Document

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13215 Bee Cave Pkwy, Suite B-300, Austin, TX 78738 |

|

Telephone: 512-538-2300 Fax: 512-538-2333 |

|

www.shpreit.com |

NEWS RELEASE

SUMMIT HOTEL PROPERTIES REPORTS THIRD QUARTER 2025 RESULTS

Completed Sale of Two Assets for $39.0 million at Blended Cap Rate of 4.3 percent Subsequent to Quarter End

Completed Refinancing of $400 Million NCI Term Loan at Accretive Pricing to Further Strengthen Balance Sheet

Austin, Texas, November 4, 2025 - - - Summit Hotel Properties, Inc. (NYSE: INN) (the “Company”), today announced results for the three and nine months ended September 30, 2025.

“Operating fundamentals in the third quarter remained relatively stable compared to the trends we observed in the second quarter, as reduced government demand and slower international inbound travel continued to pressure average daily rates. Despite this challenging backdrop, we continued to grow market share, with our RevPAR index increasing 140 basis points to ~116% in the third quarter. Our disciplined approach to cost management also resulted in pro forma operating expenses increasing less than 2% during the quarter and just over 1.5% year-to-date. Encouragingly, our outlook for the remainder of the year reflects expectations for sequential improvement in operating trends in the fourth quarter, and our longer-term outlook for better operating fundamentals is positive as the industry will benefit from a lack of new supply growth,” said Jonathan P. Stanner, President and Chief Executive Officer.

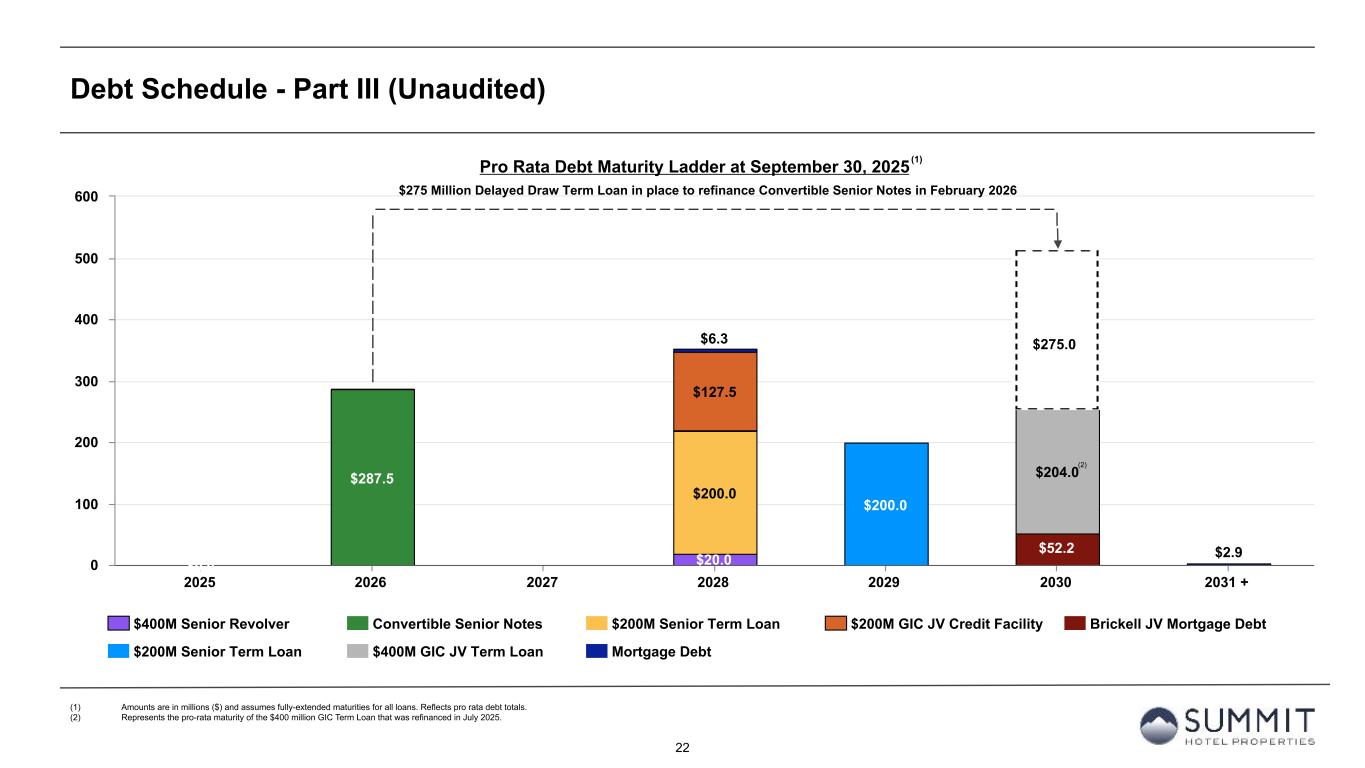

“We also continued to strengthen our balance sheet through the sale of two hotels for gross proceeds of $39.0 million subsequent to quarter end. The combined sales price reflects a blended trailing twelve-month net operating income capitalization rate of 4.3%. These transactions extend our successful capital recycling strategy, as we have sold 12 hotels since 2023, generating approximately $187 million of gross proceeds at a blended capitalization rate of 4.5%, inclusive of foregone capital expenditures. The strength of our balance sheet, which effectively has no debt maturities until 2028, together with our high-quality portfolio of well-located hotels, positions the Company favorably for long-term growth,” continued Mr. Stanner.

Third Quarter 2025 Summary

•Net Loss: Net loss attributable to common stockholders was $11.3 million, or $0.11 per diluted share, compared to net loss of $4.3 million, or $0.04 per diluted share, for the third quarter of 2024.

•Same Store RevPAR: Same store RevPAR decreased 3.7 percent to $115.77 compared to the third quarter of 2024. Same store ADR decreased 3.4 percent to $157.62, and same store occupancy decreased 0.3 percent to 73.5 percent.

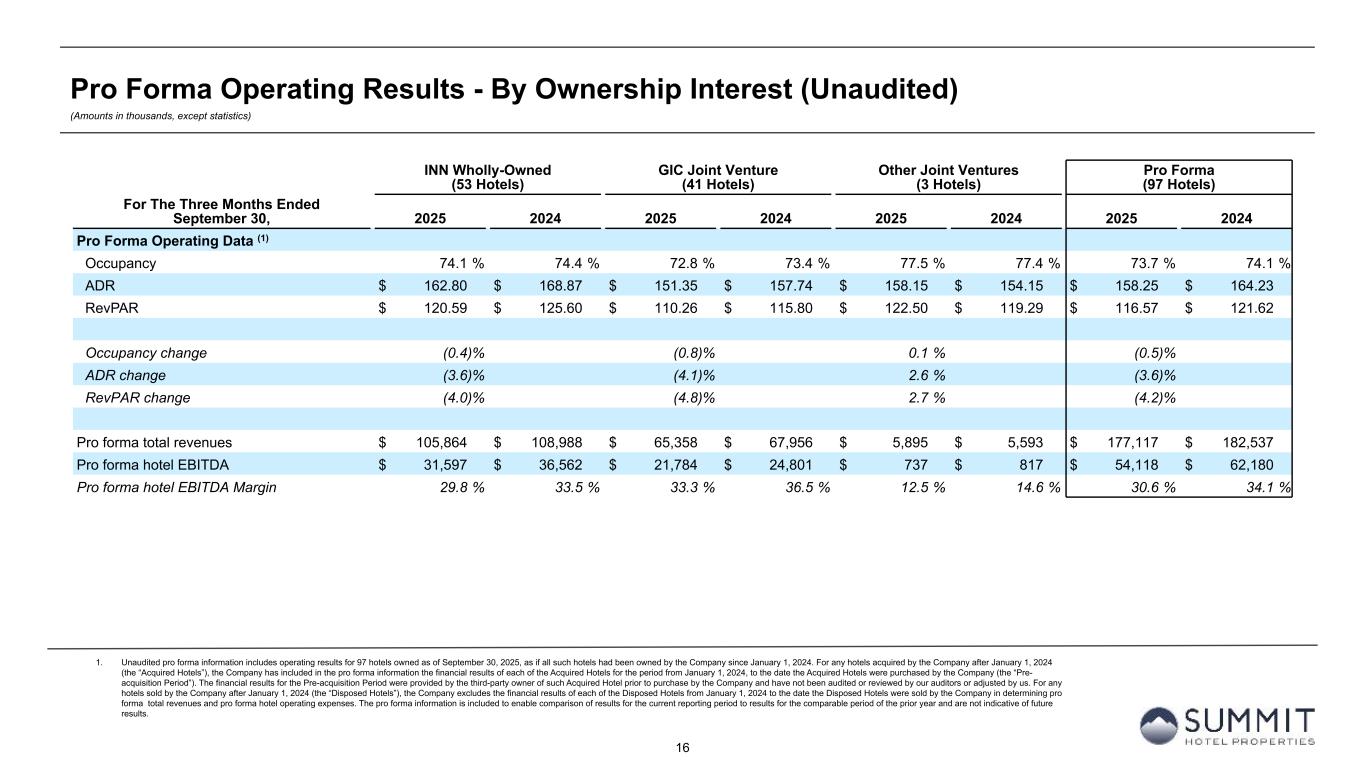

•Pro forma RevPAR: Pro forma RevPAR decreased 4.2 percent to $116.57 compared to the third quarter of 2024. Pro forma ADR decreased 3.6 percent to $158.25 compared to the same period in 2024, and pro forma occupancy decreased 0.5 percent to 73.7 percent.

•Same Store Hotel EBITDA(1): Same store hotel EBITDA decreased to $52.0 million from $59.6 million in the same period in 2024. Same store hotel EBITDA margin contracted approximately 356 basis points to 30.3 percent.

