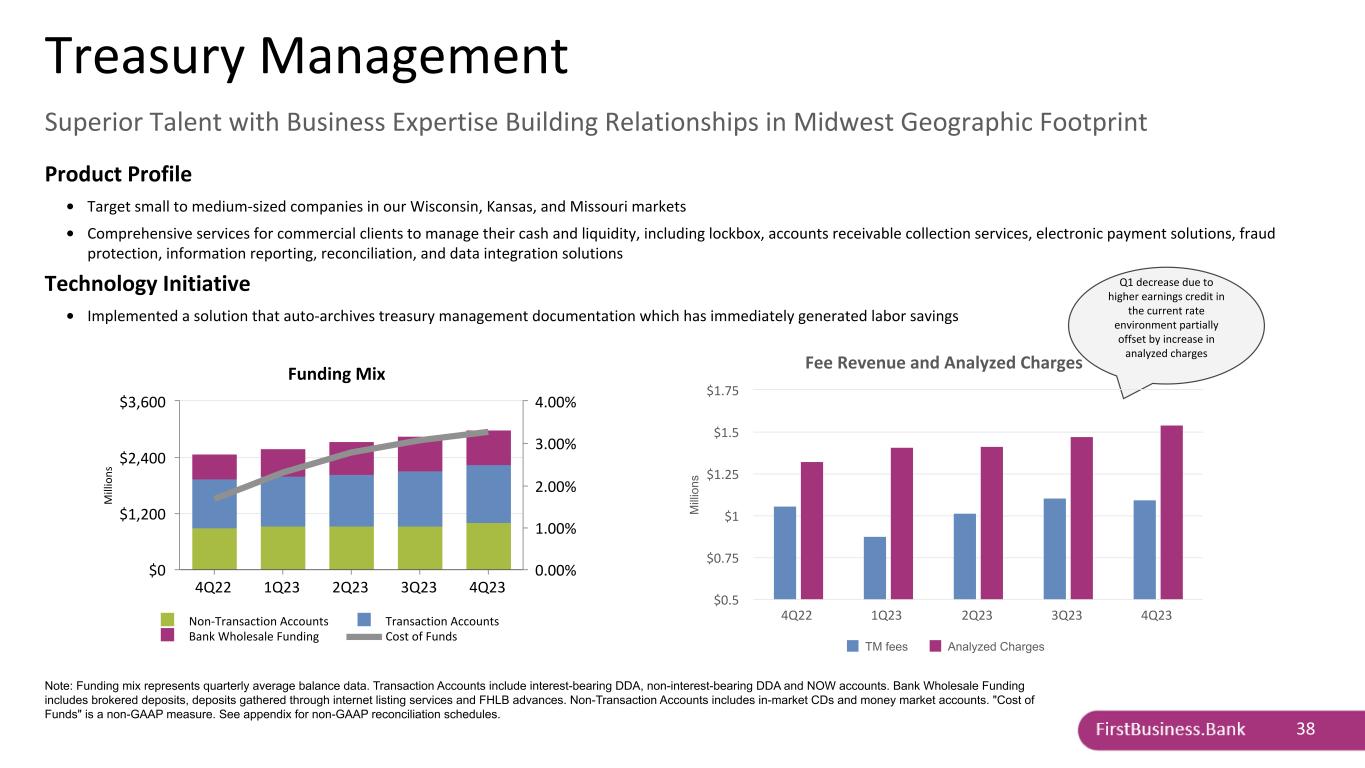

38 Product Profile • Target small to medium-sized companies in our Wisconsin, Kansas, and Missouri markets • Comprehensive services for commercial clients to manage their cash and liquidity, including lockbox, accounts receivable collection services, electronic payment solutions, fraud protection, information reporting, reconciliation, and data integration solutions Technology Initiative • Implemented a solution that auto-archives treasury management documentation which has immediately generated labor savings M ill io ns Funding Mix Non-Transaction Accounts Transaction Accounts Bank Wholesale Funding Cost of Funds 4Q22 1Q23 2Q23 3Q23 4Q23 $0 $1,200 $2,400 $3,600 0.00% 1.00% 2.00% 3.00% 4.00% M ill io ns Fee Revenue 4Q21 1Q22 2Q22 3Q22 4Q22 $0.25 $0.5 $0.75 $1 $1.25 $1.5 Note: Funding mix represents quarterly average balance data. Transaction Accounts include interest-bearing DDA, non-interest-bearing DDA and NOW accounts. Bank Wholesale Funding includes brokered deposits, deposits gathered through internet listing services and FHLB advances. Non-Transaction Accounts includes in-market CDs and money market accounts. "Cost of Funds" is a non-GAAP measure. See appendix for non-GAAP reconciliation schedules. Treasury Management Superior Talent with Business Expertise Building Relationships in Midwest Geographic Footprint M ill io ns Analyzed Charges 4Q21 1Q22 2Q22 3Q22 4Q22 $1 $1.1 $1.2 $1.3 $1.4 Q1 decrease due to higher earnings credit in the current rate environment partially offset by increase in analyzed charges M ill io ns Fee Revenue and Analyzed Charges TM fees Analyzed Charges 4Q22 1Q23 2Q23 3Q23 4Q23 $0.5 $0.75 $1 $1.25 $1.5 $1.75

