UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number 001-42132

NOVA MINERALS LIMITED

(Translation of registrant’s name into English)

Suite 5, 242 Hawthorn Road,

Caulfield, Victoria 3161

Australia

+61 3 9537 1238

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

NOVA MINERALS LIMITED

EXPLANATORY NOTE

☒ Form 20-F ☐ Form 40-F This Report of Foreign issuer on Form 6-K is being filed to disclose the (i) results of the Nova Minerals Limited (the “Company”) 2025 Annual General Meeting of Shareholders (“AGM”); (ii) Chairman letter to Company shareholder released con currently with the 2025 Annual General Meeting of Shareholders; (iii) update to the Employee Securities Ownership Plan and issuance of options to certain Company directors and (iv) to disclose a presentation made by the Company’s CEO at the AGM.

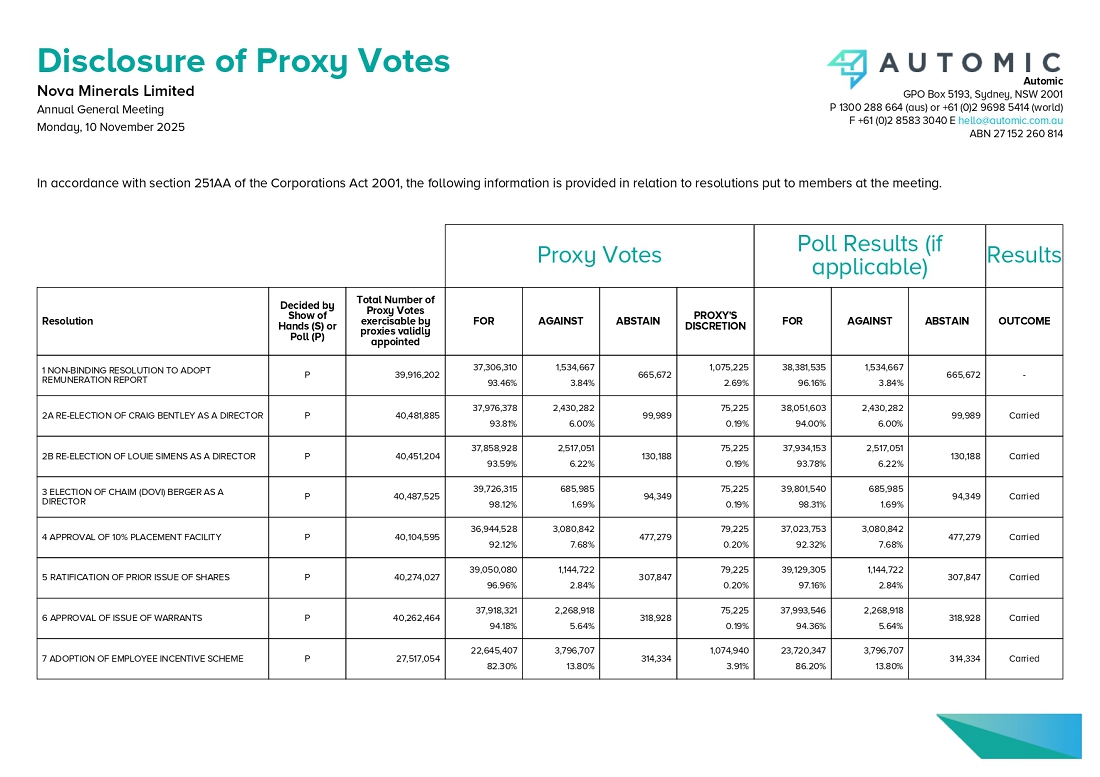

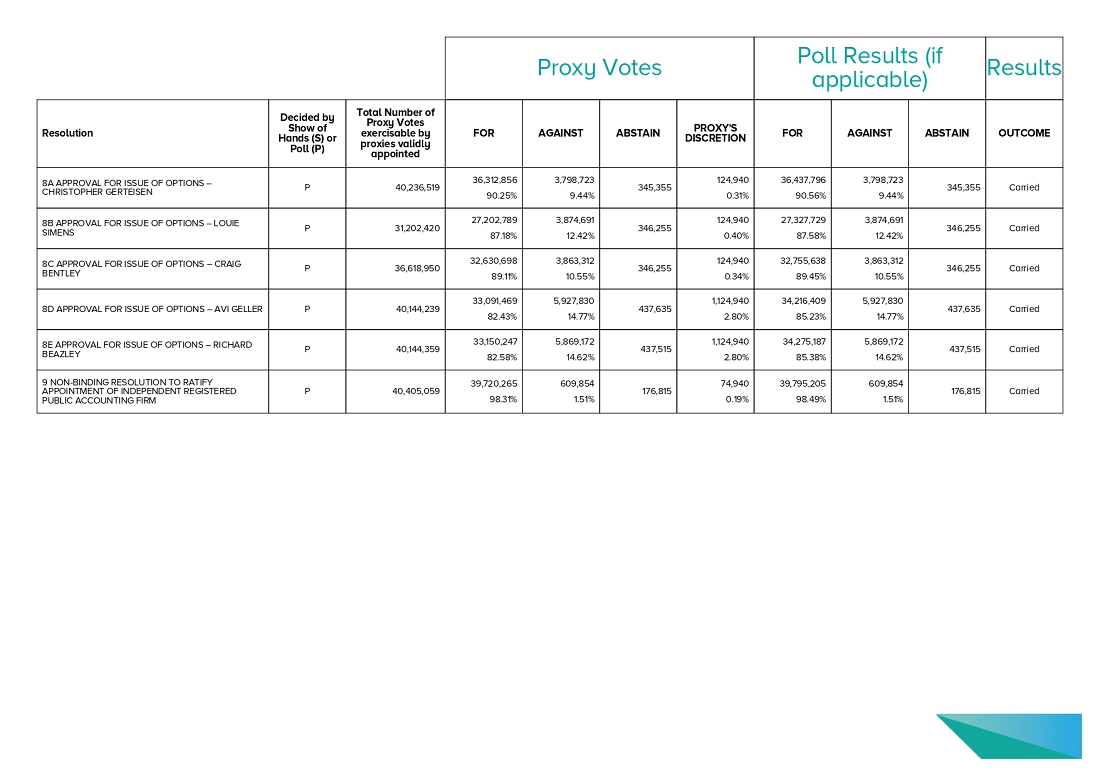

Results of 2025 Annual General Meeting of Shareholders

On November 10, 2025, Nova Minerals Ltd. (the “Company”), held its Annual General Meeting of Shareholders (the “Meeting”). At the Meeting, the Company’s shareholders voted on all resolutions described in the proxy materials including the notice for the Meeting included as an exhibit to the Company’s report on Form 6-K furnished by the Company with the Securities and Exchange Commission on September 19, 2025. The resolutions brought before the shareholders at the Meeting were approved by the shareholders of the Company with the requisite majority required for each resolution. On November 10, 2025, the Company filed its report entitled “Results of Annual General Meeting – 10 November 2025” with the Australian Securities Exchange (“ASX”) which report is attached to this report on Form 6-K as Exhibit 99.1 and was posted to the Company’s corporate website on such date.

Chairman Letter to Shareholders

Concurrent with the meeting, our Chairman, Richard Beazley released a letter to the Company’s shareholders as a release on the ASX entitled . “2025 AGM - Letter from Nova Chairman, Mr. Richard Beazley,” which is attached to this Report on 6-K as Exhibit 99.2 and was also posted to the Company’s corporate website on such date

Adoption of Employee Securities Ownership Plan; issuances of Options to Company Directors

On November 10, 2025, the Company adopted an update to the Employee Securities Ownership Plan (as updated, the “Plan”) pursuant to shareholder approval at the Annual General Meeting on November 10, 2025.

The maximum number of securities which may be issued under the Plan is 19,000,000, which represents approximately 4.4% of the issued share capital of the Company at the date of the Notice of Annual General Meeting on September 19, 2025. Shares issued on exercise of an option issued under the Plan, and options which have been cancelled or which have lapsed are not counted in determining the number of securities issued under the Plan. Any issues of securities or agreements to issue securities under the Plan will be announced to ASX. The Plan provides for shares, options or other securities or interests (including performance rights) to be issued to eligible persons.

The purpose of the Plan is to:

| (a) | provide eligible persons with an additional incentive to work to improve the performance of the Company; |

| (b) | attract and retain eligible persons essential for the continued growth and development of the Company; |

| (c) | promote and foster loyalty and support amongst eligible persons for the benefit of the Company; and |

| (d) | enhance the relationship between the Company and eligible persons for the long-term mutual benefit of all parties. |

Eligible persons are directors, officers and employees of, or consultants to, the Company or an associated body corporate and, in the case of consultants, may include bodies corporate. Participants in the Plan, the number, type and terms of any securities offered or issue, and the terms of any invitation, offer or issue are determined by the Board with the advice of the remuneration committee, if any.

