| Nevada | 001-36555 | 01-0949984 | ||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

||||||

| Title of each class: | Trading Symbol(s): | Name of each exchange on which registered: | ||||||||||||

| Common Stock | MARA | NASDAQ Capital Market |

||||||||||||

| Exhibit No. | Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 104 | Cover page interactive data file (embedded with the inline XBRL document) | ||||

| MARA HOLDINGS, INC. | ||||||||

Date: November 4, 2025 |

By: | /s/ Zabi Nowaid |

||||||

Zabi Nowaid |

||||||||

| General Counsel and Corporate Secretary | ||||||||

Key Highlights |

Revenues increased

92% to $252.4 million

|

IN Q3 2025 |

from $131.6 million in Q3 2024. |

Net income (loss)

increased to $123.1 million

|

IN Q3 2025 |

from ($124.8) million in Q3 2024. |

Adjusted EBITDA

increased 1,671%

|

$395.6 MILLION |

compared to $22.3 million in Q3 2024. |

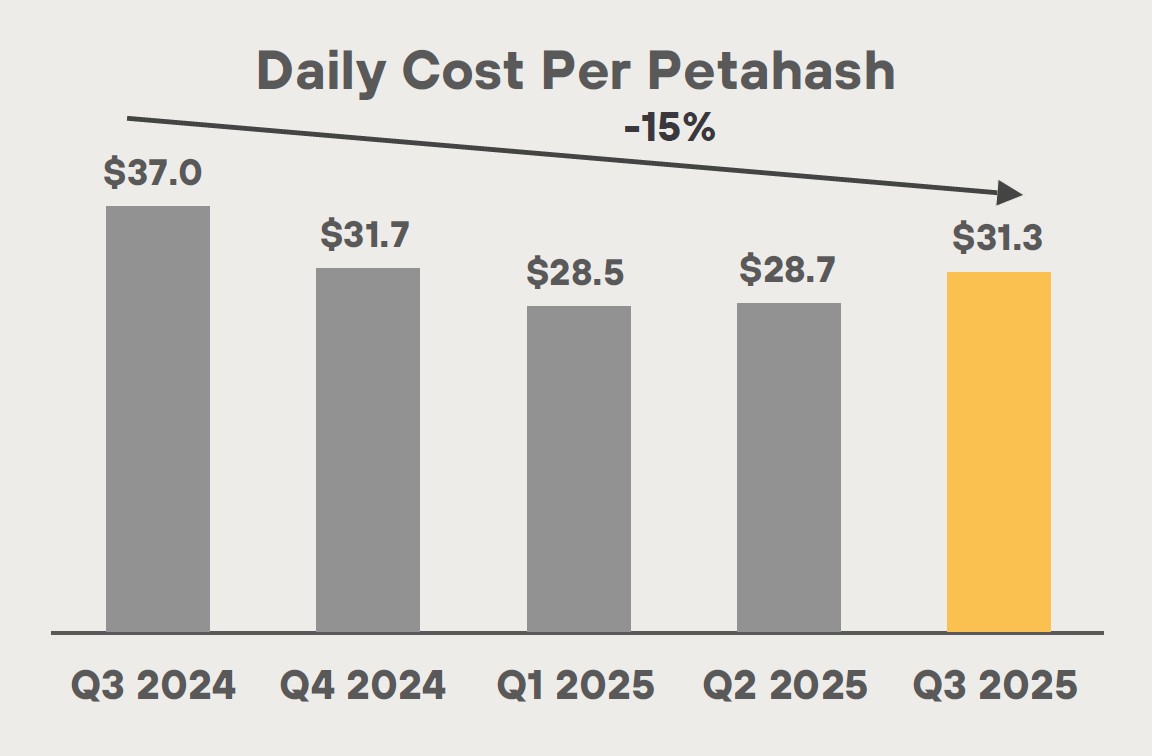

Cost/petahash per

day improved by 15%

|

IN Q3 2025 |

from Q3 2024. |

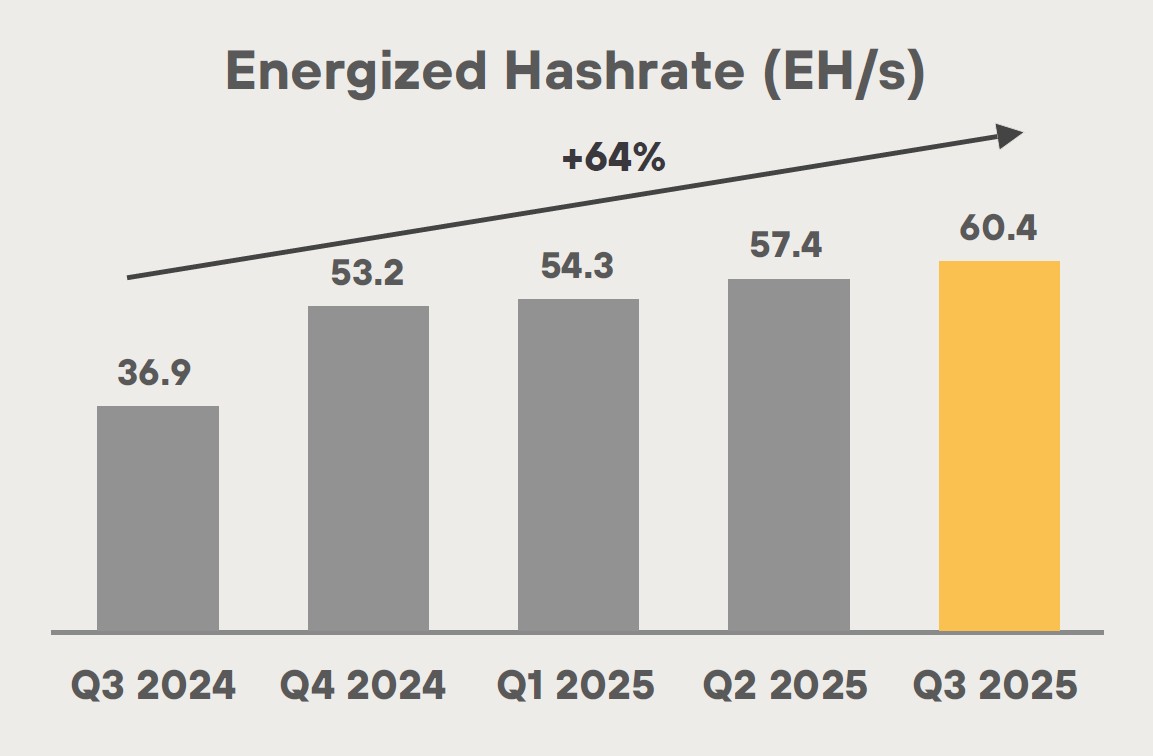

Energized hashrate

("EH/s") increased 64%

|

TO 60.4 EH/S IN Q3 2025 |

from 36.9 EH/s in Q3 2024. |

Bitcoin holdings

increased 98%

|

TO 52,850 BTC (C. $6.0B) |

Including 17,357 BTC loaned, actively managed and pledged as

collateral as of September 30, 2025.

