Document

Exhibit 99.1

For Immediate Release

ORIGIN BANCORP, INC. REPORTS EARNINGS FOR FOURTH QUARTER AND FULL YEAR 2024

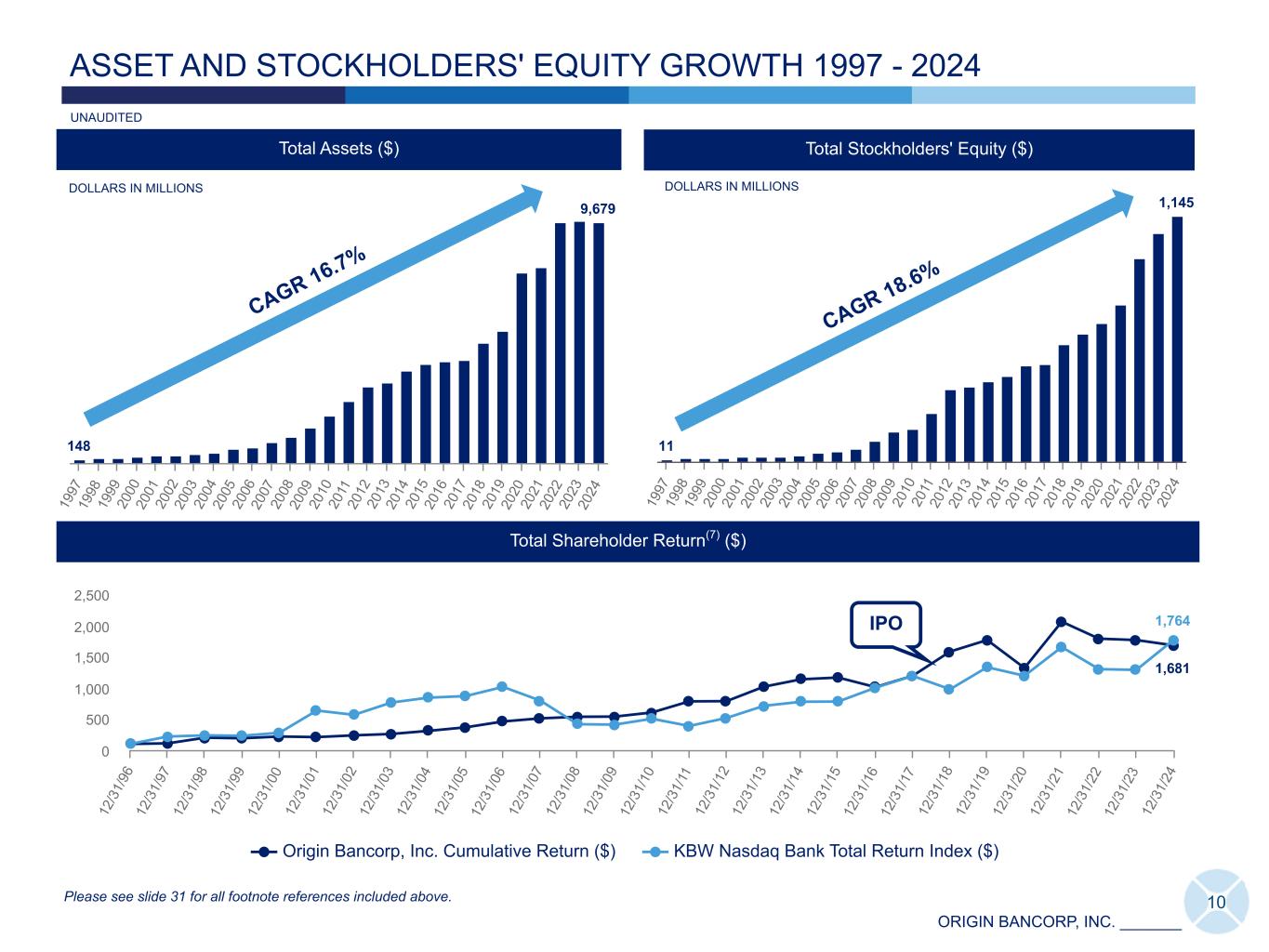

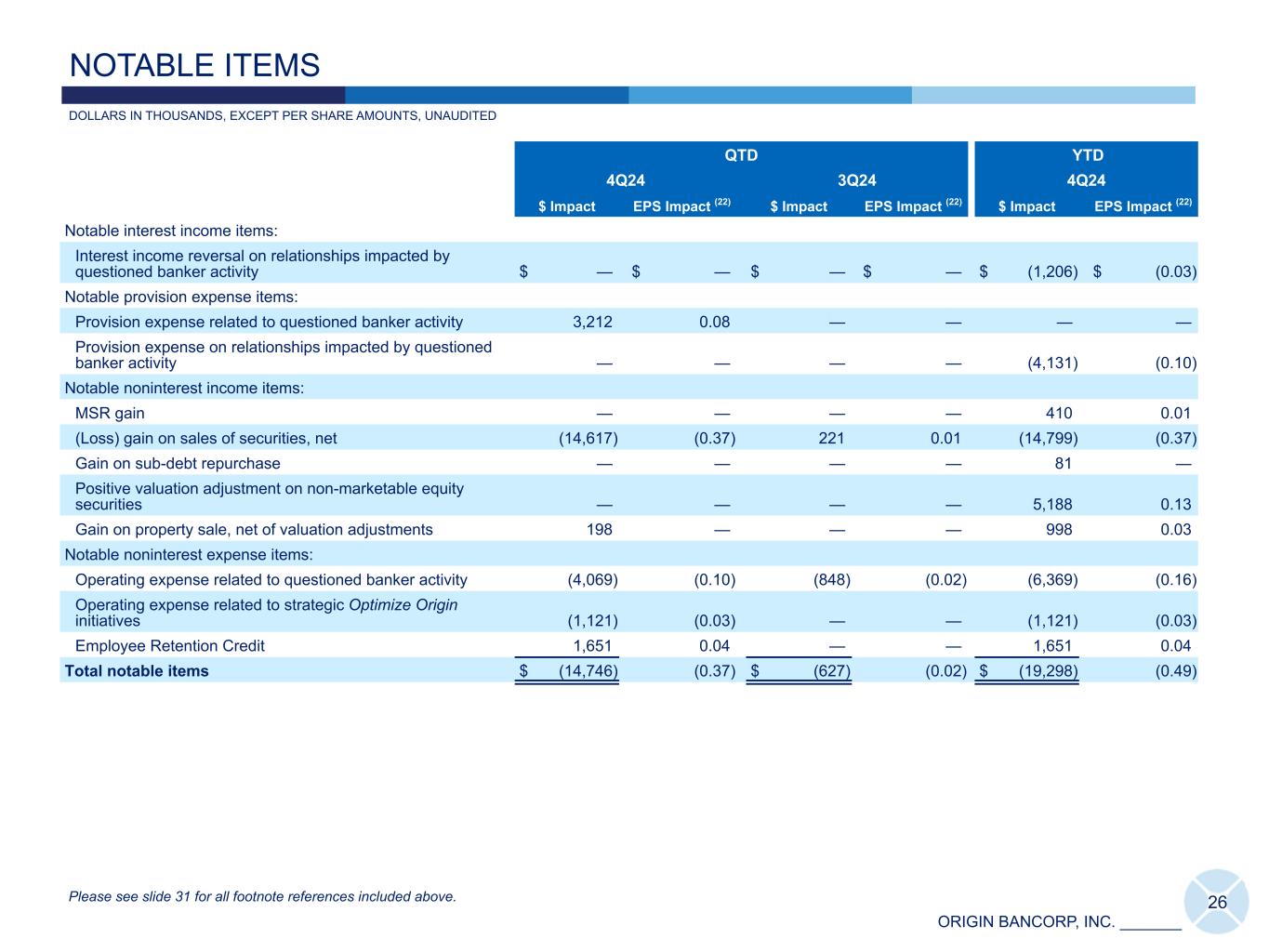

RUSTON, Louisiana (January 22, 2025) - Origin Bancorp, Inc. (NYSE: OBK) (“Origin,” “we,” “our” or the “Company”), the holding company for Origin Bank (the “Bank”), today announced net income of $14.3 million, or $0.46 diluted earnings per share (“EPS”) for the quarter ended December 31, 2024, compared to net income of $18.6 million, or $0.60 diluted earnings per share, for the quarter ended September 30, 2024. Pre-tax, pre-provision (“PTPP”)(1) earnings was $12.6 million for the quarter ended December 31, 2024, compared to $28.3 million for the linked quarter.

Net income for the year ended December 31, 2024, was $76.5 million, or $2.45 diluted earnings per share, representing a decrease of $0.26, or 9.6%, from diluted earnings per share of $2.71 for the year ended December 31, 2023. Pre-tax, pre-provision (“PTPP”)(1) earnings for the year ended December 31, 2024, was $104.7 million, representing a decrease of $18.0 million, or 14.6%, from the year ended December 31, 2023.

“I am excited about where we are going as a company as we enter 2025 with an organizational commitment to what Optimize Origin means to all of our stakeholders. This initiative is the continual enhancement of our award-winning culture and the drive for elite financial performance.” said Drake Mills, chairman, president and CEO of Origin Bancorp, Inc. “Our team has worked hard over the past year creating and implementing a strategy that is the basis for the next evolution of our company.”

(1) PTPP earnings is a non-GAAP financial measure, please see the last few pages of this document for a reconciliation of this alternative financial measure to its most directly comparable GAAP measure.

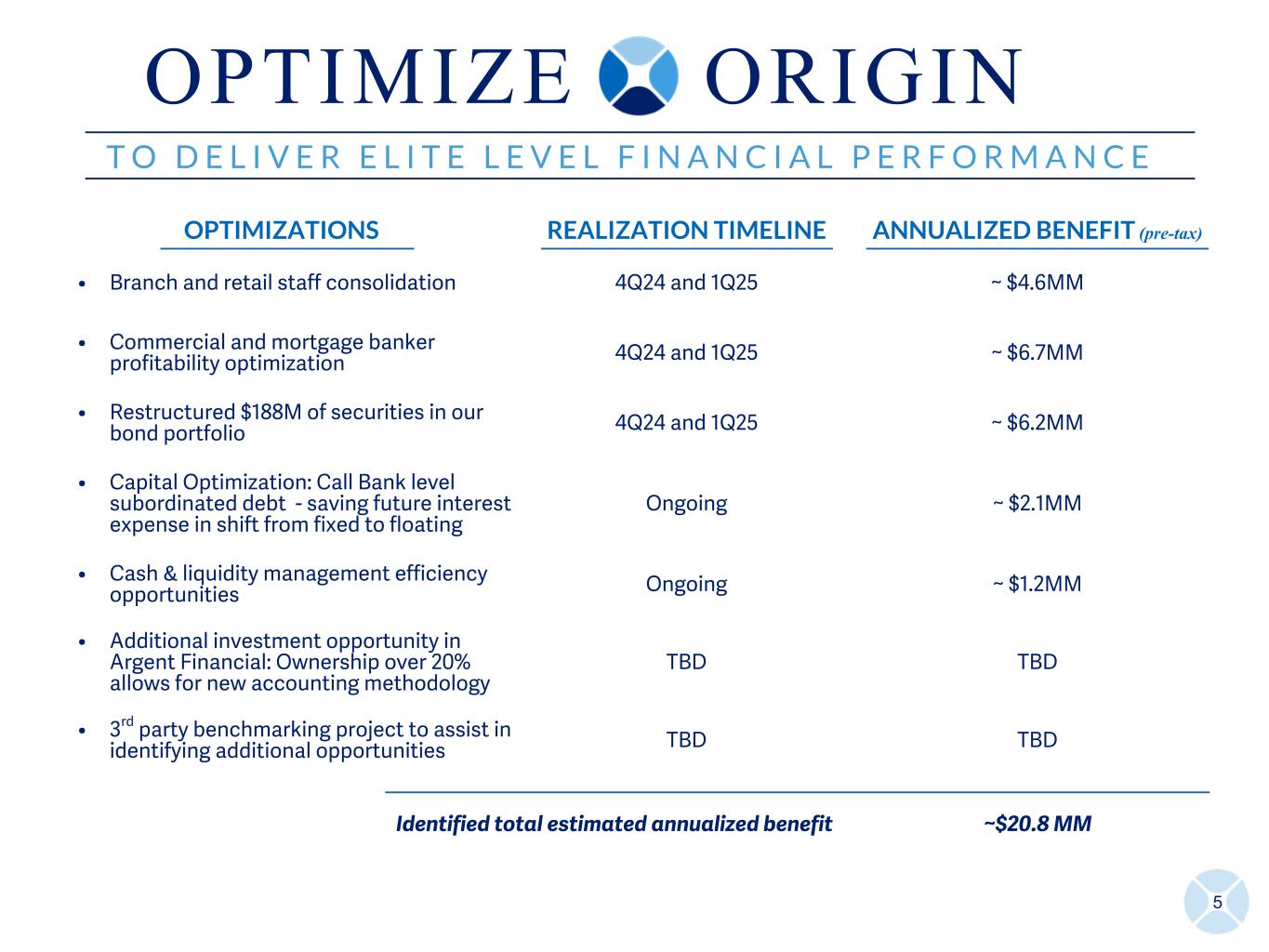

Optimize Origin

•Our newly announced initiative to drive elite financial performance and enhance our award-winning culture

•Built on three primary pillars:

◦Productivity, Delivery & Efficiency

◦Balance Sheet Optimization

◦Culture & Employee Engagement

•Established near term target of greater than a 1% ROAA run rate by 4Q25 and an ultimate target of top quartile ROAA

•Near term target will be achieved in part by branch consolidation, headcount reduction, securities optimization, capital optimization, and cash/liquidity management

•We believe the actions we have taken will drive earnings improvement of approximately $21 million annually on a pre-tax pre-provision basis.