The Company’s board of directors will administer the terms of the Plan, including but not limited to determining the terms of securities issued, adoption of rules subordinate to the Plan for the administration of the Plan and the suspension or termination of the Plan.

| - |

On November 10, 2025, following approval by the shareholders at the AGM, the Company issued the following option issuances to the Company directors listed below as follows:

| # | RECIPIENT* | Class A Options | Class B Options | Class C Options | Class D Options | TOTAL | ||||||||||||||||

| 8A | Christopher Gerteisen | 1,125,000 | 1,000,000 | 1,000,000 | 1,000,000 | 4,125,000 | ||||||||||||||||

| 8B | Louie Simens | 875,000 | 750,000 | 750,000 | 750,000 | 3,125,000 | ||||||||||||||||

| 8C | Craig Bentley | 875,000 | 750,000 | 750,000 | 750,000 | 3,125,000 | ||||||||||||||||

| 8D | Avi Geller | 375,000 | 375,000 | 250,000 | 375,000 | 1,375,000 | ||||||||||||||||

| 8E | Richard Beazley | 250,000 | 375,000 | 250,000 | 375,000 | 1,250,000 | ||||||||||||||||

| TOTAL | 3,500,000 | 2,250,000 | 3,000,000 | 3,250,000 | 13,000,000 | |||||||||||||||||

*options may be issued to nominee(s) as advised to the Company

The Options to granted to Company directors will have the following terms:

| Class | Exercise Price | Expiry Date | Vesting Conditions | |||

| Class A Options | A$0.45 (45 cents) | 3 years from issue | Vesting 31 December 2025, provided the holder is an employee or contractor or director of the Company at all times during the period from the date of issue and ending on 31 December 2025. | |||

| Class B Options | A$0.45 (45 cents) | 3 years from issue | The share price closing price being greater than or equal to a 5 day volume weighted average price (“VWAP”) of A$0.75 (75 cents) on ASX prior to the expiry date, provided that the holder is an employee or contractor or director of the Company at all times during the period from the date of issue and ending on the date the vesting condition is satisfied. | |||

| Class C Options | A$0.45 (45 cents) | 3 years from issue | Completion of an RPM Area Pre-Feasibility Study (PFS) by 31 December 2026, provided that the holder is an employee or contractor or director of the Company at all times during the period from the date of issue and ending on the date the vesting condition is satisfied. | |||

| Class D Options | A$0.45 (45 cents) | 3 years from issue | First commercial sales of antimony to an unrelated third party prior to the expiry date, provided that the holder is an employee or contractor or director of the Company at all times during the period from the date of issue and ending on the date the vesting condition is satisfied. |

The Options granted to Company are subject to the vesting conditions set forth above and have the following additional terms:

| ● | Each option (Option) entitles the holder to acquire one ordinary fully paid share (Share) in the capital of the Company. |

| ● | The exercise price is a price to exercise each Option is $0.45 (45 cents). |

| ● | The Options expire at 5pm (Melbourne time) on the date that is 3 years from issue of Options (Expiry Date). |

| ● | Subject to satisfaction of any applicable vesting condition, the Options can be exercised by completing an option exercise form and delivering it together with the payment for the number of Shares in respect of which the options are exercised to the Company’s share registry. |

| ● | Any Option that has not been exercised prior to the expiry date automatically lapses. |

| - |

| ● | An Option for which the applicable vesting condition has not been satisfied by the applicable date for satisfaction (or which becomes incapable of being satisfied) automatically lapses and is cancelled. |

| ● | Holders shall not be entitled to exercise their Options (and the Company will not be required to issue shares upon such exercise) if it would be unlawful to do so. |

| ● | Subject to applicable law, the Options are freely transferable. |

| ● | The exercise price of an Option is payable in full on exercise. |

| ● | Where an Option holder determines to exercise some, but not all, of their held Options, the total aggregate amount payable to exercise the Options must be a minimum of $1,000. |

| ● | All Shares issued upon exercise of Options will rank pari passu in all respect with, and have the same terms as, the Company’s then issued fully paid ordinary shares. The Company will apply for official quotation by ASX of all Shares issued upon exercise of Options, subject to any restriction obligations imposed by ASX and the Company being listed on ASX at the relevant time. The Options will not give any right to participate in dividends until shares are issued pursuant to the terms of the relevant Options. |

| ● | There are no participation rights or entitlements inherent in the Options. Option holders are not entitled to participate in new issues of securities offers to shareholders without first exercising the Option. Prior to the Expiry Date and if required by the Listing Rules, the Company will send notices to option holders in accordance with the time limits required by the Listing Rules in respect of offers of securities made to shareholders. |

| ● | In the event of any reconstruction (including consolidation, subdivision, reduction or return) of the issued capital of the Company prior to the Expiry Date, the number of Options or the exercise price of the Options or both shall be reconstructed in accordance with the Listing Rules applying to a reorganisation of capital at the time of the reconstruction. |

| ● | These terms of Options shall be interpreted in accordance with, and governed by, the terms of the Plan. |

| ● | Options will otherwise have the terms as required by ASX and the Listing Rules. |

The foregoing description of the Plan does not purport to be a complete description thereof and is qualified in its entirety by reference to the full text of the Plan, a copy of which is attached hereto as Exhibit 10.1

