UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of, November 2025

Commission File Number 001-38172

FREIGHT TECHNOLOGIES, INC.

(Translation of registrant’s name into English)

Mr. Javier Selgas, Chief Executive Officer

2001 Timberloch Place, Suite 500

The Woodlands, TX 77380

Telephone: (773) 905-5076

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | Notice of 2025 Annual Meeting of Members and Proxy Statement | |

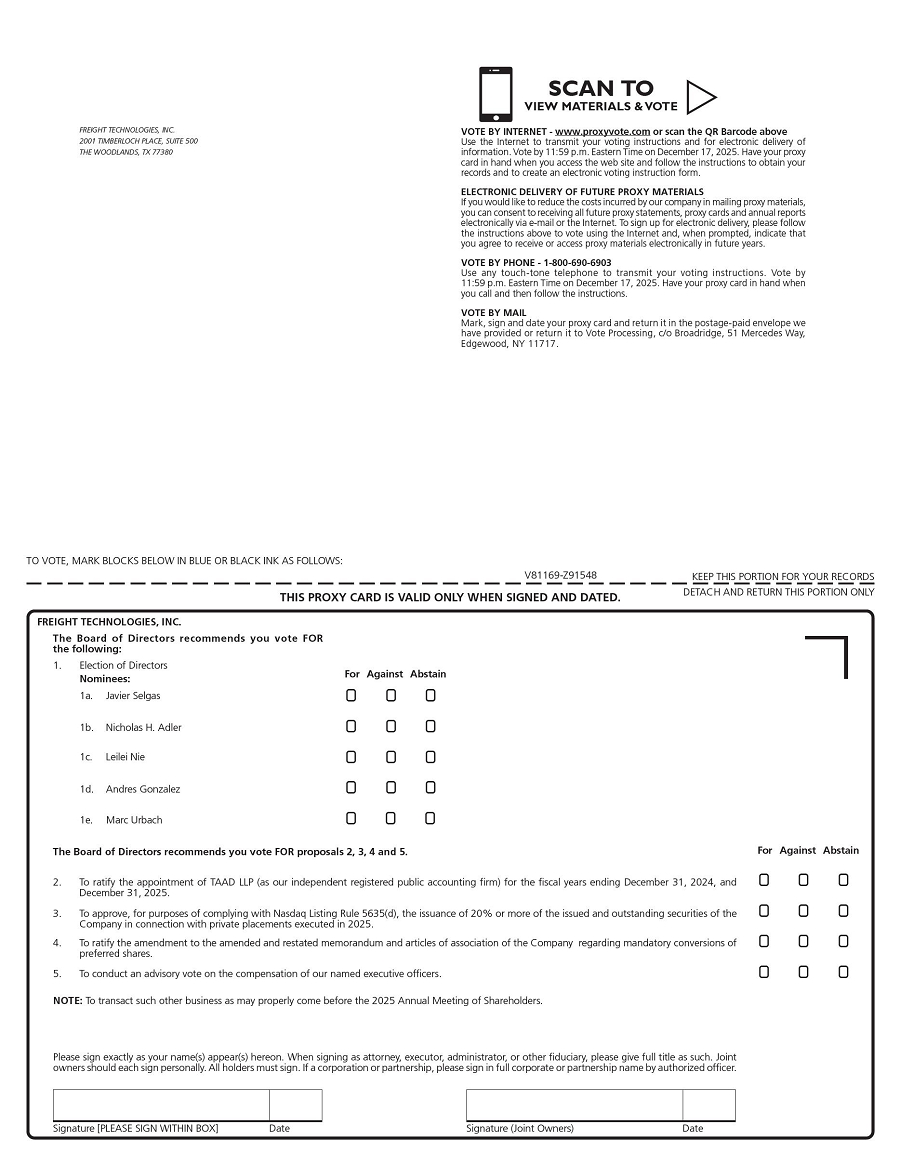

| 99.2 | Form of Proxy Card for 2025 Annual Meeting of Members |

SIGNATURES

| Date: November 12 , 2025 | FREIGHT TECHNOLOGIES, INC. | |

| By: | /s/ Javier Selgas | |

| Name: | Javier Selgas | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

FREIGHT TECHNOLOGIES, INC.

2001 Timberloch Place, Suite 500

The Woodlands, TX 77380

November 10, 2025

Dear Shareholder:

You are cordially invited to attend our 2025 Annual Meeting of Shareholders of Freight Technologies, Inc. (“Freight Technologies”, the “Company”, “we”, “us”, or “our”), which will be held on December 18, 2025, at 1:00 p.m. Monterrey, Mexico time at our office at Emilio Zola Num. 743 Piso 4, Int. 1, Col. Obispado, Monterrey Nuevo Leon, Mexico CP 64060 (the “2025 Annual Meeting”).

If you owned our ordinary shares at the close of business on November 4, 2025, you are entitled to vote on the matters which are listed in the Notice of 2025 Annual Meeting of Shareholders.

The Board of Directors of the Company (the “Board”) recommends a vote “FOR” each of the proposals listed as Items 1, 2, 3, 4 and 5 in the Notice.

You may vote via the Internet, by telephone or by completing and mailing the proxy card you received in the mail. If you attend the 2025 Annual Meeting, you may vote your shares in person, even if you have previously voted your proxy. Your vote is important, regardless of the number of ordinary shares you own or whether or not you plan to attend the 2025 Annual Meeting. Accordingly, whether or not you plan to attend the 2025 Annual Meeting, after reading the enclosed Notice and accompanying proxy statement, please sign, date and mail the enclosed proxy card in the envelope provided or vote by telephone or over the Internet in accordance with the instructions on your proxy card or your voting instructions form to ensure that your shares will be represented and voted at the 2025 Annual Meeting.

We are proud that you have chosen to invest in Freight Technologies. On behalf of our management and directors, thank you for your continued support and confidence. We look forward to seeing you at the 2025 Annual Meeting.

| Sincerely, | |

| /s/ Javier Selgas | |

| Javier Selgas | |

| Chief Executive Officer |

|

|

IT IS IMPORTANT THAT YOU VOTE, SIGN AND RETURN

THE ACCOMPANYING PROXY CARD AS SOON AS POSSIBLE

FREIGHT TECHNOLOGIES, INC.

2001 Timberloch Place, Suite 500

The Woodlands, TX 77380

Notice of 2025 Annual Meeting of Shareholders

To Be Held on December 18, 2025

| TIME AND DATE | 1:00 P.M. LOCAL TIME, December 18, 2025 |

| PLACE | Emilio Zola Num. 743 Piso 4, Int. 1 , Col. Obispado , Monterrey N.L. CP 64060 |

ITEMS OF BUSINESS

|

|

| Item |

Board Vote Recommendation |

|||

| 1. | To elect each of the five directors named in the proxy statement to hold office until the next annual meeting of shareholders and until his/her respective successor is elected and duly qualified. | “FOR” | ||

| 2. | To ratify the appointment of TAAD LLP (“TAAD”) as our independent registered public accounting firm for the fiscal years ending December 31, 2024 and December 31, 2025. | “FOR” | ||

| 3. | To approve, for purposes of complying with Nasdaq Listing Rule 5635(d) (as defined below), the issuance of 20% or more of the issued and outstanding securities of the Company (the “20% Securities Issuance”) in connection with the private placements (the “Private Placements”) pursuant to: |

