UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| (Mark One) | ||

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the quarterly period ended September 30, 2025 | ||

| or | ||

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the transition period from _____ to _____ |

Commission File Number: 001-40578

AVAX ONE TECHNOLOGY LTD.

(Exact name of registrant as specified in its charter)

| British ColumbiaA1 | Not Applicable | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

800 – 525 West 8th Avenue Vancouver, BC, Canada |

V5Z 1C6 | |

| (Address of principal executive offices) | (Zip Code) |

(604) 757-0952

(Registrant’s telephone number, including area code)

AgriForce Growing Systems, Ltd.

(Former name or former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares | AVX |

NASDAQ Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of November 14, 2025, the registrant had 93,112,148 common shares, no par value per share, outstanding.

TABLE OF CONTENTS

|

|

Cautionary Note Regarding Forward-Looking Information

This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; volatility and other risks of cryptocurrencies; and the economy in general or the future of the agriculture technology industry, all of which were subject to various risks and uncertainties.

When used in this Quarterly Report on Form 10- Q and other reports, statements, and information we have filed with the Securities and Exchange Commission (“Commission” or “SEC”), in our press releases, in our periodic reports on Forms 10-K and 10-Q, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this Quarterly Report on Form 10-Q that are not statements of historical fact may be deemed to be forward-looking statements. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors.

We do not assume the obligation to update any forward-looking statement. You should carefully evaluate such statements in light of factors described in this quarterly report. In this Quarterly Report on Form 10-Q, AVAX One Technology Ltd. has identified important factors that could cause actual results to differ from expected or historic results. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete list of all potential risks or uncertainties.

|

|

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

AVAX ONE TECHNOLOGY LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| September 30, 2025 | December 31, 2024 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current | ||||||||

| Cash | $ | 894,701 | $ | 489,868 | ||||

| Digital assets | 1,079,429 | 26,282 | ||||||

| Other receivables | 187,758 | 115,520 | ||||||

| Deposit receivable | 58,177 | 73,849 | ||||||

| Prepaid expenses and other current assets | 758,233 | 314,252 | ||||||

| Inventories | 5,961 | 5,961 | ||||||

| Current assets in discontinued operations | - | 281,501 | ||||||

| Total current assets | $ | 2,984,259 | 1,307,233 | |||||

| Non-current | ||||||||

| Property and equipment, net | 4,691,326 | 808,895 | ||||||

| Intangible assets, net | 7,248,588 | 7,813,576 | ||||||

| Goodwill | 1,535,333 | - | ||||||

| Lease deposit | 50,079 | 45,224 | ||||||

| Long-term assets in discontinued operations | - | 789,055 | ||||||

| Total assets | $ | 16,509,585 | $ | 10,763,983 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current | ||||||||

| Accounts payable and accrued liabilities | 2,669,631 | $ | 2,484,184 | |||||

| Debentures | 1,372,679 | 1,443,209 | ||||||

| Derivative liabilities, current | - | 293,761 | ||||||

| Loan payable | 275,000 | - | ||||||

| Current liabilities in discontinued operations | - | 99,111 | ||||||

| Total current liabilities | 4,317,310 | 4,320,265 | ||||||

| Non-current | ||||||||

| Derivative liabilities | - | 191,902 | ||||||

| Long-term debt | 41,736 | 41,699 | ||||||

| Long-term liabilities in discontinued operations | - | 98,864 | ||||||

| Total liabilities | 4,359,046 | 4,652,730 | ||||||

| Commitments and contingencies | - | - | ||||||

| Shareholders’ equity | ||||||||

| Common shares, no par value per share - unlimited shares authorized, 4,128,089 and 172,255 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively * | 84,407,522 | 65,042,657 | ||||||

| Additional paid in capital | 6,159,083 | 2,964,795 | ||||||

| Obligation to issue shares | 44,214 | 44,214 | ||||||

| Accumulated deficit | (77,339,142 | ) | (60,782,119 | ) | ||||

| Accumulated other comprehensive income (loss) | (1,121,138 | ) | (1,158,294 | ) | ||||

| Total shareholders’ equity | 12,150,539 | 6,111,253 | ||||||

| Total liabilities and shareholders’ equity | $ | 16,509,585 | $ | 10,763,983 | ||||

| * | reflects the 1:9 reverse stock split effected on July 28, 2025 and 1:100 reverse stock split effected on December 5, 2024. |

The accompanying notes are an integral part of these Unaudited Condensed Consolidated Interim Financial Statements.

|

|

AVAX ONE TECHNOLOGY LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

| Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| REVENUE | $ | 525,915 | $ | - | $ | 1,251,124 | $ | - | ||||||||

| OPERATING EXPENSES | ||||||||||||||||

| Cost of revenue, excluding depreciation | $ | 265,908 | $ | - | $ | 728,762 | $ | - | ||||||||

| Consulting | 2,605 | 141,694 | 190,075 | 327,794 | ||||||||||||

| Depreciation and amortization | 311,069 | 163,544 | 874,238 | 493,468 | ||||||||||||

| Intangible asset impairment | - | 4,137,271 | - | 4,137,271 | ||||||||||||

| Investor and public relations | 290,622 | 61,814 | 400,693 | 104,460 | ||||||||||||

| Lease expense | 9,476 | 782 | 22,491 | 59,358 | ||||||||||||

| Office and administrative | 186,167 | 277,438 | 545,608 | 853,881 | ||||||||||||

| Professional fees | 198,142 | 91,852 | 770,998 | 417,335 | ||||||||||||

| Repairs and maintenance | 207,002 | - | 407,393 | - | ||||||||||||

| Research and development | (48,141 | ) | 1,135 | 18,775 | 5,087 | |||||||||||

| Sales and marketing | 45,087 | 20,281 | 113,780 | 79,022 | ||||||||||||

| Severance expense | - | - | 124,983 | - | ||||||||||||

| Share-based compensation | 1,138,108 | 63,552 | 1,346,606 | 127,674 | ||||||||||||

| Shareholder and regulatory | 31,694 | 13,431 | 151,353 | 98,880 | ||||||||||||

| Travel and entertainment | 821 | 23,757 | 9,114 | 31,915 | ||||||||||||

| Wages and salaries | 547,512 | 486,521 | 1,632,850 | 1,205,741 | ||||||||||||

| Bitcoin unrealized (gain) loss market valuation | (259 | ) | - | (80,577 | ) | - | ||||||||||

| Realized gain on sale of Bitcoin | (48,371 | ) | - | (48,371 | ) | - | ||||||||||

| Write-off of inventory | - | - | - | 38,470 | ||||||||||||

| Total operating expenses | 3,137,442 | 5,483,072 | 7,208,771 | 7,980,356 | ||||||||||||

| Operating loss | (2,611,527 | ) | (5,483,072 | ) | (5,957,647 | ) | (7,980,356 | ) | ||||||||

| OTHER EXPENSES | ||||||||||||||||

| Accretion of interest on debentures | 383,290 | 469,684 | 2,320,917 | 2,672,765 | ||||||||||||

| Change in fair value of derivative liabilities | - | (505,628 | ) | (2,976,911 | ) | (1,198,554 | ) | |||||||||

| Foreign exchange (gain) loss | (4,078 | ) | 67,699 | 73,548 | (26,819 | ) | ||||||||||

| Loss (gain) on conversion of convertible debt | - | 235,376 | (86,563 | ) | 1,627,858 | |||||||||||

| Loss (Gain) on debt extinguishment | 5,389,071 | (75,119 | ) | 10,119,711 | 2,223,250 | |||||||||||

| Loss (Gain) on extinguishment of warrant liability | - | (14,769 | ) | - | (14,769 | ) | ||||||||||

| Other income | - | (28,956 | ) | (51,997 | ) | (102,762 | ) | |||||||||

| Other loss | 15,657 | - | - | 4,252 | ||||||||||||

| Net loss from continuing operations | $ | (8,395,467 | ) | $ | (5,631,359 | ) | (15,356,352 | ) | $ | (13,165,577 | ) | |||||

| Gain (loss) from operations of discontinued component | 20,511 | (216,006 | ) | (320,189 | ) | (241,587 |

