Document

Quanterix Releases Financial Results for the Third Quarter of 2025

BILLERICA, Mass. – November 10, 2025 - Quanterix Corporation (NASDAQ: QTRX), a company transforming healthcare by accelerating biomarker breakthroughs from discovery to diagnostics, today announced financial results for the third quarter ended September 30, 2025.

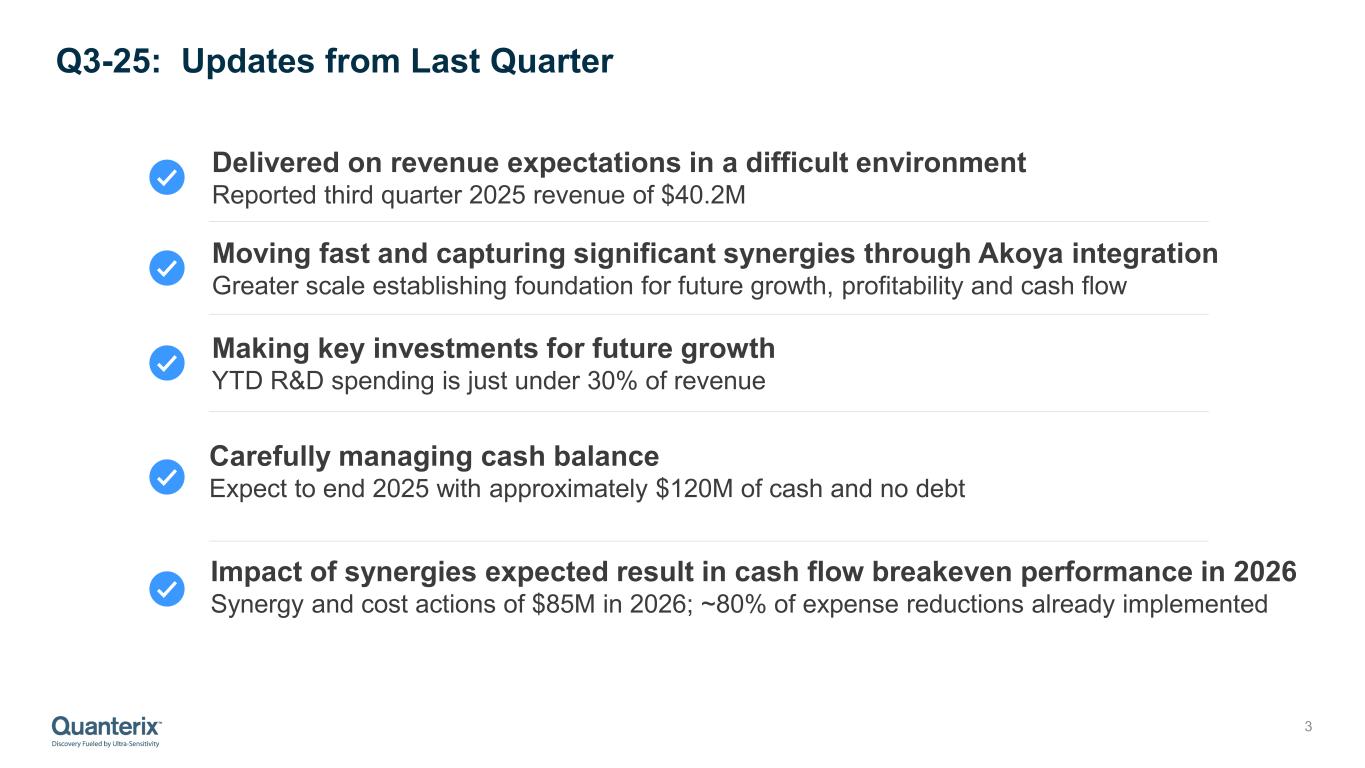

“During the third quarter, we delivered on our revenue expectations despite challenging market conditions,” said Masoud Toloue, Chief Executive Officer of Quanterix. “Equally important, we achieved key integration milestones from our Akoya transaction — keeping us firmly on track to realize $85 million in annualized synergies and reach cash flow break-even in 2026. Together, we have built a stronger, more scalable company with the foundation to drive sustained growth, profitability, and cash flow in the years ahead.”

