Document

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13215 Bee Cave Pkwy, Suite B-300, Austin, TX 78738 |

|

Telephone: 512-538-2300 Fax: 512-538-2333 |

|

www.shpreit.com |

NEWS RELEASE

SUMMIT HOTEL PROPERTIES REPORTS SECOND QUARTER 2025 RESULTS

Second Quarter Operating Income of $22.7 Million; AFFO of $32.7 Million or $0.27 per Share

Repurchased 3.6 Million Shares for $15.4 Million, an Average of $4.30 per Share

Completed Two Significant Debt Financings to Extend Maturity Dates and Enhance Corporate Liquidity

Austin, Texas, August 5, 2025 - - - Summit Hotel Properties, Inc. (NYSE: INN) (the “Company”), today announced results for the three and six months ended June 30, 2025.

“Despite a challenging operating backdrop in the second quarter, we continued to successfully execute on a number of key strategic priorities. RevPAR index, our best measure of market share, increased nearly 150 basis points to 115% during the quarter and year-to-date operating expenses have increased a mere 1.5 percent as we continue to effectively manage expenses and benefit from the efficient operating model of our hotel portfolio. While RevPAR in our same store portfolio declined 3.6 percent during the second quarter, this was significantly influenced by difficult comparisons to robust special event driven demand that benefited the second quarter of last year. Overall demand across the Company’s portfolio remains stable as absolute occupancy in the second quarter approached record highs. Our portfolio of high quality, well located hotels is in excellent physical condition and we believe remains well positioned for longer-term, outsized growth,” said Jonathan P. Stanner, President and Chief Executive Officer.

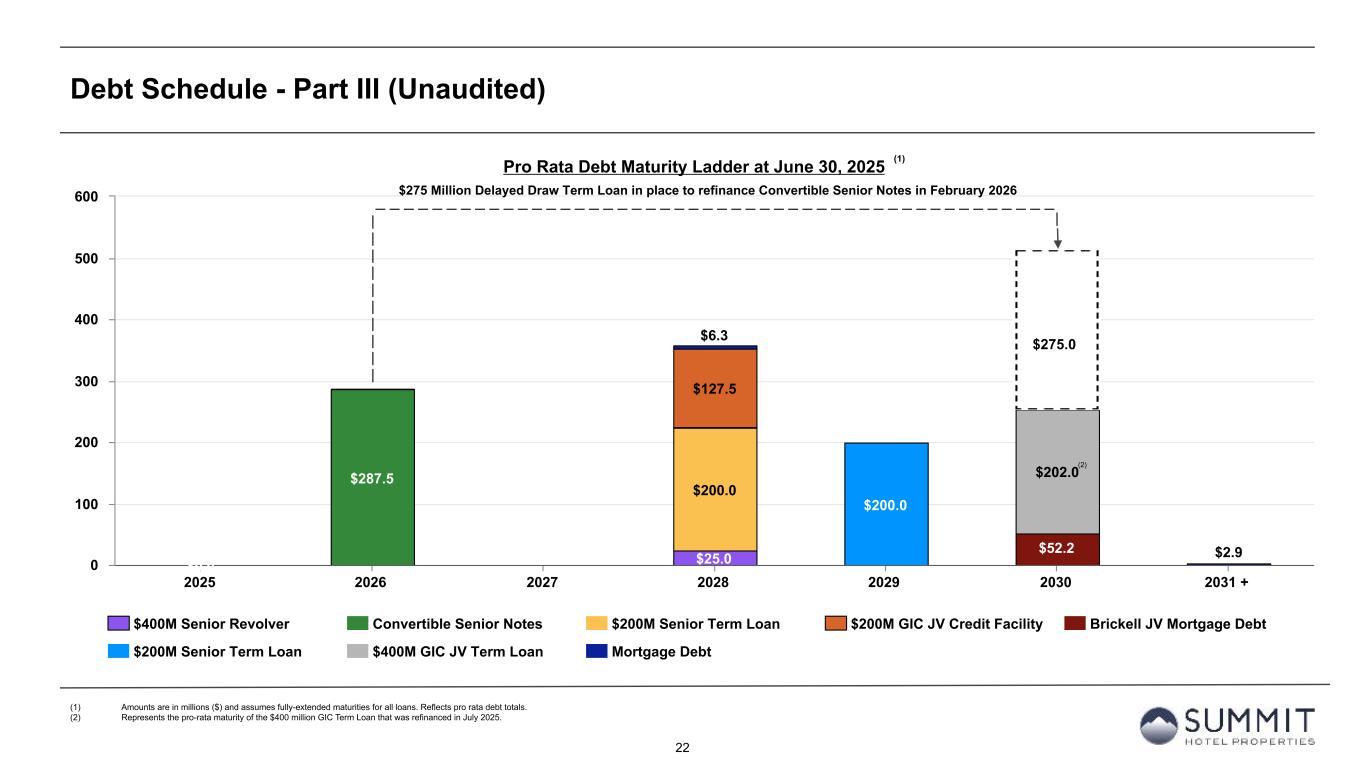

“During the quarter, we also continued to strengthen our balance sheet with the closing of two additional financings, with improved pricing that will supplement our future free cash flow and earnings profiles. With these closings and the in-place delayed draw term loan to fund the repayment of our convertible notes early next year, we now effectively have no debt maturities until 2028 and over $310 million of corporate liquidity. Finally, in April, our Board of Directors approved a $50 million share repurchase program, of which we utilized $15.4 million in the second quarter to repurchase 3.6 million common shares at an average price of $4.30 per share. These well-executed repurchases represent an 15% discount to the current trading price,” continued Mr. Stanner.

Second Quarter 2025 Summary

•Net Loss: Net loss attributable to common stockholders was $1.6 million, or $0.02 per diluted share, compared to net income of $30.8 million, or $0.23 per diluted share, for the second quarter of 2024.

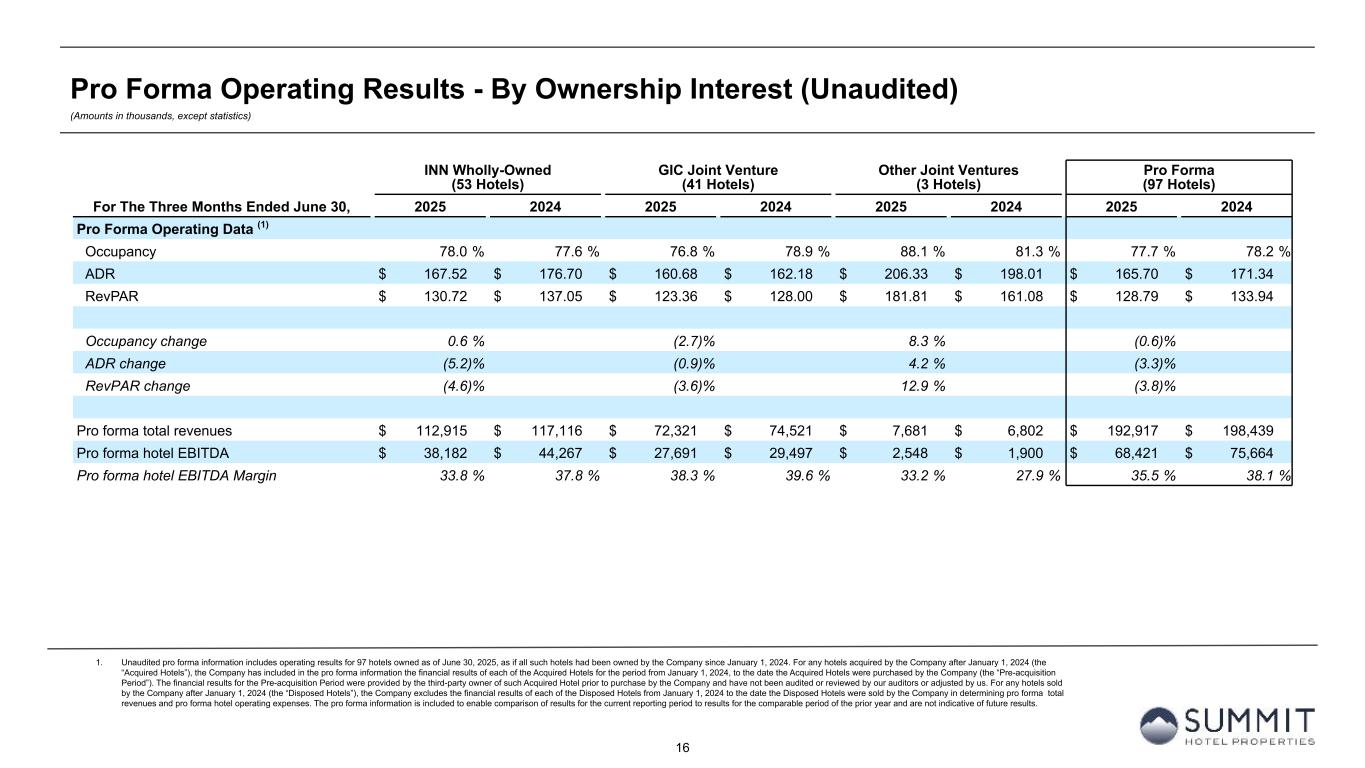

•Pro forma RevPAR: Pro forma RevPAR decreased 3.8 percent to $128.79 compared to the second quarter of 2024. Pro forma ADR decreased 3.3 percent to $165.70 compared to the same period in 2024, and pro forma occupancy decreased 0.6 percent to 77.7 percent.

•Same Store RevPAR: Same store RevPAR decreased 3.6 percent to $128.07 compared to the second quarter of 2024. Same store ADR decreased 3.3 percent to $165.04, and same store occupancy decreased 0.4 percent to 77.6 percent.

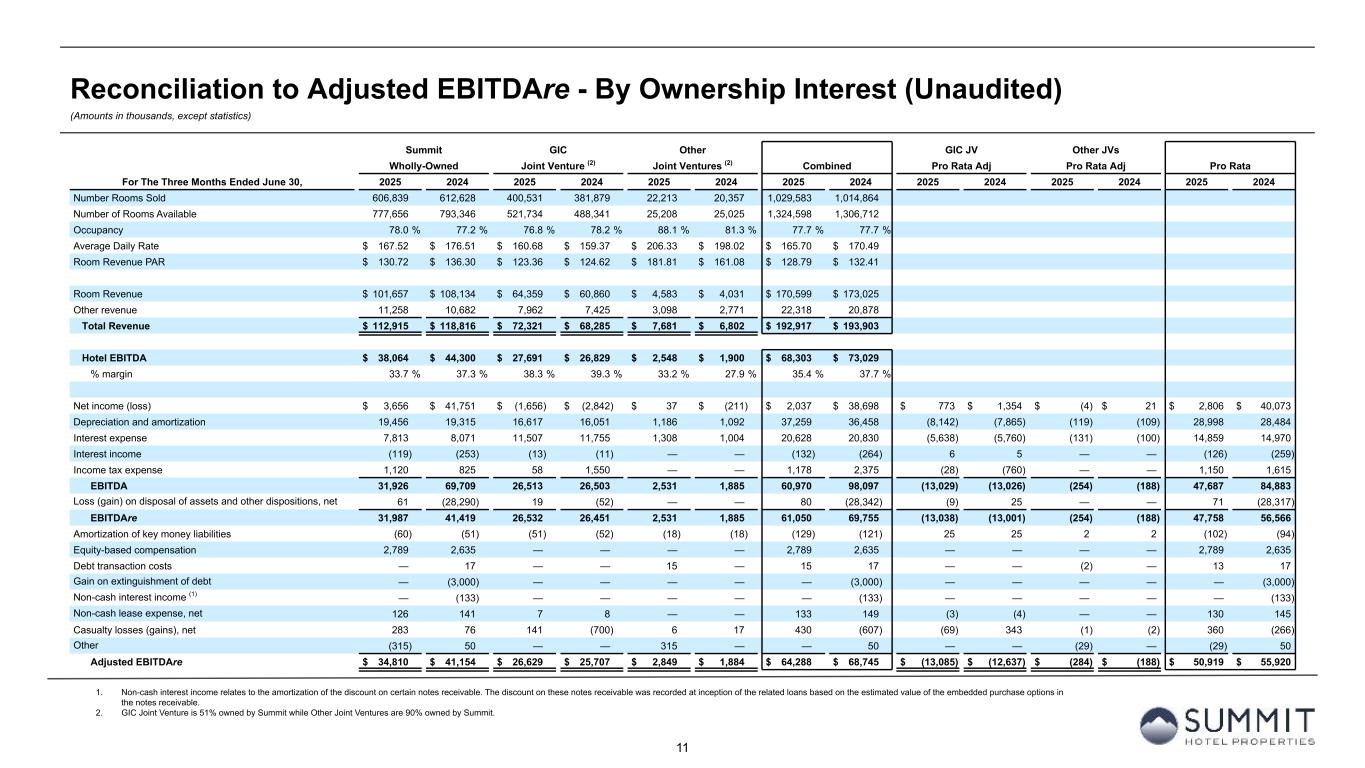

•Pro Forma Hotel EBITDA(1): Pro forma hotel EBITDA decreased to $68.4 million from $75.7 million in the same period in 2024. Pro forma hotel EBITDA margin contracted approximately 266 basis points to 35.5 percent.

