UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 16, 2025

| AMERICAN BATTERY TECHNOLOGY COMPANY |

| (Exact name of registrant as specified in its charter) |

| Nevada | 001-41811 | 33-1227980 | ||

| (State or other jurisdiction of | (Commission | (IRS Employer | ||

| incorporation or organization) | File No.) | Identification Number) |

|

100 Washington Street, Suite 100 Reno, NV |

89503 |

|

| (Address of principal executive offices) | (Zip Code) |

(775) 473-4744

(Registrant’s telephone number including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, $0.001 par value | ABAT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On October 16, 2025, the Company issued a press release announcing the completion of the S-K 1300 Technical Report and Preliminary Feasibility Study (the “PFS”) disclosing mineral reserves and mineral resources, including economic assessment, for the Tonopah Flats Lithium Project. The PFS was completed by Daniel R. Palo, qualified person on behalf of Barr Engineering Co., Jeffrey Woods, qualified person on behalf of Woods Process Services, LLC, and Jacob Anderson, qualified person on behalf of Dahrouge Geologic Consulting Ltd., in compliance with Item 1300 of Regulation S-K and with an effective date of September 4, 2025.

A copy of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference. The PFS is filed as Exhibit 96.1 and the qualified person consents are filed as Exhibits 23.1 through 23.3 to this Form 8-K, each of which are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 23.1 | Consent of Daniel R. Palo. | |

| 23.2 | Consent of Jeffrey Woods. | |

| 23.3 | Consent of Jacob Anderson. | |

| 96.1 | S-K 1300 Technical Report and Preliminary Feasibility Study, effective as of September 4, 2025. | |

| 99.1 | Press Release, dated October 16, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AMERICAN BATTERY TECHNOLOGY COMPANY | ||

| Date: October 16, 2025 | By: | /s/ Ryan Melsert |

| Ryan Melsert | ||

| Chief Executive Officer | ||

Exhibit 23.1

|

|

Consent of Qualified Person

I, Daniel R. Palo , PE on behalf of Barr Engineering Co., hereby consent to:

| 1. | The inclusion of Barr Engineering Co., and associated Qualified Persons in connection with American Battery Technology Company’s anticipated filing of the technical report and preliminary feasibility study titled “Tonopah Flats Lithium Project S-K 1300 Technical Report and Preliminary Feasibility Study, Esmeralda and Nye Counties, Nevada, USA” dated September 4, 2025, as an exhibit to and referenced in Form 10-K/Form 8-K/or other filing, prepared in accordance with Item 601(b)(96) of Regulation S-K (17 CFR §229.601 (b)(96)) and Subpart 1300 of Regulation S-K. |

| 2. | The incorporation, by reference, of the Report, in the above filing, or any other periodic reports filed by the company, and to the extent practicable in the Registration Statements on any of the associated forms prepared in relation to the filing mentioned above. |

| 3. | The information derived, summarized, quoted, or referenced from the Report, or portions thereof, that was prepared by us, that we supervised in the preparation of, and/or that was reviewed and approved by us, that is included or incorporated by reference in any of the forms associated with the above mentioned filing, other periodic reports, or the Registration Statements. |

Barr Engineering Co. is responsible for authoring, and this consent pertains to, all chapters of the Report, except for chapters 6, 7, 8, 9, 10, 11, 14, and subsections 18.2.2 and 18.3.2.

Report Effective Date: September 04, 2025.

| By: | /s/ Daniel R. Palo | |

| Name: | Daniel R. Palo | |

| Title: | Vice President | |

| Company: | Barr Engineering Co. |

Exhibit 23.2

|

Consent of Qualified Person |

I, Jeffrey Woods , License (i.e., PE) or QP Designation on behalf of Woods Process Services, LLC., hereby consent to:

| 1. | The inclusion of Woods Process Services, LLC., and associated Qualified Persons in connection with American Battery Technology Company’s anticipated filing of the technical report and preliminary feasibility study titled “Tonopah Flats Lithium Project S-K 1300 Technical Report and Preliminary Feasibility Study, Esmeralda and Nye Counties, Nevada, USA” dated September 4, 2025, as an exhibit to and referenced in Form 10-K/Form 8-K/or other filing, prepared in accordance with Item 601(b)(96) of Regulation S-K (17 CFR §229.601 (b)(96)) and Subpart 1300 of Regulation S-K. |

| 2. | The incorporation, by reference, of the Report, in the above filing, or any other periodic reports filed by the company, and to the extent practicable in the Registration Statements on any of the associated forms prepared in relation to the filing mentioned above. |

| 3. | The information derived, summarized, quoted, or referenced from the Report, or portions thereof, that was prepared by us, that we supervised in the preparation of, and/or that was reviewed and approved by us, that is included or incorporated by reference in any of the forms associated with the above mentioned filing, other periodic reports, or the Registration Statements. |

Woods Process Services, LLC., is responsible for authoring, and this consent pertains to, the following Chapters of the Report: Only Chapters 10 and 14 and sections 18.2.2 and 18.3.2.

Report Effective Date: September 04, 2025.

| By: | /s/ Jeffrey Woods | |

| Name: | Jeffrey Woods | |

| Title: | Owner/President | |

| Company: | WPS |

Exhibit 23.3

|

Consent of Qualified Person |

I, Jacob Anderson , CPG, MAusIMM on behalf of Dahrouge Geologic Consulting Ltd., hereby consent to:

| 1. | The inclusion of Dahrouge Geologic Consulting Ltd., and associated Qualified Persons in connection with American Battery Technology Company’s anticipated filing of the technical report and preliminary feasibility study titled “Tonopah Flats Lithium Project S-K 1300 Technical Report and Preliminary Feasibility Study, Esmeralda and Nye Counties, Nevada, USA” dated September 4, 2025, as an exhibit to and referenced in Form 10-K/Form 8-K/or other filing, prepared in accordance with Item 601(b)(96) of Regulation S-K (17 CFR §229.601 (b)(96)) and Subpart 1300 of Regulation S-K. |

| 2. | The incorporation, by reference, of the Report, in the above filing, or any other periodic reports filed by the company, and to the extent practicable in the Registration Statements on any of the associated forms prepared in relation to the filing mentioned above. |

| 3. | The information derived, summarized, quoted, or referenced from the Report, or portions thereof, that was prepared by us, that we supervised in the preparation of, and/or that was reviewed and approved by us, that is included or incorporated by reference in any of the forms associated with the above mentioned filing, other periodic reports, or the Registration Statements. |

Dahrouge Geologic Consulting Ltd. is responsible for authoring, and this consent pertains to, the following Chapters of the Report: Only chapters 6, 7, 8, 9, and 11.

Report Effective Date: September 04, 2025.

| By: | /s/ Jacob Anderson | |

| Name: | Jacob Anderson | |

| Title: | Resource Geologist | |

| Company: | Dahrouge Geological Consulting Ltd. |

Exhibit 96.1

|

|

Important Notice

This Report was prepared for American Battery Technology Company by the qualified persons (QPs) identified in the Report’s Date and Signature Page.

This Report contains estimates, projections, and conclusions that are forward-looking information within the meaning of applicable securities laws. Forward-looking statements are based upon the responsible QPs opinions at the time that they are made but, in most cases, involve significant risk and uncertainty.

Although each of the responsible QPs has attempted to identify factors that could cause actual events or results to differ materially from those described in this Report, there may be other factors that cause events or results to not be as anticipated, estimated, or projected. None of the QPs undertake any obligation to update the forward-looking information.

This Report is intended to be used by American Battery Technology Company subject to the terms and conditions of its contracts with each of the QPs. Except for the purposes legislated under United States securities law, any use of, or reliance on, this Report by any third party is at that party’s sole risk.

| barr.com |

Date and Signature Page

| This technical report and pre-feasibility study is effective as of the 4th day of September, 2025. | ||

| Original signed and sealed on file | September 4, 2025 | |

|

Daniel R. Palo, PE On behalf of Barr Engineering Co. Chapters 1-5, 12-13, and 15-25 (excluding sections 18.2.2 and 18.3.2) |

Date | |

| Original signed and sealed on file | September 4, 2025 | |

| Jacob

Anderson, CPG On behalf of Dahrouge Geologic Consulting Ltd. |

Date | |

| Chapters 6-9 and 11 | ||

| Original signed and sealed on file | September 4, 2025 | |

| Jeffrey

Woods, RM-SME, QP-MMSA Woods Process Services, LLC. |

Date | |

| Chapters 10, 14, and sections 18.2.2, and 18.3.2 | ||

| barr.com |

Tonopah

Flats Lithium Project

Pre-Feasibility Study

September 2025

Contents

| 1 Executive Summary | 1 |

| 1.1 Property Description and Ownership | 1 |

| 1.2 Geology and Mineralization | 1 |

| 1.3 Status of Exploration, Development, and Operations | 2 |

| 1.4 Metallurgical Testing and Mineral Processing | 2 |

| 1.5 Mineral Resource Estimate | 2 |

| 1.6 Mineral Reserves | 3 |

| 1.7 Mining Methods | 4 |

| 1.8 Processing and Recovery Methods | 5 |

| 1.9 Infrastructure | 5 |

| 1.10 Capital and Operating Costs | 6 |

| 1.11 Economic Analysis | 8 |

| 1.12 Economic Sensitivities | 8 |

| 1.13 Conclusions and Recommendations | 9 |

| 1.13.1 Project Risks | 10 |

| 1.13.2 Recommendations | 11 |

| 2 Introduction | 12 |

| 2.1 Sources of Information | 12 |

| 2.2 Personal Inspections | 12 |

| 2.3 Effective Date | 13 |

| 3 Property Description and Location | 14 |

| 3.1 Property Location | 14 |

| 3.2 Property Area and Claim Type | 15 |

| 3.3 Mineral Rights | 16 |

| 3.4 Significant Encumbrances and Permitting | 16 |

| 3.5 Royalties | 16 |

| 3.6 Significant Factors and Risks | 16 |

| barr.com |

|

|

| 4 Accessibility, Climate, Local Resources, Infrastructure and Physiography | 17 |

