UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2025

Commission File Number 001-36896

CHAINCE DIGITAL HOLDINGS INC.

(Registrant’s name)

1251 Avenue of the Americas, Fl 41,

New York, NY 10020

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F ☒ | Form 40-F ☐ |

EXPLANATORY NOTE

Chaince Digital Holdings Inc. (formerly known as Mercurity Fintech Holding Inc.), a Cayman Islands exempted company (the “Company”), is furnishing this Form 6-K to provide its unaudited condensed consolidated financial statements for the six months ended June 30, 2025, and incorporate such financial statements into the Company’s registration statement referenced below.

Except as expressly stated below, this report on Form 6-K (including the exhibits hereto) is being furnished and shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

This report of foreign private issuer on Form 6-K is hereby incorporated by reference into the registration statement on Form S-8 of the Company (File Number 333-287201), as amended, and into the prospectus outstanding under the foregoing registration statement; and the Company’s Registration Statement on Form F-3 filed with the Securities and Exchange Commission on May 20, 2025 and last amended on June 26, 2025 (Registration No. 333-287428).

to the extent not superseded by documents or reports subsequently filed or furnished by the Company under the Securities Act or the Exchange Act.

Financial Statements and Exhibits.

Exhibits:

| Exhibit No. | Description | |

| 99.1 | Unaudited Condensed Consolidated Financial Statements as of June 30, 2025 and for the Six Months Ended June 30, 2025 and 2024 and Management’s Discussion and Analysis for Financial Condition and Results of Operations | |

| 101.INS | Inline XBRL Instance Document | |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document. | |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document. | |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document. | |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. | |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document. | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Chaince Digital Holdings Inc. | ||

| By: | /s/ Shi Qiu | |

| Name: | Shi Qiu | |

| Title: | Chief Executive Officer | |

| By: | /s/ Yukuan Zhang | |

| Name: | Yukuan Zhang | |

| Title: | Chief Financial Officer | |

Date: December 10, 2025

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This management’s discussion and analysis is designed to provide you with a narrative explanation of our financial condition and results of operations for the six months ended June 30, 2023, 2024 and 2025. This section should be read in conjunction with our unaudited interim condensed consolidated financial statements and the related notes included elsewhere in this interim report. See Unaudited Interim Condensed Consolidated Financial Statements of Chaince Digital Holdings Inc. (formerly known as Mercurity Fintech Holding Inc.) as of December 31, 2024 and June 30, 2025 and for the six months ended June 30, 2023, 2024 and 2025. We also recommend that you read our management’s discussion and analysis and our audited consolidated financial statements for fiscal year ended December 31, 2024, and the notes thereto, which appear in our annual report on Form 20-F for the year ended December 31, 2024, or the Annual Report, filed with the U.S. Securities and Exchange Commission, or the SEC, on April 30, 2025.

Unless otherwise indicated or the context otherwise requires, all references to “our company,” “we,” “our,” “ours,” “us” or similar terms refer to Chaince Digital Holdings Inc. (formerly known as Mercurity Fintech Holding Inc.), its predecessor entities, its subsidiaries and consolidated affiliated subsidiaries.

All such financial statements were prepared in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. We have made rounding adjustments to some of the figures included in this management’s discussion and analysis. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors.

RECENT DEVELOPMENTS

The financial services business line has become the Company’s primary focus since March 2025, following FINRA’s approval for Chaince Securities, LLC’s Continuing Membership Application (“CMA”), and now forms an integral part of the Company’s strategic landscape.

Since the commencement of its operations, Chaince Securities, Inc. has primarily focused on providing financial services. Its subsidiary, Chaince Securities, LLC, is a FINRA-registered broker-dealer and registered investment advisor (RIA), offering investment banking and related business consulting services to companies conducting securities offerings in the U.S. capital markets, as well as investment solutions for institutions, high-net-worth individuals, and emerging issuers worldwide. The operations team is based in New York and actively conducts business with clients based in the U.S.

Ucon Capital (HK) Limited (“Ucon”), together with its PRC subsidiary, Chaince (Shenzhen) Consulting Co., Ltd., provides business consulting services targeting clients in the Asia-Pacific region. Chaince (Shenzhen) Consulting Co., Ltd. was established in August 2025, maintains an office in Shenzhen, and employs a full operations team locally.

Looking ahead, the Company’s primary objective for the next one to two years remains focused on the financial services sector, with the goal of significantly expanding its customer base, increasing revenue scale, reducing losses, and ultimately achieving profitability within this period.

On November 12, 2025, the Company announced that it would rebrand from Mercurity Fintech Holding Inc. to Chaince Digital Holdings Inc. The new corporate name, ticker symbol “CD,” and website www.chaincedigital.com went live on November 13, 2025 at the opening of trading on the Nasdaq Global Market. The rebranding was approved by the Company’s shareholders at its 2025 Annual General Meeting held on September 15, 2025.

In addition, in the first eleven months of 2025, the Company substantially increased its total shareholders’ equity through a combination of proceeds raised from its PIPE financing and the conversion of certain outstanding convertible notes into ordinary shares. As of December 10, 2025, the Company has a total of 69,874,797 ordinary shares issued and outstanding, and approximately 45,898,236 ordinary shares are freely tradable on the public market.

Overview

The Company’s business objectives are focused on two main sectors: (1) financial services, conducted primarily through our wholly owned subsidiary, Chaince Securities, Inc., with Chaince Securities LLC and Ucon Capital (HK) Limited (together with its subsidiaries in China) engaged in investment banking and related business consultation services; and (2) blockchain and digital asset solutions, carried out through Mercurity Fintech Technology Holding Inc., which is engaged in distributed computing and storage services and digital asset technical services.

Set forth below is a detailed update of the business lines in which the Company currently operates.

Financial services

Since August 2022, the Company has been operating in the financial services sector, mainly providing business consultation services. For example, in November 2023, the Company entered into a consulting agreement with a U.S.-based logistics company to provide business consulting services, assisting the client in enhancing its corporate governance and internal accounting management in preparation for its public listing.

The financial services business line has become the Company’s primary focus since March 2025, following FINRA’s approval for Chaince Securities, LLC’s Continuing Membership Application (“CMA”), and now forms an integral part of the Company’s strategic landscape. Since the commencement of its operations, Chaince Securities, Inc. has primarily focused on providing financial services. Its subsidiary, Chaince Securities, LLC, is a FINRA-registered broker-dealer and registered investment advisor (RIA), offering investment banking and related business consulting services to companies conducting securities offerings in the U.S. capital markets, as well as investment solutions for institutions, high-net-worth individuals, and emerging issuers worldwide. The operations team is based in New York and actively conducts business with clients based in the U.S. Ucon Capital (HK) Limited (“Ucon”), together with its PRC subsidiary, Chaince (Shenzhen) Consulting Co., Ltd., provides business consulting services targeting clients in the Asia-Pacific region.

Blockchain and digital asset solutions

Mercurity Fintech Technology Holding Inc. (“MFH Tech”) has been engaged in blockchain and digital asset solutions, including distributed storage and computing services (mainly Filecoin mining operations), and digital asset technical services.

In December 2022, we acquired a batch of Web3 decentralized storage infrastructure, including cryptocurrency mining servers, cables, and other electronic devices, and commenced our Filecoin (“FIL”) mining operations. Our Filecoin mining facilities are located in the State of New Jersey and are operated through Cologix US, Inc.

With the ongoing development of the digital asset industry and regulatory landscape, the Company’s accumulated experience positions it to expand its client base and further generate revenue from digital asset technical services. As of June 30, 2025, the Company’s digital asset technical services had not generated any revenue.

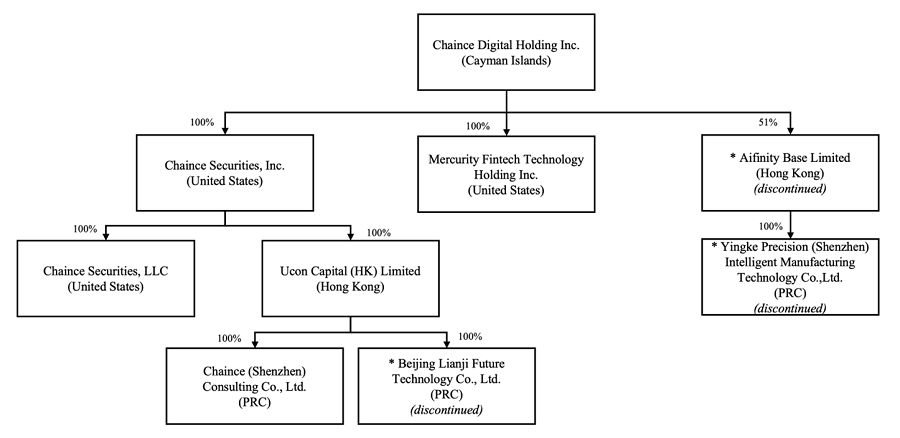

Our current business structure is as follows:

* Note: Beijing Lianji Future Technology Co., Ltd., Aifinity Base Limited, and Yingke Precision (Shenzhen) Intelligent Manufacturing Technology Co., Ltd. have not actually conducted any business and we have decided to deregister them all.

