R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 1 Carlyle Credit Income Fund (“CCIF”) Q2 2025 Quarterly Earnings Presentation May 2025

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 2 This presentation (the “Presentation”) has been prepared by Carlyle Credit Income Fund. (together with its consolidated subsidiaries, “we,” “us,” “our,” “CCIF” or the “Fund”) (NYSE: CCIF) and may only be used for informational purposes only. This Presentation should be viewed in conjunction with the earnings conference call of the Fund held on May 21, 2025. The information contained herein may not be used, reproduced, referenced, quoted, linked by website, or distributed to others, in whole or in part, except as agreed in writing by the Fund. This Presentation does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy our common shares or any other securities nor will there be any sale of the common shares or any other securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. This Presentation provides limited information regarding the Fund and is not intended to be taken by, and should not be taken by, any individual recipient as investment advice, a recommendation to buy, hold or sell, or an offer to sell or a solicitation of offers to purchase, our common shares or any other securities that may be issued by the Fund, or as legal, accounting or tax advice. An investment in securities of the type described herein presents certain risks. This Presentation may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make them. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission (the “SEC”), and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Information throughout the Presentation provided by sources other than the Fund (including information relating to portfolio companies) has not been independently verified and, accordingly, the Fund makes no representation or warranty in respect of this information. The following slides contain summaries of certain financial and statistical information about the Fund. The information contained in this Presentation is summary information that is intended to be considered in the context of our SEC filings and other public announcements that we may make, by press release or otherwise, from time to time. We undertake no duty or obligation to publicly update or revise the information contained in this Presentation. CCIF is managed by Carlyle Global Credit Investment Management L.L.C. (the “Investment Adviser”), an SEC-registered investment adviser and a wholly owned subsidiary of The Carlyle Group Inc. (together with its affiliates, “Carlyle”). This Presentation contains information about the Fund and certain of its affiliates and includes the Fund’s historical performance. You should not view information related to the past performance of the Fund as indicative of the Company’s future results, the achievement of which is dependent on many factors, many of which are beyond the control of the Fund and the Investment Adviser and cannot be assured. There can be no assurances that future dividends will match or exceed historical rates or will be paid at all. Further, an investment in the Fund is discrete from, and does not represent an interest in, any other Carlyle entity. Nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance of the Fund or any other Carlyle entity. This presentation contains non-GAAP financial information. The Fund's management uses this information in its internal analysis of results and believes that this information may be informative to investors gauging the quality of the Fund's financial performance, identifying trends in its results and providing meaningful period-to-period comparisons. However, these non-GAAP measures should not be considered in isolation or as a substitute for or superior to any measures of financial performance calculated and presented in accordance with GAAP. Other Funds may calculate this or similarly titled non-GAAP measures differently than we do. See "Appendix - Non-GAAP Measures" in this presentation for more information. 2 Important Information

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 3 Fund Overview (1) Current dividend rate based on dividends declared through August 2025, and the closing market share price at May 16, 2025. (2) As of March 31, 2025. Carlyle Platform Carlyle Expertise CLOs PRIMARILY INVESTING IN EQUITY AND JUNIOR DEBT TRANCHES OF COLLATERALIZED LOAN OBLIGATIONS (CLOs) 1,428 Underlying exposure to 1,428 companies 18.75%(1) MONTHLY DIVIDEND THAT IS DECLARED QUARTERLY Carlyle Credit Income Fund (“CCIF”) Overview Carlyle Platform Carlyle (NASDAQ:CG) IS A GLOBAL INVESTMENT FIRM FOUNDED IN 1987 $453 Billion OF ASSETS UNDER MANAGEMENT (AUM) (2) 2,300+ EMPLOYEES AND OVER 700 INVESTMENT PROFESSIONALS GLOBALLY (2) 25+ YEAR HISTORY IN THE CLO MARKET ~$50 Billion IN CLOs ACROSS U.S. AND EUROPE (2) 30+ INDUSTRY-FOCUSED RESEARCH ANALYSTS Carlyle Expertise

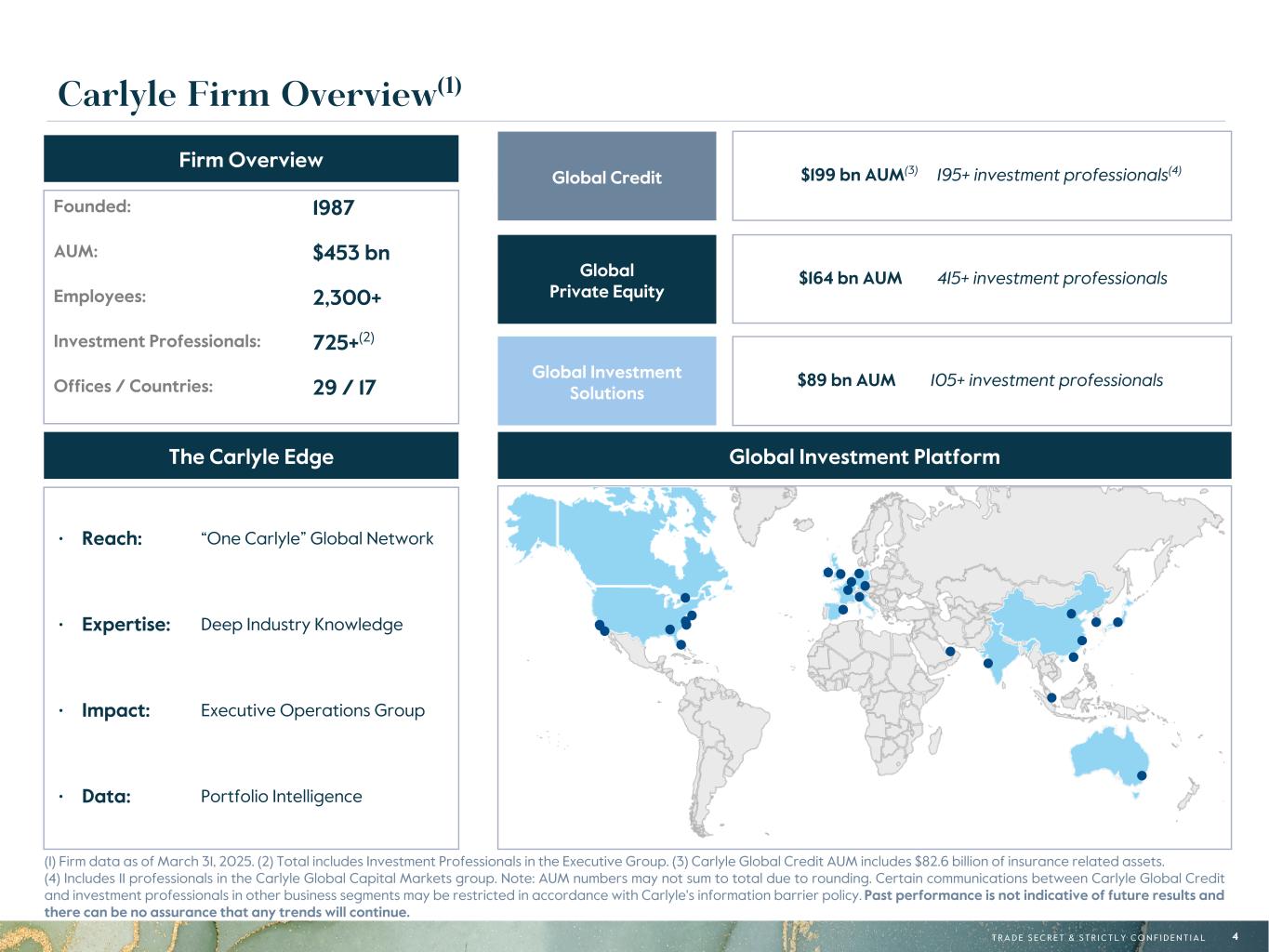

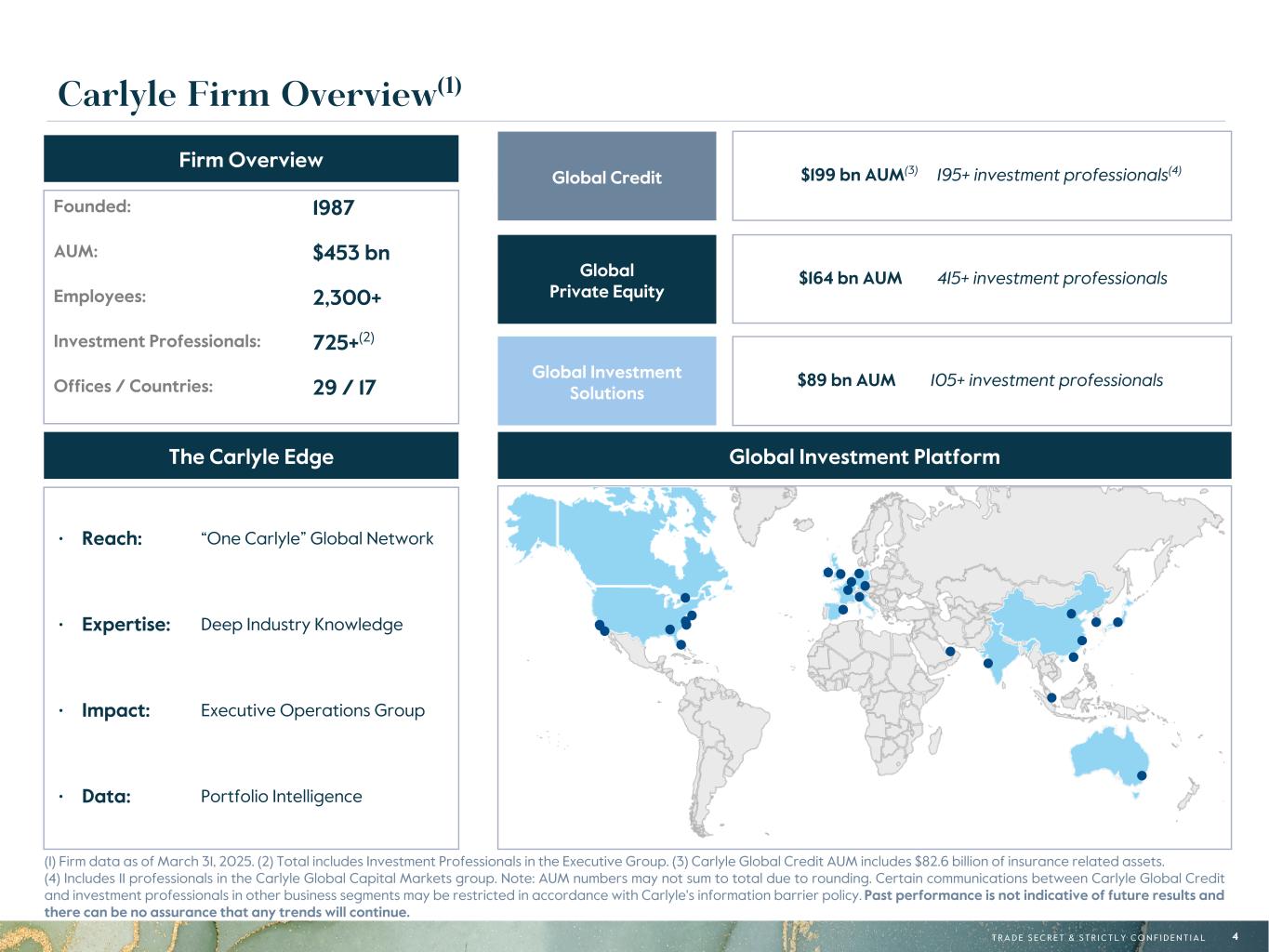

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 4 (1) Firm data as of March 31, 2025. (2) Total includes Investment Professionals in the Executive Group. (3) Carlyle Global Credit AUM includes $82.6 billion of insurance related assets. (4) Includes 11 professionals in the Carlyle Global Capital Markets group. Note: AUM numbers may not sum to total due to rounding. Certain communications between Carlyle Global Credit and investment professionals in other business segments may be restricted in accordance with Carlyle's information barrier policy. Past performance is not indicative of future results and there can be no assurance that any trends will continue. Firm Overview The Carlyle Edge • Reach: “One Carlyle” Global Network • Expertise: Deep Industry Knowledge • Impact: Executive Operations Group • Data: Portfolio Intelligence Global Private Equity Global Credit Global Investment Solutions Global Investment Platform Founded: 1987 AUM: $453 bn Employees: 2,300+ Investment Professionals: 725+(2) Offices / Countries: 29 / 17 $164 bn AUM 415+ investment professionals $199 bn AUM(3) 195+ investment professionals(4) $89 bn AUM 105+ investment professionals Carlyle Firm Overview(1)