| 4.1 Property Access | 17 |

| 4.2 Climate and Length of Operating Season | 17 |

| 4.3 Infrastructure | 17 |

| 5 History | 19 |

| 6 Geologic Setting, Deposit Type, and Mineralization | 20 |

| 6.1 Regional Geologic Setting | 20 |

| 6.2 Regional Geology | 20 |

| 6.3 District and Local Geology | 20 |

| 6.4 Mineralization | 27 |

| 6.5 Deposit Type | 27 |

| 6.5.1 Lithium Deposit Model | 27 |

| 6.5.2 Sources of and Concentration of Lithium in Clays | 28 |

| 7 Exploration | 30 |

| 7.1 ABTC 2021 Surface Sampling | 30 |

| 7.2 ABTC 2021 and 2022 Exploration Drilling | 32 |

| 7.3 ABTC 2023 Exploration Drilling | 35 |

| 7.4 ABTC 2025 Exploration and Geotechnical Drilling | 35 |

| 7.5 Interpretation of Drilling Results and Adequacy of Sample Quality | 38 |

| 8 Sample Preparation, Analysis, and Security | 41 |

| 8.1 Historical Sample Preparation, Analysis, Quality Assurance/ Quality Control Procedures, and Historical Sample Security | 41 |

| 8.2 Sample Preparation, Analyses, Sample Security, and Quality Assurance/Quality Control Procedures by ABTC | 41 |

| 8.2.1 ABTC 2021 Surface Sampling | 41 |

| 8.2.2 ABTC 2021-2022 Air Core and RC Drill Sampling | 41 |

| 8.2.3 ABTC 2023 Core Drill Sampling | 42 |

| 8.2.4 ABTC 2025 Core Drill Sampling | 43 |

| 8.3 ABTC Quality Assurance/Quality Control Results | 43 |

| 8.3.1 Standards | 44 |

| 8.3.2 Lithium CRM Results in the 2021-2022 Drill Programs | 45 |

| 8.3.3 Lithium CRM Results in the 2023 Drill Programs | 47 |

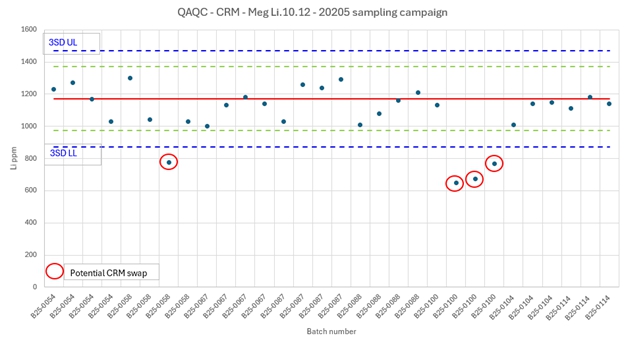

| 8.3.4 Lithium CRM Results in the 2025 Drill Programs | 48 |

| 8.4 Duplicates | 49 |

| 8.5 Blanks | 56 |

| 8.5.1 Results for Blanks in the 2021 to 2022 Drill Program | 56 |

| 8.5.2 Results for Blanks in the 2023 Drill Program | 57 |

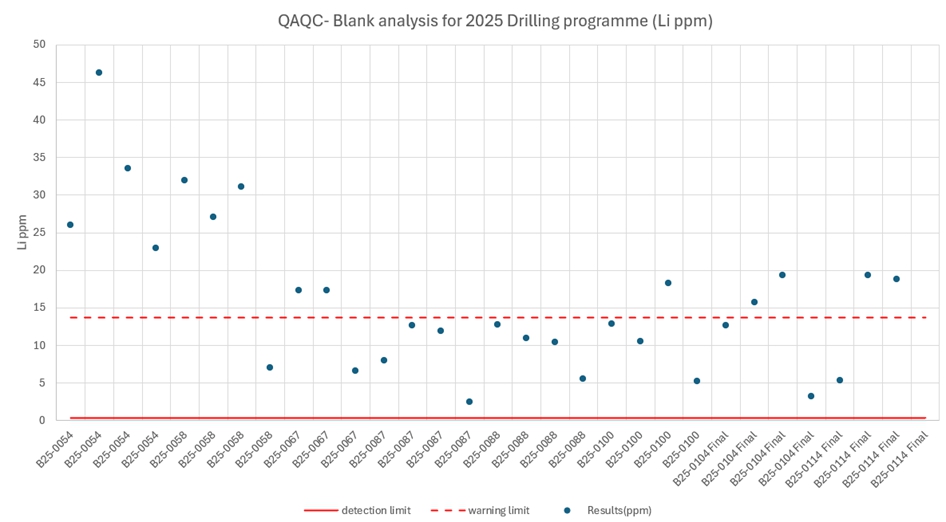

| 8.5.3 Results for Blanks in the 2025 Drill Program | 58 |

| 8.6 Adequacy of Sample Preparation, Analyses, and Security | 58 |

| barr.com |

|

|

| 9 Data Verification | 60 |

| 9.1 Site Visit | 60 |

| 9.2 Drilling Database Verification | 60 |

| 9.2.1 Assays | 61 |

| 9.3 Adequacy of Data | 61 |

| 9.4 Metallurgical Test Work and Pilot Plant Adequacy of Data | 62 |

| 10 Mineral Processing and Metallurgical Testing | 64 |

| 10.1 Mineral Processing and Metallurgical Testing Summary | 64 |

| 10.2 Sample Information | 65 |

| 10.3 Sample Analysis Methods and Validation | 66 |

| 10.4 Mineralogy and Particle Properties | 68 |

| 10.4.1 Particle Size and Mineralogy | 69 |

| 10.4.2 QEMSCAN Field Imaging | 72 |

| 10.4.3 Specific Gravity Analysis | 73 |

| 10.4.4 Thermogravimetric Analysis | 73 |

| 10.5 Mineral Processing | 74 |

| 10.5.1 Bond Ball Work Index | 74 |

| 10.5.2 Beneficiation | 75 |

| 10.5.3 Mineral Processing – Dewatering | 76 |

| 10.5.4 Pulp Rheology | 78 |

| 10.6 Lithium Extraction – Pretreatment and Water Leaching of Beneficiated Claystone | 78 |

| 10.6.1 Counter Current Decantation Leaching | 78 |

| 10.7 PLS Purification and Polishing | 79 |

| 10.7.1 Alkaline-Earth Metal Removal by Precipitation | 79 |

| 10.7.2 Ion-Exchange Screening | 79 |

| 10.8 Sulfate to Hydroxide Conversion | 80 |

| 10.9 Crystallization of Lithium Hydroxide Monohydrate | 80 |

| 10.10 Pilot Plant | 81 |

| 10.11 Conclusions | 82 |

| 11 Mineral Resource Estimate | 83 |

| 11.1 Summary | 83 |

| 11.2 Key Assumptions and Methods | 83 |

| 11.3 Database | 84 |

| 11.4 Interpretation and Modeling | 88 |

| 11.5 Density | 89 |

| 11.6 Compositing | 90 |

| 11.7 Outlier and Capping | 90 |

| barr.com |

|

|

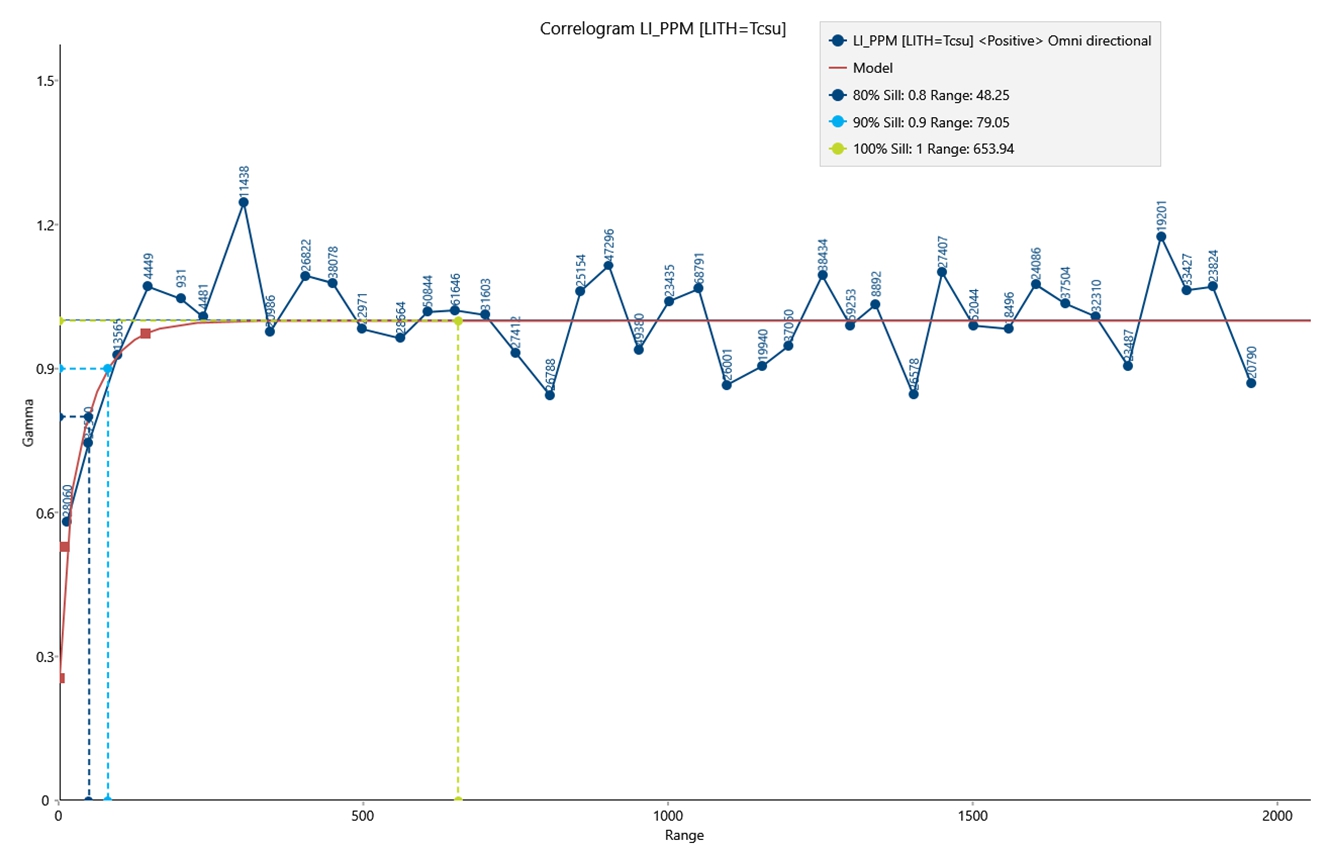

| 11.8 Variography | 91 |

| 11.9 Lithium Block Modeling and Estimation | 93 |

| 11.9.1 Estimation Domains | 93 |

| 11.9.2 Grade Simulation | 98 |

| 11.9.3 Block Model Validation | 98 |

| 11.10 Reasonable Prospects of Economic Extraction for Mineral Resources | 101 |

