Nasdaq: HMST 2nd Quarter 2023 July 28, 2023

Important Disclosures Forward-Looking Statements This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance, business plans and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are based on our management's current expectations, beliefs, projections, and related to future plans and strategies, anticipated events, outcomes, or trends, as well as a number of assumptions concerning future events, are not historical facts and are identified by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will,” “would” and similar expressions. Forward-looking statements in this presentation include, among other matters, statements regarding our business plans and strategies, general economic trends, strategic initiatives we have announced, growth scenarios and performance targets and key drivers guidance with respect to loans held for investment, average deposits, net interest margin, noninterest income and noninterest expense. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our Annual Report on Form 10-K for the year ended December 31, 2022, and in our subsequent quarterly reports on Forms 10-Q and Forms 8-K. Many of these factors and events that affect the volatility in our stock price and shareholders’ response to those events and factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These risks include, without limitation, changes in the U.S. and global economies, including business disruptions, reductions in employment, inflationary pressures and an increase in business failures, specifically among our customers; changes in the interest rate environment may reduce interest margins; changes in deposit flows, loan demand or real estate values may adversely affect the business of the Bank, through which substantially all of our operations are carried out; there may be increases in competitive pressure among financial institutions or from non-financial institutions; our ability to attract and retain key members of our senior management team; the timing and occurrence or non-occurrence of events may be subject to circumstances beyond our control; our ability to control operating costs and expenses; our credit quality and the effect of credit quality on our credit losses expense and allowance for credit losses; the adequacy of our allowance for credit losses; changes in accounting principles, policies or guidelines may cause our financial condition to be perceived or interpreted differently; legislative or regulatory changes that may adversely affect our business or financial condition, including, without limitation, changes in corporate and/or individual income tax laws and policies, changes in privacy laws, and changes in regulatory capital or other rules, and the availability of resources to address or respond to such changes; general economic conditions, either nationally or locally in some or all areas in which we conduct business, or conditions in the securities markets or banking industry, may be less favorable than what we currently anticipate; challenges our customers may face in meeting current underwriting standards may adversely impact all or a substantial portion of the value of our rate-lock loan activity we recognize; technological changes may be more difficult or expensive than what we anticipate; a failure in or breach of our operational or security systems or information technology infrastructure, or those of our third-party providers and vendors, including due to cyber-attacks; success or consummation of new business initiatives may be more difficult or expensive than what we anticipate; our ability to grow efficiently both organically and through acquisitions and to manage our growth and integration costs; staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our work force and potential associated charges; litigation, investigations or other matters before regulatory agencies, whether currently existing or commencing in the future, may delay the occurrence or non- occurrence of events longer than what we anticipate; our ability to obtain regulatory approvals or non-objection to take various capital actions, including the payment of dividends by us or the Bank, or repurchases of our common stock; and the consummation of our transaction to purchase three branches in southern California. Actual results may fall materially short of our expectations and projections, and we may be unable to execute on our strategic initiatives, or we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to us as of the date hereof, and we do not undertake to update or revise any forward-looking statements for any reason. As used in this presentation, "HMST," "HomeStreet," the "Company," "we," "us," "our," or similar references refer to HomeStreet, Inc., a Washington corporation, and its consolidated subsidiary, HomeStreet Bank (the "Bank"). Non-GAAP Financial Measures This presentation contains supplemental financial information determined by methods other than in accordance with U.S. generally accepted accounting principles ("GAAP"). Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures, may also be found in the appendix, our SEC filings, and in the earnings release available on our web site. p. 1

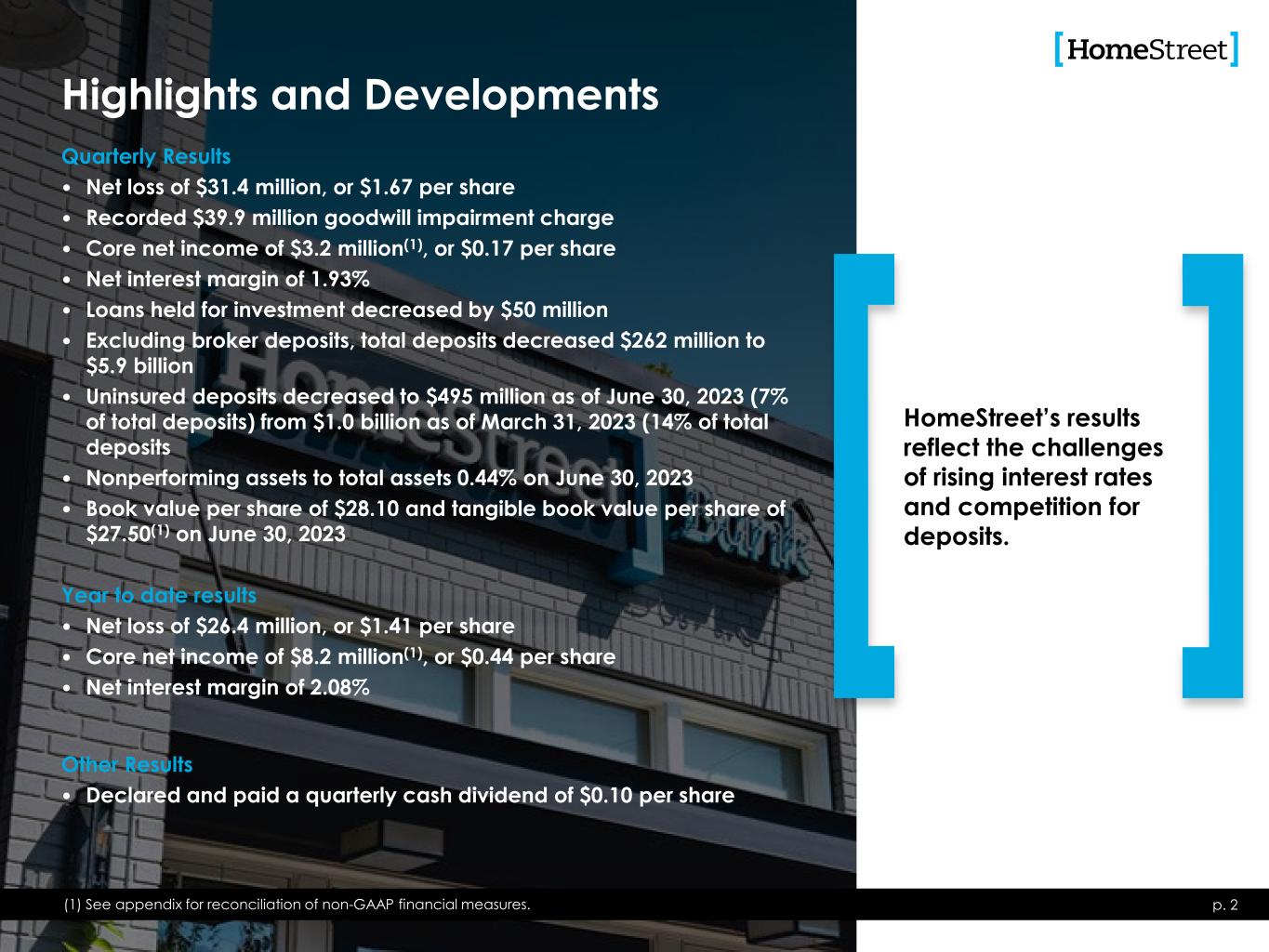

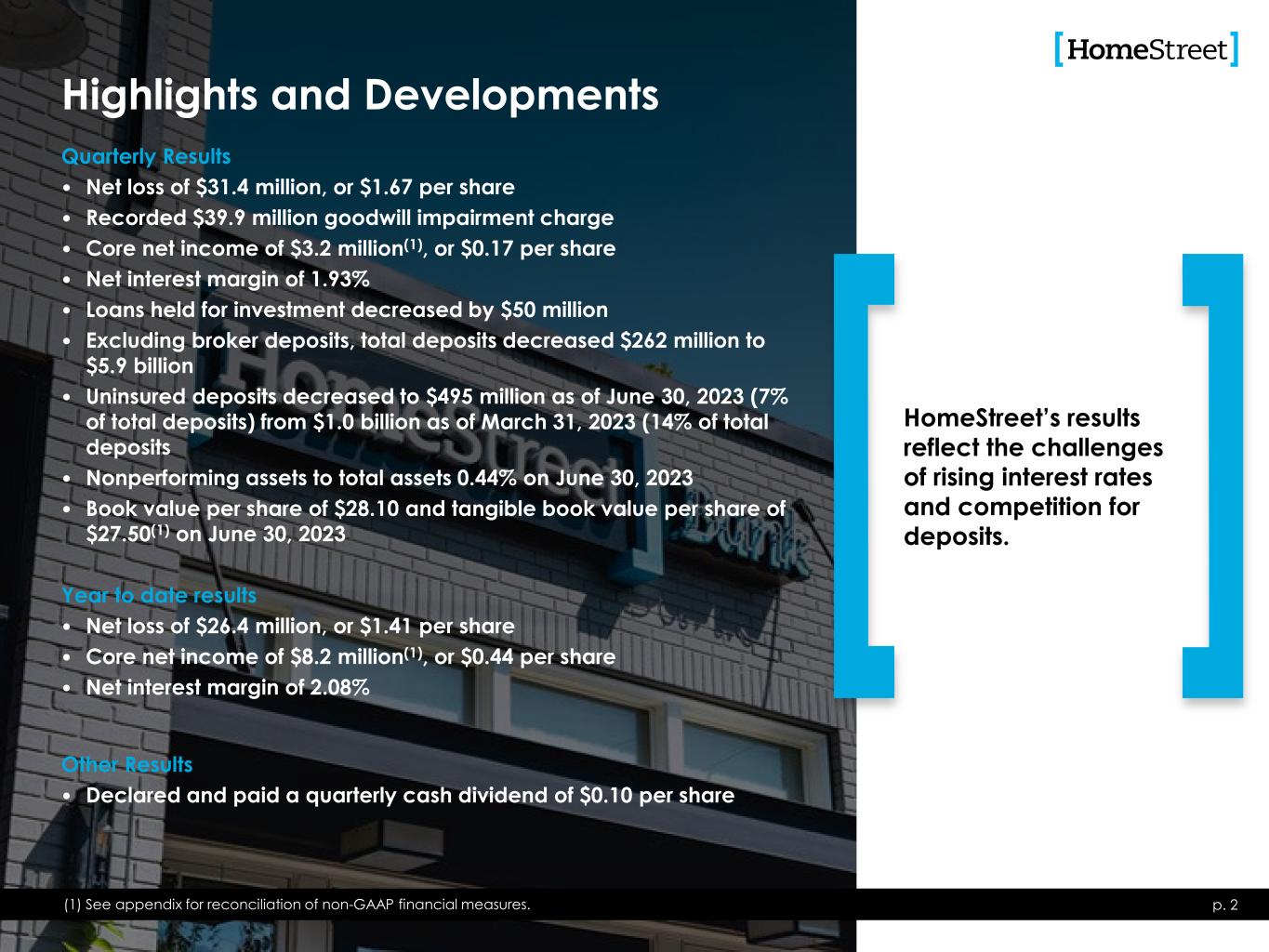

Highlights and Developments p. 2 Quarterly Results • Net loss of $31.4 million, or $1.67 per share • Recorded $39.9 million goodwill impairment charge • Core net income of $3.2 million(1), or $0.17 per share • Net interest margin of 1.93% • Loans held for investment decreased by $50 million • Excluding broker deposits, total deposits decreased $262 million to $5.9 billion • Uninsured deposits decreased to $495 million as of June 30, 2023 (7% of total deposits) from $1.0 billion as of March 31, 2023 (14% of total deposits • Nonperforming assets to total assets 0.44% on June 30, 2023 • Book value per share of $28.10 and tangible book value per share of $27.50(1) on June 30, 2023 Year to date results • Net loss of $26.4 million, or $1.41 per share • Core net income of $8.2 million(1), or $0.44 per share • Net interest margin of 2.08% Other Results • Declared and paid a quarterly cash dividend of $0.10 per share HomeStreet’s results reflect the challenges of rising interest rates and competition for deposits. (1) See appendix for reconciliation of non-GAAP financial measures.

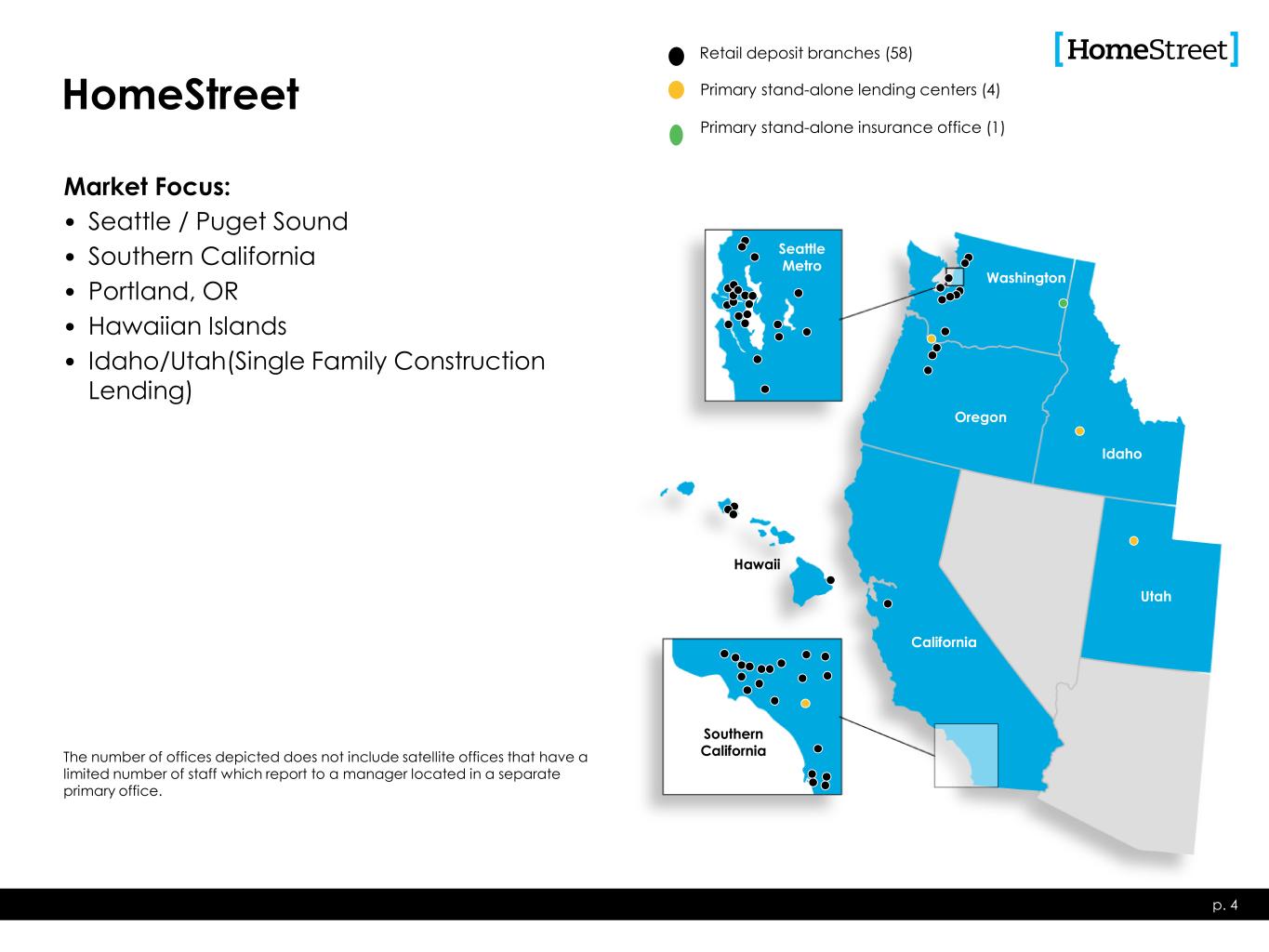

p. 3 Managing through challenging times • Seattle-based diversified commercial & consumer bank – company founded in 1921 • Serving customers throughout the western United States • 58 bank branches • Total assets $9.5 billion Nasdaq: HMST

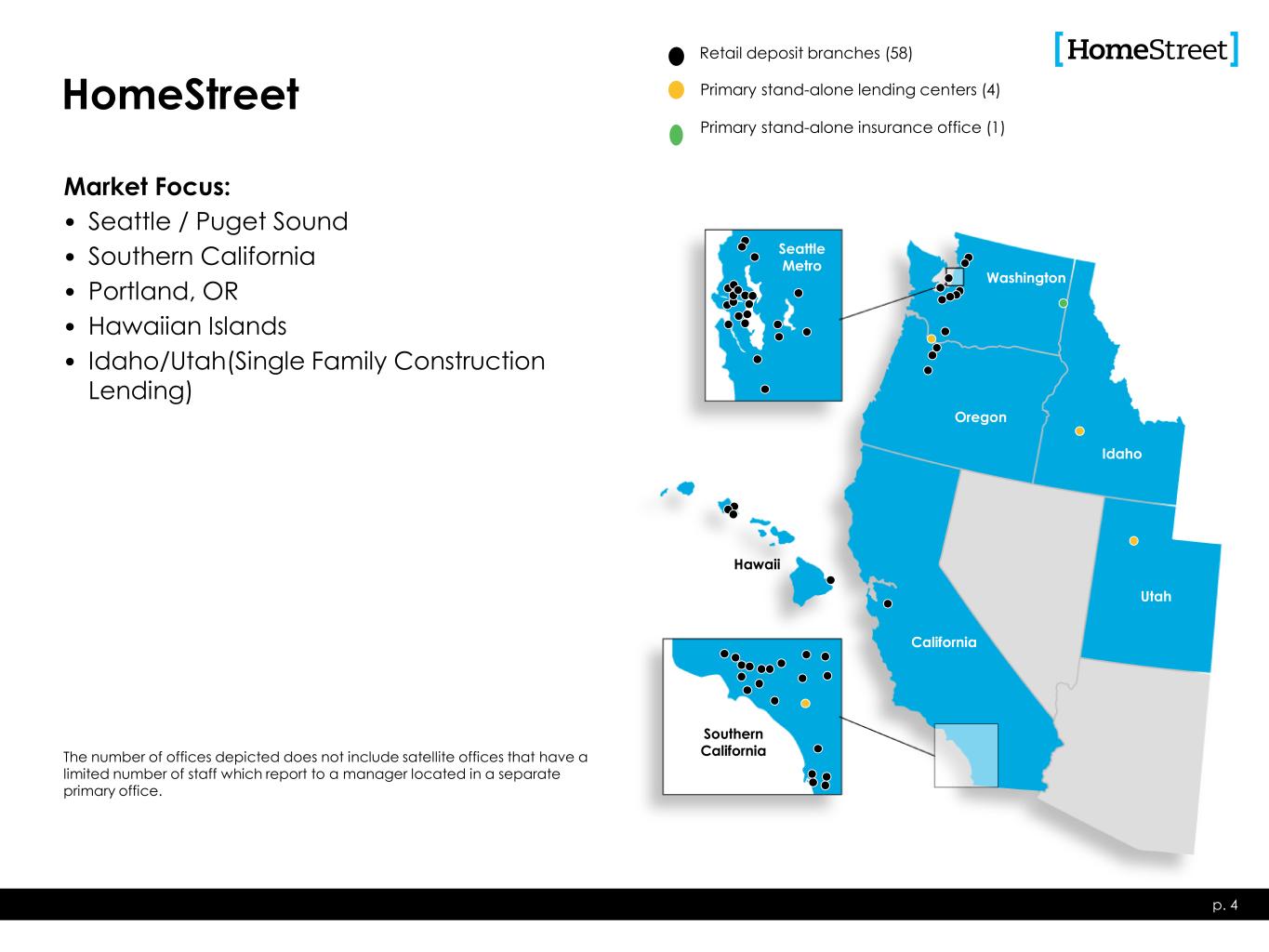

Seattle Metro Washington Oregon Idaho Utah California Hawaii Southern California Retail deposit branches (58) Primary stand-alone insurance office (1) Primary stand-alone lending centers (4)HomeStreet p. 4 The number of offices depicted does not include satellite offices that have a limited number of staff which report to a manager located in a separate primary office. Market Focus: • Seattle / Puget Sound • Southern California • Portland, OR • Hawaiian Islands • Idaho/Utah(Single Family Construction Lending)

