FYFALSE20240001506293P2Y1http://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent360360179386386iso4217:USDxbrli:sharesiso4217:USDxbrli:sharespins:segmentxbrli:pure00015062932024-01-012024-12-3100015062932024-06-280001506293us-gaap:CommonClassAMember2025-01-310001506293us-gaap:CommonClassBMember2025-01-3100015062932024-12-3100015062932023-12-310001506293us-gaap:CommonClassAMember2023-12-310001506293us-gaap:CommonClassAMember2024-12-310001506293us-gaap:CommonClassBMember2024-12-310001506293us-gaap:CommonClassBMember2023-12-3100015062932023-01-012023-12-3100015062932022-01-012022-12-310001506293us-gaap:CommonStockMember2021-12-310001506293us-gaap:AdditionalPaidInCapitalMember2021-12-310001506293us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001506293us-gaap:RetainedEarningsMember2021-12-3100015062932021-12-310001506293us-gaap:CommonStockMember2022-01-012022-12-310001506293us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001506293us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001506293us-gaap:RetainedEarningsMember2022-01-012022-12-310001506293us-gaap:CommonStockMember2022-12-310001506293us-gaap:AdditionalPaidInCapitalMember2022-12-310001506293us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001506293us-gaap:RetainedEarningsMember2022-12-3100015062932022-12-310001506293us-gaap:CommonStockMember2023-01-012023-12-310001506293us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001506293us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001506293us-gaap:RetainedEarningsMember2023-01-012023-12-310001506293us-gaap:CommonStockMember2023-12-310001506293us-gaap:AdditionalPaidInCapitalMember2023-12-310001506293us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001506293us-gaap:RetainedEarningsMember2023-12-310001506293us-gaap:CommonStockMember2024-01-012024-12-310001506293us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001506293us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001506293us-gaap:RetainedEarningsMember2024-01-012024-12-310001506293us-gaap:CommonStockMember2024-12-310001506293us-gaap:AdditionalPaidInCapitalMember2024-12-310001506293us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001506293us-gaap:RetainedEarningsMember2024-12-310001506293us-gaap:RestrictedStockUnitsRSUMemberpins:A2009StockPlanMember2024-01-012024-12-310001506293pins:A2019OmnibusIncentivePlanMembersrt:MinimumMember2024-01-012024-12-310001506293pins:A2019OmnibusIncentivePlanMembersrt:MaximumMember2024-01-012024-12-310001506293us-gaap:ComputerEquipmentMember2024-12-310001506293us-gaap:FurnitureAndFixturesMember2024-12-310001506293us-gaap:LeaseholdImprovementsMember2024-12-310001506293us-gaap:CashMember2024-12-310001506293us-gaap:MoneyMarketFundsMember2024-12-310001506293us-gaap:CommercialPaperMember2024-12-310001506293us-gaap:CorporateBondSecuritiesMember2024-12-310001506293us-gaap:CertificatesOfDepositMember2024-12-310001506293us-gaap:CorporateBondSecuritiesMember2024-12-310001506293us-gaap:USTreasurySecuritiesMember2024-12-310001506293us-gaap:CommercialPaperMember2024-12-310001506293us-gaap:CertificatesOfDepositMember2024-12-310001506293us-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310001506293us-gaap:CashMember2023-12-310001506293us-gaap:MoneyMarketFundsMember2023-12-310001506293us-gaap:CommercialPaperMember2023-12-310001506293us-gaap:CertificatesOfDepositMember2023-12-310001506293us-gaap:CorporateBondSecuritiesMember2023-12-310001506293us-gaap:CorporateBondSecuritiesMember2023-12-310001506293us-gaap:USTreasurySecuritiesMember2023-12-310001506293us-gaap:CommercialPaperMember2023-12-310001506293us-gaap:CertificatesOfDepositMember2023-12-310001506293us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001506293us-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2024-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2024-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2024-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2024-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2024-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2023-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2023-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2023-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2023-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2023-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001506293us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001506293us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310001506293us-gaap:LeaseholdsAndLeaseholdImprovementsMember2024-12-310001506293us-gaap:LeaseholdsAndLeaseholdImprovementsMember2023-12-310001506293us-gaap:FurnitureAndFixturesMember2023-12-310001506293us-gaap:ComputerEquipmentMember2023-12-310001506293pins:DepreciablePropertyPlantAndEquipmentMember2024-12-310001506293pins:DepreciablePropertyPlantAndEquipmentMember2023-12-310001506293us-gaap:ConstructionInProgressMember2024-12-310001506293us-gaap:ConstructionInProgressMember2023-12-310001506293pins:AcquiredTechnologyPatentsAndOtherIntangiblesMember2024-12-310001506293us-gaap:TechnologyBasedIntangibleAssetsMember2024-12-310001506293pins:AcquiredTechnologyPatentsAndOtherIntangiblesMember2023-12-310001506293us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-3100015062932021-04-300001506293us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2018-11-300001506293us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-012022-10-310001506293us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-310001506293pins:CreditAgreementAmendedAndRestatedMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-310001506293us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-310001506293pins:CreditAgreementAmendedAndRestatedMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-310001506293us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2022-10-012022-10-310001506293us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2022-10-012022-10-310001506293us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2022-10-012022-10-310001506293us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001506293us-gaap:EmployeeStockOptionMemberpins:A2009StockPlanMember2024-01-012024-12-310001506293pins:A2009StockPlanMember2024-12-310001506293us-gaap:EmployeeStockOptionMemberpins:A2019OmnibusIncentivePlanMember2024-01-012024-12-310001506293pins:A2019OmnibusIncentivePlanMemberus-gaap:CommonClassAMember2024-12-310001506293pins:A2019OmnibusIncentivePlanMember2024-01-012024-12-310001506293pins:RestrictedStockUnitsRSUsAndRestrictedStockAwardsRSAsMember2023-12-310001506293pins:RestrictedStockUnitsRSUsAndRestrictedStockAwardsRSAsMember2024-01-012024-12-310001506293pins:RestrictedStockUnitsRSUsAndRestrictedStockAwardsRSAsMember2024-12-310001506293us-gaap:CostOfSalesMember2024-01-012024-12-310001506293us-gaap:CostOfSalesMember2023-01-012023-12-310001506293us-gaap:CostOfSalesMember2022-01-012022-12-310001506293us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001506293us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001506293us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001506293us-gaap:SellingAndMarketingExpenseMember2024-01-012024-12-310001506293us-gaap:SellingAndMarketingExpenseMember2023-01-012023-12-310001506293us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001506293us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001506293us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001506293us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001506293us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001506293pins:StockRepurchaseProgramFebruary2023Member2023-02-020001506293pins:StockRepurchaseProgramFebruary2023Member2023-02-022023-02-020001506293pins:StockRepurchaseProgramSeptember2023Member2023-09-160001506293pins:StockRepurchaseProgramSeptember2023Member2023-09-162023-09-160001506293pins:StockRepurchaseProgramNovember2024Member2024-11-050001506293pins:StockRepurchaseProgramSeptember2023Member2024-11-300001506293pins:StockRepurchaseProgramNovember2024Member2024-01-012024-12-310001506293pins:StockRepurchaseProgramNovember2024Member2024-12-310001506293us-gaap:CommonClassAMember2024-01-012024-12-310001506293us-gaap:CommonClassBMember2024-01-012024-12-310001506293us-gaap:CommonClassAMember2023-01-012023-12-310001506293us-gaap:CommonClassBMember2023-01-012023-12-310001506293us-gaap:CommonClassAMember2022-01-012022-12-310001506293us-gaap:CommonClassBMember2022-01-012022-12-310001506293us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001506293us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001506293us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001506293pins:RestrictedStockUnitsRSUsAndRestrictedStockAwardsRSAsMember2024-01-012024-12-310001506293pins:RestrictedStockUnitsRSUsAndRestrictedStockAwardsRSAsMember2023-01-012023-12-310001506293pins:RestrictedStockUnitsRSUsAndRestrictedStockAwardsRSAsMember2022-01-012022-12-310001506293us-gaap:DomesticCountryMember2024-01-012024-12-310001506293us-gaap:DomesticCountryMember2024-12-310001506293us-gaap:StateAndLocalJurisdictionMemberus-gaap:CaliforniaFranchiseTaxBoardMember2024-12-310001506293us-gaap:StateAndLocalJurisdictionMemberpins:StateTaxAuthoritiesExcludingCaliforniaMember2024-12-310001506293country:IEus-gaap:ForeignCountryMember2024-12-310001506293pins:OtherForeignMemberus-gaap:ForeignCountryMember2024-12-310001506293us-gaap:ResearchMemberus-gaap:DomesticCountryMember2024-12-310001506293us-gaap:ResearchMemberus-gaap:StateAndLocalJurisdictionMemberus-gaap:CaliforniaFranchiseTaxBoardMember2024-12-310001506293us-gaap:ResearchMemberus-gaap:ForeignCountryMemberus-gaap:CaliforniaFranchiseTaxBoardMember2024-12-310001506293pins:UnitedStatesAndCanadaMember2024-01-012024-12-310001506293pins:UnitedStatesAndCanadaMember2023-01-012023-12-310001506293pins:UnitedStatesAndCanadaMember2022-01-012022-12-310001506293srt:EuropeMember2024-01-012024-12-310001506293srt:EuropeMember2023-01-012023-12-310001506293srt:EuropeMember2022-01-012022-12-310001506293pins:RestOfWorldMember2024-01-012024-12-310001506293pins:RestOfWorldMember2023-01-012023-12-310001506293pins:RestOfWorldMember2022-01-012022-12-310001506293country:US2024-01-012024-12-310001506293country:US2023-01-012023-12-310001506293country:US2022-01-012022-12-310001506293country:US2024-12-310001506293country:US2023-12-310001506293country:IE2024-12-310001506293country:IE2023-12-310001506293country:MX2024-12-310001506293country:MX2023-12-310001506293us-gaap:NonUsMember2024-12-310001506293us-gaap:NonUsMember2023-12-3100015062932024-10-012024-12-310001506293pins:AndreaAcostaMember2024-01-012024-12-310001506293pins:AndreaAcostaMember2024-10-012024-12-310001506293pins:AndreaAcostaTradingArrangementClassACommonStockMemberpins:AndreaAcostaMember2024-12-310001506293pins:AndreaAcostaTradingArrangementRSUsMemberpins:AndreaAcostaMember2024-12-310001506293pins:JuliaBrauDonnellyMember2024-10-012024-12-310001506293pins:JuliaBrauDonnellyMember2024-01-012024-12-310001506293pins:JuliaBrauDonnellyMember2024-12-310001506293pins:MatthewMadrigalMember2024-01-012024-12-310001506293pins:MatthewMadrigalMember2024-10-012024-12-310001506293pins:MatthewMadrigalTradingArrangementClassACommonStockMemberpins:MatthewMadrigalMember2024-12-310001506293pins:MatthewMadrigalTradingArrangementRSUsMemberpins:MatthewMadrigalMember2024-12-310001506293pins:BenjaminSilbermannMember2024-10-012024-12-310001506293pins:BenjaminSilbermannMember2024-01-012024-12-310001506293pins:BenjaminSilbermannMember2024-12-310001506293pins:SFTCLLCMember2024-01-012024-12-310001506293pins:SFTCLLCMember2024-10-012024-12-310001506293pins:SFTCLLCMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_________________

