Document

|

|

|

|

Adecoagro S.A.

Société Anonyme

28, Boulevard F. W. Raiffeisen

L - 2411 Luxembourg

Grand Duchy of Luxembourg

R.C.S. Luxembourg: B153681

(the “Company”)

|

Convening Notice to the

Annual General Meeting of Shareholders (the “AGM”)

and the

Extraordinary General Meeting of Shareholders (the “EGM”)

to be held on June 6, 2025, at 11:00 a.m. (CET)

with the EGM being held immediately after the AGM

at 5, Place Winston Churchill, L-1340 Luxembourg, Grand Duchy of Luxemburg.

Dear Shareholders,

The Board of Directors of Adecoagro S.A. (the “Board”) is pleased to invite you to attend the Annual General Meeting of Shareholders of Adecoagro S.A and the Extraordinary General Meeting of Shareholders of Adecoagro S.A. to be held on June 6, 2025 at 11:00 a.m. (CET) (with the EGM being held immediately after the AGM ) at 5, Place Winston Churchill, L-1340 Luxembourg, Grand Duchy of Luxemburg, with the following agendas:

|

|

|

|

A. Agenda for the Annual General Meeting of Shareholders

|

1.Approval of the Consolidated Financial Statements as of and for the financial years ended December 31, 2024, December 31, 2023, and December 31, 2022.

The Board of Directors of the Company recommends a vote FOR approval of the Company’s consolidated financial statements as of December 31, 2024, 2023 and 2022, after due consideration of the reports from each of the Board and the independent auditor on such consolidated financial statements. The consolidated balance sheets of the Company and its subsidiaries and the related consolidated income statements, consolidated statements of changes in shareholders’ equity, consolidated cash flow statements and the notes to such consolidated financial statements, the report from the independent auditor on such consolidated financial statements and management’s discussion and analysis on the Company’s results of operations and financial condition are included in the Company’s 2024 annual report, a copy of which is available on Company’s website at www.adecoagro.com. Copies of the Company’s 2024 annual report are also available to the shareholders of the Company free of charge at the Company’s registered office in Luxembourg, between 10:00 a.m. and 5:00 p.m., Luxembourg time.

2.Approval of the Company’s annual accounts for the financial year ended on December 31, 2024.

The Board recommends a vote FOR approval of the Company’s annual accounts as of December 31, 2024, after due consideration of the Board’s management report and the report from the independent auditor on such annual accounts.

These documents are included in the Company’s 2024 annual report, a copy of which is available on our website at www.adecoagro.com. Copies of the Company’s 2024 annual report are also available free of charge at the Company’s registered office in Luxembourg, between 10:00 a.m. and 5:00 p.m., Luxembourg time.

3.Allocation of results for the financial year ended December 31, 2024.

The statutory solus account of the Company for the financial year ended December 31, 2024 under Luxembourg GAAP (the “2024 Annual Accounts”) show a gain of USD 8,274,834. The Board recommends a vote FOR the carry forward of such results to the next financial year.

4.Declaration of dividends of an amount of USD 35 million to be allocated to the Interim Dividend and for the balance of USD 17.5 million to be paid in November.

The Board noted that on November 9, 2021, the Board approved the implementation of a distribution policy as of 2022 (the “Distribution Policy”) to distribute annually a minimum of 40% of the Adjusted Free Cash from Operations generated during the previous year, subject to the conditions set forth by Luxembourg law. The Distribution Policy consists of a cash dividend distribution and share repurchases under the existing program from time to time as deemed appropriate.

On March 11, 2025 the Board, on the basis of the interim accounts as at January 31st, 2025 and the statutory auditor report issued on the proposed advance on dividends, and considering the conditions of law for the distribution of an advance on dividends, declared the distribution of an advance on dividends of USD 17.5 million paid out of the share premium account of the Company to the shareholders as at the date of record of May 2, 2025 payable on May 17, 2025 (the “Interim Dividend”).

Furthermore, considering the 2024 Annual Accounts and that the Company has sufficient distributable reserves and subject to the conditions set forth by Luxembourg law, the Board recommends a vote FOR the declaration of a dividend of a total amount of USD 35 million in two installments, with the first part to cover the Interim Dividend and for the balance of USD 17.5 million to be paid to the shareholders as at the date of record in November, and to delegate power to the Board of Directors to determine the record date and the payment date therefore.

5.Vote on discharge (quitus) to all the members of the Board of Directors for the proper exercise of their mandate during the financial year ended December 31, 2024.

In accordance with applicable Luxembourg law and regulations, it is proposed that, upon approval of the Company’s annual accounts as of December 31, 2024, all who were members of the Board during the financial year 2024, be discharged from any liability in connection with the management of the Company’s affairs during such year.

The Board recommends a vote FOR the discharge (quitus) of the members of the Board of Directors for the proper exercise of their mandate during the year ended December 31, 2024.

6.Appointment of PricewaterhouseCoopers Société Coopérative, réviseur d’entreprises agréé (Luxembourg) and Price Waterhouse & Co. S.R.L. (Argentina), as auditor of the Company for a period ending on the date of the general meeting approving the annual accounts for the year ending on December 31, 2025.