p. 5 Strategy • Long term strategy to replace borrowings and certificates of deposit with transaction accounts through organic growth and acquisitions • Demonstrated ability to attract deposits at interest rates meaningfully below wholesale borrowing rates • Hedged borrowings ($1.6 billion) to mitigate risk of continued increases in interest rates • Utilize Fed Bank Term Funding Program to replace FHLB advances, hedge forward rate risk, better utilize collateral, and preserve contingent funding availability at the Federal Home Loan Bank and the Federal Reserve Current loan production strategy • Substantially reduced production levels in 2023 • Focus on variable rate loan production Higher Interest Rate Environment

p. 6 • Low level of uninsured deposits • Diversified deposit base • Continuing ability to attract new deposit clients • Strong Contingent Liquidity • New loan originations focus is on variable rate products • Incentivizing multifamily borrowers to refinance loans, resulting in higher current yields Funding Overview

p. 7 Diversified Deposit Base: • The average balance of our noninterest-bearing consumer deposit accounts as of June 30, 2023, was $8,000 and overall average consumer deposit account balance was $30,000. • The average balance of our noninterest-bearing business deposit accounts as of June 30, 2023, was $70,000 and overall average business deposit account balance was $100,000. • As a percentage of our deposit portfolio, our top ten customers make up only 4.6% of our total deposit balances. • Uninsured deposits of $495 million as of June 30, 2023 (7% of total deposits) • We do not have exposure to volatile deposits such as start-up funds, venture capital or crypto funds . Continuing ability to attract new deposit clients • Our branch system added 299 new business customers in the first six months of 2023. • Commercial banking added 64 new customers in the first six months of 2023. Liquidity: • Our on-balance sheet liquidity as of June 30, 2023, was 14%. • Our available contingent liquidity borrowing sources ($5.6 billion) equal to 84% of the total amount of deposits outstanding as of June 30, 2023. • Optimizing funding costs by utilizing least cost option (borrowings / brokered deposits) • Liquidity Considerations

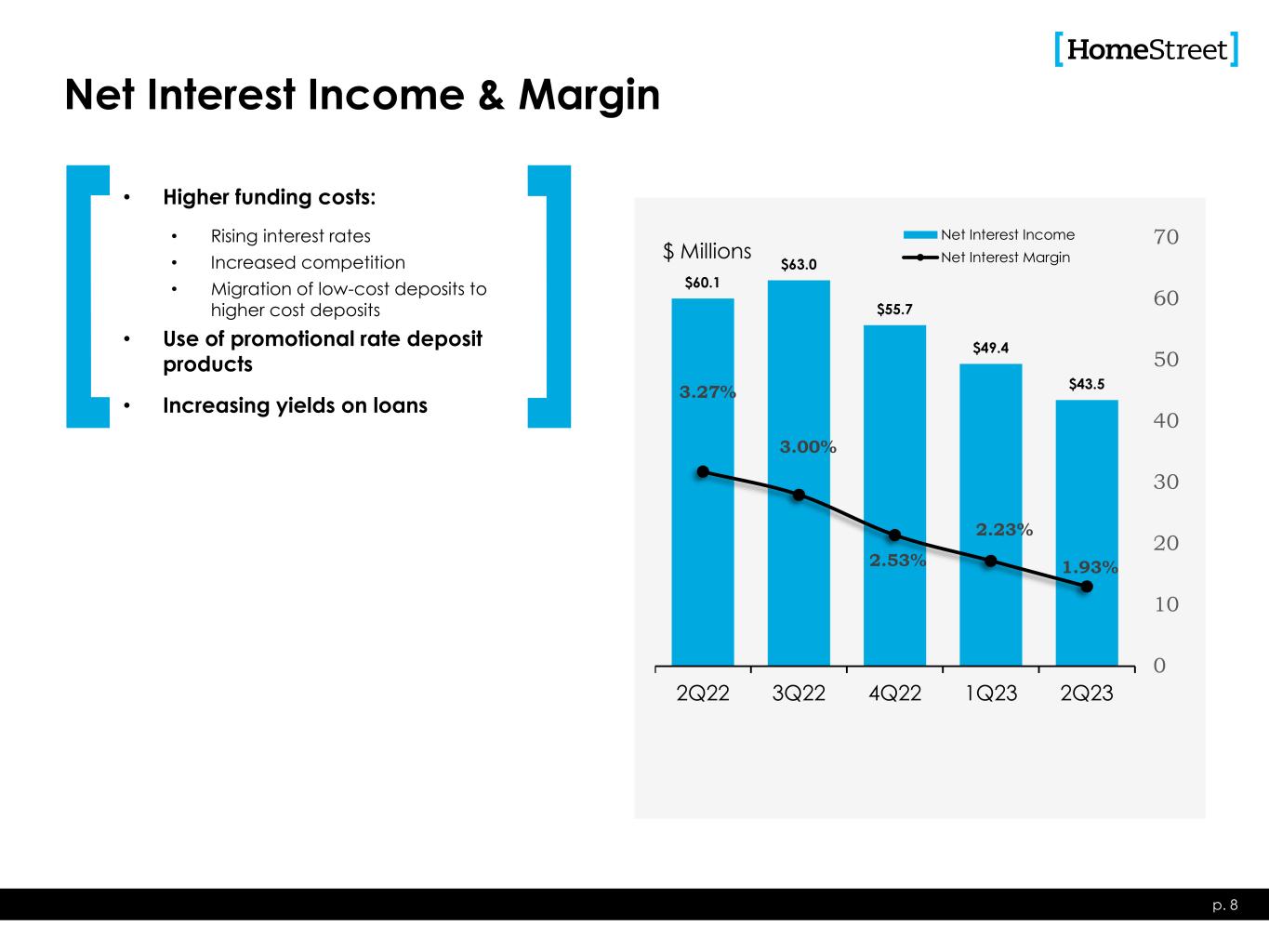

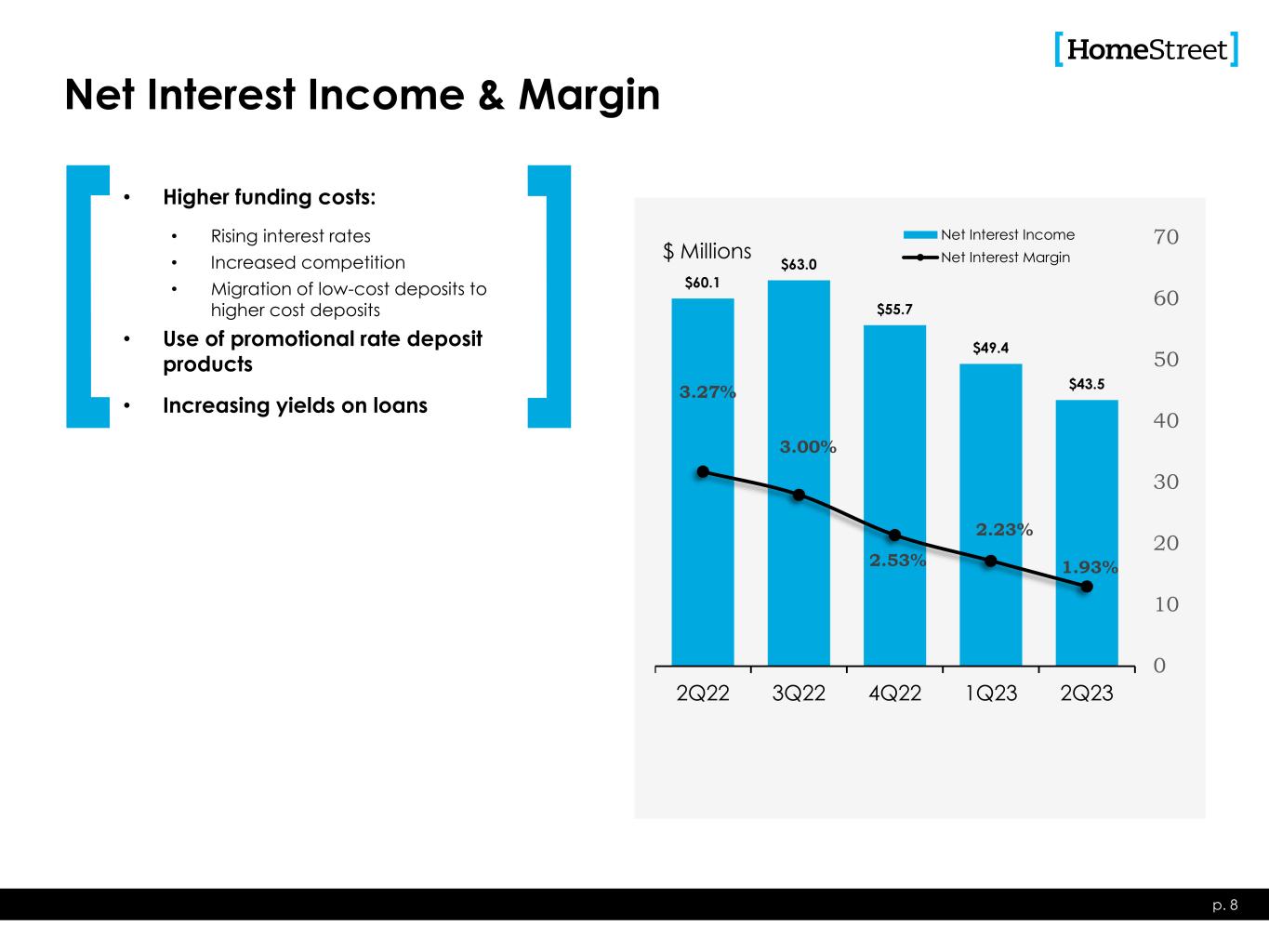

$60.1 $63.0 $55.7 $49.4 $43.53.27% 3.00% 2.53% 2.23% 1.93% 0 10 20 30 40 50 60 70 2Q22 3Q22 4Q22 1Q23 2Q23 Net Interest Income Net Interest Margin Net Interest Income & Margin p. 8 $ Millions • Higher funding costs: • Rising interest rates • Increased competition • Migration of low-cost deposits to higher cost deposits • Use of promotional rate deposit products • Increasing yields on loans

$7.45 $8.44 $8.89 $9.05 $9.11 3.68% 3.95% 4.24% 4.35% 4.45% 3.0% 3.5% 4.0% 4.5% 5.0% $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 2Q22 3Q22 4Q22 1Q23 2Q23 Investment Securities Loans Average Yield Interest-Earning Assets p. 9 Average Balances $ Billions Average Rate Percent

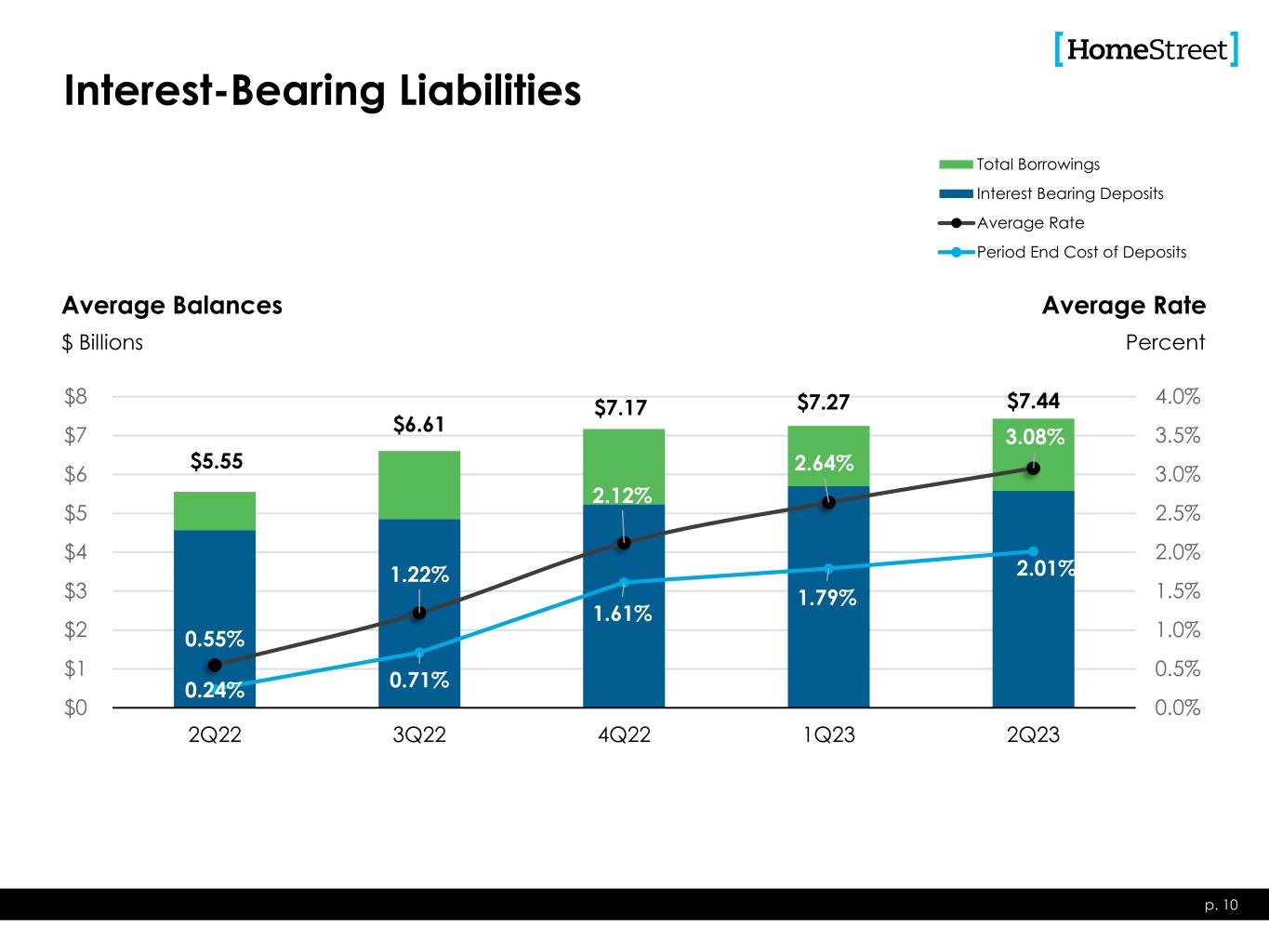

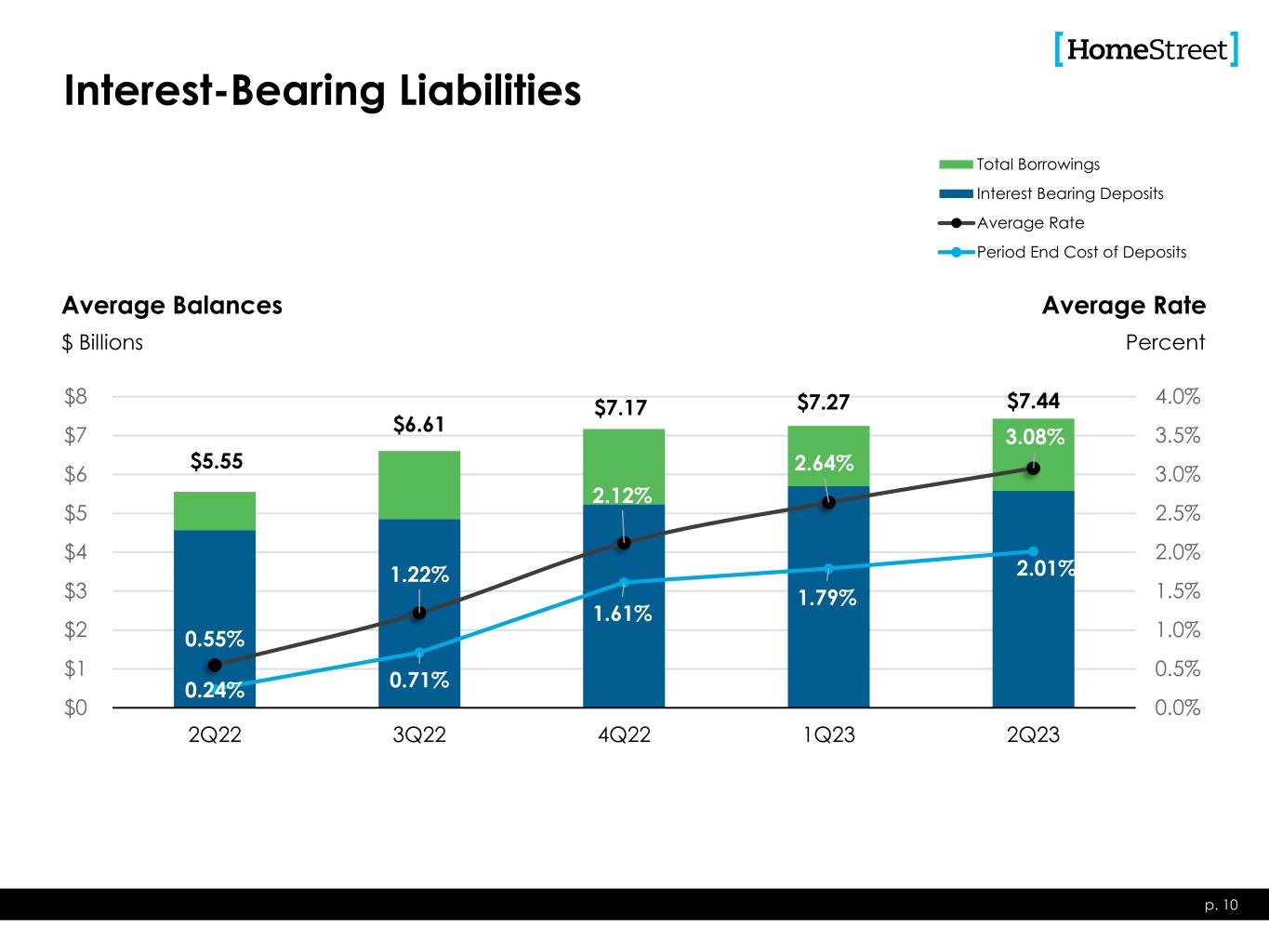

$5.55 $6.61 $7.17 $7.27 $7.44 0.55% 1.22% 2.12% 2.64% 3.08% 0.24% 0.71% 1.61% 1.79% 2.01% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% $0 $1 $2 $3 $4 $5 $6 $7 $8 2Q22 3Q22 4Q22 1Q23 2Q23 Total Borrowings Interest Bearing Deposits Average Rate Period End Cost of Deposits Interest-Bearing Liabilities Average Balances p. 10 $ Billions Average Rate Percent