FORM 10-K

_________________

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from to

Commission file number 001-38872

Pinterest, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

| Delaware |

26-3607129 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

| 651 Brannan Street |

|

San Francisco, California |

94107 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(415) 762-7100

Registrant’s Telephone Number, Including Area Code

_______________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Class A Common Stock, $0.00001 par value |

PINS |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of a share of the registrant’s common stock on June 28, 2024 as reported by the New York Stock Exchange on such date was approximately $23.1 billion.

As of January 31, 2025, there were 595,091,038 shares of the registrant’s Class A common stock, $.00001 par value per share, outstanding, and 83,146,379 shares of the registrant’s Class B common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement for the 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2024.

Pinterest, Inc.

Table of contents

Note about forward-looking statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which statements involve substantial risk and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and are often characterized by the use of words such as “believe,” “estimate,” “expect,” “may,” “will,” “can,” “could” “would,” “might,” “continue” “intend,” “plan,” “forecast” “strategy” “projection” “goal” “trends” “project” “target” “anticipate,” “potential” or similar expressions, or by discussions of strategy, plans or intentions. Such forward-looking statements involve known and unknown risks, uncertainties, assumptions and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from historical results or any future results, performance or achievements expressed, suggested or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, statements about:

•general economic uncertainty in global markets and a worsening of global economic conditions or low levels of economic growth, including inflation, tariffs, stress in the banking industry, foreign exchange fluctuations and supply-chain issues;

•the effect of general economic and political conditions;

•our financial performance, including revenue, cost and expenses and cash flows;

•our ability to attract, retain and recover users and maintain and grow their level of engagement;

•our ability to provide content that is useful and relevant to users’ personal taste and interests;

•our ability to develop successful new products or improve existing ones;

•our ability to maintain and enhance our brand and reputation;

•potential harm caused by compromises in security, including our cybersecurity protections and resources and costs required to prevent, detect and remediate potential security breaches;

•potential harm caused by changes in online application stores or internet search engines’ methodologies, particularly search engine optimization methodologies and policies;

•discontinuation, disruptions or outages in third-party single sign-on access;

•our ability to compete effectively in our industry;

•our ability to scale our business, including our monetization efforts;

•our ability to attract and retain advertisers and scale our revenue model;

•our ability to attract and retain creators and publishers that create relevant and engaging content;

•our ability to develop effective products and tools for advertisers, including measurement tools;

•our ability to expand and monetize our platform internationally;

•our ability to effectively manage the growth of our business;

•our ability to continue to use and develop artificial intelligence (“AI”) as well as managing the challenges and risks posed by AI;

•our ability to successfully manage our flexible work model with a more distributed workforce;

•our ability to sustain profitability;

•decisions that reduce short-term revenue or profitability or do not produce the long-term benefits we expect;

•fluctuations in our operating results;

•our ability to raise additional capital on favorable terms or at all;

•our ability to realize anticipated benefits from mergers and acquisitions, joint ventures, strategic partnerships and other investments;

•our ability to protect our intellectual property;

•our ability to receive, process, store, use and share data, and compliance with laws and regulations related to data privacy and content;

Note about forward-looking statements

•current or potential litigation and regulatory actions involving us;

•our ability to comply with modified or new laws and regulations applying to our business, and potential harm to our business as a result of those laws and regulations;

•real or perceived inaccuracies in metrics related to our business;

•disruption of, degradation in or interference with our use of Amazon Web Services ("AWS") and our infrastructure; and

•our ability to attract and retain personnel.

These statements are based on our historical performance and on our current plans, estimates and projections in light of information currently available to us, and therefore you should not place undue reliance on them. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Forward-looking statements made in this Annual Report on Form 10-K speak only as of the date on which such statements are made, and we undertake no obligation to update them in light of new information or future events, except as required by law.

You should carefully consider the above factors, as well as the factors discussed elsewhere in this Annual Report on Form 10-K. The factors identified above should not be construed as an exhaustive list of factors that could affect our future results and should be read in conjunction with the other cautionary statements that are included in this Annual Report. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. If any of these trends, risks or uncertainties actually occurs or continues, our business, revenue and financial results could be harmed, the trading price of our Class A common stock could decline and you could lose all or part of your investment.

Unless expressly indicated or the context requires otherwise, the terms "Pinterest," "company," "we," "us," and "our" in this document refer to Pinterest, Inc., a Delaware corporation, and, where appropriate, its wholly owned subsidiaries. The term "Pinterest" may also refer to our products, regardless of the manner in which they are accessed. For references to accessing Pinterest on the "web" or via a "website," such terms refer to accessing Pinterest on personal computers. For references to accessing Pinterest on "mobile," such term refers to accessing Pinterest via a mobile application or via a mobile-optimized version of our website such as m.pinterest.com, whether on a mobile phone or tablet.

Summary of risk factors

The following summarizes the principal factors that make an investment in our company speculative or risky, all of which are more fully described in the Risk Factors section below. This summary should be read in conjunction with the Risk Factors section and should not be relied upon as an exhaustive summary of the material risks facing our business. The following factors could result in harm to our business, reputation, revenue, financial results, and prospects, among other impacts:

Business Strategy and Growth. Our strategic decisions and efforts to expand the business, including:

•our ability to scale our business for future growth;

•our ability to attract, grow, retain, recover, and engage our user base;

•our dependence on advertising for substantially all of our revenue;

•providing content that is useful and relevant to users’ personal taste and interests;

•decisions consistent with our mission and values that may reduce our short- or medium-term operating results;

•removing objectionable content or blocking objectionable practices by advertisers or third parties;

•our ability to compete effectively for users, creators, publishers or advertisers;

•our ability to develop effective products and tools for advertisers;

•our further expansion and monetization of our platform internationally;

•effective management of our business growth;

•our acquisition of other businesses;

•our development of or investment in successful new products or improvements to existing one;

•our dependence on and ability to maintain and enhance a strong brand and reputation; and

•the attraction, retention, and loss of our key personnel and other highly qualified personnel.