The Board recommends a vote FOR the re-appointment of PricewaterhouseCoopers Société Cooperative, réviseur d’entreprises agréé (Luxembourg) as auditor of the Company's consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union and Luxembourg legal and regulatory requirements for the fiscal year ending December 31, 2025 and of Price Waterhouse & Co. S.R.L. (Argentina), a PCAOB registered public accounting firm, as auditor of the Company's and Company’s subsidiaries consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) for the fiscal year ending December 31, 2025 for the purposes of compliance with the Group’s filings with the U.S. Securities and Exchange Commission (SEC).

7.Acknowledgement of the co-optation of certain directors and election of the following members of the Board of Directors:

(i)Mr. Ivo Sarjanovic, Mr. Oscar Alejandro León Bentancor and Mr. Andres Larriera, for a term of one (1) year each, ending on the date of the Annual General Meeting of Shareholders of the Company to be held in year 2026;

(ii)Mr. Daniel González, Mr. Christian De Prati and Mr. Kyril Robert Leonid Louis-Dreyfus, for a term of two (2) years each, ending on the date of the Annual General Meeting of Shareholders of the Company to be held in year 2027; and

(iii)Mrs. Manuela Artigas, Mr. Juan José Sartori Piñeyro and Mr. Mariano Bosch, for a term of three (3) years each, ending on the date of the Annual General Meeting of Shareholders of the Company to be held in year 2028.

The Directors are appointed by the General Meeting of Shareholders for a period of up to three (3) years; provided however the Directors shall be elected on a staggered basis, with one third (1/3) of the Directors being elected each year and provided further that such three year term may be exceeded by a period up to the annual general meeting held following the third anniversary of the appointment. The Directors shall be eligible for re-election indefinitely.

Certain Directors presented their resignation letters as members of the Board of Directors effective as of April 28, 2025, namely Mr. Plinio Musetti, Mrs. Ana Cristina Russo, Mr. Guillaume van der Linden, Mr. Alan Leland Boyce and Mr. Andres Velasco Brañes. Noting the vacancies resulting therefrom at the Board level, the non-resigning members of the Board resolved to fill in the vacancies caused by the resignations detailed above and to co-opt and appoint the following members as directors of the Company from 28 April 2025 until the next general meeting of shareholders (being the AGM): Mr. Juan José Sartori Piñeyro, Mr. Andres Larriera, Mr. Christian De Prati, Mr. Kyril Robert Leonid Louis-Dreyfus, and Mr. Oscar Alejandro León Bentancor.

The Board recommends a vote FOR: (i) the confirmation of the appointments of the new directors listed above by co-optation, (ii) the re-election of Mr. Ivo Sarjanovic and the election of Mr. Oscar Alberto Leon Bentancor and Mr. Andres Larriera, each as member of the Board, for a term of one (1) year each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2026, (iii) the re-election of Mr. Daniel Gonzalez and the election of Mr. Christian De Prati and Mr. Kyril Robert Leonid Louis-Dreyfus, each as member of the Board, for a term of two (2) years each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2027, and (iv) the re-election of Mrs. Manuela Artigas and Mr. Mariano Bosch and the election of Mr. Juan José Sartori Piñeyro, each as member of the Board, for a term of three (3) years each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2028.

Set forth below is a summary biographical information of each of the candidates:

Juan José Sartori Piñeyro. Mr. Sartori is the Chairman and founder of Union Group International Holdings, a privately owned investment and private equity management firm with significant strategic Latin American interests. These cover the agricultural, energy, forestry, infrastructure and real estate sectors. Mr. Sartori established Union Group in 2007. Since its incorporation, Union Group and its subsidiaries have performed numerous transactions growing its portfolio of businesses of private and public companies. Mr. Sartori is the co-owner of Sunderland A.F.C, Vice-President of AS Monaco Football Club and Board member of the European Club Association and of the Professional Football League (LFP) in France. Mr. Sartori was elected and served as Senator of the Uruguayan Parliament for the legislative period going from February 15, 2020 to February 15, 2025. Mr. Sartori received a Bachelor Degree in Business and Economics from École des Hautes Études Commerciales de Lausanne.

Christian De Prati. Dr. De Prati has a degree in political economy and a doctorate in economics from the University of Zurich, Switzerland. His activities include corporate governance, investment banking, real estate and philanthropy. Currently he is member of the Board of Directors and member of Audit & Risk Committee of Rothschild & Co. Bank AG. Moreover he is member of the Board of Advisors of Center for Innovation and Sustainability in Business. Dr. De Prati was a member of the Board of Directors of Sterling Strategic Value, Channel Plus AG, Peach Property Group, Lastminute.com and Cornèr Bank Group. Previously he served as Andres Larriera.

CEO and Country Head Switzerland at Bank of America Merrill Lynch. Dr. De Prati was named Young Global Leader by the World Economic Forum.

Mr. Larriera is Managing Director of Aldwych Advisors, a London-based strategic advisory firm he founded in 2019, providing commercial and operational support for acquisitions and corporate transformations. He also serves on the Boards of Flow Management Industries UK (the Group’s parent company) and six UK sub-holding companies, roles he has held since 2020. Mr. Larriera formerly held several executive leadership roles at Hitachi from 2009 to 2017, including serving on Hitachi Europe Executive Committee as Head of the Smart Cities Energy Business Group, from 2012 to 2017. During his tenure at Hitachi, he founded the Smart Grid Venture in 2010 and subsequently established and led the expansion of the Smart Cities Energy business from 2012. He worked closely with the EU, as well as the governments of the UK and Japan, to unlock strategic investments in smart energy systems through pioneering UK client engagements. He was also part of the founding management team at Hitachi Consulting UK from 2006 to 2009, where he played a key role in launching consulting operations and driving fee revenue growth across the UK, Belgium and Japan. From 2003 to 2006, he served as Director of Operations and Practice Lead at The Evaluation Partnership (TEP), later acquired by Tetra Tech Coffey (NASDAQ: TTEK), where he built a successful policy evaluation and strategy practice, and held principal operational responsibility for EMEA—primarily serving the European Commission and other regional clients. Earlier in his career, Mr Larriera was a Management Consultant at Accenture across Argentina, Mexico and Spain, and formerly he worked at the Ministry of Finance of Argentina. He holds a Licentiate in Business Administration from the Universidad de Buenos Aires, an MSc in Public Policy from the London School of Economics, and completed an Executive Management Program at Wharton. He is a Chevening Scholar and holds dual Argentine and British citizenship.

