UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 16, 2025

KOPIN CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 000-19882 | 04-2833935 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

125 North Drive, Westborough, MA 01581

(Address of principal executive offices) (Zip Code)

(508) 870-5959

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock, par value $0.01 | KOPN | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Definitive Material Agreement. |

On October 16, 2025, Kopin Corporation (the Company) announced that the previously announced $15 Million Strategic Investment from Theon International Plc (the Agreements) had been completed.

Under the terms of the Agreements, Theon acquired a 49% interest in Kopin’s subsidiary, Kopin Europe Ltd. for $8.0 million and the parties entered into a licensing and development agreement and funding agreements relating to the joint development of military products.

In addition, Theon purchased $7.0 million worth of shares of Series A Convertible Preferred Stock, par value $0.01 per share, of Kopin (the “Preferred Stock”). Each share of the Preferred Stock is convertible into shares of common stock, par value $0.01 per share, of the Company (the “Common Stock”) at an initial fixed conversion price of $3.00 per share, pursuant to the terms of the Certificate of Designation for Series A Convertible Preferred Stock of the Company (the “Certificate of Designations”). Kopin will have the ability to force the conversion of the preferred stock into common stock once Kopin’s common stock trades at $5.50 per share or higher for 10 Trading Days (as defined in the Certificate of Designation) within a 30 consecutive Trading Day period. The Preferred Stock will carry an annual dividend of at the base rate dividend rate of 4%, payable in cash and stock.

| Item 3.02. | Unregistered Sales of Equity Securities. |

The disclosure under Item 1.01 above is incorporated herein by reference.

| Item 5.03, | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On October 15, 2025 the Company filed a Certificate of Designation of Series A Convertible Preferred Stock to amend its Certificate of Incorporation of Kopin Corporation to incorporate the terms of the Series A Convertible Preferred Stock sale disclosed under Item 1.01

| Item 7.01 | Regulation FD. |

The Company has issued a press release, dated October 16, 2025, announcing the closing of the $15 Million Strategic Investment from Theon International Plc.. The press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein. The information furnished in Exhibit 99.1 hereto shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into future filings by the Company under the Securities Act of 1933, as amended, or under the Exchange Act, unless the Company expressly sets forth in such future filings that such information is to be considered “filed” or incorporated by reference therein.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Certificate of Designation of Series A Convertible Preferred Stock. | |

| 99.2 | Kopin Corporation Announces “Kopin and THEON International Advance Alliance Following Direct Foreign Investment (DFI) Approval of $15M Agreement & Additional $8M Joint Development” | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Kopin Corporation | ||

| (Registrant) | ||

| By: | /s/ Erich Manz | |

| Name: | Erich Manz | |

| Title: | Treasurer and Chief Financial Officer | |

| (Principal Financial and Accounting Officer) | ||

Date: October 16, 2025

Exhibit 99.1

CERTIFICATE OF DESIGNATION

OF

SERIES A CONVERTIBLE PREFERRED STOCK

OF

KOPIN CORPORATION

(Pursuant to Section 151 of the

Delaware General Corporation Law)

The following resolutions were duly adopted by the Board of Directors (the “Board of Directors”) of Kopin Corporation, a Delaware corporation (the “Corporation”), pursuant to the provisions of Section 151 of the General Corporation Law of the State of Delaware:

WHEREAS, the Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), provides for a class of its authorized stock known as preferred stock, consisting of 3,000 shares, $0.01 par value, issuable from time to time in one or more series;

WHEREAS, pursuant to the Certificate of Incorporation, the Board of Directors is authorized to establish and designate the different series of preferred stock and to fix and determine the voting powers, full or limited, or no voting powers, and such designations, preferences and relative, participating, optional or other special rights and qualifications, limitations or restrictions thereof, as shall be stated in a resolution or resolutions providing for the issue of such series adopted by the Board of Directors, which powers, preferences, rights, qualifications, limitations and restrictions need not be uniform among series; and

WHEREAS, it is the desire of the Board of Directors to fix the designations, preferences rights and other matters relating to a new series of preferred stock, which shall consist of 1,500 shares of preferred stock which the Corporation has the authority to issue as follows:

NOW, THEREFORE, BE IT RESOLVED, that, pursuant to the authority set forth in Article IV.B of the Certificate of Incorporation of the Corporation, the Board of Directors hereby fixes the designations, preferences and relative, participating, optional or other special rights, and qualifications, limitations and restrictions thereof, of a series of the preferred stock as follows:

TERMS OF SERIES A CONVERTIBLE PREFERRED STOCK

Section 1. Designation and Amount. There is hereby authorized for issuance a series of preferred stock, par value $0.01 per share. The shares of such series shall be designated as “Series A Convertible Preferred Stock” (the “Preferred Stock”) and the number of shares constituting the Preferred Stock shall be One Thousand Five Hundred (1,500). Subject to and in accordance with the provisions of Section 11(b), such number of shares may be increased or decreased by resolution of the Board of Directors; provided, that no decrease shall reduce the number of Preferred Stock to a number less than the number of shares then outstanding plus the number of shares reserved for issuance upon the exercise of outstanding options, rights or warrants or upon the conversion of any outstanding securities issued by the Corporation convertible into Preferred Stock.

Section 2. Rank. Each share of Preferred Stock shall rank equally in all respects and shall be subject to the provisions herein. The Preferred Stock shall, with respect to payment of dividends, redemption payments or rights (including as to the distribution of assets) upon Liquidation (as defined below), (i) rank senior and prior to the Corporation’s common stock, par value $0.01 per share (the “Common Stock”) and each other class or series of equity securities of the Corporation, whether currently issued or issued in the future, that by its terms does not expressly rank senior to, or on parity with, the Preferred Stock as to payment of dividends, redemption payments, rights (including as to the distribution of assets) upon Liquidation, or otherwise (all such equity securities, including the Common Stock, are collectively referred to herein as “Junior Securities”) (ii) rank junior to the Corporation’s debt obligations and each class or series of equity securities of the Corporation, whether currently issued or issued in the future in accordance with the terms hereof, that by its terms expressly ranks senior to the Preferred Stock as to payment of dividends, redemption payments, rights (including as to the distribution of assets) upon Liquidation, or otherwise (all such equity securities are collectively referred to herein as “Senior Securities”) and (iii) rank on parity with each class or series of equity securities of the Corporation, whether currently issued or issued in the future in accordance with the terms hereof, that expressly provides that it ranks on parity with the Preferred Stock as to payment of dividends, redemption payments, rights (including as to the distribution of assets) upon Liquidation, or otherwise (all such equity securities are collectively referred to herein as “Parity Securities”). The respective definitions of Junior Securities, Senior Securities and Parity Securities shall also include any securities, rights or options exercisable or exchangeable for or convertible into any of the Junior Securities, Senior Securities or Parity Securities, as the case may be.

Section 3. Definitions.

(a) As used herein, the following terms shall have the meanings set forth below or in the Section cross-referenced below, as applicable, whether used in the singular or the plural:

“Accrued Dividends” means, as of any date, with respect to any Preferred Stock, all dividends that have accrued in respect of such share pursuant to Section 4(a)(i) but that have not been paid as of such date as Cash Dividends.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly controlling, controlled by or under common control with, such Person.

“Base Amount” means, with respect to any Preferred Stock, as of any date, the sum of (x) the Liquidation Preference and (y) the Base Amount Accrued Dividends with respect to such share as of such date.

