UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934:

For the fiscal year ending September 30, 2025

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934:

For the transition period from __________ to __________.

Commission file number: 001-41882

INNO HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Texas | 87-4294543 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

RM1, 5/F, No. 43 Hung To Road, Kwun Tong,

Kowloon, Hong Kong 999077

(Address of principal executive offices, including ZIP Code)

+852-54795450

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, no par value | INHD | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of March 31, 2025, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was $16,953,353.

As of December 15, 2025, there were 97,948,480 shares of common stock, no par value, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this annual report, including in the following sections: “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. When used in this annual report, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements include, but are not limited to, statements contained in this annual report relating to our business strategy, our future operating results, and our liquidity and capital-resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you, therefore, against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation:

| ● | our ability to effectively operate our business segments; |

| ● | our ability to manage our research, development, expansion, growth, and operating expenses; |

| ● | our ability to evaluate and measure our business, prospects, and performance metrics; |

| ● | our ability to compete, directly and indirectly, and succeed in a highly competitive and evolving industry; |

| ● | our ability to respond and adapt to changes in technology and customer behavior; |

| ● | our ability to protect our intellectual property and to develop, maintain, and enhance a strong brand; and |

| ● | other factors relating to our industry, our operations, and results of operations. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

USE OF CERTAIN DEFINED TERMS

Unless the context otherwise requires, in this annual report on Form 10-K references to:

| ● | the “Company,” “INNO,” the “registrant,” “we,” “our,” or “us” mean INNO HOLDINGS INC. and its subsidiaries; | |

| ● | “year” or “fiscal year” means the year ending September 30; | |

| ● | all dollar or $ references, when used in this prospectus, refer to United States dollars; | |

| ● | “Hong Kong” or “HK” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; | |

| ● | “HKD,” “HK$” or “H.K. Dollars” refers to the official legal currency of Hong Kong; | |

| ● | “Common stock” refers to Inno Holdings Inc.’s shares of common stock, no par value. |

|

|

PART I

ITEM 1. BUSINESS

Overview

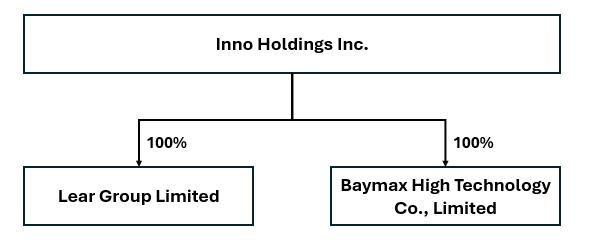

INNO HOLDINGS INC. (“INNO,” “we,” “us,” or “Company”) is an innovative technology company that engages in the business of recycled consumer electronic devices. We source and purchase pre-owned consumer electronic devices such as smartphones and tablets from suppliers and sell the electronic devices to wholesalers that re-sell these products to their wholesale and/or retail customers in Southeast Asia, Middle East Asia, Europe and other regions. We conduct our business of recycled consumer electronic devices through two Hong Kong-based wholly-owned subsidiaries Lear Group Limited and Baymax High Technology Co., Limited, acquired by the Company in October and December 2024, respectively.

Previously the Company engaged in the business of manufacturing cold-formed-steel and offering a range of services required to transform raw materials into precise steel framing products and prefabricated homes. In the second quarter of 2025, the Company decided to discontinue its cold-formed-steel business and sold all of the Company’s ownership in the subsidiaries through which the Company conducted its cold-formed-steel business. From March 2025 till April 2025, the Company completed the disposition of all its ownership or membership interests in its former wholly- and partially-owned subsidiaries, namely Inno Metal Studs Corp, Inno AI Tech Corp., Inno Disrupts Inc., and Castor Building Tech LLC.

Our Products

Recycled consumer electronic devices

The recycled consumer electronic devices offered by us include smartphones (various models of iPhone) and tablets (various models of iPad). For the years ended September 30, 2025, revenues generated from recycled iPhones accounted for 100% of our revenue.

We expect to expand our products into more categories in the future including but not limited to laptops, such as MacBook, and other accessories, such as smartwatches and headphones.

Our Customers

Currently we derive all of our revenues from wholesale customers. Such wholesaler customers purchase recycled consumer electronic devices from us and then re-sell them in Southeast Asia, Middle East Asia, Europe and other regions.

Our Suppliers

We currently rely on a limited number of suppliers that collect pre-owned consumer electronic devices from network carriers, companies, and individuals. For the year ended September 30, 2025, two suppliers accounted for all of the Company’s total purchases. We endeavor to broaden our supplier base. However, we maintain a high standard requirement for supplies of recycled consumer electronic devices. Before purchasing products from a new supplier, the Company will perform a background check, taken into consideration the new supplier’s past track record.

|

|

Our Competitive Strengths

Purchase and sale of high quality Like-New products

Recycled consumer electronic devices vary greatly in their quality. Our business strategy is purchasing and selling high quality Like-New electronic devices that have minimal signs of use, scratches, cracks or scuffs to the screen or rear housing. Such business strategy contributes to not only high efficiency on inspection, testing and refurbishment of the purchased products but also extremely low return rate from our global customers.

Dynamic inventory level management

We maintain a dynamic level of inventories of recycled consumer electronic devices, based on our knowledge of the prevailing market trend and estimation of electronic devices price fluctuation. We continuously adjust our inventory levels by lowering inventory of products in downward trend and increasing inventory of those in upward trend.

Fast response to our customers’ needs

We respond fast to our customers’ needs. The fast response is enabled by the inventories maintained in our leased warehouse in Hong Kong that are ready for shipping to our customers. Also, since our products are high quality Like-New devices, our warehouse personnels can quickly package and ship the goods via third party couriers. These measures help shorten the time between our receipt of customers’ orders and the delivery of the goods. Fast response to our customers’ needs contribute to higher level of customer loyalty to our products.

Flexible product pricing algorithm

We have developed a database and algorithm for pricing strategies in purchase and sales of recycled consumer electronic devices. We are able to set prices in a flexible way to balance demands and profitability by comprehensively considering factors including the current market price of similar products, historical transaction prices of similar products, size of the order, specifications of the products, and the quantity of the products.

Strategic location of Hong Kong

Our operating subsidiaries, Lear Group Limited and Baymax High Technology Co., Limited, are located in Hong Kong. Hong Kong is one of the busiest ports and enjoys the advantage of duty-free status, making it a major hub for the global recycled electronic devices industry. Located in Hong Kong, the Company can conveniently receive recycled electronic devices from, and have them dispatched to, most of the regions in the world.

Marketing

We endeavor to broaden our customer base. Our marketing strategy is a long-term plan to achieve our Company’s mission by understanding the needs of customers and creating a distinct and sustainable competitive advantage. We intend to leverage our marketing and sales efforts to establish new potential customers. We also intend to leverage customer referrals, which in the past have been a source of new business. We believe that the reputation we have developed with our current customers represents an important part of our marketing effort.