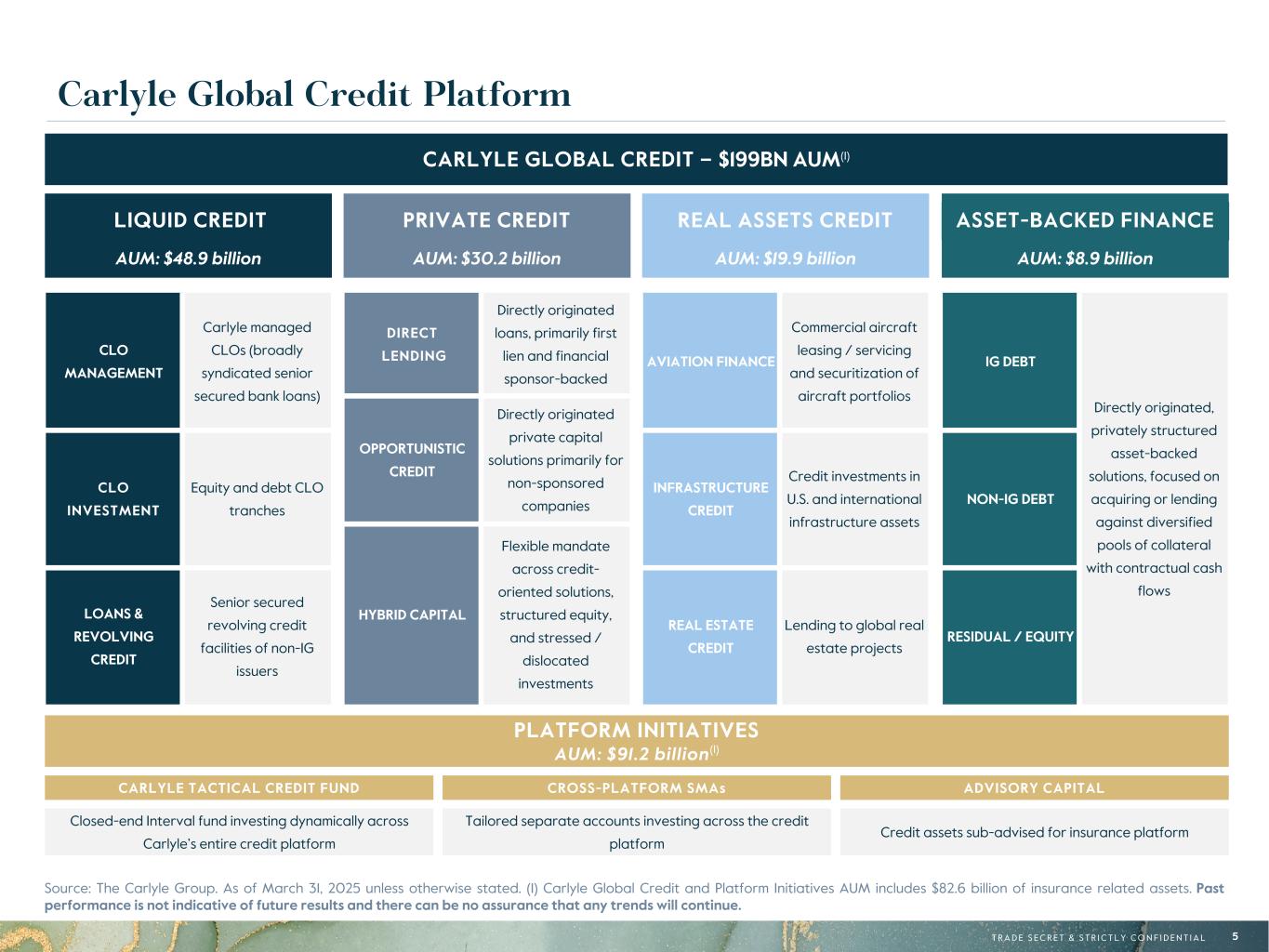

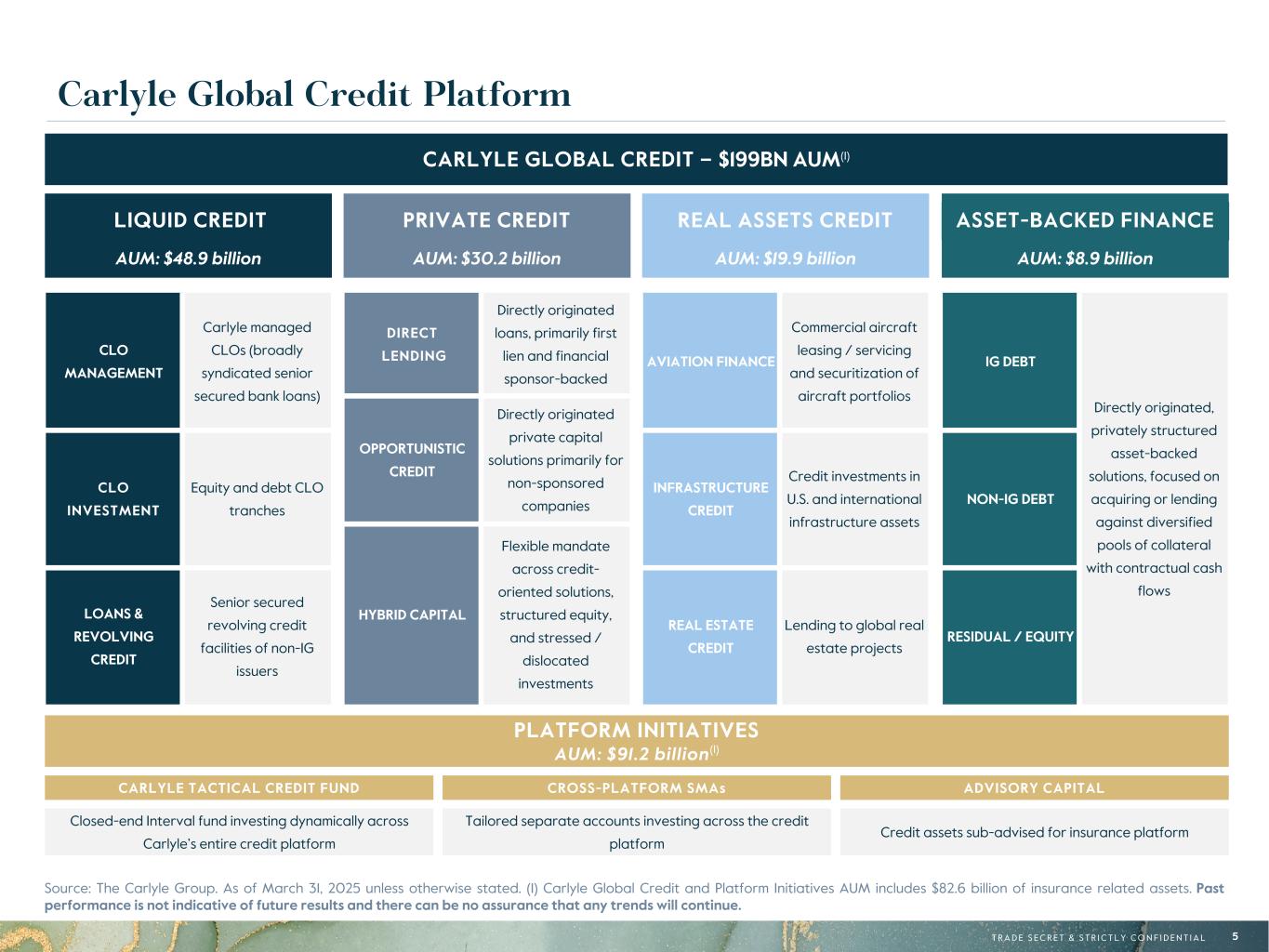

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 5 AUM: $8.9 billion ASSET-BACKED FINANCE Carlyle Global Credit Platform Source: The Carlyle Group. As of March 31, 2025 unless otherwise stated. (1) Carlyle Global Credit and Platform Initiatives AUM includes $82.6 billion of insurance related assets. Past performance is not indicative of future results and there can be no assurance that any trends will continue. CARLYLE GLOBAL CREDIT – $199BN AUM(1) AUM: $48.9 billion LIQUID CREDIT AUM: $30.2 billion PRIVATE CREDIT AUM: $19.9 billion REAL ASSETS CREDIT CLO MANAGEMENT Carlyle managed CLOs (broadly syndicated senior secured bank loans) CLO INVESTMENT Equity and debt CLO tranches LOANS & REVOLVING CREDIT Senior secured revolving credit facilities of non-IG issuers DIRECT LENDING Directly originated loans, primarily first lien and financial sponsor-backed OPPORTUNISTIC CREDIT Directly originated private capital solutions primarily for non-sponsored companies HYBRID CAPITAL Flexible mandate across credit- oriented solutions, structured equity, and stressed / dislocated investments AVIATION FINANCE Commercial aircraft leasing / servicing and securitization of aircraft portfolios INFRASTRUCTURE CREDIT Credit investments in U.S. and international infrastructure assets REAL ESTATE CREDIT Lending to global real estate projects PLATFORM INITIATIVES AUM: $91.2 billion(1) CARLYLE TACTICAL CREDIT FUND CROSS-PLATFORM SMAs ADVISORY CAPITAL Closed-end Interval fund investing dynamically across Carlyle’s entire credit platform Tailored separate accounts investing across the credit platform Credit assets sub-advised for insurance platform IG DEBT Directly originated, privately structured asset-backed solutions, focused on acquiring or lending against diversified pools of collateral with contractual cash flows NON-IG DEBT RESIDUAL / EQUITY

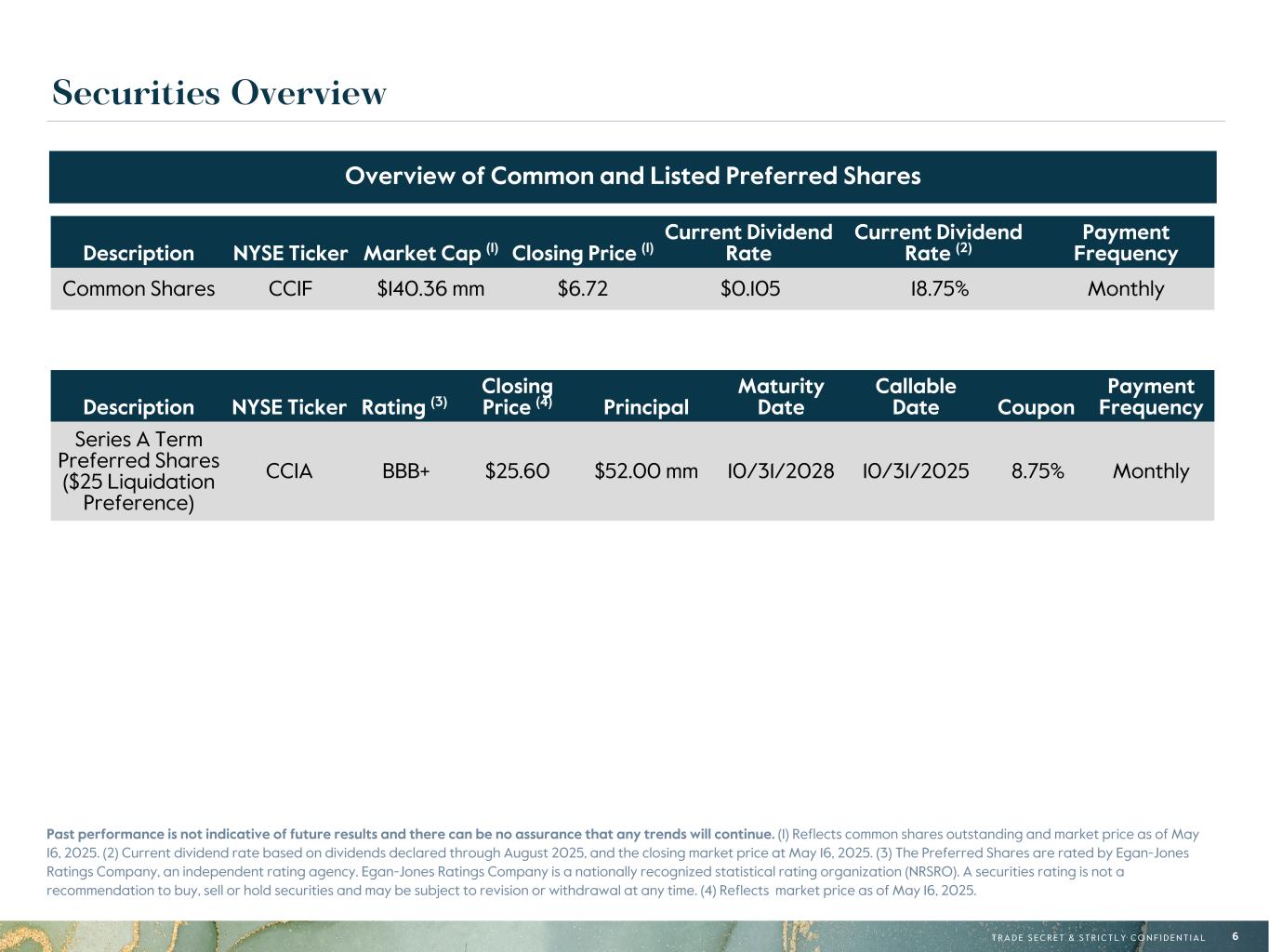

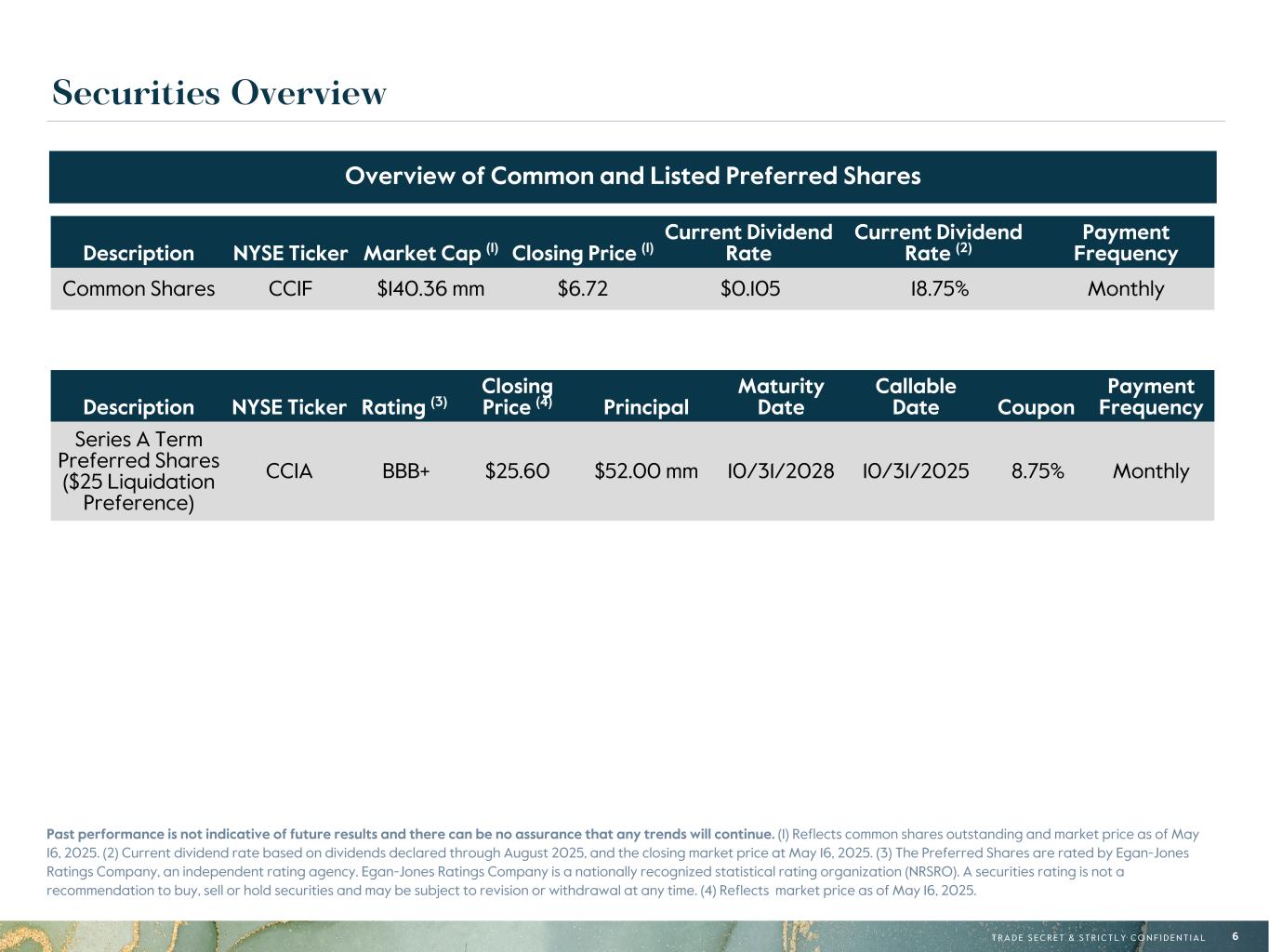

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 6 Securities Overview Description NYSE Ticker Market Cap (1) Closing Price (1) Current Dividend Rate Current Dividend Rate (2) Payment Frequency Common Shares CCIF $140.36 mm $6.72 $0.105 18.75% Monthly Overview of Common and Listed Preferred Shares Description NYSE Ticker Rating (3) Closing Price (4) Principal Maturity Date Callable Date Coupon Payment Frequency Series A Term Preferred Shares ($25 Liquidation Preference) CCIA BBB+ $25.60 $52.00 mm 10/31/2028 10/31/2025 8.75% Monthly Past performance is not indicative of future results and there can be no assurance that any trends will continue. (1) Reflects common shares outstanding and market price as of May 16, 2025. (2) Current dividend rate based on dividends declared through August 2025, and the closing market price at May 16, 2025. (3) The Preferred Shares are rated by Egan-Jones Ratings Company, an independent rating agency. Egan-Jones Ratings Company is a nationally recognized statistical rating organization (NRSRO). A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. (4) Reflects market price as of May 16, 2025.

