| Maryland | 001-35030 |

27-3338708 | ||||||

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Name of Registrant | Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||

| American Assets Trust, Inc. | Common Stock, par value $0.01 per share | AAT | New York Stock Exchange | ||||||||

Exhibit Number |

Exhibit Description |

|||||||

| 99.1** | ||||||||

| 99.2** | ||||||||

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). | |||||||

American Assets Trust, Inc. |

||||||||

By: |

/s/ Robert F. Barton |

|||||||

|

Robert F. Barton

Executive Vice President, CFO

|

||||||||

| July 26, 2022 | ||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | |||||||||

| Total Portfolio | |||||||||||

| Office | 91.0% | 91.5% | 90.3% | ||||||||

| Retail | 92.5% | 92.2% | 91.1% | ||||||||

| Multifamily | 92.0% | 94.8% | 87.8% | ||||||||

| Mixed-Use: | |||||||||||

| Retail | 94.9% | 94.3% | 89.2% | ||||||||

| Hotel | 75.8% | 72.8% | 57.4% | ||||||||

| Same-Store Portfolio | |||||||||||

Office (1) |

95.8% | 95.6% | 92.6% | ||||||||

| Retail | 92.5% | 92.2% | 91.1% | ||||||||

| Multifamily | 92.0% | 94.8% | 87.8% | ||||||||

| Mixed-Use: | |||||||||||

| Retail | 94.9% | 94.3% | 89.2% | ||||||||

| Hotel | 75.8% | 72.8% | 57.4% | ||||||||

| Number of Leases Signed | Comparable Leased Sq. Ft. | Average Cash Basis % Change Over Prior Rent | Average Cash Contractual Rent Per Sq. Ft. | Prior Average Cash Contractual Rent Per Sq. Ft. | Straight-Line Basis % Change Over Prior Rent | ||||||||||||||||||||||||||||||

| Office | Q2 2022 | 11 | 128,000 | 21.1% | $60.65 | $50.07 | 20.7% | ||||||||||||||||||||||||||||

| Last 4 Quarters | 36 | 309,000 | 16.6% | $63.16 | $54.14 | 20.3% | |||||||||||||||||||||||||||||

| Retail | Q2 2022 | 16 | 67,000 | 5.7% | $29.01 | $27.43 | 20.2% | ||||||||||||||||||||||||||||

| Last 4 Quarters | 71 | 322,000 | (2.7)% | $34.54 | $35.49 | 11.0% | |||||||||||||||||||||||||||||

Three Months Ended (1) |

Six Months Ended (1) |

||||||||||||||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change | 2022 | 2021 | Change | ||||||||||||||||||||||||||||||||||||

| Cash Basis: | |||||||||||||||||||||||||||||||||||||||||

| Office | $ | 30,155 | $ | 30,088 | 0.2 | % | $ | 59,643 | $ | 56,377 | 5.8 | % | |||||||||||||||||||||||||||||

| Retail | 16,827 | 17,142 | (1.8) | 33,521 | 33,431 | 0.3 | |||||||||||||||||||||||||||||||||||

| Multifamily | 7,975 | 6,651 | 19.9 | 15,996 | 13,759 | 16.3 | |||||||||||||||||||||||||||||||||||

| Mixed-Use | 5,600 | 4,546 | 23.2 | 10,202 | 4,547 | — | |||||||||||||||||||||||||||||||||||

| Same-store Cash NOI | $ | 60,557 | $ | 58,427 | 3.6 | % | $ | 119,362 | $ | 108,114 | 10.4 | % | |||||||||||||||||||||||||||||

| June 30, 2022 | December 31, 2021 | ||||||||||||||||

| Assets | (unaudited) | ||||||||||||||||

| Real estate, at cost | |||||||||||||||||

| Operating real estate | $ | 3,454,499 | $ | 3,389,726 | |||||||||||||

| Construction in progress | 176,582 | 139,098 | |||||||||||||||

| Held for development | 547 | 547 | |||||||||||||||

| 3,631,628 | 3,529,371 | ||||||||||||||||

| Accumulated depreciation | (894,202) | (847,390) | |||||||||||||||

| Real estate, net | 2,737,426 | 2,681,981 | |||||||||||||||

| Cash and cash equivalents | 60,750 | 139,524 | |||||||||||||||

| Accounts receivable, net | 7,218 | 7,445 | |||||||||||||||

| Deferred rent receivables, net | 87,579 | 82,724 | |||||||||||||||

| Other assets, net | 114,217 | 106,253 | |||||||||||||||

| Total assets | $ | 3,007,190 | $ | 3,017,927 | |||||||||||||

| Liabilities and equity | |||||||||||||||||

| Liabilities: | |||||||||||||||||

| Secured notes payable, net | $ | 110,986 | $ | 110,965 | |||||||||||||

| Unsecured notes payable, net | 1,538,519 | 1,538,238 | |||||||||||||||

| Unsecured line of credit, net | — | — | |||||||||||||||

| Accounts payable and accrued expenses | 66,334 | 64,531 | |||||||||||||||

| Security deposits payable | 8,519 | 7,855 | |||||||||||||||

| Other liabilities and deferred credits, net | 82,864 | 86,215 | |||||||||||||||

| Total liabilities | 1,807,222 | 1,807,804 | |||||||||||||||

| Commitments and contingencies | |||||||||||||||||

| Equity: | |||||||||||||||||

| American Assets Trust, Inc. stockholders' equity | |||||||||||||||||

| Common stock, $0.01 par value, 490,000,000 shares authorized, 60,528,115 and 60,525,580 shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively | 605 | 605 | |||||||||||||||

| Additional paid-in capital | 1,456,747 | 1,453,272 | |||||||||||||||

| Accumulated dividends in excess of net income | (235,107) | (217,785) | |||||||||||||||

| Accumulated other comprehensive income | 9,457 | 2,872 | |||||||||||||||

| Total American Assets Trust, Inc. stockholders' equity | 1,231,702 | 1,238,964 | |||||||||||||||

| Noncontrolling interests | (31,734) | (28,841) | |||||||||||||||

| Total equity | 1,199,968 | 1,210,123 | |||||||||||||||

| Total liabilities and equity | $ | 3,007,190 | $ | 3,017,927 | |||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Revenue: | |||||||||||||||||||||||

| Rental income | $ | 99,016 | $ | 87,639 | $ | 196,002 | $ | 168,769 | |||||||||||||||

| Other property income | 5,139 | 4,170 | 9,623 | 7,026 | |||||||||||||||||||

| Total revenue | 104,155 | 91,809 | 205,625 | 175,795 | |||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Rental expenses | 25,853 | 20,204 | 49,998 | 38,450 | |||||||||||||||||||

| Real estate taxes | 11,287 | 10,612 | 22,716 | 21,966 | |||||||||||||||||||

| General and administrative | 7,612 | 6,924 | 14,754 | 13,747 | |||||||||||||||||||

| Depreciation and amortization | 31,087 | 27,646 | 61,499 | 55,147 | |||||||||||||||||||

| Total operating expenses | 75,839 | 65,386 | 148,967 | 129,310 | |||||||||||||||||||

| Operating income | 28,316 | 26,423 | 56,658 | 46,485 | |||||||||||||||||||

| Interest expense | (14,547) | (14,862) | (29,213) | (28,867) | |||||||||||||||||||

| Loss on early extinguishment of debt | — | — | — | (4,271) | |||||||||||||||||||

| Other (expense) income, net | (181) | (74) | (343) | (127) | |||||||||||||||||||

| Net income | 13,588 | 11,487 | 27,102 | 13,220 | |||||||||||||||||||

| Net income attributable to restricted shares | (154) | (135) | (309) | (272) | |||||||||||||||||||

Net income attributable to unitholders in the Operating Partnership |

(2,852) | (2,411) | (5,688) | (2,750) | |||||||||||||||||||

Net income attributable to American Assets Trust, Inc. stockholders |

$ | 10,582 | $ | 8,941 | $ | 21,105 | $ | 10,198 | |||||||||||||||

| Net income per share | |||||||||||||||||||||||

Basic income attributable to common stockholders per share |

$ | 0.18 | $ | 0.15 | $ | 0.35 | $ | 0.17 | |||||||||||||||

Weighted average shares of common stock outstanding - basic |

60,040,243 | 59,985,787 | 60,039,467 | 59,985,065 | |||||||||||||||||||

Diluted income attributable to common stockholders per share |

$ | 0.18 | $ | 0.15 | $ | 0.35 | $ | 0.17 | |||||||||||||||

Weighted average shares of common stock outstanding - diluted |

76,221,780 | 76,167,324 | 76,221,004 | 76,166,602 | |||||||||||||||||||

| Dividends declared per common share | $ | 0.32 | $ | 0.28 | $ | 0.64 | $ | 0.56 | |||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||

| June 30, 2022 | June 30, 2022 | ||||||||||||||||

| Funds From Operations (FFO) | |||||||||||||||||

| Net income | $ | 13,588 | $ | 27,102 | |||||||||||||

| Depreciation and amortization of real estate assets | 31,087 | 61,499 | |||||||||||||||

| FFO, as defined by NAREIT | $ | 44,675 | $ | 88,601 | |||||||||||||

| Less: Nonforfeitable dividends on restricted stock awards | (153) | (306) | |||||||||||||||

| FFO attributable to common stock and units | $ | 44,522 | $ | 88,295 | |||||||||||||

| FFO per diluted share/unit | $ | 0.58 | $ | 1.16 | |||||||||||||

| Weighted average number of common shares and units, diluted | 76,222,271 | 76,221,747 | |||||||||||||||

Three Months Ended (1) |

Six Months Ended (1) |

||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Same-store cash NOI | 60,557 | $ | 58,427 | $ | 119,362 | $ | 108,114 | ||||||||||||||||

| Non-same-store cash NOI | 2,951 | 82 | 5,424 | 107 | |||||||||||||||||||

Tenant improvement reimbursements (2) |

2,612 | 220 | 2,770 | 291 | |||||||||||||||||||

| Cash NOI | $ | 66,120 | $ | 58,729 | $ | 127,556 | $ | 108,512 | |||||||||||||||