|

Total blocks won

increased 5% to 633

|

IN Q3 2025 |

from 604 in Q3 2024. |

Purchased energy cost per

BTC $39,235

|

IN Q3 2025 |

for our owned sites. |

Cost per kWh: $0.04 |

FOR Q3 2025. |

Mined 2,144 BTC and

purchased 2,257 BTC

|

IN Q3 2025. |

To Our Shareholders |

Third Quarter Financial and Operational Discussion |

Prior Quarter Comparison |

|||

Metric |

Q3 2025 |

Q2 2025 |

% Δ |

Number of Blocks Won |

633 |

694 |

(9)% |

BTC Produced |

2,144 |

2,358 |

(9)% |

Average BTC Produced per Day |

23.3 |

25.9 |

(10)% |

Share of Available Miners Rewards (1) |

5.0% |

5.7% |

N/A |

Energized Hashrate (EH/s) (2) |

60.4 |

57.4 |

5% |

MARA's BTC Holdings | |

Quantity |

|

Bitcoin, unrestricted |

35,493 |

Bitcoin - Receivable |

|

Bitcoin - Loaned |

10,377 |

Bitcoin - Actively Managed |

1,903 |

Bitcoin - Pledged as Collateral |

5,077 |

17,357 |

|

Total |

52,850 |

Earnings Webcast

and Conference Call

|

Twitter |

@MARAHoldings |

LinkedIn |

MARAHoldings |

Facebook |

MARAHoldings |

Instagram |

@MARAHoldingsinc |

Three Months Ended September

30,

|

Nine Months Ended September

30,

|

|||||||

(in thousands, except share and per share data) |

2025 |

2024 |

2025 |

2024 |

||||

Revenues |

$252,410 |

$131,647 |

$704,779 |

$441,984 |

||||

Costs and operating expenses |

||||||||

Purchased energy costs |

43,080 |

26,988 |

128,291 |

59,189 |

||||

Operating and maintenance costs |

26,310 |

9,365 |

68,466 |

40,774 |

||||

Third-party hosting and other energy costs |

75,664 |

63,694 |

212,876 |

187,280 |

||||

General and administrative |

85,296 |

58,744 |

264,109 |

181,142 |

||||

Depreciation and amortization |

167,312 |

101,859 |

486,950 |

290,969 |

||||

Change in fair value of digital assets |

(234,240) |

(30,088) |

(686,105) |

(370,896) |

||||

Change in fair value of derivative instrument |

4,422 |

58,234 |

(42,717) |

35,235 |

||||

Impairment of assets |

— |

— |

26,253 |

— |

||||

Taxes other than on income |

2,354 |

1,957 |

7,886 |

6,022 |

||||

Early termination expenses |

5,000 |

10,304 |

5,000 |

38,061 |

||||

Research and development |

8,716 |

2,813 |

26,560 |

9,124 |

||||

Restructuring costs |

20,905 |

— |

20,905 |

— |

||||

Total costs and operating expenses |

204,819 |

303,870 |

518,474 |

476,900 |

||||

Operating income (loss) |

47,591 |

(172,223) |

186,305 |

(34,916) |

||||

Other income (loss) |

||||||||

Change in fair value of digital assets - receivable, net |

108,859 |

— |

339,339 |

— |

||||

Interest income |

17,689 |

3,894 |

39,315 |

8,775 |

||||

Interest expense |

(12,760) |

(2,342) |

(35,536) |

(4,967) |

||||

Equity in net earnings of unconsolidated affiliate |

(1,711) |

(2,133) |

(2,626) |

(825) |

||||

Other |

1,144 |

(1,146) |

(1,891) |

1,891 |

||||

Total other income (loss) |

113,221 |

(1,727) |

338,601 |

4,874 |

||||

Income (loss) before income taxes |

160,812 |

(173,950) |

524,906 |

(30,042) |

||||

Income tax benefit (expense) |

(37,678) |

49,161 |

(127,010) |

42,767 |

||||

Net income (loss) |

$123,134 |

$(124,789) |

$397,896 |

$12,725 |

||||

Less: net (income) loss attributable to noncontrolling interest |

(6) |

— |

268 |

— |

||||

Net income (loss) attributable to common stockholders |

$123,128 |

$(124,789) |

$398,164 |

$12,725 |

||||

Net income (loss) per share of common stock - basic |

$0.33 |

$(0.42) |

$1.13 |

$0.05 |

||||

Weighted average shares of common stock - basic |