Financial Highlights

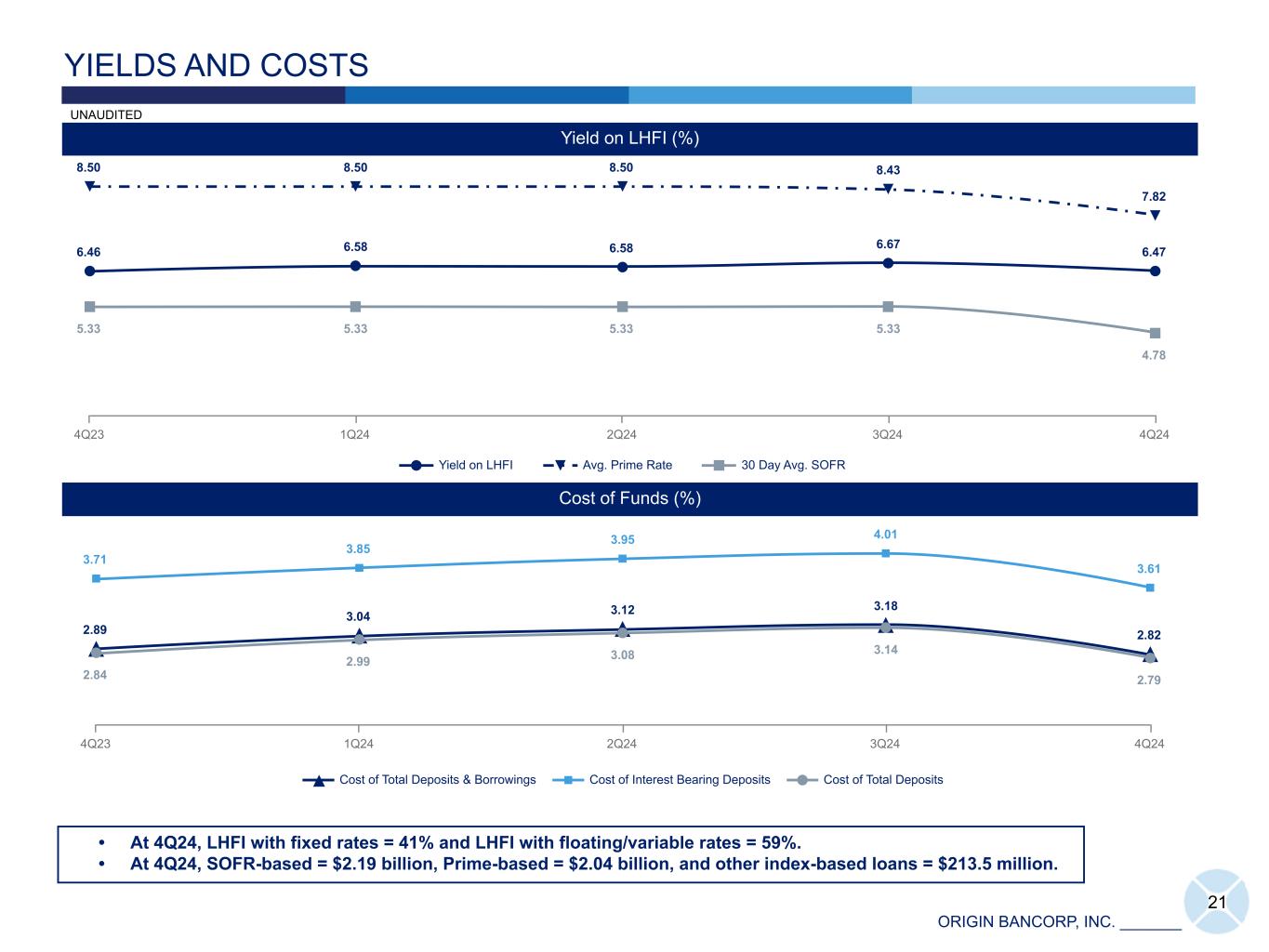

•Our fully tax equivalent net interest margin (“NIM-FTE”) expanded 15 basis points for the quarter ended December 31, 2024, compared to the quarter ended September 30, 2024. This expansion was driven primarily by a 40 basis point reduction in rates paid on interest-bearing liabilities, offset by an 18 basis point decline in our yield on interest-earning assets.

•Net interest income was $78.3 million for the quarter ended December 31, 2024, reflecting an increase of $3.5 million, or 4.7%, compared to the linked quarter and is at its highest level in two years.

•Provision for credit loss benefit was $5.4 million for the quarter ended December 31, 2024, compared to a provision for credit loss expense of $4.6 million in the linked quarter, representing a $10.0 million change from the linked quarter.

•Our bond portfolio optimization strategy, aimed at enhancing long-term yields and improving overall portfolio performance, positively impacted our NIM-FTE by three basis points for the quarter ended December 31, 2024, and is estimated to provide a total positive impact to NIM-FTE of seven basis points in the twelve months following the date of sale. We sold available-for-sale investment securities with a book value of $188.2 million and realized a loss of $14.6 million, which negatively impacted our diluted EPS by $0.37 for the quarter ended December 31, 2024.

Results of Operations for the Three Months Ended December 31, 2024

Net Interest Income and Net Interest Margin

Net interest income for the quarter ended December 31, 2024, was $78.3 million, an increase of $3.5 million, or 4.7%, compared to the quarter ended September 30, 2024. The increase was primarily driven by a $7.5 million decrease in interest expense paid on interest-bearing deposits and a $1.6 million increase in interest income earned on average interest-earning balances due from banks, partially offset by a decrease of $6.1 million in interest income earned on loans held for investment (“LHFI”).

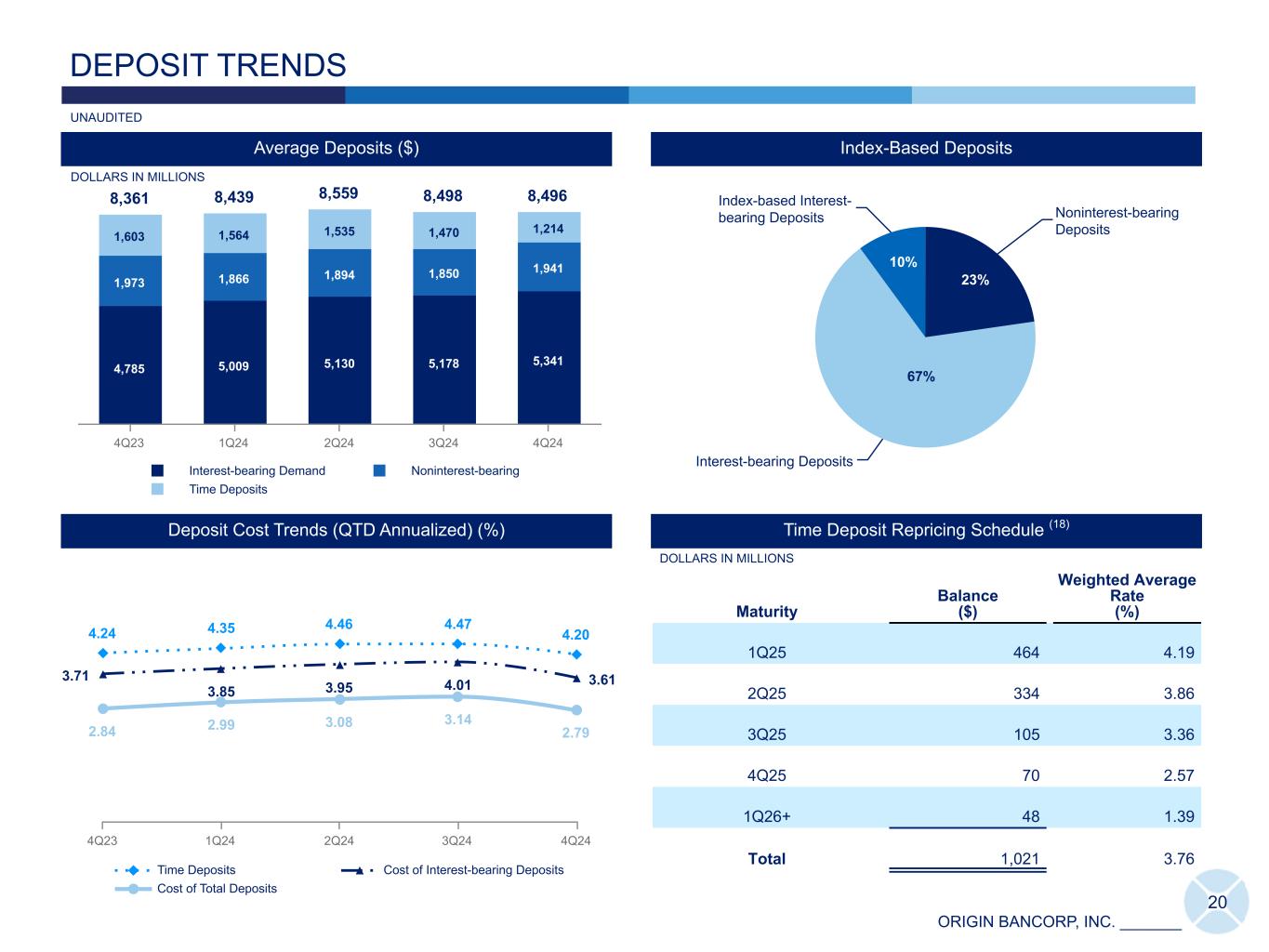

The decrease in average rates and average balances of interest-bearing deposits during the quarter ended December 31, 2024, reduced interest expense by $6.2 million and $1.3 million, respectively, when compared to the quarter ended September 30, 2024. The decrease in average balances of interest-bearing deposits was primarily driven by a $256.3 million decrease in average time deposit balances, partially offset by a $190.5 million increase in average money market deposit balances. The average rate on interest-bearing deposits was 3.61% for the quarter ended December 31, 2024, a decrease of 40 basis points, from 4.01% for the quarter ended September 30, 2024.

The $1.6 million increase in interest income earned on average interest-earning balances due from banks was primarily driven by a $165.6 million increase in average interest-earning balances due from banks which led to a $2.3 million increase in interest income, partially offset by a reduction in average yield.

The decrease in average rates and average principal balance of LHFI during the quarter ended December 31, 2024, resulted in decreases of $3.4 million and $2.7 million, respectively, to interest income when compared to the quarter ended September 30, 2024. The average rate on LHFI was 6.47% for the quarter ended December 31, 2024, a decrease of 20 basis points, compared to 6.67% for the quarter ended September 30, 2024. The decrease in average LHFI principal balance was primarily driven by decreases of $83.2 million, $43.7 million and $25.0 million in average construction/land/land development, commercial and industrial and mortgage warehouse lines of credit (“MW LOC”) loan balances.

