False000149696312-312023Q200014969632023-01-012023-06-300001496963us-gaap:CommonClassAMember2023-06-30xbrli:shares0001496963us-gaap:CommonClassBMember2023-06-300001496963us-gaap:CommonClassCMember2023-06-3000014969632023-06-30iso4217:USD00014969632022-12-31iso4217:USDxbrli:shares0001496963us-gaap:CommonClassAMember2022-12-310001496963us-gaap:CommonClassBMember2022-12-310001496963us-gaap:CommonClassCMember2022-12-3100014969632023-04-012023-06-3000014969632022-04-012022-06-3000014969632022-01-012022-06-300001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001496963us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-12-310001496963us-gaap:AdditionalPaidInCapitalMember2022-12-310001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001496963us-gaap:RetainedEarningsMember2022-12-310001496963us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100014969632023-01-012023-03-310001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-310001496963us-gaap:RetainedEarningsMember2023-01-012023-03-310001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-03-310001496963us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-03-310001496963us-gaap:AdditionalPaidInCapitalMember2023-03-310001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001496963us-gaap:RetainedEarningsMember2023-03-3100014969632023-03-310001496963us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-04-012023-06-300001496963us-gaap:RetainedEarningsMember2023-04-012023-06-300001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-06-300001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-06-300001496963us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-06-300001496963us-gaap:AdditionalPaidInCapitalMember2023-06-300001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001496963us-gaap:RetainedEarningsMember2023-06-300001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001496963us-gaap:CommonClassCMemberus-gaap:CommonStockMember2021-12-310001496963us-gaap:AdditionalPaidInCapitalMember2021-12-310001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001496963us-gaap:RetainedEarningsMember2021-12-3100014969632021-12-310001496963us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100014969632022-01-012022-03-310001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-03-310001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-01-012022-03-310001496963us-gaap:RetainedEarningsMember2022-01-012022-03-310001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-03-310001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-03-310001496963us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-03-310001496963us-gaap:AdditionalPaidInCapitalMember2022-03-310001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001496963us-gaap:RetainedEarningsMember2022-03-3100014969632022-03-310001496963us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-04-012022-06-300001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-04-012022-06-300001496963us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-04-012022-06-300001496963us-gaap:RetainedEarningsMember2022-04-012022-06-300001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001496963us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-06-300001496963us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-06-300001496963us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-06-300001496963us-gaap:AdditionalPaidInCapitalMember2022-06-300001496963us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001496963us-gaap:RetainedEarningsMember2022-06-3000014969632022-06-30sqsp:institution0001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001496963sqsp:PresenceMember2023-04-012023-06-300001496963sqsp:CommerceMember2023-04-012023-06-300001496963sqsp:PresenceMember2023-01-012023-06-300001496963sqsp:CommerceMember2023-01-012023-06-300001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001496963sqsp:PresenceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001496963sqsp:CommerceMembersqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001496963sqsp:SubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001496963sqsp:PresenceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001496963sqsp:CommerceMembersqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001496963sqsp:NonSubscriptionRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001496963sqsp:PresenceMember2022-04-012022-06-300001496963sqsp:CommerceMember2022-04-012022-06-300001496963sqsp:PresenceMember2022-01-012022-06-300001496963sqsp:CommerceMember2022-01-012022-06-300001496963country:US2023-04-012023-06-300001496963country:US2022-04-012022-06-300001496963country:US2023-01-012023-06-300001496963country:US2022-01-012022-06-300001496963us-gaap:NonUsMember2023-04-012023-06-300001496963us-gaap:NonUsMember2022-04-012022-06-300001496963us-gaap:NonUsMember2023-01-012023-06-300001496963us-gaap:NonUsMember2022-01-012022-06-300001496963sqsp:PrepaidReferralFeesMember2023-06-300001496963sqsp:PrepaidReferralFeesMember2022-12-310001496963sqsp:PrepaidAppFeesMember2023-06-300001496963sqsp:PrepaidAppFeesMember2022-12-310001496963sqsp:SalesCommissionsMember2023-06-300001496963sqsp:SalesCommissionsMember2022-12-310001496963sqsp:CorporateDebtSecuritiesAndCommercialPaperMember2022-12-310001496963us-gaap:AssetBackedSecuritiesMember2022-12-310001496963us-gaap:USTreasurySecuritiesMember2022-12-310001496963us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-06-300001496963us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-06-300001496963us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-06-300001496963us-gaap:MoneyMarketFundsMember2023-06-300001496963us-gaap:FairValueInputsLevel1Member2023-06-300001496963us-gaap:FairValueInputsLevel2Member2023-06-300001496963us-gaap:FairValueInputsLevel3Member2023-06-300001496963us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-12-310001496963us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001496963us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310001496963us-gaap:MoneyMarketFundsMember2022-12-310001496963us-gaap:FairValueInputsLevel1Membersqsp:CorporateDebtSecuritiesAndCommercialPaperMember2022-12-310001496963us-gaap:FairValueInputsLevel2Membersqsp:CorporateDebtSecuritiesAndCommercialPaperMember2022-12-310001496963us-gaap:FairValueInputsLevel3Membersqsp:CorporateDebtSecuritiesAndCommercialPaperMember2022-12-310001496963us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001496963us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001496963us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001496963us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2022-12-310001496963us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2022-12-310001496963us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001496963us-gaap:FairValueInputsLevel1Member2022-12-310001496963us-gaap:FairValueInputsLevel2Member2022-12-310001496963us-gaap:FairValueInputsLevel3Member2022-12-310001496963us-gaap:LineOfCreditMembersqsp:A2019CreditAgreementMember2019-12-120001496963us-gaap:RevolvingCreditFacilityMembersqsp:A2019CreditAgreementMember2019-12-120001496963us-gaap:LetterOfCreditMembersqsp:A2019CreditAgreementMember2019-12-120001496963us-gaap:LineOfCreditMembersqsp:A2020CreditAgreementMember2020-12-110001496963us-gaap:LineOfCreditMembersqsp:A2020CreditAgreementMembersqsp:SecuredOvernightFinancingRateSOFRMember2023-06-300001496963sqsp:A2020CreditAgreementMember2023-01-012023-06-30xbrli:pure0001496963sqsp:A2020CreditAgreementMember2022-01-012022-06-300001496963sqsp:LondonInterbankOfferedRateLIBOR1Membersqsp:A2020CreditAgreementMember2023-06-220001496963sqsp:A2020CreditAgreementMember2023-06-300001496963sqsp:A2020CreditAgreementMember2022-06-300001496963sqsp:A2020CreditAgreementMemberus-gaap:LetterOfCreditMember2023-06-300001496963sqsp:A2020CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-06-3000014969632022-09-072022-09-070001496963srt:MinimumMembersqsp:A2020CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-06-300001496963srt:MaximumMembersqsp:A2020CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-06-300001496963sqsp:A2020CreditAgreementMember2020-01-012020-12-310001496963sqsp:A2020CreditAgreementMember2022-01-012022-03-310001496963sqsp:A2020CreditAgreementMember2022-04-012022-06-300001496963sqsp:A2020CreditAgreementMember2022-07-012022-09-300001496963sqsp:A2020CreditAgreementMember2022-10-012022-12-310001496963sqsp:A2020CreditAgreementMember2023-01-012023-03-31sqsp:time0001496963us-gaap:CustomerRelatedIntangibleAssetsMember2023-06-150001496963us-gaap:LineOfCreditMembersqsp:A2020AmendedCreditAgreementMember2023-06-1500014969632022-03-10sqsp:sublease0001496963stpr:IL2023-04-012023-06-300001496963stpr:IL2023-01-012023-06-300001496963stpr:IL2022-01-012022-06-300001496963stpr:IL2022-04-012022-06-300001496963stpr:CA2022-01-012022-06-300001496963us-gaap:CommonClassAMember2023-01-012023-06-30sqsp:vote0001496963us-gaap:CommonClassAMember2022-05-100001496963us-gaap:CommonClassAMember2022-04-012022-06-300001496963us-gaap:CommonClassAMember2022-01-012022-06-300001496963us-gaap:CommonClassBMember2023-01-012023-06-300001496963us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001496963us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-03-310001496963us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-03-310001496963us-gaap:AccumulatedTranslationAdjustmentMember2023-04-012023-06-300001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-012023-06-300001496963us-gaap:AccumulatedTranslationAdjustmentMember2023-06-300001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-06-300001496963us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001496963us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-03-310001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-03-310001496963us-gaap:AccumulatedTranslationAdjustmentMember2022-03-310001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-03-310001496963us-gaap:AccumulatedTranslationAdjustmentMember2022-04-012022-06-300001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-04-012022-06-300001496963us-gaap:AccumulatedTranslationAdjustmentMember2022-06-300001496963us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-06-300001496963sqsp:A2008EquityIncentivePlanMember2017-11-182023-06-300001496963sqsp:A2008EquityIncentivePlanMember2023-04-012023-06-300001496963sqsp:A2008EquityIncentivePlanMember2023-01-012023-06-300001496963sqsp:A2008EquityIncentivePlanMember2022-04-012022-06-300001496963sqsp:A2008EquityIncentivePlanMember2022-01-012022-06-300001496963sqsp:A2017EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001496963sqsp:A2017EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001496963sqsp:A2017EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001496963sqsp:A2017EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001496963sqsp:A2017EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-04-162023-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMemberus-gaap:PerformanceSharesMember2023-03-012023-03-310001496963sqsp:A2021EquityIncentivePlanMemberus-gaap:PerformanceSharesMember2023-03-012023-03-310001496963srt:MinimumMembersqsp:A2021EquityIncentivePlanMemberus-gaap:PerformanceSharesMember2023-03-012023-03-310001496963srt:MaximumMembersqsp:A2021EquityIncentivePlanMemberus-gaap:PerformanceSharesMember2023-03-012023-03-310001496963sqsp:CasalenaPerformanceAwardMemberus-gaap:CommonClassAMembersrt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2021-04-152021-04-150001496963sqsp:CasalenaPerformanceAwardMemberus-gaap:CommonClassAMembersrt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMembersqsp:CasalenaPerformanceAwardMembersrt:ChiefExecutiveOfficerMember2023-04-012023-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMembersqsp:CasalenaPerformanceAwardMembersrt:ChiefExecutiveOfficerMember2023-01-012023-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMembersqsp:CasalenaPerformanceAwardMembersrt:ChiefExecutiveOfficerMember2022-04-012022-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMembersqsp:CasalenaPerformanceAwardMembersrt:ChiefExecutiveOfficerMember2022-01-012022-06-300001496963us-gaap:CostOfSalesMember2023-04-012023-06-300001496963us-gaap:CostOfSalesMember2022-04-012022-06-300001496963us-gaap:CostOfSalesMember2023-01-012023-06-300001496963us-gaap:CostOfSalesMember2022-01-012022-06-300001496963us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001496963us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001496963us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001496963us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300001496963us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001496963us-gaap:SellingAndMarketingExpenseMember2022-04-012022-06-300001496963us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300001496963us-gaap:SellingAndMarketingExpenseMember2022-01-012022-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001496963us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-06-300001496963us-gaap:PropertyPlantAndEquipmentMember2023-04-012023-06-300001496963us-gaap:PropertyPlantAndEquipmentMember2023-01-012023-06-300001496963us-gaap:PropertyPlantAndEquipmentMember2022-04-012022-06-300001496963us-gaap:PropertyPlantAndEquipmentMember2022-01-012022-06-300001496963srt:ScenarioForecastMember2023-01-012026-12-310001496963srt:ManagementMember2022-04-012022-06-300001496963srt:ManagementMember2022-01-012022-06-300001496963srt:ManagementMember2022-06-300001496963us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001496963us-gaap:EmployeeStockOptionMember2022-04-012022-06-300001496963us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001496963us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001496963us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001496963us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001496963us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001496963us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 10-Q