Results of Operations

Comparison of Results of Operations for the six months ended June 30, 2025 and 2024

The following summary of the unaudited consolidated financial data for the periods and as of the dates indicated is qualified by reference to, and should be read in conjunction with, our unaudited consolidated financial statements and related notes. Our historical results do not necessarily indicate our results to be expected for any future period.

(Amounts expressed in U.S. dollars, except share data and per share data, or otherwise noted)

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2025 | 2024 | Amount | % | |||||||||||||

| Revenue | 466,577 | 517,177 | (50,600 | ) | -9.78 | % | ||||||||||

| Cost of revenue | (655,773 | ) | (793,621 | ) | 137,848 | -17.37 | % | |||||||||

| Gross loss | $ | (189,196 | ) | $ | (276,444 | ) | $ | 87,248 | -31.56 | % | ||||||

| Selling and marketing expenses | (58,131 | ) | (42,295 | ) | (15,836 | ) | 37.44 | % | ||||||||

| General and administrative expenses | (1,698,162 | ) | (1,061,417 | ) | (636,745 | ) | 59.99 | % | ||||||||

| Provision for doubtful accounts | — | (11,451 | ) | 11,451 | -100.00 | % | ||||||||||

| Impairment loss of property and equipment | (504,693 | ) | (1,827,373 | ) | 1,322,680 | -72.38 | % | |||||||||

| Loss on market price of crypto assets | (653,164 | ) | (651,441 | ) | (1,723 | ) | 0.26 | % | ||||||||

| Operating loss | $ | (3,103,346 | ) | $ | (3,870,421 | ) | $ | 767,075 | -19.82 | % | ||||||

| Interest income/(expenses), net | 171,431 | 109,773 | 61,658 | 56.17 | % | |||||||||||

| Other income/(expenses), net | 15 | (352 | ) | 367 | -104.26 | % | ||||||||||

| Gain from market price of short-term investment | 3,474 | 216,410 | (212,936 | ) | -98.39 | % | ||||||||||

| Gain from selling short-term investments | — | 35,771 | (35,771 | ) | -100.00 | % | ||||||||||

| Loss on share-based payment liabilities | (73,500 | ) | — | (73,500 | ) | — | ||||||||||

| Loss before provision for income taxes | $ | (3,001,926 | ) | (3,508,819 | ) | $ | 506,893 | -14.45 | % | |||||||

| Income tax (expenses)/benefits | 13,334 | (325,646 | ) | 338,980 | -104.09 | % | ||||||||||

| Net loss | $ | (2,988,592 | ) | $ | (3,834,465 | ) | $ | 845,873 | -22.06 | % | ||||||

Revenue

Our revenues mainly represent revenues from business consultation services, distributed computing and storage services (Filecoin mining), and others.

The following table sets forth the revenues of our different types of businesses:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2025 | 2024 | Amount | % | |||||||||||||

| Revenue | ||||||||||||||||

| Consultation services | 243,569 | 195,000 | 48,569 | 24.9 | % | |||||||||||

| Distributed computing and storage services | 208,008 | 296,177 | (88,169 | ) | -29.8 | % | ||||||||||

| Others | 15,000 | 26,000 | (11,000 | ) | -42.3 | % | ||||||||||

| Total revenue | $ | 466,577 | $ | 517,177 | $ | (50,600 | ) | -9.8 | % | |||||||

For the six months ended June 30, 2025 and 2024, our total revenues were $466,577 and $517,177, respectively. Revenues generated from consultation services accounted for 52.2% and 37.7% of the total revenue for the six months ended June 30, 2025 and 2024, respectively. Revenues generated from distributed computing and storage services (Filecoin mining) accounted for 44.6% and 57.3% of the total revenue for the six months ended June 30, 2025 and 2024, respectively. Revenues generated from others (mainly referral services) accounted for 3.2% and 5.0% of the total revenue for the six months ended June 30, 2025 and 2024, respectively.

Our total revenues decreased by $50,600, or approximately 9.8%, to $466,577 for the six months ended June 30, 2025 from $517,177 for the six months ended June 30, 2024.

Consultation services

Our revenues from consultation services increased by $48,569, or approximately 24.9%, to $243,569 for the six months ended June 30, 2025 from $195,000 for the six months ended June 30, 2024.

The financial services business line (including investment banking and related business consultation services) has become the Company’s primary focus since March 2025, following FINRA’s approval, and now forms an integral part of the Company’s strategic landscape.

In the first half of 2025, the Company’s consultation service revenue was generated by five clients, a significant increase from the three clients in the same period in the previous year. Despite variations in the content and considerations of the consulting services provided to different clients, the substantial increase in the number of clients is the primary factor contributing to the significant rise in consultation service revenue for the six months ended June 30, 2025, compared to the same period in the previous year.

Distributed computing and storage services

Our revenues from distributed computing and storage services (Filecoin mining) decreased by $88,169, or approximately 29.8%, to $208,008 for the six months ended June 30, 2025 from $296,177 for the six months ended June 30, 2024.

The analysis for the revenue of our Filecoin mining business for the six months ended June 30, 2025 and 2024 is as follows:

|

For the six months ended June 30, 2025 |

Average storage capacity (PiB) | Mining efficiency (FIL/TiB/day) | The number of Filecoin rewards | Average daily lowest transaction price |

Total revenue |

|||||||||||||||

| January, 2025 | 76.51 | 0.0038 | 9,229.78 | $ | 4.9622 | $ | 45,800 | |||||||||||||

| February, 2025 | 90.38 | 0.0037 | 10,615.19 | $ | 3.2184 | $ | 34,164 | |||||||||||||

| March, 2025 | 108.14 | 0.0037 | 12,700.84 | $ | 2.8636 | $ | 36,370 | |||||||||||||

| April, 2025 | 106.27 | 0.0036 | 12,143.82 | $ | 2.5041 | $ | 30,410 | |||||||||||||

| May, 2025 | 112.19 | 0.0035 | 12,464.93 | $ | 2.7576 | $ | 34,372 | |||||||||||||

| June, 2025 | 106.51 | 0.0034 | 11,496.11 | $ | 2.3393 | $ | 26,892 | |||||||||||||

| Total Amount | 68,650.67 | $ | 3.0300 | $ | 208,008 | |||||||||||||||

|

For the six months ended June 30, 2024 |

Average storage capacity (PiB) | Mining efficiency (FIL/TiB/day) | The number of Filecoin rewards | Average daily lowest transaction price |

Total revenue |

|||||||||||||||

| January, 2024 | 19.58 | 0.0054 | 2,942.96 | $ | 5.5273 | $ | 16,267 | |||||||||||||

| February, 2024 | 23.88 | 0.0052 | 3,719.80 | $ | 6.5307 | $ | 24,293 | |||||||||||||

| March, 2024 | 59.53 | 0.0048 | 9,128.70 | $ | 8.9813 | $ | 81,988 | |||||||||||||

| April, 2024 | 70.27 | 0.0048 | 10,468.26 | $ | 6.7498 | $ | 70,659 | |||||||||||||

| May, 2024 | 70.27 | 0.0045 | 9,932.80 | $ | 5.6718 | $ | 56,337 | |||||||||||||

| June, 2024 | 70.27 | 0.0043 | 9,382.04 | $ | 4.9705 | $ | 46,633 | |||||||||||||

| Total Amount | 45,574.55 | $ | 6.4987 | $ | 296,177 | |||||||||||||||

During the first half of 2025, our Filecoin mining business generated 68,650.67 Filecoin rewards and recognized $208,008 in Filecoin mining revenue. In contrast, during the same period last year, we received 45,574.55 Filecoin rewards and recognized $296,177 in Filecoin mining revenue. Although the Company expanded its overall effective storage capacity by adding Filecoin joint mining nodes in the first half of 2025, resulting in more Filecoin rewards than the same period in the previous year, the significant decline in Filecoin market prices led to a decrease in the Company’s revenue during the first half of 2025 compared to the same period in the previous year.

Others

Our revenues from others (mainly referral services) decreased by $11,000, or approximately 42.3%, to $15,000 for the six months ended June 30, 2025 from $26,000 for the six months ended June 30, 2024.