“FOR” |

| a. | The securities purchase agreement dated as of January 31, 2025, by and among the Company and certain accredited investors (the “January 2025 SPA”) in connection with the issuance of 1,540,832 Series A4 preferred shares of the Company, par value $0.0001 per share (the “Series A4 Preferred Shares”), for aggregate gross proceeds of $3,000,000; | |||

| b. | The securities purchase agreement dated as of March 31, 2025, between the Company and an accredited investor, as amended on June 26, 2025, (the “March 2025 SPA”) in connection with the issuance of 2,311,248 Series A4 Preferred Shares, for a total purchase price of approximately $5,200,000, payable in 11,300,000 FET Tokens (as defined in the March 2025 SPA); | |||

| c. | The securities purchase agreement dated as of April 29, 2025, by and among the Company and certain accredited investors (the “April 2025 SPA”) in connection with the sale of senior convertible notes (the “Notes”) and warrants to purchase the Notes for a total purchase price of approximately $20,000,000; | |||

| d. | In connection with the April 2025 SPA, the Company entered into an amendment and exchange agreement (the “Amendment and Exchange Agreement”) with one of the holders of the Notes (the “Holder”) on May 27, 2025, pursuant to which the Company agreed to exchange certain Notes previously issued to the Holder for Series A4 Preferred Shares; | |||

| e. | The securities purchase agreement dated as of August 6, 2025, between the Company and an accredited investor (the “August 2025 SPA”) in connection with the issuance of (i) 12,540,000 series B preferred shares of the Company, par value $0.0001 per share (the “Series B Preferred Shares”), and (ii) 126,005 Series A4 Preferred Shares, for aggregate gross proceeds of $500,000; and | |||

| f. | The equity purchase facility agreement (the “ELOC Agreement”), dated as of October 28, 2025, between the Company and an accredited investor (the “ELOC Investor”), pursuant to which the Company has the right, from time to time as provided herein, to issue and sell to the ELOC Investor, and the ELOC Investor is obligated to purchase from the Company, up to an aggregate of $1.0 billion in newly issued ordinary shares of the Company, with no par value per share ( the “Ordinary Shares”). |

| 4. | To ratify the proposed amendment to the amended and restated memorandum and articles of association of the Company (the “M&A”) regarding mandatory conversions of preferred shares. |

“FOR” | ||

| 5. | To conduct an advisory vote on the compensation of our named executive officers. |

“FOR” | ||

| 6. | To transact such other business as may properly come before the 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”). | “N/A” |

The accompanying proxy statement describes these items in more detail. As of the date of this Notice of 2025 Annual Meeting of Shareholders (the “Notice”), we have not received notice of any other matters that may be properly presented at the 2025 Annual Meeting.

| RECORD DATE | The record date for the determination of the shareholders entitled to vote at the 2025 Annual Meeting, or any adjournments or postponements thereof, was the close of business on November 4, 2025 (the “Record Date”). | |

| INSPECTION OF LIST OF SHAREHOLDERS OF RECORD | A list of the shareholders of record as of the Record Date will be available for inspection at the 2025 Annual Meeting. | |

| VOTING | We strongly encourage you to vote. Please vote as soon as possible, even if you plan to attend the 2025 Annual Meeting in person. You can submit your vote prior to the date of the Annual Meeting by: Internet, telephone, or mail in accordance with instructions on your proxy card or your voting instructions form. PLEASE MARK, SIGN, DATE AND RETURN YOUR PROXY CARD. |

|

|

A proxy statement describing the matters to be voted upon at the 2025 Annual Meeting along with a proxy card enabling the shareholders to indicate their vote will be mailed on or about November 10, 2025, to all shareholders entitled to vote at the 2025 Annual Meeting. Such proxy statement will also be furnished to the U.S. Securities and Exchange Commission, or the SEC, under cover of the Report of Foreign Private Issuer on Form 6-K and will be available on our website at https://fr8technologies.com/ on or about November 10, 2025. If you plan to attend the 2025 Annual Meeting and your shares are not registered in your own name, please ask your broker, bank or other nominee that holds your shares to provide you with evidence of your share ownership. Such proof of share ownership will be required to gain admission to the 2025 Annual Meeting.

Whether or not you plan to attend the 2025 Annual Meeting, it is important that your shares be represented and voted at the 2025 Annual Meeting. Accordingly, after reading the Notice and accompanying proxy statement, please sign, date and mail the enclosed proxy card in the envelope provided or vote by telephone or over the Internet in accordance with the instructions on your proxy card. The proxy card must be received by Broadridge Financial Solutions, Inc. at 51 Mercedes Way, Edgewood NY, 11717 or at our office located at 2001 Timberloch Place, Suite 500, The Woodlands, TX 77380 not later than 11:59 p.m. local time on December 17, 2025 to be validly included in the tally of shares voted at the 2025 Annual Meeting. Detailed proxy voting instructions are provided both in the proxy statement and on the proxy card.

| By Order of the Board of Directors | |

| /s/ Javier Selgas | |

| Javier Selgas | |

| Chief Executive Officer |

|

|

TABLE OF CONTENTS

| PAGE | ||

| GENERAL INFORMATION | 6 | |

| QUESTIONS AND ANSWERS ABOUT THE 2025 ANNUAL MEETING, THE PROXY MATERIALS AND VOTING YOUR SHARES | 7 | |

| PROPOSAL 1: ELECTION OF DIRECTORS | 11 | |

| PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 20 | |

| PROPOSAL 3: APPROVAL OF, FOR PURPOSES OF COMPLYING WITH NASDAQ LISTING RULE 5635(D), 20% SECURITIES ISSUANCE PURSUANT TO THE PRIVATE PLACEMENTS | 22 | |

| PROPOSAL 4: RATIFICATION OF THE PROPOSED AMENDMENT TO THE M&A REGARDING MANDATORY CONVERSIONS OF PREFERRED SHARES | 25 | |

| PROPOSAL 5: ADVISORY VOTE ON EXECUTIVE COMPENSATION | 27 | |

| DOCUMENTS ON DISPLAY | 28 | |

| OTHER MATTERS | 28 |

|

|

PROXY STATEMENT

FREIGHT TECHNOLOGIES, INC. 2025 ANNUAL MEETING OF SHAREHOLDERS

The Board of Directors (the “Board”) of Freight Technologies, Inc., a British Virgin Islands company (“Freight Technologies”, the “Company”, “we”, “us”, or “our”), is soliciting proxies to be used at the annual meeting of shareholders (the “2025 Annual Meeting”) of the Company to be held at our office at Emilio Zola Num. 743 Piso 4, Int. 1, Col. Obispado , Monterrey N.L. CP 64060, Mexico on December 18, 2025, at 1 p.m. local time and any postponement or adjournment thereof.

This proxy statement (the “Proxy Statement”) and the accompanying notice and form of proxy are first being distributed to shareholders on or about November 10, 2025. The Board is requesting that you permit your Ordinary Shares to be represented at the 2025 Annual Meeting by the persons named as proxies for the 2025 Annual Meeting.

The proxy solicitation materials, including the Notice of the 2025 Annual Meeting (the “Notice”), this Proxy Statement, our annual report on Form 10-K for the fiscal year ended December 31, 2024, which includes our audited consolidated financial statements for the fiscal year ended December 31, 2024 (together with the Amendment No. 1 on Form 10-K, the “2024 Annual Report”), and the proxy card (collectively, the “Proxy Materials”), are being furnished to the holders of our Ordinary Shares, in connection with the solicitation of proxies by the Board for use in voting at the 2025 Annual Meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the 2025 Annual Meeting. Please read it carefully.

Historically, the Company has received deficiency notices from the Nasdaq Listing Qualifications Staff (the “Staff”) notifying the Company that it was not in compliance with Nasdaq Listing Rule 5550(a)(2) requiring a minimum bid price of $1.00 over the previous 30 consecutive business days (the “Minimum Bid Price Requirement”). For instance, on May 22, 2024, the Staff notified the Company that it had failed to maintain the Minimum Bid Price Requirement. On September 25, 2024, the Company effected a one-for-twenty-five (1-for-25) reverse share split (the “September 2024 Reverse Split”) of the authorized and issued and outstanding Ordinary Shares. On October 8, 2024, the Staff notified the Company that, since the closing bid price of the Ordinary Shares had been at $1.00 per share or greater, the Company had regained compliance with Nasdaq Listing Rule 5550(a)(2), and this matter was closed. On May 27, 2025, the Company effected a one-for-four (1-for-4) reverse share split (the “May 2025 Reverse Split”) of the authorized and issued and outstanding Ordinary Shares.