_________________________________

[Mark One]

|

|

|

|

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

|

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File Number: 001-40393

SQUARESPACE, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

(State or Other Jurisdiction of

Incorporation or Organization)

|

20-0375811

(I.R.S. Employer

Identification No.)

|

|

|

|

225 Varick Street, 12th Floor

New York, New York

(Address of Principal Executive Offices)

|

10014

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (646) 580-3456

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class

Class A Common Stock, $0.0001 par value per share

|

Trading Symbol(s)

SQSP

|

Name of each exchange on which registered

New York Stock Exchange

|

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

Emerging Growth Company |

☒ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2023, the registrant had 87,723,667 shares of Class A Common Stock, 47,844,755 shares of Class B Common Stock, and no shares of Class C Common Stock, each with a par value of $0.0001 per share, outstanding.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that reflect our current views with respect to, among other things, future events and our future business, financial condition and results of operations. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or phrases or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not statements of historical fact, and are based on current expectations, estimates and projections about our industry as well as certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, which you should consider and read carefully, including but not limited to:

• our ability to attract and retain customers and expand our customers’ use of our platform;

•our ability to anticipate market needs and develop new solutions to meet those needs;

•our ability to improve and enhance the functionality, performance, reliability, design, security and scalability of our existing solutions;

•our ability to compete successfully in our industry against current and future competitors;

•the impact of the COVID-19 pandemic on how we, our providers, and consumers operate and its impact on the global economy, and the duration and extent to which the pandemic will affect our business, future results of operations, and financial condition;

•our ability to manage growth and maintain demand for our solutions;

•our ability to protect and promote our brand;

•our ability to generate new customers through our marketing and selling activities;

•our ability to successfully identify, manage and integrate any existing and potential acquisitions;

•our ability to hire, integrate and retain highly skilled personnel;

•our ability to adapt to and comply with existing and emerging regulatory developments, technological changes and cybersecurity needs;

•our compliance with privacy and data protection laws and regulations as well as contractual privacy and data protection obligations;

•our ability to establish and maintain intellectual property rights;

•our ability to manage expansion into international markets;

•the expected timing, amount, and effect of our share repurchases; and

• the other risks and uncertainties described under “Risk Factors.”

This list of factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Quarterly Report on Form 10-Q. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Quarterly Report on Form 10-Q, and our future levels of activity and performance, may not occur and actual results could differ materially and adversely from those described or implied in the forward-looking statements. As a result, you should not regard any of these forward-looking statements as a representation or warranty by us or any other person or place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

In addition, statements that contain “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report on Form 10-Q. While we believe that this information provides a reasonable basis for these statements, this information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

You should read this Quarterly Report on Form 10-Q and the documents that we reference herein and have filed as exhibits to the Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by the cautionary statements contained in this section and elsewhere in this Quarterly Report on Form 10-Q.

PART 1 - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

SQUARESPACE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

December 31, 2022 |

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

274,004 |

|

|

$ |

197,037 |

|

| Restricted cash |

34,272 |

|

|

35,583 |

|

| Investment in marketable securities |

— |

|

|

31,757 |

|

| Accounts receivable, net |

9,748 |

|

|

10,748 |

|

| Due from vendors |

3,030 |

|

|

4,442 |

|

| Prepaid expenses and other current assets |

51,305 |

|

|

48,326 |

|

| Total current assets |

372,359 |

|

|

327,893 |

|

| Property and equipment, net |

53,874 |

|

|

51,633 |

|

| Operating lease right-of-use assets |

82,247 |

|

|

86,824 |

|

| Goodwill |

210,438 |

|

|

210,438 |

|

| Intangible assets, net |

35,118 |

|

|

42,808 |

|

| Other assets |

12,376 |

|

|

10,921 |

|

| Total assets |

$ |

766,412 |

|

|

$ |

730,517 |

|

Liabilities and Stockholders’ Deficit |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

4,782 |

|

|

$ |

12,987 |

|

| Accrued liabilities |

83,222 |

|

|

64,360 |

|

| Deferred revenue |

308,662 |

|

|

269,689 |

|

| Funds payable to customers |

36,713 |

|

|

38,845 |

|

| Debt, current portion |

40,758 |

|

|

40,758 |

|

| Operating lease liabilities, current portion |

12,104 |

|

|

11,514 |

|

| Total current liabilities |

486,241 |

|

|

438,153 |

|

| Deferred income taxes, non-current portion |

912 |

|

|

788 |

|

| Debt, non-current portion |

453,230 |

|

|

473,167 |

|

| Operating lease liabilities, non-current portion |

104,020 |

|

|

110,169 |

|

| Other liabilities |

13,205 |

|

|

11,231 |

|

| Total liabilities |

1,057,608 |

|

|

1,033,508 |

|

| Commitments and contingencies (see Note 10) |

|

|

|

| Stockholders’ deficit: |

|

|

|

Class A common stock, par value of $0.0001; 1,000,000,000 shares authorized as of June 30, 2023 and December 31, 2022, respectively; 87,723,667 and 87,754,534 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively |

8 |

|

|

8 |

|

Class B common stock, par value of $0.0001; 100,000,000 shares authorized as of June 30, 2023 and December 31, 2022, respectively; 47,844,755 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively |

5 |

|

|

5 |

|

Class C common stock (authorized May 10, 2021), par value of $0.0001; 1,000,000,000 shares authorized as of June 30, 2023 and December 31, 2022, respectively; zero shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively |

— |

|

|

— |

|

| Additional paid in capital |

883,192 |

|

|

875,737 |

|

| Accumulated other comprehensive loss |

(1,487) |

|

|

(1,665) |

|

| Accumulated deficit |

(1,172,914) |

|

|

(1,177,076) |

|

| Total stockholders’ deficit |

(291,196) |

|

|

(302,991) |

|

| Total liabilities and stockholders’ deficit |

$ |

766,412 |

|

|

$ |

730,517 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

SQUARESPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

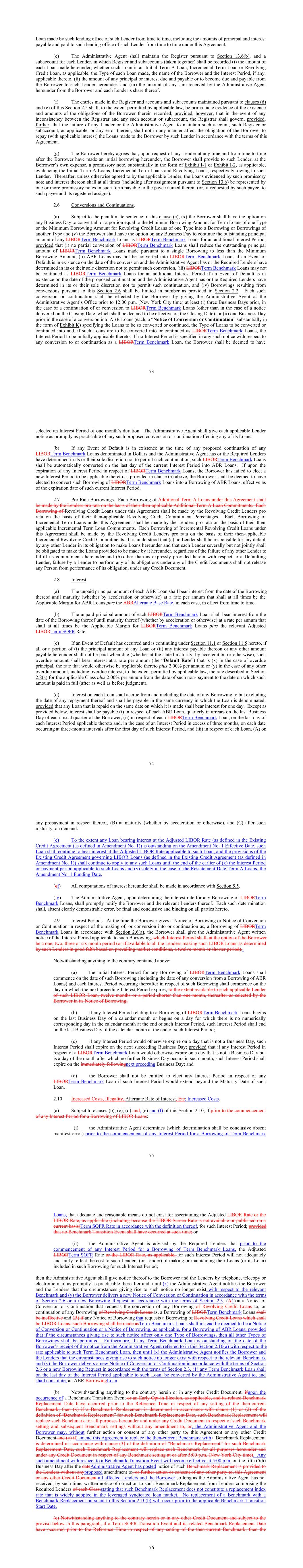

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenue |

$ |

247,529 |

|

|

$ |

212,702 |

|

|

$ |

484,557 |

|

|

$ |

420,464 |

|

| Cost of revenue |

43,167 |

|

|

36,993 |

|

|

86,117 |

|

|

73,642 |

|

| Gross profit |

204,362 |

|

|

175,709 |

|

|

398,440 |

|

|

346,822 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Research and product development |

61,412 |

|

|

58,829 |

|

|

119,982 |

|

|

116,157 |

|

| Marketing and sales |

75,373 |

|

|

68,743 |

|

|

177,045 |

|

|

181,649 |

|

| General and administrative |

30,909 |

|

|

39,190 |

|

|

63,249 |

|

|

75,171 |

|

| Total operating expenses |

167,694 |

|

|

166,762 |

|

|

360,276 |

|

|

372,977 |

|

| Operating income/(loss) |

36,668 |

|

|

8,947 |

|

|

38,164 |

|

|

(26,155) |

|

| Interest expense |

(8,635) |

|

|

(3,319) |

|

|

(16,729) |

|

|

(5,768) |

|

| Other income, net |

2,038 |

|

|

6,217 |

|

|

1,198 |

|

|

7,728 |

|

| Income/(loss) before (provision for)/benefit from income taxes |

30,071 |

|

|

11,845 |

|

|

22,633 |

|

|

(24,195) |

|

| (Provision for)/benefit from income taxes |

(26,411) |

|

|

52,651 |

|

|

(18,471) |

|

|

(4,169) |

|

| Net income/(loss) |

$ |

3,660 |

|

|

$ |

64,496 |

|

|

$ |

4,162 |

|

|

$ |

(28,364) |

|

|

|

|

|

|

|

|

|

| Net income/(loss) per share attributable to Class A, Class B and Class C common stockholders, basic |

$ |

0.03 |

|

|

$ |

0.46 |

|

|

$ |

0.03 |

|

|

$ |

(0.20) |

|

| Net income/(loss) per share attributable to Class A, Class B and Class C common stockholders, dilutive |

$ |

0.03 |

|

|

$ |

0.45 |

|

|

$ |

0.03 |

|

|

$ |

(0.20) |

|

| Weighted-average shares used in computing net income/(loss) per share attributable to Class A, Class B and Class C stockholders, basic |

135,302,409 |

|

|

140,082,038 |

|

|

135,111,072 |

|

|

139,754,453 |

|

| Weighted-average shares used in computing net income/(loss) per share attributable to Class A, Class B and Class C stockholders, dilutive |

138,771,613 |

|

|

142,133,303 |

|

|

138,013,454 |

|

|

139,754,453 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

SQUARESPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/(LOSS)

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net income/(loss) |

$ |

3,660 |

|

|

$ |

64,496 |

|

|

$ |

4,162 |

|

|

$ |

(28,364) |

|

| Other comprehensive (loss)/income |

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

(296) |

|

|

(2,037) |

|

|

(38) |

|

|

(2,838) |

|

| Unrealized (loss)/gain on marketable securities, net of income taxes |

— |

|

|

(77) |

|

|

216 |

|

|

(255) |

|

| Total other comprehensive (loss)/income |

(296) |

|

|

(2,114) |

|

|

178 |

|

|

(3,093) |

|

| Total comprehensive income/(loss) |

$ |

3,364 |

|

|

$ |

62,382 |

|

|

$ |

4,340 |

|

|

$ |

(31,457) |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

SQUARESPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' DEFICIT

(in thousands, except share and per share data)

(unaudited)