•Same Store Hotel EBITDA(1): Same store hotel EBITDA decreased to $65.8 million from $73.1 million in the same period in 2024. Same store hotel EBITDA margin contracted approximately 289 basis points to 35.2 percent.

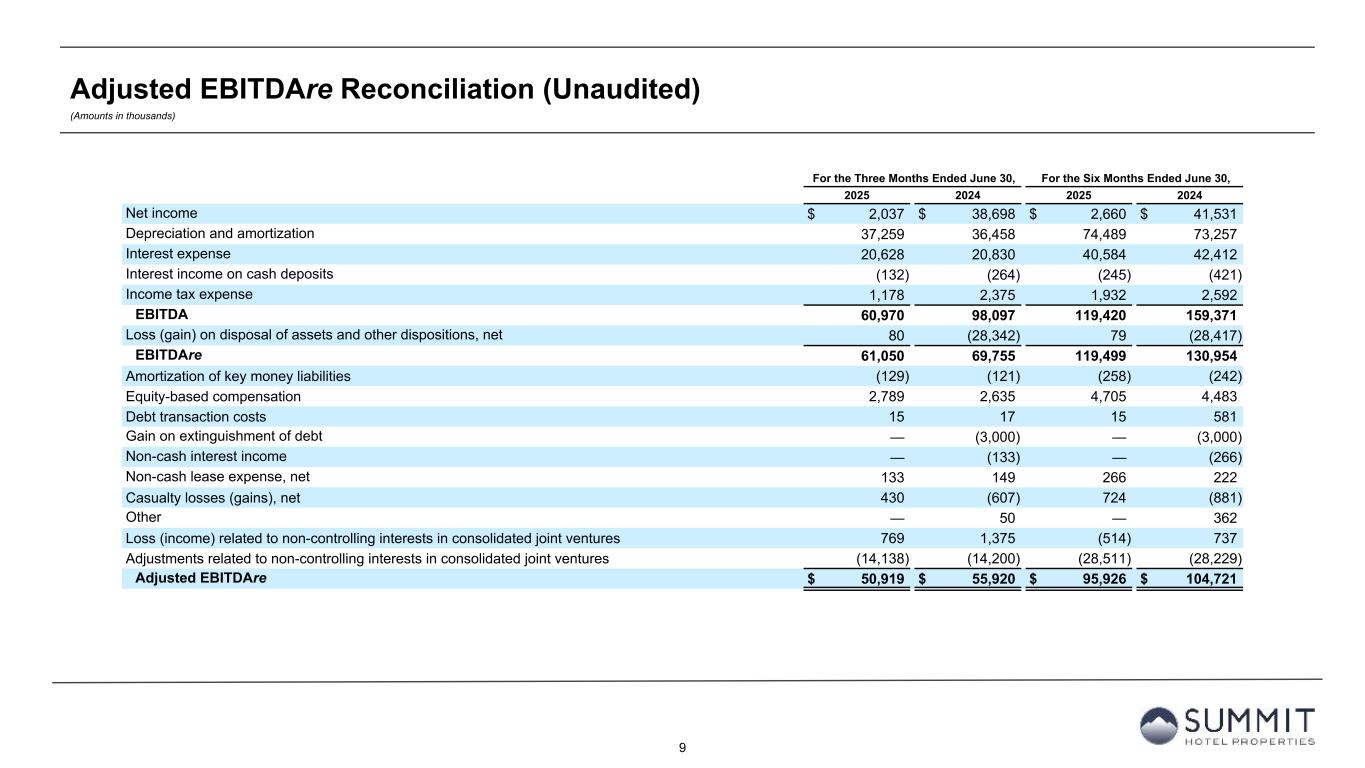

•Adjusted EBITDAre(1): Adjusted EBITDAre decreased to $50.9 million from $55.9 million in the second quarter of 2024.

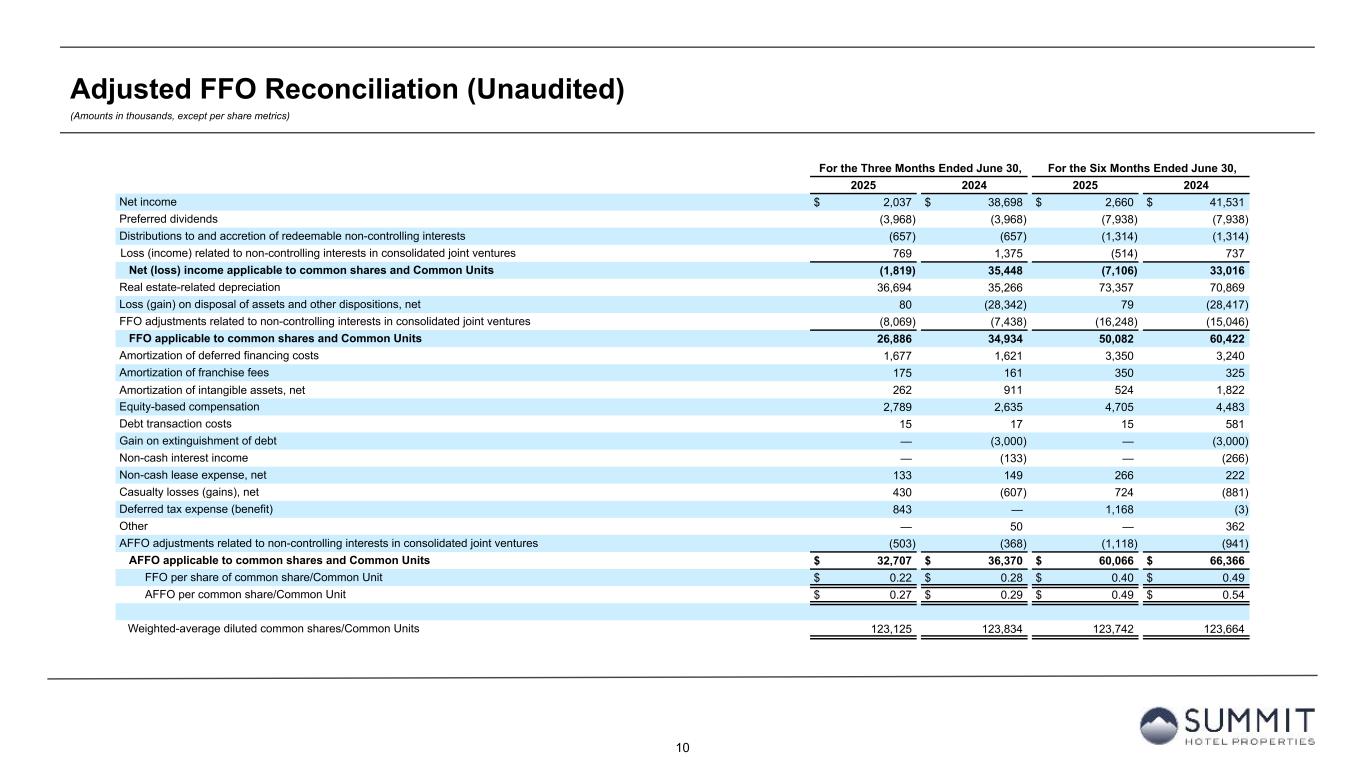

•Adjusted FFO(1): Adjusted FFO decreased to $32.7 million, or $0.27 per diluted share, compared to $36.4 million, or $0.29 per diluted share, in the second quarter of 2024.

Year-to-Date 2025 Summary

•Net Loss: Net loss attributable to common stockholders was $6.3 million, or $0.06 per diluted share, compared to net income of $28.7 million, or $0.21 per diluted share, in the same period of 2024.

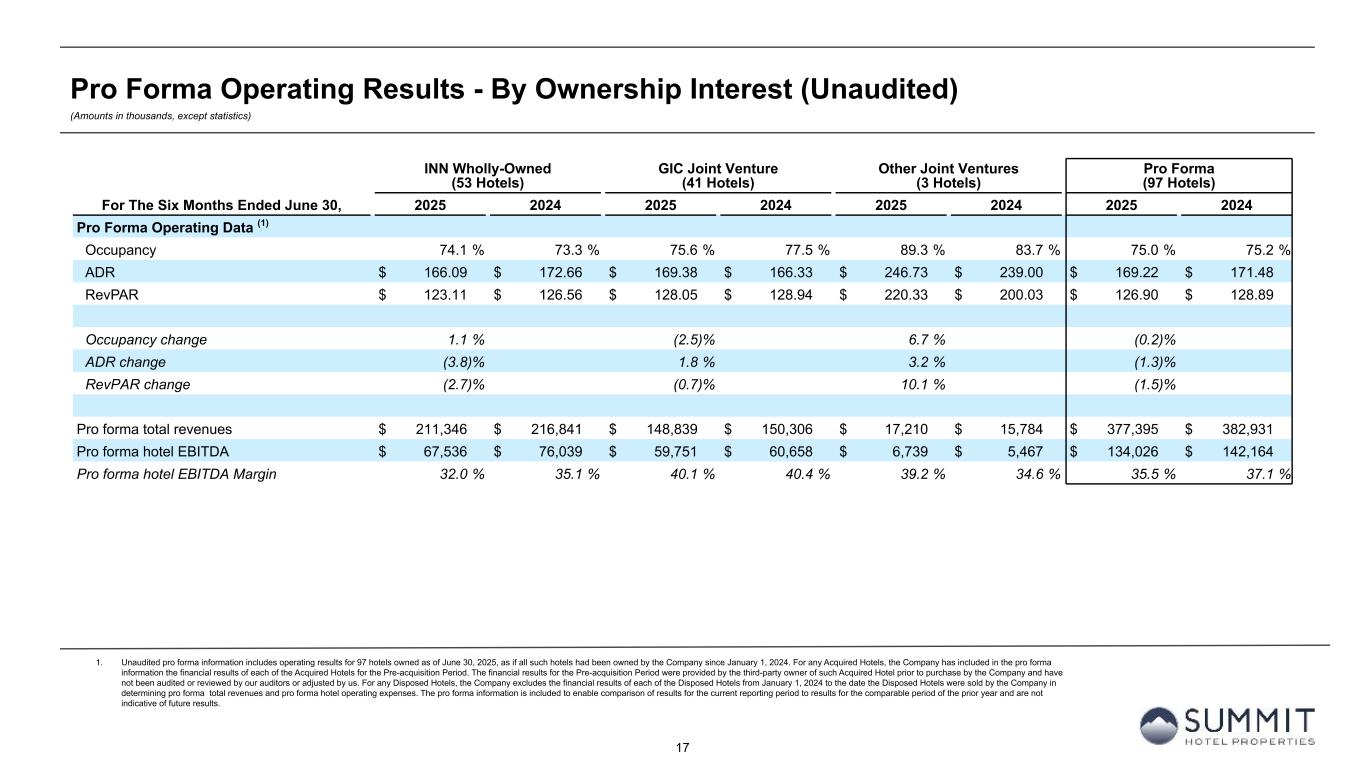

•Pro forma RevPAR: Pro forma RevPAR decreased 1.5 percent to $126.90 compared to the same period of 2024. Pro forma ADR decreased 1.3 percent to $169.22, and pro forma occupancy decreased 0.2 percent to 75.0 percent.

•Same Store RevPAR: Same store RevPAR decreased 1.1 percent to $127.17 compared to the same period of 2024. Same store ADR decreased 1.3 percent to $169.36, and same store occupancy increased 0.2 percent to 75.1 percent.