“Base Amount Accrued Dividends” means, with respect to any Preferred Stock, as of any date, (i) if a Preferred Dividend Payment Date has occurred since the issuance of such share, the Accrued Dividends with respect to such share as of the preceding Preferred Dividend Payment Date (taking into account the payment of Preferred Dividends in respect of such period ending on such preceding Preferred Dividend Payment Date, if any, as of such Preferred Dividend Payment Date) or (ii) if no Preferred Dividend Payment Date has occurred since the issuance of such share, zero.

|

|

“Base Dividend Rate” means, for any day, 2.00% per annum.

“Beneficially Own” and “Beneficial Ownership” has the meaning given such term in Rule 13d-3 under the Exchange Act, and a Person’s beneficial ownership of Equity Interests of any Person shall be calculated in accordance with the provisions of such rule, but without taking into account any contractual restrictions or limitations on voting or other rights; provided, that for purposes of determining beneficial ownership, a Person shall be deemed to be the beneficial owner of any security which may be acquired by such Person, whether within sixty (60) days or thereafter, upon the conversion, exchange or exercise of any warrants, options, rights or other securities.

“Beneficial Ownership Limitation” shall have the meaning set forth in Section 10(a).

“Board of Directors” means the board of directors of the Corporation or any committee thereof duly authorized to act on behalf of such board of directors for the purposes in question.

“Business Day” means any day that is not a Saturday, a Sunday or any other day on which commercial banks are generally required or authorized by Law to be closed in the State of Delaware.

“By-Laws” means the Sixth Amended and Restated By-Laws of the Corporation, as amended from time to time.

“Cash Dividend” has the meaning set forth in Section 4(a)(i).

“Certificate of Incorporation” means the Amended and Restated Certificate of Incorporation of the Corporation, as amended from time to time.

“Change of Control” means the occurrence, directly or indirectly, of any of the following:

(i) any purchase, merger, acquisition or other transaction or series of related transactions immediately following which any Person or Group (excluding the Investor or its Affiliates or any Group including the Investor or its Affiliates) shall Beneficially Own, directly or indirectly, Voting Stock entitling such Person or Group to exercise more than 50% of the total voting power of all classes of Voting Stock of the Corporation, other than as a result of any such transaction in which (x) the holders of securities that represented 100% of the Voting Stock of the Corporation immediately prior to such transaction are substantially the same as the holders of securities that represent a majority of the total voting power of all classes of Voting Stock of the surviving Person or any parent entity thereof immediately after such transaction and (y) the holders of securities that represented 100% of the Voting Stock of the Corporation immediately prior to such transaction own directly or indirectly Voting Stock of the surviving Person or any parent entity thereof in substantially the same proportion to each other as immediately prior to such transaction;

|

|

(ii) any transaction or series of related transactions immediately following which the Persons who Beneficially Own the Voting Stock of the Corporation immediately prior to such transaction or transactions cease to Beneficially Own more than 50% of the Voting Stock of the Corporation, any successor thereto or any parent entity thereof immediately following such transaction or transactions; or

(iii) (x) the Corporation merges or consolidates with or into any other Person, another Person merges with or into the Corporation, or the Corporation conveys, sells, transfers or leases all or substantially all of the Corporation’s assets to another Person (other than a wholly-owned Subsidiary of the Corporation), or (y) the Corporation engages in any recapitalization, reclassification or other transaction in which all or substantially all of the Common Stock are exchanged for or converted into cash, securities or other property, in each case of clauses (x) and (y), other than any such transaction: (A) that does not result in a reclassification, conversion, exchange or cancellation of the outstanding Common Stock; (B) which is effected solely to change the Corporation’s jurisdiction of incorporation and results in a reclassification, conversion or exchange of outstanding Common Stock solely into shares of common stock (or equivalent) of the surviving entity; or (C) where the Voting Stock of the Corporation outstanding immediately prior to such transaction remains, or is converted into or is exchanged for, Voting Stock of the surviving or transferee Person constituting a majority of the outstanding shares of Voting Stock of such surviving or transferee Person (immediately after giving effect to such merger or consolidation).

“Change of Control Effective Date” has the meaning set forth in Section 8(a).

“Change of Control Redemption” has the meaning set forth in Section 8(a).

“Change of Control Redemption Notice” has the meaning set forth in Section 8(b).

“COC Redemption Price” has the meaning set forth in Section 8(a).

“COI Amendment” means an amendment to the Certificate of Incorporation.

“Common Stock Trading Price” means, as of any Trading Day, the closing price of a Common Stock on such Trading Day (as reported on Bloomberg, based on composite transactions for the Trading Market).

“Common Stock” has the meaning set forth in Section 2.

“control” (including the terms “controlling” “controlled by” and “under common control with”) with respect to the relationship between or among two or more Persons, means the possession, directly or indirectly, of the power to direct or cause the direction of the affairs or management of a Person, whether through the ownership of voting securities, as trustee or executor, by contract or otherwise.

“Conversion Date” has the meaning set forth in Section 6(b)(iv).

“Conversion Notice” has the meaning set forth in Section 6(b)(ii).

“Conversion Option” has the meaning set forth in Section 6(a)(i)(A).

|

|

“Conversion Option Date” has the meaning set forth in Section 6(a)(i)(A).

“Conversion Option Measurement Period” has the meaning set forth in Section 6(a)(i)(A).

“Conversion Price” means, as of any date, the Initial Conversion Price, as adjusted pursuant to Section 9.

“Conversion Right” has the meaning set forth in Section 6(a)(i)(B).

“Convertible Preferred Stock Purchase Agreement” means that certain Series A Convertible Preferred Stock Purchase Agreement, dated as of August 8, 2025, by and between the Corporation and the Investor, as may be amended from time to time.

“Convertible Securities” means indebtedness or Equity Interests convertible into or exchangeable for Common Stock.

“Corporation” means Kopin Corporation, a Delaware corporation.

“Dividend Payment Record Date” has the meaning set forth in Section 4(a)(ii).

“Dividend Rate” means, for any day, the Base Dividend Rate as increased by the Noncompliance Additional Rate, if any, applicable on such day pursuant to Section 4(b).

“Equity Interests” of any Person means any and all shares, interests (including partnership interests), rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) equity of such Person, including any preferred stock, but excluding any debt securities convertible into such equity.

“Ex-Date” means, when used with respect to any distribution, the first date on which the Common Stock or other securities in question do not have the right to receive the distribution giving rise to an adjustment to the Conversion Price.

“Excess Amount” shall have the meaning set forth in Section 10(b).

“Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time.

“Exchange Property” has the meaning set forth in Section 7(a).

“Governmental Entity” means any transnational, multinational, domestic or foreign federal, state, provincial or local governmental, regulatory or administrative authority, instrumentality, department, court, arbitrator, agency, commission or official, including any political subdivision thereof, any state-owned or state-controlled enterprise, or any non-governmental self-regulatory agency, commission or authority.

“Group” means any “group” as such term is used in Section 13(d)(3) of the Exchange Act.

|

|

“Holder” means, at any time, any Person in whose name Preferred Stock are registered, which may be treated by the Corporation as the absolute owner of such Preferred Stock for the purpose of making payment and settling the related conversions and for all other purposes.

“Holder COC Redemption Price” has the meaning set forth in Section 8(a).

“Initial Conversion Price” means (i) with respect to each Preferred Stock issued on the Original Issuance Date, the conversion price shall be $3.00 and (ii) with respect to each Preferred Stock issued after the Original Issuance Date, the Conversion Price in effect immediately prior to the issuance of such share.

“Investor” means Theon International PLC.

“Issuance Date” means, with respect to a Preferred Stock, the date of issuance of such Preferred Stock.

“Issued Underlying Shares” means the aggregate number of shares of Common Stock issued since the Original Issuance Date upon the conversion of Preferred Stock.