The Federal Reserve Board sets various benchmark rates, including the federal funds rate, and thereby influences the general market rates of interest, including the loan and deposit rates offered by financial institutions. On September 18, 2024, the Federal Reserve reduced the federal funds target rate range by 50 basis points, to a range of 4.75% to 5.00%, marking the first rate reduction since early 2020. Subsequently, it implemented two additional reductions, with the current federal funds target range set to 4.25% to 4.50% on December 18, 2024. During the second half of 2024, the federal funds target range decreased 100 basis points from its recent cycle high.

Our NIM-FTE was 3.33% for the quarter ended December 31, 2024, representing a 15- and a 14-basis-point increase compared to the linked quarter and the prior year same quarter, respectively. The yield earned on interest-earning assets for the quarter ended December 31, 2024, was 5.91%, a decrease of 18 basis points compared to the linked quarter and an increase of five basis points compared to the quarter ended December 31, 2023. The average rate paid on total interest-bearing liabilities for the quarter ended December 31, 2024, was 3.64%, representing a 40- and 11-basis point decrease compared to the quarters ended September 30, 2024, and December 31, 2023, respectively. The bond portfolio optimization strategy positively impacted our NIM-FTE by three basis points for the quarter ended December 31, 2024.

During the quarter ended December 31, 2024, we executed a bond portfolio optimization strategy aimed at enhancing long-term yields and improving overall portfolio performance. This strategy involved selling lower-yielding available-for-sale investment securities prior to their maturity and using the proceeds to purchase higher-yielding available-for-sale investment securities. As a result, we replaced securities with a total book value of $188.2 million and a weighted average yield of 1.51% with new securities totaling $173.7 million with a weighted average yield of 5.22%, realizing a loss of $14.6 million. The weighted average duration of the securities portfolio increased to 4.46 years as of December 31, 2024, compared to 4.21 years as of September 30, 2024. While the associated loss, net of the increase in interest income, resulted in a $0.35 negative impact to diluted EPS during the quarter ended December 31, 2024, we believe the trade-off in yield represents an attractive opportunity with an estimated increase in annual net interest income of $5.6 million, an earn-back period of 2.4 years and a twelve month total positive impact to NIM-FTE of seven basis points.

Credit Quality

The table below includes key credit quality information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At and For the Three Months Ended |

|

Change |

|

% Change |

|

| (Dollars in thousands, unaudited) |

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

Linked

Quarter |

|

Linked

Quarter |

|

| Past due LHFI |

$ |

42,437 |

|

|

$ |

38,838 |

|

|

$ |

26,043 |

|

|

$ |

3,599 |

|

|

9.3 |

% |

|

Allowance for loan credit losses (“ALCL”) |

91,060 |

|

|

95,989 |

|

|

96,868 |

|

|

(4,929) |

|

|

(5.1) |

|

|

| Classified loans |

118,782 |

|

|

107,486 |

|

|

80,545 |

|

|

11,296 |

|

|

10.5 |

|

|

| Total nonperforming LHFI |

75,002 |

|

|

64,273 |

|

|

30,115 |

|

|

10,729 |

|

|

16.7 |

|

|

| Provision (benefit) for credit losses |

(5,398) |

|

|

4,603 |

|

|

2,735 |

|

|

(10,001) |

|

|

(217.3) |

|

|

| Net charge-offs (recoveries) |

(560) |

|

|

9,520 |

|

|

1,891 |

|

|

(10,080) |

|

|

(105.9) |

|

|

Credit quality ratios(1): |

|

|

|

|

|

|

|

|

|

|

| ALCL to nonperforming LHFI |

121.41 |

% |

|

149.35 |

% |

|

321.66 |

% |

|

(27.94) |

% |

|

N/A |

|

| ALCL to total LHFI |

1.20 |

|

|

1.21 |

|

|

1.26 |

|

|

(0.01) |

|

|

N/A |

|

ALCL to total LHFI, adjusted(2) |

1.25 |

|

|

1.28 |

|

|

1.31 |

|

|

(0.03) |

|

|

N/A |

|

| Classified loans to total LHFI |

1.57 |

|

|

1.35 |

|

|

1.05 |

|

|

0.22 |

|

|

N/A |

|

| Nonperforming LHFI to LHFI |

0.99 |

|

|

0.81 |

|

|

0.39 |

|

|

0.18 |

|

|

N/A |

|

| Net charge-offs to total average LHFI (annualized) |

(0.03) |

|

|

0.48 |

|

|

0.10 |

|

|

(0.51) |

|

|

N/A |

|

___________________________

(1)Please see the Loan Data schedule at the back of this document for additional information.

(2)The ALCL to total LHFI, adjusted, is calculated by excluding the ALCL for MW LOC loans from the total LHFI ALCL in the numerator and excluding the MW LOC loans from the LHFI in the denominator. Due to their low-risk profile, MW LOC loans require a disproportionately low allocation of the ALCL.

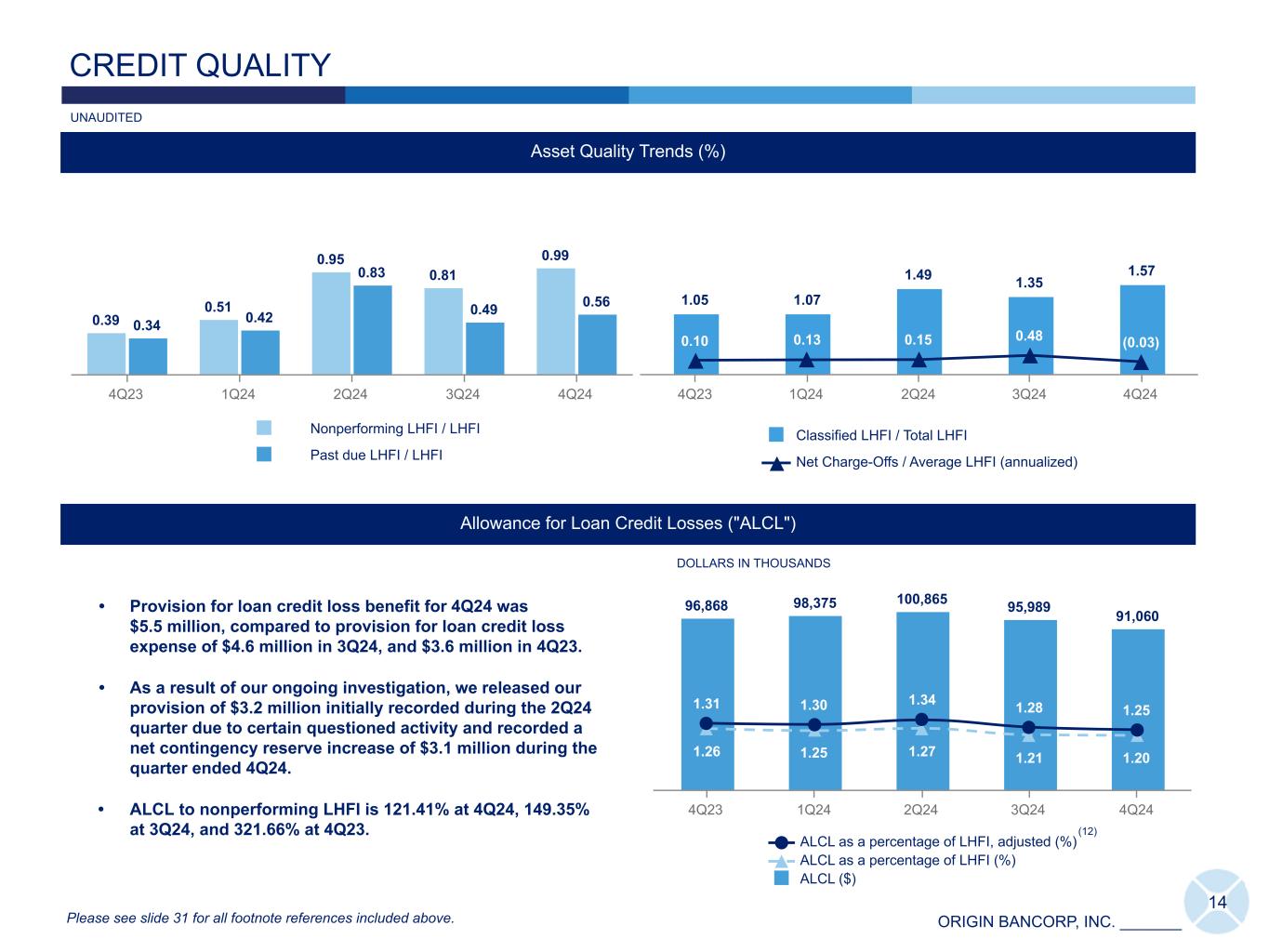

As discussed previously in our Origin Bancorp, Inc. Earnings Releases, our credit metrics were negatively impacted by certain questioned activity involving a former banker in our East Texas market. Our investigation of this activity remains ongoing. During the current quarter, classified and nonperforming LHFI related to the questioned banker activity decreased $5.8 million and $3.8 million, respectively, from September 30, 2024. This decline was primarily driven by one $2.0 million classified loan paying off and, as a result of our on-going investigation and litigation, the decision to remove $3.3 million in classified/nonperforming LHFI balances due to results from a third-party forensic analysis. We released $3.2 million in provision for loan credit losses related to the questioned banker activity and recorded a net contingency reserve increase of $3.1 million during the quarter ended December 31, 2024. There was no material change in the level of past due LHFI principal balances between the current quarter and the linked quarter as a result of the questioned activity. While the forensic analysis is largely completed, we continue to work with the outside forensic accounting firm to confirm the bank’s identification and reconciliation of the activity. At this time, we continue to believe that any ultimate loss arising from the situation will not be material to our financial position. The Company has notified its insurance providers of anticipated claims resulting from this activity, but there is no consideration in the Company’s financial results of any potential insurance recoveries.

Our results included a credit loss provision benefit of $5.4 million during the quarter ended December 31, 2024, which was primarily driven by a $5.5 million release of loan credit loss provision, $3.2 million of which was related to the questioned banker activity discussed in the previous paragraph. Also contributing to the release of the loan credit loss provision during the quarter ended December 31, 2024, compared to September 30, 2024, was a decrease of $237.0 million in total LHFI excluding MW LOC and an increase in loan recoveries of $879,000. Net charge-offs decreased $10.1 million for the quarter ended December 31, 2024, when compared to the quarter ended September 30, 2024, primarily due to total charge-offs of $2.0 million in the current quarter compared to total charge-offs of $11.2 million in the linked quarter consisting primarily of three commercial and industrial loan relationships with charge-offs totaling $10.4 million. Nonperforming LHFI increased $10.7 million for the current quarter compared to the linked quarter, reflecting an increase in the percentage of nonperforming LHFI to LHFI to 0.99% compared to 0.81% for the linked quarter. The increase in nonperforming loans was primarily driven by four loan relationships totaling $14.4 million at December 31, 2024, with single-family residential real estate loans totaling $8.1 million of the increase. Classified loans increased $11.3 million to $118.8 million at December 31, 2024.