Three and Six Months Ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A

Common Stock

|

|

Class B

Common Stock

|

|

Class C

Common Stock

|

|

Additional

Paid in

Capital

|

|

Accumulated Other Comprehensive Loss |

|

Accumulated

Deficit |

|

Total

Stockholders’

Deficit |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

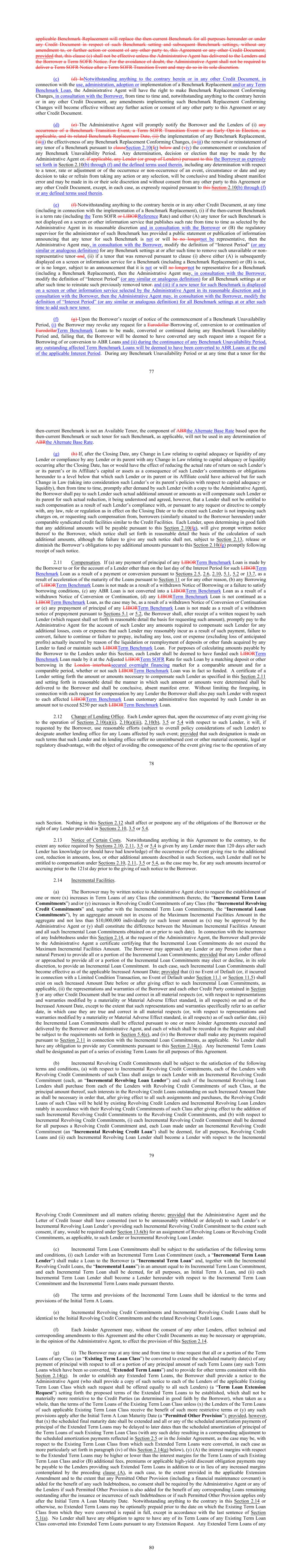

| Balance at December 31, 2022 |

87,754,534 |

|

|

$ |

8 |

|

|

47,844,755 |

|

|

$ |

5 |

|

|

— |

|

|

$ |

— |

|

|

$ |

875,737 |

|

|

$ |

(1,665) |

|

|

$ |

(1,177,076) |

|

|

$ |

(302,991) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

22,595 |

|

|

— |

|

|

— |

|

|

22,595 |

|

| Stock option exercises |

13,050 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

52 |

|

|

— |

|

|

— |

|

|

52 |

|

| Vested RSUs converted to common shares |

1,357,462 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Taxes paid related to net share settlement of equity awards |

(573,862) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(13,369) |

|

|

— |

|

|

— |

|

|

(13,369) |

|

| Repurchase and retirement of Class A common stock |

(1,256,170) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(25,321) |

|

|

— |

|

|

— |

|

|

(25,321) |

|

| Excise tax on repurchase of Class A common stock |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(277) |

|

|

— |

|

|

— |

|

|

(277) |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

502 |

|

|

502 |

|

| Total other comprehensive income, net of taxes |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

474 |

|

|

— |

|

|

474 |

|

| Balance at March 31, 2023 |

87,295,014 |

|

|

$ |

8 |

|

|

47,844,755 |

|

|

$ |

5 |

|

|

— |

|

|

$ |

— |

|

|

$ |

859,417 |

|

|

$ |

(1,191) |

|

|

$ |

(1,176,574) |

|

|

$ |

(318,335) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

30,648 |

|

|

— |

|

|

— |

|

|

30,648 |

|

| Stock option exercises |

21,635 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

42 |

|

|

— |

|

|

— |

|

|

42 |

|

| Vested RSUs converted to common shares |

640,562 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Taxes paid related to net share settlement of equity awards |

(233,544) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(6,915) |

|

|

— |

|

|

— |

|

|

(6,915) |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3,660 |

|

|

3,660 |

|

| Total other comprehensive loss, net of taxes |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(296) |

|

|

— |

|

|

(296) |

|

| Balance at June 30, 2023 |

87,723,667 |

|

|

$ |

8 |

|

|

47,844,755 |

|

|

$ |

5 |

|

|

— |

|

|

$ |

— |

|

|

$ |

883,192 |

|

|

$ |

(1,487) |

|

|

$ |

(1,172,914) |

|

|

$ |

(291,196) |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

SQUARESPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' DEFICIT

(in thousands, except share and per share data)

(unaudited)

Three and Six Months Ended June 30, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A

Common Stock

|

|

Class B

Common Stock

|

|

Class C

Common Stock

|

|

Additional

Paid in

Capital

|

|

Accumulated Other Comprehensive Loss |

|

Accumulated

Deficit |

|

Total

Stockholders’

Deficit |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

| Balance at December 31, 2021 |

90,826,625 |

|

|

$ |

9 |

|

|

48,344,755 |

|

|

$ |

5 |

|

|

— |

|

|

$ |

— |

|

|

$ |

911,570 |

|

|

$ |

(208) |

|

|

$ |

(924,855) |

|

|

$ |

(13,479) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

24,160 |

|

|

— |

|

|

— |

|

|

24,160 |

|

| Stock option exercises |

343,687 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,141 |

|

|

— |

|

|

— |

|

|

1,141 |

|

| Vested RSUs converted to common shares |

680,134 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Taxes paid related to net share settlement of equity awards |

(287,455) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(7,672) |

|

|

— |

|

|

— |

|

|

(7,672) |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(92,860) |

|

|

(92,860) |

|

| Total other comprehensive loss, net of taxes |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(979) |

|

|

— |

|

|

(979) |

|

| Balance at March 31, 2022 |

91,562,991 |

|

|

$ |

9 |

|

|

48,344,755 |

|

|

$ |

5 |

|

|

— |

|

|

$ |

— |

|

|

$ |

929,199 |

|

|

$ |

(1,187) |

|

|

$ |

(1,017,715) |

|

|

$ |

(89,689) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

27,056 |

|

|

— |

|

|

— |

|

|

27,056 |

|

| Stock option exercises |

269,064 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

969 |

|

|

— |

|

|

— |

|

|

969 |

|

| Vested RSUs converted to common shares |

827,149 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Taxes paid related to net share settlement of equity awards |