Kyril Robert Leonid Louis-Dreyfus. Mr. Louis Dreyfus is a descendant of the founder of the Louis Dreyfus Group, where a family foundation remains the controlling shareholder of the Louis Dreyfus Group and Louis Dreyfus Company. After completing his studies in Switzerland, he co-founded Bia Sports Group, a sports investment platform that owns Sunderland AFC and the rights to the FIM World Supercross Championship. He is also the Founder of Narion Holding AG, a Swiss-based holding company with a diversified portfolio across private equity, real estate, and venture capital.

Oscar Alberto Leon Bentancor. Mr. León is a seasoned Certified Public Accountant (CPA) with over 30 years of experience in financial management, project finance, and risk analysis. He has worked extensively across diverse industries, including agriculture, mining, and hydropower, providing strategic financial leadership to public companies. His expertise includes US/Canadian GAAP, IFRS, SEC/TSX reporting, and regulatory compliance. As a Chief Financial Officer and Board Member for multiple organizations, including ICC Labs, Biomind Labs, SX Global United Ltd., Union Agriculture Group and Union Group Ventures, he has successfully overseen financial operations, corporate strategy, and risk management initiatives. His leadership in project finance and cost control has driven financial success in multinational settings. Mr. Leon’s educational background includes CPA certification from Universidad de la República Oriental de Uruguay, advanced training from Harvard University, and executive environmental management studies at Universidad ORT Uruguay.

Manuela Artigas. Mrs. Artigas is an independent board member of LWSA, Pague Menos SA, Solar Coca Cola and Banco BMG, where she participates and leads a series of committees. In these companies, she has worked on strategy, organization, restructuring, IPO and M&A matters. Her previous roles include CEO of Calila Investimentos, board member of JCC and Sistema Jangadeiro and partner of McKinsey & Company. Mrs. Artigas holds a degree in Economics from Unicamp with an MBA from the Anderson Business School at the University of California Los Angeles, where she graduated as a member of the Anderson Business Society and received the Fred Weston Excellence Finance Award. Mrs. Artigas is a Brazilian citizen.

Ivo Sarjanovic. Mr. Sarjanovic has been a member of the Company’s Board of Directors since 2018. Mr. Sarjanovic is also currently serving as non-executive Board member of Sucafina S.A and Minerva Foods. Further, Mr. Sarjanovic is a a lecturer at the University of Geneva’s Master in Commodities program, and at Universidad Di Tella’s Master of Finances program and is an Associated Fellow at the Erasmus Commodity & Trade Centre in Rotterdam. Mr. Sarjanovic served as the Chief Executive Officer of Alvean until 2017, during which time he led the company to become the biggest sugar trader in the world. Previously, Mr. Sarjanovic served for more than 25 years at Cargill International, where he commenced his career as trader in the Grain and Oilseeds business. From 2011 to 2014 Mr. Sarjanovic held the position of Vice-president and World Manager of Cargill Sugar Operations, playing a leading role in the radical transformation of the organization that led to the strategic decision to spin-off the sugar business of Cargill in 2014, creating Alvean Sugar SL, a joint venture with Copersucar, Brazil. Between 2007 and 2011, he was also the Africa and Middle East General Manager of Agriculture at Cargill.

activities. Mr. Sarjanovic holds a B.A. in Economic Sciences, with a major in Accounting, from the National University of Rosario, Argentina and a Master’s in Economics from Universidad Francisco Marroquin, in Spain. Additionally, he completed executive studies at IMD in Lausanne, Oxford University and Harvard Business School. Mr. Sarjanovic is an Argentine, Italian and Swiss citizen.

While in Cargill he also held the position of Vice-president and Global Trading Manager of Oilseeds in Geneva between 2000 and 2011, coordinating worldwide trading and crushing Daniel C. Gonzalez. Mr. Gonzalez has been a member of the Company’s Board of Directors since 2014. He currently serves as the Vice Minister of Energy and Mining of Argentina. Before this current role, Mr. Gonzalez served as the Executive Director of IDEA (Instituto para el Desarrollo Empresarial Argentino), a not-for-profit business council in Argentina. Previously, Mr. Gonzalez was the Chief Executive Officer of YPF Sociedad Anónima, Argentina’s largest corporation, from 2018 to 2020, where he previously served as Chief Financial Officer from 2012 to 2018. He served for 14 years at the investment banking division of Merrill Lynch & Co in Buenos Aires and New York, where he held the positions of Head of Mergers and Acquisitions for Latin America and President for the Southern Cone (Argentina, Chile, Peru and Uruguay), among others. While at Merrill Lynch, Mr. Gonzalez played a leading role in several of the most important investment banking transactions in the region and was an active member of the firm’s global fairness opinion committee. He remained as a consultant to Bank of America Merrill Lynch after his departure. Mr. Gonzalez holds a degree in Business Administration from the Argentine Catholic University. Mr. González is an Argentinean citizen.