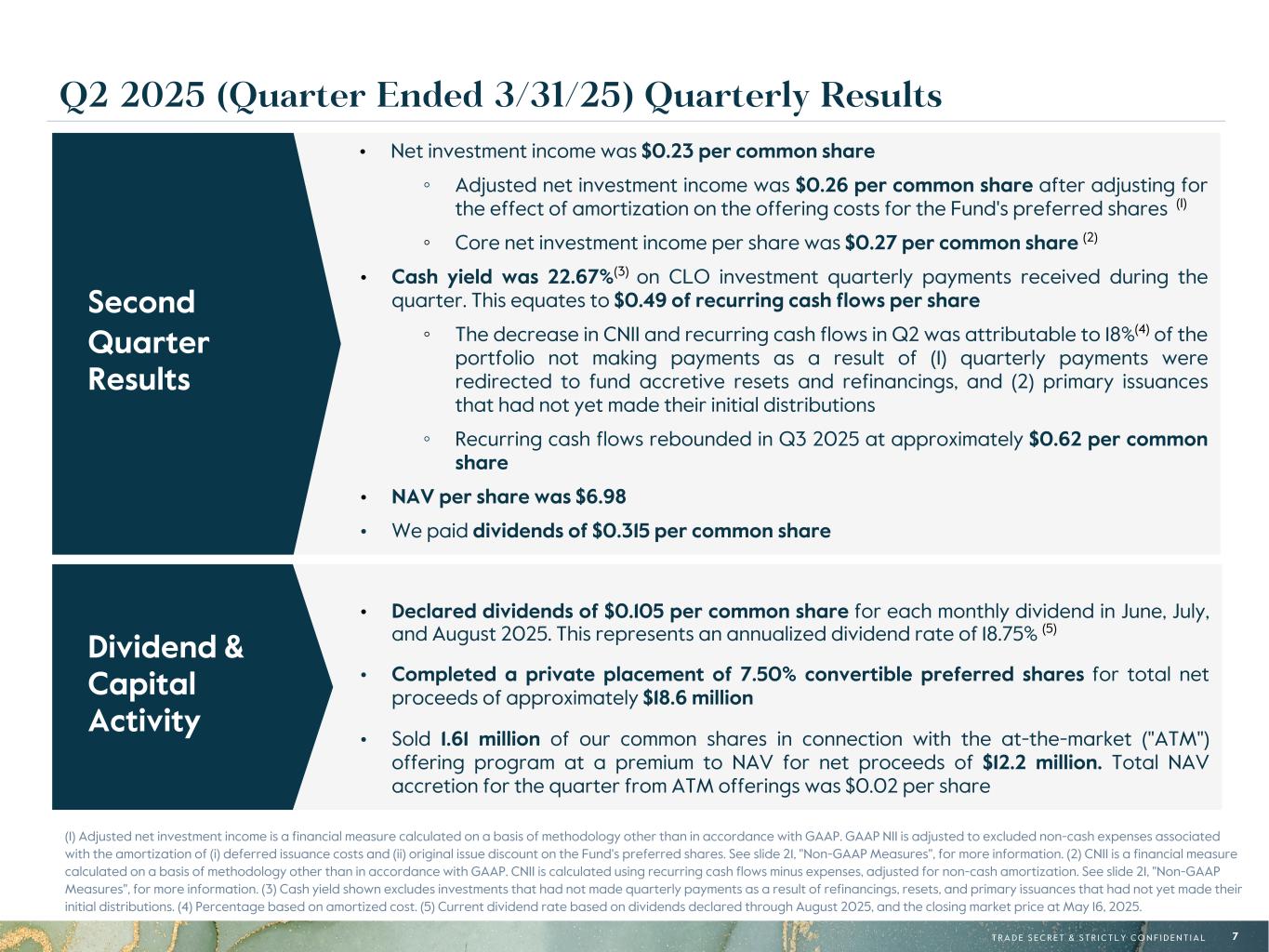

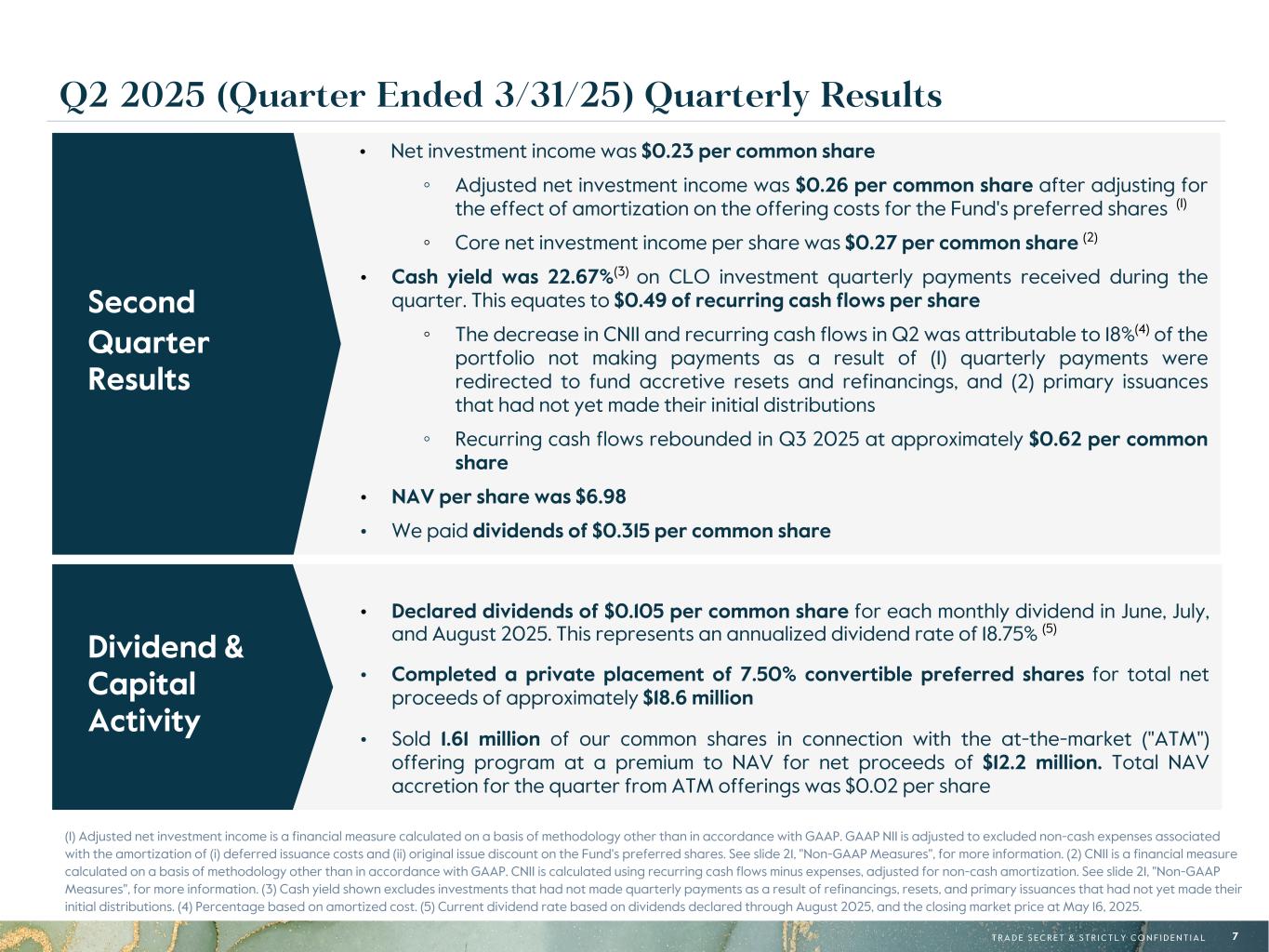

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 7 • Net investment income was $0.23 per common share ◦ Adjusted net investment income was $0.26 per common share after adjusting for the effect of amortization on the offering costs for the Fund's preferred shares (1) ◦ Core net investment income per share was $0.27 per common share (2) • Cash yield was 22.67%(3) on CLO investment quarterly payments received during the quarter. This equates to $0.49 of recurring cash flows per share ◦ The decrease in CNII and recurring cash flows in Q2 was attributable to 18%(4) of the portfolio not making payments as a result of (1) quarterly payments were redirected to fund accretive resets and refinancings, and (2) primary issuances that had not yet made their initial distributions ◦ Recurring cash flows rebounded in Q3 2025 at approximately $0.62 per common share • NAV per share was $6.98 • We paid dividends of $0.315 per common share • Declared dividends of $0.105 per common share for each monthly dividend in June, July, and August 2025. This represents an annualized dividend rate of 18.75% (5) • Completed a private placement of 7.50% convertible preferred shares for total net proceeds of approximately $18.6 million • Sold 1.61 million of our common shares in connection with the at-the-market ("ATM") offering program at a premium to NAV for net proceeds of $12.2 million. Total NAV accretion for the quarter from ATM offerings was $0.02 per share Dividend & Capital Activity (1) Adjusted net investment income is a financial measure calculated on a basis of methodology other than in accordance with GAAP. GAAP NII is adjusted to excluded non-cash expenses associated with the amortization of (i) deferred issuance costs and (ii) original issue discount on the Fund's preferred shares. See slide 21, "Non-GAAP Measures", for more information. (2) CNII is a financial measure calculated on a basis of methodology other than in accordance with GAAP. CNII is calculated using recurring cash flows minus expenses, adjusted for non-cash amortization. See slide 21, "Non-GAAP Measures", for more information. (3) Cash yield shown excludes investments that had not made quarterly payments as a result of refinancings, resets, and primary issuances that had not yet made their initial distributions. (4) Percentage based on amortized cost. (5) Current dividend rate based on dividends declared through August 2025, and the closing market price at May 16, 2025. Second Quarter Results Q2 2025 (Quarter Ended 3/31/25) Quarterly Results

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 8 • Total fair value of the portfolio excluding cash was $197.9 million • New CLO investment deployments during the quarter were $30.3 million with a weighted average GAAP yield of 15.41% • Total portfolio weighted average GAAP yield was 16.48% • Completed 13 accretive refinancings and resets in the underlying portfolio during the quarter increasing the weighted average remaining CLO reinvestment period from 2.5 years to 3.1 years • Underlying CLOs continue to maintain healthy overcollateralization cushions with a weighted average cushion of 4.46% and no holdings with a cushion of less than 2.50% Portfolio & Investment Activity Q2 2025 (Quarter Ended 3/31/25) Quarterly Results

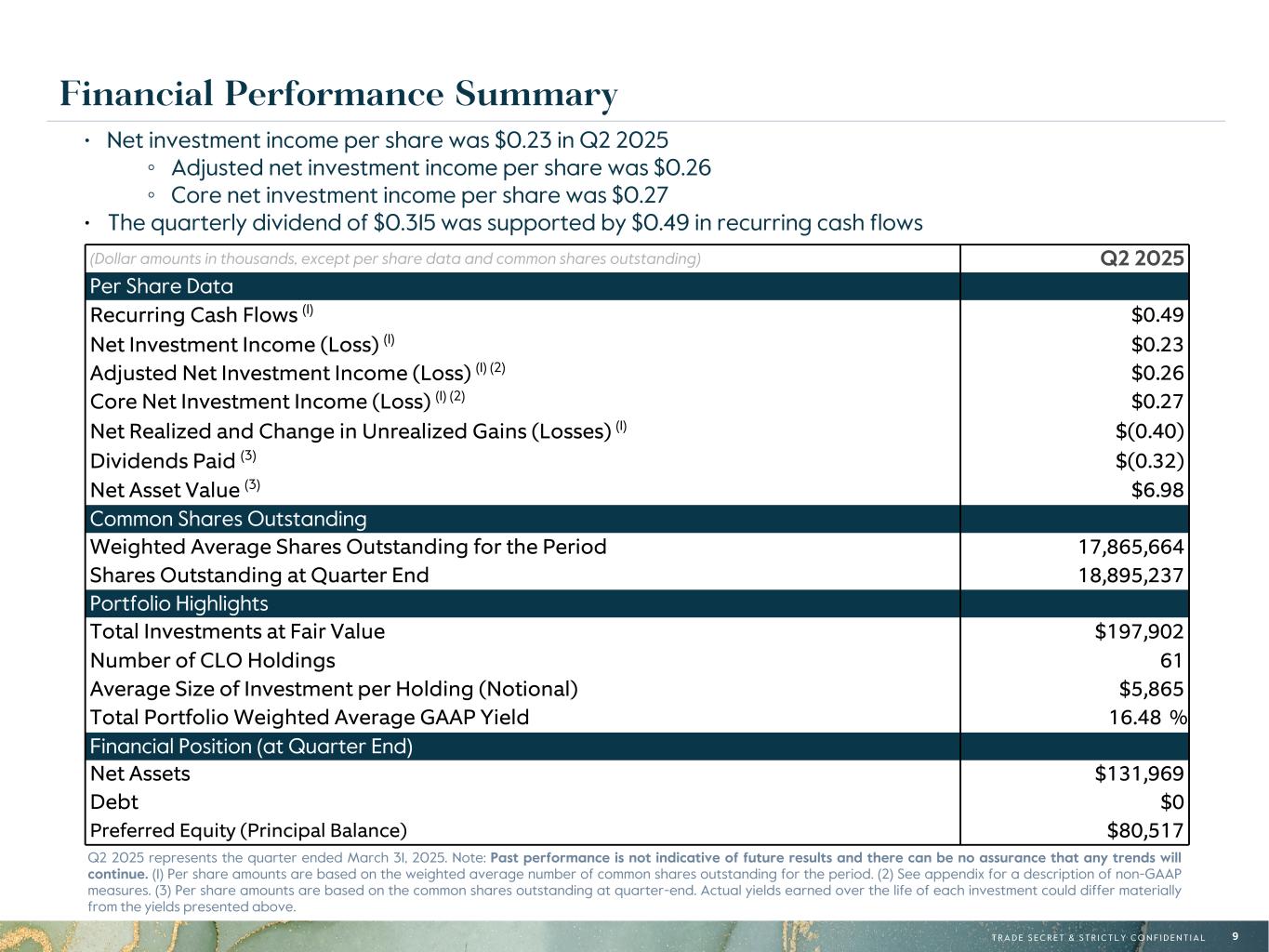

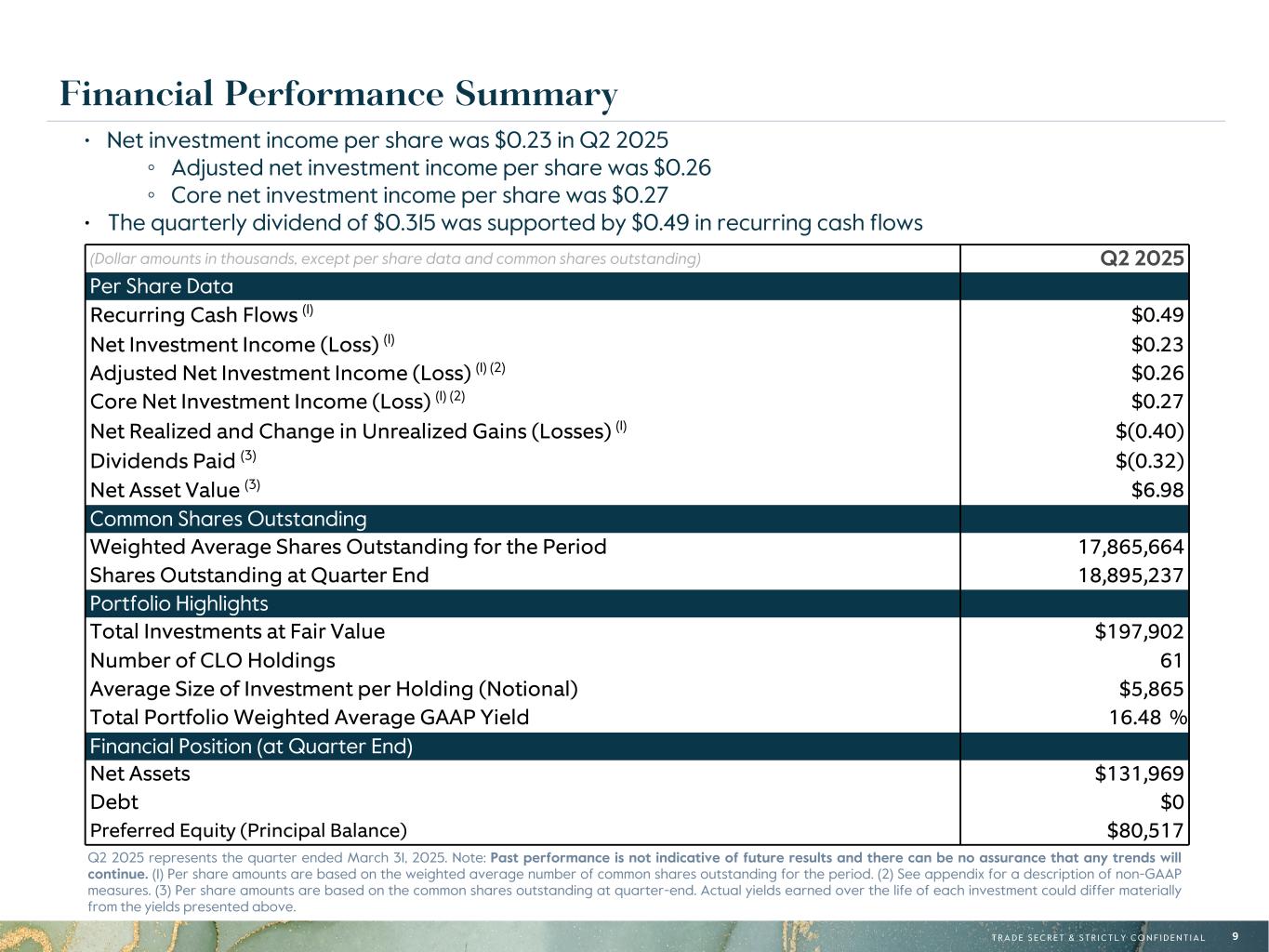

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 9 • Net investment income per share was $0.23 in Q2 2025 ◦ Adjusted net investment income per share was $0.26 ◦ Core net investment income per share was $0.27 • The quarterly dividend of $0.315 was supported by $0.49 in recurring cash flows Q2 2025 represents the quarter ended March 31, 2025. Note: Past performance is not indicative of future results and there can be no assurance that any trends will continue. (1) Per share amounts are based on the weighted average number of common shares outstanding for the period. (2) See appendix for a description of non-GAAP measures. (3) Per share amounts are based on the common shares outstanding at quarter-end. Actual yields earned over the life of each investment could differ materially from the yields presented above. Financial Performance Summary (Dollar amounts in thousands, except per share data and common shares outstanding) Q2 2025 Per Share Data Recurring Cash Flows (1) $0.49 Net Investment Income (Loss) (1) $0.23 Adjusted Net Investment Income (Loss) (1) (2) $0.26 Core Net Investment Income (Loss) (1) (2) $0.27 Net Realized and Change in Unrealized Gains (Losses) (1) $(0.40) Dividends Paid (3) $(0.32) Net Asset Value (3) $6.98 Common Shares Outstanding Weighted Average Shares Outstanding for the Period 17,865,664 Shares Outstanding at Quarter End 18,895,237 Portfolio Highlights Total Investments at Fair Value $197,902 Number of CLO Holdings 61 Average Size of Investment per Holding (Notional) $5,865 Total Portfolio Weighted Average GAAP Yield 16.48 % Financial Position (at Quarter End) Net Assets $131,969 Debt $0 Preferred Equity (Principal Balance) $80,517