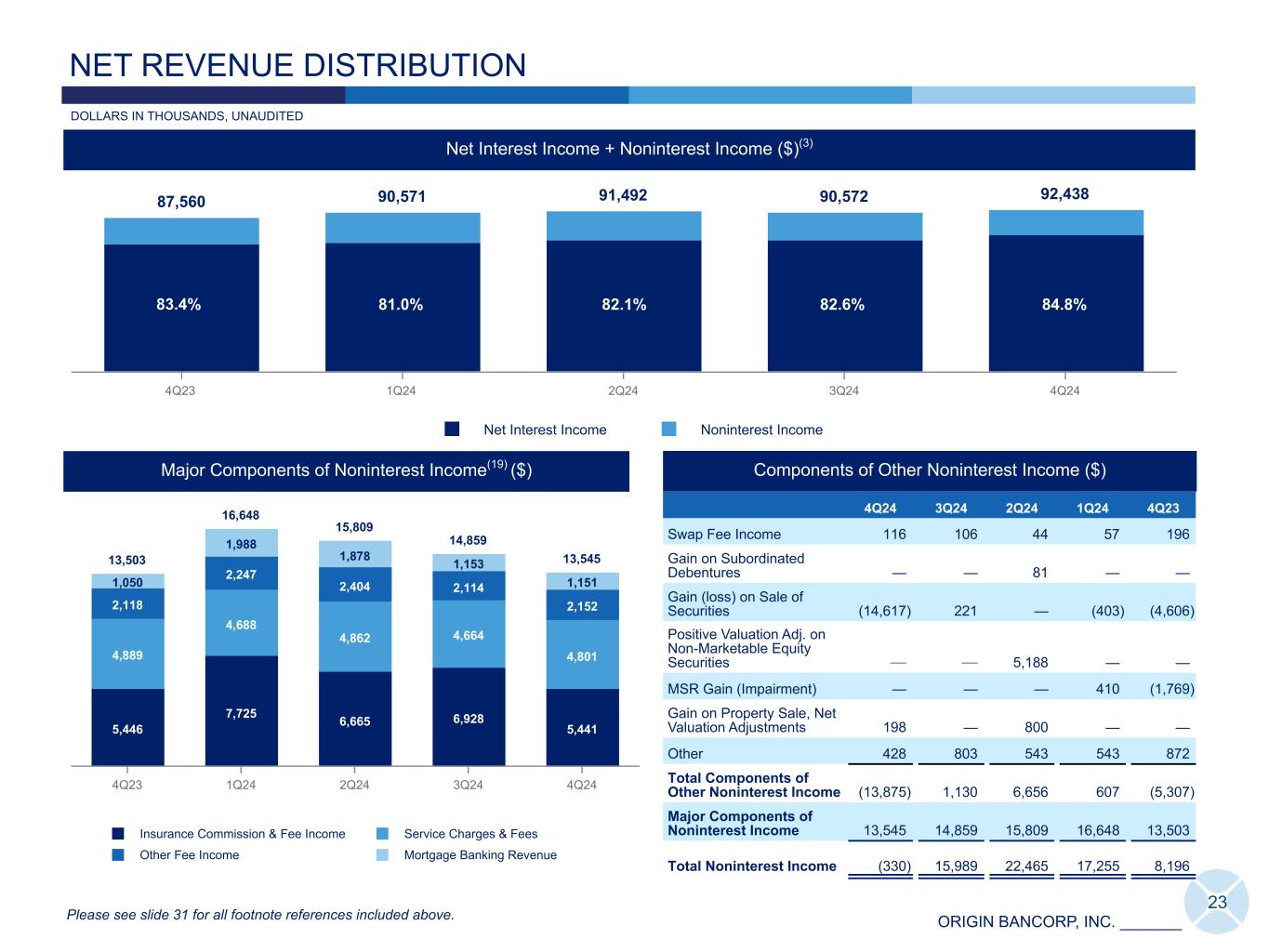

Noninterest Income

Noninterest income for the quarter ended December 31, 2024, was a negative $330,000, a decrease of $16.3 million from the linked quarter, primarily driven by decreases of $14.8 million and $1.5 million in the change in gain (loss) on sales of securities, net and insurance commission and fee income, respectively.

The decrease in gain (loss) on sales of securities, net, during the current quarter when compared to the linked quarter was due to the execution of the bond portfolio optimization strategy discussed above. The loss on the sale of securities negatively impacted our diluted EPS by $0.37 for the quarter ended December 31, 2024.

The decrease in insurance commission and fee income was primarily due to the seasonal nature of insurance income.

Noninterest Expense

Noninterest expense for the quarter ended December 31, 2024, was $65.4 million, an increase of $2.9 million, or 4.6% from the linked quarter. The increase was primarily driven by increases of $3.4 million and $1.6 million in other noninterest expense and occupancy and equipment expense, net, respectively, that was partially offset by a decrease of $2.1 million in salaries and employee benefit expense.

The increase in other noninterest expense was primarily due to $3.1 million in contingency expense related to certain questioned activity involving a former banker in our East Texas market, as described in the Credit Quality section above. We had previously recorded a $3.2 million provision for loan credit losses and a $1.2 million contingency reserve during the quarter ended June 30, 2024. As a result of our on-going investigation of this matter, and to more accurately reflect the nature of the expense, we released the provision expense. This resulted in a reduction to our loan credit loss allowance through provision expense and an increase of our contingency reserve in other noninterest expense.

The $1.6 million increase in occupancy and equipment, net was primarily due to an increase in rent associated with the accounting for our strategic Optimize Origin initiative which includes consolidation of six banking centers, four in the Dallas-Fort Worth market, with one each in the Louisiana and Mississippi markets. We expect to close these six banking centers at the end of February 2025, which is expected to reduce our occupancy expense by approximately $3.6 million annually. These branch closures combined with the two branch closures that occurred mid-year 2024 are expected to reduce our annual occupancy expense by $4.6 million in total.

The decrease in salaries and employee benefit expense was primarily due to an Employee Retention Credit (“ERC”) of $1.7 million that was recorded in the current quarter and related to the operations of BTH Bank, N.A., which we acquired in 2022. The ERC is a refundable tax credit for certain eligible businesses that had employees affected during the COVID-19 pandemic.

Financial Condition

Loans

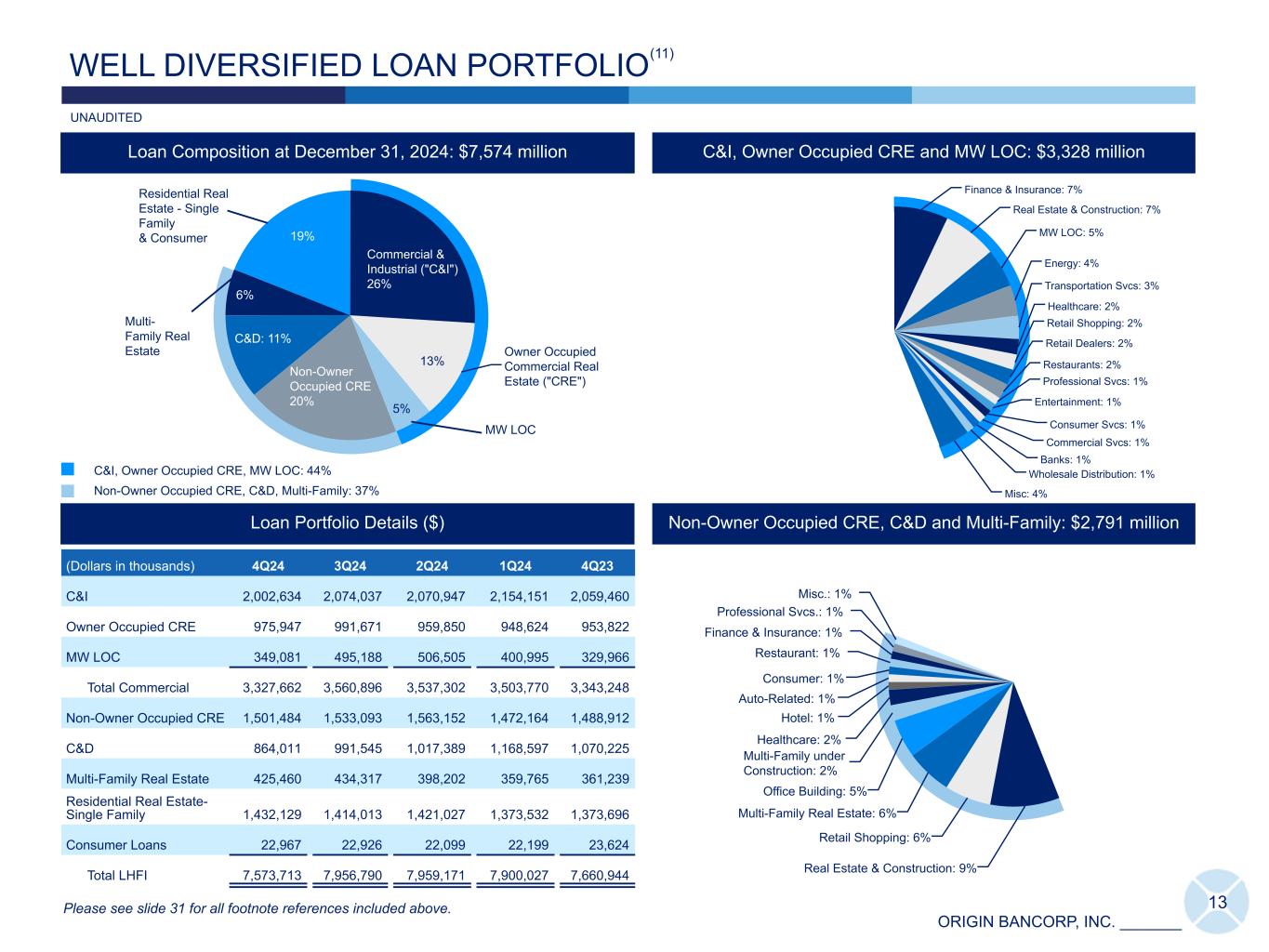

•Total LHFI at December 31, 2024, were $7.57 billion, a decrease of $383.1 million, or 4.8%, from $7.96 billion at September 30, 2024, and a decrease of $87.2 million, or 1.1%, compared to December 31, 2023.

•During the quarter ended December 31, 2024, compared to the linked quarter, we experienced declines in significantly all loan categories, but primarily reflected in MW LOC and construction/land/land development loans of $146.1 million and $127.5 million, respectively.

Securities

•Total securities at December 31, 2024 were $1.12 billion, a decrease of $58.5 million, or 5.0%, from $1.18 billion at September 30, 2024, and a decrease of $151.9 million, or 11.9%, compared to December 31, 2023.

•During the quarter, we made a strategic decision to optimize our bond portfolio by selling available-for-sale investment securities with a book value of $188.2 million and realized a loss of $14.6 million.

•Accumulated other comprehensive loss, net of taxes, primarily associated with unrealized losses within the available for sale portfolio, was $106.0 million at December 31, 2024, an increase of $11.8 million, or 12.5% , from the linked quarter.

•The weighted average effective duration for the total securities portfolio was 4.46 years as of December 31, 2024, compared to 4.21 years as of September 30, 2024.

Deposits

•Total deposits at December 31, 2024, were $8.22 billion, a decrease of $263.4 million, or 3.1%, compared to the linked quarter, and a decrease of $28.0 million, or 0.3%, from December 31, 2023. The decrease in the current quarter compared to the linked quarter was primarily due to a decrease of $351.4 million in brokered deposits. The decrease was partially offset by an increase of $187.4 million in interest-bearing demand deposits.

•At December 31, 2024, noninterest-bearing deposits as a percentage of total deposits were 23.1%, compared to 22.3% and 23.3% at September 30, 2024, and December 31, 2023, respectively. Excluding brokered deposits, noninterest-bearing deposits as a percentage of total deposits were 23.3%, compared to 23.5% and 24.6% at September 30, 2024, and December 31, 2023, respectively.

Conference Call

Origin will hold a conference call to discuss its fourth quarter and full year 2024 results on Thursday, January 23, 2025, at 8:00 a.m. Central Time (9:00 a.m. Eastern Time). To participate in the live conference call, please dial +1 (929) 272-1574 (U.S. Local / International 1); +1 (857) 999-3259 (U.S. Local / International 2); +1 (888) 700-7550 (U.S. Toll Free), enter Conference ID: 53414 and request to be joined into the Origin Bancorp, Inc. (OBK) call. A simultaneous audio-only webcast may be accessed via Origin’s website at www.origin.bank under the investor relations, News & Events, Events & Presentations link or directly by visiting https://dealroadshow.com/e/ORIGINQ424.

If you are unable to participate during the live webcast, the webcast will be archived on the Investor Relations section of Origin’s website at www.origin.bank, under Investor Relations, News & Events, Events & Presentations.

