00014976452023FYfalse0.08340280.11467880.0870869P5Y200http://fasb.org/us-gaap/2023#GainLossOnDispositionOfAssets100014976452023-01-012023-12-310001497645us-gaap:CommonStockMember2023-01-012023-12-310001497645us-gaap:SeriesEPreferredStockMember2023-01-012023-12-310001497645us-gaap:SeriesFPreferredStockMember2023-01-012023-12-3100014976452023-06-30iso4217:USD00014976452024-02-09xbrli:shares00014976452023-10-012023-12-3100014976452023-12-3100014976452022-12-31iso4217:USDxbrli:sharesxbrli:pure0001497645us-gaap:SeriesEPreferredStockMember2022-01-012022-12-310001497645us-gaap:SeriesEPreferredStockMember2022-12-310001497645us-gaap:SeriesEPreferredStockMember2023-12-310001497645us-gaap:SeriesFPreferredStockMember2022-01-012022-12-310001497645us-gaap:SeriesFPreferredStockMember2022-12-310001497645us-gaap:SeriesFPreferredStockMember2023-12-310001497645us-gaap:OccupancyMember2023-01-012023-12-310001497645us-gaap:OccupancyMember2022-01-012022-12-310001497645us-gaap:OccupancyMember2021-01-012021-12-310001497645us-gaap:FoodAndBeverageMember2023-01-012023-12-310001497645us-gaap:FoodAndBeverageMember2022-01-012022-12-310001497645us-gaap:FoodAndBeverageMember2021-01-012021-12-310001497645us-gaap:HotelOtherMember2023-01-012023-12-310001497645us-gaap:HotelOtherMember2022-01-012022-12-310001497645us-gaap:HotelOtherMember2021-01-012021-12-3100014976452022-01-012022-12-3100014976452021-01-012021-12-310001497645us-gaap:ManagementServiceMember2023-01-012023-12-310001497645us-gaap:ManagementServiceMember2022-01-012022-12-310001497645us-gaap:ManagementServiceMember2021-01-012021-12-3100014976452020-12-310001497645us-gaap:PreferredStockMember2020-12-310001497645us-gaap:CommonStockMember2020-12-310001497645us-gaap:AdditionalPaidInCapitalMember2020-12-310001497645us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001497645us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-12-310001497645us-gaap:ParentMember2020-12-310001497645us-gaap:NoncontrollingInterestMember2020-12-310001497645us-gaap:PreferredStockMember2021-01-012021-12-310001497645us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001497645us-gaap:ParentMember2021-01-012021-12-310001497645us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-01-012021-12-310001497645us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001497645us-gaap:CommonStockMember2021-01-012021-12-310001497645us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-3100014976452021-12-310001497645us-gaap:PreferredStockMember2021-12-310001497645us-gaap:CommonStockMember2021-12-310001497645us-gaap:AdditionalPaidInCapitalMember2021-12-310001497645us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001497645us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-12-310001497645us-gaap:ParentMember2021-12-310001497645us-gaap:NoncontrollingInterestMember2021-12-310001497645us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-01-012022-12-310001497645us-gaap:ParentMember2022-01-012022-12-310001497645us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001497645us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001497645us-gaap:CommonStockMemberus-gaap:CommonStockMember2022-01-012022-12-310001497645us-gaap:CommonStockMember2022-01-012022-12-310001497645us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001497645us-gaap:PreferredStockMember2022-12-310001497645us-gaap:CommonStockMember2022-12-310001497645us-gaap:AdditionalPaidInCapitalMember2022-12-310001497645us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001497645us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-12-310001497645us-gaap:ParentMember2022-12-310001497645us-gaap:NoncontrollingInterestMember2022-12-310001497645us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-01-012023-12-310001497645us-gaap:ParentMember2023-01-012023-12-310001497645us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001497645us-gaap:CommonStockMemberus-gaap:CommonStockMember2023-01-012023-12-310001497645us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001497645us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001497645us-gaap:PreferredStockMember2023-12-310001497645us-gaap:CommonStockMember2023-12-310001497645us-gaap:AdditionalPaidInCapitalMember2023-12-310001497645us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001497645us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-12-310001497645us-gaap:ParentMember2023-12-310001497645us-gaap:NoncontrollingInterestMember2023-12-310001497645srt:HotelMember2023-12-31inn:hotelinn:roominn:state0001497645inn:HotelPortfolioOtherThanOnesOwnedThroughJointVentureMemberus-gaap:WhollyOwnedPropertiesMembersrt:HotelMember2023-12-310001497645inn:HotelsOwnedThroughJointVentureMemberinn:GICJointVentureMemberus-gaap:PartiallyOwnedPropertiesMembersrt:HotelMember2021-01-012021-12-310001497645inn:HotelsOwnedThroughJointVentureMemberus-gaap:PartiallyOwnedPropertiesMembersrt:HotelMember2023-12-310001497645srt:HotelMember2023-01-012023-12-31inn:joint_venture0001497645inn:BrickellJointVentureMembersrt:HotelMember2023-12-310001497645inn:OneraJointVentureMembersrt:HotelMember2023-12-31inn:segment0001497645srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001497645srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001497645inn:FurnitureFixturesAndEquipmentMembersrt:MinimumMember2023-12-310001497645srt:MaximumMemberinn:FurnitureFixturesAndEquipmentMember2023-12-310001497645srt:RestatementAdjustmentMember2022-12-310001497645us-gaap:LandMember2023-12-310001497645us-gaap:LandMember2022-12-310001497645us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001497645us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001497645inn:IntangibleAssetsMember2023-12-310001497645inn:IntangibleAssetsMember2022-12-310001497645us-gaap:ConstructionInProgressMember2023-12-310001497645us-gaap:ConstructionInProgressMember2022-12-310001497645inn:FurnitureFixturesAndEquipmentMember2023-12-310001497645inn:FurnitureFixturesAndEquipmentMember2022-12-310001497645us-gaap:RealEstateLoanMember2023-12-310001497645us-gaap:RealEstateLoanMember2022-12-310001497645srt:AffiliatedEntityMemberinn:MezzanineLoansMember2023-01-310001497645srt:HotelMember2022-01-012022-12-310001497645srt:HotelMember2021-01-012021-12-310001497645inn:ResidencyInnMemberinn:ScottsdaleAZJointVentureMembersrt:HotelMember2023-06-300001497645inn:ResidencyInnMemberinn:ScottsdaleAZJointVentureMembersrt:HotelMember2023-06-012023-06-300001497645inn:ScottsdaleAZJointVentureMember2023-06-012023-06-300001497645inn:OperatingPartnershipUnitsMemberinn:ScottsdaleAZJointVentureMember2023-06-012023-06-300001497645inn:ResidencyInnMemberinn:SteamboatSpringsCOJointVentureMembersrt:HotelMember2023-06-300001497645inn:ResidencyInnMemberinn:SteamboatSpringsCOJointVentureMembersrt:HotelMember2023-06-012023-06-300001497645inn:SteamboatSpringsCOJointVentureMember2023-06-012023-06-300001497645inn:OperatingPartnershipUnitsMemberinn:SteamboatSpringsCOJointVentureMember2023-06-012023-06-300001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:JointVentureWithGICMembersrt:HotelMember2022-03-31inn:parkingStructureinn:parkingSpace0001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:JointVentureWithGICMembersrt:HotelMember2022-01-012022-03-310001497645inn:OperatingPartnershipUnitsMemberinn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:SummitHotelOPLPMembersrt:HotelMember2022-01-012022-03-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:SeriesZPreferredUnitsMemberinn:SummitHotelOPLPMembersrt:HotelMember2022-01-012022-03-310001497645inn:NCITransactionMemberinn:SeriesZPreferredUnitsMember2022-01-012022-03-310001497645inn:NCITransactionMemberinn:SeriesZPreferredUnitsMember2022-03-310001497645inn:JointVentureTermLoanMemberus-gaap:SecuredDebtMemberinn:NCITransactionMember2022-03-310001497645inn:NCITransactionMemberinn:JointVentureWithGICMemberinn:HotelPortfolioAcquiredInJanuary2022Membersrt:HotelMember2022-03-310001497645inn:NCITransactionMemberinn:JointVentureWithGICMemberinn:HotelPortfolioAcquiredInJanuary2022Memberinn:GICMembersrt:HotelMember2022-03-310001497645inn:NCITransactionMemberinn:HotelPortfolioAcquiredInJanuary2022Memberinn:GICMember2022-01-012022-03-310001497645inn:OperatingPartnershipUnitsMemberinn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:JointVentureWithGICMembersrt:HotelMember2022-01-012022-03-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:JointVentureWithGICMemberinn:SeriesZPreferredUnitsMembersrt:HotelMember2022-01-012022-03-310001497645inn:OperatingPartnershipUnitsMemberinn:NCITransactionMember2022-03-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:JointVentureWithGICMemberinn:SeriesZPreferredUnitsMembersrt:HotelMember2022-03-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:TaxIncentivesMembersrt:HotelMember2022-03-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:TaxIncentivesMembersrt:HotelMember2022-01-012022-03-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberus-gaap:OtherIntangibleAssetsMembersrt:HotelMember2022-03-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberus-gaap:OtherIntangibleAssetsMembersrt:HotelMember2022-01-012022-03-310001497645inn:MezzanineLoansMemberinn:BrickellJointVentureMember2022-06-100001497645inn:MezzanineLoansMemberinn:BrickellJointVentureMember2022-06-102022-06-100001497645inn:MezzanineLoansMemberinn:OneraTransactionMember2022-10-310001497645inn:OneraJointVentureMember2022-10-012022-10-310001497645srt:MaximumMemberinn:OneraJointVentureMember2022-10-310001497645inn:JointVentureMember2022-10-31inn:unit0001497645inn:OneraJointVentureMember2022-10-31utr:acre0001497645inn:ResidenceInnByMarriottMembersrt:HotelMember2023-06-010001497645inn:ResidenceInnByMarriottMembersrt:HotelMember2023-06-012023-06-010001497645inn:NordicLodgeMembersrt:HotelMember2023-06-230001497645inn:NordicLodgeMembersrt:HotelMember2023-06-232023-06-230001497645inn:AcquisitionsOf2023Membersrt:HotelMember2023-12-310001497645inn:AcquisitionsOf2023Membersrt:HotelMember2023-01-012023-12-310001497645inn:HotelPortfolioAcquiredInJanuary2022Membersrt:HotelMember2022-01-130001497645inn:HotelPortfolioAcquiredInJanuary2022Membersrt:HotelMember2022-01-132022-01-130001497645inn:CanopyNewOrleansMembersrt:HotelMember2022-03-230001497645inn:CanopyNewOrleansMembersrt:HotelMember2022-03-232022-03-230001497645inn:ACElementHotelMembersrt:HotelMember2022-06-100001497645inn:ACElementHotelMembersrt:HotelMember2022-06-102022-06-100001497645inn:OneraTransactionMembersrt:HotelMember2022-10-260001497645inn:OneraTransactionMembersrt:HotelMember2022-10-262022-10-260001497645inn:AcquisitionsOf2022Membersrt:HotelMember2022-12-310001497645inn:AcquisitionsOf2022Membersrt:HotelMember2022-01-012022-12-310001497645inn:HotelPortfolioAcquiredInJanuary2022Membersrt:HotelMember2022-01-310001497645inn:ParkingGaragesMemberinn:HotelPortfolioAcquiredInJanuary2022Member2022-01-310001497645inn:HotelPortfolioAcquiredInJanuary2022Membersrt:HotelMember2022-01-012022-01-310001497645inn:HotelPortfolioAcquiredInTexasOnJanuary2022Membersrt:HotelMember2022-01-310001497645inn:HotelPortfolioAcquiredInLouisianaOnJanuary2022Membersrt:HotelMember2022-01-310001497645inn:HotelPortfolioAcquiredInOklahomaOnJanuary2022Membersrt:HotelMember2022-01-310001497645inn:CanopyNewOrleansMembersrt:HotelMember2022-03-012022-03-310001497645inn:BrickellJointVentureMember2022-06-100001497645inn:BrickellJointVentureMember2023-12-310001497645inn:BrickellJointVentureMember2022-06-102022-06-100001497645inn:JointVentureMember2022-10-012022-10-310001497645inn:NCITransactionMember2022-01-012022-12-310001497645inn:BrickellJointVentureMember2022-12-310001497645inn:BrickellJointVentureMember2022-01-012022-12-310001497645inn:OneraJointVentureMember2022-12-310001497645srt:HotelMember2023-05-190001497645srt:HotelMember2023-05-192023-05-190001497645inn:HiltonGardenInnMembersrt:HotelMember2023-05-190001497645inn:HolidayInnExpressSuitesMembersrt:HotelMember2023-05-190001497645inn:HyattPlaceHoffmanEstatesMembersrt:HotelMember2023-05-190001497645inn:HyattPlaceLombardMembersrt:HotelMember2023-05-1900014976452023-05-190001497645inn:PurchaseAgreementPortfolio1Membersrt:HotelMember2022-12-312022-12-310001497645inn:HyattPlaceMemberinn:BaltimoreMDMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-12-012023-12-310001497645inn:HiltonGardenInnSanFranciscoMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:SanFranciscoCaliforniaMember2022-05-310001497645inn:HiltonGardenInnSanFranciscoMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:SanFranciscoCaliforniaMember2022-05-012022-05-310001497645inn:HiltonGardenInnSanFranciscoMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:SanFranciscoCaliforniaMember2022-01-012022-12-310001497645us-gaap:SubsequentEventMember2024-02-150001497645us-gaap:SubsequentEventMember2024-02-152024-02-150001497645inn:AirRightsMember2023-12-310001497645inn:AirRightsMember2022-12-310001497645us-gaap:UnclassifiedIndefinitelivedIntangibleAssetsMember2023-12-310001497645us-gaap:UnclassifiedIndefinitelivedIntangibleAssetsMember2022-12-310001497645inn:TaxIncentivesMember2023-01-012023-12-310001497645inn:TaxIncentivesMember2023-12-310001497645inn:TaxIncentivesMember2022-12-310001497645inn:KeyMoneyMember2023-01-012023-12-310001497645inn:KeyMoneyMember2023-12-310001497645inn:KeyMoneyMember2022-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:PortfolioPropertyFourLodgingPropertiesMember2023-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:PortfolioPropertyFourLodgingPropertiesMember2022-12-310001497645inn:DallasTXMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:UnderContractForSaleMember2023-12-310001497645inn:DallasTXMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:UnderContractForSaleMember2022-12-310001497645inn:SaleOfThreeLodgingPropertiesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-12-310001497645inn:SaleOfThreeLodgingPropertiesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-12-310001497645inn:SanAntonioTXMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:UndevelopedLandMember2023-12-310001497645inn:SanAntonioTXMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:UndevelopedLandMember2022-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:UnderContractForSaleMember2023-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberinn:UnderContractForSaleMember2022-12-310001497645inn:OneIndividualLodgingPropertyMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-12-310001497645inn:OneIndividualLodgingPropertyMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-12-310001497645inn:FlagstaffAZMemberinn:MarketForSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-12-310001497645inn:FlagstaffAZMemberinn:MarketForSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-12-310001497645inn:MarketForSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-12-310001497645inn:MarketForSaleMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-12-310001497645srt:ScenarioForecastMembersrt:HotelMember2024-06-30inn:tradingday0001497645srt:ScenarioForecastMemberinn:PurchaseAndSaleAgreementMember2024-06-300001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:HotelMember2023-12-310001497645inn:PurchaseAndSaleAgreementMember2023-10-012023-12-310001497645inn:PurchaseAndSaleAgreementMember2023-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:HotelMember2023-10-012023-12-310001497645srt:ScenarioForecastMemberinn:PurchaseAndSaleAgreementMemberinn:SanAntonioTXMemberinn:UndevelopedLandMember2024-06-300001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:HotelMember2022-01-012022-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:HotelMember2022-12-310001497645inn:OneraMezzanineLoanMember2023-01-012023-12-310001497645inn:OneraMezzanineLoanMember2023-12-310001497645srt:AffiliatedEntityMemberus-gaap:LetterOfCreditMemberus-gaap:ConstructionLoansMember2023-12-310001497645inn:MezzanineLoansMember2023-12-310001497645inn:MezzanineLoansMember2023-01-012023-12-310001497645us-gaap:OtherAssetsMemberinn:OneraMezzanineLoanMember2023-12-310001497645inn:MezzanineLoansMember2019-12-310001497645inn:MezzanineLoansMember2022-06-300001497645inn:BrickellMezzanineLoanMember2023-12-310001497645inn:HolidayInnAndHiltonGardenInnMemberinn:DuluthGeorgiaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2018-06-300001497645inn:SellerFinancingLoansMemberinn:HolidayInnAndHiltonGardenInnMemberinn:DuluthGeorgiaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2018-06-012018-06-30inn:note0001497645inn:SellerFinancingLoansMemberinn:HolidayInnAndHiltonGardenInnMemberinn:DuluthGeorgiaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2018-06-300001497645inn:SellerFinancingLoansMemberinn:HolidayInnAndHiltonGardenInnMemberinn:DuluthGeorgiaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-31inn:loan0001497645inn:SellerFinancingLoansMember2022-01-012022-12-310001497645inn:SellerFinancingLoansMemberinn:HolidayInnAndHiltonGardenInnMemberinn:DuluthGeorgiaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-12-310001497645inn:SellerFinancingLoansMember2023-01-012023-12-310001497645inn:FurnitureFixturesAndEquipmentCapitalExpendituresReservesMember2023-12-310001497645inn:FurnitureFixturesAndEquipmentCapitalExpendituresReservesMember2022-12-310001497645inn:PropertyTaxesMember2023-12-310001497645inn:PropertyTaxesMember2022-12-310001497645inn:OtherFundsInEscrowMember2023-12-310001497645inn:OtherFundsInEscrowMember2022-12-310001497645srt:MinimumMember2023-01-012023-12-310001497645srt:MaximumMember2023-01-012023-12-310001497645inn:SeniorCreditFacilitySixHundredMillionMemberus-gaap:UnsecuredDebtMember2018-12-060001497645inn:SeniorCreditFacilitySixHundredMillionMemberus-gaap:UnsecuredDebtMember2023-06-300001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:UnsecuredDebtMember2023-06-300001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:UnsecuredDebtMember2023-12-310001497645us-gaap:UnsecuredDebtMemberinn:TermLoanTwoHundredMillionMember2023-06-300001497645us-gaap:UnsecuredDebtMemberinn:TermLoanTwoHundredMillionMember2023-12-310001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001497645us-gaap:UnsecuredDebtMemberinn:TermLoanTwoHundredMillionMember2023-01-012023-12-310001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2023-06-012023-06-300001497645inn:RevolvingCreditFacilityFourHundredMillionMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-06-012023-06-300001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:BaseRateMembersrt:MinimumMember2023-06-012023-06-300001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:BaseRateMembersrt:MaximumMember2023-06-012023-06-300001497645us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMemberinn:TermLoanTwoHundredMillionMember2023-01-012023-12-310001497645srt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberinn:TermLoanTwoHundredMillionMember2023-01-012023-12-310001497645us-gaap:BaseRateMembersrt:MinimumMemberinn:TermLoanTwoHundredMillionMember2023-01-012023-12-310001497645us-gaap:BaseRateMembersrt:MaximumMemberinn:TermLoanTwoHundredMillionMember2023-01-012023-12-310001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:FederalFundsEffectiveSwapRateMember2023-01-012023-12-310001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-12-310001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:InterestRateFloorMember2023-12-310001497645inn:RevolvingCreditFacilityFourHundredMillionMember2023-01-012023-12-310001497645inn:SeniorCreditFacilitySixHundredMillionMemberus-gaap:UnsecuredDebtMember2023-12-310001497645srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001497645us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2023-01-012023-12-310001497645inn:A2018TermLoanMemberus-gaap:UnsecuredDebtMember2018-02-280001497645inn:A2018TermLoanMemberus-gaap:UnsecuredDebtMember2018-02-150001497645inn:A2018TermLoanMemberinn:SecuredOvernightFinancingRateMembersrt:MinimumMemberus-gaap:UnsecuredDebtMember2018-02-152018-02-150001497645inn:A2018TermLoanMemberinn:SecuredOvernightFinancingRateMemberus-gaap:UnsecuredDebtMember2018-02-152018-02-150001497645inn:A2018TermLoanMemberinn:SecuredOvernightFinancingRateMembersrt:MinimumMemberus-gaap:UnsecuredDebtMember2018-02-150001497645srt:MaximumMemberinn:A2018TermLoanMemberinn:SecuredOvernightFinancingRateMemberus-gaap:UnsecuredDebtMember2018-02-150001497645inn:A2024TermLoanMemberus-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMember2024-02-280001497645inn:A2024TermLoanMemberinn:SecuredOvernightFinancingRateMembersrt:MinimumMemberus-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMember2024-02-012024-02-280001497645srt:MaximumMemberinn:A2024TermLoanMemberinn:SecuredOvernightFinancingRateMemberus-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMember2024-02-012024-02-280001497645us-gaap:BaseRateMemberinn:A2024TermLoanMembersrt:MinimumMemberus-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMember2024-02-012024-02-280001497645us-gaap:BaseRateMembersrt:MaximumMemberinn:A2024TermLoanMemberus-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMember2024-02-012024-02-280001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMember2024-02-280001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMember2024-02-012024-02-280001497645inn:A2024TermLoanMemberus-gaap:SubsequentEventMember2024-02-012024-02-280001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2021-01-070001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2021-01-072021-01-070001497645inn:A62MillionTermLoanMemberus-gaap:UnsecuredDebtMember2021-01-072021-01-070001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2023-01-012023-12-310001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2022-01-012022-12-310001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2021-01-012021-12-310001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2023-12-310001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2022-12-310001497645inn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2021-01-120001497645us-gaap:SecuredDebtMemberinn:MetabankMemberinn:NonRecourseLoanMember2017-06-300001497645us-gaap:SecuredDebtMemberinn:MetabankMemberinn:NonRecourseLoanMember2017-06-012017-06-300001497645us-gaap:MortgagesMember2023-12-310001497645us-gaap:MortgagesMember2022-12-31inn:property0001497645us-gaap:MortgagesMember2022-01-012022-12-31inn:security0001497645us-gaap:LineOfCreditMemberinn:JointVentureCreditFacilityMember2019-10-310001497645us-gaap:RevolvingCreditFacilityMemberinn:A125MillionRevolvingCreditFacilityMember2019-10-080001497645inn:A75MillionTermLoanMember2019-10-080001497645us-gaap:LineOfCreditMemberinn:JointVentureCreditFacilityMember2019-10-080001497645us-gaap:RevolvingCreditFacilityMemberinn:A125MillionRevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-12-310001497645us-gaap:RevolvingCreditFacilityMemberinn:A125MillionRevolvingCreditFacilityMember2023-12-310001497645us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberinn:A125MillionRevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001497645us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberinn:A125MillionRevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:UnsecuredDebtMember2023-12-310001497645us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberinn:A125MillionRevolvingCreditFacilityMember2023-12-310001497645us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberinn:A125MillionRevolvingCreditFacilityMember2023-01-012023-12-310001497645inn:A75MillionTermLoanMember2023-12-310001497645inn:JointVentureCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001497645us-gaap:RevolvingCreditFacilityMemberinn:A75MillionTermLoanMember2023-12-310001497645inn:NCITransactionMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:JointVentureWithGICMembersrt:HotelMember2023-12-310001497645us-gaap:RevolvingCreditFacilityMemberinn:DebtCovenantWaiverPeriodMemberinn:A125MillionRevolvingCreditFacilityMember2021-04-292021-04-290001497645inn:A75MillionTermLoanMemberinn:DebtCovenantWaiverPeriodMember2021-04-292021-04-290001497645us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-02-012023-02-280001497645us-gaap:RevolvingCreditFacilityMemberinn:A125MillionRevolvingCreditFacilityMember2023-09-300001497645inn:A75MillionTermLoanMember2023-09-300001497645us-gaap:SecuredDebtMemberinn:JointVentureCreditFacilityMember2023-09-012023-09-300001497645us-gaap:SecuredDebtMemberinn:JointVentureTermLoanMember2022-01-130001497645us-gaap:SecuredDebtMemberinn:JointVentureTermLoanMember2023-09-012023-09-300001497645inn:BankOfAmericaNAVariableDueJanuary132026Memberus-gaap:UnsecuredDebtMember2023-12-310