(350,156) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(7,602) |

|

|

— |

|

|

— |

|

|

(7,602) |

|

| Repurchase and retirement of Class A common stock |

(1,562,460) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(35,202) |

|

|

— |

|

|

— |

|

|

(35,202) |

|

| Conversion of Class B common stock to Class A common stock |

500,000 |

|

|

— |

|

|

(500,000) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

64,496 |

|

|

64,496 |

|

| Total other comprehensive loss, net of taxes |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,114) |

|

|

— |

|

|

(2,114) |

|

| Balance at June 30, 2022 |

91,246,588 |

|

|

$ |

9 |

|

|

47,844,755 |

|

|

$ |

5 |

|

|

— |

|

|

$ |

— |

|

|

$ |

914,420 |

|

|

$ |

(3,301) |

|

|

$ |

(953,219) |

|

|

$ |

(42,086) |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

SQUARESPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

OPERATING ACTIVITIES: |

|

|

|

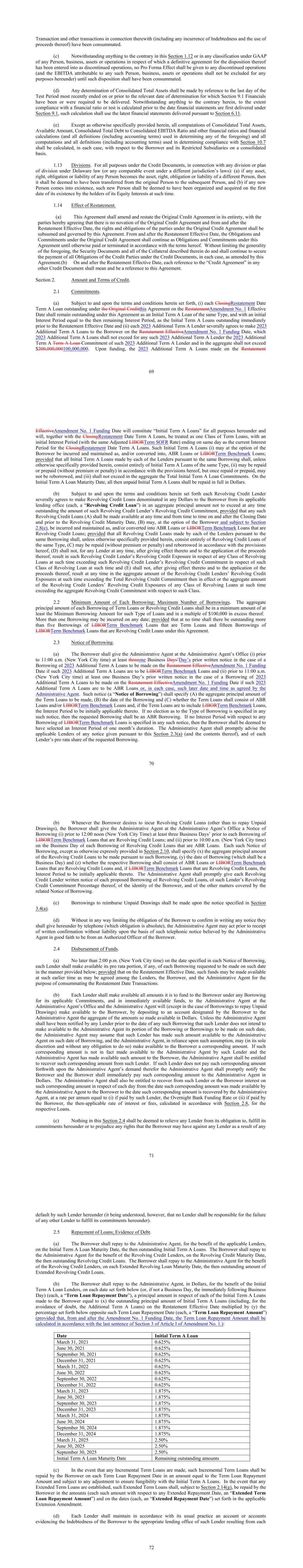

| Net income/(loss) |

$ |

4,162 |

|

|

$ |

(28,364) |

|

| Adjustments to reconcile net income/(loss) to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

14,477 |

|

|

15,869 |

|

| Stock-based compensation |

51,605 |

|

|

50,957 |

|

| Deferred income taxes |

124 |

|

|

— |

|

| Non-cash lease (income)/expense |

(989) |

|

|

638 |

|

| Other |

310 |

|

|

502 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable and due from vendors |

2,364 |

|

|

(1,701) |

|

| Prepaid expenses and other current assets |

(1,480) |

|

|

(3,021) |

|

| Accounts payable and accrued liabilities |

9,822 |

|

|

9,260 |

|

| Deferred revenue |

38,030 |

|

|

30,294 |

|

| Funds payable to customers |

(2,131) |

|

|

9,456 |

|

| Other operating assets and liabilities |

408 |

|

|

(207) |

|

| Net cash provided by operating activities |

116,702 |

|

|

83,683 |

|

INVESTING ACTIVITIES: |

|

|

|

| Proceeds from the sale and maturities of marketable securities |

39,664 |

|

|

15,940 |

|

| Purchases of marketable securities |

(7,824) |

|

|

(17,016) |

|

| Purchase of property and equipment |

(7,167) |

|

|

(5,735) |

|

| Net cash provided by/(used in) investing activities |

24,673 |

|

|

(6,811) |

|

FINANCING ACTIVITIES: |

|

|

|

| Principal payments on debt |

(20,379) |

|

|

(6,793) |

|

| Payments for repurchase and retirement of Class A common stock |

(25,321) |

|

|

(35,202) |

|

| Taxes paid related to net share settlement of equity awards |

(20,318) |

|

|

(15,269) |

|

| Proceeds from exercise of stock options |

134 |

|

|

2,110 |

|

| Net cash used in financing activities |

(65,884) |

|

|

(55,154) |

|

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

165 |

|

|

(600) |

|

| Net increase in cash, cash equivalents and restricted cash |

75,656 |

|

|

21,118 |

|

| Cash, cash equivalents, and restricted cash at the beginning of the period |

232,620 |

|

|

233,680 |

|

| Cash, cash equivalents, and restricted cash at the end of the period |

$ |

308,276 |

|

|

$ |

254,798 |

|

|

|

|

|

| Reconciliation of cash, cash equivalents, and restricted cash: |

|

|

|

| Cash and cash equivalents |

$ |

274,004 |

|

|

$ |

215,092 |

|

| Restricted cash |

34,272 |

|

|

39,706 |

|

| Cash, cash equivalents, and restricted cash at the end of the period |

$ |

308,276 |

|

|

$ |

254,798 |

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW |

|

|

|

| Cash paid during the year for interest |

$ |

16,360 |

|

|

$ |

5,247 |

|

| Cash paid during the year for income taxes |

$ |

22,902 |

|

|

$ |

5,968 |

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCE ACTIVITIES |

|

|

|

| Purchases of property and equipment included in accounts payable and accrued liabilities |