“Junior Securities” has the meaning set forth in Section 2.

“Law” means any statute, law, ordinance, treaty, rule, code, regulation or other binding directive issued, promulgated or enforced by any Governmental Entity.

“Liquidation” means the voluntary or involuntary liquidation, dissolution or winding up of the Corporation.

“Liquidation Preference” means, with respect to each Preferred Stock, $7,000 per share.

“Mandatory Conversion Price” has the meaning set forth in Section 6(a)(i)(A).

“Market Price” means, with respect to any particular security on any particular date, (i) if such security is listed or quoted on a principal U.S. national or regional securities exchange or traded on an over-the-counter market, the volume weighted average price per share (as reported on Bloomberg based, in the case of a listed security, on composite transactions for the principal U.S. national or regional securities exchange on which such security is listed or quoted) of such security for the period of ten (10) consecutive Trading Days preceding (and excluding) the date of determination (or for any other period specified for this purpose in the applicable provision hereof), or (ii) if such security is not listed or quoted on a principal U.S. national or regional securities exchange or traded on an over-the-counter market, the fair market value of such security on the date of determination, as determined pursuant to the Valuation Methodology.

“NASDAQ” means the NASDAQ Stock Market (or its successor).

“Noncompliance Additional Rate” means 3.00% per annum, which shall automatically increase by 0.5% per annum semiannually for so long as any Triggering Event is continuing, provided in no event shall the Noncompliance Additional Rate exceed 4.00% per annum.

|

|

“NYSE” means the New York Stock Exchange (or its successor).

“Options” means rights, options or warrants to subscribe for, purchase or otherwise acquire Common Stock or Convertible Securities.

“Original Issuance Date” means the date of closing pursuant to the Convertible Preferred Stock Purchase Agreement.

“Parity Securities” has the meaning set forth in Section 2.

“Payment Period” means, with respect to a Preferred Stock, the period beginning on the day after the preceding Preferred Dividend Payment Date (or if no Preferred Dividend Payment Date has occurred since the Issuance Date of such Preferred Stock, the day that would have been the day after the preceding Preferred Dividend Payment Date had the Issuance Date with respect to such Preferred Stock occurred prior to such date) to and including the next Preferred Dividend Payment Date.

“Person” means an individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act).

“Preferred Dividend Payment Date” means January 1 and July 1 of each year (each, a “Semi-Annual Date”), commencing on the first Semi-Annual Date immediately following the Original Issuance Date; provided, that if any such Semi-Annual Date is not a Business Day, then the “Preferred Dividend Payment Date” shall be the next Business Day immediately following such Semi-Annual Date.

“Preferred Dividends” has the meaning set forth in Section 4(a)(i).

“Preferred Stock” has the meaning set forth in Section 1.

“Pro Rata Repurchase” means any acquisition (whether effected by repurchase or redemption) of Common Stock by the Corporation or any Affiliate thereof (other than, if applicable, the Investor or any of its Affiliates) pursuant to any tender offer or exchange offer subject to Section 13(e) of the Exchange Act, or pursuant to any other offer available to substantially all holders of Common Stock, whether for cash, Equity Interests or other securities of the Corporation, evidences of indebtedness of the Corporation or any other Person or any other property (including Equity Interests, other securities or evidences of indebtedness of a Subsidiary of the Corporation), or any combination thereof, effected while any Preferred Stock are outstanding; provided that “Pro Rata Repurchase” shall not include any acquisition (whether effected by repurchase or redemption) of shares by the Corporation or any Affiliate thereof made in accordance with the requirements of Rule 10b-18 as in effect under the Exchange Act. The “Effective Date” of a Pro Rata Repurchase means the date of acceptance of shares for purchase or exchange under any tender or exchange offer which is a Pro Rata Repurchase or the date of acquisition (whether effected by repurchase or redemption) with respect to any Pro Rata Repurchase that is not a tender or exchange offer.

|

|

“Recognized Exchange” means any of the following: the NASDAQ, The Nasdaq Global Market, The Nasdaq Global Select Market, the New York Stock Exchange, the NYSE American, the NYSE Arca, or the OTCQB or the OTCQX operated by OTC Markets Group, Inc. (or any nationally recognized successor to any of the foregoing).

“Register” means the securities register maintained in respect of the Preferred Stock by the Corporation, or to the extent the Corporation has engaged a transfer agent, such transfer agent.

“Reorganization Event” means any of the following transactions:

(i) any reorganization, consolidation, merger, share exchange, statutory exchange, tender or exchange offer or other similar business combination involving the Corporation with or into another Person, in each case, pursuant to which the Common Stock will be converted into, or exchanged for, cash, securities or other property of the Corporation or another Person;

(ii) any reclassification, recapitalization or reorganization of the Common Stock into securities other than the Common Stock; or

(iii) any direct or indirect sale, assignment, conveyance, transfer, lease or other disposition (including in connection with any Liquidation) by the Corporation of all or substantially all of its assets or business, in each case under this clause (iii), pursuant to which the Common Stock will be converted into cash, securities or other property.

“Securities Act” means the Securities Act of 1933, as amended.

“Share Cap” means 19.99% of the outstanding s shares of Common Stock as of the Original Issuance Date (such number of shares subject to proportionate adjustment for share dividends, share splits or share combinations with respect to the Common Stock).

“Subsidiary” or “Subsidiaries” means, with respect to any Person, any other Person of which (i) if a corporation, a majority of the total voting power of shares of capital stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof, or (ii) if a limited liability company, partnership, association or other business entity (other than a corporation), a majority of partnership or other similar ownership interest thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more other Subsidiaries of that Person or a combination thereof and for this purpose, a Person or Persons owns a majority ownership interest in such a business entity (other than a corporation) if such Person or Persons shall be allocated a majority of such business entity’s gains or losses or shall be or control any managing director or general partner of such business entity (other than a corporation). For the purposes hereof, the term “Subsidiary” shall include all Subsidiaries of such Subsidiary.

|

|

“Trading Day” means a day on which the Trading Market is open for the transaction of business.

“Trading Market” means the NASDAQ (or any nationally recognized successor thereto); provided, however, that in the event the Common Stock are not listed on the NASDAQ (or any nationally recognized successor thereto) but are then listed or traded on a Recognized Exchange, then the “Trading Market” shall mean such Recognized Exchange on which the Common Stock are then listed or traded.

“Triggering Event” means any of the following:

| (i) | the Corporation’s failure to (x) comply with its obligations to effect the conversion of Preferred Stock in compliance with Section 6, or (y) to comply with the terms of Section 7; |

| (ii) | the Corporation taking any action which requires the prior affirmative vote or written consent of any Holder pursuant to the terms of hereof, including any action described in Section 11(b) without the prior affirmative vote or written consent of such required affirmative vote or written consent; |

| (iii) | the Corporation’s failure to maintain the listing of the Common Stock on the Nasdaq or NYSE; |

| (iv) | subject to the provisions of Section 170 of the Delaware General Corporation Law, the Board fails to declare any Preferred Dividend to be paid on the applicable Preferred Dividend Payment Date in accordance with Section 4; |

| (v) | the Corporation’s failure to pay any Holder any Preferred Dividend on any Preferred Dividend Payment Date (whether or not declared by the Board) or any other amount when and as due under this Certificate of Designation (including, without limitation, the Corporation’s failure to pay any redemption payments or amounts hereunder), except, in the case of a failure to pay Preferred Dividends and Late Charges when and as due, in each such case only if such failure remains uncured for a period of at least thirty (30) days; or |

| (vi) | any other noncompliance with the terms set forth hereof by the Corporation that, in case of this clause (vi) is not cured within thirty (30) days of the Corporation’s receipt of written notice from the Holders representing at least a majority of the then-issued and outstanding Preferred Stock. |

“Valuation Methodology” means (i) if, within ten (10) Business Days following notice from the Corporation of a good faith determination by the Board of Directors, the Holders of a majority of the outstanding Preferred Stock deliver written notice to the Corporation that they object to such determination, then determined by a nationally recognized independent investment banking firm that has for this purpose (x) been selected by the Board of Directors, and (y) been consented to by Holders of a majority of the outstanding Preferred Stock or (ii) otherwise the good faith determination of the Board of Directors as set forth in the notice described in clause (i).

|

|

“Voting Stock” means Equity Interests of the class or classes pursuant to which the holders thereof have the general voting power under ordinary circumstances (determined without regard to any classification of directors) to elect one or more members of the Board of Directors (without regard to whether or not, at the relevant time, Equity Interests of any other class or classes (other than Common Stock) shall have or might have voting power by reason of the happening of any contingency).