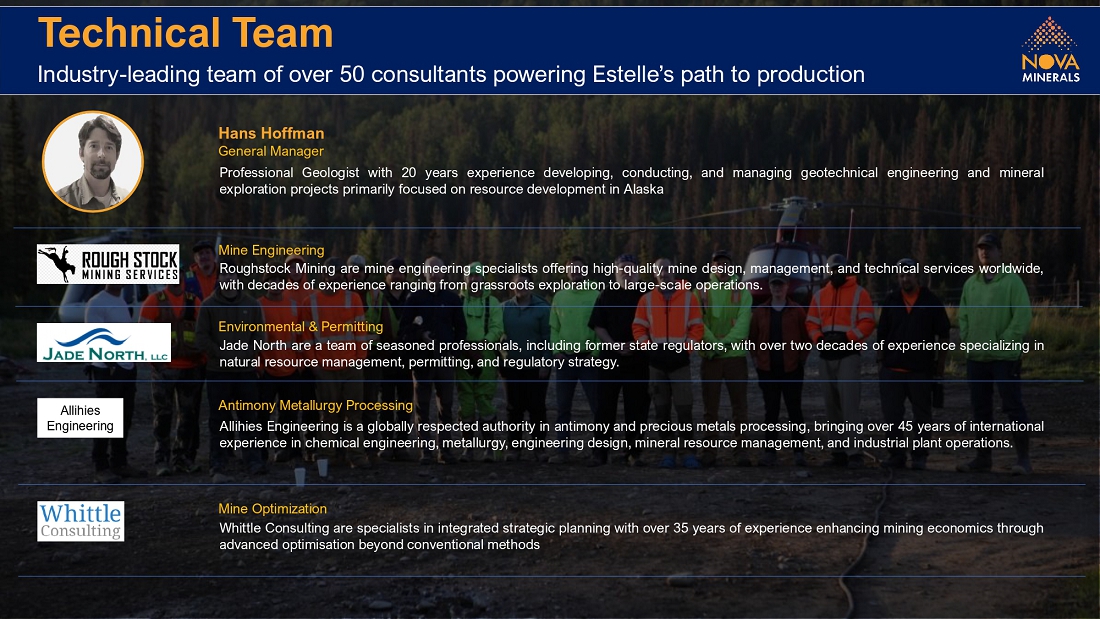

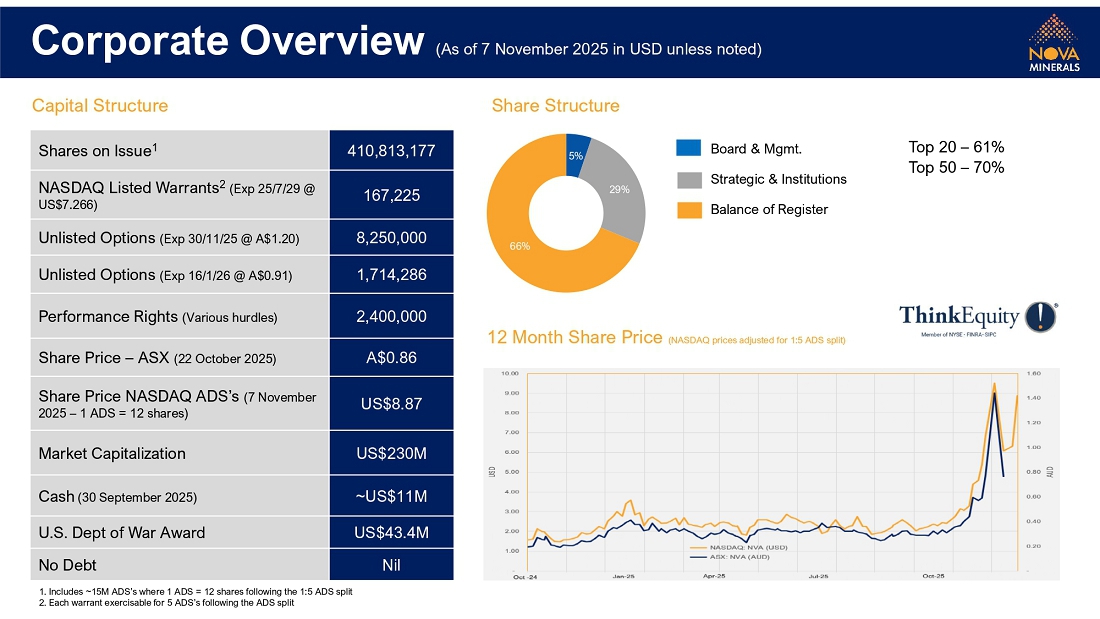

CEO Presentation

On November 10, 2025, Christopher Gerteisen, CEO of the Company, made a presentation to shareholders of the Company at the AGM. A copy of this presentation is attached to this report on Form 6-K as Exhibit 99.4 and was also posted to the Company’s corporate website on such date.

This report on Form 6-K (including the exhibit attached hereto) shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| - |

Financial Statements and Exhibits.

The following exhibits are being filed herewith:

| Exhibit No. | Description | |

| 10.1 | Employee Securities Ownership Plan | |

| 99.1 | Results of Annual General Meeting | |

| 99.2 | 2025 AGM - Letter from Nova Chairman, Mr. Richard Beazley | |

| 99.3 | Presentation |

| - |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NOVA MINERALS LIMITED | ||

| Date: November 10, 2025 | By: | /s/ Ian Pamensky |

| Name: | Ian Pamensky | |

| Title: | Company Secretary | |

| - |

Exhibit 10.1

|

EMPLOYEE SECURITIES OWNERSHIP PLAN

NOVA MINERALS LIMITED

ACN 006 690 348 |

|

| Date Adopted: | 29 November 2023 | |

| Date Updated: | 10 November 2025 |

SUMMARY OF EMPLOYEE SECURITIES OWNERSHIP PLAN (PLAN)

The maximum number of securities which may be issued under the Plan is 19,000,000.

Shares issued on exercise of an option issued under the Plan, and options which have been cancelled or which have lapsed are not counted in determining the number of securities issued under the Plan.

Any issues of securities or agreements to issue securities under the Plan will be announced to ASX.

The Plan provides for shares, options or other securities or interests (including performance rights) to be issued to eligible persons.

The purpose of the Plan is to:

| (a) | provide eligible persons with an additional incentive to work to improve the performance of the Company; |

| (b) | attract and retain eligible persons essential for the continued growth and development of the Company; |

| (c) | promote and foster loyalty and support amongst eligible persons for the benefit of the Company; and |

| (d) | enhance the relationship between the Company and eligible persons for the long-term mutual benefit of all parties. |

| Nova Minerals Limited | EMPLOYEE SECURITIES OWNERSHIP PLAN |

|

Eligible persons are directors, officers and employees of, or consultants to, the Company or an associated body corporate and, in the case of consultants, may include bodies corporate. Participants in the Plan, the number, type and terms of any securities offered or issue, and the terms of any invitation, offer or issue are determined by the Board with the advice of the remuneration committee, if any.

Directors and related parties of the Company may only participate in the Plan if prior shareholder approval is obtained in accordance with the ASX Listing Rules.

The Board is to administer the terms of the Plan, including but not limited to determining the terms of securities issued, adoption of rules subordinate to the Plan for the administration of the Plan and the suspension or termination of the Plan.

The Plan is to be interpreted and applied in accordance with and subject to the ASX Listing Rules.

TERMS OF EMPLOYEE SHARE OPTION PLAN

The key terms of the 2023 Employee Share Option Plan (ESOP in this Annexure A) are as follows:

| (a) | Eligibility: Participants in the ESOP may be: |

| (i) | a Director (whether executive or non-executive) of the Company, its subsidiaries and any other related body corporate of the Company (Group Company); | |

| (ii) | a full or part time employee of any Group Company; | |

| (iii) | a casual employee or contractor of a Group Company to the extent permitted by applicable law; or | |

| (iv) | a prospective participant, being a person to whom the offer is made but who can only accept the offer if an arrangement has been entered into that will result in the person becoming a Participant under clauses (a), (b) or (c) above, |

who is declared by the Board to be eligible to receive grants of Options under the ESOP or an approved nominee (Participants).

| (b) | ESOP Limit: The maximum number of securities which may be issued under the Plan from time to time is 19,000,000. Shares issued on exercise of an option or exercise or conversion of an interest issued under the Plan, and options which have been cancelled or which have lapsed are not counted in determining the number of Options issued under the Plan. |

| Nova Minerals Limited | Director Share Plan |

|

| (c) | Administration of ESOP: The Board (or its delegated authority) is responsible for the operation of the ESOP and has a broad discretion to determine which Participants will be offered Options under the ESOP. |

| (d) | Offer: The Board may issue an offer to a Participant to participate in the ESOP. The offer will: |

| (i) | set out the number of Options offered under the ESOP; | |

| (ii) | specify the exercise price and expiry date of the Options; | |

| (iii) | specify any vesting and exercise conditions and restriction periods applying to the Options (and Shares when Options are exercised); | |

| (iv) | specify an acceptance period; and | |

| (v) | specify any other terms and conditions attaching to the Options. |

| (d) | Issue price: unless the Options are quoted on the ASX, Options issued under the ESOP will be issued for no more than nominal cash consideration. |

| (e) | Exercise Conditions: Participants may only exercise vested Options by paying the Exercise Price. Vested Options must be exercised during one of the Company’s trading windows (subject to the Company’s Trading in Securities Policy). An Option may be made subject to such other exercise conditions as determined by the Board in its discretion and as specified in the offer for the Option. |

| (f) | Cashless exercise facility: If determined by the Board (in its discretion) and specified in an invitation, the holder of Options may elect to pay the Exercise Price for an Option by setting off the exercise price against the relevant number of Shares which they are entitled to receive upon exercise or, if the circumstances are deemed appropriate at the time, the Company may cancel or procure the acquisition of the relevant number of vested Options in consideration for the relevant Exercise Price that would have been payable (Cashless Exercise Facility). By using the Cashless Exercise Facility, the holder will receive Shares to the value of the surplus after the Exercise Price has been set off. If a holder elects to use the Cashless Exercise Facility, the holder will only be issued that number of Shares (rounded down to the nearest whole number) as are equal in value to the difference between the total Exercise Price otherwise payable for the Options on the Options being exercised and the then market value of the Shares at the time of exercise (determined as the volume weighted average of the prices at which Shares were traded on the ASX during the one week period immediately preceding the exercise date) calculated in accordance with the following formula: |

| Nova Minerals Limited | Director Share Plan |

|

S = 0 x (MSP-EP) / MSP Where:

S Number of Shares to be issued on exercise of the Options.

0 Number of Options.

| MSP | Market value of the Shares (calculated using the volume weighted average prices at which Shares were traded on the ASX over the one week period immediately preceding the exercise date). |

EP Option exercise price.