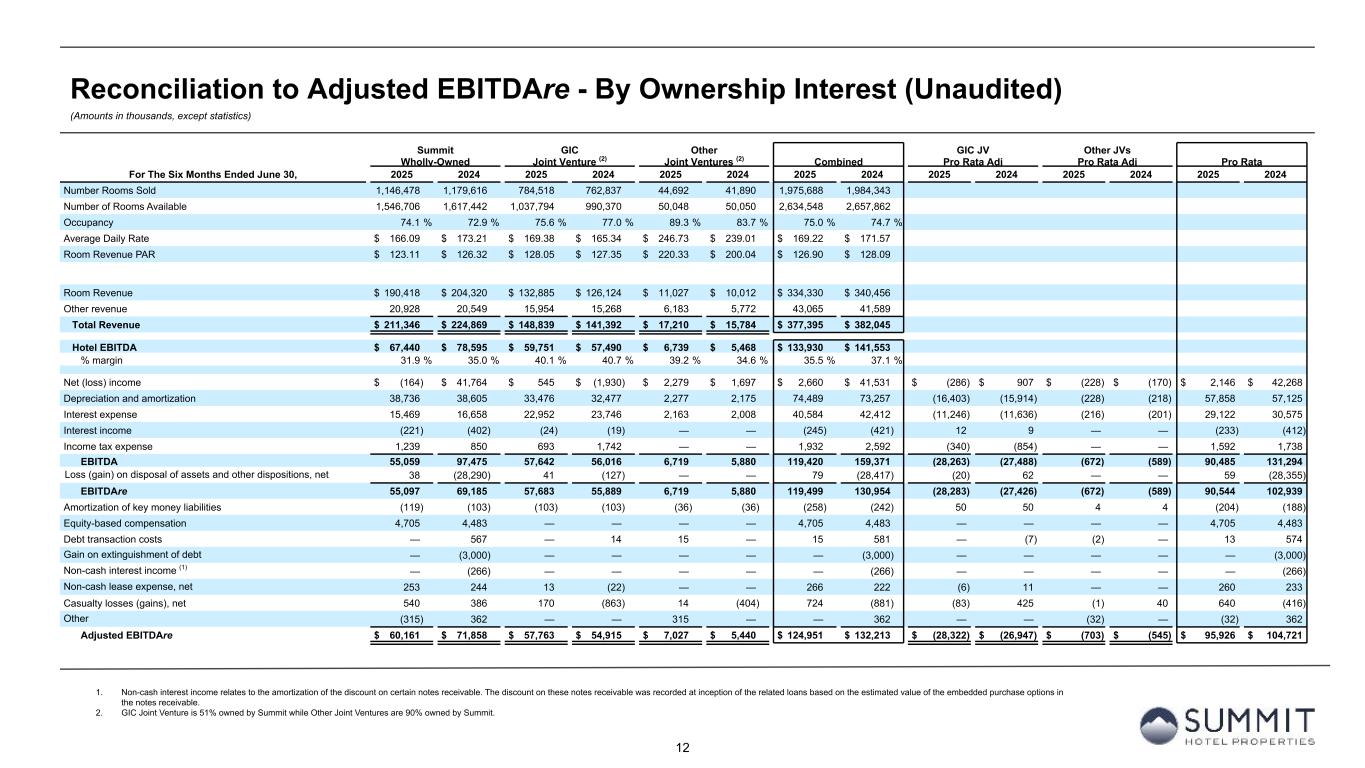

•Pro Forma Hotel EBITDA(1): Pro forma hotel EBITDA decreased to $134.0 million from $142.2 million, and pro forma hotel EBITDA margin contracted 161 basis points to 35.5 percent.

•Same Store Hotel EBITDA(1): Same store hotel EBITDA decreased to $131.0 million from $138.8 million, and same store hotel EBITDA margin contracted 172 basis points to 35.6 percent.

•Adjusted EBITDAre(1): Adjusted EBITDAre decreased to $95.9 million from $104.7 million in the same period of 2024.

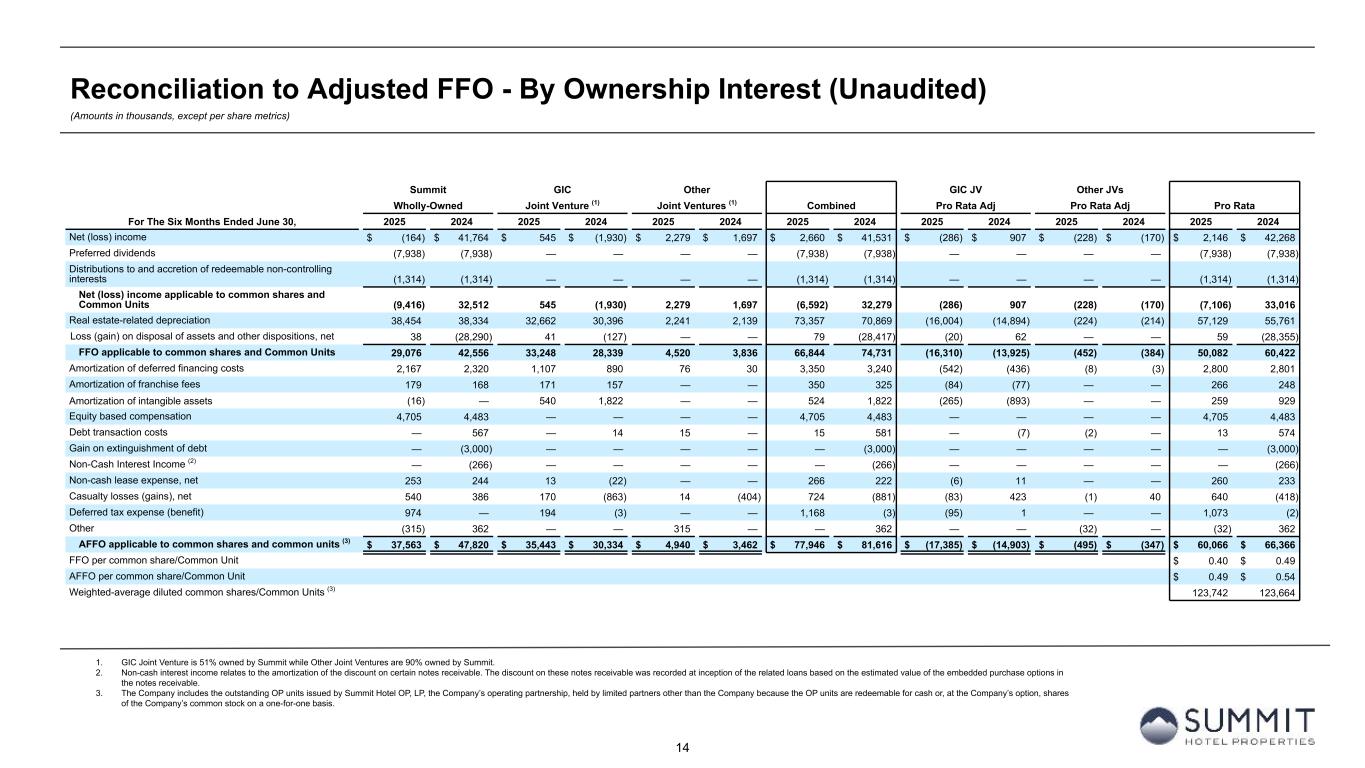

•Adjusted FFO(1): Adjusted FFO decreased to $60.1 million, or $0.49 per diluted share, compared to $66.4 million, or $0.54 per diluted share, in the same period of 2024.

The Company’s results for the three and six months ended June 30, 2025 and 2024 are as follows (in thousands, except per share amounts and metrics):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

| Net (loss) income attributable to common stockholders |

$ |

(1,612) |

|

$ |

30,849 |

|

$ |

(6,296) |

|

$ |

28,733 |

| Net (loss) income per diluted share |

$ |

(0.02) |

|

$ |

0.23 |

|

$ |

(0.06) |

|

$ |

0.21 |

| Total revenues |

$ |

192,917 |

|

$ |

193,903 |

|

$ |

377,395 |

|

$ |

382,045 |

EBITDAre (1) |

$ |

61,050 |

|

$ |

69,755 |

|

$ |

119,499 |

|

$ |

130,954 |

Adjusted EBITDAre (1) |

$ |

50,919 |

|

$ |

55,920 |

|

$ |

95,926 |

|

$ |

104,721 |

FFO (1) |

$ |

26,886 |

|

$ |

34,934 |

|

$ |

50,082 |

|

$ |

60,422 |

Adjusted FFO (1) |

$ |

32,707 |

|

$ |

36,370 |

|

$ |

60,066 |

|

$ |

66,366 |

FFO per diluted share and unit (1) |

$ |

0.22 |

|

$ |

0.28 |

|

$ |

0.40 |

|

$ |

0.49 |

Adjusted FFO per diluted share and unit (1) |

$ |

0.27 |

|

$ |

0.29 |

|

$ |

0.49 |

|

$ |

0.54 |

|

|

|

|

|

|

|

|

Pro Forma (2) |

|

|

|

|

|

|

|

| RevPAR |

$ |

128.79 |

|

$ |

133.94 |

|

$ |

126.90 |

|

$ |

128.89 |

| RevPAR Contraction |

(3.8)% |

|

|

|

(1.5)% |

|

|

| Hotel EBITDA |

$ |

68,421 |

|

$ |

75,664 |

|

$ |

134,026 |

|

$ |

142,164 |

| Hotel EBITDA Margin |

35.5% |

|

38.1% |

|

35.5% |

|

37.1% |

| Hotel EBITDA Margin Change |

(266) bps |

|

|

|

(161) bps |

|

|

|

|

|

|

|

|

|

|

Same Store (3) |

|

|

|

|

|

|

|

| RevPAR |

$ |

128.07 |

|

$ |

132.89 |

|

$ |

127.17 |

|

$ |

128.65 |

| RevPAR Contraction |

(3.6)% |

|

|

|

(1.1)% |

|

|

| Hotel EBITDA |

$ |

65,811 |

|

$ |

73,087 |

|

$ |

130,987 |

|

$ |

138,821 |

| Hotel EBITDA Margin |

35.2% |

|

38.1% |

|

35.6% |

|

37.3% |

| Hotel EBITDA Margin Change |

(289) bps |

|

|

|

(172) bps |

|

|

(1) See tables later in this press release for a discussion and reconciliation of net (loss) income to non-GAAP financial measures, including earnings before interest, taxes, depreciation, and amortization (“EBITDA”), EBITDAre, adjusted EBITDAre, funds from operations (“FFO”), FFO per diluted share and unit, adjusted FFO (“AFFO”), and AFFO per diluted share and unit, as well as a reconciliation of operating income to hotel EBITDA. See “Non-GAAP Financial Measures” at the end of this release.

(2) Unless stated otherwise in this release, all pro forma information includes operating and financial results for 97 hotels owned as of June 30, 2025, as if each hotel had been owned by the Company since January 1, 2024 and remained open for the entirety of the reporting period. As a result, all pro forma information includes operating and financial results for hotels acquired since January 1, 2024, which may include periods prior to the Company’s ownership. Pro forma and non-GAAP financial measures are unaudited.

(3) All same store information includes operating and financial results for 95 hotels owned as of January 1, 2024 and at all times during the three and six months ended June 30, 2025, and 2024.

Capital Markets and Balance Sheet

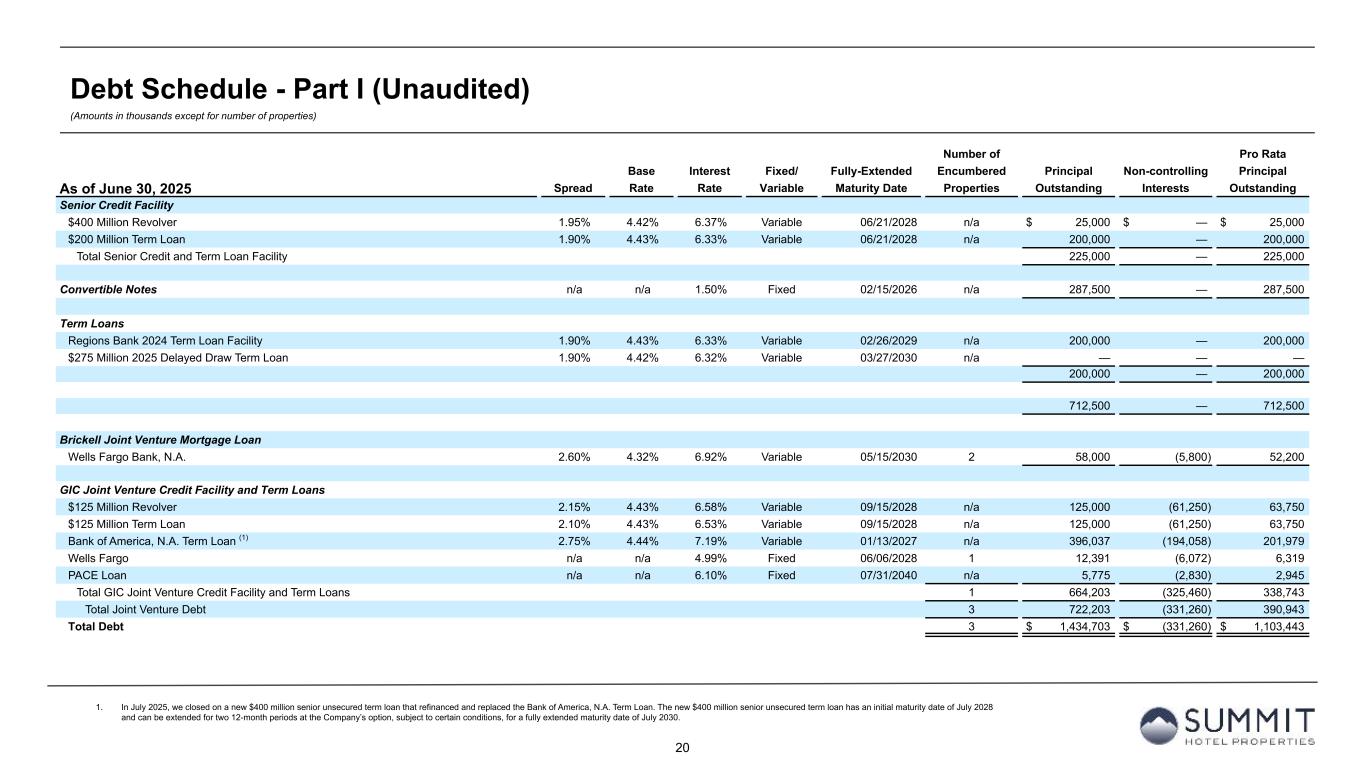

NCI Term Loan Refinancing

In July 2025, the Company, together with its joint venture partner, closed a $400.0 million senior unsecured term loan (the “2025 GIC Joint Venture Term Loan”) to refinance the previous GIC joint venture term loan that was scheduled to mature in January 2026. The 2025 GIC Joint Venture Term Loan has an initial maturity date of July 2028 and can be extended for two 12-month periods at the Company’s option, subject to certain conditions, for a fully extended maturity date of July 2030.