001497645inn:JointVentureTermLoanMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001497645inn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:JointVentureWithGICMembersrt:HotelMember2021-11-020001497645inn:NCITransactionMemberinn:PACELoanMember2023-12-310001497645inn:NCITransactionMemberinn:PACELoanMember2023-01-012023-12-310001497645inn:BrickellMortgageLoanMemberus-gaap:MortgagesMemberinn:BrickellJointVentureMember2022-06-300001497645inn:BrickellMortgageLoanMemberus-gaap:MortgagesMemberinn:ACElementHotelMemberinn:BrickellJointVentureMember2022-06-300001497645inn:BrickellMortgageLoanMemberus-gaap:MortgagesMemberinn:ACElementHotelMemberinn:BrickellJointVentureMember2023-06-012023-06-300001497645inn:BrickellMortgageLoanMemberus-gaap:MortgagesMemberinn:BrickellJointVentureMember2023-06-012023-06-300001497645inn:RevolvingCreditFacilityFourHundredMillionMemberus-gaap:UnsecuredDebtMember2022-12-310001497645us-gaap:UnsecuredDebtMemberinn:TermLoanTwoHundredMillionMember2022-12-310001497645inn:SeniorCreditFacilitySixHundredMillionMemberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:KeybankNationalAssociationTermLoanDueFebruary142025Memberus-gaap:UnsecuredDebtMember2023-12-310001497645inn:KeybankNationalAssociationTermLoanDueFebruary142025Memberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:MortgageLoanWithMetaBankDueJuly12027Memberus-gaap:MortgagesMember2023-12-310001497645inn:MortgageLoanWithMetaBankDueJuly12027Memberus-gaap:MortgagesMember2023-01-012023-12-310001497645inn:MortgageLoanWithMetaBankDueJuly12027Memberus-gaap:MortgagesMember2022-12-310001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteAMemberus-gaap:MortgagesMember2023-12-310001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteAMemberus-gaap:MortgagesMember2023-01-012023-12-310001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteAMemberus-gaap:MortgagesMember2022-12-310001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteBMemberus-gaap:MortgagesMember2023-12-310001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteBMemberus-gaap:MortgagesMember2023-01-012023-12-310001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteBMemberus-gaap:MortgagesMember2022-12-310001497645inn:SecuredMortgageIndebtednessMemberus-gaap:MortgagesMember2023-12-310001497645inn:SecuredMortgageIndebtednessMemberus-gaap:MortgagesMember2022-12-310001497645us-gaap:LoansPayableMember2023-12-310001497645us-gaap:LoansPayableMember2022-12-310001497645us-gaap:MortgagesMemberinn:CityNationalBankOfFloridaVariableDueJune92025Member2023-12-310001497645us-gaap:MortgagesMemberinn:CityNationalBankOfFloridaVariableDueJune92025Member2023-01-012023-12-310001497645us-gaap:MortgagesMemberinn:CityNationalBankOfFloridaVariableDueJune92025Member2022-12-310001497645us-gaap:RevolvingCreditFacilityMemberinn:A125MillionRevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:A75MillionTermLoanMemberus-gaap:UnsecuredDebtMember2023-12-310001497645inn:A75MillionTermLoanMemberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:BankOfAmericaNAVariableDueJanuary132026Memberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:TermLoansWithWellsFargoDueJune62028Memberus-gaap:UnsecuredDebtMember2023-12-310001497645inn:TermLoansWithWellsFargoDueJune62028Memberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001497645inn:TermLoansWithWellsFargoDueJune62028Member2023-12-310001497645inn:TermLoansWithWellsFargoDueJune62028Memberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:PACELoanMemberus-gaap:UnsecuredDebtMember2023-12-310001497645inn:PACELoanMemberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001497645inn:PACELoanMember2023-12-310001497645inn:PACELoanMemberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:GICJointVentureCreditFacilityAndTermLoansMemberus-gaap:UnsecuredDebtMember2023-12-310001497645inn:GICJointVentureCreditFacilityAndTermLoansMemberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:JointVentureCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-12-310001497645inn:JointVentureCreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001497645inn:SeniorCreditFacilitySixHundredMillionMemberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001497645inn:MortgageLoanWithBankOfCascadesMemberus-gaap:MortgagesMember2014-12-012014-12-31inn:contract0001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteAMemberinn:LondonInterbankOfferedRateLIBOR1Memberus-gaap:MortgagesMember2014-12-012014-12-310001497645inn:MortgageLoanWithBankOfCascadesDueDecember192024NoteBMemberus-gaap:MortgagesMember2014-12-310001497645inn:MortgageLoanWithBankOfCascadesMemberus-gaap:MortgagesMember2014-12-31inn:Instrument0001497645inn:TermLoansWithWellsFargoDueJune62028Memberus-gaap:UnsecuredDebtMember2021-12-310001497645inn:NCITransactionMemberinn:PACELoanMember2022-03-230001497645inn:WhollyOwnedPropertiesAndJointVentureDebtMember2023-12-310001497645us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ConvertibleDebtMember2023-12-310001497645us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ConvertibleDebtMember2023-12-310001497645us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ConvertibleDebtMember2022-12-310001497645us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ConvertibleDebtMember2022-12-310001497645us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgagesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001497645us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgagesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001497645us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgagesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001497645us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgagesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001497645us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001497645us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001497645us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001497645us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapsExpiringBetween2023And2039Member2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapsExpiringBetween2023And2039Member2022-12-310001497645srt:MaximumMemberinn:A150ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2021-01-072021-01-070001497645inn:InterestRateSwapExpiringJanuary312023OneMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001497645inn:InterestRateSwapExpiringJanuary312023OneMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapExpiringJanuary312023TwoMember2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapExpiringJanuary312023TwoMember2022-12-310001497645inn:InterestRateSwapExpiringSeptember302024Memberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001497645inn:InterestRateSwapExpiringSeptember302024Memberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapExpiringDecember312025Member2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapExpiringDecember312025Member2022-12-310001497645inn:InterestRateSwapExpiringJanuary312027Memberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001497645inn:InterestRateSwapExpiringJanuary312027Memberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapExpiringJanuary312029Member2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:InterestRateSwapExpiringJanuary312029Member2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:GICJointVentureCreditFacilityAndTermLoansMemberinn:InterestRateSwapExpiringJanuary132026OneMember2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:GICJointVentureCreditFacilityAndTermLoansMemberinn:InterestRateSwapExpiringJanuary132026OneMember2022-12-310001497645inn:InterestRateSwapExpiringJanuary132026TwoMemberus-gaap:DesignatedAsHedgingInstrumentMemberinn:GICJointVentureCreditFacilityAndTermLoansMember2023-12-310001497645inn:InterestRateSwapExpiringJanuary132026TwoMemberus-gaap:DesignatedAsHedgingInstrumentMemberinn:GICJointVentureCreditFacilityAndTermLoansMember2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:GICJointVentureCreditFacilityAndTermLoansMember2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberinn:GICJointVentureCreditFacilityAndTermLoansMember2022-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