| 11.11 Mineral Resource Estimate | 103 |

| 11.12 Qualified Person Statement | 104 |

| 11.13 Mineral Resource Uncertainty | 104 |

| 12 Mineral Reserves Estimates | 106 |

| 12.1 Approach | 106 |

| 12.2 Design Pit Selection | 107 |

| 12.3 Open-Pit Design | 109 |

| 12.4 Mining Dilution and Ore Loss | 112 |

| 12.5 Mineral Reserve Estimate | 112 |

| 13 Mining Methods | 113 |

| 13.1 Economic Parameters and Cut-Off Grades | 113 |

| 13.2 Pit Optimization | 114 |

| 13.3 Road and Ramp Design | 114 |

| 13.4 Open Pit Design | 115 |

| 13.4.1 Open Pit Geotechnical Considerations | 115 |

| 13.4.2 Rock and Soils Strength Assessment | 123 |

| 13.4.3 Stability Analysis | 124 |

| 13.4.4 Open-Pit Slope Design Recommendations | 126 |

| 13.5 Pit, Tailings, Coarse Gangue, Waste Dump, and Backfill Designs | 127 |

| 13.6 Phase Design | 128 |

| 13.7 Production Schedule | 130 |

| 13.8 Mine Equipment | 142 |

| 13.8.1 Drilling and Blasting | 143 |

| 13.8.2 Loading and Hauling | 145 |

| 13.8.3 ROM Ore Handling | 148 |

| 13.8.4 Tailings And Coarse Gangues Handling | 148 |

| 13.8.5 Support and Service Equipment | 149 |

| 13.9 Mine Personnel | 150 |

| 13.10 Reclamation and Closure | 152 |

| 14 Processing and Recovery Methods | 154 |

| 14.1 Introduction | 154 |

| barr.com |

|

|

| 14.2 ABTC’s Pilot-Scale Plant | 155 |

| 14.2.1 Pertinent Results | 155 |

| 14.2.2 Key Findings and Scale-Up Differences | 155 |

| 14.3 High Level Design Criteria | 157 |

| 14.4 Comminution and Screening | 158 |

| 14.5 Beneficiation | 159 |

| 14.6 Extraction | 160 |

| 14.7 Impurity Removal and Concentration | 162 |

| 14.8 Impurity Crystallization | 163 |

| 14.9 Sulfate Crystallization | 163 |

| 14.10 Hydroxide Conversion and Crystallization | 164 |

| 14.11 Tailings | 165 |

| 14.12 Utilities | 165 |

| 14.12.1 Off-Gas Handling | 165 |

| 14.12.2 Water | 165 |

| 14.12.3 Chilled Water | 165 |

| 14.12.4 Cooling Water | 165 |

| 14.12.5 Reagents | 166 |

| 15 Infrastructure | 167 |

| 15.1 Site General Arrangement | 167 |

| 15.1.1 Access Roads | 167 |

| 15.1.2 Process Plant General Arrangement | 167 |

| 15.1.3 Reagents, Consumables, and Shipping | 169 |

| 15.1.4 Ancillary Buildings | 169 |

| 15.2 Mine Infrastructure and Tailings Facility | 170 |

| 15.2.1 Mine Workshop and Truck Maintenance | 170 |

| 15.2.2 Fuel Storage and Distribution | 170 |

| 15.2.3 Tailings Storage Facility | 170 |

| 15.3 Power Infrastructure | 173 |

| 15.3.1 Site Power Distribution | 173 |

| 15.3.2 Onsite Power Generation | 174 |

| 15.3.3 Financial Incentives and Revenue Opportunities | 175 |

| 15.4 Water Infrastructure | 176 |

| 15.4.1 Water Supply | 176 |

| 15.4.2 Process Water Treatment and Recovery | 176 |

| 15.4.3 Water Discharge | 176 |

| 15.4.4 Storm Water Handling | 176 |

| 15.5 Waste Management | 176 |

| barr.com |

|

|

| 15.6 Communications | 176 |

| 15.7 Mobile Equipment | 177 |

| 15.8 Rail | 177 |

| 15.9 Fossil Fuels | 177 |

| 16 Market Studies | 178 |

| 16.1 Demand | 180 |

| 16.2 Comparable Pricing | 181 |

| 17 Environmental Studies, Permitting, and Plans; Negotiations or Agreements with Local Individuals or Groups | 182 |

| 17.1 Introduction | 182 |

| 17.2 Environmental Baseline Studies | 182 |

| 17.2.1 Visual | 183 |

| 17.2.2 Environmental Justice | 183 |

| 17.2.3 Human Noise | 183 |

| 17.2.4 Paleontology | 184 |

| 17.2.5 Grazing | 184 |

| 17.2.6 Lands and Realty | 184 |

| 17.2.7 Socioeconomics | 184 |

| 17.2.8 Floodplains | 184 |

| 17.2.9 Cultural Resources | 185 |

| 17.2.10 Biological | 185 |

| 17.2.11 Raptors | 185 |

| 17.2.12 Geochemistry | 185 |

| 17.2.13 Hydrology | 186 |

| 17.2.14 Air Quality | 187 |

| 17.3 Permitting | 187 |

| 18 Capital and Operating Costs | 192 |

| 18.1 Introduction | 192 |

| 18.2 Capital Cost Estimate | 192 |

| 18.2.1 Mining Capital Cost Estimates | 193 |

| 18.2.2 Refinery CAPEX | 195 |

| 18.3 OPEX Estimate | 196 |

| 18.3.1 Mining OPEX Estimates | 197 |

| 18.3.2 Refining OPEX | 200 |

| 18.3.3 Energy Cost | 202 |

| 18.3.4 General and Administrative OPEX | 203 |

| 19 Economic Analysis | 205 |

| 19.1 Sensitivity Analysis | 210 |

| barr.com |

|

|

| 20 Adjacent Properties | 212 |

| 21 Other Relevant Data and Information | 215 |

| 22 Interpretations and Conclusions | 216 |

| 22.1 Conclusions | 216 |

| 22.2 Tonopah Flats Expansion Potential | 217 |

| 22.3 Project Risks | 217 |

| 23 Recommendations | 219 |

| 23.1 Mining, Ore Handling, and Tailings Handling | 219 |

| 23.2 Metallurgy and Processing | 219 |

| 23.2.1 Recommended Metallurgical Test Work | 219 |

| 23.3 Passive Seismic Study | 220 |

| 23.4 Geotechnical | 220 |

| 23.5 Baseline Environmental Studies and NEPA Documentation | 221 |

| 23.6 Feasibility Study | 222 |

| 24 References | 223 |

| 25 Reliance on Information Provided by the Registrant | 226 |

| barr.com |

|

|

Tables

| Table 1-1 | Tonopah Flats Mineral Resources | 3 |

| Table 1-2 | Tonopah Flats Mineral Reserves Estimate Effective as of the Date of this PFS | 4 |

| Table 1-3 | Total Capital Cost Summary | 7 |

| Table 1-4 | Operating Cost Summary | 8 |

| Table 1-5 | ABTC Estimated Costs for Tonopah Flats Recommended Work Program | 11 |

| Table 3-1 | Summary of Annual Property Holding Costs | 16 |

| Table 4-1 | Average Climate Data for Tonopah, Nevada | 17 |

| Table 7-1 | ABTC Drilling 2021 - 2023 | 32 |

| Table 7-2 | ABTC 2025 Drilling Program | 35 |

| Table 7-3 | Drill Intervals of Interest | 38 |

| Table 8-1 | Summary Counts of Tonopah Flats QA/QC Analyses | 44 |

| Table 8-2 | CRMs Used by ABTC | 45 |

| Table 8-3 | Summary of Lithium Results for Certified Reference Materials, 2021-2022 | 45 |

| Table 8-4 | Lithium CRM Failures in the 2022 Drill Program | 46 |

| Table 8-5 | Explanation for Figure 8-1 | 47 |

| Table 8-6 | Summary of Tonopah Flats Lithium Results for Certified Reference Materials, 2023 | 47 |

| Table 8-7 | Lithium Failures in the 2023 Drill Program | 48 |

| Table 8-8 | Summary of Tonopah Flats Lithium Results for Certified Reference Materials, 2025 | 49 |

| Table 8-9 | Summary of Results for Field Duplicates and Laboratory Preparation Duplicates | 51 |

| Table 8-10 | Summary of Results for Blanks | 56 |

| Table 8-11 | Blank Failures and Preceding Samples 2021-2022 | 56 |

| Table 9-1 | Limits of Detection for Analytical Methods | 63 |

| Table 10-1 | Materials Used for Mineral Processing and Metallurgical Test Work | 66 |

| Table 10-2 | Limits of Detection for Analytical Methods | 67 |

| Table 10-3 | Particle Size Distribution for BS-TF-2219 | 69 |

| Table 10-4 | Semi-Quantitative Mineralogical Composition of DC-TF-2218 (Head Material) and DC-TF-2218-BC2 (Beneficiated Clay) (SGS Canada, Inc., 2025) | 72 |

| Table 10-5 | Bond Ball Work for Two Closing Screen Sizes | 75 |

| Table 11-1 | Descriptive Statistics of Sample Assays in Tonopah Flats Drillhole Database | 84 |

| Table 11-2 | Drillhole Sample Statistics | 84 |

| Table 11-3 | Lithium Statistics by Geologic Unit | 86 |

| Table 11-4 | Tonopah Flats Deposit Average Specific Gravity Measurements by Lithology | 89 |

| Table 11-5 | Approximate Grade Ranges of Lithium Domains for Fault Block 3 | 94 |

| Table 11-6 | Approximate Grade Ranges of Lithium Domains for Fault Block 4 | 95 |

| Table 11-7 | Tonopah Flats Sequential Gaussian Simulation Parameters | 98 |

| Table 11-8 | Pit Optimization Parameters | 101 |

| Table 11-9 | Tonopah Flats Inferred Mineral Resources at Various Cut-Offs (Exclusive of Measured and Indicated) | 103 |

| Table 11-10 | Classified Lithium Mineralization Exclusive of the Mineral Reserve with a Cut-Off of 300 ppm Li | 104 |

| Table 11-11 | Lithium Mineral Resources Inclusive of the Mineral Reserve with a Cut-Off of 300 ppm Li | 104 |

| Table 12-1 | Primary Pit Optimization Parameters | 107 |

| Table 12-2 | Overall Results of the Tonopah Flats Open Pit Optimization | 108 |