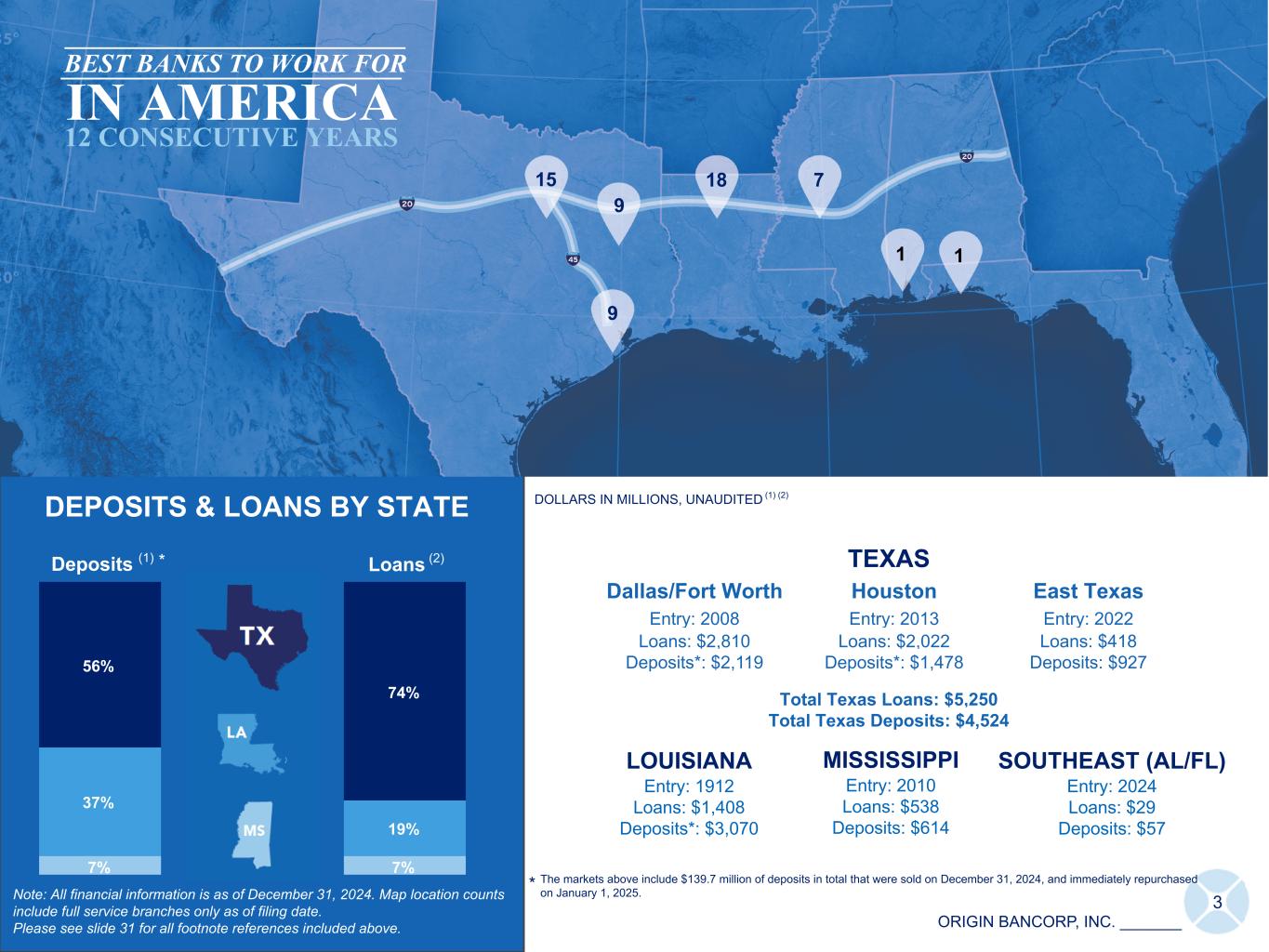

About Origin

Origin Bancorp, Inc. is a financial holding company headquartered in Ruston, Louisiana. Origin’s wholly owned bank subsidiary, Origin Bank, was founded in 1912 in Choudrant, Louisiana. Deeply rooted in Origin’s history is a culture committed to providing personalized relationship banking to businesses, municipalities, and personal clients to enrich the lives of the people in the communities it serves. Origin provides a broad range of financial services and currently operates more than 60 locations in Dallas/Fort Worth, East Texas, Houston, North Louisiana, Mississippi, South Alabama and the Florida Panhandle. For more information, visit www.origin.bank.

Non-GAAP Financial Measures

Origin reports its results in accordance with generally accepted accounting principles in the United States of America ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures may provide meaningful information to investors that is useful in understanding Origin's results of operations and underlying trends in its business. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this release: PTPP earnings, adjusted NIM-FTE, PTPP ROAA, tangible book value per common share, adjusted tangible book value per common share, ROATCE, and core efficiency ratio.

Please see the last few pages of this release for reconciliations of non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin Bancorp, Inc’s (“Origin”, “we”, “our” or the “Company”) future financial performance, business and growth strategies, projected plans and objectives, and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including changes to interest rates by the Federal Reserve and the resulting impact on Origin’s results of operations, estimated forbearance amounts and expectations regarding the Company’s liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin’s control. Statements or statistics preceded by, followed by or that otherwise include the words “assumes,” “anticipates,” “believes,” “estimates,” “expects,” “foresees,” “intends,” “plans,” “projects,” and similar expressions or future or conditional verbs such as “could,” “may,” “might,” “should,” “will,” and “would” and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect Origin’s future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: (1) the impact of current and future economic conditions generally and in the financial services industry, nationally and within Origin’s primary market areas, as well as the financial stress on borrowers and changes to customer and client behavior as a result of the foregoing; (2) changes in benchmark interest rates and the resulting impacts on net interest income; (3) deterioration of Origin’s asset quality; (4) factors that can impact the performance of Origin’s loan portfolio, including real estate values and liquidity in Origin’s primary market areas; (5) the financial health of Origin’s commercial borrowers and the success of construction projects that Origin finances; (6) changes in the value of collateral securing Origin’s loans; (7) the impact of generative artificial intelligence; (8) Origin’s ability to anticipate interest rate changes and manage interest rate risk; (9) the impact of heightened regulatory requirements, reduced debit interchange and overdraft income and the possibility of facing related adverse business consequences if our total assets grow in excess of $10 billion as of December 31 of any calendar year; (10) the effectiveness of Origin’s risk management framework and quantitative models; (11) Origin’s inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin’s common stockholders, repurchase Origin’s shares of common stock and satisfy obligations as they become due; (12) the impact of labor pressures; (13) changes in Origin’s operation or expansion strategy or Origin’s ability to prudently manage its growth and execute its strategy; (14) changes in management personnel; (15) Origin’s ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; (16) increasing costs as Origin grows deposits; (17) operational risks associated with Origin’s business; (18) significant turbulence or a disruption in the capital or financial markets and the effect of market disruption and interest rate volatility on our investment securities; (19) increased competition in the financial services industry, particularly from regional and national institutions, as well as from fintech companies; (20) compliance with governmental and regulatory requirements and changes in laws, rules, regulations, interpretations or policies relating to financial institutions; (21) periodic changes to the extensive body of accounting rules and best practices; (22) further government intervention in the U.S. financial system; (23) a deterioration of the credit rating for U.S. long-term sovereign debt; (24) Origin’s ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; (25) natural disasters and other adverse weather events, pandemics, acts of terrorism, war, and other matters beyond Origin’s control; (26) developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; (27) fraud or misconduct by internal or external actors (including Origin employees); (28) cybersecurity threats or security breaches and the cost of defending against them; (29) Origin’s ability to maintain adequate internal controls over financial and non-financial reporting; and (30) potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Origin’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any updates to those sections set forth in Origin’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin’s underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin’s behalf may issue. Annualized, pro forma, adjusted, projected, and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results.

This press release contains projected financial information with respect to Origin, including with respect to certain goals and strategic initiatives of Origin and the anticipated benefits thereof. This projected financial information constitutes forward-looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to significant business, economic (including interest rate), competitive, and other risks and uncertainties. Actual results may differ materially from the results contemplated by the projected financial information contained herein and the inclusion of such projected financial information in this release should not be regarded as a representation by any person that such actions will be taken or accomplished or that the results reflected in such projected financial information with respect thereto will be achieved.

Contact:

Investor Relations

Chris Reigelman

318-497-3177

chris@origin.bank

Media Contact

Ryan Kilpatrick

318-232-7472

rkilpatrick@origin.bank

Origin Bancorp, Inc.

Selected Quarterly Financial Data

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

| Income statement and share amounts |

(Dollars in thousands, except per share amounts) |

|

Net interest income |

$ |

78,349 |

|

|

$ |

74,804 |

|

|

$ |

73,890 |

|

|

$ |

73,323 |

|

|

$ |

72,989 |

|

|

| Provision (benefit) for credit losses |

(5,398) |

|

|

4,603 |

|

|

5,231 |

|

|

3,012 |

|

|

2,735 |

|

|

Noninterest income |

(330) |

|

|

15,989 |

|

|

22,465 |

|

|

17,255 |

|

|

8,196 |

|

|

| Noninterest expense |

65,422 |

|

|

62,521 |

|

|

64,388 |

|

|

58,707 |

|

|

60,906 |

|

|

Income before income tax expense |

17,995 |

|

|

23,669 |

|

|

26,736 |

|

|

28,859 |

|

|

17,544 |

|

|

| Income tax expense |

3,725 |

|

|

5,068 |

|

|

5,747 |

|

|

6,227 |

|

|

4,119 |

|

|

Net income |

$ |

14,270 |

|

|

$ |

18,601 |

|

|

$ |

20,989 |

|

|

$ |

22,632 |

|

|

$ |

13,425 |

|

|

PTPP earnings(1) |

$ |

12,597 |

|

|

$ |

28,272 |

|

|

$ |

31,967 |

|

|

$ |

31,871 |

|

|

$ |

20,279 |

|

|

Basic earnings per common share |

0.46 |

|

|

0.60 |

|

|

0.68 |

|

|

0.73 |

|

|

0.43 |

|

|

| Diluted earnings per common share |

0.46 |

|

|

0.60 |

|

|

0.67 |

|

|

0.73 |

|

|

0.43 |

|

|

| Dividends declared per common share |

0.15 |

|

|

0.15 |

|

|

0.15 |

|

|

0.15 |

|

|

0.15 |

|

|

Weighted average common shares outstanding - basic |

31,155,486 |

|

|

31,130,293 |

|

|

31,042,527 |

|

|

30,981,333 |

|

|

30,898,941 |

|

|

Weighted average common shares outstanding - diluted |

31,308,805 |

|

|

31,239,877 |

|

|

31,131,829 |

|

|

31,078,910 |

|

|

30,995,354 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance sheet data |

|

|

|

|

|

|

|

|

|

|

Total LHFI |

$ |

7,573,713 |

|

|

$ |

7,956,790 |

|

|

$ |

7,959,171 |

|

|

$ |

7,900,027 |

|

|

$ |

7,660,944 |

|

|

| Total LHFI excluding MW LOC |

7,224,632 |

|

|

7,461,602 |

|

|

7,452,666 |

|

|

7,499,032 |

|

|

7,330,978 |

|

|

Total assets |

9,678,702 |

|

|

9,965,986 |

|

|

9,947,182 |

|

|

9,892,379 |

|

|

9,722,584 |

|

|

| Total deposits |

8,223,120 |

|

|

8,486,568 |

|

|

8,510,842 |

|

|

8,505,464 |

|

|

8,251,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

1,145,245 |

|

|

1,145,673 |

|

|

1,095,894 |

|

|

1,078,853 |

|

|

1,062,905 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance metrics and capital ratios |