Mariano Bosch. Mr Bosch is a co-founder of Adecoagro. Since the beginning he has been our CEO and is also a member of the Company’s Board of Directors. In 1995 he founded and was the CEO of BLS Agribusiness, an agricultural consulting, technical management, and administration company. He has a degree in Agricultural Engineering from the University of Buenos Aires and has over 25 years of experience in agribusiness development. He is involved in business organizations such as IDEA, AEA, YPO, AACREA, FPC and AAPRESID. Mariano was distinguished by Endeavor as Entrepreneur of the Year (2019) and received the Konex award for Businessman of the Year in 2018. Mr. Bosch is an Argentinean citizen.

8.Approval of compensation of members of the Board of Directors for year 2025.

The compensation of the Company’s directors is approved annually at the ordinary general shareholders’ meeting.

The proposed aggregate compensation to our directors for year 2025 amounts to up to USD 420,000 and a grant of restricted shares (out of the treasury shares) of up to an aggregate amount of 36,085 shares under the Adecoagro’s Amended and Restated Restricted Share and Restricted Stock Unit Plan, as amended, allocated as follows:

|

|

|

|

|

|

|

|

|

Name |

Cash USD (**) |

Restricted Shares |

Juan José Sartori Piñeyro (*) |

- |

- |

Christian De Prati |

60,000 |

5,155 |

Kyril Louis-Dreyfus |

60,000 |

5,155 |

Andres Larriera |

60,000 |

5,155 |

Mariano Bosch (*) |

- |

- |

Daniel González |

60,000 |

5,155 |

Oscar Alejandro León Bentancor |

60,000 |

5,155 |

Ivo Andrés Sarjanovic |

60,000 |

5,155 |

Manuela Vaz Artigas |

60,000 |

5,155 |

TOTAL |

420,000 |

36,085 |

(*) Mr. Mariano Bosch and Mr. Juan José Sartori Piñeyro declined and therefore will not receive compensation neither in cash nor in restricted shares.

(**) Board members serving as Chair of any Company’s committee will receive an additional cash compensation of USD 20,000.

The Board recommends a vote FOR the proposed compensation of directors for year 2025.

9. Authorization under article 430-15 of the Luxembourg law of August 10, 1915, granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting on their behalf), to from time to time and for a period of five (5) years purchase, acquire, or

receive shares in the Company up to twenty per cent (20%) of the issued share capital (in addition to any treasury shares already held by the Company or subsidiaries), on such terms as referred to below, and as shall further be determined by the Board of Directors of the Company; whereby any shares held in treasury further to such authorisation being able to be held by the Company for a period of five (5) years. Acquisitions may be made in any manner including without limitation, by tender or other offer(s), buyback program(s), over the stock exchange or in privately negotiated transactions or in any other manner as determined by the Board of Directors (including derivative transactions or transactions having the same or similar economic effect than an acquisition).

In the case of acquisitions for value:

(i)in the case of acquisitions other than in the circumstances set forth under (ii), for a net purchase price being (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the closing price, as reported by the New York City edition of the Wall Street Journal, or, if not reported therein, any other authoritative source to be selected by the Board of Directors of the Company (the “Closing Price”), over the ten (10) trading days preceding the date of the purchase (or as the case may be the date of the commitment to the transaction);

(ii)in case of a tender offer (or if deemed appropriate by the Board of Directors, a buyback program),

a.in case of a formal offer being published, for a set net purchase price or a purchase price range, each time within the following parameters: (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over the ten (10) trading days preceding the publication date, provided however that if the stock exchange price during the offer period fluctuates by more than 10 %, the Board of Directors may adjust the offer price or range to such fluctuations;

b.in case a public request for sell offers is made, a price range may be set (and revised by the Board of Directors as deemed appropriate) provided that acquisitions may be made at a price which is no less than (x) fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over a period determined by the Board of Directors provided that such period may not start more than five (5) trading days before the sell offer start date of the relevant offer and may not end after the last day of the relevant sell offer period.

The Board noted that the Company reached the threshold of shares bought under the buyback program which are in turn held in treasury. In April 28, 2025, the Board resolved to propose to the shareholders of the Company (i) to cancel all or a portion of the shares held in treasury (and reduce the share capital), cancellation which will be addressed and resolved upon by the EGM convened right thereafter this AGM; and (ii) to provide a new authorization to purchase, acquire, or receive shares in the Company up to twenty per cent (20%) of the issued share capital of the Company for a period of five (5) years; whereby any shares held in treasury further to such authorization being able to be held by the Company for a period of five (5) years.

In furtherance thereof, the Board of Directors of the Company recommends a vote FOR the approval of a new authorization under article 430-15 of the Luxembourg law of August 10, 1915, granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting on their behalf), to from time to time and for a period of five (5) years purchase, acquire, or receive shares in the Company up to twenty per cent (20%) of the issued share capital, on such terms as referred to below, and as shall further be determined by the Board of Directors of the Company; whereby any shares held in treasury further to such authorization being able to held for a period of five (5) years.