-12-310001497645us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2022-12-310001497645us-gaap:InterestRateSwapMember2023-12-310001497645us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001497645us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310001497645us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2021-01-012021-12-310001497645us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2023-01-012023-12-310001497645us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2022-01-012022-12-310001497645us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2021-01-012021-12-310001497645us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberinn:GICJointVentureMemberus-gaap:InterestRateSwapMemberus-gaap:SubsequentEventMember2024-01-310001497645inn:GICJointVentureMemberus-gaap:InterestRateSwapMemberus-gaap:SubsequentEventMember2024-01-31inn:vote0001497645srt:MaximumMemberinn:A2022ATMProgramMember2022-05-012022-05-310001497645srt:DirectorMember2023-01-012023-12-310001497645srt:DirectorMember2022-01-012022-12-310001497645inn:PreferredStockUndesignatedMember2023-12-310001497645us-gaap:SeriesFPreferredStockMember2021-08-120001497645srt:MaximumMemberus-gaap:SeriesEPreferredStockMember2023-01-012023-12-310001497645srt:MaximumMemberus-gaap:SeriesFPreferredStockMember2023-01-012023-12-310001497645inn:SummitHotelOperatingPartnershipMemberinn:UnaffiliatedThirdPartiesMember2023-01-012023-12-310001497645inn:OperatingPartnershipUnitsMemberinn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:SummitHotelOPLPMembersrt:HotelMember2022-01-012022-03-310001497645inn:SummitHotelOperatingPartnershipMemberinn:UnaffiliatedThirdPartiesMember2023-12-310001497645inn:SummitHotelOperatingPartnershipMemberinn:UnaffiliatedThirdPartiesMember2022-12-310001497645us-gaap:NoncontrollingInterestMemberinn:SummitHotelOperatingPartnershipMember2022-01-012022-12-310001497645us-gaap:NoncontrollingInterestMemberinn:SummitHotelOperatingPartnershipMember2023-01-012023-12-310001497645inn:JointVentureWithGICMemberinn:JointVentureWithGICMember2023-01-012023-12-310001497645inn:JointVentureWithGICMemberinn:GICMemberinn:JointVentureWithGICMember2023-01-012023-12-310001497645inn:JointVentureWithGICMemberinn:JointVentureWithGICMember2022-01-012022-12-310001497645inn:JointVentureWithGICMemberinn:JointVentureWithGICMembersrt:HotelMember2023-12-310001497645inn:ACElementHotelMemberinn:BrickellJointVentureMember2022-06-300001497645inn:BrickellJointVentureMemberinn:BrickellJointVentureMember2022-06-300001497645inn:OneraJointVentureMember2022-10-262022-10-260001497645inn:OneraJointVentureMember2022-10-260001497645inn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:SeriesZPreferredUnitsMemberinn:SummitHotelOPLPMembersrt:HotelMember2022-01-012022-01-310001497645inn:SeriesZPreferredUnitsMember2023-01-012023-12-31utr:Rate0001497645inn:SeriesZPreferredUnitsMember2022-01-310001497645inn:SeriesZPreferredUnitsMember2022-01-012022-01-310001497645inn:PortfolioPurchaseThroughContributionAndPurchaseAgreementMemberinn:SeriesZPreferredUnitsMemberinn:SummitHotelOPLPMembersrt:HotelMember2023-12-310001497645us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001497645us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001497645us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001497645us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001497645us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001497645us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputExercisePriceMember2023-12-310001497645us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputOptionVolatilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001497645us-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001497645us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-12-310001497645srt:MinimumMemberinn:FranchiseAgreementsMember2023-01-012023-12-310001497645srt:MaximumMemberinn:FranchiseAgreementsMember2023-01-012023-12-310001497645inn:FranchiseAgreementsMember2023-01-012023-12-310001497645inn:FranchiseAgreementsMember2022-01-012022-12-310001497645inn:FranchiseAgreementsMember2021-01-012021-12-310001497645inn:ManagementAgreementsMember2023-01-012023-12-310001497645inn:ManagementAgreementsMember2022-01-012022-12-310001497645inn:ManagementAgreementsMember2021-01-012021-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:RestrictedStockMember2021-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:RestrictedStockMember2022-01-012022-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:RestrictedStockMember2022-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:RestrictedStockMember2023-12-310001497645inn:EmployeesMemberinn:VestingBasedOnServiceMemberinn:PriorTo2022Memberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:EmployeesMemberinn:VestingBasedOnServiceMemberinn:PriorTo2022Memberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-310001497645inn:EmployeesMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberinn:VestingBasedOnServiceMemberinn:PriorTo2022Memberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645us-gaap:ShareBasedCompensationAwardTrancheThreeMemberinn:EmployeesMemberinn:VestingBasedOnServiceMemberinn:PriorTo2022Memberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:EmployeesMemberinn:VestingBasedOnServiceMemberinn:PriorTo2022Memberinn:SharebasedCompensationAwardTrancheFourMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:EmployeesMemberinn:VestingBasedOnServiceMemberinn:In2022AndThereafterMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:EmployeesMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberinn:VestingBasedOnServiceMemberinn:In2022AndThereafterMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:EmployeesMemberinn:VestingBasedOnServiceMemberinn:In2022AndThereafterMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-310001497645us-gaap:ShareBasedCompensationAwardTrancheThreeMemberinn:EmployeesMemberinn:VestingBasedOnServiceMemberinn:In2022AndThereafterMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:VestingBasedOnServiceMembersrt:ExecutiveOfficerMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645us-gaap:ShareBasedCompensationAwardTrancheTwoMemberinn:VestingBasedOnServiceMembersrt:ExecutiveOfficerMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:VestingBasedOnServiceMembersrt:ExecutiveOfficerMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-310001497645us-gaap:ShareBasedCompensationAwardTrancheThreeMemberinn:VestingBasedOnServiceMembersrt:ExecutiveOfficerMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001497645inn:VestingBasedOnServiceMemberinn:FormerExecutiveVicePresidentAndChiefOperatingOfficerMemberus-gaap:RestrictedStockMember2022-01-012022-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:RestrictedStockMemberinn:FormerExecutiveChairmanMember2021-01-012021-12-310001497645us-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2021-12-310001497645us-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2022-01-012022-12-310001497645us-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2022-12-310001497645us-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2023-01-012023-12-310001497645us-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2023-12-310001497645srt:ExecutiveOfficerMembersrt:MinimumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645us-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2021-01-012021-12-31inn:Iteration0001497645us-gaap:CommonStockMembersrt:DirectorMember2023-01-012023-12-310001497645us-gaap:CommonStockMembersrt:DirectorMember2022-01-012022-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMember2022-01-012022-12-310001497645inn:VestingBasedOnServiceMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2023-01-012023-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2022-01-012022-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2021-01-012021-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:StockCompensationPlanMembersrt:DirectorMember2023-01-012023-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:StockCompensationPlanMembersrt:DirectorMember2022-01-012022-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