UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2025

CIMG Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 001-39338 | 38-3849791 | ||

|

(State or other jurisdiction of incorporation or organization |

(Commission File No.) |

(IRS Employer Identification No.) |

Room R2, FTY D, 16/F, Kin Ga Industrial Building,

9 San On Street, Tuen Mun, Hong Kong 00000

(Address of principal executive offices)

+ 852 70106695

Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.00001 par value | IMG | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

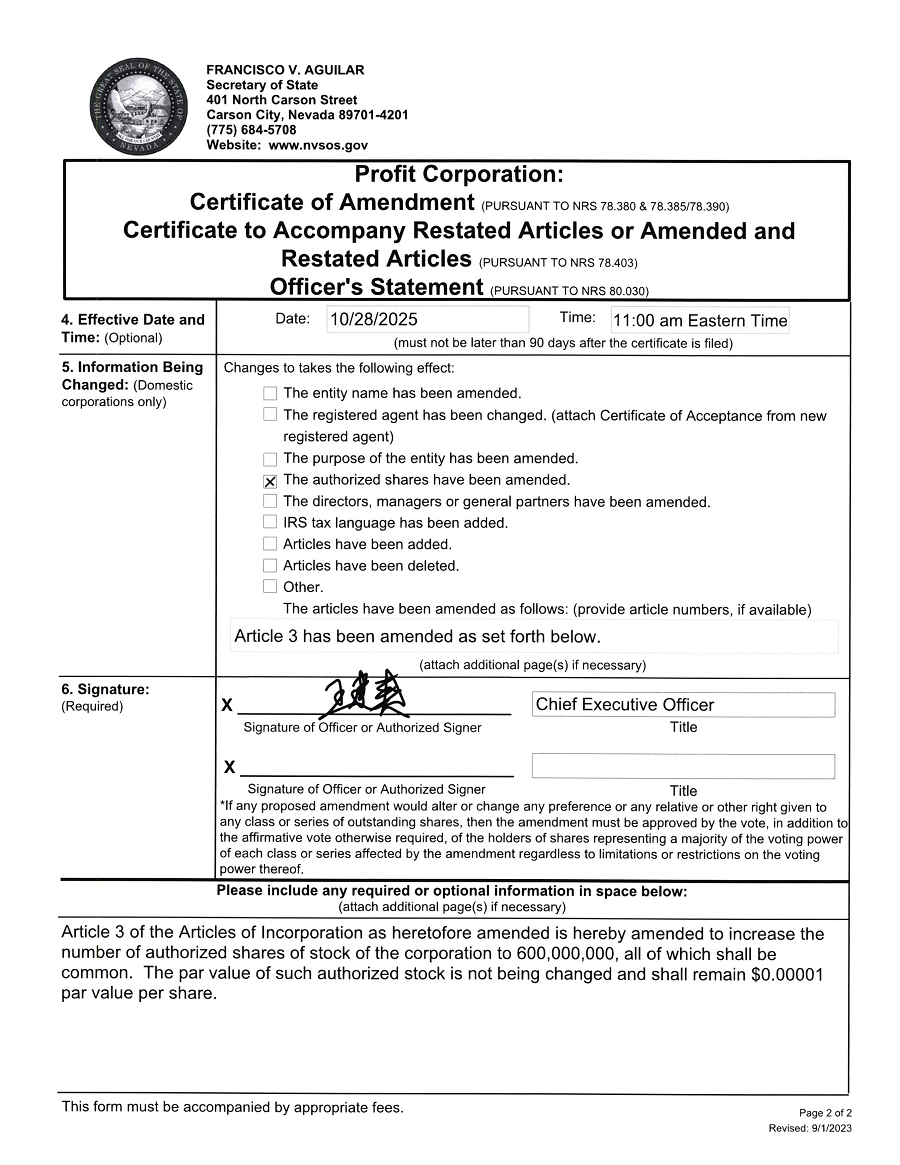

On October 28, 2025, CIMG Inc, a Nevada corporation (the “Company”) filed a Certificate of Amendment (the “Certificate of Amendment”) to the Company’s Articles of Incorporation (the “Articles of Incorporation”) with the Secretary of State of Nevada to increase the number of authorized shares of the Company’s common stock, par value $0.00001 per share (the “Common Stock”) from 200,000,000 to 600,000,000 and to make a corresponding change to the number of authorized shares of capital stock, effective as of 11:00 a.m. (New York time) on October 28, 2025 (the “Increase of Authorized Shares”). As reported below under Item 5.07 of this report, the Company held CIMG Inc. 2025 Annual Meeting of Stockholders (the “Annual Meeting”) on October 28, 2025, at which meeting the Company’s stockholders approved an amendment to the Articles of Incorporation to authorize the Company to effect the Increase of Authorized Shares. Following the Annual Meeting, the Company effected the Increase of Authorized Shares on October 28, 2025.

The information set forth herein is qualified in its entirety by reference to the complete text of the Certificate of Amendment, a copy of which is filed with this report as Exhibit 3.1.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On October 28, 2025, at 10:00 a.m. (Eastern time), the Company held its virtual Annual Meeting.

A quorum was present for the Annual Meeting. At the Annual Meeting, four proposals were submitted to the stockholders for approval as set forth in the definitive Proxy Statement (the “Proxy Statement”) as filed with the U.S. Securities and Exchange Commission (the “SEC”) on October 6, 2025. As of the record date, September 30, 2025, a total of 196,514,084 shares of Common Stock were issued and outstanding and entitled to vote. The holders of record of 156,695,414 shares of Common Stock were present in person or represented by proxy at said meeting. Such amounts represented approximately 79.74% of the Common Stock entitled to vote at such meeting and of the Company’s total voting power.

At the Annual Meeting, the stockholders approved six of the six proposals submitted. The votes on the proposals were cast as set forth below:

| 1. | Election of the five nominees to the Board: |

| Name | Votes For | Votes Against | Abstain | Broker Non-Votes |