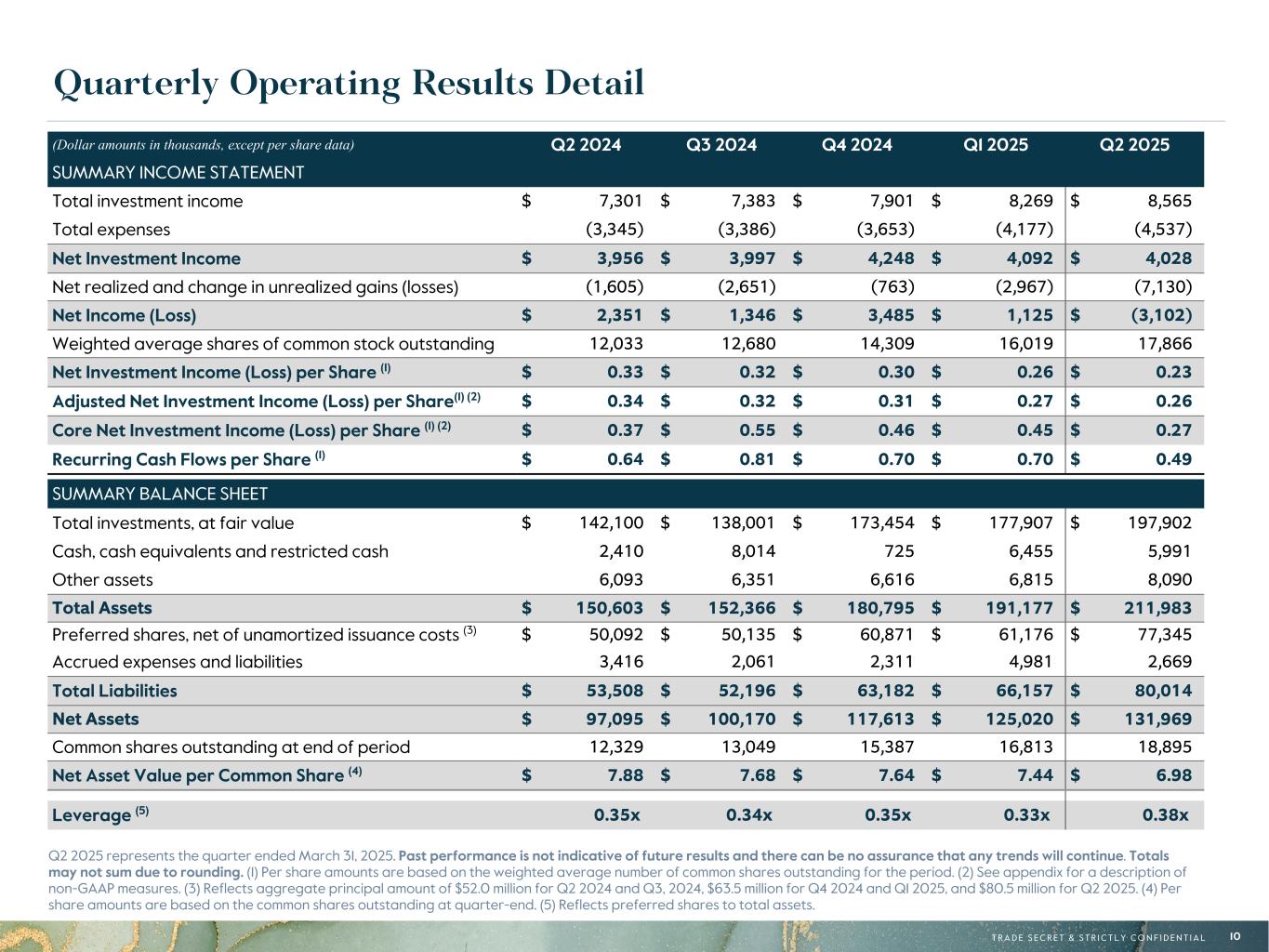

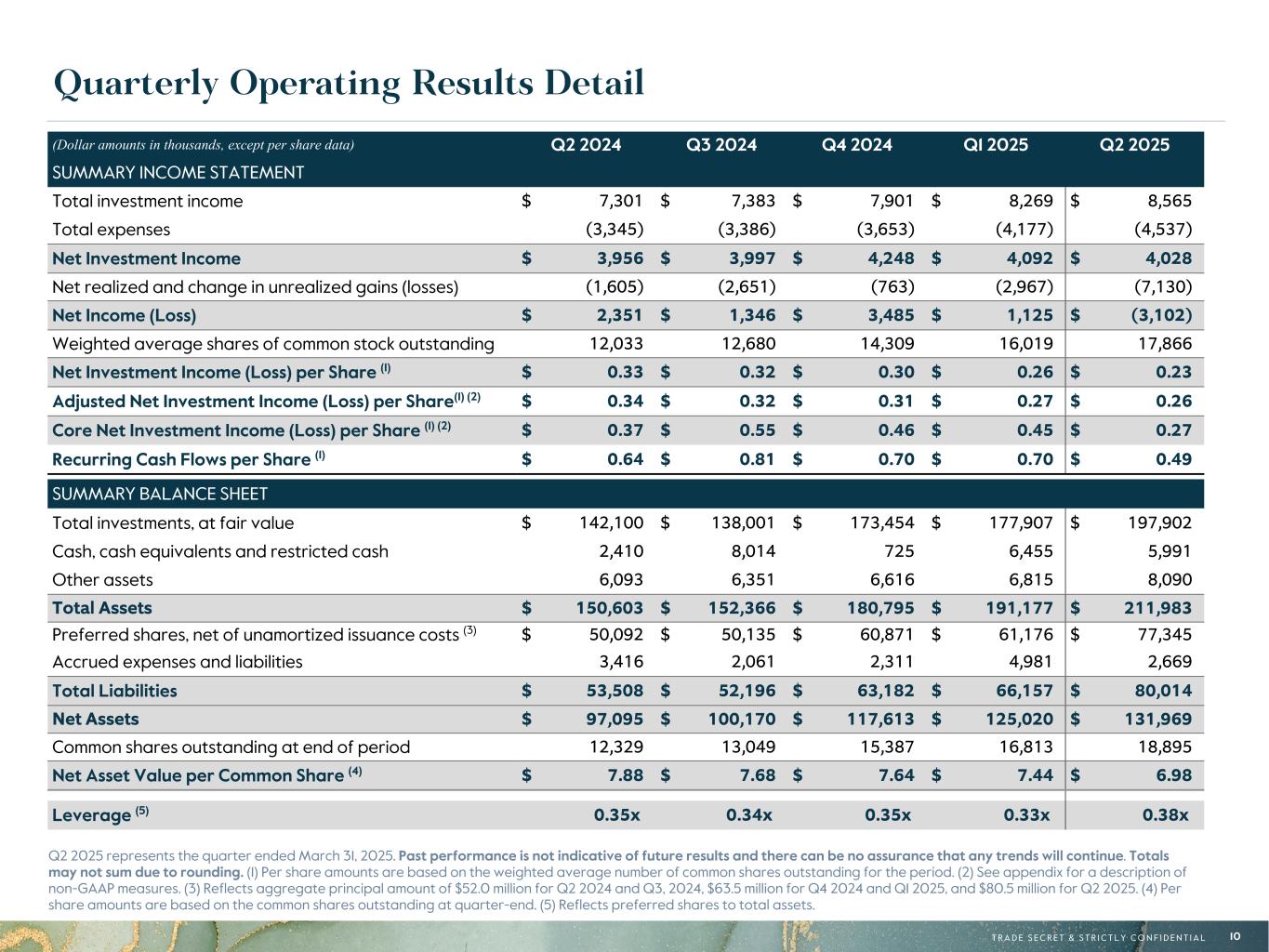

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 10 Quarterly Operating Results Detail Q2 2025 represents the quarter ended March 31, 2025. Past performance is not indicative of future results and there can be no assurance that any trends will continue. Totals may not sum due to rounding. (1) Per share amounts are based on the weighted average number of common shares outstanding for the period. (2) See appendix for a description of non-GAAP measures. (3) Reflects aggregate principal amount of $52.0 million for Q2 2024 and Q3, 2024, $63.5 million for Q4 2024 and Q1 2025, and $80.5 million for Q2 2025. (4) Per share amounts are based on the common shares outstanding at quarter-end. (5) Reflects preferred shares to total assets. (Dollar amounts in thousands, except per share data) Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 SUMMARY INCOME STATEMENT Total investment income $ 7,301 $ 7,383 $ 7,901 $ 8,269 $ 8,565 Total expenses (3,345) (3,386) (3,653) (4,177) (4,537) Net Investment Income $ 3,956 $ 3,997 $ 4,248 $ 4,092 $ 4,028 Net realized and change in unrealized gains (losses) (1,605) (2,651) (763) (2,967) (7,130) Net Income (Loss) $ 2,351 $ 1,346 $ 3,485 $ 1,125 $ (3,102) Weighted average shares of common stock outstanding 12,033 12,680 14,309 16,019 17,866 Net Investment Income (Loss) per Share (1) $ 0.33 $ 0.32 $ 0.30 $ 0.26 $ 0.23 Adjusted Net Investment Income (Loss) per Share(1) (2) $ 0.34 $ 0.32 $ 0.31 $ 0.27 $ 0.26 Core Net Investment Income (Loss) per Share (1) (2) $ 0.37 $ 0.55 $ 0.46 $ 0.45 $ 0.27 Recurring Cash Flows per Share (1) $ 0.64 $ 0.81 $ 0.70 $ 0.70 $ 0.49 SUMMARY BALANCE SHEET Total investments, at fair value $ 142,100 $ 138,001 $ 173,454 $ 177,907 $ 197,902 Cash, cash equivalents and restricted cash 2,410 8,014 725 6,455 5,991 Other assets 6,093 6,351 6,616 6,815 8,090 Total Assets $ 150,603 $ 152,366 $ 180,795 $ 191,177 $ 211,983 Preferred shares, net of unamortized issuance costs (3) $ 50,092 $ 50,135 $ 60,871 $ 61,176 $ 77,345 Accrued expenses and liabilities 3,416 2,061 2,311 4,981 2,669 Total Liabilities $ 53,508 $ 52,196 $ 63,182 $ 66,157 $ 80,014 Net Assets $ 97,095 $ 100,170 $ 117,613 $ 125,020 $ 131,969 Common shares outstanding at end of period 12,329 13,049 15,387 16,813 18,895 Net Asset Value per Common Share (4) $ 7.88 $ 7.68 $ 7.64 $ 7.44 $ 6.98 Leverage (5) 0.35x 0.34x 0.35x 0.33x 0.38x

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 11 13% 11% 10% 8% 5%5%5% 4% 4% 4% 31% High Tech Healthcare & Pharmaceuticals Banking, Finance, Insurance & Real Estate Services: Business Hotels, Gaming & Leisure Construction & Building Capital Equipment Chemicals, Plastics & Rubber Aerospace & Defense Beverage, Food & Tobacco All Others UNDERLYING INDUSTRYCLO MANAGER EXPOSUREREINVESTMENT END DATEASSET MIX 33% 7% 10% 25% 26% 2026 2027 2028 2029 2030 Underlying Portfolio Overview Note: As of March 31, 2025. Totals may not sum due to rounding. 7% 6% 6% 6% 6% 5% 5% 5% 5%4% 46% Voya Alternative Asset Management Irradiant Partners CIFC Asset Management Ballyrock Investment Advisors Benefit Street Partners Allstate Investment Management Company Barings Onex Credit Partners Elmwood Asset Management MidOcean Credit Fund Management All Others 99% 1% CLO Equity Legacy Real Estate Loan