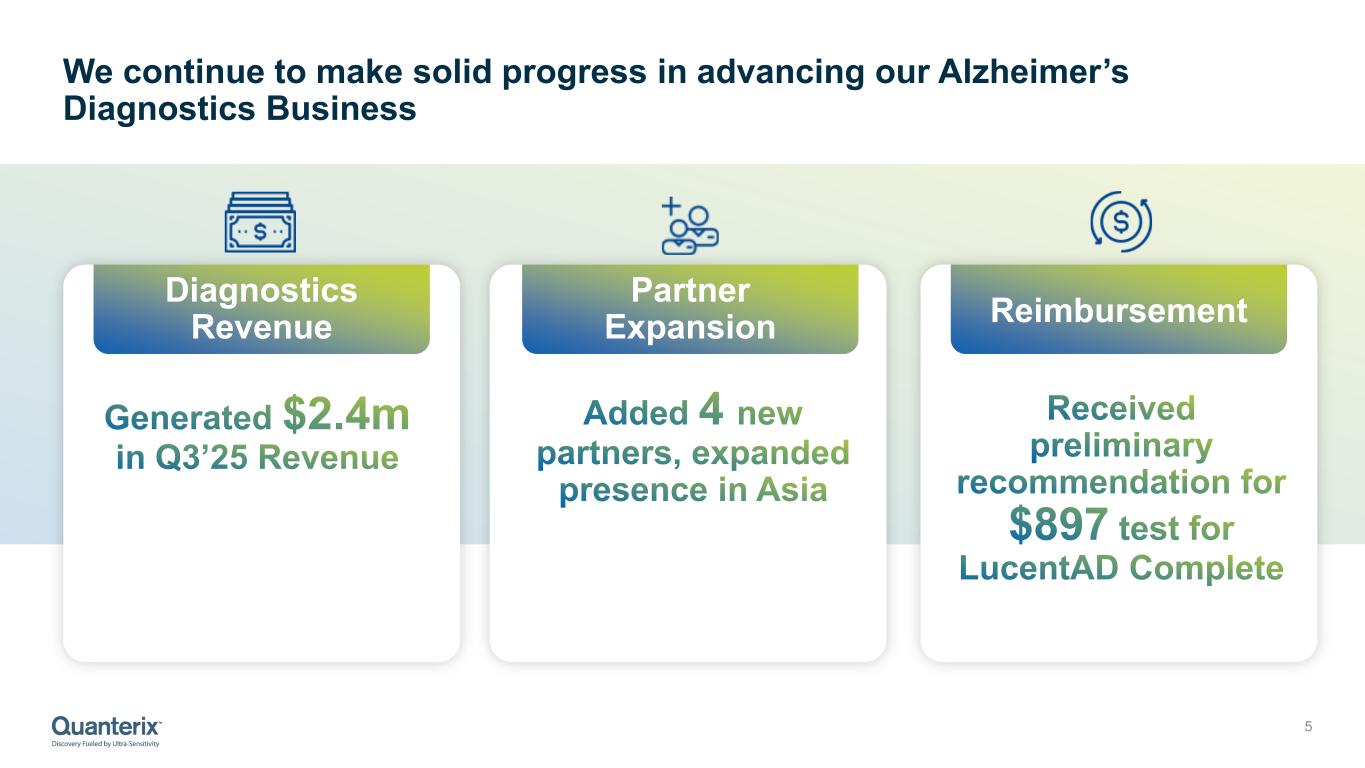

“Our Alzheimer’s diagnostics business also continues to accelerate. With a positive Medicare pricing recommendation and expanding partnerships across Asia, we are advancing toward a future where blood-based testing for neurodegenerative disease becomes standard clinical practice — and Quanterix is at the center of that transformation.”

Third Quarter Financial Highlights

•Revenue of $40.2 million, an increase of 12.3% compared to $35.8 million in the prior year.

•GAAP gross margin of 42.8%, as compared to 56.3% in the prior year. Adjusted gross margin (non-GAAP) of 45.9% as compared to 50.7% in the prior year.

•Adjusted EBITDA (non-GAAP) loss of $11.9 million, compared to a loss of $5.5 million in the prior year. The increase is primarily related to higher acquisition and restructuring charges.

•The Company ended the third quarter with $138.1 million of cash, cash equivalents, marketable securities, and restricted cash. Adjusted cash usage, after accounting for one-time deal and restructuring costs, was $16.1 million. Adjusted cash usage is expected to decline in Q4 2025 due to improved working capital performance and a full quarter effect of cost synergies. The company continues to expect it will end 2025 with approximately $120 million in cash, cash equivalents, marketable securities, and restricted cash.

Operational and Business Highlights

•Executed key integration activities in the quarter, capturing $67 million of cost synergies and savings. Key integration milestones include:

•Commercial: Combined the Quanterix and Akoya sales organizations, under one sales leadership, selling one combined portfolio of products.

•Operations: Consolidated four manufacturing and lab facilities into two main sites in Billerica and Burlington Massachusetts.

•Back Office/G&A: Eliminated nearly all redundant public company costs and initiated a series of IT systems integrations.

•Established new partnerships in the Asia-Pacific region, including All-Eight (Singapore); Union Clinical Laboratory (Taiwan); and NSW Health Pathology (Australia).