:StockCompensationPlanMembersrt:DirectorMember2021-01-012021-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001497645us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001497645inn:FormerExecutiveVicePresidentAndChiefOperatingOfficerMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:VestingBasedOnServiceMemberinn:FormerExecutiveVicePresidentAndChiefOperatingOfficerMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:FormerExecutiveVicePresidentAndChiefOperatingOfficerMemberus-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMember2023-01-012023-12-310001497645us-gaap:RestrictedStockMemberinn:FormerExecutiveChairmanMember2021-01-012021-12-310001497645us-gaap:RestrictedStockMemberinn:VestingBasedOnPerformanceMemberinn:FormerExecutiveChairmanMember2021-01-012021-12-310001497645srt:MaximumMembersrt:ExecutiveOfficerMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001497645inn:TRSsMemberus-gaap:DomesticCountryMember2023-12-310001497645inn:TRSsMemberus-gaap:StateAndLocalJurisdictionMember2023-12-310001497645us-gaap:DomesticCountryMember2023-12-310001497645inn:REITSubsidiariesMemberus-gaap:DomesticCountryMember2023-12-310001497645us-gaap:CommonStockMember2022-01-012022-12-310001497645us-gaap:CommonStockMember2021-01-012021-12-310001497645us-gaap:SeriesDPreferredStockMember2023-01-012023-12-310001497645us-gaap:SeriesDPreferredStockMember2022-01-012022-12-310001497645us-gaap:SeriesDPreferredStockMember2021-01-012021-12-310001497645us-gaap:SeriesEPreferredStockMember2021-01-012021-12-310001497645us-gaap:SeriesFPreferredStockMember2021-01-012021-12-310001497645us-gaap:SeriesEPreferredStockMemberus-gaap:SubsequentEventMember2024-01-012024-01-310001497645us-gaap:SeriesFPreferredStockMemberus-gaap:SubsequentEventMember2024-01-012024-01-310001497645inn:SeriesZPreferredUnitsMemberus-gaap:SubsequentEventMember2024-01-012024-01-310001497645us-gaap:SubsequentEventMember2024-01-012024-01-310001497645us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberinn:GICJointVentureMemberus-gaap:InterestRateSwapMemberus-gaap:SubsequentEventMember2024-01-190001497645inn:GICJointVentureMemberus-gaap:InterestRateSwapMemberus-gaap:SubsequentEventMember2024-01-190001497645inn:HomewoodSuitesAlisoViejoCAMember2023-12-310001497645inn:CourtyardArlingtonTXMember2023-12-310001497645inn:EmbassySuitesAmarilloTXMember2023-12-310001497645inn:CourtyardArlingtonTX1Member2023-12-310001497645inn:ResidenceInnArlingtonTXMember2023-12-310001497645inn:HotelIndigoAshevilleNCMember2023-12-310001497645inn:ACHotelAtlantaGAMember2023-12-310001497645inn:CourtyardAtlantaGAMember2023-12-310001497645inn:ResidenceInnAtlantaGAMember2023-12-310001497645inn:HamptonInnSuitesAustinTXMember2023-12-310001497645inn:HamptonInnSuitesBaltimoreMDMember2023-12-310001497645inn:ResidenceInnBaltimoreMDMember2023-12-310001497645inn:MarriottBoulderCOMember2023-12-310001497645inn:ResidenceInnBranchburgNJMember2023-12-310001497645inn:DoubleTreeBrisbaneCAMember2023-12-310001497645inn:HiltonGardenInnBryanTXMember2023-12-310001497645inn:HamptonInnSuitesCamarilloCAMember2023-12-310001497645inn:CourtyardCharlotteNCMember2023-12-310001497645inn:HyattPlaceChicagoILMember2023-12-310001497645inn:ResidenceInnClevelandOHMember2023-12-310001497645inn:ACHotelDallasTXMember2023-12-310001497645inn:HamptonInnSuitesDallasTXMember2023-12-310001497645inn:ParkingGarageDallasTXMember2023-12-310001497645inn:ResidenceInnDallasTXMember2023-12-310001497645inn:SpringHillSuitesDallasTXMember2023-12-310001497645inn:CourtyardDecaturGAMember2023-12-310001497645inn:HiltonGardenInnEdenPrairieMNMember2023-12-310001497645inn:HyattHouseEnglewoodCOMember2023-12-310001497645inn:HyattPlaceEnglewoodCOMember2023-12-310001497645inn:CourtyardFortLauderdaleFLMember2023-12-310001497645inn:NewBuildsFortLauderdaleFLMember2023-12-310001497645inn:CourtyardFortWorthTXMember2023-12-310001497645inn:OneraEscapesFredericksburgTXMember2023-12-310001497645inn:ACHotelFriscoTXMember2023-12-310001497645inn:CanopyHotelFriscoTXMember2023-12-310001497645inn:ParkingGarageFriscoTXMember2023-12-310001497645inn:ResidenceInnFriscoTXMember2023-12-310001497645inn:HyattPlaceGardenCityNYMember2023-12-310001497645inn:StaybridgeSuitesGlendaleCOMember2023-12-310001497645inn:CourtyardGrapevineTXMember2023-12-310001497645inn:HiltonGardenInnGrapevineTXMember2023-12-310001497645inn:HolidayInnExpressSuitesGrapevineTXMember2023-12-310001497645inn:HyattPlaceGrapevineTXMember2023-12-310001497645inn:TownePlaceSuitesGrapevineTXMember2023-12-310001497645inn:HiltonGardenInnGreenvilleSCMember2023-12-310001497645inn:ResidenceInnHillsboroORMember2023-12-310001497645inn:HyattPlaceHoffmanEstatesILMember2023-12-310001497645inn:ACHotelHoustonTXMember2023-12-310001497645inn:HiltonGardenInnHoustonTX1Member2023-12-310001497645inn:HiltonGardenInnHoustonTX2Member2023-12-310001497645inn:ResidenceInnHuntValleyMDMember2023-12-310001497645inn:CourtyardIndianapolisINMember2023-12-310001497645inn:SpringHillSuitesIndianapolisINMember2023-12-310001497645inn:CourtyardKansasCityMOMember2023-12-310001497645inn:LandParcelsMember2023-12-310001497645inn:HyattPlaceLombardILMember2023-12-310001497645inn:HyattPlaceLoneTreeCOMember2023-12-310001497645inn:HiltonGardenInnLongviewTXMember2023-12-310001497645inn:FairfieldInnSuitesLouisvilleKYMember2023-12-310001497645inn:SpringHillSuitesLouisvilleKYMember2023-12-310001497645inn:HyattPlaceLubbockTXMember2023-12-310001497645inn:HyattPlaceMesaAZMember2023-12-310001497645inn:CourtyardMetairieLAMember2023-12-310001497645inn:ResidenceInnMetairieLAMember2023-12-310001497645inn:ACHotelMiamiFLMember2023-12-310001497645inn:ElementMiamiFLMember2023-12-310001497645inn:HyattHouseMiamiFLMember2023-12-310001497645inn:SkyLoungeMiamiFLMember2023-12-310001497645inn:HomewoodSuitesMidlandTXMember2023-12-310001497645inn:HiltonGardenInnMilpitasCAMember2023-12-310001497645inn:HamptonInnSuitesMinneapolisMNMember2023-12-310001497645inn:HyattPlaceMinneapolisMNMember2023-12-310001497645inn:HolidayInnExpressSuitesMinnetonkaMNMember2023-12-310001497645inn:CourtyardNashvilleTNMember2023-12-310001497645inn:SpringHillSuitesNashvilleTNMember2023-12-310001497645inn:CourtyardNewHavenCTMember2023-12-310001497645inn:CanopyHotelNewOrleansLAMember2023-12-310001497645inn:CourtyardNewOrleansLA1Member2023-12-310001497645inn:CourtyardNewOrleansLA2Member2023-12-310001497645inn:SpringHillSuitesNewOrleansLA1Member2023-12-310001497645inn:SpringHillSuitesNewOrleansLA2Member2023-12-310001497645inn:TownePlaceSuitesNewOrleansLAMember2023-12-310001497645inn:ACHotelOklahomaCityOKMember2023-12-310001497645inn:HolidayInnExpressSuitesOklahomaCityOKMember2023-12-310001497645inn:HyattPlaceOklahomaCityOKMember2023-12-310001497645inn:HyattHouseOrlandoFLMember2023-12-310001497645inn:HyattPlaceOrlandoFL1Member2023-12-310001497645inn:HyattPlaceOrlandoFL2Member2023-12-310001497645inn:HyattPlaceOwingsMillsMDMember2023-12-310001497645inn:CourtyardPittsburghPAMember2023-12-310001497645inn:HyattPlacePlanoTXMember2023-12-310001497645inn:HyattPlacePortlandORMember2023-12-310001497645inn:ResidenceInnPortlandOR1Member2023-12-310001497645inn:ResidenceInnPortlandOR2Member2023-12-310001497645inn:HamptonInnSuitesPowayCAMember2023-12-310001497645inn:FourPointsSanFranciscoCAMember2023-12-310001497645inn:HiltonGardenInnSanFranciscoCAMember2023-12-310001497645inn:HolidayInnExpressSuitesSanFranciscoCAMember2023-12-310001497645inn:CourtyardScottsdaleAZMember2023-12-310001497645inn:HyattPlaceScottsdaleAZMember2023-12-310001497645inn:ResidenceInnScottsdaleAZMember2023-12-310001497645inn:SpringHillSuitesScottsdaleAZMember2023-12-310001497645inn:HamptonInnSuites.SilverthorneCOMember2023-12-310001497645inn:ParkingGarage.SilverthorneCOMember2023-12-310001497645inn:NordicLodgeSteamboatSpringsCOMember2023-12-310001497645inn:ResidenceInnSteamboatSpringsCOMember2023-12-310001497645inn:HamptonInnSuitesTampaFLMember2023-12-310001497645inn:EmbassySuitesTucsonAZMember2023-12-310001497645inn:HomewoodSuitesTucsonAZMember2023-12-310001497645inn:ResidenceInnTylerTXMember2023-12-310001497645inn:HiltonGardenInnWalthamMAMember2023-12-310001497645inn:ResidenceInnWatertownMAMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35074