) | |||||||||

| Gain (loss) on disposal of discontinued operations | 23,630 | - | (880,482 | ) | - | |||||||||||

| Net gain (loss) from discontinued operations | 44,141 | (216,006 |

) | (1,200,671 | ) | (241,587 |

) | |||||||||

| Net loss | $ | (8,351,326 | ) | $ | (5,847,365 | ) | $ | (16,557,023 | ) | $ | (13,407,164 | ) | ||||

| Other comprehensive loss | ||||||||||||||||

| Foreign currency translation | - | 179,950 | 37,156 | (228,699 | ) | |||||||||||

| Comprehensive loss attributable to common shareholders | $ | (8,351,326 | ) | $ | (5,667,415 | ) | $ | (16,519,867 | ) | $ | (13,635,863 | ) | ||||

| Basic and diluted net loss per common share for continuing operations | $ | (5.58 | ) | $ | (55.08 | ) | $ | (23.04 | ) | $ | (235.41 | ) | ||||

| Basic and diluted net loss per common share for discontinued operations | $ | 0.03 | $ | (2.11) | $ | (1.80 | ) | $ | (4.32 | ) | ||||||

| Basic and diluted net loss per common share, total | $ | (5.55 | ) | $ | (57.19 | ) | $ | (24.85 | ) | $ | (239.73 | ) | ||||

| Weighted average number of commons shares outstanding - basic and diluted | 1,505,204 | 102,240 | 666,376 | 55,926 | ||||||||||||

| * | reflects the 1:9 reverse stock split effected on July 28, 2025 and 1:100 reverse stock split effected on December 5, 2024. |

The accompanying notes are an integral part of these Unaudited Condensed Consolidated Interim Financial Statements.

|

|

AVAX ONE TECHNOLOGY LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (Unaudited)

| For the three months ended September 30, 2025 | ||||||||||||||||||||||||||||

| Common shares | Obligation | Accumulated other | Total | |||||||||||||||||||||||||

|

# of Shares |

Amount |

Additional paid-in-capital |

to issue shares |

Accumulated Deficit | comprehensive income (loss) | shareholders’ equity | ||||||||||||||||||||||

| Balance, July 1, 2025 | 420,901 | $ | 68,345,760 | $ | 5,777,963 | $ | 44,214 | $ | (68,987,816 | ) | $ | (1,121,138 | ) | $ | 4,058,983 | |||||||||||||

| Shares issued for conversion of convertible debt | 2,559,800 | 13,240,311 | - | - | - | - | 13,240,311 | |||||||||||||||||||||

| Shares issued for cash, net of issuance costs | 424,078 | 1,259,066 | - | - | - | - | 1,259,066 | |||||||||||||||||||||

| Shares issued for compensation | 489,450 | 1,168,324 | - | - | - | - | 1,168,324 | |||||||||||||||||||||

| Shares issued for consulting services | 7,496 | 50,000 | - | - | - | - | 50,000 | |||||||||||||||||||||

| Warrants issued with convertible debt | - | - | 381,120 | - | - | - | 381,120 | |||||||||||||||||||||

| Shares issued on exercise of warrants | 226,364 | 344,061 | - | - | - | - | 344,061 | |||||||||||||||||||||

| Net loss | - | - | - | - | (8,351,326 | ) | - | (8,351,326 | ) | |||||||||||||||||||

| Balance, September 30, 2025 | 4,128,089 | $ | 84,407,522 | $ | 6,159,083 | $ | 44,214 | $ | (77,339,142 | ) | $ | (1,121,138 | ) | $ | 12,150,539 | |||||||||||||

| For the nine months ended September 30, 2025 | ||||||||||||||||||||||||||||

| Common shares | Obligation | Accumulated other | Total | |||||||||||||||||||||||||

|

# of Shares |

Amount |

Additional paid-in-capital |

to issue shares |

Accumulated Deficit | comprehensive income (loss) | shareholders’ equity | ||||||||||||||||||||||

| Balance, January 1, 2025 | 172,255 | $ | 65,042,657 | $ | 2,964,795 | $ | 44,214 | $ | (60,782,119 | ) | $ | (1,158,294 | ) | $ | 6,111,253 | |||||||||||||

| Shares issued for conversion of convertible debt | 2,774,169 | 16,161,914 | - | - | - | - | 16,161,914 | |||||||||||||||||||||

| Shares issued for cash, net of issuance costs | 424,078 | 1,259,066 | - | - | - | - | 1,259,066 | |||||||||||||||||||||

| Shares issued for compensation | 518,171 | 1,490,824 | - | - | - | - | 1,490,824 | |||||||||||||||||||||

| Shares issued for consulting services | 7,496 | 50,000 | 50,000 | |||||||||||||||||||||||||

| Reclassification of derivative liabilities to additional-paid-in capital | - | - | 2,771,503 | - | - | - | 2,771,503 | |||||||||||||||||||||

| Warrants issued with convertible debt | - | - | 422,785 | - | - | - | 422,785 | |||||||||||||||||||||

| Shares issued on exercise of warrants | 231,920 | 403,061 | 403,061 | |||||||||||||||||||||||||

| Share-based compensation | - | |||||||||||||||||||||||||||

| Net loss | - | - | - | - | (16,557,023 | ) | - | (16,557,023 | ) | |||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | 37,156 | 37,156 | |||||||||||||||||||||

| Balance, September 30, 2025 | 4,128,089 | $ | 84,407,522 | $ | 6,159,083 | $ | 44,214 | $ | (77,339,142 | ) | $ | (1,121,138 | ) | $ | 12,150,539 | |||||||||||||

|

|

| For the three months ended September 30, 2024 | ||||||||||||||||||||||||||||

| Common shares | Obligation | Accumulated other | Total | |||||||||||||||||||||||||

|

# of Shares |

Amount |

Additional paid-in-capital |

to issue shares |

Accumulated Deficit | comprehensive income (loss) | shareholders’ equity | ||||||||||||||||||||||

| Balance, July 1, 2024 | 93,704 | $ | 61,085,023 | $ | 2,953,883 | $ | 86,432 | $ | (52,067,103 | ) | $ | (735,245 | ) | $ | 11,322,990 | |||||||||||||

| Shares issued for conversion of convertible debt | 10,556 | 708,000 | - | - | - | - | 708,000 | |||||||||||||||||||||

| Shares issued for compensation | 566 | 42,218 | - | (42,218 | ) | - | - | - | ||||||||||||||||||||

| Shares issued for business combination | 5,556 | 295,000 | - | - | - | - | 295,000 | |||||||||||||||||||||

| Share-based compensation | - | - | 10,912 | - | - | - | 10,912 | |||||||||||||||||||||

| Net loss | - | - | - | - | (5,847,365 | ) | - | (5,847,365 | ) | |||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | 179,950 | 179,950 | |||||||||||||||||||||

| Balance, September 30, 2024 | 110,382 | $ | 62,130,241 | $ | 2,964,795 | $ | 44,214 | $ | (57,914,468 | ) | $ | (555,295 | ) | $ | 6,669,487 | |||||||||||||

| For the nine months ended September 30, 2024 | ||||||||||||||||||||||||||||

| Common shares | Obligation | Accumulated other | Total | |||||||||||||||||||||||||

|

# of Shares |

Amount |

Additional paid-in-capital |

to issue shares |

Accumulated Deficit | comprehensive income (loss) | shareholders’ equity | ||||||||||||||||||||||

| Balance, January 1, 2024 | 6,490 | $ | 49,828,942 | $ | 3,472,444 | $ | 97,094 | $ | (44,507,304 | ) | $ | (326,596 | ) | $ | 8,564,580 | |||||||||||||

| Shares issued for conversion of convertible debt | 97,221 | 11,332,607 | - | - | - | - | 11,332,607 | |||||||||||||||||||||

| Shares issued for compensation | 950 | 115,639 | - | (52,880 | ) | - | - | 62,759 | ||||||||||||||||||||

| Shares issued for consulting services | 158 | 27,624 | - | - | - | - | 27,624 | |||||||||||||||||||||

| Shares issued for business combination | 5,556 | 295,000 | - | - | - | - | 295,000 | |||||||||||||||||||||

| Shares issued on conversion of prefunded warrants | 7 | 530,429 | (530,429 | ) | - | - | - | - | ||||||||||||||||||||

| Share-based compensation | - | - | 22,780 | - | - | - | 22,780 | |||||||||||||||||||||

| Net loss | - | - | - | - | (13,407,164 | ) | - | (13,407,164 | ) | |||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | (228,699 | ) | (228,699 | ) | |||||||||||||||||||

| Balance, September 30, 2024 | 110,382 | $ | 62,130,241 | $ | 2,964,795 | $ | 44,214 | $ | (57,914,468 | ) | $ | (555,295 | ) | $ | 6,669,487 | |||||||||||||

| * | reflects the 1:9 reverse stock split effected on July 28, 2025 and 1:100 reverse stock split effected on December 5, 2024. |