Data, Security and Privacy.

•actual or perceived compromises in our security;

Note about forward-looking statements

•the data, including personal information, we receive, process, store, use, and share, which subjects us to complex and evolving governmental regulation and other legal obligations related to data privacy, data protection and other matters; and

•the development of tools to accurately measure the effectiveness of advertisements on our platform and thereby attract and maintain advertisers.

Operation of Our Business. The manner in which we operate our business, including:

•the inherent challenges of measurements related to user metrics and other estimates; and

•our ability to maintain and scale our technology infrastructure, including the speed and availability of our service.

Third-Party Reliance. Our use and dependence on third-party businesses and products, or the impacts of third-party business and products, including:

•our dependence on online application stores and internet search engines, including their methodologies, policies, and results, to direct traffic and refer new users to our service;

•users’ ability to authenticate with our service through third-party login providers;

•our dependence on AWS for the vast majority of our compute, storage, data transfer, and other services;

•effectively operating with mobile operating systems, web browsers, networks, regulations, and standards, which we do not control, and changes in our products or to those mobile operating systems, web browsers, networks, regulations or standards;

•our reliance on software, technologies, and related services from other parties; and

•technologies that can block the display of our ads.

Legal and Regulatory Matters. The legal and regulatory frameworks, actions, and requirements to which our business, products, services, and operations are subject, including:

•any liability as a result of content or information that is published or made available on our service;

•government action to restrict access to our service or certain of our products in their countries;

•our involvement in any legal disputes or other disputes that are expensive to support and may be resolved adversely;

•an ability to protect our intellectual property and our use of “open source” software; and

•the interpretation and application of U.S. and non-U.S. tax legislation or other changes in U.S. or non-U.S. taxation of our operations.

Financial Statements and Performance. The preparation of our financial statements and our financial and operating performance, including:

•our limited operating history and previously incurred operating losses, anticipated increases to operating costs and expenses and our ability to obtain or maintain profitability;

•fluctuations in our operating results from quarter to quarter;

•our ability to obtain additional financing, if needed and any default on our credit obligations;

•greater than anticipated tax liabilities;

•limitations in our ability to use or benefit from our net operating loss carryforwards and certain other tax attributes;

•the requirements of being a public company; and

•adverse global economic and financial conditions.

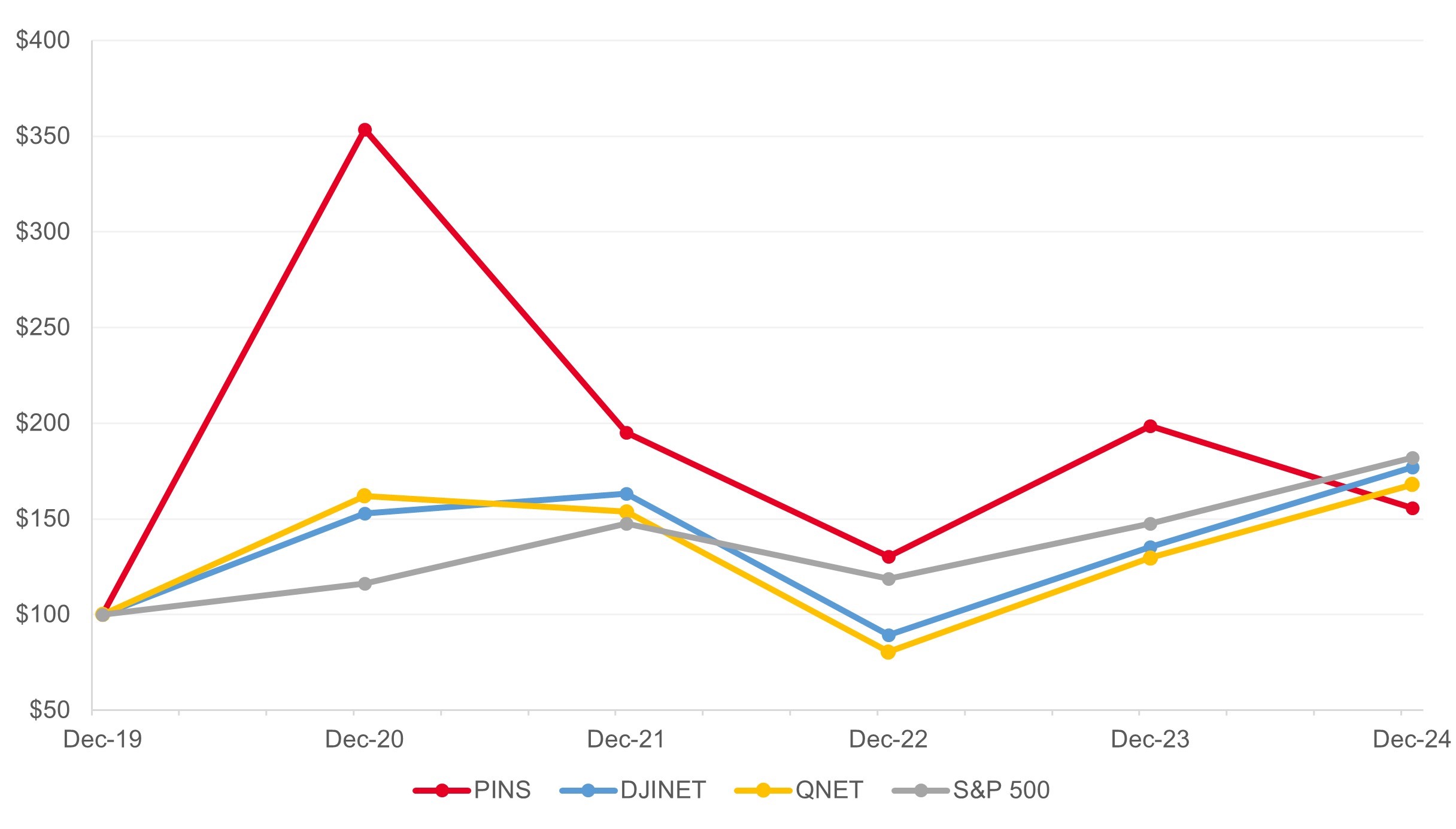

Our Common Stock. The rights, restrictions, and structure of, and actions that we may take that impact, our common stock, including:

•the dual class structure of our common stock;

•trading price volatility of our Class A common stock;

•future offerings of debt or equity securities by us or existing stockholders that could adversely impact the market price of our Class A common stock;

•additional stock issuances, including in connection with settlement of equity awards, and any resulting dilution;

•provisions under Delaware law and our governing documents that could make a merger, tender offer, or proxy contest difficult; and

•our certificate of incorporation’s designation of a state or federal court located within Delaware as the exclusive forum for substantially all disputes between us and our stockholders.