Though the Company has not received any notices from the Staff since the Staff’s notice on October 8, 2024, the Company may need to effect another reverse share split to maintain the Minimum Bid Price Requirement on or about December 16, 2025, subject to the Board’s discretion and the Staff’s approval pursuant to applicable Nasdaq Listing Rules (the “Presumptive Reverse Split”). Further to note, the Company is able to effect a reverse split under section 40(A)(1) of the BVI Business Companies Act, which allows for, “subject to its memorandum and articles, a company may — (a) divide its shares, including issued shares, into a larger number of shares; or (b) combine its shares, including issued shares, into a smaller number of shares”. Pursuant to the Company’s current amended and restated memorandum and articles of association clause 5.2, “the Company may issue fractional Shares and a fractional Share shall have the corresponding fractional rights, obligations and liabilities of a whole Share of the same class or series of Shares”.

|

|

The implementation of the Presumptive Reverse Split will result in a reduction in the number of issued and outstanding Ordinary Shares. In addition, the exercise price and the number of Ordinary Shares issuable pursuant to outstanding convertible securities, such as options and warrants, will be adjusted pursuant to the terms of such instruments in connection with the Presumptive Reverse Split. If the Presumptive Reverse Split is approved by the Board and the Staff, the Company will issue a press release announcing the effective date of the Presumptive Reverse Split. A Presumptive Reverse Split will not impact the on voting rights or vote count of holders of Ordinary Shares (the “Ordinary Shareholders”) as of the date of record, November 4, 2025, for the Company’s 2025 Annual Meeting, and therefore it will not impact the outcome of the proposals as put forth in this proxy. A Presumptive Reverse Split will be effected simultaneously for all of the Ordinary Shares, and the exchange ratio will be the same for all Ordinary Shares. The Presumptive Reverse Split will affect all of the Company’s shareholders uniformly and will not affect any shareholder’s percentage ownership interest in the Company, relative voting rights, or other rights. Ordinary Shares issued pursuant to the Presumptive Reverse Split will remain fully paid and non-assessable. No fractional shares will be issued as a result of the Presumptive Reverse Split. Instead, all fractional shares will be rounded up to the nearest whole Ordinary Share. Upon the implementation of the Presumptive Reverse Split, the Company intends to treat shares held by shareholders through a bank, broker, custodian, or other nominee in the same manner as shares held by registered shareholders whose shares are registered in their names. Banks, brokers, custodians, or other nominees will be instructed to effect the Presumptive Reverse Split for their beneficial holders holding Ordinary Shares in street name. However, these banks, brokers, custodians, or other nominees may have different procedures than registered shareholders for processing the Presumptive Reverse Split. Shareholders who hold Ordinary Shares with a bank, broker, custodian, or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians, or other nominees.

Unless otherwise noted, the share and per-share information in this Proxy Statement has been adjusted to give effect to the September 2024 Reverse Split and the May 2025 Reverse Split, but not the Presumptive Reverse Split.

QUESTIONS

AND ANSWERS ABOUT

THE 2025 ANNUAL MEETING, THE PROXY MATERIALS AND VOTING YOUR SHARES

WHY AM I RECEIVING THESE MATERIALS?

Our Board has delivered the Proxy Materials to you in connection with the solicitation of proxies for use at the 2025 Annual Meeting. As a shareholder, you are invited to attend the 2025 Annual Meeting and are requested to vote on the items of business described in this Proxy Statement.

WHAT IS A PROXY?

Our Board is soliciting your vote at the 2025 Annual Meeting. You may vote by proxy as explained in this Proxy Statement. A proxy is your formal legal designation of another person to vote the Ordinary Shares you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card.

Mr. Javier Selgas has been designated as the Company’s proxy for the 2025 Annual Meeting.

WHAT PROPOSALS WILL BE VOTED ON AT THE 2025 ANNUAL MEETING?

There are four proposals that will be voted on at the 2025 Annual Meeting:

| 1. | To elect each of the five directors named in this Proxy Statement to hold office until the next annual meeting of shareholders and until his/her respective successor is elected and duly qualified; and | |

| 2. | To ratify the appointment of TAAD as our independent registered public accounting firm for the fiscal years ending December 31, 2024 and December 31, 2025. | |

| 3. | To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the 20% Securities Issuance pursuant to the Private Placements. | |

| 4. | To ratify the proposed amendment to the M&A regarding mandatory conversions of preferred shares. | |

| 5. | To conduct an advisory vote on the Company’s named executive officers’ compensation. |

|

|

HOW DOES THE BOARD RECOMMEND I VOTE?

Our Board unanimously recommends that you vote:

| ● | “FOR” the election of each director named in this Proxy Statement (Proposal No. 1); | |

| ● | “FOR” the ratification of the appointment of TAAD as our independent registered public accounting firm for the fiscal years ending December 31, 2024 and December 31, 2025 (Proposal No. 2); | |

| ● | “FOR” the approval of, for purposes of complying with Nasdaq Listing Rule 5635(d), the 20% Securities Issuance pursuant to the Private Placements (Proposal No. 3); | |

| ● | “FOR” the ratification of the proposed amendment to the M&A regarding mandatory conversions of preferred shares (Proposal No. 4); and | |

| ● | “FOR” the ratification of Company’s named executive officers’ compensation (Proposal No. 5). |

WHAT HAPPENS IF ADDITIONAL MATTERS ARE PRESENTED AT THE 2025 ANNUAL MEETING?

If any other matters are properly presented for consideration at the 2025 Annual Meeting, including, among other things, consideration of a motion to adjourn or postpone the 2025 Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxy holders will have discretion to vote on those matters in accordance with their best judgment, unless you direct them otherwise in your proxy instructions. We do not currently anticipate that any other matters will be raised at the 2025 Annual Meeting.

WHO CAN VOTE AT THE 2025 Annual Meeting?

Shareholders of record at the close of business on November 4, 2025, the date established by the Board for determining the shareholders entitled to vote at the 2025 Annual Meeting, are entitled to vote at the 2025 Annual Meeting.

On the Record Date 5,897,975 Ordinary Shares were outstanding and entitled to vote at the 2025 Annual Meeting. Holders of Ordinary Shares are entitled to one vote for each share owned for each matter to be voted on at the 2025 Annual Meeting. Holders of Ordinary Shares will vote together as a single class on all proposals to be voted on at the 2025 Annual Meeting.

A list of the shareholders of record as of November 4, 2025 will be available for inspection at the 2025 Annual Meeting.

WHAT CONSTITUTES A QUORUM?

Not less than one-third of the votes of our outstanding Ordinary Shares as of the Record Date must be present, in person or by proxy, at the 2025 Annual Meeting in order to properly convene the 2025 Annual Meeting. This is called a quorum. If there are not enough votes of the Ordinary Shares present both in person and by timely and properly submitted proxies to constitute a quorum, the 2025 Annual Meeting may be adjourned by the Chairman of the meeting until such time as a sufficient number of votes are present. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum.

WHAT IS THE DIFFERENCE BETWEEN BEING A “SHAREHOLDER OF RECORD” AND A “BENEFICIAL OWNER” HOLDING SHARES IN STREET NAME?

Shareholder of Record: You are a “shareholder of record” if your shares are registered directly in your name with our transfer agent, TranShare Securities Transfer and Registrar. The Proxy Materials are sent directly to a shareholder of record.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name” and your bank or other nominee is considered the shareholder of record. Your bank or other nominee forwarded the Proxy Materials to you. As the beneficial owner, you have the right to direct your bank or other nominees how to vote your shares by completing a voting instruction form. Because a beneficial owner is not the shareholder of record, you are invited to attend the 2025 Annual Meeting, but you may not vote these shares in person at the 2025 Annual Meeting unless you obtain a “legal proxy” from the bank or other nominee that holds your shares, giving you the right to vote the shares at the 2025 Annual Meeting.

|

|

HOW DO I VOTE?

Shareholders of record can vote their shares in person, by attending the 2025 Annual Meeting, by telephone or over the Internet in accordance with the instructions on your proxy card, or by mail, by completing, signing and mailing your proxy card. The proxy card must be received by Broadridge Financial Solutions, Inc. at 51 Mercedes Way, Edgewood NY, 11717 or at our office located at 2001 Timberloch Place, Suite 500, The Woodlands, TX 77380 not later than 11:59 p.m. local time on December 17, 2025, 2025, to be validly included in the tally of shares voted at the 2025 Annual Meeting.

If you are a beneficial owner whose Ordinary Shares are held in “street name” (i.e. through a bank, broker or other nominee), you will receive voting instructions from the institution holding your shares. The methods of voting will depend upon the institution’s voting processes, including voting via the telephone or the Internet. Please contact the institution holding your Ordinary Shares for more information.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD?

It means that your Ordinary Shares are registered differently or you have multiple accounts. Please vote all of these shares separately to ensure all of the shares you hold are voted.

WHAT IF I DO NOT SPECIFY HOW MY SHARES ARE TO BE VOTED?