We have a digital market channel and a social media presence. Our marketing channels include creating and implementing ad campaigns, and word of mouth. Also, we are actively conducting market research to determine the viability of our new products and new patents. We have increased our marketing budget and formed a professional sales team to increase our online marketing, which we believe can help us grow our revenue.

|

|

Business Plan

Diversify the product portfolio

We built a solid business model of recycling and reselling smartphones and tablets. With the experience and capital gained over the years, we plan to further diversify our product portfolio by participating in laptops, such as MacBook, and other accessories, such as smartwatches and headphones.

Expand into strategic overseas markets

The Company expects the recycled consumer electronic devices market to experience robust growth in Southeast and Middle Asia in the near future. To shorten the supply chain and better interact with the clients located in these strategic markets, the Company intends to set up offices in Singapore, Malaysia, Dubai and other areas in Southeast and Middle Asia in the next five years. We expect this strategic move to help increase its revenues and market presence.

Expand the wholesale business and develop a B2B Marketplace Platform

We plan to further expand our wholesale customer base in recycled consumer electronic devices. The Company is now in process of developing a Business to Business (“B2B”) marketplace platform that will facilitate manufacturers and distributors as suppliers to sell direct to business buyers as wholesalers. This marketplace platform, empowered by cloud computing, big data, and high-frequency matchmaking technology, will provide sellers with marketplace technology to enhance and grow their business while offering buyers access to an exclusive collection of top brands at or below wholesale prices. The platform is expected to supplement the Company’s traditional business model of individual negotiations and attract potential customers. We expect to obtain more customers and suppliers through this marketplace platform.

Potential acquisitions for horizonal and vertical integration

In accordance with our growth strategy, the Company intends to pursue horizonal and vertical integration by acquiring companies operating within the industry of recycled consumer electronic devices. The objective of this horizonal and vertical integration is to strengthen and expand our capabilities within the market. We will position ourselves to offer a comprehensive range of solutions encompassing the entire value chain of recycled consumer electronic devices.

To fortify our supply chain and augment our capabilities, we will consider the strategic acquisition of distributors/wholesalers with the proceeds from our equity and/or debt financing activities to pursue potential acquisitions. The targeted companies would include the ones that enjoy the popularities in the industry, including but not limited to the companies that have already built stable sales connection to whole and retail customers in regions that we currently do not reach to, such as North and South America. The Company may also consider the strategic acquisition of its competitors within the industry in order to strengthen its capabilities of inspection, testing and refurbishment as well as pricing.

Recruit additional employees

We plan to employ additional personnel to meet the Company’s growth needs. Our hiring plan includes the recruitment of marketing personnel to build and improve our brand recognition, the sales personnels to meet and satisfy the increased wholesale demands from our existing and new customers, and also a financial and accounting team to strengthen our financial control system.

Enhance business infrastructures

The Company plans to upgrade its business infrastructure to better prepare for its future growth, including the inventory management and information system. In order to improve our dynamic inventory management, we plan to upgrade the inventory management system so that the Company’s inventories of recycled consumer electronic devices can be maintained at a more efficient and flexible level. In addition, the Company may develop a proprietary device testing software to further facilitate the inspection and testing process of purchased recycled consumer electronic devices. With the updated infrastructures, we expect to increase the efficiency and data security in our business operations.

|

|

Seasonality

We experience a moderate level of seasonality in our business primarily as a result of new product launches by consumer electronic devices manufacturers and promotional campaigns by e-commerce platforms. New product launches by major cell phone brands such as Apple each year also boost our customer traffic and purchase orders. All of these activities can affect our results for those quarters. The seasonality in our business also results from major promotions and holidays such as Black Friday, Cyber Monday, and Christmas Holiday. Overall, the historical seasonality of our business has been relatively moderate. Our financial condition and results of operations for future periods may continue to fluctuate.

Radio Dealers License (unrestricted)

Our operating subsidiaries Lear Group Limited and Baymax High Technology Co., Limited have obtained the Radio Dealers License (Unrestricted), the document required to conduct the trade or business in apparatus or material for radio-communications or any components part thereof, including the performing of repairs and refurbishment, and the import and export of radio-communications transmitting apparatus. The current term of the License of Lear Group Limited and Baymax High Technology Co., Limited will expire on September 30, 2025 and December 31, 2025, respectively. We will comply with the requirements and keep the license valid.

Competition

The recycled consumer electronic wholesale industry in Hong Kong is competitive and relatively fragmented, with approximately 1,000 wholesalers engaged in sourcing, grading, refurbishing and resale of pre-owned consumer electronic devices. The major competitors of the Company include the following:

| ● | Guang Yi Co. Ltd., founded in 2020, is primarily engaged in the international wholesaling and trading of cellphones and other consumer electronic devices in various grades, including brand new, nearly new, and average grading. Suppliers of Guang Yi Co. Ltd. include telecommunication companies and over 100 other vendors. In addition, the Guang Yi Co. Ltd. has built a global buy-back network to recycle pre-owned cellphones through a B2C channel. |

| ● | Brightway Trading Co., established in 2013, is focusing on the submarket of cell phones returned by customers. Brightway Trading Co. sources cellphones of all conditions from Europe, the U.K., the U.S. |

| ● | CommNet Telecom Limited, a Hong Kong based consumer electronic devices recycling firm that started its business in 2004, specializes in the import and export of brand new and used cell phones. The majority of CommNet Telecom Limited’s suppliers are located in the U.S. and the U.K. |

Government Regulations

As we conduct business in Hong Kong through our wholly-owned subsidiaries, our business operations are subject to various regulations and rules promulgated by the Hong Kong government. The following is a brief summary of the Hong Kong laws and regulations that currently and materially affect our business. This section does not purport to be a comprehensive summary of all present and proposed regulations and legislation relating to the industries in which we operate.

Hong Kong Laws and Regulations Relating to Trade Descriptions

Trade Descriptions Ordinance (Chapter 362 of the Laws of Hong Kong) (the “TDO”), which came into full effect in Hong Kong on April 1, 1981, aims to prohibit false or misleading trade description and statements to goods and services provided to the customers during or after a commercial transaction. Pursuant to the TDO, any person in the course of any trade or business applies a false trade description to any goods or supply or offers to supply them commits an offence and a person also commits the same offence if he/she is in possession for sale or for any purpose of trade or manufacture of any goods with a false description. The TDO also provides that traders may commit an offence if they engage in a commercial practice that has a misleading omission of material information of the goods, an aggressive commercial practice, involves bait advertising, bait and switch or wrong acceptance of payment. It is also an offence for any person to have in his possession for sale or for any purpose of trade or manufacture any goods to which a false trade description is applied. To amount to a false trade description, the falsity of the trade descriptions has to be to a material degree. Trivial errors or discrepancies in trade descriptions would not constitute an offence. What constitutes a material degree will vary with the facts.

|

|

Contravention of the prohibitions in the TDO is an offence, with a maximum penalty of up to HK$500,000 and five years’ imprisonment. However, the TDO also provides regulators with the ability to accept (and publish) written undertakings from businesses and individuals not to continue, repeat or engage in unfair trade practices in return of which regulator will not commence or continue investigations or proceedings relating to that matter. Regulators will also be empowered to seek an injunction against businesses and persons engaging in unfair trade practices or who have breached an undertaking.