If the difference between the total Exercise Price otherwise payable for the Options on the Options being exercised and the then market value of the Shares at the time of exercise (calculated in accordance with the above formula) is zero or negative, then a holder will not be entitled to use the Cashless Exercise Facility.

| (g) | Loans: A Participant may apply for a loan to fund the exercise of Options in the manner determined by the Board. The loans may bear interest or be interest-free at the discretion of the Board taking into consideration, among other things, the likelihood of adverse taxation consequences for the Company. Upon expiry of the loan to the Participant, they will have the choice of either repaying the loan in full or selling the Shares. The Board may extend the period of repayment of the loan where it sees fit. Shares acquired using the loans will be subject to a holding lock which will effectively prevent the Shares from being transferred unless the loan is either repaid or the Shares are sold to enable the loan to be repaid. The loans will also be of limited recourse in that the total amount under the loan that the participant will be liable for, including any interest, will be no greater than the value of the Shares acquired under the loan. That is, in the event the Shares obtained under the loan are sold for an amount less than the amount of the loan, the participant will only be required to repay the loan, including any interest, to the amount of the sale proceeds (in proportion to the number of Shares sold). The Company will have no other recourse against the participant in respect of the balance of the loan and any interest not met by the sale proceeds. In the event that the Shares obtained under the loan are sold for an amount greater than the amount of the loan, the Participant would be entitled to any excess of the sale proceeds over the outstanding amount of the loan (in proportion to the number of Shares sold). The Board may only approve a loan to a Participant if they remain a Participant at the time the application for a loan is made, and if the market value of the Shares underlying the Options proposed to be exercised is greater than the aggregate exercise price payable by the Participant in respect of those Options. The provision of any loan is subject to applicable law including without limitation compliance with Chapter 2E of the Corporations Act. |

| (h) | Restriction Periods: A Share issued on exercise of an Option may be made subject to a restriction period as determined by the Board in with the ESOP and as specified in the Offer for the Option. |

| Nova Minerals Limited | Director Share Plan |

|

| (i) | Change of Control: All vested Options must be exercised within 30 days of a change of control. Where vesting conditions apply, all unvested Options will vest unless the Board determines otherwise. |

| (j) | Lapse of Options: Subject to this ESOP, a Participant’s unexercised Option will lapse immediately and all rights in respect of that Option will be lost if, in respect of the Option: |

| (i) | the relevant person ceases to be an employee (permanent or otherwise) of the Company, director of the Company or ceases to provide services to the Company for any reason (including without limitation resignation or termination for cause) unless the reason is due to death, total and permanent disability or redundancy and: |

| (A) | any vesting conditions have not been met by the date the relevant person ceases to be a Participant (Ceasing Date); or | |

| (B) | where any vesting conditions have been met by the Ceasing Date or the Option is not subject to any exercise conditions, the Participant does not exercise the Option within a period of three months after the Ceasing Date (or a further date as determined by the Board after the Ceasing Date); |

| (ii) | any vesting conditions are unable to be met; or | |

| (iii) | the expiry date for the Options has passed, |

whichever is earlier.

| (k) | Power of attorney: Each Participant, in consideration of an offer, irrevocably appoints the Company and any person nominated from time to time by the Company (each an “attorney”), severally, as the Participant’s attorney to complete and execute any documents including applications for Shares and Share transfers and to do all acts or things on behalf of and in the name of the Participant which may be convenient or necessary for the purpose of giving effect to the provisions of the ESOP. |

| (m) | Restriction on transfer: Options will not be transferable except to the extent provided for by the ESOP or unless the Offer provides otherwise. |

| (n) | Quotation on ASX: Options will not be quoted on the ASX, except to the extent provided for by the ESOP or unless the Offer provides otherwise. |

| (o) | Rights attaching to Shares: Each Share issued on exercise of an Option will have the same terms and conditions as the Company’s issued Shares (other than in respect of transfer restrictions imposed by the ESOP) and it will rank equally with all other issued Shares from the issue date except for entitlements which have a record date before the issue date. |