Shareholders of Record: If you are a shareholder of record and you properly submit your proxy but do not give voting instructions, the persons named as proxies will vote your shares as follows: “FOR” the election of the five director nominees named in this Proxy Statement (Proposal No. 1), “FOR” the ratification of the appointment of TAAD as our independent registered public accounting firm for the fiscal years ending December 31, 2024 and December 31, 2025 (Proposal No. 2), “FOR” the approval, for purposes of complying with Nasdaq Listing Rule 5635(d), the 20% Securities Issuance pursuant to the Private Placements (Proposal No. 3), “FOR” the ratification of the proposed amendment to the M&A regarding mandatory conversions of preferred shares (Proposal No. 4), and “FOR” the ratification of compensation of the Company’s named executive officers (Proposal No. 5). If you do not return a proxy, your shares will not be counted for purposes of determining whether a quorum exists and your shares will not be voted at the 2025 Annual Meeting.

Beneficial Owners: If you are a beneficial owner whose Ordinary Shares are held in street name and you do not give voting instructions to your bank, broker or other nominee, your bank, broker or other nominee may exercise discretionary authority to vote on matters that The Nasdaq Stock Market LLC (“Nasdaq”) determines to be “routine.” Your bank, broker or other nominee is not allowed to vote your shares on “non-routine” matters and this will result in a “broker non-vote” on that non-routine matter, but the shares will be counted for purposes of determining whether a quorum exists. The items on the 2025 Annual Meeting agenda that may be considered non-routine are Proposal No. 2 relating to the ratification of appointment of the independent registered public accounting firm for the fiscal years ending December 31, 2024 and December 31, 2025; Proposal No. 3 relating to the approval, for purposes of complying with Nasdaq Listing Rule 5635(d), the 20% Securities Issuance pursuant to the Private Placements; and Proposal No. 4 relating to the ratification of the proposed amendment to the M&A regarding mandatory conversions of preferred shares; however, we cannot be certain whether this will be treated as a routine matter since our Proxy Statement is prepared in compliance with the laws of British Virgin Islands rather than the rules applicable to domestic U.S. reporting companies. We strongly encourage you to submit your voting instructions and exercise your right to vote as a shareholder.

|

|

CAN I CHANGE MY VOTE OR REVOKE MY PROXY?

If you are a shareholder of record, you may revoke your proxy at any time prior to the vote at the 2025 Annual Meeting. If you submitted your proxy by mail, you must file with the Chief Financial Officer of the Company a written notice of revocation or delivery, prior to the vote at the 2025 Annual Meeting, a valid, later-dated proxy. Attendance at the 2025 Annual Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Chief Financial Officer before the proxy is exercised or you vote by written ballot at the 2025 Annual Meeting. If you are a beneficial owner whose Ordinary Shares are held through a bank, broker or other nominee, you may change your vote by submitting new voting instructions to your bank, broker or other nominee, or, if you have obtained a legal proxy from your bank, broker or other nominee giving you the right to vote your shares, by attending the 2025 Annual Meeting and voting in person.

HOW WILL THE PROXIES BE SOLICITED AND WHO WILL BEAR THE COSTS?

We will pay the cost of soliciting proxies for the 2025 Annual Meeting. Proxies may be solicited by our directors, executive officers and employees, without additional compensation, in person, or by mail, courier, telephone, email or facsimile. We may also make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of shares held of record by such persons. We may reimburse such brokerage houses and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

WHO WILL COUNT THE VOTES AND HOW CAN I FIND THE VOTING RESULTS OF THE 2025 ANNUAL MEETING?

Our inspector of election will tabulate and certify the votes. We plan to announce preliminary voting results at the 2025 Annual Meeting, and we will report the final results in a Report of Foreign Private Issuer on Form 6-K, which we will file with the SEC shortly after the 2025 Annual Meeting.

WHAT VOTE IS REQUIRED TO APPROVE EACH ITEM?

The affirmative vote of a majority of the votes of the shares entitled to vote on the proposal that were present and voted at the 2025 Annual Meeting is required to elect each director (Proposal No. 1), to ratify the appointment of the Audit Committee of the Board (the “Audit Committee”) of TAAD as the Company’s independent registered public accounting firm for the years ending December 31, 2024 and December 31, 2025 (Proposal No. 2), to approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the 20% Securities Issuance pursuant to the Private Placements (Proposal No. 3). The ratification of the proposed amendment to the M&A regarding the mandatory conversions of preferred shares (Proposal No. 4) and the advisory vote on executive compensation (Proposal No. 5) are not binding on the Board. However, the Board will take into account the result of the vote when determining future amendment to the M&A, executive compensation arrangements and the frequency of having advisory votes on such compensation arrangements.

WHAT ARE ABSTENTIONS AND BROKER NON-VOTES AND HOW WILL THEY BE TREATED?

An “abstention” occurs when a shareholder chooses to abstain or refrain from voting their shares on one or more matters presented for a vote. For the purpose of determining the presence of a quorum, abstentions are counted as present.

Abstentions will have no effect on the outcome of either proposal.

A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner attends the 2025 Annual Meeting in person or by proxy but does not vote on a particular proposal because that holder does not have discretionary authority to vote on that particular item and has not received instructions from the beneficial owner.

Broker non-votes will have no effect on the outcome of either proposal.

|

|

WHAT DO I NEED TO DO TO ATTEND THE 2025 ANNUAL MEETING?

If you plan to attend the 2025 Annual Meeting in person, you will need to bring proof of your ownership of Ordinary Shares, such as your proxy card or transfer agent statement, as of the close of business on November 4, 2025 and present an acceptable form of photo identification such as a passport or driver’s license. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

If you are a beneficial owner holding shares in “street name” through a bank, broker or other nominee and you would like to attend the 2025 Annual Meeting, you will need to bring an account statement or other acceptable evidence of ownership of Ordinary Shares as of the close of business on November 4, 2025. In order to vote at the meeting, you must contact your bank, broker or other nominee in whose name your shares are registered and obtain a legal proxy from your bank, broker or other nominee and bring it to the 2025 Annual Meeting.

WHAT ARE THE FISCAL YEAR END DATES?

Each of our fiscal years ends on December 31.

WHERE CAN I GET A COPY OF THE PROXY MATERIALS?

Copies of the 2024 Annual Report, including consolidated financial statements as of and for the year ended December 31, 2024, the proxy card, the Notice and this Proxy Statement are available on our Company’s website at https://fr8technologies.com/. The contents of that website are not a part of this Proxy Statement.

Additional copies of the 2024 Annual Report are available at no charge upon written request. To obtain additional copies of the 2024 Annual Report, please contact us at Freight Technologies, Inc., 2001 Timberloch Place, Suite 500, Attention: Chief Financial Officer. The request must include a representation by the shareholder that as of our record date, November 4, 2025, such shareholder was entitled to vote at the 2025 Annual Meeting.

ELECTION OF DIRECTORS

Our Memorandum and Articles of Association provide that the Board will at least have one director, and it does not specify the maximum number of directors. The exact number of members of the Board will be determined from time to time by resolution of a majority of our entire Board or by resolution of a majority of the votes of the holders of our Ordinary Shares. The Board currently consists of five members. The Board has determined that Nicholas H. Adler, Andres Gonzalez, Marc Urbach and Leilei Nie are independent under applicable SEC and Nasdaq Corporate Governance rules. During the year ended December 31, 2024, each of our directors attended 100% of all Board meetings and 100% of the meetings of each committee of the Board on which he or she serves.

Our Board has nominated the individuals identified below for election as directors at the 2025 Annual Meeting, each of whom is a current director of the Company. Each of these directors will hold office until the annual meeting of shareholders in 2026, and until his respective successor has been elected and duly qualified. The director nominees set forth below have consented to being named in this Proxy Statement as nominees for election as directors and have agreed to serve as directors if elected.

We are soliciting proxies in favor of the election of the nominees identified below. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the director nominees named below. If any nominee becomes unable to serve or for good cause will not serve as a director, an event that the Company does not currently anticipate, it is intended that proxies will be voted for any substitute nominee designated by the Board to fill the vacancy or the Board may elect to reduce its size. As of the date of this Proxy Statement, the Board has no reason to believe that the persons named below will be unable or unwilling to serve as directors, if elected.