Non-cash revenue and other operating expenses (3) |

895 | 2,264 | 5,355 | 6,867 | |||||||||||||||||||

| General and administrative | (7,612) | (6,924) | (14,754) | (13,747) | |||||||||||||||||||

| Depreciation and amortization | (31,087) | (27,646) | (61,499) | (55,147) | |||||||||||||||||||

| Interest expense | (14,547) | (14,862) | (29,213) | (28,867) | |||||||||||||||||||

| Loss on early extinguishment of debt | — | — | — | (4,271) | |||||||||||||||||||

| Other (expense) income, net | (181) | (74) | (343) | (127) | |||||||||||||||||||

| Net income | $ | 13,588 | $ | 11,487 | $ | 27,102 | $ | 13,220 | |||||||||||||||

| Number of properties included in same-store analysis | 27 | 26 | 27 | 26 | |||||||||||||||||||

| SECOND QUARTER 2022 | |||||

| Supplemental Information | |||||

|

|||||

| Investor and Media Contact | |||||

| American Assets Trust, Inc. | |||||

| Robert F. Barton | |||||

| Executive Vice President and Chief Financial Officer | |||||

| 858-350-2607 | |||||

|

|||||

|

|||||||||||||||||||||||||||||||||||

| Office | Retail | Multifamily | Mixed-Use | ||||||||||||||||||||||||||||||||

| Market | Square Feet | Square Feet | Units | Square Feet | Suites | ||||||||||||||||||||||||||||||

| San Diego | 1,563,221 | 1,322,200 | 1,455 | (1) | — | — | |||||||||||||||||||||||||||||

| Bellevue | 1,026,063 | — | — | — | — | ||||||||||||||||||||||||||||||

| Portland | 876,242 | 44,236 | 657 | — | — | ||||||||||||||||||||||||||||||

| Monterey | — | 673,155 | — | — | — | ||||||||||||||||||||||||||||||

| San Antonio | — | 588,148 | — | — | — | ||||||||||||||||||||||||||||||

| San Francisco | 522,696 | 35,159 | — | — | — | ||||||||||||||||||||||||||||||

| Oahu | 429,718 | — | 93,925 | 369 | |||||||||||||||||||||||||||||||

| Total | 3,988,222 | 3,092,616 | 2,112 | 93,925 | 369 | ||||||||||||||||||||||||||||||

| Square Feet | % | NOI % (2) |

|||||||||||||||||||||||||||

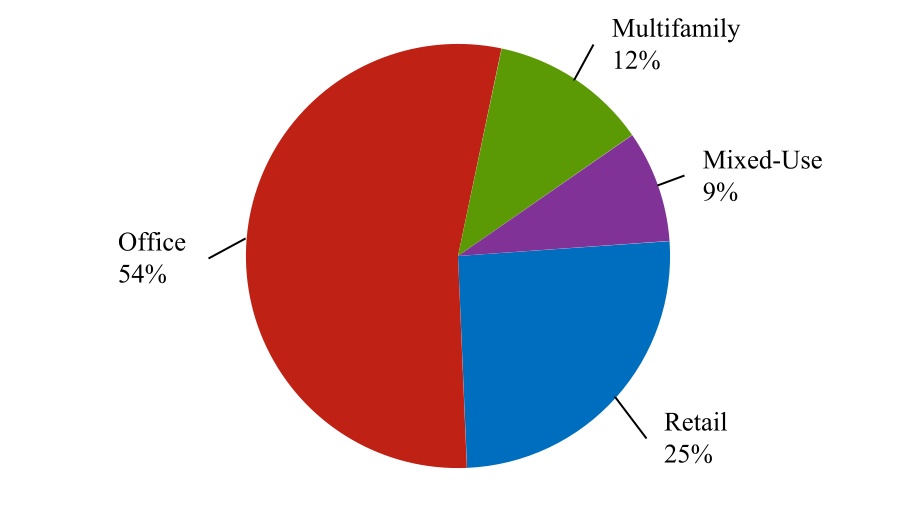

| Note: Circled areas represent all markets in which American Assets Trust, Inc. currently owns and operates its real estate properties. Net rentable square footage may be adjusted from the prior periods to reflect re-measurement of leased space at the properties. | Office | 4.0 | million | 56% | 55% | ||||||||||||||||||||||||

| Retail | 3.1 | million | 44% | 25% | |||||||||||||||||||||||||

| Data is as of June 30, 2022. | Totals | 7.1 | million | ||||||||||||||||||||||||||

(1) Includes 122 RV spaces. |

|||||||||||||||||||||||||||||

| (2) Percentage of Net Operating Income (NOI) calculated for the three months ended June 30, 2022. Reconciliation of NOI to net income is included in the Glossary of Terms. | |||||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| INDEX |  |

||||

| SECOND QUARTER 2022 SUPPLEMENTAL INFORMATION | ||||||||

| 1. | FINANCIAL HIGHLIGHTS | |||||||

| Consolidated Balance Sheets | ||||||||

| Consolidated Statements of Operations | ||||||||

| Funds From Operations (FFO), FFO As Adjusted & Funds Available for Distribution | ||||||||

| Corporate Guidance | ||||||||

| Same-Store Net Operating Income (NOI) | ||||||||

| Same-Store Cash NOI Comparison excluding Redevelopment | ||||||||

| Same-Store Cash NOI Comparison with Redevelopment | ||||||||

| Cash NOI By Region | ||||||||

| Cash NOI Breakdown | ||||||||

| Property Revenue and Operating Expenses | ||||||||

| Segment Capital Expenditures | ||||||||

| Summary of Outstanding Debt | ||||||||

| Market Capitalization | ||||||||

| Summary of Development Opportunities | ||||||||

| 2. | PORTFOLIO DATA | |||||||

| Property Report | ||||||||

| Office Leasing Summary | ||||||||

| Retail Leasing Summary | ||||||||

| Multifamily Leasing Summary | ||||||||

| Mixed-Use Leasing Summary | ||||||||

| Lease Expirations | ||||||||

| Portfolio Leased Statistics | ||||||||

| Top Tenants - Office | ||||||||

| Top Tenants - Retail | ||||||||

| 3. | APPENDIX | |||||||

| Glossary of Terms | ||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

|

|||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| CONSOLIDATED BALANCE SHEETS |  |

||||

| (Amounts in thousands, except shares and per share data) | June 30, 2022 | December 31, 2021 | |||||||||

| ASSETS | (unaudited) | ||||||||||

| Real estate, at cost | |||||||||||

| Operating real estate | $ | 3,454,499 | $ | 3,389,726 | |||||||

| Construction in progress | 176,582 | 139,098 | |||||||||

| Held for development | 547 | 547 | |||||||||

| 3,631,628 | 3,529,371 | ||||||||||

| Accumulated depreciation | (894,202) | (847,390) | |||||||||

| Net real estate | 2,737,426 | 2,681,981 | |||||||||

| Cash and cash equivalents | 60,750 | 139,524 | |||||||||

| Accounts receivable, net | 7,218 | 7,445 | |||||||||

| Deferred rent receivable, net | 87,579 | 82,724 | |||||||||

| Other assets, net | 114,217 | 106,253 | |||||||||

| TOTAL ASSETS | $ | 3,007,190 | $ | 3,017,927 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| LIABILITIES: | |||||||||||

| Secured notes payable, net | $ | 110,986 | $ | 110,965 | |||||||

| Unsecured notes payable, net | 1,538,519 | 1,538,238 | |||||||||

| Accounts payable and accrued expenses | 66,334 | 64,531 | |||||||||

| Security deposits payable | 8,519 | 7,855 | |||||||||

| Other liabilities and deferred credits, net | 82,864 | 86,215 | |||||||||

| Total liabilities | 1,807,222 | 1,807,804 | |||||||||

| Commitments and contingencies | |||||||||||

| EQUITY: | |||||||||||

| American Assets Trust, Inc. stockholders' equity | |||||||||||

| Common stock, $0.01 par value, 490,000,000 shares authorized, 60,528,115 and 60,525,580 shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively | 605 | 605 | |||||||||

| Additional paid in capital | 1,456,747 | 1,453,272 | |||||||||

| Accumulated dividends in excess of net income | (235,107) | (217,785) | |||||||||

| Accumulated other comprehensive income | 9,457 | 2,872 | |||||||||

| Total American Assets Trust, Inc. stockholders' equity | 1,231,702 | 1,238,964 | |||||||||

| Noncontrolling interests | (31,734) | (28,841) | |||||||||

| Total equity | 1,199,968 | 1,210,123 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 3,007,190 | $ | 3,017,927 | |||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| CONSOLIDATED STATEMENTS OF OPERATIONS |  |

||||

| (Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | Six Months Ended | |||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| REVENUE: | |||||||||||||||||||||||

| Rental income | $ | 99,016 | $ | 87,639 | $ | 196,002 | $ | 168,769 | |||||||||||||||

| Other property income | 5,139 | 4,170 | 9,623 | 7,026 | |||||||||||||||||||

| Total revenue | 104,155 | 91,809 | 205,625 | 175,795 | |||||||||||||||||||

| EXPENSES: | |||||||||||||||||||||||

| Rental expenses | 25,853 | 20,204 | 49,998 | 38,450 | |||||||||||||||||||

| Real estate taxes | 11,287 | 10,612 | 22,716 | 21,966 | |||||||||||||||||||

| General and administrative | 7,612 | 6,924 | 14,754 | 13,747 | |||||||||||||||||||

| Depreciation and amortization | 31,087 | 27,646 | 61,499 | 55,147 | |||||||||||||||||||

| Total operating expenses | 75,839 | 65,386 | 148,967 | 129,310 | |||||||||||||||||||

| OPERATING INCOME | 28,316 | 26,423 | 56,658 | 46,485 | |||||||||||||||||||

| Interest expense | (14,547) | (14,862) | (29,213) | (28,867) | |||||||||||||||||||

| Loss on early extinguishment of debt | — | — | — | (4,271) | |||||||||||||||||||

| Other (expense) income, net | (181) | (74) | (343) | (127) | |||||||||||||||||||

| NET INCOME | 13,588 | 11,487 | 27,102 | 13,220 | |||||||||||||||||||

| Net income attributable to restricted shares | (154) | (135) | (309) | (272) | |||||||||||||||||||

| Net income attributable to unitholders in the Operating Partnership | (2,852) | (2,411) | (5,688) | (2,750) | |||||||||||||||||||

| NET INCOME ATTRIBUTABLE TO AMERICAN ASSETS TRUST, INC. STOCKHOLDERS | $ | 10,582 | $ | 8,941 | $ | 21,105 | $ | 10,198 | |||||||||||||||

| EARNINGS PER COMMON SHARE | |||||||||||||||||||||||

| Basic income from operations attributable to common stockholders per share | $ | 0.18 | $ | 0.15 | $ | 0.35 | $ | 0.17 | |||||||||||||||

| Weighted average shares of common stock outstanding - basic | 60,040,243 | 59,985,787 | 60,039,467 | 59,985,065 | |||||||||||||||||||

| Diluted income from continuing operations attributable to common stockholders per share | $ | 0.18 | $ | 0.15 | $ | 0.35 | $ | 0.17 | |||||||||||||||

| Weighted average shares of common stock outstanding - diluted | 76,221,780 | 76,167,324 | 76,221,004 | 76,166,602 | |||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| FUNDS FROM OPERATIONS, FFO AS ADJUSTED & FUNDS AVAILABLE FOR DISTRIBUTION |  |

||||

| (Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | Six Months Ended | |||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