| Nova Minerals Limited | Director Share Plan |

|

Exhibit 99.1

Exhibit 99.2

|

ASX RELEASE 10 November 2025 |

|

2025 AGM - Letter from Nova Chairman, Mr. Richard Beazley

Dear fellow shareholders

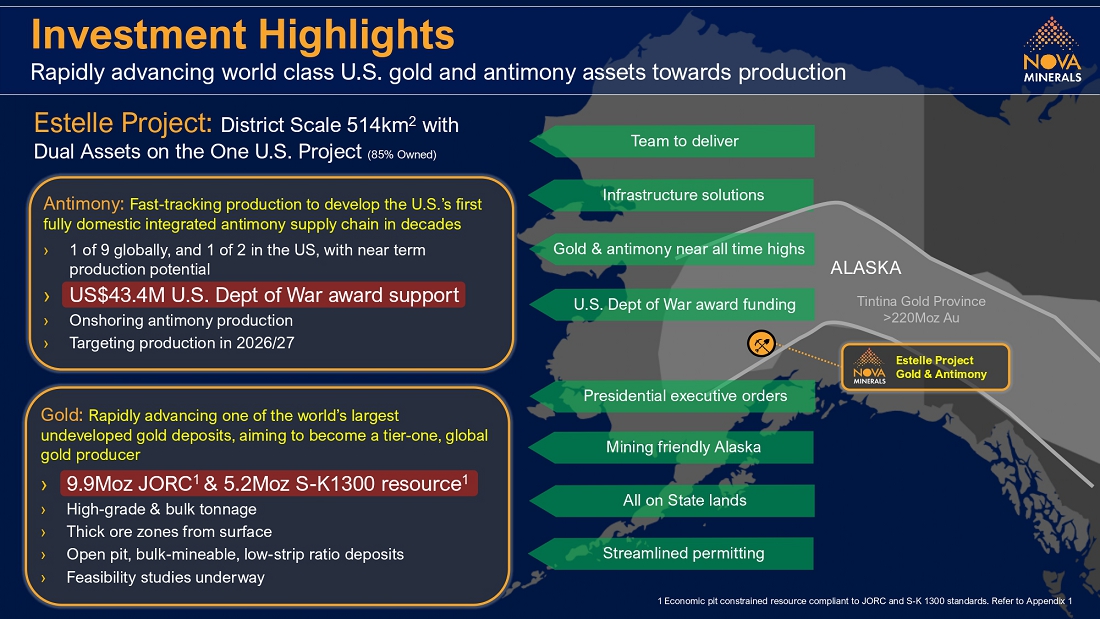

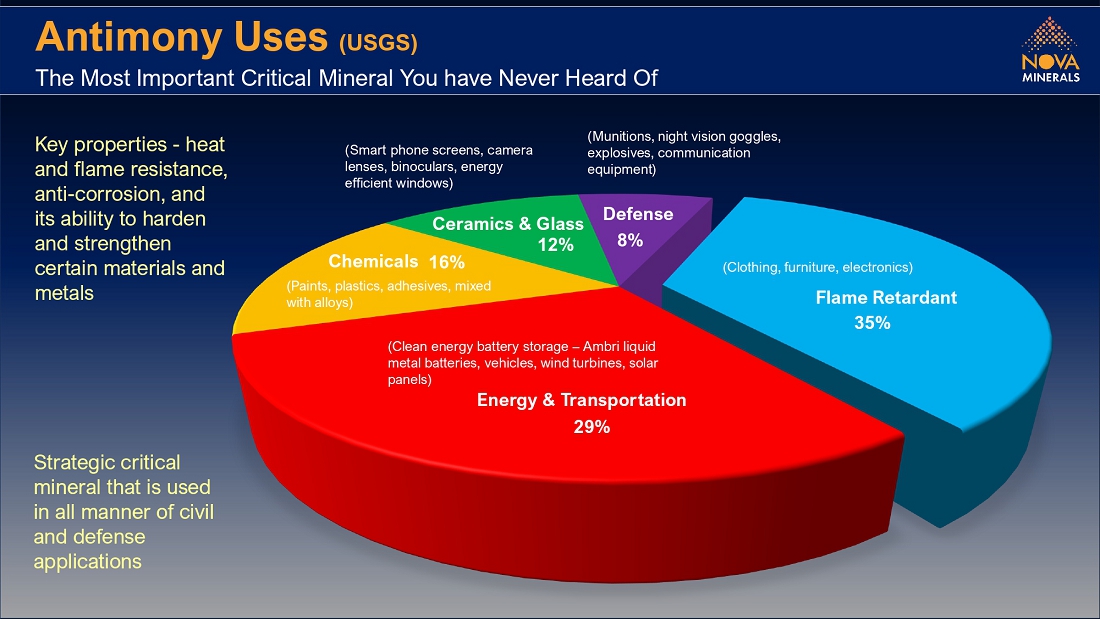

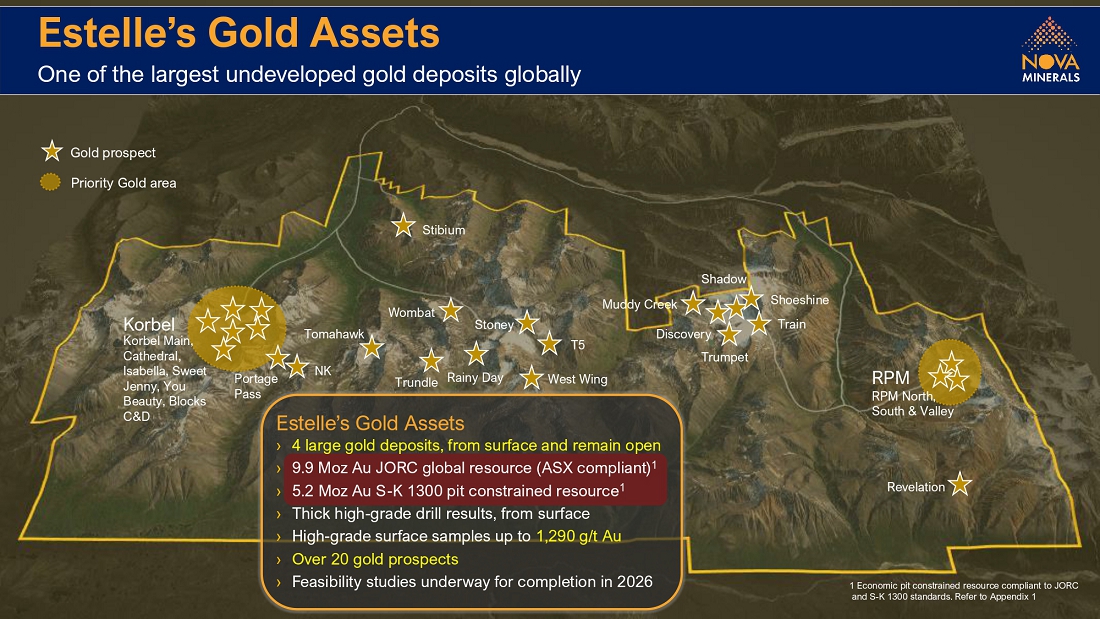

During the past year, our seventh year operating at Estelle, we believe that Nova has definitively matured in its mission to transform Estelle into a world class, tier one, global gold producer and to potentially help secure a US domestic supply chain for the strategic mineral antimony, from mining to a refined product.

In future years looking back over this period, it may be celebrated as an inflection point in the growth of the Company. Events and activities have seen a new phase of scale, opportunity and national significance come to fruition which appears to have generated an anticipation for the Board, the Nova Minerals team and our shareholders on achieving our mission.

