UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 28, 2025

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ until ___

Commission File Number 001-41644

OPTEX SYSTEMS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 90-0609531 | |

|

(State or other jurisdiction of incorporation organization) |

(I.R.S. Employer Identification No.) |

|

| 1420 Presidential Drive | ||

| Richardson, TX | 75081-2439 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (972) 764-5700

Securities Registered under Section 12(b) of the Act

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.001 par value | OPXS | The Nasdaq Stock Market LLC |

Securities Registered under Section 12(g) of the Act

Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the 4,748,418 shares of voting stock held by non-affiliates of the registrant based on the Nasdaq closing price on March 30, 2025 was $25,591,141.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Shares Outstanding | ||

| Title of Class | December 16, 2025 | |

| Common Stock | 6,937,358 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the annual meeting of stockholders to be filed pursuant to Regulation 14A or an amendment to this Annual Report on Form 10-K are incorporated by reference into Items 10, 11, 12, 13, and 14 of Part III of this report. The registrant expects to file its definitive proxy statement or an amendment to this Annual Report on Form 10-K with the Securities and Exchange Commission within 120 days of September 28, 2025.

TABLE OF CONTENTS

| PART I | ||

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 21 |

| Item 1C. | Cybersecurity | 31 |

| Item 2. | Properties | 32 |

| Item 3. | Legal Proceedings | 32 |

| Item 4. | Mine Safety Disclosures | 32 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 32 |

| Item 7. | Management’s Discussion and Analysis of Financial Conditions and Results of Operations | 33 |

| Item 8. | Financial Statements and Supplementary Data | 43 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 65 |

| Item 9A. | Controls and Procedures | 65 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 66 |

| Item 11. | Executive Compensation | 66 |

| Item 12. | Security Ownership of Certain Beneficial Owners | 67 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 67 |

| Item 14. | Principal Accountant Fees and Services | 67 |

| PART IV | ||

| Item 15. | Exhibits | 67 |

|

|

Cautionary Note Regarding Forward-Looking Information

This Annual Report on Form 10-K by Optex Systems Holdings, Inc. (“Optex Systems Holdings,” the “Company,” “we,” “us,” or “our”), in particular Part II Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements contained in this Annual Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. When used in this Annual Report on Form 10- K and other reports, statements, and information we have filed with the Securities and Exchange Commission (“Commission” or “SEC”), in our press releases, presentations to securities analysts or investors, or in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements.

These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding growth strategy; product and development programs; financial performance and financial condition (including revenue, net income, profit margins and working capital); orders and backlog; expected timing of contract deliveries to customers and corresponding revenue recognition; increases in the cost of materials and labor; costs remaining to fulfill contracts; contract loss reserves; labor shortages; follow-on orders; supply chain challenges; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the defense industry.

We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors. Such risks and uncertainties include, but are not limited to, continued funding of defense programs and military spending, the timing of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in the U.S. government’s interpretation of federal procurement rules and regulations, changes in spending due to policy changes in any new federal presidential administration, market acceptance of the Company’s products, shortages in components, production delays due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, changes in the market for microcap stocks regardless of growth and value and various other factors beyond our control. Some of these risks and uncertainties are identified in this Management’s Discussion and Analysis of Financial Condition and Results of Operations and the section “Item 1A Risk Factors” in this Annual Report on Form 10-K and you are urged to review those sections. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete list of all potential risks or uncertainties.

We do not assume the obligation to update any forward-looking statement. You should carefully evaluate such statements in light of factors described in this Annual Report on Form 10-K.

|

|

PART I

Item 1. Business

Current Lines of Business

We manufacture optical sighting systems and assemblies for the U.S. Department of Defense (“DoD”), foreign military applications, commercial markets, and consumer markets. Our products are installed on a variety of U.S. military land vehicles, such as the Abrams and Bradley fighting vehicles, light armored and advanced security vehicles and the Stryker family of vehicles. We also manufacture and deliver numerous periscope configurations, rifle and surveillance sights and night vision optical assemblies. Our products consist primarily of build-to-customer print products that are delivered both directly to the armed services and to other defense prime contractors. Less than 1% of our revenue is related to the resale of products substantially manufactured by others. In this case, the product would likely be a simple replacement part of a larger system previously produced by us.

We continue to field new product opportunities from both domestic and international customers. We believe that given continuing unrest in multiple global “hot spots”, the need for precision optics continues to increase. Most of these requirements are for observation and situational awareness applications; however, we continue to see requests for higher magnification and custom reticles in various product modifications. The basic need to protect the soldier while providing information about the mission environment continues to be the primary driver for these requirements.

Recent Events

Appointment of Chief Executive Officer

In response to the notification by Danny Schoening that he intends to resign from the position of Chief Executive Officer of the Company, effective as of December 20, 2025 (the “Effective Date”), on December 5, 2025, the Board of Directors of the Company (the “Board”) appointed Chad George, the Company’s President, to assume the additional role of Chief Executive Officer to fill the vacancy left by Mr. Schoening, effective as of the Effective Date.

Mr. George, 48, has served as President of the Company since August 11, 2025. Previously, he spent 20 years in senior operations and supply chain roles in the defense sector. Between January 2022 and August 2025, he served as Vice President of Operations and Supply Chain at Leonardo DRS, where he played a key role in streamlining production processes and enhancing strategic sourcing capabilities. He also worked as Factory Manager and Operations Leader at Raytheon from April 2009 through March 2021. He holds a Bachelor’s Degree in Industrial Engineering from Oklahoma State University and a Master of Business Administration from the University of Texas at Dallas.

In connection with the appointment, the Company entered into a new employment agreement with Mr. George as of the Effective Date (the “New Employment Agreement”). Pursuant to the agreement, Mr. George will serve as the Company’s President and Chief Executive Officer through December 31, 2028. Thereafter, the term of the agreement will automatically extend for successive additional 12-month periods unless Mr. George or the Company provides written notice of termination at least 90 days prior to the end of the term then in effect.

Mr. George’s initial annual base salary under the new agreement is $300,000, which may be increased by the Compensation Committee and/or by the Board in their sole discretion but may not be decreased without Mr. George’s consent. Mr. George’s base salary will increase at 3.5% annually in accordance with the then-current Company policy. Mr. George will be eligible for a performance bonus based upon a one-year operating plan adopted by the Company’s Board. The bonus will be based on financial and/or operating metrics decided annually by the Board or the Compensation Committee and tied to such one-year plan. The target bonus will equate to 30% of Mr. George’s base salary. The Board will have discretion in good faith to alter the performance bonus upward or downward by 20%. Mr. George is entitled to 200 hours paid vacation and paid time off (PTO) each year and all other benefits accorded to our other senior executives.

|

|

The employment agreement may be terminated by either party upon written notice. Other events of termination consist of: (i) death or permanent disability of Mr. George; (ii) termination by the Company for cause (including in connection with the conviction of a felony, commission of fraudulent, illegal or dishonest acts, certain willful misconduct or gross negligence, continued failure to perform material duties or cure material breach after written notice, violation of securities laws and material breach of the employment agreement), (iii) termination by the Company without cause and (iv) termination by Mr. George for good reason (including continued breach by the Company of its material obligations under the agreement after written notice, the requirement for Mr. George to move more than 100 miles away for his employment without consent, and merger or consolidation that results in more than 66% of the combined voting power of the Company’s then outstanding securities or those of its successor changing ownership or the sale of all or substantially all of its assets, without the surviving entity assuming the obligations under the agreement). For a termination by the Company for cause or upon death or permanent disability of Mr. George, Mr. George will be paid accrued and unpaid salary and any bonus earned through the date of termination. For a termination by the Company without cause or by Mr. George with good reason, Mr. George will also be paid six months’ base salary in effect.