| Table 12-3 | Tonopah Flats Mineral Reserves Estimate as of PFS Date | 112 |

| barr.com |

|

|

| Table 13-1 | Economic Parameters for Calculation of the Cut-Off Grade | 114 |

| Table 13-2 | Geotechnical Borings Drilled for South Lobe of the Open Pit | 116 |

| Table 13-3 | Atterberg Limits Summary | 119 |

| Table 13-4 | Results of Uniaxial Compressive Strength Tests | 120 |

| Table 13-5 | Summary of Uniaxial Compressive Strength Tests | 120 |

| Table 13-6 | Results of Splitting Tensile Strength Tests | 121 |

| Table 13-7 | Summary of Splitting Tensile Strength Tests | 121 |

| Table 13-8 | Summary of Triaxial Compressive Strength Tests | 122 |

| Table 13-9 | Results of Direct Shear Strength Tests | 122 |

| Table 13-10 | Summary of Unconsolidated-Undrained Triaxial Compression Test | 123 |

| Table 13-11 | Results of Consolidated-Undrained Triaxial Compression Tests | 123 |

| Table 13-12 | Typical FOS and POF Acceptance Criteria Values (Read & Stacey, 2009) | 125 |

| Table 13-13 | Recommended Open-Pit Design Slope Configuration | 126 |

| Table 13-14 | Tonopah Flats Phase Design Report | 129 |

| Table 13-15 | 45-Year Production Schedule | 132 |

| Table 13-16 | 45-Year Mining Quantities (tonnes) | 133 |

| Table 13-17 | Major Mining Equipment – Maximum Units Required | 143 |

| Table 13-18 | Drilling Productivity | 143 |

| Table 13-19 | Drilling Productivity by Period | 144 |

| Table 13-20 | Blasting Patterns and Powder Factors | 144 |

| Table 13-21 | Blasting and Explosives by Period | 145 |

| Table 13-22 | Loading and Hauling Productivity | 145 |

| Table 13-23 | Truck Speed Limits and Grade-Speed Bin | 147 |

| Table 13-24 | Average Load-Haul Units and Productivity by Period | 147 |

| Table 13-25 | Feed Handling Equipment By Period | 148 |

| Table 13-26 | Tailings Handling Equipment By Period | 149 |

| Table 13-27 | Support and Service Equipment-Maximum Units Required | 150 |

| Table 13-28 | Mining Labor Requirements | 151 |

| Table 14-1 | Differences Between Pilot and Commercial Scale | 156 |

| Table 14-2 | Design Requirements Not Previously Identified | 156 |

| Table 14-3 | High Level Process Design Criteria | 157 |

| Table 15-1 | Tailings Index Properties | 171 |

| Table 15-2 | Direct Shear Test Results for Tailings | 171 |

| Table 15-3 | Geotechnical Model Parameters | 171 |

| Table 15-4 | Tailings Storage Facility Stability Modeling Results | 172 |

| Table 15-5 | Seismic Sensitivity Results | 173 |

| Table 15-6 | Water Sensitivity Analysis | 173 |

| Table 16-1 | Historic 3-Year LHM Pricing FOB North America (S&P Global Market Intelligence, n.d.) | 179 |

| Table 16-2 | Industry LiOH Pricing Data | 181 |

| Table 16-3 | Average LiOH Prices Using a Five-Year Pricing Window | 181 |

| Table 17-1 | Required Baseline Studies for TFLP | 183 |

| Table 17-2 | Federal Environmental Permits, Reviews, and Approvals | 188 |

| Table 17-3 | State of Nevada Environmental Permits, Reviews, and Approvals | 189 |

| Table 18-1 | Project Capital Estimates | 193 |

| Table 18-2 | Mining Capital Estimates | 194 |

| Table 18-3 | Overview of Refinery Direct Capital Costs ($000) | 196 |

| barr.com |

|

|

| Table 18-4 | Refinery Capital Cost Timeline ($ 000s) | 196 |

| Table 18-5 | Operating Cost Summary | 197 |

| Table 18-6 | Mining Operating Costs Summary | 198 |

| Table 18-7 | Mining Operating Costs By Period | 199 |

| Table 18-8 | Energy Usage By Mining Activity | 200 |

| Table 18-9 | Refinery OPEX Cost Summary | 200 |

| Table 18-10 | Estimated Refinery Labor | 201 |

| Table 18-11 | G&A Operating Costs – Personnel ($000s) | 203 |

| Table 18-12 | G&A Operating Costs – General ($000s) | 203 |

| Table 19-1 | PFS Production Schedule | 206 |

| Table 19-2 | Project Cash Flow | 207 |

| Table 19-3 | After Tax Cash Flow Lithium Price Sensitivity | 210 |

| Table 19-4 | After Tax Cash Flow Capital Cost Sensitivity (US$ Billion) | 210 |

| Table 19-5 | After Tax Cash Flow Energy Cost Sensitivity (US$ Billion) | 211 |

Figures

| Figure 1-1 | After-Tax Cash Flow Sensitivity - NPV (8%) US$ Billion | 9 |

| Figure 3-1 | Location Map for the Tonopah Flats Property | 14 |

| Figure 3-2 | Tonopah Flats Property Map | 15 |

| Figure 6-1 | Property Geologic Map of the Tonopah Flats Lithium Project - Modified from Bonham & Garside, 1979 | 22 |

| Figure 6-2 | Generalized North-South Cross Section Through the Central Portion of the Tonopah flats Property (provided by ABTC, 2023) | 24 |

| Figure 6-3 | Generalized East-West Cross Section through the Central Portion of the Tonopah Flats Property (provided by ABTC, 2023) | 25 |

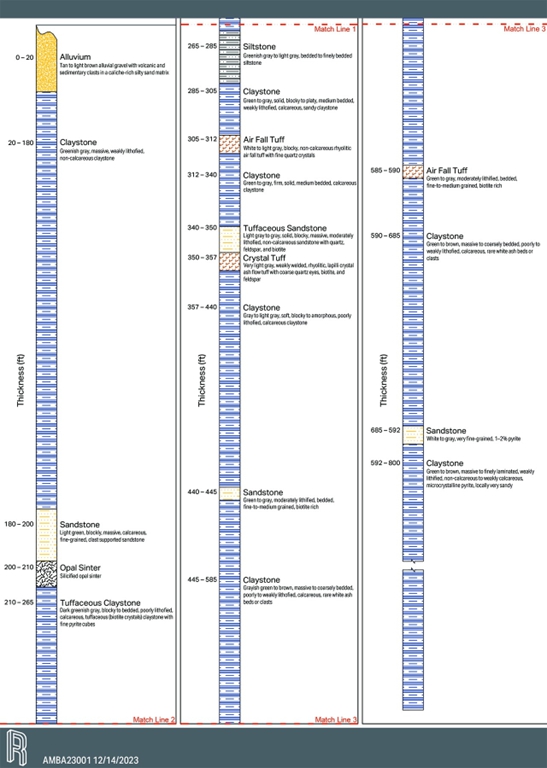

| Figure 6-4 | Detailed Stratigraphic Column of the Tonopah Flats Lithologic Units from Drilling | 26 |

| Figure 6-5 | Modified Schematic Model of Sedimentary or Clay Lithium Deposits (modified after Helvaci (2015), from Vardar Minerals Ltd, Viti Li-B Project, Kosovo) | 29 |

| Figure 7-1 | Map of Tonopah Flats Surface Sample Locations | 31 |

| Figure 7-2 | Map of Tonopah Flats Drillhole Collars | 33 |

| Figure 7-3 | ABTC 2025 Sonic Drillhole Locations | 36 |

| Figure 7-4 | ABTC 2025 Diamond Drilled Core Hole Locations | 37 |

| Figure 8-1 | Lithium Control Chart for MEG Li.10.14 | 46 |

| Figure 8-2 | Lithium Control Chart for MEG Li.10.11, 2023 Drill Program | 48 |

| Figure 8-3 | Li CRM MEG Li 10.12 Used for the 2025 Drill Program | 49 |

| Figure 8-4 | Lithium AAL vs. Paragon Scatterplot, 2021-2022 | 52 |

| Figure 8-5 | Lithium Relative Percent Difference, AAL vs. Paragon, 2021-2022 | 52 |

| Figure 8-6 | AAL Preparation Duplicate vs. Original for Lithium, 2021-2022 | 53 |

| Figure 8-7 | Lithium Field Duplicates Scatterplot, 2023 | 54 |

| Figure 8-8 | Field Duplicates for 2025 Program (Li ppm) | 55 |

| Figure 8-9 | Relative Percentage Difference Between Duplicates for the 2025 Drilling Program | 55 |

| Figure 8-10 | Lithium in "MEG Silica Blank 21.03" and Preceding Samples 2021-2022 | 57 |

| Figure 8-11 | Lithium in "MEG Silica Blank 21.03" and Preceding Samples 2023 | 57 |

| Figure 8-12 | Blank Analysis Completed on the 2025 Drilling Program | 58 |

| barr.com |

|

|

| Figure 9-1 | Lithium Concentration Control Chart for Certified Reference Materials from Moment Exploration Geochemistry LLC, MEG Li.10.14 | 62 |

| Figure 9-2 | Lithium Concentration Control Chart for Certified Reference Material from Moment Exploration Geochemistry LLC, MEG Li.10.15 | 63 |

| Figure 10-1 | Lithium Concentration Control Charts for Certified Reference Materials from Moment Exploration Geochemistry LLC., MEG Li.10.14 and MEG Li.10.15. | 68 |

| Figure 10-2 | Particle Size Distribution of -20 µm Fraction Showing a Bimodal Distribution of the Head Material For BS-TF-2219 | 70 |

| Figure 10-3 | Cumulative Elemental Distribution of Clay Materials Shows That 90% of Li Mass is Reported in Less Than 20 µm Size Fraction for BS-TF-2219 (Hazen Research Inc., 2024) | 70 |

| Figure 10-4 | Cumulative Distributions of Lithium, Magnesium, and Silicon of Sample DC-TF-2218 (SGS Canada, Inc., 2025) | 71 |

| Figure 10-5 | Detailed QEMSCAN Field Image Of 100% -600 µm Sample. Calcite is Present as Discrete Finer Grains and Pervasively Penetrates the Surrounding Illite-Smectite Clay Minerals (Hazen Research Inc., 2024) | 73 |

| Figure 10-6 | Thermogravimetric Analysis of DC-TF-2218 (Homogenized Clay) and DC-TF-2218-BC2 (Beneficiated Clay) | 74 |