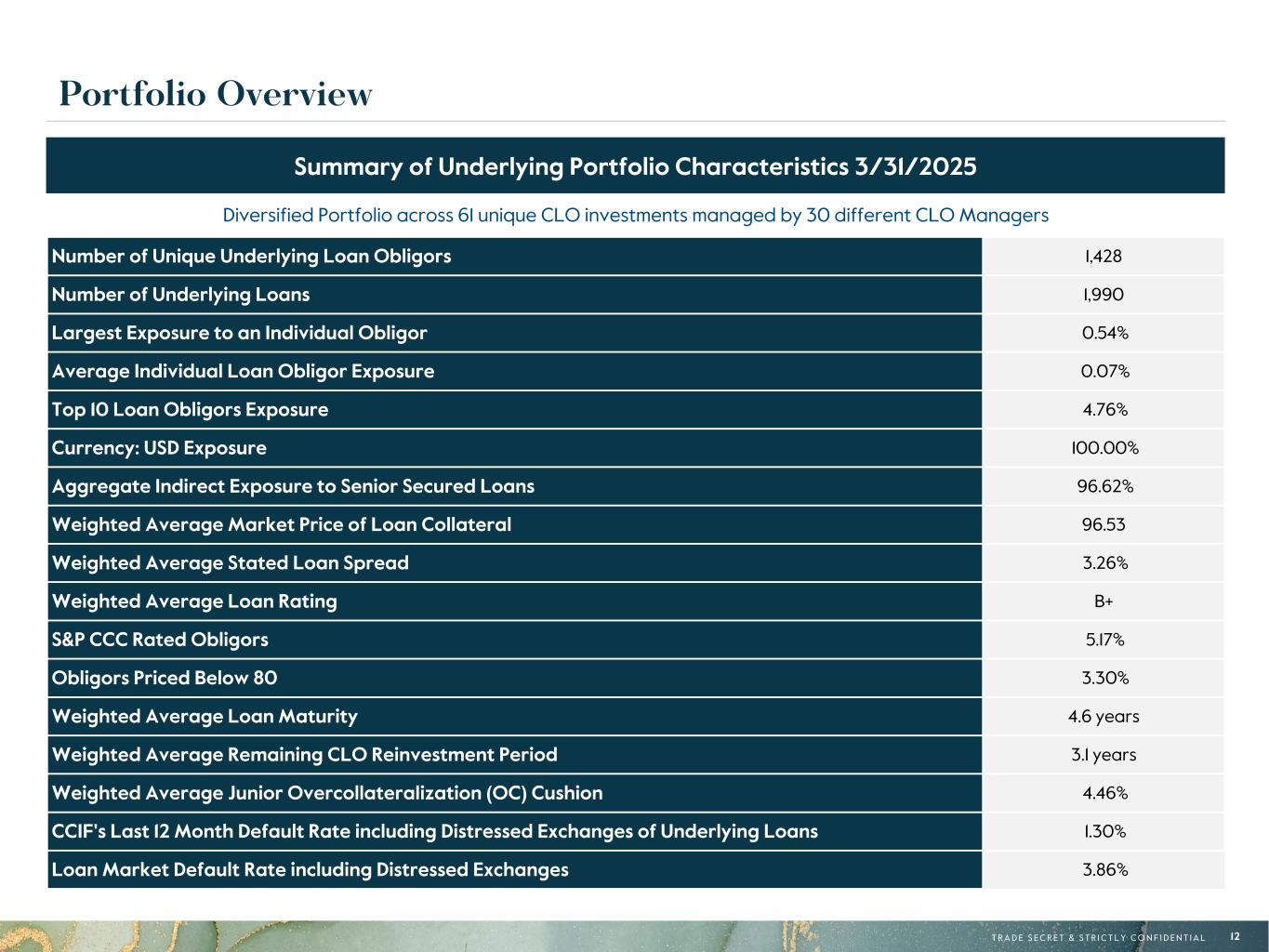

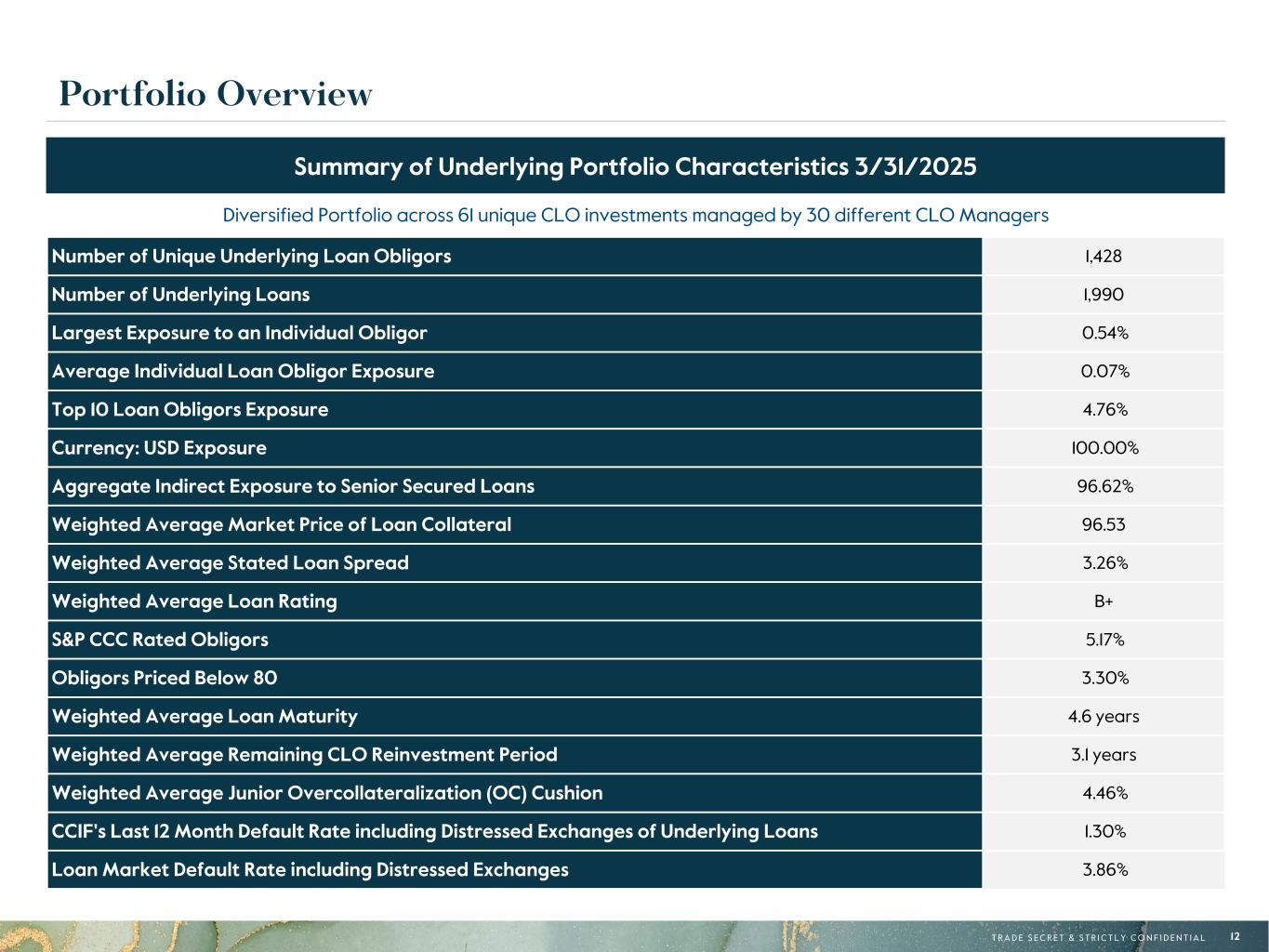

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 12 Portfolio Overview Diversified Portfolio across 61 unique CLO investments managed by 30 different CLO Managers Number of Unique Underlying Loan Obligors 1,428 Number of Underlying Loans 1,990 Largest Exposure to an Individual Obligor 0.54% Average Individual Loan Obligor Exposure 0.07% Top 10 Loan Obligors Exposure 4.76% Currency: USD Exposure 100.00% Aggregate Indirect Exposure to Senior Secured Loans 96.62% Weighted Average Market Price of Loan Collateral 96.53 Weighted Average Stated Loan Spread 3.26% Weighted Average Loan Rating B+ S&P CCC Rated Obligors 5.17% Obligors Priced Below 80 3.30% Weighted Average Loan Maturity 4.6 years Weighted Average Remaining CLO Reinvestment Period 3.1 years Weighted Average Junior Overcollateralization (OC) Cushion 4.46% CCIF's Last 12 Month Default Rate including Distressed Exchanges of Underlying Loans 1.30% Loan Market Default Rate including Distressed Exchanges 3.86% Summary of Underlying Portfolio Characteristics 3/31/2025

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 13 Obligor and Industry Exposures Top 10 Underlying Obligors % Total (1) TransDigm 0.54% Medline 0.52% Sedgwick Claims Management Service 0.50% TIBCO Software 0.50% Calpine 0.50% Quikrete Companies 0.46% Peraton 0.45% Caesars Entertainment 0.44% Asurion 0.44% Citadel Securities LP 0.42% Total 4.76% As of March 31, 2025, CCIF has exposure to 1,428 unique loan obligors across a range of industries Obligor and Industry Exposure Top 10 Industries of Underlying Obligors % Total (1) High Tech 12.64% Healthcare & Pharmaceuticals 11.33% Banking, Finance, Insurance & Real Estate 10.37% Services: Business 8.27% Hotels, Gaming & Leisure 5.21% Construction & Building 4.84% Capital Equipment 4.51% Chemicals, Plastics & Rubber 4.08% Aerospace & Defense 3.93% Beverage, Food & Tobacco 3.52% Total 68.68% (1) Totals may not sum due to rounding