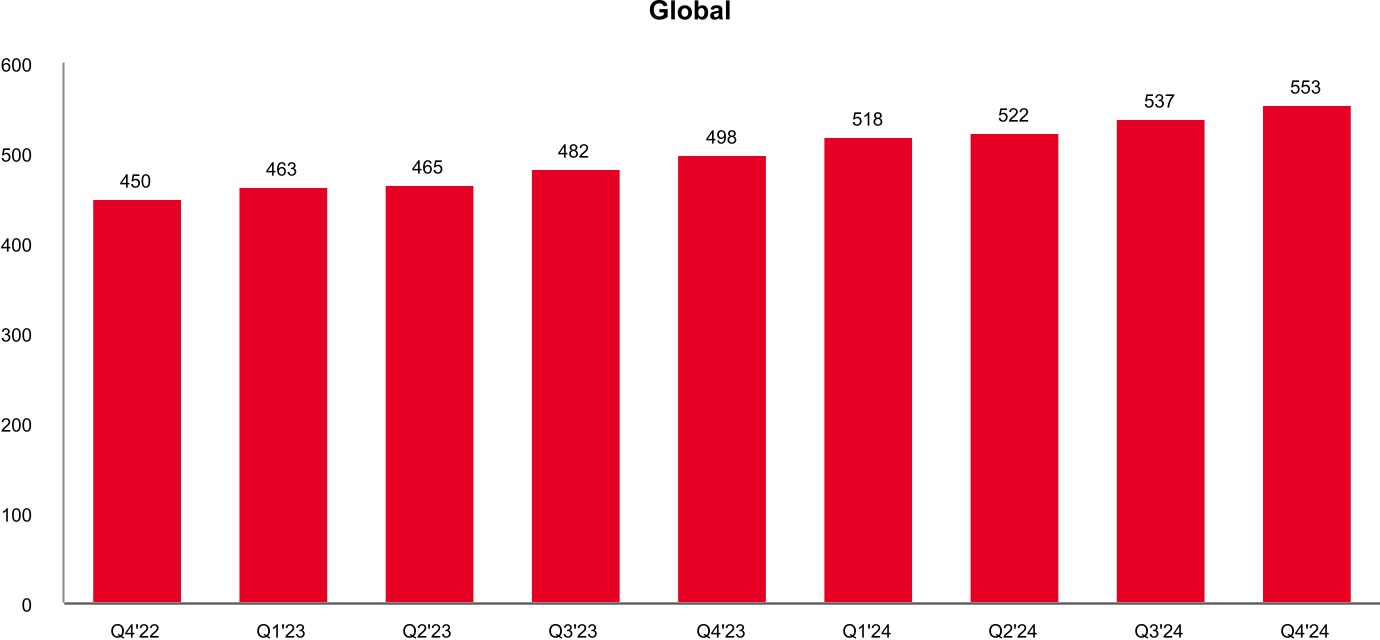

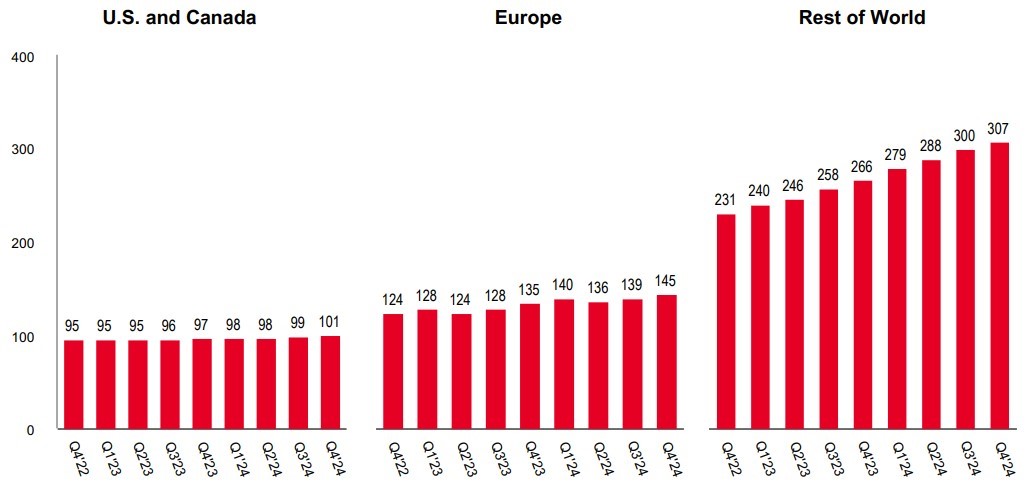

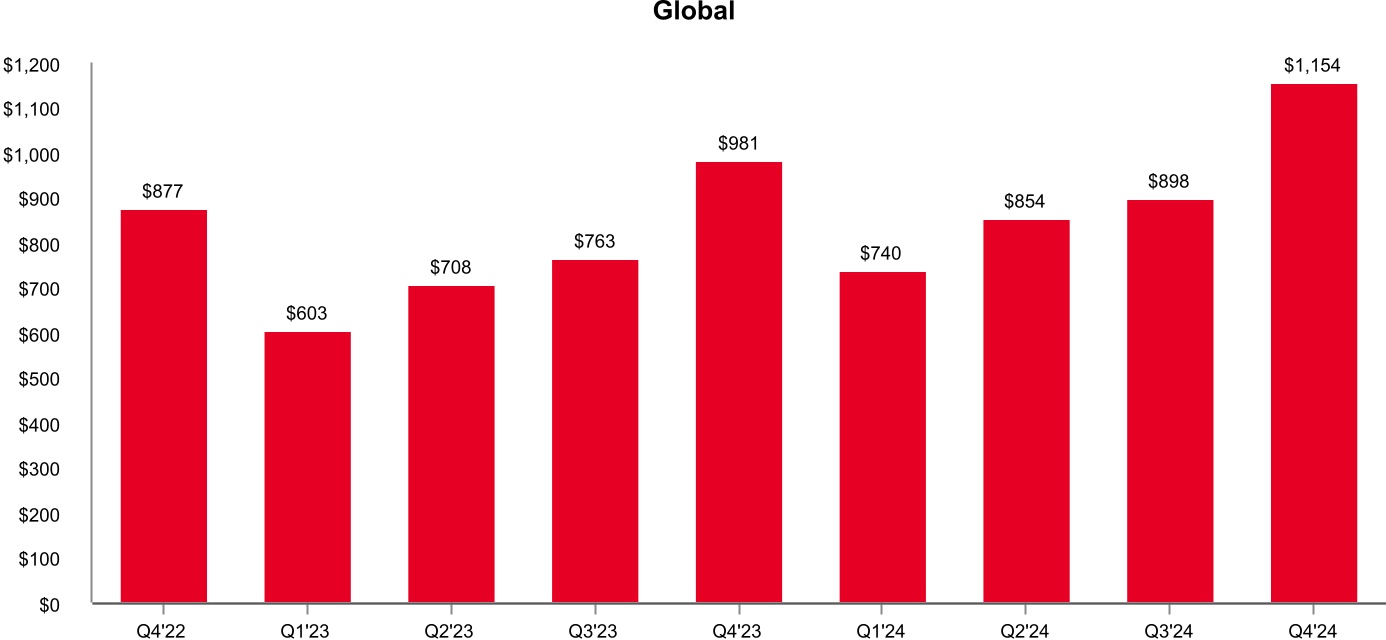

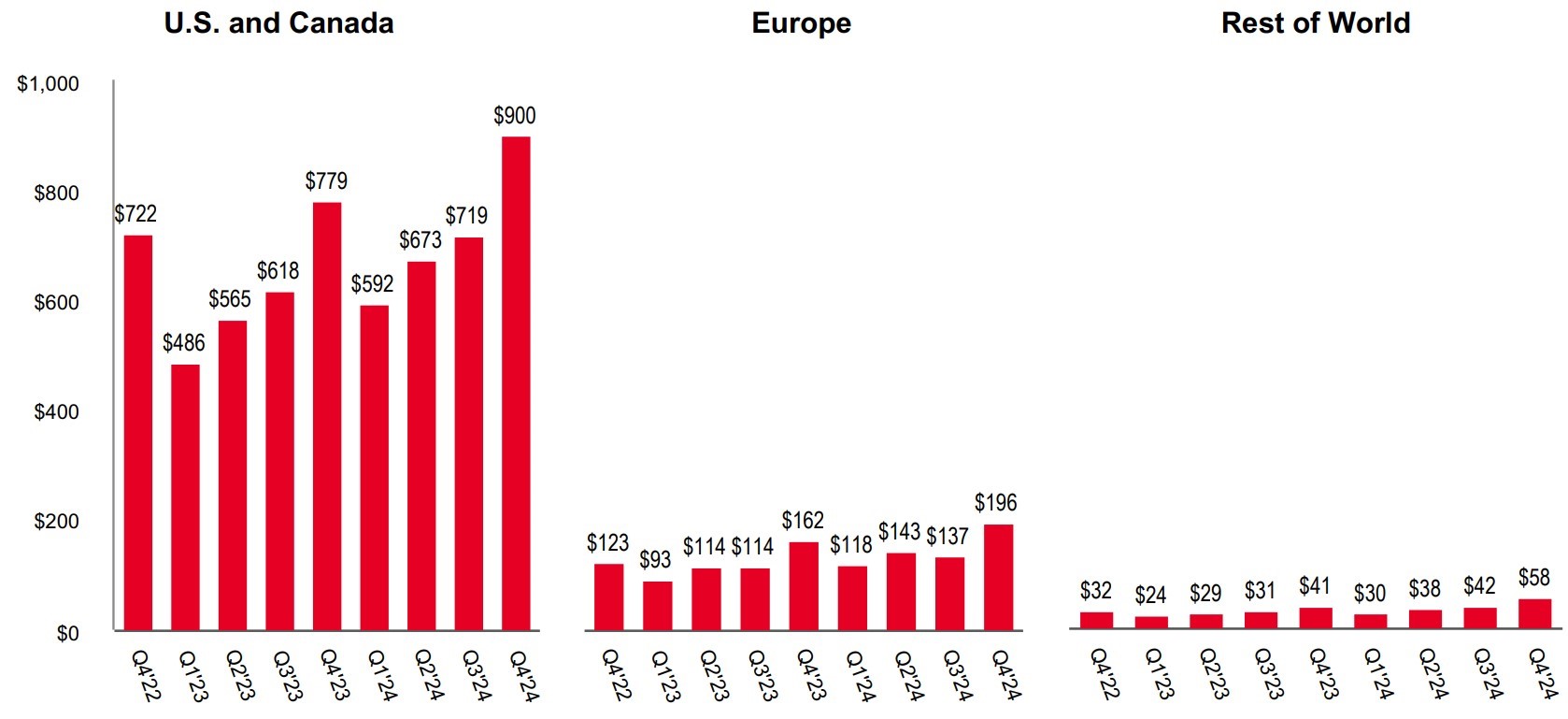

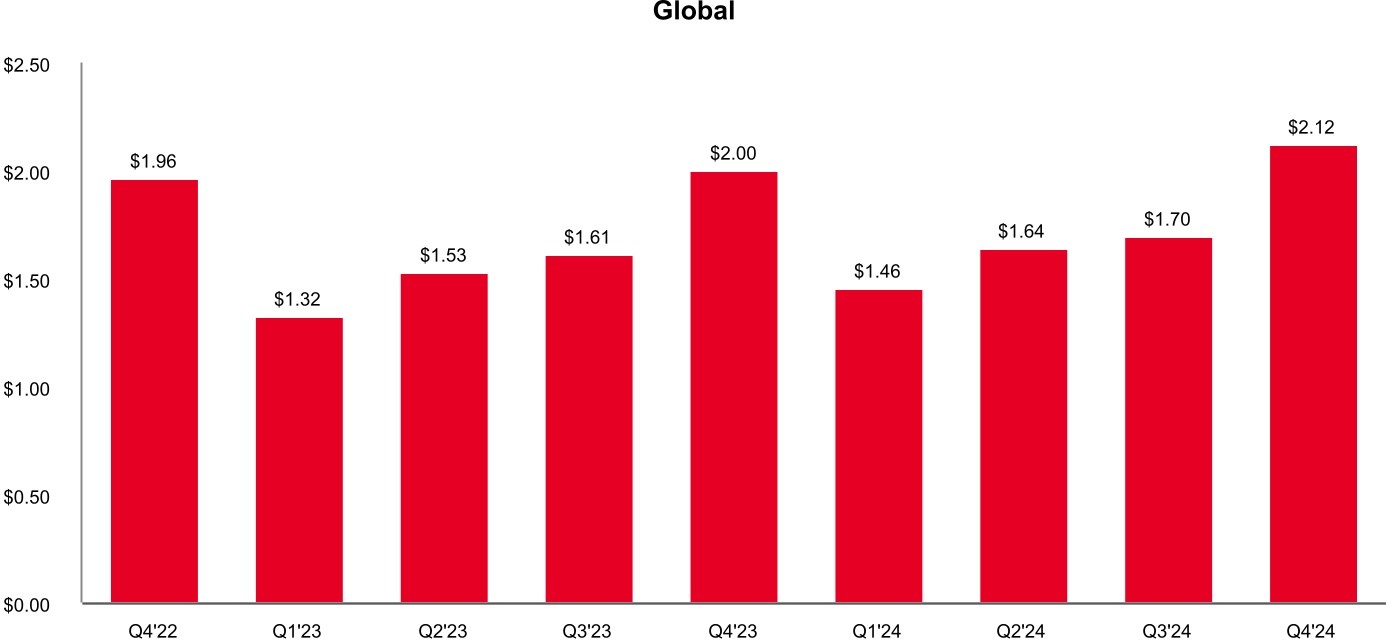

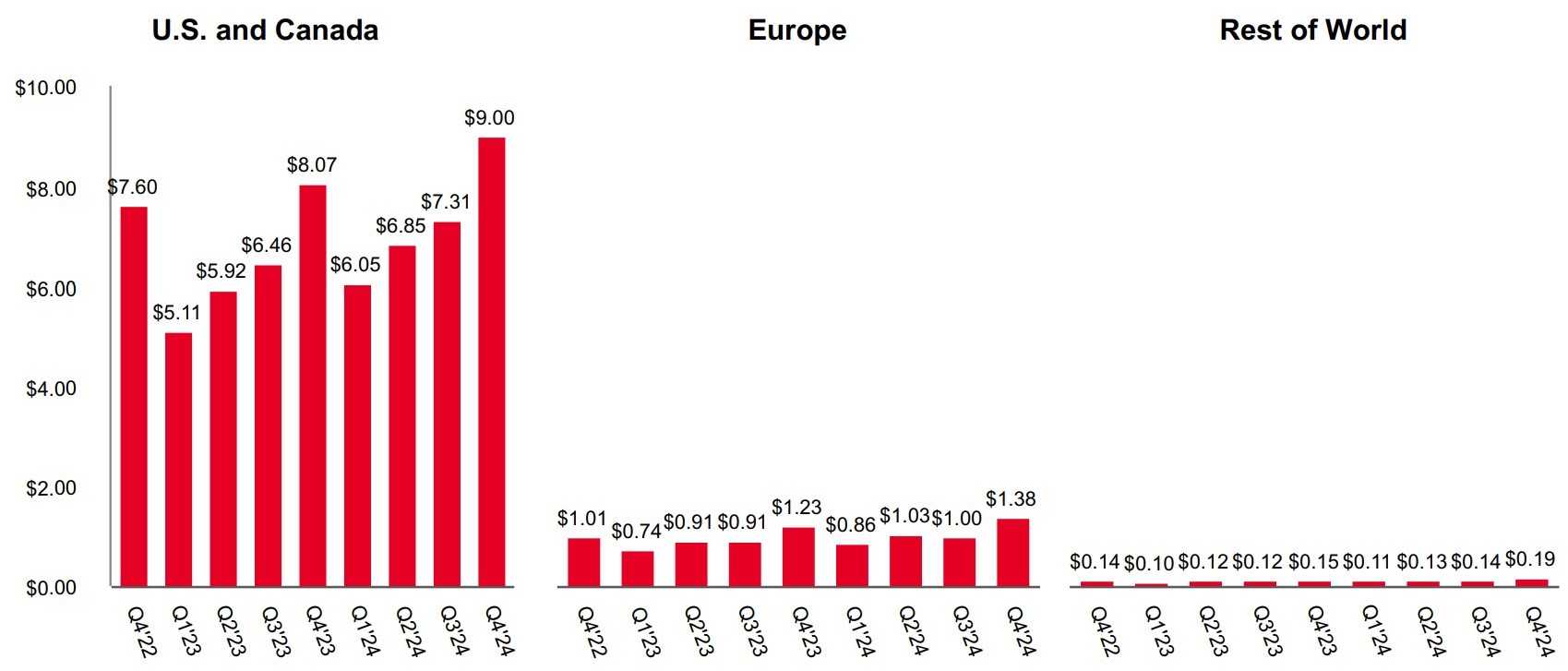

Limitations of key metrics and other data

The numbers for our key metrics, which include our monthly active users ("MAUs") and average revenue per user ("ARPU"), are calculated using internal company data based on the activity of user accounts. We define an MAU as an authenticated Pinterest user who visits our website, opens our mobile application or interacts with Pinterest through one of our browser or site extensions, such as the Save button, at least once during the 30-day period ending on the date of measurement. The number of MAUs does not include Shuffles users unless they would otherwise qualify as MAUs. Unless otherwise indicated, we present MAUs based on the number of MAUs measured on the last day of the current period. We measure monetization of our platform through our ARPU metric. We define ARPU as our total revenue in a given geography during a period divided by the average of the number of MAUs in that geography during the period. We calculate average MAUs based on the average of the number of MAUs measured on the last day of the current period and the last day prior to the beginning of the current period. We calculate ARPU by geography based on our estimate of the geography in which revenue-generating activities occur. We use these metrics to assess the growth and health of the overall business and believe that MAUs and ARPU best reflect our ability to attract, retain, engage and monetize our users, and thereby drive revenue. While these numbers are based on what we believe to be reasonable estimates of our user base for the applicable period of measurement, there are inherent challenges in measuring usage of our products across large online and mobile populations around the world. In addition, we are continually seeking to improve our estimates of our user base, and such estimates may change due to improvements or changes in technology or our methodology.

Part I

Item 1. Business

Overview

Pinterest is a visual search and discovery platform, positioned at the intersection of search, social, and commerce. We offer a unique and differentiated experience that enables people to go from inspiration to action all on one consumer internet property. Pinterest can be accessed through our mobile application or the web.

People use Pinterest to find useful, relevant ideas—and then bring them to life. People don’t always have the words to describe what they’re looking for, but often know it when they see it. As they browse Pinterest content (called “Pins”), they fine-tune their tastes and find the perfect idea. Users interact with the platform in dynamic multi-session journeys to find inspiration, curate their latest look, plan their next project and shop from great brands. This happens at a massive scale, with billions of searches and saves per month.