| Figure 10-7 | Lithium Recovery vs. Grade for Bench Scale Trials Carried Out by SGS (SGS Canada, Inc., 2025). HC-3 Gives a Highest Grade of Lithium in the Beneficiated Clay | 75 |

| Figure 10-8 | Particle Size Distribution of DC-TF-2218-BC2. The D80, D50, and D10 of the Beneficiated Clay is 1.680 µm, 0.932 µm, 0.455 µm Respectively | 76 |

| Figure 10-9 | Process Flow Sheet for Lithium Extraction from Claystone by Pretreated Selective Extraction | 78 |

| Figure 10-10 | Lithium Hydroxide Monohydrate Battery-Grade Sample Certificate of Analysis Manufactured from ABTC Claystone Material | 81 |

| Figure 10-11 | Photograph of ABTC’s Lithium Hydroxide Pilot Plant Processing Materials from the Tonopah Flats Sedimentary Claystone Deposit with a Nominal Plant Capacity of Multi-Kilograms of Products/Day. | 82 |

| Figure 11-1 | Lithium PPM Histogram for the Upper Unit – Tcsu | 86 |

| Figure 11-2 | Lithium (ppm) Histogram for the Middle Unit – Tcsm | 87 |

| Figure 11-3 | Box Plot of the Tcsu, Tcsm, and Tcsl Geologic Units | 87 |

| Figure 11-4 | Fault Traces Interpreted from Drilling (Left); Corresponding Fault Blocks Used to Constrain the Conditional Simulations (Right) | 89 |

| Figure 11-5 | Perspective View Looking Down Towards the East Showing the Relative Positions of Qal (Yellow), Tcsu (Green), Tcsm (Brown) and Tcsl (Dk Green) Lithologies in Fault Block 3 | 90 |

| Figure 11-6 | Variogram for Tcsu with Ranges to Sill Included | 91 |

| Figure 11-7 | Variogram for Tcsm with Ranges to Sill Included | 92 |

| Figure 11-8 | Variogram for Tcsl with Ranges to Sill Included | 92 |

| Figure 11-9 | Lithium Drillhole Sample Variography in Fault Block 3 | 93 |

| Figure 11-10 | Lithium Population Probability Distribution Graph | 94 |

| Figure 11-11 | Cross Section Looking North Showing Lithium Domains | 96 |

| Figure 11-12 | Cross Section Looking East Showing Lithium Domains | 97 |

| Figure 11-13 | Comparison Of Drillhole Composite Lithium Grades (Bars) to Conditionally Simulated Block Grades (Red Line) | 99 |

| barr.com |

|

|

| Figure 11-14 | Swath Plots Comparing Drillhole Composite Lithium Grades (Black Lines) to Simulated Grades In 5 m by 5 m by 1 m Model (Red Lines) | 100 |

| Figure 11-15 | Resource Classification | 101 |

| Figure 12-1 | Tonopah Flats Open Pit Optimization - Overall Pit Shell Results | 109 |

| Figure 12-2 | Final Pit Design | 110 |

| Figure 12-3 | Measured and Indicated Resources Relative to the Final Pit Design | 111 |

| Figure 12-4 | E470300 Cross Section of the Final Pit Showing Measured and Indicated Resources (Li ppm) | 111 |

| Figure 12-5 | N4215200 Cross Section of the Final Pit Showing Measured and Indicated Resources (Li ppm) | 112 |

| Figure 13-1 | Open Pit Geotechnical Boring Locations | 116 |

| Figure 13-2 | Poles of Features Picked by IDS as Sealed (Type 0), Partial Open (Type 1), and Continuous Open (Type 2) Structures from TF25-GT1 and TF25-GT3 | 118 |

| Figure 13-3 | Density Concentrations and Mean Set Planes for Structures Picked by IDS As Type 1 and Type 2 (i.e., Potentially Structures Other Than Bedding Planes) | 118 |

| Figure 13-4 | Shear Strength Data from Laboratory Testing | 124 |

| Figure 13-5 | Tonopah Flats Ultimate Pit Design and Facilities | 127 |

| Figure 13-6 | Tonopah Flats Ultimate Pit Design, Facilities, and In-Pit Backfill (Year 45) | 128 |

| Figure 13-7 | Tonopah Flats Phase Design | 129 |

| Figure 13-8 | Total Tonnage Scheduled by Phase | 130 |

| Figure 13-9 | Process Feed and Li Grade | 131 |

| Figure 13-10 | Process Feed and LHM Production | 131 |

| Figure 13-11 | Production Schedule and Strip Ratio | 131 |

| Figure 13-12 | LOM Material Movements | 135 |

| Figure 13-13 | LOM Truck Hours | 135 |

| Figure 13-14 | Tonopah Flats Phase 1 Mining (Year 5) | 136 |

| Figure 13-15 | Tonopah Flats Phase 2 Mining and Backfill (Year 7) | 137 |

| Figure 13-16 | Tonopah Flats Phase 3 Mining and Backfill (Year 13) | 138 |

| Figure 13-17 | Tonopah Flats Phase 4 Mining and Backfill (Year 17) | 139 |

| Figure 13-18 | Tonopah Flats Phase 5 Mining and Backfill (Year 21) | 140 |

| Figure 13-19 | Tonopah Flats Phase 6 Mining and Backfill (Year 28) | 141 |

| Figure 13-20 | Tonopah Flats Phase 7 Mining and Backfill (Year 37) | 142 |

| Figure 14-1 | ABTC’s Process Block Flow Diagram | 154 |

| Figure 14-2 | Comminution and Screening Flow Diagram | 158 |

| Figure 14-3 | Beneficiation Flow Diagram | 159 |

| Figure 14-4 | Filter Press Flow Diagram | 160 |

| Figure 14-5 | Extraction Flow Diagram | 160 |

| Figure 14-6 | Thickener and Leaching Flow Diagram | 161 |

| Figure 14-7 | Precipitation Flow Diagram | 162 |

| Figure 14-8 | Osmosis Flow Diagram | 162 |

| Figure 14-9 | Crystallizer Flow Diagram | 163 |

| Figure 14-10 | Ion Exchange Flow Diagram | 164 |

| Figure 14-11 | Electrochemical Conversion Process Flow Diagram | 164 |

| Figure 15-1 | Refinery Block Layout | 168 |

| Figure 16-1 | Industry Price Chart from S&P Global Market Intelligence (accessed July 31, 2025) Showing Historic 5-Year LHM Pricing | 179 |

| Figure 18-1 | Mining Operating Costs (weighted $/t moved) | 198 |

| barr.com |

|

|

| Figure 19-1 | After Tax Cash Flow Sensitivity - NPV (8%) (US$ Billion) | 211 |

| Figure 20-1 | Adjacent Properties | 212 |

Appendices

| Appendix A | List of Unpatented Lode Claims of the Tonopah Flats Property |

| barr.com |

|

|

Abbreviations, Acronyms, and Units

| °C | degrees Celsius |

| µg/g | micrograms per gram |

| μm | micrometer (micron) |

| 45X MPTC | Advanced Manufacturing Production Tax Credit |

| AACE | Association for the Advancement of Cost Engineering (AACE International) |