39 Product Profile • Fiduciary and investment manager for individual and corporate clients, creating and executing asset allocation strategies tailored to each client’s unique situation • Holds full fiduciary powers and offers trust, estate, financial planning, and investment services, acting in a trustee or agent capacity as well as Employee Benefit/Retirement Plan services • Also includes brokerage and custody-only services, for which we administer and safeguard assets but do not provide investment advice Technology Initiative • Implementing client portal for new client onboarding M ill io ns Assets Under Management & Administration Private Wealth Employee Benefits Other 4Q22 1Q23 2Q23 3Q23 4Q23 $1,500 $2,000 $2,500 $3,000 $3,500 M ill io ns Fee Revenue 4Q22 1Q23 2Q23 3Q23 4Q23 $0 $1 $2 $3 $4 Note: Total Assets Under Management & Administration represent period-end balances. Private Wealth Management Wealth Management Services for Businesses, Executives, and High Net Worth Individuals

40 “Adjusted Net Interest Margin” is a non-GAAP measure representing net interest income excluding the fees in lieu of interest and other recurring, but volatile, components of net interest margin divided by average interest-earning assets excluding other recurring, but volatile, components of average interest-earning assets. Fees in lieu of interest are defined as prepayment fees, asset-based loan fees, non-accrual interest, and loan fee amortization. In the judgment of the Company’s management, the adjustments made to net interest income allow investors and analysts to better assess the Company’s net interest income in relation to its core client-facing loan and deposit rate changes by removing the volatility that is associated with these recurring but volatile components. The information provided below reconciles the net interest margin to its most comparable GAAP measure. For the Three Months Ended (Dollars in Thousands) December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 December 31, 2023 Interest income $ 38,319 $ 42,064 $ 47,161 $ 50,941 $ 54,761 Interest expense 10,867 15,359 19,414 22,345 25,222 Net interest income(a) 27,452 26,705 27,747 28,596 29,539 Less fees in lieu of interest 1,318 651 936 582 1,075 Less FRB interest income and FHLB dividend income 613 656 1,064 870 1,466 Adjusted net interest income(b) $ 25,521 $ 25,398 $ 25,747 $ 27,144 $ 26,998 Average interest-earning assets(c) $ 2,649,149 $ 2,765,087 $ 2,913,751 $ 3,038,776 $ 3,199,485 Less Average FRB cash and FHLB stock 50,522 45,150 76,678 54,677 99,118 Less Average non-accrual loans and leases 3,591 3,536 3,781 15,775 18,602 Adjusted average interest-earning assets(d) $ 2,595,036 $ 2,716,401 $ 2,833,292 $ 2,968,324 $ 3,081,765 Net interest margin(a / c) 4.15 % 3.86 % 3.81 % 3.76 % 3.69 % Adjusted net interest margin(b / d) 3.93 % 3.74 % 3.63 % 3.66 % 3.50 % Adjusted Net Interest Margin Non-GAAP Reconciliation

