UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Roma Green Finance Limited

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

Flat 605, 6/F., Tai Tung Building, 8 Fleming Road

Wanchai, Hong Kong

(Address of principal executive offices)

Luk Huen Ling Claire, CEO

Tel: + 852 2529 6878

Email: claireluk@roma-international.com

Flat 605, 6/F., Tai Tung Building, 8 Fleming Road

Wanchai, Hong Kong

(Name, Telephone, email and/or fax number and address of Company Contact Person)

Indicate by check mark whether the registrant files or will file extraordinary reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

2025 Extraordinary General Meeting

In connection with the 2025 extraordinary general meeting of Roma Green Finance Limited, a Cayman Islands company (the “Company”), the Company hereby furnishes the following documents:

Exhibits

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: November 12, 2025

| Roma Green Finance Limited | ||

| By: | /s/ Luk Huen Ling Claire | |

| Name: | Luk Huen Ling Claire | |

| Title: | Chairlady, Executive Director and Chief Executive Officer | |

|

|

Exhibit 99.1

Roma Green Finance Limited

(incorporated in the Cayman Islands with limited liability)

(NASDAQ: ROMA)

Flat 605, 6/F., Tai Tung Building, 8 Fleming Road

Wanchai, Hong Kong

November 7, 2025

Dear Shareholders:

You are cordially invited to attend the 2025 Extraordinary General Meeting of Shareholders (the “2025 Extraordinary General Meeting”) of Roma Green Finance Limited to be held at Rooms 1101-4, 11/F Harcourt House, 39 Gloucester Road, Wanchai, Hong Kong on December 17, 2025, at 10 P.M. (Eastern Time). The matters to be acted upon at the 2025 Extraordinary General Meeting are set forth and described in the notice of the 2025 Extraordinary General Meeting of shareholders and proxy statement, which are attached hereto. We request that you read all of them carefully.

We hope that you will attend the 2025 Extraordinary General Meeting. Whether or not you expect to attend the 2025 Extraordinary General Meeting in person, we urge you to sign, date and return the enclosed Proxy Card in the enclosed postage prepaid envelope (if mailed in the United States) as promptly as possible in accordance with the instructions printed on it, not less than 48 hours before the time appointed for holding the 2025 Extraordinary General Meeting or adjourned or postponed 2025 Extraordinary General Meeting in accordance with the currently effective memorandum and articles of association. You may, of course, attend the 2025 Extraordinary General Meeting and vote in person even if you have signed and returned your Proxy Card to us.

| Sincerely, | |

| /s/ Luk Huen Ling Claire | |

| Luk Huen Ling Claire | |

| Chairlady, Executive Director and Chief Executive Officer |

|

|

Roma Green Finance Limited

(incorporated in the Cayman Islands with limited liability)

(NASDAQ: ROMA)

NOTICE OF THE 2025 EXTRAORDINARY GENERAL MEETING

To be held on December 17, 2025, at 10 P.M. (Eastern Time)

To the Shareholders of Roma Green Finance Limited:

This notice to shareholders is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Roma Green Finance Limited (the “Company”) for use at the 2025 Extraordinary General Meeting of the Company (the “2025 Extraordinary General Meeting”) and at all adjournments and postponements thereof. The 2025 Extraordinary General Meeting will be held at Rooms 1101-4, 11/F Harcourt House, 39 Gloucester Road, Wanchai, Hong Kong, on December 17, 2025, at 10 P.M. (Eastern Time), to consider and vote upon the following proposal(s):