||||||||||||

| Jianshuang Wang | 156,496,876 | 171,107 | 27,431 | |||||||||||||

| Zongmei Huang | 156,572,485 | 95,476 | 27,453 | |||||||||||||

| Yanli Hou | 156,573,551 | 94,410 | 27,453 | |||||||||||||

| Changzheng Ye | 156,572,346 | 95,615 | 27,453 | |||||||||||||

| Jinmei Guo Hellstroem | 156,599,836 | 95,125 | 453 | |||||||||||||

Each director nominee was elected to serve as a director until the Company’s 2026 annual meeting of stockholders, or until such person’s successor is duly elected and qualified, or until such person’s earlier resignation, death, or removal. The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting in person or represented by proxy and entitled to vote was required for approval. The proposal was approved.

| 2. | To approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers.. |

| Votes For | Votes Against | Abstentions | ||

| 156,563,197 | 131,430 | 787 |

The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting in person or represented by proxy and entitled to vote was required for approval. The proposal was approved.

| 3. | To approve the adoption of the CIMG Inc. 2026 Equity Incentive Plan. |

| Votes For | Votes Against | Abstentions | ||

| 156,513,223 | 181,863 | 328 |

The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting in person or represented by proxy and entitled to vote was required for approval. The proposal was approved.

| 4. | The approval of an amendment to the Company’s Articles of Incorporation to increase the number of shares of common stock, par value $0.00001 per share, authorized for issuance from 200,000,000 to 600,000,000. |

| Votes For | Votes Against | Abstentions | Broker Non-Votes | |||

| 156,380,013 | 312,687 | 2,713 |

The affirmative vote of the holders of a majority of the voting power of the issued and outstanding shares of Common Stock of the Company was required for approval. The proposal was approved.

| 5. | The ratification of the selection by our Board of Assentsure PAC, our independent auditor for the fiscal year ended September 30, 2025. |

| Votes For | Votes Against | Abstentions | ||

| 156,599,235 | 94,452 | 1,727 |

The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting in person or represented by proxy and entitled to vote was required for approval. The proposal was approved.

| 6. | The approval of the transaction of such other business as may properly come before the annual meeting or any adjournment or postponement thereof, including, if necessary or advisable, the adjournment of the annual meeting to solicit additional proxies: |

| Votes For | Votes Against | Abstentions | Broker Non-Votes | |||

| 156,599,235 | 94,452 | 1,727 |

The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting in person or represented by proxy and entitled to vote was required for approval. The proposal was approved.