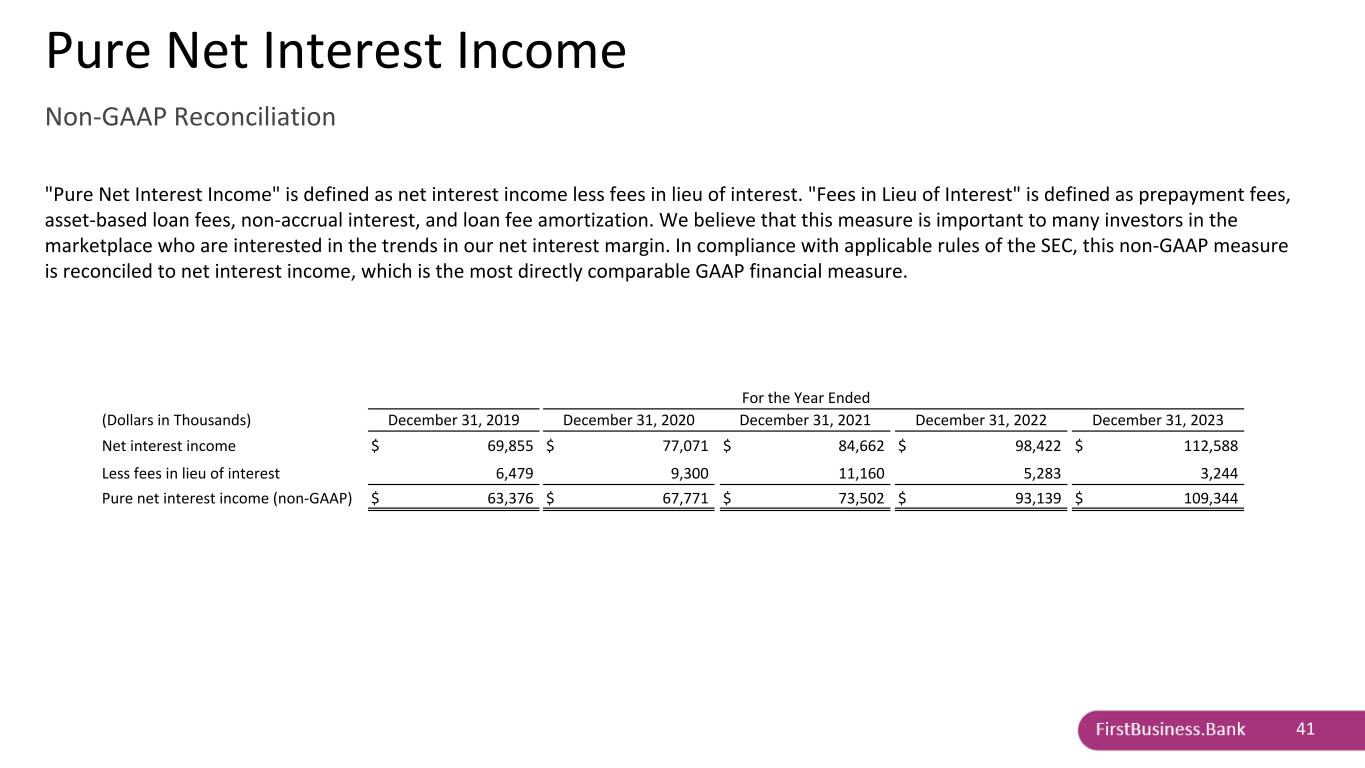

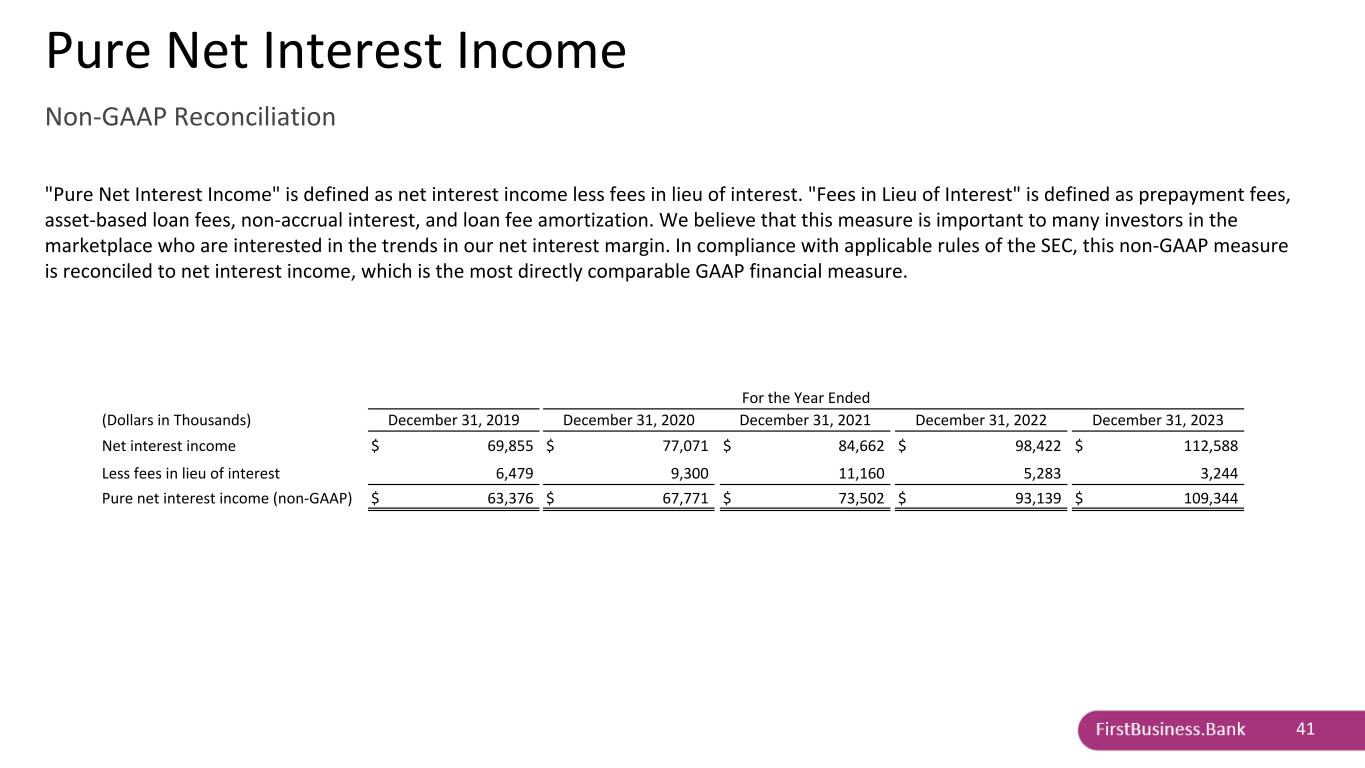

41 "Pure Net Interest Income" is defined as net interest income less fees in lieu of interest. "Fees in Lieu of Interest" is defined as prepayment fees, asset-based loan fees, non-accrual interest, and loan fee amortization. We believe that this measure is important to many investors in the marketplace who are interested in the trends in our net interest margin. In compliance with applicable rules of the SEC, this non-GAAP measure is reconciled to net interest income, which is the most directly comparable GAAP financial measure. For the Year Ended (Dollars in Thousands) December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 December 31, 2023 Net interest income $ 69,855 $ 77,071 $ 84,662 $ 98,422 $ 112,588 Less fees in lieu of interest 6,479 9,300 11,160 5,283 3,244 Pure net interest income (non-GAAP) $ 63,376 $ 67,771 $ 73,502 $ 93,139 $ 109,344 Pure Net Interest Income Non-GAAP Reconciliation For the Year Ended For the Three Months Ended (Dollars in Thousands) December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 June 30, 2022 June 30, 2023 Net interest income $ 69,856 $ 77,071 $ 84,662 $ 98,422 $ 23,660 $ 27,747 Less fees in lieu of interest 6,479 9,315 11,160 5,283 1,865 936 Pure net interest income (non-GAAP) $ 63,377 $ 67,756 $ 73,502 $ 93,139 $ 21,795 $ 26,811