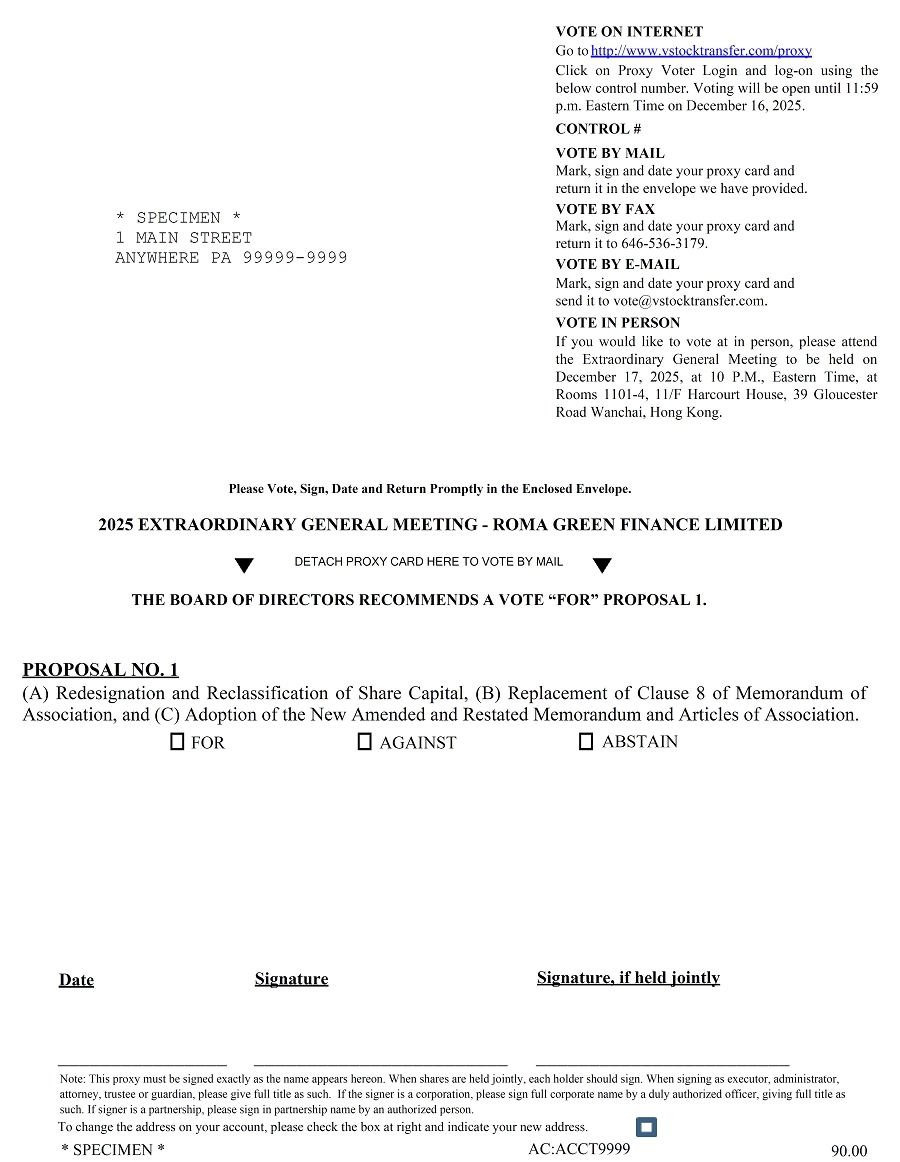

| 1. | (A) Redesignation and Reclassification of Share Capital, (B) Replacement of Clause 8 of Memorandum of Association, and (C) Adoption of the New Amended and Restated Memorandum and Articles of Association: To consider and approve, as a special resolution, that (the “Proposal No. 1”): |

| (A) | the shares of the Company be re-designated and re-classified (the “Redesignation and Reclassification of Share Capital”) such that the currently authorised share capital of the Company shall be re-classified and re-designated from (i) US$500,000 divided into 500,000,000 shares of a nominal or par value of US$0.001 each to (ii) US$500,000 divided into 400,000,000 Class A ordinary shares of a nominal or par value of US$0.001 each, 50,000,000 Class B ordinary shares of a nominal or par value of US$0.001 each, and 50,000,000 shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, by the re-designation and re-classification of (x) 346,506,533 unissued shares of a nominal or par value of US$0.001 each into 346,506,533 unissued Class A ordinary shares of a nominal or par value of US$0.001 each, and (y) 43,928,896 unissued shares of a nominal or par value of US$0.001 each into 43,928,896 unissued Class B ordinary shares of a nominal or par value of US$0.001 each, and (z) 50,000,000 unissued shares of a nominal or par value of US$0.001 each into 50,000,000 unissued shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, and the currently issued 59,564,571 shares of a nominal or par value of US$0.001 each in the Company be and are re-designated and re-classified into 53,493,467 Class A ordinary shares of a nominal or par value of US$0.001 each with 1 vote per share (the “Class A Ordinary Shares”), 6,071,104 Class B ordinary shares of a nominal or par value of US$0.001 each with 25 votes per share (the “Class B Ordinary Shares”), and 0 share of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, on a one for one basis, as follows: |

| Name of Shareholder |

Number of existing ordinary shares held |

Number and

class of shares to be held after the re-designation and re-classification of shares of the Company |

||

| Top Elect Group Limited | 6,071,104 | 6,071,104 Class B Ordinary Shares | ||

| All other shareholders | 53,493,467 | 53,493,467 Class A Ordinary Shares | ||

| Total | 59,564,571 |

| (B) | the existing clause 8 of the existing amended and restated memorandum of association be deleted in its entirety and be replaced with the following new clause 8: |