| AAL | American Assay Laboratory |

| ABA | acid-base accounting |

| ABI | acoustic borehole imagers |

| ABTC | American Battery Technology Company |

| ac | acres |

| AC | air core (drilling) |

| ACOE | U.S. Army Corps of Engineers |

| AGP | acid generation potential |

| ALS | ALS Limited - Geochemistry |

| AMSL | above mean sea level |

| ANP | acid neutralization potential |

| ARPD | absolute relative percent difference |

| ATF | U.S. Bureau of Alcohol, Tobacco, Firearms and Explosives |

| avg | average |

| B | billion |

| B&V | Black & Veatch Corporation |

| BAPC | NDEP Bureau of Air Pollution Control |

| BESS | battery energy storage system |

| bgs | below ground surface |

| BLM | U.S. Bureau of Land Management |

| BMRR | NDEP Bureau of Mining Regulation and Reclamation |

| BSDW | NDEP Bureau of Safe Drinking Water |

| BWM | NDEP Bureau of Waste Management |

| BWPC | NDEP Bureau of Water Pollution Control |

| CAA | U.S. Clean Air Act |

| CAPEX | capital expenditures |

| CCD | countercurrent decantation |

| CFR | Code of Federal Regulations |

| barr.com |

|

|

| CG | coarse gangues |

| CH | high-plasticity clay |

| CI | confidence interval |

| cm | centimeter |

| cm/s | centimeters per second |

| cm3 | cubic centimeters |

| COA | Certificate of Analysis |

| COG | cut-off grade |

| CRM | Certified Reference Material |

| CU | consolidated-undrained (triaxial test) |

| Dahrouge | Dahrouge Geological Consulting Ltd. |

| DC | direct current |

| DDS | NDWR Dams & Dam Safety |

| dm | decimeters |

| DSFM | NDPS Division of State Fire Marshal |

| EDX | energy dispersive X-ray spectroscopy |

| EIS | environmental impact statement |

| EMS | Energy Management System |

| EPA | U.S. Environmental Protection Agency |

| EPC | engineering, procurement, and construction |

| EV | electric vehicle |

| FCC | U.S. Federal Communications Commission |

| FOB | free on board |

| FOS | factor of safety |

| FS | feasibility study |

| FSS | fully softened strength |

| ft | foot/feet |

| ft/s | feet per second |

| g | gram |

| G&A | general and administrative |

| g/cm3 | grams per cubic centimeter |

| g/t | grams per tonne |

| GPS | global positioning system |

| h | hour |

| barr.com |

|

|

| ha | hectares |

| Hazen | Hazen Research, Inc. |

| IA | Initial Assessment Report (April 2024) |

| IC | ion chromatograph |

| ICP | inductively coupled plasma |

| ICP-MS | inductively coupled plasma mass spectrometry |

| ICP-OES | inductively coupled plasma optical emission spectrometry |

| ID | Identification |

| IRA | Inflation Reduction Act |

| IRR | internal rate of return |

| IT | information technology |

| ITC | Investment Tax Credit |

| IX | ion exchange |

| kg | kilogram |

| kh | seismic loading coefficient |

| km | kilometer |

| kN/m3 | kilonewtons per cubic meter |

| KOP | Key Observation Points |

| kPa | kilopascals |

| kph | kilometers per hour |

| ktonnes | kilotonnes |

| kV | kilovolt |

| kWh | kilowatt-hour |

| LCL | Lower Control Limit |

| LHM | lithium hydroxide monohydrate |

| Li | lithium |

| Li-ion | lithium ion |

| LNG | liquefied natural gas |

| LOM | life of mine |

| LSL | lower specification limit |

| m | meter |

| m2 | square meter |

| m3 | cubic meter |

| Ma | mega-annum |

| barr.com |

|

|

| MEG | Moment Exploration Geochemistry, LLC. |

| mg/kg | milligrams per kilogram |

| mg/L | milligrams per liter |

| mi | mile |

| min | minimum |

| MLRS | BLM Mineral and Land Records System |

| mm | millimeter |

| MPa | megapascals |

| MPO | mine plan of operations |

| MSHA | U.S. Mine Safety and Health Administration |

| MST | NDBI Mine Safety and Training |

| Mt | million tonnes |

| Mtpa | million tonnes per annum |

| MV | medium voltage |

| MVR | mechanical vapor recompression |

| MWdc | megawatts direct current |

| MWMP | Meteoric Water Mobility Procedure |

| NAAQS | National Ambient Air Quality Standards |

| NAD | North American Datum |

| NAMC | Nevada Alaska Mining Company |

| NDBI | Nevada Division of Industrial Relations |

| NDEP | Nevada Division of Environmental Protection |

| NDOM | Nevada Division of Minerals |

| NDOT | Nevada Department of Transportation |

| NDOW | Nevada Department of Wildlife |

| NDPS | Nevada Department of Public Safety |

| NDWR | Nevada Division of Water Resources |

| NEPA | National Environmental Policy Act |

| Nexus | Nexus Environmental Consultants |

| NOH | net operating hours |

| NPDES | National Pollutant Discharge Elimination System |

| NPV | net present value |

| NREL | National Renewable Energy Laboratory |

| O&M | operations and maintenance |

| barr.com |

|

|

| OBI | optical borehole imagers |

| OPEX | operating expenditure |

| OSHA | Occupational Safety and Health Administration |

| PAM | polyacrylamide |

| Paragon | Paragon Geochemical |

| pcf | pounds per cubic foot |

| PFS | Pre-Feasibility Study |

| PGA | peak ground acceleration |

| PLS | pregnant leach solution |

| Pocock | Pocock Industrial Inc. |

| POF | probability of failure |

| ppm | parts per million |

| PSD | particle size distribution |

| psf | pounds per square foot |

| psi | pounds per square inch |

| PTC | Production Tax Credit |

| PV | photovoltaic |

| PVSCM | NREL PV System Cost Model |

| PVWatts | NREL Photovoltaic Watts Calculator |

| QA/QC | quality assurance / quality control |

| Qal | Quaternary alluvium (unconsolidated silt, sand, and gravel deposited by modern streams) |

| QEMSCAN® | Quantitative Evaluation of Minerals by Scanning Electron Microscopy |

| QP | Qualified Person |

| qty | quantity |

| R&D | research and development |

| RC | reverse circulation |

| REC | Renewable Energy Certificate |

| REF | refinery |

| RMA | reduced major axis |

| RO | reverse osmosis |

| ROM | run of mine |

| ROW | right-of-way |

| RPD | relative percent difference |

| RQD | rock quality designation |

| barr.com |

|

|

| s | seconds |

| SAM | NREL System Advisor Model |

| SCADA | supervisory control and data acquisition |

| SEC | U.S. Securities and Exchange Commission |

| SEM | scanning electron microscopy |

| sg | specific gravity |

| SGS | SGS Canada, Inc. |

| SGSim | Sequential Gaussian Simulation |

| SHPO | Nevada State Historic Preservation Office |

| SI | International System of Units |

| S-K 1300 | SEC Regulation S-K, Subpart 1300 (S-K 1300) |

| SR | stripping ratio |

| SWPPP | Stormwater Pollution Prevention Plan |

| t | metric tonne |

| TC | total carbon |

| Tcsl | Lower Siebert Formation (Tertiary tuffaceous sedimentary unit) |

| Tcsm | Middle Siebert Formation (Tertiary tuffaceous sedimentary unit) |

| Tcsu | Upper Siebert Formation (Tertiary tuffaceous sedimentary unit) |

| TFLP | ABTC’s Tonopah Flats Lithium Project |

| TGA-DSC | thermogravimetric analysis coupled with differential scanning calorimetry |

| TOC | total organic carbon |

| tpa | tonnes per annum |

| tpd | tonnes per day |

| tph | tonnes per hour |

| TRS | Technical Report Summary |

| TSF | tailings storage facility |

| TWh | terawatt hour |

| UCL | upper control limit |

| UCS | uniaxial compressive strength |

| UPS | uninterruptible power supply |

| US 6/95 | US Highways 6 and 95 |

| US/U.S. | United States |

| USCS | Unified Soil Classification System |

| USFWS | U.S. Fish and Wildlife Service |

| barr.com |

|

|

| USGS | U.S. Geological Survey |

| USL | upper specification limit |

| UTM | Universal Transverse Mercator |

| UU | unconsolidated-undrained |

| V | volt |

| VFD | variable frequency drive |

| VOC | volatile organic compounds |

| Wi-Fi | wireless fidelity |

| WMS | Aquaveo’s Watershed Modeling System |

| Woods | Woods Process Services, LLC |

| WRF | waste rock facility |

| WRSF | waste rock storage facility |

| XRD | x-ray diffraction |

| yr | year |

| barr.com |

|

|

1 Executive Summary

Barr Engineering Co. has prepared this Technical Report Summary (TRS) for the Tonopah Flats Lithium Project (TFLP), Esmeralda and Nye Counties, Nevada, USA, at the request of American Battery Technology Company (ABTC), a Nevada Corporation and a United States (U.S.) listed company (NASDAQ: ABAT) based in Reno, Nevada, USA. The purpose of this TRS is to disclose the results of a Pre-Feasibility Study (PFS) for the project. The Tonopah Flats property is considered a material property as defined under U.S. Securities and Exchange Commission (SEC) Regulation S-K, Subpart 1300 (S-K 1300).

ABTC is an integrated battery-critical material manufacturing company focused on the supply of low-cost, low-environmental impact, and domestically-sourced critical materials through its three core operations to support a sustainable closed-loop battery critical material economy. These core operations include the recycling of lithium-ion (Li-ion) batteries, the development of domestic critical mineral mines, and the refining of these primary critical materials into refined products. ABTC’s development of its lithium (Li) claystone resource and its associated claystone to lithium hydroxide refinery near Tonopah, Nevada, namely the Tonopah Flats Lithium Project, is a key project to achieving the company’s mission.

| 1.1 | Property Description and Ownership |

The Tonopah Flats property consists of 517 unpatented federal lode mining claims covering approximately 4,322 hectares (ha) (10,680 acres [ac]) and is centered at 469500.9 E, and 4218056.0 N (NAD 83 UTM Meters Zone 11N). ABTC owns 100% of the claims comprising the Tonopah Flats property. Ownership of the unpatented mining lode claims is in the name of the holder (locator), subject to the paramount title of the United States of America. Under the Mining Law of 1872, the locator has the right to explore, develop, and mine minerals on unpatented mining lode claims without payments of production royalties to the U.S. government. The 517 unpatented lode claims include rights to all locatable subsurface minerals.

| 1.2 | Geology and Mineralization |

The Tonopah Flats property is in a broad alluvial basin of subdued topography between the San Antonio Mountains to the east and the Monte Cristo Mountains to the west, approximately 11 kilometers (km) (seven miles) northwest of the town of Tonopah, Nevada. Quaternary alluvial fan and pediment sedimentary deposits cover most of the property and are generally composed of silt, sand, and gravel from local sources. The alluvial cover has an average thickness of less than 15 meters (m) (50 feet [ft]) over much of the property and overlies a thick sequence of fluvial and lacustrine epiclastic claystone, volcanic conglomerate, sandstone, siltstone, and tuff of the Miocene age Siebert Formation. The overall sedimentary package within the project area is flat lying to gently dipping.

Lithium mineralization occurs predominantly in the claystone of the Siebert Formation. Drilling by ABTC has so far defined an area of generally continuous lithium mineralization 7,925 m (26,000 ft) north to south by 1,524 m to 4,572 m (5,000 ft to 15,000 ft) east to west, with thicknesses ranging from 122 m to 436 m (400 ft to 1,430 ft).

| barr.com |

|

|

| 1.3 | Status of Exploration, Development, and Operations |

In addition to the 5,704 m from 30 drill holes already reported, ABTC has conducted additional exploration through May 2025 consisting of 2,856 m from eight boreholes. From January 2025 to February 2025, eight core holes were drilled and from April 2025 to May 2025 an additional six sonic holes were drilled to collect geotechnical data on the alluvial gravels and assay data. Lithium mineralization was encountered in the majority of the boreholes drilled.

| 1.4 | Metallurgical Testing and Mineral Processing |

ABTC has conducted material characterization, mineral processing, and metallurgical testing on sample cuttings from its drill programs and cuttings collected from bulk samples. Two processing routes were employed to empirically evaluate this material: i) conventional mineral acid leaching, and ii) internally-developed pretreatment and selective lithium leaching. Subsequent purification and conversion processes of the extracted lithium to battery grade lithium hydroxide monohydrate (LHM) were performed and evaluated for each processing route.

The conclusions from the conventional mineral acid leaching efforts were generally aligned with commercially reported observations. These trials demonstrated high lithium extraction efficiencies (>90%), however low selectivity for lithium extraction relative to other elements. This low selectivity resulted in the need for extensive purification and conversion processes that require high reagent and water consumption and result in significant operating expenses.

When implementing ABTC’s internally-developed pretreatment and selective lithium leaching processes, moderate lithium extraction (>65%) was demonstrated, however with very high selectivity of lithium to other elements. This resulted in the use of simplified purification and conversion processes with very low consumption of chemical reagents and water, and very low processing lithium losses.

ABTC has constructed and is operating a multi-tonne per day integrated demonstration scale facility that utilizes lithium-bearing claystone feedstock specifically from the Tonopah Flats deposit as feedstock and processing this material through each of the refining operations of ABTC’s internally-developed pretreatment, selective lithium leaching, and refining operations. This facility is demonstrating the attributes of the internally-developed pretreatment and selective lithium leaching technology and generating large quantities of battery grade lithium hydroxide for evaluation by customers and stakeholders.