The accompanying notes are an integral part of these Unaudited Condensed Consolidated Interim Financial Statements.

|

|

AVAX ONE TECHNOLOGY LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| For the Nine Months Ended September 30, | ||||||||

| 2025 | 2024 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss for the period | $ | (16,557,023 | ) | $ | (13,407,164 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 904,804 | 499,187 | ||||||

| Impairment of intangible assets | - | 4,137,271 | ||||||

| Share-based compensation | 1,490,824 | 22,780 | ||||||

| Shares issued for consulting services | 50,000 | 27,624 | ||||||

| Shares issued for compensation | - | 62,759 | ||||||

| Amortization of debt issuance costs | 2,295,657 | 2,619,362 | ||||||

| Amortization of power purchase agreement | 177,171 | - | ||||||

| Change in fair value of derivative liabilities | (2,976,911 | ) | (1,198,554 | ) | ||||

| Loss (gain) on debt conversion | (86,563 | ) | 1,627,858 | |||||

| Loss on debt extinguishment | 10,119,711 | 2,223,250 | ||||||

| Loss on disposal of business | 880,482 | - | ||||||

| Loss on disposal of fixed assets | - | 4,252 | ||||||

| Loss on long-term investment | - | 97,488 | ||||||

| Realized (gains) losses on sale of Bitcoin | (48,371 | ) | - | |||||

| Bitcoin unrealized (gain) loss market valuation | (80,577 | ) | - | |||||

| Changes in operating assets and liabilities: | ||||||||

| Revenue from digital assets production | (1,250,593 | ) | - | |||||

| Accounts receivable | - | (164 | ) | |||||

| Other receivables | (79,721 | ) | 7,213 | |||||

| Prepaid expenses and other current assets | (198,962 | ) | (226,810 | ) | ||||

| Inventories | - | (8,317 | ) | |||||

| Accounts payable and accrued liabilities | 84,355 | 82,610 | ||||||

| Lease deposit asset | (108,557 | ) | 15,502 | |||||

| Contract liabilities | - | (15,336 | ) | |||||

| Other liabilities | (50,000 | ) | - | |||||

| Net cash used in operating activities | (5,434,274 | ) | (3,429,189 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Bald Eagle acquisition | (4,765,000 | ) | - | |||||

| Acquisition of equipment | (1,080,348 | ) | - | |||||

| Sale of digital assets | 328,526 | - | ||||||

| Purchase of note payable | - | (202,093 | ) | |||||

| Cash consideration paid for business combination | - | (153,986 | ) | |||||

| Net cash used in investing activities | (5,516,822 | ) | (356,079 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from common shares issued for cash | 1,320,737 | - | ||||||

| Share issuance costs paid | (61,672 | ) | - | |||||

| Proceeds from debentures - net of discount | 9,795,000 | 2,250,000 | ||||||

| Repayment of convertible debentures | (110,000 | ) | (802,282 | ) | ||||

| Proceeds from loan payable | 275,000 | - | ||||||

| Proceeds from warrants exercised | 403,061 | - | ||||||

| Financing costs of debentures | (157,000 | ) | (84,463 | ) | ||||

| Net cash provided by financing activities | 11,465,126 | 1,363,255 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (109,197 | ) | (83,271 | ) | ||||

| Change in cash | 404,833 | (2,505,284 | ) | |||||

| Cash, beginning of period | 489,868 | 3,878,578 | ||||||

| Cash, end of period | 894,701 | 1,373,294 | ||||||

| Supplemental cash flow information: | ||||||||

| Cash paid during the period for interest | $ | 53,403 | ||||||

| Supplemental disclosure of non-cash investing and financing transactions: | ||||||||

| Initial fair value of debenture warrants (“Fifth Tranche Warrants”) | $ | - | $ | 564,000 | ||||

| Initial fair value of conversion feature of debentures (“Fifth Tranche Debentures”) | $ | - | $ | 359,000 | ||||

| Initial fair value of debenture warrants (“Sixth Tranche Warrants”) | $ | - | $ | 242,000 | ||||

| Initial fair value of conversion feature of debentures (“Sixth Tranche Debentures”) | $ | - | $ | 198,000 | ||||

| Initial fair value of debenture warrants (“Seventh Tranche Warrants”) | $ | - | $ | 369,000 | ||||

| Initial fair value of conversion feature of debentures (“Seventh Tranche Debentures”) | $ | - | $ | 297,000 | ||||

| Initial fair value of debenture warrants (“January 2025 Tranche Warrants”) | $ | 3,722,310 | $ | - | ||||

| Initial fair value of conversion feature of debentures (“January 2025 Tranche Debentures”) | $ | 1,012,000 | $ | - | ||||

| Initial fair value of debenture warrants (“March 2025 Tranche Warrants”) | $ | 428,350 | $ | - | ||||

| Initial fair value of conversion feature of debentures (“March 2025 Tranche Debentures”) | $ | 171,000 | $ | - | ||||

| Initial fair value of debenture warrants (“May 2025 Tranche Warrants”) | $ | 41,665 | $ | - | ||||

| Initial fair value of debenture warrants (“July 2025 Tranche Warrants”) | $ | 220,644 | $ | - | ||||

| Initial fair value of debenture warrants (“September 2025 Tranche Warrants”) | $ | 160,476 | $ | - | ||||

| Shares issued for conversion of convertible debt | 16,161,914 | 11,332,607 | ||||||

| Reclassification of derivative liabilities | $ | 2,771,503 | $ | - | ||||

| Forgiveness of note payable in business combination | $ | - | $ | 202,093 | ||||

| Initial fair value of contingent consideration for business combination | $ | - | $ | 79,000 | ||||

| Cancellation of investment balance due to business combination | $ | - | $ | 118,850 | ||||

| Conversion of prefunded warrants to equity | $ | - | $ | 530,429 | ||||

| Shares issued for business combination | - | 295,000 | ||||||

The accompanying notes are an integral part of these Unaudited Condensed Consolidated Interim Financial Statements.

|

|

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

For the nine months ended September 30, 2025 and 2024 (unaudited)

(Expressed in US Dollars, except where noted)

1. NATURE OF OPERATIONS AND BASIS OF PREPARATION

Business Overview

AVAX One Technology, Ltd., formerly known as AgriFORCE Growing Systems Ltd., (“AVAX One” or the “Company”) was incorporated on December 22, 2017 as a private company by filing of Articles of Incorporation in the Province of British Columbia pursuant to the provisions of the Business Corporations Act (British Columbia). The Company’s registered and records office address is at 800 – 525 West 8th Avenue, Vancouver, British Columbia, Canada, V5Z 1C6. On November 13, 2025, the Company changed its name to AVAX One Technology Ltd. (the defined term the “Company” also includes the recent name change entity to AVAX One Technology Ltd.) and its Nasdaq ticker symbol to AVX.

In the fourth quarter of 2024, the Company commenced operations as a sustainable bitcoin miner, and the Company now owns and operates three Bitcoin mining facilities, one in Alberta, Canada and two in Ohio, for a total of 1,522 BITMAIN Antminer S19j units, 81 BITMAIN Antminer S19k Pro units and 50 BITMAIN Antminer S21 XP units. These facilities are powered by flared natural gas, demonstrating the Company’s promotion of sustainable energy and environmental stewardship.