Biographical information concerning the nominees appears below. Ages are set forth as of November 10, 2025.

|

|

| Name | Age | Position | ||

| Javier Selgas | 41 | Chief Executive Officer and Director | ||

| Nicholas H. Adler | 50 | Independent Director and Chairman (1)(2)(3) | ||

| Leilei Nie | 43 | Independent Director (1)(3) | ||

| Andres Gonzalez | 44 | Independent Director (2)(3) | ||

| Marc Urbach | 52 | Independent Director (1)(2) |

| (1) | Member of the Audit Committee of the Board (the “Audit Committee”).. |

| (2) | Member of the Compensation Committee of the Board (the “Compensation Committee”). |

| (3) | Member of the Nominating Committee of the Board (the “Nominating Committee”). |

Director Nominees (All current Directors to be Re-elected in 2026)

Javier Selgas, Chief Executive Officer and director, was Fr8App’s Chief Technology Officer from March to September 2020, and was responsible for all of Fr8App’s technologies and products. From May 2017 to March 2020, Javier was the Country Manager in Osigu, a technology company in the healthcare space, leading its new operation in Spain. From February 2013 to May 2017, Javier also headed AJEGroup’s IT division in Asia Pacific region playing a key role in the continued development of strategic IT growth and supplier relationships, ensuring flexibility in response to an increasingly demanding corporation. Prior to joining AJEGroup, Javier dedicated his professional career as an IT consultant in big corporations such as Endesa and Ibermatica. Javier earned a Master’s Degree from Barcelona University, and a Bachelor of Science degree in Software Engineering from European University.

Nicholas H. Adler, our current Chairman of the Board, is a practicing attorney in Nashville, Tennessee specializing in defense litigation, bankruptcy, foreclosure, and real estate matters. He has been a partner at Brock & Scott PLLC since 2012. Nick is admitted to practice law in New York and Tennessee as well as all Federal districts within Tennessee. After his graduation from law school, Nick practiced with a large international firm in New York specializing in securities regulation. Since 2005, his practice has focused on the representation of national and regional credit grantors in Tennessee. He is also active in real estate development and asset management in Nashville. Nick earned his B.A. in political science from Vanderbilt University and his J.D. from The Washington and Lee University School of Law.

Leilei Nie, a current member of Fr8App’s Board of Directors, is a Strategy and Business Project Management professional with over 17 years of experience in financial services and fintech. She has been leading project management at X Star Technology, a leading non-bank car financing institution in Singapore since January 2025. Previously, Ms. Nie was a Senior Project Manager at Fidelity Fund Management (China) from May 2022 to June 2024 and a Senior Manager at Accenture from July 2021 to April 2022, focusing on financial services in Greater China. From December 2016 to June 2021, she served as Deputy Director in the Strategy and CEO Office at OneConnect Financial Technology, the fintech arm of Ping An Group in China. Her earlier roles include Strategy Manager at Commonwealth Bank of Australia (China) from January 2014 to December 2016 and Senior Associate at Z-Ben Advisors from June 2012 to December 2013, advising global asset managers on China market entry. Ms. Nie began her career in marketing roles at iFast Financial and Prudential Asset Management in Singapore from June 2005 to July 2010. Ms. Nie earned an MBA from China Europe Business School in April 2012 and a Bachelor’s degree in Computing from the National University of Singapore in May 2005. Ms. Nie is a Singaporean citizen.

Andres Gonzalez, a member of Fr8App’s Board of Directors, has served as the Chief Executive Officer of Futura Reserva, an investment management company focused on the development and investment of residential, mixed-use, industrial, and hospitality real estate projects in Mexico since 2024. Prior to joining Futura Reserva, Mr. González served as Executive Vice President and Managing Director of Capital Natural (now CREO) from October 2014 to May 2024. From February 2013 to October 2014, Mr. González had held senior management positions at Grupo MRP and Promologistics, where he was responsible for the oversight of infrastructure, shopping center, and logistics projects at a national level. Mr. González currently serves as an independent board member of Terra Energy and has been an active participant in organizations such as Young Presidents Organization since October 2021 and ECO since January 2025. He has also served as a faculty member for the Master’s in Finance program at Egade Business School, teaching at both the Monterrey and Santa Fe campuses from July 2021 to July 2023. Mr. Gonzalez earned a Bachelor’s degree in Accounting and Finance from Tec de Monterrey in December 2004 and later obtained an MBA with a specialization in Finance from Egade Business School in December 2016. Mr. Gonzalez has also completed leadership and management courses at Kellogg School of Management in May 2024, Columbia Business School in November 2018, and Babson College in 2015.

Marc Urbach, a current member of Fr8App’s Board of Directors, is the owner of Doorstep Delivery Logistics LLC and has been its Chief Executive Officer since August 2020, and consultant at OTS Ventures Inc. since January 2017. Prior to that, he was the President/CFO and board member of Ideanomics, Inc. (formerly known as YOU On Demand Holdings, Inc.) He has been an executive at various private and public companies in the past 25 years. He earned his B.S. in Accounting from Babson College.

See “What vote is required to approve each item?” and “What are abstentions and broker non-votes and how will they be treated?”

Vote Required

The election of each nominee for director requires the affirmative vote of a simple majority of the votes of the shareholders entitled to vote and voting on the proposal, present in person or by proxy.

Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH DIRECTOR NOMINEE

|

|

CORPORATE GOVERNANCE

Board of Directors

The Board oversees our business affairs and monitors the performance of our management. In accordance with our corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Executive Chairman, other key executives and by reading the reports and other materials sent to them and by participating in Board and committee meetings. Our directors hold office until the next annual meeting of shareholders and until their successors are elected and qualified or until their earlier resignation or removal, or if for some other reason they are unable to serve in the capacity of director.

Director Independence

As we are listed on Nasdaq, our determination of independence of directors is made using the definition of “independent director” contained in Rule 5605(a)(2) of the rules of the Nasdaq (the “Nasdaq Listing Rule”). Our Board affirmatively determined that Nicholas H. Adler, Andres Gonzalez and Marc Urbach and Leilei Nie are “independent” directors, as that term is defined in the Nasdaq Listing Rules.

Board Meetings and Attendance

The Board held eight telephonic meetings in 2024 at which all members were present and approved a number of items by unanimous written consent.

Annual Meeting Attendance Policy

The Company does not have a policy regarding director attendance at Annual Meetings of shareholders, however, all directors are strongly encouraged to attend.

Shareholder Communications with the Board

Shareholders wishing to communicate with the Board, the non-management directors, or with an individual Board member may do so by writing to the Board, to the non-management directors, or to the particular Board member, and mailing the correspondence to: c/o Chief Financial Officer, 2001 Timberloch Place, Suite 500, The Woodlands, TX 77380. The envelope should indicate that it contains a shareholder communication. All such shareholder communications will be forwarded to the director or directors to whom the communications are addressed.

Committees of the Board of Directors

We established three committees under the Board of Directors: the Audit Committee, the Compensation Committee and the Nominating Committee. We adopted a charter for each of the three committees. Each committee’s members and functions are described below.

Audit Committee. Our Audit Committee consists of Nicholas H. Adler, Marc Urbach and Leilei Nie. Mr. Urbach is the chairman of our Audit Committee. We have determined that Nicholas H. Adler, Marc Urbach and Leilei Nie satisfy the “independence” requirements of Nasdaq Listing Rule 5605 and Rule 10A-3 under the Securities Exchange Act of 1934. Our board of directors has determined that Mr. Urbach qualifies as an audit committee financial expert and has the accounting or financial management expertise as required under Item 407(d)(5)(ii) and (iii) of Regulation S-K. The Audit Committee will oversee our accounting and financial reporting processes and the audits of the financial statements of our company. The Audit Committee will be responsible for, among other things:

| ● | appointing the independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by the independent auditors; |

| ● | reviewing with the independent auditors any audit problems or difficulties and managements response; |

| ● | discussing the annual audited financial statements with management and the independent auditors; |

| ● | reviewing the adequacy and effectiveness of our accounting and internal control policies and procedures and any steps taken to monitor and control major financial risk exposures; |

|

|

| ● | reviewing and approving all proposed related party transactions; |

| ● | meeting separately and periodically with management and the independent auditors; and |

| ● | monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance. |

A copy of the Audit Committee’s current charter is available at our corporate website at: https://www.fr8.app/investors/governance/.

During the fiscal year of 2024, the Audit Committee held four telephonic meetings, at which all members of the Audit Committee were present.