Cost of revenue

The following table sets forth the cost of revenue of our different types of businesses:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2025 | 2024 | Amount | % | |||||||||||||

| Cost of revenue | ||||||||||||||||

| Consultation services | (160,551 | ) | (137,163 | ) | (23,388 | ) | 17.1 | % | ||||||||

| Distributed computing and storage services | (495,222 | ) | (656,458 | ) | 161,236 | -24.6 | % | |||||||||

| Others | — | — | — | — | ||||||||||||

| Total cost of revenue | $ | (655,773 | ) | $ | (793,621 | ) | $ | 372,729 | -47.0 | % | ||||||

For the six months ended June 30, 2025 and 2024, our total cost of revenue was $655,773 and $793,621, respectively.

Our cost of revenue from consultation services increased by $23,388, or approximately 17.1%, to $160,551 for the six months ended June 30, 2025 from $137,163 for the six months ended June 30, 2024. This aligns with the Company’s growing trend in consultation service revenue. The cost of our consultation services consists primarily of payroll of the consultation project team.

Our cost of revenue from distributed computing and storage services (Filecoin mining) decreased by $161,236, or approximately 24.6%, to $495,222 for the six months ended June 30, 2025 from $656,458 for the six months ended June 30, 2024. The cost of the Filecoin mining operation includes mining machine depreciation costs, mine site lease costs (including electricity), direct labor costs, software licensing costs and other technical services costs, Filecoin loan interest costs, and joint mining revenue sharing costs. The cost of Filecoin mining operations was recognized for the six months ended June 30, 2025 in the amount of $495,222, including mining machine depreciation costs of $251,805, mine lease costs (including electricity) of $180,745, software licensing costs of $8,320, Filecoin loan interest costs of $22,069, and joint mining revenue sharing costs of $32,283. The cost of Filecoin mining operations was recognized for the six months ended June 30, 2024 in the amount of $656,458, including mining machine depreciation costs of $421,409, mine lease costs (including electricity) of $174,979, software licensing costs of $8,108, other technical services costs of $11,847, and Filecoin loan interest costs of $40,115. The reduction in the cost of the Company’s Filecoin mining business during the first half of 2025 compared to the same period in the previous year, is mainly attributed to a significant decrease in depreciation of the mining machines.

Gross profit/(loss) and gross profit/(loss) margin

Gross profit/(loss) represents our net revenues less cost of revenue. Our gross profit/(loss) margin represents our gross profit/(loss) as a percentage of our net revenues.

The following table sets forth the gross profit/(loss) and gross profit/(loss) margin of our different types of businesses:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2025 | 2024 | Amount | % | |||||||||||||

| Gross profit/(loss) | ||||||||||||||||

| Consultation services | 83,018 | 57,837 | 25,181 | 43.5 | % | |||||||||||

| Distributed computing and storage services | (287,214 | ) | (360,281 | ) | 73,067 | -20.3 | % | |||||||||

| Others | 15,000 | 26,000 | (11,000 | ) | -42.3 | % | ||||||||||

| Total gross profit/(loss) | $ | (189,196 | ) | $ | (276,444 | ) | $ | 87,248 | -31.6 | % | ||||||

| Gross profit/(loss) margin | ||||||||||||||||

| Consultation services | 34.1 | % | 29.7 | % | 4.4 | % | 14.9 | % | ||||||||

| Distributed computing and storage services | -138.1 | % | -121.6 | % | -16.4 | % | 13.5 | % | ||||||||

| Others | 100.0 | % | 100.0 | % | 0.0 | % | 0.0 | % | ||||||||

| Overall gross profit/(loss) margin | -40.5 | % | -53.5 | % | -12.0 | % | 22.5 | % | ||||||||

For the six months ended June 30, 2025 and 2024, our total gross loss was $189,196 and $276,444, respectively.

Our gross profit from consultation services increased by $25,181 or approximately 43.5%, to $83,018 for the six months ended June 30, 2025 from $57,837 for the six months ended June 30, 2024. Our gross profit margin on consultation services for the six months ended June 30, 2025 increased 4.4% compared to the same period in the previous year. These increases are primarily attributed to the Company’s consultation service revenue growth and the enhanced cost-effectiveness of our consultation service team over the six months ended June 30, 2025.

Our gross loss from distributed computing and storage services (Filecoin mining) decreased by $73,067, or approximately 20.3%, to $287,214 for the six months ended June 30, 2025 from $360,281 for the six months ended June 30, 2024. This outcome is the result of the Company’s Filecoin mining revenues and costs experiencing a comprehensive decline in the first half of 2025, compared to the same period in the previous year.

Our gross profit from others (mainly referral services) decreased by $11,000, or approximately 42.3%, to $15,000 for the six months ended June 30, 2025 from $26,000 for the six months ended June 30, 2024. This was entirely due to the decrease in other revenue (mainly referral services) in the first half of 2025 compared to the same period in the previous year, which did not incur any costs.

Sales and marketing expenses

Sales and marketing expenses primarily consist of (i) labor costs of sales personnel, and (ii) referral and promotion fees for businesses. These costs are expensed as incurred.

The sales and marketing expenses for the six months ended June 30, 2025 amounted to $58,131, exclusively attributed to labor costs of sales personnel. The sales and marketing expenses for the six months ended June 30, 2024 amounted to $42,295, of which $32,295 was attributed to labor costs for sales personnel, while the remaining $10,000 was spent on referral and promotion fees for businesses.

The definition of our main business has undergone some restructuring in recent years, and as it becomes more well-defined, and as current structural business investments mature and begin to yield revenue, we have plans to steadily increase our marketing and promotional investment and efforts.

General and administrative expenses

The Company’s general and administrative expenses consist primarily of (i) salaries and benefits for employees, which are the salaries and benefits for our management, merchant service representatives and general administrative staff, (ii) office expenses, which consist primarily of office rental, maintenance and utilities expenses, depreciation of office equipment and other office expenses, and (iii) professional expenses, which consist primarily of legal expense and audit fees.

The Company’s general and administrative expenses for the six months ended June 30, 2025 amounted to $1,698,162, consisted primarily of $529,096 in employment costs, $688,568 in professional fees, and $480,497 in other office expenses. The Company’s general and administrative expenses for the six months ended June 30, 2024 amounted to $1,061,417, consisted primarily of $274,091 in employment costs, $437,124 in professional fees, and $350,202 in other office expenses. Due to the expansion of the Company’s financial services (investment banking and related consultation services) team, all employee salaries and benefits, professional expenses, and office and other miscellaneous expenses have increased significantly compared to the same period in the previous year.

Provision for doubtful accounts

There were no losses from provision for doubtful accounts for the six months ended June 30, 2025. The Company’s losses from provision for doubtful accounts for the six months ended June 30, 2024 were all due to interest receivables that could not be collected.

Impairment loss of property and equipment

For the six months ended June 30, 2025 and 2024, the Company’s impairment loss of property and equipment was $504,693 and $1,827,373, respectively, all of which were due to impairment losses on the Company’s Web3 decentralized storage infrastructure.

Loss on market price of crypto assets

Effective January 1, 2024, the Company adopted ASU No. 2023-08, Accounting for and Disclosure of Crypto Assets (“ASU 2023-08”) using a modified retrospective approach, which requires crypto assets to be measured at fair value for each reporting period with changes in fair value recorded in net income or loss.

Upon adoption, the Company recognized the cumulative effect of initially applying ASU 2023-08 of a $763,072 increase, as an adjustment to the opening balance of retained earnings. The Company recognized losses of $653,164 and $651,441 on the market price of Filecoins for the six months ended June 30, 2025, and 2024, respectively.

Interest income/(expenses), net

The Company’s interest income/(expenses), net consist of (i) convertible notes interest costs, and (ii) interest income from cash deposits and short-term investments.

The Company’s interest income/(expenses), net for the six months ended June 30, 2025 amounted to $171,431, consisted of negative $103,767 in convertible notes interest costs, and positive $275,198 in interest income from cash deposits and short-term investments. The Company’s interest income/(expenses), net for the six months ended June 30, 2024 amounted to $109,773, consisted of negative $193,562 in convertible notes interest costs, and positive $303,335 in interest income from cash deposits and short-term investments.

Other income/(expenses), net

Other income consists primarily of the gain generated from the government subsidies and other unexpected gains. Other expenses primarily consist of government fines, such as tax late fees.

Gain/(loss) from market price of short-term investment

The gain from market price of short-term investment for the six months ended June 30, 2025 and 2024 consists primarily of the net gain from the market price changes of the ETFs held by the Company.

Gain/(loss) from selling short-term investments

There were no gains or losses from selling short-term investments for the six months ended June 30, 2025. The gain from selling short-term investments for the six months ended June 30, 2024 consists primarily of the gain from selling common stocks held by the Company during the same period.

Loss on share-based payment liabilities

The losses on share-based payment liabilities for the six months ended June 30, 2025 and 2024 were primarily attributed to fluctuations in the fair value of the Company’s liabilities that are payable in a fixed number of ordinary shares. The trading price of the Company’s ordinary shares in the public market serves as the standard basis for determining its fair value.