Transition to AVAX One

On September 22, 2025, the Company entered into subscription agreements (each, a “Subscription Agreement” and collectively, the “Subscription Agreements”) with certain institutional and accredited investors (each, an “Investor” and collectively, the “Investors”), pursuant to which the Company, subject to the restrictions and upon satisfaction of the conditions in the Subscription Agreements, agreed to sell in one or more private placement transactions exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Offering”), to the Investors Company common shares, no par value per share (in generality, the “Common Shares”, and the aggregate number thereof referenced in this sentence, the “Shares”). The per Share purchase price was $2.36 (the “Share Price”).

On November 5, 2025 (the “Closing Date”), upon the satisfaction of all conditions in the Subscription Agreements, the PIPE Transaction closed, and the Company issued to the Investors an aggregate of 86,690,657 Common Shares and pre-funded warrants (the “Pre-Funded Warrants”) exercisable for an aggregate of 6,123,837 Common Shares in the PIPE Transaction. The Common Shares were sold at an offering price of $2.36 per Common Share, and the Pre-Funded Warrants were sold at an offering price of $2.3599 per Pre-Funded Warrant, which represents the per share offering price less the $0.0001 per share exercise price for each such Pre-Funded Warrant.

The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

Of the aggregate $219.0 million purchase price for the Shares, an aggregate of (i) $145.4 million was paid in cash, the cryptocurrency stablecoin commonly referred to as USDC (“USDC”) based on a purchase price of $1.00 per USDC, and the cryptocurrency stablecoin commonly referred to as USDT (“USDT” and together with USDC, “Stablecoins”) based on a purchase price of $1.00 per USDT, and (ii) $73.7 million was paid in the native cryptocurrency of the Avalanche Network, referred to as AVAX Tokens (“AVAX Tokens”), which was valued for purposes of the Subscription Agreements at the volume-weighted average price of an AVAX Token (rounded to two decimal places) during the 14 consecutive calendar days ending on the Funding Payment Deadline (as defined in the Subscription Agreements) based on midnight UTC, calculated by using the hourly volume and the Messari Price as reported on messari.io (the “Specified AVAX Token Value”).

As of the Closing Date and after giving effect to the Common Shares (but not pre funded warrants) issued in the PIPE transaction, there were 93,112,148 Common Shares issued and outstanding.

Cohen & Company Securities, LLC acted as the sole placement agent in connection with the Offering.

The Company intends to use up to $10 million of the cash net proceeds from the Offering for general corporate purposes initiated after closing and for pre-existing working capital commitments or obligations, and the remaining cash net proceeds for the acquisition of AVAX Tokens. The AVAX Tokens acquired, together with the remaining net proceeds, will be used for the establishment of the Company’s cryptocurrency treasury operations to the extent consistent with the Company’s investment policy as amended or otherwise modified from time to time. In connection with the announcement of the Offering, the Company announced the launch of its digital asset treasury reserve strategy, which became effective upon the closing of the Offering, pursuant to which the Company plans to use AVAX Tokens as its primary treasury reserve asset on an ongoing basis.

The Company also intends to continue substantive operation of its Bitcoin mining business. The Company’s current management team, consisting of Jolie Kahn, as Chief Executive Officer, and Chris Polimeni, as Chief Financial Officer, will continue in their respective roles with the Company after the closing of the Offering. Furthermore, with the exception of Amy Griffith who is continuing as a director of the Company after closing, all prior directors of the Company resigned on the Closing Date of the Offering and were replaced by the newly appointed directors.

|

|

Registration Rights

In the Subscription Agreements, the Company agreed to, among other things, use reasonable best efforts to submit or file with the Securities and Exchange Commission (the “SEC”), within 30 calendar days after the closing of the Offering, a registration statement on Form S-3 (or Form S-1 if Form S-3 is not available) (the “Registration Statement”), registering the resale of the Registrable Securities (as defined below), and the Company agreed to use its commercially reasonable efforts to have the Registration Statement declared effective as soon as practicable after filing and upon the earlier of (i) the twenty-fifth (25th) business day (or sixtieth (60th) business day if the SEC notifies the Company that it will “review” the Registration Statement) following the filing date and (ii) the 5th business day after the date the Company is notified (orally or in writing, whichever is earlier) by the SEC that the Registration Statement will not be “reviewed” or will not be subject to further review. The Company agreed to use commercially reasonable efforts to maintain the effectiveness of the Registration Statement until the earlier of (a) the Investors cease to hold any Registrable Securities, (b) the date all Registrable Securities held by the Investors may be sold without restriction under Rule 144 of the Securities Act, including without any volume and manner of sale restrictions which may be applicable to affiliates under Rule 144 and without the requirement for the Issuer to be in compliance with the current public information required under Rule 144, and (c) three years from the effective date of the Registration Statement. “Registrable Securities” means the Shares and any Common Shares issued or issuable with respect to the Shares as a result of any stock split or subdivision, stock dividend, recapitalization, exchange or similar event.

Asset Management Agreement

On September 18, 2025, the Company entered into an Asset Management Agreement (the “Asset Management Agreement”) with Hivemind Capital Partners, LLC (the “Asset Manager”). The Asset Manager shall provide discretionary asset management services with respect to, among other assets (including without limitation certain subsequently raised, received or allocated funds or assets), the Company’s proceeds from the Offering (the “Account Assets”) in connection with any of the Company’s digital asset strategies, in accordance with the terms of the Asset Management Agreement. The custodians under the Asset Management Agreement will consist of cryptocurrency wallet providers agreed to by the Company and the Asset Manager. The Asset Management Agreement will become effective upon closing of the Offering.

The Company shall pay the Asset Manager an annual management fee (the “Management Fee”) equal to one and one-quarter percent (1.25%) of the Account Size (as defined in the Asset Management Agreement). The Management Fee will be calculated and payable quarterly in advance, as of the first business day of each calendar quarter. In addition to the Management Fee, the Company will reimburse the Asset Manager for all documented out-of-pocket expenses incurred by the Asset Manager in connection with the performance of the Asset Manager’s duties under the Asset Management Agreement.

The Asset Management Agreement will, unless early terminated, continue in effect until the tenth anniversary of the Effective Date (as defined in the Asset Management Agreement) and, unless a party to the agreement elects to not continue the effectiveness of the Asset Management Agreement, will continue for successive five-year renewal periods upon the mutual agreement of the Asset Manager and the Company. The Asset Management Agreement may be terminated at any time for cause (i) by the Company upon at least 30 days prior written notice to the Asset Manager and (ii) by the Asset Manager upon at least 60 days prior written notice to the Company. The Asset Manager may immediately terminate the Asset Management Agreement upon written notice to the Company if the Asset Manager reasonably determines that the continuation of its services or the Asset Management Agreement would result in a violation of any applicable law, regulation, or regulatory guidance.

Strategic Advisor Agreement

On the Closing Date, in connection with the closing of the PIPE Transaction, the Company entered into two Strategic Advisor Agreements (each, a “Strategic Advisor Agreement” and collectively, the “Strategic Advisor Agreements”) with each of Anthony Scaramucci (through Ground Tunnel Capital LLC) and Brett Tejpaul (Messrs. Scaramucci and Tejpaul are collectively referred to as the “Strategic Advisors”), pursuant to which the Company engaged the Strategic Advisors to provide strategic advice and guidance relating to the Company’s business, operations, growth initiatives and industry trends in the digital asset and financial services sector for an initial term of one year, which will automatically renew for up to two successive one year periods unless the respective Strategic Advisor or the Company provides written notice of its intention not to extend. Either the Company or the Strategic Advisor may terminate a Strategic Advisor Agreement upon 30 days’ prior written notice to the other party in the event of a material breach that remains uncured at the end of such 30-day period or immediately upon written notice to the other party in the event of willful misconduct, gross negligence, or fraud by such other party or any allegation thereof.

Pursuant to the terms of each Strategic Advisor Agreement, the Company issued to the Strategic Advisors an aggregate of 928,145 restricted Common Shares (the “Strategic Advisor Shares”). These Shares vest monthly over a period of 36 months in equal increments in the aggregate of 1/36 of the total Strategic Advisor Shares per month, and if the Agreements are terminated at the end of any one year period, any unvested shares will be forfeited. The Strategic Advisor Agreements also contain customary representations and warranties, confidentiality provisions and limitations on liability.

On September 17, 2025, the Company’s Board of Directors approved the issuance of restricted Common Shares to the following parties in transactions exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended, which shares shall be issued on September 18, 2025 at a price equal to the per share closing price on September 17, 2025. All shares issued hereunder are subject to lockup agreements entered into by those officers and directors in January 2025.