Compensation Committee. Our compensation committee consists of Nicholas H. Adler, Andres Gonzalez and Marc Urbach. The compensation committee will assist the board in reviewing and approving the compensation structure, including all forms of compensation, relating to our directors and executive officers. Our chief executive officer may not be present at any committee meeting during which his compensation is deliberated. The compensation committee will be responsible for, among other things:

| ● | reviewing and approving, or recommending to the board for its approval, the compensation for our chief executive officer and other executive officers; |

| ● | reviewing and recommending to the board for determination with respect to the compensation of our non-employee directors; |

| ● | reviewing periodically and approving any incentive compensation or equity plans, programs or similar arrangements; and |

| ● | selecting compensation consultant, legal counsel or other adviser only after taking into consideration all factors relevant to that person’s independence from management. |

A copy of the compensation committee’s current charter is available at our corporate website at: https://www.fr8.app/investors/governance/.

During the fiscal year of 2024, the compensation committee held one telephonic meeting, at which all members of the Compensation Committee were present.

Nominating Committee. Our nominating committee consists of Nicholas H. Adler, Andres Gonzalez and Leilei Nie. The nominating committee will assist the board of directors in selecting individuals qualified to become our directors and in determining the composition of the board and its committees. The nominating committee will be responsible for, among other things:

| ● | selecting and recommending to the board nominees for election by the shareholders or appointment by the board; |

| ● | reviewing annually with the board the current composition of the board with regards to characteristics such as independence, knowledge, skills, experience and diversity; |

| ● | making recommendations on the frequency and structure of board meetings and monitoring the functioning of the committees of the board; and |

| ● | advising the board periodically with regards to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to the board on all matters of corporate governance and on any remedial action to be taken. |

| ● | reviewing annually with the board the current composition of the board with regards to characteristics such as independence, knowledge, skills, experience and diversity; |

| ● | making recommendations on the frequency and structure of board meetings and monitoring the functioning of the committees of the board; and |

| ● | advising the board periodically with regards to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to the board on all matters of corporate governance and on any remedial action to be taken. |

A copy of the nominating committee’s current charter is available at our corporate website at: https://www.fr8.app/investors/governance/

During the fiscal year of 2024, the nominating committee held two telephonic meetings.

|

|

Duties of Directors

Under British Virgin Islands law, our directors owe fiduciary duties to our company, including a duty of loyalty, a duty to act honestly and a duty to act in what they consider in good faith to be in our best interests. Our directors also have a duty to exercise the skill they actually possess and such care and diligence that a reasonably prudent person would exercise in comparable circumstances. In fulfilling their duty of care to us, our directors must ensure compliance with our Memorandum and Articles of Association, as amended and restated from time to time, and the class rights vested thereunder in the holders of the shares. Our company has the right to seek damages if a duty owed by our directors is breached. A shareholder may in certain limited exceptional circumstances have the right to seek damages in our name if a duty owed by the directors is breached.

Our Board of Directors has all the powers necessary for managing, and for directing and supervising, our business affairs. The functions and powers of our Board of Directors include, among others:

| ● | convening shareholders’ meetings; | |

| ● | declaring dividends and distributions; | |

| ● | appointing officers and determining the term of office of the officers; | |

| ● | exercising the borrowing powers of our company and mortgaging the property of our company; and | |

| ● | approving the transfer of shares in our company, including the registration of such shares in our share register. |

Code of Ethics.

A Code of Ethics is a written standard designed to deter wrongdoing and to promote:

| ● | honest and ethical conduct, | |

| ● | full, fair, accurate, timely and understandable disclosure in regulatory filings and public statements, | |

| ● | compliance with applicable laws, rules and regulations, | |

| ● | the prompt reporting violation of the code, and | |

| ● | accountability for adherence to the Code of Business Conduct and Ethics. |

We have adopted a Code of Conduct that complies with the descriptions set forth above for a Code of Ethics. Our Code of Conduct is applicable to all of our employees, and also contains provisions that set forth a higher level of expectations from our leaders. A copy of our Code of Conduct is incorporated by reference as an exhibit to the 2024 Annual Report and posted on our website at https://www.fr8.app/investors/governance/.

Directors’ and Executive Officers’ Compensation

The following table sets forth the amount of compensation that was paid, earned and/or accrued during the fiscal year ended December 31, 2024, to each of our officers and directors above.

| Name | Compensation ($) | |||

| Directors and Officers | ||||

| Nicholas H. Adler1 | 24,000 | |||

| William Samuels1 | 24,000 | |||

| Marc Urbach1 | 24,000 | |||

| Javier Selgas1 | 332,762 | |||

| Paul Freudenthaler1 | 37,215 | |||

| Luisa Lopez 1 | 194,965 | |||

| Donald Quinby1 | 224,038 | |||

| Total | $ | 860,980 | ||

| 1. | Effective as of February 14, 2022, Nicholas H. Adler, William Samuels, Marc Urbach, and Javier Selgas were appointed as directors to the board of directors, and Paul Freudenthaler was appointed as Secretary to the board of directors. Also effective as of February 14, 2022, Javier Selgas served as Chief Executive Officer, Paul Freudenthaler as Chief Financial Officer and Luisa Lopez as Chief Operating Officer. Paul Freudenthaler resigned as the Company’s Chief Financial Officer on January 19, 2024, after which he continued serving as Secretary and served as a director until February 14, 2025. Donald Quinby began serving as the Company’s Chief Financial Officer as of January 19, 2024. |

|

|

We have not set aside or accrued any amounts to provide pension, retirement or similar benefits to our executive officers and directors.

Option Grants

As adjusted for the September 2024 Reverse Split and the May 2025 Reverse Split, but not the Presumptive Reverse Split, the Company had a total of 698 stock options outstanding at the end of the 2024 fiscal year as follows: Mr. Selgas has stock options to purchase 232 shares at a weighted average strike price of $10,362.32 per share; Mr. Freudenthaler has stock options to purchase 232 shares at a weighted average strike price of $10,777.40 per share; and Mrs. Lopez has stock options to purchase 81 shares at a weighted average strike price of $10,914.56 per share.

Option Exercises and Fiscal Year-End Option Value Table

There were no stock options exercised during fiscal 2024 by the executive officers.

Long-Term Incentive Plans and Awards

There were not stock options granted to the executive officers during fiscal year 2024.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our outstanding Ordinary Shares as of November 10, 2025 by:

| ● | each person or entity that, to our knowledge, beneficially owns 5% or more of our Ordinary Shares; |

| ● | each of our director nominees and executive officers individually; and |

| ● | all of our director nominees and executive officers as a group. |

The beneficial ownership of Ordinary Shares is determined in accordance with the rules of the SEC and generally includes any Ordinary Shares over which a person exercises sole or shared voting or investment power. For purposes of the table below, we deem shares subject to options, warrants or other exercisable or convertible securities that are exercisable or convertible currently or within 60 days of November 4, 2025, to be outstanding and to be beneficially owned by the person holding the options, warrants or other currently exercisable or convertible securities for the purposes of computing the percentage ownership of that person, but we do not treat them as outstanding for the purpose of computing the percentage ownership of any other person. The percentage of shares beneficially owned is based on 5,897,975 Ordinary Shares outstanding as of November 10, 2025*** and investment power with respect to their shares, except to the extent authority is shared by spouses under community property laws.

|

|

| Name of Beneficial Owner1 | Number of Shares | % of Class* | ||||||

| Five Percent Holders | ||||||||

| Freight Opportunities, LLC 2 | 28,547,202 | 57.80 | % | |||||

| Freight Opportunities II, LLC 3 | 2,678,571 | 5.42 | % | |||||

| Fetch Compute, Inc. 4 | 10,843,373 | 21.96 | % | |||||

| Directors and Named Executive Officers 5, 6: | ||||||||

| Javier Selgas | 187 | ** | % | |||||

| Donald Quinby | 4,000 | 0.01 | % | |||||

| Luisa Irene Lopez Reyes | 63 | ** | % | |||||

| Paul Freudenthaler | 187 | ** | % | |||||

| Nicholas H. Adler | 17 | ** | % | |||||

| Andres Gonzalez | - | ** | % | |||||

| Marc Urbach | 17 | ** | % | |||||

| Leilei Nie | - | ** | % | |||||

| All Directors and Executive Officers as Group | 4,464 | .01 | % | |||||

(1) For each person and group included in this table, percentage ownership is calculated by dividing the sum of the number of Ordinary Shares beneficially owned by such person or group and the number of Ordinary Shares underlying share options or warrants held by such person or group that are exercisable within 60 days after November 4, 2025 by the sum of (i) 5,897,975 being the number of shares outstanding as of November 4, 2025 and (ii) the number of Ordinary Shares underlying share options held by such person or group that are exercisable within 60 days after November 4, 2025.