Increase in Board Size and Election of New Director

Concurrently with Mr. George’s appointment as Chief Executive Officer, the Board elected Mr. George to serve as a director of the Board, effective as of the Effective Date, until the Company’s 2026 annual meeting of shareholders and until his successor has been elected and qualified. In connection with Mr. George’s election as a director of the Board, the Board increased the total number of Board seats from four to five.

The New Employment Agreement requires Mr. George to fulfill his duties as a director without additional compensation.

Resignation of Chief Executive Officer

On December 4, 2025, Mr. Schoening notified the Company that he intends to resign, effective as of the Effective Date, from the position of Chief Executive Officer of the Company. Mr. Schoening will remain on the Board, will continue to serve in the position of Chairman of the Board, and will continue to serve as the Company’s Facilities Security Officer (“FSO”).

Appointment of New President

Effective August 11, 2025, the Board appointed Mr. George as the Company’s new President.

In connection with Mr. George’s appointment as President, the Board granted him 10,000 shares of restricted stock under an exemption from registration effective August 11, 2025, which will vest on January 1, 2026.

Amendment to Bylaws

Effective August 10, 2025, the Board amended the Company’s Bylaws to, among other things, (i) create a new Chief Executive Officer position, allowing for the offices of Chief Executive Officer and President to be held by different individuals, with the Chief Executive Officer being the principal executive officer of the Company, (ii) add deadlines and procedural requirements for shareholders to follow in making (A) proposals for consideration at an annual meeting, (B) nominations for directors to be elected at an annual meeting, and (C) nominations for directors to be elected at a special meeting, (iii) add a new article to provide for indemnification of directors and officers to the fullest extent permitted by Delaware law, and (iv) add a forum selection clause.

|

|

Recent Orders

| ● | On December 15, 2025, the Company announced it was awarded a new contract for optical sub-assemblies. The order value is $2.3 million with deliveries from April 2026 through December 2026. The units will be manufactured at the Applied Optics Center segment (“Applied Optics Center” or “AOC”) location in Dallas, Texas. | |

| ● | On August 5, 2025, the Company announced it was awarded a firm fixed price purchase order from General Dynamics Land Systems - Canada. This $1.6 million award for laser protected periscopes will be delivered in fiscal year 2026. The periscopes will be manufactured at the Optex Systems – Richardson segment (“Optex Richardson”) location in Richardson, Texas. | |

| ● | On July 22, 2025 the Company announced it was awarded an up to $10.2 million, five-year requirement-type contract by the Army Contracting Command - Detroit Arsenal for Abrams-based optical sighting systems. The contract estimates the first-year order amount to exceed $4.3 million with deliveries scheduled to begin in fiscal year 2026. The units will be manufactured at the Optex Richardson location. | |

| ● | On July 7, 2025 the Company announced it was awarded a $2.8 million purchase order from a major U.S. prime contractor in support of the XM30 Combat Vehicle. This contract will provide 13 sighting systems in support of the next milestone with deliveries in fiscal 2026. The units will be manufactured at the Optex Richardson location. | |

| ● | On April 9, 2025 the Company announced it was awarded a new contract for laser filter units associated with the XM157 Next Generation Fire Control Scope. The order value is $5.7 million with deliveries between August 2025 through December 2026. The units will be manufactured at the Applied Optics Center location. | |

| ● | On March 19, 2025 the Company announced it was awarded a $4.2 million firm fixed price purchase order from BAE Systems in support of the Bradley A4 Follow-On Production award for laser protected periscopes and optical sighting systems. This order will be manufactured at the Optex Richardson location and delivered over 28 months. | |

| ● | On December 11, 2024 the Company announced it was awarded a three-year, Indefinite Delivery Indefinite Quantity (IDIQ) contract for Optically Improved Periscopes from DLA Land and Marine with a maximum value of $6.5 million and two additional option years. The units will be manufactured at the Optex Richardson location. | |

| ● | On December 10, 2024 the Company announced it was awarded a new contract for Laser Filter Units and Window Assemblies supporting Night Vision devices utilized by the U.S. Armed Forces. The order value is $2.0 million with deliveries covering March 2025 through February 2026. The units will be manufactured at the Applied Optics Center location. |

|

|

Products

Our products are installed on various types of U.S. military land vehicles, such as the Abrams, and Bradley and Stryker families of fighting vehicles, as well as light armored and armored security vehicles. We also manufacture and deliver numerous periscope configurations, rifle and surveillance sights and night vision optical assemblies. We deliver our products both directly to the federal government and to prime contractors.

In addition, the Company offers military specification (“mil-spec”) quality High Efficiency Anti-Reflective Coatings for Infrared applications in both the military and commercial markets. These coatings are manufactured at the Applied Optics Center in Dallas, Texas.

We deliver high volume products, under multi-year contracts, to large defense contractors and government customers. Increased emphasis in the past several years has been on new opportunities to promote and deliver our products in foreign military sales, where U.S.-manufactured combat and wheeled vehicles are supplied (and upgraded) in cooperation with the DoD. We have a reputation for quality and credibility with our customers as a strategic supplier. We also anticipate the opportunity to integrate some of our night vision and optical sights products into commercial applications.

Specific product categories by product line include:

| Product Line | Product Category | |

| Periscopes | Laser & Non-Laser Protected Plastic & Glass Periscopes (“ICWS”), Electronic M17 Day/Thermal Periscopes, Digital Periscopes, Vision Blocks | |

| Sighting Systems | Back Up Sights, Digital Day and Night Sighting Systems (“DDAN”), M36 Thermal Periscope, Unity Mirrors, Optical Weapon System Support and Maintenance (“OWSS”), Commander Weapon Station Sight (“CWSS”), Sight Assembly Refurbishment (“GOI MOD/Aquila”), XM30 Driver Periscope Assembly | |

| Howitzers | M137 Telescope, M187 Mount, M119 Aiming Device, XM10 Aiming Circle | |

| Other | Muzzle Reference Systems (“MRS”), Binoculars, Collimators, Speedtracker, Optical Lenses & Elements, Windows and Optex Outdoors products | |

| Applied Optics Center | Laser Interference Filter (“LIF”), Optical Assemblies, Laser Filter Units (“LFU”), Reticles, Day Windows, Binoculars, Specialty Thin Film Coatings. |

Contracts

Our government contracts allow for Federal Acquisition Regulation (“FAR”) 52.243-1 which entitles the contractor to an “equitable adjustment” for contract or statement of work changes affecting cost or time of performance. In essence, an equitable price adjustment request is a request for a contract price modification (generally an increase) that allows for the contractor to be “made whole” for additional costs incurred which were necessitated by some modification of the contract effort. This modification may come from an overt change in U.S. government requirements or scope, or it may come from a change in the conditions surrounding the contract (e.g., differing site conditions or late delivery of U.S. government-furnished property) which result in statement of work additions, deletions, part substitutions, schedule or other changes to the contract which impact the contractor’s overall cost to complete.

|

|

Each contract with our customers has specific quantities of material that need to be purchased, assembled, and then shipped. Prior to bidding for a contract, we contact potential sources of material and receive qualified quotations for each material. In some cases, the entire volume is given to a single supplier and in other cases, the volume might be split between several suppliers. If a contract has a single source supplier and that supplier fails to meet their obligations (e.g., quality, delivery), then we would attempt to find an acceptable alternate supplier, and if successful, we would then renegotiate contractual deliverables (e.g., specifications, delivery or price). As of December 3, 2025, approximately 83% of our material requirements are single-sourced across 104 suppliers representing approximately 96% of our active supplier order values. Single-sourced component requirements span across all of our major product lines. Of these single-sourced components, we have material contracts (purchase orders) with firm pricing and delivery schedules in place with each of the suppliers to supply the parts necessary to satisfy our current contractual needs. See “Item 1.A. Risk Factors – Risks Relating to Our Business – Certain of our products are dependent on specialized sources of supply potentially subject to disruption which could have a material, adverse impact on our business” for a description of certain supplier risks we face, which description is incorporated herein by reference.

Approximately 99% of our contracts contain termination clauses for convenience. In the event these clauses should be invoked by our customer, future revenues against these contracts could be affected. However, these clauses allow for a full recovery of any incurred contract costs plus a reasonable fee up through and as a result of the contract termination. We currently have eight subcontract customer awards, representing $1.1 million of our current backlog, which are associated with two government prime contracts pending termination. We are currently in negotiation with the customer regarding the final termination claim amount, but expect to recover all of our incurred costs to date, plus a reasonable fee, against these contracts.

In some cases, contract awards may be issued that are subject to renegotiation at a date (up to 180 days) subsequent to the initial award date. Generally, these subsequent negotiations have had an immaterial impact (0% to 5%) on the contract price of the affected contracts. Currently, none of our awarded contracts are subject to renegotiation.

We are subject to, and must comply with, various laws and governmental regulations that impact, among other things, our revenue, operating costs, profit margins and the internal organization and operation of our business. The material laws and regulations affecting our U.S. government business are summarized in the table below.

| Law/Regulation | Summary | |

| Federal Acquisition Regulation (FAR) | The principal set of rules is the Federal Acquisition Regulation System. This system consists of sets of regulations issued by agencies of the federal government of the United States to govern what is called the “acquisition process,” which is the process through which the government acquires goods and services. That process consists of three phases: (1) need recognition and acquisition planning, (2) contract formation, and (3) contract administration. This system regulates the activities of government personnel in carrying out that process. It does not regulate the purchasing activities of private sector firms, except to the extent that those activities involve government solicitations and contracts by reference. | |

| International Traffic in Arms Regulations (ITAR) | United States government regulations that control the export and import of defense-related articles and services on the United States Munitions List. These regulations implement the provisions of the Arms Export Control Act. | |

| Truth in Negotiations Act (TINA) | A public law enacted for the purpose of providing for full and fair disclosure by contractors in the conduct of negotiations with the government. The most significant provision included is the requirement that contractors submit certified cost and pricing data for negotiated procurements above a defined threshold of $2.5 million for contracts entered into after June 30, 2018. The law requires contractors to provide the government with an extremely broad range of cost or pricing information relevant to the expected costs of contract performance, and it requires contractors and subcontractors to submit cost or pricing data to the government and to certify that, to the best of their knowledge and belief, the data are current, accurate, and complete. A contracting officer may still request cost or price data, if necessary, without certification, to determine whether the proposed cost or price is fair and reasonable for contracts which are below the threshold. |

|

|

We are responsible for full compliance with the FAR. Upon award, the contract may identify certain regulations that we need to meet. For example, a contract may allow progress billing pursuant to specific FAR clauses incorporated into the contract. Other contracts may call for specific first article acceptance and testing requirements. The FAR will identify the specific regulations that we must follow based on the type of contract awarded and contains guidelines and regulations for managing a contract after award, including conditions under which contracts may be terminated, in whole or in part, at the government’s convenience or for default. These regulations also subject us to financial audits and other reviews by the government of our costs, performance, accounting and general business practices relating to our government contracts, which may result in adjustment of our contract-related costs and fees and, among other things and impose accounting rules that define allowable and unallowable costs governing our right to reimbursement under certain contracts.

First Article Acceptance and Testing requirements consist of specific steps which could be comprehensive and time consuming. The dimensions and material specifications of each piece of the assembly must be verified, and some products may have in excess of 100 assembled parts. Once the individual piece parts are verified to be compliant to the specification, the assembly processes are documented and verified. A sample of the production (typically three units) is verified to meet final performance specifications. Once the units meet the final performance specification, they are then subjected to accelerated life testing, a series of tests which simulate the lifetime use of the product in the field. This consists of exposing the units to thermal extremes, humidity, mechanical shock, vibration, and other physical exposure tests. Once completed, the units undergo a final verification process to ensure that no damage has occurred as a result of the testing and that they continue to meet the performance specification. All of the information and data is recorded into a final first article inspection and test report and submitted to the customer along with the test units for final approval. First Article Acceptance and Testing is generally required on new contracts/product awards but may also be required on existing products or contracts where there has been a significant gap in production, or where the product has undergone significant manufacturing process, material, tooling, equipment or product configuration changes.

We are also subject to laws, regulations and executive orders restricting the use and dissemination of information deemed classified for national security purposes and the exportation of certain products and technical data as covered by the International Traffic in Arms Regulation (“ITAR”). In order to import or export items listed on the United States Munitions List, we are required to be registered with the Directorate of Defense Trade Controls office. The registration is valid for one year, and the registration fees are established based on the number of license applications submitted the previous year. We currently have an approved and current registration on file with the Directorate of Defense Trade Controls office. Once the registration is approved, each import/export license must be filed separately. License approval requires the company to provide proof of need, such as a valid contract or purchase order requirement for the specific product or technical data requested on the license and requires a detailed listing of the items requested for export/import, the end-user, the end-user statement, the value of the items, consignees/freight forwarders and a copy of a valid contract or purchase order from the end-user. The approval process for the license can vary from several weeks to six months or more. The licenses we currently use are the Department of State licenses: DSP-5 (permanent export), DSP-6 (license revisions) and DSP-73 (temporary export) and Department of Commerce: BIS-711 (export).

|

|

The above licenses are valid for 48 months from date that each license is issued. A summary of our active ITAR licenses is presented below (updated as of December 3, 2025):

| Fiscal Year | Number of | Total Contract Value of | ||||||||||

| Active ITAR Licenses | of Expiration | Licenses | Licenses | |||||||||

| DSP-5 | ||||||||||||

| Issued 2022 | 2026 | 4 | $ | 321,722 | ||||||||

| Issued 2023 (none issued) | N/A | — | — | |||||||||

| Issued 2024 | 2028 |

3 | 125,577 | |||||||||

| Issued 2025 | 2029 | 3 | 99,350 | |||||||||

| Total DSP-5 Licenses | 10 | $ | 546,649 | |||||||||

| DSP-6 (no active licenses) | N/A | — | $ | — | ||||||||

| DSP-73 (no active licenses) | N/A | — | $ | — | ||||||||

| BIS-711 | ||||||||||||

| Issued 2022 | 2026 | 1 | 9,372 | |||||||||

| Issued 2023 | 2027 | 10 | 1,359,344 | |||||||||

| Issued 2024 | 2028 |

7 | 1,270,327 | |||||||||

| Issued 2025 | 2029 | 3 | 72,240 | |||||||||

| Total BIS-711 Licenses | 21 | $ | 2,711,283 | |||||||||

| Total All Licenses | 31 | $ | 3,257,932 | |||||||||

These licenses are subject to termination if a licensee is found to be in violation of the Arms Export Control Act or the ITAR requirements. If a licensee is found to be in violation, in addition to a termination of its licenses, it can be subject to fines and penalties by the government.