Funds from Operations (FFO) (1) |

|||||||||||||||||||||||

| Net income | $ | 13,588 | $ | 11,487 | $ | 27,102 | $ | 13,220 | |||||||||||||||

| Depreciation and amortization of real estate assets | 31,087 | 27,646 | 61,499 | 55,147 | |||||||||||||||||||

| FFO, as defined by NAREIT | 44,675 | 39,133 | 88,601 | 68,367 | |||||||||||||||||||

| Less: Nonforfeitable dividends on restricted stock awards | (153) | (134) | (306) | (269) | |||||||||||||||||||

| FFO attributable to common stock and common units | $ | 44,522 | $ | 38,999 | $ | 88,295 | $ | 68,098 | |||||||||||||||

| FFO per diluted share/unit | $ | 0.58 | $ | 0.51 | $ | 1.16 | $ | 0.89 | |||||||||||||||

Weighted average number of common shares and common units, diluted (2) |

76,222,271 | 76,167,246 | 76,221,747 | 76,166,158 | |||||||||||||||||||

Funds Available for Distribution (FAD) (1) |

$ | 34,263 | $ | 26,453 | $ | 63,385 | $ | 44,482 | |||||||||||||||

| Dividends | |||||||||||||||||||||||

| Dividends declared and paid | $ | 24,547 | $ | 21,464 | $ | 49,092 | $ | 42,927 | |||||||||||||||

| Dividends declared and paid per share/unit | $ | 0.32 | $ | 0.28 | $ | 0.64 | $ | 0.56 | |||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| FUNDS FROM OPERATIONS, FFO AS ADJUSTED & FUNDS AVAILABLE FOR DISTRIBUTION (CONTINUED) |  |

||||

| (Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | Six Months Ended | |||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

Funds Available for Distribution (FAD) (1) |

|||||||||||||||||||||||

FFO (6) |

$ | 44,675 | $ | 39,133 | $ | 88,601 | $ | 68,367 | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Tenant improvements, leasing commissions and maintenance capital expenditures | (12,004) | (12,347) | (24,324) | (20,875) | |||||||||||||||||||

Net effect of straight-line rents (3) |

(108) | (1,905) | (3,789) | (7,126) | |||||||||||||||||||

Amortization of net above (below) market rents (4) |

(837) | (749) | (1,666) | (1,528) | |||||||||||||||||||

Net effect of other lease assets (5) |

50 | 392 | 100 | 1,789 | |||||||||||||||||||

| Amortization of debt issuance costs and debt fair value adjustment | 639 | 579 | 1,279 | 1,156 | |||||||||||||||||||

| Non-cash compensation expense | 2,001 | 1,484 | 3,490 | 2,968 | |||||||||||||||||||

| Nonforfeitable dividends on restricted stock awards | (153) | (134) | (306) | (269) | |||||||||||||||||||

| FAD | $ | 34,263 | $ | 26,453 | $ | 63,385 | $ | 44,482 | |||||||||||||||

| Summary of Capital Expenditures | |||||||||||||||||||||||

| Tenant improvements and leasing commissions | $ | 7,781 | $ | 7,383 | $ | 14,962 | $ | 12,101 | |||||||||||||||

| Maintenance capital expenditures | 4,223 | 4,964 | 9,362 | 8,774 | |||||||||||||||||||

| $ | 12,004 | $ | 12,347 | $ | 24,324 | $ | 20,875 | ||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| CORPORATE GUIDANCE |  |

||||

| (Amounts in thousands, except share and per share data) | ||||||||||||||||||||||||||

Prior 2022 Guidance Range (1) (2) |

Revised 2022 Guidance Range (2) |

|||||||||||||||||||||||||

| Funds from Operations (FFO): | ||||||||||||||||||||||||||

| Net income | $ | 49,757 | $ | 55,860 | $ | 52,989 | $ | 57,566 | ||||||||||||||||||

| Depreciation and amortization of real estate assets | 113,374 | 113,374 | 116,233 | 116,233 | ||||||||||||||||||||||

| FFO, as defined by NAREIT | 163,131 | 169,234 | 169,222 | 173,799 | ||||||||||||||||||||||

| Less: Nonforfeitable dividends on restricted stock awards | (642) | (642) | (642) | (642) | ||||||||||||||||||||||

| FFO attributable to common stock and units | $ | 162,489 | $ | 168,592 | $ | 168,580 | $ | 173,157 | ||||||||||||||||||

| Weighted average number of common shares and units, diluted | 76,285,403 | 76,285,403 | 76,280,373 | 76,280,373 | ||||||||||||||||||||||

| FFO per diluted share, updated | $ | 2.13 | $ | 2.21 | $ | 2.21 | $ | 2.27 | ||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| SAME-STORE NET OPERATING INCOME (NOI) |  |

||||

| (Unaudited, amounts in thousands) | Three Months Ended June 30, 2022 | ||||||||||||||||||||||||||||

| Office | Retail | Multifamily | Mixed-Use | Total | |||||||||||||||||||||||||

| Real estate rental revenue | |||||||||||||||||||||||||||||

| Same-store | $ | 45,839 | $ | 24,338 | $ | 14,214 | $ | 15,010 | $ | 99,401 | |||||||||||||||||||

Non-same store (1) |

4,754 | — | — | — | 4,754 | ||||||||||||||||||||||||

| Total | 50,593 | 24,338 | 14,214 | 15,010 | 104,155 | ||||||||||||||||||||||||

| Real estate expenses | |||||||||||||||||||||||||||||

| Same-store | 12,466 | 7,430 | 6,221 | 9,426 | 35,543 | ||||||||||||||||||||||||

Non-same store (1) |

1,597 | — | — | — | 1,597 | ||||||||||||||||||||||||

| Total | 14,063 | 7,430 | 6,221 | 9,426 | 37,140 | ||||||||||||||||||||||||

| Net Operating Income (NOI) | |||||||||||||||||||||||||||||

| Same-store | 33,373 | 16,908 | 7,993 | 5,584 | 63,858 | ||||||||||||||||||||||||

Non-same store (1) |

3,157 | — | — | — | 3,157 | ||||||||||||||||||||||||

| Total | $ | 36,530 | $ | 16,908 | $ | 7,993 | $ | 5,584 | $ | 67,015 | |||||||||||||||||||

| Same-store NOI | $ | 33,373 | $ | 16,908 | $ | 7,993 | $ | 5,584 | $ | 63,858 | |||||||||||||||||||

Net effect of straight-line rents (2) |

(314) | 183 | (18) | 16 | (133) | ||||||||||||||||||||||||

Amortization of net above (below) market rents (3) |

(343) | (263) | — | — | (606) | ||||||||||||||||||||||||

Net effect of other lease assets (4) |

40 | 10 | — | — | 50 | ||||||||||||||||||||||||

Tenant improvement reimbursements (5) |

(2,601) | (11) | — | — | (2,612) | ||||||||||||||||||||||||

Same-store cash NOI (5) |

$ | 30,155 | $ | 16,827 | $ | 7,975 | $ | 5,600 | $ | 60,557 | |||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| SAME-STORE NET OPERATING INCOME (NOI) (CONTINUED) |  |

||||

| (Unaudited, amounts in thousands) | Six Months Ended June 30, 2022 | ||||||||||||||||||||||||||||

| Office | Retail | Multifamily | Mixed-Use | Total | |||||||||||||||||||||||||

| Real estate rental revenue | |||||||||||||||||||||||||||||

| Same-store | $ | 91,058 | $ | 49,179 | $ | 28,103 | $ | 28,181 | $ | 196,521 | |||||||||||||||||||

Non-same store (1) |

9,104 | — | — | — | 9,104 | ||||||||||||||||||||||||

| Total | 100,162 | 49,179 | 28,103 | 28,181 | 205,625 | ||||||||||||||||||||||||

| Real estate expenses | |||||||||||||||||||||||||||||

| Same-store | 24,430 | 15,158 | 12,300 | 17,863 | 69,751 | ||||||||||||||||||||||||

Non-same store (1) |

2,963 | — | — | — | 2,963 | ||||||||||||||||||||||||

| Total | 27,393 | 15,158 | 12,300 | 17,863 | 72,714 | ||||||||||||||||||||||||

| Net Operating Income (NOI) | |||||||||||||||||||||||||||||

| Same-store | 66,628 | 34,021 | 15,803 | 10,318 | 126,770 | ||||||||||||||||||||||||

Non-same store (1) |

6,141 | — | — | — | 6,141 | ||||||||||||||||||||||||

| Total | $ | 72,769 | $ | 34,021 | $ | 15,803 | $ | 10,318 | $ | 132,911 | |||||||||||||||||||

| Same-store NOI | $ | 66,628 | $ | 34,021 | $ | 15,803 | $ | 10,318 | $ | 126,770 | |||||||||||||||||||