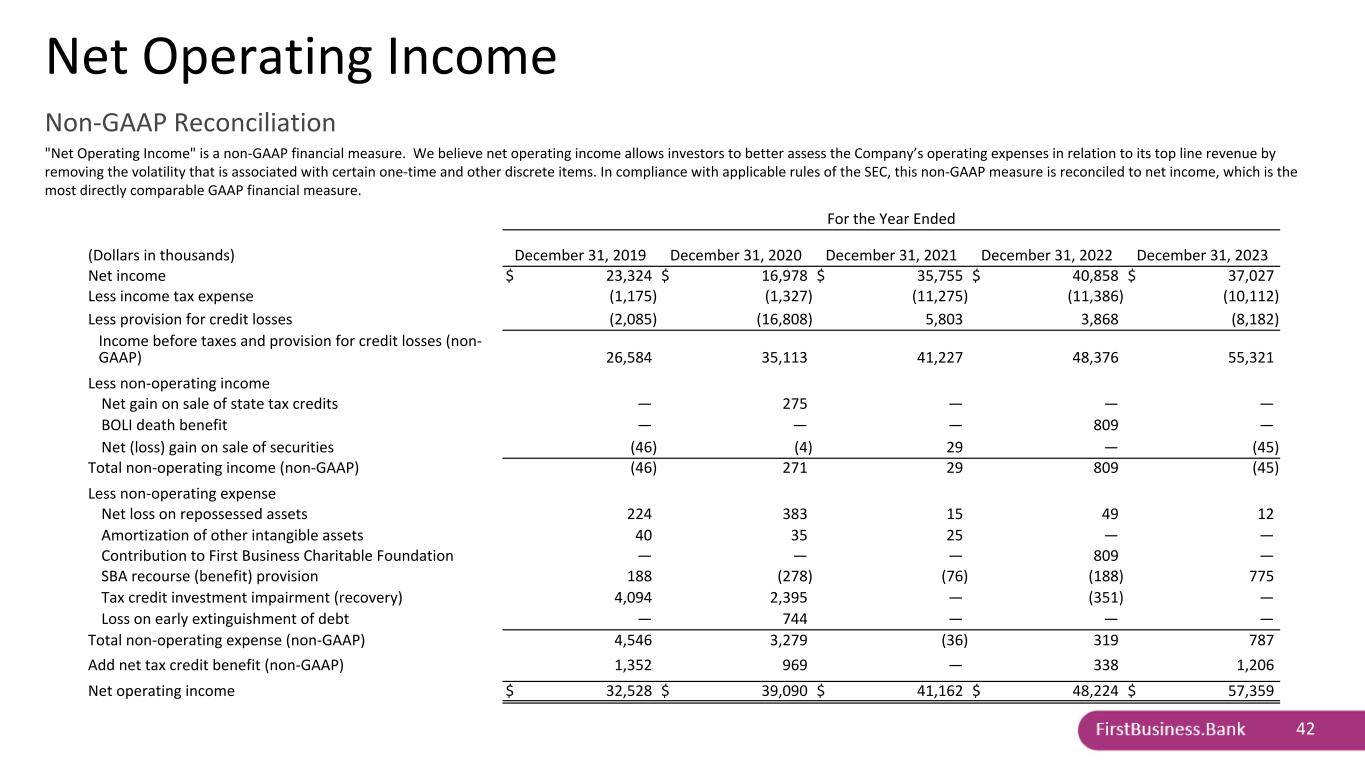

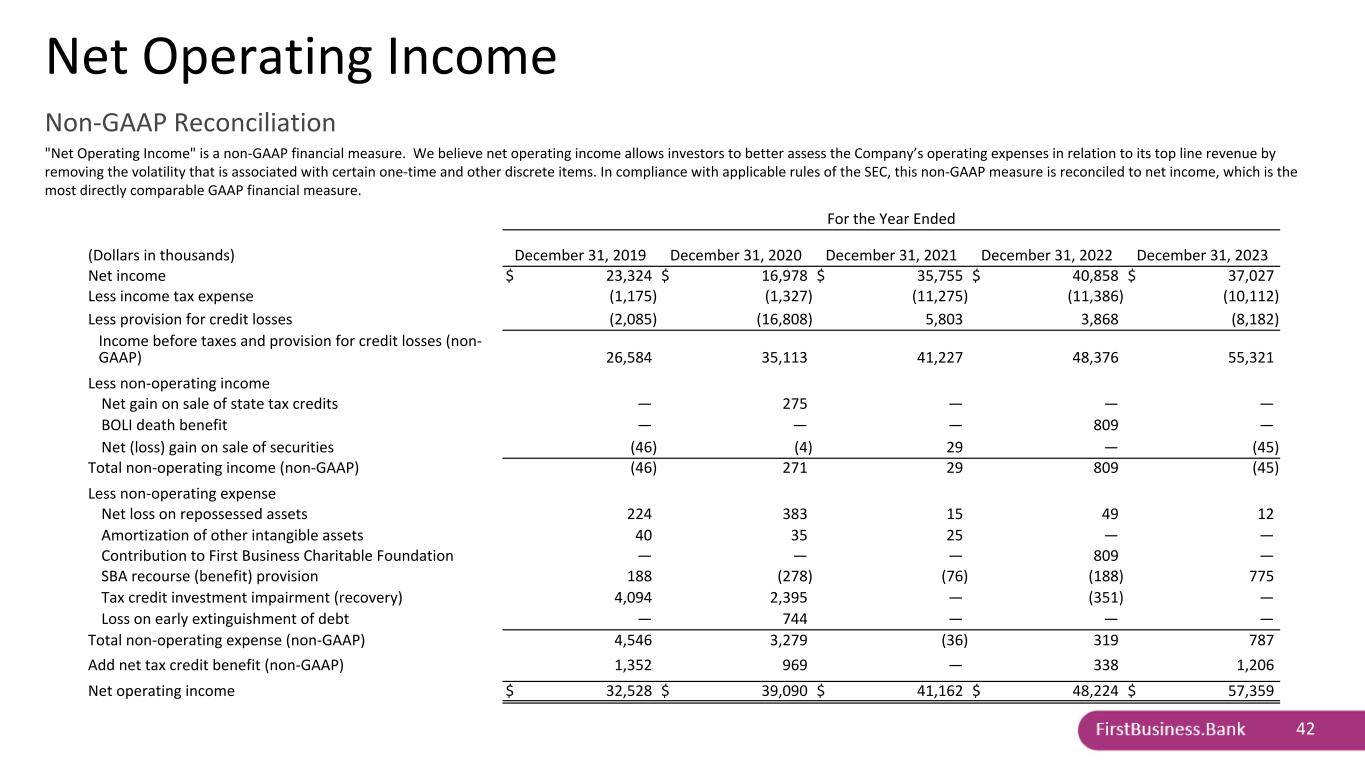

42 "Net Operating Income" is a non-GAAP financial measure. We believe net operating income allows investors to better assess the Company’s operating expenses in relation to its top line revenue by removing the volatility that is associated with certain one-time and other discrete items. In compliance with applicable rules of the SEC, this non-GAAP measure is reconciled to net income, which is the most directly comparable GAAP financial measure. For the Year Ended (Dollars in thousands) December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 December 31, 2023 Net income $ 23,324 $ 16,978 $ 35,755 $ 40,858 $ 37,027 Less income tax expense (1,175) (1,327) (11,275) (11,386) (10,112) Less provision for credit losses (2,085) (16,808) 5,803 3,868 (8,182) Income before taxes and provision for credit losses (non- GAAP) 26,584 35,113 41,227 48,376 55,321 Less non-operating income Net gain on sale of state tax credits — 275 — — — BOLI death benefit — — — 809 — Net (loss) gain on sale of securities (46) (4) 29 — (45) Total non-operating income (non-GAAP) (46) 271 29 809 (45) Less non-operating expense Net loss on repossessed assets 224 383 15 49 12 Amortization of other intangible assets 40 35 25 — — Contribution to First Business Charitable Foundation — — — 809 — SBA recourse (benefit) provision 188 (278) (76) (188) 775 Tax credit investment impairment (recovery) 4,094 2,395 — (351) — Loss on early extinguishment