Our contracts may also be governed by the Truth in Negotiation Act (“TINA”) requirements where certain of our contracts or proposals exceed the TINA threshold ($2.5 million for awards after June 30, 2018), and/or are deemed as sole source, or non-competitive awards, covered under this act. For these contracts, we must provide a vast array of cost and pricing data in addition to certification that our pricing data and disclosure materials are current, accurate and complete upon conclusion of the negotiation. Due to the additional disclosure and certification requirements, if a post contract award audit were to uncover that the pricing data provided was in any way not current, accurate or complete as of the certification date, we could be subjected to a defective pricing claim adjustment with accrued interest. We have no history of defective pricing claim adjustments and have no outstanding defective pricing claims pending. Additionally, as a result of this requirement, contract price negotiations may span from two to six months and can result in un-definitized or not to exceed ceiling priced contracts subject to future downward negotiations and price adjustments. Currently, we do not have any un-definitized contracts subject to further price negotiation.

Our failure to comply with applicable regulations, rules and approvals or misconduct by any of our employees could result in the imposition of fines and penalties, the loss of security clearances, the loss of our U.S. government contracts or our suspension or debarment from contracting with the U.S. government generally, any of which could have a material adverse effect our business, financial condition, results of operations and cash flows. We are currently in compliance with all applicable regulations and do not have any pending claims as a result of noncompliance.

|

|

The terms of our significant contracts with a total award value of more than $1.0 million as of December 4, 2025, are as follows:

| Location | Customer | Contract/PO | Product | Type | Award | Backlog | Delivery Period | |||||||||||

| OPX | DLA Land and Maritime(1) | SPE7LX21D0057 | Periscopes | IDIQ | $ | 7.4 | $ | 0.7 | Dec 2024 - Jun 2025 | |||||||||

| OPX | General Dynamics Land Systems - Canada(2) | PO 35713970 | Periscopes | FFPQ | 1.7 | 1.7 | Oct 2025 - Sept 2026 | |||||||||||

| OPX | US Army(3) | W912CH-25-D-0066 | Collimators | IDIQ | 4.3 | 4.3 | Jul 2025 - Jul 2030 | |||||||||||

| OPX | U.S. Prime Contractor(4) | PO 40471011 | Periscopes | FFPQ | 2.6 | 2.5 | Jul 2025 - Apr 2026 | |||||||||||

| AOC | U.S. Prime Contractor(5) | PO 835 | Laser Filter Units | FFPQ | 5.7 | 4.1 | Aug 2025 - Dec 2026 | |||||||||||

| OPX | BAE Systems(6) | PO 392878 | Periscopes & Optical Sighting Systems | FFPQ | 4.3 | 4.3 | Mar 2025 - Jul 2027 | |||||||||||

| OPX | DLA Land and Maritime(7) | SPE7LX25D0023 | Periscopes | IDIQ | 3.8 | 1.1 | Dec 2024 - Dec 2027 | |||||||||||

| AOC | U.S. Prime Contractor(8) | PO 921493 | Light Interference Filters | FFPQ | 1.3 | 0.5 | Mar 2025 - Feb 2026 | |||||||||||

| OPX | DLA Land and Maritime(9) | SPE7LX24D0030 | Periscopes | IDIQ | 2.8 | 0.3 | Jan 2024 - Jan 2029 | |||||||||||

| AOC | U.S. Prime Contractor(10) | NHAGP00452 | Light Interference Filters | FFPQ | 1.0 | 0.4 | Jun 2025 - Apr 2026 | |||||||||||

| OPX | U.S. Prime Contractor(11) | PO 50896 | Periscopes | FFPQ | 1.1 | 1.1 | Jun 2026 - Oct 2026 | |||||||||||

| (1) | Prime contract awarded on January 6, 2021. This is a long-term, IDIQ contract with firm fixed pricing for the duration of the contract with a base period of three years plus two firm fixed priced option years for a potential total of five years for periscopes valued up to $14.4 million. On October 7, 2024, second option was exercised by DLA Land and Maritime, extending the ordering period from January 6, 2025 through January 5, 2026. |

|

|

| (2) | Subcontract awarded on August 5, 2025 for periscope assemblies with firm fixed pricing for the duration of the contract. The award has a maximum order value of $1.7 million. |

| (3) | Prime contract with direct solicitation for W56HZV-23-R-0159 for Collimators awarded on July 22, 2025. This is a long-term IDIQ contract with firm fixed pricing for the duration of the contract with potential revenue up to $10.2 million. |

| (4) | Subcontract awarded on July 7, 2025 for periscope assemblies supporting XM30 Combat Vehicles with firm fixed pricing for the duration of the contract. The award has a maximum order value of $2.6 million. |

| (5) | Subcontract purchase order awarded on April 9, 2025 by a U.S. prime contractor in support of U.S. government contracts. |

| (6) | Subcontract with BAE Systems in support of government contract W56HZV-22-D-0083 & W912CH25F0096 for periscopes & optical subassemblies. The purchase order was awarded on March 19, 2025 for $4.3 million with final revision dated November 5, 2025. |

| (7) | Subcontract awarded on December 11, 2024. This is a long-term IDIQ contract with firm fixed pricing for the duration of the contract with a base period of three years plus two firm fixed priced option years for a potential total of five years for periscopes valued up to $6.5 million. |

| (8) | Subcontract purchase order awarded on December 10, 2024 by a U.S. prime contractor in support of U.S. government contracts. |

| (9) | Subcontract awarded on January 31, 2024 for periscopes and direct vision blocks. This is a three-year IDIQ contract with two option years and firm fixed pricing for the duration of the contract. The award has a maximum order value of $2.8 million. |

| (10) | Subcontract purchase order awarded on February 14, 2025 by a U.S. prime contractor in support of U.S. government contracts. |

| (11) | Subcontract purchase order awarded on November 19, 2025 by a U.S. prime contractor in support of U.S. government contracts. |

Market Opportunity — U.S. Military

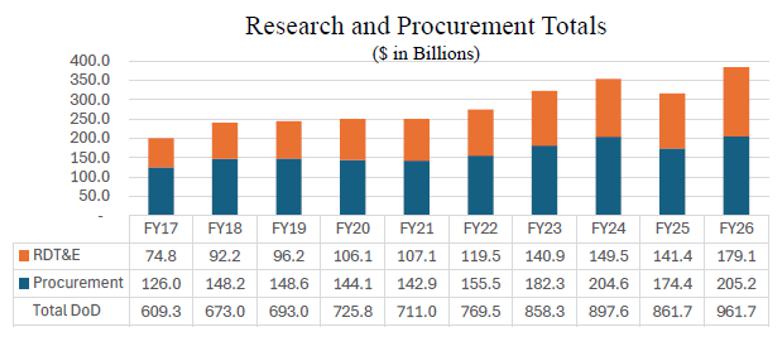

During the twelve months ended September 28, 2025, approximately 90% of our business was in support of U.S. military products. The purpose of including the chart below is to provide the reader with historical trend data and projected U.S. military defense and procurement spending over time. However, the Company cannot provide any assurances that the historical trend data is predictive of future spending.

In the chart below, for fiscal year 2026, the Government Publishing Office (“GPO”) projects total DoD spending at $961.7 billion, an overall increase of 11.6% over estimated fiscal year 2025 spending. For defense procurement spending, a subset of total defense spending, the GPO projects an overall increase of $30.8 billion, or 17.7%, in fiscal year 2026 as compared to the estimated spending in fiscal year 2025.

|

|

Source: Office of the Under Secretary of Defense (Comptroller)/Chief Financial Officer, “Program Acquisition Cost by Weapon System, United States Department of Defense, Fiscal Year 2026 Budget Request”, July 2025.