Net effect of straight-line rents (2) |

(3,572) | 19 | 193 | (106) | (3,466) | ||||||||||||||||||||||||

Amortization of net above (below) market rents (3) |

(735) | (526) | — | (10) | (1,271) | ||||||||||||||||||||||||

Net effect of other lease assets (4) |

80 | 19 | — | — | 99 | ||||||||||||||||||||||||

Tenant improvement reimbursements (5) |

(2,758) | (12) | — | — | (2,770) | ||||||||||||||||||||||||

Same-store cash NOI (5) |

$ | 59,643 | $ | 33,521 | $ | 15,996 | $ | 10,202 | $ | 119,362 | |||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| SAME-STORE CASH NOI COMPARISON EXCLUDING REDEVELOPMENT |  |

||||

| (Unaudited, amounts in thousands) | Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change | 2022 | 2021 | Change | ||||||||||||||||||||||||||||||

| Cash Basis: | |||||||||||||||||||||||||||||||||||

| Office | $ | 30,155 | $ | 30,088 | 0.2 | % | $ | 59,643 | $ | 56,377 | 5.8 | % | |||||||||||||||||||||||

| Retail | 16,827 | 17,142 | (1.8) | 33,521 | 33,431 | 0.3 | |||||||||||||||||||||||||||||

| Multifamily | 7,975 | 6,651 | 19.9 | 15,996 | 13,759 | 16.3 | |||||||||||||||||||||||||||||

| Mixed-Use | 5,600 | 4,546 | 23.2 | 10,202 | 4,547 | — | |||||||||||||||||||||||||||||

Same-store Cash NOI (1)(2) |

$ | 60,557 | $ | 58,427 | 3.6 | % | $ | 119,362 | $ | 108,114 | 10.4 | % | |||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| SAME-STORE CASH NOI COMPARISON WITH REDEVELOPMENT |  |

||||

| (Unaudited, amounts in thousands) | Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change | 2022 | 2021 | Change | ||||||||||||||||||||||||||||||

| Cash Basis: | |||||||||||||||||||||||||||||||||||

| Office | $ | 29,962 | $ | 30,181 | (0.7) | % | $ | 59,261 | $ | 56,479 | 4.9 | % | |||||||||||||||||||||||

| Retail | 16,826 | 17,142 | (1.8) | 33,520 | 33,431 | 0.3 | |||||||||||||||||||||||||||||

| Multifamily | 7,975 | 6,651 | 19.9 | 15,996 | 13,759 | 16.3 | |||||||||||||||||||||||||||||

| Mixed-Use | 5,600 | 4,546 | 23.2 | 10,202 | 4,547 | 124.4 | |||||||||||||||||||||||||||||

Same-store Cash NOI with Redevelopment (1)(2) |

$ | 60,363 | $ | 58,520 | 3.1 | % | $ | 118,979 | $ | 108,216 | 9.9 | % | |||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| CASH NOI BY REGION |  |

||||

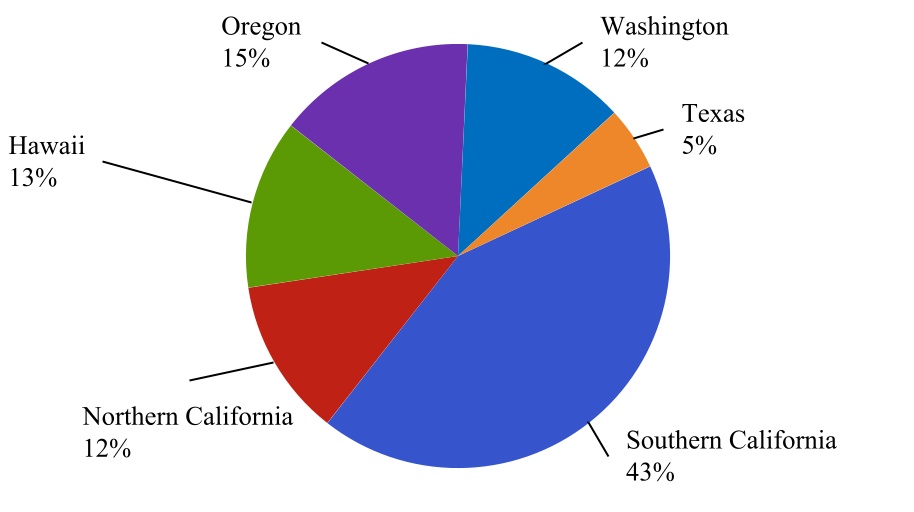

| (Unaudited, amounts in thousands) | Three Months Ended June 30, 2022 | ||||||||||||||||||||||||||||

| Office | Retail | Multifamily | Mixed-Use | Total | |||||||||||||||||||||||||

| Cash Basis: | |||||||||||||||||||||||||||||

| Southern California | $ | 13,324 | $ | 8,181 | $ | 6,615 | $ | — | $ | 28,120 | |||||||||||||||||||

| Northern California | 5,678 | 2,279 | — | — | 7,957 | ||||||||||||||||||||||||

| Hawaii | — | 2,954 | — | 5,600 | 8,554 | ||||||||||||||||||||||||

| Oregon | 8,462 | 217 | 1,360 | — | 10,039 | ||||||||||||||||||||||||

| Texas | — | 3,207 | — | — | 3,207 | ||||||||||||||||||||||||

| Washington | 8,243 | — | — | — | 8,243 | ||||||||||||||||||||||||

| Total Cash NOI | $ | 35,707 | $ | 16,838 | $ | 7,975 | $ | 5,600 | $ | 66,120 | |||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| CASH NOI BREAKDOWN |  |

||||

| Three Months Ended June 30, 2022 | ||

| Cash NOI Breakdown | ||||||||

| Portfolio Diversification by Geographic Region | Portfolio Diversification by Segment | |||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| PROPERTY REVENUE AND OPERATING EXPENSES |  |

||||

| (Unaudited, amounts in thousands) | Three Months Ended June 30, 2022 | |||||||||||||||||||||||||||||||||||||

| Additional | Property | |||||||||||||||||||||||||||||||||||||

| Property | Billed Expense | Operating | Rental | Cash | ||||||||||||||||||||||||||||||||||

| Property | Base Rent (1) |

Income (2) |

Reimbursements (3) |

Expenses (4) |

Adjustments (5) |

NOI (6) |

||||||||||||||||||||||||||||||||

| Office Portfolio | ||||||||||||||||||||||||||||||||||||||

| La Jolla Commons | $ | 7,816 | $ | 214 | $ | 2,489 | $ | (2,953) | $ | (250) | $ | 7,316 | ||||||||||||||||||||||||||

Torrey Reserve Campus (7) |

5,163 | 49 | 278 | (1,574) | (21) | 3,895 | ||||||||||||||||||||||||||||||||

| Torrey Point | 1,336 | 82 | 1 | (383) | (259) | 777 | ||||||||||||||||||||||||||||||||

| Solana Crossing | 2,008 | 15 | 58 | (584) | (140) | 1,357 | ||||||||||||||||||||||||||||||||

| The Landmark at One Market | 9,889 | 71 | 306 | (2,995) | (1,501) | 5,770 | ||||||||||||||||||||||||||||||||

| One Beach Street | — | — | — | (92) | — | (92) | ||||||||||||||||||||||||||||||||

| First & Main | 2,736 | 204 | 637 | (989) | 2,498 | 5,086 | ||||||||||||||||||||||||||||||||

Lloyd Portfolio (7) |

4,233 | 404 | 182 | (1,306) | (36) | 3,477 | ||||||||||||||||||||||||||||||||

| City Center Bellevue | 6,014 | 457 | 157 | (1,651) | 99 | 5,076 | ||||||||||||||||||||||||||||||||

Eastgate Office Park (8) |

1,549 | 50 | 685 | (733) | — | 1,551 | ||||||||||||||||||||||||||||||||

Corporate Campus East III (9) |

961 | 62 | 370 | (393) | 231 | 1,231 | ||||||||||||||||||||||||||||||||

Bel-Spring 520 (10) |

482 | 10 | 187 | (229) | (65) | 385 | ||||||||||||||||||||||||||||||||

| Subtotal Office Portfolio | $ | 42,187 | $ | 1,618 | $ | 5,350 | $ | (13,882) | $ | 556 | $ | 35,829 | ||||||||||||||||||||||||||

| Retail Portfolio | ||||||||||||||||||||||||||||||||||||||

| Carmel Country Plaza | $ | 894 | $ | 33 | $ | 198 | $ | (208) | $ | 1 | $ | 918 | ||||||||||||||||||||||||||

| Carmel Mountain Plaza | 3,171 | 40 | 783 | (877) | (93) | 3,024 | ||||||||||||||||||||||||||||||||

| South Bay Marketplace | 606 | 15 | 200 | (195) | (31) | 595 | ||||||||||||||||||||||||||||||||

| Gateway Marketplace | 669 | — | 212 | (226) | 10 | 665 | ||||||||||||||||||||||||||||||||

| Lomas Santa Fe Plaza | 1,517 | 12 | 296 | (438) | 13 | 1,400 | ||||||||||||||||||||||||||||||||

| Solana Beach Towne Centre | 1,606 | 36 | 501 | (591) | 27 | 1,579 | ||||||||||||||||||||||||||||||||

| Del Monte Center | 2,181 | 306 | 729 | (1,274) | 46 | 1,988 | ||||||||||||||||||||||||||||||||

| Geary Marketplace | 290 | — | 131 | (130) | — | 291 | ||||||||||||||||||||||||||||||||

| The Shops at Kalakaua | 258 | 14 | 47 | (88) | — | 231 | ||||||||||||||||||||||||||||||||

| Waikele Center | 3,063 | 369 | 956 | (1,681) | 16 | 2,723 | ||||||||||||||||||||||||||||||||

| Alamo Quarry Market | 3,397 | 198 | 1,184 | (1,625) | 53 | 3,207 | ||||||||||||||||||||||||||||||||

| Hassalo on Eighth - Retail | 242 | 30 | 41 | (96) | — | 217 | ||||||||||||||||||||||||||||||||