27% 23% 19% 21% 21% 57% 51% 42% 41% 41% 16% 26% 39% 38% 38% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% $- $1 $2 $3 $4 $5 $6 $7 $8 2Q22 3Q22 4Q22 1Q23 2Q23 Time Deposits Interest-Bearing Transaction & Savings Deposits Noninterest-Bearing Transaction & Savings Deposits Consumer Deposits Deposits p. 11 $6.18 $6.61 $7.45 $7.06 $6.67 Period End Balances $ Billions

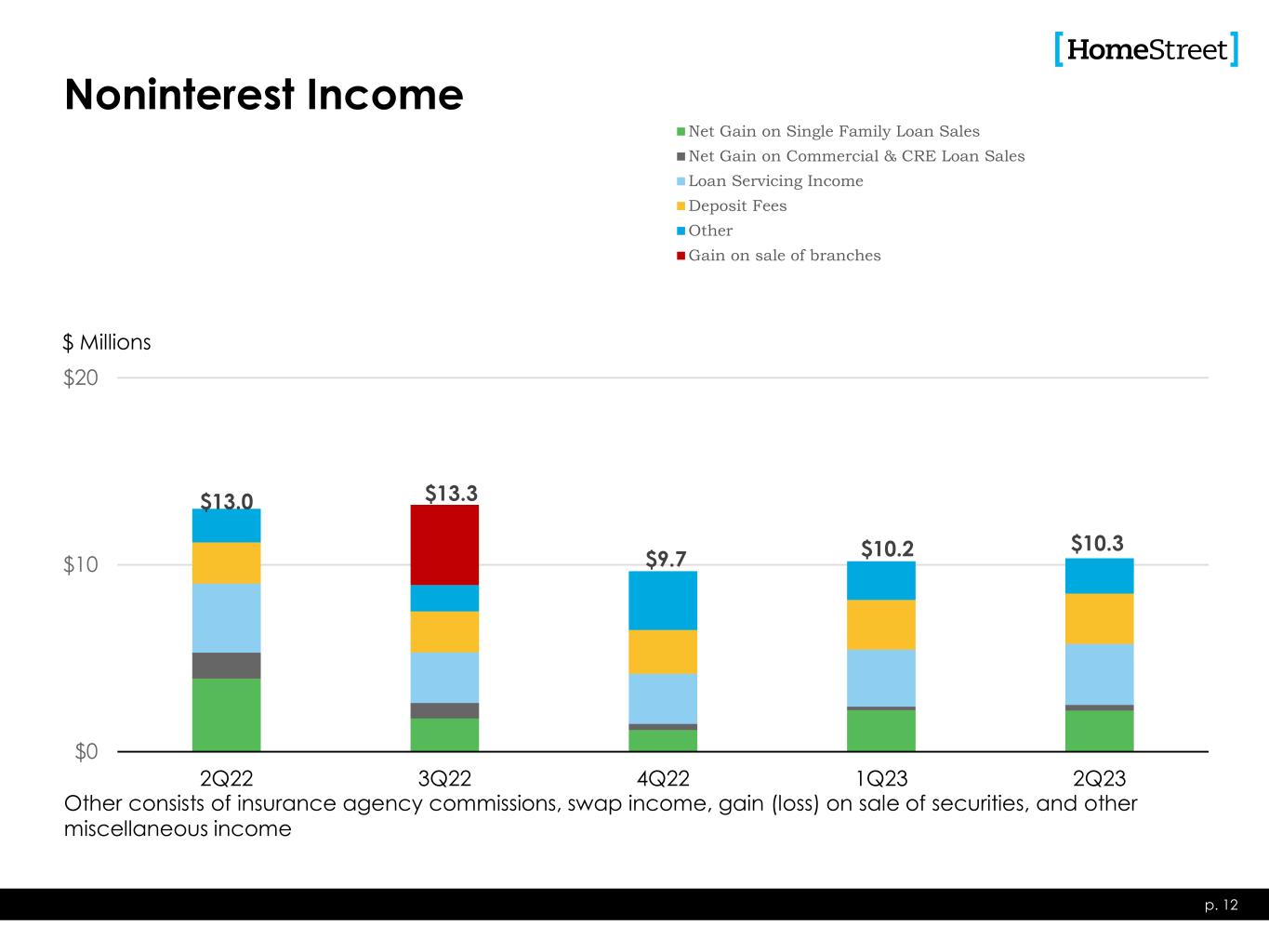

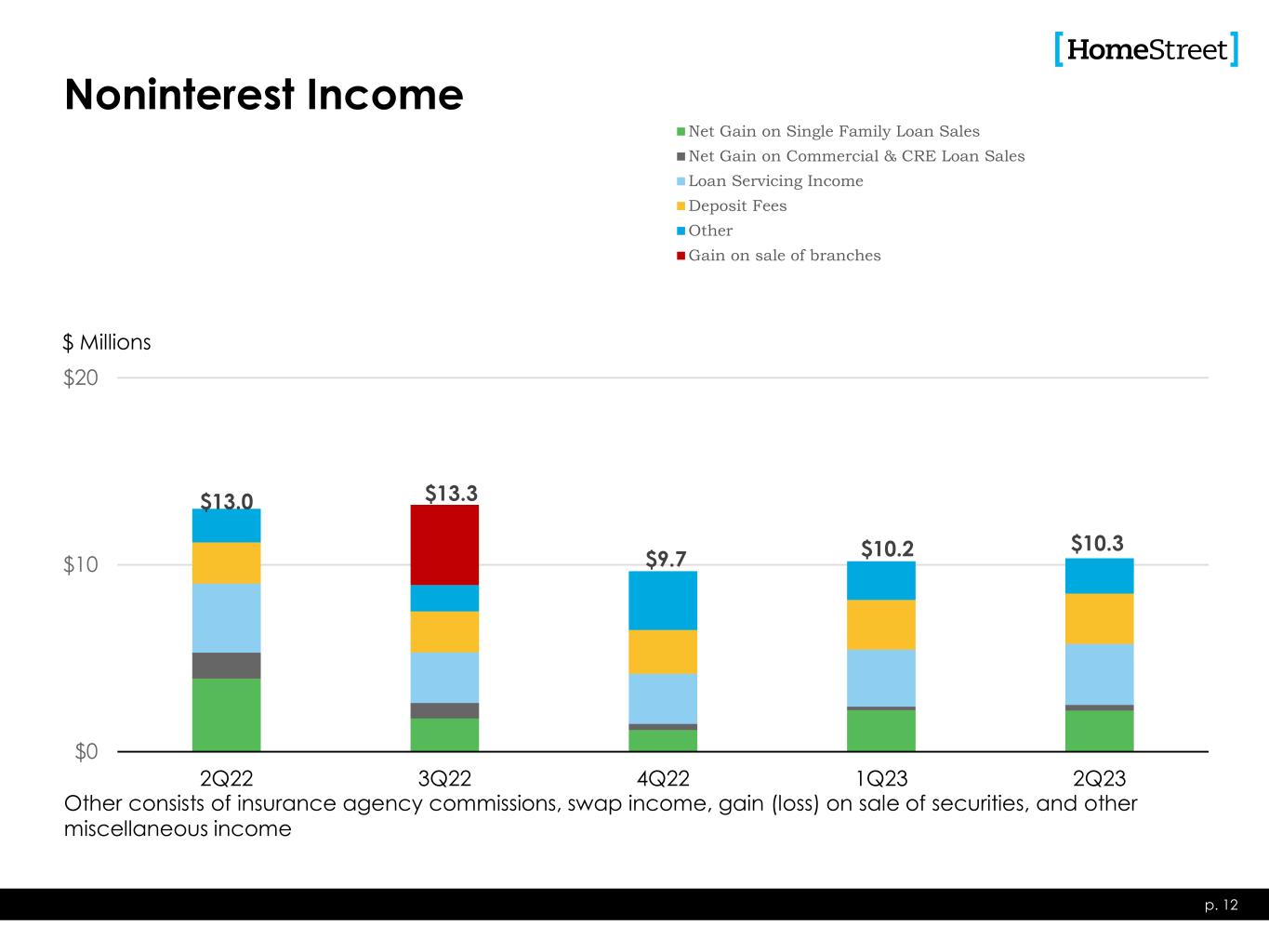

$13.0 $13.3 $9.7 $10.2 $10.3 $0 $10 $20 2Q22 3Q22 4Q22 1Q23 2Q23 Net Gain on Single Family Loan Sales Net Gain on Commercial & CRE Loan Sales Loan Servicing Income Deposit Fees Other Gain on sale of branches Noninterest Income p. 12 $ Millions Other consists of insurance agency commissions, swap income, gain (loss) on sale of securities, and other miscellaneous income

393 377 268 226 139 88 41 87 95 563 414 361 239 173 110 52 73 974.03% 3.78% 3.94% 2.73% 2.84% 2.03% 2.84% 2.56% 2.28% 0% 2% 4% 6% 8% 10% 12% 0 100 200 300 400 500 600 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Single Family Loan Sales Rate Locks Loans Closed GOS Margin Rate Locks/Loan Closings, $ in millions Margin% Single Family Mortgage Banking p. 13 6% 3% 5% 7% 8% 0% 10% 20% 30% 40% 2Q22 3Q22 4Q22 1Q23 2Q23 Single Family Mortgage Banking as a % of Total Revenues

0% 1% 2% 3% 4% 5% $0 $100 $200 $300 $400 $500 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 DUS Sales CRE Sales DUS Margin CRE Margin Commercial Real Estate Loan Sales $ Millions p. 14

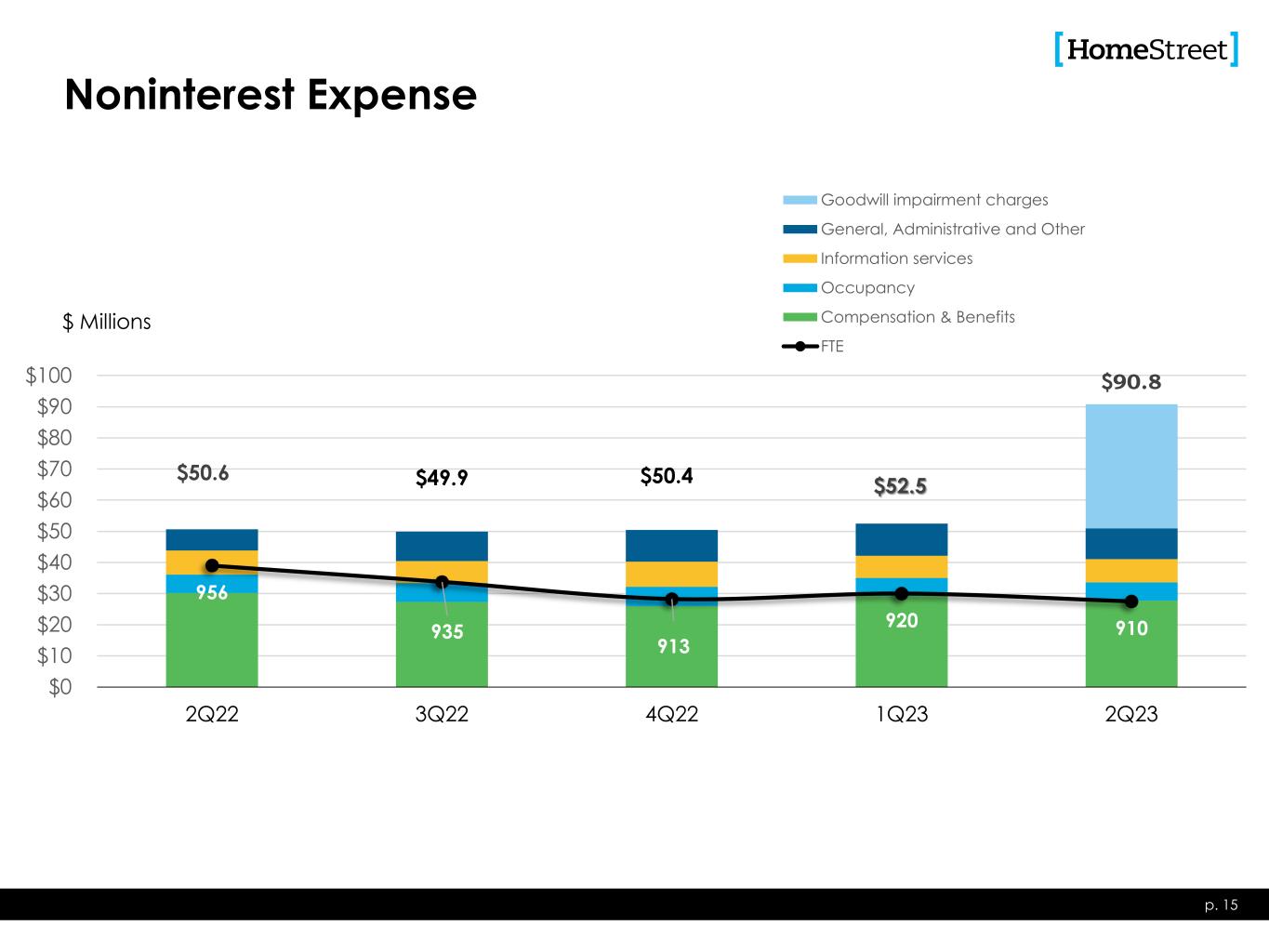

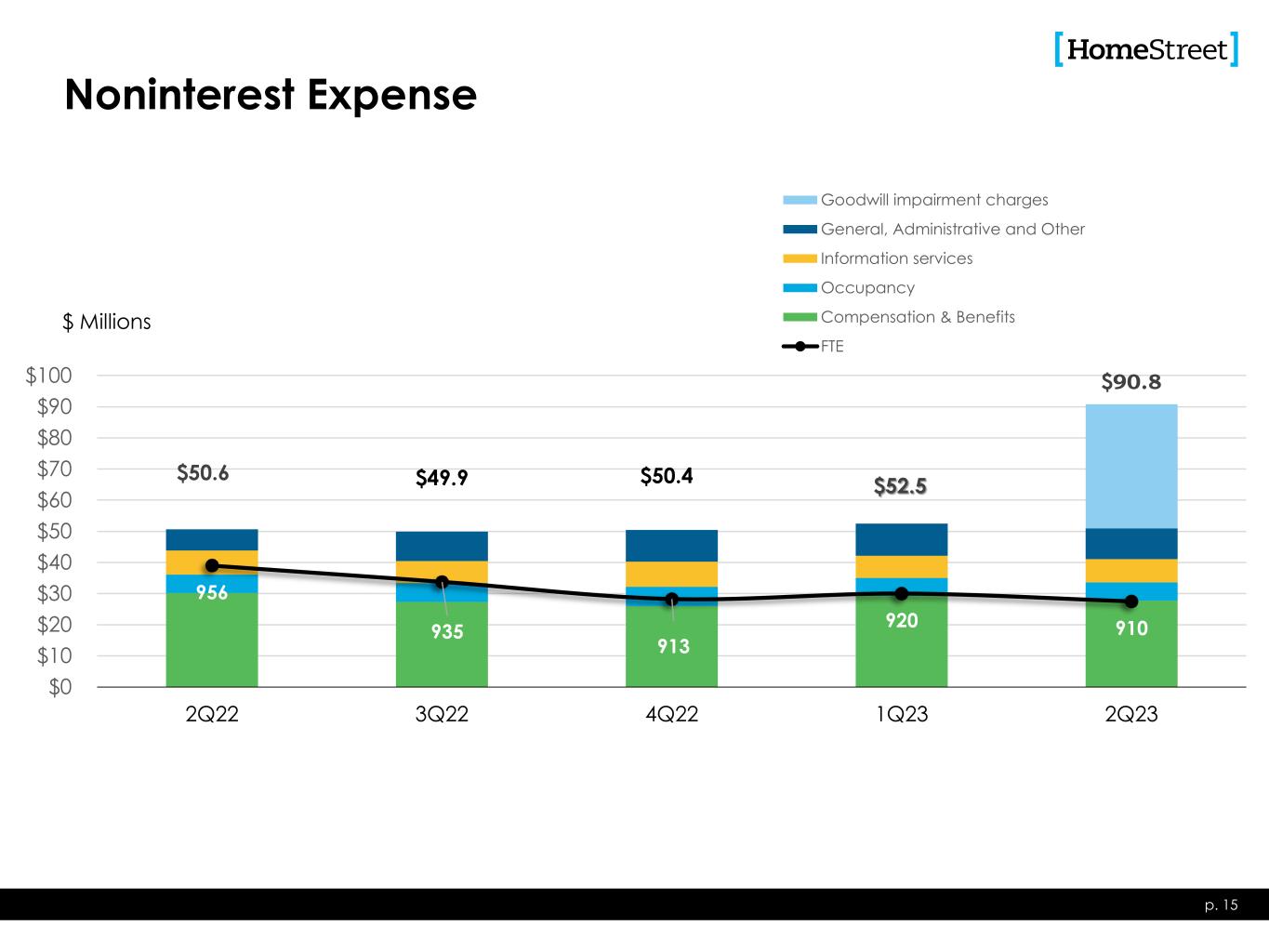

$50.6 $49.9 $50.4 $52.5 $90.8 956 935 913 920 910 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 2Q22 3Q22 4Q22 1Q23 2Q23 Goodwill impairment charges General, Administrative and Other Information services Occupancy Compensation & Benefits FTE Noninterest Expense p. 15 $ Millions