The unique, first party, intent-based signal we receive from user actions on Pinterest helps power the AI based recommendation systems that we use to surface relevant and engaging content to our users.

AI also plays a central role in how we drive value for our advertisers, who come to Pinterest to reach our users with high commercial intent. The inspiration-to-action journey on Pinterest aligns with the advertiser marketing funnel, allowing us to help brands reach customers at every stage, from discovery to purchase, through digital ads.

We believe users and advertisers intentionally choose Pinterest because of our efforts to create a positive and more brand safe environment. As a result, we make deliberate decisions through our policies and product development and aim to deliver on that experience, creating value for advertisers who can showcase their product and services in an inspiring and positive environment.

Our Users and Our Platform

553 million monthly active users from around the world come to Pinterest to find new ideas, curate and refine their tastes, and turn those ideas into reality. Our platform particularly resonates with women, who comprise roughly two-thirds of our total user base. In addition, our platform also resonates with the younger generation, as Gen Z users represent over 40% of our user base. Geographically, we have a diverse user set, representing over 100 countries globally.

Content on Pinterest comes from a variety of sources, including retailers, brands, creators, publishers and users. We acquire that content via a wide range of methods including product catalog uploads, direct publishing, and user curation. Content formats include images that allow you to click into an idea to learn more, videos that provide the steps of an idea, collages that allow users to piece together different images into one, and products that brands and merchants upload from catalogs.

On Pinterest, users interact with several surfaces, each of which offers distinct functionalities and experiences. Users often move between these surfaces various times in a single session and across multiple sessions. Saving content and creating boards and collages are highly unique and beneficial to our ecosystem, as we utilize the signals from the curation to help serve users even more relevant content recommendations.

Home Feed: When users open the Pinterest mobile application or navigate to www.pinterest.com, they are by default in their Home Feed, where they can discover Pins relevant to their tastes and interests in a scrolling format. As users interact with more content - through searching, saving and curating - their Home Feed is designed to become even more representative of their interests.

Search Page: On the Search surface, users find Pins they are looking for by typing a query in the search bar. The search functionality allows users to see many relevant possibilities that are personalized for their individual taste and interests. Users often come to Pinterest with a vague idea of what they’re looking for and use our visual search functionality to narrow their focus. As such, over 90% of our searches are unbranded.

Related Pins: Visual discovery on Pinterest also happens when a user taps on a Pin to learn more about an idea or image, and a feed of visually similar Pins is served beneath the tapped image. These related Pins help users

springboard off a point of inspiration to explore deeper into an interest or narrow in on the perfect product. Our related pins surface is powered by our recommendation models that use computer vision designed to identify products in the Pin and show other relevant organic or ads content that the user might find valuable to their inspiration to action journey.

Boards: Users save and organize Pins onto virtual “boards.” Boards often are labeled with topical categories like “Hawaiian vacation,” “spring outfits” or “living room furniture” and are a collection of Pins that help users organize the vast amount of visual content that they interact with on the platform.

How we monetize the inspiration to action journey:

Our Flywheel

Our users often come to the platform to get inspiration for many of life’s moments, which can lead to discovering new products and brands. As a result, commercial content from brands, retailers and advertisers is central to Pinterest. We believe that in-market consumers on Pinterest tend to be early in their journey toward a purchase decision and do not yet know exactly what they want to purchase. Accordingly, we believe that they are open to discovering new products and brands on Pinterest rather than merely navigating to brands they already know, as is common on traditional search engines and e-commerce platforms. This creates a unique flywheel where relevant ads can not only enhance the user experience but also drive more value for advertisers in the form of increased views, clicks and conversions.

Our Advertising System

Ad Formats

We have a number of advertising products to help advertisers meet users across the full funnel, from upper funnel brand advertising to lower funnel performance advertising. Many of our ad formats can be leveraged by advertisers across upper and lower funnel objectives. Additionally, many of these formats are enabled with mobile deep links and/or direct link capabilities for a seamless, one-click handoff from an ad to the advertiser’s mobile app or webpage.

•Standard ad: A static image used to showcase content in a simple vertical image format.

•Video ad: Used by advertisers to capture attention and tell a story with a visually engaging format.

•Shopping ad: Used by advertisers who wish to promote specific products in their catalogs to reach users who are deciding what to buy.

•Carousel ad: Multiple static images or videos in one carousel, used by advertisers to showcase more than one image or video at a time.

•Collection ad: Used by advertisers to display products in action with a hybrid format that mixes lifestyle imagery and video with featured products.

•Interactive ad: Used by advertisers to engage with their users through interactive formats.

•Premier Spotlight ad: Used by advertisers to showcase their latest product launch or seasonal moments with exclusive placements on the Pinterest Home Feed and search page.

Ad Auction

The vast majority of our advertisers buy ads through an auction-based system. Our ad auction allows us to serve ads to users at relevant moments while optimizing business outcomes for advertisers.

We offer ads across both the upper and lower funnel. Upper funnel “brand” revenue is billed when an advertiser optimizes an ad campaign around “brand” objectives like impressions ("CPM") or video views ("CPV"). Lower funnel revenue is billed when an advertiser optimizes an ad campaign around “performance” objectives like clicks ("CPC"), actions (“CPA”) or conversion events ("oCPM"), such as a checkout or add-to-cart.

Our auction system selects the best ad for each available ad impression, based on the likelihood of a desired action occurring and how much that action is worth to advertisers. The likelihood of the action occurring depends on a variety of factors, such as ad relevance and creative quality.

Campaign Management

For most campaigns, advertisers can manage set up, track results and improve performance over time through our Ads Manager or the Pinterest API. To help maximize performance, advertisers can target specific groups of users based on interests, demographics and search keywords. We continue to invest in AI to automate campaign set up and performance optimization for our advertisers.

Measurement

Measuring the effectiveness of digital ad spend is a high priority for our advertisers. Our first-party measurement solutions, including our Conversions API and clean rooms, are designed to help advertisers recognize the value of an investment on our platform across a variety of objectives. We also have tools to help advertisers understand our contribution and drivers to conversion, and incremental impact. Advertisers can leverage our leading third-party measurement partners to validate Pinterest’s performance individually and across channels. Additionally, our Conversions API is integrated with other third-party partners to help increase adoption of our measurement tools.

Sales and Marketing

Our go-to-market approach

The Pinterest platform enables a diverse group of advertisers to achieve a wide range of objectives, from building awareness to driving consideration and delivering conversions. We have advertisers across multiple verticals including retail, consumer packaged goods, travel, financial services, and auto. We serve these advertisers in customized ways depending on their size, sophistication and objectives across the full funnel. The majority of our advertisers utilize our Ads Manager platform to initiate and manage their campaigns. We also have a global sales force presence who work directly with advertisers and ad agencies to provide additional support through the campaign management cycle. In some geographies, we work with other third parties to support our sales efforts.

Marketing

We grow our global user base organically through the strength of our global brand, the utility of our service and unpaid traffic from search engines. In addition, we use paid marketing to grow and retain our user base, build brand awareness and attract advertisers through business marketing and scaled education tools for optimizing campaigns on our platform.

Our technology innovation

We believe we have one of the largest image-rich data sets ever assembled. Using our proprietary AI technology and computer vision, we can leverage our data sets to analyze trends, understand intent and predict consumer behavior at a massive scale to help serve personalized and relevant recommendations for users and improved ads delivery for our customers. We aim to continue innovating on our industry-leading work across AI to deepen our foothold in visual search and discovery.

Our competition

We primarily compete with consumer internet companies that are either tools (search, ecommerce) or media (newsfeeds, video, social networks), particularly ones focused on advertising. Competitors such as Amazon, Meta (including Facebook and Instagram), Google (including YouTube), Snap, Reddit, TikTok and X, many of which are larger and have significantly greater financial and human resources, offer users engaging content and commerce opportunities through similar technology or products to ours. We remain focused on emerging competition as well.

We face competition across almost every aspect of our business. We compete to attract, engage and retain users and their time and attention. We also compete with other platforms to attract, retain and grow our base of creators and publishers.

We also compete for advertisers and advertising revenue across a variety of formats and goals, which depends on our ability to deliver compelling returns on investment. Finally, we compete for talent to attract and retain highly talented individuals, particularly people with expertise in computer vision, artificial intelligence and machine learning.