Hong Kong Laws and Regulations Relating to Sale of Goods

Pursuant to Sale of Goods Ordinance (Chapter 26 of the Laws of Hong Kong) (the “SOGO”), which came into full effect in Hong Kong on August 1, 1896, in every contract of sale, there is an implied warranty that the goods are free, and will remain free until the time when the property is to pass, from any charge or encumbrance not disclosed or known to the buyer before the contract is made and that the buyer will enjoy quiet possession of the goods except so far as it may be disturbed by the owner or other person entitled to the benefit of any charge or encumbrance so disclosed or known. The SOGO provides that there is an implied condition that the goods shall correspond with the description where there is a contract for the sale of goods by description, and there is any implied condition or warranty as to the quality or fitness for any particular purpose of goods supplied under a contract of sale. Where the seller sells goods in the course of a business, there is an implied condition that the goods supplied under the contract are of merchantable quality, except that there is no such condition (i) as regards defects specifically drawn to the buyer’s attention before the contract is made; or (ii) if the buyer examines the goods before the contract is made, as regards defects which that examination ought to reveal; or (iii) if the contract is a contract for sale by sample, as regards defects which would have been apparent on a reasonable examination of the sample. Where there is a contract for sale by sample, there are implied conditions that (i) the bulk shall correspond with the sample in quality, (ii) the buyer shall have a reasonable opportunity of comparing the bulk with the sample, and (iii) the goods shall be free from any defect, rendering them unmerchantable, which would not be apparent on reasonable examination of the sample. Under SOGO, where any right, duty or liability would arise under a contract of sale of goods by implication of law, it may (subject to the Control of Exemption Clauses Ordinance (Chapter 71 of the Laws of Hong Kong)) be negatived or varied by express agreement, or by the course of dealing between the parties, or by usage if the usage is such as to bind both parties to the contract.

Telecommunications Ordinance (Chapter 106 of the Laws of Hong Kong) (the ‘‘TO’’)

Under the TO, a license, namely Radio Dealers License (Unrestricted), is required for dealing in the course of trade or business in apparatus or material for radio communications or in any component part of any such apparatus or in apparatus of any kind that generates and emits radio waves whether or not the apparatus is intended, or capable of being used, for radio communications. However, the above requirement does not apply to licensed exempted radio communications apparatus (e.g., mobile phones, short-range walkie-talkies, cordless phones) meeting prescribed specifications. Under the Radio Dealers License (Unrestricted), the licensee is permitted to deal in radio communications apparatus pursuant to section 9 of the TO. A Radio Dealers License (Unrestricted) is generally valid for a period of 12 months, and is renewable on payment of the prescribed fee, at the discretion of Office of the Communications Authority (“OFCA”).

Our operating subsidiaries Lear Group Limited and Baymax High Technology Co., Limited are licensees of the Radio Dealers Licenses (Unrestricted). The material licensing conditions are: (a) to store the licensed apparatus at a specified address, (b) to display the license at the licensed premises, (c) to keep and maintain complete and accurate registers for the last twelve months, of the licensed apparatus and of the licensee’s dealings and transactions therewith, except those apparatus which have been exempted, (d) not to deal locally in radio apparatus which is not of a type approved by the Communications Authority or not licensable in Hong Kong; and to only deliver radio apparatus to a customer if (i) they have been exempted by statute, (ii) the customer is not a tourist and is licensed to possess or use the apparatus, or (iii) the customer is a tourist who intends to export the apparatus after purchase.

|

|

Radio Dealers Licenses have different dates of grant and are valid for a period of 12 months. Lear Group Limited’s and Baymax High Technology Co., Limited’s radio dealers license will expire on September 30, 2026 and December 31, 2025, respectively, and will be renewed upon expiry (subject to the discretion of OFCA). We will renew the Radio Dealers Licenses in accordance with the Telecommunications Regulations (Chapter 106A of the Laws of Hong Kong) by paying the required renewal fee to OFCA. We are not aware of any legal impediment to renew the Radio Dealers Licenses subject to the conditions below: (I) We have to pay to OFCA the required renewal fee as may from time to time be determined and required by OFCA on or before the respective date of expiry of the Radio Dealers Licenses; and (II) We have to comply with the “General Conditions to be observed by Licensee of Radio Dealers License (Unrestricted)” and the “Conditions” set out in the Radio Dealers Licenses.

Consumer Goods Safety Ordinance (Chapter 456 of the Laws of Hong Kong) (the “CGSO”) and Consumer Goods Safety Regulation (Chapter 456A of the Laws of Hong Kong) (the “CGSR”)

The CGSO is enacted to impose a duty on manufacturers, importers and suppliers of certain consumer goods to ensure that the consumer goods they supply are safe. Electrical products and any other goods the safety of which is controlled by specific legislation are not covered by the CGSO.

The CGSO prohibits a person from supplying, manufacturing, or importing into Hong Kong consumer goods unless the consumer goods comply with the general safety requirement or an approved standard for consumer goods. Currently there is no approved standard which has been approved in any regulation to the CGSO. Contravention with the above requirement is an offence and the offender is liable on first conviction to a fine at HK$100,000 and to imprisonment for one year, and on subsequent conviction to a fine of HK$500,000 and to imprisonment for two years.

It is a defense to the above offence if the commission of the offence was due to (a) the act or default of another person or reliance on information given by another, and (b) that it was reasonable in all the circumstances for him to have relied on the information, having regard in particular (i) to the steps which he took, and those which might reasonably have been taken, for the purpose of verifying the information; and (ii) to whether he had any reason to disbelieve the information. A court may take into consideration the existence of a certificate from an approved laboratory showing that the samples of consumer goods which are the subject of the prosecution had been tested before being sold and had complied with the safety standard or safety specification set out in the certificate.

The CGSR requires any warning or caution affixed on any consumer goods or their packages to be in both the English and the Chinese languages. The warning or caution shall be legible and be placed in a conspicuous position on (a) the consumer goods; (b) any package of the consumer goods; (c) a label securely affixed to the package; or (d) a document enclosed in the package. Any person who supplies consumer goods which do not comply with the above requirements commits an offence and is liable (a) on first conviction to a fine at HK$100,000 and to imprisonment for one year; and (b) on subsequent conviction to a fine of HK$500,000 and to imprisonment for two years.