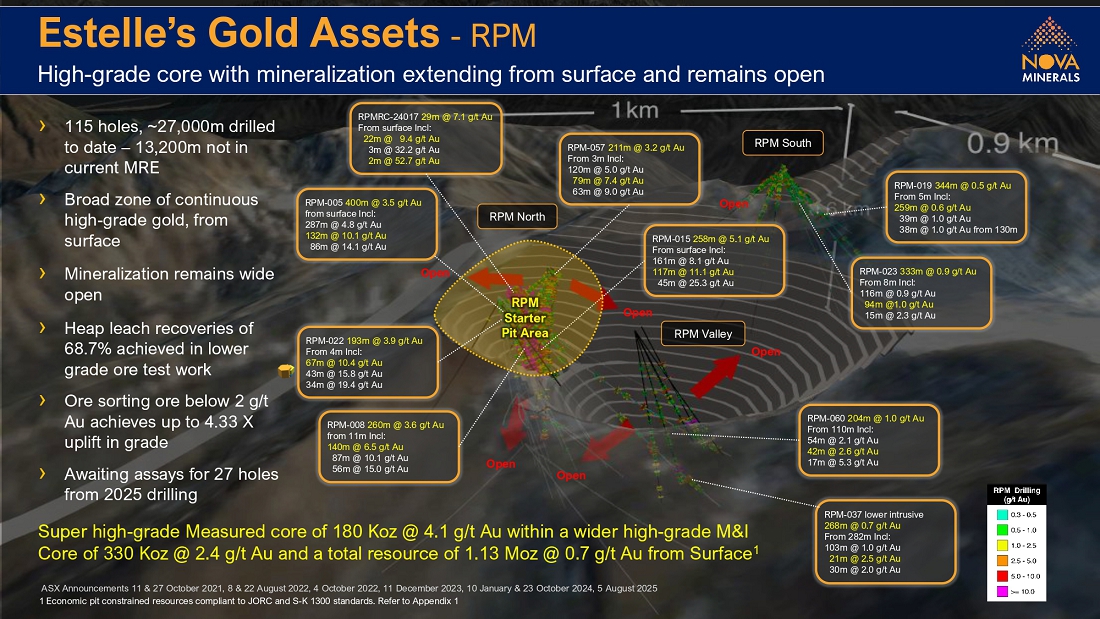

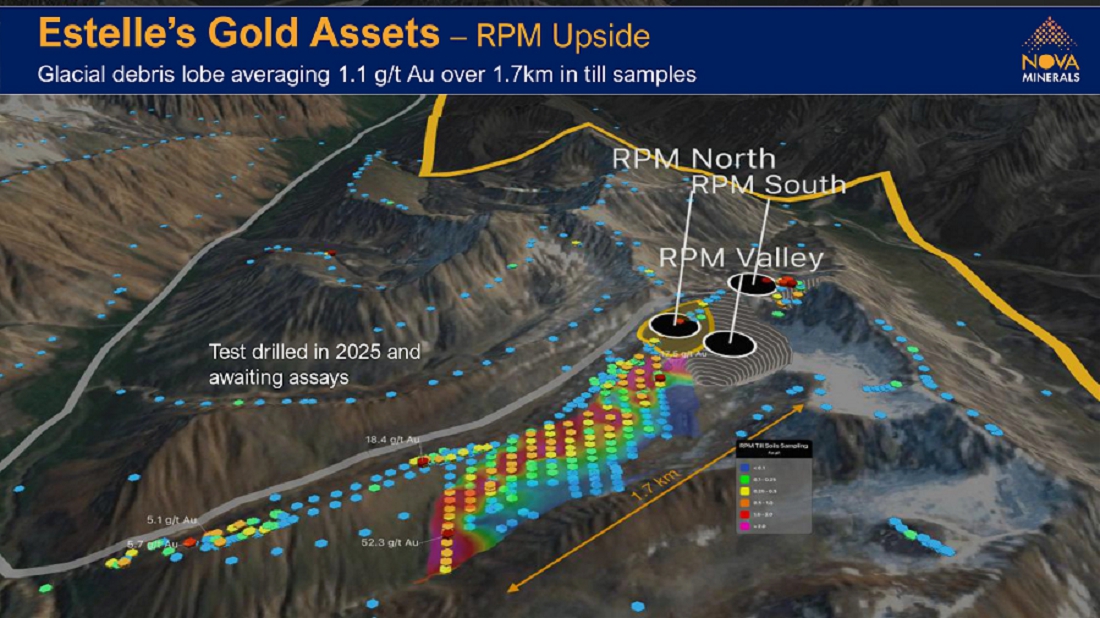

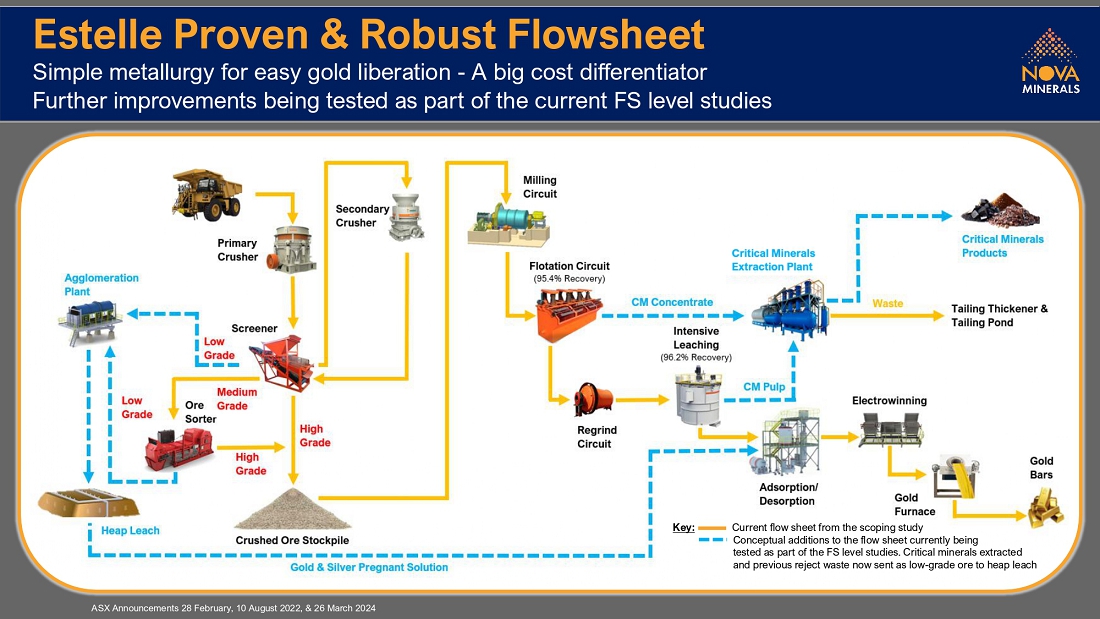

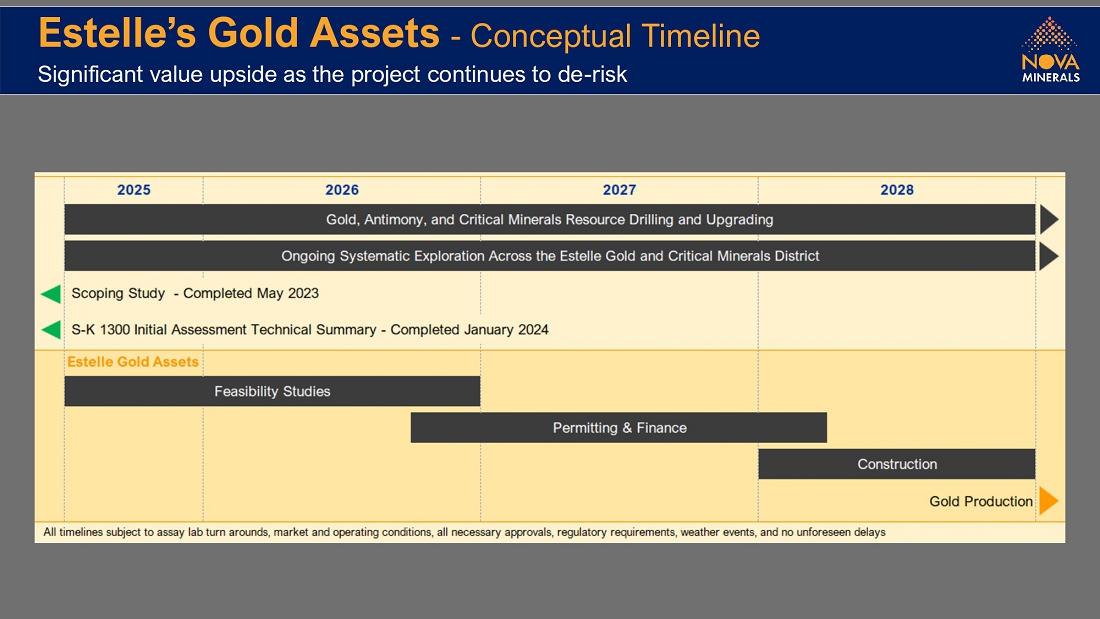

The operations saw the successful completion of the highly targeted 2024 resource and extensional drilling program at RPM, which delivered additional world-class, thick, high-grade intercepts that continue to strengthen the development story of RPM. With these outstanding results, we now eagerly await the assays pending from the 2025 drilling program, which are expected to further define and expand the mineral resources at RPM. The culmination of this work and the positive metallurgical studies will feed into next year’s feasibility studies to target a final investment decision to mine.