Intellectual property

Our success is tied in part to our ability to protect our intellectual property and key technological innovations. We rely on a combination of federal, state and common-law rights in the United States and rights under the laws of other countries, as well as contractual restrictions, to protect our intellectual property and other proprietary rights. We rely on a combination of patents, copyrights, trademarks, trade secrets, domain names and other intellectual property rights to help protect our brand and proprietary technologies. In addition, we generally enter into confidentiality and invention assignment agreements with our employees and contractors, and confidentiality agreements with other third parties, in order to limit access to, and disclosure and use of, our confidential information and proprietary technology and to preserve our rights thereto.

As of December 31, 2024, we had approximately 400 issued patents and pending patent applications in the United States and foreign countries relating to aspects of our actual or contemplated operations and technologies. We also had over 660 registered trademarks and trademark applications in the United States and foreign countries, including our “Pinterest” name and related logos.

We are also dependent on third-party content, technology and intellectual property in connection with our business.

We are presently involved in intellectual property litigation and expect to continue to face allegations from third parties, including our competitors and “non-practicing entities,” that we have infringed or otherwise violated their intellectual property rights.

For additional information on risks relating to intellectual property, please see the sections titled “Risk Factors” and “—Legal Proceedings.”

Government regulation

We are subject to many U.S. federal and state and foreign laws and regulations that involve matters central to our business, including laws and regulations that involve data privacy and data protection, intellectual property (including copyright and patent laws), content moderation, rights of publicity, advertising, marketing, health and safety, competition, protection of minors, consumer protection, taxation, anti-bribery, anti-money laundering and corruption, economic or other trade prohibitions or sanctions or securities law compliance. Our business may also be affected by the adoption of any new or existing laws or regulations or changes in laws or regulations that adversely affect the growth, popularity or use of the internet, or that significantly restrict or impose conditions on our ability to collect, store, augment, analyze, use and share data or increase consumer notice or consent requirements before a company can utilize cookies or other tracking technologies or that increase the liability of content platforms like us. Many relevant laws and regulations are still evolving and may be interpreted, applied, created or amended in a manner that could harm our business, and new laws and regulations may be enacted, including in connection with the restriction or prohibition of certain content or business activities.

We rely on a variety of statutory and common-law frameworks and defenses relevant to the content available on our service, including the Digital Millennium Copyright Act (“DMCA”), the Communications Decency Act (“CDA”) and the fair-use doctrine in the United States, and the Digital Services Act (“DSA” ) and EU Directive on Copyright in the Digital Single Market ("EU Copyright Directive") in the European Union. Additional new and pending legislation in the US and around the world may impose additional obligations or risk on us associated with content uploaded by users to our platform.

We receive, process, store, use and share data, some of which contains personal information. We are therefore subject to U.S. federal, state, local and foreign laws and regulations regarding data privacy and the collection, storage, sharing, use, processing, disclosure and protection of personal information and other data from users, employees or business partners, including the General Data Protection Regulation (“GDPR”), the California Consumer Privacy Act, as amended by the California Privacy Rights Act (“CPA”), the Florida Digital Bill of Rights, and other state laws that may take effect in 2025. These laws expand the rights of individuals to control how their personal data is processed, collected, used and shared, creates new regulatory and operational requirements for processing personal data, increases requirements for security and confidentiality and provides for significant penalties for non-compliance. There are also a number of legislative proposals recently enacted or pending concerning content moderation, transparency, and access, as well as data

protection that could affect us. These and other laws and regulations that may be enacted, or new interpretation of existing laws and regulations, may require us to modify our data processing practices and policies and to incur substantial costs in order to comply.

Government authorities outside the United States may also seek to restrict access to or block our service, prohibit or block the hosting of certain content available through our service or impose other restrictions that may affect the accessibility or usability of our service in that country for a period of time or even indefinitely. For example, access to our service has been or is currently restricted in whole or in part in certain countries. In addition, some countries have enacted laws that allow websites to be blocked for hosting certain types of content or may require websites to remove certain restricted content.

For additional information, see the sections titled “Risk Factors” and “—Legal Proceedings.”

Seasonality

We have historically experienced seasonality in monthly active user growth, monetization on our platform and free cash flow. Historically, we have had lower sequential user growth in the second calendar quarter. Industry advertising spend tends to be strongest in the fourth quarter resulting in higher revenue, and free cash flow is historically higher in the first quarter as we collect on the fourth quarter's higher revenue. We expect this seasonality to continue.

Talent management and development

In order to fulfill our mission of bringing everyone the inspiration to create a life they love, we strive to attract and retain top talent. To attract and retain great talent, we strive to create opportunities for our employees to grow and develop in their careers, supported by competitive compensation, benefits and health and wellness programs, and by programs that build connections between our employees and their communities. As of December 31, 2024, we had 4,666 full-time employees.

Inclusion and belonging

We strive to create an inclusive workplace where employees are encouraged and empowered to bring their whole, authentic selves to work every day. We seek for and respect a wide range of experiences and perspectives across our Board of Directors, leadership and employee base, which we believe helps us create a more inclusive and global product.

Employee health, safety and benefits

The success of our business is fundamentally tied to the well-being of our people. We are committed to the health, safety and wellness of our employees. We provide our employees and their families with access to a variety of flexible and convenient health and wellness programs that support their physical and mental health by providing tools and resources to help them improve or maintain their health. We also have a flexible work model that provides employees in roles that can be performed from anywhere the autonomy to live and work flexibly within their country or region, while prioritizing intentional in-person collaboration at our offices.

We provide robust compensation and benefits programs to help meet the needs of our employees and their families. In addition to salaries, these programs (which vary by country/region) include equity awards, sales incentive programs for eligible employees, a 401(k) Plan with Company matching, healthcare and insurance benefits, health savings and flexible spending accounts, flexible paid time off, family leave and family care support, flexible work schedules, employee assistance programs and charitable donation matching, among many others. We regularly review and update our compensation and benefits programs as needed to remain competitive with market compensation. For example, in 2022, we enhanced our family leave benefits for birthing and adoptive parents. Because every family is unique, we offer additional benefits to parents and caregivers with newborns in neonatal intensive care, adoptive parents and people experiencing miscarriage, and also offer fertility benefits globally. To promote financial wellbeing, we offer money management education, financial planning and investment services. To promote emotional wellbeing, we offer free access to mental health and wellbeing tools like Lyra, Calm and Cleo.

Learning and development

We help our employees create a career that is inspiring, impactful and ultimately time well spent. We have programs for open and ongoing conversation towards career growth goals both long term and short term. We also have workshops

dedicated to learning new skills and developing an employee’s career. We set aside a dedicated personal learning and development budget for every employee.

Corporate information

Our principal executive offices are located at 651 Brannan Street, San Francisco, California 94107, and our telephone number is (415) 762-7100. Our Class A common stock is listed on the New York Stock Exchange under the symbol “PINS.”

Available information

Our website is located at www.pinterest.com, and our investor relations website is located at http://investor.pinterestinc.com/. Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are available, free of charge, on our investor relations website as soon as reasonably practicable after we file such material electronically with or furnish it to the Securities and Exchange Commission, or the SEC. The SEC also maintains a website that contains our SEC filings. The address of the site is www.sec.gov. We use our http://investor.pinterestinc.com/ and www.pinterest.com websites as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD of the Exchange Act.

The contents of our websites are not intended to be incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

Item 1A. Risk factors

Investing in our Class A common stock involves a high degree of risk. In addition to the other information set forth in this Annual Report, you should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before making an investment decision with respect to our Class A common stock. Some of the factors, events, and contingencies discussed below may have occurred in the past, but the disclosures below are not representations as to whether or not the factors, events or contingencies have occurred in the past, and instead reflect our beliefs and opinions as to the factors, events, or contingencies that could materially and adversely affect us in the future. The occurrence of any of the following risks and uncertainties could in circumstances we may or may not be able to accurately predict, materially and adversely affect our business and operations, growth, prospects, reputation, revenue, financial results, financial condition, cash flows, liquidity and stock price. It is not possible to predict or identify all such risks and uncertainties; our business could also be affected by risks and uncertainties that are not presently known to us or that we currently believe are immaterial. Therefore, you should not consider the following risks to be a complete statement of all the potential risks or uncertainties that we face.

Risks Related to Our Business Strategy and Growth

We generate substantially all of our revenue from advertising. The failure to attract new advertisers, the loss of advertisers or a reduction in how much they spend could harm our business, revenue and financial results.

Substantially all of our revenue is generated from third-party advertising. However, we may not be able to continue to grow and scale this revenue model. Our growth strategy depends on, among other things, attracting more advertisers (including expanding our sales efforts to reach advertisers in international markets), retaining and scaling our business with existing advertisers and expanding our advertising product offerings.