Loss before income taxes

Loss before income taxes was $3,001,926 for the six months ended June 30, 2025, compared with loss before income taxes of $3,508,819 for the six months ended June 30, 2024.

Income tax expense/(benefits)

We recorded income tax benefits of $13,334 for the six months ended June 30, 2025 and income tax expense of $325,646 for the six months ended June 30, 2024.

Net loss

As a result of the foregoing factors, we recorded a net loss of $2,988,592 for the six months ended June 30, 2025, as compared to a net loss of $3,834,465 for the six months ended June 30, 2024.

Comparison of Results of Operations for the six months ended June 30, 2024 and 2023

The following summary of the unaudited consolidated financial data for the periods and as of the dates indicated is qualified by reference to, and should be read in conjunction with, our unaudited consolidated financial statements and related notes. Our historical results do not necessarily indicate our results to be expected for any future period.

(Amounts expressed in U.S. dollars, except share data and per share data, or otherwise noted)

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2024 | 2023 | Amount | % | |||||||||||||

| Revenue | 517,177 | 246,242 | 270,935 | 110.0 | % | |||||||||||

| Cost of revenue | (793,621 | ) | (693,420 | ) | (100,201 | ) | 14.5 | % | ||||||||

| Gross loss | $ | (276,444 | ) | $ | (447,178 | ) | $ | 170,734 | -38.2 | % | ||||||

| Selling and marketing expenses | (42,295 | ) | (152,400 | ) | 110,105 | -72.2 | % | |||||||||

| General and administrative expenses | (1,061,417 | )) | (1,251,559 | ) | 190,142 | -15.2 | % | |||||||||

| Provision for doubtful accounts | (11,451 | ) | — | (11,451 | ) | — | ||||||||||

| Impairment loss of property and equipment | (1,827,373 | ) | — | (1,827,373 | ) | — | ||||||||||

| Impairment loss of intangible assets | — | (79,821 | ) | 79,821 | -100.00 | % | ||||||||||

| Loss on market price of crypto assets | (651,441 | ) | — | (651,441 | ) | — | ||||||||||

| Operating loss | $ | (3,870,421 | ) | $ | (1,930,958 | ) | $ | (1,939,463 | ) | 100.4 | % | |||||

| Interest income/(expenses), net | 109,773 | (118,089 | ) | 227,862 | -193.0 | % | ||||||||||

| Financing costs | — | (450,000 | ) | 450,000 | -100.0 | % | ||||||||||

| Other (expenses)/income, net | (352 | ) | 70 | (422 | ) | -602.9 | % | |||||||||

| Gain/(Loss) on market price of short-term investment | 216,410 | (7 | ) | 216,417 | -3,091,671.4 | % | ||||||||||

| Gain/(Loss) from selling short-term investments | 35,771 | (79,742 | ) | 115,513 | -144.9 | % | ||||||||||

| Loss before provision for income taxes | $ | (3,508,819 | ) | $ | (2,578,726 | ) | $ | (930,093 | ) | 36.1 | % | |||||

| Income tax (expenses)/benefits | (325,646 | ) | 185 | (325,831 | ) | -176,124.9 | % | |||||||||

| Net loss | $ | (3,834,465 | ) | $ | (2,578,541 | ) | $ | (1,255,924 | ) | 48.7 | % | |||||

Revenues

Our revenues mainly represent revenues from business consultation services, distributed computing and storage services (Filecoin mining), and others.

The following table sets forth the revenues of our different types of businesses:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2024 | 2023 | Amount | % | |||||||||||||

| Revenue | ||||||||||||||||

| Consultation services | 195,000 | 80,000 | 115,000 | 143.8 | % | |||||||||||

| Distributed computing and storage services | 296,177 | 166,242 | 129,935 | 78.2 | % | |||||||||||

| Others | 26,000 | — | 26,000 | — | ||||||||||||

| Total revenue | $ | 517,177 | $ | 246,242 | $ | 270,935 | 110.0 | % | ||||||||

For the six months ended June 30, 2024 and 2023, our total revenues were $517,177 and $246,242, respectively. Revenues generated from consultation services accounted for 37.7% and 32.5% of the total revenue for the six months ended June 30, 2024 and 2023, respectively. Revenues generated from distributed computing and storage services (Filecoin mining) accounted for 57.3% and 67.5% of the total revenue for the six months ended June 30, 2024 and 2023, respectively. Revenues generated from others (mainly referral services) accounted for 5.0% and nil of the total revenue for the six months ended June 30, 2024 and 2023, respectively.

Our total revenues increased by $270,935, or approximately 110.0%, to $517,177 for the six months ended June 30, 2024 from $246,242 for the six months ended June 30, 2023.

Consultation services

Our revenues from consultation services increased by $115,000, or approximately 143.8%, to $195,000 for the six months ended June 30, 2024 from $80,000 for the six months ended June 30, 2023.

In the first half of 2024, the Company’s consultation service revenue was generated by three clients, a significant increase from the one client in the same period in the previous year. Despite variations in the content and considerations of the consulting services provided to different clients, the substantial increase in the number of clients is the primary factor contributing to the significant rise in consultation service revenue for the six months ended June 30, 2024, compared to the same period in the previous year.

Distributed computing and storage services

Our revenues from distributed computing and storage services (Filecoin mining) increased by $129,935, or approximately 78.2%, to $296,177 for the six months ended June 30, 2024 from $166,242 for the six months ended June 30, 2023.

The analysis for the revenue of our Filecoin mining business for the six months ended June 30, 2024 and 2023 is as follows:

|

For the six months ended June 30, 2024 |

Average storage capacity (PiB) |

Mining efficiency (FIL/TiB/day) |

The number of Filecoin rewards |

Average daily lowest transaction price |

Total revenue |

|||||||||||||||

| January, 2024 | 19.58 | 0.0054 | 2,942.96 | $ | 5.5273 | $ | 16,267 | |||||||||||||

| February, 2024 | 23.88 | 0.0052 | 3,719.80 | $ | 6.5307 | $ | 24,293 | |||||||||||||

| March, 2024 | 59.53 | 0.0048 | 9,128.70 | $ | 8.9813 | $ | 81,988 | |||||||||||||

| April, 2024 | 70.27 | 0.0048 | 10,468.26 | $ | 6.7498 | $ | 70,659 | |||||||||||||

| May, 2024 | 70.27 | 0.0045 | 9,932.80 | $ | 5.6718 | $ | 56,337 | |||||||||||||

| June, 2024 | 70.27 | 0.0043 | 9,382.04 | $ | 4.9705 | $ | 46,633 | |||||||||||||

| Total Amount | 45,574.55 | $ | 6.4987 | $ | 296,177 | |||||||||||||||

|

For the six months ended June 30, 2023 |

Average storage capacity (PiB) |

Mining efficiency (FIL/TiB/day) |

The number of Filecoin rewards |

Average daily lowest transaction price |

Total revenue |

|||||||||||||||

| January, 2023 | 9.19 | 0.0132 | 3,844.55 | $ | 4.4187 | $ | 16,988 | |||||||||||||

| February, 2023 | 14.95 | 0.0126 | 5,416.79 | $ | 5.9172 | $ | 32,052 | |||||||||||||

| March, 2023 | 15.1 | 0.0128 | 6,147.68 | $ | 5.5742 | $ | 34,268 | |||||||||||||

| April, 2023 | 17.4 | 0.0097 | 5,190.72 | $ | 5.5692 | $ | 28,908 | |||||||||||||

| May, 2023 | 20.22 | 0.0101 | 6,480.06 | $ | 4.5334 | $ | 29,377 | |||||||||||||

| June, 2023 | 22.57 | 0.0093 | 6,472.78 | $ | 3.8082 | $ | 24,650 | |||||||||||||

| Total Amount | 33,552.58 | $ | 4.9547 | $ | 166,243 | |||||||||||||||

During the first half of 2024, our Filecoin mining business generated 45,574.55 Filecoin rewards and recognized $296,177 in Filecoin mining revenue. In comparison, during the same period last year, we received 33,552.58 Filecoin rewards and recognized $166,243 in Filecoin mining revenue.

During the first half of 2024, the Company’s average effective storage capacity experienced a substantial increase compared to the same period in the previous year. This improvement enabled the Company to accrue more Filecoin rewards during that time. Additionally, the Filecoin market price witnessed a significant rise in the first half of 2024. All of these factors collectively contributed to a notable increase in Filecoin mining revenue for the Company compared to the same period in the previous year.

Others

For the six months ended June 30, 2024 and 2023, our revenues from others (mainly referral services) were $26,000 and nil, respectively.