(2) Freight Opportunities, LLC beneficially owns 400,000 Ordinary Shares, preferred shares convertible to 3,275,638 Ordinary Shares and warrants convertible into 24,871,564 Ordinary Shares under various terms and conditions. The address of Freight Opportunities, LLC is 1 Pennsylvania Plaza, Floor 48, NY, NY 10119.

(3) Freight Opportunities II, LLC beneficially owns preferred shares convertible to 2,678,571 Ordinary Shares under various terms and conditions. The address of Freight Opportunities II, LLC is 1 Pennsylvania Plaza, Floor 48, NY, NY 10119.

Freight Opportunities, LLC and Freight Opportunities II, LLC do not have the right to convert or exercise any portion of their holdings to Ordinary Shares if, to the extent that after giving effect to such conversion or exercise, they would beneficially own in excess of 9.99% of the Ordinary Shares outstanding immediately after giving effect to such conversion or exercise.

(4) Fetch Compute, Inc. beneficially owns preferred shares convertible to 10,843,373 Ordinary Shares under various terms and conditions. The address of Fetch Compute, Inc. is 251 Little Falls Drive, Wilmington, DE 19808.

Fetch Compute, Inc. does not have the right to convert or exercise any portion of their holdings to Ordinary Shares if, to the extent that after giving effect to such conversion or exercise, they would beneficially own in excess of 9.99% of the Ordinary Shares outstanding immediately after giving effect to such conversion or exercise.

(5) Unless otherwise indicated, the address for those listed below is c/o Freight App, Inc., at 2001 Timberloch Place, Suite 500, The Woodlands, Texas 77380.

(6) Each of the directors’ holdings represent a mixture of restricted stock and stock options from the employee stock ownership plan convertible into Ordinary Shares that have vested within 60 days after the date of November 4, 2025. Each of Nicholas H. Adler and Marc Urbach own 3 ordinary shares. Mr. Adler and Mr. Urbach also each own options convertible into 14 ordinary shares. Mr. Selgas and Mr. Freudenthaler each own 7 ordinary shares and options convertible into 180 ordinary shares. Mrs. Lopez’s entire beneficial ownership represent options from the employee stock ownership plan convertible into ordinary shares that have vested within 60 days after the date of this proxy statement.

*Rounded to the nearest hundredth digit.

**Less than 0.01%.

*** Ordinary Shares and per-share information in the table have been adjusted to give effect to the September 2024 Reverse Split and the May 2025 Reverse Split but not the Presumptive Reverse Split. For more information regarding the “Presumptive Reverse Split”, see “General Information” on page 6.

|

|

Employment Agreements and Indemnification Agreements

Fr8Tech’s current Chief Executive Officer joined Fr8Tech in March 2020 as its Chief Technology Officer, and became the Chief Executive Officer in September 2020. Our Chief Financial Officer joined Fr8Tech in January 2024. Fr8Tech’s Chief Operating Officer joined Fr8Tech in August 2021. Set forth below are compensation arrangements based on their current employment agreements with Fr8Tech. All employment agreements were continued under the same terms at the time of the Merger and all options and equity compensation items adjusted consistent with the exchange ratio related the Merger.

Under his Employment Agreement with Fr8Tech, Mr. Selgas serves as Fr8Tech’s Chief Executive Officer, receives an annual base salary of $250,000 and is eligible for benefits and a discretionary bonus payable in the first fiscal quarter after the end of each fiscal year. The most recent stock based awards to Mr. Selgas were in April 2023, when he was awarded a stock option grant for 110 Ordinary Shares of Fr8Tech at $1,820 per share, vesting over four years starting in April 2023. In the event Mr. Selgas is terminated without cause or for good reason, he will be entitled to receive continued payment of his base salary for six months immediately following the termination date.

Under his Employment Agreement with Fr8Tech, Mr. Donald Quinby receives an annual base salary of $250,000, paid in periodic installments, subject to payroll deductions and other tax withholdings in accordance with the Company’s customary payroll practices and applicable wage payment laws, but no less frequently than monthly. Mr. Quinby is eligible to receive a discretionary bonus based on performance as determined by our board of directors. Pursuant to his Employment Agreement with the Company, the Company will grant Mr. Quinby such number of options to purchase Company shares under its 2022 Stock Incentive Plan representing $220,000 in intrinsic value. The Company has not granted those options to date.

Mr. Paul Freudenthaler served as Fr8Tech’s Chief Financial Officer from September 2020 to January 2024. Under his Employment Agreement with Fr8Tech, he received an annual base salary of $250,000 and was eligible to receive a discretionary bonus payable in the first fiscal quarter after the end of each fiscal year. The most recent stock based awards to Mr. Freudenthaler were in April 2023, when he was awarded a stock option grant for 110 Ordinary Shares of Fr8Tech at $1,820 per share, vesting over four years starting in April 2023. On January 19, 2024, Mr. Freudenthaler resigned as Fr8Tech’s Chief Financial Officer, after which he continued serving as Secretary and began serving as a member of the Board of Directors. Mr. Freudenthaler’s Employment Agreement terminated upon his resignation. In connection with his appointment as director, Mr. Freudenthaler entered into a Board Services Agreement with the Company. Pursuant to such Board Services Agreement, the Company paid Mr. Freudenthaler a quarterly compensation of $4,000 for his services as a Board Director and $1,000 for his services as Secretary.

Under her Employment Agreement with Fr8Tech, Ms. Luisa Irene Lopez Reyes serves as Fr8Tech’s and Freight App de Mexico’s Chief Operating Officer, receives an annual base salary of MXN$3,000,000 and is eligible to receive a discretionary bonus payable within the first 2-1/2 months after the end of the applicable fiscal year. The most recent stock based awards to Ms. Lopez were in April 2023, when she was awarded a stock option grant for 40 Ordinary Shares of Fr8Tech at $1,820 per share, vesting over four years starting in April 2023. In the event that Ms. Reyes is terminated without cause or for good reason, she will be entitled to receive continued payment of her base salary for three months immediately following the termination date.

Each executive officer has agreed to hold, both during and after the termination or expiry of his or her employment agreement, in strict confidence and not to use, except as required in the performance of his or her duties in connection with the employment or pursuant to applicable law, any of our confidential information or trade secrets, any confidential information or trade secrets of our clients or prospective clients, or the confidential or proprietary information of any third party received by us and for which we have confidential obligations. The executive officers have also agreed to disclose in confidence to us all inventions, designs and trade secrets which they conceive, develop or reduce to practice during the executive officer’s employment with us and to assign all right, title and interest in them to us, and assist us in obtaining and enforcing patents, copyrights and other legal rights for these inventions, designs and trade secrets.

|

|

Nasdaq Requirements

Our Ordinary Shares are currently listed on the Nasdaq Capital Market and, for so long as our securities continue to be listed, we will remain subject to the rules and regulations established by Nasdaq Stock Market as being applicable to listed companies. Nasdaq has adopted, and from time-to-time adopts, amendments to the Nasdaq Listing Rule 5600 that imposes various corporate governance requirements on listed securities. Section (a)(3) of Nasdaq Listing Rule 5615 provides that foreign private issuers such as our company are required to comply with certain specific requirements of the Nasdaq Listing Rule 5600, but, as to the balance of the Nasdaq Listing Rule 5600, foreign private issuers are not required to comply if the laws of their home jurisdiction do not otherwise mandate compliance with the same or substantially similar requirement.

We currently comply with those specifically mandated provisions the Nasdaq Listing Rule 5600. In addition, we have elected to voluntarily comply with certain other requirements of Nasdaq Listing Rule 5600, notwithstanding that our home jurisdiction does not mandate compliance with the same or substantially similar requirements; although we may in the future determine to cease voluntary compliance with those provisions of Nasdaq Listing Rule 5600 that are not mandatory. However, we have elected not to comply with the following provisions of Nasdaq Listing Rule 5600, since the laws of the British Virgin Islands do not require compliance with the same or substantially similar requirements:

| ● | our independent directors do not hold regularly scheduled meetings in executive session (rather, all board members may attend all meetings of the Board of Directors); |

| ● | the compensation of our executive officers is recommended but not determined by an independent committee of the board or by the independent members of the Board of Directors; and our CEO is not prevented from being present in the deliberations concerning his compensation; |

| ● | related party transactions are not required to be reviewed and we are not required to solicit member approval of stock plans, including: those in which our officers or directors may participate; stock issuances that will result in a change in control; the issuance of our stock in related party acquisitions or other acquisitions in which we may issue 20% or more of our outstanding shares; or, below market issuances of 20% or more of our outstanding shares to any person; and |

| ● | we are not required to hold an in-person annual meeting to elect directors and transact other business customarily conducted at an annual meeting (rather, we complete these actions by written consent of holders of a majority of our voting securities). |

We may in the future determine to voluntarily comply with one or more of the foregoing provisions of Nasdaq Listing Rules. For example, we have voluntarily decided to compose of the majority of our board of directors with independent directors as defined by the Nasdaq Listing Rules.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transaction and balances from related parties:

The Company has not engaged in any related party transactions in the past three years.