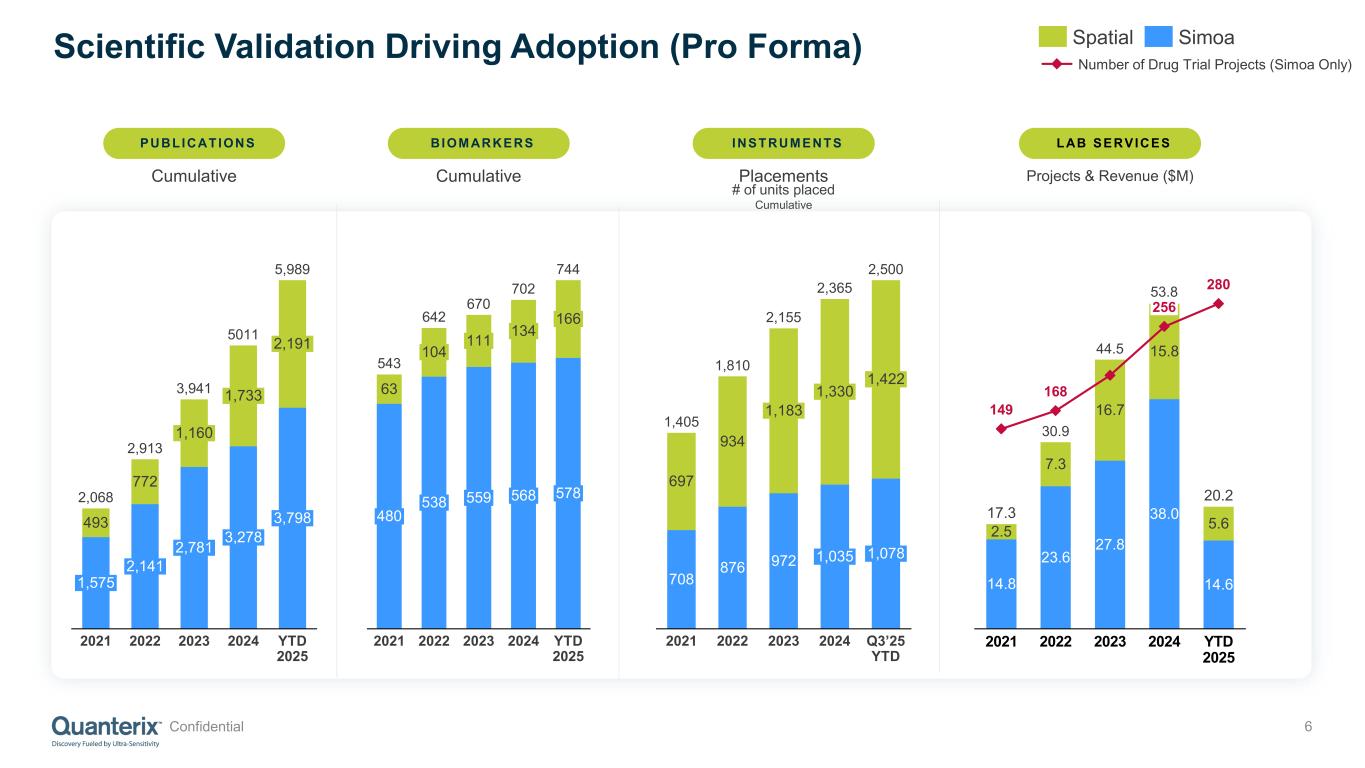

•Launched eight new Simoa assays through the first nine months of the year.

•Delivered multiple recent spatial and immuno-oncology presentations, including more than a dozen poster presentations, at the 40th annual Society for Immunotherapy of Cancer (SITC), demonstrating growing adoption of Quanterix’s high-plex spatial proteomics and AI-driven analysis platforms, underscoring their translational impact in uncovering immune resistance mechanisms and predictive biomarkers across multiple cancer indications. The Company also launched a new Metabolism Spike-in Module, designed for the PhenoCycler-Fusion and the PhenoCode™ Discovery IO60 Human Protein Panel.

2025 Full Year Business Outlook

The Company is reiterating its previous guidance for 2025 revenues to be in a range of $130 to $135 million, which includes approximately two quarters of performance from Akoya. On a pro forma basis, assuming the two companies were combined for the full year, the Company expects to generate 2025 revenue of between $165 and $170 million.

Quanterix expects GAAP and adjusted gross margin (non-GAAP) to be in the range of 45% to 47%.

Finally, the Company anticipates 2025 adjusted cash usage to be approximately $34 to $38 million. With the previously announced expense reductions, Quanterix expects to exit 2025 with approximately $120 million in cash, cash equivalents, marketable securities, and restricted cash and expects to achieve cash flow breakeven performance in 2026.

Conference Call

In conjunction with this announcement, the Company will host a conference call on November 10, 2025, at 4:30 PM E.T. The dial-in number for USA & Canada is Toll-Free (800) 715-9871 or (646) 307-1963 and the conference ID is 5591565.

Interested investors can also listen to the live webcast from the Event Details page in the Investors section of the Quanterix website at https://ir.quanterix.com. An archived webcast replay will be available on the Company’s website for one year.

About Quanterix

Quanterix is a global leader in ultra-sensitive biomarker detection, enabling breakthroughs in disease research, diagnostics, and drug development. Its proprietary Simoa® technology delivers industry-leading sensitivity, allowing researchers to detect and quantify biomarkers in blood and other fluids at concentrations far below traditional limits. With approximately 6,000 peer-reviewed publications, Quanterix has been a trusted partner to the scientific community for nearly two decades. In 2025, Quanterix acquired Akoya Biosciences, The Spatial Biology Company®, adding multiplexed tissue imaging with single-cell resolution to its portfolio and 1,396 installed instruments. Together, the combined company offers a uniquely integrated platform that connects biology across blood and tissue—advancing precision medicine from discovery to diagnostics. Learn more at www.quanterix.com.

Financial Highlights

QUANTERIX CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(amounts in thousands, except per share data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

| Product revenue |

$ |

26,151 |

|

|

$ |

19,694 |

|

|

$ |

63,723 |

|

|

$ |

59,251 |

|

| Service and other revenue |

13,953 |

|

|

$ |

13,845 |

|

|

29,806 |

|

|

$ |

39,323 |

|

| Collaboration and license revenue |

46 |

|

|

$ |

1,872 |

|

|

1,348 |

|

|

$ |

2,756 |

|

| Grant revenue |

83 |

|

|

$ |

402 |

|

|

165 |

|

|

$ |

930 |

|

| Total revenues |

40,233 |

|

|

35,813 |

|

|

95,042 |

|

|

102,260 |

|

| Costs of goods sold and services: |

|

|

|

|

|

|

|

| Cost of product revenue |

15,379 |

|

|

$ |

10,554 |

|

|

34,438 |

|

|

$ |

25,461 |

|

| Cost of service and other revenue |

7,648 |

|

|

$ |

5,106 |

|

|

15,683 |

|

|

$ |

15,864 |

|

| Total costs of goods sold and services |

23,027 |

|

|

15,660 |

|

|

50,121 |

|

|

41,325 |

|

| Gross profit |

17,206 |

|

|

20,153 |

|

|

44,921 |

|

|

60,935 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Research and development |

