UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2026

Commission File No. 001-41079

Currenc Group Inc.

(Translation of registrant’s name into English)

410 North Bridge Road,

Spaces City Hall,

Singapore

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☒ Form 40-F ☐

INFORMATION CONTAINED IN THIS REPORT

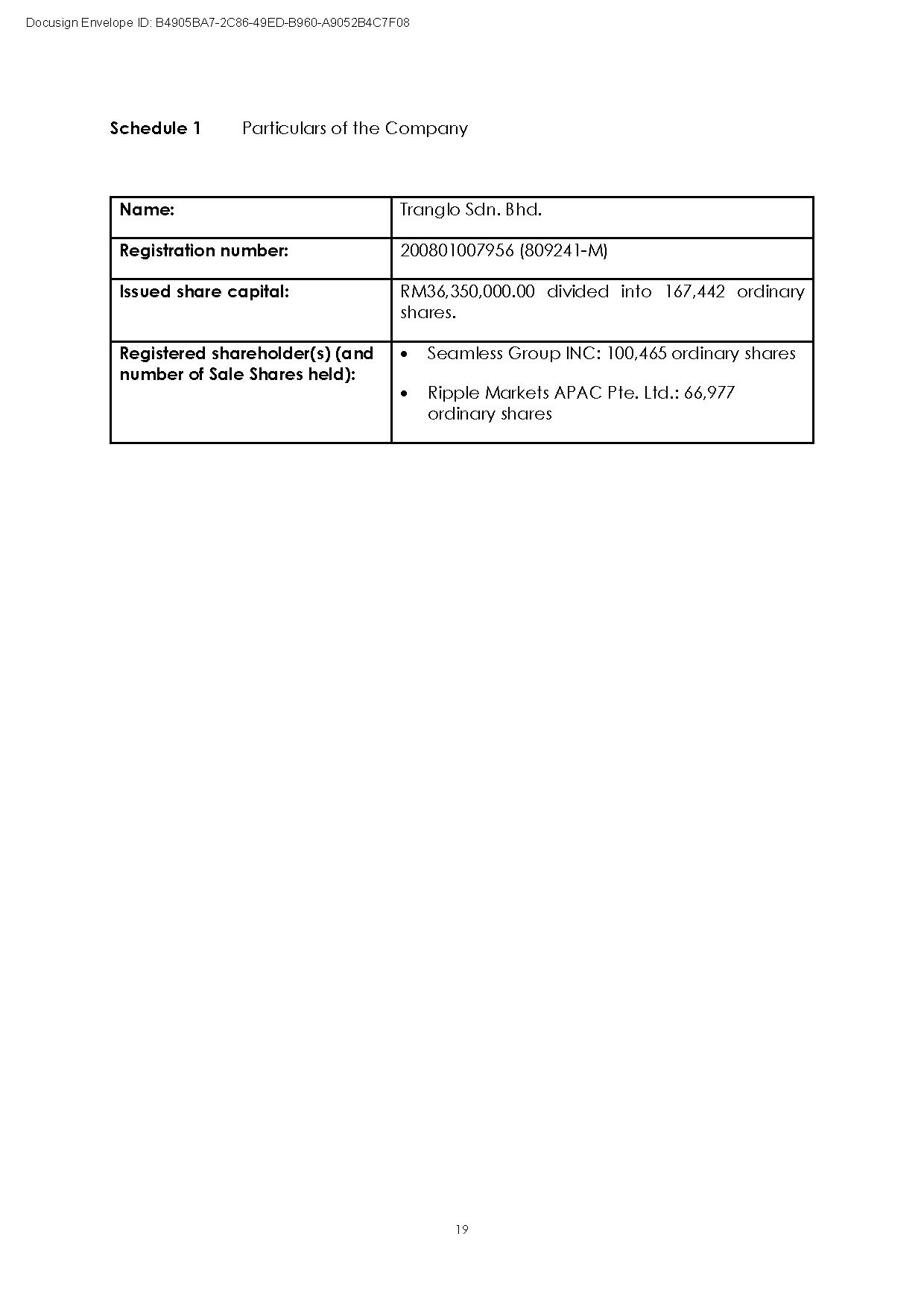

On January 2, 2026, Currenc Group Inc. (Nasdaq: CURR) (“Currenc” or the “Company”) announced that its wholly owned subsidiary, Seamless Group Inc. (“Seamless”), has entered into a definitive share purchase agreement (the “Share Purchase Agreement”) to sell its 60% controlling interest in Tranglo Sdn. Bhd. (“Tranglo”) to New Margin Holding Limited (“New Margin”). Pursuant to the Share Purchase Agreement, New Margin will acquire 100,465 ordinary shares of Tranglo from Seamless for an aggregate purchase price of US$400 million (the “Transaction”), with US$200 million payable on the closing of the Transaction and US$200 million due ninety (90) days after the closing of the Transaction. Closing is subject to certain conditions, which include securing regulatory approval and any third party consents. If closing conditions have not been satisfied or waived by the parties by September 30, 2026, the Share Purchase Agreement will automatically terminate. The Share Purchase Agreement is governed by the laws of Malaysia.

A copy of the Company’s press release dated January 2, 2026 announcing the Transaction is furnished as Exhibit 99.1 to this Report on Form 6-K. A copy of the Share Purchase Agreement is furnished as Exhibit 99.2 to this Report on Form 6-K. The descriptions of the Share Purchase Agreement and the Transaction in this Report on Form 6-K and in Exhibit 99.1 do not purport to be complete and are qualified in their entirety by reference to the Share Purchase Agreement furnished as Exhibit 99.2 and to any additional definitive agreements, if and when executed.