(b) In addition to the above definitions, unless the context requires otherwise:

(i) any reference to any statute, regulation, rule or form as of any time shall mean such statute, regulation, rule or form as amended or modified and shall also include any successor statute, regulation, rule or form from time to time;

(ii) the word “including” shall be deemed to be followed by the words “without limitation”;

(iii) references to “$” or “dollars” means the lawful coin or currency of the United States of America;

(iv) the phrase “to the extent” means the degree to which something extends (and not “if’); and

(v) references to “Section” are references to Sections hereof.

Section 4. Dividends.

(a) Holders of the issued and outstanding Preferred Stock shall be entitled to receive, out of assets legally available for the payment of dividends, dividends on the terms described below:

(i) On each Preferred Dividend Payment Date, the Corporation shall, to the extent permitted by applicable Law, (A) pay in cash out of funds legally available therefor, dividends on each outstanding share of Preferred Stock (any Preferred Dividend paid in such manner, a “Cash Dividend”) and (B) allow dividends, automatically and without any action of the Corporation, to accumulate with respect to each outstanding share of Preferred Stock for such Payment Period, thereby constituting a Base Amount Accrued Dividend and increase to the Base Amount (such dividends in accordance with clause (A) or clause (B) above, collectively, the “Preferred Dividends”) in each case at a rate per annum equal to the Dividend Rate. Preferred Dividends on each Preferred Stock shall accrue and accumulate on a semi-annual basis from the Issuance Date of such share, whether or not declared and whether or not the Corporation has funds legally available for the payment of such dividends, shall compound semi-annually on each Preferred Dividend Payment Date (to the extent not paid in cash on or prior to such Preferred Dividend Payment Date) and shall be payable semi-annually in arrears on each Preferred Dividend Payment Date, commencing on the first Preferred Dividend Payment Date following the Issuance Date of such share.

|

|

(ii) Each Preferred Dividend shall be paid pro rata to the Holders of Preferred Stock entitled thereto and shall be payable to the Holders of Preferred Stock as they appear on the Register at the close of business on the record date designated by the Board of Directors for such dividends (each such date a “Dividend Payment Record Date”) which shall be not more than thirty (30) days nor less than ten (10) days preceding the applicable Preferred Dividend Payment Date.

(b) Upon the occurrence of a Triggering Event, (i) the Corporation shall as soon as practicable but in no event later than five (5) Business Days deliver written notice thereof via electronic mail or overnight courier to each Holder that includes (A) a reasonable description of the applicable Triggering Event and (B) a certification as to whether, in the opinion of the Corporation, such Triggering Event is capable of being cured and, if applicable, a reasonable description of any existing plans of the Company to cure such Triggering Event and (ii) the Dividend Rate shall increase by the Noncompliance Additional Rate from and including the date on which the Triggering Event shall occur and be continuing through but excluding the date on which all then occurring Triggering Events are no longer continuing. Except as otherwise explicitly provided in this Certificate of Designation, the Dividend Rate shall not be increased further pursuant to this Section 4(b).

(c) At any time during which a Triggering Event shall be occurring, without the consent of the Holders representing at least a majority of the then-issued and outstanding Preferred Stock, (x) no dividends shall be declared or paid or set apart for payment, or other distributions declared or made, upon any Junior Securities, nor shall any Junior Securities be redeemed, purchased or otherwise acquired for any consideration (nor shall any moneys be paid to or made available for a sinking fund for the redemption of any shares of any such Junior Securities) by the Corporation, directly or indirectly (other than repurchases or redemptions of Common Stock from employees, officers or directors of the Corporation or any of its Subsidiaries in the ordinary course of business and, subject to and in accordance with the provisions of Section 6 hereof, by conversion into or exchange for Junior Securities or the payment of cash in lieu of fractional shares in connection therewith (collectively “Permitted Junior Repurchases”)) and (y) the Corporation shall not consummate a Change of Control unless the Corporation provides each Holder the option to either (i) receive the consideration it would have received in such Change of Control if all of its Preferred Stock had been converted into Common Stock pursuant to Section 6 immediately prior to the effective time of the Change of Control or (ii) have all of its then-outstanding Preferred Stock redeemed in full at a redemption price per share in cash equal to 150% of the sum of (A) the aggregate Liquidation Preference and (B) the aggregate Accrued Dividends of such Preferred Stock as of the date of such redemption.

(d) Without the consent of the Holders representing at least a majority of the then-issued and outstanding Preferred Stock, the Corporation shall not (i) declare, pay or set aside for payment any dividends or distributions upon any Junior Securities or (ii) repurchase, redeem or otherwise acquire any Junior Securities (other than Permitted Junior Repurchases) for any consideration or pay any moneys or make available for a sinking fund for the redemption of any shares of such Junior Securities, unless, in each case, (A) immediately before and after the taking of such action, the fair value of the Corporation’s assets would exceed the sum of its debts (including for this purpose the aggregate Liquidation Preference and the aggregate Accrued Dividends of the Preferred Stock), (B) immediately after the taking of such action, the Corporation, in its good faith judgment, would be able to pay all of its debts (including the aggregate Liquidation Preference and the aggregate Accrued Dividends of the Preferred Stock) as they are reasonably expected to come due and (C) such action is otherwise in compliance with applicable Law.

|

|

Section 5. Liquidation Rights.

(a) In the event of any Liquidation, each Holder shall be entitled to receive liquidating distributions out of the assets of the Corporation legally available for distribution to its shareholders, before any payment or distribution of any assets of the Corporation shall be made or set apart for holders of any Junior Securities, including the Common Stock, for such Holder’s Preferred Stock in an amount equal to the greater of (i) the sum of (A) the aggregate Liquidation Preference and (B) the aggregate Accrued Dividends of such Preferred Stock as of the date of the Liquidation and (ii) the amount such Holder would have received had such Preferred Stock, immediately prior to such Liquidation, been converted into Common Stock pursuant to Section 6, without regard to any of the limitations on conversion or convertibility contained therein.

(b) In the event the assets of the Corporation available for distribution to shareholders upon a Liquidation shall be insufficient to pay in full the amounts payable with respect to all outstanding Preferred Stock pursuant to Section 5(a), such assets, or the proceeds thereof, shall be distributed among the Holders ratably in proportion to the full respective liquidating distributions to which they would otherwise be respectively entitled upon such Liquidation.