In addition to this selective leaching technique, it has been observed that the lithium within the claystone is not uniformly distributed throughout the various mineralizations. Initial test work has been performed that has allowed for the beneficiation of this claystone material, where the non- and low-lithium bearing minerals are separated from the bulk material, and the high-lithium bearing minerals are concentrated. These initial trials have demonstrated an increase in the grade of approximately 2.85x to over 2,000 parts per million (ppm) lithium. These beneficiation processes have the potential to substantially increase overall lithium extraction efficiencies and further reduce reagent and energy consumption.

| 1.5 | Mineral Resource Estimate |

The mineral resources for Tonopah Flats described and tabulated in this report are classified as Measured, Indicated, and Inferred in accordance with the SEC S-K 1300 New Mining Disclosure Rule and were estimated to reflect potential open-pit extraction. These resources were constrained with an optimization and cut-off grade satisfactorily to meet the requirement of reasonable prospects for economic extraction using a cut-off of 300 ppm within the mineralized units.

| barr.com |

|

|

Sequential Gaussian Simulation (SGSim) was used to generate the mineral resource estimate for Li (ppm), which reduced uncertainty from the previous results. The Measured mineral resource blocks were classified within approximately 300 m of multiple drill holes and where the simulation variance did not exceed ±15% at the 90% confidence interval (CI). The Indicated mineral resource blocks were classified within approximately 600 m of multiple drill holes and where the variance was within ±15% at the 70% CI. The Inferred mineral resource blocks comprise the remaining blocks that fell outside of those criteria or are located more than 600 m from multiple drill holes.

The mineral resource for 2025 reported below is inclusive of the mineral reserve based on a 300 ppm cut-off.

| Table 1-1 | Tonopah Flats Mineral Resources |

| Classification | ktonnes | Grade Li (ppm) | Li (ktonnes) | LHM (ktonnes) |

| Measured | 1,126,772 | 876 | 987 | 5,968 |

| Indicated | 2,534,419 | 640 | 1,621 | 9,800 |

| Measured and Indicated | 3,661,191 | 712 | 2,608 | 15,767 |

| Inferred | 2,151,227 | 424 | 911 | 5,508 |

| a) | The estimate of mineral resources was completed by ABTC and Dahrouge. |

| b) | Tonopah Flats resources are classified as Measured, Indicated, and Inferred. |

| c) | Mineral resources comprised all model blocks at a 300 ppm tonne Li cut-off that lie within an optimized pit. |

| d) | Lithium hydroxide monohydrate (LHM) tonnes were calculated using a factor of 6.0459. |

| e) | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| f) | Mineral resources potentially amenable to open pit mining methods are reported using a LHM price of US$23,000/tonne, assumed metallurgical recoveries of 48% for Li, mining costs of US$2.70/tonne mined, processing costs of US$7.50/tonne processed, minimum grade of 300 ppm lithium within claystone, and general and administrative costs of $0.83/tonne processed, and a 45,000-tpd processing rate. |

| g) | The effective date of the estimate is as of the date of this PFS. |

| h) | Rounding may result in apparent discrepancies between tonnes, grade, and contained metal content. |

ktonnes = kilotonnes

ppm = parts per million

tonnes = metric tonnes

There is some risk that a significant commodity price drop would change the economic inputs to the pit constraints used to report this resource. As a result, a conservative cut-off concentration of 300 ppm Li within the optimized pit is used in this analysis. It should be noted that without this grade constraint, the resulting pit shell using these parameters would be larger than has been used for the resources reported herein.

| 1.6 | Mineral Reserves |

To convert a mineral resource into a mineral reserve, estimates of commodity prices, mining dilution, process recovery, refining/transport costs, royalties, mining costs, processing, and general and administration costs were used to estimate cut-off grades (COGs). These input parameters, along with geotechnical slope recommendations, formed the basis for the selection of economic mining blocks.

The economic mining blocks were identified using the Lerchs-Grossmann Pit Optimization Algorithm in the Maptek Vulcan software package, which produced a series of optimized open-pit shapes. The Qualified Person (QP) has selected one of the pit shells for detailed design and quantified the mineral reserves at the determined COG within the final pit design.

| barr.com |

|

|

The lithium resources at Tonopah Flats are not subject to royalty. A mill recovery of 48% was utilized for the pit optimization. The mineral resources and reserves were reported undiluted, as the strip ratio is very low and the deposit shows little variability at the 300 ppm COG. No additional tonnage adjustment was necessary.

A summary of the mineral reserves for the TFLP is shown in Table 1-2 within the designed final pit for the Tonopah Flats deposit. In the detailed mine production schedule, the COG has been held constant at 300 ppm Li. The QPs have not identified any known legal, political, environmental, or other risks that would materially affect the potential development of the mineral reserves, except for the risk of not being able to secure the necessary permits from the government for the development and operation of the project; however, the QPs are not aware of any unique characteristics of the project that would prevent permitting.

| Table 1-2 | Tonopah Flats Mineral Reserves Estimate Effective as of the Date of this PFS |

| Classification | Tonnes (ktonnes) |

Grade

Li (ppm) |

Contained

Li (ktonnes) |

LHM

Equivalent Mined (ktonnes) |

| Proven | 175,515 | 920 | 161 | 979 |

| Probable | 384,333 | 753 | 289 | 1,754 |

| Total Proven and Probable | 559,848 | 805 | 451 | 2,733 |

ktonnes = kilotonnes

LHM = lithium hydroxide monohydrate

ppm = parts per million

tonnes = metric tonnes

| 1.7 | Mining Methods |

The mine will be developed using conventional open-pit mining, selected based on the resources and reserves defined in the previous section, and its relatively low cost. This method encompasses drilling, blasting, loading and hauling, and related support activities. Due to the predominantly soft rock conditions within the project area, drilling and blasting requirements are expected to be minimal, accounting for only approximately 5% of the clay material.

A pit optimization process was utilized to generate the ultimate pit shell, along with eight intermediate pit shells representing the phases (pushbacks). These pit shells served as the basis for the final pit and phase designs, which were subsequently used to develop the life of mine (LOM) production schedule. These phases are designed to optimize production rates, facilitate construction activities, and support backfill operations.

The pit designs utilize 10-m-high benches with a 9.65-m-wide catch bench installed on every other bench (double-benching), or 20 vertical meters apart. The bench face angle used is 45º. The resulting inter-ramp slope is 34º. The design road width of 30 m is used resulting in the overall stope angle of 33º.

| barr.com |

|

|

Ore production rate was established in alignment with the refinery’s throughput of 30,000 tonnes (t) of LHM per year, necessitating an approximate feed rate of 12,400,000 tonnes per annum (tpa) over the LOM. The mine is planned to operate continuously, with two 12-hour shifts per day, 365 days per year. Key milestones within the LOM production schedule are summarized as follows:

| ● | Pre-mining site development and earthworks: approximately six months |

| ● | Pre-production mining (non-processing phase): approximately one year |

| ● | Initial ramp-up production phase (5,000 tpa of LHM): 1-2 years |

| ● | Full ramp-up phase achieving and sustaining 30,000 tpa: 1-3 years |

| ● | Loading and transporting dry-stack tailings to the backfill dumps: year-6 to LOM |

The waste management infrastructure comprises a waste rock facility (WRF), dry-stack tailings storage facility (TSF), a coarse gangues (CG) dump, and one backfill dump split into eight phases. These facilities were designed in accordance with geotechnical guidelines to ensure slope stability and overall structural integrity. The waste rock from the pit, along with waste generated from refinery, will be sent to these destinated waste management facilities.

As part of the comprehensive mine planning process, detailed plans have been developed for equipment selection, drilling, blasting, staffing, reclamation, ROM ore handling, tailings and coarse gangue handling, and overall costing. The primary mining fleet for this project will include hydraulic shovels, wheel loaders, haul trucks, dozers, graders, water trucks, etc. This primary equipment will be supplemented by ancillary equipment as required. Both routine and preventive maintenance will be conducted in-house, while the owner and equipment vendors will collaboratively manage major repairs and equipment overhauls.

| 1.8 | Processing and Recovery Methods |

The initial process design is scaled to produce 30,000 tpa of battery grade LHM, and the process plant is based on achieving a nameplate feed tonnage of 11.9 million tpa (Mtpa) of claystone. Refinery installation is planned in three phases of 5,000 tpa, 12,500 tpa, and 12,500 tpa, in Phases 1-3, respectively. The process flow sheet consists of six process areas, namely: Feed Comminution and Screening, Extraction, Impurity Removal and Concentration, Impurity Crystallization, Sulfate Crystallization, and Lithium Hydroxide Conversion.

The refinery will receive lithium claystone from the open pit mine via mine haul trucks. Claystone will be processed through the comminution circuit where it will be sized, processed, and pretreated as part of the extraction. Lithium will be extracted into an aqueous phase from the pretreated claystone. Impurities are to be removed from the aqueous phase using precipitation, membrane technology, and crystallization. LHM will be produced using a combination of electrochemical conversion and crystallization. The filtered tailings from the extraction and impurity removal process, along with solids generated from off-gas handling, are planned to be combined and placed in a temporary dry-stack tailing impoundment. As areas of the pit are mined out, tailings will be placed as backfill.

| 1.9 | Infrastructure |

A TSF is planned to be located between the proposed pit and the refinery facility. This TSF, storing both the CG and the tailings in two separate facilities, will be used until the tailings can be returned back into the open pit. A stability analysis was performed for both static and earthquake conditions, indicating that the TSF can be safely built using 2.5-horizontal to 1-vertical slopes (2.5H:1V) with a 9-m-high perimeter berm encapsulating both tailing facilities. Surface water from outside the mining site will be diverted to a series of ponds on the southern portion of the site. Runoff from within the mining site will be diverted to a pond located on the western edge of the facility.

| barr.com |

|

|

| 1.10 | Capital and Operating Costs |

The capital and operating cost estimates for this project were based on the costs associated with mining, processing/refining, safety and training, infrastructure, site reclamation and closure, and all other relevant direct and indirect expenditures necessary to ensure the successful execution of this project. These cost estimates were developed using data collected from in-house databases, vendor quotations, contractors, reliable publicly available sources, benchmarking from similar lithium projects, operational experiences, and other industry-standard estimating factors.

These costs in this report are presented in 2025 USD on a calendar year basis. No escalation or inflation is included.

The capital cost projections were defined and developed based on expected quantities of materials, labor, and equipment. The expected quantities were derived from engineering drawings, early-stage 3D models, and preliminary facility layout. The capital costs in this report have an expected accuracy of +/-25% based on AACE International guidance related to Class 4 capital cost estimates.