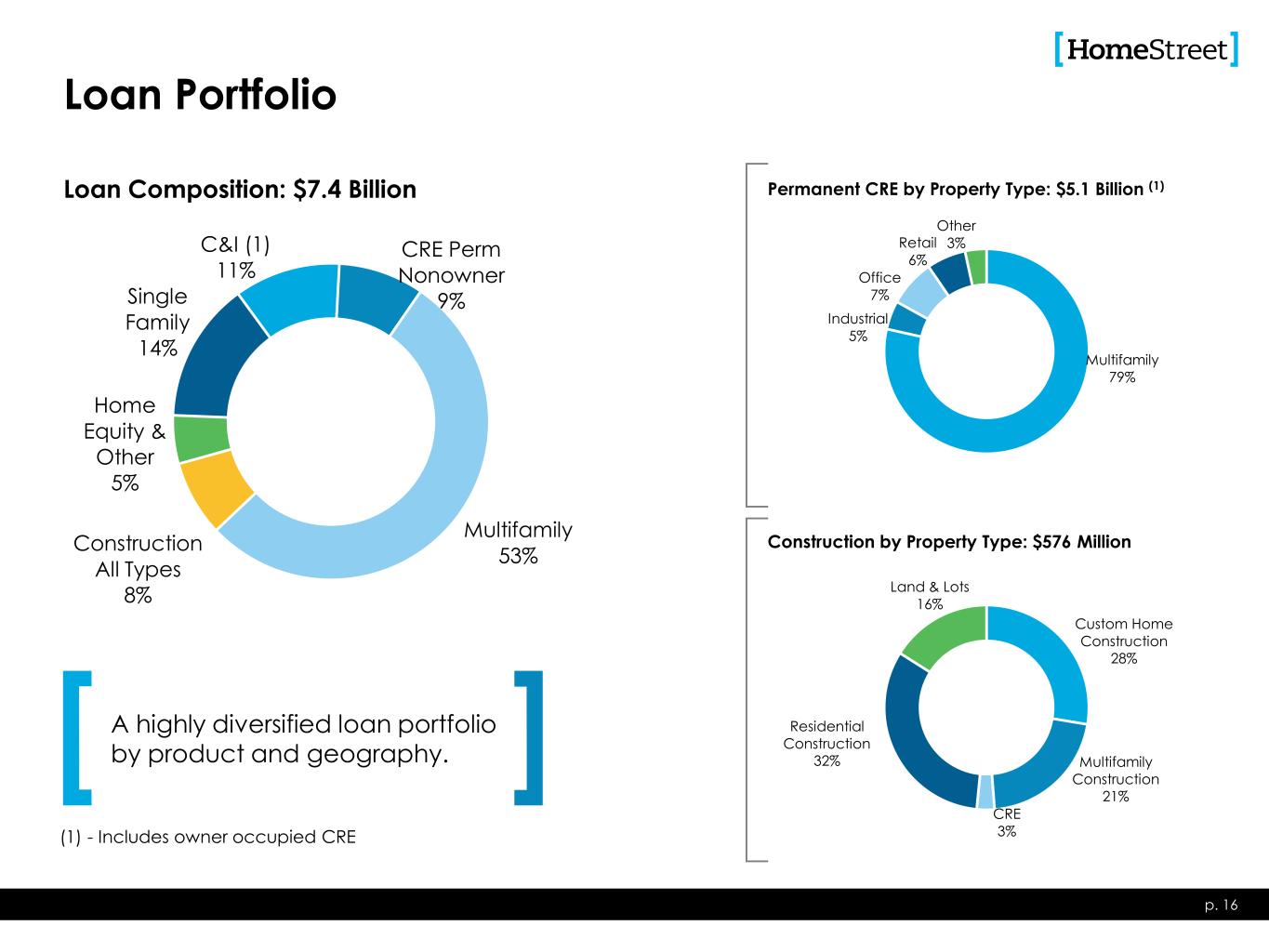

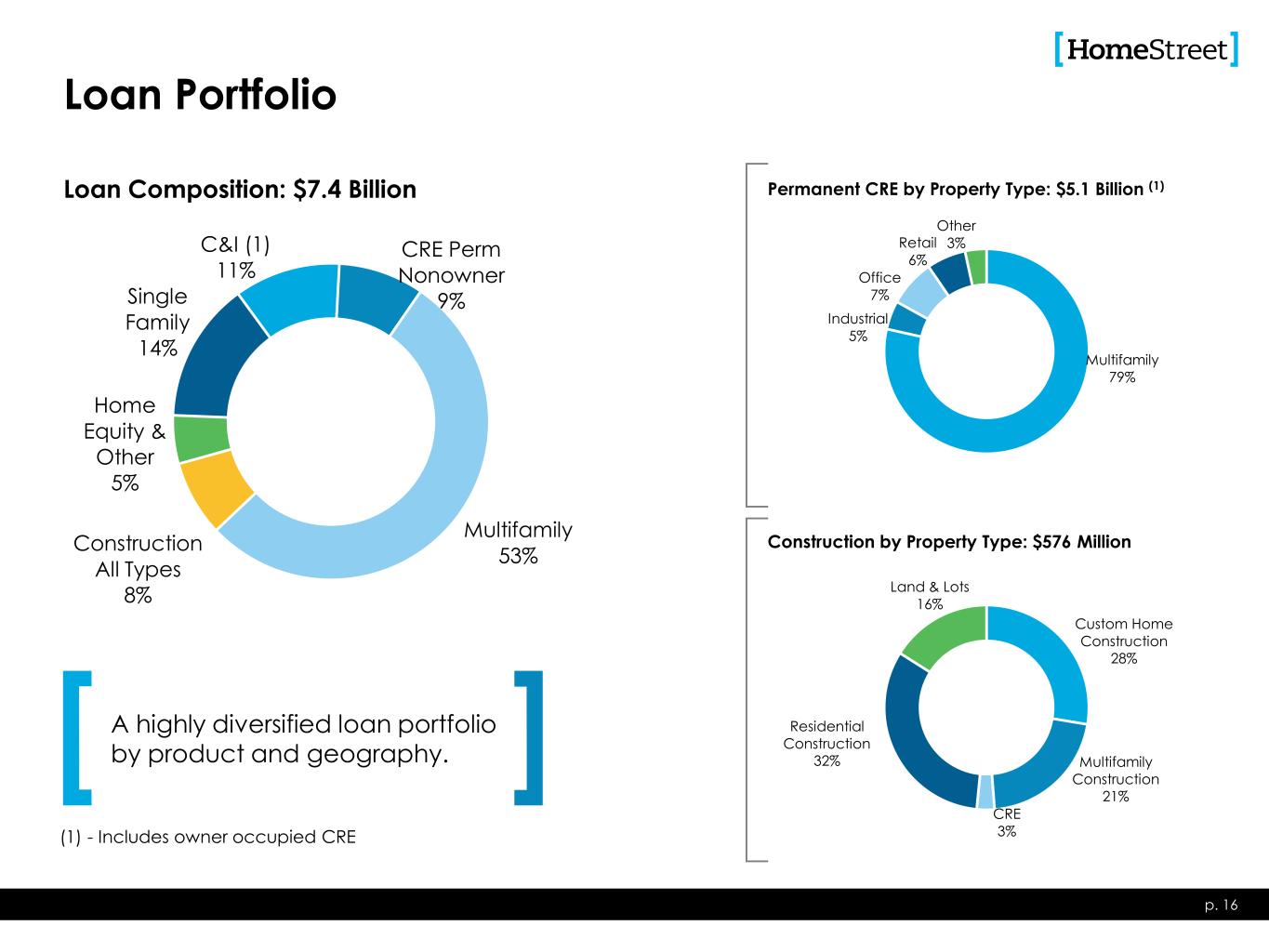

C&I (1) 11% CRE Perm Nonowner 9% Multifamily 53%Construction All Types 8% Home Equity & Other 5% Single Family 14% Loan Portfolio p. 16 A highly diversified loan portfolio by product and geography. Multifamily 79% Industrial 5% Office 7% Retail 6% Other 3% Permanent CRE by Property Type: $5.1 Billion (1) Custom Home Construction 28% Multifamily Construction 21% CRE 3% Residential Construction 32% Land & Lots 16% Construction by Property Type: $576 Million Loan Composition: $7.4 Billion (1) - Includes owner occupied CRE

Permanent Commercial Real Estate Lending Overview • Up To 30 Year Term • $30MM Loan Amt. Max • ≥ 1.15 DSCR • Avg. LTV @ Orig. ~ 60% p. 17 Loan Characteristics • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 59% • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 63% • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 55% • Additional property types are reviewed on a case by case basis • Includes acquired loan types • Examples include: hotels, schools, churches, marinas • Balance: $4.0B • % of Balances: 79% • Portfolio Avg. LTV ~ 57%(1) • Portfolio Avg. DSCR ~ 1.42x • Avg. Loan Size: $5.4M • Largest Dollar Loan: $48.0M 06/30/23 Balances Outstanding Totaling $5.1 Billion • Balance: $229M • % of Balances: 5% • % Owner Occupied: 51% • Portfolio LTV ~ 50%(1) • Portfolio Avg. DSCR ~ 1.62x • Avg. Loan Size: $2.5M • Largest Dollar Loan: $21.3M • Balance: $376M • % of Balances: 7% • % Owner Occupied: 30% • Portfolio LTV ~ 56%(1) • Portfolio Avg. DSCR ~ 1.73x • Avg. Loan Size: $2.4M • Largest Dollar Loan: $23.4M • Balance: $311M • % of Balances: 6% • % Owner Occupied: 20% • Portfolio LTV ~ 49%(1) • Portfolio Avg. DSCR ~ 1.73x • Avg. Loan Size: $2.9M • Largest Dollar Loan: $15.4M • Balance: $171M • % of Balances: 3% • % of Owner Occupied: 83% • Portfolio LTV ~ 38%(1) • Portfolio Avg. DSCR ~ 2.02x • Avg. Loan Size: $3.8M • Largest Dollar Loan: $23.6M 46% 22% 8% 15% 6% 3% Geographical Distribution (Balances) Multifamily 15% 28% 1%3% 45% 8% Industrial / Warehouse 16% 13% 4% 6% 48% 13% Office 18% 25%9% 7% 39% 2% Retail 5% 5% 1% 78% 11% Other CA Los Angeles County CA Other Oregon Other WA King/Pierce/Snohomish WA Other (1) Property values as of origination date. • HomeStreet lends across the full spectrum of commercial real estate lending types, but is deliberate in its effort to achieve diversification among property types and geographic areas to mitigate concentration risk. • “Other” category includes loans secured by Schools ($80.9 million), Hotels ($28.6 million), and Churches ($13.1 million).

Construction Lending Overview • 12 Month Term • Consumer Owner Occupied • Borrower Underwritten similar to Single Family p. 18 Loan Characteristics • 18-36 Month Term • ≤ 80% LTC • Minimum 15% Cash Equity • ≥ 1.20 DSC • Portfolio LTV ~ 37% • Liquidity and DSC covenants • 18-36 Month Term • ≤ 80% LTC • Minimum 15% Cash Equity • ≥ 1.25 DSC • ≥ 50% pre-leased office/retail • Portfolio LTV ~48% • Liquidity and DSC covenants • 12-18 Month Term • LTC: ≤ 95% Presale & Spec • Leverage, Liquid. & Net Worth Covenants as appropriate • Portfolio LTV ~ 68% • 12-24 Month Term • ≤ 50% -80% LTC • Strong, experienced, vertically integrated builders • Portfolio LTV ~ 67% • Balance: $159M • Unfunded Commitments: $101M • % of Balances: 28% • % of Unfunded Commitments: 22% • Avg. Loan Size: $684K • Largest Dollar Loan: $2.0M 06/30/23 Balances Outstanding Totaling $576 Million • Balance: $122M • Unfunded Commitments: $134M • % of Balances: 21% • % of Unfunded Commitments: 30% • Avg. Loan Size: $8.7M • Largest Dollar Loan: $20.4M • Balance: $16M • Unfunded Commitments: $1M • % of Balances: 3% • % of Unfunded Commitments: 0% • Avg. Loan Size: $8.1M • Largest Dollar Loan: $14.5M • Balance: $186M • Unfunded Commitments: $205M • % of Balances: 32% • % of Unfunded Commitments: 46% • Avg. Loan Size: $495K • Largest Dollar Loan: $10.4M • Balance: $93M • Unfunded Commitments: $10M • % of Balances: 16% • % of Unfunded Commitments: 2% • Avg. Loan Size: $956K • Largest Dollar Loan: $6.5M 25% 5% 58% 5% 4%1% 2% Geographical Distribution (Balances) Custom Home Construction 38% 12%21% 26% 3% Multifamily 89% 11% CRE 16% 9% 3% 7% 33% 15% 17% Residential Construction 23.% 27% 4%10% 7% 6% 8% 15% Land and Lots Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho Other: AZ, CO Construction lending is a broad category that includes many different loan types, which possess different risk profiles. HomeStreet lends across the full spectrum of construction lending types.

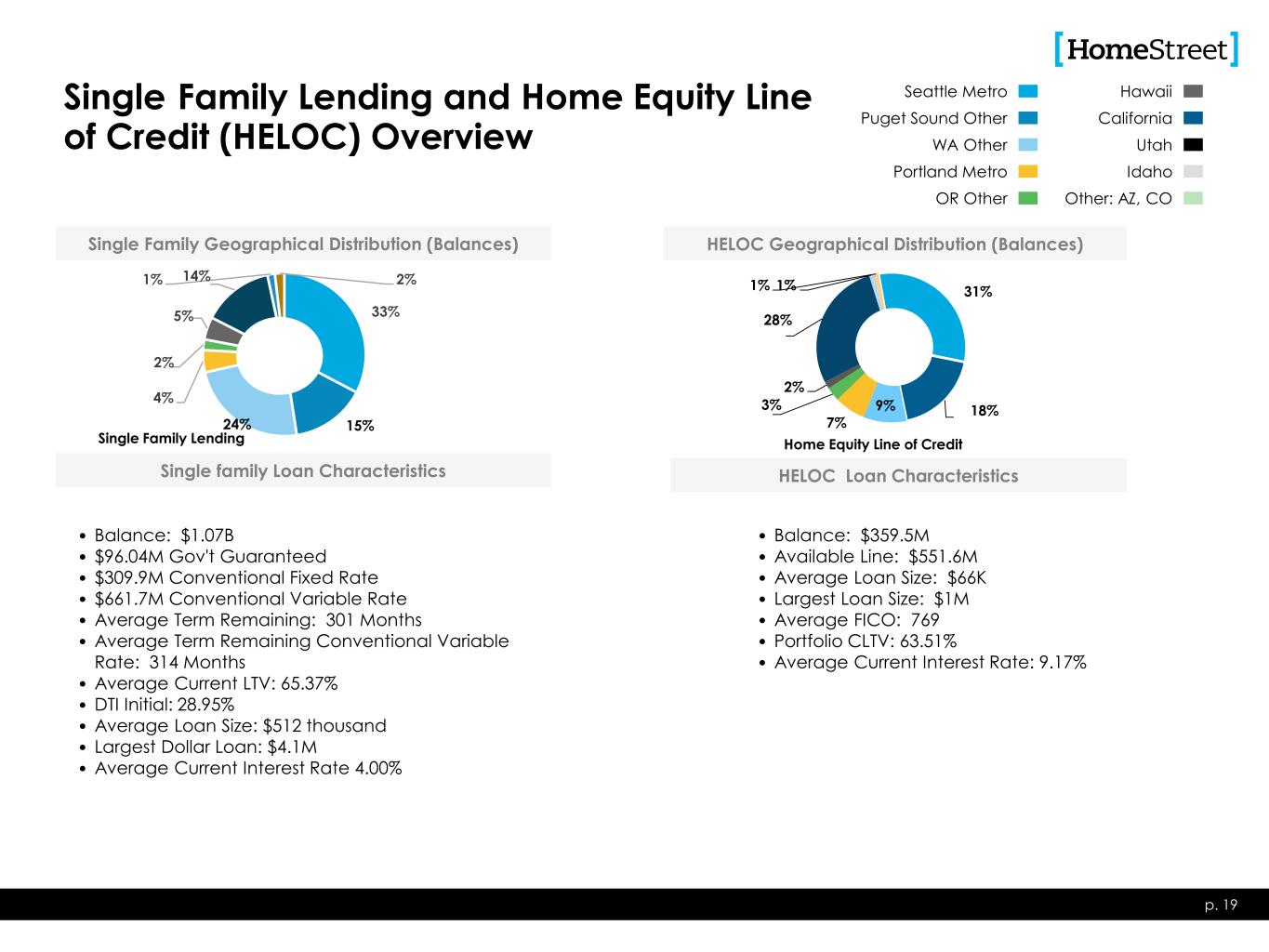

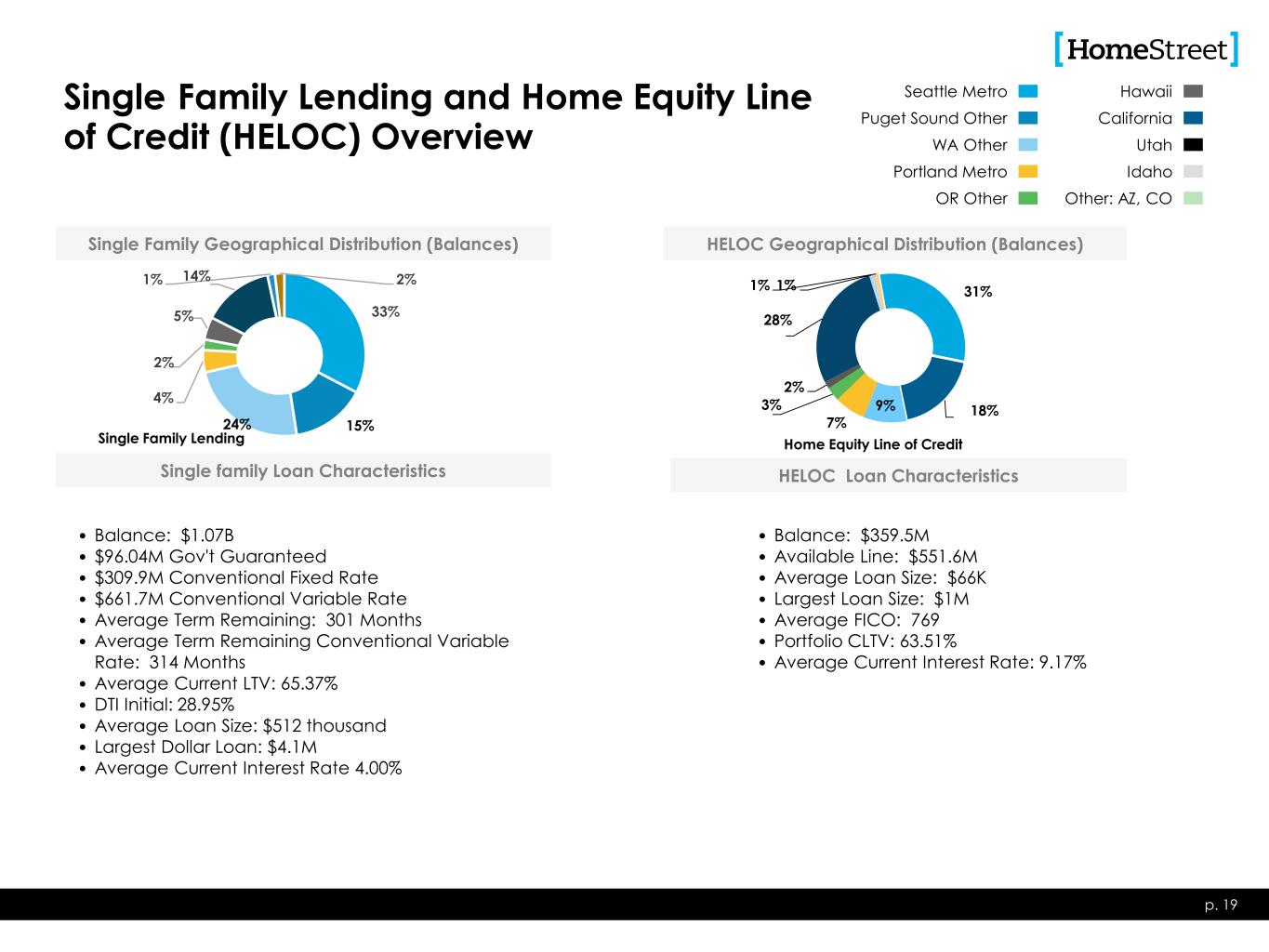

Single Family Lending and Home Equity Line of Credit (HELOC) Overview p. 19 Single family Loan Characteristics • Balance: $1.07B • $96.04M Gov't Guaranteed • $309.9M Conventional Fixed Rate • $661.7M Conventional Variable Rate • Average Term Remaining: 301 Months • Average Term Remaining Conventional Variable Rate: 314 Months • Average Current LTV: 65.37% • DTI Initial: 28.95% • Average Loan Size: $512 thousand • Largest Dollar Loan: $4.1M • Average Current Interest Rate 4.00% • Balance: $359.5M • Available Line: $551.6M • Average Loan Size: $66K • Largest Loan Size: $1M • Average FICO: 769 • Portfolio CLTV: 63.51% • Average Current Interest Rate: 9.17% 33% 15%24% 4% 2% 5% 14%1% 2% Single Family Geographical Distribution (Balances) Single Family Lending 31% 18%9% 7% 3% 2% 28% 1%1% Home Equity Line of Credit Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho Other: AZ, CO HELOC Geographical Distribution (Balances) HELOC Loan Characteristics