The 2025 GIC Joint Venture Term Loan provides for an interest rate equal to SOFR plus 235 basis points, which represents a 50 basis point reduction from the previous loan.

Brickell Mortgage Loan

In May 2025, the Company, together with its joint venture partner, closed on a $58.0 million mortgage loan (the “Brickell Mortgage Loan”) secured by the dual-branded 264-guestroom AC Hotel by Marriott and Element Hotel Miami Brickell. The Brickell Mortgage Loan proceeds were used to repay the existing $45.4 million mortgage loan, that was scheduled to mature in June 2025, and for other general corporate purposes.

The Brickell Mortgage Loan provides for an interest rate equal to SOFR plus 260 basis points, which represents a 40 basis point reduction from the previous loan. Payments on the Brickell Mortgage Loan are interest-only for the life of the loan, subject to certain financial requirements. The Brickell Mortgage Loan will mature on May 2028 and can be extended for two 12-month periods at the Company’s option, subject to certain conditions, for a fully extended maturity date of May 2030.

Subsequent to the closing of the Brickell Mortgage Loan, the Company entered into a $58.0 million interest rate swap to fix SOFR until May 2028. Pursuant to the interest rate swap, the Company will pay a fixed rate of 3.57 percent.

As a result of these refinancings, as well as the $275 million delayed draw term loan (the "Delayed Draw Term Loan") that closed in the first quarter that the Company intends to utilize to retire the outstanding $287.5 million 1.50 percent Convertible Senior Notes that mature in February 2026, the Company’s average length to maturity will increase to nearly four years on a pro forma basis, including extension options, and the Company will have no debt maturities until 2028.

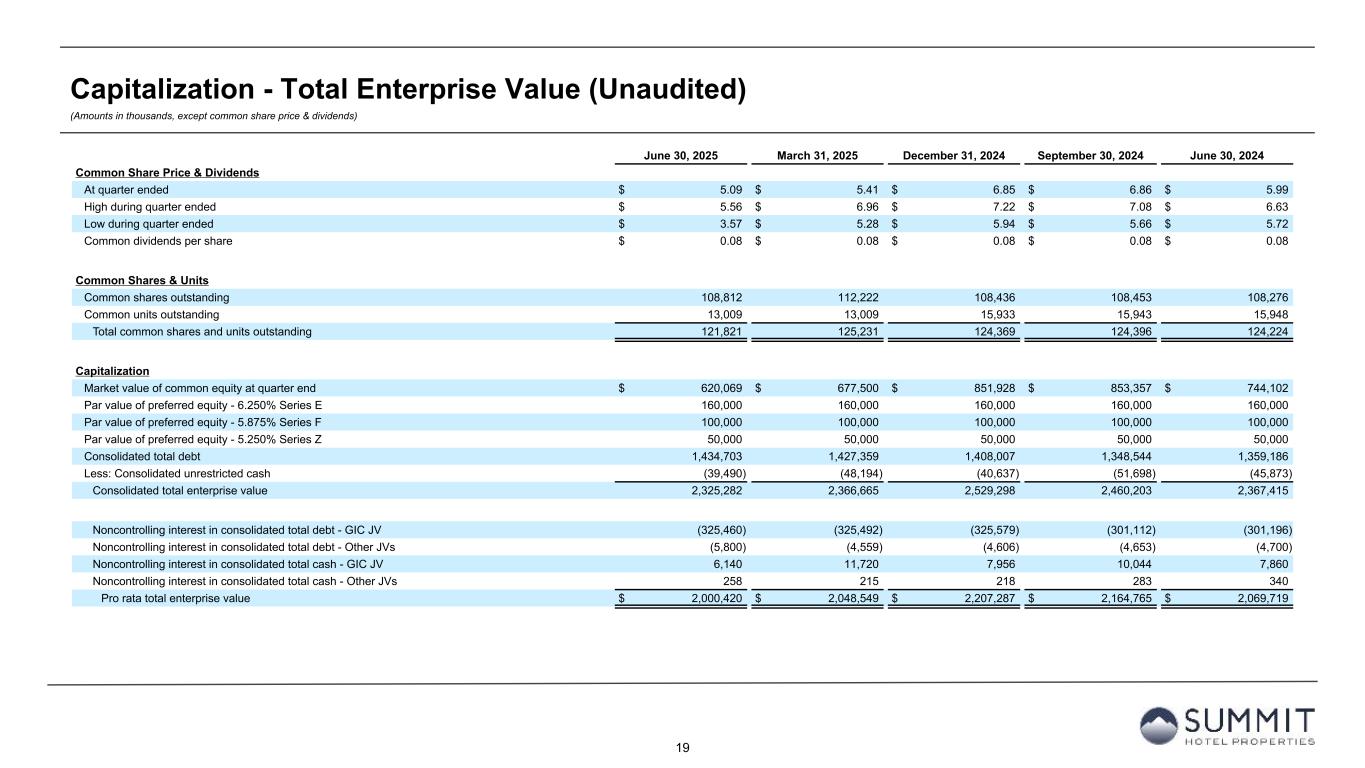

On a pro rata basis as of June 30, 2025, the Company had the following outstanding indebtedness and liquidity available:

•Outstanding debt of $1.1 billion with a weighted average interest rate of 4.60 percent. After giving effect to interest rate derivative agreements, $827.0 million, or 75 percent, of our outstanding debt had a fixed interest rate, and $276.5 million, or 25 percent, had a variable interest rate.

•Unrestricted cash and cash equivalents of $33.1 million.

•Total liquidity of over $310 million, including unrestricted cash and cash equivalents and revolving credit facility availability.

Share Repurchase Program

During the second quarter, the Company repurchased 3.6 million common shares under its share repurchase program for an aggregate purchase price of $15.4 million, or an average of approximately $4.30 per share. As of August 5, 2025, approximately $34.6 million remained available for repurchase under this program.

Common and Preferred Dividend Declaration

On August 1, 2025, the Company declared a quarterly cash dividend of $0.08 per share on its common stock and per common unit of limited partnership interest in Summit Hotel OP, LP. The quarterly dividend of $0.08 per share represents an annualized dividend yield of 6.3 percent, based on the closing price of shares of the common stock on August 4, 2025.

In addition, the Board of Directors declared a quarterly cash dividend of:

• $0.390625 per share on its 6.25% Series E Cumulative Redeemable Preferred Stock

• $0.3671875 per share on its 5.875% Series F Cumulative Redeemable Preferred Stock

• $0.328125 per unit on its 5.25% Series Z Cumulative Perpetual Preferred Units

The dividends are payable on August 29, 2025 to holders of record as of August 15, 2025.

Onera Fredericksburg Expansion

During the quarter, the Company, together with its joint venture partner, completed the expansion of Onera Fredericksburg, its luxury landscape hotel located in the heart of Texas Hill Country. The project added 23 custom-built, hard-sided, and climate-controlled units, increasing the property’s total unit count to 35. The expansion includes:

•15 luxury units that build on the property’s signature architectural innovation and showcase unobstructed views of the surrounding Hill Country landscape. New unit concepts include the Cypress Lodge, Diamond, Monolith, Post Oak, Quonset, Spiral, and Winecup, each designed to offer a unique and immersive guest experience. Units sleep between two and six guests and feature private hot tubs, with select units offering private plunge pools.

•The Great Lodge, an eight-room lodge consisting of one-bedroom suites, each with a private hot tub, that can be booked individually or as a full block. The lodge features a private pool, sauna, and a well-appointed communal great room ideal for group getaways, family gatherings, and corporate retreats.

For the six months ending June 30, 2025, prior to the expansion, Onera Fredericksburg generated a RevPAR of nearly $360 and a hotel EBITDA margin of nearly 50%. The Company expects that with the expansion, Onera Fredericksburg will continue to generate an unlevered yield on cost in the low to mid-teens.

2025 Outlook

While we remain confident in the long-term fundamentals in our portfolio, near-term results are being negatively affected by increased price sensitivity and continued macroeconomic volatility. This has created a more uncertain operating environment and a wider range of potential results than we typically observe at the midpoint of the year. Based on actual results for the first half of the year and recent portfolio trends, our performance is currently tracking modestly below the lower end of the guidance ranges we provided as part of our year-end 2024 earnings report on February 24, 2025, for full year Adjusted EBITDAre, Adjusted FFO and Adjusted FFO per share. We expect capital expenditures for full year 2025 of $60 million to $65 million on a pro rata basis.

Second Quarter 2025 Earnings Conference Call

The Company will conduct its quarterly conference call on August 6, 2025 at 9:00 AM ET.

1.To access the conference call, please pre-register using this link. Registrants will receive a confirmation with dial-in details.

2.A live webcast of the conference call can be accessed using this link. A replay of the webcast will be available in the Investors section of the Company's website, www.shpreit.com, until October 31, 2025.

Supplemental Disclosures

In conjunction with this press release, the Company has furnished a financial supplement with additional disclosures on its website. Visit www.shpreit.com for more information. The Company has no obligation to update any of the information provided to conform to actual results or changes in portfolio, capital structure, or future expectations.