•Pro Forma Hotel EBITDA(1): Pro forma hotel EBITDA decreased to $54.1 million from $62.2 million in the same period in 2024. Pro forma hotel EBITDA margin contracted approximately 351 basis points to 30.6 percent.

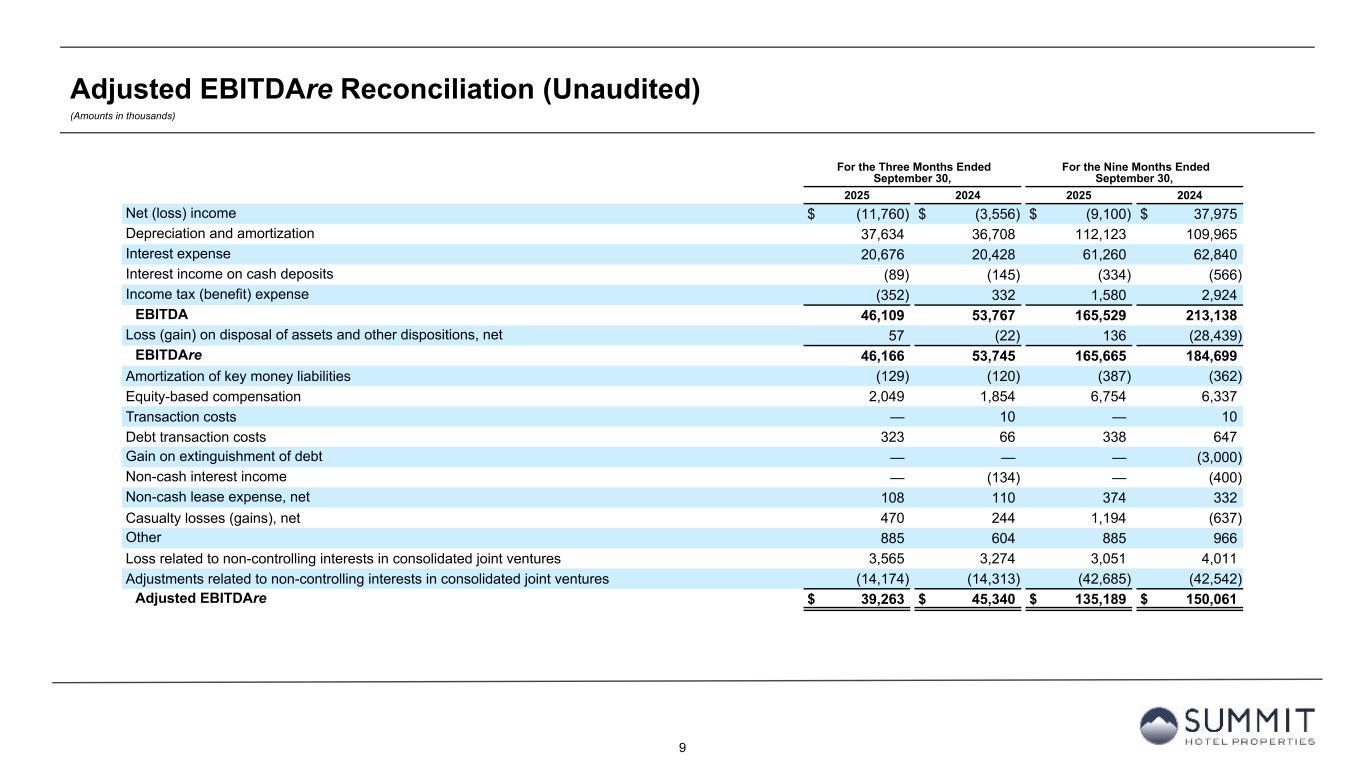

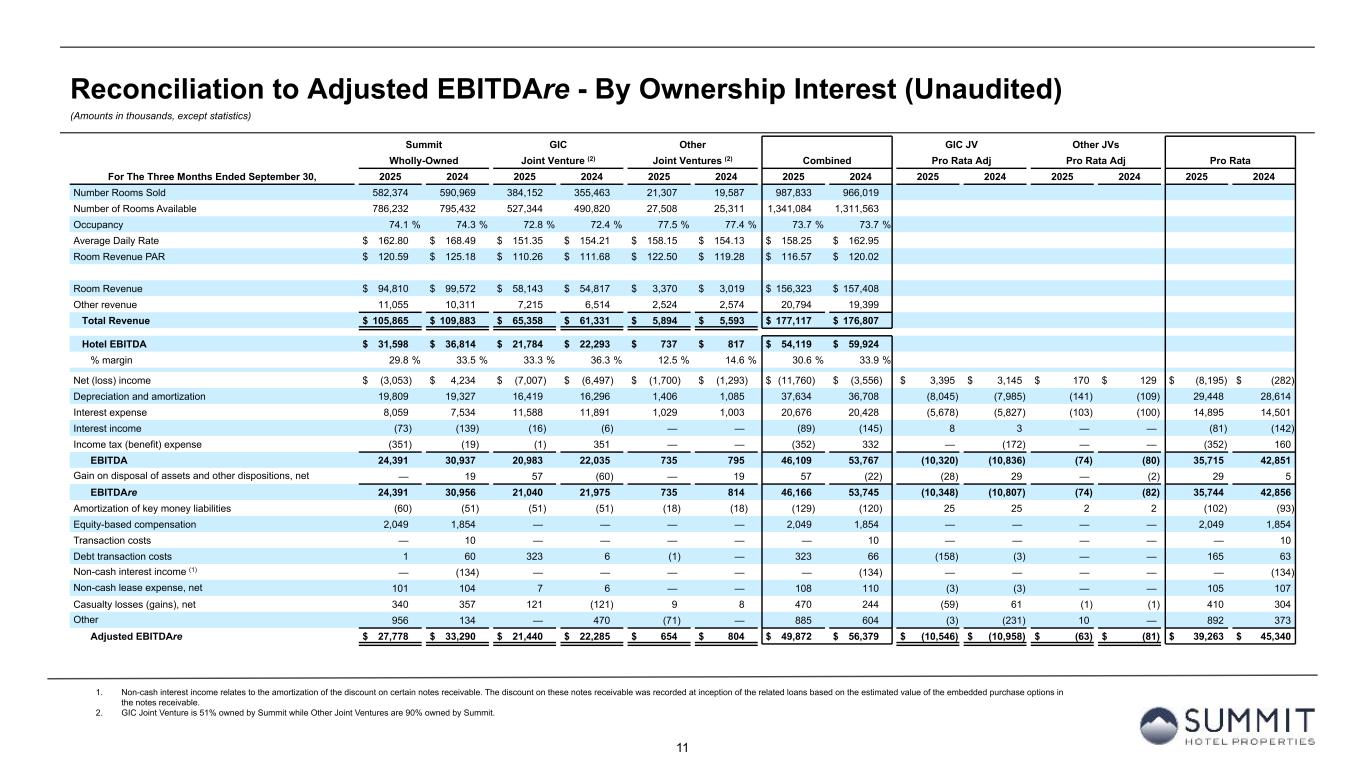

•Adjusted EBITDAre(1): Adjusted EBITDAre decreased to $39.3 million from $45.3 million in the third quarter of 2024.

•Adjusted FFO(1): Adjusted FFO decreased to $21.3 million, or $0.17 per diluted share, compared to $27.6 million, or $0.22 per diluted share, in the third quarter of 2024.

Year-to-Date 2025 Summary

•Net Loss: Net loss attributable to common stockholders was $17.6 million, or $0.17 per diluted share, compared to net income of $24.5 million, or $0.21 per diluted share, in the same period of 2024.

•Same Store RevPAR: Same store RevPAR decreased 2.0 percent to $123.32 compared to the same period of 2024. Same store ADR decreased 2.0 percent to $165.46, and same store occupancy remained unchanged at 74.5 percent.

•Pro forma RevPAR: Pro forma RevPAR decreased 2.4 percent to $123.42 compared to the same period of 2024. Pro forma ADR decreased 2.1 percent to $165.56, and pro forma occupancy decreased 0.3 percent to 74.5 percent.

•Same Store Hotel EBITDA(1): Same store hotel EBITDA decreased to $183.0 million from $198.4 million, and same store hotel EBITDA margin contracted 229 basis points to 33.9 percent.

•Pro Forma Hotel EBITDA(1): Pro forma hotel EBITDA decreased to $188.1 million from $204.3 million, and pro forma hotel EBITDA margin contracted 221 basis points to 33.9 percent.

•Adjusted EBITDAre(1): Adjusted EBITDAre decreased to $135.2 million from $150.1 million in the same period of 2024.

•Adjusted FFO(1): Adjusted FFO decreased to $81.3 million, or $0.66 per diluted share, compared to $94.0 million, or $0.76 per diluted share, in the same period of 2024.