Hong Kong Laws and Regulations Relating to Intellectual Properties Rights

Trade Marks Ordinance (Chapter 559 of the Laws of Hong Kong) (“TMO”), which came into full effect in Hong Kong on April 4, 2003 provides the framework for the Hong Kong’s system of registration of trademarks and sets out the rights attached to a registered trade mark, including logo and a brand name. The TMO restricts unauthorized use of a sign which is identical or similar to the registered mark for identical and/or similar goods and/or services for which the mark was registered, where such use is likely to cause confusion on the part of the public. The TMO provides that a person may also commit a criminal offence if that person fraudulently uses a trademark, including selling and importing goods bearing a forged trade mar, or possessing or using equipment for the purpose of forging a trademark. However, pursuant to section 20 of the TMO, a registered trade mark is not infringed by the use of trade mark in relation to goods which have been put on the market anywhere in the world under that trade mark by the owner or with his consent (whether express or implied or conditional or unconditional), unless the condition of the goods has been changed or impaired after they have been put on the market, and the use of the registered trade mark in relation to those goods is detrimental to the distinctive character or repute of the trade mark.

Patents Ordinance (Chapter 514 of the Laws of Hong Kong), which came into full effect in Hong Kong on June 27, 1997 provides the framework for “re-registration” system of Chinese, UK and European patents in Hong Kong. Pursuant to Patents (Amendment) Ordinance 2016, which came into full effect in Hong Kong on December 19, 2019 provide a new framework for a new patent system — an “original grant patent” system, running in parallel with the “re-registration” system.

|

|

Copyright Ordinance (Chapter 528 of the Laws of Hong Kong) (“CO”), which came into full effect in Hong Kong on June 27, 1997 provides comprehensive protection for recognized categories of underlying works such as literary, dramatic, musical and artistic works. The CO restricts unauthorized acts such as copying and/or making available copies to the public of a copy right work. The CO provides that a person commits an offence if he, without the license of the copyright owner of a copyright work imports an infringing copy of the work into Hong Kong, at any time within 15 months beginning on the first day of publication of the work in Hong Kong or elsewhere, otherwise than for his private and domestic use.

Human Capital Resources

The success of our business depends in large part on our ability to attract, retain, and develop a workforce of skilled employees at all levels of our organization. We provide employees with base wages and salaries that we believe are competitive and consistent with each employee’s position. We also work with local, regional, and state-wide agencies to facilitate workforce hiring and development initiatives. We had five and four full-time employees as of September 30, 2025 and 2024, respectively.

Corporate Structure

Our Company, INNO HOLDINGS INC., was incorporated in Texas on September 8, 2021. It originally had three subsidiaries, Inno Metal Studs Corp (“IMSC”), Castor Building Tech LLC (“CBT”), and Inno Research Institute LLC (“IRI”).

On January 21, 2024, the Company established Inno Disrupts Inc. (“Disrupts”), a wholly owned subsidiary in Texas. The purpose of Inno Disrupts Inc. is to remodel buildings using the Company’s framing steel products, enhance producing and marketing capabilities, manage the designated buildings in US, and other activities.

On January 27, 2024, the Company and the minority shareholder of IRI agreed to dissolve IRI, a subsidiary of IMSC with 65% ownership. The R&D activities previously carried out by IRI will be transferred to the new subsidiary, Inno AI Tech Corp.

On February 11, 2024, the Company formed Inno AI Tech Corp. (“AT”), a wholly owned entity in Texas to conduct AI tech research and consulting activities.

On October 18, 2024, the Company acquired all of the issued and outstanding shares of Lear Group Limited (“Lear”), a Hong Kong company, for a total consideration of $1,300. As a result of this transaction, Lear became a wholly-owned subsidiary of the Company.

On December 13, 2024, the Company acquired all of the issued and outstanding shares of Baymax High Technology Co., Limited (“Baymax”), a Hong Kong company, for a total consideration of $1,300. As a result of this transaction, Baymax became a wholly-owned subsidiary of the Company.

On March 4, 2025, the Company entered into a Share Purchase Agreement with a third-party Buyer, pursuant to which the Company sold all issued and outstanding shares of its wholly owned subsidiaries, IMSC and AT, to the Buyer for an aggregate purchase price of $1,000 in cash.

On March 28, 2025, the Company entered into a Membership Interest Purchase Agreement with a third-party Buyer and Core Modu LLC, a Texas limited liability company (“CM”), pursuant to which the Company sold all of the membership interest it owned in CM, which represented 15% of the outstanding membership interest in CM, to the Buyer for an aggregate purchase price of $700,000.

On March 28, 2025, the Company entered into a Membership Interest Purchase Agreement with a third-party Buyer and Castor Building Tech LLC, a California limited liability company (“CBT”), pursuant to which the Company sold all of the membership interest it owned in CBT, which represented 55% of the outstanding membership interest in CBT, to the Buyer for an aggregate purchase price of $1,000.

|

|

On April 8, 2025, the Company entered into a Share Purchase Agreement with a third-party Buyer, pursuant to which the Company sold all issued and outstanding shares it owns in Disrupts for an aggregate purchase price of $100.

Below is the corporate structure of the Company as of September 30, 2025:

Corporate Information

Our principal executive office is located at RM1, 5/F, No. 43 Hung To Road, Kwun Tong, Kowloon, Hong Kong 999077. Our corporate website address is https://www.innoholdings.com. Our telephone number is +852-54795450.

|

|

ITEM 1A. RISK FACTORS

As a “smaller reporting company,” as defined by Rule 12b-2 of the Exchange Act, we are not required to provide the information in this Item. Nonetheless, we are voluntarily providing risk factors herein. You should consider carefully the following risk factors when evaluating our business and financial condition, together with all the other information in this Annual Report on Form 10-K, and in our other public filings with the SEC. The occurrence of any of the following risks could harm our business, financial condition, results of operations and/or growth prospects or cause our actual results to differ materially from those contained in forward-looking statements we have made in this report and those we may make from time to time. In addition, these risks are not the only ones faced by the Company. Additional risks not summarized hereafter or not presently known to the Company or that the Company currently believes are immaterial may also impair business operations and financial results.

Risks Related to Our Business and Operations

We have shifted our primary business focus.

As of the date of this report, we were primarily engaged in the business of recycled consumer electronic devices. We source and purchase pre-owned consumer electronic devices such as smartphones and tablets from suppliers and sell the electronic devices to wholesalers that re-sell these products to their wholesale and/or retail customers in Southeast Asia, Middle East Asia, Europe and other regions. In the second quarter of 2025, we discontinued our previous business in cold-formed-steel business and sold all of the Company’s ownership in the subsidiaries through which the Company conducted its cold-formed-steel business.

Our experience in the business of recycled consumer electronic devices is limited. This strategic shift exposes us to uncertainties and risks associated with operating in a new industry. Our ability to execute our new business model, secure stable supply, maintain customer relationships, compete effectively and achieve profitability is uncertain. We also may face challenges in developing the operational infrastructure, internal controls and industry expertise required for this business. In addition, we may continue to incur transitional costs or potential liabilities associated with our discontinued operations. Any of these factors could materially and adversely affect our business, financial condition and results of operations.