“The share capital of the Company is US$500,000 divided into 400,000,000 Class A ordinary shares of a nominal or par value of US$0.001 each, 50,000,000 Class B ordinary shares of a nominal or par value of US$0.001 each, and 50,000,000 shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with Article 13 of the Articles of Association of the Company, with the power for the Company, insofar as is permitted by law, to redeem or purchase any of its shares and to increase or reduce the said share capital subject to the provisions of the Companies Act (As Revised) and the Articles of Association of the Company and to issue any part of its capital, whether original, redeemed or increased, with or without any preference, priority or special privilege or subject to any postponement of rights or to any conditions or restrictions; and so that, unless the conditions of issue shall otherwise expressly declare, every issue of shares, whether declared to be preference or otherwise, shall be subject to the power hereinbefore contained.”; and

| (C) | the Second Amended and Restated Memorandum of Association and Second Amended and Restated Articles of Association of the Company as set forth in Annex A to this notice (the “New Amended and Restated Memorandum and Articles of Association”) be adopted in substitution for and to the exclusion of the Amended and Restated Memorandum of Association and Amended and Restated Articles of Association of the Company currently in effect, to reflect the multi-class share structure and set out the rights and privileges of Class A Ordinary Shares and Class B Ordinary Shares. |

|

|

| 2. | To transact such other business which may properly come before the 2025 Extraordinary General Meeting or any adjournment or postponement thereof, if necessary. |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL ABOVE.

Holders of record of the Company’s ordinary shares at the close of business on October 31, 2025 (the “Record Date”) will be entitled to notice of, and to vote at, the 2025 Extraordinary General Meeting and any adjournment or postponement thereof. Each ordinary share entitles the holder thereof to one vote for every fully paid share of which he is the holder.

Your vote is important, regardless of the number of shares you own. Even if you plan to attend the 2025 Extraordinary General Meeting in person, it is strongly recommended that you complete the enclosed proxy card before the meeting date, to ensure that your shares will be represented at the 2025 Extraordinary General Meeting if you are unable to attend.

A complete list of shareholders of record entitled to vote at the 2025 Extraordinary General Meeting will be available for ten days before the 2025 Extraordinary General Meeting at the principal executive office of the Company for inspection by shareholders during ordinary business hours for any purpose germane to the 2025 Extraordinary General Meeting.

This notice and the enclosed proxy statement are first being mailed to shareholders on or about November 7, 2025.

You are urged to review carefully the information contained in the enclosed proxy statement prior to deciding how to vote your shares.

By Order of the Board of Directors,

| /s/ Luk Huen Ling Claire | |

| Luk Huen Ling Claire | |

| Chairlady, Executive Director and Chief Executive Officer | |

| November 7, 2025 |

|

|

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED “FOR” ALL OF THE PROPOSALS ABOVE.

Important

Notice Regarding the Availability of Proxy Materials

for the Extraordinary General Meeting to be held on December 17, 2025, at 10 P.M., Eastern Time

The Notice of 2025 Extraordinary General Meeting, notice to shareholders are available at www.sec.gov.

|

|

Roma Green Finance Limited

Notice to Shareholders

2025

EXTRAORDINARY GENERAL MEETING

to be held on December 17, 2025, at 10 P.M., Eastern Time

Rooms 1101-4, 11/F Harcourt House, 39 Gloucester Road, Wanchai, Hong Kong

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving this proxy statement?

This proxy statement describes the proposals on which our Board would like you, as a shareholder, to vote at the 2025 Extraordinary General Meeting, which will take place on December 17, 2025, at 10 P.M., Eastern Time, at Rooms 1101-4, 11/F Harcourt House, 39 Gloucester Road, Wanchai, Hong Kong.

Shareholders are being asked to consider and vote upon proposals to approve the Proposal No. 1 and transact other such business as may properly come before the 2025 Extraordinary General Meeting or any adjournment or postponement thereof.

This proxy statement also gives you information on the proposals so that you can make an informed decision. You should read it carefully. Your vote is important. You are encouraged to submit your proxy card as soon as possible after carefully reviewing this proxy statement.

In this proxy statement, we refer to Roma Green Finance Limited as the “Company”, “we”, “us” or “our.”

Who can vote at the 2025 Extraordinary General Meeting?

Shareholders who are the registered owners of our ordinary shares on October 31, 2025 (the “Record Date”) may attend and vote at the 2025 Extraordinary General Meeting. There were 59,564,571 ordinary shares outstanding on the Record Date. Each ordinary share entitles the holder thereof to one vote for every fully paid share of which he is the holder.

What is the proxy card?

The card enables you to appoint Luk Huen Ling Claire, the Chief Executive Officer of the Company, as your proxy to represent you at the 2025 Extraordinary General Meeting. By completing and returning the proxy card, you are authorizing this representative to vote your shares at the 2025 Extraordinary General Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the 2025 Extraordinary General Meeting. Even if you plan to attend the 2025 Extraordinary General Meeting, it is strongly recommended to complete and return your proxy card before the 2025 Extraordinary General Meeting date just in case your plans change. If a proposal comes up for vote at the 2025 Extraordinary General Meeting that is not on the proxy card, the proxies will vote your shares, under your proxy, according to their best judgment.

|

|

How does the Board recommend that I vote?