of debt — 744 — — — Total non-operating expense (non-GAAP) 4,546 3,279 (36) 319 787 Add net tax credit benefit (non-GAAP) 1,352 969 — 338 1,206 Net operating income $ 32,528 $ 39,090 $ 41,162 $ 48,224 $ 57,359 Net Operating Income Non-GAAP Reconciliation For the Year Ended For the Three Months Ended (Dollars in thousands) December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 June 30, 2022 June 30, 2023 Net income $ 23,324 $ 16,978 $ 35,755 $ 40,858 $ 11,204 $ 8,337 Less income tax expense (1,175) (1,327) (11,275) (11,386) (3,599) (2,522) Less provision for loan and lease losses (2,085) (16,808) 5,803 3,868 3,727 (2,231) Income before taxes and provision for loan and lease losses (non-GAAP) 26,584 35,113 41,227 48,376 11,076 13,090 Less non-operating income Net gain on sale of state tax credits — 275 — — — — BOLI death benefit — — — 809 — — Net (loss) gain on sale of securities (46) (4) 29 — — (45) Total non-operating income (non-GAAP) (46) 271 29 809 — (45) Less non-operating expense Net loss (gain) on foreclosed properties 224 383 15 49 8 (2) Amortization of other intangible assets 40 35 25 — — — BOLI death benefit — — — 809 — — SBA recourse (benefit) provision 188 (278) (76) (188) 114 341 Tax credit investment impairment (recovery) 4,094 2,395 — (351) (351) — Loss on early extinguishment of debt — 744 — — — — Total non-operating expense (non-GAAP) 4,546 3,279 (36) 319 (229) 339 Add net tax credit benefit (non-GAAP) 1,352 969 — 338 — 151 Net operating income $ 32,528 $ 39,090 $ 41,162 $ 48,224 $ 10,847 $ 13,625