The Company’s results for the three and nine months ended September 30, 2025 and 2024 are as follows (in thousands, except per share amounts and metrics):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

| Net (loss) income attributable to common stockholders |

$ |

(11,301) |

|

$ |

(4,272) |

|

$ |

(17,597) |

|

$ |

24,461 |

| Net (loss) income per diluted share |

$ |

(0.11) |

|

$ |

(0.04) |

|

$ |

(0.17) |

|

$ |

0.21 |

| Total revenues |

$ |

177,117 |

|

$ |

176,807 |

|

$ |

554,512 |

|

$ |

558,852 |

EBITDAre (1) |

$ |

46,166 |

|

$ |

53,745 |

|

$ |

165,665 |

|

$ |

184,699 |

Adjusted EBITDAre (1) |

$ |

39,263 |

|

$ |

45,340 |

|

$ |

135,189 |

|

$ |

150,061 |

FFO (1) |

$ |

16,289 |

|

$ |

23,135 |

|

$ |

66,371 |

|

$ |

83,557 |

Adjusted FFO (1) |

$ |

21,253 |

|

$ |

27,610 |

|

$ |

81,319 |

|

$ |

93,976 |

FFO per diluted share and unit (1) |

$ |

0.13 |

|

$ |

0.19 |

|

$ |

0.54 |

|

$ |

0.67 |

Adjusted FFO per diluted share and unit (1) |

$ |

0.17 |

|

$ |

0.22 |

|

$ |

0.66 |

|

$ |

0.76 |

|

|

|

|

|

|

|

|

Pro Forma (2) |

|

|

|

|

|

|

|

| RevPAR |

$ |

116.57 |

|

$ |

121.62 |

|

$ |

123.42 |

|

$ |

126.45 |

| RevPAR Growth |

(4.2)% |

|

|

|

(2.4)% |

|

|

| Hotel EBITDA |

$ |

54,118 |

|

$ |

62,180 |

|

$ |

188,144 |

|

$ |

204,344 |

| Hotel EBITDA Margin |

30.6% |

|

34.1% |

|

33.9% |

|

36.1% |

| Hotel EBITDA Margin Change |

(351) bps |

|

|

|

(221) bps |

|

|

|

|

|

|

|

|

|

|

Same Store (3) |

|

|

|

|

|

|

|

| RevPAR |

$ |

115.77 |

|

$ |

120.23 |

|

$ |

123.32 |

|

$ |

125.82 |

| RevPAR Growth |

(3.7)% |

|

|

|

(2.0)% |

|

|

| Hotel EBITDA |

$ |

51,993 |

|

$ |

59,615 |

|

$ |

182,980 |

|

$ |

198,436 |

| Hotel EBITDA Margin |

30.3% |

|

33.9% |

|

33.9% |

|

36.2% |

| Hotel EBITDA Margin Change |

(356) bps |

|

|

|

(229) bps |

|

|

(1) See tables later in this press release for a discussion and reconciliation of net (loss) income to non-GAAP financial measures, including earnings before interest, taxes, depreciation, and amortization (“EBITDA”), EBITDAre, adjusted EBITDAre, funds from operations (“FFO”), FFO per diluted share and unit, adjusted FFO (“AFFO”), and AFFO per diluted share and unit, as well as a reconciliation of operating income to hotel EBITDA. See “Non-GAAP Financial Measures” at the end of this release.

(2) Unless stated otherwise in this release, all pro forma information includes operating and financial results for 97 hotels owned as of September 30, 2025, as if each hotel had been owned by the Company since January 1, 2024 and remained open for the entirety of the reporting period. As a result, all pro forma information includes operating and financial results for hotels acquired since January 1, 2024, which may include periods prior to the Company’s ownership. Pro forma and non-GAAP financial measures are unaudited.

(3) All same store information includes operating and financial results for 95 hotels owned as of January 1, 2024 and at all times during the three and nine months ended September 30, 2025, and 2024.

Transaction Activity

In October 2025, the Company completed the sale of two hotels for a combined sales price of $39.0 million, including the Courtyard Kansas City Country Club Plaza for $19.0 million and the Courtyard Amarillo Downtown, which was owned in the Company’s joint venture with GIC, for $20.0 million. The aggregate sales price for the transaction represented a blended 4.3 percent capitalization rate based on the estimated net operating income for the trailing twelve months ended September 2025 and after consideration of approximately $10.2 million of foregone near-term required capital expenditures. Net proceeds from the transaction of $24.0 million (pro-rata), which will generate a net gain on sale of approximately $6.7 million, were used to repay debt, enhance liquidity and for other general corporate purposes. The combined RevPAR for the sold hotels was $89 which is a nearly 27% discount to the current pro forma portfolio.

Since 2023, the Company and its affiliates have sold 12 hotels for a combined sales price of $187.3 million at a blended capitalization rate of approximately 4.5%, inclusive of an estimated $57.4 million of foregone capital needs, based on the trailing twelve-month net operating income at the time of each sale. The combined RevPAR for the sold hotels was $85 which is a nearly 30% discount to the current pro forma portfolio.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sold Hotels |

|

|

|

Keys |

|

Date |

|

Price (1) |

|

Forgone

Capex (1)(2)

|

|

RevPAR (3) |

|

T-12 NOI Cap Rate Including Capex |

|

Summit Ownership Percentage |

| Courtyard - Kansas City Country Club Plaza |

|

|

|

123 |

|

|

Oct 2025 |

|

$ |

19,000 |

|

|

$ |

5,500 |

|

|

$ |

81 |

|

|

1.4 |

% |

|

100 |

% |

| Courtyard - Amarillo Downtown |

|

|

|

107 |

|

|

Oct 2025 |

|

20,000 |

|

|

4,700 |

|

|

97 |

|

|

7.3 |

% |

|

51 |

% |

| Total |

|

|

|

230 |

|

|

|

|

$ |

39,000 |

|

|

$ |

10,200 |

|

|

$ |

89 |

|

|

4.3 |

% |

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) In thousands.

(2) Reflects estimated near-term foregone capital expenditures for dispositions.

(3) Reflects RevPAR for the twelve-month period immediately prior to sale.

(4) Blended

Capital Markets Activity

NCI Term Loan Refinancing

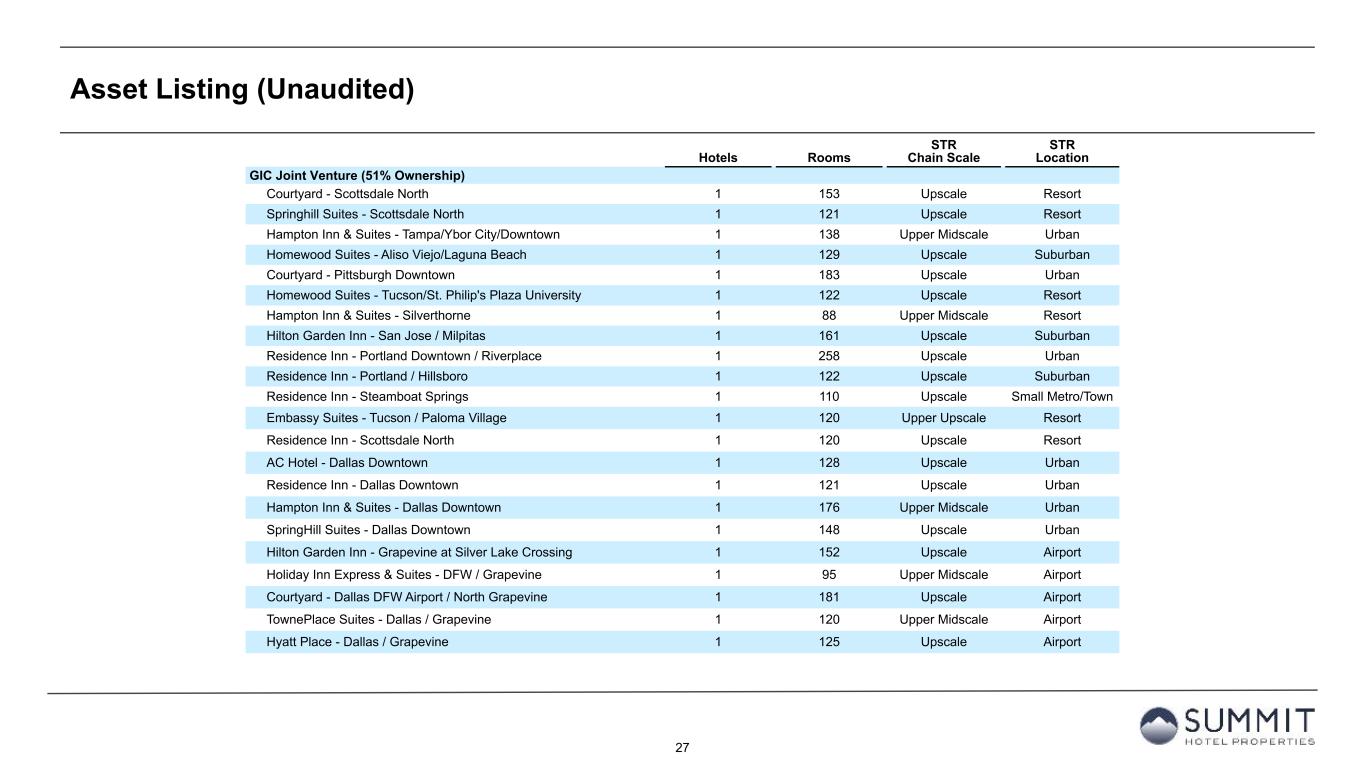

In July 2025, the Company, together with its joint venture partner, GIC, closed a $400.0 million senior unsecured term loan (the “2025 GIC Joint Venture Term Loan”) to refinance the previous GIC joint venture term loan that was scheduled to mature in January 2026.

The 2025 GIC Joint Venture Term Loan provides for an interest rate equal to SOFR plus 235 basis points, which represents a 50 basis point reduction from the previous loan, and has a fully extended maturity date of July 2030, subject to extensions and certain other conditions.

GIC Joint Venture Interest Rate Swaps

In August 2025, the GIC joint venture entered into two $150 million forward starting interest rate swaps to fix one-month term SOFR until January 2028. The interest rate swaps have an effective date of January 13, 2026 and a termination date of January 13, 2028. The two $150 million interest rate swaps with an average SOFR rate of 3.26% will replace $300 million of existing GIC Joint Venture interest rate swaps with an average SOFR rate of 3.49% scheduled to mature in January 2026.