$ |

196 |

|

|

$ |

1,582 |

|

| Non-cash leasehold improvements |

$ |

— |

|

|

$ |

5,679 |

|

| Capitalized stock-based compensation |

$ |

1,638 |

|

|

$ |

259 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

SQUARESPACE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

(unaudited)

1.Description of Business

Squarespace, Inc. and its subsidiaries (the “Company”) is a leading all-in-one platform for businesses and independent creators to build an online presence, grow their brands and manage their businesses across the internet. The Company offers websites, domains, e-commerce, tools for managing a social media presence, marketing tools, scheduling and hospitality services. The Company is headquartered in New York, NY, with additional offices operating in Chicago, IL, Dublin, Ireland, and Aveiro, Portugal.

Emerging Growth Company Status

The Company is an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act, until such time as those standards apply to private companies.

The Company has elected to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date that the Company (i) is no longer an emerging growth company or (ii) affirmatively and irrevocably opts out of the extended transition period provided in the JOBS Act. As a result, the Company’s condensed consolidated financial statements may not be comparable to financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards based on public company effective dates.

The Company will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which the Company’s total annual gross revenue is at least $1,235,000, (ii) the last day of the fiscal year following the fifth anniversary of the completion of the Company's direct listing, (iii) the date on which the Company issued more than $1,000,000 in non-convertible debt securities during the prior three-year period, or (iv) the date on which the Company becomes a large accelerated filer.

2.Summary of Significant Accounting Policies

Basis of Presentation and Consolidation

The Company’s condensed consolidated financial statements and related notes have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and include the Company’s wholly-owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to the applicable rules and regulations of the Securities and Exchange Commission. The condensed balance sheet data as of December 31, 2022 was derived from the Company's audited financial statements but does not include all disclosures required by U.S. GAAP. Therefore, these unaudited, condensed, consolidated financial statements and accompanying notes should be read in conjunction with the Company's annual consolidated financial statements and related notes included in the Company's Annual Report on Form 10-K filed with the SEC on March 9, 2023. In the opinion of management, the condensed consolidated financial statements reflect all adjustments, consisting only of normal recurring adjustments, which are necessary for the fair statement of the Company’s financial information.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Management’s estimates are based on historical experience and on various other market-specific and relevant assumptions that management believes to be reasonable under the circumstances. Actual results could differ from those estimates.

Significant estimates include but are not limited to (i) the recognition and measurement of loss contingencies; (ii) the inputs used in the valuation of acquired intangible assets; (iii) the inputs used in the quantitative assessment over goodwill impairment (iii) the grant date fair value of stock-based awards; (iv) the recognition, measurement and valuation of current and deferred income taxes; (v) existence of applicable indirect tax nexus in different jurisdictions and associated indirect tax liabilities; and (vi) the incremental borrowing rate for operating lease liabilities. The Company evaluates its assumptions and estimates on an ongoing basis and adjusts prospectively, if necessary.

Concentration of Risks Related to Credit, Interest Rates and Foreign Currencies

The Company is subject to credit risk, interest rate risk on its outstanding indebtedness, market risk on investments and foreign currency risk in connection with the Company’s operations internationally.

SQUARESPACE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

(unaudited)

The Company maintains the components of its cash and cash equivalents balance in various accounts, which from time to time exceed the federal depository insurance coverage limit. In addition, substantially all cash and cash equivalents are held by three financial institutions. The Company has not experienced any concentration losses related to its cash, cash equivalents and marketable securities to date.

As of June 30, 2023 and December 31, 2022, no single customer accounted for more than 10% of the Company’s accounts receivable. Additionally, no single customer accounted for more than 10% of the Company’s revenue during the three and six months ended June 30, 2023 and 2022.

The Company is also subject to foreign currency risks that arise from normal business operations. Foreign currency risks include the translation of local currency and intercompany balances established in local customer currencies sold through the Company's international subsidiaries.

Cash and Cash Equivalents

Cash and cash equivalents are stated at fair value. The Company considers all highly liquid investments purchased with an original maturity date of 90 days or less from the date of original purchase to be cash equivalents. Interest income on cash and cash equivalents was $1,472 and $2,534 for the three and six months ended June 30, 2023, respectively, and $216 and $317 for the three and six months ended June 30, 2022, respectively, and was included in other income, net in the condensed consolidated statements of operations.

Restricted Cash and Payment Processing Transactions

The Company processes certain payments and holds funds for its hospitality services on behalf of its restaurant customers consisting of diner prepayments for restaurant reservations as well as to-go orders. While the Company does not have any contractual obligations to hold such cash as restricted, the diner prepayments and associated sales tax are included in restricted cash in the condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022.

In addition, the Company recognizes the liability due to restaurant customers in funds payable to customers and the associated sales tax payable in accrued liabilities in the condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022. Funds are remitted to the restaurant customers based on the stipulated contract terms. In addition to restricted cash held on behalf of restaurant customers, the Company recognizes in-transit receivables from certain third-party vendors which assist in processing and settling payment transactions due to a clearing period before the related cash is received or settled. In-transit receivables are included in due from vendors in the condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022.

The following table represents the assets and liabilities related to payment processing transactions:

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

December 31, 2022 |

| Restricted cash |

$ |

34,272 |

|

|

$ |

35,583 |

|

| Due from vendors |

3,030 |

|

|

4,442 |

|

| Total payment processing assets |

37,302 |

|

|

40,025 |

|

| Funds payable to customers |

(36,713) |

|

|

(38,845) |

|

| Sales tax payable |

(589) |

|

|

(1,180) |

|

| Total payment processing liabilities |

(37,302) |

|

|

(40,025) |

|

| Total payment processing transactions, net |

$ |

— |

|

|

$ |

— |

|

Fair Value of Financial Instruments

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. Accounting Standards Codification (“ASC”) Topic 820,

SQUARESPACE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

(unaudited)

Fair Value Measurement, describes a fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value.