Each of directors, David Welch, John Meekison, Elaine Goldwater and Richard Levychin, received 42,194 restricted common shares, and director, Amy Griffith received 21,097 restricted common shares.

Jolie Kahn received 46,413 restricted common shares owed to her for compensation due for prior services rendered.

Each of Jolie Kahn and Chris Polimeni received an equity bonus of 105,485 restricted common shares in recognition of prior services to the Company.

David Welch shall receive 42,194 restricted common shares in recognition of prior services to the Company.

On September 15, 2025 and September 17, 2025, Company common shares were issued to the following parties in partial conversion of the Debentures previously issued to them by the Company in transactions exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended.

SCHEDULE OF COMMON SHARES WERE ISSUED TO THE FOLLOWING PARTIES

| 09/15/25 | Pioneer Capital Anstalt | 156,155 | ||||

| 09/17/25 | Anson Investments Master Fund | 193,440 | ||||

| 09/17/25 | Anson East Master Fund LP | 54,560 |

Basis of Presentation

The accompanying Unaudited Condensed Consolidated Interim Financial Statements and related financial information of AVAX Technology Ltd. should be read in conjunction with the audited financial statements and the related notes thereto for the years ended December 31, 2024 and 2023 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on April 7, 2025. These unaudited interim financial statements have been prepared in accordance with the rules and regulations of the United States Securities and Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by the accounting principles generally accepted in the United States of America (“U.S. GAAP”) for complete financial statements.

|

|

In the opinion of management, the accompanying interim financial statements contain all adjustments which are necessary to state fairly the Company’s financial position as of September 30, 2025 and December 31, 2024, and the results of its operations and cash flows during the nine months ended September 30, 2025 and 2024. Such adjustments are of a normal and recurring nature. The results for the nine months ended September 30, 2025 are not necessarily indicative of the results to be expected for the full fiscal year ending December 31, 2025, or for any future period.

Reverse Stock Split

On July 28, 2025, the Company effected a one-for-nine reverse stock split of the Company’s issued and outstanding common shares (the “Reverse Split”). As a result of the Reverse Split, every 9 shares of the Company’s old common shares were converted into one share of the Company’s new common shares. Fractional shares resulting from the Reverse Split were sold at the then prevailing price on the open market, with the proceeds being distributed on a pro-rata basis to the impacted stockholders. The Reverse Split automatically and proportionately adjusted all issued and outstanding shares of the Company’s common shares, as well as convertible debentures, convertible features, prefunded warrants, stock options and warrants outstanding at the time of the date of the Reverse Split. The exercise price on outstanding equity-based grants was proportionately increased, while the number of shares available under the Company’s equity-based plans was proportionately reduced. Share and per share data (except par value) for the periods presented reflect the effects of the Reverse Split. References to numbers of common shares and per share data in the accompanying financial statements and notes thereto for periods ended prior to July 28, 2025 have been adjusted to reflect the Reverse Split on a retroactive basis.

2. SIGNIFICANT ACCOUNTING POLICIES

Recent Accounting Pronouncements

The Company is an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, as modified by the Jumpstart Our Business Start-ups Act of 2012, (the “JOBS Act”). Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended, for complying with new or revised accounting standards applicable to public companies. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures.” ASU 2023-09 requires companies to provide enhanced rate reconciliation disclosures, including disclosure of specific categories and additional information for reconciling items. The standard also requires companies to disaggregate income taxes paid by federal, state and foreign taxes. ASU 2023-09 is effective for annual periods beginning after December 15, 2024 on a retrospective or prospective basis. The amendments are effective for the Company for the fiscal year ended December 31, 2025. The Company is currently evaluating the impact of adopting the standard.

In November 2024, the FASB issued ASU No. 2024-03, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses. The requires additional disclosures of certain expenses in the notes of the financial statements, to provide enhanced transparency into the expense captions presented on the Consolidated Statements of Operations. Additionally, in January 2025, the FASB issued ASU 2025-01, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40), to clarify the effective date of ASU 2024-03. The new standard is effective for the Company for its annual periods beginning January 1, 2027 and for interim periods beginning January 1, 2028, with early adoption permitted. The Company is currently evaluating the impact of adopting the standard.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its financial condition, results of operations, cash flows or disclosures.

|

|

Digital assets

Bitcoin awarded to the Company through its mining activities is accounted for in connection with the Company’s revenue recognition policy.

Digital assets are classified on the Company’s condensed consolidated interim balance sheet as a current asset due to the Company’s ability to sell it in a highly liquid marketplace and its intent to liquidate a portion of its Bitcoin to support operations as needed. The Company measures digital assets at fair value with changes recognized in operating expenses in the condensed consolidated interim statement of operations. The Company tracks its cost basis of digital assets in accordance with the first-in-first-out (“FIFO”) method of accounting.

Sales of Bitcoin by the Company are typically included within the investing activities on the condensed consolidated interim statement of cash flows since such Bitcoin is typically not sold nearly immediately after being produced. The Company will monitor its cash needs and sell Bitcoin in the future to fund its cash expenditures as needed. The aggregate cost basis of the Company’s Bitcoin as of September 30, 2025 was $998,852 (December 31, 2024 - $25,246). The Company held 9.4 BTC as of September 30, 2025 (December 31, 2024 – 0.3). In the quarter ended September 30, 2025, the Company sold two (2) BTC for $222,586 (December 31, 2024 – nil).

SCHEDULE OF FAIR VALUE OF BITCOIN

| September 30, 2025 | September 30, 2024 | |||||||||||||||||||||||

| Quantity | Cost Basis | Fair Value | Quantity | Cost Basis | Fair Value | |||||||||||||||||||

| Bitcoin | 9.4159 | $ | 998,852 | $ | 1,079,429 | - | - | - | ||||||||||||||||

The following table presents information regarding the mining operations including production and sales of mined Bitcoin:

SCHEDULE OF INFORMATION REGARDING THE MINING OPERATIONS

| September 30, 2025 | September 30, 2024 | |||||||||||||||

| Quantity | Amounts | Quantity | Amounts | |||||||||||||

| Balance as of December 31, 2024 | 0.2702 | $ | 25,246 | - | - | |||||||||||

| Revenue recognized from Bitcoin mined | 12.1512 | 1,250,592 | - | - | ||||||||||||

| Proceeds from sale of Bitcoin | (3.0010 | ) | (328,526 | ) | - | - | ||||||||||

| Realized gain from sale of Bitcoin | - | 48,371 | - | - | ||||||||||||

| Change in fair value of Bitcoin | - | 80,577 | - | - | ||||||||||||

| Transaction fees & other | (0.0045 | ) | 3,169 | - | - | |||||||||||

| Balance as of September 30, 2025 | 9.4159 | $ | 1,079,429 | - | - | |||||||||||

Bitcoin is treated as being sold on a FIFO basis. During the nine months ended September 30, 2025, gains of $48,371 were recognized on all sales of Bitcoin and are included in Realized gain on sale of Bitcoin on the Company’s condensed consolidated statements of operations.

Bitcoin closed with a market price of $114,056 on September 30, 2025.

In addition, the Company has pledged four (4) BTC as collateral for the loan as of September 30, 2025 (see Note 11).

Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. To determine if assets have been impaired, assets are grouped and tested at the lowest level for which identifiable independent cash flows are available (“asset group”). An impairment loss is recognized when the sum of projected undiscounted cash flows is less than the carrying value of the asset group. The measurement of the impairment loss to be recognized is based on the difference between the fair value and the carrying value of the asset group. Fair value can be determined using a market approach, income approach or cost approach. The reversal of impairment losses is prohibited.

Inventories

Inventories consist of finished goods of milled flour and related packaging material recorded at the lower of cost or net realizable value with the cost measured using the average cost method. Inventories include all costs that relate to bringing the inventory to its present condition and location under normal operating conditions.

Property and Equipment

Property and equipment are initially recognized at acquisition cost or manufacturing cost, including any costs directly attributable to bringing the assets to the location and condition necessary for them to be capable of operating in the manner intended by the Company’s management. Property, plant and equipment are subsequently measured at cost less accumulated depreciation and impairment losses.

|

|

Depreciation is recognized on a straight-line basis to write down the cost less estimated residual value of computer equipment and furniture and fixtures.