8,009 |

|

|

$ |

8,104 |

|

|

27,126 |

|

|

23,015 |

|

| Selling, general and administrative |

39,062 |

|

|

$ |

22,908 |

|

|

102,872 |

|

|

73,027 |

|

| Other lease costs |

286 |

|

|

$ |

889 |

|

|

870 |

|

|

2,740 |

|

| Impairment and restructuring costs |

7,174 |

|

|

— |

|

|

14,844 |

|

|

— |

|

| Total operating expenses |

54,531 |

|

|

31,901 |

|

|

145,712 |

|

|

98,782 |

|

| Loss from operations |

(37,325) |

|

|

(11,748) |

|

|

(100,791) |

|

|

(37,847) |

|

| Other income (expense): |

|

|

|

|

|

|

|

| Interest income |

1,448 |

|

|

3,535 |

|

|

7,408 |

|

|

11,165 |

|

| Change in fair value of contingent liabilities |

58 |

|

|

— |

|

|

3,952 |

|

|

— |

|

| Other income (expense), net |

(178) |

|

|

5 |

|

|

(68) |

|

|

221 |

|

| Loss before income taxes |

(35,997) |

|

|

(8,208) |

|

|

(89,499) |

|

|

(26,461) |

|

| Income tax benefit (expense) |

2,480 |

|

|

(145) |

|

|

5,466 |

|

|

(442) |

|

| Net loss |

$ |

(33,517) |

|

|

$ |

(8,353) |

|

|

$ |

(84,033) |

|

|

$ |

(26,903) |

|

|

|

|

|

|

|

|

|

| Net loss per common share, basic and diluted |

$ |

(0.73) |

|

|

$ |

(0.22) |

|

|

$ |

(2.04) |

|

|

$ |

(0.70) |

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding, basic and diluted |

46,060 |

|

38,449 |

|

41,243 |

|

38,305 |

QUANTERIX CORPORATION

CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except per share data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

38,298 |

|

|

$ |

56,709 |

|

| Marketable securities |

96,511 |

|

|

232,413 |

|

| Accounts receivable, net of allowance for expected credit losses |

33,029 |

|

|

32,141 |

|

| Inventory |

54,957 |

|

|

32,775 |

|

| Prepaid expenses and other current assets |

10,483 |

|

|

9,556 |

|

| Total current assets |

233,278 |

|

|

363,594 |

|

| Restricted cash |

3,336 |

|

|

2,610 |

|

| Property and equipment, net |

25,765 |

|

|

17,150 |

|

| Intangible assets, net |

135,148 |

|

|

4,031 |

|

| Goodwill |

23,460 |

|

|

— |

|

| Operating lease right-of-use assets |

18,184 |

|

|

16,339 |

|

| Financing lease right-of-use assets |

917 |

|

|

— |

|

| Other non-current assets |

4,052 |

|

|

2,809 |

|

| Total assets |

$ |

444,140 |

|

|

406,533 |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

10,633 |

|

|

6,953 |

|

| Accrued compensation and benefits |

12,582 |

|

|

12,620 |

|

| Accrued expenses and other current liabilities |

24,812 |

|

|

8,851 |

|

| Deferred revenue |

20,913 |

|

|

8,827 |

|

| Operating lease liabilities |

7,984 |

|

|

4,756 |

|

| Financing lease liabilities |

428 |

|

|

— |

|

| Total current liabilities |

77,352 |

|

|

42,007 |

|

| Deferred revenue, net of current portion |

7,341 |

|

|

1,073 |

|

| Operating lease liabilities, net of current portion |

31,212 |

|

|

32,615 |

|

| Financing lease liabilities, net of current portion |

496 |

|

|

— |

|

| Non-current portion of contingent liabilities |

5,904 |

|

|

— |

|

| Other non-current liabilities |

7,301 |

|

|

800 |

|

| Total liabilities |

129,606 |

|

|

76,495 |

|

| Total stockholders’ equity |

314,534 |

|

|

330,038 |

|

| Total liabilities and stockholders’ equity |

$ |

444,140 |

|

|

$ |

406,533 |

|

QUANTERIX CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

| Cash flows from operating activities: |

|

|

|

|

| Net loss |

$ |

(84,033) |

|

|

$ |

(26,903) |

|

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

| Depreciation and amortization expense |

9,618 |

|

|

4,740 |

|

|

| Credit losses on accounts receivable |

284 |

|

|

744 |

|

|

| Accretion of marketable securities |

(1,851) |

|

|

(5,317) |

|

|

| Impairment |

7,269 |

|

|

— |

|

|

| Operating lease right-of-use asset amortization |

2,058 |

|

|

1,371 |

|

|

| Stock-based compensation expense |

16,303 |

|

|

15,150 |

|

|

| Change in fair value of contingent liabilities |

(3,952) |

|

|

— |

|

|

| Deferred taxes |

(5,678) |

|

|

— |

|

|

| Other operating activity |

(76) |

|

|

(389) |

|

|

| Changes in assets and liabilities: |

|

|

|

|

| Accounts receivable |

7,901 |

|

|

(6,402) |

|

|

| Inventory |

4,204 |

|

|

(6,845) |

|

|

| Prepaid expenses and other current assets |

2,198 |

|

|

(168) |

|

|

| Other non-current assets |

110 |

|

|

(479) |

|

|

| Accounts payable |

(3,537) |

|

|

588 |

|

|

| Accrued compensation and benefits, accrued expenses, and other current liabilities |