SUMMIT HOTEL PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Maryland |

|

27-2962512 |

| (State or other jurisdiction |

|

(I.R.S. Employer Identification No.) |

| of incorporation or organization) |

|

|

13215 Bee Cave Parkway, Suite B-300

Austin, TX 78738

(Address of principal executive offices, including zip code)

(512) 538-2300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

INN |

|

New York Stock Exchange |

|

|

|

|

|

|

|

|

|

|

| 6.25% Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share |

|

INN-PE |

|

New York Stock Exchange |

| 5.875% Series F Cumulative Redeemable Preferred Stock, par value $0.01 per share |

|

INN-PF |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405) of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant’s as of June 30, 2023 was $682,825,287 based on the closing sale price of the registrant’s common stock on the New York Stock Exchange as of June 30, 2023.

As of February 9, 2024 the number of outstanding shares of common stock of Summit Hotel Properties, Inc. was 107,593,373.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement on Schedule 14A for its 2024 annual meeting of stockholders, to be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year pursuant to Regulation 14A, are incorporated herein by reference into Part III, Items 10, 11, 12, 13 and 14.

ANNUAL REPORT ON FORM 10-K

FISCAL YEAR ENDED DECEMBER 31, 2023

SUMMIT HOTEL PROPERTIES, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

| |

|

Page |

|

|

|

|

|

|

|

|

| Item 1. |

|

|

| Item 1A. |

|

|

| Item 1B. |

|

|

Item 1C. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

|

|

|

|

|

|

| Item 5. |

|

|

| Item 6. |

|

|

| Item 7. |

|

|

| Item 7A. |

|

|

| Item 8. |

|

|

| Item 9. |

|

|

| Item 9A. |

|

|

| Item 9B. |

|

|

| Item 9C. |

|

|

| |

|

|

|

|

|

| Item 10. |

|

|

| Item 11. |

|

|

| Item 12. |

|

|

| Item 13. |

|

|

| Item 14. |

|

|

|

|

|

|

|

|

| Item 15. |

|

|

Item 16. |

|

|

|

|

|

|

|

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “forecast,” “project,” “potential,” “continue,” “likely,” “will,” “would” or similar expressions. Forward-looking statements in this report include, among others, statements about our business strategy, including acquisition and development strategies, industry trends, estimated revenues and expenses, ability to realize deferred tax assets and expected liquidity needs and sources (including capital expenditures and the ability to obtain financing or raise capital). You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond our control and which could materially affect actual results, performances or achievements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to:

•global, national, regional and local economic and geopolitical conditions and events, including wars or potential hostilities, such as future terrorist attacks, that may negatively affect business transient, group and other travel or consumer behavior;

•macroeconomic conditions related to, and our ability to manage, inflationary pressures for commodities, labor and other costs of our business;

•consumer purchasing power and overall behavior, or a potential recessionary environment, which could adversely affect our costs, liquidity, consumer confidence, and demand for travel and lodging;

•levels of spending for business and leisure travel;

•adverse changes in occupancy, average daily rate (“ADR”) and revenue per available room (“RevPAR”) and other lodging property operating metrics;

• potential changes in operations as a result of new regulations or changes in brand standards;

•financing risks, including the risk of leverage and the corresponding risk of default on our existing indebtedness and potential inability to refinance or extend the maturities of our existing indebtedness;

•effects of infectious disease outbreaks or pandemics;

•default by borrowers to which we lend or provide seller financing;

•supply and demand factors in our markets or sub-markets;

•the effect of alternative accommodations on our business;

•financial condition of, and our relationships with, third-party property managers and franchisors;

•the degree and nature of our competition;

•increased interest rates or continued high rates of interest;

•increased renovation costs, which may cause actual renovation costs to exceed our current estimates;

•supply-chain disruption, which may reduce access to operating supplies or construction materials and increase related costs;

•changes in zoning laws;

•Significant increases in the cost of real property taxes and/or insurance;

•risks associated with lodging property acquisitions, including the ability to ramp up and stabilize newly acquired lodging properties with limited or no operating history or that require substantial amounts of capital improvements for us to earn economic returns consistent with our expectations at the time of acquisition;

•risks associated with dispositions of lodging properties, including our ability to successfully complete the sale of lodging properties under contract to be sold, including the risk that the purchaser may not have access to the capital needed to complete the purchase;

•the nature of our structure and transactions such that our federal and state taxes are complex and there is risk of successful challenges to our tax positions by the Internal Revenue Service (“IRS”) or other federal and state taxing authorities;

•availability of and the abilities of our property managers and us to retain qualified personnel at our lodging property and corporate offices;

•our failure to maintain our qualification as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “IRC”);

•changes in our business or investment strategy;

•availability, terms and deployment of capital;

•general volatility of the capital markets and the market price of our common stock;

•environmental uncertainties and risks related to natural disasters;

•our ability to recover fully under third-party indemnities or our existing insurance policies for insurable losses and our ability to maintain adequate or full replacement cost "all-risk" property insurance policies on our properties on commercially reasonable terms;

•the effect of a data breach or significant disruption of property operator information technology networks as a result of cyber-attacks that are greater than insurance coverages or indemnities from service providers;

•our ability to effectively manage our joint ventures with our joint venture partners;

•current and future changes to the IRC;

•our ability to continue to effectively enhance our Environmental, Social and Governance ("ESG") program to achieve expected social, environment and governance objectives and goals; and

•the other factors discussed in “Part I – Item 1A. – Risk Factors” in this report.

Accordingly, there is no assurance that our expectations will be realized. Except as otherwise required by the federal securities laws, we disclaim any obligation or undertaking to publicly release any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

PART I

Item 1. Business.

Unless the context otherwise requires, all references to “we,” “us,” “our,” or the “Company” refer to Summit Hotel Properties, Inc. and its consolidated subsidiaries.

Overview

Summit Hotel Properties, Inc. is a self-managed lodging property investment company that was organized on June 30, 2010 as a Maryland corporation. The Company holds both general and limited partnership interests in Summit Hotel OP, LP (the “Operating Partnership”), a Delaware limited partnership also organized on June 30, 2010. We focus on owning lodging properties with efficient operating models that generate strong margins and investment returns. At December 31, 2023, our portfolio consisted of 100 lodging properties with a total of 14,912 guestrooms located in 24 states. We own our properties fee simple, except for six hotel properties which are subject to ground leases. As of December 31, 2023, we own 100% of the outstanding equity interests in 56 of our lodging properties. We own a 51% controlling interest in 41 lodging properties through a joint venture with USFI G-Peak Pte. Ltd. ("GIC"), a private limited company incorporated in the Republic of Singapore (the "GIC Joint Venture"), and two 90% equity interests in separate joint ventures (the "Brickell Joint Venture" and the "Onera Joint Venture"). The Brickell Joint Venture owns two lodging properties, and the Onera Joint Venture owns one lodging property.

The GIC Joint Venture was formed in July 2019 with GIC to acquire assets that align with the Company’s current investment strategy and criteria. The Company serves as general partner and asset manager of the GIC Joint Venture and intends to invest 51% of the equity capitalization of the limited partnership, with GIC investing the remaining 49%. The GIC Joint Venture intends to finance assets with an anticipated 50% overall leverage target. The Company earns fees for providing services to the GIC Joint Venture and will have the potential to earn incentive fees based on the GIC Joint Venture achieving certain return thresholds.

As of December 31, 2023, 86% of our guestrooms were located in the top 50 metropolitan statistical areas (“MSAs”), 90% were located within the top 100 MSAs, and over 99% of our guestrooms operated under premium franchise brands owned by Marriott® International, Inc. (“Marriott”), Hilton® Worldwide (“Hilton”), Hyatt® Hotels Corporation (“Hyatt”), and InterContinental® Hotels Group (“IHG”). Our properties are typically located in markets with multiple demand generators such as corporate offices and headquarters, retail centers, airports, state capitols, convention centers, universities, and leisure attractions.

See "Part II - Item 8. – Financial Statements and Supplementary Data – Note 3 - Investments in Lodging Property, net" for further information.