Cost of revenue

The following table sets forth the cost of revenue of our different types of businesses:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2024 | 2023 | Amount | % | |||||||||||||

| Cost of revenue | ||||||||||||||||

| Consultation services | (137,163 | ) | (51,500 | ) | (85,663 | ) | 166.3 | % | ||||||||

| Distributed computing and storage services | (656,458 | ) | (641,920 | ) | (14,538 | ) | 2.3 | % | ||||||||

| Others | — | — | — | — | ||||||||||||

| Total cost of revenue | $ | (793,621 | ) | $ | (693,420 | ) | $ | (100,201 | ) | 14.5 | % | |||||

For the six months ended June 30, 2024 and 2023, our total cost of revenue was $793,621 and $693,420, respectively.

Our cost of revenue from consultation services increased by $85,663, or approximately 166.3%, to $137,163 for the six months ended June 30, 2024 from $51,500 for the six months ended June 30, 2023. This aligns with the Company’s growing trend in consultation service revenue. The cost of our consultation services consists primarily of payroll of the consultation project team.

Our cost of revenue from distributed computing and storage services (Filecoin mining) increased by $14,538, or approximately 2.3%, to $656,458 for the six months ended June 30, 2024 from $641,920 for the six months ended June 30, 2023. The cost of the Filecoin mining operation includes mining machine depreciation costs, mine site lease costs (including electricity), direct labor costs, software licensing costs and other technical services costs, and Filecoin loan interest costs. The cost of Filecoin mining operations was recognized for the six months ended June 30, 2024 in the amount of $656,458, including mining machine depreciation costs of $421,409, mine lease costs (including electricity) of $174,979, software licensing costs of $8,108, other technical services costs of $11,847, and Filecoin loan interest costs of $40,115. The cost of Filecoin mining operations was recognized in the six months ended June 30, 2023 in the amount of $641,920, including mining machine depreciation costs of $448,718, mine lease costs (including electricity) of $144,412, direct labor costs of $4,000, and software licensing costs of $44,790. Despite a substantial revenue increase during the first half of 2024, the Company’s Filecoin mining machine count remained constant. Consequently, key Filecoin mining costs, such as depreciation of Filecoin mining machines and mine lease costs (including electricity), did not experience significant fluctuations, resulting in only a slight increase in total Filecoin mining costs for the six months ended June 30, 2025 compared to the same period in the previous year.

Gross profit/(loss) and gross profit/(loss) margin

Gross profit/(loss) represents our net revenues less cost of revenue. Our gross profit/(loss) margin represents our gross profit/(loss) as a percentage of our net revenues.

The following table sets forth the gross profit/(loss) and gross profit/(loss) margin of our different types of businesses:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2024 | 2023 | Amount | % | |||||||||||||

| Gross profit/(loss) | ||||||||||||||||

| Consultation services | 57,837 | 28,500 | 29,337 | 102.9 | % | |||||||||||

| Distributed computing and storage services | (360,281 | ) | (475,678 | ) | 115,397 | -24.3 | % | |||||||||

| Others | 26,000 | — | 26,000 | — | ||||||||||||

| Total gross profit/(loss) | $ | (276,444 | ) | $ | (447,178 | ) | $ | 170,734 | -38.2 | % | ||||||

| Gross profit/(loss) margin | ||||||||||||||||

| Consultation services | 29.7 | % | 35.6 | % | -6.0 | % | -16.7 | % | ||||||||

| Distributed computing and storage services | -121.6 | % | -286.1 | % | 164.5 | % | -57.5 | % | ||||||||

| Others | 100.0 | % | — | 100.0 | % | — | ||||||||||

| Overall gross profit/(loss) margin | -53.5 | % | -181.6 | % | 258.5 | % | -142.4 | % | ||||||||

For the six months ended June 30, 2024 and 2023, our total gross loss was $276,444 and $447,178, respectively.

Our gross profit from consultation services increased by $29,337, or approximately 102.9%, to $57,837 for the six months ended June 30, 2024 from $28,500 for the six months ended June 30, 2023. Our gross profit margin on consultation services for the six months ended June 30, 2024 decreased 6.0% compared to the same period in the previous year. These changes are primarily attributed to the Company’s consultation service revenue growth and the increase in personnel costs for consultation service teams over the six months ended June 30, 2024.

Our gross loss from distributed computing and storage services (Filecoin mining) decreased by $115,397, or approximately 24.3%, to $360,281 for the six months ended June 30, 2024 from $475,678 for the six months ended June 30, 2023. The primary reason for this result is the substantial rise in the Company’s Filecoin mining revenue, while the Filecoin mining costs experienced only a slight increase for the six months ended June 30, 2024, compared to the same period in the previous year.

Our gross profit from others (mainly referral services) decreased by $26,000, or approximately 100.0%, to $26,000 for the six months ended June 30, 2024 from nil for the six months ended June 30, 2023. This was entirely due to the increase in other revenue (mainly referral services) in the first half of 2024 compared to the same period in the previous year, which did not incur any costs.

Sales and marketing expenses

Sales and marketing expenses primarily consist of (i) labor costs of sales personnel, and (ii) referral and promotion fees for businesses. These costs are expensed as incurred.

The sales and marketing expenses for the six months ended June 30, 2024 amounted to $42,295, of which $32,295 was attributed to labor costs for sales personnel, while the remaining $10,000 was spent on referral and promotion fees for businesses. The sales and marketing expenses for the six months ended June 30, 2023 amounted to $152,400, which were exclusively attributed to referral and promotion fees for businesses.

The definition of our main business has undergone some restructuring in recent years, and as it becomes more well-defined, and as current structural business investments mature and begin to yield revenue, we have plans to steadily increase our marketing and promotional investment and efforts.

General and administrative expenses

The Company’s general and administrative expenses consist primarily of (i) salaries and benefits for employees, which are the salaries and benefits for our management, merchant service representatives and general administrative staff, (ii) office expenses, which consist primarily of office rental, maintenance and utilities expenses, depreciation of office equipment and other office expenses, and (iii) professional expenses, which consist primarily of legal expense and audit fees.

The Company’s general and administrative expenses for the six months ended June 30, 2024, amounted to $1,061,417, consisted primarily of $274,091 in employment costs, $437,124 in professional fees, and $350,202 in other office expenses. The Company’s general and administrative expenses for the six months ended June 30, 2023, amounted to $1,251,559, consisted primarily of $251,747 in employment costs, $642,579 in professional fees, and $357,233 in other office expenses.

Provision for doubtful accounts

The Company’s losses from provision for doubtful accounts for the six months ended June 30, 2024 were all due to interest receivables that could not be collected. There were no losses from provision for doubtful accounts for the six months ended June 30, 2023.

Impairment loss of property and equipment

For the six months ended June 30, 2024 and 2023, the Company’s impairment loss of property and equipment was $1,827,373 and nil, respectively. The Company’s impairment loss of property and equipment for the six months ended June 30, 2024 was due to impairment losses on the Company’s Web3 decentralized storage infrastructure.

Impairment loss of intangible assets

There was no impairment loss of intangible assets for the six months ended June 30, 2024. We estimated the fair values of the cryptocurrencies based on the intraday low price every day and recognized $79,821 impairment loss for the six months ended June 30, 2023, all of which was impairment loss of Filecoins.

Loss on market price of crypto assets

Effective January 1, 2024, the Company adopted ASU No. 2023-08, Accounting for and Disclosure of Crypto Assets (“ASU 2023-08”) using a modified retrospective approach, which requires crypto assets to be measured at fair value for each reporting period with changes in fair value recorded in net income or loss.

Upon adoption, the Company recognized the cumulative effect of initially applying ASU 2023-08 of an increase of $763,072, as an adjustment to the opening balance of retained earnings. The Company recognized losses of $651,441 on the market price of Filecoins for the six months ended June 30, 2024.

Interest income/(expenses), net

The Company’s interest income/(expenses), net consist of (i) convertible notes interest costs, and (ii) interest income from cash deposits and short-term investments.

The Company’s interest income/(expenses), net for the six months ended June 30, 2024, amounted to positive $109,773, consisted of negative $193,562 in convertible notes interest costs, and positive $303,335 in interest income from cash deposits and short-term investments. The Company’s interest income/(expenses), net for the six months ended June 30, 2023, amounted to negative $118,089, consisted of negative $186,250 in convertible notes interest costs, and positive $68,161 in interest income from cash deposits and short-term investments.

Financing costs

For the six months ended June 30, 2024 and 2023, the Company’s financing costs was nil and $450,000, respectively.

In February 2023, according to the agreement with the financial advisor for the Company’s Unsecured Convertible Promissory Note with a financing amount of $9 million, the Company paid a financial advisor fee of 5% of the financing amount to the financial advisor.

Other income/(expenses), net

Other income consists primarily of the gain generated from the government subsidies and other unexpected gains. Other expenses primarily consist of government fines, such as tax late fees.

Gain/(loss) from market price of short-term investment

The gain from market price of short-term investment for the six months ended June 30, 2024 and 2023 consists primarily of the net gain from the market price changes of the ETFs held by the Company.