This Report on Form 6-K, including Exhibits 99.1 and 99.2 hereto, contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements include, among other things, statements regarding the Transaction, the anticipated structure and timing of the Transaction, expected ownership percentages, listing and governance expectations, contemplated restructuring and divestiture activities, and pre-closing financing activities. Important factors that could cause actual results to differ materially are included in Currenc’s filings with the U.S. Securities and Exchange Commission. Currenc undertakes no obligation to update any forward-looking statements except as required by applicable law.

The information furnished in this Report on Form 6-K, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such a filing.

No Offer or Solicitation

This filing is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

INDEX TO EXHIBITS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 2, 2026

| CURRENC GROUP INC. | ||

| By: | /s/ Wan Lung Eng | |

| Name: | Wan Lung Eng | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

Currenc Group Announces Strategic Divestment of Controlling Interest in Tranglo to New Margin Holding for US$400 Million

SINGAPORE, January 2, 2026 — Currenc Group Inc. (Nasdaq: CURR) (“Currenc” or the “Company”), a fintech pioneer empowering financial institutions worldwide with artificial intelligence (AI) solutions, today announced that its wholly owned subsidiary, Seamless Group Inc., has executed a definitive share purchase agreement to divest its 60% controlling interest in Tranglo Sdn. Bhd. (“Tranglo”) to New Margin Holding Limited. The transaction marks a pivotal milestone in the Company’s strategic transformation and value-unlocking initiatives.

Tranglo is a leading cross-border payment hub that enables secure and seamless international transactions for businesses and financial institutions, including remittances, business payments, and mobile top-ups, supported by a broad global network of banks, e-wallets, and payout partners, facilitating last-mile remittance payout connectivity for major e-wallet players across multiple markets through more than 5,000 bank connections and over 140,000 cash pickup points globally.

The divestment represents a foundational step in Currenc’s plan to monetize and spin off its existing operating businesses, allowing the Company to streamline its corporate structure and accelerate the realization of shareholder value. Under the terms of the agreement, Currenc will divest 100,465 ordinary shares of Tranglo, representing 60% of Tranglo’s total issued share capital, for an aggregate purchase price of US$400 million, payable entirely in cash. The consideration will be paid in two installments, with US$200 million payable on the closing date and the remaining US$200 million payable on or before the date that is ninety (90) days after closing.

The US$400 million consideration underscores the intrinsic value of Tranglo and reflects Currenc’s disciplined execution in unlocking value from its operating assets. The Company intends to use the proceeds to reduce its debt, thereby strengthening its financial position and enhancing strategic flexibility as it advances its broader corporate roadmap into AI, Web3, and Digital Assets initiatives. As previously announced, Currenc is pursuing a multi-step restructuring strategy that includes the separation and spin-off of its existing businesses, alongside a proposed reverse-merger framework with Animoca Brands. The divestment of Tranglo represents the first executed step in this process, demonstrating Currenc’s commitment to delivering on its strategic guidance.

Founded in 1999, NewMargin Ventures (“NewMargin”) manages over RMB40 billion in assets and has invested in more than 300 companies, with approximately 100 portfolio companies having completed successful IPOs or strategic exits. NewMargin intends to complete this transaction through its affiliated offshore investment entity, New Margin Holding Limited. The Company believes that NewMargin’s capital strength and mergers and acquisitions expertise will support Tranglo’s next phase of growth and expansion.

Alex Kong, Founder, Chief Executive Officer, and Executive Chairman of Currenc Group, remarked, “This transaction represents a defining moment for Currenc. This US$400 million divestment of Tranglo validates the strength of the businesses we have built and marks the first concrete step in executing our spin-off and transformation strategy. We believe this action positions Currenc to unlock significant value for shareholders while setting the foundation for our next phase of growth.”

Completion of the transaction is subject to the satisfaction of customary closing conditions, including the receipt of required regulatory approvals in relevant jurisdictions, as well as the completion of applicable shareholder processes under existing arrangements. The transaction is expected to close following the satisfaction or waiver of these conditions in accordance with the terms of the agreement.

About Currenc Group Inc.

Currenc Group Inc. (Nasdaq: CURR) is a fintech pioneer dedicated to transforming global financial services through artificial intelligence

(AI). The Company empowers financial institutions worldwide with comprehensive AI solutions, including SEAMLESS AI Call Centre and other

AI-powered Agents designed to reduce costs, increase efficiency and boost customer satisfaction for banks, insurance, telecommunications

companies, government agencies and other financial institutions. The Company’s digital remittance platform also enables e-wallets,

remittance companies, and corporations to provide real-time, 24/7 global payment services, advancing financial access across underserved

communities.

For additional information, please refer to the Currenc website https://www.currencgroup.com and the annual report on Form 10-K for the year ended December 31, 2024, filed with the Securities and Exchange Commission.

Safe Harbor Statement

This press release contains forward-looking statements. These statements are made under the “safe harbor” provisions of the

U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company’s

beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a

number of factors could cause actual results to differ materially from those contained in any forward-looking statement. In some cases,

forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,”

“anticipate,” “target,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

Further information regarding these and other risks, uncertainties, or factors is included in the Company’s filings with the SEC.

All information provided in this press release is as of the date of this press release, and the Company does not undertake any duty to

update such information, except as required under applicable law.

Investor & Media Contact

Currenc Group Investor Relations

Email: investors@currencgroup.com

Exhibit 99.2