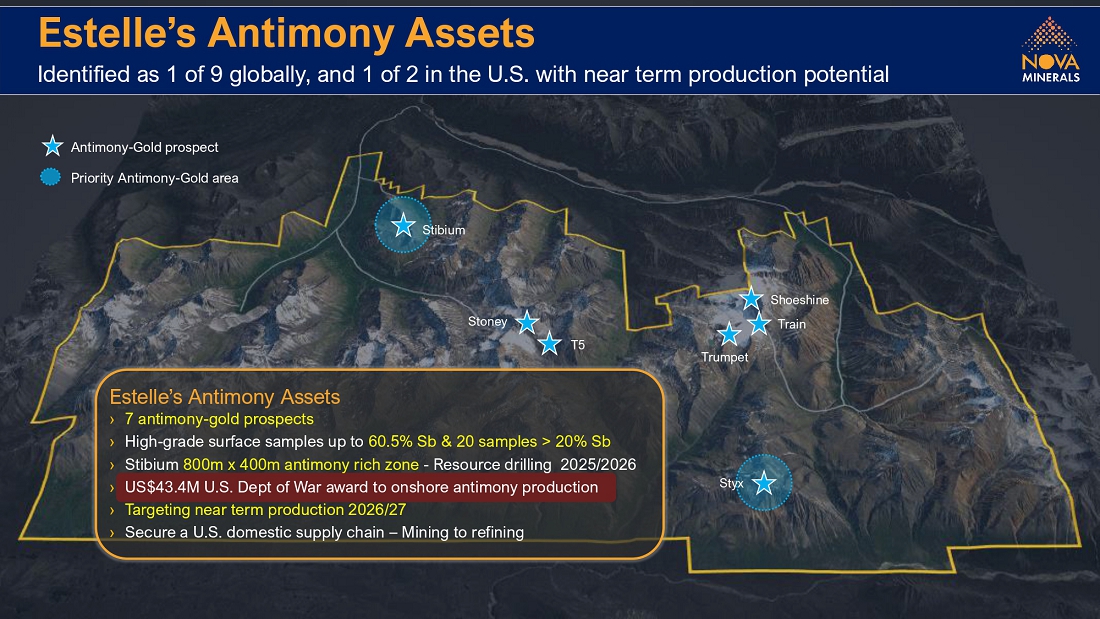

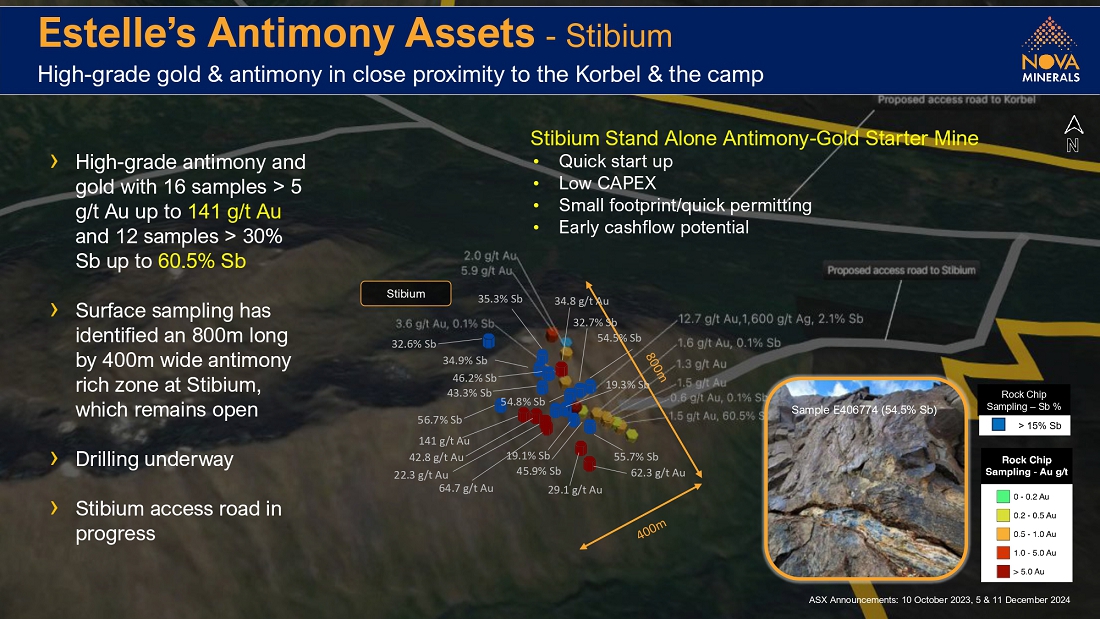

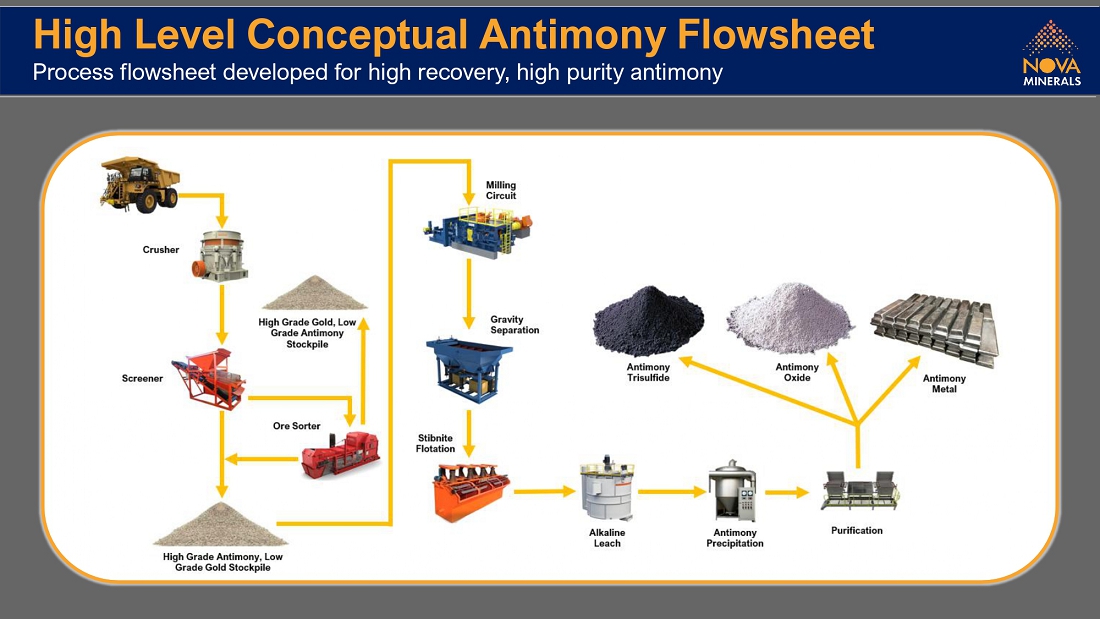

In parallel with the active drilling programs, the Company has maintained a strong focus on advancing surface exploration activities targeting both gold and antimony, which have continued to deliver numerous high-grade results. This work has highlighted the Stibium and Styx prospects as significant strategic antimony assets, each with the potential to become stand-alone projects operating alongside the RPM and Korbel gold developments. We believe that the encouraging results from the initial ore-sorting trials completed this year have further strengthened the emerging antimony opportunity.

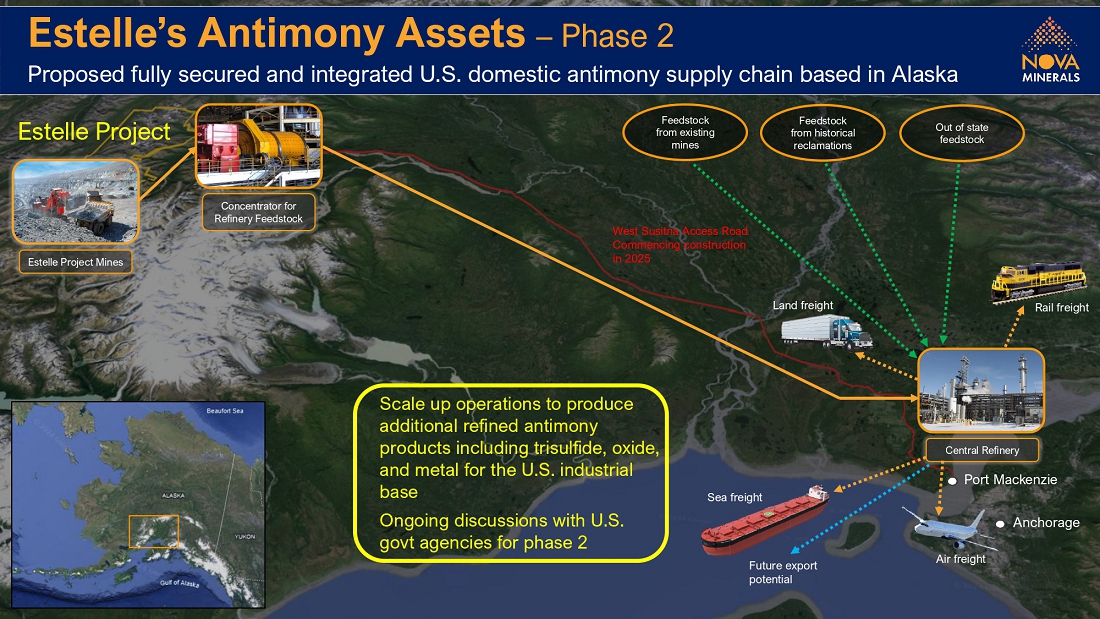

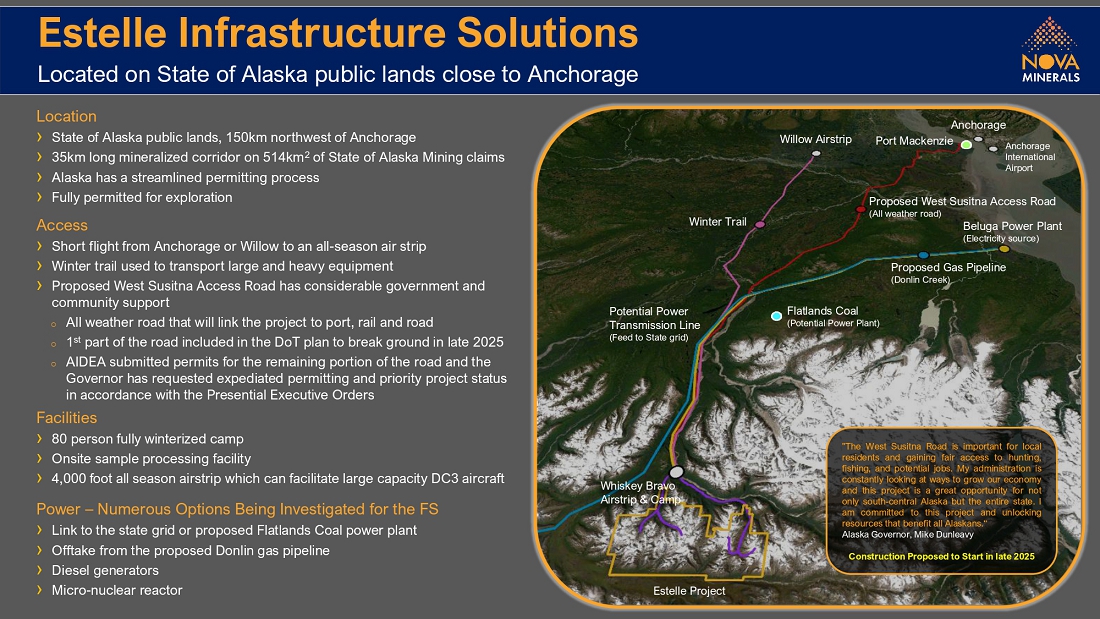

The Nova Minerals team continues to be strongly dedicated to stakeholder engagement and in particular working with the Alaskan Government on our shared commitments to building the foundational infrastructure needed to realise the Estelle projects’ full potential. These key enablers include the West Susitna Access Road development, Port Mackenzie upgrade and Alaska LNG which will support year-round access, global logistics and clean energy. These projects are not only important to Nova but will provide huge economic benefit to the state of Alaska.

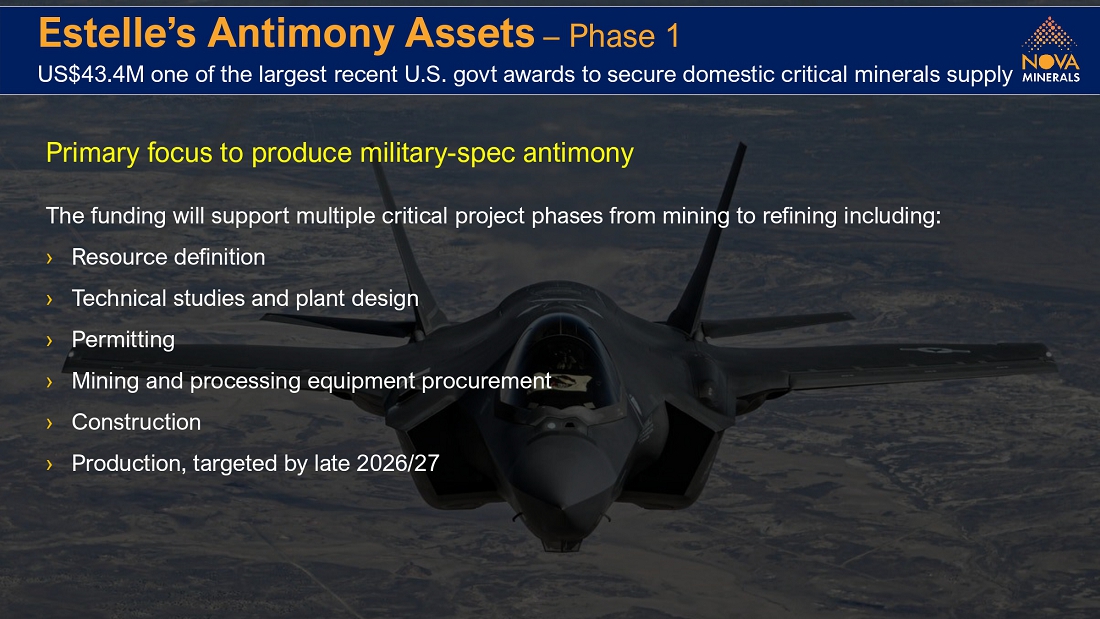

In this endeavour, the past year has seen a significant increase in executive visits to Alaska, New York, and Washington DC. These trips, which focused on investor summits and meetings with U.S. government officials, have culminated in the award of US$43.4 million, from the U.S. Department of War. The funding is intended to accelerate the development of a fully domestic, integrated antimony supply chain in Alaska.