Process capital costs were estimated by ABTC and Woods Process Services, LLC. (Woods), while mining, infrastructure, and other capital expenses were estimated by ABTC and Barr. The total estimated capital cost for the design, construction, installation, and commissioning of project facilities includes approximately $2.0 billion in pre-production and initial capital expenditures through year 5, and $205.6 million in new and sustaining capital costs over the remaining LOM, as reflected in Table 1-3, bringing the total capital requirement over the 45-year mine life considered in this PFS to an estimated $2.2 billion.

| barr.com |

|

|

| Table 1-3 | Total Capital Cost Summary |

| Capital Costs ($000) | YR -2 | YR -1 | YR 1-2 | YR 3-5 | YR 6-10 | YR 11-20 | YR 21-30 | YR 31-40 | YR 41-45 | Total |

| Pre-Mining Cost | $- | $10,170 | $- | $- | $- | $- | $- | $- | $- | $10,170 |

| Mining Capital | $- | $86,648 | $53,360 | $3,355 | $37,252 | $34 | $10,099 | $15,099 | $34 | $205,881 |

| Mining Sustaining Capital | $- | $- | $76 | $2,141 | $8,423 | $19,374 | $68,995 | $21,371 | $1,253 | $121,632 |

| Process/ Milling | $91,234 | $373,462 | $746,924 | $282,228 | $- | $- | $- | $- | $- | $1,493,848 |

| Owner's Costs | $778 | $3,723 | $7,446 | $11,169 | $14,114 | $- | $- | $- | $- | $37,230 |

| Closure Provisions | $- | $- | $- | $- | $- | $- | $- | $- | $150 | $150 |

| Subtotal | $92,012 | $474,003 | $807,806 | $298,894 | $59,789 | $19,408 | $79,094 | $36,470 | $1,437 | $1,868,912 |

| Contingency | $18,247 | $89,215 | $157,389 | $56,949 | $5,588 | $5 | $1,515 | $2,265 | $5 | $331,177 |

| Total Capital | $110,259 | $563,219 | $965,195 | $355,843 | $65,377 | $19,413 | $80,609 | $38,735 | $1,442 | $2,200,090 |

yr = year

| barr.com |

|

|

The average LOM operating cost equates to $6,994/t of LHM produced. The project average annual operating cost is approximately $199.5 million, supporting a refinery’s throughput of 30,000 tpa of LHM, along with an average refinery feed rate of 12.4 Mtpa, and an average mining rate of 15.6 Mtpa. Table 1-4 presents a summary of the operating cost.

| Table 1-4 | Operating Cost Summary |

| Cost Area Description | LOM Total Cost | LOM Average | Unit Operating Expenditure Cost | Operating Expenditure Percent |

| ($000s) | ($000s/Year) | ($/t LHM) | (%) | |

| Total Mining Cost | 3,247,358 | 70,595 | 2,476 | 35.4% |

| Process/Refining | 5,649,008 | 122,805 | 4,307 | 61.6% |

| General & Administrative | 171,953 | 3,738 | 131 | 1.9% |

| Reclamation Cost | 105,331 | 2,290 | 80 | 1.1% |

| Operating Cost | 9,173,699 | 199,428 | 6,994 | 100.0% |

LOM = life of mine

t = metric tonne

LHM = lithium hydroxide monohydrate

| 1.11 | Economic Analysis |

ABTC and Barr created a cash-flow model based on the production schedule and resulting revenue stream in accordance with the costs presented. Only Measured and Indicated mineral resources were used to create the revenue stream. The PFS limits the TFLP to a mine life of 45 years for approximately 599.8 Mt with an average of 805 ppm Li grade processed and a total recovery including beneficiation, extraction, and refining of 48%. With $2.0 billion in initial capital costs, processing costs of $4,307/t of LHM, overall operating costs of $6,994/t of LHM produced, and average production of 30,000 tpa of LHM, this project is estimated to have a $2.57 billion after-tax net present value (NPV) at an 8% discount rate. At a discount rate of 10%, the after-tax net NPV is $1.75 billion. The project has a 21.8% Internal Rate of Return (IRR) and 7.5-year payback of initial capital. Mineral resources that are not categorized as reserves do not have demonstrated economic viability.

| 1.12 | Economic Sensitivities |

Revenues, operating costs, and capital costs were evaluated from +/-30% of the values in 10% increments, using the PFS cash flow model. Figure 1-1 shows the cash flow sensitivity in NPV (8%) graphically. The steeper slope of the revenue line shows that the project is most sensitive to the price of lithium and less sensitive to the operating and capital costs.

| barr.com |

|

|

| Figure 1-1 | After-Tax Cash Flow Sensitivity - NPV (8%) US$ Billion |

| 1.13 | Conclusions and Recommendations |

This PFS has integrated drilling, testing, design, and economic evaluation data, as described in the various sections of this report. This PFS represents a significant step forward from the previously published IA, providing an updated resource estimate, reserve estimate, viable mining plan, technically feasible processing scenario, tailings and mine waste management approach, update on permitting considerations, and a resultant economic evaluation.

The Mineral Resource estimate has been updated with additional drilling conducted in 2025. This resulted in the updating of the geologic and mineralization domains. The Mineral Resource exclusive of the Mineral Reserve within Measured and Indicated categories consists of 2,333,767 ktonnes at 712 ppm Li.

The drilling has thus far defined an area of generally continuous mineralization 7,925 m (26,000 ft) north to south by 1,524 m to 4,572 m (5,000 ft to 15,000 ft) east to west, with known thicknesses up to 436 m (1,430 ft). Clay beds with higher concentrations of lithium are localized to semi-continuous, and the lithium-bearing beds are generally contained in a 1,219- to 3,048-m wide (4,000- to 10,000-ft wide) corridor in multiple stratigraphic horizons from 6.1 m to 35 m (20 ft to 115 ft) in thickness, running north to south through the central portion of the property.

ABTC, in partnership with Hazen Research, Inc. (Hazen), Pocock Industrial Inc. (Pocock), and SGS Canada, Inc. (SGS), has been conducting a comprehensive mineral processing and metallurgical testing program since Spring 2022 to produce high-purity lithium hydroxide from lithium-bearing claystone. Initial efforts using conventional acid leaching (HCl and H₂SO₄) achieved high lithium extraction rates (>80%) but also extracted unwanted gangue minerals and deleterious elements, increasing reagent consumption and complicating purification. To address this, ABTC developed pretreatment methods that improved selectivity by converting lithium into more leachable forms while minimizing impurity extraction. These methods maintained strong lithium recovery (70–85%) and significantly reduced impurities in the pregnant leach solution (PLS), streamlining downstream purification and improving economic viability.

| barr.com |

|

|

Building on successful bench-scale results, ABTC constructed and operated a 5-tpd pilot plant, validating the feasibility of producing battery-grade LHM. The team also explored beneficiation techniques to concentrate lithium-bearing minerals, achieving a 2.85x upgrade ratio from run-of-mine ore, which reduced processing costs and improved efficiency. Process simulations using METSIM and Aspen were employed to optimize operational parameters and economics. The report highlights bench-scale and pilot plant results, beneficiation and pretreatment studies, and ongoing efforts to refine reagent use and enhance final product purity. Further testing and pilot runs are planned to support the upcoming feasibility study (FS).

It should be noted that this PFS was limited to a mine life of 45 years and only a portion of the South Pit was included in the mine life and economic analysis. A 45-year mine life will not exhaust the known mineral reserves and resources.

The QPs believe that the data provided by ABTC, and the geological interpretations Dahrouge Geological Consulting Ltd. (Dahrouge) has derived from the data, are an accurate and reasonable representation of the project, subject to those concerns written elsewhere in this report.

The current lithium resources remain open to the south, southwest, and at depth. It is reasonable to assume that there is the potential to significantly expand the resources with further drilling extending to the south and southwest property boundaries, and at greater depths.

| 1.13.1 | Project Risks |

Processing lithium-clay deposits is an uncommon practice in lithium production worldwide, currently. The work to date has demonstrated the likely economic extraction of the resources reported herein, based on the test work described in this report. To address this risk, ABTC has constructed and continues to operate a multi-tonne per day pilot plant that operates on representative bulk samples from the deposit and these operations will continue to derisk the processing approach.

The operating expenditure (OPEX) for this project are heavily weighted to the power consumption of the refinery. As a result, the power supply to the TFLP is a major risk factor. ABTC has addressed this through a combination of power sources, namely solar power production, with battery energy storage, combined with grid power supplied by NV Energy. Furthermore, ABTC has an operational plan that prorates production during times of high and low power availability or constraint. Further refinement of this approach through power system modeling and process design modifications will help reduce the risk in this area.

The price of LHM can vary widely. This represents a major risk to project economics. Expected reasonable near-term lithium price variations are addressed in the sensitivity analysis of this report.

| barr.com |

|

|

| 1.13.2 | Recommendations |

While the PFS indicates positive cash flow, additional studies are needed to advance to the FS, as described below.

| ● | Additional study of mining, ore handling, and tailings handling to improve approaches and reduce risk. |

| ● | Additional metallurgy and processing test work, supported by metallurgical drilling to provide composites for testing |

| ● | Additional test campaigns in the pilot plant, incorporate ore beneficiation, stress test the operations, and provide longer-duration test campaign data |

| ● | Develop a geometallurgical model, unified metallurgical dataset, and ore control methodology |

| ● | A passive seismic study for the southern portion of the property south of US 6/95 to improve the understanding of the subsurface geologic structure and depth to basement rock in areas that have not yet been tested by exploration drilling |

| ● | Additional geotechnical drilling and testing related to slope stability and deformation analysis |

| ● | Additional baseline environmental studies, including raptor surveys, geochemistry, hydrology, and air quality to support the NEPA process |

| ● | Completion of a FS to further reduce risk and further refine the economics of the project, including additional resource drilling, process recovery improvements, energy efficiency improvements, further detailed refinery design work, further tailings design work, environmental study advancement, and updated detailed economic evaluations |

| Table 1-5 | ABTC Estimated Costs for Tonopah Flats Recommended Work Program |

| Category | Estimated Cost USD |

| Mining, Ore Handling, and Tailings Handling | $250,000 |

| Metallurgy and Processing | $550,000 |

| Passive Seismic Study | $30,000 |

| Geotechnical Drilling | $300,000 |

| Baseline Environmental Studies including NEPA Documentation | $1,000,000 |

| Feasibility Study | $3,000,000 to $4,000,000 |

| Total | $5,130,000 to $6,130,000 |

NEPA = National Environmental Policy Act

| barr.com |

|

|

2 Introduction