Gains or losses arising on the disposal of property, plant and equipment are determined as the difference between the disposal proceeds and the carrying amount of the assets and are recognized in profit or loss within other income or other expenses.

Revenue Recognition

The Company recognizes revenue in accordance with ASC 606. The core principle of the revenue standard is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. The following five steps are applied to achieve that core principle:

| ● | Step 1: Identify the contract with the customer; | |

| ● | Step 2: Identify the performance obligations in the contract; | |

| ● | Step 3: Determine the transaction price; | |

| ● | Step 4: Allocate the transaction price to the performance obligations in the contract; and | |

| ● | Step 5: Recognize revenue when the Company satisfies a performance obligation. |

In order to identify the performance obligations in a contract with a customer, an entity must assess the promised goods or services in the contract and identify each promised good or service that is distinct. A performance obligation meets ASC 606’s definition of a “distinct” good or service (or bundle of goods or services) if both of the following criteria are met:

| ● | The customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer (i.e., the good or service is capable of being distinct); and | |

| ● | The entity’s promise to transfer the good or service to the customer is separately identifiable from other promises in the contract (i.e., the promise to transfer the good or service is distinct within the context of the contract). |

If a good or service is not distinct, the good or service is combined with other promised goods or services until a bundle of goods or services is identified that is distinct.

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer. The consideration promised in a contract with a customer may include fixed amounts, variable amounts, or both. When determining the transaction price, an entity must consider the effects of all of the following:

| ● | Variable consideration | |

| ● | Constraining estimates of variable consideration | |

| ● | The existence of a significant financing component in the contract | |

| ● | Noncash consideration | |

| ● | Consideration payable to a customer |

Variable consideration is included in the transaction price only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized under the accounting contract will not occur when the uncertainty associated with the variable consideration is subsequently resolved.

The transaction price is allocated to each performance obligation on a relative standalone selling price basis.

The transaction price allocated to each performance obligation is recognized when that performance obligation is satisfied, at a point in time or over time, as appropriate.

The Company earns revenue from the production of digital assets through mining activities. This revenue represents proceeds received from participating in a third-party operated bitcoin mining pool. When the Company is a participant in a third-party operated mining pool, the Company provides a service to perform hash calculations to the third-party pool operators.

|

|

The Company is entitled to non-cash compensation in the form of bitcoin based on the pool operator’s payout model, which is the Full-Pay-Per-Share (“FPPS”) model, under which the pool pays out block rewards and transaction fees, less mining pool fees. The Company is entitled to such non-cash consideration even if a block is not successfully validated by the mining pool operators.

The Company considers the third-party mining pool operator to be its customer under ASC 606. Contract inception and the Company’s enforceable right to consideration begins when the Company commences providing hash calculation services to the mining pool operators. Each party to the contract has the unilateral right to terminate the contract within 24 hours’ notice without any compensation to the other party for such termination. As such, the duration of a contract is less than a day and may be continuously renewed multiple times throughout the day. The implied renewal option is not a material right because there are no upfront or incremental fees in the initial contract and the terms, conditions, and compensation amount for the renewal options are at the then market rates.

The Company’s sole performance obligation is to provide hash calculations to the third-party pool operators. Accordingly, the entire transaction price is allocated to such performance obligation. The Company measures the non-cash consideration (bitcoin) it receives is based on the simple average daily spot rate of bitcoin determined using the Company’s primary trading platform for bitcoin on the day of contract inception. The Company recognizes non-cash consideration on the same day that control of the contracted service is transferred to the pool operator, which is the same day as the contract inception.

Expenses associated with providing bitcoin transaction verification services, such as hosting fees, electricity costs, and related fees are recorded as cost of revenues. Digital assets received are recorded as digital assets. Cash flows from selling digital assets are typically included within the investing activities on the condensed consolidated interim Statement of Cash Flows.

The Company evaluates and accounts for its digital assets in accordance with ASU 2023-08, Intangibles—Goodwill and Other—Crypto Assets (Subtopic 350-60), the Company measures digital assets at fair value with changes recognized in operating expenses. The Company applies the first-in-first-out method of accounting to its digital assets and tracks the cost basis of the crypto asset by wallet.

Product revenue in 2024 was limited to sales from hydroxyl generators. We recognized product revenue when we satisfied performance obligations by transferring control of the promised products or services to customers. Product revenue was recognized at a point in time when control of the promised good or service was transferred to the customer, which was at the point of shipment or delivery of the goods.

Convertible Instruments

The Company evaluates and accounts for conversion options embedded in its convertible instruments in accordance with ASC 815, Derivatives and Hedging (“ASC 815”), which provides that if three criteria are met, the Company is required to bifurcate conversion options from their host instruments and account for them as free-standing derivative financial instruments. These three criteria include circumstances in which;

(a) the economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract;

(b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur; and

(c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative instrument.

ASC 815 also provides an exception to this rule when the host instrument is deemed to be conventional as defined under professional standards as “The Meaning of Conventional Convertible Debt Instrument”. Accordingly, the Company records, when necessary, discounts to convertible notes for the fair value of conversion options embedded in debt instruments. Debt discounts under these arrangements are amortized over the term of the related debt to their earliest date of redemption. ASC 815 provides that, among other things, generally, if an event is not within the entity’s control or could require net cash settlement, then the contract shall be classified as an asset or a liability.

|

|

Foreign Currency Transactions

The financial statements of the Company and its subsidiaries whose functional currencies are the local currencies are translated into USD for consolidation as follows: assets and liabilities at the exchange rate as of the balance sheet date, shareholders’ equity at the historical rates of exchange, and income and expense amounts at the average exchange rate for the period. Translation adjustments resulting from the translation of the subsidiaries’ accounts are included in “Accumulated other comprehensive loss” as equity in the consolidated balance sheets. Transactions denominated in currencies other than the applicable functional currency are converted to the functional currency at the exchange rate on the transaction date. At period end, monetary assets and liabilities are remeasured to the reporting currency using exchange rates in effect at the balance sheet date. Non-monetary assets and liabilities are remeasured at historical exchange rates. Gains and losses resulting from foreign currency transactions are included within non-operating expenses. As of April 1, 2025, the functional currency of the Company was changed from Canadian dollars (“CAD”) to USD due to a change in the primary economic environment in which the Company operates. The majority of the Company’s executive leadership and operations are located in the United States. The majority of revenue generation, expenditures, cash flows, financing, and contractual terms are denominated in USD.

Definite Lived Intangible Assets

Definite lived intangible assets consist of a granted patent and intangible assets acquired from an acquisition. Amortization is computed using the straight-line method over the estimated useful life of the asset (Note 7).

Goodwill

Goodwill is not amortized, however the Company reviews goodwill for impairment annually or whenever events or changes in circumstances indicate that the fair value of goodwill is less than its carrying value. To determine if goodwill has been impaired, the Company performs a qualitative assessment to determine if more likely than not the fair value of goodwill is below its carrying value. If it is determined that more likely than not there is impairment, a quantitative impairment assessment is performed to identify potential goodwill impairment. An impairment loss is recognized when the fair value as at the measurement date is less than the carrying value. The measurement of the impairment loss to be recognized is based on the difference between the fair value and the carrying value of the goodwill.

The Company presents basic and diluted loss per share data for its common shares. Basic loss per common share is calculated by dividing the profit or loss attributable to common shareholders of the Company by the weighted average number of common shares outstanding during the year. The number of common shares used in the loss per shares calculation includes all outstanding common shares plus all common shares issuable for which there are no conditions to issue other than time. Diluted loss per common share is calculated by adjusting the weighted average number of common shares outstanding to assume conversion of all potentially dilutive share equivalents, such as stock options and warrants and assumes the receipt of proceeds upon exercise of the dilutive securities to determine the number of shares assumed to be purchased at the average market price during the year.

Loss per common share calculations for all periods have been adjusted to reflect the reverse stock splits effected on December 5, 2024 and July 28, 2025.

Fair Value Accounting

The fair value of the Company’s accounts receivable, accounts payable and other current liabilities approximate their carrying amounts due to the relatively short maturities of these items.