Review, approval or ratification of transactions with related persons.

Our Audit Committee, consisting of independent directors, is charged with reviewing and approving all agreements and transactions which had been entered into with related parties, as well as reviewing and approving all future related party transactions.

|

|

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee, which is composed entirely of independent directors, has selected TAAD, independent registered public accounting firm, to audit our financial statements for the fiscal years ending December 31, 2024 and December 31, 2025. Ratification of the selection of TAAD by shareholders is not required by law. However, as a matter of good corporate practice, such selection is being submitted to the shareholders for ratification at the 2025 Annual Meeting. If the shareholders do not ratify the selection, the Board and the Audit Committee will reconsider whether or not to retain TAAD, but may, in their discretion, retain TAAD. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such change would be in the best interests of the Company and its shareholders.

Representatives from TAAD will be in attendance at the 2025 Annual Meeting via teleconference to respond to any appropriate questions and will have the opportunity to make a statement, if they so desire.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

UHY LLP (“UHY”) audited the Company’s financial statements annually for the Company’s fiscal years ended December 31, 2022 to December 31, 2023. On July 4, 2024, UHY was dismissed as our independent registered public accounting firm. The audit reports of UHY on the Company’s financial statements as of and for the fiscal years ended December 31, 2023 and 2022 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. UHY did not provide an audit report on our financial statements for any period subsequent to December 31, 2023. UHY has not provided any audit services to the Company subsequent to July 4, 2024.

During the Company’s fiscal years ended December 31, 2023 and 2022, and for the subsequent interim period through July 4, 2024, (i) there were no “disagreements” between us and UHY (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K promulgated by the SEC (“Regulation S-K”) and the related instructions to this item) on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of UHY, would have caused them to make reference to the subject matter of the disagreements in connection with their report on the financial statements for such period, and (ii) there were no “reportable events” as such term is defined in Item 304(a)(1)(v) of Regulation S-K, other than as described below.

We provided UHY with a copy of the foregoing disclosures and requested UHY to furnish us with a letter addressed to the SEC stating whether or not UHY agrees with the above disclosures. A copy of UHY’s letter is filed as Exhibit 16.1 to the 2024 Annual Report.

On August 22, 2024, we engaged Marcum LLP (“Marcum”) as our new independent registered public accounting firm. During the Company’s fiscal years ended December 31, 2023 and 2022, and for the subsequent interim period through the date hereof prior to the engagement of Marcum, neither the Company nor anyone on its behalf consulted Marcum regarding any of the matters described in Items 304(a)(2)(i) or 304(a)(2)(ii) of Regulation S-K.

On January 7, 2025, Marcum was dismissed as our independent registered public accounting firm. Marcum did not reported on the Company’s consolidated financial statements for any interim or annual period. Marcum did not provided any audit services to the Company subsequent to January 7, 2025.

During the Company’s fiscal year ended December 31, 2024, and for the subsequent interim period through January 7, 2025, (i) there were no “disagreements” between us and Marcum (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to this item) on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum, would have caused them to make reference to the subject matter of the disagreements in connection with their report on the financial statements for such period, and (ii) there were no “reportable events” as such term is defined in Item 304(a)(1)(v) of Regulation S-K, other than as described below. We provided Marcum with a copy of the foregoing disclosures and requested Marcum to furnish us with a letter addressed to the SEC stating whether or not Marcum agrees with the above disclosures. A copy of Marcum’s letter is filed as Exhibit 16.2 to the 2024 Annual Report.

|

|

On January 6, 2025, we engaged TAAD as our new independent registered public accounting firm. During the Company’s two most recent fiscal years ended December 31, 2024 and 2023, and for the subsequent interim period through the date hereof prior to the engagement of TAAD, neither the Company nor anyone on its behalf consulted TAAD regarding any of the matters described in Items 304(a)(2)(i) or 304(a)(2)(ii) of Regulation S-K.

Independent Registered Public Accounting Firm Fees and Other Matters

The aggregate fees billed to the Company by the Company’s principal accountant for the indicated services for each of the last two fiscal years were as follows:

| Fiscal 2024 | Fiscal 2023 | |||||||

| Audit Fees | $ | 418,200 | $ | 256,250 | ||||

| Audit-Related Fees | - | - | ||||||

| Tax Fees | - | - | ||||||

| All Other Fees | 111,750 | - | ||||||

| Total | $ | 529,950 | $ | 256,250 | ||||

Audit Fees — Audit fees consist of aggregate fees billed for each of the last two fiscal years for professional services performed by the Company’s principal accountant for the audit of the financial statements included in our annual reports on Form 10-K and review of the financial statements included in our quarterly reports on Form 10-Q, reviews of registration statements and issuances of consents, and services that are normally provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees — Audit-related fees consist of aggregate fees billed for each of the last two fiscal years for assurance and related services performed by the Company’s principal accountant that are reasonably related to the performance of the audit or review of our financial statements and are not reported under the paragraph captioned “Audit Fees” above. We did not engage our principal accountant to provide assurance or related services during the last two fiscal years.

Tax Fees — Tax fees consist of aggregate fees billed for each of the last two fiscal years for professional services performed by the Company’s principal accountant with respect to tax compliance, tax advice, tax consulting and tax planning. We did not engage our principal accountant to provide tax compliance, tax advice or tax planning services during the last two fiscal years.

All Other Fees — All other fees consist of aggregate fees billed for each of the last two fiscal years for products and services provided by the Company’s prior principal accountant, UHY LLP, for services other than those reported under the headings “Audit Fees,” “Audit-Related Fees” and “Tax Fees” above. Such services included consent to reference prior period results as audited by their firm in our 2024 financial statements and a comfort letter for referencing our 2023 financial statements as audited by their firm for the Form 424B5 - Prospectus filed on May 23, 2024 for our ATM offering.

The Audit Committee has adopted a procedure for pre-approval of all fees charged by the Company’s independent registered public accounting firm. Under the procedure, the Audit Committee approves the engagement letter with respect to audit, tax and review services. Other fees are subject to pre-approval by the entire Committee, or, in the period between meetings, by a designated member of the Audit Committee. Any such approval by the designated member is disclosed to the entire Audit Committee at the next meeting. The audit fees paid to Company’s principal accountant for fiscal years 2024 and 2023 were all approved by the Audit Committee.

See “What vote is required to approve each item?” and “What are abstentions and broker non-votes and how will they be treated?”

Vote Required

The ratification of the appointment of TAAD as our independent auditor requires the affirmative vote of a simple majority of the votes of the shareholders entitled to vote and voting on the proposal, present in person or voting by proxy.

Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF TAAD AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024 AND DECEMBER 31, 2025.

|

|

PROPOSAL NO. 3:

APPROVAL OF, FOR PURPOSES OF COMPLYING WITH NASDAQ LISTING RULE 5635(D), 20% SECURITIES ISSUANCE PURSUANT TO THE PRIVATE PLACEMENTS

Overview

Proposal No. 3 is to approve the issuance of 20% or more of the issued and outstanding securities of the Company pursuant to the Private Placements as described below, for purposes of complying with Nasdaq Listing Rule 5635(d).

Background of the Private Placements

On February 3, 2025, the Company completed a private placement with certain investors, wherein a total of 1,540,832 Series A4 Preferred Shares with each investor receiving 770,416 Preferred Shares, for a total purchase price of approximately $3,000,000 in connection with the January 2025 SPA. The private placement offering was exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D of the Securities Act and in reliance on similar exemptions under applicable state laws. According the section 4.10 of the January 2025 SPA, the Company shall host a shareholder meeting to ratify and approve all of the transactions contemplated by therein.