Our future growth strategies may not be as effective as we expect.

We are actively seeking to expand our business into new industry sectors. As previously announced and disclosed in our filing with the SEC, we entered into a non-binding Memorandum of Understanding (MoU) with Megabyte Solutions Limited (“MEGABYTE”), a Web3 technology service provider. We plan to form a strategic partnership with MEGABYTE to jointly deploy the in-depth application of Web3 technology in the Company’s cross-border B2B marketplace platform under development. Additionally, in response to the supply chain and trade needs of B2B businesses, we and MEGABYTE plan to launch an innovative decentralized, blockchain-powered service model integrating hardware and software.

These initiatives remain in early stages, and there is no assurance that the partnership will be finalized, that the planned technologies will be successfully developed or commercialized, or that market acceptance will meet our expectations. Web3 and blockchain technologies are evolving rapidly and are subject to regulatory, operational and adoption risks. We may face challenges in securing required technical expertise, integrating new technologies into our platform, or achieving the anticipated synergies and economic benefits. If our growth strategies fail to generate the expected results, our business prospects, financial condition and results of operations could be materially and adversely affected.

We are operated primarily in Hong Kong.

As of the date of this report, we operate primarily in Hong Kong, and our business, financial condition and results of operations are subject to the economic, political, legal and regulatory environments of Hong Kong. Any adverse developments in these conditions (such as changes in trade policies, geopolitical tensions, regulatory requirements, data and cybersecurity laws, taxation rules, labor conditions, or market demand) could materially and adversely affect our operations.

|

|

We face concentration risks in our revenue as we rely on our major customers.

A significant portion of our revenue is generated from a limited number of our major customers. For the year ended September 30, 2025, two customers accounted for 77% of the Company’s total revenues. For the year ended September 30, 2024, four customers accounted for 90% of the Company’s total revenues. If any of these customers reduces its purchase volume, experiences financial difficulties, delays payments, or terminates its relationship with us, our revenue and cash flows could be materially and adversely affected. Our dependence on a small customer base also limits our ability to negotiate favorable pricing and terms. If we fail to diversify our customer base or replace lost customers in a timely manner, our business, financial condition and results of operations may be materially harmed.

We face concentration risks in our purchases as we rely on our major suppliers.

We depend on a limited number of major suppliers for the purchase of pre-owned electronic device products. For the year ended September 30, 2025, two suppliers accounted for 100% of the Company’s total purchases. For the year ended September 30, 2024, two suppliers accounted for 58% of the Company’s total purchases. Any disruption in these supplier relationships could materially affect our ability to source inventory and meet customer demand. Our reliance on a concentrated supplier base also exposes us to risks associated with supplier financial instability, operational disruptions, and competitive pressures. If we are unable to diversify our supplier base or secure alternative sources of supply on commercially reasonable terms, our business, financial condition and results of operations could be materially and adversely affected.

There is no assurance that the Company will be profitable.

There is no assurance that we will earn profits in the future, or that profitability will be sustained. There is no assurance that future revenues will be sufficient to generate the funds required to continue our business development and marketing activities. If we do not have sufficient capital to fund our operations, we may be required to reduce our sales and marketing efforts or forego certain business opportunities.

The Company may not have the ability to manage its growth.

The Company anticipates that significant expansion will be required to address potential growth in its customer base and market opportunities. The Company’s anticipated expansion is expected to place a significant strain on the Company’s management, operational, and financial resources. To manage any material growth of its operations and personnel, the Company may be required to improve existing operational and financial systems, procedures, and controls and to expand, train, and manage its employee base. There can be no assurance that the Company’s planned personnel, systems, procedures, and controls will be adequate to support the Company’s future operations, that management will be able to hire, train, retain, motivate, and manage required personnel, or that the Company’s management will be able to successfully identify, manage, and exploit existing and potential market opportunities. If the Company is unable to manage growth effectively, its business, prospects, financial condition, and results of operations may be materially adversely affected.

We rely on the leadership of our management team and the performance of highly skilled personnel.

The Company is, and will be, heavily dependent on the skill, acumen, and services of the management and other employees of the Company. Our future success depends on our continuing ability to attract, develop, motivate, and retain highly qualified and skilled employees. Qualified individuals are in high demand, and we may incur significant costs to attract them. In addition, the loss of any of our senior management or key employees could materially adversely affect our ability to execute our business plan, and we may not be able to find adequate replacements. During the financial year ended September 30, 2025, we experienced changes in senior management, including the replacement of our Chief Executive Officer and Chief Financial Officer. All of our officers and employees are at-will employees, which means they may terminate their employment relationship with us at any time, and their knowledge of our business and industry would be extremely difficult to replace. The loss of any of our senior management or key employees could materially adversely affect our ability to execute our business plan, and we may not be able to find adequate replacements. We cannot ensure that we will be able to retain the services of any members of our senior management or other key employees. If we do not succeed in attracting well-qualified employees or retaining and motivating existing employees, our business could be harmed.

|

|

We have incurred costs in our compliance measures as a public company.

As a public company, we are required to comply with extensive regulatory, reporting, corporate governance and internal control requirements. These obligations have resulted in increased legal, accounting, administrative and compliance costs, and we expect such costs to continue. We may also be required to dedicate significant management time and resources to maintain and enhance our compliance programs. If we fail to comply with applicable requirements or if our compliance efforts become more costly than anticipated, our business, financial condition and results of operations could be adversely affected.

Litigation is costly and time-consuming and could have a material adverse effect on our business, results of operations, and reputation.

The Company, as well as the Company’s directors and officers, may be subject to a variety of civil or other legal proceedings relating to the business affairs of companies with which they are, were or may be in the future affiliated, with or without merit. From time to time in the ordinary course of the Company’s business, we may become involved in various legal proceedings — including commercial, employment, and other litigation and claims — as well as governmental and other regulatory investigations and proceedings. Such matters can be time-consuming, divert management’s attention and resources, and cause us to incur significant expenses. Furthermore, because litigation is inherently unpredictable, the results of any such actions may have a material adverse effect on our business, operating results, or financial condition.

Even if the claims are without merit, the costs associated with defending these types of claims may be substantial, in terms of time, money, and management distraction. In particular, patent and other intellectual property litigation may be protracted and expensive, and the results are difficult to predict and may require us to stop offering certain features, purchase licenses, or modify our products and features while we develop non-infringing substitutes or may result in significant settlement costs.

The results of litigation and claims to which we may be subject cannot be predicted with certainty. Even if these matters do not result in litigation or are resolved in our favor or without significant cash settlements, these matters, and the time and resources necessary to litigate or resolve them, could harm our business, results or operations, and reputation.