| Subtotal Retail Portfolio | $ | 17,894 | $ | 1,053 | $ | 5,278 | $ | (7,429) | $ | 42 | $ | 16,838 | ||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| PROPERTY REVENUE AND OPERATING EXPENSES (CONTINUED) |  |

||||

| (Unaudited, amounts in thousands) | Three Months Ended June 30, 2022 | |||||||||||||||||||||||||||||||||||||

| Additional | Property | |||||||||||||||||||||||||||||||||||||

| Property | Billed Expense | Operating | Rental | Cash | ||||||||||||||||||||||||||||||||||

| Property | Base Rent (1) |

Income (2) |

Reimbursements (3) |

Expenses (4) |

Adjustments (5) |

NOI (6) |

||||||||||||||||||||||||||||||||

| Multifamily Portfolio | ||||||||||||||||||||||||||||||||||||||

| Loma Palisades | $ | 3,904 | $ | 243 | $ | — | $ | (1,437) | $ | (6) | $ | 2,704 | ||||||||||||||||||||||||||

| Imperial Beach Gardens | 1,070 | 62 | — | (482) | — | 650 | ||||||||||||||||||||||||||||||||

| Mariner's Point | 516 | 28 | — | (227) | — | 317 | ||||||||||||||||||||||||||||||||

| Santa Fe Park RV Resort | 526 | 37 | — | (250) | — | 313 | ||||||||||||||||||||||||||||||||

| Pacific Ridge Apartments | 4,491 | 267 | — | (2,120) | (7) | 2,631 | ||||||||||||||||||||||||||||||||

| Hassalo on Eighth - Multifamily | 2,863 | 410 | — | (1,706) | (207) | 1,360 | ||||||||||||||||||||||||||||||||

| Subtotal Multifamily Portfolio | $ | 13,370 | $ | 1,047 | $ | — | $ | (6,222) | $ | (220) | $ | 7,975 | ||||||||||||||||||||||||||

| Mixed-Use Portfolio | ||||||||||||||||||||||||||||||||||||||

| Waikiki Beach Walk - Retail | $ | 2,624 | $ | 1,236 | $ | 771 | $ | (1,515) | $ | (563) | $ | 2,553 | ||||||||||||||||||||||||||

| Waikiki Beach Walk - Embassy Suites™ | 9,413 | 1,545 | — | (7,911) | — | 3,047 | ||||||||||||||||||||||||||||||||

| Subtotal Mixed-Use Portfolio | $ | 12,037 | $ | 2,781 | $ | 771 | $ | (9,426) | $ | (563) | $ | 5,600 | ||||||||||||||||||||||||||

| Subtotal Development Properties | $ | — | $ | 28 | $ | — | $ | (150) | $ | — | $ | (122) | ||||||||||||||||||||||||||

| Total | $ | 85,488 | $ | 6,527 | $ | 11,399 | $ | (37,109) | $ | (185) | $ | 66,120 | ||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| SEGMENT CAPITAL EXPENDITURES |  |

||||

| (Unaudited, amounts in thousands) | Three Months Ended June 30, 2022 | |||||||||||||||||||||||||||||||||||||

| Segment | Tenant Improvements and Leasing Commissions | Maintenance Capital Expenditures | Total Tenant Improvements, Leasing Commissions and Maintenance Capital Expenditures | Redevelopment and Expansions | New Development | Total Capital Expenditures | ||||||||||||||||||||||||||||||||

| Office Portfolio | $ | 5,707 | $ | 1,204 | $ | 6,911 | $ | 8,455 | $ | 14,685 | $ | 30,051 | ||||||||||||||||||||||||||

| Retail Portfolio | 2,074 | 1,615 | 3,689 | 8 | — | 3,697 | ||||||||||||||||||||||||||||||||

| Multifamily Portfolio | — | 1,283 | 1,283 | 32 | — | 1,315 | ||||||||||||||||||||||||||||||||

| Mixed-Use Portfolio | — | 121 | 121 | — | — | 121 | ||||||||||||||||||||||||||||||||

| Total | $ | 7,781 | $ | 4,223 | $ | 12,004 | $ | 8,495 | $ | 14,685 | $ | 35,184 | ||||||||||||||||||||||||||

| Six Months Ended June 30, 2022 | ||||||||||||||||||||||||||||||||||||||

| Segment | Tenant Improvements and Leasing Commissions | Maintenance Capital Expenditures | Total Tenant Improvements, Leasing Commissions and Maintenance Capital Expenditures | Redevelopment and Expansions | New Development | Total Capital Expenditures | ||||||||||||||||||||||||||||||||

| Office Portfolio | $ | 10,595 | $ | 3,213 | $ | 13,808 | $ | 15,350 | $ | 27,559 | $ | 56,717 | ||||||||||||||||||||||||||

| Retail Portfolio | 4,119 | 3,127 | 7,246 | 11 | — | 7,257 | ||||||||||||||||||||||||||||||||

| Multifamily Portfolio | — | 2,818 | 2,818 | 68 | — | 2,886 | ||||||||||||||||||||||||||||||||

| Mixed-Use Portfolio | 248 | 204 | 452 | — | — | 452 | ||||||||||||||||||||||||||||||||

| Total | $ | 14,962 | $ | 9,362 | $ | 24,324 | $ | 15,429 | $ | 27,559 | $ | 67,312 | ||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

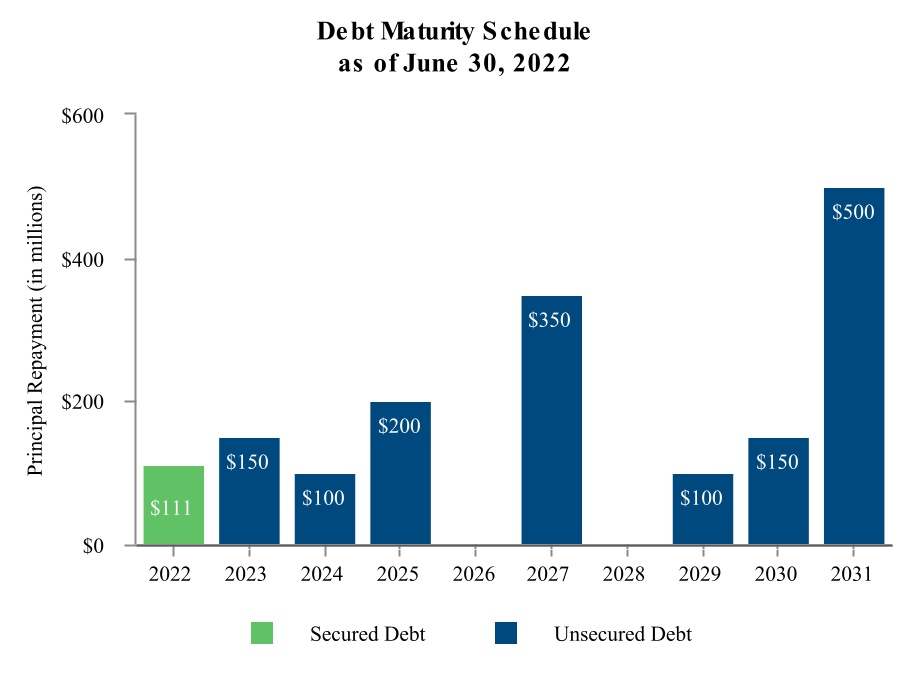

| SUMMARY OF OUTSTANDING DEBT |  |

||||

| (Unaudited, amounts in thousands) | Amount | |||||||||||||||||||||||||

| Outstanding at | Annual Debt | |||||||||||||||||||||||||

| Debt | June 30, 2022 | Interest Rate | Service (1) |

Maturity Date | ||||||||||||||||||||||

| City Center Bellevue | 111,000 | 3.98 | % | 112,878 | November 1, 2022 | |||||||||||||||||||||

Secured Notes Payable / Weighted Average (3) |

$ | 111,000 | 3.98 | % | $ | 112,878 | ||||||||||||||||||||

Term Loan A (3) |

$ | 100,000 | 2.70 | % | $ | 2,700 | January 5, 2027 | |||||||||||||||||||

Term Loan B (4) |

100,000 | 2.65 | % | 101,981 | March 1, 2023 | |||||||||||||||||||||

Term Loan C (5) |

50,000 | 2.64 | % | 50,988 | March 1, 2023 | |||||||||||||||||||||

Series F Notes (6) |

100,000 | 3.85 | % | 3,780 | July 19, 2024 | |||||||||||||||||||||

| Series B Notes | 100,000 | 4.45 | % | 4,450 | February 2, 2025 | |||||||||||||||||||||

| Series C Notes | 100,000 | 4.50 | % | 4,500 | April 1, 2025 | |||||||||||||||||||||

Series D Notes (7) |

250,000 | 3.87 | % | 10,725 | March 1, 2027 | |||||||||||||||||||||

Series E Notes (8) |

100,000 | 4.18 | % | 4,240 | May 23, 2029 | |||||||||||||||||||||

Series G Notes (9) |

150,000 | 3.88 | % | 5,865 | July 30, 2030 | |||||||||||||||||||||

3.375% Senior Unsecured Notes (10) |

500,000 | 3.38 | % | 16,875 | February 1, 2031 | |||||||||||||||||||||

Unsecured Notes Payable / Weighted Average (11) |

$ | 1,550,000 | 3.61 | % | $ | 206,104 | ||||||||||||||||||||

Unsecured Line of Credit (12) |

$ | — | — | % | ||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| MARKET CAPITALIZATION |  |