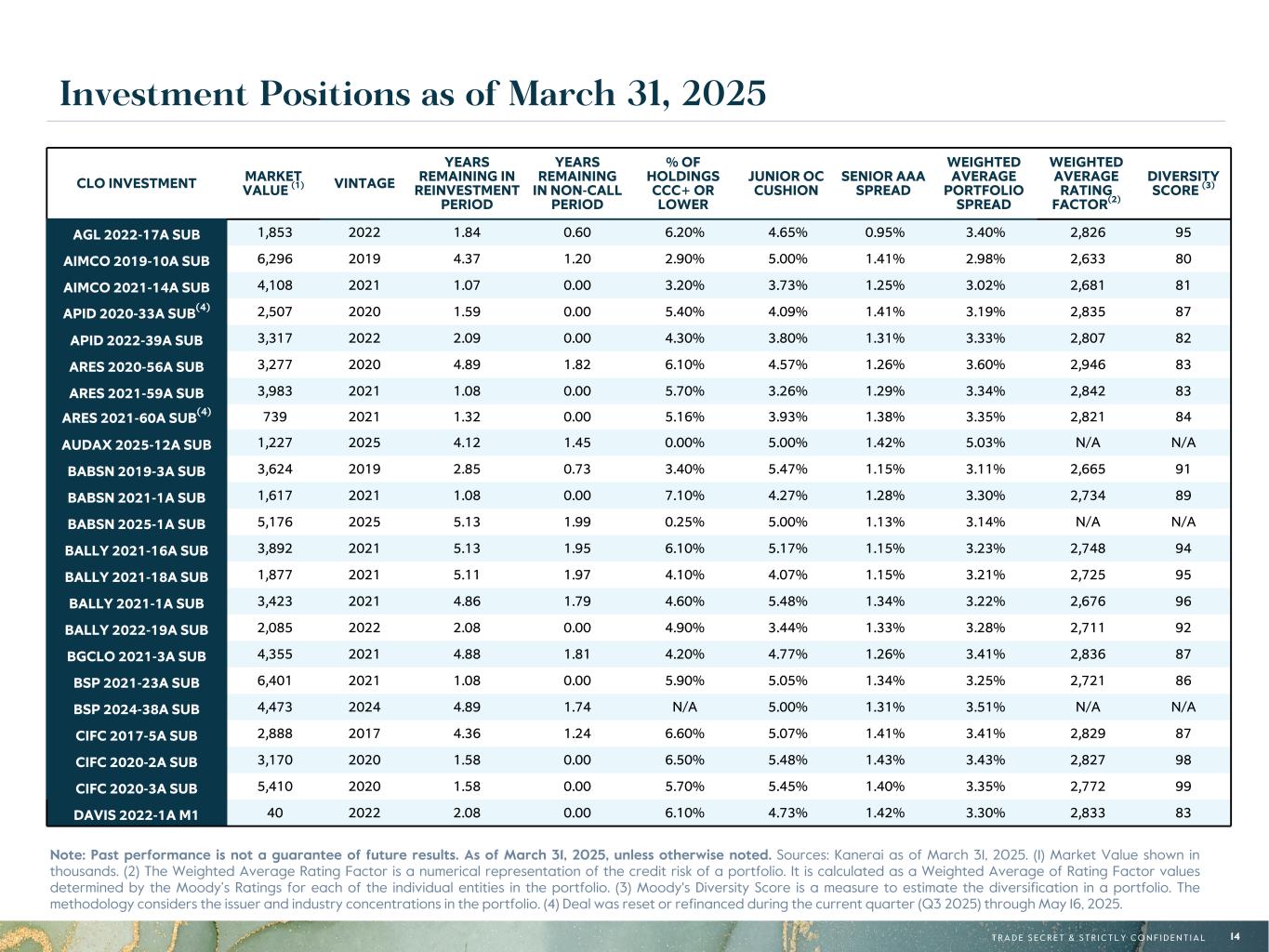

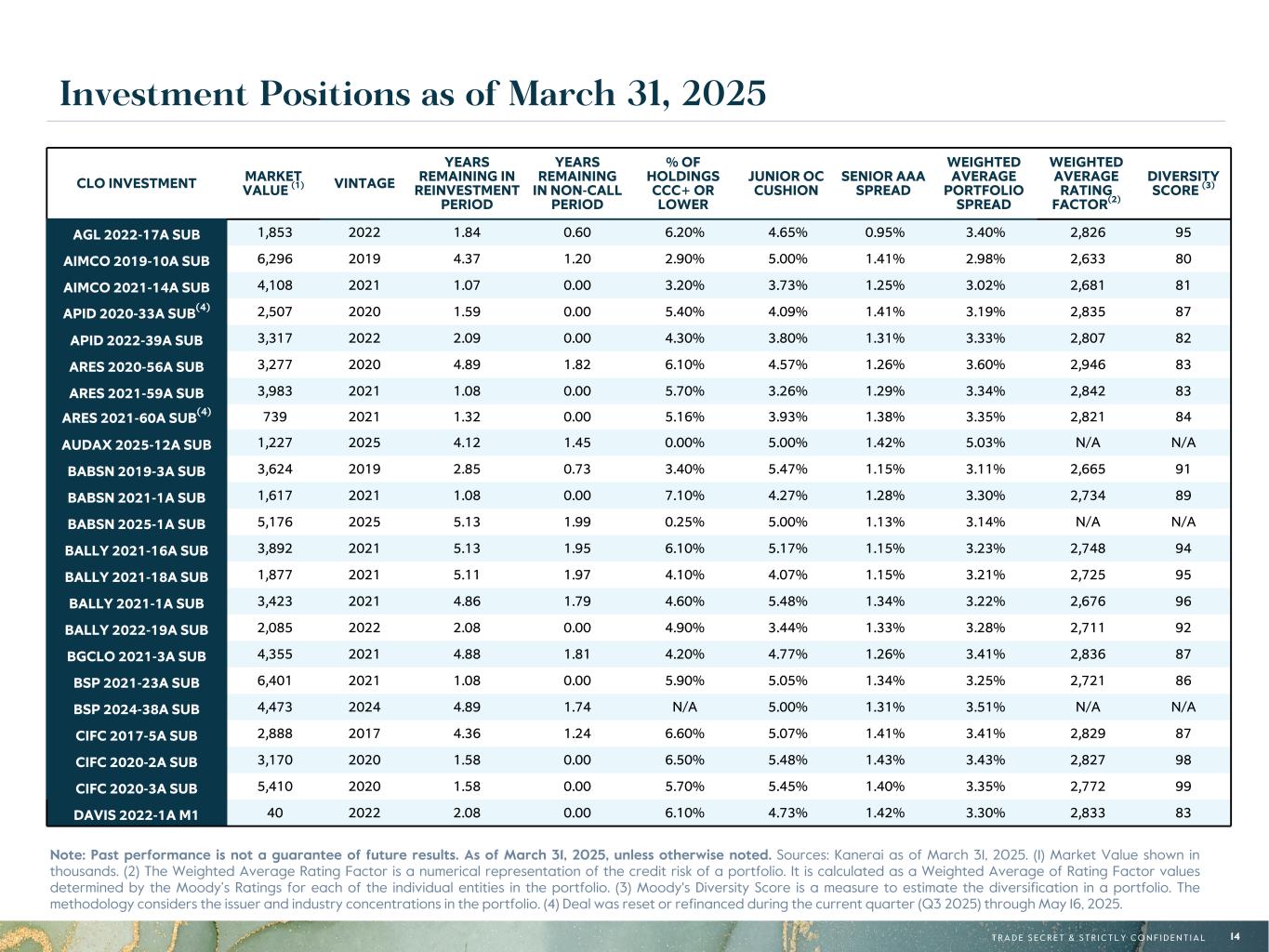

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 14 Investment Positions as of March 31, 2025 CLO INVESTMENT MARKET VALUE (1) VINTAGE YEARS REMAINING IN REINVESTMENT PERIOD YEARS REMAINING IN NON-CALL PERIOD % OF HOLDINGS CCC+ OR LOWER JUNIOR OC CUSHION SENIOR AAA SPREAD WEIGHTED AVERAGE PORTFOLIO SPREAD WEIGHTED AVERAGE RATING FACTOR(2) DIVERSITY SCORE (3) AGL 2022-17A SUB 1,853 2022 1.84 0.60 6.20% 4.65% 0.95% 3.40% 2,826 95 AIMCO 2019-10A SUB 6,296 2019 4.37 1.20 2.90% 5.00% 1.41% 2.98% 2,633 80 AIMCO 2021-14A SUB 4,108 2021 1.07 0.00 3.20% 3.73% 1.25% 3.02% 2,681 81 APID 2020-33A SUB(4) 2,507 2020 1.59 0.00 5.40% 4.09% 1.41% 3.19% 2,835 87 APID 2022-39A SUB 3,317 2022 2.09 0.00 4.30% 3.80% 1.31% 3.33% 2,807 82 ARES 2020-56A SUB 3,277 2020 4.89 1.82 6.10% 4.57% 1.26% 3.60% 2,946 83 ARES 2021-59A SUB 3,983 2021 1.08 0.00 5.70% 3.26% 1.29% 3.34% 2,842 83 ARES 2021-60A SUB(4) 739 2021 1.32 0.00 5.16% 3.93% 1.38% 3.35% 2,821 84 AUDAX 2025-12A SUB 1,227 2025 4.12 1.45 0.00% 5.00% 1.42% 5.03% N/A N/A BABSN 2019-3A SUB 3,624 2019 2.85 0.73 3.40% 5.47% 1.15% 3.11% 2,665 91 BABSN 2021-1A SUB 1,617 2021 1.08 0.00 7.10% 4.27% 1.28% 3.30% 2,734 89 BABSN 2025-1A SUB 5,176 2025 5.13 1.99 0.25% 5.00% 1.13% 3.14% N/A N/A BALLY 2021-16A SUB 3,892 2021 5.13 1.95 6.10% 5.17% 1.15% 3.23% 2,748 94 BALLY 2021-18A SUB 1,877 2021 5.11 1.97 4.10% 4.07% 1.15% 3.21% 2,725 95 BALLY 2021-1A SUB 3,423 2021 4.86 1.79 4.60% 5.48% 1.34% 3.22% 2,676 96 BALLY 2022-19A SUB 2,085 2022 2.08 0.00 4.90% 3.44% 1.33% 3.28% 2,711 92 BGCLO 2021-3A SUB 4,355 2021 4.88 1.81 4.20% 4.77% 1.26% 3.41% 2,836 87 BSP 2021-23A SUB 6,401 2021 1.08 0.00 5.90% 5.05% 1.34% 3.25% 2,721 86 BSP 2024-38A SUB 4,473 2024 4.89 1.74 N/A 5.00% 1.31% 3.51% N/A N/A CIFC 2017-5A SUB 2,888 2017 4.36 1.24 6.60% 5.07% 1.41% 3.41% 2,829 87 CIFC 2020-2A SUB 3,170 2020 1.58 0.00 6.50% 5.48% 1.43% 3.43% 2,827 98 CIFC 2020-3A SUB 5,410 2020 1.58 0.00 5.70% 5.45% 1.40% 3.35% 2,772 99 DAVIS 2022-1A M1 40 2022 2.08 0.00 6.10% 4.73% 1.42% 3.30% 2,833 83 Note: Past performance is not a guarantee of future results. As of March 31, 2025, unless otherwise noted. Sources: Kanerai as of March 31, 2025. (1) Market Value shown in thousands. (2) The Weighted Average Rating Factor is a numerical representation of the credit risk of a portfolio. It is calculated as a Weighted Average of Rating Factor values determined by the Moody’s Ratings for each of the individual entities in the portfolio. (3) Moody's Diversity Score is a measure to estimate the diversification in a portfolio. The methodology considers the issuer and industry concentrations in the portfolio. (4) Deal was reset or refinanced during the current quarter (Q3 2025) through May 16, 2025.

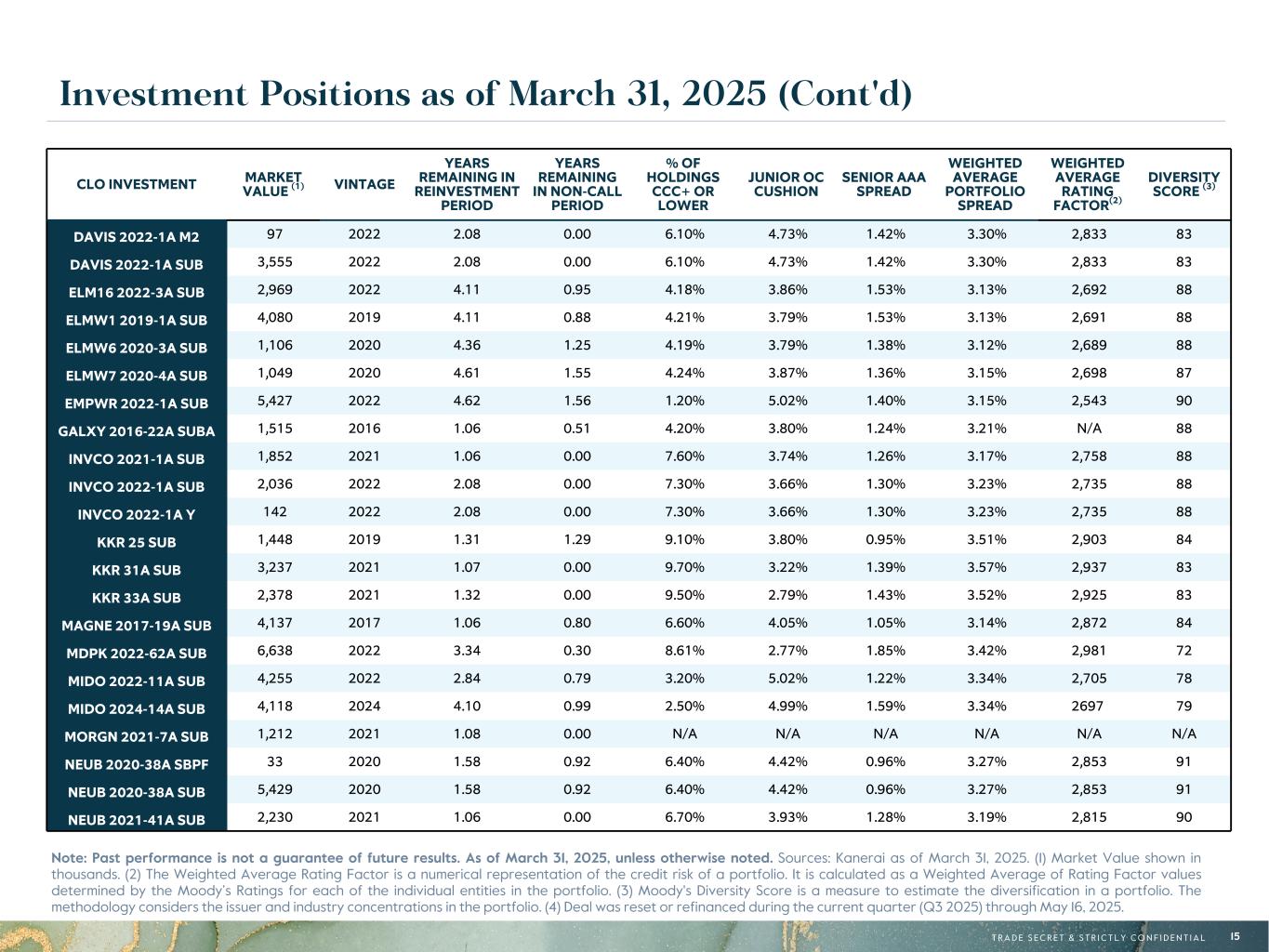

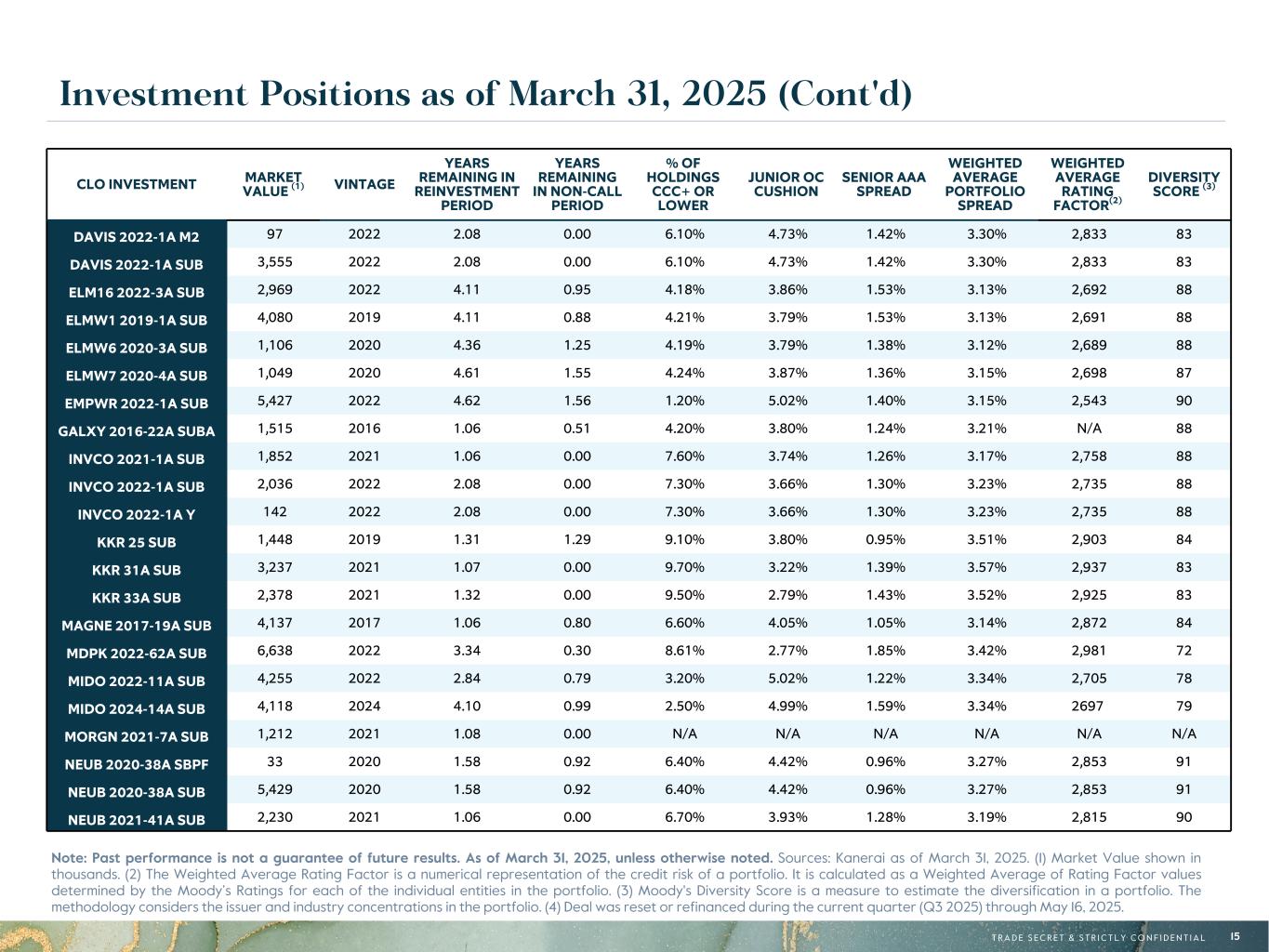

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 15 Investment Positions as of March 31, 2025 (Cont'd) CLO INVESTMENT MARKET VALUE (1) VINTAGE YEARS REMAINING IN REINVESTMENT PERIOD YEARS REMAINING IN NON-CALL PERIOD % OF HOLDINGS CCC+ OR LOWER JUNIOR OC CUSHION SENIOR AAA SPREAD WEIGHTED AVERAGE PORTFOLIO SPREAD WEIGHTED AVERAGE RATING FACTOR(2) DIVERSITY SCORE (3) DAVIS 2022-1A M2 97 2022 2.08 0.00 6.10% 4.73% 1.42% 3.30% 2,833 83 DAVIS 2022-1A SUB 3,555 2022 2.08 0.00 6.10% 4.73% 1.42% 3.30% 2,833 83 ELM16 2022-3A SUB 2,969 2022 4.11 0.95 4.18% 3.86% 1.53% 3.13% 2,692 88 ELMW1 2019-1A SUB 4,080 2019 4.11 0.88 4.21% 3.79% 1.53% 3.13% 2,691 88 ELMW6 2020-3A SUB 1,106 2020 4.36 1.25 4.19% 3.79% 1.38% 3.12% 2,689 88 ELMW7 2020-4A SUB 1,049 2020 4.61 1.55 4.24% 3.87% 1.36% 3.15% 2,698 87 EMPWR 2022-1A SUB 5,427 2022 4.62 1.56 1.20% 5.02% 1.40% 3.15% 2,543 90 GALXY 2016-22A SUBA 1,515 2016 1.06 0.51 4.20% 3.80% 1.24% 3.21% N/A 88 INVCO 2021-1A SUB 1,852 2021 1.06 0.00 7.60% 3.74% 1.26% 3.17% 2,758 88 INVCO 2022-1A SUB 2,036 2022 2.08 0.00 7.30% 3.66% 1.30% 3.23% 2,735 88 INVCO 2022-1A Y 142 2022 2.08 0.00 7.30% 3.66% 1.30% 3.23% 2,735 88 KKR 25 SUB 1,448 2019 1.31 1.29 9.10% 3.80% 0.95% 3.51% 2,903 84 KKR 31A SUB 3,237 2021 1.07 0.00 9.70% 3.22% 1.39% 3.57% 2,937 83 KKR 33A SUB 2,378 2021 1.32 0.00 9.50% 2.79% 1.43% 3.52% 2,925 83 MAGNE 2017-19A SUB 4,137 2017 1.06 0.80 6.60% 4.05% 1.05% 3.14% 2,872 84 MDPK 2022-62A SUB 6,638 2022 3.34 0.30 8.61% 2.77% 1.85% 3.42% 2,981 72 MIDO 2022-11A SUB 4,255 2022 2.84 0.79 3.20% 5.02% 1.22% 3.34% 2,705 78 MIDO 2024-14A SUB 4,118 2024 4.10 0.99 2.50% 4.99% 1.59% 3.34% 2697 79 MORGN 2021-7A SUB 1,212 2021 1.08 0.00 N/A N/A N/A N/A N/A N/A NEUB 2020-38A SBPF 33 2020 1.58 0.92 6.40% 4.42% 0.96% 3.27% 2,853 91 NEUB 2020-38A SUB 5,429 2020 1.58 0.92 6.40% 4.42% 0.96% 3.27% 2,853 91 NEUB 2021-41A SUB 2,230 2021 1.06 0.00 6.70% 3.93% 1.28% 3.19% 2,815 90 Note: Past performance is not a guarantee of future results. As of March 31, 2025, unless otherwise noted. Sources: Kanerai as of March 31, 2025. (1) Market Value shown in thousands. (2) The Weighted Average Rating Factor is a numerical representation of the credit risk of a portfolio. It is calculated as a Weighted Average of Rating Factor values determined by the Moody’s Ratings for each of the individual entities in the portfolio. (3) Moody's Diversity Score is a measure to estimate the diversification in a portfolio. The methodology considers the issuer and industry concentrations in the portfolio. (4) Deal was reset or refinanced during the current quarter (Q3 2025) through May 16, 2025.