Risks Related to Our Financing Activities

We may need new or additional financing in the future to expand our business, and our inability to obtain capital on satisfactory terms or at all may have an adverse impact on our operations and our financial results.

We may need new or additional financing in the future to expand our business, refinance existing indebtedness, or make strategic acquisitions, and our inability to obtain capital on satisfactory terms or at all may have an adverse impact on our operations and our financial results. As we grow our business, we may have to incur significant capital expenditures. We may make capital investments to, among other things, build new or upgrade our existing facilities, purchase or lease new equipment, and enhance our production processes. If we are unable to access capital on satisfactory terms and conditions, we may not be able to expand our business or meet our payment requirements under our existing credit facilities. Our ability to obtain new or additional financing will depend on a variety of factors, many of which are beyond our control. We may not be able to obtain new or additional financing because we may have substantial debt, our current receivable and inventory balances may not support additional debt availability, or we may not have sufficient cash flows to service or repay our existing or future debt. In addition, depending on market conditions and our financial performance, equity financing may not be available on satisfactory terms or at all. Moreover, if we raise additional funds through issuances of equity or convertible debt securities, our current stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our common stock. If we are unable to access capital on satisfactory terms and conditions, this could have an adverse impact on our business, results of operations, and financial condition.

Future issuances of our shares or other equity securities may result in significant dilution to our existing shareholders.

To raise additional capital, we have issued and may continue to issue additional shares of our common stock or securities convertible into or exercisable for our shares of common stock. Any such issuance would dilute the ownership interests of our existing shareholders and could adversely affect the market price of our securities. We cannot predict the timing, size or terms of future issuances, and shareholders may suffer significant and substantial dilution.

Our financing activities may negatively affect our cash flows and financial flexibility.

Our financing transactions may require us to incur expenses, pay interest or other financing costs, or allocate cash to service obligations. These payments may reduce funds available for operations, limit our financial flexibility, and increase our vulnerability to adverse business conditions. If our cash flows are insufficient to meet financing obligations, our business and results of operations could be harmed.

|

|

Frequent or unfavorable financing transactions may harm our reputation and investor confidence.

If we engage in repeated or sizable capital raising activities, particularly at discounts to market price, investors may perceive us as overly reliant on external financing. Such perception may adversely affect investor confidence, harm our reputation in the capital markets, and contribute to downward pressure on the trading price of our securities. Negative market perception could also make future financings more difficult or costly to complete.

We may not be able to access the capital markets when needed, which could adversely affect our operations.

Our ability to raise capital through public or private offerings of securities depends on market liquidity, our business and financial performance, our trading volume, regulatory developments and general economic conditions. Market volatility, declining stock price, or low investor demand may restrict our ability to obtain financing in a timely manner or on acceptable terms. If we cannot raise capital when required, we may be unable to execute our business plans, meet working capital needs or respond to competitive pressures.

Risks Relating to Ownership of Our Securities

The market price of our common stock may be volatile and could, following any offering or sale, decline significantly and rapidly.

The price at which our securities are offered or sold in any registered or exempt offering will be determined by negotiations between us and the applicable underwriter, placement agent or investor, and such price may not be indicative of the prices that will prevail in the open market following the offering. The market price of our common stock may decline below the offering price, and you may not be able to sell your shares at or above the price you paid, or at all. Following any such offering, the public price of our common stock in the secondary market will continue to be determined by private buy-and-sell transactions effected through broker-dealers and may fluctuate significantly in response to various factors, many of which are outside our control.

We may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for investors to assess the rapidly changing value of our common stock.

Recently, a number of publicly traded companies, particularly those with relatively small public floats, have experienced extreme stock price run-ups followed by rapid price declines and elevated volatility. We have been and may continue to be susceptible to significant stock price volatility, extreme price run-ups, lower trading volume and reduced liquidity than large-capitalization companies. Our common stock may be subject to rapid and substantial price volatility, low volumes of trades and wide bid-ask spreads. Such volatility, including any rapid price appreciation followed by decline, may be unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for investors to assess the value of our common stock.

In addition, if the trading volumes of our common stock are low, persons buying or selling in relatively small quantities may easily influence the price of our common stock. Low trading volume could cause the price of our common stock to fluctuate significantly, including large percentage changes in a single trading day. Holders of our common stock may not be able to readily liquidate their investment or may be forced to sell at depressed prices due to limited liquidity. Broad market fluctuations and general economic and political conditions may also adversely affect the market price of our common stock.

As a result of this volatility, investors may experience losses on their investment in our common stock. A decline in the market price of our common stock could adversely affect our ability to issue additional common stock or other securities and our ability to obtain additional financing in the future. No assurance can be given that an active or liquid market for our common stock will be sustained, and if an active market does not continue, holders of our common stock may be unable to readily sell their shares or may not be able to sell their common stock at all.

We may not be able to satisfy the listing requirements of Nasdaq to maintain a listing of our common stock.

As a company listed and publicly traded on Nasdaq, we must meet certain financial and liquidity criteria to maintain such listing status. If we violate the maintenance requirements for continued listing of our common stock, our common stock may be delisted. In addition, our board may determine that the cost of maintaining our listing on a national securities exchange outweighs the benefits of such listing. A delisting of our common stock from Nasdaq may materially impair our stockholders’ ability to buy and sell our common stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock. In addition, the delisting of our common stock could significantly impair our ability to raise capital in the future.

We may be subject to securities litigation, which is expensive and could divert our management’s attention.

The market price of our securities may be volatile, and in the past, companies that experienced volatility in the market price of their securities were subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management’s attention from other business concerns.

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 1C. CYBERSECURITY

We acknowledge the increasing importance of cybersecurity in today’s digital and interconnected world. Cybersecurity threats pose significant risks to the integrity of our systems and data, potentially impacting our business operations, financial condition and reputation.

As a smaller reporting company, we currently do not have formalized cybersecurity measures, a dedicated cybersecurity team or specific protocols in place to manage cybersecurity risks. Our approach to cybersecurity is in the developmental stage, and we have not yet conducted comprehensive risk assessments, established an incident response plan or engaged with external cybersecurity consultants for assessments or services.

Given our current stage of cybersecurity development, we have not experienced any significant cybersecurity incidents to date. However, we recognize that the absence of a formalized cybersecurity framework may leave us vulnerable to cyberattacks, data breaches and other cybersecurity incidents. Such events could potentially lead to unauthorized access to, or disclosure of, sensitive information, disrupt our business operations, result in regulatory fines or litigation costs and negatively impact our reputation among customers and partners.

We are in the process of evaluating our cybersecurity needs and developing appropriate measures to enhance our cybersecurity posture. This includes considering the engagement of external cybersecurity experts to advise on best practices, conducting vulnerability assessments and developing an incident response strategy. Our goal is to establish a cybersecurity framework that is commensurate with our size, complexity and the nature of our operations, thereby reducing our exposure to cybersecurity risks.

|

|

In addition, the Board will oversee any cybersecurity risk management framework and a dedicated committee of the Board or an officer appointed by the Board will review and approve any cybersecurity policies, strategies and risk management practices.