(c) Neither the sale, conveyance, exchange or transfer (for cash, equity securities, other securities or other consideration) of all or substantially all of the assets, capital stock or business of the Corporation (other than in connection with the liquidation, dissolution or winding up of the Corporation) nor the merger, consolidation, share exchange, statutory exchange or any other business combination transaction of the Corporation into or with any other Person shall by itself be deemed to be a Liquidation for purposes of this Section 5.

Section 6. Conversion.

(a) Conversion of Preferred Stock.

(i) Subject to and in accordance with the provisions of this Section 6 Preferred Stock may be converted into Common Stock as follows:

(A) If at any time after the Original Issuance Date, the Common Stock Trading Price is $4.50 (such price subject to proportionate adjustment for share dividends, share splits or share combinations with respect to the Common Stock) (the “Mandatory Conversion Price”) or more for at least ten (10) Trading Days (whether or not consecutive) during any thirty (30) consecutive Trading Day period (such period, the “Conversion Option Measurement Period”) and the Corporation, at its option, delivers a written notice to the Holders of the Preferred Stock within five (5) Business Days following the conclusion of the applicable Conversion Option Measurement Period, then each outstanding Preferred Stock shall be converted (the “Conversion Option”) as of the Business Day immediately prior to the date of such notice (the “Conversion Option Date”) into such number of fully paid and non-assessable shares of Common Stock (calculated as to each conversion to the nearest 1/10,000th of a share) equal to the quotient of (A) the sum of (1) the Liquidation Preference and (2) the Accrued Dividends on such share as of the Conversion Option Date, divided by (B) 80% of the Mandatory Conversion Price.

|

|

(B) Each Holder shall have the right (the “Conversion Right”) at any time and from time to time at such Holder’s option, to convert all or any portion of such Holder’s Preferred Stock into fully paid and non-assessable Common Stock. Upon a Holder’s election to exercise its Conversion Right, each Preferred Stock for which the Conversion Right is exercised shall be converted into such number of Common Stock (calculated as to each conversion to the nearest 1/10,000th of a share) equal to the quotient of (A) the sum of (1) the Liquidation Preference and (2) the Accrued Dividends on such share as of the Conversion Date, divided by (B) the Conversion Price of such share in effect at the time of conversion.

(ii) No fractional shares of Common Stock shall be issued upon the conversion of any shares of Preferred Stock. If more than one shares of Preferred Stock subject to conversion is held by the same Holder, the number of full shares of Common Stock issuable upon conversion thereof shall be computed on the basis of the sum of (A) the aggregate Liquidation Preference and (B) the aggregate Accrued Dividends as of the Conversion Date on all shares of Preferred Stock so subject. If the conversion of any share or Preferred Stock results in a fractional share of Common Stock issuable after application of the immediately preceding sentence, the Corporation shall pay a cash amount in lieu of issuing such fractional share in an amount equal to the value of such fractional interest multiplied by the Market Price of a share of Common Stock on the Trading Day immediately prior to the Conversion Date.

(iii) The Corporation shall at all times reserve and keep available out of its authorized and unissued Common Stock, solely for issuance upon the conversion of the Preferred Stock, such number of shares of Common Stock equal to 110% of the number of shares of Common Stock issuable upon the conversion of all the shares of Preferred Stock then outstanding. The Corporation shall take all commercially reasonable actions permitted by law, including calling meetings of stockholders of the Corporation and soliciting proxies for any necessary vote of the stockholders of the Corporation, to amend the Certificate of Incorporation to increase the number of authorized and unissued shares of Common Stock, if at any time there shall be insufficient authorized and unissued shares of Common Stock to permit such reservation or to permit the conversion of all outstanding shares of Preferred Stock. The Corporation covenants that the Preferred Stock and all Common Stock that may be issued upon conversion of Preferred Stock shall upon issuance be duly authorized, fully paid and non-assessable and will not be subject to preemptive rights or subscription rights of any other shareholder of the Corporation. The Corporation further covenants that the Corporation shall, from time to time, at its sole expense, cause to be authorized for listing or quotation on the Trading Market (to the extent permitted by the Trading Market), the maximum number of Common Stock issued and issuable upon conversion of the Preferred Stock, subject to official notice of issuance.

(b) Mechanics of Conversion.

(i) If the Corporation exercises the Conversion Option and delivers notice thereof in accordance with Section 6(a)(i)(A), the Corporation shall notify the Holders of Preferred Stock in writing of the Conversion Option promptly (and in any event within three (3) Business Days) following the Conversion Option Date by delivery of written notice to such Holders and shall update or cause to be updated the Register, effective as of the Conversion Option Date, to reflect the shares of Common Stock held by such Holders as a result of the Conversion Option and shall, as promptly as practicable thereafter, re-designate or issue or cause to be issued to each such Holder the number of validly issued, fully paid and non-assessable Common Stock to which such Holder shall be entitled and deliver or cause to be delivered to each such Holder evidence of such re-designation or issuance reasonably satisfactory to such Holders.

|

|

(ii) The Conversion Right of a Holder of Preferred Stock shall be exercised by the Holder by delivering written notice to the Corporation that the Holder elects to convert all or a portion of the shares of Preferred Stock held by such Holder (a “Conversion Notice”) and specifying the name or names (with address or addresses) in which shares of Common Stock are to be issued and (if so required by the Corporation or the Corporation’s transfer agent) by a written instrument or instruments of transfer in form reasonably satisfactory to the Corporation or the transfer agent, as applicable, duly executed by the Holder or its legal representative.

(iii) As promptly as practicable after the receipt of the Conversion Notice, and the payment of required taxes or duties pursuant to Section 13(i) if applicable, and in no event later than one (1) Trading Day thereafter, the Corporation shall update or cause to be updated the Register to reflect the Common Stock held by such Holder as a result of such conversion and shall issue and shall deliver or cause to be issued and delivered to such Holder, or to such other Person on such Holder’s written order (A) evidence of such issuance reasonably satisfactory to such Holder, and (B) cash for any fractional interest in respect of a Common Stock arising upon such conversion settled as provided in Section 6(a)(ii).

(iv) The conversion of any Preferred Stock shall be deemed to have been made (i) in connection with any Conversion Option, at the close of business on the Conversion Option Date, and (ii) in connection with any exercise of the Conversion Right, at the close of business on the date of giving the Conversion Notice (the “Conversion Date”). Until the Conversion Date with respect to any Preferred Stock has occurred, such Preferred Stock will remain outstanding and will be entitled to all of the powers, designations, preferences and other rights provided herein, including that such share shall (A) accrue and accumulate Preferred Dividends pursuant to Section 4 and (B) entitle the Holder thereof to the voting rights provided in Section 10.

|

|

Section 7. Reorganization Events.