Gain/(loss) from selling short-term investments

The gain from selling short-term investments for the six months ended June 30, 2024 consists primarily of the gain from selling common stocks held by the Company during the same period.

The loss from selling short-term investments for the six months ended June 30, 2023 consists primarily of the loss from selling common stocks held by the Company during the same period.

Loss before income taxes

Loss before income taxes was $3,508,819 for the six months ended June 30, 2024, compared with loss before income taxes of $2,578,726 for the six months ended June 30, 2023.

Income tax expense/(benefits)

We recorded income tax expense of $325,646 for the six months ended June 30, 2024, and income tax benefits of $185 for the six months ended June 30, 2023.

Net loss

As a result of the foregoing factors, we recorded a net loss of $3,834,465 for the six months ended June 30, 2024, as compared to a net loss of $2,578,541 for the six months ended June 30, 2023.

Liquidity and Capital Resources

Primary Sources of Liquidity

Our primary sources of liquidity consist of existing cash and cash equivalents and cash flows from our operating and financing activities.

As of June 30, 2025, we had cash and cash equivalents of $25,159,033, positive working capital of $24,560,249 and total equity of $29,423,200. In assessing our liquidity, management monitors and analyzes our cash on-hand, the ability to generate sufficient revenue in the future, our operating and capital expenditure commitments, and our ability to raise funds through certain financing measures such as bank borrowing.

If there is any change in business conditions or other future developments, including any investments we may decide to pursue, we may also seek to sell additional equity securities or debt securities or borrow from lending institutions. Financing may be unavailable in the amounts we need or on terms acceptable to us, if at all. The sale of additional equity securities, including convertible debt securities, would dilute our earnings per share. The incurrence of debt would divert cash for working capital and capital expenditures to service debt obligations and could result in operating and financial covenants that restrict our operations and our ability to pay dividends to our shareholders. If we are unable to obtain additional equity or debt financing as required, our business operations and prospects may suffer.

Cash Flows

Cash Flows for the six months ended June 30, 2025, compared to the six months ended June 30, 2024

The following table sets forth a summary of our cash flows for the periods indicated:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2025 | 2024 | Amount | % | |||||||||||||

| Net cash used in operating activities | (1,328,938 | ) | (1,188,426 | ) | (140,512 | ) | 11.8 | % | ||||||||

| Net cash (used in)/provided by investing activities | (1,094,595 | ) | 1,620,602 | (2,715,197 | ) | -167.5 | % | |||||||||

| Net cash provided by/(used in) financing activities | 3,666,900 | (2,430,000 | ) | 6,096,900 | -250.9 | % | ||||||||||

| Effect of exchange rate changes | 53 | (19 | ) | 72 | -378.9 | % | ||||||||||

| Net change in cash and cash equivalents | $ | 1,243,420 | $ | (1,997,843 | ) | $ | 3,241,263 | -162.2 | % | |||||||

| Cash and cash equivalents, beginning of the year | 24,009,331 | 16,208,949 | 7,800,382 | 48.1 | % | |||||||||||

| Cash and cash equivalents, end of the year | $ | 25,252,751 | $ | 14,211,106 | $ | 11,041,645 | 77.7 | % | ||||||||

Operating Activities

For the six months ended June 30, 2025, our net cash used in operating activities was $1,328,938, which was primarily attributable to (i) our net loss of $2,988,592, (ii) an adjustment of deducted non-cash profit and loss items of a positive net amount of $1,786,905, mainly inclusive of depreciation, impairment loss of property and equipment, gain from market price of short-term investment, loss on market price of crypto assets, loss on share-based payment liabilities, interest income/(expenses), stock-based compensations, exchange gains and losses, and other income or loss, (iii) changes in working capital that negatively affected the cash flow from operating activities, primarily including: an increase of $100,445 in clearing deposits, an increase of $98,942 in accounts receivable, an increase of $19,934 in accrued revenue, a decrease of $30,622 in prepaid expenses and other current assets, an increase of $17 in accounts payable, an increase of $285,307 in advance from customers, a decrease of $187,281 in lease liabilities, and a decrease of $36,629 in accrued expenses and other current liabilities, and (iii) changes in non-current assets and liabilities that positively affected the cash flow from operating activities, primarily including: a decrease of $158,887 in right-of-use assets, an increase of $13,334 in deferred tax assets, and an increase of $145,519 in digital assets.

For the six months ended June 30, 2024, our net cash used in operating activities was $1,188,426, which was primarily attributable to (i) our net loss of $3,834,465, (ii) an adjustment of deducted non-cash profit and loss items of a positive net amount of $2,793,459, mainly inclusive of depreciation, impairment loss of property and equipment, gain from selling short-term investments, gain from market price of short-term investment, loss on market price of crypto assets, interest income/(expenses), exchange gains and losses, and other income or loss, (iii) changes in working capital that negatively affected the cash flow from operating activities, primarily including: a decrease of $12,285 in prepaid expenses and other current assets, an increase of $41,234 in accounts payable, a decrease of $45,000 in advance from customers, a decrease of $173,017 in lease liabilities, and a decrease of $193,005 in accrued expenses and other current liabilities, and (iii) changes in non-current assets and liabilities that positively affected the cash flow from operating activities, primarily including: a decrease of $158,887 in right-of-use assets, a decrease of $325,646 in deferred tax assets, and an increase of $274,450 in digital assets.

Investing Activities

For the six months ended June 30, 2025, our net cash used in investing activities was $1,094,595, which was attributable to: received short-term investment interest of $301, and cash paid for short-term investments of $1,094,896.

For the six months ended June 30, 2024, our net cash provided by investing activities was $1,620,602, which was attributable to: cash from selling short-term investments of $1,939,850, received short-term investment interest of $47,894, cash paid for short-term investments of $364,531, and cash paid for purchasing fixed assets of $2,611.

Financing Activities

For the six months ended June 30, 2025, our net cash provided by financing activities was $3,666,900, which was attributable to: received equity financing cash of $8,041,900, and paying for part of the principal and interest of convertible notes of $4,375,000.

For the six months ended June 30, 2024, our net cash used in financing activities was $2,430,000, which was attributable to: paying for part of the principal and interest of convertible bonds of $1,950,000, and paying related financial advisory fees of $480,000.

Cash Flows for the six months ended June 30, 2024, compared to the six months ended June 30, 2023

The following table sets forth a summary of our cash flows for the periods indicated:

| For the six months ended June 30, |

Variance in | |||||||||||||||

| 2024 | 2023 | Amount | % | |||||||||||||

| Net cash used in operating activities | (1,188,426 | ) | (1,509,535 | ) | 321,109 | -21.3 | % | |||||||||

| Net cash (used in)/provided by investing activities | 1,620,602 | (5,660,208 | ) | 7,280,810 | -128.6 | % | ||||||||||

| Net cash provided by/(used in) financing activities | (2,430,000 | ) | 13,300,000 | (15,730,000 | ) | -118.3 | % | |||||||||

| Effect of exchange rate changes | (19 | ) | (100 | ) | 81 | -81.0 | % | |||||||||

| Net change in cash and cash equivalents | $ | (1,997,843 | ) | $ | 6,130,157 | $ | (8,128,000 | ) | -132.6 | % | ||||||

| Cash and cash equivalents, beginning of the year | 16,208,949 | 7,537,873 | 8,671,076 | 115.0 | % | |||||||||||

| Cash and cash equivalents, end of the year | $ | 14,211,106 | $ | 13,668,030 | $ | 543,076 | 4.0 | % | ||||||||

Operating Activities

For the six months ended June 30, 2024, our net cash used in operating activities was $1,188,426, which was primarily attributable to (i) our net loss of $3,834,465, (ii) an adjustment of deducted non-cash profit and loss items of a positive net amount of $2,793,459, mainly inclusive of depreciation, impairment loss of property and equipment, gain from selling short-term investments, gain from market price of short-term investment, loss on market price of crypto assets, interest income/(expenses), exchange gains and losses, and other income or loss, (iii) changes in working capital that negatively affected the cash flow from operating activities, primarily including: a decrease of $12,285 in prepaid expenses and other current assets, an increase of $41,234 in accounts payable, a decrease of $45,000 in advance from customers, a decrease of $173,017 in lease liabilities, and a decrease of $193,005 in accrued expenses and other current liabilities, and (iii) changes in non-current assets and liabilities that positively affected the cash flow from operating activities, primarily including: a decrease of $158,887 in right-of-use assets, a decrease of $325,646 in deferred tax assets, and an increase of $274,450 in digital assets.