Balance Sheet Summary

On a pro rata basis as of September 30, 2025, the Company had the following outstanding indebtedness and liquidity available:

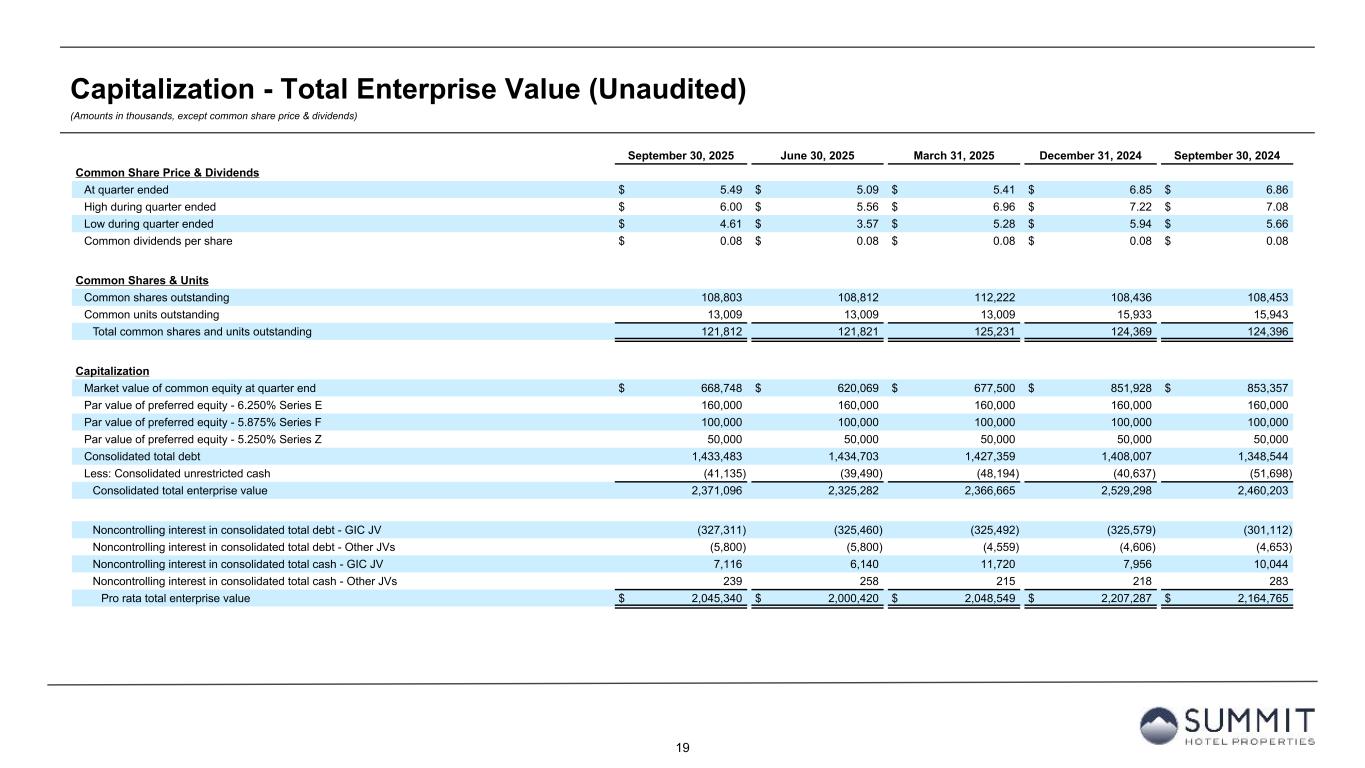

•Outstanding debt of $1.1 billion with a weighted average interest rate of 4.52 percent. After giving effect to interest rate derivative agreements, $826.9 million, or 75 percent, of our outstanding debt had a fixed interest rate, and $273.5 million, or 25 percent, had a variable interest rate.

•Unrestricted cash and cash equivalents of $33.8 million.

•Total liquidity of over $280 million, including unrestricted cash and cash equivalents and revolving credit facility availability.

Common and Preferred Dividend Declaration

On October 31, 2025, the Company declared a quarterly cash dividend of $0.08 per share on its common stock and per common unit of limited partnership interest in Summit Hotel OP, LP. The quarterly dividend of $0.08 per share represents an annualized dividend yield of 6.1 percent, based on the closing price of shares of the common stock on November 3, 2025.

In addition, the Board of Directors declared a quarterly cash dividend of:

• $0.390625 per share on its 6.25% Series E Cumulative Redeemable Preferred Stock

• $0.3671875 per share on its 5.875% Series F Cumulative Redeemable Preferred Stock

• $0.328125 per unit on its 5.25% Series Z Cumulative Perpetual Preferred Units

The dividends are payable on November 28, 2025 to holders of record as of November 14, 2025.

2025 Outlook

While we remain confident in the long-term fundamentals in our portfolio, near-term results are being negatively affected by increased price sensitivity and continued macroeconomic volatility. We currently expect fourth quarter 2025 RevPAR growth to range from -2.0% to -2.5% as operating trends reflect sequential improvement from the second and third quarters of this year. We expect capital expenditures for full year 2025 of $60 million to $65 million on a pro rata basis.

Third Quarter 2025 Earnings Conference Call

The Company will conduct its quarterly conference call on November 5, 2025 at 9:00 AM ET.

1.To access the conference call, please pre-register using this link. Registrants will receive a confirmation with dial-in details.

2.A live webcast of the conference call can be accessed using this link. A replay of the webcast will be available in the Investors section of the Company's website, www.shpreit.com, until February 2, 2026.

Supplemental Disclosures

In conjunction with this press release, the Company has furnished a financial supplement with additional disclosures on its website. Visit www.shpreit.com for more information. The Company has no obligation to update any of the information provided to conform to actual results or changes in portfolio, capital structure, or future expectations.

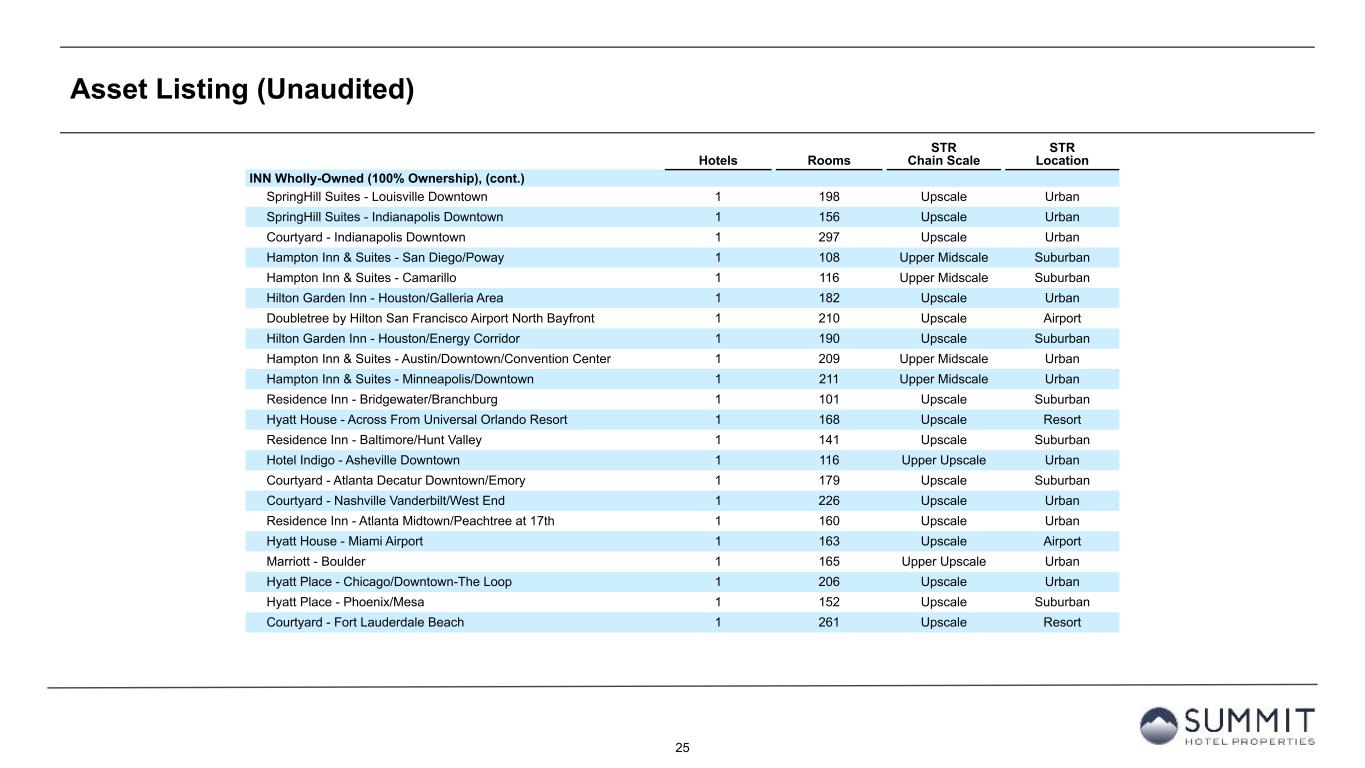

About Summit Hotel Properties

Summit Hotel Properties, Inc. is a publicly traded real estate investment trust focused on owning premium-branded lodging facilities with efficient operating models primarily in the upscale segment of the lodging industry. As of November 4, 2025, the Company's portfolio consisted of 95 assets, 52 of which are wholly owned, with a total of 14,347 guestrooms located in 24 states.

For additional information, please visit the Company's website, www.shpreit.com, and follow on X at @SummitHotel_INN.

Contact:

Kevin Milota

SVP - Corporate Finance

Summit Hotel Properties, Inc.