Our Board unanimously recommends that shareholders vote “FOR” Proposal No. 1.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Certain of our Shareholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record/Registered Shareholders

If, on the Record Date, your shares were registered directly in your name with our transfer agent, VStock Transfer, LLC, you are a “Shareholder of Record” who may vote at the 2025 Extraordinary General Meeting, and we are sending these proxy materials directly to you. As the Shareholder of Record, you have the right to direct the voting of your shares by returning the enclosed proxy card to us or appointing your proxy via the Internet or to vote in person at the 2025 Extraordinary General Meeting. Whether or not you plan to attend the 2025 Extraordinary General Meeting, please read, complete, sign, date, and return the attached proxy card (or appoint your proxy via the Internet) in accordance with the instructions set out therein to ensure that your vote is counted.

Beneficial Owner

If, on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered the beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered the Shareholder of Record for purposes of voting at the 2025 Extraordinary General Meeting. As the beneficial owner, you have the right to direct your broker on how to vote your shares and to attend the 2025 Extraordinary General Meeting. However, since you are not the Shareholder of Record, you may not vote these shares in person at the 2025 Extraordinary General Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank or other nominee holder. If you do not make this request, you can still vote by using the voting instruction card enclosed with this proxy statement; however, you will not be able to vote in person at the 2025 Extraordinary General Meeting.

How do I vote?

If you were a Shareholder of Record of the Company’s Ordinary Shares on the Record Date, you may vote in person at the 2025 Extraordinary General Meeting or by submitting a proxy. Each Ordinary Share that you own in your name entitles you to one vote, in each case, on the applicable proposals.

(1) You may submit your proxy by mail. You may submit your proxy by mail by completing, signing and dating your proxy card and returning it in the enclosed, postage-paid and addressed envelope. If we receive your proxy card prior to the 2025 Extraordinary General Meeting and if you mark your voting instructions on the proxy card, your shares will be voted:

| ● | as you instruct, and | |

| ● | according to the best judgment of the proxies if a proposal comes up for a vote at the 2025 Extraordinary General Meeting that is not on the proxy card. |

We encourage you to examine your proxy card closely to make sure you are voting all of your shares in the Company.

If you return a signed card, but do not provide voting instructions, your shares will be voted:

| ● | FOR the Proposal No. 1 ((A) Redesignation and Reclassification of Share Capital, (B) Replacement of Clause 8 of Memorandum of Association, and (C) Adoption of the New Amended and Restated Memorandum and Articles of Association); | |

| ● | according to the best judgment of your proxy if a proposal comes up for a vote at the 2025 Extraordinary General Meeting that is not on the proxy card. |

|

|

(2) You may submit your proxy by email. You may submit your proxy by completing, signing, and dating your proxy card and returning a scanned copy of your proxy card by emailing to claireluk@roma-international.com. Your vote by email must be received by 9 P.M. Eastern Time on December 15, 2025.

(3) You may vote in person at the 2025 Extraordinary General Meeting. We will pass out written ballots to any Shareholder of Record who wants to vote at the 2025 Extraordinary General Meeting.

If I plan on attending the 2025 Extraordinary General Meeting, should I return my proxy card?

Yes. Whether or not you plan to attend the 2025 Extraordinary General Meeting, after carefully reading and considering the information contained in this proxy statement, please complete and sign your proxy card. Then return the proxy card in the pre-addressed, postage-paid envelope provided herewith as soon as possible so your shares may be represented at the 2025 Extraordinary General Meeting.

May I change my mind after I return my proxy?

Yes. You may revoke your proxy and change your vote at any time before the polls close at the 2025 Extraordinary General Meeting.

You may do this by:

| ● | sending a written notice to the Secretary of the Company at the Company’s executive offices stating that you would like to revoke your proxy of a particular date; | |

| ● | signing another proxy card with a later date and returning it to the Secretary before the polls close at the 2025 Extraordinary General Meeting; or | |

| ● | attending the 2025 Extraordinary General Meeting and voting in person. |

What does it mean if I receive more than one proxy card?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards to ensure that all of your shares are voted.

What happens if I do not indicate how to vote my proxy?

Signed and dated proxies received by the Company without an indication of how the shareholder desires to vote on a proposal will be voted in favor of each proposal presented to the shareholders.

Will my shares be voted if I do not sign and return my proxy card?

If you do not sign and return your proxy card, your shares will not be voted unless you vote in person at the 2025 Extraordinary General Meeting.

How many votes are required to approve the proposals?