Acquisitions may be made in any manner including without limitation, by tender or other offer(s), buyback program(s), over the stock exchange or in privately negotiated transactions or in any other manner as determined by the Board of Directors (including derivative transactions or transactions having the same or similar economic effect than an acquisition).

In the case of acquisitions for value:

(i)in the case of acquisitions other than in the circumstances set forth under (ii), for a net purchase price being (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the closing price, as reported by the New York City edition of the Wall Street Journal, or, if not reported therein, any other authoritative source to be selected by the Board of Directors of the Company (the “Closing Price”), over the ten (10) trading days preceding the date of the purchase (or as the case may be the date of the commitment to the transaction);

(ii)in case of a tender offer (or if deemed appropriate by the Board of Directors, a buyback program),

a.in case of a formal offer being published, for a set net purchase price or a purchase price range, each time within the following parameters: (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over the ten (10) trading days preceding the publication date, provided however that if the stock exchange price during the offer period fluctuates by more than 10 %, the Board of Directors may adjust the offer price or range to such fluctuations;

b.in case a public request for sell offers is made, a price range may be set (and revised by the Board of Directors as deemed appropriate) provided that acquisitions may be made at a price which is no less than (x) fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over a period determined by the Board of Directors provided that such period may not start more than five (5) trading days before the sell offer start date of the relevant offer and may not end after the last day of the relevant sell offer period.

|

|

|

|

B. Agenda for the Extraordinary General Meeting of Shareholders

|

1.Reduction of the issued share capital of the Company by an amount of nine million United States Dollars (USD 9,000,000) by the cancellation of six million (6,000,000) shares with a nominal value of one United States Dollar and fifty cents (USD 1.50) each held in treasury by the Company; and consequential amendment of the article 5.1 of the articles of association of the Company.

The Board recommends a vote FOR the approval of: (i) the reduction of the issued share capital of the Company by an amount of nine million United States Dollars (USD 9,000,000) by the cancellation of six million (6,000,000) shares with a nominal value of one United States Dollar and fifty cents (USD 1.50) each held in treasury by the Company; and (ii) the consequential amendment of the article 5.1 of the articles of association of the Company, so as to now read as follows:

“5.1. The Company has an issued share capital of one hundred and fifty eight million seventy-two thousand seven hundred and twenty-two US Dollars and fifty cents (USD 158,072,722.50) represented by a total of one hundred and five million three hundred and eighty-one thousand eight hundred and fifteen (105,381,815) fully paid Shares, each with a nominal value of one US Dollar and fifty cents (USD1.50), with such rights and obligations as set forth in the present Articles.”

2.Renewal of the authorized share capital of the Company (and any authorization granted to the board of directors of the Company (the “Board of Directors”) in relation thereto) until 6 June 2030; renewal of the authorization that the Board of Directors, or any delegate(s) duly appointed by the Board of Directors, may from time to time issue shares within the limits of the authorized (unissued) share capital against contributions in cash, contributions in kind or by way of incorporation of available reserves at such times and on such terms and conditions, including the issue price, as the Board of Directors or its delegate(s) may in its or their discretion resolve while reserving a preemptive

subscription right to existing shareholders for any issue of shares; and consequential amendment of article 5.1.1 of the articles of association of the Company.

The Board recommends a vote FOR the approval of: (i) the renewal of the Company’s authorized share capital (and any authorization granted to the board of directors of the Company (the “Board of Directors”) in relation thereto) until 6 June 2030; (ii) the authorization that the Board of Directors, or any delegate(s) duly appointed by the Board of Directors, may from time to time issue shares within the limits of the authorized (unissued) share capital against contributions in cash or by way of incorporation of available reserves at such times and on such terms and conditions, including the issue price, as the Board of Directors or its delegate(s) may in its or their discretion resolve while reserving a preemptive subscription right to existing shareholders for any issue of shares, and (iii) the consequential amendment of article 5.1.1. of the articles of association of the Company, so as to read as follows:

“5.1.1 The Company has an authorized share capital of two hundred and twenty million two hundred and eighty-seven thousand two hundred and sixty-seven US Dollars (USD 220,287,267), including the issued share capital, represented by one hundred and forty-six million eight hundred and fifty-eight thousand one hundred and seventy-eight (146,858,178) shares, each with a nominal value of one US Dollar and fifty cents (USD1.50). The Company's authorized share capital (and any authorization granted to the Board of Directors in relation thereto) shall be valid from 6 June 2025 and until 6 June 2030. The Board of Directors, or any delegate(s) duly appointed by the Board of Directors, may from time to time issue shares within the limits of the authorized (unissued) share capital against contributions in cash or by way of incorporation of available reserves at such times and on such terms and conditions, including the issue price, as the Board of Directors or its delegate(s) may in its or their discretion resolve while reserving a preemptive subscription right to existing shareholders for any issue of shares.”

3. Amendment to the articles of association of the Company, in particular amendment of articles 7, 12.2.1, 13, 15, 17.2 and include new Articles 9.3, 9.4, 11.6, 11.9, 17.3, new Part VIII, new definition of Candidate Number and removal of definition of Material Transaction and Related Party from Article 25.