(737) 205-5787

Forward-Looking Statements

This press release contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” “forecast,” “continue,” “plan,” “likely,” “would” or other similar words or expressions. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections, or other forward-looking information. Examples of forward-looking statements include the following: the Company’s ability to realize growth from the deployment of renovation capital; projections of the Company’s revenues and expenses, capital expenditures or other financial items; descriptions of the Company’s plans or objectives for future operations, acquisitions, dispositions, financings, redemptions or services; forecasts of the Company’s future financial performance and potential increases in average daily rate, occupancy, RevPAR, room supply and demand, EBITDAre, Adjusted EBITDAre, FFO and AFFO; the Company’s outlook with respect to pro forma RevPAR, pro forma RevPAR growth, RevPAR, RevPAR growth, AFFO, AFFO per diluted share and unit and renovation capital deployed; and descriptions of assumptions underlying or relating to any of the foregoing expectations regarding the timing of their occurrence. These forward-looking statements are subject to various risks and uncertainties, not all of which are known to the Company and many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the state of the U.S. economy, supply and demand in the hotel industry, and other factors as are described in greater detail in the Company’s filings with the Securities and Exchange Commission (“SEC”). Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

For information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC, and its quarterly and other periodic filings with the SEC. The Company undertakes no duty to update the statements in this release to conform the statements to actual results or changes in the Company’s expectations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Consolidated Balance Sheets

(In thousands)

|

|

|

September 30, 2025 |

|

December 31, 2024 |

|

|

(Unaudited) |

|

|

| ASSETS |

|

|

|

|

| Investments in lodging property, net |

|

$ |

2,677,174 |

|

|

$ |

2,746,765 |

|

| Investment in lodging property under development |

|

— |

|

|

7,617 |

|

|

|

|

|

|

| Assets held for sale, net |

|

31,548 |

|

|

1,225 |

|

|

|

|

|

|

| Cash and cash equivalents |

|

41,135 |

|

|

40,637 |

|

| Restricted cash |

|

6,270 |

|

|

7,721 |

|

| Right-of-use assets, net |

|

32,482 |

|

|

33,309 |

|

| Trade receivables, net |

|

19,022 |

|

|

18,625 |

|

| Prepaid expenses and other |

|

14,319 |

|

|

9,580 |

|

|

|

|

|

|

| Deferred charges, net |

|

10,335 |

|

|

6,460 |

|

|

|

|

|

|

| Other assets |

|

16,195 |

|

|

24,291 |

|

| Total assets |

|

$ |

2,848,480 |

|

|

$ |

2,896,230 |

|

|

|

|

|

|

| LIABILITIES, REDEEMABLE NON-CONTROLLING INTERESTS AND EQUITY |

|

|

|

|

| Liabilities: |

|

|

|

|

| Debt, net of debt issuance costs |

|

$ |

1,421,777 |

|

|

$ |

1,396,710 |

|

| Lease liabilities, net |

|

24,421 |

|

|

24,871 |

|

| Accounts payable |

|

9,859 |

|

|

7,450 |

|

| Accrued expenses and other |

|

92,907 |

|

|

82,153 |

|

|

|

|

|

|

| Total liabilities |

|

1,548,964 |

|

|

1,511,184 |

|

|

|

|

|

|

| Redeemable non-controlling interests |

|

50,219 |

|

|

50,219 |

|

|

|

|

|

|

| Total stockholders’ equity |

|

875,794 |

|

|

909,545 |

|

| Non-controlling interests |

|

373,503 |

|

|

425,282 |

|

| Total equity |

|

1,249,297 |

|

|

1,334,827 |

|

| Total liabilities, redeemable non-controlling interests and equity |

|

$ |

2,848,480 |

|

|

$ |

2,896,230 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

|

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

| Room |

|

$ |

156,323 |

|

|

$ |

157,408 |

|

|

$ |

490,653 |

|

|

$ |

497,864 |

|

| Food and beverage |

|

10,017 |

|

|

9,272 |

|

|

32,202 |

|

|

30,174 |

|

| Other |

|

10,777 |

|

|

10,127 |

|

|

31,657 |

|

|

30,814 |

|

| Total revenues |

|

177,117 |

|

|

176,807 |

|

|

554,512 |

|

|

558,852 |

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

| Room |

|

38,958 |

|

|

37,286 |

|

|

114,256 |

|

|

111,303 |

|

| Food and beverage |

|

8,217 |

|

|

7,289 |

|

|

24,596 |

|

|

23,130 |

|

| Other lodging property operating expenses |

|

58,575 |

|

|

56,330 |

|

|

174,440 |

|

|

170,061 |

|

| Property taxes, insurance and other |

|

14,106 |

|

|

13,250 |

|

|

41,123 |

|

|

40,822 |

|

| Management fees |

|

3,142 |

|

|

2,728 |

|

|

12,048 |

|

|

12,059 |

|

| Depreciation and amortization |

|

37,634 |

|

|

36,708 |

|

|

112,123 |

|

|

109,965 |

|

| Corporate general and administrative |

|

7,845 |

|

|

7,473 |

|

|

24,696 |

|

|

24,488 |

|

| Transaction costs |

|

— |

|

|

10 |

|

|

— |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

168,477 |

|

|

161,074 |

|

|

503,282 |

|

|

491,838 |

|

| (Loss) gain on disposal of assets, net |

|

(57) |

|

|

22 |

|

|

(136) |

|

|

28,439 |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

8,583 |

|

|

15,755 |

|

|

51,094 |

|

|

95,453 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

| Interest expense |

|

(20,676) |

|

|

(20,428) |

|

|

(61,260) |

|

|

(62,840) |

|

| Interest income |

|

259 |

|

|

450 |

|

|

836 |

|

|

1,473 |

|

|

|

|

|

|

|

|

|

|

| Gain on extinguishment of debt |

|

— |

|

|

— |

|

|

— |

|

|

3,000 |

|

| Other (expense) income, net |

|

(278) |

|

|

999 |

|

|

1,810 |

|

|

3,813 |

|

| Total other expense, net |

|

(20,695) |

|

|

(18,979) |

|

|

(58,614) |

|

|

(54,554) |

|

| (Loss) income from continuing operations before income taxes |

|

(12,112) |

|

|

(3,224) |

|

|

(7,520) |

|

|

40,899 |

|

| Income tax benefit (expense) |

|

352 |

|

|

(332) |

|

|

(1,580) |

|

|

(2,924) |

|

| Net (loss) income |

|

(11,760) |

|

|

(3,556) |

|

|

(9,100) |

|

|

37,975 |

|

| Less - Loss attributable to non-controlling interests |

|

(5,083) |

|

|

(3,908) |

|

|

(5,379) |

|

|

(362) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to Summit Hotel Properties, Inc. before preferred dividends |

|

(6,677) |

|

|

352 |

|

|

(3,721) |

|

|

38,337 |

|

| Less - Distributions to and accretion of redeemable non-controlling interests |

|

(656) |

|

|

(656) |

|

|

(1,970) |

|

|

(1,970) |

|

| Less - Preferred dividends |

|

(3,968) |

|

|

(3,968) |

|

|

(11,906) |

|

|

(11,906) |

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to common stockholders |

|

$ |

(11,301) |

|

|

$ |

(4,272) |

|

|

$ |

(17,597) |

|

|

$ |

24,461 |

|

|

|

|

|

|

|

|

|

|

| (Loss) income per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.11) |

|

|

$ |

(0.04) |

|

|

$ |

(0.17) |

|

|

$ |

0.23 |

|

| Diluted |

|

$ |

(0.11) |

|

|

$ |

(0.04) |

|

|

$ |

(0.17) |

|

|

$ |

0.21 |

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

105,889 |

|

|

106,033 |

|

|

107,169 |

|

|

105,891 |

|

| Diluted |

|

105,889 |

|

|

106,033 |

|

|

107,169 |

|

|

150,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net (Loss) Income to Non-GAAP Measures - Funds From Operations |

| (Unaudited) |

| (In thousands, except per share and unit amounts) |

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net (loss) income |

|

$ |

(11,760) |

|

|

$ |

(3,556) |

|

|

$ |

(9,100) |

|

|

$ |

37,975 |

|

| Preferred dividends |

|

(3,968) |

|

|

(3,968) |

|

|

(11,906) |

|

|

(11,906) |

|

| Distributions to and accretion of redeemable non-controlling interests |

|

(656) |

|

|

(656) |

|

|

(1,970) |

|

|

(1,970) |

|

|

|

|

|

|

|

|

|

|

| Loss related to non-controlling interests in consolidated joint ventures |

|

3,565 |

|

|

3,274 |

|

|

3,051 |

|

|

4,011 |

|

| Net (loss) income applicable to common shares and Common Units |

|

(12,819) |

|

|

(4,906) |

|

|

(19,925) |

|

|

28,110 |

|

| Real estate-related depreciation |

|

37,064 |

|

|

35,721 |

|

|

110,421 |

|

|

106,590 |

|

|

|

|

|

|

|

|

|

|

| Loss (gain) on disposal of assets and other dispositions, net |

|

57 |

|

|

(22) |

|

|

136 |

|

|

(28,439) |

|

| FFO adjustments related to non-controlling interests in consolidated joint ventures |

|

(8,013) |

|

|

(7,658) |

|

|

(24,261) |

|

|

(22,704) |

|

| FFO applicable to common shares and Common Units |

|

16,289 |

|

|

23,135 |

|

|

66,371 |

|

|

83,557 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of deferred financing costs |

|

1,929 |

|

|

1,640 |

|

|

5,279 |

|

|

4,880 |

|

| Amortization of franchise fees |

|

180 |

|

|

169 |

|

|

530 |

|

|

494 |

|

| Amortization of intangible assets, net |

|

263 |

|

|

698 |

|

|

787 |

|

|

2,520 |

|

|

|

|

|

|

|

|

|

|

| Equity-based compensation |

|

2,049 |

|

|

1,854 |

|

|

6,754 |

|

|

6,337 |

|

|

|

|

|

|

|

|

|

|

| Transaction costs |

|

— |

|

|

10 |

|

|

— |

|

|

10 |

|

| Debt transaction costs |

|

323 |

|

|

66 |

|

|

338 |

|

|

647 |

|

|

|

|

|

|

|

|

|

|

| Gain on extinguishment of debt |

|

— |

|

|

— |

|

|

— |

|

|

(3,000) |

|

Non-cash interest income (1) |

|

— |

|

|

(134) |

|

|

— |

|

|

(400) |

|

| Non-cash lease expense, net |

|

108 |

|

|

110 |

|

|

374 |

|

|

332 |

|

| Casualty losses (gains), net |

|

470 |

|

|

244 |

|

|

1,194 |

|

|

(637) |

|

| Deferred tax (benefit) expense |

|

(532) |

|

|

— |

|

|

636 |

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

| Other |

|

885 |

|

|

604 |

|

|

885 |

|

|

966 |

|

| AFFO adjustments related to non-controlling interests in consolidated joint ventures |