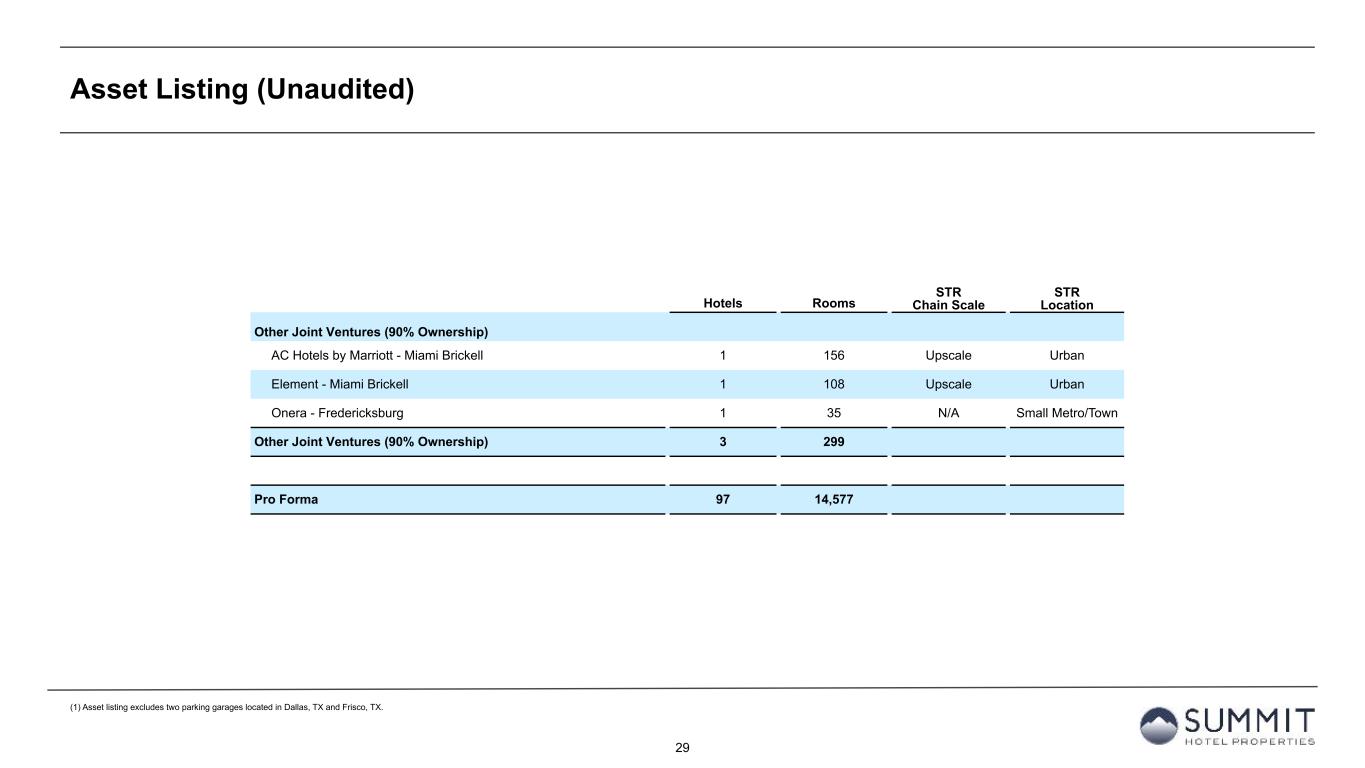

About Summit Hotel Properties

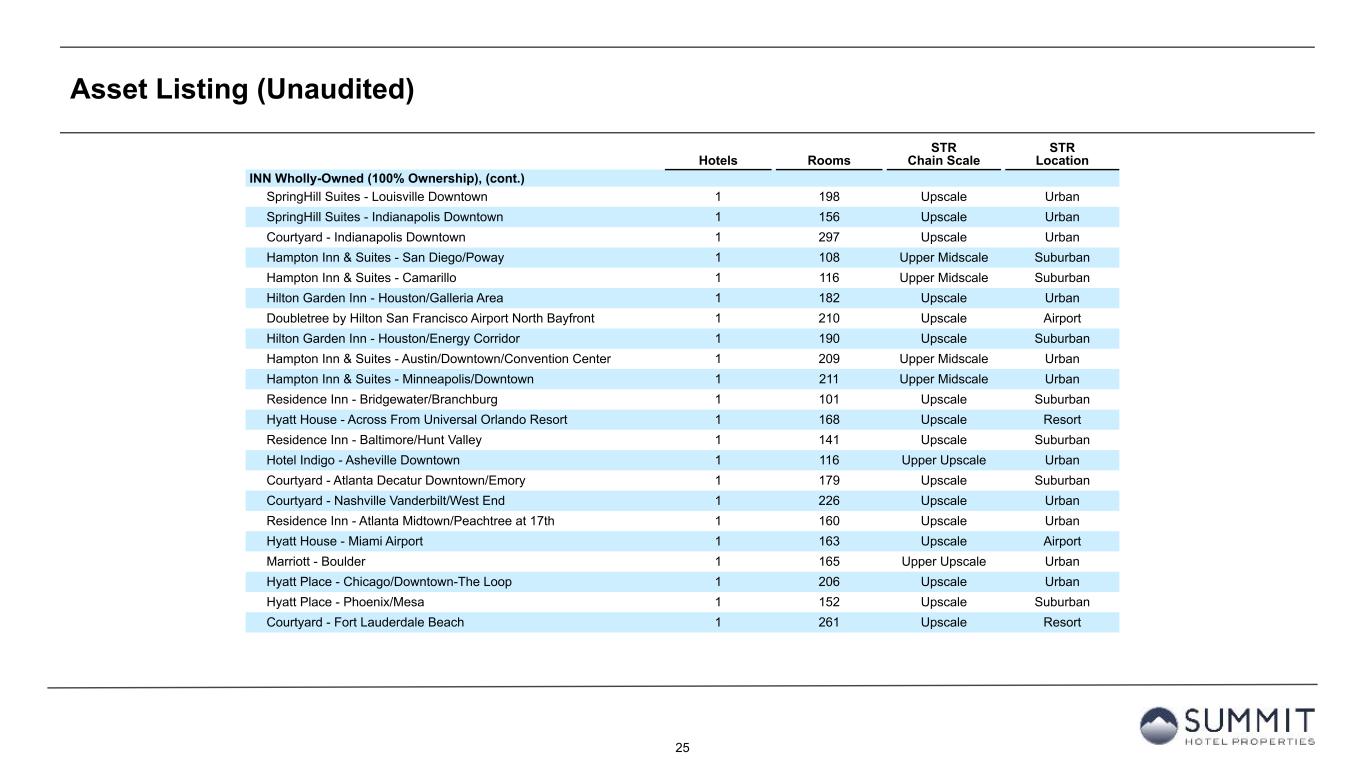

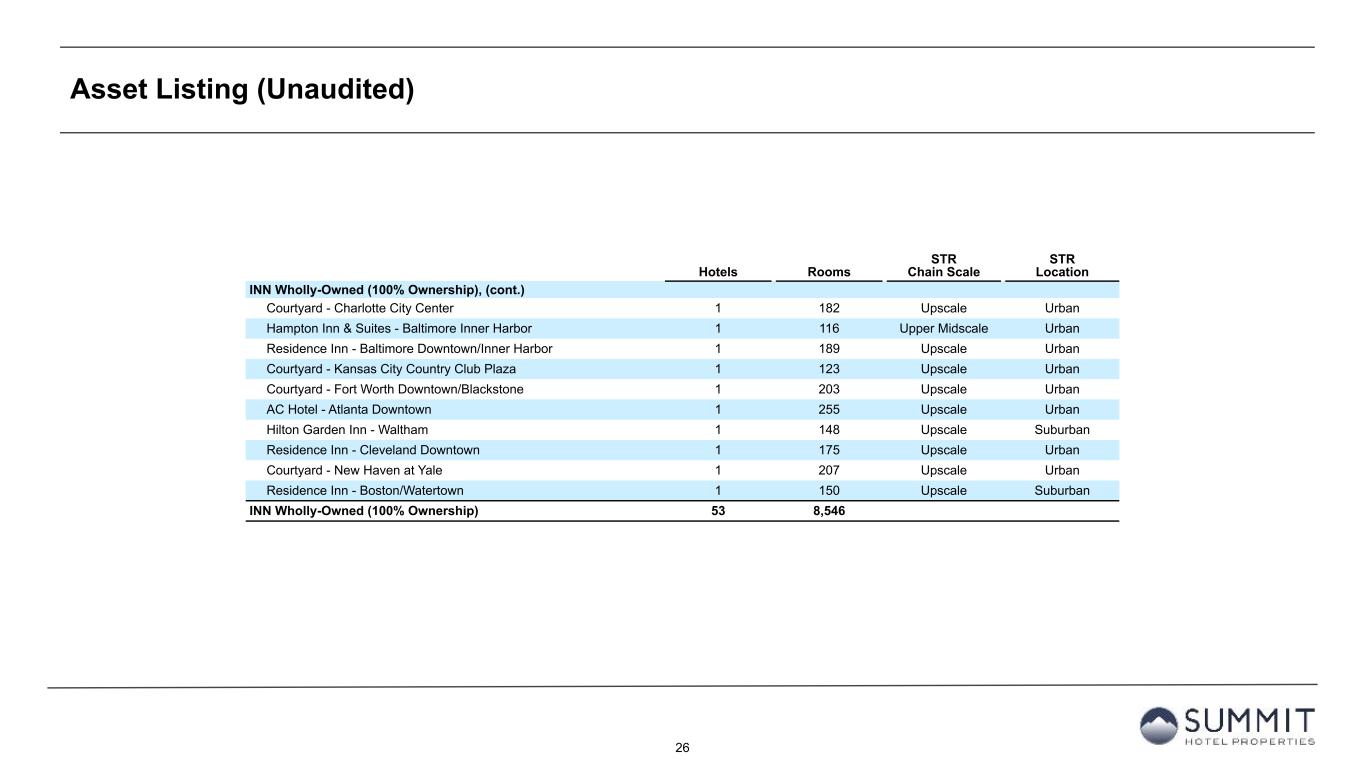

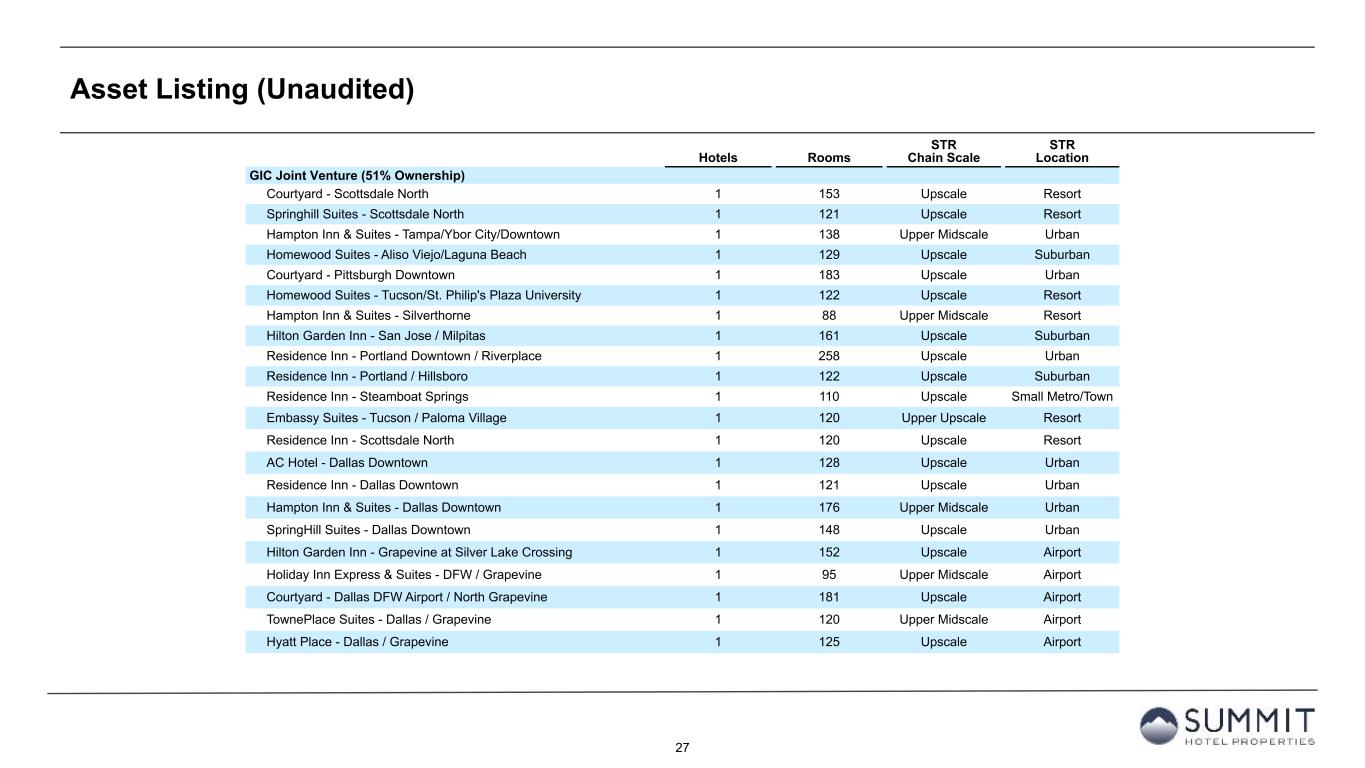

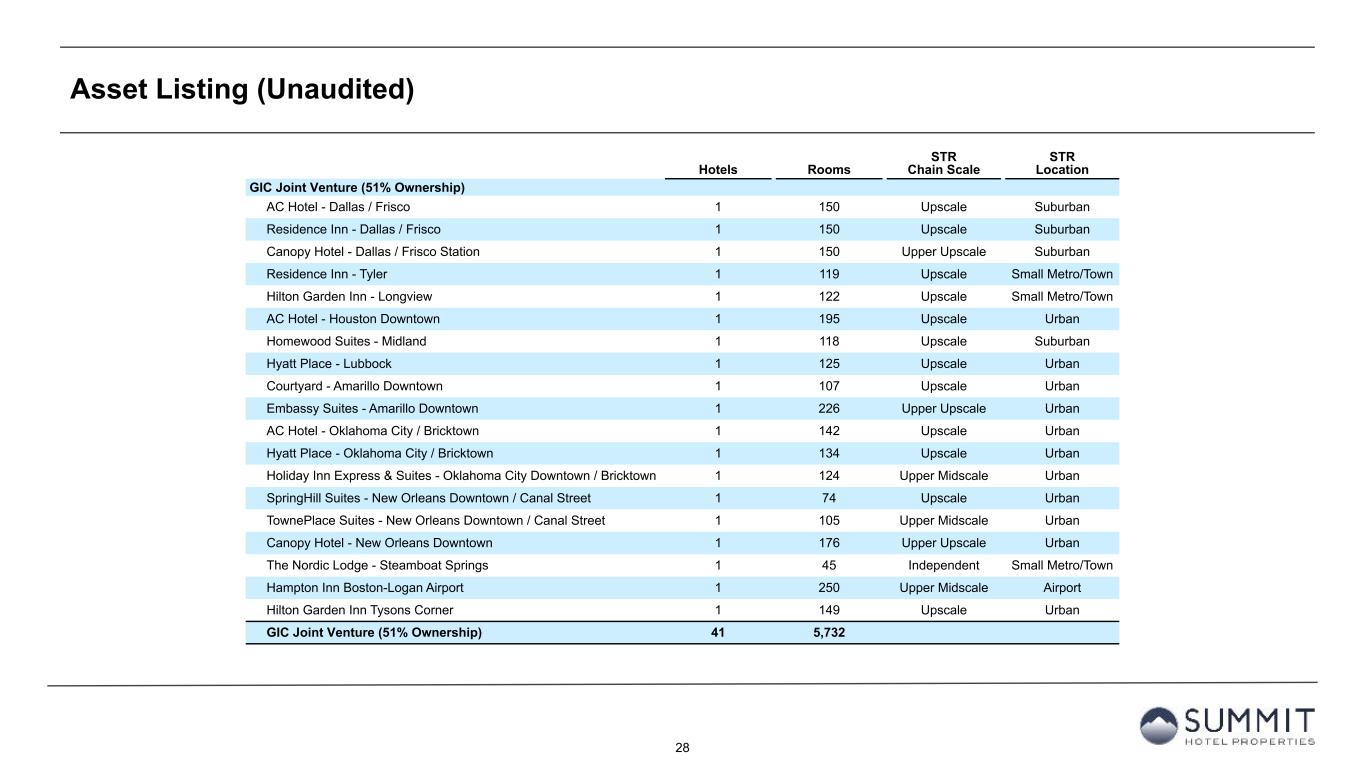

Summit Hotel Properties, Inc. is a publicly traded real estate investment trust focused on owning premium-branded lodging facilities with efficient operating models primarily in the upscale segment of the lodging industry. As of August 5, 2025, the Company's portfolio consisted of 97 assets, 53 of which are wholly owned, with a total of 14,577 guestrooms located in 25 states.

For additional information, please visit the Company's website, www.shpreit.com, and follow on X at @SummitHotel_INN.

Contact:

Kevin Milota

SVP - Corporate Finance

Summit Hotel Properties, Inc.

(737) 205-5787

Forward-Looking Statements

This press release contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” “forecast,” “continue,” “plan,” “likely,” “would” or other similar words or expressions. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections, or other forward-looking information. Examples of forward-looking statements include the following: the Company’s ability to realize growth from the deployment of renovation capital; projections of the Company’s revenues and expenses, capital expenditures or other financial items; descriptions of the Company’s plans or objectives for future operations, acquisitions, dispositions, financings, redemptions or services; forecasts of the Company’s future financial performance and potential increases in average daily rate, occupancy, RevPAR, room supply and demand, EBITDAre, Adjusted EBITDAre, FFO and AFFO; the Company’s outlook with respect to pro forma RevPAR, pro forma RevPAR growth, RevPAR, RevPAR growth, AFFO, AFFO per diluted share and unit and renovation capital deployed; and descriptions of assumptions underlying or relating to any of the foregoing expectations regarding the timing of their occurrence. These forward-looking statements are subject to various risks and uncertainties, not all of which are known to the Company and many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the state of the U.S. economy, supply and demand in the hotel industry, and other factors as are described in greater detail in the Company’s filings with the Securities and Exchange Commission (“SEC”). Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

For information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC, and its quarterly and other periodic filings with the SEC. The Company undertakes no duty to update the statements in this release to conform the statements to actual results or changes in the Company’s expectations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Consolidated Balance Sheets

(In thousands)

|

|

|

June 30, 2025 |

|

December 31, 2024 |

|

|

(Unaudited) |

|

|

| ASSETS |

|

|

|

|

| Investments in lodging property, net |

|

$ |

2,722,459 |

|

|

$ |

2,746,765 |

|

| Investment in lodging property under development |

|

— |

|

|

7,617 |

|

|

|

|

|

|

| Assets held for sale, net |

|

— |

|

|

1,225 |

|

|

|

|

|

|

| Cash and cash equivalents |

|

39,490 |

|

|

40,637 |

|

| Restricted cash |

|

8,734 |

|

|

7,721 |

|

| Right-of-use assets, net |

|

32,933 |

|

|

33,309 |

|

| Trade receivables, net |

|

22,554 |

|

|

18,625 |

|

| Prepaid expenses and other |

|

14,197 |

|

|

9,580 |

|

|

|

|

|

|

| Deferred charges, net |

|

10,468 |

|

|

6,460 |

|

|

|

|

|

|

| Other assets |

|

17,335 |

|

|

24,291 |

|

| Total assets |

|

$ |

2,868,170 |

|

|

$ |

2,896,230 |

|

|

|

|

|

|

| LIABILITIES, REDEEMABLE NON-CONTROLLING INTERESTS AND EQUITY |

|

|

|

|

| Liabilities: |

|

|

|

|

| Debt, net of debt issuance costs |

|

$ |

1,425,799 |

|

|

$ |

1,396,710 |

|

| Lease liabilities, net |

|

24,763 |

|

|

24,871 |

|

| Accounts payable |

|

7,285 |

|

|

7,450 |

|

| Accrued expenses and other |

|

81,142 |

|

|

82,153 |

|

|

|

|

|

|

| Total liabilities |

|

1,538,989 |

|

|

1,511,184 |

|

|

|

|

|

|

| Redeemable non-controlling interests |

|

50,219 |

|

|

50,219 |

|

|

|

|

|

|

| Total stockholders’ equity |

|

895,146 |

|

|

909,545 |

|

| Non-controlling interests |

|

383,816 |

|

|

425,282 |

|

| Total equity |

|

1,278,962 |

|

|

1,334,827 |

|

| Total liabilities, redeemable non-controlling interests and equity |

|

$ |

2,868,170 |

|

|

$ |

2,896,230 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

| Room |

|

$ |

170,599 |

|

|

$ |

173,025 |

|

|

$ |

334,330 |

|

|

$ |

340,456 |

|

| Food and beverage |

|

11,195 |

|

|

10,069 |

|

|

22,185 |

|

|

20,902 |

|

| Other |

|

11,123 |

|

|

10,809 |

|

|

20,880 |

|

|

20,687 |

|

| Total revenues |

|

192,917 |

|

|

193,903 |

|

|

377,395 |

|

|

382,045 |

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

| Room |

|

39,166 |

|

|

38,044 |

|

|

75,298 |

|

|

74,017 |

|

| Food and beverage |

|

8,388 |

|

|

7,639 |

|

|

16,379 |

|

|

15,841 |

|

| Other lodging property operating expenses |

|

58,943 |

|

|

57,470 |

|

|

115,865 |

|

|

113,731 |

|

| Property taxes, insurance and other |

|

13,706 |

|

|

13,287 |

|

|

27,017 |

|

|

27,572 |

|

| Management fees |

|

4,411 |

|

|

4,434 |

|

|

8,906 |

|

|

9,331 |

|

| Depreciation and amortization |

|

37,259 |

|

|

36,458 |

|

|

74,489 |

|

|

73,257 |

|

| Corporate general and administrative |

|

8,280 |

|

|

8,704 |

|

|

16,851 |

|

|

17,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

170,153 |

|

|

166,036 |

|

|

334,805 |

|

|

330,764 |

|