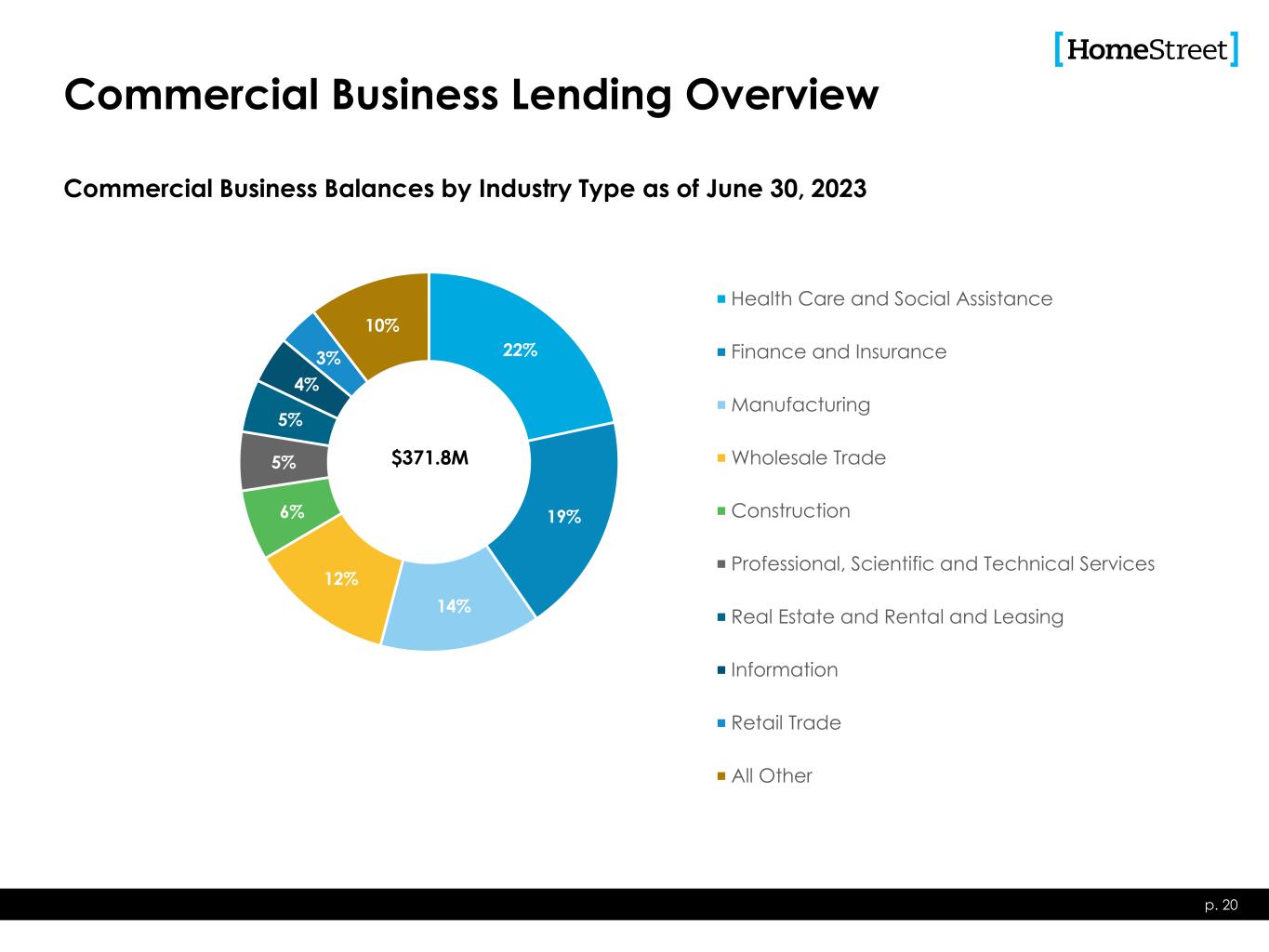

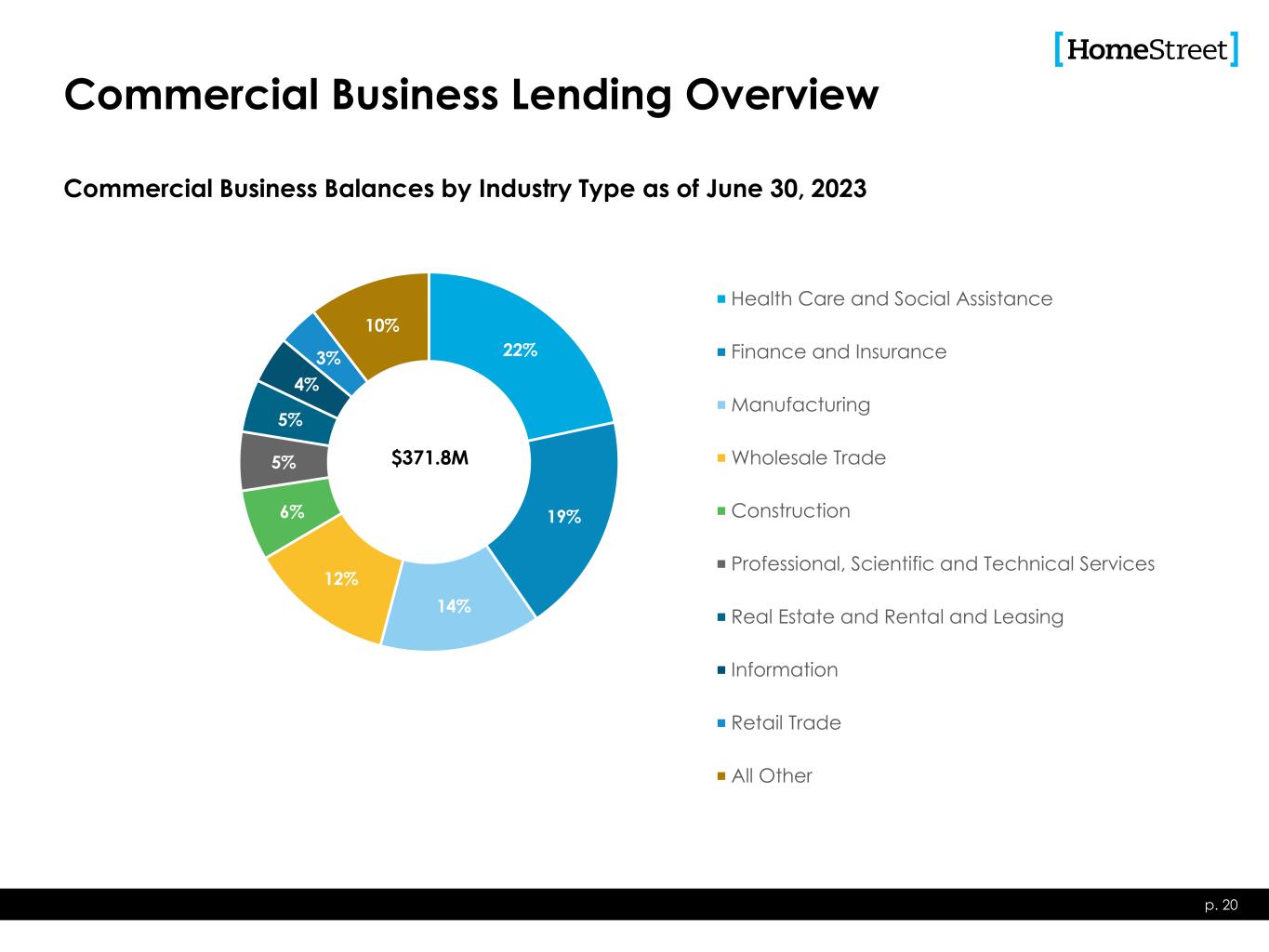

Commercial Business Lending Overview Commercial Business Balances by Industry Type as of June 30, 2023 p. 20 22% 19% 14% 12% 6% 5% 5% 4% 3% 10% Health Care and Social Assistance Finance and Insurance Manufacturing Wholesale Trade Construction Professional, Scientific and Technical Services Real Estate and Rental and Leasing Information Retail Trade All Other $371.8M

Tops in the nation – Our recent awards p. 21 Ranked #8 among all U.S. Banks and #6 in the $5-50 billion in assets category by Bank Director. Ranked #1 in Depository Segment: • Overall Satisfaction • Net Promoter Score • Likelihood to Use Again • Loan Officer • Processor • Application Process • Products and Costs The MortgageCX Borrower Satisfaction Program is recognized as the industry benchmark for mortgage borrower satisfaction. Being named a Best-in-Class lender means we’ve received outstanding ratings from the borrowers our team served in 2022.

The content Operational Metric: Net Promotor Score We are pleased to announce that we achieved a Net Promoter Score (NPS) of 40 in 2022– exceeding the bank industry benchmark for the seventh consecutive year. The NPS is a measure of customer satisfaction calculated based on responses to a single question: How likely is it that you would recommend HomeStreet Bank to a friend or colleague? To calculate the bank’s latest NPS rating, we surveyed 33,200 checking customers and received more than 2,500 survey responses. 22 37 50 56 60 53 44 40 2016 2017 2018 2019 2020 2021 2022 HomeStreet Bank Net Promoter Score NPS Bank Industry NPS* Sources: *Qualtrics XM institute, **Customer Guru, ***BECU Annual Report Summary 2021, and ****WaFD Bank Investor Presentation 2022.

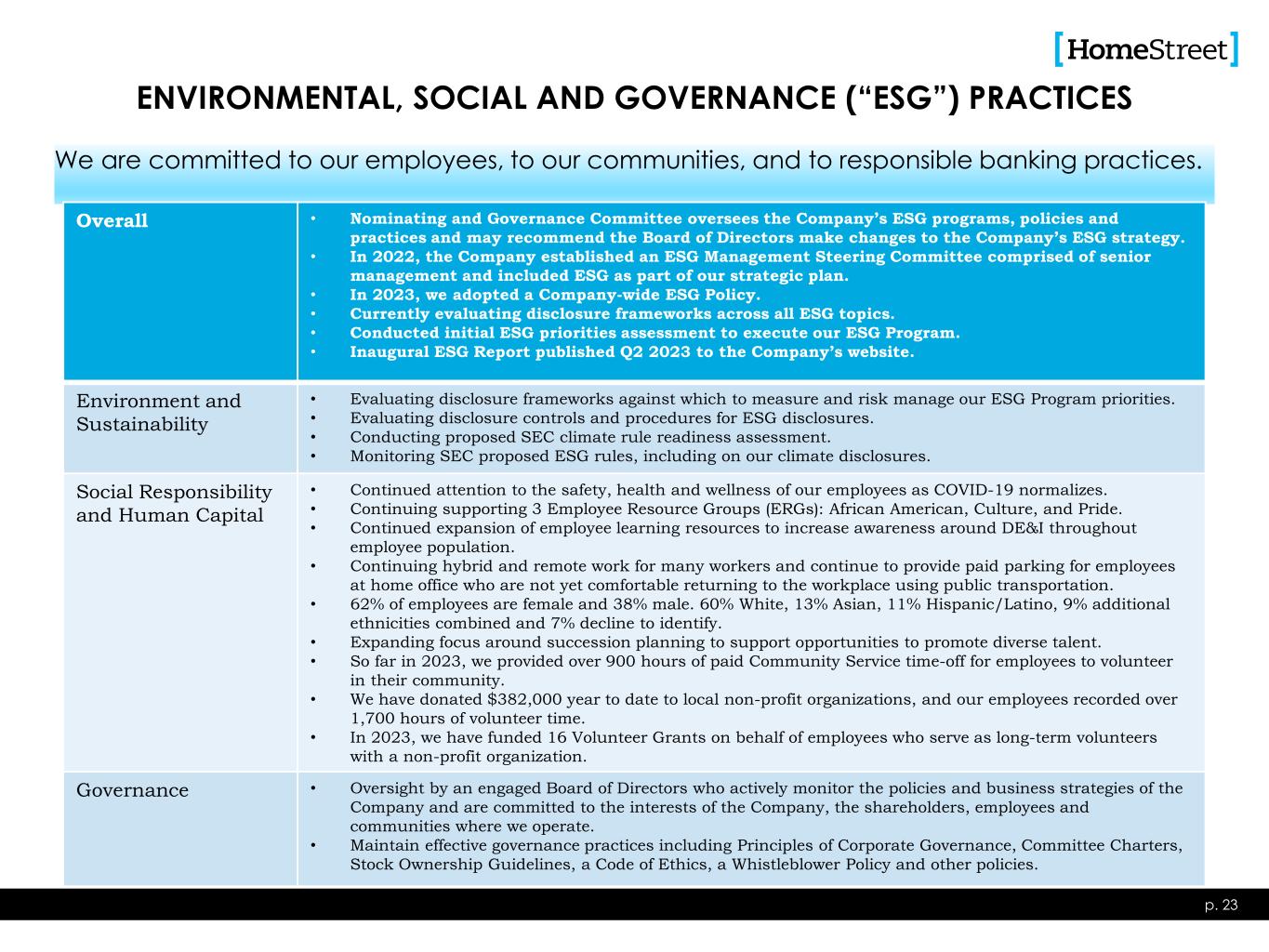

We are committed to our employees, to our communities, and to responsible banking practices. ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”) PRACTICES p. 23 Overall • Nominating and Governance Committee oversees the Company’s ESG programs, policies and practices and may recommend the Board of Directors make changes to the Company’s ESG strategy. • In 2022, the Company established an ESG Management Steering Committee comprised of senior management and included ESG as part of our strategic plan. • In 2023, we adopted a Company-wide ESG Policy. • Currently evaluating disclosure frameworks across all ESG topics. • Conducted initial ESG priorities assessment to execute our ESG Program. • Inaugural ESG Report published Q2 2023 to the Company’s website. Environment and Sustainability • Evaluating disclosure frameworks against which to measure and risk manage our ESG Program priorities. • Evaluating disclosure controls and procedures for ESG disclosures. • Conducting proposed SEC climate rule readiness assessment. • Monitoring SEC proposed ESG rules, including on our climate disclosures. Social Responsibility and Human Capital • Continued attention to the safety, health and wellness of our employees as COVID-19 normalizes. • Continuing supporting 3 Employee Resource Groups (ERGs): African American, Culture, and Pride. • Continued expansion of employee learning resources to increase awareness around DE&I throughout employee population. • Continuing hybrid and remote work for many workers and continue to provide paid parking for employees at home office who are not yet comfortable returning to the workplace using public transportation. • 62% of employees are female and 38% male. 60% White, 13% Asian, 11% Hispanic/Latino, 9% additional ethnicities combined and 7% decline to identify. • Expanding focus around succession planning to support opportunities to promote diverse talent. • So far in 2023, we provided over 900 hours of paid Community Service time-off for employees to volunteer in their community. • We have donated $382,000 year to date to local non-profit organizations, and our employees recorded over 1,700 hours of volunteer time. • In 2023, we have funded 16 Volunteer Grants on behalf of employees who serve as long-term volunteers with a non-profit organization. Governance • Oversight by an engaged Board of Directors who actively monitor the policies and business strategies of the Company and are committed to the interests of the Company, the shareholders, employees and communities where we operate. • Maintain effective governance practices including Principles of Corporate Governance, Committee Charters, Stock Ownership Guidelines, a Code of Ethics, a Whistleblower Policy and other policies.