The Proposal No. 1 requires the affirmative vote of a majority of not less than two-thirds of votes cast by such shareholders as, being entitled so to do, vote in person or, in the case of any shareholder being a corporation, by its duly authorized representative or by proxy at the 2025 Extraordinary General Meeting.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying Shareholders are kept confidential and will not be disclosed, except as may be necessary to meet legal requirements.

Where do I find the voting results of the 2025 Extraordinary General Meeting?

We will announce voting results at the 2025 Extraordinary General Meeting and also file a Current Report on Form 6-K with the Securities and Exchange Commission (the “SEC”) reporting the voting results.

Who can help answer my questions?

You can contact the investors relation team of the Company at + 852 2529 6878 or by sending a letter to the offices of the Company at Flat 605, 6/F., Tai Tung Building, 8 Fleming Road, Wanchai, Hong Kong or email at claireluk@roma-international.com with any questions about proposals described in this proxy statement or how to execute your vote.

|

|

THE 2025 EXTRAORDINARY GENERAL MEETING

General

We are furnishing this proxy statement to you, as a shareholder of Roma Green Finance Limited, as part of the solicitation of proxies by our Board for use at the 2025 Extraordinary General Meeting to be held on December 17, 2025, and any adjournment or postponement thereof. This proxy statement is first being furnished to Shareholders on or about November 7, 2025. This proxy statement provides you with information you need to know to be able to vote or instruct your proxy how to vote at the 2025 Extraordinary General Meeting.

Date, Time and Place of the 2025 Extraordinary General Meeting

The 2025 Extraordinary General Meeting will be held on 10 P.M. Eastern Time on December 17, 2025, at Rooms 1101-4, 11/F Harcourt House, 39 Gloucester Road, Wanchai, Hong Kong, or such other date, time and place to which the 2025 Extraordinary General Meeting may be adjourned or postponed.

Purpose of the 2025 Extraordinary General Meeting

At the 2025 Extraordinary General Meeting, the Company will ask Shareholders to consider and vote upon the following proposals:

| 1. | (A) Redesignation and Reclassification of Share Capital, (B) Replacement of Clause 8 of Memorandum of Association, and (C) Adoption of the New Amended and Restated Memorandum and Articles of Association: To consider and approve, as a special resolution, that (the “Proposal No. 1”): |

| (A) | the shares of the Company be re-designated and re-classified (the “Redesignation and Reclassification of Share Capital”) such that the currently authorised share capital of the Company shall be re-classified and re-designated from (i) US$500,000 divided into 500,000,000 shares of a nominal or par value of US$0.001 each to (ii) US$500,000 divided into 400,000,000 Class A ordinary shares of a nominal or par value of US$0.001 each, 50,000,000 Class B ordinary shares of a nominal or par value of US$0.001 each, and 50,000,000 shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, by the re-designation and re-classification of (x) 346,506,533 unissued shares of a nominal or par value of US$0.001 each into 346,506,533 unissued Class A ordinary shares of a nominal or par value of US$0.001 each, and (y) 43,928,896 unissued shares of a nominal or par value of US$0.001 each into 43,928,896 unissued Class B ordinary shares of a nominal or par value of US$0.001 each, and (z) 50,000,000 unissued shares of a nominal or par value of US$0.001 each into 50,000,000 unissued shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, and the currently issued 59,564,571 shares of a nominal or par value of US$0.001 each in the Company be and are re-designated and re-classified into 53,493,467 Class A ordinary shares of a nominal or par value of US$0.001 each with 1 vote per share (the “Class A Ordinary Shares”), 6,071,104 Class B ordinary shares of a nominal or par value of US$0.001 each with 25 votes per share (the “Class B Ordinary Shares”), and 0 share of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, on a one for one basis, as follows: |

| Name of Shareholder |

Number of existing ordinary shares held |

Number and

class of shares to be held after the re-designation and re-classification of shares of the Company |

||

| Top Elect Group Limited | 6,071,104 | 6,071,104 Class B Ordinary Shares | ||

| All other shareholders | 53,493,467 | 53,493,467 Class A Ordinary Shares | ||

| Total | 59,564,571 |

| (B) | the existing clause 8 of the existing amended and restated memorandum of association be deleted in its entirety and be replaced with the following new clause 8: |