The Board recommends a vote FOR the approval of the following amendments to the Articles of Association of the Company:

(i)Amend Article 7 to read as follows:

“Article 7. Shareholder Rights / Obligations

|

|

|

|

|

|

| 7.1 |

Voting Rights |

| 7.1.1. |

Subject as set forth in the present Articles, each Share shall be entitled to one vote at all General Meetings of Shareholders. |

| 7.2 |

Obligations |

| 7.2.1 |

Any person or group of persons acting in concert holding or acquiring eighty percent (80%) or more of the outstanding Shares or of the voting rights in the Company (including as a result of a repurchase of Shares or other securities of the Company by (directly or indirectly) the Company or its subsidiaries), shall be obliged to make, or cause to be made, in each country where the Company's securities are admitted to trading on a Regulated Market and in each of the countries in which the Company has made a public offering of its shares, an unconditional public offer to acquire for cash all outstanding Shares and securities giving access to Shares, linked to the share capital or whose rights are dependent on the profits of the Company (hereafter, collectively, “securities linked to capital”), whether those securities were issued by the Company or by entities controlled or established by it or members of its group. Each of these public offers must be conducted in conformity and compliance with the legal and regulatory requirements applicable to public offers in each country concerned. |

| 7.2.2 |

In any case, the price must be fair and equitable and, in order to guarantee equality of treatment of shareholders and holders of securities linked to capital of the Company, the said public offers must be made at or on the basis of an identical price, which must be justified by a report drawn up by a first rank financial institution nominated by the Company whose fees and costs must be advanced by the person subject to the obligation laid down in the first paragraph of this Article 7.2. |

| 7.2.3 |

The provisions of Article 7.2 above shall not apply: |

| 7.2.3.1 |

to the Company itself in respect of shares directly or indirectly held in treasury; |

| 7.2.3.2 |

to a common or central depository of the Shares for the purposes of a listing or trading of the Shares; acting as such, provided that said depository may only exercise the voting right attached to such Shares if they have received instructions from the (beneficial) owner of the Shares, the provisions of Article 7.2 thereby applying to the (beneficial) owner of the Shares, |

| 7.2.3.3 |

to the acquisition of Shares resulting from a public offer for the acquisition of all the Shares in the Company and all of the securities linked to capital; |

| 7.2.4 |

Voting rights are calculated on the basis of the entirety of the outstanding Shares to which voting rights are attached even if the exercise of such voting rights is suspended.” |

(ii) Include new articles 9.3 and 9.4, renumber the prior article 9.3 as 9.5 and amend article 9.5, so as to read as follows:

“9.3 The Board of Directors must always include at least three (3) Directors which qualify as independent members of the Board of Directors.

9.4 Any Shareholder (other than the Company in respect to treasury shares, or a common depository) holding or controlling more than fifty percent (50%) of the outstanding Shares shall be entitled (but not obliged) to nominate candidates for appointment to the Board of Directors up to the Candidate Number.

9.5 In the event of a vacancy in the office of a Director because of death, retirement, resignation, dismissal, removal or otherwise, the remaining Directors may fill such vacancy and appoint a successor in accordance with applicable law and the Articles.”

(iii)Amend article 11.5, include a new article 11.6 (and renumber subsequent articles) and amend article 11.9 (prior 11.8), to read as follows:

“11.5 The Board of Directors may deliberate and act validly only if the majority of the Board members (able to vote) are present or represented. Subject to Article 11.6 and Article 23, decisions shall be taken by a simple majority of the votes validly cast by the Board members present or represented (and able to vote).

11.6 Any related party transaction (as defined under Item 7.B of Form 20-F promulgated by the United States Securities and Exchange Commission) shall be subject to the prior authorisation of the Board deciding at simple majority provided that such majority includes at least a majority of the independent members of the Board of Directors.”

“11.9 The minutes of any meeting of the Board of Directors (or copies or extracts of such minutes which may be produced in judicial proceedings or otherwise) shall be signed by the Chairman, the chairman (ad hoc) of the relevant meeting or by any two (2) Directors (including at least one independent member of the Board of Directors) or as resolved at the relevant Board meeting or any subsequent Board meeting.”

(iv)Amend Article 12.2.1, to read as follows:

“12.2.1 Audit Committee: in the case the Board of Directors decides to set up an audit committee (the “Audit Committee”), such Audit Committee shall be composed of at least three (3) members and the Board of Directors shall appoint one of the members of the Audit Committee as the chairperson of the Audit Committee. The Audit Committee shall (a) assist the Board of Directors in fulfilling its oversight responsibilities relating to the integrity of the Company’s financial statements, including periodically reporting to the Board of Directors on its activity and the adequacy of the Company’s systems of internal controls over financial reporting; (b) make recommendations for the appointment, compensation, retention and oversight of, and consider the independence of, the Company’s external auditors; (c) review and approve related party transactions (as defined under Item 7.B of Form 20-F promulgated by the United States Securities and Exchange Commission) (other than transactions that were reviewed and approved by the independent members of the Board of Directors (if any) or other governing body of any subsidiary of the Company or through any other procedures as the Board of Directors may deem substantially equivalent to the foregoing) to determine whether their terms are consistent with market conditions or are otherwise fair to the Company and its subsidiaries; and (d) perform such other duties imposed to it by the laws and regulations of the Regulated Market(s) on which the shares of the Company are listed applicable to the Company, as well as any other duties entrusted to it by the Board of Directors. The Board of Directors shall allocate to the Audit Committee the necessary resources and authority to fulfil its functions.”

(v)Amend Article 13 to read as follows:

“Article 13. Binding Signature. The Company will be bound by the joint signature of any two (2) Directors or by the sole or joint signatures of any persons to whom such signatory power shall have been delegated by the Board of Directors. For the avoidance of doubt, for acts regarding the daily management of the Company the Company will be bound by the sole signature of the administrateur délégué ("Chief Executive Officer" or "CEO") or any person or persons to whom such signatory power shall be delegated by the Board of Directors.”