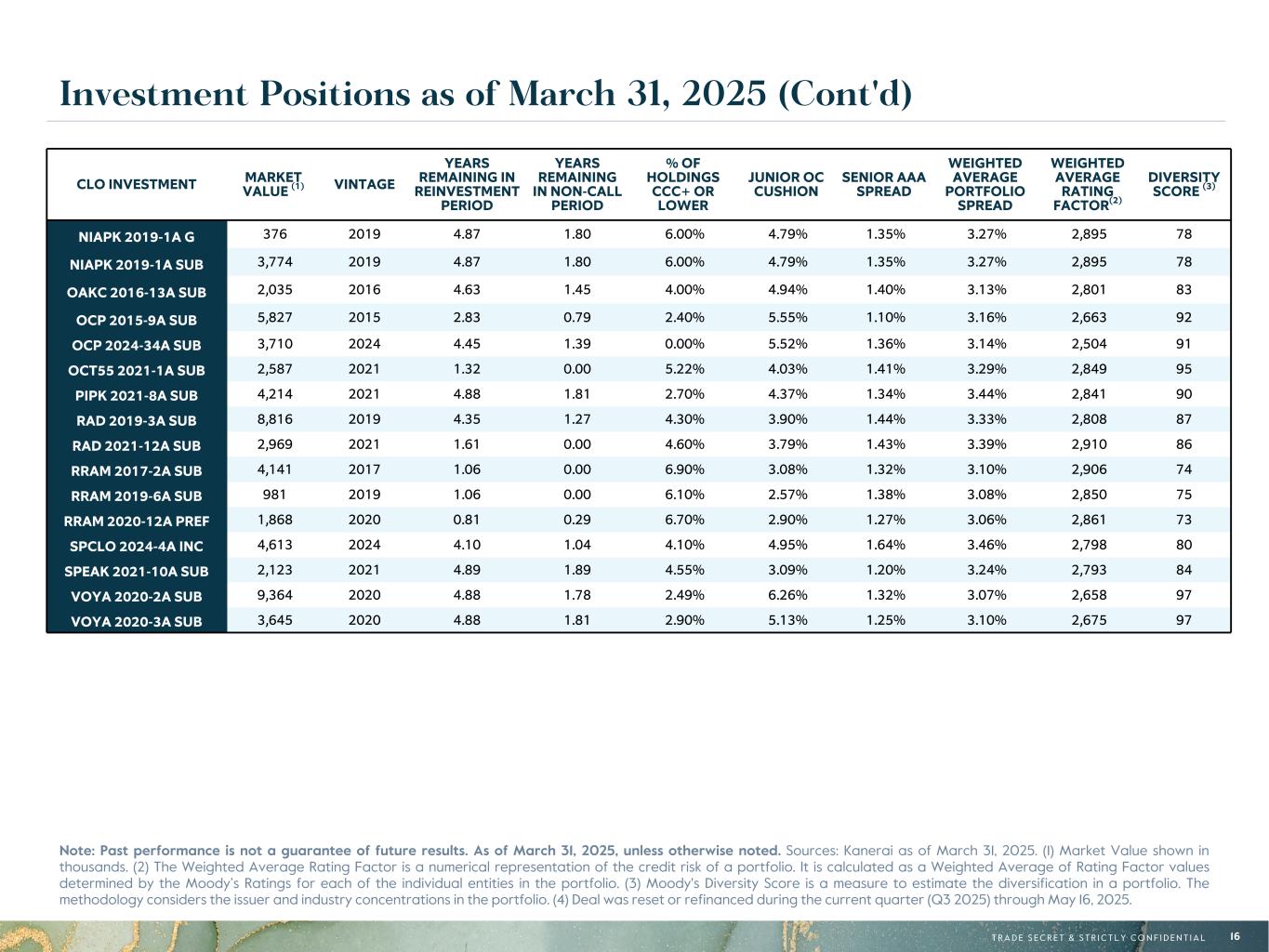

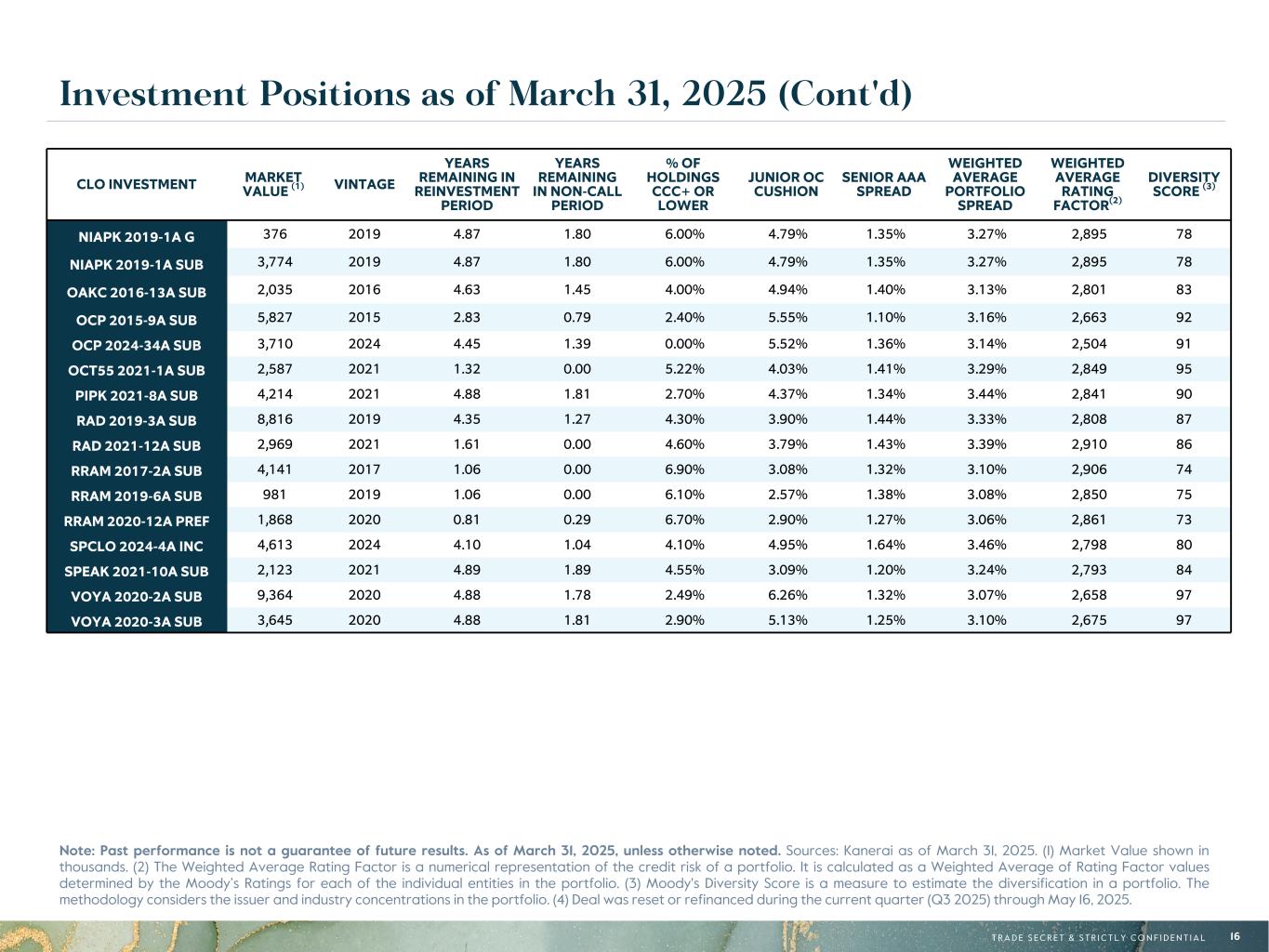

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 16 Investment Positions as of March 31, 2025 (Cont'd) CLO INVESTMENT MARKET VALUE (1) VINTAGE YEARS REMAINING IN REINVESTMENT PERIOD YEARS REMAINING IN NON-CALL PERIOD % OF HOLDINGS CCC+ OR LOWER JUNIOR OC CUSHION SENIOR AAA SPREAD WEIGHTED AVERAGE PORTFOLIO SPREAD WEIGHTED AVERAGE RATING FACTOR(2) DIVERSITY SCORE (3) NIAPK 2019-1A G 376 2019 4.87 1.80 6.00% 4.79% 1.35% 3.27% 2,895 78 NIAPK 2019-1A SUB 3,774 2019 4.87 1.80 6.00% 4.79% 1.35% 3.27% 2,895 78 OAKC 2016-13A SUB 2,035 2016 4.63 1.45 4.00% 4.94% 1.40% 3.13% 2,801 83 OCP 2015-9A SUB 5,827 2015 2.83 0.79 2.40% 5.55% 1.10% 3.16% 2,663 92 OCP 2024-34A SUB 3,710 2024 4.45 1.39 0.00% 5.52% 1.36% 3.14% 2,504 91 OCT55 2021-1A SUB 2,587 2021 1.32 0.00 5.22% 4.03% 1.41% 3.29% 2,849 95 PIPK 2021-8A SUB 4,214 2021 4.88 1.81 2.70% 4.37% 1.34% 3.44% 2,841 90 RAD 2019-3A SUB 8,816 2019 4.35 1.27 4.30% 3.90% 1.44% 3.33% 2,808 87 RAD 2021-12A SUB 2,969 2021 1.61 0.00 4.60% 3.79% 1.43% 3.39% 2,910 86 RRAM 2017-2A SUB 4,141 2017 1.06 0.00 6.90% 3.08% 1.32% 3.10% 2,906 74 RRAM 2019-6A SUB 981 2019 1.06 0.00 6.10% 2.57% 1.38% 3.08% 2,850 75 RRAM 2020-12A PREF 1,868 2020 0.81 0.29 6.70% 2.90% 1.27% 3.06% 2,861 73 SPCLO 2024-4A INC 4,613 2024 4.10 1.04 4.10% 4.95% 1.64% 3.46% 2,798 80 SPEAK 2021-10A SUB 2,123 2021 4.89 1.89 4.55% 3.09% 1.20% 3.24% 2,793 84 VOYA 2020-2A SUB 9,364 2020 4.88 1.78 2.49% 6.26% 1.32% 3.07% 2,658 97 VOYA 2020-3A SUB 3,645 2020 4.88 1.81 2.90% 5.13% 1.25% 3.10% 2,675 97 Note: Past performance is not a guarantee of future results. As of March 31, 2025, unless otherwise noted. Sources: Kanerai as of March 31, 2025. (1) Market Value shown in thousands. (2) The Weighted Average Rating Factor is a numerical representation of the credit risk of a portfolio. It is calculated as a Weighted Average of Rating Factor values determined by the Moody’s Ratings for each of the individual entities in the portfolio. (3) Moody's Diversity Score is a measure to estimate the diversification in a portfolio. The methodology considers the issuer and industry concentrations in the portfolio. (4) Deal was reset or refinanced during the current quarter (Q3 2025) through May 16, 2025.

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 17 Monthly Dividend Trend Dividends may include return of capital. (1) Based on our share price as of May 16, 2025. CNII per share and recurring cash flows per share are based on the weighted average number of common shares outstanding for the period. • In conjunction with earnings, CCIF has declared a dividend of $0.105 for the months of June, July, and August 2025, equating to an annualized dividend rate of 18.75% (1) • The dividend is supported by CNII of $0.27 per share and $0.49 per share of recurring cash flows for Q2 2025, and approximately $0.62 per share of recurring cash flows for Q3 2025. $0.1050 $0.0551 $0.0994