| Main Operations | Corporate | ASX: NVA | NASDAQ: NVA | FRA: QM3 |

|

| Whiskey Bravo Airstrip | Suite 5, 242 Hawthorn Road, | www.novaminerals.com.au |

|

| Matanuska-Susitna Borough, Alaska, USA | Caulfield, VICTORIA 3161, | Email info@novaminerals.com.au | |

| 1150 S Colony Way Suite 3-440, | Australia | ||

| Palmer, AK 99645 | Phone +61 3 9537 1238 | ACN 006 690 348 |

With the U.S. Department of War’s endorsement which provides some validation to the strategic importance of Nova Minerals’ antimony assets, we continue to advance our dual-commodity strategy:

| 1. | Accelerating the development of Estelle’s gold assets — one of the largest undeveloped gold deposits globally — into a Tier 1 global gold producer, and; | |

| 2. | Fast-tracking the development of Estelle’s antimony assets to establish the first fully integrated domestic antimony supply chain in Alaska, supporting U.S. critical mineral independence. |

Corporately, Nova Minerals has monetised its investment in Snow Lake Resources realizing US$6.53 million in proceeds from the sale of our entire holding. Additionally, Nebari converted the full outstanding balance of the their convertible note in January 2025 resulting in Nova Minerals being debt free.

In September 2025 the Company also made a strategic cornerstone investment of 7.8% in Adelong Gold Limited, a gold-antimony explorer and near-term producer with high-grade projects in Australia and Brazil. We believe this investment allows us to partner with undervalued, high-growth resource companies offering strong exploration and production potential.

As of the close of the September 2025 quarter, we had access to over A$86.3 million in funding comprising of, A$17.5 million in cash, US$43.4 million (A$65.5 million) 24 month award from the U.S. Department of War to support antimony production in Alaska, and approximately ~A$3.3million in liquid investments, with no debt.

On a broader outlook, in our opinion, the global economy remains dynamic and uncertain with the various tensions and conflicts around the globe, the changing political outlooks, and the inflationary effects and weakness in the US dollar. We believe the results of these events could continue to culminate in the central banks around the world continuing to buy up gold bullion putting upward pressure on gold prices and a focus in the western world to mitigate strategic risk for critical minerals supply with the development of independent supply chains.

These impacts allow us to remain optimistic about the rising importance of gold and antimony in the marketplace and take the view that we are well placed to recognise this significant upside.

We will continue to strive for de-risking of the project and the establishment of a solid foundation for future growth through the prudent allocation of capital.

As always, we want to actively engage with all our stakeholders as we continue in creating value

through the development of the Estelle gold and critical minerals district. With that in mind I would like to acknowledge the diligent contributions from the Nova team, supporting stakeholders, and fellow Board of Directors for another immense year with all its achievements. We believe that Novais well position for another exciting year ahead and we look forward to updating the market on our progress.

Richard Beazley

Non-executive Chairman

Further discussion and analysis of the Estelle Project is available through the interactive Vrify 3D animations, presentations, and videos, all available on the Company’s website. www.novaminerals.com.au

Nova Minerals Limited | ASX Announcement |

|

This announcement has been authorized for release by the Executive Directors.

|

Christopher Gerteisen CEO and Executive Director E: info@novaminerals.com.au |

Craig Bentley Director of Finance & Compliance & Investor Relations E: craig@novaminerals.com.au M: +61 414 714 196 |

Ian Pamensky Company Secretary E: info@novaminerals.com.au |

About Nova Minerals Limited

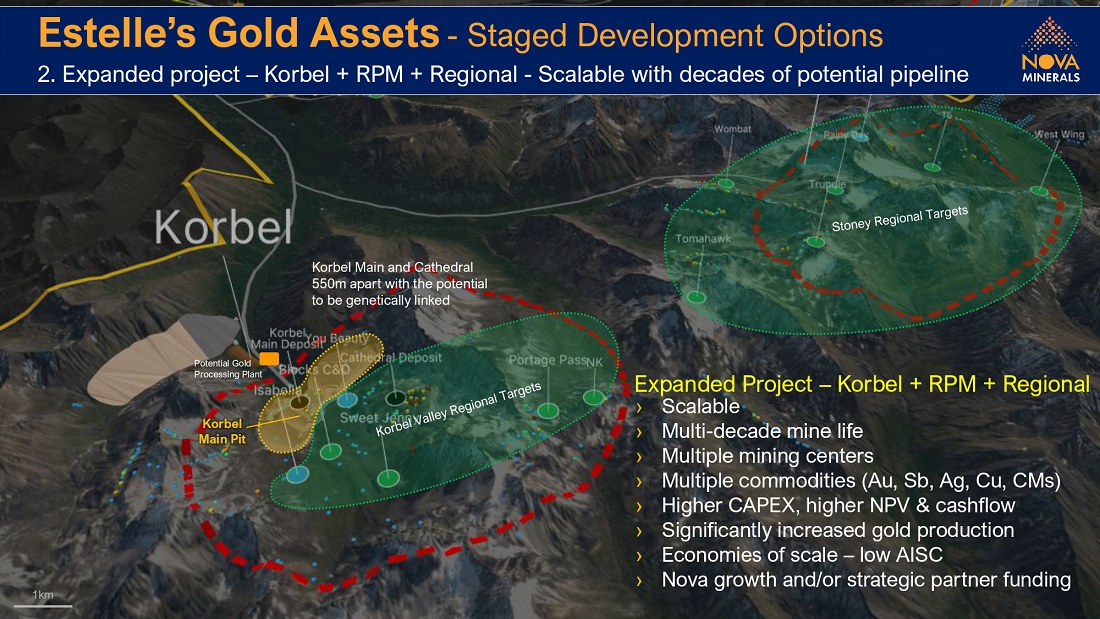

Nova Minerals Limited is a Gold, Antimony and Critical Minerals exploration and development company focused on advancing the Estelle Project, comprised of 514 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 advanced Gold and Antimony prospects, including two already defined multi-million ounce resources, and several drill ready Antimony prospects with massive outcropping stibnite vein systems observed at surface. The 85% owned project is located 150 km northwest of Anchorage, Alaska, USA, in the prolific Tintina Gold Belt, a province which hosts a >220 million ounce (Moz) documented gold endowment and some of the world’s largest gold mines and discoveries including, Nova Gold and Paulson Advisors Donlin Creek Gold Project and Kinross Gold Corporation’s Fort Knox Gold Mine. The belt also hosts significant Antimony deposits and was a historical North American Antimony producer.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget” “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or indicates that certain actions, events or results “may”, “could”, “would”, “might” or “will be” taken, “occur” or “be achieved.” Forward-looking information is based on certain factors and assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, Gold and other metal prices, the estimation of initial and sustaining capital requirements, the estimation of labor costs, the estimation of mineral reserves and resources, assumptions with respect to currency fluctuations, the timing and amount of future exploration and development expenditures, receipt of required regulatory approvals, the availability of necessary financing for the Project, permitting and such other assumptions and factors as set out herein. apparent inconsistencies in the figures shown in the MRE are due to rounding Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in Gold prices; sources and cost of power and water for the Project; the estimation of initial capital requirements; the lack of historical operations; the estimation of labor costs; general global markets and economic conditions; risks associated with exploration of mineral deposits; the estimation of initial targeted mineral resource tonnage and grade for the Project; risks associated with uninsurable risks arising during the course of exploration; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support exploration activities; risks associated with changes in the mining regulatory regime governing the Company and the Project; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued exploration and development activities at the Project may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of the Company; the risk of litigation.

Although the Company has attempted to identify important factors that cause results not to be as anticipated, estimated or intended, there can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Forward looking information is made as of the date of this announcement and the Company does not undertake to update or revise any forward-looking information which is included herein, except in accordance with applicable securities laws. All drilling and exploration activities is subject to no unforeseen circumstances.

Nova Minerals Limited | ASX Announcement |

|

Exhibit 99.3