||||

| (Unaudited, amounts in thousands, except per share data) | ||||||||||||||

| Market data | June 30, 2022 | |||||||||||||

| Common shares outstanding | 60,528 | |||||||||||||

| Common units outstanding | 16,181 | |||||||||||||

| Common shares and common units outstanding | 76,709 | |||||||||||||

| Market price per common share | $ | 29.70 | ||||||||||||

| Equity market capitalization | $ | 2,278,257 | ||||||||||||

| Total debt | $ | 1,661,000 | ||||||||||||

| Total market capitalization | $ | 3,939,257 | ||||||||||||

| Less: Cash on hand | $ | (60,750) | ||||||||||||

| Total enterprise value | $ | 3,878,507 | ||||||||||||

| Total unencumbered assets, gross | $ | 3,614,841 | ||||||||||||

| Total debt/Total capitalization | 42.2 | % | ||||||||||||

| Total debt/Total enterprise value | 42.8 | % | ||||||||||||

Net debt/Total enterprise value (1) |

41.3 | % | ||||||||||||

| Total unencumbered assets, gross/Unsecured debt | 233.2 | % | ||||||||||||

| Quarter Annualized | Trailing 12 Months | |||||||||||||

Total debt/Adjusted EBITDA (2)(3) |

7.0 | x | 7.1 | x | ||||||||||

Net debt/Adjusted EBITDA (1)(2)(3) |

6.7 | x | 6.9 | x | ||||||||||

Interest coverage ratio (4) |

3.9 | x | 3.9 | x | ||||||||||

Fixed charge coverage ratio (4) |

3.9 | x | 3.9 | x | ||||||||||

| Weighted Average Fixed Interest Rate | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | ||||||||||||||||||||||

| 4.0% | 2.6% | 3.8% | 4.5% | —% | 3.5% | —% | 4.2% | 3.9% | 3.4% | |||||||||||||||||||||||

| Total Weighed Average Fixed Interest Rate: | 3.64% | ||||

| Weighted Average Term to Maturity: | 5.2 | ||||

| Credit Ratings | ||||||||

| Rating Agency | Rating | Outlook | ||||||

| Fitch | BBB | Stable | ||||||

| Moody's | Baa3 | Stable | ||||||

| Standard & Poors | BBB- | Stable | ||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| SUMMARY OF DEVELOPMENT OPPORTUNITIES |  |

||||

| Our portfolio has numerous potential opportunities to create future shareholder value. These opportunities could be subject to government approvals, lender consents, tenant consents, market conditions, availability of debt and/or equity financing, etc. Many of these opportunities are in their preliminary stages and may not ultimately come to fruition. This schedule will update as we modify various assumptions and markets conditions change. Square footages and units set forth below are estimates only and ultimately may differ materially from actual square footages and units. | |||||||||||||||||||||||||||||

| Development/Redevelopment Projects | |||||||||||||||||||||||||||||

Project Costs (in thousands) (3) |

|||||||||||||||||||||||||||||

| Start Date |

Completion Date |

Estimated Stabilized

Yield (1)

|

Rentable Square Feet | Percent Leased |

Estimated Stabilization Date (2) |

Cost Incurred to Date | Total Estimated Investment | ||||||||||||||||||||||

| Property | Location | ||||||||||||||||||||||||||||

| Office Property: | |||||||||||||||||||||||||||||

| La Jolla Commons | University Town Center, San Diego, CA | April 2021 | September 2023 | 6.5% - 7.5% | 213,000 | —% | 2024 | $85,799 | $175,000 | ||||||||||||||||||||

| One Beach Street | San Francisco, CA | February 2021 | August 2022 | TBD | 102,000 | —% | 2023 | $30,345 | $42,800 | ||||||||||||||||||||

| Development/Redevelopment Pipeline | |||||||||||||||||

| Property | Property Type | Location | Estimated Rentable Square Feet |

Multifamily Units | Opportunity | ||||||||||||

| Waikele Center | Retail | Honolulu, HI | 90,000 | N/A | Development of 90,000 square feet retail building (former KMart Space) | ||||||||||||

| Lomas Santa Fe Plaza | Retail | Solana Beach, CA | 45,000 | N/A | Development of 45,000 square feet retail building | ||||||||||||

Lloyd Portfolio - multiple phases (4) |

Mixed Use | Portland, OR | |||||||||||||||

Phase 2A - Oregon Square |

33,000 | N/A | Remodel and repurpose a 33,000 square feet office building into flexible creative office space | ||||||||||||||

Phase 2B - Oregon Square |

385,000 | N/A | Development of build-to-suit office towers | ||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

|

|||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| PROPERTY REPORT |  |

||||

| As of June 30, 2022 | Office and Retail Portfolios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net | Annualized | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number | Rentable | Base Rent per | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Built/ | of | Square | Percentage | Annualized | Square | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Property | Location | Renovated | Buildings | Feet (1) |

Leased (2) |

Base Rent (3) |

Foot (4) |

Retail Anchor Tenant(s) (5) |

Other Principal Retail Tenants (6) |

|||||||||||||||||||||||||||||||||||||||||||||||

| Office Properties | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| La Jolla Commons | San Diego, CA | 2008/2014 | 2 | 724,208 | 99.0% | $ | 46,017,122 | $64.18 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Torrey Reserve Campus | San Diego, CA | 1996-2000/2014-2016/2021 | 14 | 521,740 | 93.7% | 23,242,868 | 47.54 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Torrey Point | San Diego, CA | 2017 | 2 | 93,264 | 96.8 | 5,350,758 | 59.27 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Solana Crossing | Solana Beach, CA | 1982/2005 | 4 | 224,009 | 82.6 | 8,206,551 | 44.35 | |||||||||||||||||||||||||||||||||||||||||||||||||

The Landmark at One Market (7) |

San Francisco, CA | 1917/2000 | 1 | 422,426 | 100.0 | 39,562,897 | 93.66 | |||||||||||||||||||||||||||||||||||||||||||||||||

| One Beach Street | San Francisco, CA | 1924/1972/1987/1992 | 1 | 100,270 | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| First & Main | Portland, OR | 2010 | 1 | 360,314 | 93.0 | 10,959,123 | 32.70 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lloyd Portfolio | Portland, OR | 1940-2015 | 3 | 515,928 | 96.8 | 16,763,718 | 33.57 | |||||||||||||||||||||||||||||||||||||||||||||||||

| City Center Bellevue | Bellevue, WA | 1987 | 1 | 496,437 | 96.5 | 24,252,504 | 50.63 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Eastgate Office Park | Bellevue, WA | 1985 | 4 | 280,053 | 76.2 | 8,594,510 | 40.27 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Campus East III | Bellevue, WA | 1986 | 4 | 157,163 | 86.8 | 5,725,045 | 41.97 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Bel-Spring 520 | Bellevue, WA | 1983 | 2 | 92,410 | 68.3% | 2,719,854 | $43.09 | |||||||||||||||||||||||||||||||||||||||||||||||||

Subtotal/Weighted Average Office Portfolio (8) |

39 | 3,988,222 | 91.0% | $ | 191,394,950 | $52.74 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Retail Properties | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Carmel Country Plaza | San Diego, CA | 1991 | 9 | 78,098 | 84.2% | $ | 3,581,052 | $54.46 | Sharp Healthcare, San Diego County Credit Union | |||||||||||||||||||||||||||||||||||||||||||||||

Carmel Mountain Plaza (9) |

San Diego, CA | 1994/2014 | 15 | 528,416 | 96.1 | 13,435,504 | 26.46 | At Home Stores | Dick's Sporting Goods, Sprouts Farmers Market, Nordstrom Rack, Total Wine | |||||||||||||||||||||||||||||||||||||||||||||||

South Bay Marketplace (9) |

San Diego, CA | 1997 | 9 | 132,877 | 100.0 | 2,483,031 | 18.69 | Ross Dress for Less, Grocery Outlet | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gateway Marketplace | San Diego, CA | 1997/2016 | 3 | 127,861 | 100.0 | 2,657,205 | 20.78 | Hobby Lobby | Smart & Final, Aldi | |||||||||||||||||||||||||||||||||||||||||||||||

| Lomas Santa Fe Plaza | Solana Beach, CA | 1972/1997 | 9 | 208,297 | 97.7 | 6,136,862 | 30.16 | Vons, Home Goods | ||||||||||||||||||||||||||||||||||||||||||||||||

| Solana Beach Towne Centre | Solana Beach, CA | 1973/2000/2004 | 12 | 246,651 | 93.8 | 6,429,232 | 27.79 | Dixieline Probuild, Marshalls | ||||||||||||||||||||||||||||||||||||||||||||||||

Del Monte Center (9) |

Monterey, CA | 1967/1984/2006 | 16 | 673,155 | 81.6 | 9,025,208 | 16.43 | Macy's | Century Theatres, Whole Foods Market | |||||||||||||||||||||||||||||||||||||||||||||||

| Geary Marketplace | Walnut Creek, CA | 2012 | 3 | 35,159 | 95.6 | 1,203,624 | 35.81 | Sprouts Farmers Market | ||||||||||||||||||||||||||||||||||||||||||||||||

| The Shops at Kalakaua | Honolulu, HI | 1971/2006 | 3 | 11,671 | 77.7 | 1,032,073 | 113.81 | Hawaii Beachware & Fashion, Diesel U.S.A. Inc. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Waikele Center | Waipahu, HI | 1993/2008 | 9 | 418,047 | 100.0 | 12,283,203 | 29.38 | Lowe's, Safeway | UFC Gym, OfficeMax, Old Navy | |||||||||||||||||||||||||||||||||||||||||||||||

Alamo Quarry Market (9) |

San Antonio, TX | 1997/1999 | 16 | 588,148 | 93.6 | 13,906,167 | 25.26 | Regal Cinemas | Whole Foods Market, Nordstrom Rack | |||||||||||||||||||||||||||||||||||||||||||||||

| Hassalo on Eighth | Portland, OR | 2015 | 3 | 44,236 | 69.0 | 990,882 | 32.46 | Providence Health & Services, Sola Salons | ||||||||||||||||||||||||||||||||||||||||||||||||

Subtotal/Weighted Average Retail Portfolio (8) |

107 | 3,092,616 | 92.5% | $ | 73,164,043 | $25.58 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Total/Weighted Average Office and Retail Portfolio (8) |

146 | 7,080,838 | 91.7% | $ | 264,558,993 | $40.74 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| PROPERTY REPORT (CONTINUED) |  |

||||

| As of June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number | Average Monthly | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Built/ | of | Percentage |

Annualized | Base Rent per | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property | Location | Renovated | Buildings | Units | Leased (2) |