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 18 Appendix

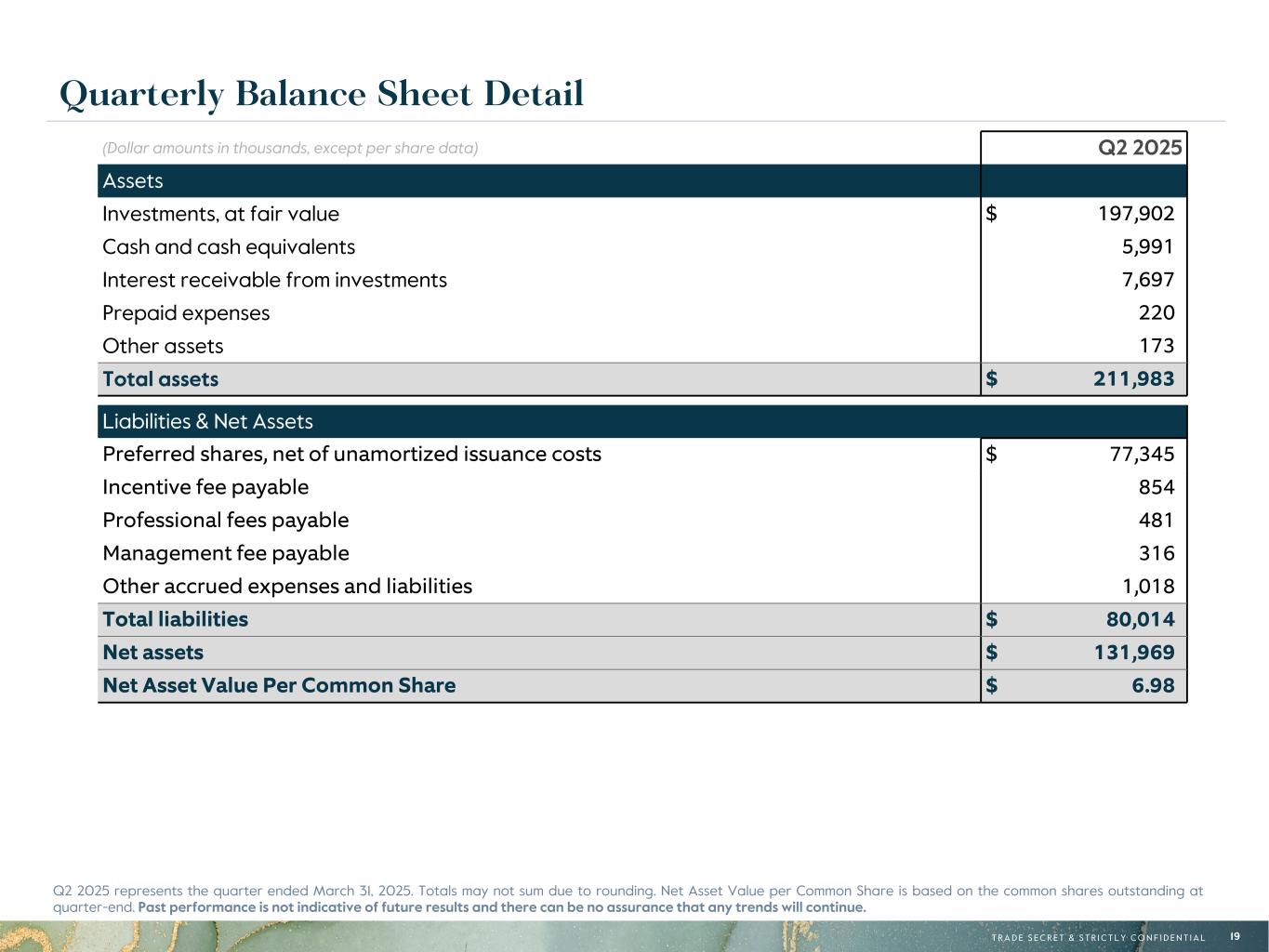

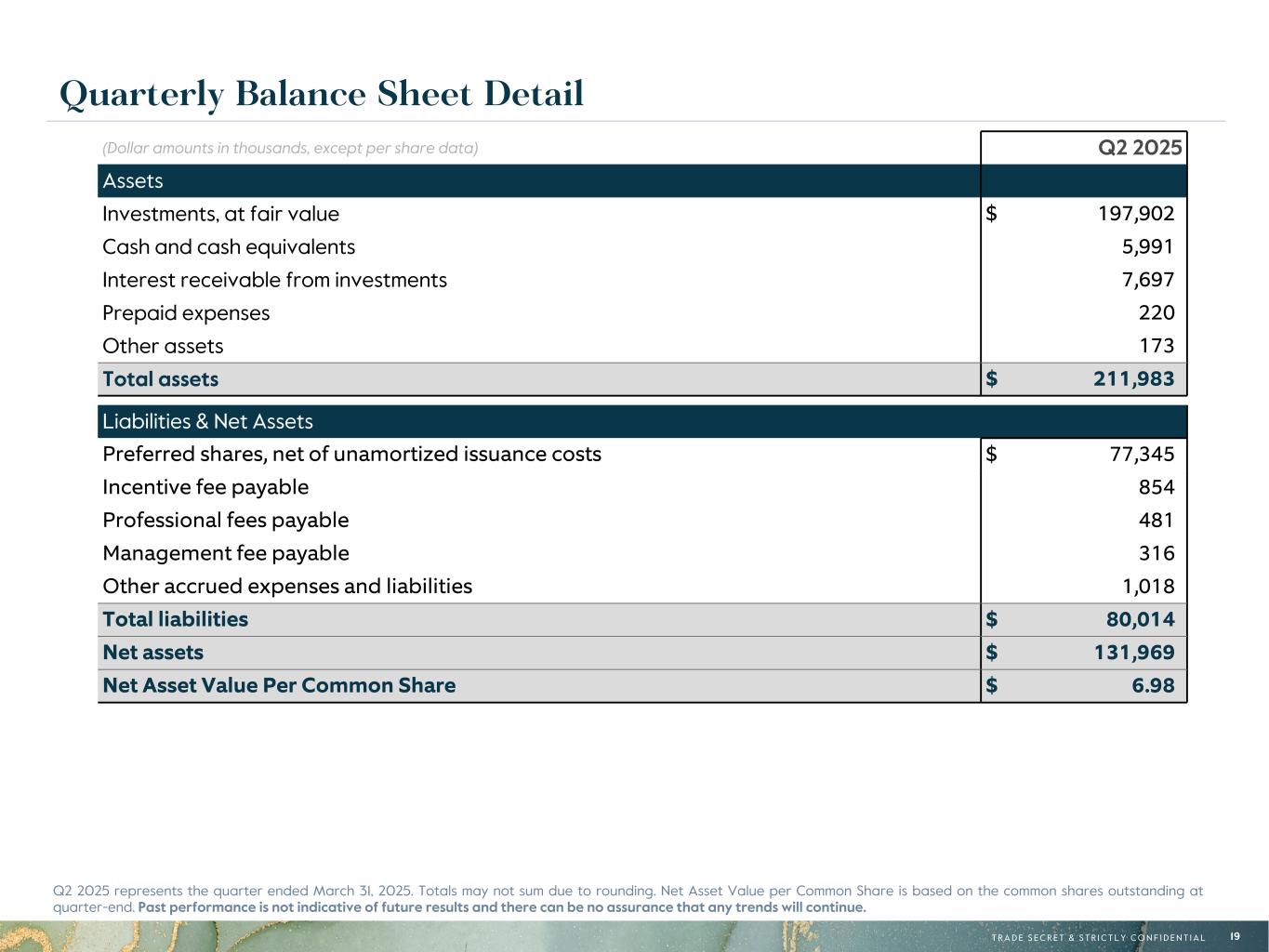

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 19 Quarterly Balance Sheet Detail (Dollar amounts in thousands, except per share data) Q2 2025 Assets Investments, at fair value $ 197,902 Cash and cash equivalents 5,991 Interest receivable from investments 7,697 Prepaid expenses 220 Other assets 173 Total assets $ 211,983 Liabilities & Net Assets Preferred shares, net of unamortized issuance costs $ 77,345 Incentive fee payable 854 Professional fees payable 481 Management fee payable 316 Other accrued expenses and liabilities 1,018 Total liabilities $ 80,014 Net assets $ 131,969 Net Asset Value Per Common Share $ 6.98 Q2 2025 represents the quarter ended March 31, 2025. Totals may not sum due to rounding. Net Asset Value per Common Share is based on the common shares outstanding at quarter-end. Past performance is not indicative of future results and there can be no assurance that any trends will continue.

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 20 Q2 2025 represents the quarter ended March 31, 2025. Totals may not sum due to rounding. Net Investment Income (Loss) per share and Net Income (Loss) per share are based on the weighted average number of common shares outstanding for the period. Past performance is not indicative of future results and there can be no assurance that any trends will continue. Quarterly Income Statement Detail (Dollar amounts in thousands, except per share data) Q2 2025 Investment Income Interest income $ 8,565 Total investment income $ 8,565 Expenses Interest expense $ 2,297 Management fee 929 Incentive fee 854 Professional fees 212 Other fees and expenses 245 Total expenses $ 4,537 Net Investment Income (Loss) $ 4,028 Net realized and change in unrealized gains (losses) (7,130) Net Income (Loss) $ (3,102) Net Investment Income (Loss) per share $ 0.23 Net Income (Loss) per share $ (0.17)

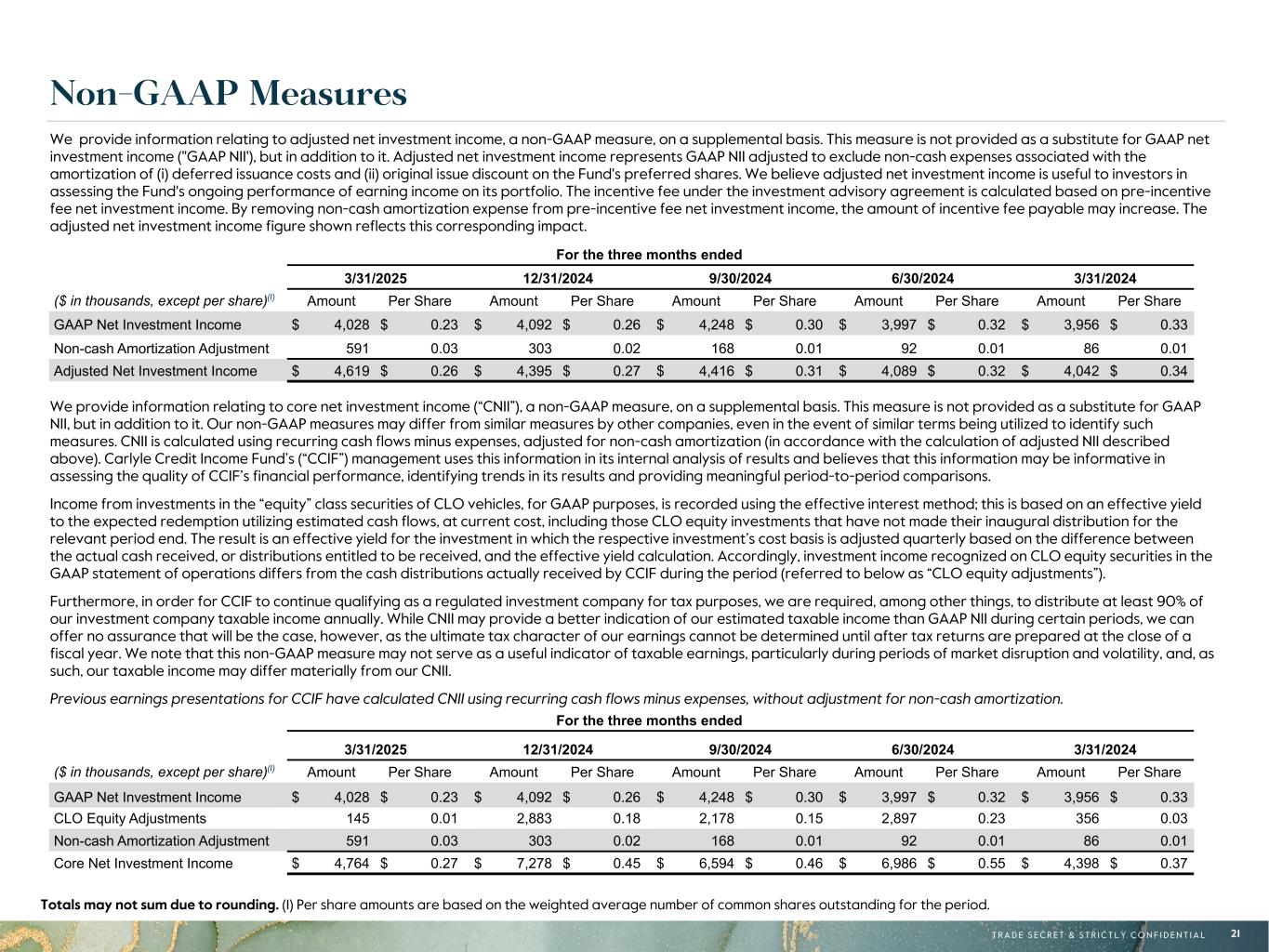

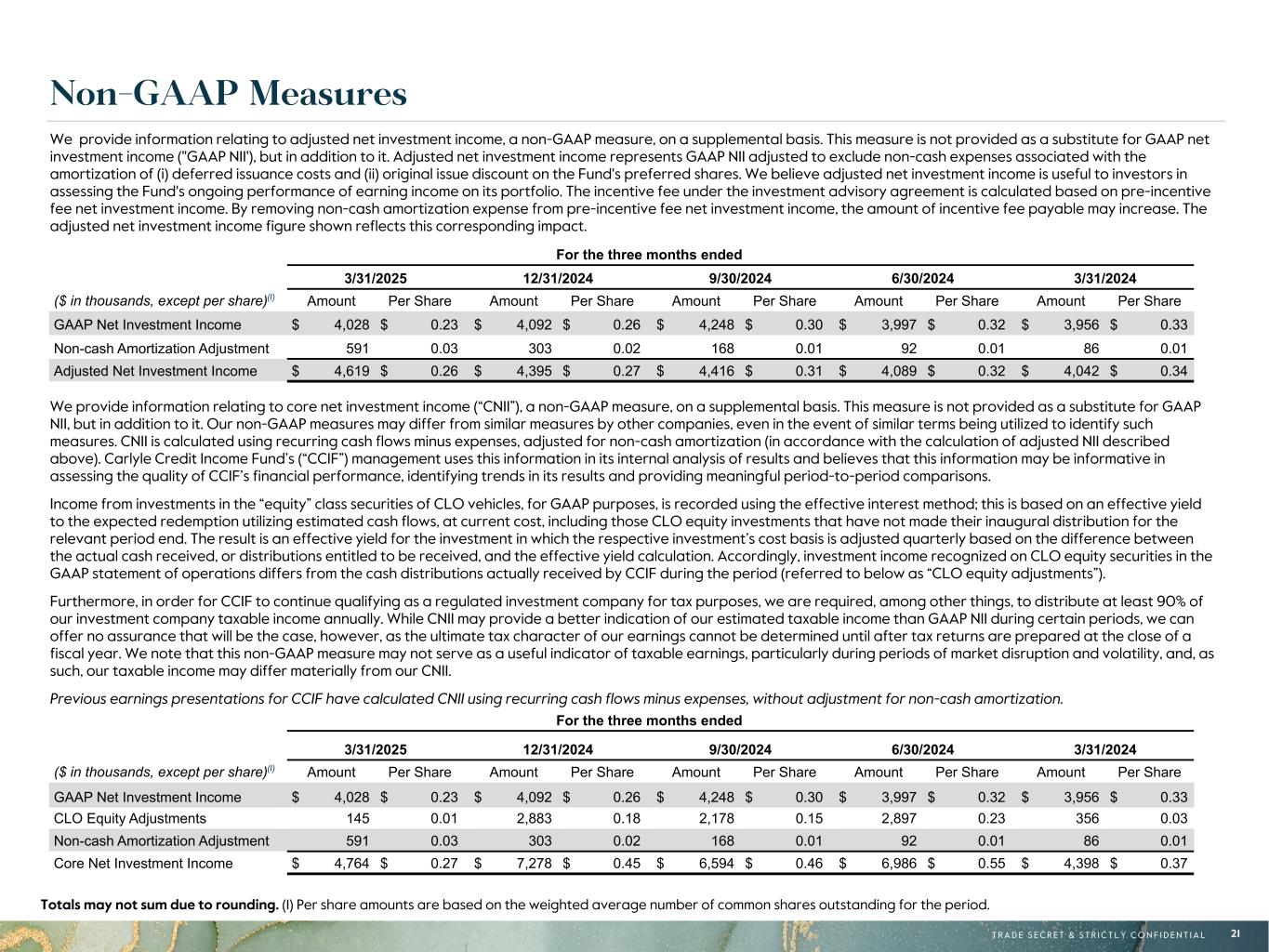

R-171, G-132, B-51 R-108, G-132, B-156 R-97, G-161, B-224 R-10, G-54, B-74 R-29, G-101, B-113 R-182, G-231, B-250 R-215, G-185, B-122 R-196, G-206, B-215 R-171, G-202, B-243 R-13, G-107, B-147 R-33, G-152, B-172 R-208, G-232, B-248 R-0, G-0, B-0 R-95, G-95, B-95 R-188, G-188, B-188 R-235, G-235, B-235 R-242, G-232, B-211 R-196, G-234, B-240 T R A D E S E C R E T & S T R I C T L Y C O N F I D E N T I A L 21 Non-GAAP Measures We provide information relating to core net investment income (“CNII”), a non-GAAP measure, on a supplemental basis. This measure is not provided as a substitute for GAAP NII, but in addition to it. Our non-GAAP measures may differ from similar measures by other companies, even in the event of similar terms being utilized to identify such measures. CNII is calculated using recurring cash flows minus expenses, adjusted for non-cash amortization (in accordance with the calculation of adjusted NII described above). Carlyle Credit Income Fund’s (“CCIF”) management uses this information in its internal analysis of results and believes that this information may be informative in assessing the quality of CCIF’s financial performance, identifying trends in its results and providing meaningful period-to-period comparisons. Income from investments in the “equity” class securities of CLO vehicles, for GAAP purposes, is recorded using the effective interest method; this is based on an effective yield to the expected redemption utilizing estimated cash flows, at current cost, including those CLO equity investments that have not made their inaugural distribution for the relevant period end. The result is an effective yield for the investment in which the respective investment’s cost basis is adjusted quarterly based on the difference between the actual cash received, or distributions entitled to be received, and the effective yield calculation. Accordingly, investment income recognized on CLO equity securities in the GAAP statement of operations differs from the cash distributions actually received by CCIF during the period (referred to below as “CLO equity adjustments”). Furthermore, in order for CCIF to continue qualifying as a regulated investment company for tax purposes, we are required, among other things, to distribute at least 90% of our investment company taxable income annually. While CNII may provide a better indication of our estimated taxable income than GAAP NII during certain periods, we can offer no assurance that will be the case, however, as the ultimate tax character of our earnings cannot be determined until after tax returns are prepared at the close of a fiscal year. We note that this non-GAAP measure may not serve as a useful indicator of taxable earnings, particularly during periods of market disruption and volatility, and, as such, our taxable income may differ materially from our CNII. Previous earnings presentations for CCIF have calculated CNII using recurring cash flows minus expenses, without adjustment for non-cash amortization. For the three months ended 3/31/2025 12/31/2024 9/30/2024 6/30/2024 3/31/2024 ($ in thousands, except per share)(1) Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share GAAP Net Investment Income $ 4,028 $ 0.23 $ 4,092 $ 0.26 $ 4,248 $ 0.30 $ 3,997 $ 0.32 $ 3,956 $ 0.33 CLO Equity Adjustments 145 0.01 2,883 0.18 2,178 0.15 2,897 0.23 356 0.03 Non-cash Amortization Adjustment 591 0.03 303 0.02 168 0.01 92 0.01 86 0.01 Core Net Investment Income $ 4,764 $ 0.27 $ 7,278 $ 0.45 $ 6,594 $ 0.46 $ 6,986 $ 0.55 $ 4,398 $ 0.37 We provide information relating to adjusted net investment income, a non-GAAP measure, on a supplemental basis. This measure is not provided as a substitute for GAAP net investment income ("GAAP NII'), but in addition to it. Adjusted net investment income represents GAAP NII adjusted to exclude non-cash expenses associated with the amortization of (i) deferred issuance costs and (ii) original issue discount on the Fund's preferred shares. We believe adjusted net investment income is useful to investors in assessing the Fund's ongoing performance of earning income on its portfolio. The incentive fee under the investment advisory agreement is calculated based on pre-incentive fee net investment income. By removing non-cash amortization expense from pre-incentive fee net investment income, the amount of incentive fee payable may increase. The adjusted net investment income figure shown reflects this corresponding impact. For the three months ended 3/31/2025 12/31/2024 9/30/2024 6/30/2024 3/31/2024 ($ in thousands, except per share)(1) Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share GAAP Net Investment Income $ 4,028 $ 0.23 $ 4,092 $ 0.26 $ 4,248 $ 0.30 $ 3,997 $ 0.32 $ 3,956 $ 0.33 Non-cash Amortization Adjustment 591 0.03 303 0.02 168 0.01 92 0.01 86 0.01 Adjusted Net Investment Income $ 4,619 $ 0.26 $ 4,395 $ 0.27 $ 4,416 $ 0.31 $ 4,089 $ 0.32 $ 4,042 $ 0.34 Totals may not sum due to rounding. (1) Per share amounts are based on the weighted average number of common shares outstanding for the period.