As is common in our industry, most of our advertisers do not have long-term advertising commitments with us. Many of our advertisers spend a relatively small portion of their overall advertising budget with us. To increase the number of advertisers and increase the portion of the advertising budget that our existing advertisers spend with us, we must invest in new tools and technology and/or expand our sales force, and there can be no assurance that those efforts will be successful. The insights on user behavior we provide to advertisers may not yield effective results for the advertisers and may reduce or stop their spend on our platform. In addition, unless we improve existing and develop new measurement tools that better showcase our platform’s effectiveness, some advertisers may view our products or platform as experimental and may devote less advertising spend on our platform. In addition, many advertisers do not have advertising creative content in a format that would be successful on our platform and may be unable or unwilling to devote the technical or financial resources required to develop content for our platform. Further, we may not always be able to develop tools that effectively and efficiently meet the needs of advertisers. Advertisers will not do business with us if they do not believe that advertisements on our platform are effective in meeting their campaign goals, if we cannot measure the effectiveness of our advertising products or if they do not believe that their investment in advertising with us will generate a competitive return relative to other alternatives.

A substantial portion of our revenue is derived from a small number of advertisers and is currently concentrated in certain verticals, particularly CPG and retail. We either contract directly with advertisers or with advertising agencies on behalf of advertisers, many of which are owned by large media corporations that exercise varying degrees of control over the agencies. Our business, revenue and financial results could be harmed by the loss of, or a deterioration in our relationship with, any of our largest advertisers or with any advertising agencies or the large media corporations that control them.

In addition, a portion of our revenue is derived from partnerships with third-party advertising platforms. We may be unable to maintain these partnerships or identify and secure new partnerships on commercially reasonable terms. In addition, we may be exposed to reputational and other risks arising from our business association with these partners.

Our advertising revenue could be harmed by many other factors, including:

•decreases in the number of our MAUs or our MAU growth rate;

•decreases in our users’ engagement with us and the ads on our platform;

•changes in the price of advertisements;

•our inability to create new products that sustain or increase the value of our advertisements;

•our inability to meet advertiser demand on our platform if we cannot increase the size and engagement of our user base;

• if our partnerships for third-party advertisement demand do not yield expected business impact;

•our inability to find the right balance between brand and performance advertising and provide the right products and platform to support the pricing and demand needed for each of the advertisers and their advertising objectives;

•changes in user demographics that make us less attractive to advertisers;

•our inability to make our ads more relevant and effective;

•any decision to serve contextually relevant or less personalized advertisements;

•the availability, accuracy and utility of our analytics and measurement solutions that demonstrate the value of our advertisements, or our ability to further improve such tools;

•changes to our data privacy practices (including those relating to protecting the security and integrity of our platform, our use of artificial intelligence, as well those resulting from changes to laws, regulations, legal decisions, or third-party policies) that affect the type or manner of advertising that we are able to provide;

•our inability to collect, process and share data which new or existing advertisers find useful;

•competitive developments or advertiser perception of the value of our products;

•product changes or advertising inventory management decisions we make that change the type, size or frequency of advertisements on our platform;

•reductions of advertising due to users that upload content or take other actions that are deemed to be hostile, inappropriate, illicit, objectionable, illegal or otherwise not consistent with our advertisers’ brands;

•the impact of invalid clicks or click fraud on our advertisements;

•the failure of our advertising auction mechanism to target and price ads effectively;

•decreases in user response rate to application notifications received from Pinterest, whether due to decreased user appreciation for notifications generally or changes in the manner notifications are delivered by mobile operating systems, which may decrease user engagement;

•difficulty and frustration from advertisers who may need to reformat or change their advertisements to comply with our guidelines or experience challenges uploading and conforming their advertisements with our system requirements;

•the macroeconomic conditions and the status of the advertising industry, such as fear of recession, inflation, the impact of tariffs, supply chain issues and inventory and labor shortages, which could cause businesses to spend less on advertising and/or direct their advertising spend to larger companies that offer more traditional and widely accepted advertising products;

•restrictions placed on, or the relevance of, ads outside of the United States;

•adverse publicity, whether or not accurate, relating to us or to social media platforms in general (including those relating to data security and protection), may tarnish our reputation and erode advertisers’ confidence in our platform;

•laws that allow users to opt out of the use of personal data or restrict the use of personal data of teens, which may limit or prohibit us and our customers from targeting advertising to users, including teens; and

•the other risks and uncertainties described in this Annual Report on Form 10-K.

These and other factors could reduce the amount that advertisers spend on our platform, or cause advertisers to stop advertising with us altogether.

Our ecosystem of users and advertisers depends on our ability to attract, retain and engage our user base. If we fail to add new users or retain or recover users, or if users engage less with us, our business, revenue and financial results could be harmed.

If current and potential users do not perceive their experience with our platform to be useful, or the content that we serve to them to be relevant to their personal taste and interests, we may not be able to attract new users, retain existing users, recover past users or maintain or increase the frequency and duration of users' engagement. User engagement fluctuates depending on factors beyond our control. For example, although we saw a higher number of users and higher user engagement during the peak of the COVID-19 pandemic in 2020, we experienced declines in the number of users and lower levels of user engagement as the COVID-19 pandemic subsided.

We anticipate that our active user growth rate will decline over time if the size of our active user base increases or we achieve higher market penetration rates. As a result, our financial performance will increasingly depend on our ability to increase user engagement and our monetization efforts. Our platform particularly resonates with women, who comprise a significant majority of our total user base. In addition, our platform also resonates with the younger generation, as Gen Z users represent a large portion of our user base. We may not be able to further increase the number of users in these demographics and may need to increase the number of users in other demographics, such as men and international users, in order to grow our users. Further, we may make changes to our product that makes it less attractive for a particular demographic.

There are many other factors that could negatively affect user growth, retention and engagement, including if:

•our competitors mimic our products or product features or create more engaging platforms or products, causing users to utilize their products instead of, or more frequently than, our products;

•we do not provide a compelling user experience because of the decisions we make regarding our products or the type and frequency of advertisements that we display;

•our content is not relevant to users’ personal taste and interests;

•search queries by users do not yield relevant results;

•third parties do not permit or continue to permit their content to be displayed on our platform;

•users have difficulty or are blocked from installing, updating or otherwise accessing our platform on mobile devices or web browsers;

•there are changes in the amount of time users spend across all applications and platforms, including ours;

•users use or spend more time on other platforms that they feel are more relevant or engaging in lieu of our platform;

•we are unable to attract creators or publishers to create engaging and relevant content on our platform;

•there is decreased engagement with our products, decreased efficiency of our advertising products, or failure to accept our terms of service as part of changes that we have implemented or may implement in the future, whether required or voluntarily, in connection with, for example, the GDPR, the DSA, the CCPA, and other U.S. federal and state privacy, and youth and social media laws, among others;

•technical or other problems frustrate the user experience, particularly if those problems prevent us from delivering our service in a fast and reliable manner;

•we are unable to successfully educate users how to utilize new products and product features that we introduce, such as live stream content, video and shopping features;

•users are located in countries with low smartphone penetration or with lack of cellular based data network since our products typically require high bandwidth data capabilities;

•changes in regulations or our contractual arrangements that adversely impact our access to, and use of, zero-rating offers or other discounts or data usage for our platform;

•we are unable to address user and advertiser concerns regarding the content, privacy and security of our platform;

•we are unable to combat spam, harassment, cyberbullying, discriminatory, political or other harmful, hostile, inappropriate, misleading, abusive, offensive, or illegal content or usage on our products or services;

•users adopt new technologies that block our products or services or where our products or services may be displaced in favor of other products or services, or may not be featured or otherwise available;

•third-party initiatives that may enable greater use of our platform, including low-cost or discounted data plans, are discontinued;

•merchants on Pinterest do not provide users with positive shopping experiences, for example, if products are not of the quality depicted on the platform or not readily available for purchase;

•there are macro level conditions that are beyond our control; or

•the other risks and uncertainties described in this Annual Report on Form 10-K occur.

Our ability to serve advertisements on our platform, and therefore the value proposition for our advertisers, depends on the size and engagement of our user base. Our growth efforts are not currently focused on increasing the number of daily active users, and we do not anticipate that most of our users will become daily active users. Therefore, even if we are able to increase demand for our advertising products, we may not be able to deliver those advertisements if we cannot also increase the size and engagement of our user base, which could harm our business, revenue and financial results.

Any decrease in user growth, retention or engagement could render our platform less attractive to users or advertisers.

If we are not able to continue to provide content that is useful and relevant to users’ personal taste and interests or fail to take appropriate action on objectionable content or block objectionable practices by advertisers or third parties, user growth, retention or engagement could decline, which could result in the loss of advertisers and revenue.