372,073,173 |

294,942,685 |

352,315,857 |

277,643,666 |

||||

Net income (loss) per share of common stock - diluted |

$0.27 |

$(0.42) |

$0.90 |

$0.05 |

||||

Weighted average shares of common stock - diluted |

470,126,290 |

294,942,685 |

450,081,096 |

282,651,034 |

||||

Three Months Ended September

30,

|

Nine Months Ended September

30,

|

|||||||

(in thousands, except share and per share data) |

2025 |

2024 |

2025 |

2024 |

||||

Reconciliation to Adjusted EBITDA: |

||||||||

Net income (loss) attributable to common stockholders |

$123,128 |

$(124,789) |

$398,164 |

$12,725 |

||||

Interest income, net |

(4,929) |

(1,552) |

(3,779) |

(3,808) |

||||

Income tax expense (benefit) |

37,678 |

(49,161) |

127,010 |

(42,767) |

||||

Depreciation and amortization |

170,521 |

104,967 |

496,437 |

300,199 |

||||

EBITDA |

326,398 |

(70,535) |

1,017,832 |

266,349 |

||||

Stock-based compensation expense |

38,466 |

23,340 |

142,237 |

103,585 |

||||

Change in fair value of derivative instrument |

4,422 |

58,234 |

(42,717) |

35,235 |

||||

Impairment of assets |

— |

— |

26,253 |

— |

||||

Restructuring costs |

20,905 |

— |

20,905 |

— |

||||

Acquisition and integration costs |

1,475 |

— |

1,475 |

— |

||||

Net gain from extinguishment of debt |

(1,029) |

— |

(1,029) |

— |

||||

Net (gain) loss on investments |

— |

1,000 |

(12,429) |

(4,236) |

||||

Early termination expenses |

5,000 |

10,304 |

5,000 |

38,061 |

||||

Adjusted EBITDA (1) |

$395,637 |

$22,343 |

$1,157,527 |

$438,994 |

||||

Three Months Ended |

||||||||||

(in thousands, except return on capital employed) |

September

30, 2025

|

June 30, 2025 |

March 31,

2025

|

December 31,

2024

|

September

30, 2024

|

|||||

Reconciliation of last twelve month ("LTM") net income to LTM Adjusted EBITDA (2): | ||||||||||

Net income (loss) attributable to common

stockholders

|

$926,692 |

$678,775 |

$(329,119) |

$541,253 |

$164,551 |

|||||

Interest income, net |

(3,686) |

(309) |

(4,452) |

(3,715) |

(4,068) |

|||||

Income tax expense (benefit) |

245,272 |

158,433 |

(81,728) |

75,495 |

(26,692) |

|||||

Depreciation and amortization |

637,792 |

572,238 |

518,371 |

441,554 |

372,749 |

|||||

EBITDA |

1,806,070 |

1,409,137 |

103,072 |

1,054,587 |

506,540 |

|||||

Stock-based compensation expense |

196,294 |

181,168 |

154,844 |

157,642 |

122,322 |

|||||

Change in fair value of derivative instrument |

(75,909) |

(22,097) |

(40,037) |

2,043 |

35,235 |

|||||

Impairment of assets |

26,253 |

26,253 |

— |

— |

— |

|||||

Restructuring costs |

20,905 |

— |

— |

— |

— |

|||||

Acquisition and integration costs |

1,475 |

— |

— |

— |

— |

|||||

Net gain on investments |

(12,429) |

(11,429) |

(11,429) |

(4,236) |

(4,236) |

|||||

Net gain from extinguishment of debt |

(14,150) |

(13,121) |

(13,121) |

(13,121) |

— |

|||||

Early termination expenses |

5,000 |

10,304 |

15,964 |

38,061 |

38,061 |

|||||

Adjusted EBITDA |

$1,953,509 |

$1,580,215 |

$209,293 |

$1,234,976 |

$697,922 |

|||||

LTM total assets |

$7,530,146 |

$6,136,839 |

$4,985,767 |

$4,113,902 |

$2,911,316 |

|||||

Less: LTM total current liabilities |

340,990 |

241,094 |

155,642 |

81,332 |

65,972 |

|||||

Average capital employed |

$7,189,156 |

$5,895,745 |

$4,830,125 |

$4,032,570 |

$2,845,344 |

|||||

Return on capital employed (1) |

27% |

27% |

4% |

31% |

25% |

|||||

Forward-Looking Statements |