Base Rent (3) |

Leased Unit (4) |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Loma Palisades | San Diego, CA | 1958/2001 - 2008/2021 | 80 | 548 | 97.3% | $ | 15,963,624 | $ | 2,495 | |||||||||||||||||||||||||||||||||||||||||||||||

| Imperial Beach Gardens | Imperial Beach, CA | 1959/2008 | 26 | 160 | 99.4 | 4,425,768 | $ | 2,319 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Mariner's Point | Imperial Beach, CA | 1986 | 8 | 88 | 95.5 | 2,216,472 | $ | 2,198 | ||||||||||||||||||||||||||||||||||||||||||||||||

Santa Fe Park RV Resort (10) |

San Diego, CA | 1971/2007-2008 | 1 | 126 | 88.9 | 2,327,904 | $ | 1,732 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Pacific Ridge Apartments | San Diego, CA | 2013 | 3 | 533 | 81.6 | 17,226,732 | $ | 3,301 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Hassalo on Eighth - Velomor | Portland, OR | 2015 | 1 | 177 | 93.8 | 3,093,876 | $ | 1,553 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Hassalo on Eighth - Aster Tower | Portland, OR | 2015 | 1 | 337 | 95.3 | 6,152,100 | $ | 1,596 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Hassalo on Eighth - Elwood | Portland, OR | 2015 | 1 | 143 | 93.7 | 2,341,560 | $ | 1,456 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average Multifamily Portfolio | 121 | 2,112 | 92.0% | $ | 53,748,036 | $ | 2,305 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Mixed-Use Portfolio | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number | Net Rentable | Annualized Base | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Built/ | of | Square | Percentage |

Annualized | Rent per Leased | Retail | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Retail Portion | Location | Renovated | Buildings | Feet (1) |

Leased (2) |

Base Rent (3) |

Square Foot (4) |

Anchor Tenant(s) (5) |

Other Principal Retail Tenants (6) |

|||||||||||||||||||||||||||||||||||||||||||||||

| Waikiki Beach Walk - Retail | Honolulu, HI | 2006 | 3 | 93,925 | 94.9 | % | $ | 8,521,724 | $ | 95.60 | Yard House, Roy's | |||||||||||||||||||||||||||||||||||||||||||||

| Number | Annualized | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Built/ | of | Average | Average | Revenue per | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotel Portion | Location | Renovated | Buildings | Units | Occupancy (11) |

Daily Rate (11) |

Available Room (11) |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Waikiki Beach Walk - Embassy Suites™ | Honolulu, HI | 2008/2014/2020 | 2 | 369 | 78.8 | % | $ | 355.74 | $ | 280.36 | ||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| PROPERTY REPORT (CONTINUED) |  |

||||

| Leased Square Feet | Annualized Base | Pro Forma Annualized | |||||||||||||||||||||

| Under Signed But | Annualized | Rent per | Base Rent per | ||||||||||||||||||||

| Not Commenced Leases (a) | Base Rent (b) | Leased Square Foot (b) | Leased Square Foot (c) | ||||||||||||||||||||

| Office Portfolio | 71,068 | $ | 4,489,389 | $ | 63.17 | $ | 53.96 | ||||||||||||||||

| Retail Portfolio | 40,692 | $ | 1,010,583 | $ | 24.83 | $ | 25.93 | ||||||||||||||||

| Total Retail and Office Portfolio | 111,760 | $ | 5,499,972 | $ | 49.21 | $ | 41.61 | ||||||||||||||||

| Property | Number of Ground Leases | Square Footage Leased Pursuant to Ground Leases (a) | Aggregate Annualized Base Rent | |||||||||||||||||

| Carmel Mountain Plaza | 5 | 17,607 | $ | 805,561 | ||||||||||||||||

| South Bay Marketplace | 1 | 2,824 | $ | 102,276 | ||||||||||||||||

| Del Monte Center | 1 | 212,500 | $ | 96,000 | ||||||||||||||||

| Alamo Quarry Market | 3 | 20,694 | $ | 385,506 | ||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| OFFICE LEASING SUMMARY |  |

||||

| As of June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Lease Summary - Comparable (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Prior Rent Per Sq. Ft. (3) |

Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 11 | 100% | 128,335 | $60.65 | $50.07 | $ | 1,357,877 | 21.1 | % | 20.7 | % | 4.8 | $ | 1,128,669 | $8.79 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 10 | 100% | 103,941 | $77.58 | $68.94 | $ | 897,892 | 12.5 | % | 17.6 | % | 3.9 | $ | 2,842,679 | $27.35 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 10 | 100% | 67,835 | $48.61 | $41.21 | $ | 501,419 | 17.9 | % | 26.5 | % | 3.8 | $ | 2,058,774 | $30.35 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 5 | 100% | 9,269 | $42.62 | $39.32 | $ | 30,555 | 8.4 | % | 13.5 | % | 4.3 | $ | 274,672 | $29.63 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 36 | 100% | 309,380 | $63.16 | $54.14 | $ | 2,787,743 | 16.6 | % | 20.3 | % | 4.3 | $ | 6,304,794 | $20.38 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

New Lease Summary - Comparable (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Prior Rent Per Sq. Ft. (3) |

Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 3 | 27% | 12,365 | $57.80 | $50.23 | $ | 93,527 | 15.1 | % | 48.9 | % | 9.6 | $ | 1,128,669 | $91.28 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 2 | 20% | 13,086 | $55.76 | $54.52 | $ | 16,215 | 2.3 | % | 30.1 | % | 6.4 | $ | 591,171 | $45.18 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 2 | 20% | 30,584 | $55.93 | $42.31 | $ | 416,743 | 32.2 | % | 44.9 | % | 5.9 | $ | 1,933,215 | $63.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 2 | 40% | 6,451 | $38.77 | $34.63 | $ | 26,723 | 12.0 | % | 16.5 | % | 5.0 | $ | 252,672 | $39.17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 9 | 25% | 62,486 | $54.49 | $45.64 | $ | 553,208 | 19.4 | % | 40.1 | % | 6.6 | $ | 3,905,727 | $62.51 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Renewal Lease Summary - Comparable (1)(5) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Prior Rent Per Sq. Ft. (3) |

Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 8 | 73% | 115,970 | $60.95 | $50.05 | $ | 1,264,350 | 21.8 | % | 18.3 | % | 4.3 | $ | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 8 | 80% | 90,855 | $80.73 | $71.02 | $ | 881,677 | 13.7 | % | 16.4 | % | 3.6 | $ | 2,251,508 | $24.78 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 8 | 80% | 37,251 | $42.59 | $40.32 | $ | 84,676 | 5.6 | % | 9.7 | % | 2.1 | $ | 125,559 | $3.37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 3 | 60% | 2,818 | $51.44 | $50.08 | $ | 3,832 | 2.7 | % | 8.1 | % | 2.6 | $ | 22,000 | $7.81 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 27 | 75% | 246,894 | $65.35 | $56.30 | $ | 2,234,535 | 16.1 | % | 16.5 | % | 3.7 | $ | 2,399,067 | $9.72 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Lease Summary - Comparable and Non-Comparable | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 15 | 148,677 | $60.09 | 5.4 | $ | 2,756,504 | $18.54 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 19 | 169,848 | $69.31 | 5.5 | $ | 8,527,244 | $50.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 18 | 129,690 | $53.28 | 5.6 | $ | 7,771,227 | $59.92 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 6 | 13,064 | $47.96 | 3.4 | $ | 274,672 | $21.03 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 58 | 461,279 | $61.23 | 5.4 | $ | 19,329,647 | $41.91 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| RETAIL LEASING SUMMARY |  |

||||

| As of June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Lease Summary - Comparable (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Prior Rent Per Sq. Ft. (3) |

Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 16 | 100% | 67,209 | $29.01 | $27.43 | $ | 105,846 | 5.7 | % | 20.2 | % | 4.5 | $ | 267,191 | $3.98 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 16 | 100% | 77,708 | $35.05 | $37.20 | $ | (166,622) | (5.8) | % | 13.5 | % | 4.6 | $ | 456,000 | $5.87 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 16 | 100% | 60,343 | $35.70 | $38.23 | $ | (152,659) | (6.6) | % | 5.2 | % | 3.9 | $ | 88,000 | $1.46 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 23 | 100% | 116,877 | $36.77 | $37.58 | $ | (94,939) | (2.2) | % | 6.7 | % | 4.1 | $ | 1,563,500 | $13.38 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 71 | 100% | 322,137 | $34.54 | $35.49 | $ | (308,374) | (2.7) | % | 11.0 | % | 4.3 | $ | 2,374,691 | $7.37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

New Lease Summary - Comparable (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Prior Rent Per Sq. Ft. (3) |

Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 2 | 13% | 4,004 | $30.57 | $29.09 | $ | 5,904 | 5.1 | % | — | % | 6 |

5.4 | $ | 179,726 | $44.89 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 1 | 6% | 5,500 | $39.60 | $26.18 | $ | 73,797 | 51.2 | % | — | % | 6 |

10.1 | $ | 176,000 | $32.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 3 | 19% | 3,114 | $65.27 | $83.58 | $ | (57,007) | (21.9) | % | (11.4) | % | 4.1 | $ | 78,000 | $25.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 1 | 4% | 7,000 | $32.00 | $23.78 | $ | 57,575 | 34.6 | % | 74.6 | % | 10.8 | $ | 1,505,000 | $215.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 7 | 10% | 19,618 | $39.12 | $35.03 | $ | 80,269 | 11.7 | % | 113.5 | % | 8.4 | $ | 1,938,726 | $98.82 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Renewal Lease Summary - Comparable (1)(5) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Prior Rent Per Sq. Ft. (3) |

Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 14 | 88% | 63,205 | $28.91 | $27.33 | $ | 99,942 | 5.8 | % | 11.9 | % | 4.5 | $ | 87,465 | $1.38 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 15 | 94% | 72,208 | $34.71 | $38.03 | $ | (240,419) | (8.8) | % | 2.4 | % | 4.2 | $ | 280,000 | $3.88 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 13 | 81% | 57,229 | $34.10 | $35.77 | $ | (95,652) | (4.7) | % | 9.3 | % | 3.9 | $ | 10,000 | $0.17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 22 | 96% | 109,877 | $37.07 | $38.46 | $ | (152,514) | (3.6) | % | 3.4 | % | 3.7 | $ | 58,500 | $0.53 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 64 | 90% | 302,519 | $34.24 | $35.52 | $ | (388,643) | (3.6) | % | 5.6 | % | 4.0 | $ | 435,965 | $1.44 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Lease Summary - Comparable and Non-Comparable (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) |