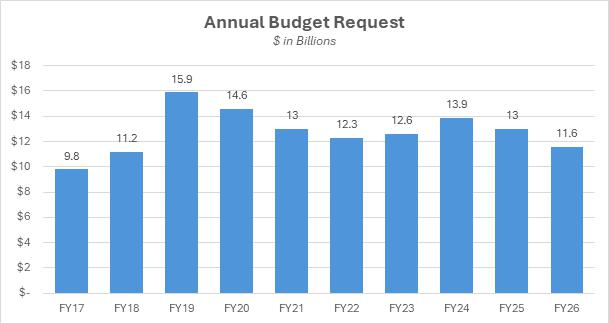

The table below depicts the DoD budget request for fiscal year 2026 for major ground system programs. The last two years have experienced a significant reduction in spending for U.S. ground system military programs. The total fiscal year 2026 budget request for major ground system programs decreased by 10.8% from the fiscal year 2025 levels and by 16.5% from the fiscal year 2024 levels. Although it is difficult to directly tie the budget request to specific components provided by Optex Richardson, we provide periscopes, collimator assemblies, vision blocks and laser interface filters to the U.S. armed forces on almost all of the ground system platforms categorized below and budget requests for at least two of the major platforms (AMPV and M1) are showing growth of 39.2% and 43.6% respectively in fiscal year 2026.

Source: Office of the Under Secretary of Defense (Comptroller)/Chief Financial Officer, “Program Acquisition Cost by Weapon System, United States Department of Defense, Fiscal Year 2026 Budget Request”, July 2025.

|

|

The table below depicts the DoD budget request for fiscal year 2026 for major ground system programs. The last three years have experienced a significant reduction in spending for U.S. ground system military programs. The total fiscal year 2026 budget request for major ground system programs decreased by 27% from the fiscal year 2025 levels and by 36% from the fiscal year 2024 levels. Although it is difficult to directly tie the budget request to specific components provided by Optex Richardson, we provide periscopes, collimator assemblies, vision blocks and laser interface filters to the U.S. armed forces on almost all of the ground system platforms categorized below.

| ($ in Millions) | FY2022 | FY2023 | FY2024 | FY2025 | FY2026 | |||||||||||||||

| ARMY | ||||||||||||||||||||

| Abrams Tank Modification/Upgrade (M-1) | $ | 1,264.3 | $ | 1,297.7 | $ | 1,421.3 | $ | 1,051.4 | $ | 1,464.0 | ||||||||||

| Armored Multi-Purpose Vehicle (AMPV) | 984.6 | 1,237.0 | 603.9 | 393.8 | 565.4 | |||||||||||||||

| Paladin Integrated Management (PIM) | 662.9 | 1,026.8 | 783.2 | 611.1 | 262.7 | |||||||||||||||

| Family of Medium Tactical Vehicles (PIM) | 144.4 | 233.9 | 230.5 | 262.0 | 107.9 | |||||||||||||||

| Family Of Heavy Tactical Vehicles (FHTV) | 214.0 | 326.3 | 283.2 | 220.2 | 148.5 | |||||||||||||||

| Next Generation Squad Weapon (NGSW) | 127.6 | 199.6 | 343.4 | 389.4 | 395.5 | |||||||||||||||

| XM30 Combat Vehicle | 194.9 | 519.1 | 565.0 | 499.5 | 387.4 | |||||||||||||||

| M10 Booker (Mobile Protected Firepower) | - | 410.5 | 482.2 | 487.2 | 81.5 | |||||||||||||||

| Stryker | 1,112.7 | 1,275.0 | 694.2 | 503.3 | 145.6 | |||||||||||||||

| USMC | ||||||||||||||||||||

| Amphibious Combat Vehicle (ACV) | 591.9 | 605.4 | 632.8 | 857.0 | 835.4 | |||||||||||||||

| Total Ground Systems Vehicles (millions) | $ | 5,297.3 | $ | 7,131.3 | $ | 6,039.7 | $ | 5,274.9 | $ | 4,393.9 | ||||||||||

Sources: Office of the Under Secretary of Defense (Comptroller)/Chief Financial Officer, “Program Acquisition Cost by Weapon System, United States Department of Defense, Fiscal Year 2026 Budget Request”, July 2025, “Program Acquisition Cost by Weapon System, United States Department of Defense, Fiscal Year 2025 Budget Request”, March 2024 and “Program Acquisition Cost by Weapon System, United States Department of Defense, Fiscal Year 2024 Budget Request”, April 2023.

The proposed 2026 Department of Defense Budget indicates an overall decrease in ground system vehicle program spending (or requests therefor) since fiscal year 2023. There is generally a six- to eighteen-month delay between U.S. defense budget requests and program delivery orders related to our products from government agencies and our prime defense customers. In addition, DoD budget requests are often changed throughout the congressional National Defense Authorization Act (“NDAA”) Budgeting and Budget appropriations process. The DoD budget requests exclude any foreign military sales as they are funded separately from the annual NDAA budgets. We are carefully watching the projected trends in both DoD military spending and FMS as defense allocation priorities change, as well as challenges which are presented from the global recession and changes in political climate to ascertain any potential impact to the Company’s future revenue.

A substantial portion of our revenue is derived from U.S. government contracts, which are subject to annual congressional appropriations. Failure to pass the annual appropriations by October 1, the start of the new fiscal year, often results in a continuing resolution (“CR”) which can delay new contract awards, exercising of contract options, and starting of new program initiatives, which could materially and adversely affect our future revenues. From October 1, 2025 to November 12, 2025, the federal government of the United States was in a shutdown as Congress failed to pass appropriations legislation for the 2026 fiscal year. On November 10, 2025, Congress passed a CR, which funds the government at existing spending levels through January 30, 2026, by which time the legislature must approve the annual appropriations bill or an additional CR to avoid another government shutdown. As a result of the 2025 government shutdown and CR through January 2026, the Company has experienced a slow-down of contract awards. While we are unable to predict the outcome past January 2026, we anticipate the funding delays may affect our revenue during the second through fourth quarters of fiscal year 2026. See “Item 1.A. Risk Factors – Risks Relating to Our Business – A delay in the completion of the U.S. government’s budget and appropriation process could delay procurement of our products and services and have an adverse effect on our future revenues.”

The Applied Optics Center supports numerous other military platforms outside of the ground system vehicles budget, such as infantry rifle scopes, night vision monoculars, infantry and navy binoculars, night goggles, and infrared aircraft filters. The Applied Optics Center has seen a substantial increase in orders from new and existing customers in support of the other platforms, which we expect to offset the impact of the ground systems reductions to their base revenue.

|

|

Market Opportunity — Foreign Military

Our products directly support FMS combat vehicles globally, including Canada, the Kingdom of Saudi Arabia, Kuwait, Morocco, Egypt, South America, and Israel. We have increased efforts to promote our proven military products, as well as newly improved product solutions directly to foreign military representatives and domestic defense contractors supporting the FMS initiatives.

We were successful with the Israeli Ministry of Defense (“IMOD”) in refurbishing a small quantity of their Night Vision Rifle Scopes. Given this success, in November 2022, the IMOD awarded us a $3.4 million follow on contract to continue this activity through fiscal year 2026. We began deliveries against the contract during the first quarter of fiscal year 2024. If we successfully execute this contract, we would expect another contract award of similar size and duration in fiscal year 2026 or 2027.

We are also exploring possibilities to adapt some of our products for commercial use in those markets that demonstrate potential for solid revenue growth, both domestically and internationally.