For the six months ended June 30, 2023, our net cash used in operating activities was $1,509,535, which was primarily attributable to (i) our net loss of $2,578,541, (ii) an adjustment of deducted non-cash profit and loss items of a positive net amount of $1,252,722, mainly inclusive of depreciation, loss from selling short-term investments, loss on market price of short-term investment, impairment loss of crypto assets, interest income/(expenses), financial advisory fees for convertible note, and exchange gains and losses, (iii) changes in working capital that negatively affected the cash flow from operating activities, primarily including: a decrease of $9,850 in prepaid expenses and other current assets, a decrease of $22,075 in accounts payable, a decrease of $80,000 in advance from customers, a decrease of $104,324 in lease liabilities, and an increase of $20,960 in accrued expenses and other current liabilities, and (iii) changes in non-current assets and liabilities that positively affected the cash flow from operating activities, primarily including: a decrease of $158,887 in right-of-use assets, an increase of $772 in deferred tax assets, and an increase of $166,242 in digital assets.

Investing Activities

For the six months ended June 30, 2024, our net cash provided by investing activities was $1,620,602, which was attributable to: cash from selling short-term investments of $1,939,850, received short-term investment interest of $47,894, cash paid for short-term investments of $364,531, and cash paid for purchasing fixed assets of $2,611.

For the six months ended June 30, 2023, our net cash used in investing activities was $5,660,208, which was attributable to: cash from selling short-term investments of $750,258, received short-term investment interest of $5,945, cash paid for short-term investments of $3,136,411, cash paid for long-term equity investments of $160,000, prepayments for purchasing fixed assets of $3,000,000, and prepayments for assets acquisition of $120,000.

Financing Activities

For the six months ended June 30, 2024, our net cash used in financing activities was $2,430,000, which was attributable to: paying for part of the principal and interest of convertible bonds of $1,950,000, and paying related financial advisory fees of $480,000.

For the six months ended June 30, 2023, our net cash provided by financing activities was $13,300,000, which was attributable to: cash provided by private placement of $5 million, cash provided by convertible notes of $9 million, and paying related financial advisory fees of $700,000.

Cash and Cash Equivalents, and Restricted Cash

As of June 30, 2025, the Company had cash and cash equivalents of $25,159,033 and a security deposit of $93,718, compared with cash and cash equivalents of $23,915,856 and a security deposit of $93,475 as of December 31, 2024.

Short-term Investments

As of June 30, 2025, the Company had short-term investments of $2,069,569, which are primally T-Bill ETFs and Certified of Deposits, compared with short-term investments of $957,729 as of December 31, 2024.

Crypto Assets

As of June 30, 2025, the Company had crypto assets of $1,544,790 in aggregate, which is the U.S. dollar equivalent of Filecoins, compared with crypto assets of $3,019,896 as of December 31, 2024. In addition, the Sheyang Public Security Bureau of China improperly seized our 125.8585 Bitcoins and 2,005,537.50 USD Coins. Once these out-of-control crypto assets are recovered, the Company will have more realizable assets.

Contingencies

From time to time, we may become involved in litigation relating to claims arising in the ordinary course of the business. However, there are no claims or acts pending or threatened against us that, if adversely determined, would, in our judgment, have a material adverse effect on us.

Capital Expenditures

We made capital expenditures, including for property and equipment, and business acquisition, of nil, $2,611, and $3,280,000 for the six months ended June 30, 2025, 2024 and 2023, respectively.

We plan to fund our future capital expenditures with our existing cash and cash equivalents balance. We intend to make capital expenditures to support the expected growth of our business.

Contractual Obligations

The following table sets forth our contractual obligations as of June 30, 2025:

| Payment Due by Period | ||||||||||||||||

| Total | Less than 1 year |

1-3 years | More than 3 years |

|||||||||||||

| Operating lease commitments | 96,198 | 96,198 | — | — | ||||||||||||

| Total | $ | 96,198 | $ | 96,198 | $ | — | $ | — | ||||||||

Other than those shown above, we did not have any significant capital and other commitments as of June 30, 2025.

Off-balance Sheet Commitments and Arrangements

We have not entered into any off-balance sheet financial guarantees or other off-balance sheet commitments to guarantee the payment obligations of any third parties. We have not entered into any derivative contracts that are indexed to our shares and classified as shareholder’s equity or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. We do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or product development services with us.

UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

INDEX

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED BALANCE SHEETS

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| Note |

June 30, 2025 |

December 31, 2024 |

||||||||||

| ASSETS: | ||||||||||||

| Current assets: | ||||||||||||

| Cash and cash equivalents | 4 | 25,159,033 | 23,915,856 | |||||||||

| Security deposit | 93,718 | 93,475 | ||||||||||

| Clearing deposit | 100,445 | — | ||||||||||

| Short-term investments | 5 | 2,069,569 | 957,729 | |||||||||

| Accounts receivable | 98,942 | — | ||||||||||

| Accrued revenue | 19,934 | — | ||||||||||

| Interest receivable | 104,303 | 3,825 | ||||||||||

| Prepaid expenses and other current assets, net | 6 | 4,849,474 | 5,053,824 | |||||||||

| Total current assets | $ | 32,495,418 | $ | 30,024,709 | ||||||||

| Non-current assets: | ||||||||||||

| Operating right-of-use assets, net | 13 | 79,443 | 238,330 | |||||||||

| Property and equipment, net | 7 | 1,500,000 | 2,257,794 | |||||||||

| Intangible assets, net | 8 | 1,664,790 | 3,139,896 | |||||||||

| Deferred tax assets | 14 | 43,918 | 30,584 | |||||||||

| Other long-term investments | 9 | 800,000 | — | |||||||||

| Total non-current assets | $ | 4,088,151 | $ | 5,666,604 | ||||||||

| TOTAL ASSETS | $ | 36,583,569 | $ | 35,691,313 | ||||||||

| LIABILITIES AND SHAREHOLDER’S EQUITY: | ||||||||||||

| Current liabilities: | ||||||||||||

| Bonds payable | 11 | 3,500,000 | 7,500,000 | |||||||||

| Interest payable | 12 | 123,350 | 419,005 | |||||||||

| Deferred revenue | 9 | 800,000 | — | |||||||||

| Accrued expenses and other current liabilities | 10 | 1,629,265 | 2,466,436 | |||||||||

| Amounts due to related parties | 16 | 987,556 | 909,575 | |||||||||

| Operating lease liabilities | 13 | 94,998 | 282,279 | |||||||||

| Total current liabilities | $ | 7,135,169 | $ | 11,577,295 | ||||||||

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED BALANCE SHEETS (CONTINUED)

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| Note |

June 30, 2025 |

December 31, 2024 |

||||||||||

| LIABILITIES AND SHAREHOLDER’S EQUITY (CONTINUED): | ||||||||||||

| Non-current liabilities: | ||||||||||||

| Deferred tax liabilities | 14 | 25,200 | 25,200 | |||||||||

| Total non-current liabilities | $ | 25,200 | $ | 25,200 | ||||||||

| TOTAL LIABILITIES | $ | 7,160,369 | $ | 11,602,495 | ||||||||

| Commitments and contingencies | 17 | |||||||||||

| Shareholders’ equity: | ||||||||||||

| Ordinary shares ($0.004 par value, 1,000,000,000 shares authorized as of June 30, 2025, 63,711,562 and 62,299,897 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively) | 15 | 254,865 | 249,218 | |||||||||

| Additional paid-in capital | 711,428,270 | 703,098,695 | ||||||||||

| Accumulated deficit | (683,437,402 | ) | (680,448,810 | ) | ||||||||

| Accumulated other comprehensive income | 1,177,467 | 1,189,715 | ||||||||||

| Total shareholders’ equity | $ | 29,423,200 | $ | 24,088,818 | ||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 36,583,569 | $ | 35,691,313 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| For the six months ended June 30, | ||||||||||||||||

| Note | 2025 | 2024 | 2023 | |||||||||||||

| Revenue: | ||||||||||||||||

| Consultation services | 243,569 | 195,000 | 80,000 | |||||||||||||

| Distributed computing and storage services | 208,008 | 296,177 | 166,242 | |||||||||||||

| Others | 15,000 | 26,000 | — | |||||||||||||

| Total Revenue | $ | 466,577 | $ | 517,177 | $ | 246,242 | ||||||||||

| Cost of Revenue: | ||||||||||||||||

| Consultation services | (160,551 | ) | (137,163 | ) | (51,500 | |||||||||||

| Distributed computing and storage services | (495,222 | ) | (656,458 | ) | (641,920 | ) | ||||||||||

| Total Cost of Revenue | $ | (655,773 | ) | $ | (793,621 | ) | $ | (693,420 | ) | |||||||

| Gross loss | $ | (189,196 | ) | $ | (276,444 | ) | $ | (447,178 | ) | |||||||

| Operating expenses and gains/losses: | ||||||||||||||||

| Sales and marketing | (58,131 | ) | (42,295 | ) | (152,400 | ) | ||||||||||

| General and administrative | (1,698,162 | ) | (1,061,417 | ) | (1,251,559 | ) | ||||||||||