(5,847) |

|

|

(3,166) |

|

|

| Deferred revenue |

(526) |

|

|

(826) |

|

|

| Operating lease liabilities |

(4,003) |

|

|

(2,971) |

|

|

| Other non-current liabilities |

(1,234) |

|

|

11 |

|

|

| Net cash used in operating activities |

(60,792) |

|

|

(30,862) |

|

|

| Cash flows from investing activities: |

|

|

|

|

| Purchases of marketable securities |

(45,658) |

|

|

(270,972) |

|

|

| Proceeds from sales and maturities of marketable securities |

183,389 |

|

|

159,279 |

|

|

| Purchases of property and equipment |

(2,710) |

|

|

(2,956) |

|

|

| Acquisitions, net of cash acquired |

(93,229) |

|

|

— |

|

|

| Net cash provided by (used in) investing activities |

41,792 |

|

|

(114,649) |

|

|

| Cash flows from financing activities: |

|

|

|

|

| Principal payments on financing leases |

(106) |

|

|

— |

|

|

| Proceeds from common stock issued under stock plans |

930 |

|

|

2,999 |

|

|

| Payments for employee taxes withheld on stock-based compensation awards |

(1,010) |

|

|

(2,584) |

|

|

| Net cash provided by (used in) financing activities |

(186) |

|

|

415 |

|

|

| Net increase (decrease) in cash, cash equivalents, and restricted cash |

(19,186) |

|

|

(145,096) |

|

|

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

1,501 |

|

|

18 |

|

|

| Cash, cash equivalents, and restricted cash at beginning of period |

59,319 |

|

|

177,026 |

|

|

| Cash, cash equivalents, and restricted cash at end of period |

$ |

41,634 |

|

|

$ |

31,948 |

|

|

Use of Non-GAAP Financial Measures

To supplement our financial statements presented on a U.S. GAAP basis, we present the following non-GAAP financial measures:

•Adjusted EBITDA and adjusted EBITDA margin: We define adjusted EBITDA as net income (loss) adjusted to exclude interest income, income tax (expense) benefit, depreciation and amortization expense, stock-based compensation expense, acquisition and integration related costs, impairment and restructuring, and certain other items which include other charges or benefits resulting from transactions or events that are highly variable, significant in size, and that we do not believe are indicative of ongoing or future business operations. These items are discussed in more detail below the tables reconciling the GAAP to non-GAAP measures. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by total revenues.

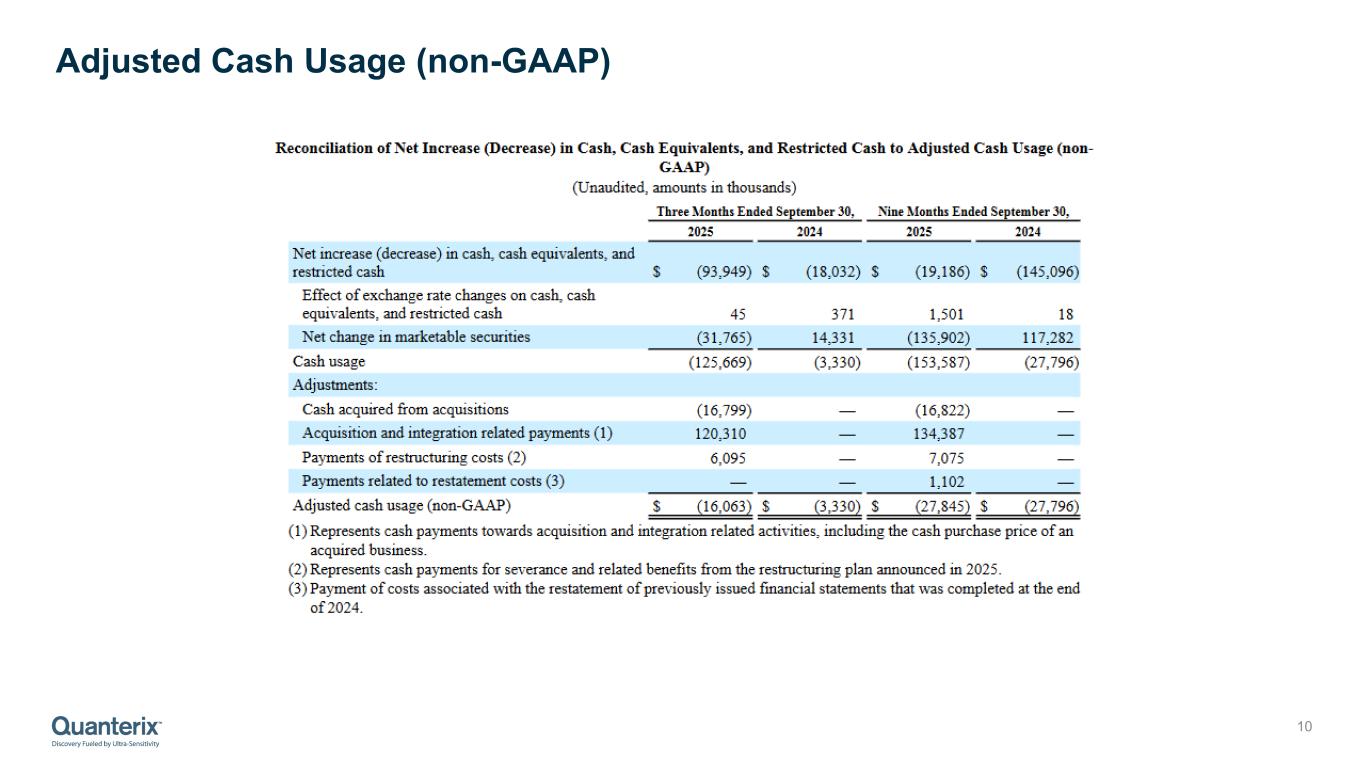

•Adjusted cash usage: We calculate cash usage as the total change in cash, cash equivalents, and restricted cash adjusted to include the net change from purchases, sales, and maturities of marketable securities (excluding any interest receivable). Adjusted cash usage is calculated as cash usage further adjusted to exclude cash payments related to transactions or events that are highly variable, significant in size, and that we do not believe are indicative of ongoing or future business operations.