Substantially all of our assets are held by, and all of our operations are conducted through, the Operating Partnership. Through a wholly-owned subsidiary, we are the sole general partner of the Operating Partnership. At December 31, 2023, we owned, directly and indirectly, approximately 87% of the Operating Partnership’s issued and outstanding common units of limited partnership interest (“Common Units”), and all of the Operating Partnership’s issued and outstanding Series E and Series F preferred units of limited partnership interests. NewcrestImage Holdings, LLC owns all of the issued and outstanding 5.25% Series Z Cumulative Perpetual Preferred Units (Liquidation preference $25 per unit) of the Operating Partnership ("Series Z Preferred Units"), which was issued as part of the NCI Transaction (as defined under Part 1 - Item 1. "Our Financing Strategy" below). We collectively refer to preferred units of limited partnership interests of our Operating Partnership as "Preferred Units."

Pursuant to the Operating Partnership’s partnership agreement, we have full, exclusive and complete responsibility and discretion in the management and control of the Operating Partnership, including the ability to cause the Operating Partnership to enter into certain major transactions including acquisitions, dispositions and refinancings, to make distributions to partners and to cause changes in the Operating Partnership’s business activities.

We have elected to be taxed as a REIT for federal income tax purposes. To qualify as a REIT, we cannot operate or manage our lodging properties. Accordingly, all of our lodging properties are leased to our taxable REIT subsidiaries ("TRS Lessees" or "TRSs") and managed by professional third-party property management companies. We have one reportable segment as defined by generally accepted accounting principles (“GAAP”). See "Part II – Item 8. – Financial Statements and Supplementary Data – Note 2 – Basis of Presentation and Significant Accounting Policies" to our Consolidated Financial Statements.

Our corporate offices are located at 13215 Bee Cave Parkway, Suite B-300, Austin, TX 78738. Our telephone number is (512) 538-2300. Our website is www.shpreit.com. The information contained on, or accessible through, our website is not incorporated by reference into this report and should not be considered a part of this report.

Effects of COVID-19 Pandemic

Beginning in March 2020, we experienced the adverse effects of the COVID-19 pandemic (the "Pandemic"), which had a significant negative effect on the U.S. and global economies, including a rapid and sharp decline in all forms of travel, both domestic and international, and a significant decline in lodging demand. As such, we experienced a substantial decline in our revenues, profitability and cash flows from operations from the onset of the Pandemic and into the first quarter of 2022. We began to experience a recovery in our business in the first quarter of 2022, which accelerated in the second quarter of 2022 and thereafter. As a result, we experienced significant improvement in lodging demand during the years ended December 31, 2023 and 2022 led by strong leisure travel and more recently, growth in business transient and group travel.

Business Strategy

Our portfolio consists of lodging properties in desirable locations with efficient operating models. Our approach to creating value includes the following:

•Strategically allocate capital which includes, among other things, capital investment, growth initiatives and other strategic transactions;

•Evolving our portfolio by selling assets with lower operating margins, RevPAR growth opportunities or risk-adjusted return profiles and purchasing assets with higher operating margins, RevPAR growth opportunities or risk-adjusted return profiles; and

•Intensive asset and revenue management.

The key elements of our strategy that we believe will allow us to create long-term value include the following:

Focus on Lodging Properties with Efficient Operating Models. We focus on lodging properties with efficient operating models that are predominantly in the Upscale segment of the lodging industry, as defined by Smith Travel Research ("STR"). We believe that our focus on this segment provides us the opportunity to achieve strong, risk-adjusted returns across multiple lodging cycles for several reasons, including:

•RevPAR Growth. We believe that our lodging properties are positioned for long-term demand growth supported by the characteristics of our portfolio and its ability to appeal to evolving guests preferences.

•Stable Cash Flow. Our lodging properties are generally operated with fewer employees than full-service lodging properties, which enables our assets to generate higher operating margins and cash flows with less volatility.

•Broad Customer Base. Our target brands deliver consistently high-quality guest accommodations with value-oriented pricing that we believe appeals to a wide range of customers, including business transient, group, leisure and government travelers. We believe that our lodging properties are particularly popular with frequent travelers who seek to stay in properties operating under Marriott, Hilton, Hyatt, or IHG brands, which offer strong loyalty rewards programs.

•Lower Capital Requirements and Enhanced Diversification. Lodging properties with efficient operating models generally require less capital to acquire, build, and maintain on an absolute and a per-key basis, than lodging properties in the full-service segment of the industry. As a result, we can diversify our investment capital into ownership of a larger number of lodging properties than we could in the full-service segment.

Capitalize on Investments in Our Lodging Properties. We believe in the benefits of strategically investing capital in our properties to ensure they are in good physical condition and facilitate market leading financial performance. We believe these investments produce attractive returns, and we intend to continue to invest capital to upgrade our lodging properties with strategic renovations, property improvement plans, and return on discretionary investments.

External Growth Through Acquisitions. We intend to continue to opportunistically grow through acquisitions of existing lodging properties either through wholly owned or joint venture structures using a disciplined approach, while maintaining a prudent capital structure. We generally target lodging facilities with efficient operating models that meet one or more of the following acquisition criteria:

•potential for strong risk-adjusted returns and are located in the top 50 MSAs and other select destination markets;

•operate under leading franchise brands, which may include but are not limited to brands owned by Marriott, Hilton, Hyatt, and IHG, as well as select independent lodging properties that meet our investment criteria;

•located in close proximity to multiple demand generators, such as corporate offices and headquarters, retail centers, airports, state capitols, convention centers, universities, and leisure attractions, with a diverse source of potential guests, including business transient, group, leisure, and government travelers;

•located in markets with barriers to entry due to lengthy or challenging real estate entitlement processes or other factors;

•can be acquired at a discount to replacement cost; and

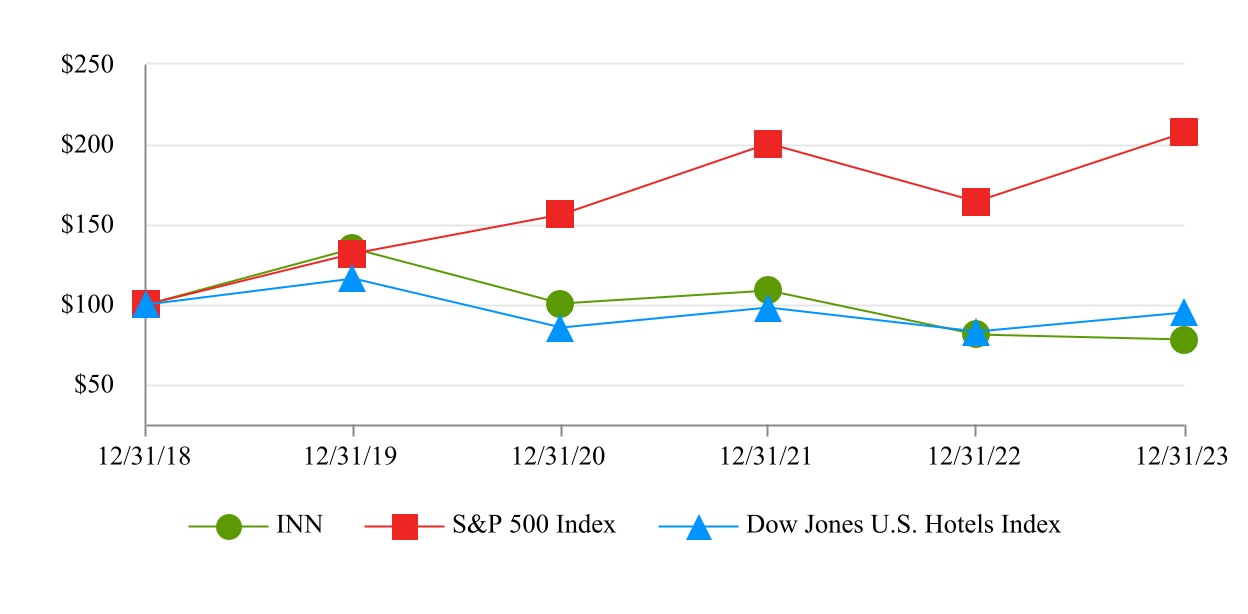

•provide an opportunity to add value through operating efficiencies, revenue management and asset management expertise, repositioning, renovating or rebranding.