| (Loss) gain on disposal of assets, net |

|

(80) |

|

|

28,342 |

|

|

(79) |

|

|

28,417 |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

22,684 |

|

|

56,209 |

|

|

42,511 |

|

|

79,698 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

| Interest expense |

|

(20,628) |

|

|

(20,830) |

|

|

(40,584) |

|

|

(42,412) |

|

| Interest income |

|

301 |

|

|

565 |

|

|

577 |

|

|

1,023 |

|

|

|

|

|

|

|

|

|

|

| Gain on extinguishment of debt |

|

— |

|

|

3,000 |

|

|

— |

|

|

3,000 |

|

| Other income, net |

|

858 |

|

|

2,129 |

|

|

2,088 |

|

|

2,814 |

|

| Total other expense, net |

|

(19,469) |

|

|

(15,136) |

|

|

(37,919) |

|

|

(35,575) |

|

| Income from continuing operations before income taxes |

|

3,215 |

|

|

41,073 |

|

|

4,592 |

|

|

44,123 |

|

| Income tax expense |

|

(1,178) |

|

|

(2,375) |

|

|

(1,932) |

|

|

(2,592) |

|

| Net income |

|

2,037 |

|

|

38,698 |

|

|

2,660 |

|

|

41,531 |

|

| Less - (Loss) income attributable to non-controlling interests |

|

(976) |

|

|

3,224 |

|

|

(296) |

|

|

3,546 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Summit Hotel Properties, Inc. before preferred dividends |

|

3,013 |

|

|

35,474 |

|

|

2,956 |

|

|

37,985 |

|

| Less - Distributions to and accretion of redeemable non-controlling interests |

|

(657) |

|

|

(657) |

|

|

(1,314) |

|

|

(1,314) |

|

| Less - Preferred dividends |

|

(3,968) |

|

|

(3,968) |

|

|

(7,938) |

|

|

(7,938) |

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to common stockholders |

|

$ |

(1,612) |

|

|

$ |

30,849 |

|

|

$ |

(6,296) |

|

|

$ |

28,733 |

|

|

|

|

|

|

|

|

|

|

| (Loss) income per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.02) |

|

|

$ |

0.29 |

|

|

$ |

(0.06) |

|

|

$ |

0.27 |

|

| Diluted |

|

$ |

(0.02) |

|

|

$ |

0.23 |

|

|

$ |

(0.06) |

|

|

$ |

0.21 |

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

107,633 |

|

|

105,918 |

|

|

107,820 |

|

|

105,819 |

|

| Diluted |

|

107,633 |

|

|

149,451 |

|

|

107,820 |

|

|

149,112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net Income to Non-GAAP Measures - Funds From Operations |

| (Unaudited) |

| (In thousands, except per share and unit amounts) |

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income |

|

$ |

2,037 |

|

|

$ |

38,698 |

|

|

$ |

2,660 |

|

|

$ |

41,531 |

|

| Preferred dividends |

|

(3,968) |

|

|

(3,968) |

|

|

(7,938) |

|

|

(7,938) |

|

| Distributions to and accretion of redeemable non-controlling interests |

|

(657) |

|

|

(657) |

|

|

(1,314) |

|

|

(1,314) |

|

|

|

|

|

|

|

|

|

|

| Loss (income) related to non-controlling interests in consolidated joint ventures |

|

769 |

|

|

1,375 |

|

|

(514) |

|

|

737 |

|

| Net (loss) income applicable to common shares and Common Units |

|

(1,819) |

|

|

35,448 |

|

|

(7,106) |

|

|

33,016 |

|

| Real estate-related depreciation |

|

36,694 |

|

|

35,266 |

|

|

73,357 |

|

|

70,869 |

|

|

|

|

|

|

|

|

|

|

| Loss (gain) on disposal of assets and other dispositions, net |

|

80 |

|

|

(28,342) |

|

|

79 |

|

|

(28,417) |

|

| FFO adjustments related to non-controlling interests in consolidated joint ventures |

|

(8,069) |

|

|

(7,438) |

|

|

(16,248) |

|

|

(15,046) |

|

| FFO applicable to common shares and Common Units |

|

26,886 |

|

|

34,934 |

|

|

50,082 |

|

|

60,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of deferred financing costs |

|

1,677 |

|

|

1,621 |

|

|

3,350 |

|

|

3,240 |

|

| Amortization of franchise fees |

|

175 |

|

|

161 |

|

|

350 |

|

|

325 |

|

| Amortization of intangible assets, net |

|

262 |

|

|

911 |

|

|

524 |

|

|

1,822 |

|

|

|

|

|

|

|

|

|

|

| Equity-based compensation |

|

2,789 |

|

|

2,635 |

|

|

4,705 |

|

|

4,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt transaction costs |

|

15 |

|

|

17 |

|

|

15 |

|

|

581 |

|

|

|

|

|

|

|

|

|

|

| Gain on extinguishment of debt |

|

— |

|

|

(3,000) |

|

|

— |

|

|

(3,000) |

|

Non-cash interest income (1) |

|

— |

|

|

(133) |

|

|

— |

|

|

(266) |

|

| Non-cash lease expense, net |

|

133 |

|

|

149 |

|

|

266 |

|

|

222 |

|

| Casualty losses (gains), net |

|

430 |

|

|

(607) |

|

|

724 |

|

|

(881) |

|

| Deferred tax expense (benefit) |

|

843 |

|

|

— |

|

|

1,168 |

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

| Other |

|

— |

|

|

50 |

|

|

— |

|

|

362 |

|

| AFFO adjustments related to non-controlling interests in consolidated joint ventures |

|

(503) |

|

|

(368) |

|

|

(1,118) |

|

|

(941) |

|

|

|

|

|

|

|

|

|

|

| AFFO applicable to common shares and Common Units |

|

$ |

32,707 |

|

|

$ |

36,370 |

|

|

$ |

60,066 |

|

|

$ |

66,366 |

|

| FFO per share of common share/Common Unit |

|

$ |

0.22 |

|

|

$ |

0.28 |

|

|

$ |

0.40 |

|

|

$ |

0.49 |

|

| AFFO per common share/Common Unit |

|

$ |

0.27 |

|

|

$ |

0.29 |

|

|

$ |

0.49 |

|

|

$ |

0.54 |

|

|

|

|

|

|

|

|

|

|

| Weighted-average diluted common shares/Common Units |

|

123,125 |

|

|

123,834 |

|

|

123,742 |

|

|

123,664 |

|

|

|

|

|

|

|

|

|

|

(1) Non-cash interest income relates to the amortization of the discount on a note receivable. The discount on the note receivable was recorded at inception of the related loan based on the estimated value of the embedded purchase option in the note receivable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Reconciliation of Weighted Average Diluted Common Shares