|

(711) |

|

|

(786) |

|

|

(1,829) |

|

|

(1,727) |

|

|

|

|

|

|

|

|

|

|

| AFFO applicable to common shares and Common Units |

|

$ |

21,253 |

|

|

$ |

27,610 |

|

|

$ |

81,319 |

|

|

$ |

93,976 |

|

| FFO per share of common share/Common Unit |

|

$ |

0.13 |

|

|

$ |

0.19 |

|

|

$ |

0.54 |

|

|

$ |

0.67 |

|

| AFFO per common share/Common Unit |

|

$ |

0.17 |

|

|

$ |

0.22 |

|

|

$ |

0.66 |

|

|

$ |

0.76 |

|

|

|

|

|

|

|

|

|

|

| Weighted-average diluted common shares/Common Units |

|

121,635 |

|

|

124,580 |

|

|

123,211 |

|

|

124,389 |

|

|

|

|

|

|

|

|

|

|

(1) Non-cash interest income relates to the amortization of the discount on a note receivable. The discount on the note receivable was recorded at inception of the related loan based on the estimated value of the embedded purchase option in the note receivable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Reconciliation of Weighted Average Diluted Common Shares

(Unaudited)

(In thousands)

|

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Weighted average common shares outstanding - diluted |

|

105,889 |

|

|

106,033 |

|

|

107,169 |

|

|

150,003 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

Non-GAAP adjustment for restricted stock awards (1) |

|

2,737 |

|

|

2,604 |

|

|

2,688 |

|

|

— |

|

Non-GAAP adjustment for dilutive effects of Common Units (2) |

|

13,009 |

|

|

15,943 |

|

|

13,354 |

|

|

— |

|

Non-GAAP adjustment for dilutive effect of shares of common stock issuable upon conversion of convertible debt (3) |

|

— |

|

|

— |

|

|

— |

|

|

(25,614) |

|

Non-GAAP weighted diluted share of common stock and Common Units (3) |

|

121,635 |

|

|

124,580 |

|

|

123,211 |

|

|

124,389 |

|

(1) The weighted-average diluted shares of Common Stock and Common Units used to calculate FFO and AFFO per share of Common Stock and Common Units for the three months ended September 30, 2025 and 2024 and the nine months ended September 30, 2025 includes the dilutive effect of our outstanding restricted stock awards. These shares were excluded from our weighted-average shares outstanding used to calculate net loss per share because they would have been antidilutive.

(2) The Company includes the outstanding OP units issued by Summit Hotel OP, LP, the Company’s operating partnership, held by limited partners other than the Company because the OP units are redeemable for cash or, at the Company’s option, shares of the Company’s common stock on a one-for-one basis.

(3) The weighted-average shares of Common Stock and Common Units used to calculate FFO and AFFO per share of Common Stock and Common Unit for the three and nine months ended September 30, 2025 and 2024 exclude the potential dilution related to our Convertible Notes as we intend to settle the principal value of the Convertible Notes in cash.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net (Loss) Income to Non-GAAP Measures - EBITDAre |

| (Unaudited) |

| (In thousands) |

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net (loss) income |

|

$ |

(11,760) |

|

|

$ |

(3,556) |

|

|

$ |

(9,100) |

|

|

$ |

37,975 |

|

| Depreciation and amortization |

|

37,634 |

|

|

36,708 |

|

|

112,123 |

|

|

109,965 |

|

| Interest expense |

|

20,676 |

|

|

20,428 |

|

|

61,260 |

|

|

62,840 |

|

| Interest income on cash deposits |

|

(89) |

|

|

(145) |

|

|

(334) |

|

|

(566) |

|

| Income tax (benefit) expense |

|

(352) |

|

|

332 |

|

|

1,580 |

|

|

2,924 |

|

| EBITDA |

|

46,109 |

|

|

53,767 |

|

|

165,529 |

|

|

213,138 |

|

|

|

|

|

|

|

|

|

|

| Loss (gain) on disposal of assets and other dispositions, net |

|

57 |

|

|

(22) |

|

|

136 |

|

|

(28,439) |

|

EBITDAre |

|

46,166 |

|

|

53,745 |

|

|

165,665 |

|

|

184,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of key money liabilities |

|

(129) |

|

|

(120) |

|

|

(387) |

|

|

(362) |

|

| Equity-based compensation |

|

2,049 |

|

|

1,854 |

|

|

6,754 |

|

|

6,337 |

|

|

|

|

|

|

|

|

|

|

| Transaction costs |

|

— |

|

|

10 |

|

|

— |

|

|

10 |

|

| Debt transaction costs |

|

323 |

|

|

66 |

|

|

338 |

|

|

647 |

|

| Gain on extinguishment of debt |

|

— |

|

|

— |

|

|

— |

|

|

(3,000) |

|

Non-cash interest income (1) |

|

— |

|

|

(134) |

|

|

— |

|

|

(400) |

|

| Non-cash lease expense, net |

|

108 |

|

|

110 |

|

|

374 |

|

|

332 |

|

| Casualty losses (gains), net |

|

470 |

|

|

244 |

|

|

1,194 |

|

|

(637) |

|

|

|

|

|

|

|

|

|

|

| Other |

|

885 |

|

|

604 |

|

|

885 |

|

|

966 |

|

| Loss related to non-controlling interests in consolidated joint ventures |

|

3,565 |

|

|

3,274 |

|

|

3,051 |

|

|

4,011 |

|

| Adjustments related to non-controlling interests in consolidated joint ventures |

|

(14,174) |

|

|

(14,313) |

|

|

(42,685) |

|

|

(42,542) |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDAre |

|

$ |

39,263 |

|

|

$ |

45,340 |

|

|

$ |

135,189 |

|

|

$ |

150,061 |

|

(1) Non-cash interest income relates to the amortization of the discount on a note receivable. The discount on the note receivable was recorded at inception of the related loan based on the estimated fair value of the embedded purchase option in the note receivable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Pro Forma Hotel Operating Data

(Unaudited)

(Dollars in thousands)

|

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

Pro Forma Operating Data: (1) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Pro forma room revenue |

|

$ |

156,323 |

|

|

$ |

162,848 |

|

|

$ |

490,653 |

|

|

$ |

504,244 |

|

| Pro forma other hotel operations revenue |

|

20,794 |

|

|

19,689 |

|

|

63,859 |

|

|

61,224 |

|

| Pro forma total revenues |

|

177,117 |

|

|

182,537 |

|

|

554,512 |

|

|

565,468 |

|

| Pro forma total hotel operating expenses |

|

122,999 |

|

|

120,357 |

|

|

366,368 |

|

|

361,124 |

|

| Pro forma hotel EBITDA |

|

$ |

54,118 |

|

|

$ |

62,180 |

|

|

$ |

188,144 |

|

|

$ |

204,344 |

|

| Pro forma hotel EBITDA Margin |

|

30.6 |

% |

|

34.1 |

% |

|

33.9 |

% |

|

36.1 |

% |

|

|

|

|

|

|

|

|

|

| Reconciliations of Non-GAAP financial measures to comparable GAAP financial measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

177,117 |

|

|

$ |

176,807 |

|

|

$ |

554,512 |

|

|

$ |

558,852 |

|

| Total revenues - acquisitions |

|

— |

|

|

6,626 |

|

|

— |

|

|

17,257 |

|

| Total revenues - dispositions |

|

— |

|

|

(896) |

|

|

— |

|

|

(10,641) |

|

Pro forma total revenues (1) |

|

177,117 |

|

|

182,537 |

|

|

554,512 |

|

|

565,468 |

|

|

|

|

|

|

|

|

|

|

| Hotel Operating Expenses: |

|

|

|

|

|

|

|

|

| Hotel operating expenses |

|

$ |

122,998 |

|

|

$ |

116,883 |

|

|

$ |

366,463 |

|

|

$ |

357,375 |

|

| Hotel operating expenses - acquisitions |

|

— |

|

|

4,061 |

|

|

— |

|

|

11,349 |

|

| Hotel operating expenses - dispositions |

|

1 |

|

|

(587) |

|

|

(95) |

|

|

(7,600) |

|

Pro forma hotel operating expense (1) |

|

122,999 |

|

|

120,357 |

|

|

366,368 |

|

|

361,124 |

|

|

|

|

|

|

|

|

|

|

| Hotel EBITDA: |

|

|

|

|

|

|

|

|

| Operating income |

|

8,583 |

|

|

15,755 |

|

|

51,094 |

|

|

95,453 |

|

| Loss (gain) on disposal of assets and other dispositions, net |

|

57 |

|

|

(22) |

|

|

136 |

|

|

(28,439) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction costs |

|

— |

|

|

10 |

|

|

— |

|

|

10 |

|

| Corporate general and administrative |

|

7,845 |

|

|

7,473 |

|

|

24,696 |

|

|

24,488 |

|

| Depreciation and amortization |

|

37,634 |

|

|

36,708 |

|

|

112,123 |

|

|

109,965 |

|

| Hotel EBITDA |

|

54,119 |

|

|

59,924 |

|

|

188,049 |

|

|

201,477 |

|

Hotel EBITDA - acquisitions (2) |

|

(2,125) |

|

|

— |

|

|

(5,164) |

|

|

— |

|

Hotel EBITDA - dispositions (3) |

|

(1) |

|

|

(309) |

|

|

95 |

|

|

(3,041) |

|

| Same Store hotel EBITDA |

|

51,993 |

|

|

59,615 |

|

|

182,980 |

|

|

198,436 |

|

| Hotel EBITDA - acquisitions |

|

2,125 |

|

|

2,565 |

|

|

5,164 |

|

|

5,908 |

|

Pro forma hotel EBITDA (1) |

|

$ |

54,118 |

|

|

$ |

62,180 |

|

|

$ |

188,144 |

|

|

$ |

204,344 |

|

(1) Unaudited pro forma information includes operating results for 97 hotels owned as of September 30, 2025, as if all such hotels had been owned by the Company since January 1, 2024. For hotels acquired by the Company after January 1, 2024 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2024, to September 30, 2025. The financial results for the Acquired Hotels include information provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. For any hotels sold by the Company after January 1, 2024 (the “Disposed Hotels”), the Company excludes the financial results of each of the Disposed Hotels from January 1, 2024 to the date the Disposed Hotels were sold by the Company in determining pro forma total revenues and pro forma hotel operating expenses. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results.