(vi)Amend Article 15.1 to read as follows:

“15.1 Subject to Article 11, no contract or other transaction between the Company and any other company or firm shall be affected or invalidated by the fact that any one or more of the Directors, member of any committee or officers of the Company is interested in, or is a director, associate, officer, agent, adviser or employee of such other company or firm. Any Director, member of any committee or officer who serves as a director, officer or employee or otherwise of any company or firm with which the Company shall contract or otherwise engage in business shall not, by reason of such affiliation with such other company or firm only, be prevented from considering and voting or acting upon any matters with respect to such contract or other business.”

(vii) Amend Article 17.2 and include a new article 17.3 to read as follows:

“17.2 Subject to Article 17.3, at any extraordinary General Meeting of Shareholders for the purpose of amending the Company’s Articles of Incorporation or voting on resolutions whose adoption is subject to the quorum and majority requirements for amendments of the Articles of Incorporation, the quorum shall be at least one half of the issued share capital of the Company. If the said quorum is not present, a second Meeting may be convened at which there shall be no quorum requirement. In order for the proposed resolutions to be adopted at such a General Meeting, and save as otherwise provided by law or Article 17.3, a two thirds (2/3) majority of the votes validly cast at any such General Meeting.

17.3 Any direct or indirect amendment of Article 7, Article 9.3, Article 11.6, Article 17.2, Article 23 and this Article 17.3 or any of the provisions thereof shall, in addition to the majority required by law, always be subject to a 90% majority of the outstanding voting rights in the Company.”

(viii)Include new Part VIII (with a new article 23) to read as follows (and renumbering of the subsequent parts and articles):

“PART VIII. RESTRICTION ON SHAREHOLDER RIGHTS

Article 23 Waiver and/or Suspension of Voting Rights

|

|

|

|

|

|

| 23.1 |

A Shareholder may individually decide not to exercise and waive, temporarily or permanently, all or part of its voting rights and the exercise thereof. The waiving Shareholder is bound by such waiver. |

| 23.2 |

The Board may suspend the voting rights of any Shareholder that it determines (acting reasonably and in good faith) to be in breach of its obligations as described by the Articles, or any subscription, transaction, governance, shareholders or like agreement; and voting (and such other rights as provided for herein) rights shall be suspended by operation of the Articles as and to the extent provided for in these Articles. Such Board decision shall be taken by simple majority provided that such majority includes at least a majority of the independent members of the Board of Directors. |

| 23.3 |

In case the exercise of the voting rights has been waived by one or several Shareholders or are suspended in accordance with the Articles, such Shareholders may attend any General Meeting of the Company but the Shares they hold are not taken into account for the determination of the conditions of quorum and majority to be complied with.” |

(ix)In renumbered article 25 – Definitions include the definition of Candidate Number to read as follows and remove the definitions of Material Transactions and Related Party :

“Candidate Number. Means the number of candidates for nomination as directors, rounded up to the next whole number, determined by multiplying: (i) the total number of Directors on the Company Board (giving effect to any increase in the size of the Company Board effected pursuant to Article 9.4); by (ii) a fraction having a numerator equal to the aggregate number of Shares then beneficially owned by the relevant Shareholder (and evidenced to the Company), and having a denominator equal to the total number of Shares then issued and outstanding; provided that such number of candidates shall be reduced to the extent necessary to comply with Article 9.3.”

It is noted that, as a result of the amendments to certain existing articles and the insertion of new articles into the Articles of Association, the numbering of the articles and cross-references therein shall be adjusted accordingly to ensure consistency and accuracy throughout the document.

***************

Each of the items to be voted on the AGM will be passed by a simple majority of the votes validly cast, irrespective of the number of Shares represented.

Quorum for EGM shall be at least one half of the issued share capital of the Company. If said quorum is not reached, a second meeting may be convened at which there shall be no quorum requirement. Each of the items to be voted on the EGM will be passed by a two thirds (2/3) majority of the votes validly cast.

Any shareholder who holds one or more shares(s) of the Company on May 2, 2025 (the “Record Date”) shall be admitted to the meetings and may attend the meetings in person or vote by proxy. Shareholders who have sold their Shares between the Record Date and the date of the meetings cannot attend the meetings or vote by proxy. In case of breach of such prohibition, criminal sanctions may apply.

Holders who have withdrawn their shares from DTC between May 2, 2025, and the date of the meetings should contact the Company in advance of the date of the meetings at 28, Boulevard F. W. Raiffeisen, L-2411 Luxembourg, Grand Duchy of Luxembourg or at Av. Fondo de la Legua 936, B1640EDO | Martínez, Pcia de Buenos Aires, Argentina, to make separate arrangements to be able to attend the meetings or vote by proxy.