(Unaudited)

(In thousands)

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Weighted average common shares outstanding - diluted |

|

107,633 |

|

|

149,451 |

|

|

107,820 |

|

|

149,112 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

Non-GAAP adjustment for restricted stock awards (1) |

|

2,483 |

|

|

— |

|

|

2,393 |

|

|

— |

|

Non-GAAP adjustment for dilutive effects of Common Units (2) |

|

13,009 |

|

|

— |

|

|

13,529 |

|

|

— |

|

Non-GAAP adjustment for dilutive effect of shares of common stock issuable upon conversion of convertible debt (3) |

|

— |

|

|

(25,617) |

|

|

— |

|

|

(25,448) |

|

Non-GAAP weighted diluted share of common stock and Common Units (3) |

|

123,125 |

|

|

123,834 |

|

|

123,742 |

|

|

123,664 |

|

(1) The weighted-average diluted shares of Common Stock and Common Units used to calculate FFO and AFFO per share of Common Stock and Common Units for the three months ended June 30, 2025 and 2024 includes the dilutive effect of our outstanding restricted stock awards. These shares were excluded from our weighted-average shares outstanding used to calculate net loss per share because they would have been antidilutive.

(2) The Company includes the outstanding OP units issued by Summit Hotel OP, LP, the Company’s operating partnership, held by limited partners other than the Company because the OP units are redeemable for cash or, at the Company’s option, shares of the Company’s common stock on a one-for-one basis.

(3) The weighted-average shares of Common Stock and Common Units used to calculate FFO and AFFO per share of Common Stock and Common Unit for the three and six months ended June 30, 2025 and 2024 exclude the potential dilution related to our Convertible Notes as we intend to settle the principal value of the Convertible Notes in cash.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net Income to Non-GAAP Measures - EBITDAre |

| (Unaudited) |

| (In thousands) |

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income |

|

$ |

2,037 |

|

|

$ |

38,698 |

|

|

$ |

2,660 |

|

|

$ |

41,531 |

|

| Depreciation and amortization |

|

37,259 |

|

|

36,458 |

|

|

74,489 |

|

|

73,257 |

|

| Interest expense |

|

20,628 |

|

|

20,830 |

|

|

40,584 |

|

|

42,412 |

|

| Interest income on cash deposits |

|

(132) |

|

|

(264) |

|

|

(245) |

|

|

(421) |

|

| Income tax expense |

|

1,178 |

|

|

2,375 |

|

|

1,932 |

|

|

2,592 |

|

| EBITDA |

|

60,970 |

|

|

98,097 |

|

|

119,420 |

|

|

159,371 |

|

|

|

|

|

|

|

|

|

|

| Loss (gain) on disposal of assets and other dispositions, net |

|

80 |

|

|

(28,342) |

|

|

79 |

|

|

(28,417) |

|

EBITDAre |

|

61,050 |

|

|

69,755 |

|

|

119,499 |

|

|

130,954 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of key money liabilities |

|

(129) |

|

|

(121) |

|

|

(258) |

|

|

(242) |

|

| Equity-based compensation |

|

2,789 |

|

|

2,635 |

|

|

4,705 |

|

|

4,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt transaction costs |

|

15 |

|

|

17 |

|

|

15 |

|

|

581 |

|

| Gain on extinguishment of debt |

|

— |

|

|

(3,000) |

|

|

— |

|

|

(3,000) |

|

Non-cash interest income (1) |

|

— |

|

|

(133) |

|

|

— |

|

|

(266) |

|

| Non-cash lease expense, net |

|

133 |

|

|

149 |

|

|

266 |

|

|

222 |

|

| Casualty losses (gains), net |

|

430 |

|

|

(607) |

|

|

724 |

|

|

(881) |

|

|

|

|

|

|

|

|

|

|

| Other |

|

— |

|

|

50 |

|

|

— |

|

|

362 |

|

| Loss (income) related to non-controlling interests in consolidated joint ventures |

|

769 |

|

|

1,375 |

|

|

(514) |

|

|

737 |

|

| Adjustments related to non-controlling interests in consolidated joint ventures |

|

(14,138) |

|

|

(14,200) |

|

|

(28,511) |

|

|

(28,229) |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDAre |

|

$ |

50,919 |

|

|

$ |

55,920 |

|

|

$ |

95,926 |

|

|

$ |

104,721 |

|

(1) Non-cash interest income relates to the amortization of the discount on a note receivable. The discount on the note receivable was recorded at inception of the related loan based on the estimated fair value of the embedded purchase option in the note receivable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Pro Forma Hotel Operating Data

(Unaudited)

(Dollars in thousands)

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

Pro Forma Operating Data: (1) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Pro forma room revenue |

|

$ |

170,599 |

|

|

$ |

177,392 |

|

|

$ |

334,330 |

|

|

$ |

341,396 |

|

| Pro forma other hotel operations revenue |

|

22,318 |

|

|

21,047 |

|

|

43,065 |

|

|

41,535 |

|

| Pro forma total revenues |

|

192,917 |

|

|

198,439 |

|

|

377,395 |

|

|

382,931 |

|

| Pro forma total hotel operating expenses |

|

124,496 |

|

|

122,775 |

|

|

243,369 |

|

|

240,767 |

|

| Pro forma hotel EBITDA |

|

$ |

68,421 |

|

|

$ |

75,664 |

|

|

$ |

134,026 |

|

|

$ |

142,164 |

|

| Pro forma hotel EBITDA Margin |

|

35.5 |

% |

|

38.1 |

% |

|

35.5 |

% |

|

37.1 |

% |

|

|

|

|

|

|

|

|

|

| Reconciliations of Non-GAAP financial measures to comparable GAAP financial measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

192,917 |

|

|

$ |

193,903 |

|

|

$ |

377,395 |

|

|

$ |

382,045 |

|

| Total revenues - acquisitions |

|

— |

|

|

6,556 |

|

|

— |

|

|

10,631 |

|

| Total revenues - dispositions |

|

— |

|

|

(2,020) |

|

|

— |

|

|

(9,745) |

|

Pro forma total revenues (1) |

|

192,917 |

|

|

198,439 |

|

|

377,395 |

|

|

382,931 |

|

|

|

|

|

|

|

|

|

|

| Hotel Operating Expenses: |

|

|

|

|

|

|

|

|

| Hotel operating expenses |

|

$ |

124,614 |

|

|

$ |

120,874 |

|

|

$ |

243,465 |

|

|

$ |

240,492 |

|

| Hotel operating expenses - acquisitions |

|

— |

|

|

3,979 |

|

|

— |

|

|

7,288 |

|

| Hotel operating expenses - dispositions |

|

(118) |

|

|

(2,078) |

|

|

(96) |

|

|

(7,013) |

|

Pro forma hotel operating expense (1) |

|

124,496 |

|

|

122,775 |

|

|

243,369 |

|

|

240,767 |

|

|

|

|

|

|

|

|

|

|

| Hotel EBITDA: |

|

|

|

|

|

|

|

|

| Operating income |

|

22,684 |

|

|

56,209 |

|

|

42,511 |

|

|

79,698 |

|

| Loss (gain) on disposal of assets and other dispositions, net |

|

80 |

|

|

(28,342) |

|

|

79 |

|

|

(28,417) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate general and administrative |

|

8,280 |

|

|

8,704 |

|

|

16,851 |

|

|

17,015 |

|

| Depreciation and amortization |

|

37,259 |

|

|

36,458 |

|

|

74,489 |

|

|

73,257 |

|

| Hotel EBITDA |

|

68,303 |

|

|

73,029 |

|

|

133,930 |

|

|

141,553 |

|

Hotel EBITDA - acquisitions (2) |

|

(2,610) |

|

|

— |

|

|

(3,039) |

|

|

— |

|

Hotel EBITDA - dispositions (3) |

|

118 |

|

|

58 |

|

|

96 |

|

|

(2,732) |

|

| Same Store hotel EBITDA |

|

65,811 |

|

|

73,087 |

|

|

130,987 |

|

|

138,821 |

|

| Hotel EBITDA - acquisitions |

|

2,610 |

|

|

2,577 |

|

|

3,039 |

|

|

3,343 |

|

Pro forma hotel EBITDA (1) |

|

$ |

68,421 |

|

|

$ |

75,664 |

|

|

$ |

134,026 |

|

|

$ |

142,164 |

|

(1) Unaudited pro forma information includes operating results for 97 hotels owned as of June 30, 2025, as if all such hotels had been owned by the Company since January 1, 2024. For hotels acquired by the Company after January 1, 2024 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2024, to June 30, 2025. The financial results for the Acquired Hotels include information provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. For any hotels sold by the Company after January 1, 2024 (the “Disposed Hotels”), the Company excludes the financial results of each of the Disposed Hotels from January 1, 2024 to the date the Disposed Hotels were sold by the Company in determining pro forma total revenues and pro forma hotel operating expenses. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results.

(2) For any hotels acquired by the Company after January 1, 2024, the Company has excluded the financial results of each of the Acquired Hotels for the period the Acquired Hotels were purchased by the Company to June 30, 2025 (the “Acquisition Period”) in determining same-store hotel EBITDA.

(3) For hotels sold by the Company between January 1, 2024, and June 30, 2025, the Company has excluded the financial results of each of the Disposed Hotels for the period beginning on January 1, 2024, and ending on the date the Disposed Hotels were sold by the Company (the “Disposition Period”) in determining same-store hotel EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Pro Forma Hotel Operating Data

(Unaudited)

(In thousands, except operating statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2025 |

|

Trailing Twelve Months Ended |

Pro Forma Operating Data: (1) |

|

Q3 |

|

Q4 |

|

Q1 |

|

Q2 |

|

June 30, 2025 |

| Pro forma room revenue |

|

$ |

162,848 |

|

|

$ |

156,955 |

|

|

$ |

163,731 |

|

|

$ |

170,599 |

|

|

$ |

654,133 |

|

| Pro forma other hotel operations revenue |

|

19,689 |

|

|

20,299 |

|

|

20,747 |

|

|

22,318 |

|

|

83,053 |

|

| Pro forma total revenues |

|

182,537 |

|

|

177,254 |

|

|

184,478 |

|

|

192,917 |

|

|

737,186 |

|

| Pro forma total hotel operating expenses |

|

120,357 |

|

|

116,886 |

|

|

118,873 |

|

|

124,496 |

|

|

480,612 |

|

| Pro forma hotel EBITDA |

|

$ |

62,180 |

|

|

$ |

60,368 |

|

|

$ |

65,605 |

|

|

$ |

68,421 |

|

|

$ |

256,574 |

|

| Pro forma hotel EBITDA Margin |

|

34.1 |

% |

|

34.1 |

% |

|

35.6 |

% |

|

35.5 |

% |

|

34.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Statistics: (1) |

|

|

|

|

|

|

|

|

|

|

| Rooms sold |

|

991,580 |

|

|

957,027 |

|

|

946,105 |

|

|

1,029,583 |

|

|

3,924,295 |

|

| Rooms available |

|

1,338,979 |

|

|

1,339,060 |

|

|

1,309,950 |

|

|

1,324,598 |

|

|

5,312,587 |

|

| Occupancy |

|

74.1 |

% |

|

71.5 |

% |

|

72.2 |

% |

|

77.7 |

% |

|

73.9 |

% |

| ADR |

|

$ |

164.23 |

|

|

$ |

164.00 |

|

|

$ |

173.06 |

|

|

$ |

165.70 |

|

|

$ |

166.69 |

|

| RevPAR |

|

$ |

121.62 |

|

|

$ |

117.21 |

|

|

$ |

124.99 |

|

|

$ |

128.79 |

|

|

$ |

123.13 |

|

|

|

|

|

|

|

|

|

|

|

|

| Actual Statistics: |

|

|

|

|

|

|

|

|

|

|

| Rooms sold |

|

966,019 |

|

|

935,012 |

|

|

946,105 |

|

|

1,029,583 |

|

|

3,876,719 |

|

| Rooms available |

|

1,311,563 |

|

|

1,312,953 |

|

|

1,309,950 |

|

|

1,324,598 |

|

|

5,259,064 |

|

| Occupancy |

|

73.7 |

% |

|

71.2 |

% |

|

72.2 |

% |

|

77.7 |

% |

|

73.7 |

% |

| ADR |

|

$ |

162.95 |

|

|

$ |

163.47 |

|

|

$ |

173.06 |

|

|

$ |

165.70 |

|

|

$ |

166.27 |

|

| RevPAR |

|

$ |

120.02 |

|

|

$ |

116.42 |

|

|

$ |

124.99 |

|

|

$ |

128.79 |

|

|

$ |

122.57 |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliations of Non-GAAP financial measures to comparable GAAP financial measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