Market Opportunity — Commercial

Our products are currently sold to military and related government markets. We believe there may be opportunities to commercialize various products we presently manufacture to address other markets. Our initial focus will be directed in four product areas.

| ● | Big Eye Binoculars — While the military application we produce is based on mature military designs, we own all castings, tooling and glass technology. The big eye binocular technology is potentially applicable to other commercial uses where high magnification and resolution is required. | |

| ● | Thin Film Coatings — The acquisition of the Applied Optics Center also creates a new sector of opportunity for commercial products for us. Globally, commercial optical products use thin film coatings to create product differentiation. These coatings can be used for redirecting light (mirrors), blocking light (laser protection), absorbing select light (desired wavelengths), and many other combinations. They are used in telescopes, rifle scopes, binoculars, microscopes, range finders, protective eyewear, photography, etc. Given this broad potential, the commercial applications are a key opportunity going forward. | |

| ● | Optical Assemblies – Through the Applied Optics Center, we are utilizing our experience in military sighting systems to pursue commercial opportunities associated with products that incorporate multi-lens optical cell assemblies, bonded optical elements and mechanical assemblies. There are a wide variety of products in the medical, machine vision, automotive and outdoor recreation fields that can benefit from our capabilities. Support to domestic customers for these type products has driven significant increases in Applied Optics Segment sales during the last five years. | |

| ● | Optex Outdoors – This launch brings military-grade optical technology directly to civilian marksmen and extreme long-range competitors, expanding Optex’s reach beyond its traditional military market. The Optex Outdoors webstore offers a curated selection of advanced optical products, including riflescope prisms, chronographs, and stabilized viewing products—designed specifically for the needs of elite shooters and outdoor enthusiasts. Each product is engineered and built in Richardson, Texas. |

Customer Base

We serve customers in four primary categories: as prime defense contractor (Defense Logistics Agency (“DLA”) Land and Maritime, DLA Land at Aberdeen, DLA Aviation, U.S. Army, Navy and Marine Corps), as defense subcontractor (General Dynamics, L-3 Communications, Elbit Systems, BAE, Sig Sauer, Vortex Optics, Trijicon Inc. and Ducommun Aerostructures), as a military supplier to foreign governments (Israel, Australia, South America and Canada) and as a commercial optical assembly supplier (Nightforce Optics, Lightforce USA, Inc. and Gables Engineering). During the twelve months ended September 28, 2025, we derived approximately 70% of our gross business revenue from five major customers: U.S. government agencies (29%) and four U.S. defense contractors (19%, 10%, 6% and 6%). We have approximately 120 discrete contracts for items that are utilized in vehicles, optical product lines and as spare parts. Due to the high percentage of prime and subcontracted U.S. defense revenues, large customer size and the fact that there are multiple contracts with each entity, which are not interdependent, we are of the opinion that this provides us with a fairly well diversified revenue pool.

|

|

Marketing Plan

We believe we are well positioned to service both U.S. and foreign military needs by our focus on delivering products that satisfy the following factors important to the U.S. military:

| ● | Product reliability — failure can cost lives | |

| ● | Speed to delivery and adherence to delivery schedule | |

| ● | System life cycle extension | |

| ● | Low cost/best value | |

| ● | Visual aids for successful execution of mission objectives | |

| ● | Mission critical products specifically related to soldier safety. |

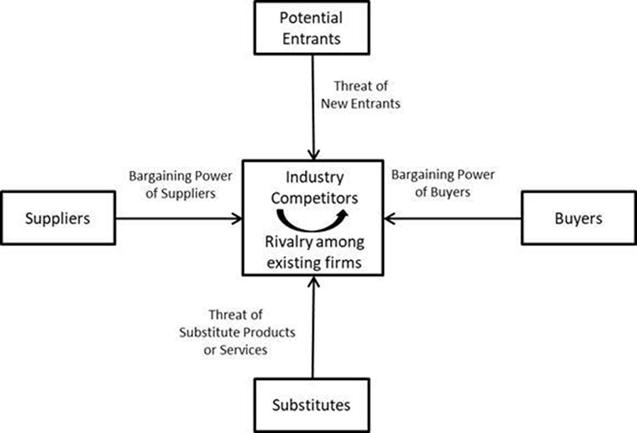

Potential Entrants — Low Risk to us. In order to enter this market, potential competitors must overcome several barriers to entry. The first hurdle is that an entrant would need to prove to the government agency in question the existence of a government approved accounting system for larger contracts. Second, the entrant would need to develop the processes required to produce the product. Third, the entrant would then need to produce the product and submit successful test requirements (many of which require lengthy government consultation for completion). Finally, in many cases, the customer has an immediate need and therefore cannot wait for this qualification cycle and therefore must issue the contracts to existing suppliers. Given the expense and time commitment of development and qualification testing, the barrier to entry is high for new competitors.

|

|

Buyers — Medium Risk to us. In most cases the buyers (usually government agencies or defense contractors) have two fairly strong suppliers. It is in their best interest to keep at least two, and therefore, in some cases, the contracts are split between suppliers. In the case of larger contracts, the customer can request an open book policy on costs and expects a reasonable margin to have been applied.

Substitutes — Low Risk to us. We have both new vehicle contracts and replacement part contracts for the same product. Three combat vehicles have a long history of service in the U.S. Army. The first M-1 Abrams Tank entered service with the Army in 1980; the M-2/M-3 Bradley Fighting Vehicle in 1981; and the Stryker Combat Vehicle in 2001. Since it was first fielded in 1980, the Abrams tank has undergone near-continuous upgrades and improvements and is the principal battle tank of the United States Army and Marine Corps, and the armies of Egypt, Kuwait, Saudi Arabia, Iraq and Australia. On average, there has been a new improvement package every seven years. The XM30 Mechanized Infantry Combat Vehicle, formerly known as the Optionally Manned Combat Vehicle, is the U.S. Army’s sixth attempt to replace the Bradley fighting vehicle. The latest Army “light tank” is the M10 Booker Combat Vehicle, formerly known as the Mobile Protected Firepower System, and is much smaller than the Abrams main battle tank. The Abrams, XM30, M10 Booker and Stryker vehicles are the only tanks currently in production by the government. Optex Richardson provides periscopes and optical sighting systems in support of all four vehicle platforms. We expect that these tanks will continue to be used through approximately 2040.

Suppliers — Low to Medium Risk to us. The suppliers of standard processes (e.g., casting, machining and plating) need to be very competitive to gain and/or maintain contracts. Those suppliers of products that use top secret clearance processes have a slight advantage; however, there continues to be multiple avenues of supply and therefore only moderate power.

Consistent with our marketing plan and business model, the AOC acquisition strengthened our overall position by decreasing the bargaining power of their suppliers through the backwards integration of a key supplier and created additional barriers of entry for potential competitors.

The following matrix reflects the current focus of our four basic approaches for sales and development:

| 1) | Sell existing products to existing customers. | |

| 2) | Sell existing products to new customers. | |

| 3) | Develop new products to meet the needs of our existing customers. | |

| 4) | Develop new products to meet the needs of new customers. |

| Existing Customers | New Customers | |||

| New Products |

US Army Central Command - Binoculars GDLS - DDAN, OWSS, XM30 |

Israel - GOI MOD/Aquila U.S. Prime Contractor - XM10 Aiming Circle |

||

|

Commercial - Optical Lens, Reticles, DLC coatings, IR Opto-Mechanical Assembly, Micro Optical Systems |

Commercial - Optical Lens, Spotting Scopes, Monocular Lens, Chronographs, Optical Wedges U.S. Prime Contractor – Aerospace and Space U.S. Prime Contractor – Drone Technology |

|||

| Existing Products | US Army Central Command - Periscopes, Back Up Sights, | Commercial - Optical Lens, Spotting Scopes Monocular Lens | ||

| Binoculars, Vision Blocks, | ||||

| Laser Filter Units | U.S. Prime Contractor – Laser Filter Units | |||

| GDLS - Periscopes, Collimators | ||||

| BAE - Periscopes | ||||

| L3 - Laser Interface Filters | ||||

| DLA - Optical Elements |

|

|

Operations Plan

Our operations plan can be broken down into three distinct areas: material management, manufacturing space planning and efficiencies associated with economies of scale.