|

|

|

|

|

|

|

|

|

|

| Yield on LHFI |

6.47 |

% |

|

6.67 |

% |

|

6.58 |

% |

|

6.58 |

% |

|

6.46 |

% |

|

| Yield on interest-earnings assets |

5.91 |

|

|

6.09 |

|

|

6.04 |

|

|

5.99 |

|

|

5.86 |

|

|

| Cost of interest-bearing deposits |

3.61 |

|

|

4.01 |

|

|

3.95 |

|

|

3.85 |

|

|

3.71 |

|

|

| Cost of total deposits |

2.79 |

|

|

3.14 |

|

|

3.08 |

|

|

2.99 |

|

|

2.84 |

|

|

| NIM - fully tax equivalent ("FTE") |

3.33 |

|

|

3.18 |

|

|

3.17 |

|

|

3.19 |

|

|

3.19 |

|

|

| Return on average assets (annualized) ("ROAA") |

0.57 |

|

|

0.74 |

|

|

0.84 |

|

|

0.92 |

|

|

0.55 |

|

|

PTPP ROAA (annualized)(1) |

0.50 |

|

|

1.13 |

|

|

1.28 |

|

|

1.30 |

|

|

0.82 |

|

|

| Return on average stockholders’ equity (annualized) ("ROAE") |

4.94 |

|

|

6.57 |

|

|

7.79 |

|

|

8.57 |

|

|

5.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per common share |

$ |

36.71 |

|

|

$ |

36.76 |

|

|

$ |

35.23 |

|

|

$ |

34.79 |

|

|

$ |

34.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

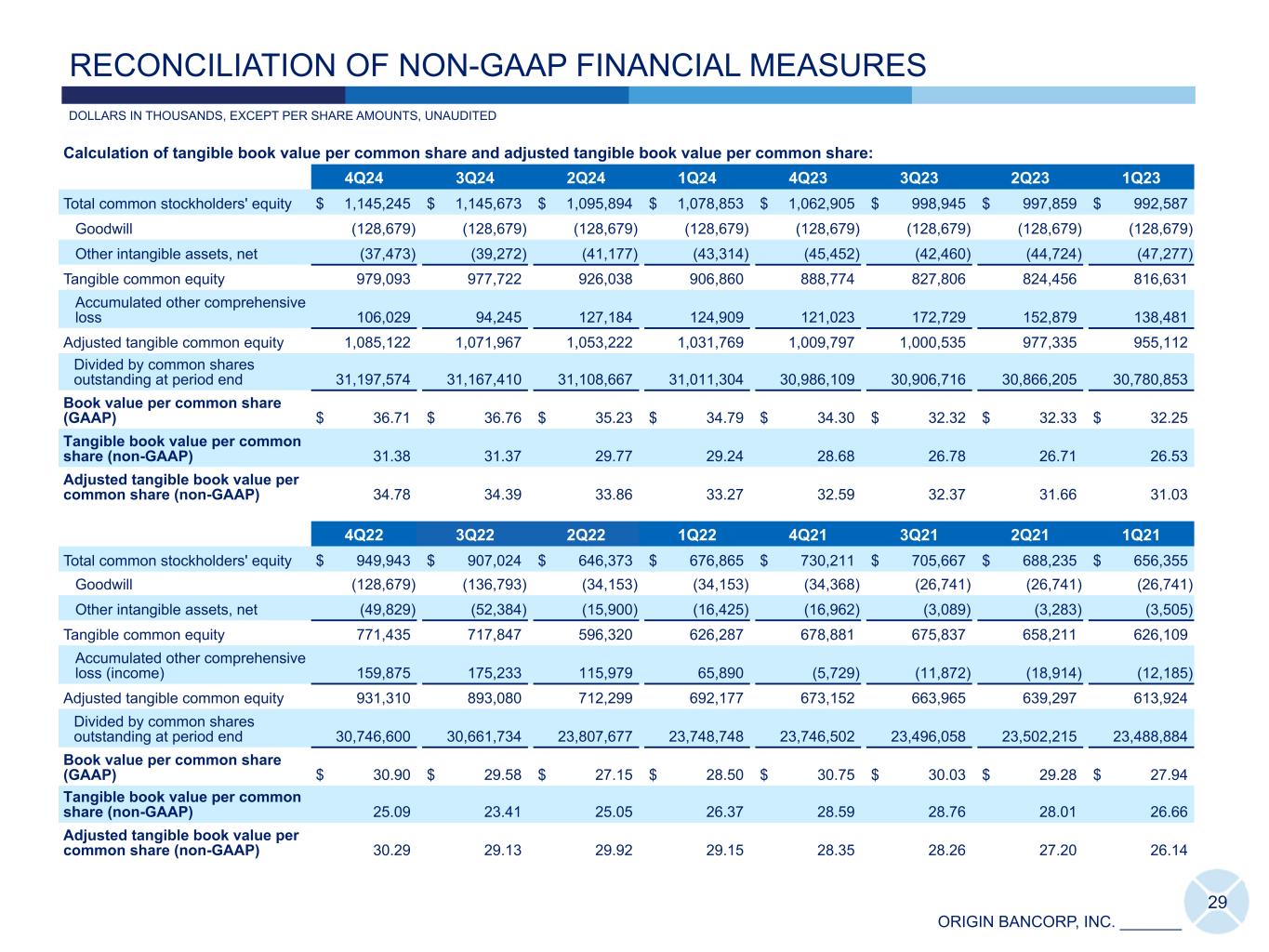

Tangible book value per common share (1) |

31.38 |

|

|

31.37 |

|

|

29.77 |

|

|

29.24 |

|

|

28.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted tangible book value per common share(1) |

34.78 |

|

|

34.39 |

|

|

33.86 |

|

|

33.27 |

|

|

32.59 |

|

|

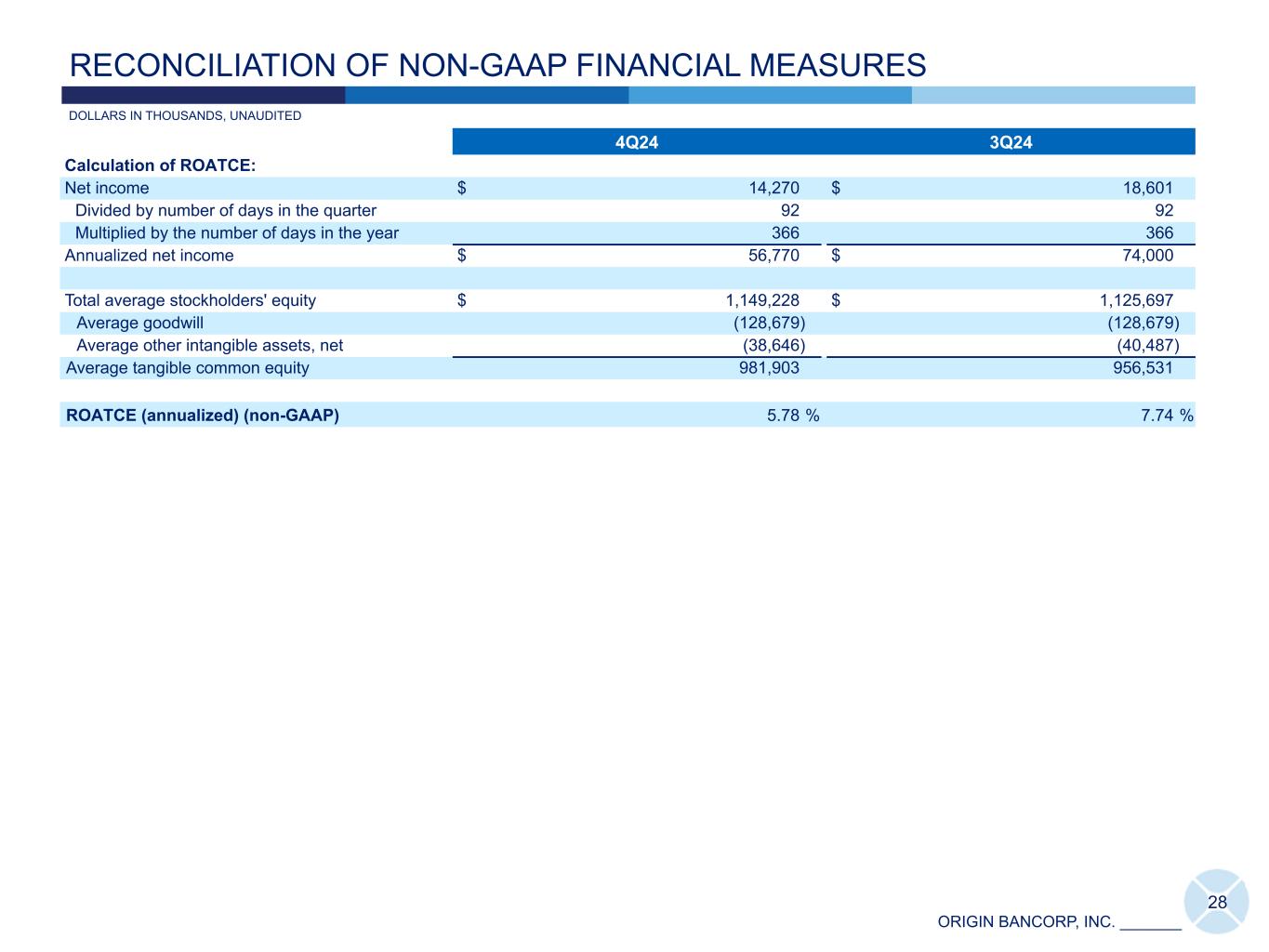

Return on average tangible common equity (annualized) ("ROATCE")(1) |

5.78 |

% |

|

7.74 |

% |

|

9.25 |

% |

|

10.24 |

% |

|

6.36 |

% |

|

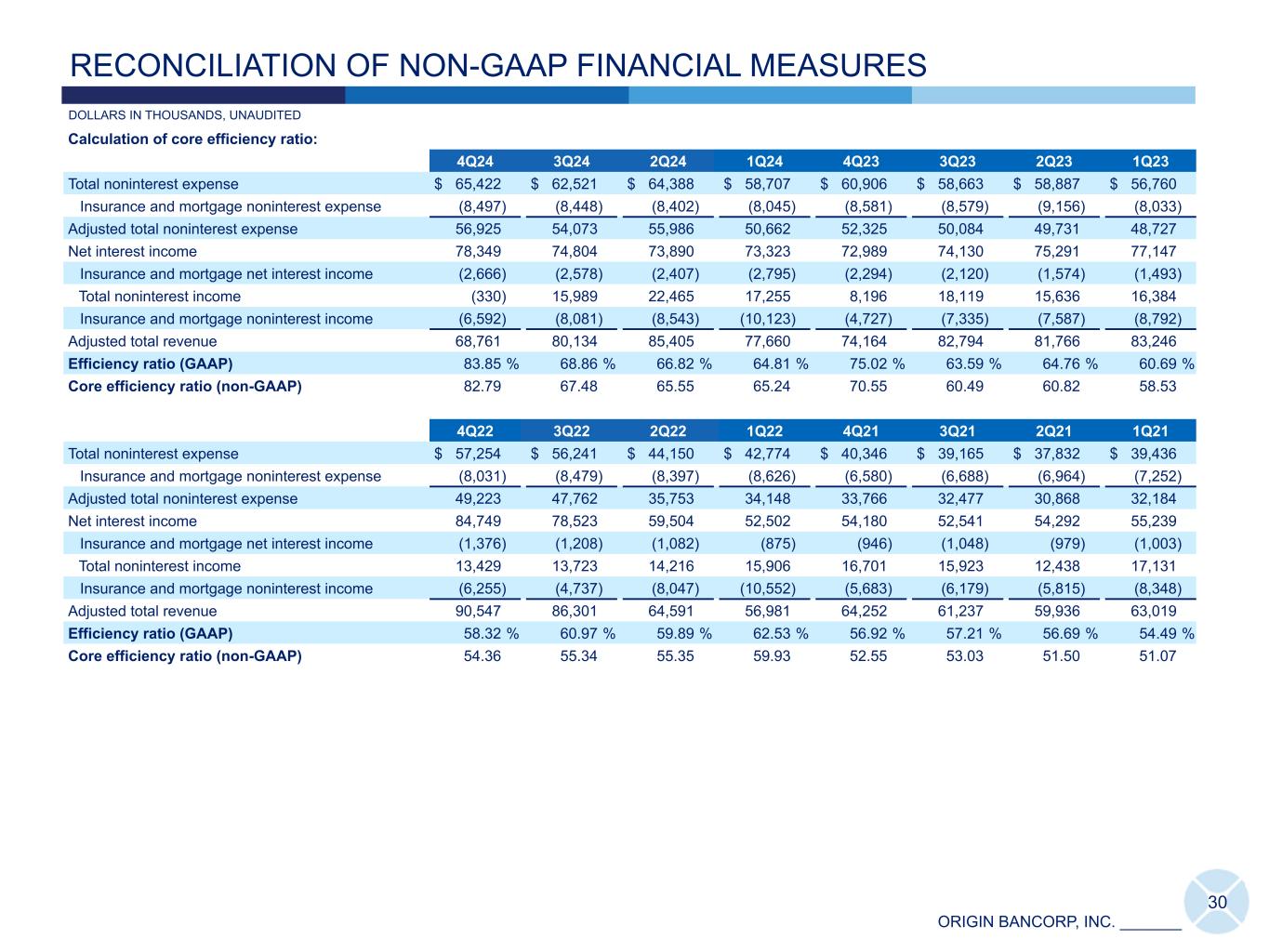

Efficiency ratio(2) |

83.85 |

|

|

68.86 |

|

|

66.82 |

|

|

64.81 |

|

|

75.02 |

|

|

Core efficiency ratio(1) |

82.79 |

|

|

67.48 |

|

|

65.55 |

|

|

65.24 |

|

|

70.55 |

|

|

Common equity tier 1 to risk-weighted assets(3) |

13.32 |

|

|

12.46 |

|

|

12.15 |

|

|

11.97 |

|

|

11.83 |

|

|

Tier 1 capital to risk-weighted assets(3) |

13.52 |

|

|

12.64 |

|

|

12.33 |

|

|

12.15 |

|

|

12.01 |

|

|

Total capital to risk-weighted assets(3) |

16.44 |

|

|

15.45 |

|

|

15.16 |

|

|

14.98 |

|

|

15.02 |

|

|

Tier 1 leverage ratio(3) |

11.08 |

|

|

10.93 |

|

|

10.70 |

|

|

10.66 |

|

|

10.50 |

|

|

__________________________

(1)PTPP earnings, PTPP ROAA, tangible book value per common share, adjusted tangible book value per common share, ROATCE, and core efficiency ratio are either non-GAAP financial measures or use a non-GAAP contributor in the formula. For a reconciliation of these alternative financial measures to their most directly comparable GAAP measures, please see the last few pages of this release.