Weighted Average Lease

Term (4)

|

Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2022 | 21 | 77,201 | $29.93 | 4.9 | $ | 945,515 | $12.25 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2022 | 20 | 87,903 | $37.25 | 5.1 | $ | 1,282,094 | $14.59 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter 2021 | 20 | 95,963 | $32.37 | 6.0 | $ | 3,399,809 | $35.43 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter 2021 | 30 | 129,325 | $36.80 | 4.5 | $ | 2,442,851 | $18.89 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 12 months | 91 | 390,392 | $34.45 | 5.1 | $ | 8,070,269 | $20.67 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| MULTIFAMILY LEASING SUMMARY |  |

||||

| As of June 30, 2022 | ||||||||||||||||||||||||||

| Lease Summary - Loma Palisades | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 533 | 97.3% | $15,963,624 | $2,495 | ||||||||||||||||||||||

| 1st Quarter 2022 | 533 | 97.3% | $15,277,872 | $2,388 | ||||||||||||||||||||||

| 4th Quarter 2021 | 534 | 97.5% | $15,005,424 | $2,340 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 542 | 98.9% | $14,635,764 | $2,250 | ||||||||||||||||||||||

| Lease Summary - Imperial Beach Gardens | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 159 | 99.4% | $4,425,768 | $2,319 | ||||||||||||||||||||||

| 1st Quarter 2022 | 156 | 97.5% | $4,064,940 | $2,171 | ||||||||||||||||||||||

| 4th Quarter 2021 | 153 | 95.6% | $4,134,048 | $2,252 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 156 | 97.5% | $3,989,664 | $2,131 | ||||||||||||||||||||||

| Lease Summary - Mariner's Point | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 84 | 95.5% | $2,216,472 | $2,198 | ||||||||||||||||||||||

| 1st Quarter 2022 | 85 | 96.6% | $2,062,044 | $2,021 | ||||||||||||||||||||||

| 4th Quarter 2021 | 84 | 95.5% | $1,988,148 | $1,971 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 88 | 100.0% | $2,002,440 | $1,896 | ||||||||||||||||||||||

| Lease Summary - Santa Fe Park RV Resort | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 112 | 88.9% | $2,327,904 | $1,732 | ||||||||||||||||||||||

| 1st Quarter 2022 | 111 | 88.1% | $1,943,196 | $1,459 | ||||||||||||||||||||||

| 4th Quarter 2021 | 118 | 93.7% | $1,793,688 | $1,266 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 108 | 85.7% | $1,629,444 | $1,257 | ||||||||||||||||||||||

| Lease Summary - Pacific Ridge Apartments | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 435 | 81.6% | $17,226,732 | $3,301 | ||||||||||||||||||||||

| 1st Quarter 2022 | 512 | 96.1% | $19,078,404 | $3,104 | ||||||||||||||||||||||

| 4th Quarter 2021 | 521 | 97.7% | $19,541,508 | $3,127 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 527 | 98.9% | $19,166,088 | $3,030 | ||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| MULTIFAMILY LEASING SUMMARY (CONTINUED) |  |

||||

| As of June 30, 2022 | ||||||||||||||||||||||||||

| Lease Summary - Hassalo on Eighth - Velomor | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 166 | 93.8% | $3,093,876 | $1,553 | ||||||||||||||||||||||

| 1st Quarter 2022 | 163 | 92.1% | $2,991,060 | $1,529 | ||||||||||||||||||||||

| 4th Quarter 2021 | 169 | 95.5% | $3,055,992 | $1,507 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 168 | 94.9% | $3,031,260 | $1,504 | ||||||||||||||||||||||

| Lease Summary - Hassalo on Eighth - Aster Tower | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 321 | 95.3% | $6,152,100 | $1,596 | ||||||||||||||||||||||

| 1st Quarter 2022 | 313 | 92.9% | $5,765,316 | $1,535 | ||||||||||||||||||||||

| 4th Quarter 2021 | 313 | 92.9% | $5,715,888 | $1,521 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 325 | 96.4% | $5,736,348 | $1,471 | ||||||||||||||||||||||

| Lease Summary - Hassalo on Eighth - Elwood | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 134 | 93.7% | $2,341,560 | $1,456 | ||||||||||||||||||||||

| 1st Quarter 2022 | 129 | 90.2% | $2,327,976 | $1,504 | ||||||||||||||||||||||

| 4th Quarter 2021 | 136 | 95.1% | $2,322,624 | $1,423 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 136 | 95.1% | $2,269,248 | $1,391 | ||||||||||||||||||||||

| Total Multifamily Lease Summary | ||||||||||||||||||||||||||

| Number of Leased Units | Percentage leased (1) |

Annualized Base Rent (2) |

Average Monthly Base Rent per Leased Unit (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 1,944 | 92.0% | $53,748,036 | $2,305 | ||||||||||||||||||||||

| 1st Quarter 2022 | 2,002 | 94.8% | $53,510,808 | $2,227 | ||||||||||||||||||||||

| 4th Quarter 2021 | 2,028 | 96.0% | $53,557,320 | $2,201 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 2,050 | 97.1% | $52,460,256 | $2,132 | ||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| MIXED-USE LEASING SUMMARY |  |

||||

| As of June 30, 2022 | ||||||||||||||||||||||||||

| Lease Summary - Retail Portion | ||||||||||||||||||||||||||

| Number of Leased Square Feet | Percentage leased (1) |

Annualized Base Rent (2) |

Annualized Base Rent per Leased Square Foot (3) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 89,100 | 94.9% | $8,521,724 | $96 | ||||||||||||||||||||||

| 1st Quarter 2022 | 88,532 | 94.3% | $8,101,688 | $91 | ||||||||||||||||||||||

| 4th Quarter 2021 | 84,117 | 89.6% | $6,413,365 | $76 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 83,790 | 86.6% | $5,953,268 | $71 | ||||||||||||||||||||||

| Lease Summary - Hotel Portion | ||||||||||||||||||||||||||

| Number of Leased Units | Average Occupancy (4) |

Average Daily Rate (4) |

Annualized Revenue per Available Room (4) |

|||||||||||||||||||||||

| Quarter | ||||||||||||||||||||||||||

| 2nd Quarter 2022 | 291 | 78.8% | $356 | $280 | ||||||||||||||||||||||

| 1st Quarter 2022 | 269 | 72.8% | $333 | $243 | ||||||||||||||||||||||

| 4th Quarter 2021 | 268 | 72.6% | $297 | $215 | ||||||||||||||||||||||

| 3rd Quarter 2021 | 287 | 77.9% | $309 | $240 | ||||||||||||||||||||||

| Second Quarter 2022 Supplemental Information | Page | ||||

| LEASE EXPIRATIONS |  |

||||

| As of June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assumes no exercise of lease options | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Office | Retail | Mixed-Use (Retail Portion Only) | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % of | % of | Annualized | % of | % of | Annualized | % of | % of | Annualized | % of | Annualized | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expiring | Office | Total | Base Rent | Expiring | Retail | Total | Base Rent | Expiring | Mixed-Use | Total | Base Rent | Expiring | Total | Base Rent | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year | Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) |

Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) |

Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) |

Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month to Month | 39,753 | 1.0 | % | 0.6 | % | $2.48 | 13,820 | 0.4 | % | 0.2 | % | $49.78 | 5,660 | 6.0 | % | 0.1 | % | $6.36 | 59,233 | 0.8 | % | $13.89 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 177,396 | 4.4 | 2.5 | $41.18 | 62,917 | 2.0 | 0.9 | $26.52 | 6,698 | 7.1 | 0.1 | $80.04 | 247,011 | 3.4 | $38.50 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 371,695 | 9.3 | 5.2 | $54.12 | 202,583 | 6.6 | 2.8 | $30.95 | 7,882 | 8.4 | 0.1 | $41.80 | 582,160 | 8.1 | $45.89 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 292,284 | 7.3 | 4.1 | $44.24 | 475,844 | 15.4 | 6.6 | $29.63 | 10,811 | 11.5 | 0.2 | $118.75 | 778,939 | 10.9 | $36.35 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2025 | 349,876 | 8.8 | 4.9 | $38.87 | 241,630 | 7.8 | 3.4 | $31.36 | 18,275 | 19.5 | 0.3 | $91.74 | 609,781 | 8.5 | $37.48 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2026 | 354,347 | 8.9 | 4.9 | $41.49 | 270,344 | 8.7 | 3.8 | $32.82 | 5,096 | 5.4 | 0.1 | $205.03 | 629,787 | 8.8 | $39.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2027 | 365,326 | 9.2 | 5.1 | $51.41 | 393,837 | 12.7 | 5.5 | $29.03 | 3,553 | 3.8 | — | $86.30 | 762,716 | 10.6 | $40.02 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2028 | 230,810 | 5.8 | 3.2 | $48.92 | 607,436 | 19.6 | 8.5 | $15.03 | 8,820 | 9.4 | 0.1 | $161.50 | 847,066 | 11.8 | $25.79 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2029 | 868,680 | 21.8 | 12.1 | $62.07 | 182,602 | 5.9 | 2.5 | $19.55 | 1,055 | 1.1 | — | $195.96 | 1,052,337 | 14.7 | $54.83 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2030 | 232,739 | 5.8 | 3.2 | $38.43 | 43,630 | 1.4 | 0.6 | $37.16 | — | — | — | — | 276,369 | 3.9 | $38.23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2031 | 145,236 | 3.6 | 2.0 | $42.12 | 119,558 | 3.9 | 1.7 | $21.56 | 14,965 | 15.9 | 0.2 | $112.07 | 279,759 | 3.9 | $37.08 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Thereafter | 131,110 | 3.3 | 1.8 | $46.93 | 205,352 | 6.6 | 2.9 | $27.55 | — | — | — | — | 336,462 | 4.7 | $35.10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Signed Leases Not Commenced | 71,068 | 1.8 | 1.0 | — | 40,692 | 1.3 | 0.6 | — | 6,285 | 6.7 | 0.1 | — | 118,045 | 1.6 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||