(2) For any hotels acquired by the Company after January 1, 2024, the Company has excluded the financial results of each of the Acquired Hotels for the period the Acquired Hotels were purchased by the Company to September 30, 2025 (the “Acquisition Period”) in determining same-store hotel EBITDA.

(3) For hotels sold by the Company between January 1, 2024, and September 30, 2025, the Company has excluded the financial results of each of the Disposed Hotels for the period beginning on January 1, 2024, and ending on the date the Disposed Hotels were sold by the Company (the “Disposition Period”) in determining same-store hotel EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Pro Forma Hotel Operating Data

(Unaudited)

(In thousands, except operating statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2025 |

|

Trailing Twelve Months Ended September 30, 2025 |

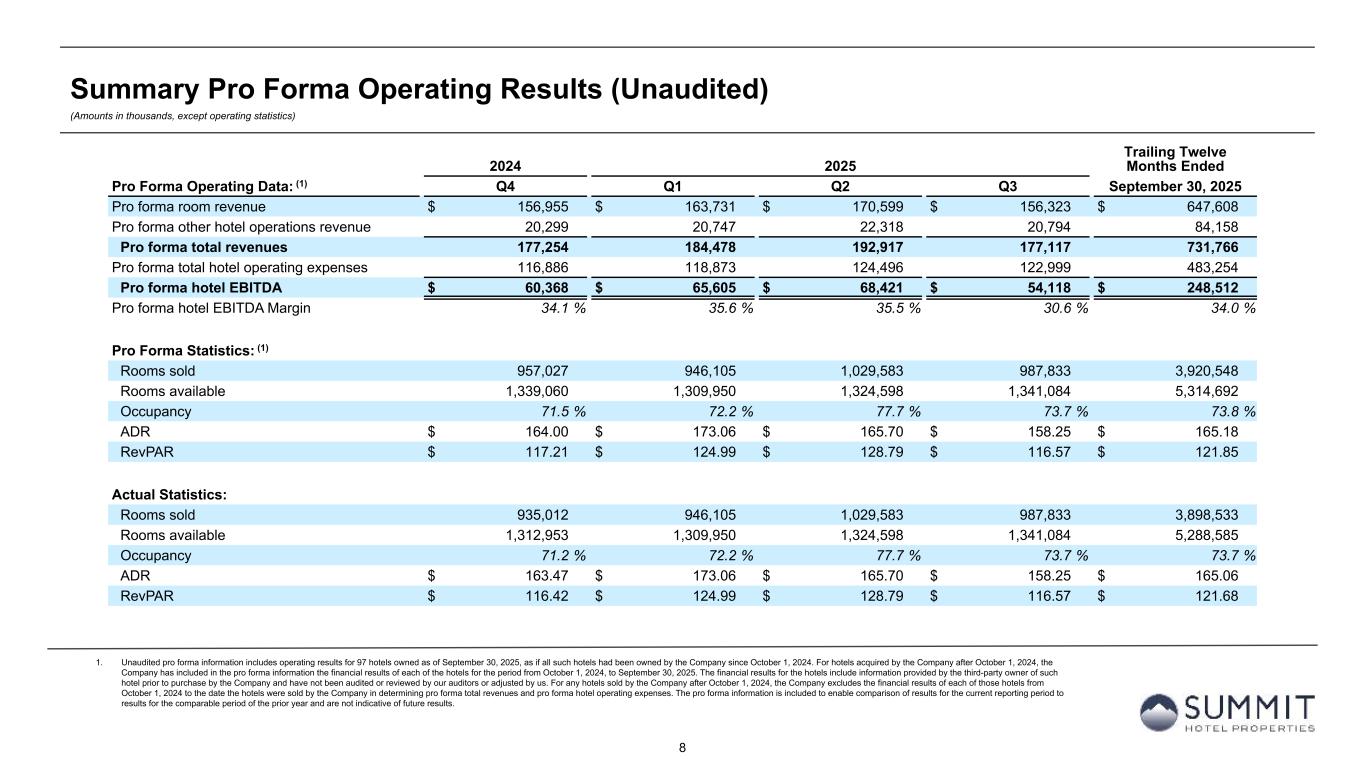

Pro Forma Operating Data: (1) |

|

Q4 |

|

Q1 |

|

Q2 |

|

Q3 |

|

| Pro forma room revenue |

|

$ |

156,955 |

|

|

$ |

163,731 |

|

|

$ |

170,599 |

|

|

$ |

156,323 |

|

|

$ |

647,608 |

|

| Pro forma other hotel operations revenue |

|

20,299 |

|

|

20,747 |

|

|

22,318 |

|

|

20,794 |

|

|

84,158 |

|

| Pro forma total revenues |

|

177,254 |

|

|

184,478 |

|

|

192,917 |

|

|

177,117 |

|

|

731,766 |

|

| Pro forma total hotel operating expenses |

|

116,886 |

|

|

118,873 |

|

|

124,496 |

|

|

122,999 |

|

|

483,254 |

|

| Pro forma hotel EBITDA |

|

$ |

60,368 |

|

|

$ |

65,605 |

|

|

$ |

68,421 |

|

|

$ |

54,118 |

|

|

$ |

248,512 |

|

| Pro forma hotel EBITDA Margin |

|

34.1 |

% |

|

35.6 |

% |

|

35.5 |

% |

|

30.6 |

% |

|

34.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Statistics: (1) |

|

|

|

|

|

|

|

|

|

|

| Rooms sold |

|

957,027 |

|

|

946,105 |

|

|

1,029,583 |

|

|

987,833 |

|

|

3,920,548 |

|

| Rooms available |

|

1,339,060 |

|

|

1,309,950 |

|

|

1,324,598 |

|

|

1,341,084 |

|

|

5,314,692 |

|

| Occupancy |

|

71.5 |

% |

|

72.2 |

% |

|

77.7 |

% |

|

73.7 |

% |

|

73.8 |

% |

| ADR |

|

$ |

164.00 |

|

|

$ |

173.06 |

|

|

$ |

165.70 |

|

|

$ |

158.25 |

|

|

$ |

165.18 |

|

| RevPAR |

|

$ |

117.21 |

|

|

$ |

124.99 |

|

|

$ |

128.79 |

|

|

$ |

116.57 |

|

|

$ |

121.85 |

|

|

|

|

|

|

|

|

|

|

|

|

| Actual Statistics: |

|

|

|

|

|

|

|

|

|

|

| Rooms sold |

|

935,012 |

|

|

946,105 |

|

|

1,029,583 |

|

|

987,833 |

|

|

3,898,533 |

|

| Rooms available |

|

1,312,953 |

|

|

1,309,950 |

|

|

1,324,598 |

|

|

1,341,084 |

|

|

5,288,585 |

|

| Occupancy |

|

71.2 |

% |

|

72.2 |

% |

|

77.7 |

% |

|

73.7 |

% |

|

73.7 |

% |

| ADR |

|

$ |

163.47 |

|

|

$ |

173.06 |

|

|

$ |

165.70 |

|

|

$ |

158.25 |

|

|

$ |

165.06 |

|

| RevPAR |

|

$ |

116.42 |

|

|

$ |

124.99 |

|

|

$ |

128.79 |

|

|

$ |

116.57 |

|

|

$ |

121.68 |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliations of Non-GAAP financial measures to comparable GAAP financial measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

172,931 |

|

|

$ |

184,478 |

|

|

$ |

192,917 |

|

|

$ |

177,117 |

|

|

$ |

727,443 |

|

| Total revenues - acquisitions |

|

4,586 |

|

|

— |

|

|

— |

|

|

— |

|

|

4,586 |

|

| Total revenues - dispositions |

|

(263) |

|

|

— |

|

|

— |

|

|

— |

|

|

(263) |

|

Pro forma total revenues (1) |

|

177,254 |

|

|

184,478 |

|

|

192,917 |

|

|

177,117 |

|

|

731,766 |

|

|

|

|

|

|

|

|

|

|

|

|

| Hotel Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

| Hotel operating expenses |

|

114,770 |

|

|

118,851 |

|

|

124,614 |

|

|

122,998 |

|

|

481,233 |

|

| Hotel operating expenses - acquisitions |

|

2,261 |

|

|

— |

|

|

— |

|

|

— |

|

|

2,261 |

|

| Hotel operating expenses - dispositions |

|

(145) |

|

|

22 |

|

|

(118) |

|

|

1 |

|

|

(240) |

|

Pro forma hotel operating expenses (1) |

|

116,886 |

|

|

118,873 |

|

|

124,496 |

|

|

122,999 |

|

|

483,254 |

|

|

|

|

|

|

|

|

|

|

|

|

| Hotel EBITDA: |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

8,037 |

|

|

19,827 |

|

|

22,684 |

|

|

8,583 |

|

|

59,131 |

|

| (Gain) loss on disposal of assets, net |

|

(473) |

|

|

(1) |

|

|

80 |

|

|

57 |

|

|

(337) |

|

| Loss on impairment and write-down of assets |

|

6,723 |

|

|

— |

|

|

— |

|

|

— |

|

|

6,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate general and administrative |