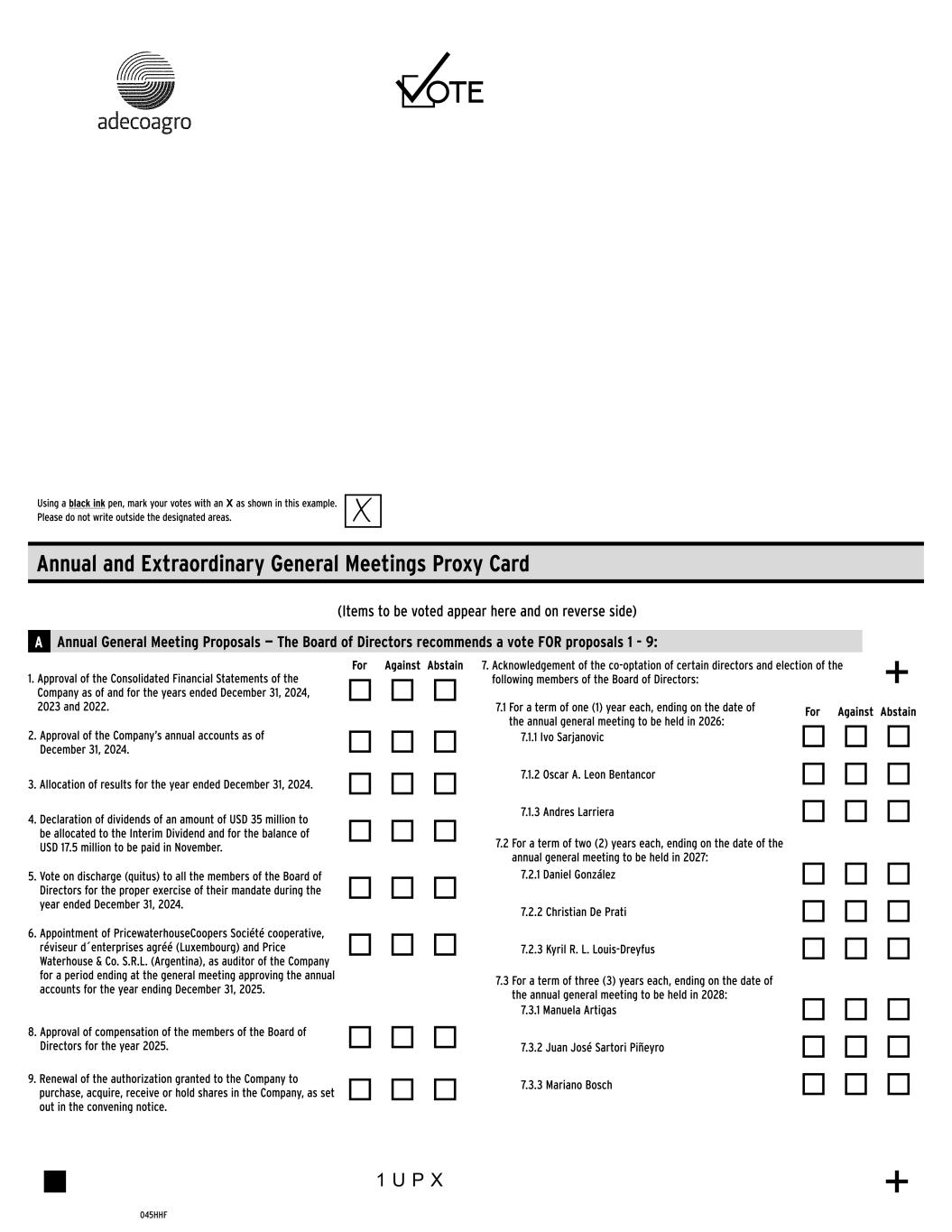

Attached to this notice is a proxy card which you will need to complete in order to vote your Shares by proxy. Proxy cards must be received by the tabulation agent no later than 4:00 p.m. New York City Time on June 3, 2025, in order for such votes to count.

Please consult the Company’s website as to the procedures for attending the meetings or to be represented by way of proxy. A copy of this notice is also available on the Company’s website.

Copies of the Consolidated Financial Statements of the Company as of and for the financial years ended on December 31, 2024, December 31, 2023, and December 31, 2022 and the Company’s annual accounts as of December 31, 2024 together with the Company´s 2024 annual report, relevant management and audit reports are available on the Company’s website www.adecoagro.com and may also be obtained by the shareholders free of charge at the Company's registered office in Luxembourg.

Yours faithfully

The Board of Directors

Procedures for Attending the meetings and Voting by Proxy

Any shareholder who holds one or more shares(s) of the Company on May 2, 2025 (the “Record Date”) shall be admitted to the meetings and may attend the meetings in person, through their duly appointed attorneys or vote by proxy. Attorneys must properly evidence their powers to represent a shareholder by a valid power-of-attorney which should be filed no later than June 3, 2025, at the address indicated below.

In the case of Shares owned by a corporation or any other legal entity, individuals representing such entity who wish to attend the meetings in person and vote at the meetings on behalf of such entity, must present evidence of their authority to attend and vote at the meetings, by means of a proper document (such as a general or special power-of-attorney) issued by the respective entity. A copy of such power of attorney or other proper document should be filed not later than June 3, 2025, at any of the addresses indicated below.

Address for filing powers-of-attorney:

Adecoagro S.A.

28, Boulevard F. W. Raiffeisen

L – 2411, Luxembourg

Grand Duchy of Luxembourg

Attention: Emilio Gnecco

To vote by proxy, holders of Shares will need to complete proxy cards. Proxy cards must be received by the tabulation agent at the return address indicated on the proxy cards, Computershare Shareowner Services LLC, P.O. Box 43101, Providence, RI 02940, no later than 4:00 p.m. New York City Time on June 3, 2025, in order for such votes to count.

If you hold your shares through a brokerage account, please contact your broker to receive information regarding how you may vote your shares.