176,807 |

|

|

$ |

172,931 |

|

|

$ |

184,478 |

|

|

$ |

192,917 |

|

|

$ |

727,133 |

|

| Total revenues - acquisitions |

|

6,626 |

|

|

4,586 |

|

|

— |

|

|

— |

|

|

11,212 |

|

| Total revenues - dispositions |

|

(896) |

|

|

(263) |

|

|

— |

|

|

— |

|

|

(1,159) |

|

Pro forma total revenues (1) |

|

182,537 |

|

|

177,254 |

|

|

184,478 |

|

|

192,917 |

|

|

737,186 |

|

|

|

|

|

|

|

|

|

|

|

|

| Hotel Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

| Hotel operating expenses |

|

116,883 |

|

|

114,770 |

|

|

118,851 |

|

|

124,614 |

|

|

475,118 |

|

| Hotel operating expenses - acquisitions |

|

4,061 |

|

|

2,261 |

|

|

— |

|

|

— |

|

|

6,322 |

|

| Hotel operating expenses - dispositions |

|

(587) |

|

|

(145) |

|

|

22 |

|

|

(118) |

|

|

(828) |

|

Pro forma hotel operating expenses (1) |

|

120,357 |

|

|

116,886 |

|

|

118,873 |

|

|

124,496 |

|

|

480,612 |

|

|

|

|

|

|

|

|

|

|

|

|

| Hotel EBITDA: |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

15,755 |

|

|

8,037 |

|

|

19,827 |

|

|

22,684 |

|

|

66,303 |

|

| (Gain) loss on disposal of assets, net |

|

(22) |

|

|

(473) |

|

|

(1) |

|

|

80 |

|

|

(416) |

|

| Loss on impairment and write-down of assets |

|

— |

|

|

6,723 |

|

|

— |

|

|

— |

|

|

6,723 |

|

|

|

|

|

|

|

|

|

|

|

|

| Hotel acquisition and transition costs |

|

10 |

|

|

— |

|

|

— |

|

|

— |

|

|

10 |

|

| Corporate general and administrative |

|

7,473 |

|

|

7,403 |

|

|

8,571 |

|

|

8,280 |

|

|

31,727 |

|

| Depreciation and amortization |

|

36,708 |

|

|

36,471 |

|

|

37,230 |

|

|

37,259 |

|

|

147,668 |

|

| Hotel EBITDA |

|

59,924 |

|

|

58,161 |

|

|

65,627 |

|

|

68,303 |

|

|

252,015 |

|

Hotel EBITDA - acquisitions (2) |

|

— |

|

|

(89) |

|

|

(429) |

|

|

(2,610) |

|

|

(3,128) |

|

Hotel EBITDA - dispositions (3) |

|

(309) |

|

|

(118) |

|

|

(22) |

|

|

118 |

|

|

(331) |

|

| Same store hotel EBITDA |

|

59,615 |

|

|

57,954 |

|

|

65,176 |

|

|

65,811 |

|

|

248,556 |

|

| Hotel EBITDA - acquisitions |

|

2,565 |

|

|

2,414 |

|

|

429 |

|

|

2,610 |

|

|

8,018 |

|

Pro forma hotel EBITDA (1) |

|

$ |

62,180 |

|

|

$ |

60,368 |

|

|

$ |

65,605 |

|

|

$ |

68,421 |

|

|

$ |

256,574 |

|

(1) Unaudited pro forma information includes operating results for 97 hotels owned as of June 30, 2025 as if all such hotels had been owned by the Company since July 1, 2024. For Acquired Hotels, the Company has included in the pro forma information the financial results of each of the hotels acquired for the period from July 1, 2024, to June 30, 2025. The financial results for the hotels acquired include information provided by the third-party owner of such hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. For any hotels sold by the Company after July 1, 2024, the Company excludes the financial results of each of those hotels from July 1, 2024 to the date the hotels were sold by the Company in determining pro forma total revenues and pro forma hotel operating expenses. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results.

(2) For any hotels acquired by the Company after July 1, 2024, the Company has excluded the financial results of each of the Acquired Hotels for the period the Acquired Hotels were purchased by the Company to June 30, 2025 (the “Acquisition Period”) in determining same-store hotel EBITDA.

(3) For hotels sold by the Company between July 1, 2024, and June 30, 2025, the Company has excluded the financial results of each of the hotels for the period beginning on July 1, 2024, and ending on the date the hotels were sold by the Company in determining same-store hotel EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Hotel Properties, Inc.

Pro Forma and Same Store Data

(Unaudited)

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Pro Forma (1) |

|

|

|

|

|

|

|

|

| Rooms sold |

|

1,029,583 |

|

|

1,035,292 |

|

|

1,975,688 |

|

|

1,990,825 |

|

| Rooms available |

|

1,324,598 |

|

|

1,324,414 |

|

|

2,634,548 |

|

|

2,648,828 |

|

| Occupancy |

|

77.7 |

% |

|

78.2 |

% |

|

75.0 |

% |

|

75.2 |

% |

| ADR |

|

$ |

165.70 |

|

|

$ |

171.34 |

|

|

$ |

169.22 |

|

|

$ |

171.48 |

|

| RevPAR |

|

$ |

128.79 |

|

|

$ |

133.94 |

|

|

$ |

126.90 |

|

|

$ |

128.89 |

|

|

|

|

|

|

|

|

|

|

| Occupancy change |

|

(0.6) |

% |

|

|

|

(0.2) |

% |

|

|

| ADR change |

|

(3.3) |

% |

|

|

|

(1.3) |

% |

|

|

| RevPAR change |

|

(3.8) |

% |

|

|

|

(1.5) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Same-Store (2) |

|

|

|

|

|

|

|

|

| Rooms sold |

|

999,712 |

|

|

1,003,343 |

|

|

1,924,004 |

|

|

1,930,852 |

|

| Rooms available |

|

1,288,289 |

|

|

1,288,105 |

|

|

2,562,329 |

|

|

2,576,210 |

|

| Occupancy |

|

77.6 |

% |

|

77.9 |

% |

|

75.1 |

% |

|

74.9 |

% |

| ADR |

|

$ |

165.04 |

|

|

$ |

170.60 |

|

|

$ |

169.36 |

|

|

$ |

171.64 |

|

| RevPAR |

|

$ |

128.07 |

|

|

$ |

132.89 |

|

|

$ |

127.17 |

|

|

$ |

128.65 |

|

|

|

|

|

|

|

|

|

|

| Occupancy change |

|

(0.4) |

% |

|

|

|

0.2 |

% |

|

|

| ADR change |

|

(3.3) |

% |

|

|

|

(1.3) |

% |

|

|

| RevPAR change |

|

(3.6) |

% |

|

|

|

(1.1) |

% |

|

|

(1) Unaudited pro forma information includes operating results for 97 hotels owned as of June 30, 2025, as if each hotel had been owned by the Company since January 1, 2024. As a result, these pro forma operating and financial measures include operating results for certain hotels for periods prior to the Company’s ownership.

(2) Same-store information includes operating results for 95 hotels owned by the Company as of January 1, 2024, and at all times during the three and six months ended June 30, 2025, and 2024.

Non-GAAP Financial Measures

We disclose certain “non-GAAP financial measures,” which are measures of our historical financial performance. Non-GAAP financial measures are financial measures not prescribed by Generally Accepted Accounting Principles ("GAAP"). These measures are as follows: (i) Funds From Operations (“FFO”) and Adjusted Funds from Operations ("AFFO"), (ii) Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA"), Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate ("EBITDAre"), Adjusted EBITDAre, and hotel EBITDA (as described below). We caution investors that amounts presented in accordance with our definitions of non-GAAP financial measures may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non-GAAP financial measures in the same manner. Our non-GAAP financial measures should be considered along with, but not as alternatives to, net income (loss) as a measure of our operating performance. Our non-GAAP financial measures may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures, property acquisitions, debt service obligations and other commitments and uncertainties. Although we believe that our non-GAAP financial measures can enhance the understanding of our financial condition and results of operations, these non-GAAP financial measures are not necessarily better indicators of any trend as compared to a comparable measure prescribed by GAAP such as net income (loss).

Funds From Operations (“FFO”) and Adjusted FFO (“AFFO”)

As defined by Nareit, FFO represents net income or loss (computed in accordance with GAAP), excluding preferred dividends, gains (or losses) from sales of real property, impairment losses on real estate assets, items classified by GAAP as extraordinary, the cumulative effect of changes in accounting principles, plus depreciation and amortization related to real estate assets, and adjustments for unconsolidated partnerships, and joint ventures. AFFO represents FFO excluding amortization of deferred financing costs, franchise fees, equity-based compensation expense, debt transaction costs, premiums on redemption of preferred shares, losses from net casualties, non-cash lease expense, non-cash interest income and non-cash income tax related adjustments to our deferred tax assets. Unless otherwise indicated, we present FFO and AFFO applicable to our common shares and common units. We present FFO and AFFO because we consider FFO and AFFO an important supplemental measure of our operational performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of REITs, many of which present FFO and AFFO when reporting their results. FFO and AFFO are intended to exclude GAAP historical cost depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO and AFFO exclude depreciation and amortization related to real estate assets, gains and losses from real property dispositions and impairment losses on real estate assets, FFO and AFFO provide performance measures that, when compared year over year, reflect the effect to operations from trends in occupancy, guestroom rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income. Our computation of FFO differs slightly from the computation of Nareit-defined FFO related to the reporting of corporate depreciation and amortization expense. Our computation of FFO may also differ from the methodology for calculating FFO used by other equity REITs and, accordingly, may not be comparable to such other REITs. FFO and AFFO should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Where indicated in this release, FFO is based on our computation of FFO and not the computation of Nareit-defined FFO unless otherwise noted.

EBITDA, EBITDAre, Adjusted EBITDAre, and Hotel EBITDA

In September 2017, Nareit proposed a standardized performance measure, called EBITDAre, which is based on EBITDA and is expected to provide additional relevant information about REITs as real estate companies in support of growing interest among generalist investors. The conclusion was reached that, while dedicated REIT investors have long been accustomed to utilizing the industry’s supplemental measures such as FFO and net operating income (“NOI”) to evaluate the investment quality of REITs as real estate companies, it would be helpful to generalist investors for REITs as real estate companies to also present EBITDAre as a more widely known and understood supplemental measure of performance. EBITDAre is intended to be a supplemental non-GAAP performance measure that is independent of a company’s capital structure and will provide a uniform basis for one measurement of the enterprise value of a company compared to other REITs.

EBITDAre, as defined by Nareit, is calculated as EBITDA, excluding: (i) loss and gains on disposition of property and (ii) asset impairments, if any. We believe EBITDAre is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results.

We make additional adjustments to EBITDAre when evaluating our performance because we believe that the exclusion of certain additional non-recurring or unusual items described below provides useful supplemental information to investors regarding our on-going operating performance. We believe that the presentation of Adjusted EBITDAre, when combined with the primary GAAP presentation of net income, is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results.

With respect to hotel EBITDA, we believe that excluding the effect of corporate-level expenses and non-cash items provides a more complete understanding of the operating results over which individual hotels and operators have direct control. We believe the property-level results provide investors with supplemental information on the on-going operational performance of our hotels and effectiveness of the third-party management companies operating our business on a property-level basis.

We caution investors that amounts presented in accordance with our definitions of EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non-GAAP measures in the same manner. EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA should not be considered as an alternative measure of our net income (loss) or operating performance. EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures and property acquisitions and other commitments and uncertainties. Although we believe that EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA can enhance your understanding of our financial condition and results of operations, these non-GAAP financial measures are not necessarily a better indicator of any trend as compared to a comparable GAAP measure such as net income (loss). Above, we include a quantitative reconciliation of EBITDA, EBITDAre, adjusted EBITDAre and hotel EBITDA to the most directly comparable GAAP financial performance measure, which is net income (loss) and operating income (loss).