The three-level hierarchy for fair value measurements is defined as follows:

Level 1 Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets;

Level 2 Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability other than quoted prices, either directly or indirectly, including inputs in markets that are not considered to be active; and

Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

See “Note 5. Fair Value of Financial Instruments” for further information.

Leases

The Company adopted ASC Topic 842, Leases ("ASC Topic 842"), as of January 1, 2022. The Company determines if an arrangement is or contains a lease at inception by assessing whether the arrangement conveys the right to control the use of an identified asset. The Company classifies, measures and recognizes a lease liability on the lease commencement date based on the present value of lease payments over the remaining lease term. As of June 30, 2023, the Company's leases were classified as operating leases. The Company uses an estimated incremental borrowing rate based on information available at the lease commencement date in determining the present value of future payments as the rate implicit in the lease is not generally known. The incremental borrowing rate is based on the rate of interest the Company would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment. Operating right-of-use assets related to operating lease liabilities equal the amount of the initial measurement of the lease liability adjusted for any initial direct costs, prepaid rent and lease incentives received. Lease terms that are used in determining operating lease liabilities at lease inception may include options to extend or terminate the leases and when it is reasonably certain that the Company will exercise such options. Operating lease expense is recorded on a straight-line basis over the lease term. The straight-line expense is allocated within the condensed consolidated statements of operations based on departmental employee headcount. Variable lease costs are recognized as incurred and allocated within the condensed consolidated statements of operations based on departmental employee headcount. The Company has applied practical expedients for lease agreements with lease and non-lease components, and in such cases, accounts for the components as a single lease component. The Company has also elected not to recognize operating right-of-use assets and operating lease liabilities for any lease with an original lease term of less than one year.

Operating lease right-of-use assets are included in non-current assets on the condensed consolidated balance sheets for the entire lease term. The Company includes the portion of the total lease payments, net of implicit interest, that are due in the next 12 months in current liabilities and the remaining portion in non-current liabilities on the condensed consolidated balance sheets. The difference between straight-line lease expense and the cash paid for leases is included as non-cash lease expense in the adjustments to reconcile net loss to net cash provided by operating activities on the condensed consolidated statements of cash flows.

Operating sublease income is recognized on a straight-line basis over the sublease term and is allocated within the condensed consolidated statements of operations based on departmental employee headcount.

See “Note 11. Leases” for further information on impairment losses on leases recorded during the year ended December 31, 2022.

Net Income/(Loss) Per Share Attributable to Class A, Class B and Class C Common Stockholders

Basic net income/(loss) per share is computed by dividing net income/(loss) attributable to Class A, Class B and Class C common stockholders by the weighted-average number of shares of the Company’s Class A, Class B and Class C common stock outstanding.

Diluted net income/(loss) per share attributable to Class A, Class B and Class C common stockholders is computed by giving effect to all dilutive securities. Diluted net income/(loss) per share attributable to Class A, Class B and Class C common stockholders is computed by dividing the resulting net income/(loss) attributable to Class A, Class B and Class C common stockholders by the weighted-average number of fully diluted Class A, Class B and Class C common shares outstanding. The Company used the if-converted method as though the conversion, exchange or vesting, respectively, had occurred as of the beginning of the period or the original date of issuance, if later. During periods when there is a net loss attributable to Class A, Class B and Class C common stockholders, potentially dilutive Class A, Class B and Class C common stock equivalents are excluded from the calculation of diluted net loss per share attributable to Class A, Class B

SQUARESPACE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

(unaudited)

and Class C common stockholders as their effect is anti-dilutive. If the effect of a conversion of an instrument is neutral to earnings per share, the Company considers the security to be dilutive.

Recently Issued Accounting Pronouncements

Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act, until such time as those standards apply to private companies. The Company has elected to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies. See “Note 1. Description of Business” for further information on the Company's status as an emerging growth company.

Accounting Pronouncements Recently Adopted

In October 2021, the FASB issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers ("ASC 2021-08"). This standard requires that an entity recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with ASC Topic 606, Revenue from Contracts with Customers, as if the acquirer had originated the contracts. ASU 2021-08 is effective for fiscal years and interim periods in those years beginning after December 15, 2022 for nonpublic entities with early adoption permitted. The Company adopted this standard as of January 1, 2023, however, as the Company has not completed any acquisitions subsequent to the date of adoption, the adoption of this standard did not have a material impact on the Company’s condensed consolidated financial statements.

In December 2022, the FASB issued ASU No. 2022-06, Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848. This standard defers the sunset date of Topic 848 from December 31, 2022, to December 31, 2024, after which entities will no longer be permitted to apply the relief in Topic 848. ASU No. 2022-06 is effective upon issuance of this update for all entities that have contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. The Company adopted this standard as of December 31, 2022. The Company replaced LIBOR as the benchmark rate with SOFR as of June 30, 2023. See “Note 8. Debt" for further information. The adoption of this standard did not have a material impact on the Company’s condensed consolidated financial statements.

3.Revenue

The Company primarily derives revenue from annual and monthly subscriptions. Revenue is also derived from non-subscription services, including fixed percentages or fixed-fees earned on revenue share arrangements with third-parties and on sales made through our customers’ sites.

The Company has disaggregated revenue from contracts with customers by product type, subscription type, revenue recognition pattern, and geography as these categories depict the nature, amount, timing and uncertainty of revenue and how cash flows are affected by economic factors. The Company disaggregates revenue by product type as follows:

Presence