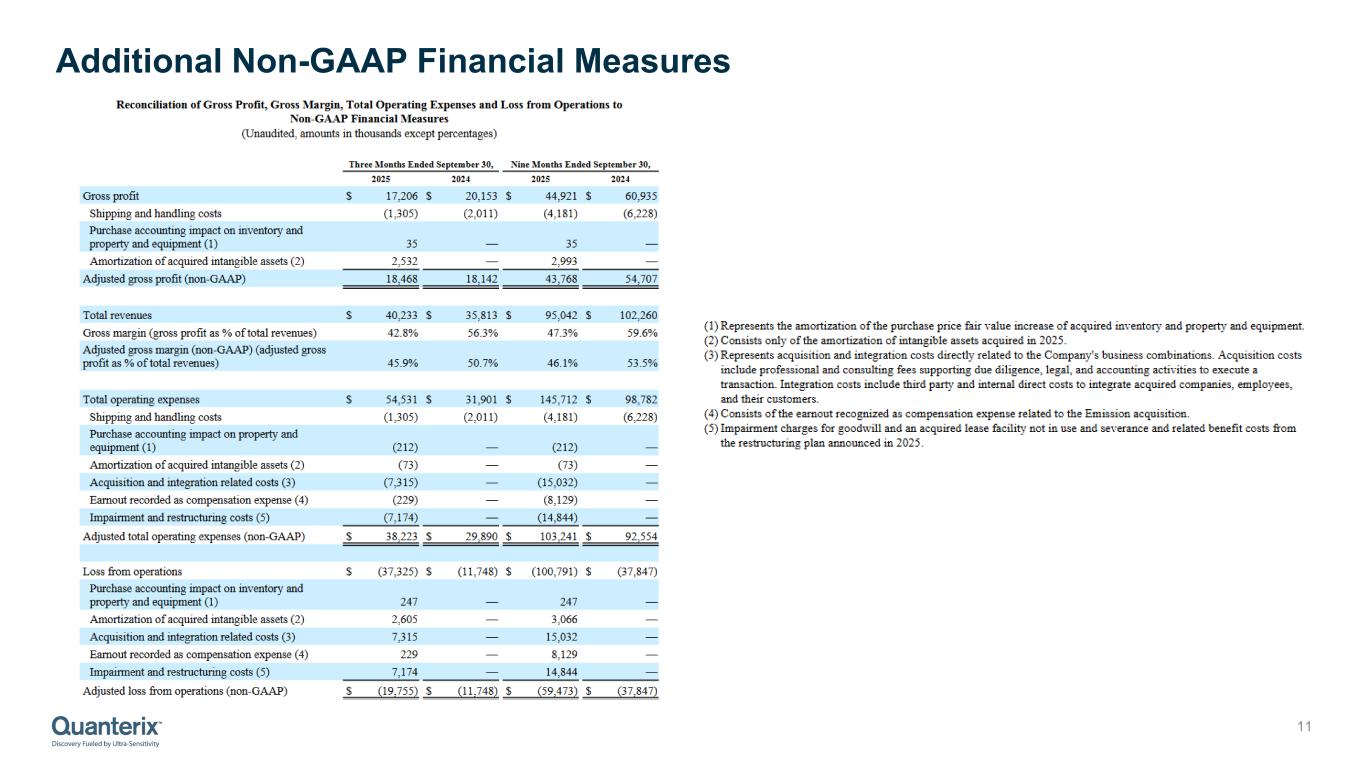

•Adjusted gross profit, adjusted gross margin, adjusted total operating expenses, and adjusted loss from operations: We calculate these non-GAAP financial measures by including shipping and handling costs for product sales within cost of product revenue instead of within selling, general and administrative expenses. Additionally, we exclude amortization of certain acquired intangible assets, acquisition and integration related costs, and certain other items which include other charges or benefits resulting from transactions or events that are highly variable, significant in size, and that we do not believe are indicative of ongoing or future business operations. Adjusted gross margin is calculated as adjusted gross profit divided by total revenues.

We believe that presentation of these non-GAAP financial measures provides supplemental information useful to investors in understanding our underlying operating results and trends. We use these non-GAAP financial measures to evaluate our operating performance in a manner that allows for meaningful period-to-period comparison and analysis of trends in our business and our competitors. We believe that presentation of these non-GAAP financial measures provides useful information to investors in assessing our operating performance within our industry and to allow comparability with the presentation of other companies in our industry.

The non-GAAP financial measures presented here should be considered in conjunction with, and not as a substitute for, the financial information presented in accordance with U.S. GAAP. For example, adjusted EBITDA excludes a number of expense items that are included in net loss and adjusted cash usage excludes certain actual cash payments. As a result, positive adjusted EBITDA or positive adjusted cash usage may be achieved even where we record a significant net loss or reduction in our cash and marketable securities balances in accordance with U.S. GAAP.

Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures set forth in the tables captioned “Reconciliation of GAAP to Non-GAAP Financial Measures” in the section below.

Additionally, we make certain forward-looking statements about our future financial performance that include non-GAAP financial measures, which are difficult to predict for future periods because the nature of the adjustments pertains to events that have not yet occurred. We do not forecast many of the excluded items for internal use and therefore information reconciling forward-looking non-GAAP financial measures to U.S. GAAP financial measures is not available without unreasonable effort and is not provided. The occurrence, timing, and amount of any of the items excluded from U.S. GAAP to calculate non-GAAP financial measures could significantly impact our U.S. GAAP results.