43 “Pre-tax, pre-provision adjusted return on average assets” is defined as operating revenue less operating expense divided by average total assets. In the judgment of the Company’s management, the adjustments made to non-interest expense and non-interest income allow investors and analysts to better assess the Company’s operating expenses in relation to its core operating revenue by removing the volatility that is associated with certain one-time items and other discrete items. Adjusted PTPP ROAA Non-GAAP Reconciliation (Unaudited) For the Three Months Ended (Dollars in thousands) December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 December 31, 2023 Total non-interest expense $ 21,167 $ 21,767 $ 22,031 $ 23,189 $ 21,588 Less: Net loss (gain) on repossessed assets 22 6 (2) 4 4 SBA recourse provision (benefit) (322) (18) 341 242 210 Contribution to First Business Charitable Foundation 809 — — — — Total operating expense (a) $ 20,658 $ 21,779 $ 21,692 $ 22,943 $ 21,374 Net interest income $ 27,452 $ 26,705 $ 27,747 $ 28,596 $ 29,540 Total non-interest income 6,973 8,410 7,374 8,430 7,094 Less: Bank-owned life insurance claim 809 — — — — Net loss on sale of securities — — (45) — — Adjusted non-interest income 6,164 8,410 7,419 8,430 7,094 Total operating revenue (b) $ 33,616 $ 35,115 $ 35,166 $ 37,026 $ 36,634 Pre-tax, pre-provision adjusted earnings (b - a) $ 12,958 $ 13,336 $ 13,474 $ 14,083 $ 15,260 Average total assets $ 2,867,475 $ 2,984,600 $ 3,127,234 $ 3,276,240 $ 3,454,652 Pre-tax, pre-provision adjusted return on average assets 1.81 % 1.79 % 1.72 % 1.72 % 1.77 %