Outlook

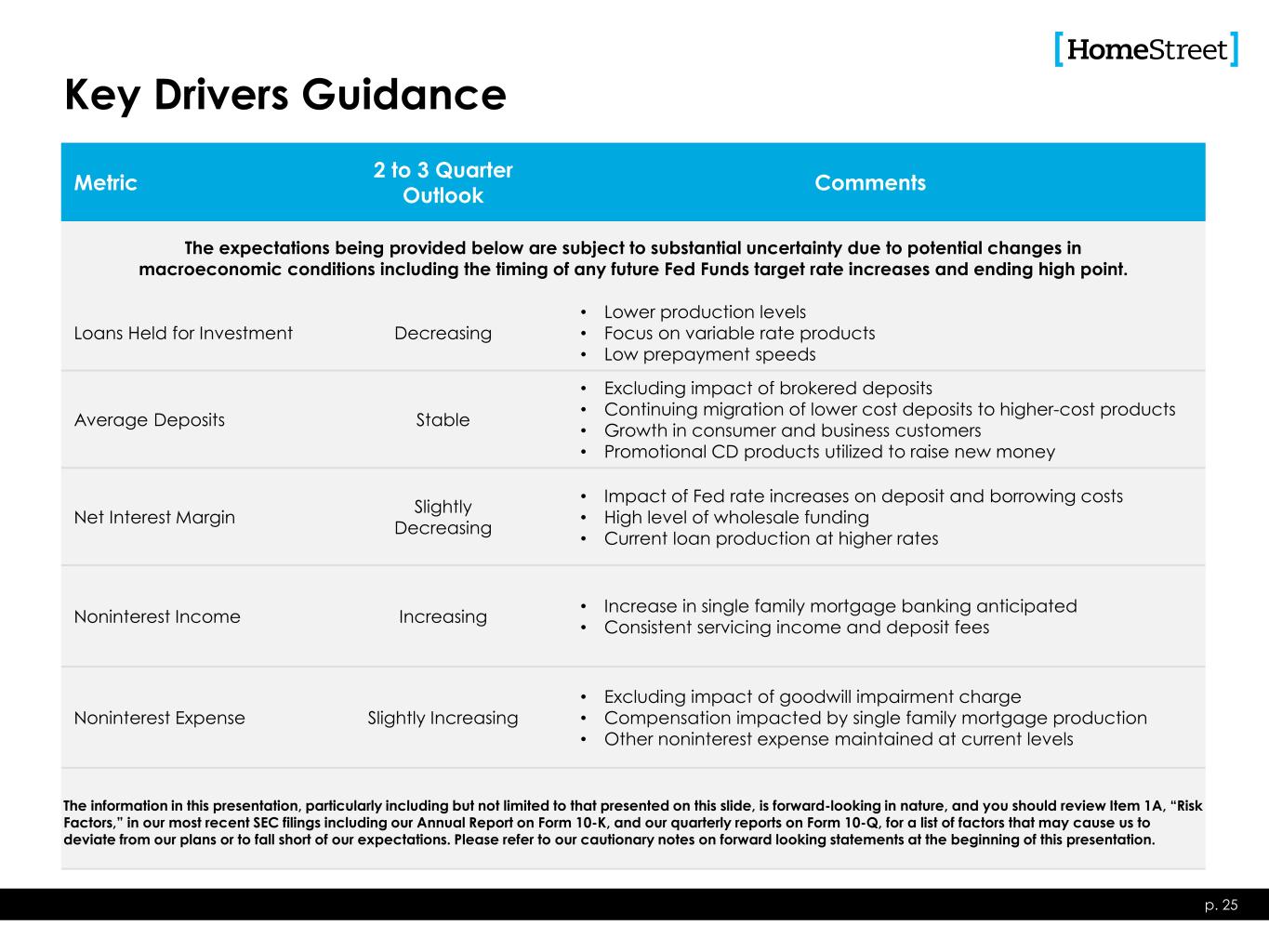

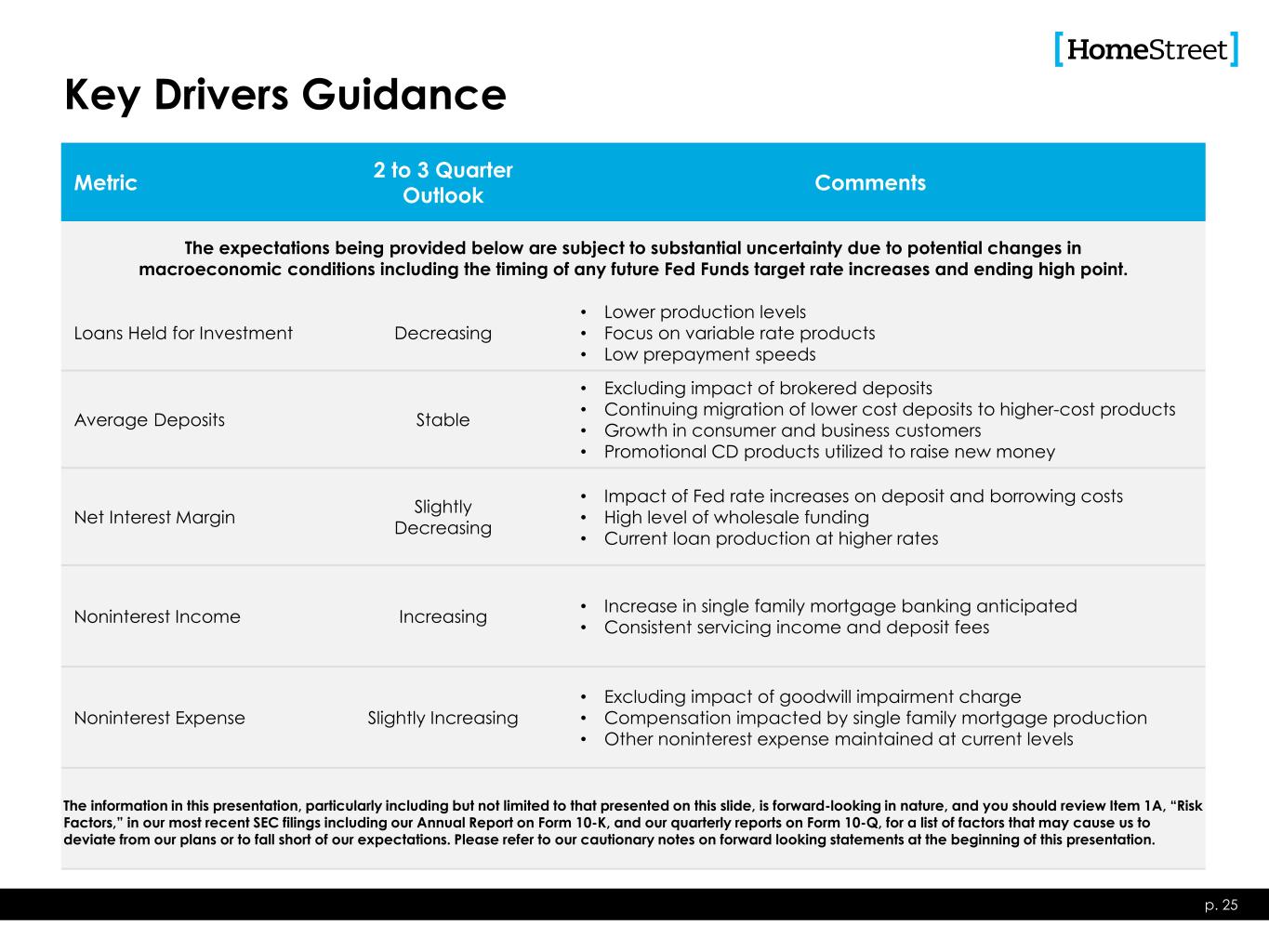

Key Drivers Guidance Metric 2 to 3 Quarter Outlook Comments The expectations being provided below are subject to substantial uncertainty due to potential changes in macroeconomic conditions including the timing of any future Fed Funds target rate increases and ending high point. Loans Held for Investment Decreasing • Lower production levels • Focus on variable rate products • Low prepayment speeds Average Deposits Stable • Excluding impact of brokered deposits • Continuing migration of lower cost deposits to higher-cost products • Growth in consumer and business customers • Promotional CD products utilized to raise new money Net Interest Margin Slightly Decreasing • Impact of Fed rate increases on deposit and borrowing costs • High level of wholesale funding • Current loan production at higher rates Noninterest Income Increasing • Increase in single family mortgage banking anticipated • Consistent servicing income and deposit fees Noninterest Expense Slightly Increasing • Excluding impact of goodwill impairment charge • Compensation impacted by single family mortgage production • Other noninterest expense maintained at current levels p. 25 The information in this presentation, particularly including but not limited to that presented on this slide, is forward-looking in nature, and you should review Item 1A, “Risk Factors,” in our most recent SEC filings including our Annual Report on Form 10-K, and our quarterly reports on Form 10-Q, for a list of factors that may cause us to deviate from our plans or to fall short of our expectations. Please refer to our cautionary notes on forward looking statements at the beginning of this presentation.

Appendix

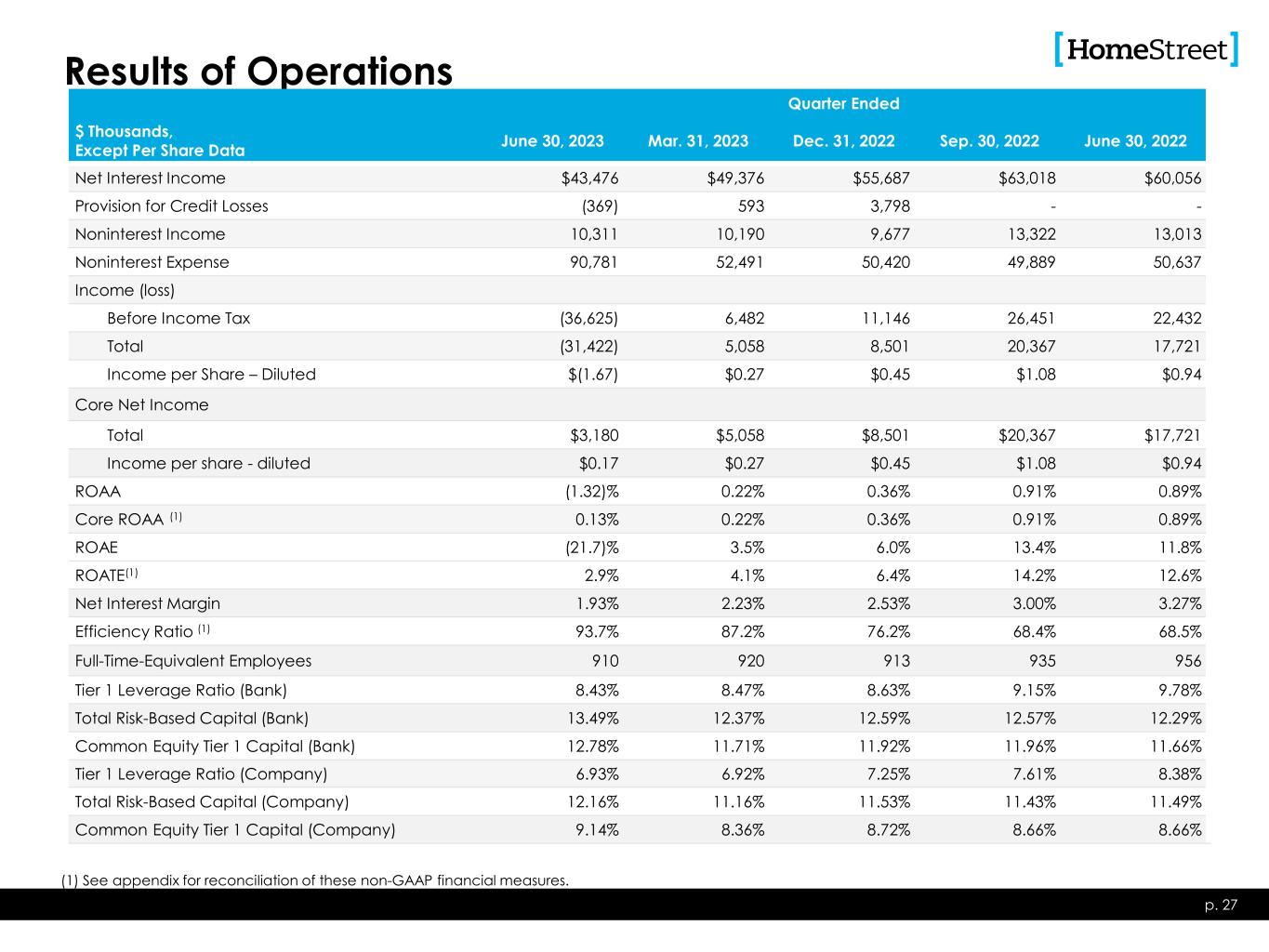

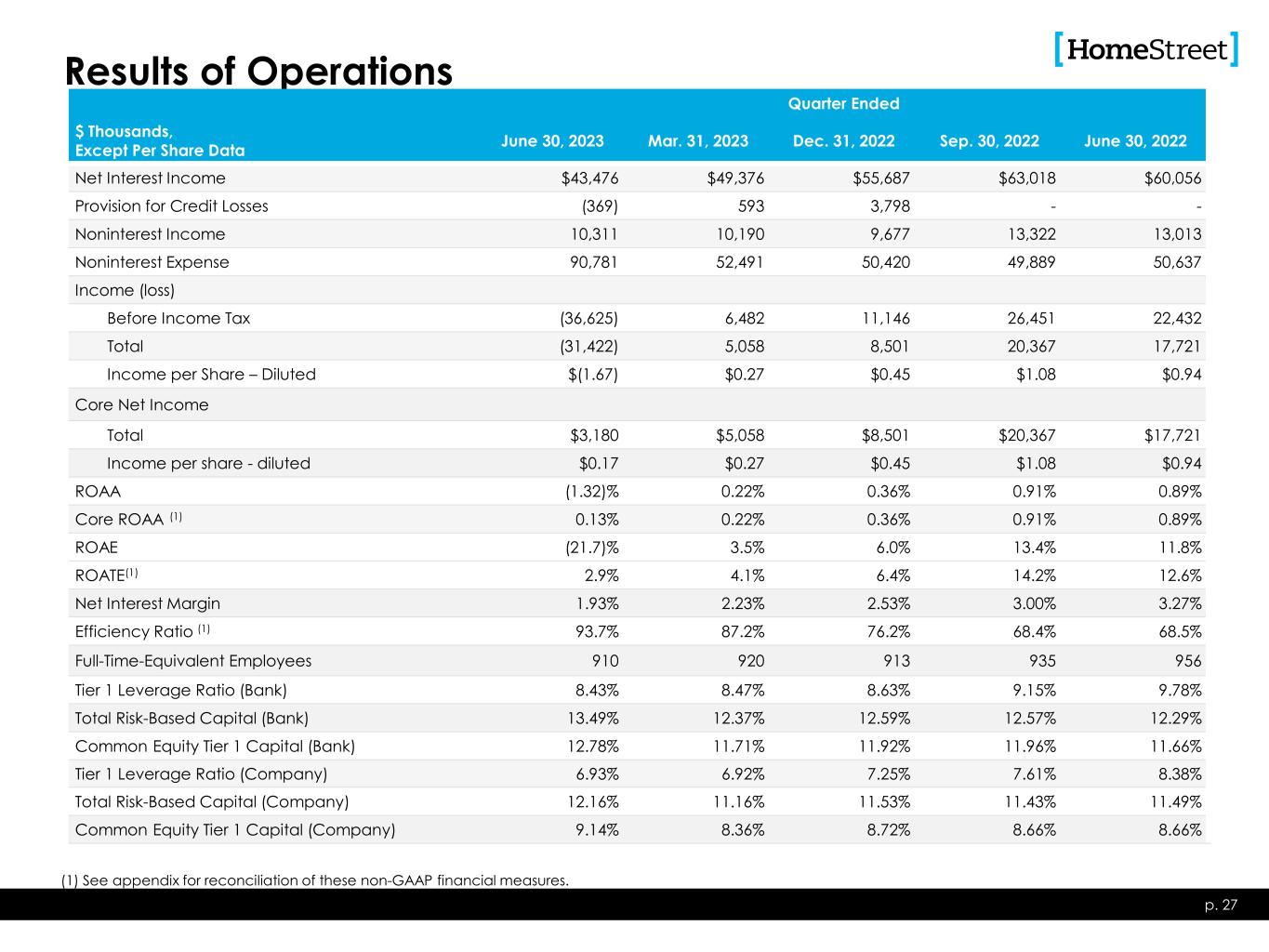

Results of Operations Quarter Ended $ Thousands, Except Per Share Data June 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 June 30, 2022 Net Interest Income $43,476 $49,376 $55,687 $63,018 $60,056 Provision for Credit Losses (369) 593 3,798 - - Noninterest Income 10,311 10,190 9,677 13,322 13,013 Noninterest Expense 90,781 52,491 50,420 49,889 50,637 Income (loss) Before Income Tax (36,625) 6,482 11,146 26,451 22,432 Total (31,422) 5,058 8,501 20,367 17,721 Income per Share – Diluted $(1.67) $0.27 $0.45 $1.08 $0.94 Core Net Income Total $3,180 $5,058 $8,501 $20,367 $17,721 Income per share - diluted $0.17 $0.27 $0.45 $1.08 $0.94 ROAA (1.32)% 0.22% 0.36% 0.91% 0.89% Core ROAA (1) 0.13% 0.22% 0.36% 0.91% 0.89% ROAE (21.7)% 3.5% 6.0% 13.4% 11.8% ROATE(1) 2.9% 4.1% 6.4% 14.2% 12.6% Net Interest Margin 1.93% 2.23% 2.53% 3.00% 3.27% Efficiency Ratio (1) 93.7% 87.2% 76.2% 68.4% 68.5% Full-Time-Equivalent Employees 910 920 913 935 956 Tier 1 Leverage Ratio (Bank) 8.43% 8.47% 8.63% 9.15% 9.78% Total Risk-Based Capital (Bank) 13.49% 12.37% 12.59% 12.57% 12.29% Common Equity Tier 1 Capital (Bank) 12.78% 11.71% 11.92% 11.96% 11.66% Tier 1 Leverage Ratio (Company) 6.93% 6.92% 7.25% 7.61% 8.38% Total Risk-Based Capital (Company) 12.16% 11.16% 11.53% 11.43% 11.49% Common Equity Tier 1 Capital (Company) 9.14% 8.36% 8.72% 8.66% 8.66% p. 27 (1) See appendix for reconciliation of these non-GAAP financial measures.

Selected Balance Sheet and Other Data As of: $ Thousands, except per share data June 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 June 30, 2022 Loans Held For Sale $31,873 $24,253 $17,327 $13,787 $47,314 Loans Held for Investment, net 7,395,151 7,444,882 7,384,820 7,175,881 6,722,382 Allowance for Credit Losses 41,500 41,500 41,500 37,606 37,355 Investment Securities 1,397,051 1,477,004 1,400,212 1,311,941 1,237,957 Total Assets 9,501,475 9,858,889 9,364,760 9,072,887 8,582,886 Deposits 6,670,033 7,056,603 7,451,919 6,610,231 6,183,299 Borrowings 1,972,000 1,878,000 1,016,000 1,569,000 1,458,000 Long-Term Debt 224,583 224,492 224,404 224,314 224,227 Total Shareholders’ Equity 527,623 574,994 562,147 522,789 580,767 Other Data: Book Value per Share $28.10 $30.64 $30.01 $29.53 $31.04 Tangible Book Value per Share(1) $27.50 $27.87 $28.41 $27.92 $29.37 Shares Outstanding 18,776,597 18,767,811 18,730,380 18,717,557 18,712,789 Loans to Deposit Ratio 112.0% 106.4% 99.9% 109.3% 110.1% Asset Quality: ACL to Total Loans(2) 0.57% 0.56% 0.57% 0.53% 0.56% ACL to Nonaccrual Loans 104.3% 318.1% 412.7% 306.6% 411.3% Nonaccrual Loans to Total Loans 0.54% 0.17% 0.14% 0.17% 0.13% Nonperforming Assets to Total Assets 0.44% 0.15% 0.13% 0.15% 0.13% Nonperforming Assets $41,469 $14,886 $11,893 $13,991 $10,835 p. 28 (1) See appendix for reconciliation of this non-GAAP financial measure. (2) This ratio excludes balances insured by the FHA or guaranteed by the VA or SBA.