QUANTERIX CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

Reconciliation of Net Loss to Adjusted EBITDA (non-GAAP) and Adjusted EBITDA Margin (non-GAAP)

(Unaudited, amounts in thousands except percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net loss |

$ |

(33,517) |

|

|

$ |

(8,353) |

|

|

$ |

(84,033) |

|

|

$ |

(26,903) |

|

| Interest income |

(1,448) |

|

|

(3,535) |

|

|

(7,408) |

|

|

(11,165) |

|

| Income tax expense (benefit) |

(2,480) |

|

|

145 |

|

|

(5,466) |

|

|

442 |

|

| Depreciation and amortization |

5,431 |

|

|

1,616 |

|

|

9,618 |

|

|

4,740 |

|

| Stock-based compensation expense |

5,469 |

|

|

4,657 |

|

|

16,303 |

|

|

15,150 |

|

| Acquisition and integration related costs (1) |

7,315 |

|

|

— |

|

|

15,032 |

|

|

— |

|

| Earnout recorded as compensation expense (2) |

229 |

|

|

— |

|

|

8,129 |

|

|

— |

|

| Changes in contingent liabilities (3) |

(58) |

|

|

— |

|

|

(3,952) |

|

|

— |

|

| Impairment and restructuring costs (4) |

7,174 |

|

|

— |

|

|

14,844 |

|

|

— |

|

| Adjusted EBITDA (non-GAAP) |

$ |

(11,885) |

|

|

$ |

(5,470) |

|

|

$ |

(36,933) |

|

|

$ |

(17,736) |

|

|

|

|

|

|

|

|

|

| Total revenues |

$ |

40,233 |

|

|

$ |

35,813 |

|

|

$ |

95,042 |

|

|

$ |

102,260 |

|

| Adjusted EBITDA margin (non-GAAP) (adjusted EBITDA as a % of revenue) |

(29.5) |

% |

|

(15.3) |

% |

|

(38.9) |

% |

|

(17.3) |

% |

(1)Represents acquisition and integration costs directly related to the Company's business combinations. Acquisition costs include professional and consulting fees supporting due diligence, legal, and accounting activities to execute a transaction. Integration costs include third party and internal direct costs to integrate acquired companies, employees, and their customers.

(2)Consists of the earnout recognized as compensation expense related to the Emission acquisition.

(3)Consists of fair value adjustments for contingent consideration liabilities related to acquisitions.

(4)Impairment charges for goodwill and an acquired lease facility not in use and severance and related benefit costs from the restructuring plan announced in 2025.

Reconciliation of Net Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash to Adjusted Cash Usage (non-GAAP)

(Unaudited, amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

| Net increase (decrease) in cash, cash equivalents, and restricted cash |

$ |

(93,949) |

|

|

$ |

(18,032) |

|

|

$ |

(19,186) |

|

|

$ |

(145,096) |

|

|

|

|

|

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

45 |

|

|

371 |

|

|

1,501 |

|

|

18 |

|

|

|

|

|

| Net change in marketable securities |

(31,765) |

|

|

14,331 |

|

|

(135,902) |

|

|

117,282 |

|

|

|

|

|

| Cash usage |

(125,669) |

|

|

(3,330) |

|

|

(153,587) |

|

|

(27,796) |

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

| Cash acquired from acquisitions |

(16,799) |

|

|

— |

|

|

(16,822) |

|

|

— |

|

|

|

|

|

| Acquisition and integration related payments (1) |

120,310 |

|

|

— |

|

|

134,387 |

|

|

— |

|

|

|

|

|

| Payments of restructuring costs (2) |

6,095 |

|

|

— |

|

|

7,075 |

|

|

— |

|

|

|

|

|

| Payments related to restatement costs (3) |

— |

|

|

— |

|

|

1,102 |

|

|

— |

|

|

|

|

|

| Adjusted cash usage (non-GAAP) |

$ |

(16,063) |

|

|

$ |

(3,330) |

|

|

$ |

(27,845) |

|

|

$ |

(27,796) |

|

|

|

|

|

(1)Represents cash payments towards acquisition and integration related activities, including the cash purchase price of an acquired business.

(2)Represents cash payments for severance and related benefits from the restructuring plan announced in 2025.

(3)Payment of costs associated with the restatement of previously issued financial statements that was completed at the end of 2024.

Reconciliation of Gross Profit, Gross Margin, Total Operating Expenses and Loss from Operations to

Non-GAAP Financial Measures

(Unaudited, amounts in thousands except percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

| Gross profit |

$ |

17,206 |

|

$ |

20,153 |

|

$ |

44,921 |

|

$ |

60,935 |

|

|

|

|

| Shipping and handling costs |

(1,305) |

|

(2,011) |

|

(4,181) |

|

(6,228) |

|

|

|

|

| Purchase accounting impact on inventory and property and equipment (1) |

35 |

|

— |

|

35 |

|

— |

|

|

|

|

| Amortization of acquired intangible assets (2) |

2,532 |

|

— |

|

2,993 |

|

— |

|

|

|

|

| Adjusted gross profit (non-GAAP) |

18,468 |

|

18,142 |

|

43,768 |

|

54,707 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

$ |

40,233 |

|

$ |

35,813 |

|

$ |

95,042 |

|

$ |

102,260 |

|

|

|

|

| Gross margin (gross profit as % of total revenues) |

42.8% |

|

56.3% |

|

47.3% |

|

59.6% |

|

|

|

|

| Adjusted gross margin (non-GAAP) (adjusted gross profit as % of total revenues) |