(a) Treatment of Preferred Stock Upon a Reorganization Event. Subject to applicable Law, upon the occurrence of any Reorganization Event, (i) if the Corporation is the surviving company in such Reorganization Event, each Preferred Stock outstanding immediately prior to such Reorganization Event shall remain outstanding following such Reorganization Event (or be exchanged for an equivalent Preferred Stock governed by the terms herein) (provided, that (x) each Preferred Stock shall become convertible into the kind and amount of securities, cash and other property that the Holder of such Preferred Stock (other than the counterparty to the Reorganization Event or an Affiliate of such other party) would have received in such Reorganization Event had such Preferred Stock, immediately prior to such Reorganization Event, been converted into the applicable number of Common Stock using (i) the Conversion Price immediately prior to such Reorganization Event and (ii) the Liquidation Preference, together with the Accrued Dividends thereon, applicable at the time of such subsequent conversion (such securities, cash and other property, the “Exchange Property”) (provided, further that any Exchange Property that is not cash shall consist of marketable securities listed on the NASDAQ or NYSE), and (y) appropriate adjustments shall be made to the conversion provisions set forth in Section 6 and the adjustment to conversion price provisions set forth in Section 9 as determined reasonably and in good faith by the Board of Directors to place the Holders in as nearly as equal of a position as possible with respect to such matters following such Reorganization Event as compared to immediately prior to such Reorganization Event) or (ii) if the Corporation is not the surviving entity in such Reorganization Event or will be dissolved in connection with such Reorganization Event, each Preferred Stock outstanding immediately prior to such Reorganization Event shall be converted or exchanged into a security of the Person surviving such Reorganization Event or such other continuing entity in such Reorganization Event having rights, powers and preferences, and the qualifications, limitations and restrictions thereof, as nearly equal as possible to those provided herein (including with respect to any securities or other property to which the holders of Common Stock become entitled as a result of such Reorganization Event, which shall be determined in a manner similar to the rights in respect of Exchange Property in accordance with the preceding clause (i)) (with such adjustments as are appropriate to place the Holders in as nearly as equal of a position as possible following such Reorganization Event as compared to immediately prior to such Reorganization Event) (provided, for the avoidance of doubt, that any Exchange Property that is not cash shall consist of marketable securities listed on the NASDAQ or NYSE).

(b) Form of Consideration. In the event that Preferred Stock become convertible into Exchange Property in connection with a Reorganization Event and the holders of Common Stock have the opportunity to elect the form of consideration to be received in such transaction, the Exchange Property shall be based on the types and amounts of consideration received by the holders of Common Stock in the same proportion as was selected in the aggregate by the holders of Common Stock; provided that, to the extent the applicable transaction agreement provides for adjustments to such elected types and amounts of consideration that are generally applicable to holders of Common Stock making such elections, the Exchange Property will be subject to such adjustments.

(c) Successive Reorganization Events. The provisions of this Section 7 shall similarly apply to successive Reorganization Events.

(d) Notice of Reorganization Events. The Corporation (or any successor) shall, no later than ten (10) days following the consummation of any Reorganization Event, provide written notice to the Holders of such consummation of such event and of the kind and amount of the cash, securities or other property that constitutes the Exchange Property. Failure to deliver such notice shall not affect the operation of this Section 7.

|

|

(e) Requirements of Reorganization Events. The Corporation shall not, without consent of the Holders representing at least a majority of the then-issued and outstanding Preferred Stock, enter into any agreement for, or consummate, any transaction or series of transactions constituting a Reorganization Event unless (A) (i) such agreement provides for or does not interfere with or prevent (as applicable) conversion of the Preferred Stock into the Exchange Property in a manner that is consistent with and gives effect to this Section 7 (including by reserving Exchange Property that allows any conversion of the Preferred Stock (or replacement securities) into Exchange Property to be completed in accordance with the terms of this Section 7), and (ii) to the extent that the Corporation is not the surviving company in such Reorganization Event or will be dissolved in connection with such Reorganization Event, proper provision shall be made in the agreements governing such Reorganization Event for the conversion of the Preferred Stock into a security of the Person surviving such Reorganization Event or such other continuing entity in such Reorganization Event, which security shall meet the requirements of this Section 7 and (B) immediately following such Reorganization Event, neither the Preferred Stock (or any share of preferred equity into which the Preferred Stock are exchanged) nor any Exchange Property is subject to any limitations on conversion or voting pursuant to the rules of the applicable stock exchange or applicable Law. For the avoidance of doubt, no consent of any Holder shall be required if in connection with any Reorganization the Holder is paid in full the Liquidation Preference amount plus all Accrued Dividends.

(f) Change of Control. For the avoidance of doubt, if a Reorganization Event constitutes a Change of Control, then Section 8 shall take precedence over this Section 7 to the extent there is any inconsistency between such sections.

Section 8. Change of Control.

(a) Change of Control Redemption. In the event of a Change of Control, the Corporation shall have the option, in its sole discretion and in accordance with applicable Law and subject to compliance with the notice requirements set forth in Section 8(b) and the Corporation having sufficient legally available funds to comply with its obligations hereunder (including pursuant to a binding commitment by the counterparty to any Change of Control Agreement (as defined below) to provide the necessary funds), to at any time following the execution of the definitive agreement contemplating the Change of Control until ten (10) Business Days prior to the effective date of the Change of Control (the effective date of the Change of Control, the “Change of Control Effective Date”) irrevocably elect to redeem on the Change of Control Effective Date, but immediately prior, and subject to, consummation of the Change of Control, all (and not less than all) of the outstanding Preferred Stock (a “Change of Control Redemption”) for a price in cash per Preferred Stock equal to 100% of the sum of (x) the Liquidation Preference of such Preferred Stock plus (y) the aggregate Accrued Dividends of such Preferred Stock in each case, as of the Change of Control Effective Date (the “COC Redemption Price”); provided that a Holder may, at any time following the receipt of a Change of Control Redemption Notice until the date that is five (5) Business Days prior to the Change of Control Effective Date elect (by irrevocable written notice to the Corporation) to instead receive, at the Change of Control Effective Date, consideration of the kind and amount that such Holder of such Preferred Stock would have received in such Change of Control had such Preferred Stock, immediately prior to the Change of Control Effective Date, been converted into the applicable number of Common Stock using the Conversion Price on the Change of Control Effective Date and the Liquidation Preference, together with Accrued Dividends thereon, applicable at the time of such conversion (the “Holder COC Redemption Price”).

|

|

(b) Change of Control Notice. On or before the twentieth (20th) Business Day prior to the date on which the Corporation anticipates consummating any Change of Control (or, if later, promptly after the Corporation discovers that the Change of Control will occur but in no event later than ten (10) Business Days prior to the actual consummation of the Change of Control), the Corporation shall deliver to each Holder (as appearing in the Register of the Corporation) a written notice setting forth a description of the anticipated Change of Control and the date on which the Change of Control is anticipated to be effected (or, if applicable, the date on which a Schedule TO or other schedule, form or report disclosing a Change of Control was filed). On or before the tenth (10th) Business Day prior to the date on which the Corporation anticipates consummating a Change of Control, the Corporation shall deliver to each Holder (as appearing in the Register of the Corporation) a written notice (the “Change of Control Redemption Notice”) setting forth the Corporation’s intention to exercise its right to effect a Change of Control Redemption and the expected Change of Control Effective Date. Any such Change of Control Redemption Notice shall also set forth the amount of (or methodology for determining) the COC Redemption Price and the Holder COC Redemption Price, together with the calculation of each and reasonable supporting details which shall include the Conversion Price used in such calculations. Upon a Change of Control, the Corporation shall (i) if the Preferred Stock are to be redeemed in accordance with this Section 8 in exchange for the COC Redemption Price, deliver or cause to be delivered to the Holder by wire transfer the COC Redemption Price substantially concurrent with the consummation of the Change of Control and (ii) if the Preferred Stock are to be redeemed in accordance with this Section 8 in exchange for the Holder COC Redemption Price, deliver or cause to be delivered to the Holder the Holder COC Redemption Price concurrently with when the consideration in such Change of Control is delivered to the holders of Common Stock.

(c) Change of Control Agreements. The Corporation shall not enter into any definitive agreement for a Change of Control (such an agreement, a “Change of Control Agreement”), or otherwise engage in or consummate, a transaction constituting a Change of Control, unless (i) such Change of Control Agreement provides for or does not interfere with or prevent (as applicable) the exercise by the Holders of their rights and the Corporation’s obligations under this Certificate of Designation, including this Section 8 and (ii) the acquiring or surviving Person in such Change of Control represents and covenants, in form and substance reasonably satisfactory to the Board of Directors acting in good faith, that at the consummation of such Change of Control, to the effect that such Person shall have sufficient funds (which may include, without limitation, cash and cash equivalents on the Corporation’s balance sheet, the proceeds of any debt or equity financing, available lines of credit or uncalled capital commitments) to consummate such Change of Control (taking into account the satisfaction of any indebtedness required in connection with the Change of Control), including making all required payments to the Holders hereunder, including the payment of the COC Redemption Price or the Holder COC Redemption Price, as elected by each Holder.