|

7,403 |

|

|

8,571 |

|

|

8,280 |

|

|

7,845 |

|

|

32,099 |

|

| Depreciation and amortization |

|

36,471 |

|

|

37,230 |

|

|

37,259 |

|

|

37,634 |

|

|

148,594 |

|

| Hotel EBITDA |

|

58,161 |

|

|

65,627 |

|

|

68,303 |

|

|

54,119 |

|

|

246,210 |

|

Hotel EBITDA - acquisitions (2) |

|

(89) |

|

|

(429) |

|

|

(2,610) |

|

|

(2,125) |

|

|

(5,253) |

|

Hotel EBITDA - dispositions (3) |

|

(118) |

|

|

(22) |

|

|

118 |

|

|

(1) |

|

|

(23) |

|

| Same store hotel EBITDA |

|

57,954 |

|

|

65,176 |

|

|

65,811 |

|

|

51,993 |

|

|

240,934 |

|

| Hotel EBITDA - acquisitions |

|

2,414 |

|

|

429 |

|

|

2,610 |

|

|

2,125 |

|

|

7,578 |

|

Pro forma hotel EBITDA (1) |

|

$ |

60,368 |

|

|

$ |

65,605 |

|

|

$ |

68,421 |

|

|

$ |

54,118 |

|

|

$ |

248,512 |

|

(1) Unaudited pro forma information includes operating results for 97 hotels owned as of September 30, 2025 as if all such hotels had been owned by the Company since October 1, 2024. For Acquired Hotels, the Company has included in the pro forma information the financial results of each of the hotels acquired for the period from October 1, 2024, to September 30, 2025. The financial results for the hotels acquired include information provided by the third-party owner of such hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. For any hotels sold by the Company after October 1, 2024, the Company excludes the financial results of each of those hotels from October 1, 2024 to the date the hotels were sold by the Company in determining pro forma total revenues and pro forma hotel operating expenses. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results.

(2) For any hotels acquired by the Company after October 1, 2024, the Company has excluded the financial results of each of the Acquired Hotels for the period the Acquired Hotels were purchased by the Company to September 30, 2025 in determining same-store hotel EBITDA.

(3) For hotels sold by the Company between October 1, 2024, and September 30, 2025, the Company has excluded the financial results of each of the hotels for the period beginning on October 1, 2024, and ending on the date the hotels were sold by the Company in determining same-store hotel EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Pro Forma and Same Store Data

(Unaudited)

|

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Pro Forma (1) |

|

|

|

|

|

|

|

|

| Rooms sold |

|

987,833 |

|

|

991,580 |

|

|

2,963,521 |

|

|

2,982,405 |

|

| Rooms available |

|

1,341,084 |

|

|

1,338,979 |

|

|

3,975,632 |

|

|

3,987,807 |

|

| Occupancy |

|

73.7 |

% |

|

74.1 |

% |

|

74.5 |

% |

|

74.8 |

% |

| ADR |

|

$ |

158.25 |

|

|

$ |

164.23 |

|

|

$ |

165.56 |

|

|

$ |

169.07 |

|

| RevPAR |

|

$ |

116.57 |

|

|

$ |

121.62 |

|

|

$ |

123.42 |

|

|

$ |

126.45 |

|

|

|

|

|

|

|

|

|

|

| Occupancy change |

|

(0.5) |

% |

|

|

|

(0.3) |

% |

|

|

| ADR change |

|

(3.6) |

% |

|

|

|

(2.1) |

% |

|

|

| RevPAR change |

|

(4.2) |

% |

|

|

|

(2.4) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Same-Store (2) |

|

|

|

|

|

|

|

|

| Rooms sold |

|

958,077 |

|

|

959,772 |

|

|

2,882,081 |

|

|

2,890,624 |

|

| Rooms available |

|

1,304,376 |

|

|

1,302,271 |

|

|

3,866,705 |

|

|

3,878,481 |

|

| Occupancy |

|

73.5 |

% |

|

73.7 |

% |

|

74.5 |

% |

|

74.5 |

% |

| ADR |

|

$ |

157.62 |

|

|

$ |

163.14 |

|

|

$ |

165.46 |

|

|

$ |

168.82 |

|

| RevPAR |

|

$ |

115.77 |

|

|

$ |

120.23 |

|

|

$ |

123.32 |

|

|

$ |

125.82 |

|

|

|

|

|

|

|

|

|

|

| Occupancy change |

|

(0.3) |

% |

|

|

|

— |

% |

|

|

| ADR change |

|

(3.4) |

% |

|

|

|

(2.0) |

% |

|

|

| RevPAR change |

|

(3.7) |

% |

|

|

|

(2.0) |

% |

|

|

(1) Unaudited pro forma information includes operating results for 97 hotels owned as of September 30, 2025, as if each hotel had been owned by the Company since January 1, 2024. As a result, these pro forma operating and financial measures include operating results for certain hotels for periods prior to the Company’s ownership.

(2) Same-store information includes operating results for 95 hotels owned by the Company as of January 1, 2024, and at all times during the three and nine months ended September 30, 2025, and 2024.

Non-GAAP Financial Measures

We disclose certain “non-GAAP financial measures,” which are measures of our historical financial performance. Non-GAAP financial measures are financial measures not prescribed by Generally Accepted Accounting Principles ("GAAP"). These measures are as follows: (i) Funds From Operations (“FFO”) and Adjusted Funds from Operations ("AFFO"), (ii) Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA"), Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate ("EBITDAre"), Adjusted EBITDAre, and hotel EBITDA (as described below). We caution investors that amounts presented in accordance with our definitions of non-GAAP financial measures may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non-GAAP financial measures in the same manner. Our non-GAAP financial measures should be considered along with, but not as alternatives to, net income (loss) as a measure of our operating performance. Our non-GAAP financial measures may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures, property acquisitions, debt service obligations and other commitments and uncertainties. Although we believe that our non-GAAP financial measures can enhance the understanding of our financial condition and results of operations, these non-GAAP financial measures are not necessarily better indicators of any trend as compared to a comparable measure prescribed by GAAP such as net income (loss).

Funds From Operations (“FFO”) and Adjusted FFO (“AFFO”)

As defined by Nareit, FFO represents net income or loss (computed in accordance with GAAP), excluding preferred dividends, gains (or losses) from sales of real property, impairment losses on real estate assets, items classified by GAAP as extraordinary, the cumulative effect of changes in accounting principles, plus depreciation and amortization related to real estate assets, and adjustments for unconsolidated partnerships, and joint ventures. AFFO represents FFO excluding amortization of deferred financing costs, franchise fees, equity-based compensation expense, debt transaction costs, premiums on redemption of preferred shares, losses from net casualties, non-cash lease expense, non-cash interest income and non-cash income tax related adjustments to our deferred tax assets. Unless otherwise indicated, we present FFO and AFFO applicable to our common shares and common units. We present FFO and AFFO because we consider FFO and AFFO an important supplemental measure of our operational performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of REITs, many of which present FFO and AFFO when reporting their results. FFO and AFFO are intended to exclude GAAP historical cost depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO and AFFO exclude depreciation and amortization related to real estate assets, gains and losses from real property dispositions and impairment losses on real estate assets, FFO and AFFO provide performance measures that, when compared year over year, reflect the effect to operations from trends in occupancy, guestroom rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income. Our computation of FFO differs slightly from the computation of Nareit-defined FFO related to the reporting of corporate depreciation and amortization expense. Our computation of FFO may also differ from the methodology for calculating FFO used by other equity REITs and, accordingly, may not be comparable to such other REITs. FFO and AFFO should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Where indicated in this release, FFO is based on our computation of FFO and not the computation of Nareit-defined FFO unless otherwise noted.

EBITDA, EBITDAre, Adjusted EBITDAre, and Hotel EBITDA

In September 2017, Nareit proposed a standardized performance measure, called EBITDAre, which is based on EBITDA and is expected to provide additional relevant information about REITs as real estate companies in support of growing interest among generalist investors. The conclusion was reached that, while dedicated REIT investors have long been accustomed to utilizing the industry’s supplemental measures such as FFO and net operating income (“NOI”) to evaluate the investment quality of REITs as real estate companies, it would be helpful to generalist investors for REITs as real estate companies to also present EBITDAre as a more widely known and understood supplemental measure of performance. EBITDAre is intended to be a supplemental non-GAAP performance measure that is independent of a company’s capital structure and will provide a uniform basis for one measurement of the enterprise value of a company compared to other REITs.

EBITDAre, as defined by Nareit, is calculated as EBITDA, excluding: (i) loss and gains on disposition of property and (ii) asset impairments, if any. We believe EBITDAre is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results.

We make additional adjustments to EBITDAre when evaluating our performance because we believe that the exclusion of certain additional non-recurring or unusual items described below provides useful supplemental information to investors regarding our on-going operating performance. We believe that the presentation of Adjusted EBITDAre, when combined with the primary GAAP presentation of net income, is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results.

With respect to hotel EBITDA, we believe that excluding the effect of corporate-level expenses and non-cash items provides a more complete understanding of the operating results over which individual hotels and operators have direct control. We believe the property-level results provide investors with supplemental information on the on-going operational performance of our hotels and effectiveness of the third-party management companies operating our business on a property-level basis.

We caution investors that amounts presented in accordance with our definitions of EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non-GAAP measures in the same manner. EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA should not be considered as an alternative measure of our net income (loss) or operating performance. EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures and property acquisitions and other commitments and uncertainties. Although we believe that EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA can enhance your understanding of our financial condition and results of operations, these non-GAAP financial measures are not necessarily a better indicator of any trend as compared to a comparable GAAP measure such as net income (loss). Above, we include a quantitative reconciliation of EBITDA, EBITDAre, adjusted EBITDAre and hotel EBITDA to the most directly comparable GAAP financial performance measure, which is net income (loss) and operating income (loss).