As part of the issuance of debentures on June 30, 2022, January 17, 2023, October 18, 2023, November 30, 2023, February 21, 2024, April 11, 2024, May 22, 2024, January 16, 2025, and March 21, 2025 as well as the private placements on June 20, 2023 and October 15, 2024, the Company issued warrants having strike prices denominated in USD. This creates an obligation to issue shares for a price that is not denominated in the Company’s functional currency and renders the warrants not indexed to the Company’s stock, and therefore, must be classified as a derivative liability and measured at fair value at the end of each reporting period. On the same basis, the Series A Warrants and the representative warrants issued as part of the IPO are also classified as a derivative liability and measured at fair value. As of April 1, 2025, the Company changed its functional currency to USD. The strike prices of the warrants and the Company’s functional currency are both denominated in USD. The Company reassessed that the warrants met the classification criteria to be recorded as equity and the warrants were reclassified to additional-paid-in capital.

The fair value of the Company’s warrants is determined in accordance with FASB ASC 820, “Fair Value Measurement,” which establishes a fair value hierarchy that prioritizes the assumptions (inputs) to valuation techniques used to price assets or liabilities that are measured at fair value. The hierarchy, as defined below, gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The guidance for fair value measurements requires that assets and liabilities measured at fair value be classified and disclosed in one of the following categories:

| ● | Level 1: Defined as observable inputs, such as quoted (unadjusted) prices in active markets for identical assets or liabilities. | |

| ● | Level 2: Defined as observable inputs other than quoted prices included in Level 1. This includes quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

|

|

| ● | Level 3: Defined as unobservable inputs to the valuation methodology that are supported by little or no market activity and that are significant to the measurement of the fair value of the assets or liabilities. Level 3 assets and liabilities include those whose fair value measurements are determined using pricing models, discounted cash flow methodologies or similar valuation techniques, as well as significant management judgment or estimation. |

3. ACQUISITIONS

| (a) | Radical Clean Solutions Acquisition |

On August 16, 2024, the Company completed the acquisition of assets of Radical Clean Solutions, Inc. (“RCS”), effectively increasing its interest from 14% to 100%, and providing the Company control over RCS. The RCS technology is a product line consisting of patent-pending “smart hydroxyl generation systems” focused on numerous industry verticals that is proven to eliminate 99.99+% of all major pathogens, virus, mold, volatile organic compounds (“VOCs”) and allergy triggers. As the Company’s investment in RCS does not have a readily determinable fair value, the Company previously elected to account for its 14% interest in RCS at cost, less impairment. The Company recognized a loss on the investment of $97,488 during the year ended December 31, 2024.

On July 1, 2025, the Company mutually agreed to return the RCS assets and certain liabilities to the seller, and as a result, the Company accrued a loss on disposal of the RCS business, which is reflected on the condensed consolidated statement of operations as a loss on disposal of business of $880,482.

Details of the assets and liabilities of discontinued operations are as follows:

SCHEDULE OF ASSETS AND LIABILITIES DISCONTINUED OPERATIONS

| September 30, 2025 | December 31, 2024 | |||||||

| Carry amounts of major classes of assets included as part of discontinued operations | ||||||||

| Current | ||||||||

| Prepaid expenses and other current assets | $ | - | $ | 245,019 | ||||

| Inventories | - | 36,482 | ||||||

| Total current assets in discontinued operations | - | 281,501 | ||||||

| Non-current | ||||||||

| Intangible assets, net | - | 494,114 | ||||||

| Goodwill | - | 294,941 | ||||||

| Total long-term assets in discontinued operations | $ | - | $ | 789,055 | ||||

| Carry amounts of major classes of liabilities included as part of discontinued operations | - | |||||||

| Current | ||||||||

| Accounts payable and accrued liabilities | $ | - | $ | 99,111 | ||||

| Total current liabilities in discontinued operations | - | 99,111 | ||||||

| Non-current | ||||||||

| Other liabilities | - | 98,864 | ||||||

| Long-term liabilities in discontinued operations | $ | - | 98,864 | |||||

Cash used in operating activities from discontinued operations was $0.3 million for the nine months ended September 30, 2025 (September 30, 2024 - $0.2 million). There were no cash flows related to investing or financing activities of discontinued operations for the nine months ended September 30, 2025 or September 30, 2024.

The details of the component information of the discontinued operations are disclosed under columns Radical Clean Solutions in segment reporting information in Note 18.

| (b) | Redwater Acquisition |

On November 28, 2024, the Company completed its acquisition of the Redwater Bitcoin Mining Facility, located in Alberta, Canada (“Redwater”) for a total purchase price of approximately $1.5 million. The acquisition was accounted for as an asset acquisition as, at the time of acquisition, no outputs were produced from the property, and skilled employees or contractors required for the operation of the facility were not included in the transaction. The purchase price consisted primarily of cash proceeds paid to the seller, and legal transaction costs. The acquired assets are amortized commencing on the acquisition date over the remaining estimated useful lives thereof.

The purchase price was allocated based on the relative fair value of the assets acquired as follows:

SCHEDULE OF FAIR VALUE OF THE ASSETS ACQUIRED

| Assets Acquired: | Fair Value | |||

| S19J Pro Bitmain ASIC Miners | $ | 102,812 | ||

| Natural Gas Power Plant | 566,009 | |||

| Power Purchase Agreement | 673,769 | |||

| Bitcoin Mining Facility and Infrastructure | 171,116 | |||

| Total assets acquired | $ | 1,513,706 | ||

|

|

The Power Purchase Agreement between the Company and Rivogenix Energy Corp (“Rivogenix”), allows the Company to obtain natural gas for its Natural Gas Power Plant. The Power Purchase Agreement was determined to be a favorable contract asset, and as such was recorded at the present value of the contractual benefit. As per the agreement, Rivogenix procures the natural gas required to generate power using the Natural Gas Power Plant and allows the Company to purchase the power generated at a rate of CAD $0.055 per kilowatt hour (KWH). The expected power cost per kilowatt hour in Alberta was determined to be CAD $0.0883, providing a discount of CAD $0.0383. The power usage required to operate each of the acquired Bitcoin Miners is 75.9KWH per day per Bitcoin Miner. The discount rate used in the present value calculation is 11.25%, and the period of the contract has been determined to be 3 years.

| (c) | Bald Eagle Acquisition |

On January 17, 2025, the Company consummated the acquisition of assets of Bald Eagle Mining, LLC (“Bald Eagle”), located in Columbiana Country, Ohio, for a total purchase price of $4,765,000. Bald Eagle is a Bitcoin mining facility, powered by 5MW of flared natural gas energy, which at the time of the acquisition supported over 900 bitcoin mining units. During the third quarter of 2025, the Company increased the number of mining units at the Bald Eagle mining site to 1,662.

The following pro forma summary presents consolidated information of the Company as if the business combination had occurred on January 1, 2024.

SCHEDULE OF UNAUDITED PRO FORMA INFORMATION

| Proforma for the three months ended September 30, | Proforma for the nine months ended September 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenue | $ | 525,915 | $ | 319,739 | $ | 1,251,124 | $ | 1,363,168 | ||||||||

| Net loss | $ | (8,351,326 | ) | $ | (6,101,455 | ) | $ | (16,557,023 | ) | $ | (13,447,604 | ) | ||||

The Company did not have any material, nonrecurring pro forma adjustments directly attributable to the business combination included in the reported pro forma revenue and net loss position.

These pro forma amounts have been calculated after applying the Company’s accounting policies and adjusting the results of Bald Eagle to reflect the additional amortization that would have been charged assuming the fair value adjustments to the intangible assets had been applied from January 1, 2025, with the consequential tax effects.

The following table summarizes the consideration transferred to acquire Bald Eagle and the amounts of identified assets acquired and liabilities assumed at the acquisition date.