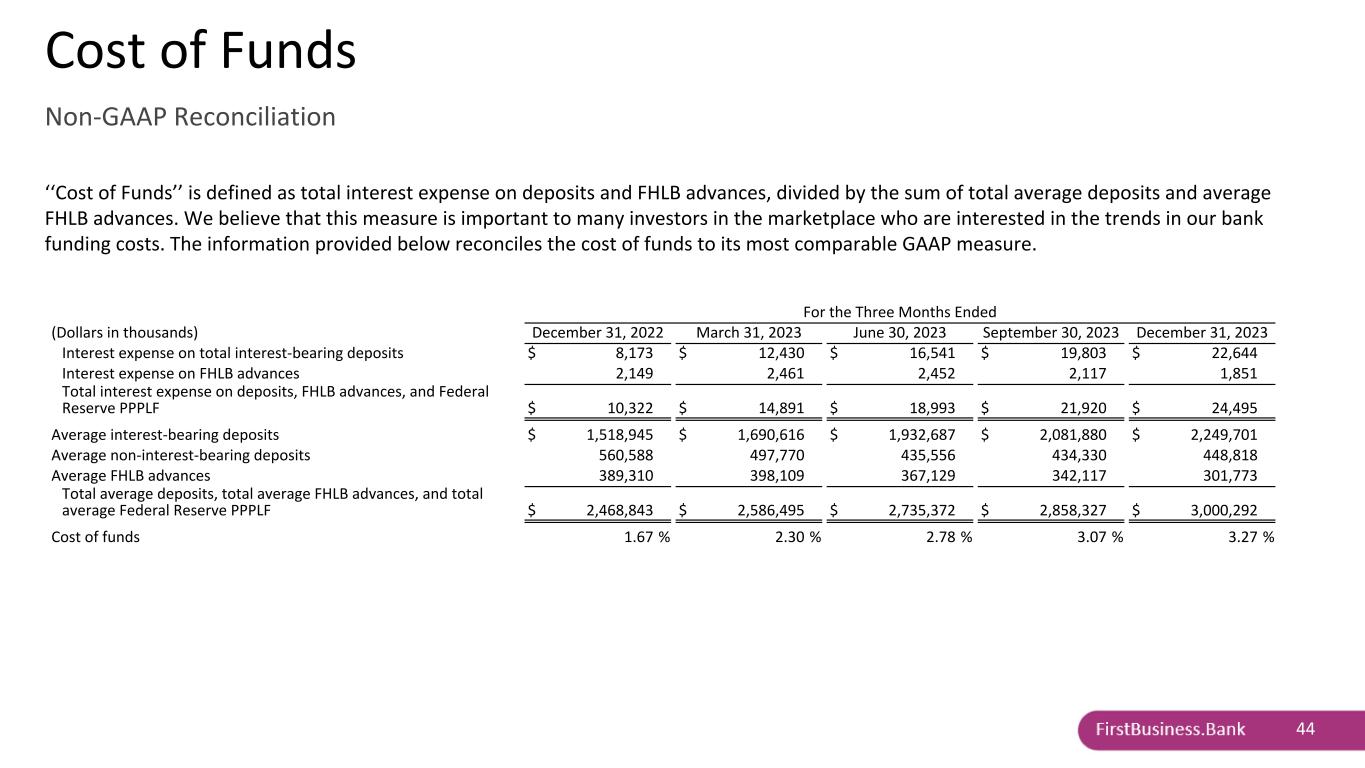

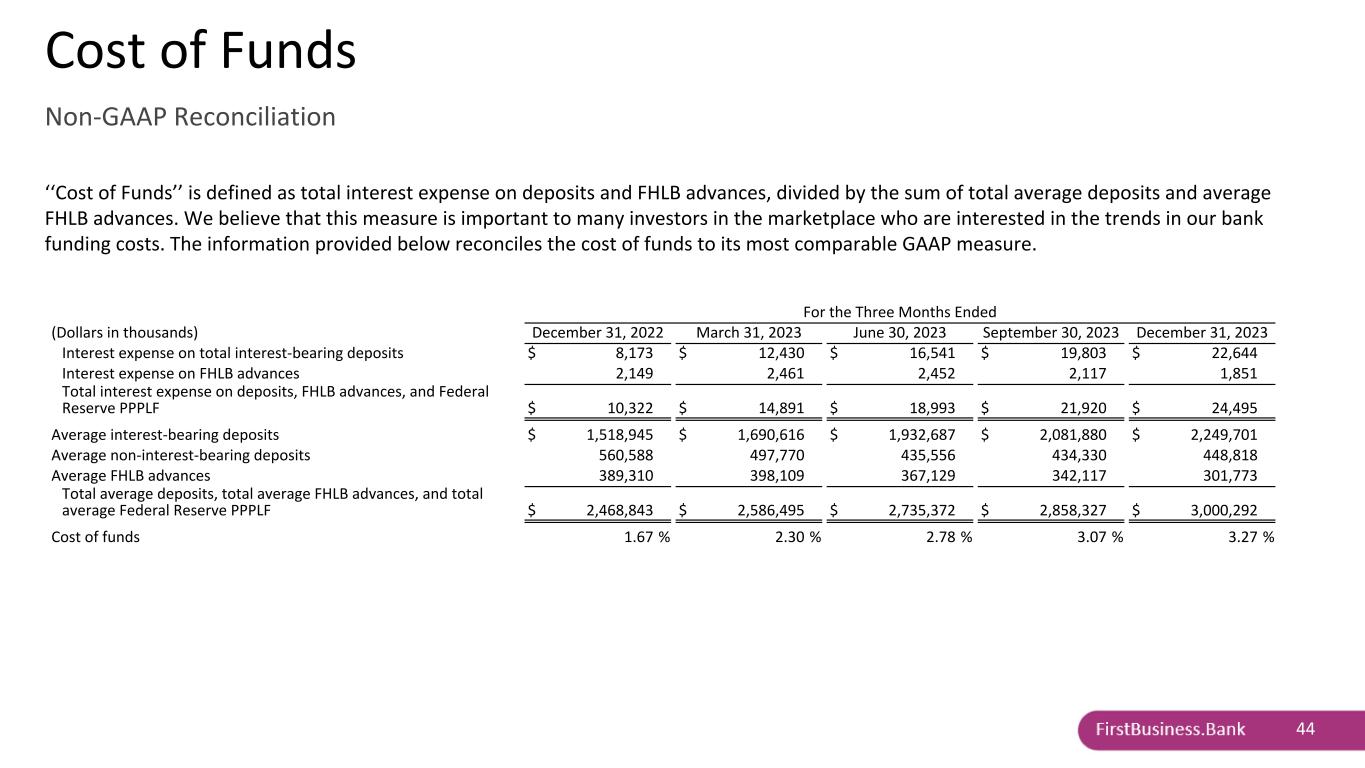

44 ‘‘Cost of Funds’’ is defined as total interest expense on deposits and FHLB advances, divided by the sum of total average deposits and average FHLB advances. We believe that this measure is important to many investors in the marketplace who are interested in the trends in our bank funding costs. The information provided below reconciles the cost of funds to its most comparable GAAP measure. For the Three Months Ended (Dollars in thousands) December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 December 31, 2023 Interest expense on total interest-bearing deposits $ 8,173 $ 12,430 $ 16,541 $ 19,803 $ 22,644 Interest expense on FHLB advances 2,149 2,461 2,452 2,117 1,851 Total interest expense on deposits, FHLB advances, and Federal Reserve PPPLF $ 10,322 $ 14,891 $ 18,993 $ 21,920 $ 24,495 Average interest-bearing deposits $ 1,518,945 $ 1,690,616 $ 1,932,687 $ 2,081,880 $ 2,249,701 Average non-interest-bearing deposits 560,588 497,770 435,556 434,330 448,818 Average FHLB advances 389,310 398,109 367,129 342,117 301,773 Total average deposits, total average FHLB advances, and total average Federal Reserve PPPLF $ 2,468,843 $ 2,586,495 $ 2,735,372 $ 2,858,327 $ 3,000,292 Cost of funds 1.67 % 2.30 % 2.78 % 3.07 % 3.27 % Cost of Funds Non-GAAP Reconciliation