Materials Management

The largest portion of our costs is materials. Our continuous improvements to effectively manage material costs include the following activities:

| - | Successful completion of annual surveillance audit for ISO 9001:2008 certificate, with no major nonconformance issues | |

| - | Weekly cycle counts on inventory items | |

| - | Weekly material review board meeting on non-moving piece parts | |

| - | Kanban kitting on products with consistent ship weekly ship quantities | |

| - | Daily cross functional floor meetings focused on delivery, yields and labor savings | |

| - | Redesigned floor layout using tenant improvement funds | |

| - | Daily review of yields and product velocity | |

| - |

Bill of material reviews prior to work order release

|

|

| - | Supplier management and notification tools for on time delivery and quality tracking |

Future continuous improvement opportunities include the full implementation and training of the shop floor control module within our ERP system. We have begun testing and implementation within selected process.

Manufacturing Space Planning

We currently lease 93,967 square feet of manufacturing space (see “Properties”). Our current facilities are sufficient to meet our immediate production needs without excess capacity. As our processes are primarily labor driven, we are able to easily adapt to changes in customer demand by adjusting headcounts, overtime schedules and shifts in line with production needs. In the event additional floor space is required to accommodate new contracts, Optex has the option to lease adjacent floor space at the current negotiated lease cost per square foot. Consistent with the space planning, we will drive economies of scale to reduce support costs on a percentage of sales basis. These cost reductions can then be either passed through directly to the bottom line or used for business investment.

Our manufacturing process is driven by the use of six sigma techniques and process standardization. Our activities in this area have included the use of six sigma projects in several production areas which has led to improved output and customer approval on the aesthetics of the work environment. In addition, we use many tools including 5S programs, six sigma processes, and define, measure, analyze, improve, control (DMAIC) problem solving techniques, to identify bottlenecks within the process flow, reduce cost and improve product yields. Successful results can then be replicated across the production floor and drive operational improvements.

|

|

Economies of Scale

Plant efficiencies fluctuate as a function of program longevity, complexity and overall production volume. Our internal processes are primarily direct labor intensive and can be more easily adapted to meet fluctuations in customer demand; however, our material purchases, subcontracted operations and manufacturing support costs are extremely sensitive to changes in volume. As our volume increases, our support labor, material and scrap costs decline as a percentage of revenue as we are able to obtain better material pricing, and scrap, start up and support labor (fixed) costs and they are spread across a higher volume base. Conversely, as production volumes decline, our labor and material costs per unit of production generally increase. Additional factors that contribute to economies of scale relate to the longevity of the program. Long running, less complex programs (e.g., periscopes) do not experience as significant of an impact on labor costs as production volumes change, as the associated workforce is generally less specialized and can be ramped quickly as headcounts shift. Our more complex thin laser filter coatings, Howitzer and thermal day/night programs are more significantly impacted by volume changes as they require a highly specialized workforce and ramp time is longer as the training is more complex. We continually monitor customer demand over a rolling twelve-month window and in order to anticipate any changes in necessary manpower and material which allows us to capitalize on any benefits associated with increased volume and minimize any negative impact associated with potential declines in product quantities.

Sources and Availability of Raw Materials

Disclosure responsive to this item is incorporated herein by reference to “Risk Factors – Risks Related to Our Business – Certain of our products are dependent on specialized sources of supply potentially subject to disruption which could have a material, adverse impact on our business.”

Intellectual Property

Trade Secrets and Know-How

We utilize several highly specialized and unique processes in the manufacture of our products. While we believe that these trade secrets have value, it is probable that our future success will depend primarily on the innovation, technical expertise, manufacturing and marketing abilities of our personnel. We cannot assure you that we will be able to maintain the confidentiality of our trade secrets or that our non-disclosure agreements will provide meaningful protection of our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or other disclosure. The confidentiality agreements that are designed to protect our trade secrets could be breached, and we might not have adequate remedies for the breach. Additionally, our trade secrets and proprietary know-how might otherwise become known or be independently discovered by others.

Patents

We possess five utility patents and three design patents. Two new patents have been reviewed by the U.S. Patent and Trademark Office and approved in fiscal year 2025. These are for U.S. Patent No. 12,352,533 titled “Improved Next Shot Compensation System for Weapons” and for our Laser Filter Antenna, which is awaiting a U.S. Patent number.

The following patents generally expire 20 years after issuance.

On November 6, 2025, we received a notice of allowance for our U.S. Patent Application No. 18/809,740 filed on August 20, 2024 on the Laser Filter Antenna. The U.S. Patent number is pending receipt of our payment of the Issue Fee which is due by January 9, 2026.

On July 8, 2025, we were issued U.S. Patent No. 12,352,533 titled “Next Shot Compensation System for Weapons” which is a filtered unit to prevent light having a threshold wavelength from passing through the filter unit; and one or more radar antennae deposited on a surface of the filter unit, wherein the one or more radar antennae are configured to capture a velocity of a projectile fired from the weapon.

On April 4, 2023, we were issued U.S. Patent No. 11,619,824 B2 titled “Selectable Offset Image Wedge” which is a mechanical wedge used to offset the image anywhere in the selectable range of circular travel within the defined offset field of view. This application is a continuation-in-part of U.S. Patent No. 10,324,298 and claims priority to U.S. Patent No. 10,324,298, issued on June 18, 2019.

|

|

On November 4, 2021 we were issued U.S. Patent No. 2021/0341746A1 titled “Selectable Offset Image Wedge” which is a mechanical wedge used to offset the image anywhere in the selectable range of circular travel within the defined offset field of view. This application is a continuation-in-part of U.S. Patent No. 10,324,298 and claims priority to U.S. Patent No. 10,324,298, issued on June 18, 2019.

On June 18, 2019 we were issued U.S. Patent No. 10,324,298 titled “Offset Image Wedge with Dual Capability and Alignment Technique”. The invention relates to an offset image wedge for use on a bore-sighted rifle mounted directly onto the scope via a clamp mounting device. The wedge allows for a dual image which can be aligned in the field and provides the user with a choice of either a bore-sighted image or an offset image without removing the wedge.

On July 11, 2017, we were issued U.S. Patent No. D791,852 S, for our Red Tail Digital Spotting Scope. We have a retail sales relationship with Cabela’s Inc. and Amazon, to distribute these scopes. They are currently the only digital spotting scope offered by Cabela’s Inc. Our Red Tail Digital Spotting Scopes also received a favorable review from Trigger Magazine in 2017.

In May 2015, we announced the issuance to us of U.S. Patent No. 13,792,297 titled “ICWS Periscope”. This invention improves previously accepted levels of periscope performance that, in turn, improves soldier’s safety.

In December 2013, Optex Systems, Inc. was issued U.S. Patent No. 23,357,802 titled “Multiple Spectral Single Image Sighting System Using Single Objective Lens Set.” The technology platform, designed for our DDAN program, is applicable to all ground combat vehicles used by the US and foreign militaries. This invention presents a single image to both day and night sensors using precision optics, which in turn allows the user to individually observe day, night, or day and night simultaneously. In addition, it has proven to be especially useful in light transition points experienced at dusk and dawn. We are in production and currently delivering sighting systems with this advanced technology, a significant upgrade in the goal of supporting our customers as they modernize the worldwide inventory of aging armored vehicles. This technology is applicable to many sighting systems, and it has already been designed for implementation on the Light Armored Vehicles, the Armored Security Vehicle, the Amphibious Assault Vehicle, and the M60 Main Battle Tank. DDAN technology has advanced the capabilities of these installed weapon systems and is the first in a series of patents we have applied for to protect our Intellectual Property portfolio in support of the warfighters who use these systems.