Despite our efforts to improve our cybersecurity measures, there can be no assurance that our initiatives will fully mitigate the risks posed by cyber threats. The landscape of cybersecurity risks is constantly evolving, and we will continue to assess and update our cybersecurity measures in response to emerging threats.

For a discussion of potential cybersecurity risks affecting us, please refer to the “Risk Factors” section of our Registration Statement on Form S-1 filed with the Securities and Exchange Commission on October 20, 2023 titled “Our systems and information technology infrastructure may be subject to security breaches and other cybersecurity incidents.”

ITEM 2. PROPERTIES

We lease our principal executive office and warehouse which is located at RM1, 5/F, No. 43 Hung To Road, Kwun Tong, Kowloon, Hong Kong 999077. The lease for this principal executive office and warehouse had a 12-month term beginning on November 1, 2024 and ending on October 31, 2025. On June 1, 2025, this lease was terminated without penalty and a new lease agreement was entered with the landlord. The new lease term is from June 1, 2024 to May 31, 2026, with a monthly rent of $12,000. The facility consists of approximately 1,400 square feet of indoor space.

The lease agreement contains standard commercial lease terms including but not limited to provisions regarding utilities, alterations, maintenance and repair, insurance and indemnification.

We believe that our current leased property is in good condition and suitable for the conduct of our business.

ITEM 3. LEGAL PROCEEDINGS

We are not currently a party to any material legal proceedings, investigations or claims. From time to time, we involve in legal matters arising in the ordinary course of our business. There can be no assurance that such matters will not arise in the future or that any such matters in which we are involved, or which may arise in the ordinary course of our business, will not at some point proceed to litigation or that such litigation will not have a material adverse effect on our business, financial condition or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

|

|

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

We have our common stock listed on The Nasdaq Capital Market under the symbol “INHD”.

Holders

As of September 30, 2025, there were 19 stockholders of record of our common stock. The actual number of stockholders is greater than this number of record holders, and includes stockholders who are beneficial owners, but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

Reverse Stock Split

On November 30, 2022, the Company effected a forward stock split (the “Stock Split”) of the Company’s issued and outstanding shares of the common stock at a split ratio of 2-for-1. Further on July 24, 2023, the Company effected a reverse stock split (the “Reverse Stock Split”) of the Company’s issued and outstanding shares of the common stock at a split ratio of 1-for-2 such that every holder of common stock of the Company shall receive one share of common stock for every two shares of common stock held and to reduce the number of authorized shares of common stock from 200,000,000 to 100,000,000. Shortly after the Reverse Stock Split, the Board of Directors of the Company approved issuance of additional shares to preserve the original purchase price per share of the shares sold in the period from February 1 to June 30, 2023.

On October 9, 2024, the Company completed a 1-for-10 reverse stock split of its issued and outstanding common stock, no par value, (the “Reverse Stock Split”). As a result of the Reverse Stock Split, each share of common stock issued and outstanding immediately prior to October 9, 2024 were automatically converted into one-tenth (1/10) of a share of common stock. The Common Stock began trading on a Reverse Stock Split-adjusted basis on the Nasdaq Capital Market on October 10, 2024. The trading symbols for the Common Stock remains “INHD”. The Reverse Stock Split did not reduce the number of authorized shares of Common Stock and did not change the par value of the Common Stock. The Reverse Stock Split affected all stockholders uniformly. Except to the extent that the Reverse Stock Split resulted in the stockholders’ fractional shares being rounded up, no other effects affect stockholder’s ownership percentage of the Company’s shares of Common Stock. 199,787 fractional shares were issued in connection with the Reverse Stock Split.

All common share and per-share amounts in this Form 10-K have been retroactively restated to reflect the effect of the Reverse Stock Split.

Dividend Policy

We have not declared any cash dividends since inception, and we do not anticipate paying any dividends in the foreseeable future. Instead, we anticipate that all of our earnings will be used to provide working capital, to support our operations, and to finance the growth and development of our business. The payment of dividends is within the discretion of the Board and will depend on our earnings; capital requirements; financial condition; prospects; applicable Texas law, which provides that dividends are only payable out of surplus or current net profits; and other factors our Board might deem relevant. There are no restrictions that currently limit our ability to pay dividends on our common stock other than those generally imposed by applicable state law.

Transfer Agent

VStock Transfer, LLC., 18 Lafayette Place, Woodmere, New York 11598.

Recent Sales of Unregistered Securities

During the period from October 1, 2024 to September 30, 2025, we have granted or issued the following securities that were not registered under the Securities Act:

| Issuance of common stock. |

| ● | On November 4, 2024, the Company issued 500,000 shares of its common stock to certain investors for an aggregate purchase price of $2,000,000 at $4.00 per share in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act or Regulation S promulgated under the Securities Act. |

| ● | On November 20, 2024, the Company issued 277,083 shares of its common stock to certain investors at a purchase price per share of $4.80 in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act or Regulation S promulgated under the Securities Act. |

| ● | On December 13, 2024, the Company issued 452,084 shares of its common stock to certain investors at a purchase price per share of $4.80 in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act or Regulation S promulgated under the Securities Act. |

| ● | On December 23, 2024, the Company issued 700,000 shares of its common stock to certain investors at a purchase price per share of $2.50 in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act or Regulation S promulgated under the Securities Act. |

| ● | On June 20, 2025, the Company issued 1,400,000 shares of its common stock to certain accredited investor a consideration of $1,050,000. |

|

|

The issuance of the common stock in private placements was deemed exempt from registration under Section 4(a)(2) of, and/or Rule 506(b) of Regulation D and/or Regulation S promulgated under the Securities Act in that the issuance of securities were made to an accredited investor and did not involve a public offering. The recipient of such securities represented its intention to acquire the securities for investment purposes only and not with a view to or for sale in connection with any distribution thereof.

Use of Proceeds from our Initial Public Offering of Common Stock

On December 18, 2023, we closed our initial public offering (the “IPO”), in which we sold and issued 250,000 shares of our common stock at a price to the public of $4.00 per share. We received approximately $7,859,533 in aggregate net proceeds from our IPO after deducting underwriting discounts and commissions and other offering expenses. AC Sunshine Securities LLC was the underwriter of our IPO.

The offer and sale of all of the shares of our common stock in our IPO were registered under the Securities Act pursuant to a registration statement on Form S-1 (File No. 333-273429), which was declared effective by the SEC on November 9, 2023.

As of November 30, 2024, we used all of the net proceeds from our IPO for working capital and general corporate purposes. There was no material change in our use of the net proceeds from our IPO as described in our final prospectus filed pursuant to Rule 424(b)(4) under the Securities Act with the SEC on December 4, 2023.

Purchases of Equity Securities

Neither we nor any “affiliated purchaser,” as defined in Rule 10b-18(a)(3) of the Exchange Act, purchased any of our equity securities during the period covered by this annual report.