For more information about the foregoing proposals, see the Proxy Statement, the relevant portions of which are incorporated herein by reference. The results reported above are final voting results. No other matters were considered or voted upon at the Annual Meeting.

Item 7.01 Regulation FD Disclosure.

On October 31, 2025, the Company issued a press release announcing the Company’s Subsidiary has been authorized as a distributor of Inspur Electronic Information Industry Co., Ltd., a copy of which is attached hereto as Exhibit 99.1.

The information in this Item 7.01, including Exhibit 99.1 to this report, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liability under that section or Section 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information contained in this Item 7.01 and Exhibit 99.1 shall not be incorporated by reference into any filing under the Exchange Act or the Securities Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 3.1 | Certificate of Amendment to the Articles of Incorporation of CIMG Inc., dated October 28, 2025. | |

| 99.1 | Press Release announcing CIMG Inc.’s Subsidiary has been authorized as a distributor of Inspur Electronic Information Industry Co., Ltd., issued October 31, 2025. | |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| CIMG Inc. | ||

| Dated: October 31, 2025 | By: | /s/ Jianshuang Wang |

| Name: | Jianshuang Wang | |

| Title: | Chief Executive Officer | |

Exhibit 3.1

Exhibit 99.1

CIMG Inc's Subsidiary Becomes Authorized Distributor for Inspur Information, in a Strategic Move to Expand Into the High-Growth Computing Power Industry

BEIJING, Oct. 31, 2025 /PRNewswire/ — CIMG Inc. (“CIMG” or the “Company”) (Nasdaq: IMG), a business group specializing in digital health and sales development, which utilizes technology and marketing to enhance its partners’ sales growth and commercial value, today announced that its subsidiary, Beijing Xinmiao Times Technology Development Co., Ltd. (“Xinmiao Times”), has been authorized as a distributor of Inspur Electronic Information Industry Co., Ltd. (“Inspur Information”), enabling it to sell Inspur products through offline channels.

This authorization marks Xinmiao Times’ official entry into the high-growth computing power industry and represents a significant step for CIMG in expanding its footprint in this sector.

Inspur Information is a leading provider of IT infrastructure products in China. Its core businesses include the R&D, production, and sales of computing infrastructure products such as servers, as well as delivering full-stack AI computing solutions.

Alice Wang, Chairwoman and Chief Executive Officer of CIMG, stated, “The collaboration with Inspur aligns with CIMG’s long-term strategy to deepen our presence in the computing power industry. As a global leader in computing infrastructure, Inspur’s product technology and ecosystem resources complement our channel presence in the digital health industry. This partnership will help us build differentiated competitive advantages.”

About CIMG Inc.

CIMG Inc. is a global business group in the digital health industry, built around cryptocurrency strategies. The company leverages AI and cryptocurrencies (such as Bitcoin and stablecoins) to drive industry growth, helping clients maximize user acquisition and brand management value. Its current portfolio includes brands like Kangduoyuan, Maca-Noni, Qianmao, Huomao, and Coco-mango.

Forward-Looking Statements

This press release contains information about the Company’s view of its future expectations, plans and prospects that constitute forward-looking statements. Actual results may differ materially from historical results or those indicated by these forward-looking statements as a result of a variety of factors including, but not limited to, risks and uncertainties associated with its ability to raise additional funding, its ability to maintain and grow its business, variability of operating results, its ability to maintain and enhance its brand, its development and introduction of new products and services, the successful integration of acquired companies, technologies and assets into its portfolio of products and services, marketing and other business development initiatives, competition in the industry, general government regulation, economic conditions, dependence on key personnel, the ability to attract, hire and retain personnel who possess the technical skills and experience necessary for its operations, and its ability to protect its intellectual property. There cannot be any assurance that the Company and Flock well enter into a definitive agreement. The Company encourages you to review other factors that may affect its future results in the Company’s annual reports and in its other filings with the Securities and Exchange Commission.

For more information, please contact:

http://www.ccmg.tech

ir@ccmg.tech