45.9% |

|

50.7% |

|

46.1% |

|

53.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

$ |

54,531 |

|

$ |

31,901 |

|

$ |

145,712 |

|

$ |

98,782 |

|

|

|

|

| Shipping and handling costs |

(1,305) |

|

(2,011) |

|

(4,181) |

|

(6,228) |

|

|

|

|

| Purchase accounting impact on property and equipment (1) |

(212) |

|

— |

|

(212) |

|

— |

|

|

|

|

| Amortization of acquired intangible assets (2) |

(73) |

|

— |

|

(73) |

|

— |

|

|

|

|

| Acquisition and integration related costs (3) |

(7,315) |

|

— |

|

(15,032) |

|

— |

|

|

|

|

| Earnout recorded as compensation expense (4) |

(229) |

|

— |

|

(8,129) |

|

— |

|

|

|

|

| Impairment and restructuring costs (5) |

(7,174) |

|

— |

|

(14,844) |

|

— |

|

|

|

|

| Adjusted total operating expenses (non-GAAP) |

$ |

38,223 |

|

$ |

29,890 |

|

$ |

103,241 |

|

$ |

92,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

$ |

(37,325) |

|

$ |

(11,748) |

|

$ |

(100,791) |

|

$ |

(37,847) |

|

|

|

|

| Purchase accounting impact on inventory and property and equipment (1) |

247 |

|

— |

|

247 |

|

— |

|

|

|

|

| Amortization of acquired intangible assets (2) |

2,605 |

|

— |

|

3,066 |

|

— |

|

|

|

|

| Acquisition and integration related costs (3) |

7,315 |

|

— |

|

15,032 |

|

— |

|

|

|

|

| Earnout recorded as compensation expense (4) |

229 |

|

— |

|

8,129 |

|

— |

|

|

|

|

| Impairment and restructuring costs (5) |

7,174 |

|

— |

|

14,844 |

|

— |

|

|

|

|

| Adjusted loss from operations (non-GAAP) |

$ |

(19,755) |

|

$ |

(11,748) |

|

$ |

(59,473) |

|

$ |

(37,847) |

|

|

|

|

(1)Represents the amortization of the purchase price fair value increase of acquired inventory and property and equipment.

(2)Consists only of the amortization of intangible assets acquired in 2025.

(3)Represents acquisition and integration costs directly related to the Company's business combinations. Acquisition costs include professional and consulting fees supporting due diligence, legal, and accounting activities to execute a transaction. Integration costs include third party and internal direct costs to integrate acquired companies, employees, and their customers.

(4)Consists of the earnout recognized as compensation expense related to the Emission acquisition.

(5)Impairment charges for goodwill and an acquired lease facility not in use and severance and related benefit costs from the restructuring plan announced in 2025.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Statements included in this press release that are not historical in nature or do not relate to current facts are intended to be, and are hereby identified as, forward-looking statements for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements about Quanterix’s future business outlook, operations, strategy and financial performance, including statements related to our expectations about the development and commercialization of our products, about the benefits we may realize from the acquisition of Akoya Biosciences Inc., and under the header “2025 Full Year Business Outlook.”. Words and phrases such as “may,” “approximately,” “continue,” “should,” “expects,” “projects,” “anticipates,” “is likely,” “look ahead,” “look forward,” “believes,” “will,” “intends,” “estimates,” “strategy,” “plan,” “could,” “potential,” “possible” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to certain risks and uncertainties that are difficult to predict with regard to, among other things, timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks and uncertainties include, among others, the following possibilities with respect to Quanterix’s future business, operations, strategy and financial performance: risks related to the impact of recent U.S. government policies, including reductions in federal research funding and increased tariffs; risks that we may not realize the expected benefits of our cost reduction actions; risks associated with the anticipated timing for launch of, and features of, Quanterix’s next-generation instrument, Simoa One; risks that Quanterix may fail to realize the anticipated benefits and synergies of its recent acquisitions of Emission, Inc. and Akoya Biosciences Inc.; risk that integrating Quanterix’s business with that of Akoya could be more difficult, costly or time-consuming than expected; Quanterix risks that Quanterix’s estimates regarding expenses, future revenues, capital requirements, and needs for additional financing could be incorrect; risks related to the restatement of Quanterix’s consolidated financial statements, including risks of increased costs and the increased possibility of legal proceedings and regulatory inquiries, sanctions, or investigation; risks related to Quanterix’s ability to maintain effective internal control over financial reporting and disclosure controls and procedures, including its ability to remediate existing material weaknesses in its internal control over financial reporting and the timing of any such remediation; risks related to defects or other quality issues in Quanterix’s products that could lead to unforeseen costs, product recalls, adverse regulatory actions, negative publicity and litigation; risks related to Quanterix’s ability to retain and expand its customer base and achieve sufficient market acceptance of its products; and other factors that may affect future results of Quanterix. Additional factors that could cause results to differ materially from those described above can be found in the periodic reports filed by Quanterix with the SEC, including the “Risk Factors” sections contained therein, which are available on the SEC’s website at www.sec.gov.

All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by the cautionary statements contained or referred to herein. If one or more events related to these or other risks or uncertainties materialize, or if Quanterix’s underlying assumptions prove to be incorrect, actual results may differ materially from what Quanterix anticipates. Quanterix cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and are based on information available at that time. Quanterix does not assume any obligation to update or otherwise revise any forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws.

Contact:

Joshua Young

(508) 846-3327

ir@quanterix.com