(d) Conversion Prior to Redemption. In the event that the Preferred Stock has been called for redemption under this Section 8, notwithstanding anything to the contrary in this Certificate of Designation, a Holder shall remain entitled, pursuant to Section 6(a)(i)(B) and subject to the limitations thereof, to convert all or any portion of such Holder’s Preferred Stock into fully paid and non-assessable Common Stock until the close of business on the fifth (5th) Business Day following receipt of a Change of Control Redemption Notice. To the extent that a Holder exercises such conversion right, the number of such Holder’s share of Preferred Stock subject to the Corporation’s Change of Control Redemption Notice shall be reduced by the same amount as converted by such Holder.

|

|

Section 9. Adjustments to Conversion Price.

(a) Adjustments to Conversion Price. Except as provided in Section 9(d), the Conversion Price shall be subject to the following adjustments:

(i) In-Kind Dividends and Distributions. If the Corporation declares a dividend or makes an in-kind distribution on the Common Stock payable in Common Stock, then the Conversion Price in effect at the opening of business on the Ex-Date for such dividend or distribution shall be adjusted to the price determined by multiplying the Conversion Price at the opening of business on such Ex-Date by the following fraction:

Where,

OS0 = the number of Common Stock outstanding at the close of business on the Business Day immediately preceding the Ex-Date for such dividend or distribution.

OS1 = the sum of the number of Common Stock outstanding at the close of business on the Business Day immediately preceding the Ex-Date for such dividend or distribution plus the total number of Common Stock constituting such dividend or distribution.

If any dividend or distribution described in this Section 9(a)(i) is declared but not so paid or made, the Conversion Price shall be readjusted, effective as of the date and time the Board of Directors determines not to make such dividend or distribution, to such Conversion Price that would be in effect if such dividend or distribution had not been declared.

(ii) Subdivisions, Splits and Combination of the Common Stock. If the Corporation subdivides, splits or combines the Common Stock, then the Conversion Price in effect immediately prior to the effective date of such share subdivision, split or combination shall be adjusted to the price determined by multiplying the Conversion Price in effect immediately prior to the effective date of such share subdivision, split or combination by the following fraction:

Where,

OS0 = the number of Common Stock outstanding immediately prior to the effective date of such share subdivision, split or combination.

OS1 = the number of Common Stock outstanding immediately after the opening of business on the effective date of such share subdivision, split or combination.

|

|

If any subdivision, split or combination described in this Section 9(a)(ii) is announced but the outstanding Common Stock are not subdivided, split or combined, the Conversion Price shall be readjusted, effective as of the date the Board of Directors determines not to subdivide, split or combine the outstanding Common Stock, to such Conversion Price that would be in effect if such subdivision, split or combination had not been announced.

(iii) Other Distributions. If the Corporation distributes to all holders of shares of Common Stock any Convertible Securities or Options or any other assets for which there is no corresponding distribution in respect of the Preferred Stock pursuant to Section 4(a)(i) (which excludes, for the avoidance of doubt, any distribution of cash or non-cash property for which there is a corresponding distribution in respect of the Preferred Stock pursuant to Section 4(a)(i)), then the Conversion Price in effect immediately prior to the Ex-Date for such distribution shall be adjusted to the price determined by multiplying the Conversion Price in effect immediately prior to the Ex-Date for such distribution by the following fraction:

Where,

SP0=the Market Price of a share of Common Stock on the date immediately prior to the Ex-Date for such distribution.

FMV = the fair market value of the portion of the distribution applicable to one share of Common Stock on the Ex-Date for such distribution, in the case of a non-cash distribution or with respect to the non-cash portion of a distribution, if any, as determined pursuant to the Valuation Methodology; provided, that such value, whether determined pursuant to the foregoing clause (i) or (ii), shall not for the purposes hereof in any event be equal to or greater than the Market Price of a share of Common Stock on such date.

In a “spin-off,” where the Corporation makes a distribution to all holders of shares of Common Stock consisting of capital stock of any class or series, or similar equity interests of, or relating to, a Subsidiary of the Corporation or other business unit, the Conversion Price will be adjusted on the 15th Trading Day after the effective date of the distribution by multiplying such Conversion Price in effect immediately prior to such 15th Trading Day by the following fraction:

|

|

Where,

MP0 = (i) if the Common Stock are listed or quoted on a principal U.S. national or regional securities exchange or traded on an over-the-counter market, the Market Price of a share of Common Stock for the period ending on and including the tenth Trading Day following the effective date of such distribution, or (ii) if the Common Stock are not listed or quoted on a principal U.S. national or regional securities exchange or traded on an over-the-counter market, the Market Price of a share of Common Stock on the effective date of such distribution.

MPs = (i) if the capital stock or equity interests distributed to the holders of shares of Common Stock are listed or quoted on a principal U.S. national or regional securities exchange or traded on an over-the-counter market, an amount equal to the product of (x) the number of shares of such capital stock or equity interests representing the portion of the distribution applicable to one share of Common Stock and (y) the Market Price of such capital stock or equity interests for the period ending on and including the tenth Trading Day following the effective date of such distribution, or (ii) if such capital stock or equity interests are not listed or quoted on a principal U.S. national or regional securities exchange or traded on an over-the-counter market, the Market Price of the capital stock or equity interests representing the portion of the distribution applicable to one share of Common Stock on the effective date of such distribution (after giving effect to such distribution).

In the event that such distribution described in this Section 9(a)(iii) is not so paid or made, the Conversion Price shall be readjusted, effective as of the date the Board of Directors publicly announces its decision not to pay, make or consummate such dividend or distribution, to the Conversion Price that would then be in effect if such dividend or distribution had not been declared.

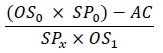

(iv) Certain Repurchases of Common Stock. If the Corporation effects a Pro Rata Repurchase of Common Stock that involves the payment by the Corporation of consideration per share of Common Stock that exceeds the Market Price of a share of Common Stock on the Effective Date of such Pro Rata Repurchase (provided that if part or all of the consideration is not cash, the fair market value of the non-cash consideration shall be determined pursuant to the Valuation Methodology, then the Conversion Price in effect immediately prior to the Effective Date of such Pro Rata Repurchase shall be adjusted (such adjustment to become effective immediately prior to the opening of business on the day following the Effective Date of such Pro Rata Repurchase) by multiplying the Conversion Price in effect immediately prior to the Effective Date of such Pro Rata Repurchase by the following fraction:

Where,

SP0 = the Market Price of a share of Common Stock on the Trading Day immediately preceding the first announcement of the intent to effect such Pro Rata Repurchase.

|

|

OS0 = the number of shares of Common Stock outstanding at the Effective Date of such Pro Rata Repurchase, including, if applicable, any shares validly tendered and not withdrawn or exchanged shares.

OS1= the number of shares of Common Stock outstanding at the Effective Date of such Pro Rata Repurchase, including, if applicable, any shares validly tendered or exchanged and not withdrawn, minus the number of shares purchased in such Pro Rata Repurchase (which shares shall equal the Purchased Shares (as defined below) if such Pro Rata Repurchase is effected pursuant to a tender offer or exchange offer).