“The share capital of the Company is US$500,000 divided into 400,000,000 Class A ordinary shares of a nominal or par value of US$0.001 each, 50,000,000 Class B ordinary shares of a nominal or par value of US$0.001 each, and 50,000,000 shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with Article 13 of the Articles of Association of the Company, with the power for the Company, insofar as is permitted by law, to redeem or purchase any of its shares and to increase or reduce the said share capital subject to the provisions of the Companies Act (As Revised) and the Articles of Association of the Company and to issue any part of its capital, whether original, redeemed or increased, with or without any preference, priority or special privilege or subject to any postponement of rights or to any conditions or restrictions; and so that, unless the conditions of issue shall otherwise expressly declare, every issue of shares, whether declared to be preference or otherwise, shall be subject to the power hereinbefore contained.”; and

|

|

| (C) | the Second Amended and Restated Memorandum of Association and Second Amended and Restated Articles of Association of the Company as set forth in Annex A to this notice (the “New Amended and Restated Memorandum and Articles of Association”) be adopted in substitution for and to the exclusion of the Amended and Restated Memorandum of Association and Amended and Restated Articles of Association of the Company currently in effect, to reflect the multi-class share structure and set out the rights and privileges of Class A Ordinary Shares and Class B Ordinary Shares. |

| 2. | To transact such other business which may properly come before the 2025 Extraordinary General Meeting or any adjournment or postponement thereof, if necessary. |

Record Date and Voting Power

Our Board fixed the close of business on October 31, 2025, as the record date for the determination of the outstanding shares of Ordinary Shares entitled to notice of, and to vote on, the matters presented at the 2025 Extraordinary General Meeting. As of the Record Date, there were 59,564,571 Ordinary Shares outstanding. Each Ordinary Share entitles the holder thereof to one vote. Accordingly, a total of 59,564,571 votes may be cast at the 2025 Extraordinary General Meeting.

Quorum and Required Vote

A quorum of Shareholders is necessary to hold a valid meeting. Two shareholders holding shares which carry in aggregate (or representing by proxy) not less than one-third in nominal value of the total issued voting shares in the Company throughout the meeting shall constitute a quorum at the 2025 Extraordinary General Meeting.

Proposal No. 1 requires the affirmative vote of a majority of not less than two-thirds of votes cast by such shareholders as, being entitled so to do, vote in person or, in the case of any shareholder being a corporation, by its duly authorized representative or by proxy at the 2025 Extraordinary General Meeting.

Revocability of Proxies

Any proxy may be revoked by the shareholder of record giving it at any time before it is voted. A proxy may be revoked by (A) sending to our investors relation team, at Roma Green Finance Limited, Flat 605, 6/F., Tai Tung Building, 8 Fleming Road, Wanchai, Hong Kong, either (i) a written notice of revocation bearing a date later than the date of such proxy or (ii) a subsequent proxy relating to the same shares, or (B) by attending the 2025 Extraordinary General Meeting and voting in person.

If the shares are held by the broker or bank as a nominee or agent, the beneficial owners should follow the instructions provided by their broker or bank.

Proxy Solicitation Costs

The cost of preparing, assembling, printing and mailing this proxy statement and the accompanying form of proxy, and the cost of soliciting proxies relating to the 2025 Extraordinary General Meeting, will be borne by the Company. If any additional solicitation of the holders of our outstanding Ordinary Shares is deemed necessary, we (through our directors and officers) anticipate making such solicitation directly. The solicitation of proxies by mail may be supplemented by telephone, telegram and personal solicitation by officers, directors and other employees of the Company, but no additional compensation will be paid to such individuals.

No Right of Appraisal

None of Cayman Islands law, our Memorandum and Articles of Association, as amended and restated, provides for appraisal or other similar rights for dissenting shareholders in connection with any of the proposals to be voted upon at the 2025 Extraordinary General Meeting. Accordingly, our Shareholders will have no right to dissent and obtain payment for their shares.

Who Can Answer Your Questions about Voting Your Shares

You can contact investors relation team of the Company at + 852 2529 6878 or by sending a letter to the offices of the Company at Flat 605, 6/F., Tai Tung Building, 8 Fleming Road, Wanchai, Hong Kong or email at claireluk@roma-international.com with any questions about proposals described in this proxy statement or how to execute your vote.

Principal Offices

The principal executive offices of our Company are located at Flat 605, 6/F., Tai Tung Building, 8 Fleming Road, Wanchai, Hong Kong. The Company’s telephone number at such address is + 852 2529 6878.

|

|

PROPOSAL

NO. 1

RE-DESIGNATION AND RE-CLASSIFICATION OF SHARES

The Board of Directors approved, and directed that there be submitted to the shareholders of the Company for approval the Proposal No. 1, being the (A) Redesignation and Reclassification of Share Capital, (B) Replacement of Clause 8 of Memorandum of Association, and (C) Adoption of the New Amended and Restated Memorandum and Articles of Association.

Under the Proposal No. 1, we are also proposing to amend and restate the Company’s current amended and restated memorandum and articles of association to reflect the multi-class share structure by adoption of the New Amended and Restated Memorandum and Articles of Association in the form attached as Annex A to this proxy statement. The New Amended and Restated Memorandum and Articles of Association set out the rights and privileges of Class A Ordinary Shares and Class B Ordinary Shares, including (without limitation) updates to the quorum threshold and voting on a show of hands or by poll for a general meeting, so that they are tied to the voting rights represented at the meeting.