| Provision for doubtful accounts | — | (11,451 | ) | — | ||||||||||||

| Loss on disposal of intangible assets | — | — | — | |||||||||||||

| Impairment loss of intangible assets | — | — | (79,821 | ) | ||||||||||||

| Impairment loss of property and equipment | 8 | (504,693 | ) | (1,827,373 | ) | — | ||||||||||

| Loss on market price of crypto assets | (653,164 | ) | (651,441 | ) | — | |||||||||||

| Total operating expenses and gains/losses | $ | (2,914,150 | ) | $ | (3,593,977 | ) | $ | (1,483,780 | ) | |||||||

| Operating loss from continuing operations | $ | (3,103,346 | ) | $ | (3,870,421 | ) | $ | (1,930,958 | ) | |||||||

| Interest income/(expenses), net | 171,431 | 109,773 | (118,089 | ) | ||||||||||||

| Financing costs | — | — | (450,000 | ) | ||||||||||||

| Other (expenses)/income, net | 15 | (352 | ) | 70 | ||||||||||||

| Gain/(Loss) on market price of short-term investment | 3,474 | 216,410 | (7 | ) | ||||||||||||

| Gain/(Loss) from selling short-term investments | — | 35,771 | (79,742 | ) | ||||||||||||

| Loss on share-based payment liabilities | (73,500 | ) | — | — | ||||||||||||

| Loss before provision for income taxes | $ | (3,001,926 | ) | $ | (3,508,819 | ) | $ | (2,578,726 | ) | |||||||

| Income tax benefits/(expenses) | 14 | 13,334 | (325,646 | ) | 185 | |||||||||||

| Loss from continuing operations | $ | (2,988,592 | ) | $ | (3,834,465 | ) | $ | (2,578,541 | ) | |||||||

| Discontinued operations: | ||||||||||||||||

| Loss from discontinued operations | — | — | — | |||||||||||||

| Net loss | $ | (2,988,592 | ) | $ | (3,834,465 | ) | $ | (2,578,541 | ) | |||||||

| Net loss attributable to holders of ordinary shares of CHAINCE DIGITAL HOLDINGS INC. | $ | (2,988,592 | ) | $ | (3,834,465 | ) | $ | (2,578,541 | ) | |||||||

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS (CONTINUED)

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| For the six months ended June 30, | ||||||||||||||||

| Note | 2025 | 2024 | 2023 | |||||||||||||

| Numerator | ||||||||||||||||

| Net loss attributable to holders of ordinary shares of CHAINCE DIGITAL HOLDINGS INC. | $ | (2,988,592 | ) | $ | (3,834,465 | ) | $ | (2,578,541 | ) | |||||||

| Continuing operations | (2,988,592 | ) | (3,834,465 | ) | (2,578,541 | ) | ||||||||||

| Discontinued operations | — | — | — | |||||||||||||

| Denominator | ||||||||||||||||

| Weighted average shares used in calculating basic net loss per ordinary share | 63,562,650 | 45,841,825 | 42,750,237 | |||||||||||||

| Weighted average shares used in calculating diluted net loss per ordinary share | 63,562,650 | 45,841,825 | 42,750,237 | |||||||||||||

| Net Loss per ordinary share | ||||||||||||||||

| Basic | (0.05 | ) | (0.08 | ) | (0.06 | ) | ||||||||||

| Diluted | (0.05 | ) | (0.08 | ) | (0.06 | ) | ||||||||||

| Net Loss per ordinary share from continuing operation | ||||||||||||||||

| Basic | (0.05 | ) | (0.08 | ) | (0.06 | ) | ||||||||||

| Diluted | (0.05 | ) | (0.08 | ) | (0.06 | ) | ||||||||||

| Net Loss per ordinary share from discontinued operation | ||||||||||||||||

| Basic | — | — | — | |||||||||||||

| Diluted | — | — | — | |||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS (CONTINUED)

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| For the six months ended June 30 | ||||||||||||||||

| Note | 2025 | 2024 | 2023 | |||||||||||||

| Net loss | $ | (2,988,592 | ) | $ | (3,834,465 | ) | $ | (2,578,541 | ) | |||||||

| Change in cumulative foreign currency trans adjustment | (12,248 | ) | 13,376 | 25,843 | ||||||||||||

| Comprehensive loss | $ | (3,000,840 | ) | $ | (3,821,089 | ) | $ | (2,552,698 | ) | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| Ordinary shares | Additional | Accumulated other | Total CHAINCE DIGITAL HOLDINGS INC. | Total | ||||||||||||||||||||||||

| Number of Shares | Amount |

paid-in Capital |

Accumulated deficit |

comprehensive loss | shareholders’ equity | Shareholders’ equity | ||||||||||||||||||||||

| Balance as of January 1, 2025 | 62,299,897 | 249,218 | 703,098,695 | (680,448,810 | ) | 1,189,715 | 24,088,818 | 24,088,818 | ||||||||||||||||||||

| Share-based compensation | 41,665 | 167 | 293,155 | — | — | 293,322 | 293,322 | |||||||||||||||||||||

| Issuance of shares in the private placement (Note 15) | 1,370,000 | 5,480 | 8,036,420 | — | — | 8,041,900 | 8,041,900 | |||||||||||||||||||||

| Net loss | — | — | — | (2,988,592 | ) | — | (2,988,592 | ) | (2,988,592 | ) | ||||||||||||||||||

| Foreign currency translation | — | — | — | — | (12,248 | ) | (12,248 | ) | (12,248 | ) | ||||||||||||||||||

| Balance as of June 30, 2025 | 63,711,562 | 254,865 | 711,428,270 | (683,437,402 | ) | 1,177,467 | 29,423,200 | 29,423,200 | ||||||||||||||||||||

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| Ordinary shares | Additional | Accumulated other | Total CHAINCE DIGITAL HOLDINGS INC. | Total | ||||||||||||||||||||||||

| Number of Shares | Amount |

paid-in Capital |

Accumulated deficit |

comprehensive loss |

shareholders’ equity |

Shareholders’ equity |

||||||||||||||||||||||

| Balance as of January 1, 2024 | 60,819,897 | 243,298 | 693,093,915 | (676,677,485 | ) | 1,173,039 | 17,832,767 | 17,832,767 | ||||||||||||||||||||

| Issuance of shares in the private placement (Note 15) | — | — | — | — | — | — | — | |||||||||||||||||||||

| Net loss | — | — | — | (3,834,465 | ) | — | (3,834,465 | ) | (3,834,465 | |||||||||||||||||||

| Foreign currency translation | — | — | — | — | 13,376 | 13,376 | 13,376 | |||||||||||||||||||||

| Adjustment of beginning differences in fair value measurement of crypto assets | — | — | — | 763,072 | — | 763,072 | 763,072 | |||||||||||||||||||||

| Balance as of June 30, 2024 | 60,819,897 | 243,298 | 693,093,915 | (679,748,878 | ) | 1,186,415 | 14,774,750 | 14,774,750 | ||||||||||||||||||||

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (CONTINUED)

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| Ordinary shares | Additional | Accumulated other | Total CHAINCE DIGITAL HOLDINGS INC. | Total | ||||||||||||||||||||||||

| Number of Shares | Amount |

paid-in Capital |

Accumulated deficit | comprehensive loss | shareholders’ equity | Shareholders’ equity | ||||||||||||||||||||||

| Balance as of January 1, 2023 | 35,174,479 | 140,716 | 682,848,997 | (667,320,289 | ) | 1,159,440 | 16,828,864 | 16,828,864 | ||||||||||||||||||||

| Issuance of shares in the private placement (Note 15) | 11,363,637 | 45,455 | 4,704,545 | — | — | 4,750,000 | 4,750,000 | |||||||||||||||||||||

| Net loss | — | — | — | (2,578,541 | ) | — | (2,578,541 | ) | (2,578,541 | ) | ||||||||||||||||||

| Foreign currency translation | — | — | — | — | 25,843 | 25,843 | 25,843 | |||||||||||||||||||||

| Balance as of June 30, 2023 | 46,538,116 | 186,171 | 687,553,542 | (669,898,830 | ) | 1,185,283 | 19,026,166 | 19,026,166 | ||||||||||||||||||||

We have revised the January 1, 2023 number of ordinary shares amounts to retroactively present our February 2023 1-for-400 share consolidation back to the earliest period presented as stipulated in SAB 4C.

| F- |

CHAINCE DIGITAL HOLDINGS INC.

(FORMERLY KNOWN AS MERCURITY FINTECH HOLDING INC.)

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(In U.S. dollars, except for number of shares and per share (or ADS) data)

| For the six months ended June 30 | ||||||||||||

| 2025 | 2024 | 2023 | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net loss | (2,988,592 | ) | (3,834,465 | ) | (2,578,541 | ) | ||||||