Loans Held for Investment Balance Trend p. 29 $ Millions June 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 June 30, 2022 Non-owner Occupied CRE $651 9% $652 9% $658 9% $666 9% $711 11% Multifamily 3,967 53% 3,976 53% 3,976 54% 3,924 54% 3,476 51% Construction / Land Development 576 8% 607 8% 627 8% 590 8% 570 8% Total CRE Loans $5,194 70% $5,235 70% $5,261 71% $5,180 71% $4,757 70% Owner Occupied CRE $434 6% $438 6% $443 6% $432 6% $470 7% Commercial Business 372 5% 393 5% 360 5% 362 5% 394 6% Total C&I Loans $806 11% $831 11% $803 11% $794 11% $864 13% Single Family $1,068 14% $1,058 14% $1,009 13% $907 13% $822 12% Home Equity and Other 368 5% 362 5% 353 5% 332 5% 317 5% Total Consumer Loans $1,436 19% $1,420 19% $1,362 18% $1,239 18% $1,139 17% Total Loans Held for Investment $7,437 100% $7,486 100% $7,426 100% $7,213 100% $6,760 100%

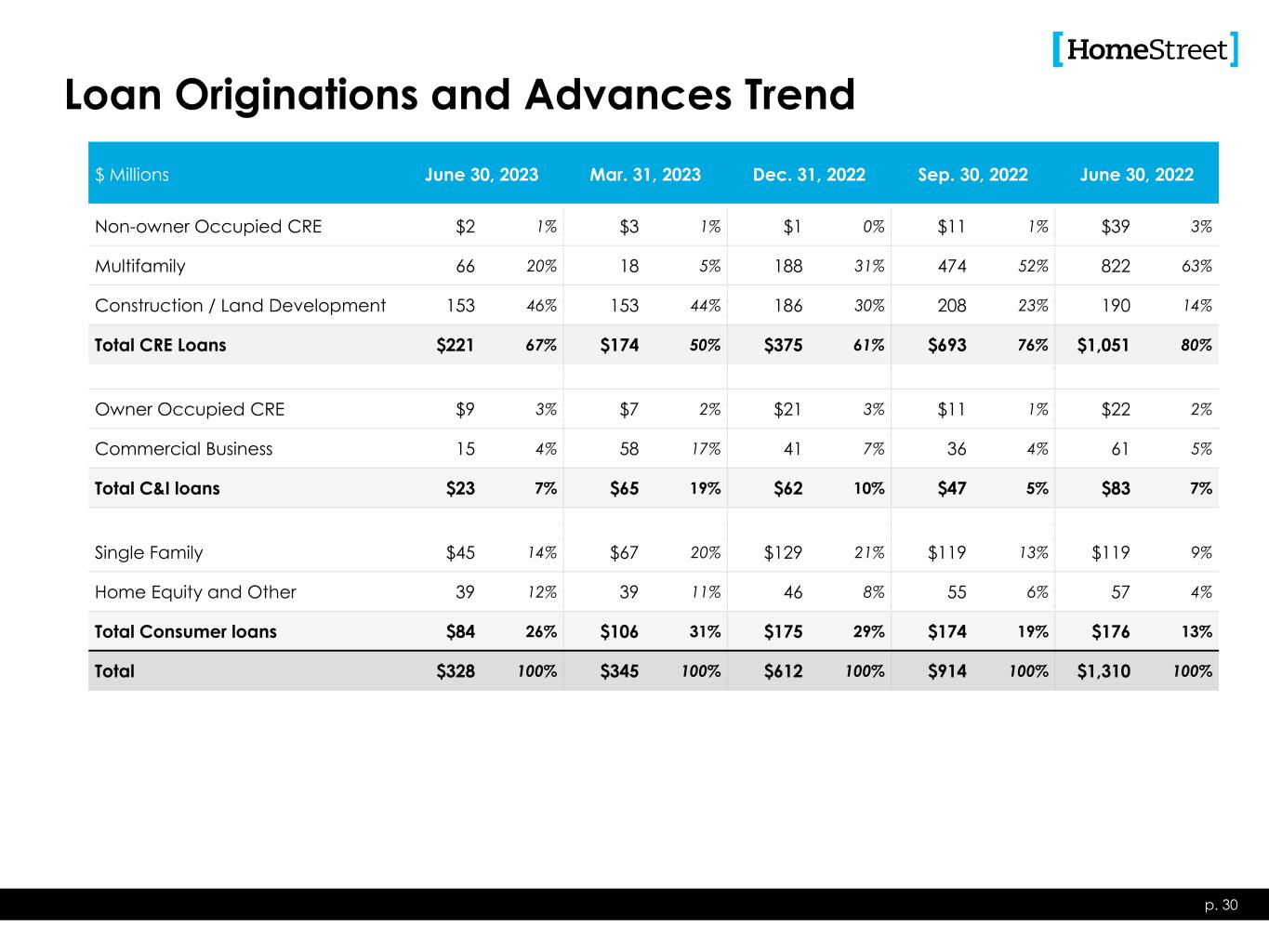

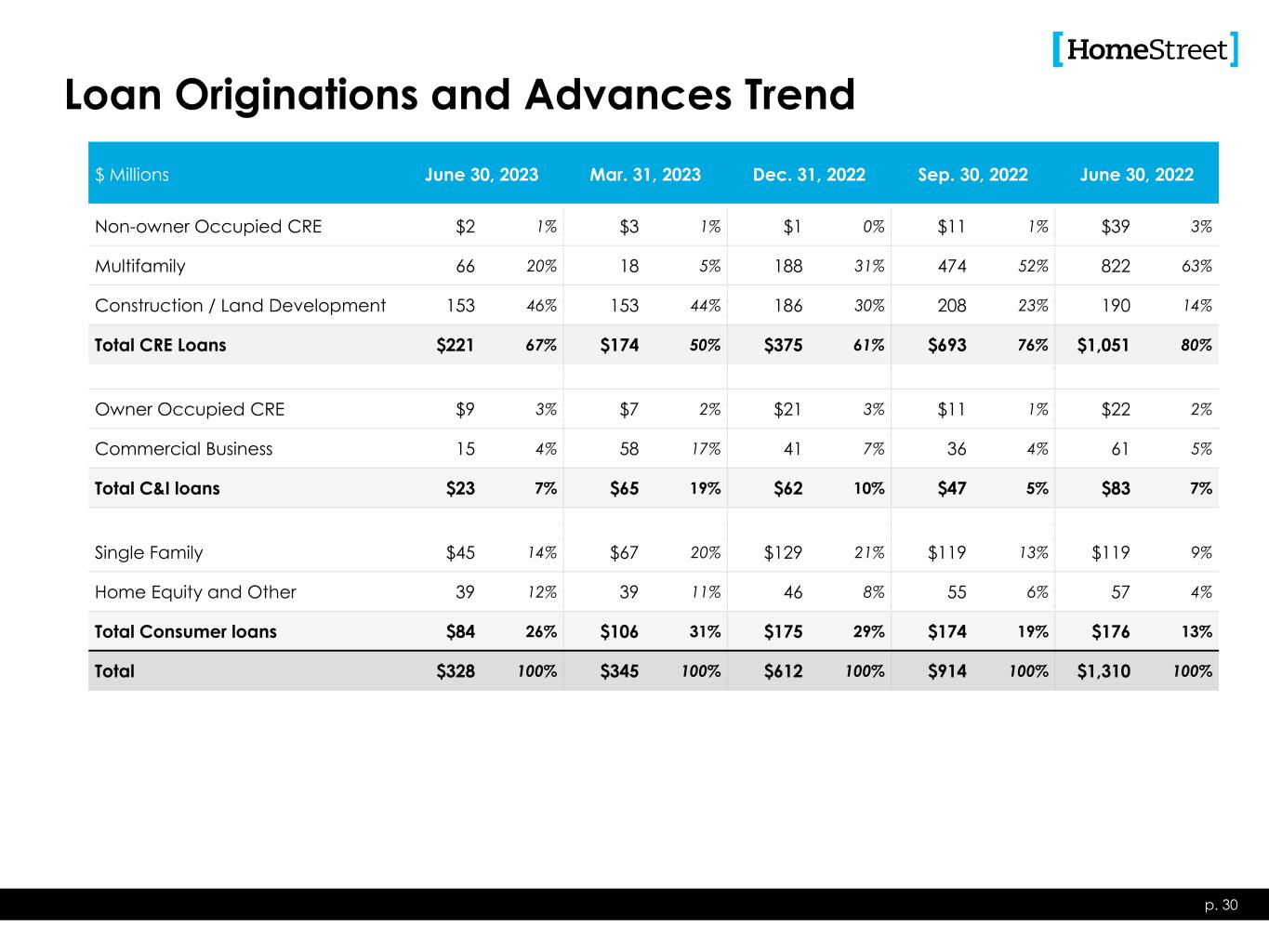

Loan Originations and Advances Trend p. 30 $ Millions June 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 June 30, 2022 Non-owner Occupied CRE $2 1% $3 1% $1 0% $11 1% $39 3% Multifamily 66 20% 18 5% 188 31% 474 52% 822 63% Construction / Land Development 153 46% 153 44% 186 30% 208 23% 190 14% Total CRE Loans $221 67% $174 50% $375 61% $693 76% $1,051 80% Owner Occupied CRE $9 3% $7 2% $21 3% $11 1% $22 2% Commercial Business 15 4% 58 17% 41 7% 36 4% 61 5% Total C&I loans $23 7% $65 19% $62 10% $47 5% $83 7% Single Family $45 14% $67 20% $129 21% $119 13% $119 9% Home Equity and Other 39 12% 39 11% 46 8% 55 6% 57 4% Total Consumer loans $84 26% $106 31% $175 29% $174 19% $176 13% Total $328 100% $345 100% $612 100% $914 100% $1,310 100%

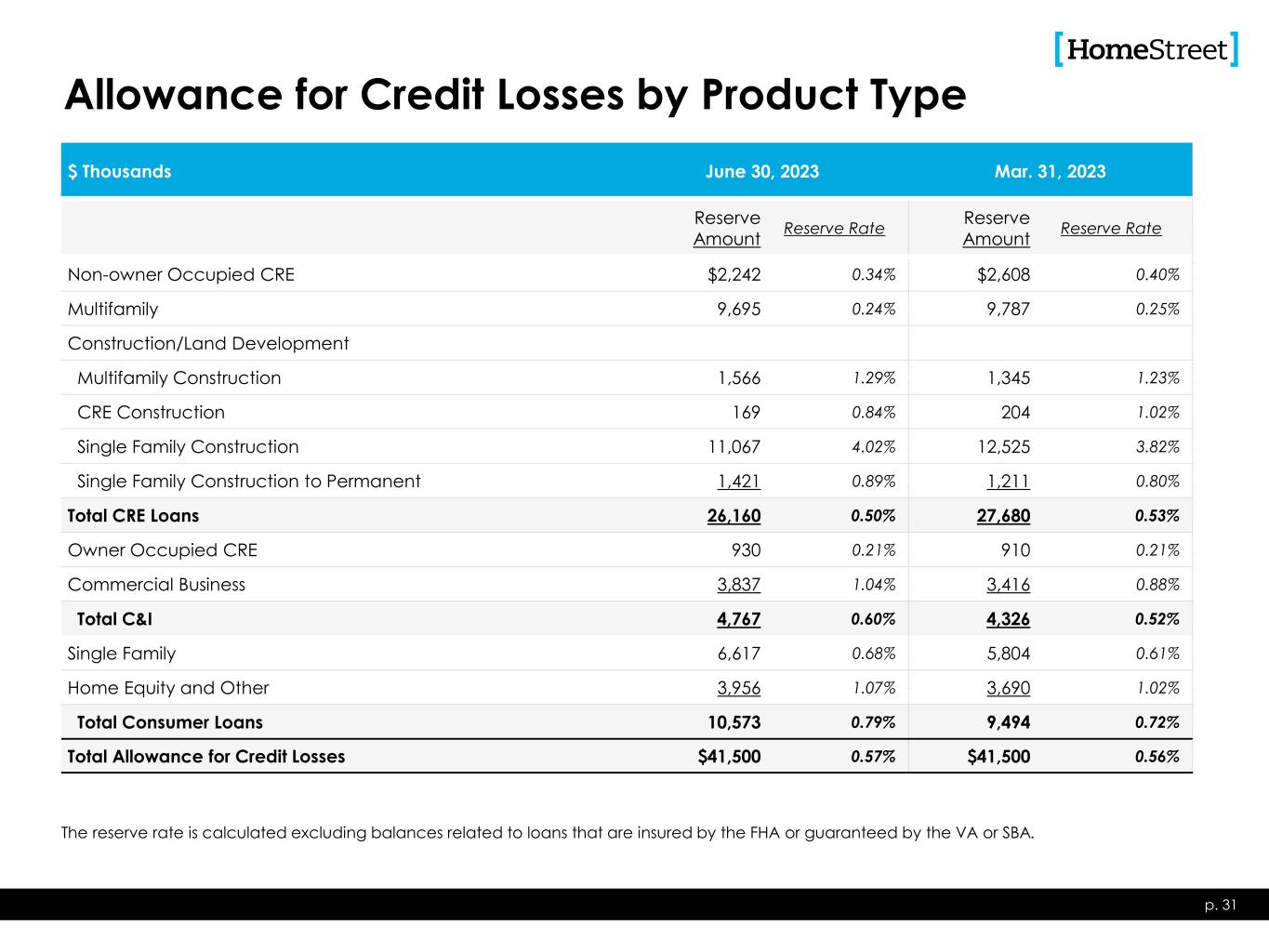

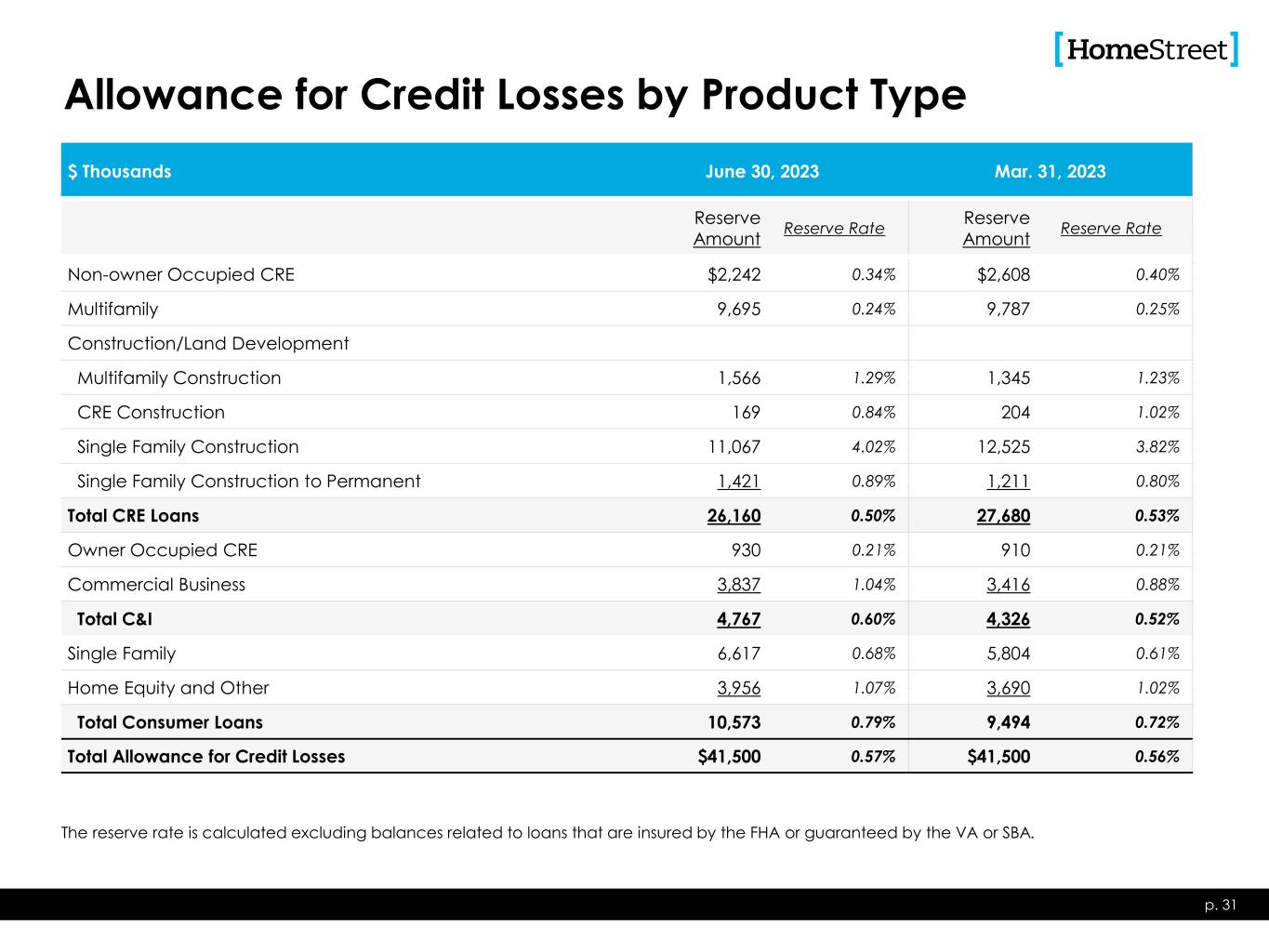

Allowance for Credit Losses by Product Type p. 31 $ Thousands June 30, 2023 Mar. 31, 2023 Reserve Amount Reserve Rate Reserve Amount Reserve Rate Non-owner Occupied CRE $2,242 0.34% $2,608 0.40% Multifamily 9,695 0.24% 9,787 0.25% Construction/Land Development Multifamily Construction 1,566 1.29% 1,345 1.23% CRE Construction 169 0.84% 204 1.02% Single Family Construction 11,067 4.02% 12,525 3.82% Single Family Construction to Permanent 1,421 0.89% 1,211 0.80% Total CRE Loans 26,160 0.50% 27,680 0.53% Owner Occupied CRE 930 0.21% 910 0.21% Commercial Business 3,837 1.04% 3,416 0.88% Total C&I 4,767 0.60% 4,326 0.52% Single Family 6,617 0.68% 5,804 0.61% Home Equity and Other 3,956 1.07% 3,690 1.02% Total Consumer Loans 10,573 0.79% 9,494 0.72% Total Allowance for Credit Losses $41,500 0.57% $41,500 0.56% The reserve rate is calculated excluding balances related to loans that are insured by the FHA or guaranteed by the VA or SBA.