Proposal No. 1 will become effective upon approval of our shareholders. Following such approval, each Class A Ordinary Share would be entitled to one vote and each Class B Ordinary Share would be entitled to 25 votes on all matters subject to vote at general meetings of the Company and with such other rights, preferences, and privileges as set forth in the Company’s New Amended and Restated Memorandum and Articles of Association.

Also, following such approval, the Company’s current amended and restated memorandum and articles of association will be amended and restated in the form of the New Amended and Restated Memorandum and Articles of Association attached as Annex A to this proxy statement effective immediately upon this proposal being passed at the 2025 Extraordinary General Meeting.

In addition, all Class B Ordinary Shares will be convertible, at the option of the holder thereof, into the number of fully paid and non-assessable Class A Ordinary Shares on a one-for-one basis.

The resolution to be proposed shall be as follows:

RESOLVED AS A SPECIAL RESOLUTION, that:

| (A) | the shares of the Company be re-designated and re-classified (the “Redesignation and Reclassification of Share Capital”) such that the currently authorised share capital of the Company shall be re-classified and re-designated from (i) US$500,000 divided into 500,000,000 shares of a nominal or par value of US$0.001 each to (ii) US$500,000 divided into 400,000,000 Class A ordinary shares of a nominal or par value of US$0.001 each, 50,000,000 Class B ordinary shares of a nominal or par value of US$0.001 each, and 50,000,000 shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, by the re-designation and re-classification of (x) 346,506,533 unissued shares of a nominal or par value of US$0.001 each into 346,506,533 unissued Class A ordinary shares of a nominal or par value of US$0.001 each, and (y) 43,928,896 unissued shares of a nominal or par value of US$0.001 each into 43,928,896 unissued Class B ordinary shares of a nominal or par value of US$0.001 each, and (z) 50,000,000 unissued shares of a nominal or par value of US$0.001 each into 50,000,000 unissued shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, and the currently issued 59,564,571 shares of a nominal or par value of US$0.001 each in the Company be and are re-designated and re-classified into 53,493,467 Class A ordinary shares of a nominal or par value of US$0.001 each with 1 vote per share (the “Class A Ordinary Shares”), 6,071,104 Class B ordinary shares of a nominal or par value of US$0.001 each with 25 votes per share (the “Class B Ordinary Shares”), and 0 share of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with the articles of association, on a one for one basis, as follows: |

| Name of Shareholder |

Number of existing ordinary shares held |

Number and

class of shares to be held after the re-designation and re-classification of shares of the Company |

||

| Top Elect Group Limited | 6,071,104 | 6,071,104 Class B Ordinary Shares | ||

| All other shareholders | 53,493,467 | 53,493,467 Class A Ordinary Shares | ||

| Total | 59,564,571 |

| (B) | the existing clause 8 of the existing amended and restated memorandum of association be deleted in its entirety and be replaced with the following new clause 8: |

“The share capital of the Company is US$500,000 divided into 400,000,000 Class A ordinary shares of a nominal or par value of US$0.001 each, 50,000,000 Class B ordinary shares of a nominal or par value of US$0.001 each, and 50,000,000 shares of a nominal or par value of US$0.001 each of such class or classes (however designated) as the Board may determine in accordance with Article 13 of the Articles of Association of the Company, with the power for the Company, insofar as is permitted by law, to redeem or purchase any of its shares and to increase or reduce the said share capital subject to the provisions of the Companies Act (As Revised) and the Articles of Association of the Company and to issue any part of its capital, whether original, redeemed or increased, with or without any preference, priority or special privilege or subject to any postponement of rights or to any conditions or restrictions; and so that, unless the conditions of issue shall otherwise expressly declare, every issue of shares, whether declared to be preference or otherwise, shall be subject to the power hereinbefore contained.”; and

| (C) | the Second Amended and Restated Memorandum of Association and Second Amended and Restated Articles of Association of the Company as set forth in Annex A to this notice (the “New Amended and Restated Memorandum and Articles of Association”) be adopted in substitution for and to the exclusion of the Amended and Restated Memorandum of Association and Amended and Restated Articles of Association of the Company currently in effect, to reflect the multi-class share structure and set out the rights and privileges of Class A Ordinary Shares and Class B Ordinary Shares. |

|

|

Proposal No. 1 will be approved if the affirmative vote of a majority of not less than two-thirds of the votes of the ordinary shares entitled to vote thereon which are present in person or by duly authorized representative or by proxy at the 2025 Extraordinary General Meeting by the holders of ordinary shares of the Company entitled to vote at the 2025 Extraordinary General Meeting vote “FOR” the proposal. Abstentions and broker non-votes will have no effect on the result of the vote.