(2)Calculated by dividing noninterest expense by the sum of net interest income plus noninterest income.

(3)December 31, 2024, ratios are estimated and calculated at the Company level, which is subject to the capital adequacy requirements of the Federal Reserve Board.

Origin Bancorp, Inc.

Selected Annual Financial Data

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended December 31, |

| (Dollars in thousands, except per share amounts) |

2024 |

|

2023 |

|

|

|

|

| Income statement and share amounts |

|

Net interest income |

$ |

300,366 |

|

|

$ |

299,557 |

|

| Provision for credit losses |

7,448 |

|

|

16,753 |

|

Noninterest income |

55,379 |

|

|

58,335 |

|

| Noninterest expense |

251,038 |

|

|

235,216 |

|

Income before income tax expense |

97,259 |

|

|

105,923 |

|

Income tax expense |

20,767 |

|

|

22,123 |

|

Net income |

$ |

76,492 |

|

|

$ |

83,800 |

|

PTPP earnings(1) |

$ |

104,707 |

|

|

$ |

122,676 |

|

| Basic earnings per common share |

2.46 |

|

|

2.72 |

|

| Diluted earnings per common share |

2.45 |

|

|

2.71 |

|

| Dividends declared per common share |

0.60 |

|

|

0.60 |

|

Weighted average common shares outstanding - basic |

31,077,767 |

|

|

30,822,993 |

|

Weighted average common shares outstanding - diluted |

31,201,863 |

|

|

30,931,605 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance metrics |

|

|

|

| Yield on LHFI |

6.58 |

% |

|

6.26 |

% |

| Yield on interest-earning assets |

6.01 |

|

|

5.59 |

|

| Cost of interest-bearing deposits |

3.86 |

|

|

3.21 |

|

| Cost of total deposits |

3.00 |

|

|

2.38 |

|

| NIM-FTE |

3.22 |

|

|

3.23 |

|

Adjusted NIM-FTE(2) |

3.22 |

|

|

3.21 |

|

ROAA |

0.77 |

|

|

0.84 |

|

PTPP ROAA (1) |

1.05 |

|

|

1.23 |

|

ROAE |

6.92 |

|

|

8.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ROATCE (1) |

8.18 |

|

|

10.16 |

|

Efficiency ratio(3) |

70.57 |

|

|

65.72 |

|

Core efficiency ratio(1) |

69.77 |

|

|

62.39 |

|

____________________________

(1)PTPP earnings, PTPP ROAA, ROATCE, and core efficiency ratio are either non-GAAP financial measures or use a non-GAAP contributor in the formula. For a reconciliation of these alternative financial measures to their most directly comparable GAAP measures, please see the last few pages of this release.

(2)Adjusted NIM-FTE is a non-GAAP financial measure and is calculated for the years ended December 31, 2024 and 2023, by removing the $40,000 net purchase accounting amortization and $2.1 million net purchase accounting accretion, respectively, from net interest income.

(3)Calculated by dividing noninterest expense by the sum of net interest income plus noninterest income.

Origin Bancorp, Inc.

Consolidated Quarterly Statements of Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

| Interest and dividend income |

(Dollars in thousands, except per share amounts) |

| Interest and fees on loans |

$ |

127,021 |

|

|

$ |

133,195 |

|

|

$ |

129,879 |

|

|

$ |

127,186 |

|

|

$ |

123,673 |

|

| Investment securities-taxable |

6,651 |

|

|

6,536 |

|

|

6,606 |

|

|

6,849 |

|

|

7,024 |

|

| Investment securities-nontaxable |

964 |

|

|

905 |

|

|

893 |

|

|

910 |

|

|

1,124 |

|

| Interest and dividend income on assets held in other financial institutions |

5,197 |

|

|

3,621 |

|

|

4,416 |

|

|

3,756 |

|

|

3,664 |

|

| Total interest and dividend income |

139,833 |

|

|

144,257 |

|

|

141,794 |

|

|

138,701 |

|

|

135,485 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

59,511 |

|

|

67,051 |

|

|

65,469 |

|

|

62,842 |

|

|

59,771 |

|

| FHLB advances and other borrowings |

88 |

|

|

482 |

|

|

514 |

|

|

518 |

|

|

220 |

|

| Subordinated indebtedness |

1,885 |

|

|

1,920 |

|

|

1,921 |

|

|

2,018 |

|

|

2,505 |

|

| Total interest expense |

61,484 |

|

|

69,453 |

|

|

67,904 |

|

|

65,378 |

|

|

62,496 |

|

Net interest income |

78,349 |

|

|

74,804 |

|

|

73,890 |

|

|

73,323 |

|

|

72,989 |

|

| Provision (benefit) for credit losses |

(5,398) |

|

|

4,603 |

|

|

5,231 |

|

|

3,012 |

|

|

2,735 |

|

| Net interest income after provision for credit losses |

83,747 |

|

|

70,201 |

|

|

68,659 |

|

|

70,311 |

|

|

70,254 |

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

| Insurance commission and fee income |

5,441 |

|

|

6,928 |

|

|

6,665 |

|

|

7,725 |

|

|

5,446 |

|

| Service charges and fees |

4,801 |

|

|

4,664 |

|

|

4,862 |

|

|

4,688 |

|

|

4,889 |

|

| Other fee income |

2,152 |

|

|

2,114 |

|

|

2,404 |

|

|

2,247 |

|

|

2,118 |

|

|

|

|

|

|

|

|

|

|

|

| Mortgage banking revenue (loss) |

1,151 |

|

|

1,153 |

|

|

1,878 |

|

|

2,398 |

|

|

(719) |

|

| Swap fee income |

116 |

|

|

106 |

|

|

44 |

|

|

57 |

|

|

196 |

|

| (Loss) gain on sales of securities, net |

(14,617) |

|

|

221 |

|

|

— |

|

|

(403) |

|

|

(4,606) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair value of equity investments |

— |

|

|

— |

|

|

5,188 |

|

|

— |

|

|

— |

|

| Other income |

626 |

|

|

803 |

|

|

1,424 |

|

|

543 |

|

|

872 |

|

| Total noninterest income |

(330) |

|

|

15,989 |

|

|

22,465 |

|

|

17,255 |

|

|

8,196 |

|

| Noninterest expense |

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

36,405 |

|

|

38,491 |

|

|

38,109 |

|

|

35,818 |

|

|

35,931 |

|

| Occupancy and equipment, net |

7,913 |

|

|

6,298 |

|

|

7,009 |

|

|

6,645 |

|

|

6,912 |

|

| Data processing |

3,414 |

|

|

3,470 |

|

|

3,468 |

|

|

3,145 |

|

|

3,062 |

|

| Office and operations |

2,883 |

|

|

2,984 |

|

|

3,072 |

|

|

2,502 |

|

|

2,947 |

|

| Intangible asset amortization |

1,800 |

|

|

1,905 |

|

|

2,137 |

|

|

2,137 |

|

|

2,259 |

|

| Regulatory assessments |

1,535 |

|

|

1,791 |

|

|

1,842 |

|

|

1,734 |

|

|

1,860 |

|

| Advertising and marketing |

1,929 |

|

|

1,449 |

|

|

1,328 |

|

|

1,444 |

|

|

1,690 |

|

| Professional services |

2,064 |

|

|

2,012 |

|

|

1,303 |

|

|

1,231 |

|

|

1,440 |

|

| Loan-related expenses |

431 |

|

|

751 |

|

|

1,077 |

|

|

905 |

|

|

1,094 |

|

| Electronic banking |

1,377 |

|

|

1,308 |

|

|

1,238 |

|

|

1,239 |

|

|

1,103 |

|

| Franchise tax expense |

884 |

|

|

721 |

|

|

815 |

|

|

477 |

|

|

942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expenses |

4,787 |

|

|

1,341 |

|

|

2,990 |

|

|

1,430 |

|

|

1,666 |

|

| Total noninterest expense |

65,422 |

|

|

62,521 |

|

|

64,388 |

|

|

58,707 |

|

|

60,906 |

|

| Income before income tax expense |

17,995 |

|

|

23,669 |

|

|

26,736 |

|

|

28,859 |

|

|

17,544 |

|

| Income tax expense |

3,725 |

|

|

5,068 |

|

|

5,747 |

|

|

6,227 |

|

|

4,119 |

|

| Net income |

$ |

14,270 |

|

|

$ |

18,601 |

|

|

$ |

20,989 |

|

|

$ |

22,632 |

|

|

$ |

13,425 |

|

| Basic earnings per common share |

$ |

0.46 |

|

|

$ |

0.60 |

|

|

$ |

0.68 |

|

|

$ |

0.73 |

|

|

$ |

0.43 |

|

| Diluted earnings per common share |

0.46 |

|

|

0.60 |

|

|

0.67 |

|

|

0.73 |

|

|

0.43 |

|

|

|

|

|

|

|

|

|

|

|

Origin Bancorp, Inc.

Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in thousands) |

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

132,991 |

|

|

$ |

159,337 |

|

|

$ |

137,615 |

|

|

$ |

98,147 |

|

|

$ |

127,278 |

|

|

| Interest-bearing deposits in banks |

337,258 |

|

|

161,854 |

|

|

150,435 |

|

|

193,365 |

|

|

153,163 |

|

|

| Total cash and cash equivalents |

470,249 |

|

|

321,191 |

|

|

288,050 |

|

|

291,512 |

|

|

280,441 |

|

|

| Securities: |

|

|

|

|

|

|

|

|

|

|

| AFS |

1,102,528 |

|

|

1,160,965 |

|

|

1,160,048 |

|

|

1,190,922 |

|

|

1,253,631 |

|

|

| Held to maturity, net of allowance for credit losses |

11,095 |

|

|

11,096 |

|

|

11,616 |

|

|

11,651 |

|

|

11,615 |

|

|

| Securities carried at fair value through income |

6,512 |

|

|

6,533 |

|

|

6,499 |

|

|

6,755 |

|

|

6,808 |

|

|

| Total securities |

1,120,135 |

|

|

1,178,594 |

|

|

1,178,163 |

|

|

1,209,328 |

|

|

1,272,054 |

|

|

| Non-marketable equity securities held in other financial institutions |

71,643 |

|

|

67,068 |

|

|

64,010 |

|

|

53,870 |

|

|

55,190 |

|

|

| Loans held for sale |

10,494 |

|

|

7,631 |

|

|

18,291 |

|

|

14,975 |

|

|

16,852 |

|

|

| Loans |

7,573,713 |

|

|

7,956,790 |

|

|

7,959,171 |

|

|

7,900,027 |

|

|

7,660,944 |

|

|

| Less: ALCL |

91,060 |

|

|

95,989 |

|

|

100,865 |

|

|

98,375 |

|

|

96,868 |

|

|

| Loans, net of ALCL |

7,482,653 |

|

|

7,860,801 |

|

|

7,858,306 |

|

|

7,801,652 |

|

|

7,564,076 |

|

|

| Premises and equipment, net |

126,620 |

|

|

126,751 |

|

|

121,562 |

|

|

120,931 |

|

|

118,978 |

|

|

| Mortgage servicing rights |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

15,637 |

|

|

| Cash surrender value of bank-owned life insurance |

40,840 |

|

|

40,602 |

|

|

40,365 |

|

|

40,134 |

|

|

39,905 |

|

|

| Goodwill |

128,679 |

|

|

128,679 |

|

|

128,679 |

|

|

128,679 |

|

|

128,679 |

|

|

| Other intangible assets, net |

37,473 |

|

|

39,272 |

|

|

41,177 |

|

|

43,314 |

|

|

45,452 |

|

|

| Accrued interest receivable and other assets |

189,916 |

|

|

195,397 |

|

|

208,579 |

|

|

187,984 |

|

|

185,320 |

|

|

| Total assets |

$ |

9,678,702 |

|

|

$ |

9,965,986 |

|

|

$ |

9,947,182 |

|

|

$ |

9,892,379 |

|

|

$ |

9,722,584 |

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing deposits |

$ |

1,900,651 |

|

|

$ |

1,893,767 |

|

|

$ |

1,866,622 |

|

|

$ |

1,887,066 |

|

|

$ |

1,919,638 |

|

|

| Interest-bearing deposits excluding brokered interest-bearing deposits |

5,301,243 |

|

|

5,137,940 |

|

|

4,984,817 |

|

|

4,990,632 |

|

|

4,918,597 |

|

|

| Time deposits |

941,000 |

|

|

1,023,252 |

|

|

1,022,589 |

|

|

1,030,656 |

|

|

967,901 |

|

|

| Brokered deposits |

80,226 |

|

|

431,609 |

|

|

636,814 |

|

|

597,110 |

|

|

444,989 |

|

|

| Total deposits |

8,223,120 |

|

|

8,486,568 |

|

|

8,510,842 |

|

|

8,505,464 |

|

|

8,251,125 |

|

|

| FHLB advances and other borrowings |

12,460 |

|

|

30,446 |

|

|

40,737 |

|

|

13,158 |

|

|

83,598 |

|

|

| Subordinated indebtedness |

159,943 |

|

|

159,861 |

|

|

159,779 |

|

|

160,684 |

|

|

194,279 |

|

|

| Accrued expenses and other liabilities |

137,934 |

|

|

143,438 |

|

|

139,930 |

|

|

134,220 |

|

|

130,677 |

|

|

| Total liabilities |

8,533,457 |

|

|

8,820,313 |

|

|

8,851,288 |

|

|

8,813,526 |

|

|

8,659,679 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

Common stock |

155,988 |

|

|

155,837 |

|

|

155,543 |

|

|

155,057 |

|

|

154,931 |

|

|

| Additional paid-in capital |

537,366 |

|

|

535,662 |

|

|

532,950 |

|

|

530,380 |

|

|

528,578 |

|

|

| Retained earnings |

557,920 |

|

|

548,419 |

|

|

534,585 |

|

|

518,325 |

|

|

500,419 |

|

|

| Accumulated other comprehensive loss |

(106,029) |

|

|

(94,245) |

|

|

(127,184) |

|

|

(124,909) |

|

|

(121,023) |

|

|

| Total stockholders’ equity |

1,145,245 |

|

|

1,145,673 |

|

|

1,095,894 |

|

|

1,078,853 |

|

|

1,062,905 |

|

|

| Total liabilities and stockholders’ equity |

$ |

9,678,702 |

|

|

$ |

9,965,986 |

|

|

$ |

9,947,182 |

|

|

$ |

9,892,379 |

|

|

$ |

9,722,584 |

|

|

Origin Bancorp, Inc.

Loan Data

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At and For the Three Months Ended |

|

|

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LHFI |

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Owner occupied commercial real estate |

$ |

975,947 |

|

|

$ |

991,671 |

|

|

$ |

959,850 |

|

|

$ |

948,624 |

|

|

$ |

953,822 |

|

|

|

| Non-owner occupied commercial real estate |

1,501,484 |

|

|

1,533,093 |

|

|

1,563,152 |

|

|

1,472,164 |

|

|

1,488,912 |

|

|

|

| Construction/land/land development |

864,011 |

|

|

991,545 |

|

|

1,017,389 |

|

|

1,168,597 |

|

|

1,070,225 |

|

|

|

| Residential real estate - single family |

1,432,129 |

|

|

1,414,013 |

|

|

1,421,027 |

|

|

1,373,532 |

|

|

1,373,696 |

|

|

|

| Multi-family real estate |

425,460 |

|

|

434,317 |

|

|

398,202 |

|

|

359,765 |

|

|

361,239 |

|

|

|

| Total real estate loans |

5,199,031 |

|

|

5,364,639 |

|

|

5,359,620 |

|

|

5,322,682 |

|

|

5,247,894 |

|

|

|

| Commercial and industrial |

2,002,634 |

|

|

2,074,037 |

|

|

2,070,947 |

|

|

2,154,151 |

|

|

2,059,460 |

|

|

|

| MW LOC |

349,081 |

|

|

495,188 |

|

|

506,505 |

|

|

400,995 |

|

|

329,966 |

|

|

|

| Consumer |

22,967 |

|

|

22,926 |

|

|

22,099 |

|

|

22,199 |

|

|

23,624 |

|

|

|

| Total LHFI |

7,573,713 |

|

|

7,956,790 |

|

|

7,959,171 |

|

|

7,900,027 |

|

|

7,660,944 |

|

|

|

| Less: ALCL |

91,060 |

|

|

95,989 |

|

|

100,865 |

|

|

98,375 |

|

|

96,868 |

|

|

|

| LHFI, net |

$ |

7,482,653 |

|

|

$ |

7,860,801 |

|

|

$ |

7,858,306 |

|

|

$ |

7,801,652 |

|

|

$ |

7,564,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets(1) |

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming LHFI |

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate |

$ |

4,974 |

|

|

$ |

2,776 |

|

|

$ |

2,196 |

|

|

$ |

4,474 |

|

|

$ |

786 |

|

|

|

| Construction/land/land development |

18,505 |

|

|

26,291 |

|

|

26,336 |

|

|

383 |

|

|

305 |

|

|

|

Residential real estate(2) |

36,221 |

|

|

14,313 |

|

|

13,493 |

|

|

14,918 |

|

|

13,037 |

|

|

|

| Commercial and industrial |

15,120 |

|

|

20,486 |

|

|

33,608 |

|

|

20,560 |

|

|

15,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer |

182 |

|

|

407 |

|

|

179 |

|

|

104 |

|

|

90 |

|

|

|

| Total nonperforming LHFI |

75,002 |

|

|

64,273 |

|

|

75,812 |

|

|

40,439 |

|

|

30,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other real estate owned/repossessed assets |

3,635 |

|

|

6,043 |

|

|

6,827 |

|

|

3,935 |

|

|

3,929 |

|

|

|

| Total nonperforming assets |

$ |

78,637 |

|

|

$ |

70,316 |

|

|

$ |

82,639 |

|

|

$ |

44,374 |

|

|

$ |

34,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Classified assets |

$ |

122,417 |

|

|

$ |

113,529 |

|

|

$ |

125,081 |

|

|

$ |

88,152 |

|

|

$ |

84,474 |

|

|

|

Past due LHFI(3) |

42,437 |

|

|

38,838 |

|

|

66,276 |

|

|

32,835 |

|

|

26,043 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan credit losses |

|

|

|

|

|

|

|

|

|

|

|

| Balance at beginning of period |

$ |

95,989 |

|

|

$ |

100,865 |

|

|

$ |

98,375 |

|

|

$ |

96,868 |

|

|

$ |

95,177 |

|

|

|

| Provision (benefit) for loan credit losses |

(5,489) |

|

|

4,644 |

|

|

5,436 |

|

|

4,089 |

|

|

3,582 |

|

|

|

| Loans charged off |

2,025 |

|

|

11,226 |

|

|

3,706 |

|

|

6,683 |

|

|

3,803 |

|

|

|

| Loan recoveries |

2,585 |

|

|

1,706 |

|

|

760 |

|

|

4,101 |

|

|

1,912 |

|

|

|

| Net charge-offs (recoveries) |

(560) |

|

|

9,520 |

|

|

2,946 |

|

|

2,582 |

|

|

1,891 |

|

|

|

| Balance at end of period |

$ |

91,060 |

|

|

$ |

95,989 |

|

|

$ |

100,865 |

|

|

$ |

98,375 |

|

|

$ |

96,868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit quality ratios |

|

|

|

|

|

|

|

|

|

|

|

| Total nonperforming assets to total assets |

0.81 |

% |

|

0.71 |

% |

|

0.83 |

% |

|

0.45 |

% |

|

0.35 |

% |

|

|

| Nonperforming LHFI to LHFI |

0.99 |

|

|

0.81 |

|

|

0.95 |

|

|

0.51 |

|

|

0.39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Past due LHFI to LHFI |

0.56 |

|

|

0.49 |

|

|

0.83 |

|

|

0.42 |

|

|

0.34 |

|

|

|

| ALCL to nonperforming LHFI |

121.41 |

|

|

149.35 |

|

|

133.05 |

|

|

243.27 |

|

|

321.66 |

|

|

|

| ALCL to total LHFI |

1.20 |

|

|

1.21 |

|

|

1.27 |

|

|

1.25 |

|

|

1.26 |

|

|

|

ALCL to total LHFI, adjusted(4) |

1.25 |

|

|

1.28 |

|

|

1.34 |

|

|

1.30 |

|

|

1.31 |

|

|

|

| Net charge-offs to total average LHFI (annualized) |

(0.03) |

|

|

0.48 |

|

|

0.15 |

|

|

0.13 |

|

|

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________________

(1)Nonperforming assets consist of nonperforming/nonaccrual loans and property acquired through foreclosures or repossession, as well as bank-owned property not in use and listed for sale.

(2)Includes multi-family real estate.

(3)Past due LHFI are defined as loans 30 days or more past due.

(4)The ALCL to total LHFI, adjusted is calculated by excluding the ALCL for MW LOC loans from the total LHFI ALCL in the numerator and excluding the MW LOC loans from the LHFI in the denominator. Due to their low-risk profile, MW LOC loans require a disproportionately low allocation of the ALCL.

Origin Bancorp, Inc.

Average Balances and Yields/Rates

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

Average Balance |

|

|

|

Yield/Rate |

|

Average Balance |

|

|

|

Yield/Rate |

|

Average Balance |

|

|

|

Yield/Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets |

(Dollars in thousands) |

| Commercial real estate |

$ |

2,499,279 |

|

|

|

|

5.89 |

% |

|

$ |

2,507,566 |

|

|

|

|

5.93 |

% |

|

$ |

2,438,653 |

|

|

|

|

5.79 |

% |

| Construction/land/land development |

936,134 |

|

|

|

|

6.92 |

|

|

1,019,302 |

|

|

|

|

7.37 |

|

|

1,068,243 |

|

|

|

|

7.16 |

|

Residential real estate(1) |

1,847,399 |

|

|

|

|

5.50 |

|

|

1,824,725 |

|

|

|

|

5.56 |

|

|

1,717,976 |

|

|

|

|

5.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial and industrial ("C&I") |

2,028,290 |

|

|

|

|

7.68 |

|

|

2,071,984 |

|

|

|

|

7.96 |

|

|

2,062,418 |

|

|

|

|

7.71 |

|

| MW LOC |

459,716 |

|

|

|

|

7.26 |

|

|

484,680 |

|

|

|

|

7.64 |

|

|

269,195 |

|

|

|

|

7.68 |

|

| Consumer |

23,393 |

|

|

|

|

7.64 |

|

|

22,739 |

|

|

|

|

7.93 |

|

|

24,008 |

|

|

|

|

8.04 |

|

| LHFI |

7,794,211 |

|

|

|

|

6.47 |

|

|

7,930,996 |