AC = the aggregate cash and fair market value of the other consideration payable in such Pro Rata Repurchase, and in the case of non-cash consideration, as determined pursuant to the Valuation Methodology, based, in the case of a tender offer or exchange offer, on the number of shares actually accepted for purchase (the “Purchased Shares”).

In the event that the Corporation, or one of its Affiliates, is obligated to purchase shares of Common Stock pursuant to any such Pro Rata Repurchase, but the Corporation, or such Affiliate, is permanently prevented by applicable law from effecting any such purchases, or all such purchases are rescinded, then the Conversion Price shall be readjusted to be such Conversion Price that would then be in effect if such Pro Rata Repurchase had not been made.

(v) Rights Plans. To the extent that the Corporation has a rights plan in effect with respect to the Common Stock on any Conversion Date, upon conversion of any shares of the Preferred Stock into Common Stock, the Holders will receive, in addition to the shares of Common Stock, the rights under the rights plan, unless, prior to such Conversion Date, the rights have separated from the shares of Common Stock, in which case the Conversion Price will be adjusted at the time of separation as if the Corporation had issued the rights to all holders of the Common Stock in an issuance triggering an adjustment pursuant to Section 9(a)(iii), subject to readjustment in the event of the expiration, termination or redemption of such rights

(b) Other Adjustments.

(i) The Corporation may make decreases in the Conversion Price, in addition to any other decreases required by this Section 9 if the Board of Directors deems it advisable to avoid or diminish any income tax to holders of the Common Stock resulting from any in-kind dividend or distribution of Common Stock (or issuance of Options for Common Stock) or from any event treated as such for income tax purposes.

(ii) If the Corporation takes any action affecting the Common Stock, other than an action described in Section 9(a) which upon a determination by the Board of Directors, in its good faith discretion, would materially adversely affect the Conversion Rights of the Holders of Preferred Stock, the Conversion Price shall be adjusted, to the extent permitted by Law, in such manner, if any, and at such time, as the Board of Directors determines in good faith to be equitable in the circumstances.

|

|

(c) Successive Adjustments. Successive adjustments in the Conversion Price shall be made, without duplication, whenever any event specified in Section 9(a) or Section 9(b) shall occur.

(d) Rounding of Calculations; Minimum Adjustments. All adjustments to the Conversion Price shall be calculated to the nearest one-tenth (1/10th) of a cent. No adjustment in the Conversion Price shall be required if such adjustment would be less than $0.01; provided that any adjustment which by reason of this Section 9(d) is not required to be made shall be carried forward and taken into account in any subsequent adjustment; provided, further, that on any Conversion Date adjustments to the Conversion Price will be made with respect to any such adjustment carried forward and which has not been taken into account before such date.

(e) Statement Regarding Adjustments; Notices. Whenever the Conversion Price is to be adjusted in accordance with one or more of Section 9(a) or Section 9(b), the Corporation shall the Corporation shall, as soon as practicable following the occurrence of an event that requires an adjustment to the Conversion Price pursuant to one or more of Section 9(a) or Section 9(b), taking into account the one cent threshold set forth in Section 9(d) (or if the Corporation is not aware of such occurrence, as soon as practicable after becoming so aware), provide, or cause to be provided, a written notice to the Holders of the occurrence of such event showing in reasonable detail the facts requiring such adjustment, the Conversion Price that shall be in effect after such adjustment and the method by which the adjustment to the Conversion Price was determined.

Section 10. Limitation on Conversion Rights

(a) Notwithstanding anything to the contrary in this Certificate of Designations, no shares of Common Stock will be issued or delivered upon any proposed conversion of any Preferred Stock of any Holder thereof, and no Preferred Stock of any Holder thereof will be convertible, in each case to the extent, and only to the extent, that such issuance, delivery, conversion or convertibility would cause such Holder to Beneficially Own a number of shares of Common Stock in excess of 9.99% of the total number of shares of Common Stock issued and outstanding immediately following such conversion (the “Beneficial Ownership Limitation”).

(b) Notwithstanding anything to the contrary in this Certificate of Designations, no shares of Common Stock will be issued or delivered upon any proposed conversion of any Preferred Stock of any Holder thereof, and no Preferred Stock of any Holder thereof will be convertible, in each case to the extent, and only to the extent the number of shares of Common Stock deliverable upon conversion of the Preferred Stock would cause the aggregate number of Issued Underlying Shares to exceed the Share Cap.

(c) If shares of Common Stock are not delivered as a result of the Beneficial Ownership Limitation or the Share Cap, then the Corporation will deliver, in lieu of any shares of Common Stock otherwise deliverable, an amount of cash per share equal to the volume weighted average per share price of a share of Common Stock on the Trading Day immediately preceding the Conversion Date (such cash amount, the “Excess Amount”) and the relevant shares of Preferred Stock shall be deemed converted.

|

|

Section 11. Voting Rights.

(a) General. The Holders of Preferred Stock shall be entitled to vote with the holders of the Common Stock on all matters submitted to a vote of shareholders of the Corporation, except as otherwise provided herein or as required by applicable Law, voting together with the holders of Common Stock as a single class. For such purposes, each Holder shall be entitled to a number of votes in respect of the Preferred Stock owned of record by it equal to the number of Common Stock into which such Preferred Stock could be converted, applied ratably with respect to each outstanding Preferred Stock) as of the record date for the determination of shareholders entitled to vote on such matters or, if no such record date is established, as of the date such vote is taken or any written consent of shareholders is solicited. The Holders of Preferred Stock shall be entitled to notice of any shareholders’ meeting in accordance with the Certificate of Incorporation and the By-Laws as if they were holders of record of Common Stock for such meeting.

(b) Class Voting Rights. So long as any Preferred Stock are outstanding, in addition to any other vote required by applicable Law, the Corporation may not take any of the following actions (including by means of merger, consolidation, reorganization, recapitalization or otherwise) without the prior affirmative vote or written consent of the Holders representing at least a majority of the then-issued and outstanding Preferred Stock, voting as a separate class:

(i) amend, alter, repeal or otherwise modify any provision of the Certificate of Incorporation, the By-Laws or the terms hereof in a manner that would alter or change the terms or the powers, preferences, rights or privileges of the Preferred Stock as to affect them adversely and in a manner different to the manner in which the Holders of Common Stock are affected; or

(ii) enter into any merger, reorganization or other consolidation or business combination that would treat the Preferred Stock in a manner inconsistent with the terms hereof.

(c) The consent or votes required in Section 11(b) shall be in addition to any approval of shareholders of the Corporation which may be required by Law or pursuant to any provision of the Certificate of Incorporation or the By-Laws. Each Holder will have one vote per share on any matter on which Holders of Preferred Stock are entitled to vote separately as a class, whether at a meeting or by written consent.

Section 12. Transfer Agent Certification of Preferred Stock.

(a) The Corporation may, in its sole discretion, appoint a transfer agent and remove its transfer agent in accordance with the agreement between the Corporation and such transfer agent; provided that the Corporation shall appoint a successor transfer agent of recognized standing who shall accept such appointment prior to the effectiveness of such removal. Upon any such removal or appointment, the Corporation shall send notice thereof by first-class mail, postage prepaid, to the Holders. When a Holder requests to register the transfer of Preferred Stock (provided that such transfer is not in violation of the transfer restrictions herein or the Convertible Preferred Stock Purchase Agreement), the Corporation or the Corporation’s transfer agent, as applicable, shall register the transfer as requested if its reasonable requirements for such transaction are met. Any transfer made not in compliance with the foregoing shall be disregarded and deemed void.

|

|