The Proposal No. 1 will become effective upon approval of our shareholders.

The Proposal No. 1 will not affect in any way the validity or transferability of share certificates outstanding, the capital structure of the Company or the trading of the Company’s shares on the Nasdaq Capital Market. If the amendment is passed by our shareholders, it will not be necessary for shareholders to surrender their existing share certificates. Instead, when certificates are presented for transfer, new certificates representing Class A Ordinary Shares or Class B Ordinary Shares, as the case may be, will be issued.

Future issuances of Class B Ordinary Shares or securities convertible into Class B Ordinary Shares could have a dilutive effect on our earnings per share, book value per share, and the voting power and interest of current holders of ordinary shares. In addition, the availability of additional unissued shares for issuance could, under certain circumstances, discourage or make more difficult any efforts to obtain control of the Company. The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, nor is this proposal being presented with the intent that it be used to prevent or discourage any acquisition attempt. However, nothing would prevent the Board of Directors from taking any such actions that it deems to be consistent with its fiduciary duties.

Vote Required

Proposal No. 1 requires the affirmative (“FOR”) vote of a majority of not less than two-thirds (2/3rds) of the votes of such shareholders as, being entitled to do so, vote in person or by proxy at the 2025 Extraordinary General Meeting (and where a poll is taken regard shall be had in computing a majority to the number of votes to which each shareholder is entitled). Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” this proposal. Abstentions or broker non-votes, if any, will not be counted as votes cast and will not affect the outcome of this proposal, although they will be counted for purposes of determining whether there is a quorum present.

|

|

OTHER MATTERS

Our Board knows of no other matter to be presented at the 2025 Extraordinary General Meeting. If any additional matter should properly come before the 2025 Extraordinary General Meeting, it is the intention of the persons named in the enclosed proxy to vote such proxy in accordance with their judgment on any such matters.

OTHER INFORMATION

Proxy Solicitation

The solicitation of proxies is made on behalf of the Board and we will bear the cost of soliciting proxies. Proxies may be solicited through the mail and through telephonic or telegraphic communications to, or by meetings with, shareholders or their representatives by our directors, officers and other employees who will receive no additional compensation therefor. We may also retain a proxy solicitation firm to assist us in obtaining proxies by mail, facsimile or email from record and beneficial holders of shares for the 2025 Extraordinary General Meeting. If we retain a proxy solicitation firm, we expect to pay such firm reasonable and customary compensation for its services, including out-of-pocket expenses.

We request persons such as brokers, nominees and fiduciaries holding ordinary shares in their names for others, or holding ordinary shares for others who have the right to give voting instructions, to forward proxy material to their principals and to request authority for the execution of the proxy. We will reimburse such persons for their reasonable expenses.

material.

Delivery of Proxy Materials to Households

Only one copy of this proxy statement are being delivered to multiple registered shareholders who share an address unless we have received contrary instructions from one or more of the shareholders. A separate form of proxy and a separate notice of the 2025 Extraordinary General Meeting are being included for each account at the shared address. Registered shareholders who share an address and would like to receive a separate copy of this proxy statement, or have questions regarding the householding process, may contact the investors relation team of the Company, or by forwarding a written request addressed to claireluk@roma-international.com via email or Flat 605, 6/F., Tai Tung Building, 8 Fleming Road, Wanchai, Hong Kong via mail. Promptly upon request, a separate copy of this proxy Statement will be sent. By contacting investors relation team of the Company at claireluk@roma-international.com, registered shareholders sharing an address can also (i) notify the Company that the registered shareholders wish to receive separate proxy statements and/or Notices of Internet Availability of Proxy Materials, as applicable, in the future or (ii) request delivery of a single copy of proxy statements in the future if registered shareholders at the shared address are receiving multiple copies.

Many brokers, brokerage firms, broker/dealers, banks and other holders of record have also instituted “householding” (delivery of one copy of materials to multiple shareholders who share an address). If your family has one or more “street name” accounts under which you beneficially own shares of our ordinary shares, you may have received householding information from your broker, brokerage firm, broker/dealer, bank or other nominee in the past. Please contact the holder of record directly if you have questions, require additional copies of this proxy statement or wish to revoke your decision to household and thereby receive multiple copies. You should also contact the holder of record if you wish to institute householding.

Where You Can Find Additional Information

The Company is subject to the informational requirements of the Exchange Act and in accordance therewith files reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information are available on the SEC’s website at www.sec.gov. shareholders who have questions in regard to any aspect of the matters discussed in this proxy statement should contact the investors relation team of the Company, at Flat 605, 6/F., Tai Tung Building, 8 Fleming Road, Wanchai, Hong Kong, or by telephone at + 852 2529 6878.

|

|

Exhibit 99.2