SCHEDULE OF CONSIDERATION TRANSFERRED TO ACQUIRE AND IDENTIFY ASSETS ACQUIRED AND LIABILITIES ASSUMED

| January 17, 2025 | ||||

| Cash consideration | $ | 3,550,000 | ||

| Option payment | 1,215,000 | |||

| Purchase price | $ | 4,765,000 | ||

| Assets acquired | ||||

| S19J Pro Bitmain ASIC Miners | $ | 746,159 | ||

| Natural gas power generators | 1,671,586 | |||

| Transformers | 131,878 | |||

| Data centers | 609,554 | |||

| Shipping containers | 13,744 | |||

| Standby generators | 66,090 | |||

| Fair value of identified net assets acquired | $ | 3,239,012 | ||

| Goodwill | $ | 1,525,988 | ||

As of September 30, 2025, the Company’s goodwill balance was $1,535,333 (foreign exchange gain of $9,345).

The Company will continue to operate its bitcoin mining business alongside its AVAX treasury business, which will be the main business operation post-closing.

|

|

4. PREPAID EXPENSES AND OTHER CURRENT ASSETS

SCHEDULE OF PREPAID EXPENSES AND OTHER CURRENT ASSETS

| September 30, 2025 | December 31, 2024 | |||||||

| Legal retainer | $ | 56,004 | $ | 30,976 | ||||

| Prepaid expenses | 586,488 | 3,034 | ||||||

| Inventory and equipment advances | 37,337 | 227,087 | ||||||

| Purchase prepayments | 53,204 | 53,155 | ||||||

| Deferred Financing Cost | 25,200 | - | ||||||

| Prepaid expenses, other current assets | $ | 758,233 | $ | 314,252 | ||||

5. INVENTORIES

As of September 30, 2025 and December 31, 2024, the Company had an inventory of finished goods with a fair market value of $5,961.

6. PROPERTY AND EQUIPMENT

Property and equipment consisted of the following:

SCHEDULE OF PROPERTY AND EQUIPMENT

| September 30, 2025 | December 31, 2024 | |||||||

| Bitcoin Mining Facility and Infrastructure | $ | 2,475,796 | $ | 170,139 | ||||

| Bitminers | 1,931,583 | 102,225 | ||||||

| Transformers and Generators | 752,502 | 562,778 | ||||||

| Furniture and fixtures | - | 2,358 | ||||||

| Total property and equipment | 5,159,881 | 837,500 | ||||||

| Less: accumulated depreciation | (468,555 | ) | (28,605 | ) | ||||

| Property and equipment, net | $ | 4,691,326 | $ | 808,895 | ||||

Depreciation expense on property and equipment for the nine months ended September 30, 2025 was $468,555 (September 30, 2024 - $4,716), and for the three months ended September 30, 2025 was $182,892(September 30, 2024 - $1,019). During the nine months ended September 30, 2024, the Company disposed of property and equipment which resulted in a loss of $4,252. There were no disposals in 2025 .

7. INTANGIBLE ASSETS

SCHEDULE OF INTANGIBLE ASSET

| September 30, 2025 | December 31, 2024 | |||||||

| Manna IP | $ | 7,354,404 | $ | 7,347,757 | ||||

| Power Purchase Agreement | 449,234 | 625,736 | ||||||

| Total intangible assets | 7,803,638 | 7,973,493 | ||||||

| Less: accumulated amortization | (555,050 | ) | (159,917 | ) | ||||

| Intangible assets, net | $ | 7,248,588 | $ | 7,813,576 | ||||

|

|

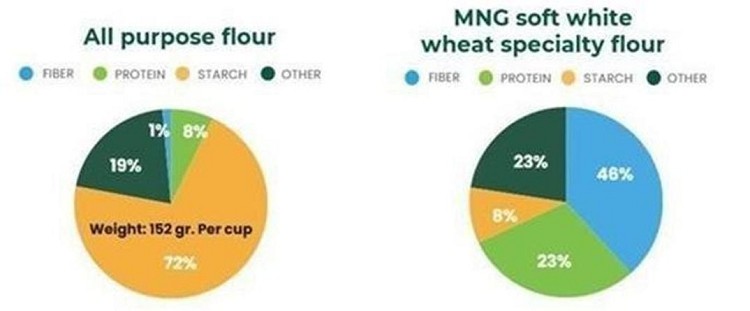

Intangible assets include $6,799,354 (December 31, 2024 - $7,209,118) for intellectual property (“Manna IP”) acquired under an asset purchase agreement with Manna Nutritional Group, LLC (“Manna”) dated September 10, 2021. The Manna IP encompasses patented technologies to naturally process and convert grains, pulses, and root vegetables, into low-starch, low-sugar, high-protein, fiber-rich baking flour products, as well as a wide range of breakfast cereals, juices, natural sweeteners, and baking enhancers. The Company paid $1,475,000 in cash and issued 1,476 prefunded warrants valued at $12,106,677, in a private placement transaction (the “Purchase Price”). Subject to a 9.99% blocker, the prefunded warrants vested in tranches up until March 10, 2024, at which time all tranches were fully vested. When vested the tranches of prefunded warrants became convertible into an equal number of restricted common shares.

The asset was available for use on January 3, 2023. The asset has a useful life of 20 years. The Company recorded $416,286 in amortization expense related to the Manna IP for the nine months ended September 30, 2025 (September 30, 2024- $488,752), and $138,762 for the three months ended September 30, 2025 (September 30, 2024 $165,510).

The Company acquired intangible assets from RCS as part of the business combination (Note 3). The following intangible assets were acquired from RCS:

SCHEDULE OF INTANGIBLE ASSETS ACQUIRED FROM RCS

|

Weighted Average Useful Life (Years) |

Amount | |||||

| In-process research and development | Term of the patent | $ | 300,000 | |||

| Trademark | 10 | 10,000 | ||||

| Brand logo | 10 | 10,000 | ||||

| Web domain | 5 | 10,000 | ||||

| Customer list | 5 | 138,000 | ||||

| Device firmware and software | 5 | 50,000 | ||||

| RCS blueprints | 5 | 20,000 | ||||

| Identified assets acquired and liabilities assumed intangibles | $ | 538,000 | ||||

The Company recorded $30,548 (September 30, 2024 - $Nil) in amortization expense, and a foreign exchange loss of $nil (September 30, 2024 - $Nil) related to the RCS assets for the nine months ended September 30, 2025. The Company recorded $15,274 (September 30, 2024 - $Nil) in amortization expense, and a foreign exchange loss of $Nil (September 30, 2024 - $Nil) related to the RCS assets for the three months ended September 30, 2025.

As of June 30, 2025, the Company recorded the disposal of the RCS assets due to the mutual agreement to return the RCS assets to the seller which resulted in a loss on disposal of business of $880,482 (Note 3). The Company reclassified the assets and liabilities of RCS to assets held for sale and liabilities held for sale. The Company reclassified the revenues and expenses of RCS to net loss from discontinued operations.

The Company acquired an intangible asset from the acquisition of Redwater, as part of the asset acquisition (note 3). The Power Purchase Agreement between the Company and Rivogenix, allows the Company to obtain natural gas for its Natural Gas Power Plant. The Power Purchase Agreement was determined to be a favorable contract asset, and as such was recorded as an intangible asset at the present value of the contractual benefit. The period of the contract has been determined to be 3 years. As of September 30, 2025, 2.25 years remain on the contract. The fair value of the Power Purchase Agreement Contract as of September 30, 2025 is $449,234 (December 31, 2024 - $625,736). The Company recognized $177,171 in amortization expense (reflected in cost of sales) during the nine months ended September 30, 2025 and $61,872 for the three months ended September 30, 2025 (September 30, 2024 - $Nil) in relation to the Power Purchase Agreement.

The estimated annual amortization expense for each of the next five years is as follows:

SCHEDULE OF FUTURE AMORTIZATION EXPENSE

| Period ending: | Amount | |||

| Remaining 2025 | $ | 196,670 | ||

| 2026 | 769,316 | |||

| 2027 | 732,110 | |||

| 2028 | 555,049 | |||

| 2029 | 555,049 | |||

| Subsequent years | 4,440,394 | |||

| Total | $ | 7,248,588 | ||

8. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

SCHEDULE OF ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

| September 30, 2025 | December 31, 2024 | |||||||

| Accounts payable | $ | 1,156,518 | $ | 597,057 | ||||

| Accrued expenses | 1,513,113 | 1,887,127 | ||||||

| Accounts payable and accrued liabilities | $ | 2,669,631 | $ | 2,484,184 | ||||

|

|