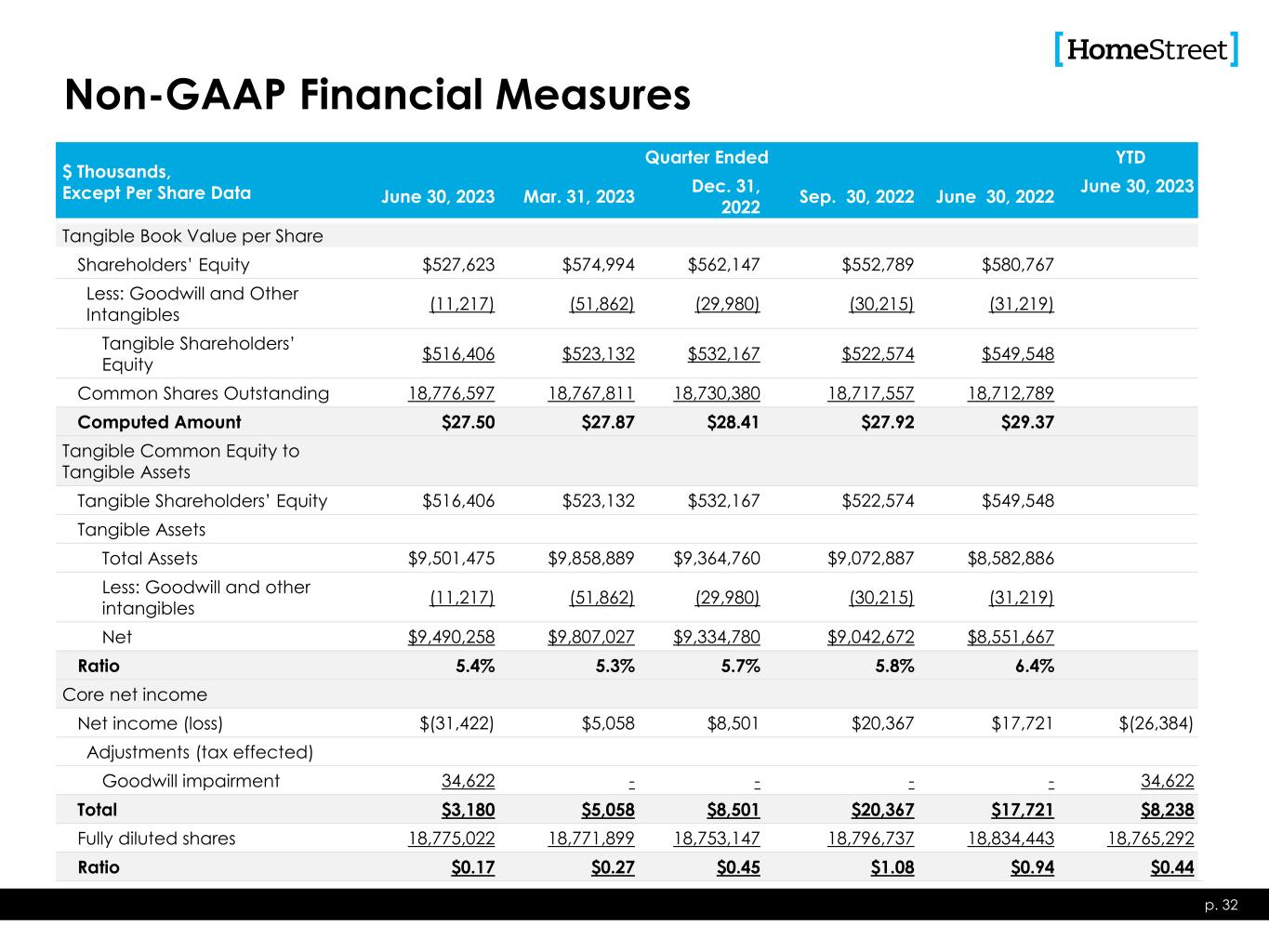

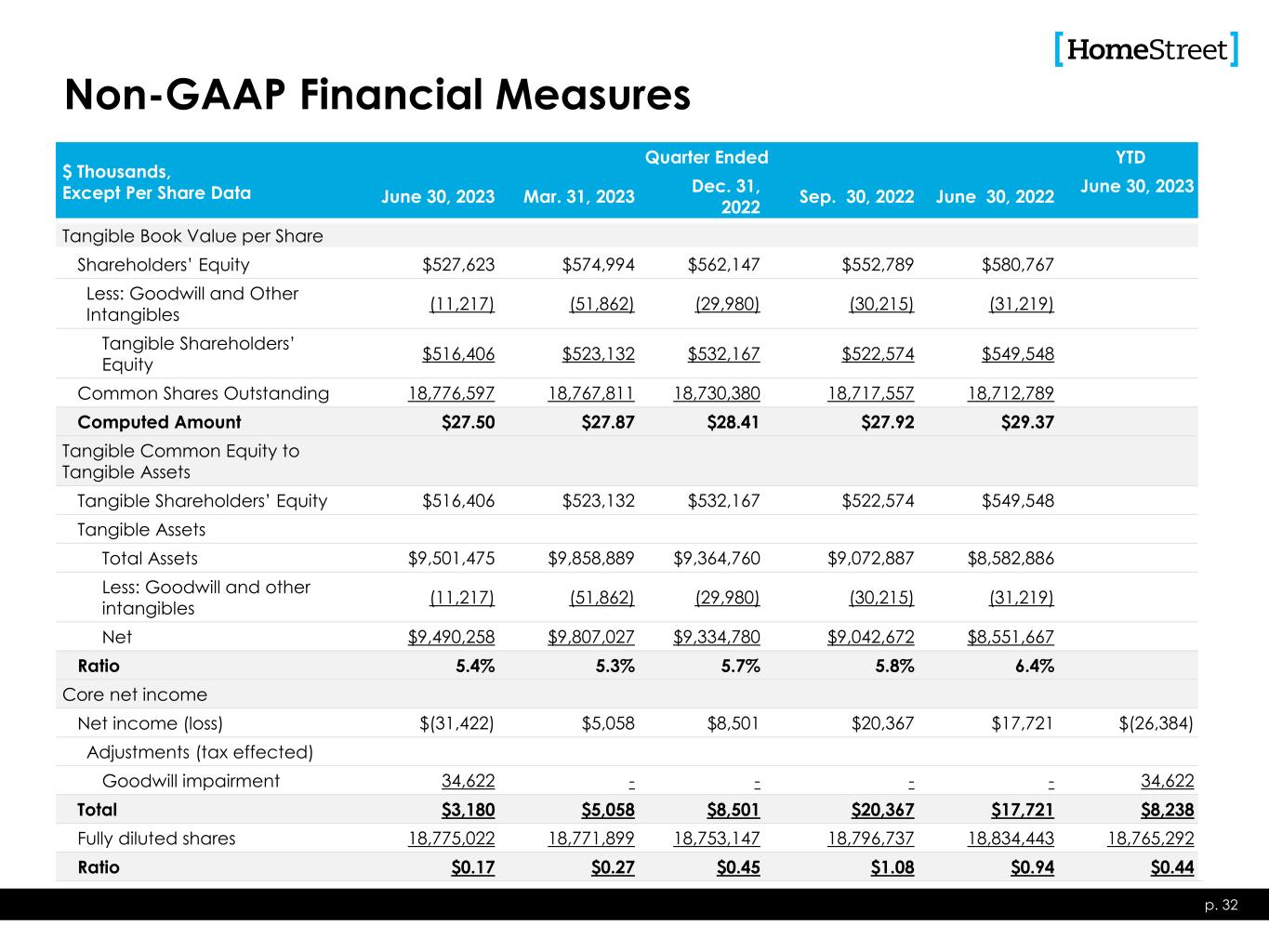

Non-GAAP Financial Measures $ Thousands, Except Per Share Data Quarter Ended YTD June 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 June 30, 2022 June 30, 2023 Tangible Book Value per Share Shareholders’ Equity $527,623 $574,994 $562,147 $552,789 $580,767 Less: Goodwill and Other Intangibles (11,217) (51,862) (29,980) (30,215) (31,219) Tangible Shareholders’ Equity $516,406 $523,132 $532,167 $522,574 $549,548 Common Shares Outstanding 18,776,597 18,767,811 18,730,380 18,717,557 18,712,789 Computed Amount $27.50 $27.87 $28.41 $27.92 $29.37 Tangible Common Equity to Tangible Assets Tangible Shareholders’ Equity $516,406 $523,132 $532,167 $522,574 $549,548 Tangible Assets Total Assets $9,501,475 $9,858,889 $9,364,760 $9,072,887 $8,582,886 Less: Goodwill and other intangibles (11,217) (51,862) (29,980) (30,215) (31,219) Net $9,490,258 $9,807,027 $9,334,780 $9,042,672 $8,551,667 Ratio 5.4% 5.3% 5.7% 5.8% 6.4% Core net income Net income (loss) $(31,422) $5,058 $8,501 $20,367 $17,721 $(26,384) Adjustments (tax effected) Goodwill impairment 34,622 - - - - 34,622 Total $3,180 $5,058 $8,501 $20,367 $17,721 $8,238 Fully diluted shares 18,775,022 18,771,899 18,753,147 18,796,737 18,834,443 18,765,292 Ratio $0.17 $0.27 $0.45 $1.08 $0.94 $0.44 p. 32

Non-GAAP Financial Measures (continued) $ Thousands, Except Per Share Data Quarter Ended June 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 June 30, 2022 Return on Average Tangible Equity Average Shareholders’ Equity $582,172 $578,533 $565,950 $603,278 $603,664 Less: Average Goodwill and Other Intangibles (51,138) (30,969) (30,133) (30,602) (31,380) Average Tangible Equity $531,034 $547,564 $535,817 $572,676 $572,284 Core Net Income (per above) $3,180 $5,058 $8,501 $20,367 $17,721 Amortization of Core Deposit Intangibles (net of tax) 614 459 183 186 191 Tangible Income Applicable to Shareholders $3,794 $5,517 $8,684 $20,553 $17,912 Ratio 2.9% 4.1% 6.4% 14.2% 12.6% Return on Average Assets - Annualized core Average Assets $9,562,817 $9,530,705 $9,348,396 $8,899,684 $7,945,298 Core Net Income (per above) $3,180 $5,058 $8,501 $20,367 $17,721 Ratio 0.13% 0.22% 0.36% 0.91% 0.89% Effective Tax Rate Used in Computations Above (1) 22.0% 22.0% 22.0% 22.0% 22.0% (1) Effective tax rate indicated is used for all adjustment except the goodwill impairment charge as a portion of this charge was not deductible for tax purposes. Instead a computed effective rate of 13.1% was used for the goodwill impairment charge. p. 33

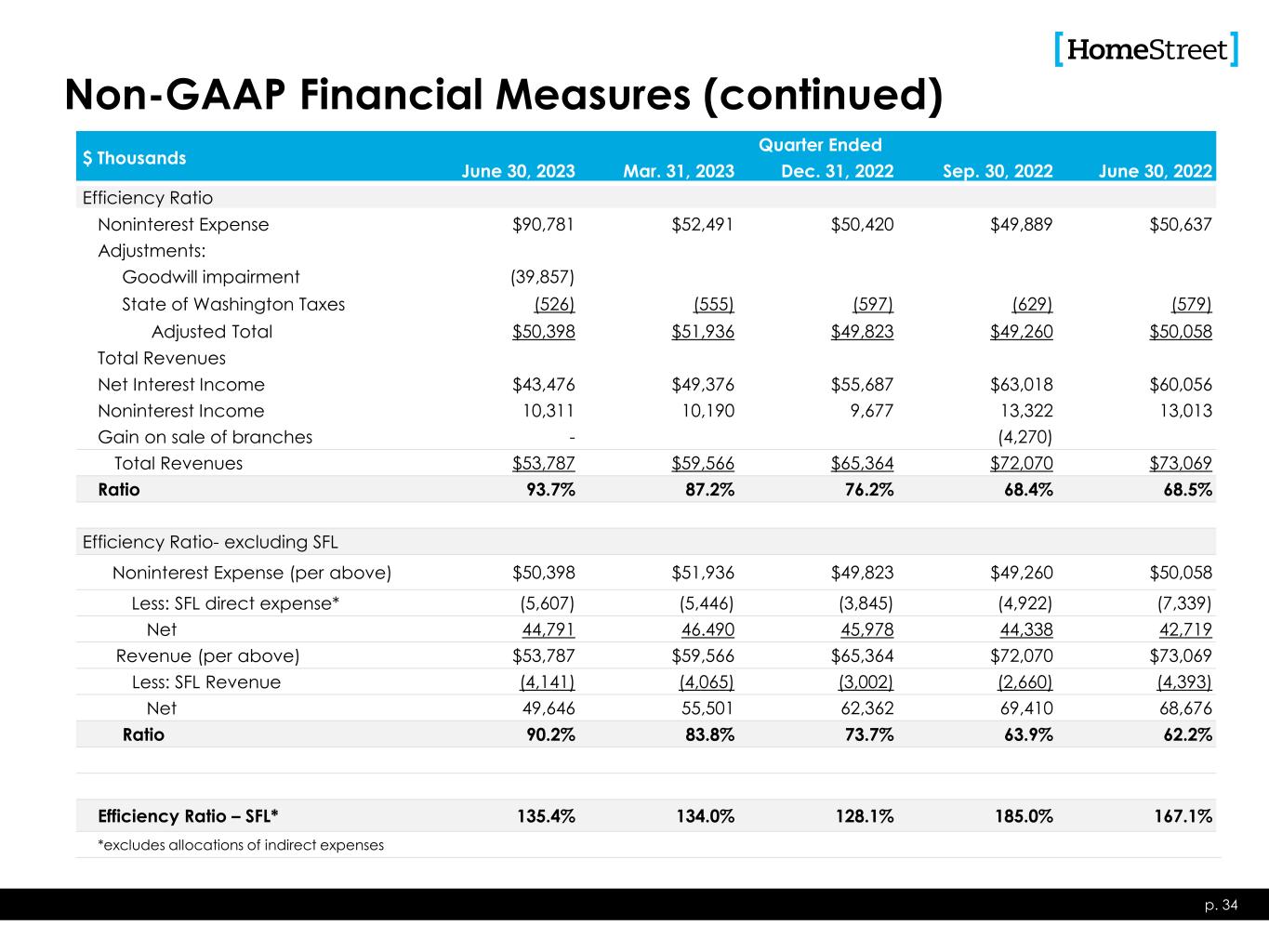

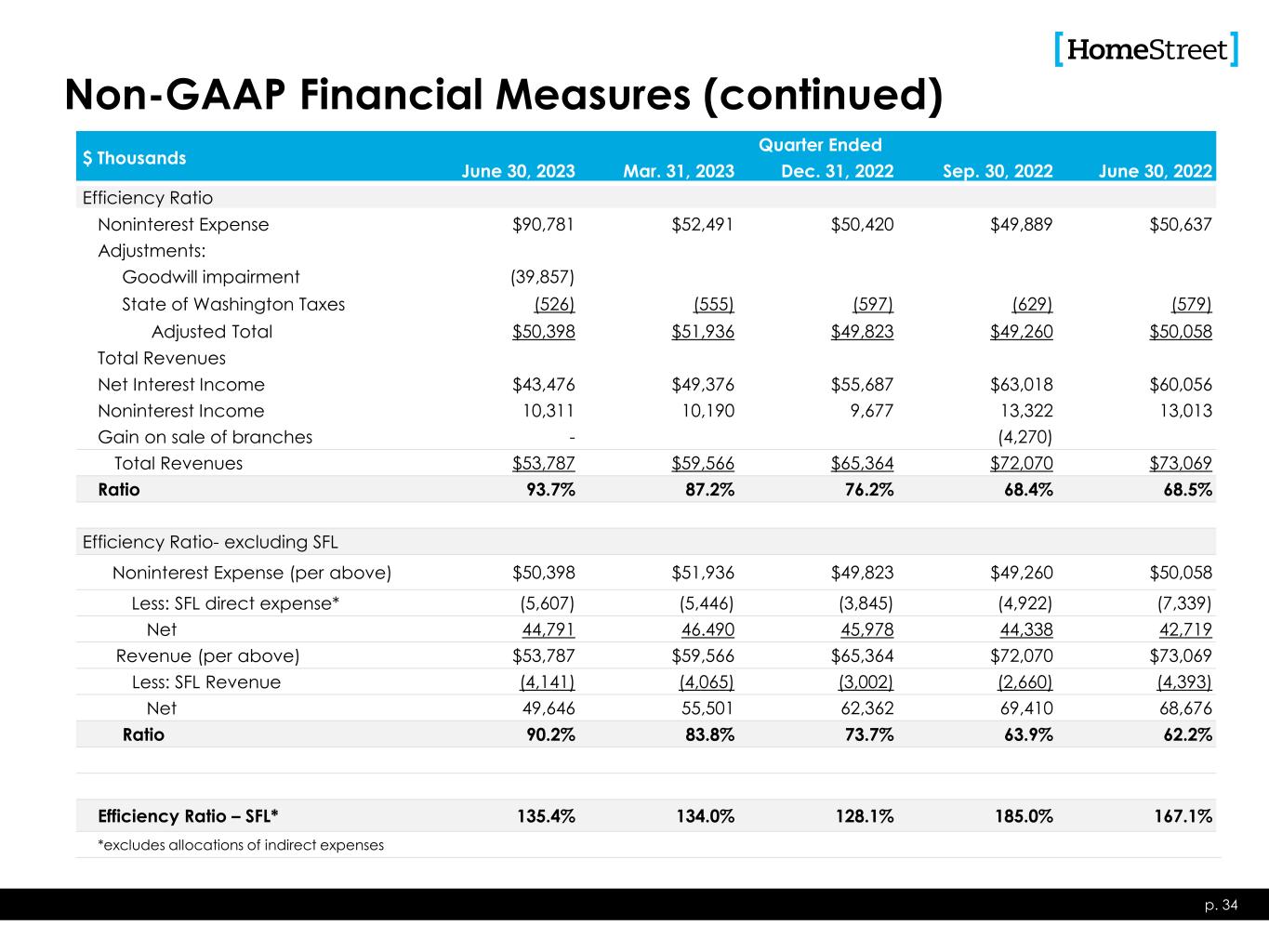

Non-GAAP Financial Measures (continued) $ Thousands Quarter Ended June 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 June 30, 2022 Efficiency Ratio Noninterest Expense $90,781 $52,491 $50,420 $49,889 $50,637 Adjustments: Goodwill impairment (39,857) State of Washington Taxes (526) (555) (597) (629) (579) Adjusted Total $50,398 $51,936 $49,823 $49,260 $50,058 Total Revenues Net Interest Income $43,476 $49,376 $55,687 $63,018 $60,056 Noninterest Income 10,311 10,190 9,677 13,322 13,013 Gain on sale of branches - (4,270) Total Revenues $53,787 $59,566 $65,364 $72,070 $73,069 Ratio 93.7% 87.2% 76.2% 68.4% 68.5% Efficiency Ratio- excluding SFL Noninterest Expense (per above) $50,398 $51,936 $49,823 $49,260 $50,058 Less: SFL direct expense* (5,607) (5,446) (3,845) (4,922) (7,339) Net 44,791 46.490 45,978 44,338 42,719 Revenue (per above) $53,787 $59,566 $65,364 $72,070 $73,069 Less: SFL Revenue (4,141) (4,065) (3,002) (2,660) (4,393) Net 49,646 55,501 62,362 69,410 68,676 Ratio 90.2% 83.8% 73.7% 63.9% 62.2% Efficiency Ratio – SFL* 135.4% 134.0% 128.1% 185.0% 167.1% *excludes allocations of indirect expenses p. 34

Non-GAAP Financial Measures (continued) p. 35 To supplement our unaudited condensed consolidated financial statements presented in accordance with GAAP, we use certain non- GAAP measures of financial performance. In this presentation, we use the following non-GAAP measures: (i) tangible common equity and tangible assets as we believe this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios; (ii) core income which excludes goodwill impairment charges as we believe this is a better comparison to be used in projecting future results and (iii)an efficiency ratio, which is the ratio of noninterest expense to the sum of net interest income and noninterest income, excluding certain items of income or expense and excluding taxes incurred and payable to the state of Washington as such taxes are not classified as income taxes, and we believe including them in noninterest expense impacts the comparability of our results to those companies whose operations are in states where assessed taxes on business are classified as income taxes. These supplemental performance measures may vary from, and may not be comparable to, similarly titled measures provided by other companies in our industry. Non-GAAP financial measures are not in accordance with, or an alternative for, GAAP. Generally, a non- GAAP financial measure is a numerical measure of a company’s performance that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. A non- GAAP financial measure may also be a financial metric that is not required by GAAP or other applicable requirements. We believe that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by providing additional information used by management that is not otherwise required by GAAP or other applicable requirements. Our management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing our operating results and when planning, forecasting and analyzing future periods. These non-GAAP financial measures also facilitate a comparison of our performance to prior periods. We believe these measures are frequently used by securities analysts, investors and other parties in the evaluation of companies in our industry. Rather, these non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures prepared in accordance with GAAP. We have provided reconciliations of, where applicable, the most comparable GAAP financial measures to the non-GAAP measures used in this presentation, or a reconciliation of the non-GAAP calculation of the financial measure.