Licenses

In May 2012, we purchased a perpetual, non-exclusive license, with a single up-front license fee of $200,000 to use Patent 7,880,792 “Optical and Infrared Periscope with Display Monitor” (issued in 2011 and owned by Synergy International Optronics, LLC). We believe the purchase of the license agreement may allow us to extend and expand our market potential for the M113APC vehicle type which has the highest number of commonly used armored vehicles in the world. The current estimated active M113 APC worldwide inventory is over 80,000 units. This licensing of this patent allows us to develop additional products for this vehicle type, including the M17 Day/Thermal and M17 Day/Night periscopes. We are actively marketing the new periscopes internationally and completed our first international shipment utilizing this technology in March 2014. We continue to prototype these products and demonstrate them to potential customers.

On June 29, 2023, the “Effective Date”, we executed a License agreement LA12342 with Pratt & Whitney Division (“P&W”) of Raytheon Technologies Corporation for a six-year term from the Effective date. The agreement allows the Company the use of P&W’s proprietary technology to perform the application and inspection of proprietary coatings on a selection of vane part numbers for the upturned exhaust system (UESII) utilized on Sikorsky’s Blackhawk aircraft variants. The license grant is exclusive to the Applied Optics Center for the application and inspection of coatings for the end customer, provided that AOC is able to sufficiently meet the end customer volume demand for the licensed items during the term. In consideration of the license rights, AOC agrees to pay P&W a royalty of $200 per vain, or $2000 per shipset of 10 vanes to which the coating is applied. On the 2nd anniversary of the Effective date, and every two years thereafter during the term of the agreement, the royalty rate shall be increased by 3%. Semiannual payments are to be paid within 15 days of June 30th and December 31st throughout the duration of the agreement.

Our competitors, many of which have substantially greater resources, may have applied for or obtained, or may in the future apply for and obtain, patents that will prevent, limit or interfere with our ability to make and sell some of our products. Although we believe that our products do not infringe on the patents or other proprietary rights of third parties, we cannot assure you that third parties will not assert infringement claims against us or that such claims will not be successful.

Competition

The markets for our products are competitive. We compete primarily on the basis of our ability to design and engineer products to meet performance specifications set by our customers. Our customers include military and government end users as well as prime contractors that purchase component parts or subassemblies, which they incorporate into their end products. Product pricing, quality, customer support, experience, reputation and financial stability are also important competitive factors.

|

|

There are a limited number of competitors in each of the markets for the various types of products that we design, manufacture and sell. At this time, we consider our primary competitor for the Optex Richardson site to be Gus Periscopes. The Applied Optics Center thin film and laser coatings products compete primarily with Materion-Barr, G&H Artemis and Alluxa.

Our competitors are often well entrenched, particularly in the defense markets. While we believe that the quality of our technologies and product offerings provides us with a competitive advantage over certain manufacturers, some of our competitors have substantially greater financial and other resources than we do to spend on the research and development of their technologies and for funding the construction and operation of commercial scale plants.

We expect our competitors to continue to improve the design and performance of their products. We cannot assure investors that our competitors will not develop enhancements to, or future generations of, competitive products that will offer superior price or performance features, or that new technology or processes will not emerge that render our products less competitive or obsolete. Increased competitive pressure could lead to lower prices for our products, thereby adversely affecting our business, financial condition and results of operations. Also, competitive pressures may force us to implement new technologies at a substantial cost, and we may not be able to successfully develop or expend the financial resources necessary to acquire new technology. We cannot assure you that we will be able to compete successfully in the future.

Employees and Human Capital

We had 132 full-time equivalent employees as of September 28, 2025, which include a small temporary work force to handle peak loads as needed. We are in compliance with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees, who are not currently unionized. We use outside consultants for various services. We have not experienced any work stoppages and are not a party to a collective bargaining agreement. Management considers labor relations to be good.

We are dedicated to preserving operational excellence and remaining an employer of choice. We provide and maintain a work environment that is designed to attract, develop and retain top talent through offering our employees an engaging work experience that contributes to their career development. We recognize that our success is based on the collective talents and dedication of those we employ, and we are highly invested in their success. We value our employees and believe that employee loyalty and enthusiasm are key elements of our operating performance.

Corporate History

Optex Systems Holdings, Inc. is a Delaware corporation originally organized in Delaware as Sustut Exploration, Inc. in April 2006. Optex Systems, Inc. is a Delaware corporation organized in September 2008. In March 2009, Optex Systems, Inc. engaged in a reverse merger with Sustut Exploration, Inc., in connection with which the latter was renamed Optex Systems Holdings, Inc. and the former became a wholly-owned subsidiary of Optex Systems Holdings, Inc.

Internet Address

The Company maintains an internet website at the following address: www.optexsys.com. The information on the Company’s website is not incorporated by reference in this Annual Report on Form 10-K.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this Annual Report, before purchasing shares of our common stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. The risks described below are not the only risks we face. If any of these risks actually materializes, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment. The risks and uncertainties described below are not exclusive and are intended to reflect the material risks that are specific to us, our industry and companies that have securities trading on an over-the-counter market.

|

|

Risks Related to our Business

Our historical operations depend on government contracts and subcontracts. We face risks related to contracting with the federal government, including federal budget issues and fixed price contracts.

Future general political and economic conditions, which cannot be accurately predicted, may directly and indirectly affect the quantity and allocation of expenditures by federal agencies and foreign governments. Even the timing of incremental funding commitments to existing, but partially funded, contracts can be affected by these factors. Therefore, cutbacks or re-allocations in the federal or foreign government budgets could have a material adverse impact on our results of operations. Obtaining government contracts may also involve long purchase and payment cycles, competitive bidding, qualification requirements, delays or changes in funding, budgetary constraints, political agendas, extensive specification development, price negotiations and milestone requirements. In addition, our government contracts are primarily fixed price contracts, which may prevent us from recovering costs incurred in excess of budgeted costs. Fixed price contracts require us to estimate the total project cost based on preliminary projections of the project’s requirements. The financial viability of any given project depends in large part on our ability to estimate such costs accurately and complete the project on a timely basis. Some of those contracts are for products that are new to our business and are thus subject to unanticipated impacts to manufacturing costs. Even if our estimates are reasonable at the time made, prices of materials are subject to unanticipated adverse fluctuation, and are affected by inflationary pressures. In the event our actual costs exceed the fixed costs determined under our product contracts, we will not be able to recover the excess costs which could have a material adverse effect on our business and results of operations. We examine these contracts on a regular basis and accrue for anticipated losses on these contracts, if necessary.

We have several multiyear IDIQ contracts at fixed prices which have open ordering periods and are currently at low profit rates or in a loss condition. These contracts are typically three-year IDIQ contracts with two optional award years, and as such, we are obligated to accept new task awards against these contracts until the contract expiration. Should contract costs continue to increase above the negotiated selling price, or in the event the customer should release substantial quantities against these existing loss contracts, the losses could be material. For contracts currently in a loss status based on the estimated per unit contract costs, losses are booked immediately on new task order awards. As of September 28, 2025, there was $132 thousand in accrued loss provisions for loss contracts or cost overruns.