Securities Authorized for Issuance Under Equity Compensation Plans.

The information required by this Item regarding equity compensation plans is incorporated by reference to the information set forth in Item 12 of this Annual Report on Form 10-K.

ITEM 6. [RESERVED]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes that appear elsewhere in this Annual Report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements as a result of various factors.

Overview

We are an innovative technology company that engages in the business of recycled consumer electronic devices. We source and purchase pre-owned consumer electronic devices such as smartphones and tablets from suppliers and sell the electronic devices to wholesalers that re-sell these products to their wholesale and/or retail customers in Southeast Asia, Middle East Asia, Europe and other regions. We conduct our business of recycled consumer electronic devices through two Hong Kong-based wholly-owned subsidiaries Lear Group Limited and Baymax High Technology Co., Limited, acquired by the Company in October and December 2024, respectively.

|

|

Previously the Company engaged in the business of manufacturing cold-formed-steel and offering a range of services required to transform raw materials into precise steel framing products and prefabricated homes. In the second quarter of 2025, the Company decided to discontinue its cold-formed-steel business and sold all of the Company’s ownership in the subsidiaries through which the Company conducted its cold-formed-steel business. From March 2025 till April 2025, the Company completed the disposition of all its ownership or membership interests in its former wholly- and partially-owned subsidiaries, namely Inno Metal Studs Corp, Inno AI Tech Corp., Inno Disrupts Inc., and Castor Building Tech LLC.

Results of Operation

The following table presents certain Consolidated statement-of-operations information and presentation of that data as a percentage of change from year to year.

For the Years Ended September 30, 2025, and 2024

| Years Ended September 30, | ||||||||||||

| 2025 | 2024 | |||||||||||

| Revenue - products | $ | 2,846,250 | $ | - | 100 | % | ||||||

| Total Revenue | 2,846,250 | - | 100 | % | ||||||||

| Costs of materials and labor | 2,790,500 | - | 100 | % | ||||||||

| Selling, general and administrative expenses (exclusive of items shown separately below) | 4,414,709 | 844,844 | 423 | % | ||||||||

| Impairment loss on goodwill | 3,514 | - | 100 | % | ||||||||

| Operating loss | (4,362,473 | ) | (844,844 | ) | 416 | % | ||||||

| Other income (expenses) | (2,450,777 | ) | 237,952 | -1130 | % | |||||||

| Income tax expense | (800 | ) | (800 | ) | 0 | % | ||||||

| Net loss from discontinued operations | (195,796 | ) | (2,643,435 | ) | -93 | % | ||||||

| Net loss | (7,009,846 | ) | (3,251,127 | ) | 116 | % | ||||||

| Non-controlling interest | 69,517 | (37,298 | ) | -286 | % | |||||||

| Net loss attributable to INNO HOLDINGS INC. | $ | (7,079,363 | ) | $ | (3,213,829 | ) | 120 | % | ||||

Revenues

Revenue for the year ended September 30, 2025 increased 100% to $2,846,250 in comparison to $Nil for the year ended September 30, 2024. Revenue for the year ended September 30, 2025 consists solely of the Company’s new business of electronic products trading that started since October 2024. The new business of electronic products trading contributes to the increase in revenue for the year ended September 30, 2025 against the comparable period in 2024.

Our revenues are significantly impacted by demand for economic conditions including costs of labor, materials and other variables that impact the cost of our finished goods. We cannot ensure that growth will continue, and our business may be adversely affected by the negative overall economic conditions currently being experienced.

Costs of Materials and Labor

Cost of Goods Sold (COGS) includes electronic products purchased from our suppliers. COGS for the year ended September 30, 2025 increased to $2,790,500 in comparison to $Nil for the year ended September 30, 2024. COGS for the year ended September 30, 2025 consists solely of electronic products purchased from our suppliers in the Company’s new business of electronic products trading that started since October 2024. The new business of electronic products trading contributes to the increase in COGS for the year ended September 30, 2025 against the comparable period in 2024.

|

|

Selling, General and Administrative Expenses

Selling, general and administrative expenses for the year ended September 30, 2025, increased 423% to $4,414,709 in comparison to $844,844 for the comparable period in 2024. This increase was primarily driven by stock compensation, legal expenses, auditing expenses and consulting expenses.

Operating Loss

Operating loss was $4,362,473 for the year ended September 30,2025, in comparison to an operating loss of $844,844 for the comparable period in 2024. The increase in operating loss was primarily attributed to the increase in selling, general and administrative expenses, as discussed above.

Other Income (Expense)

Other expenses for the year ended September 30, 2025, was $2,450,777, in comparison to other income of $237,952 for the comparable period in 2024. The increase in other expenses was primarily due to loss on investment disposal. Other income for the year ended September 30, 2024, were primarily attributable to the recognition of supporting services provided to one of customers and the interest income.

Net Loss

Net loss for the year ended September 30, 2025 was $7,009,846, in comparison to a net loss of $3,251,127 for the year ended September 30, 2024. The increase in net loss was primarily due to changes in revenue, costs, expenses and other income (expense) as outlined above.

Liquidity and Capital Resources

Sources of Liquidity

During the year ended September 30, 2025 and 2024, we primarily funded our operations with cash generated from operations, private and public shares offering, as well as through borrowing under our revolving line of credit, a long-term promissory note, and related parties. We had cash of $10,130,942 as of September 30, 2025 compared to $1,077,138 of cash as of September 30, 2024. The cash increase was primarily due to the proceeds from the multiple private offerings during the periods ended September 30, 2025 and offset by the cash usage in operating and investing activities during the periods ended September 30, 2025.

The Company has participated in several private-placement offerings during the quarter ended December 31, 2024. On October 31, 2024, the Company entered into a securities purchase agreement with certain investors, providing for the sale and issuance of 500,000 shares of the Company’s common stock, no par value, for an aggregate purchase price of $2,000,000 at $4.00 per share (the “October 2024 Private Placement”). The offering closed on November 6, 2024.

On November 13, 2024, the Company entered into a securities purchase agreement with nine non-U.S. investors, pursuant to which the Company agreed to issue and sell in a private placement offering (the “November 2024 Private Placement”) an aggregate of 729,167 shares of common stock, no par value, at a purchase price per share of $4.80, for gross proceeds of approximately $3.5 million, of which proceeds will be used for working capital and other general corporate purposes. The offering closed on December 13, 2024.

On December 11, 2024, the Company entered into a securities purchase agreement with nine non-U.S. investors, pursuant to which the Company agreed to issue and sell in a private placement offering (the “December 2024 Private Placement”) an aggregate of 700,000 shares of common stock, no par value, at a purchase price per share of $2.50, for gross proceeds of approximately $1.75 million, of which proceeds will be used for working capital and other general corporate purposes. The offering closed on December 23, 2024.

|

|